Summit Midstream Corporation Tall Oak Midstream Acquisition October 1, 2024 Exhibit 99.2

2 Forward-Looking Statements, Legal Disclaimers & Use of Non-GAAP Investors are cautioned that certain statements contained in this presentation are “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” In addition, any statement concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions taken by us or our subsidiaries, are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of our management team. All forward-looking statements in this presentation and subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements in this paragraph. These risks and uncertainties include, among others: Developments in any of these areas could cause actual results to differ materially from those anticipated or projected or cause a significant reduction in the market price of our common units, preferred units and senior notes. You should also consider the factors described in the Partnership's Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q under "Risk Factors", and in other filings with the Securities and Exchange Commission (the "SEC") by the Partnership, which can be found on the SEC's website at www.sec.gov. The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this document may not in fact occur. Accordingly, undue reliance should not be placed on these statements. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investors page of our website. In the future, we will continue to use these channels to distribute material information about the Partnership and to communicate important information about the Partnership, key personnel, corporate initiatives, regulatory updates and other matters. This presentation contains non-GAAP financial measures, such as adjusted EBITDA and distributable cash flow. We report our financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide users of this financial information additional meaningful comparisons between current results and the results of our peers and of prior periods. Please see the Appendix for definitions and reconciliations of the non-GAAP financial measures that are based on reconcilable historical information. Additional Information and Where to Find It In connection with the proposed transaction (the "Proposed Transaction"), Summit intends to file a proxy statement with the Securities and Exchange Commission (the “SEC”) and also plans to file other relevant documents with the SEC regarding the Proposed Transaction. COMMON STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain a free copy of the proxy statement (if and when it becomes available) and other relevant documents filed by Summit with the SEC at the SEC’s website at www.sec.gov. You may also obtain copies of the documents Summit files with the SEC on Summit’s website at www.summitmidstream.com. Participants in the Solicitation Summit and its directors, executive officers and other members of management and employees may, under the rules of the SEC, be deemed to be "participants" in the solicitation of proxies in connection with the Proposed Transaction. Information about Summit’s directors and executive officers is available in Summit’s Registration Statement on Form S-4 (Registration No. 333-279903), as declared effective by the SEC on June 14, 2024 (the “Form S-4”). To the extent that holdings of Summit's securities have changed from the amounts reported in the Form S-4, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. These documents may be obtained free of charge from the sources indicated above. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials relating to the Proposed Transaction filed with the SEC. Common stockholders and other investors should read the proxy statement carefully before making any voting or investment decisions. ▪ our decision whether to pay, or our ability to grow, our cash dividends; ▪ fluctuations in natural gas, NGLs and crude oil prices, including as a result of the political or economic measures taken by various countries or OPEC; ▪ the extent and success of our customers' drilling and completion efforts, as well as the quantity of natural gas, crude oil, fresh water deliveries, and produced water volumes produced within proximity of our assets; ▪ the current and potential future impact of the COVID-19 pandemic on our business, results of operations, financial position or cash flows; ▪ failure or delays by our customers in achieving expected production in their natural gas, crude oil and produced water projects; ▪ competitive conditions in our industry and their impact on our ability to connect hydrocarbon supplies to our gathering and processing assets or systems; ▪ actions or inactions taken or nonperformance by third parties, including suppliers, contractors, operators, processors, transporters and customers, including the inability or failure of our shipper customers to meet their financial obligations under our gathering agreements and our ability to enforce the terms and conditions of certain of our gathering agreements in the event of a bankruptcy of one or more of our customers; ▪ our ability to divest of certain of our assets to third parties on attractive terms, which is subject to a number of factors, including prevailing conditions and outlook in the natural gas, NGL and crude oil industries and markets; ▪ the ability to attract and retain key management personnel; ▪ commercial bank and capital market conditions and the potential impact of changes or disruptions in the credit and/or capital markets; ▪ changes in the availability and cost of capital and the results of our financing efforts, including availability of funds in the credit and/or capital markets; ▪ restrictions placed on us by the agreements governing our debt and preferred equity instruments; ▪ the availability, terms and cost of downstream transportation and processing services; ▪ natural disasters, accidents, weather-related delays, casualty losses and other matters beyond our control; ▪ operational risks and hazards inherent in the gathering, compression, treating and/or processing of natural gas, crude oil and produced water; ▪ our ability to comply with the terms of the agreements related to our settlement of the legal matters related to the release of produced water from a pipeline operated by Meadowlark Midstream Company, LLC in 2015, which is still subject to court approval; ▪ weather conditions and terrain in certain areas in which we operate; ▪ physical and financial risks associated with climate change; ▪ any other issues that can result in deficiencies in the design, installation or operation of our gathering, compression, treating, processing and freshwater facilities; ▪ timely receipt of necessary government approvals and permits, our ability to control the costs of construction, including costs of materials, labor and rights-of-way and other factors that may impact our ability to complete projects within budget and on schedule; ▪ our ability to finance our obligations related to capital expenditures, including through opportunistic asset divestitures or joint ventures and the impact any such divestitures or joint ventures could have on our results; ▪ the effects of existing and future laws and governmental regulations, including environmental, safety and climate change requirements and federal, state and local restrictions or requirements applicable to oil and/or gas drilling, production or transportation; ▪ changes in tax status; ▪ the effects of litigation; ▪ interest rates; ▪ changes in general economic conditions; and ▪ certain factors discussed elsewhere in this presentation.

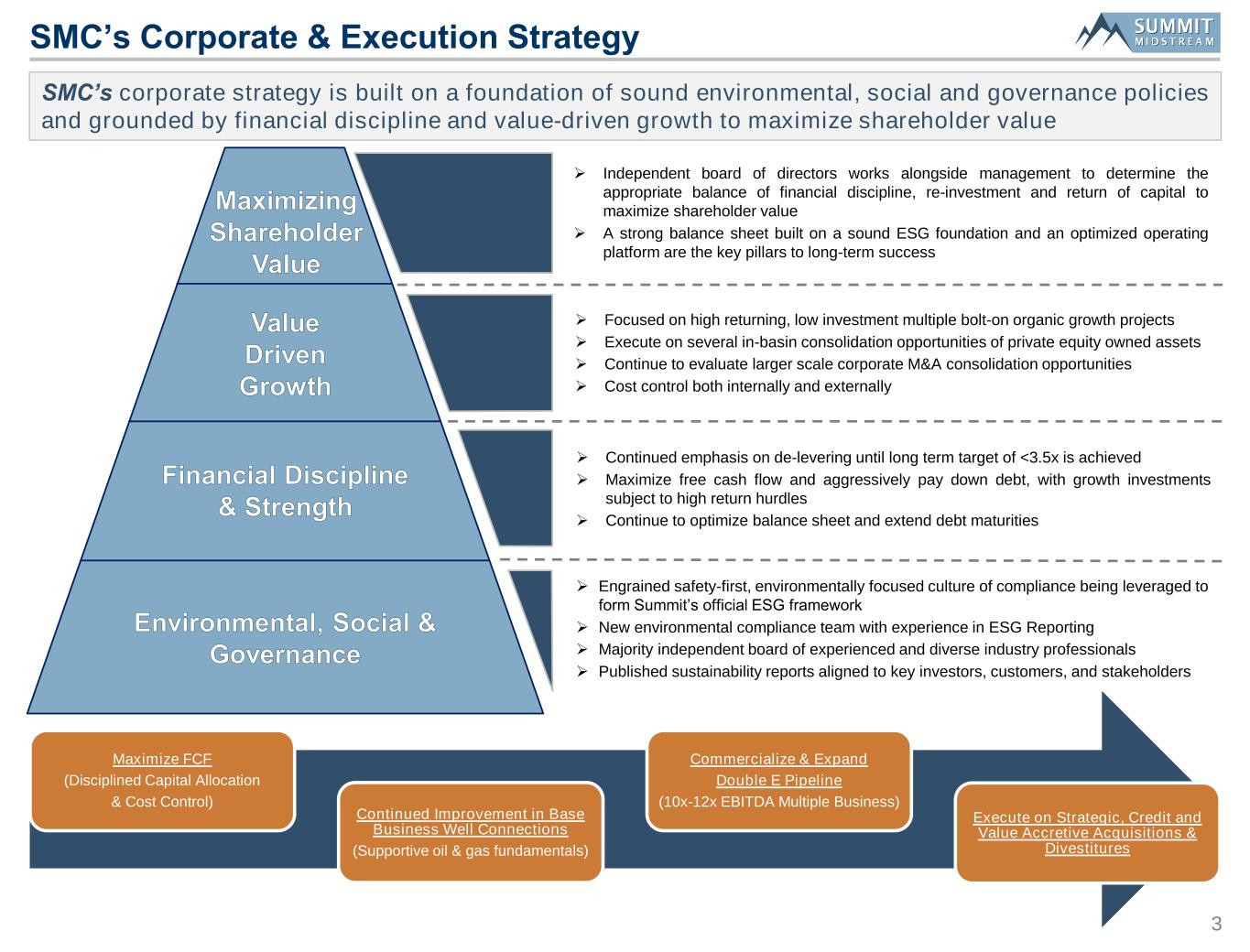

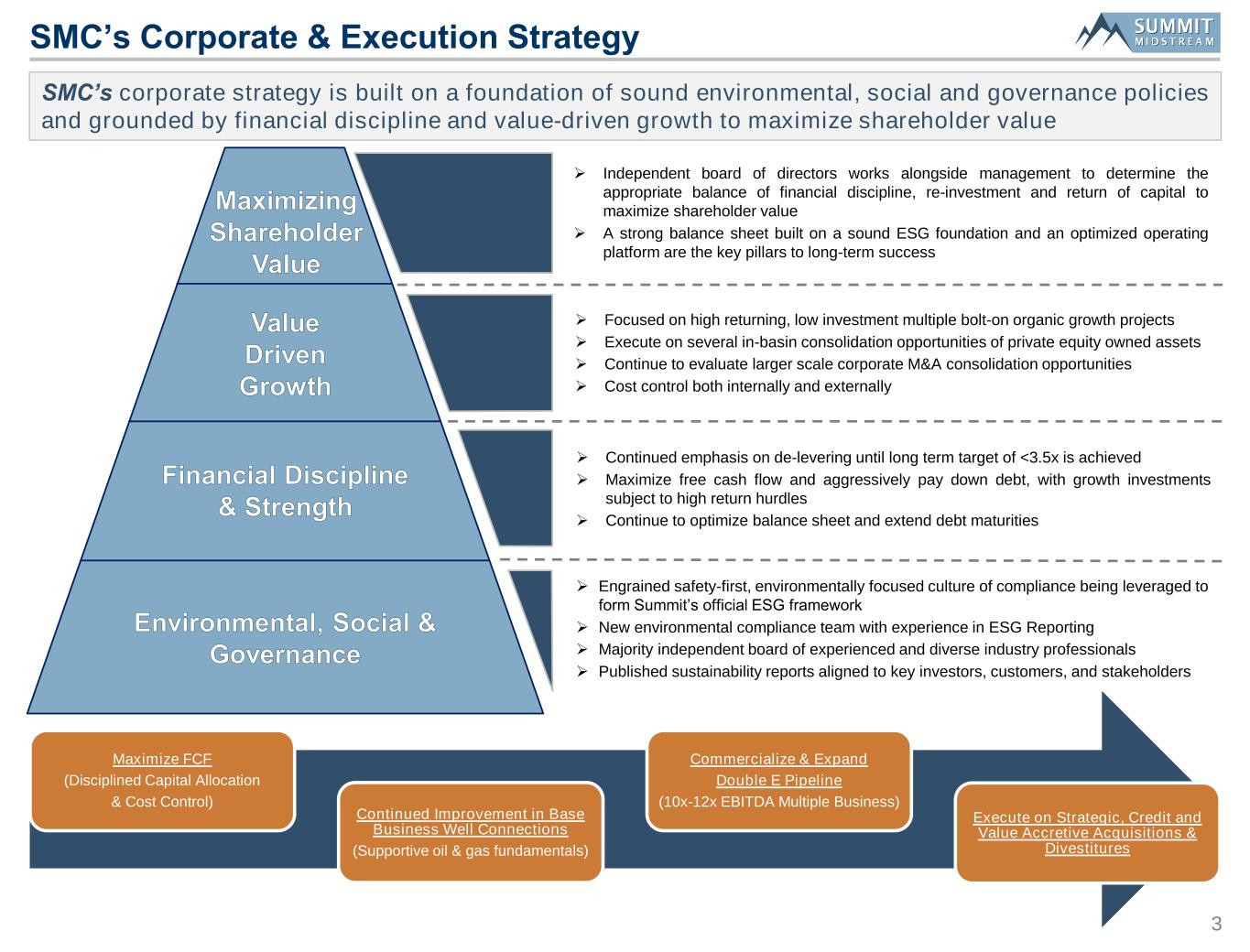

3 SMC’s Corporate & Execution Strategy SMC’s corporate strategy is built on a foundation of sound environmental, social and governance policies and grounded by financial discipline and value-driven growth to maximize shareholder value ➢ Independent board of directors works alongside management to determine the appropriate balance of financial discipline, re-investment and return of capital to maximize shareholder value ➢ A strong balance sheet built on a sound ESG foundation and an optimized operating platform are the key pillars to long-term success ➢ Continued emphasis on de-levering until long term target of <3.5x is achieved ➢ Maximize free cash flow and aggressively pay down debt, with growth investments subject to high return hurdles ➢ Continue to optimize balance sheet and extend debt maturities ➢ Engrained safety-first, environmentally focused culture of compliance being leveraged to form Summit’s official ESG framework ➢ New environmental compliance team with experience in ESG Reporting ➢ Majority independent board of experienced and diverse industry professionals ➢ Published sustainability reports aligned to key investors, customers, and stakeholders Maximizing Shareholder Value Value Driven Growth Financial Discipline & Strength Environmental, Social & Governance ➢ Focused on high returning, low investment multiple bolt-on organic growth projects ➢ Execute on several in-basin consolidation opportunities of private equity owned assets ➢ Continue to evaluate larger scale corporate M&A consolidation opportunities ➢ Cost control both internally and externally Maximize FCF (Disciplined Capital Allocation & Cost Control) Continued Improvement in Base Business Well Connections (Supportive oil & gas fundamentals) Commercialize & Expand Double E Pipeline (10x-12x EBITDA Multiple Business) Execute on Strategic, Credit and Value Accretive Acquisitions & Divestitures

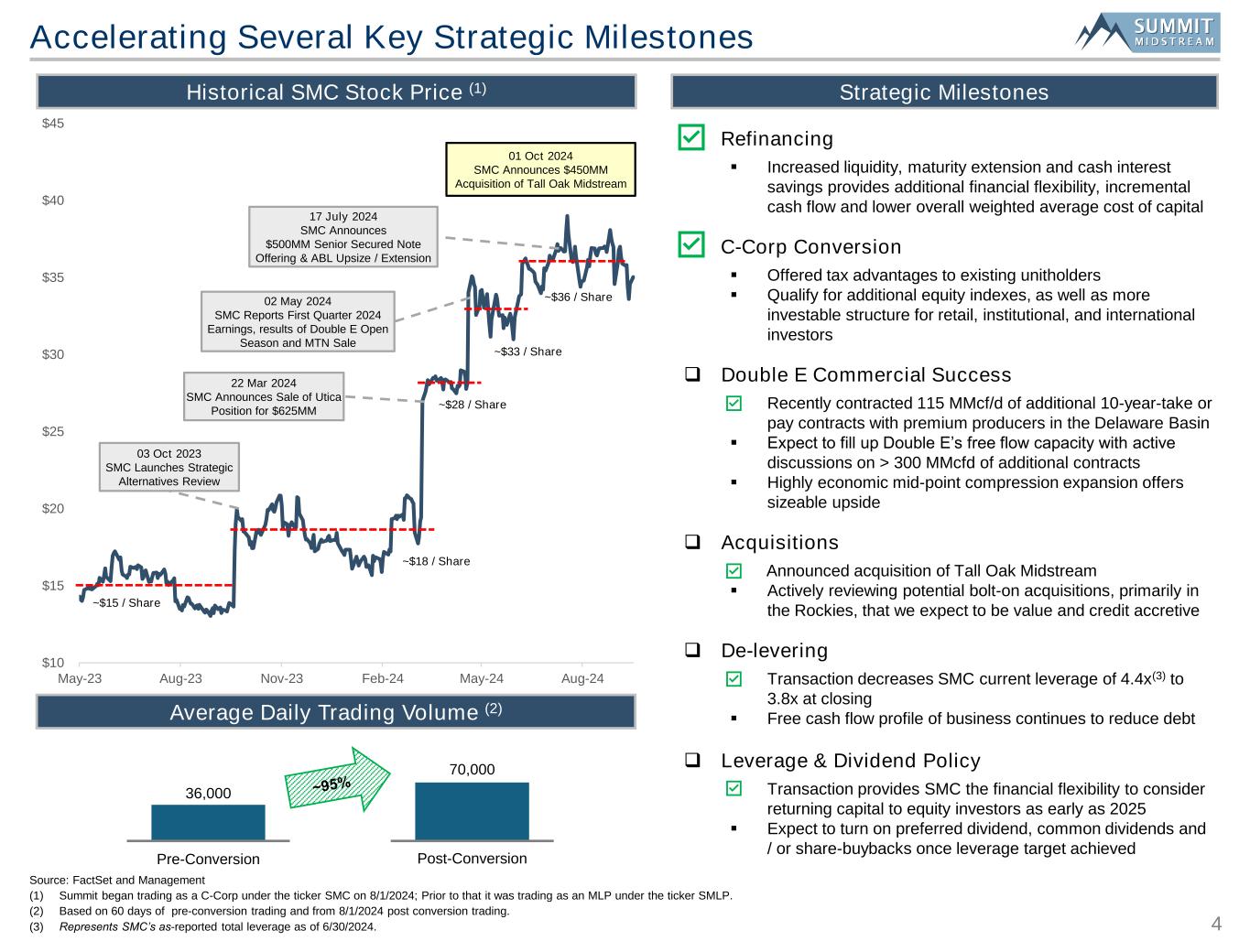

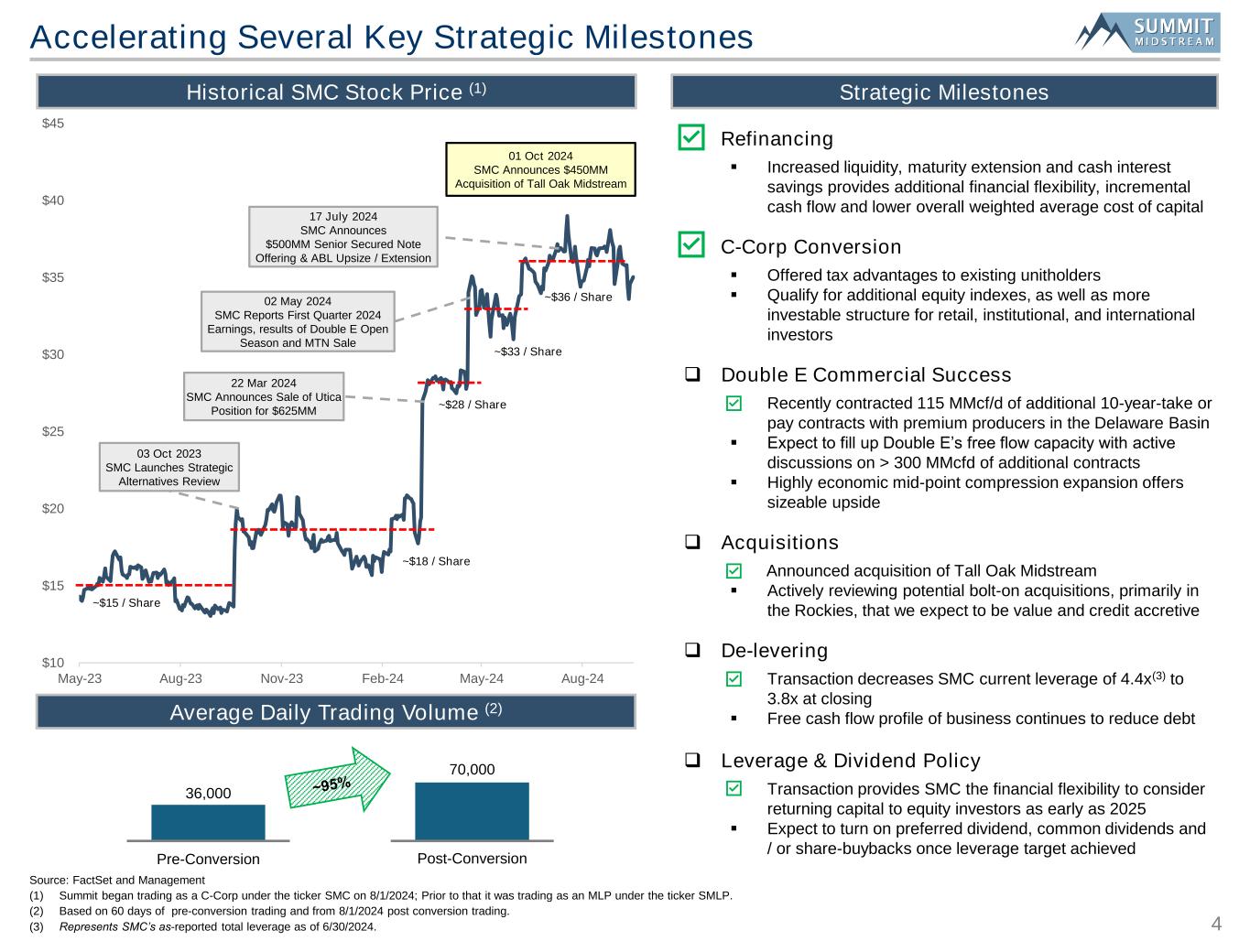

4 $10 $15 $20 $25 $30 $35 $40 $45 May-23 Aug-23 Nov-23 Feb-24 May-24 Aug-24 Accelerating Several Key Strategic Milestones Historical SMC Stock Price (1) Refinancing ▪ Increased liquidity, maturity extension and cash interest savings provides additional financial flexibility, incremental cash flow and lower overall weighted average cost of capital C-Corp Conversion ▪ Offered tax advantages to existing unitholders ▪ Qualify for additional equity indexes, as well as more investable structure for retail, institutional, and international investors ❑ Double E Commercial Success ▪ Recently contracted 115 MMcf/d of additional 10-year-take or pay contracts with premium producers in the Delaware Basin ▪ Expect to fill up Double E’s free flow capacity with active discussions on > 300 MMcfd of additional contracts ▪ Highly economic mid-point compression expansion offers sizeable upside ❑ Acquisitions Announced acquisition of Tall Oak Midstream ▪ Actively reviewing potential bolt-on acquisitions, primarily in the Rockies, that we expect to be value and credit accretive ❑ De-levering ▪ Transaction decreases SMC current leverage of 4.4x(3) to 3.8x at closing ▪ Free cash flow profile of business continues to reduce debt ❑ Leverage & Dividend Policy ▪ Transaction provides SMC the financial flexibility to consider returning capital to equity investors as early as 2025 ▪ Expect to turn on preferred dividend, common dividends and / or share-buybacks once leverage target achieved 03 Oct 2023 SMC Launches Strategic Alternatives Review 22 Mar 2024 SMC Announces Sale of Utica Position for $625MM 02 May 2024 SMC Reports First Quarter 2024 Earnings, results of Double E Open Season and MTN Sale ~$15 / Share ~$18 / Share ~$28 / Share ~$33 / Share 17 July 2024 SMC Announces $500MM Senior Secured Note Offering & ABL Upsize / Extension Strategic Milestones ~$36 / Share 01 Oct 2024 SMC Announces $450MM Acquisition of Tall Oak Midstream Average Daily Trading Volume (2) 36,000 Pre-Conversion 70,000 Post-Conversion Source: FactSet and Management (1) Summit began trading as a C-Corp under the ticker SMC on 8/1/2024; Prior to that it was trading as an MLP under the ticker SMLP. (2) Based on 60 days of pre-conversion trading and from 8/1/2024 post conversion trading. (3) Represents SMC’s as-reported total leverage as of 6/30/2024.

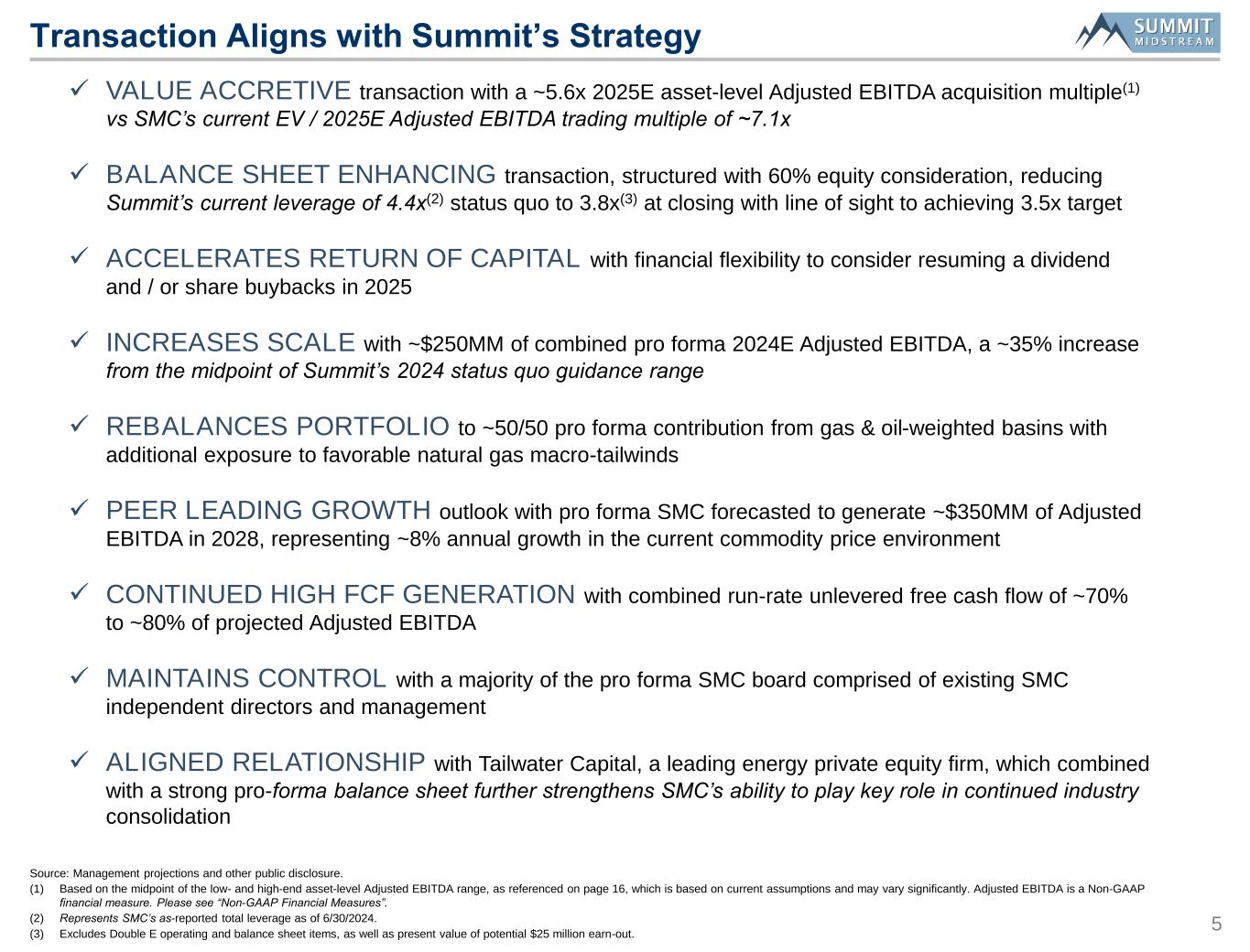

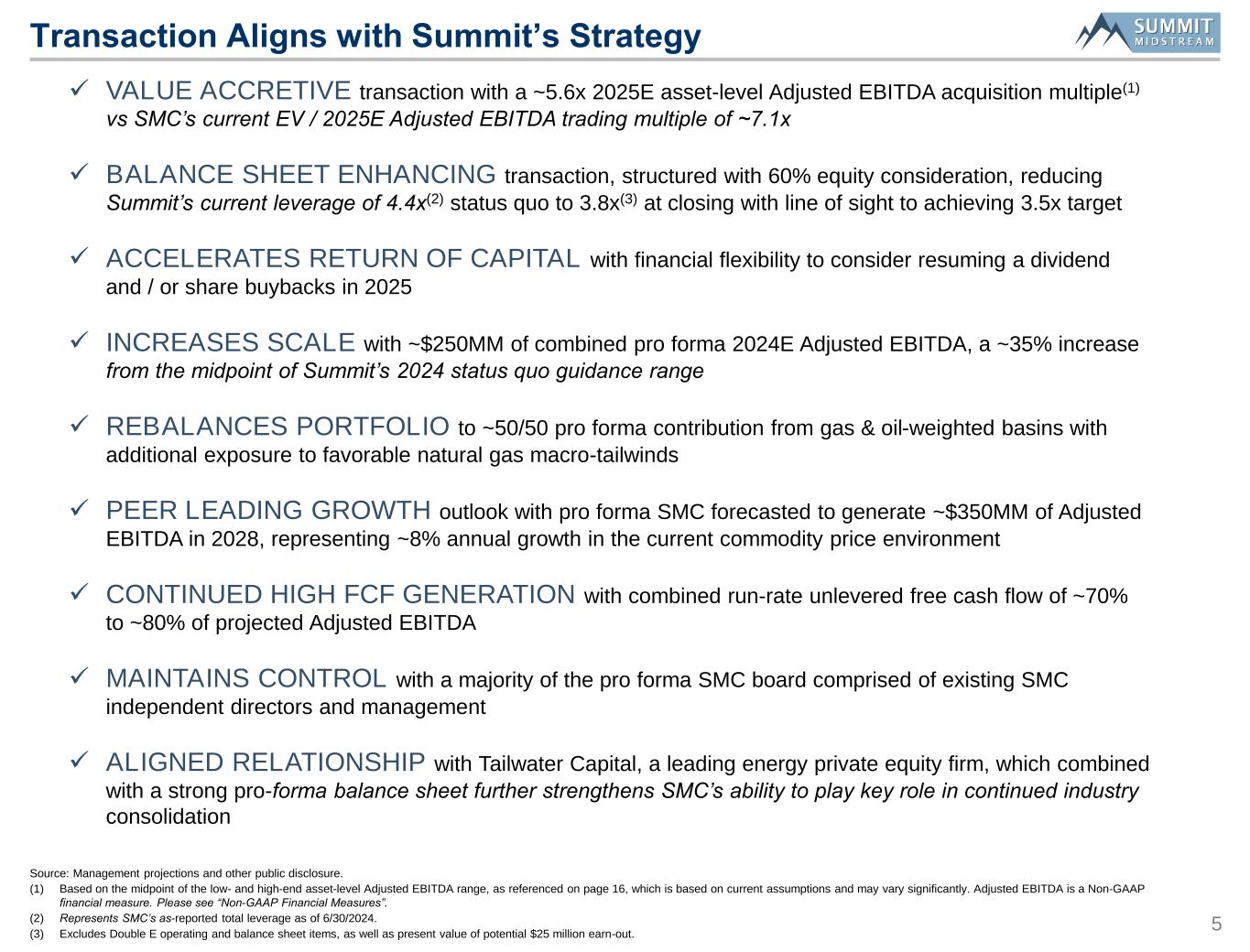

5 Source: Management projections and other public disclosure. (1) Based on the midpoint of the low- and high-end asset-level Adjusted EBITDA range, as referenced on page 16, which is based on current assumptions and may vary significantly. Adjusted EBITDA is a Non-GAAP financial measure. Please see “Non-GAAP Financial Measures”. (2) Represents SMC’s as-reported total leverage as of 6/30/2024. (3) Excludes Double E operating and balance sheet items, as well as present value of potential $25 million earn-out. Transaction Aligns with Summit’s Strategy ✓ VALUE ACCRETIVE transaction with a ~5.6x 2025E asset-level Adjusted EBITDA acquisition multiple(1) vs SMC’s current EV / 2025E Adjusted EBITDA trading multiple of ~7.1x ✓ BALANCE SHEET ENHANCING transaction, structured with 60% equity consideration, reducing Summit’s current leverage of 4.4x(2) status quo to 3.8x(3) at closing with line of sight to achieving 3.5x target ✓ ACCELERATES RETURN OF CAPITAL with financial flexibility to consider resuming a dividend and / or share buybacks in 2025 ✓ INCREASES SCALE with ~$250MM of combined pro forma 2024E Adjusted EBITDA, a ~35% increase from the midpoint of Summit’s 2024 status quo guidance range ✓ REBALANCES PORTFOLIO to ~50/50 pro forma contribution from gas & oil-weighted basins with additional exposure to favorable natural gas macro-tailwinds ✓ PEER LEADING GROWTH outlook with pro forma SMC forecasted to generate ~$350MM of Adjusted EBITDA in 2028, representing ~8% annual growth in the current commodity price environment ✓ CONTINUED HIGH FCF GENERATION with combined run-rate unlevered free cash flow of ~70% to ~80% of projected Adjusted EBITDA ✓ MAINTAINS CONTROL with a majority of the pro forma SMC board comprised of existing SMC independent directors and management ✓ ALIGNED RELATIONSHIP with Tailwater Capital, a leading energy private equity firm, which combined with a strong pro-forma balance sheet further strengthens SMC’s ability to play key role in continued industry consolidation

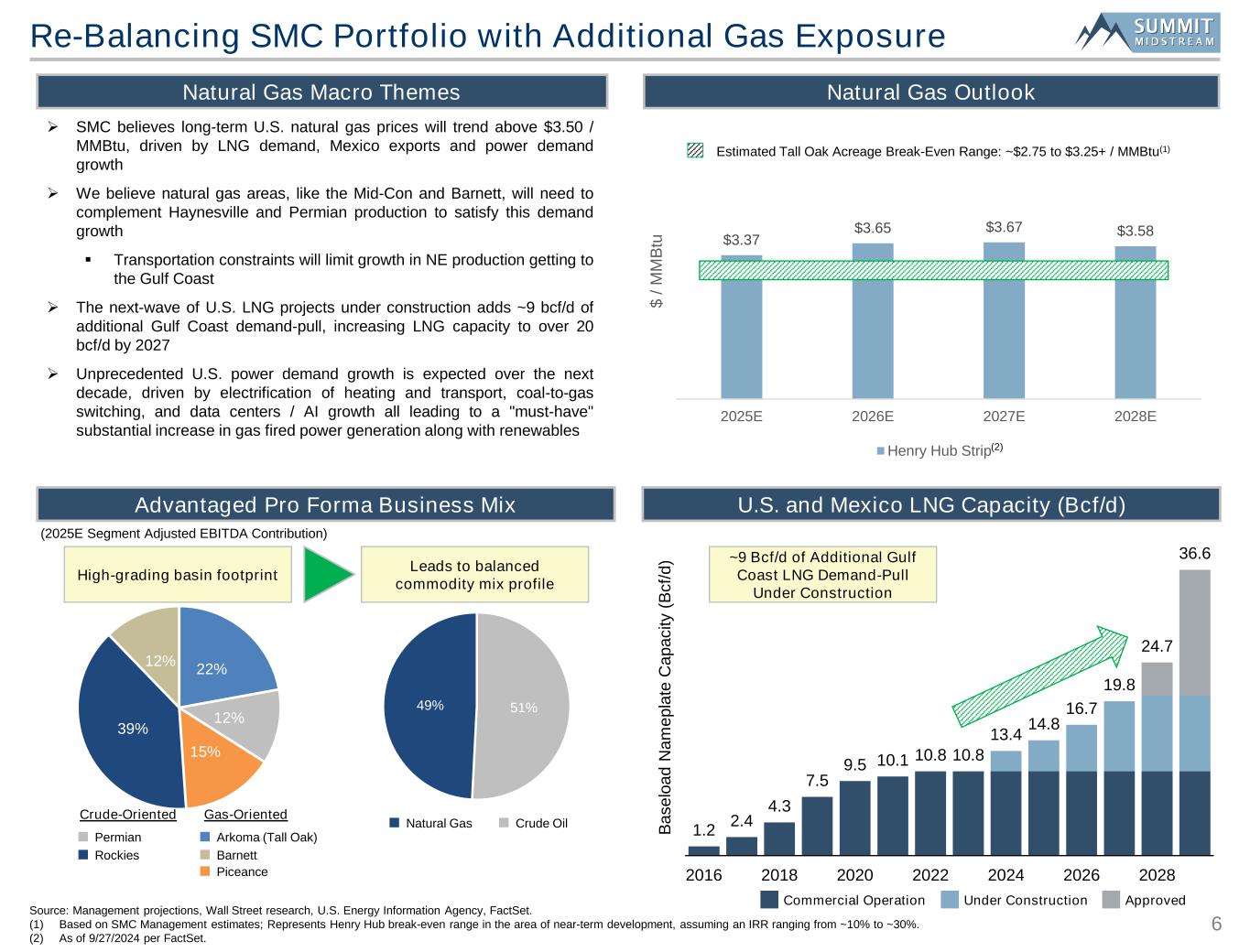

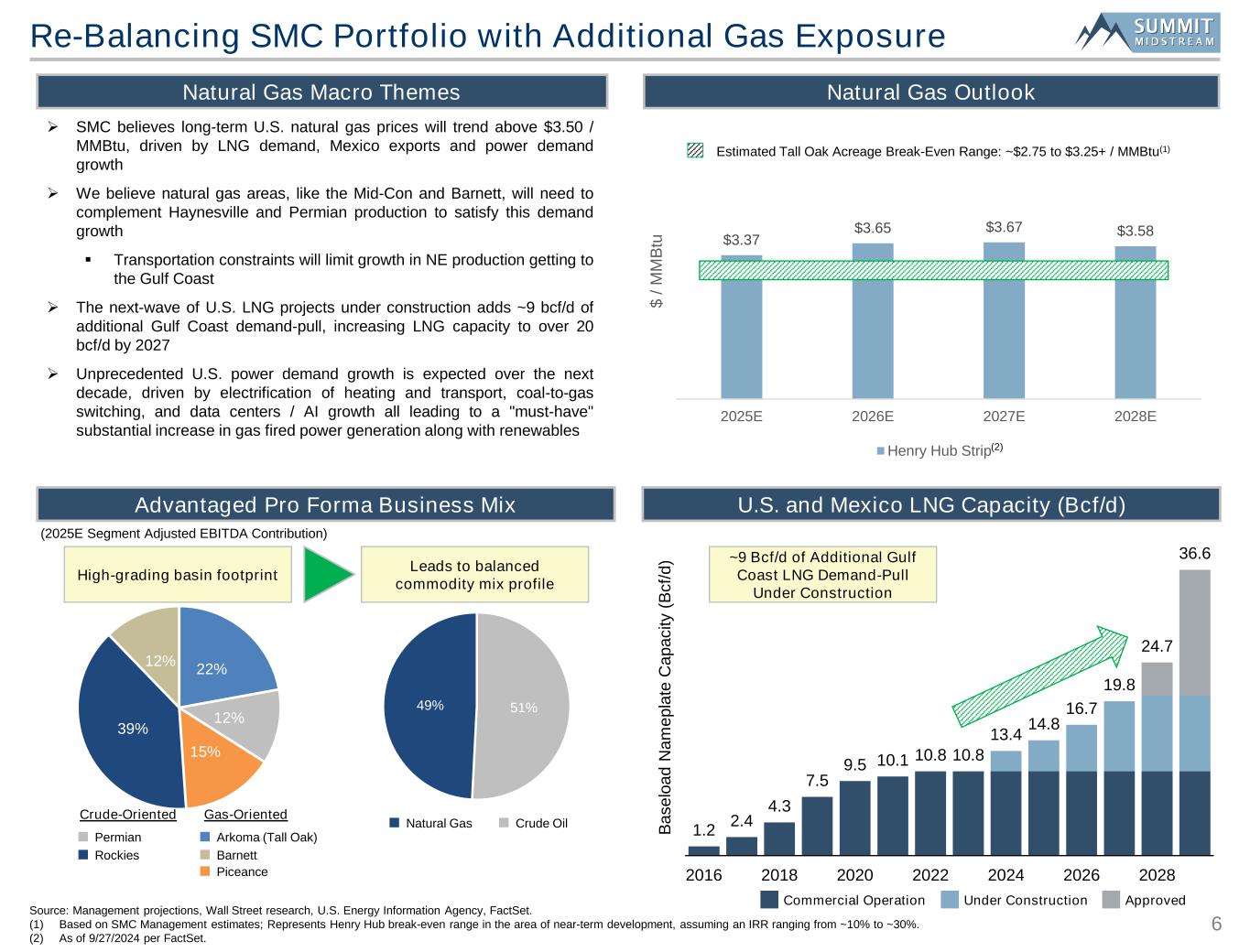

6 $3.37 $3.65 $3.67 $3.58 2025E 2026E 2027E 2028E $ / M M B tu Henry Hub Strip 1.2 2.4 4.3 7.5 9.5 10.1 10.8 10.8 13.4 14.8 16.7 19.8 24.7 36.6 2016 2018 2020 2022 2024 2026 2028 B a s e lo a d N a m e p la te C a p a c it y ( B c f/ d ) Re-Balancing SMC Portfolio with Additional Gas Exposure Natural Gas Macro Themes Natural Gas Outlook U.S. and Mexico LNG Capacity (Bcf/d) Estimated Tall Oak Acreage Break-Even Range: ~$2.75 to $3.25+ / MMBtu(1) ➢ SMC believes long-term U.S. natural gas prices will trend above $3.50 / MMBtu, driven by LNG demand, Mexico exports and power demand growth ➢ We believe natural gas areas, like the Mid-Con and Barnett, will need to complement Haynesville and Permian production to satisfy this demand growth ▪ Transportation constraints will limit growth in NE production getting to the Gulf Coast ➢ The next-wave of U.S. LNG projects under construction adds ~9 bcf/d of additional Gulf Coast demand-pull, increasing LNG capacity to over 20 bcf/d by 2027 ➢ Unprecedented U.S. power demand growth is expected over the next decade, driven by electrification of heating and transport, coal-to-gas switching, and data centers / AI growth all leading to a "must-have" substantial increase in gas fired power generation along with renewables Source: Management projections, Wall Street research, U.S. Energy Information Agency, FactSet. (1) Based on SMC Management estimates; Represents Henry Hub break-even range in the area of near-term development, assuming an IRR ranging from ~10% to ~30%. (2) As of 9/27/2024 per FactSet. Commercial Operation Under Construction Approved 51%49% Crude Oil Natural Gas 22% 12% 15% 39% 12% Leads to balanced commodity mix profile High-grading basin footprint Gas-OrientedCrude-Oriented Arkoma (Tall Oak) Barnett Piceance Permian Rockies Natural Gas Crude Oil Advantaged Pro Forma Business Mix (2025E Segment Adjusted EBITDA Contribution) (2) ~9 Bcf/d of Additional Gulf Coast LNG Demand-Pull Under Construction

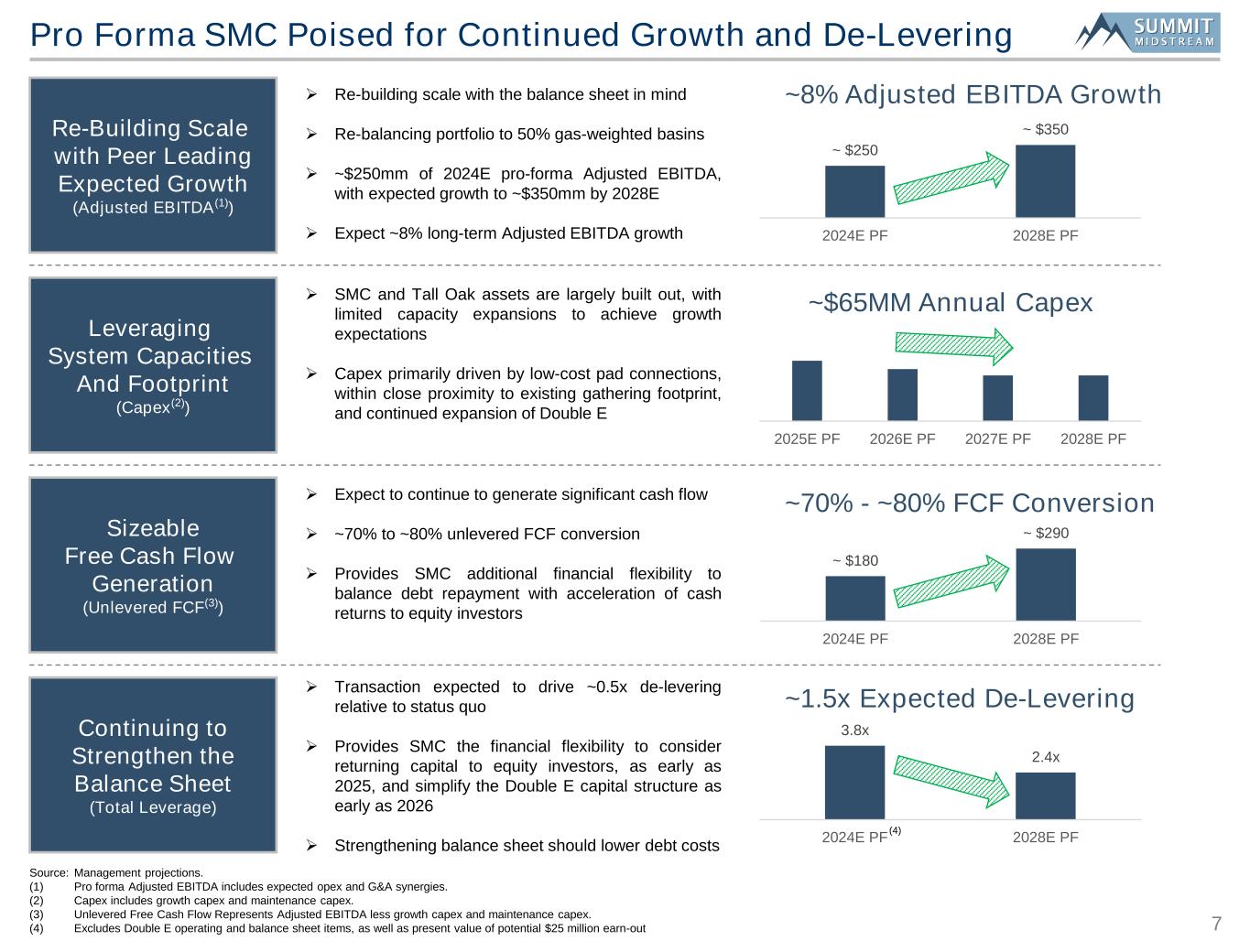

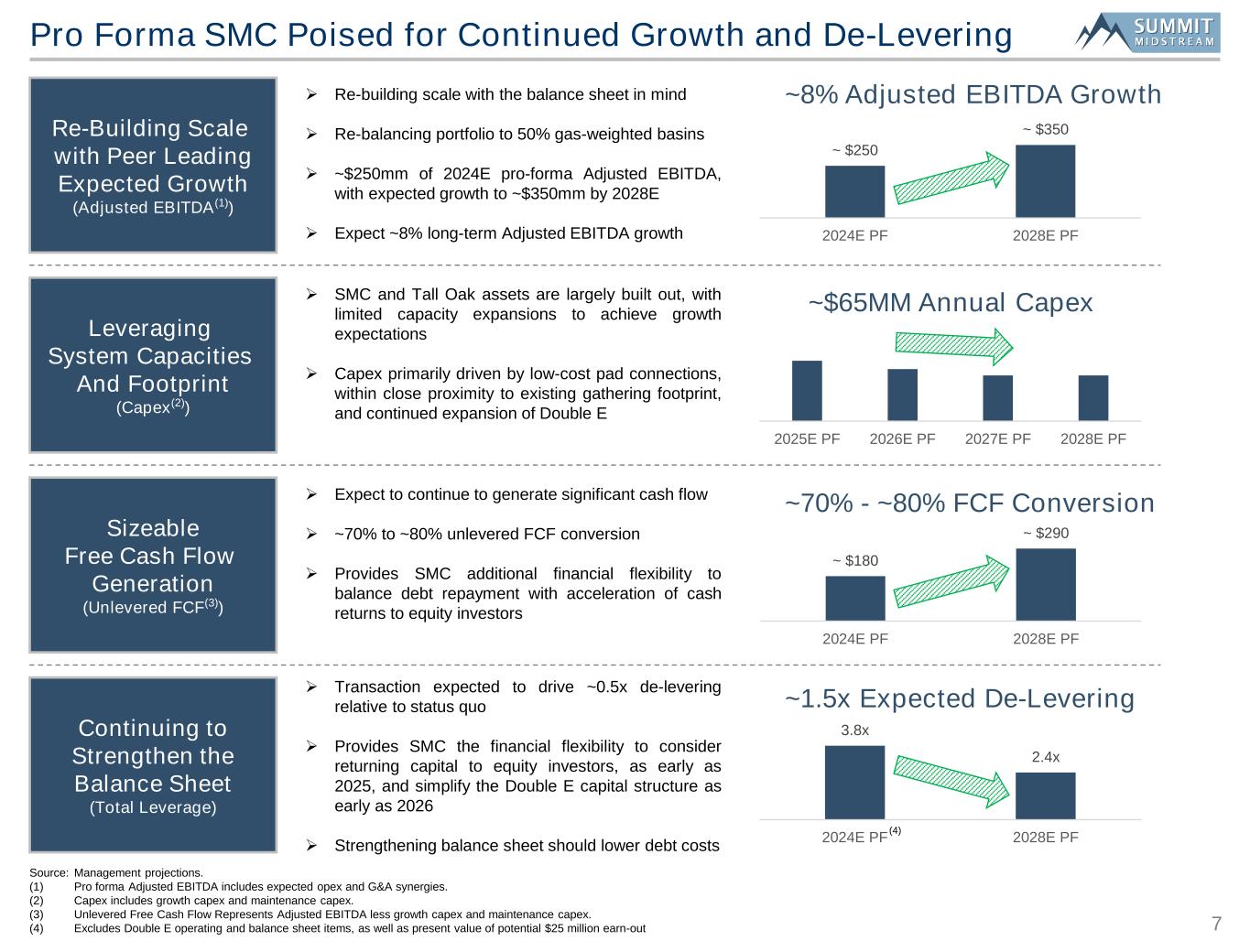

7 ~ $180 ~ $290 2024E PF 2028E PF 3.8x 2.4x 2024E PF 2028E PF ~ $250 ~ $350 2024E PF 2028E PF 2025E PF 2026E PF 2027E PF 2028E PF Pro Forma SMC Poised for Continued Growth and De-Levering Re-Building Scale with Peer Leading Expected Growth (Adjusted EBITDA(1)) Source: Management projections. (1) Pro forma Adjusted EBITDA includes expected opex and G&A synergies. (2) Capex includes growth capex and maintenance capex. (3) Unlevered Free Cash Flow Represents Adjusted EBITDA less growth capex and maintenance capex. (4) Excludes Double E operating and balance sheet items, as well as present value of potential $25 million earn-out ➢ Re-building scale with the balance sheet in mind ➢ Re-balancing portfolio to 50% gas-weighted basins ➢ ~$250mm of 2024E pro-forma Adjusted EBITDA, with expected growth to ~$350mm by 2028E ➢ Expect ~8% long-term Adjusted EBITDA growth Continuing to Strengthen the Balance Sheet (Total Leverage) Leveraging System Capacities And Footprint (Capex(2)) Sizeable Free Cash Flow Generation (Unlevered FCF(3)) ➢ SMC and Tall Oak assets are largely built out, with limited capacity expansions to achieve growth expectations ➢ Capex primarily driven by low-cost pad connections, within close proximity to existing gathering footprint, and continued expansion of Double E ➢ Expect to continue to generate significant cash flow ➢ ~70% to ~80% unlevered FCF conversion ➢ Provides SMC additional financial flexibility to balance debt repayment with acceleration of cash returns to equity investors ➢ Transaction expected to drive ~0.5x de-levering relative to status quo ➢ Provides SMC the financial flexibility to consider returning capital to equity investors, as early as 2025, and simplify the Double E capital structure as early as 2026 ➢ Strengthening balance sheet should lower debt costs ~8% Adjusted EBITDA Growth ~$65MM Annual Capex ~70% - ~80% FCF Conversion ~1.5x Expected De-Levering (4)

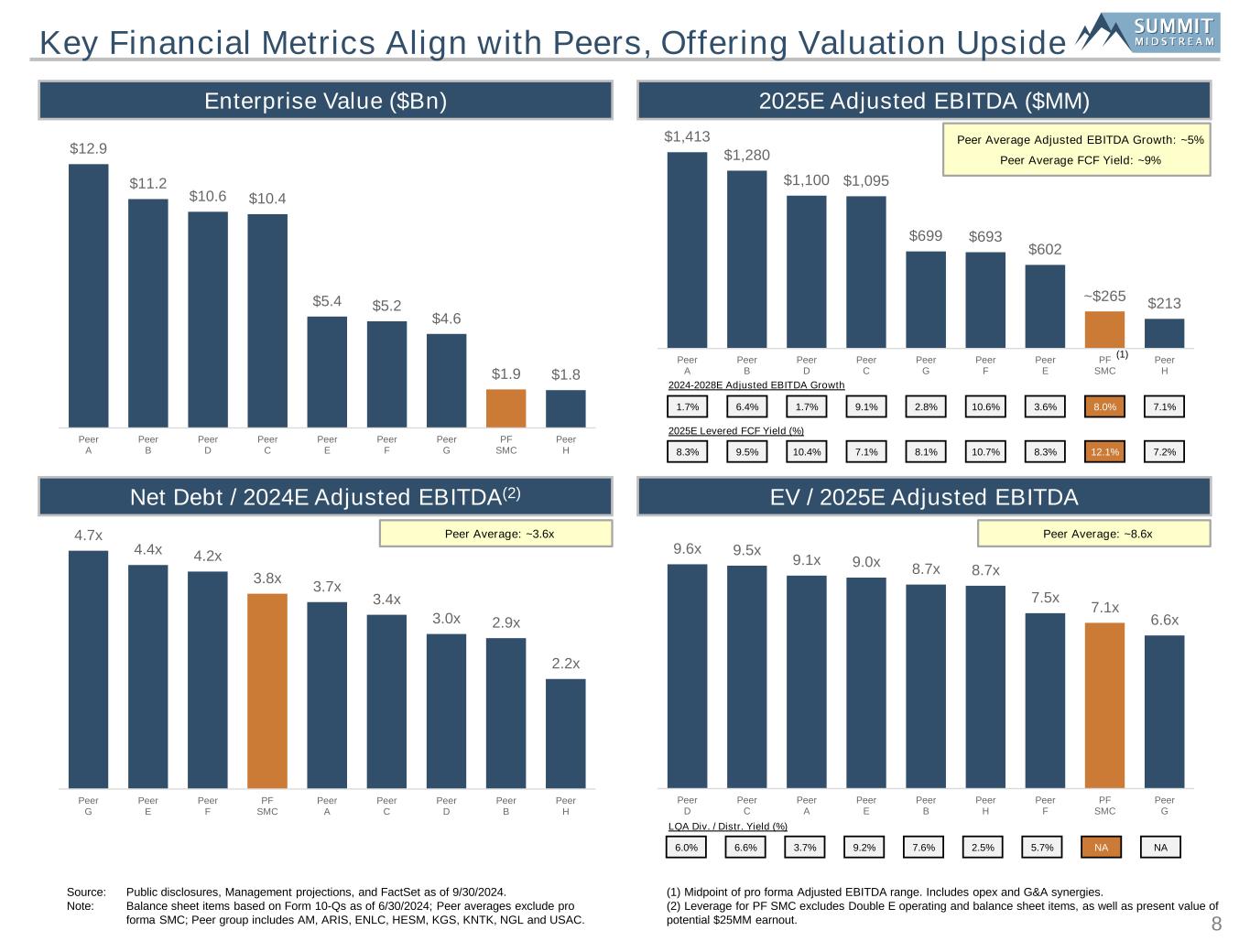

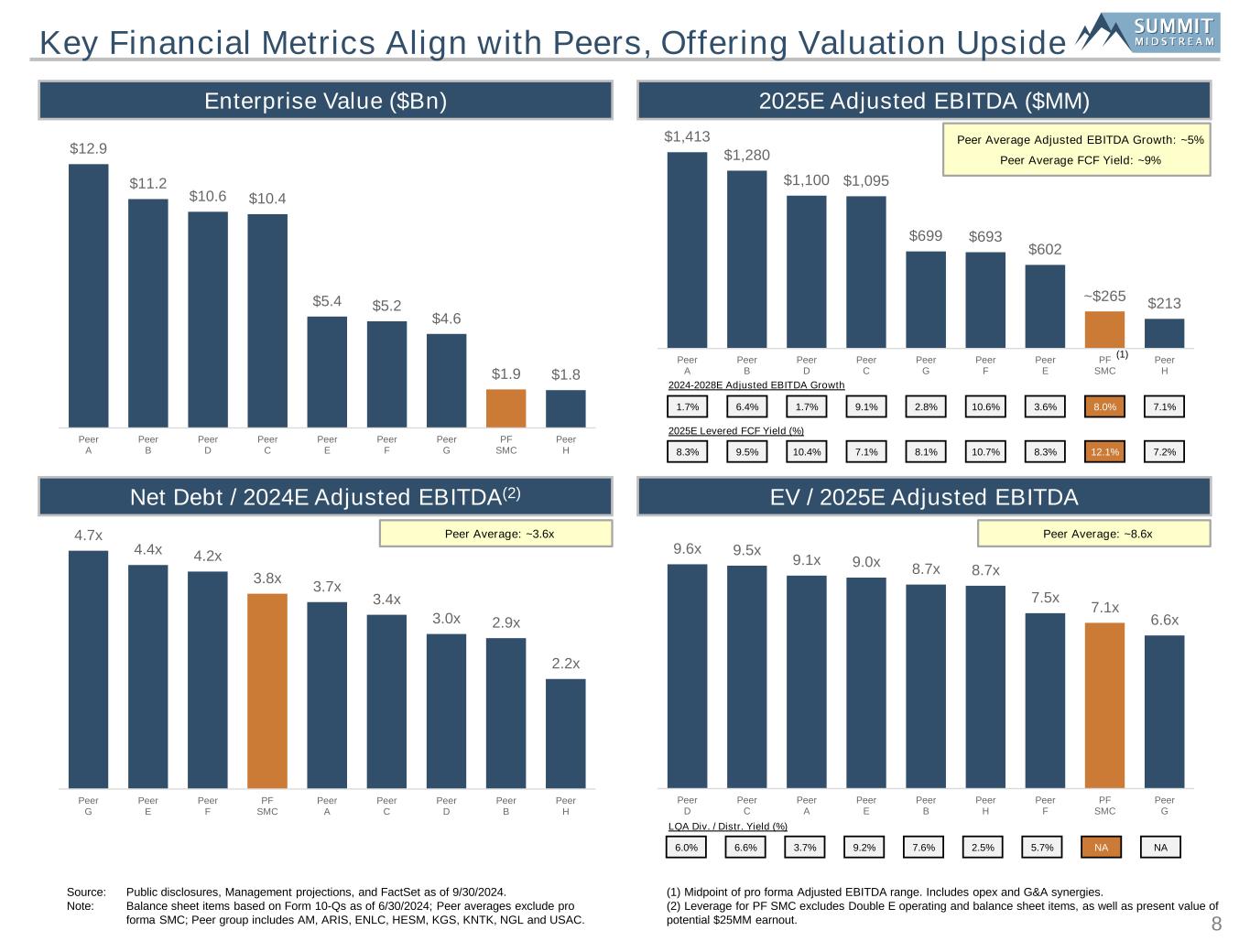

8 Key Financial Metrics Align with Peers, Offering Valuation Upside Enterprise Value ($Bn) 2025E Adjusted EBITDA ($MM) Net Debt / 2024E Adjusted EBITDA(2) EV / 2025E Adjusted EBITDA $12.9 $11.2 $10.6 $10.4 $5.4 $5.2 $4.6 $1.9 $1.8 Peer A Peer B Peer D Peer C Peer E Peer F Peer G PF SMC Peer H $1,413 $1,280 $1,100 $1,095 $699 $693 $602 ~$265 $213 Peer A Peer B Peer D Peer C Peer G Peer F Peer E PF SMC Peer H 6.0% 6.6% 3.7% 9.2% 7.6% 2.5% 5.7% NA Source: Public disclosures, Management projections, and FactSet as of 9/30/2024. Note: Balance sheet items based on Form 10-Qs as of 6/30/2024; Peer averages exclude pro forma SMC; Peer group includes AM, ARIS, ENLC, HESM, KGS, KNTK, NGL and USAC. (1) Midpoint of pro forma Adjusted EBITDA range. Includes opex and G&A synergies. (2) Leverage for PF SMC excludes Double E operating and balance sheet items, as well as present value of potential $25MM earnout. 4.7x 4.4x 4.2x 3.8x 3.7x 3.4x 3.0x 2.9x 2.2x Peer G Peer E Peer F PF SMC Peer A Peer C Peer D Peer B Peer H 9.6x 9.5x 9.1x 9.0x 8.7x 8.7x 7.5x 7.1x 6.6x Peer D Peer C Peer A Peer E Peer B Peer H Peer F PF SMC Peer G NA 8.3% 9.5% 10.4% 7.1% 8.1% 10.7% 8.3% 7.2%12.1% (1) 2024-2028E Adjusted EBITDA Growth 1.7% 6.4% 1.7% 9.1% 2.8% 10.6% 3.6% 7.1%8.0% 2025E Levered FCF Yield (%) LQA Div. / Distr. Yield (%) Peer Average Adjusted EBITDA Growth: ~5% Peer Average FCF Yield: ~9% Peer Average: ~8.6xPeer Average: ~3.6x

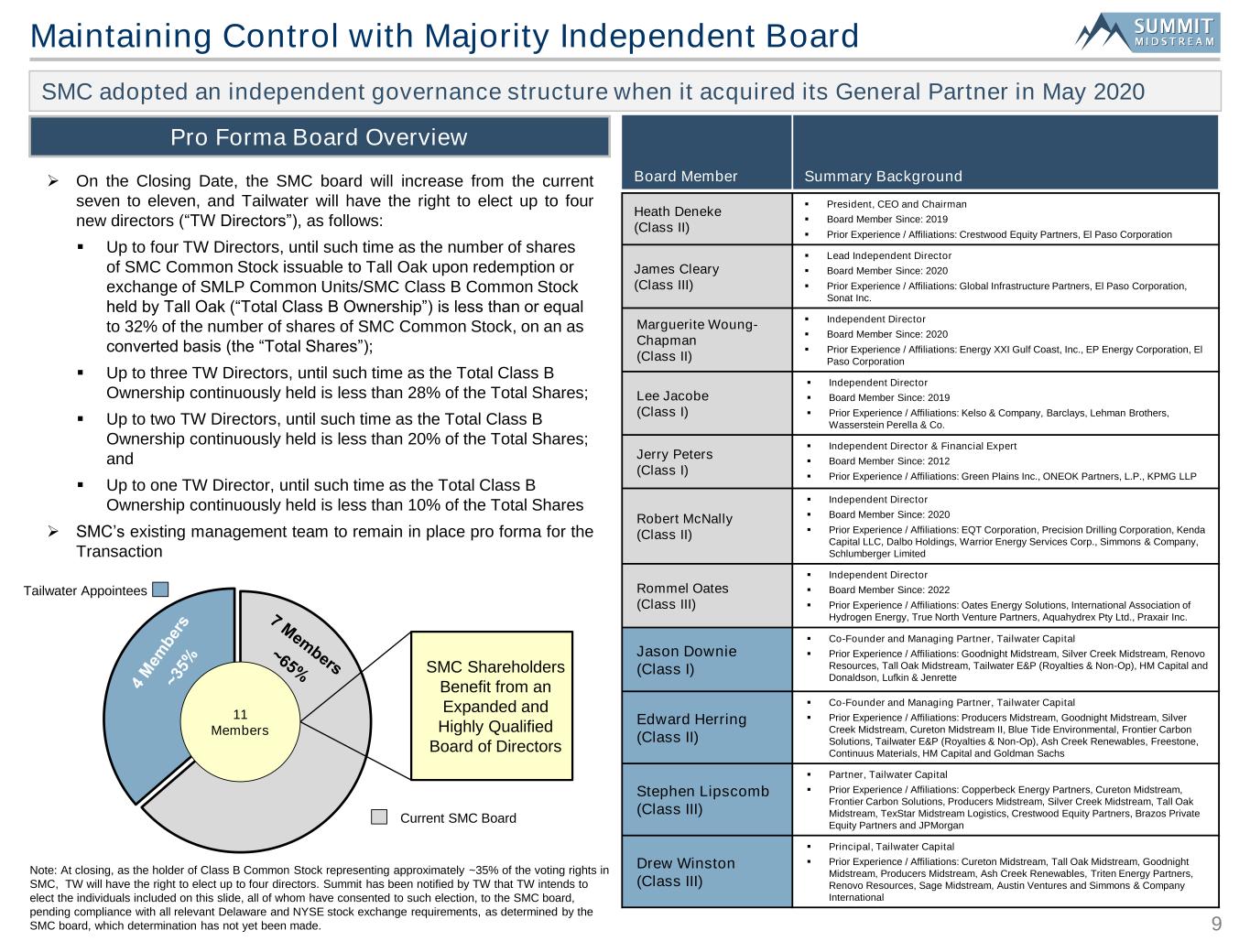

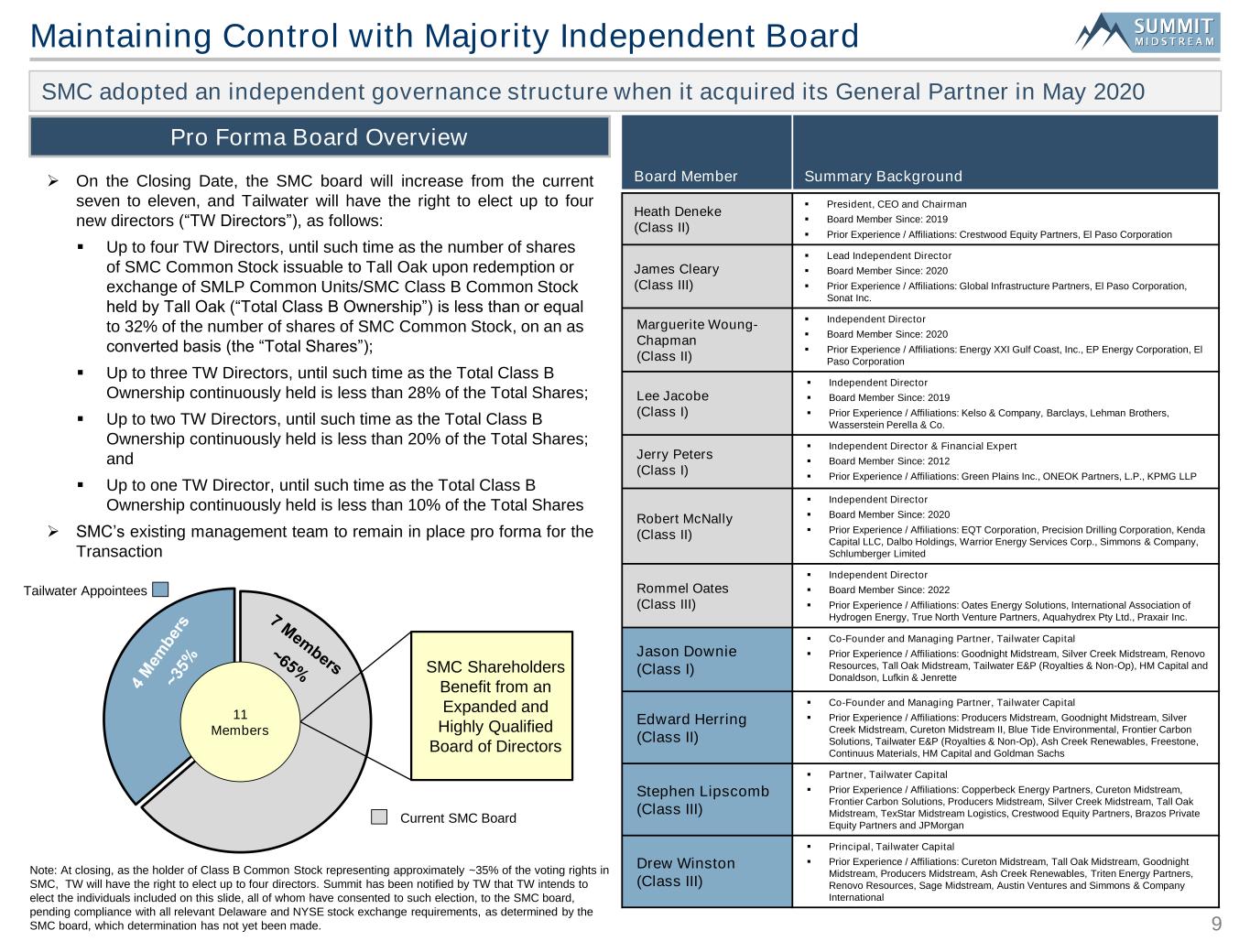

9 SMC adopted an independent governance structure when it acquired its General Partner in May 2020 Board Member Summary Background Heath Deneke (Class II) ▪ President, CEO and Chairman ▪ Board Member Since: 2019 ▪ Prior Experience / Affiliations: Crestwood Equity Partners, El Paso Corporation James Cleary (Class III) ▪ Lead Independent Director ▪ Board Member Since: 2020 ▪ Prior Experience / Affiliations: Global Infrastructure Partners, El Paso Corporation, Sonat Inc. Marguerite Woung- Chapman (Class II) ▪ Independent Director ▪ Board Member Since: 2020 ▪ Prior Experience / Affiliations: Energy XXI Gulf Coast, Inc., EP Energy Corporation, El Paso Corporation Lee Jacobe (Class I) ▪ Independent Director ▪ Board Member Since: 2019 ▪ Prior Experience / Affiliations: Kelso & Company, Barclays, Lehman Brothers, Wasserstein Perella & Co. Jerry Peters (Class I) ▪ Independent Director & Financial Expert ▪ Board Member Since: 2012 ▪ Prior Experience / Affiliations: Green Plains Inc., ONEOK Partners, L.P., KPMG LLP Robert McNally (Class II) ▪ Independent Director ▪ Board Member Since: 2020 ▪ Prior Experience / Affiliations: EQT Corporation, Precision Drilling Corporation, Kenda Capital LLC, Dalbo Holdings, Warrior Energy Services Corp., Simmons & Company, Schlumberger Limited Rommel Oates (Class III) ▪ Independent Director ▪ Board Member Since: 2022 ▪ Prior Experience / Affiliations: Oates Energy Solutions, International Association of Hydrogen Energy, True North Venture Partners, Aquahydrex Pty Ltd., Praxair Inc. Jason Downie (Class I) ▪ Co-Founder and Managing Partner, Tailwater Capital ▪ Prior Experience / Affiliations: Goodnight Midstream, Silver Creek Midstream, Renovo Resources, Tall Oak Midstream, Tailwater E&P (Royalties & Non-Op), HM Capital and Donaldson, Lufkin & Jenrette Edward Herring (Class II) ▪ Co-Founder and Managing Partner, Tailwater Capital ▪ Prior Experience / Affiliations: Producers Midstream, Goodnight Midstream, Silver Creek Midstream, Cureton Midstream II, Blue Tide Environmental, Frontier Carbon Solutions, Tailwater E&P (Royalties & Non-Op), Ash Creek Renewables, Freestone, Continuus Materials, HM Capital and Goldman Sachs Stephen Lipscomb (Class III) ▪ Partner, Tailwater Capital ▪ Prior Experience / Affiliations: Copperbeck Energy Partners, Cureton Midstream, Frontier Carbon Solutions, Producers Midstream, Silver Creek Midstream, Tall Oak Midstream, TexStar Midstream Logistics, Crestwood Equity Partners, Brazos Private Equity Partners and JPMorgan Drew Winston (Class III) ▪ Principal, Tailwater Capital ▪ Prior Experience / Affiliations: Cureton Midstream, Tall Oak Midstream, Goodnight Midstream, Producers Midstream, Ash Creek Renewables, Triten Energy Partners, Renovo Resources, Sage Midstream, Austin Ventures and Simmons & Company International Pro Forma Board Overview Maintaining Control with Majority Independent Board ➢ On the Closing Date, the SMC board will increase from the current seven to eleven, and Tailwater will have the right to elect up to four new directors (“TW Directors”), as follows: ▪ Up to four TW Directors, until such time as the number of shares of SMC Common Stock issuable to Tall Oak upon redemption or exchange of SMLP Common Units/SMC Class B Common Stock held by Tall Oak (“Total Class B Ownership”) is less than or equal to 32% of the number of shares of SMC Common Stock, on an as converted basis (the “Total Shares”); ▪ Up to three TW Directors, until such time as the Total Class B Ownership continuously held is less than 28% of the Total Shares; ▪ Up to two TW Directors, until such time as the Total Class B Ownership continuously held is less than 20% of the Total Shares; and ▪ Up to one TW Director, until such time as the Total Class B Ownership continuously held is less than 10% of the Total Shares ➢ SMC’s existing management team to remain in place pro forma for the Transaction Tailwater Appointees Current SMC Board 11 Members SMC Shareholders Benefit from an Expanded and Highly Qualified Board of Directors Note: At closing, as the holder of Class B Common Stock representing approximately ~35% of the voting rights in SMC, TW will have the right to elect up to four directors. Summit has been notified by TW that TW intends to elect the individuals included on this slide, all of whom have consented to such election, to the SMC board, pending compliance with all relevant Delaware and NYSE stock exchange requirements, as determined by the SMC board, which determination has not yet been made.

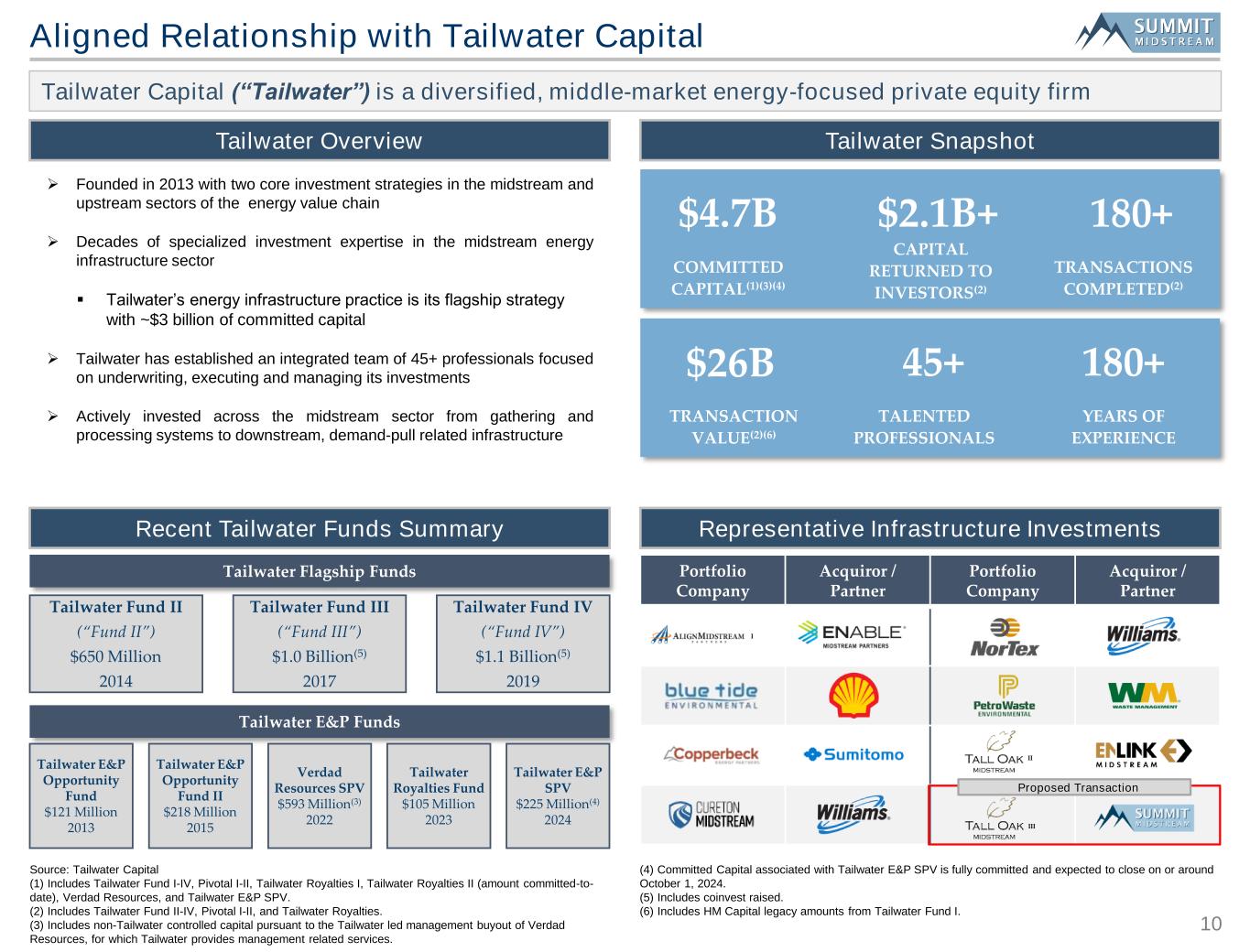

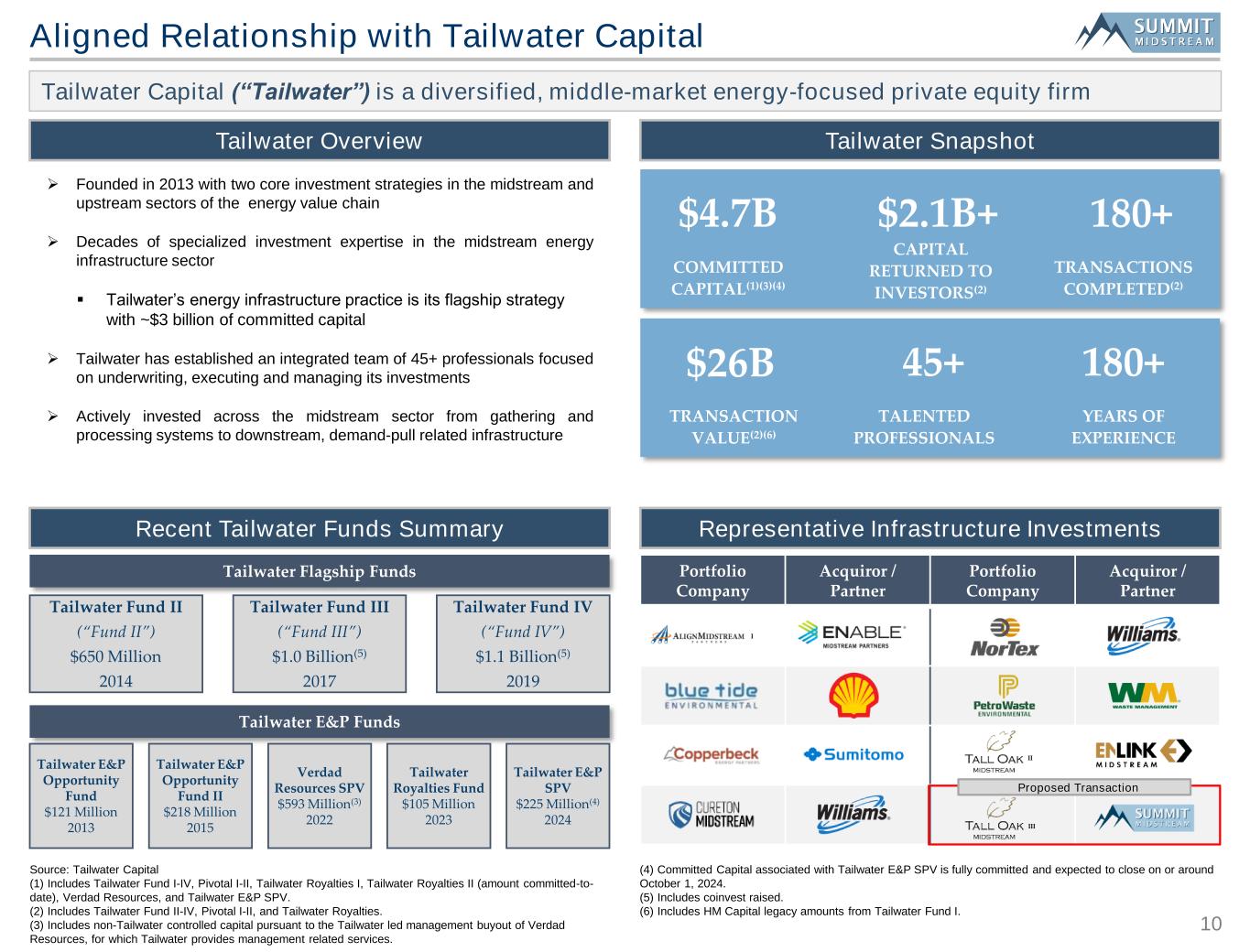

10 Source: Tailwater Capital (1) Includes Tailwater Fund I-IV, Pivotal I-II, Tailwater Royalties I, Tailwater Royalties II (amount committed-to- date), Verdad Resources, and Tailwater E&P SPV. (2) Includes Tailwater Fund II-IV, Pivotal I-II, and Tailwater Royalties. (3) Includes non-Tailwater controlled capital pursuant to the Tailwater led management buyout of Verdad Resources, for which Tailwater provides management related services. Aligned Relationship with Tailwater Capital Tailwater Overview ➢ Founded in 2013 with two core investment strategies in the midstream and upstream sectors of the energy value chain ➢ Decades of specialized investment expertise in the midstream energy infrastructure sector ▪ Tailwater’s energy infrastructure practice is its flagship strategy with ~$3 billion of committed capital ➢ Tailwater has established an integrated team of 45+ professionals focused on underwriting, executing and managing its investments ➢ Actively invested across the midstream sector from gathering and processing systems to downstream, demand-pull related infrastructure Tailwater Capital (“Tailwater”) is a diversified, middle-market energy-focused private equity firm Recent Tailwater Funds Summary Tailwater Flagship Funds Tailwater E&P Funds Tailwater E&P Opportunity Fund $121 Million 2013 Tailwater E&P Opportunity Fund II $218 Million 2015 Verdad Resources SPV $593 Million(3) 2022 Tailwater Royalties Fund $105 Million 2023 Tailwater E&P SPV $225 Million(4) 2024 Tailwater Fund II (“Fund II”) $650 Million 2014 Tailwater Fund III (“Fund III”) $1.0 Billion(5) 2017 Tailwater Fund IV (“Fund IV”) $1.1 Billion(5) 2019 Tailwater Snapshot Representative Infrastructure Investments $4.7B $2.1B+ COMMITTED CAPITAL(1)(3)(4) CAPITAL RETURNED TO INVESTORS(2) $26B 180+ TRANSACTION VALUE(2)(6) YEARS OF EXPERIENCE 45+ TALENTED PROFESSIONALS 180+ TRANSACTIONS COMPLETED(2) Portfolio Company Acquiror / Partner Portfolio Company Acquiror / Partner I II III Proposed Transaction (4) Committed Capital associated with Tailwater E&P SPV is fully committed and expected to close on or around October 1, 2024. (5) Includes coinvest raised. (6) Includes HM Capital legacy amounts from Tailwater Fund I.

Transaction Details & Tall Oak Overview

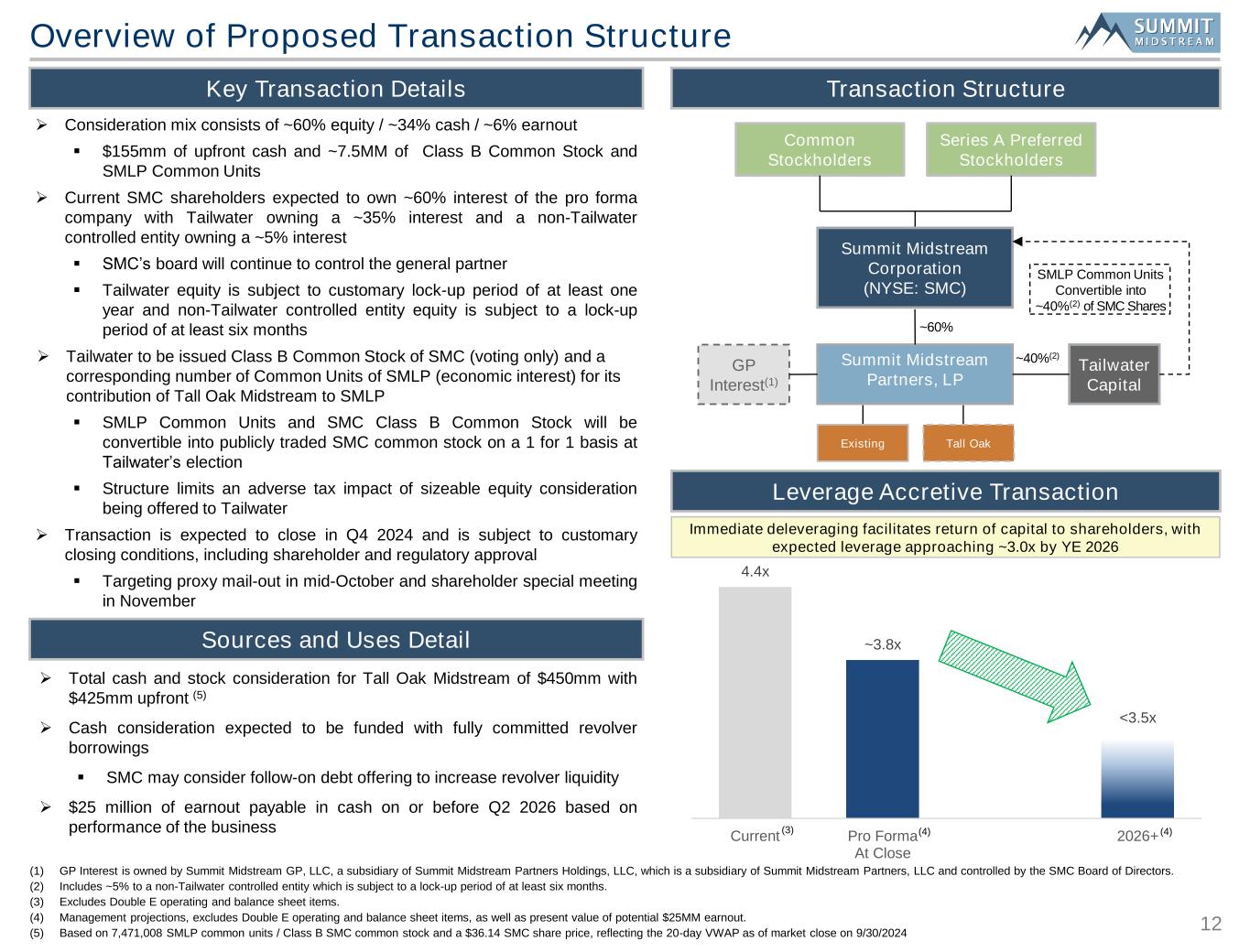

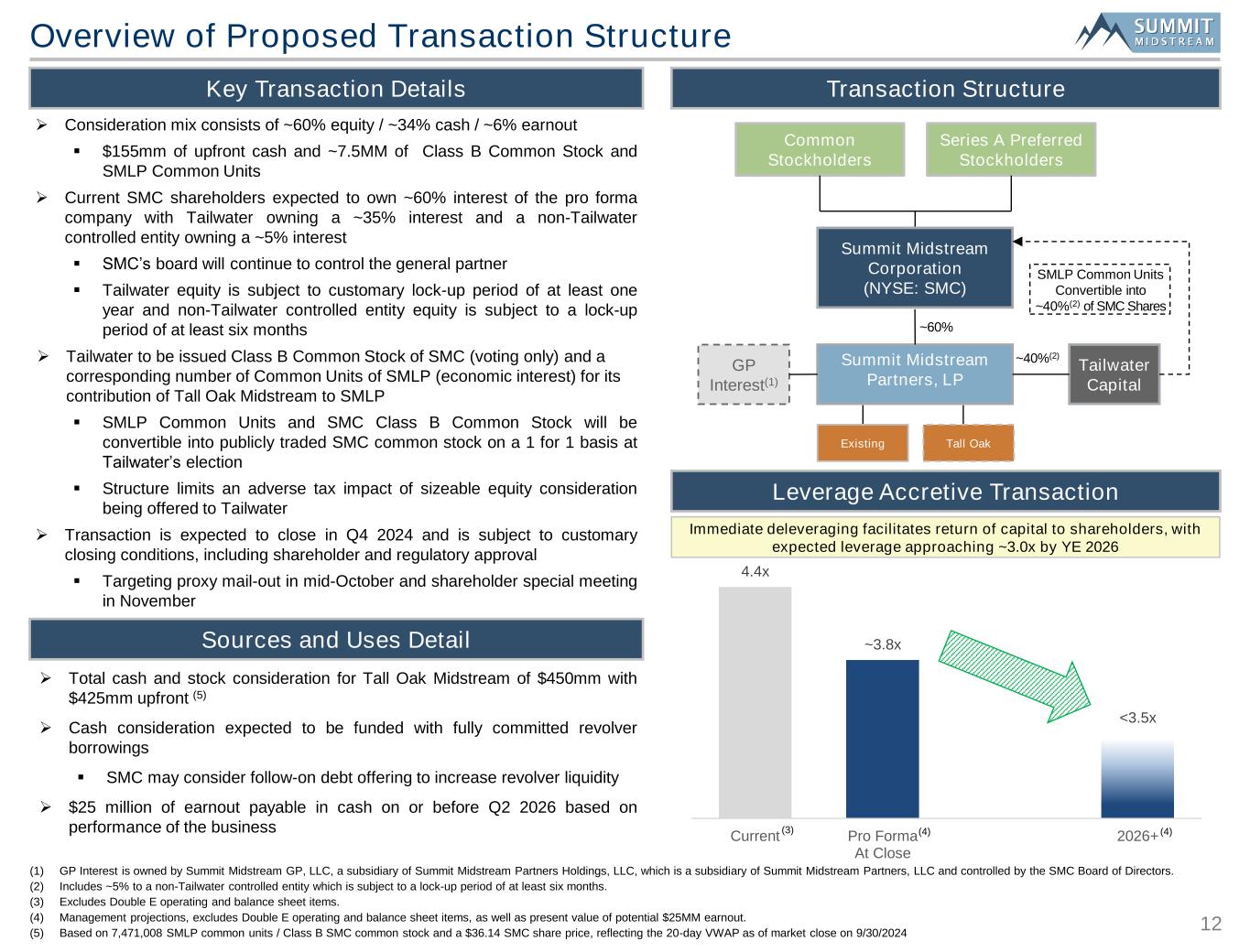

12 4.4x ~3.8x <3.5x Current Pro Forma At Close 2026+ Key Transaction Details Overview of Proposed Transaction Structure Sources and Uses Detail ➢ Consideration mix consists of ~60% equity / ~34% cash / ~6% earnout ▪ $155mm of upfront cash and ~7.5MM of Class B Common Stock and SMLP Common Units ➢ Current SMC shareholders expected to own ~60% interest of the pro forma company with Tailwater owning a ~35% interest and a non-Tailwater controlled entity owning a ~5% interest ▪ SMC’s board will continue to control the general partner ▪ Tailwater equity is subject to customary lock-up period of at least one year and non-Tailwater controlled entity equity is subject to a lock-up period of at least six months ➢ Tailwater to be issued Class B Common Stock of SMC (voting only) and a corresponding number of Common Units of SMLP (economic interest) for its contribution of Tall Oak Midstream to SMLP ▪ SMLP Common Units and SMC Class B Common Stock will be convertible into publicly traded SMC common stock on a 1 for 1 basis at Tailwater’s election ▪ Structure limits an adverse tax impact of sizeable equity consideration being offered to Tailwater ➢ Transaction is expected to close in Q4 2024 and is subject to customary closing conditions, including shareholder and regulatory approval ▪ Targeting proxy mail-out in mid-October and shareholder special meeting in November ➢ Total cash and stock consideration for Tall Oak Midstream of $450mm with $425mm upfront (5) ➢ Cash consideration expected to be funded with fully committed revolver borrowings ▪ SMC may consider follow-on debt offering to increase revolver liquidity ➢ $25 million of earnout payable in cash on or before Q2 2026 based on performance of the business Leverage Accretive Transaction Immediate deleveraging facilitates return of capital to shareholders, with expected leverage approaching ~3.0x by YE 2026 Summit Midstream Corporation (NYSE: SMC) Summit Midstream Partners, LP Series A Preferred Stockholders Common Stockholders Tailwater Capital GP Interest(1) ~60% ~40%(2) SMLP Common Units Convertible into ~40%(2) of SMC Shares Transaction Structure (1) GP Interest is owned by Summit Midstream GP, LLC, a subsidiary of Summit Midstream Partners Holdings, LLC, which is a subsidiary of Summit Midstream Partners, LLC and controlled by the SMC Board of Directors. (2) Includes ~5% to a non-Tailwater controlled entity which is subject to a lock-up period of at least six months. (3) Excludes Double E operating and balance sheet items. (4) Management projections, excludes Double E operating and balance sheet items, as well as present value of potential $25MM earnout. (5) Based on 7,471,008 SMLP common units / Class B SMC common stock and a $36.14 SMC share price, reflecting the 20-day VWAP as of market close on 9/30/2024 Existing Tall Oak (4)(3) (4)

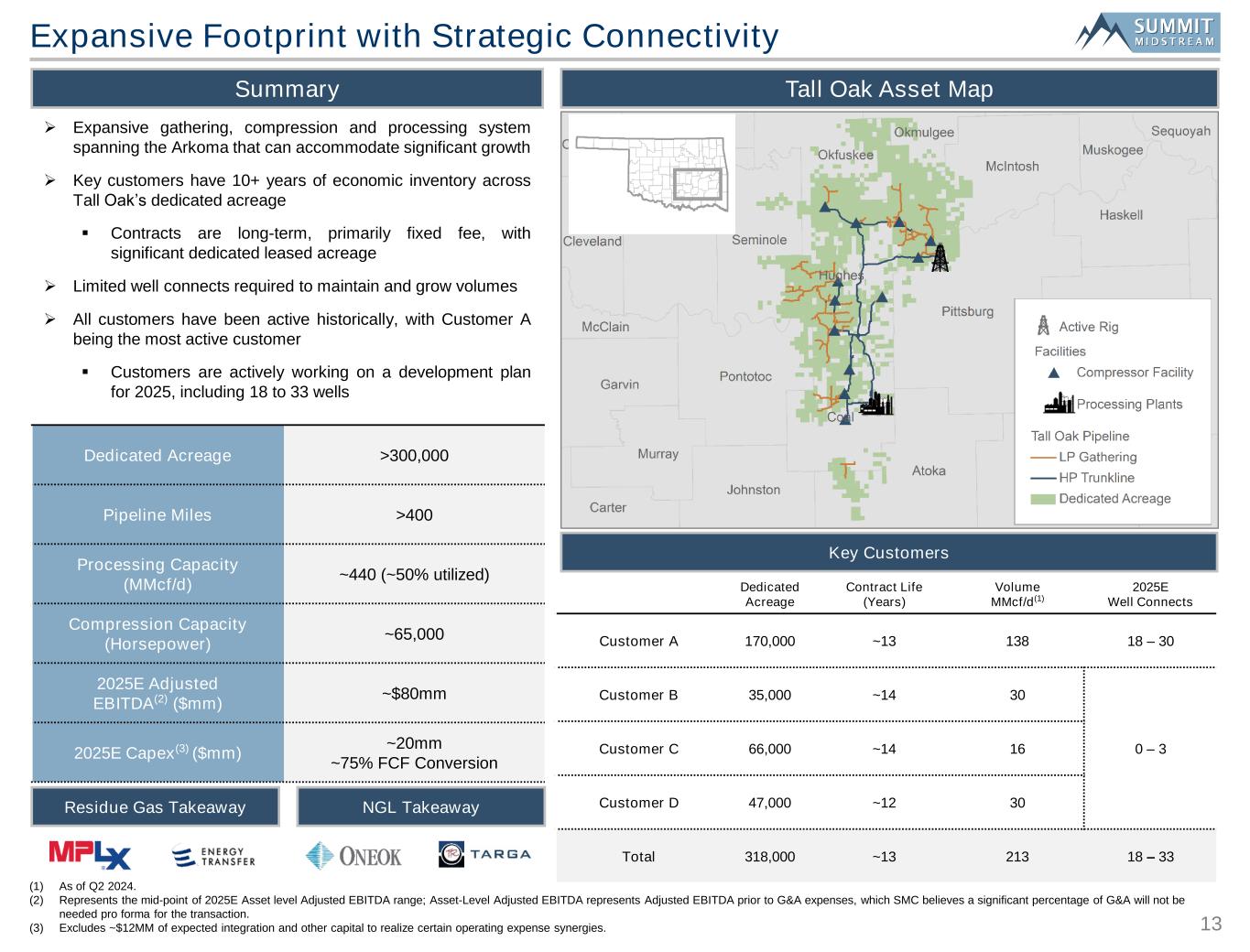

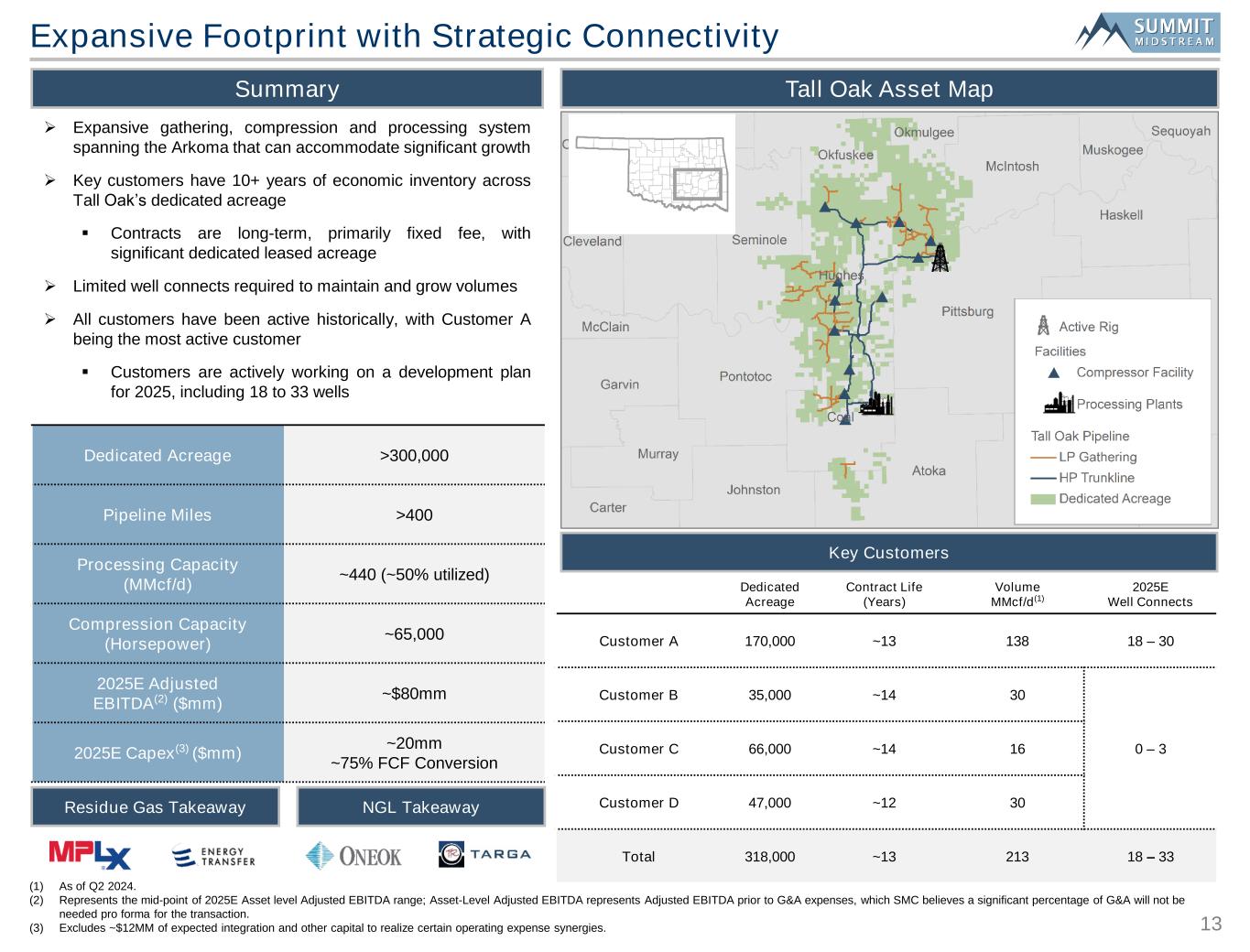

13 Expansive Footprint with Strategic Connectivity Tall Oak Asset Map Key Customers Summary Dedicated Acreage Contract Life (Years) Volume MMcf/d(1) 2025E Well Connects Customer A 170,000 ~13 138 18 – 30 Customer B 35,000 ~14 30 0 – 3Customer C 66,000 ~14 16 Customer D 47,000 ~12 30 Total 318,000 ~13 213 18 – 33 Dedicated Acreage >300,000 Pipeline Miles >400 Processing Capacity (MMcf/d) ~440 (~50% utilized) Compression Capacity (Horsepower) ~65,000 2025E Adjusted EBITDA(2) ($mm) ~$80mm 2025E Capex(3) ($mm) ~20mm ~75% FCF Conversion Residue Gas Takeaway NGL Takeaway (1) As of Q2 2024. (2) Represents the mid-point of 2025E Asset level Adjusted EBITDA range; Asset-Level Adjusted EBITDA represents Adjusted EBITDA prior to G&A expenses, which SMC believes a significant percentage of G&A will not be needed pro forma for the transaction. (3) Excludes ~$12MM of expected integration and other capital to realize certain operating expense synergies. ➢ Expansive gathering, compression and processing system spanning the Arkoma that can accommodate significant growth ➢ Key customers have 10+ years of economic inventory across Tall Oak’s dedicated acreage ▪ Contracts are long-term, primarily fixed fee, with significant dedicated leased acreage ➢ Limited well connects required to maintain and grow volumes ➢ All customers have been active historically, with Customer A being the most active customer ▪ Customers are actively working on a development plan for 2025, including 18 to 33 wells

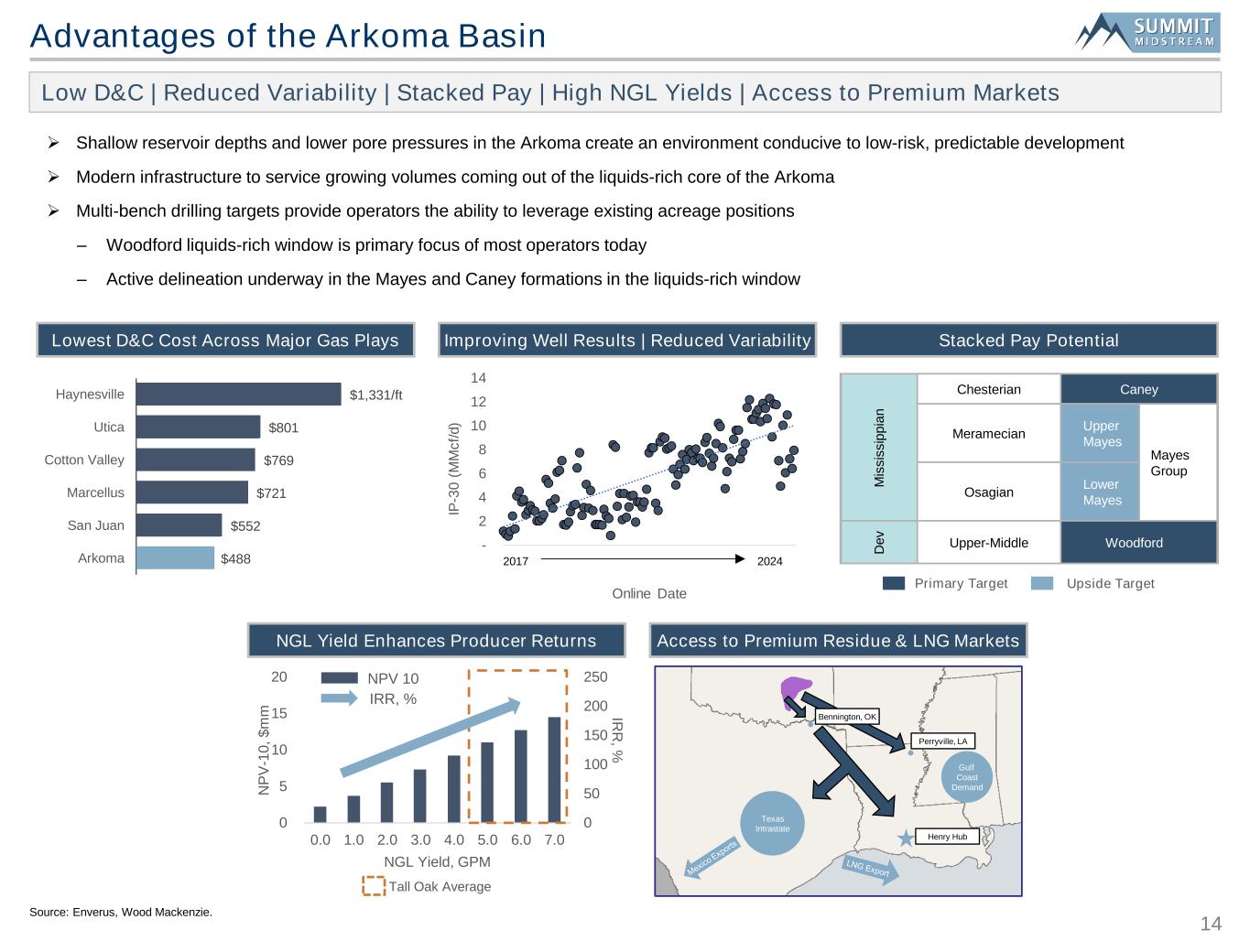

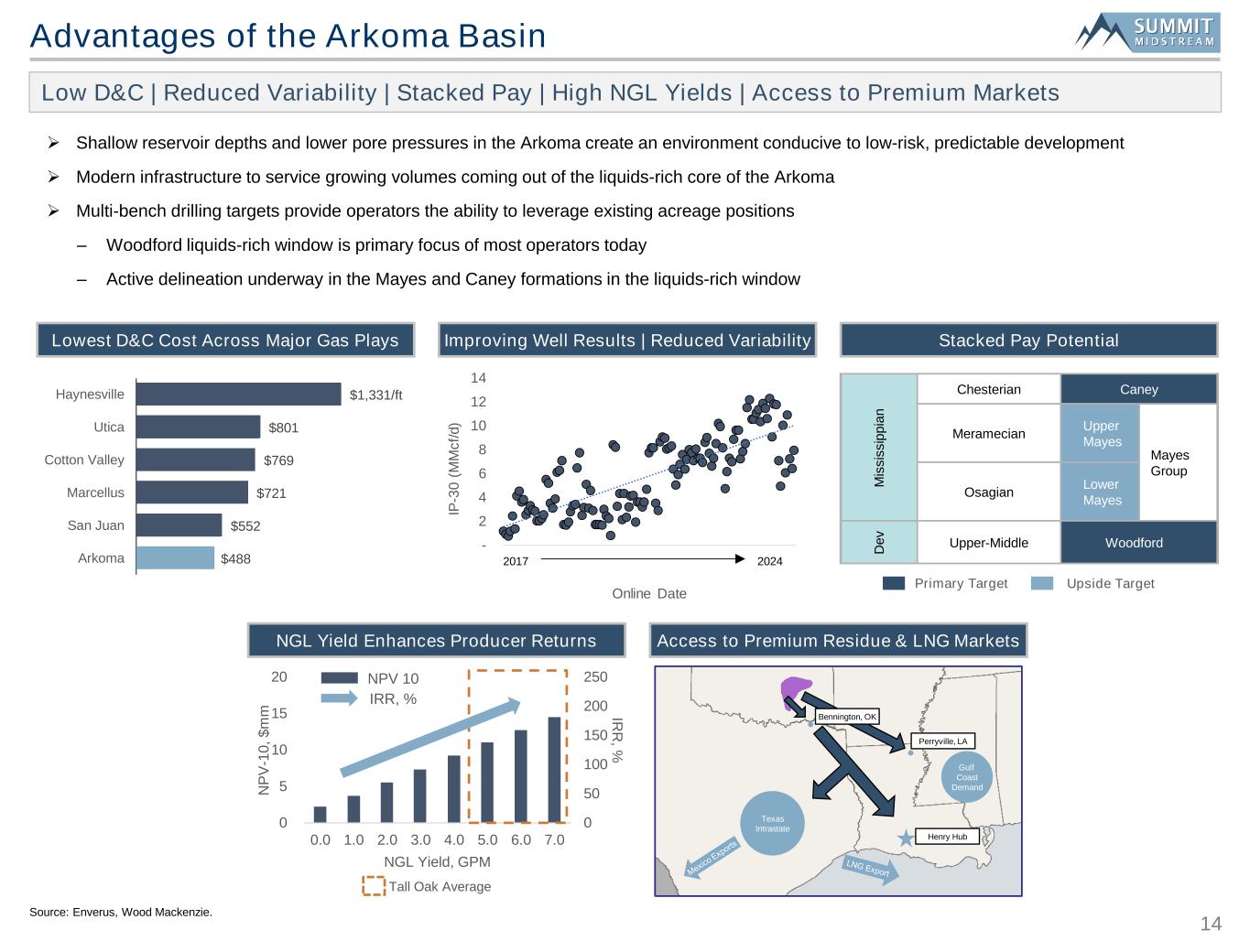

14 Advantages of the Arkoma Basin NGL Yield Enhances Producer Returns ➢ Shallow reservoir depths and lower pore pressures in the Arkoma create an environment conducive to low-risk, predictable development ➢ Modern infrastructure to service growing volumes coming out of the liquids-rich core of the Arkoma ➢ Multi-bench drilling targets provide operators the ability to leverage existing acreage positions – Woodford liquids-rich window is primary focus of most operators today – Active delineation underway in the Mayes and Caney formations in the liquids-rich window Source: Enverus, Wood Mackenzie. Lowest D&C Cost Across Major Gas Plays Stacked Pay PotentialImproving Well Results | Reduced Variability Access to Premium Residue & LNG Markets - 2 4 6 8 10 12 14 IP -3 0 ( M M c f/ d ) Online Date 2017 2024 M is s is s ip p ia n Chesterian Caney Meramecian Upper Mayes Mayes Group Osagian Lower Mayes D e v Upper-Middle Woodford Primary Target Upside Target Texas Intrastate Henry Hub Gulf Coast Demand Perryville, LA Bennington, OK $488 $552 $721 $769 $801 $1,331/ft Arkoma San Juan Marcellus Cotton Valley Utica Haynesville 0 50 100 150 200 250 0 5 10 15 20 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 IR R , % N P V -1 0 , $ m m NGL Yield, GPM NPV10 IRR, % Tall Oak Average NPV 10 IRR, % Low D&C | Reduced Variability | Stacked Pay | High NGL Yields | Access to Premium Markets

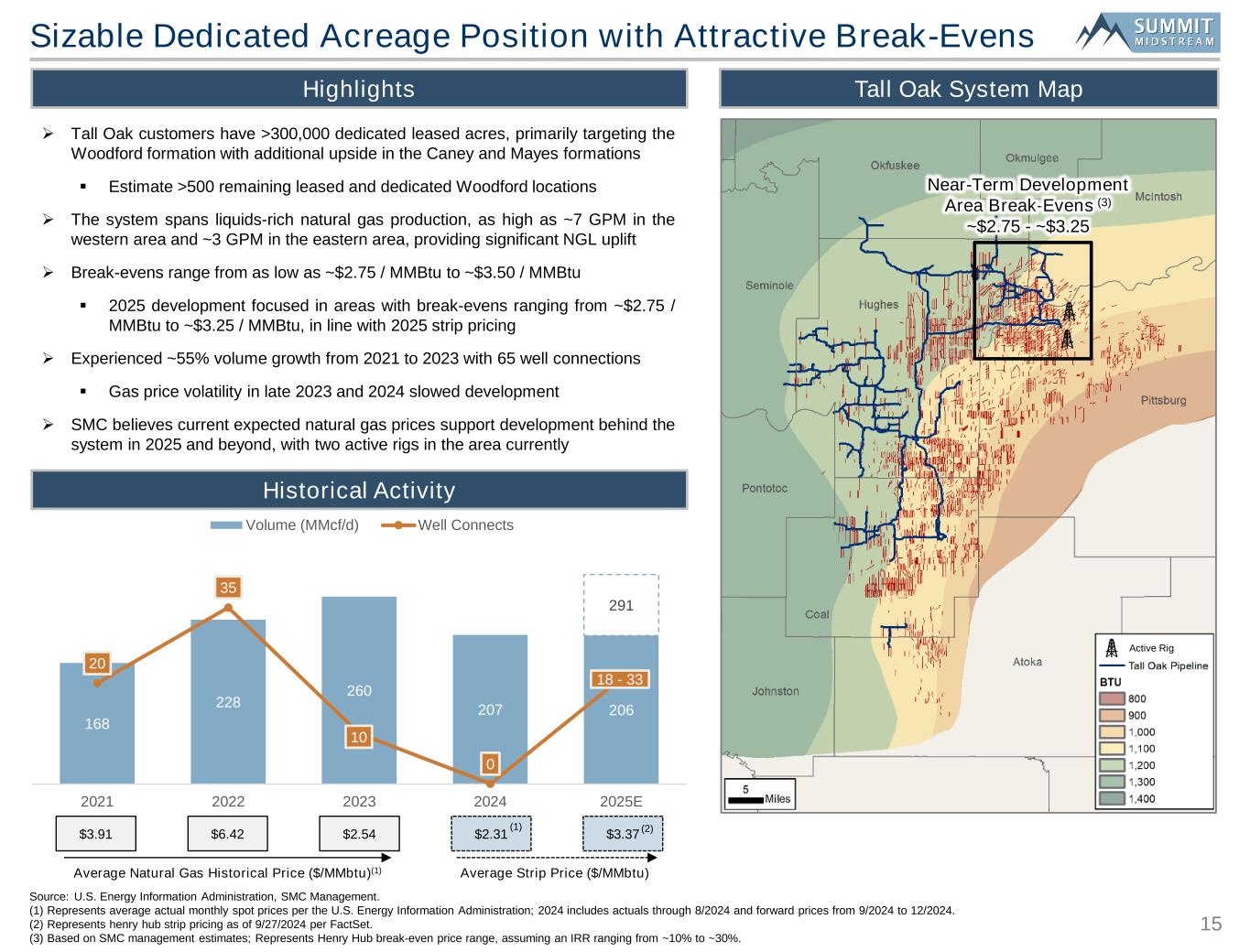

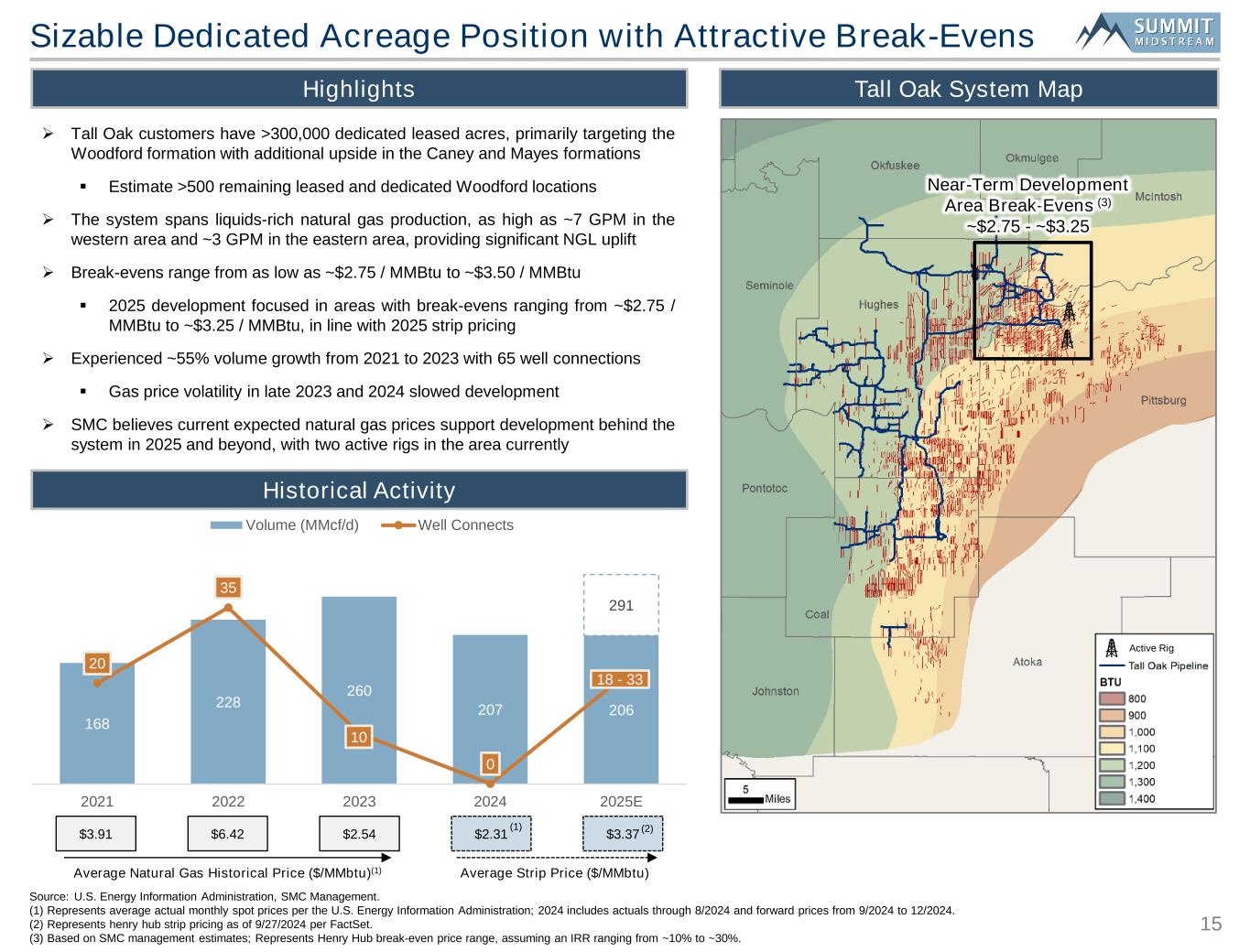

15 168 228 260 207 206 291 20 35 10 0 18 - 33 2021 2022 2023 2024 2025E Volume (MMcf/d) Well Connects Sizable Dedicated Acreage Position with Attractive Break-Evens Highlights Historical Activity Tall Oak System Map Active Rig Average Natural Gas Historical Price ($/MMbtu)(1) $3.91 $6.42 $2.54 $2.31 $3.37 Average Strip Price ($/MMbtu) Source: U.S. Energy Information Administration, SMC Management. (1) Represents average actual monthly spot prices per the U.S. Energy Information Administration; 2024 includes actuals through 8/2024 and forward prices from 9/2024 to 12/2024. (2) Represents henry hub strip pricing as of 9/27/2024 per FactSet. (3) Based on SMC management estimates; Represents Henry Hub break-even price range, assuming an IRR ranging from ~10% to ~30%. ➢ Tall Oak customers have >300,000 dedicated leased acres, primarily targeting the Woodford formation with additional upside in the Caney and Mayes formations ▪ Estimate >500 remaining leased and dedicated Woodford locations ➢ The system spans liquids-rich natural gas production, as high as ~7 GPM in the western area and ~3 GPM in the eastern area, providing significant NGL uplift ➢ Break-evens range from as low as ~$2.75 / MMBtu to ~$3.50 / MMBtu ▪ 2025 development focused in areas with break-evens ranging from ~$2.75 / MMBtu to ~$3.25 / MMBtu, in line with 2025 strip pricing ➢ Experienced ~55% volume growth from 2021 to 2023 with 65 well connections ▪ Gas price volatility in late 2023 and 2024 slowed development ➢ SMC believes current expected natural gas prices support development behind the system in 2025 and beyond, with two active rigs in the area currently (1) Near-Term Development Area Break-Evens (3) ~$2.75 - ~$3.25 (2)

16 $81 $66 ~$65 ~$95 $0 $30 $60 $90 $120 2023A 2024E 2025E Tall Oak Financial Profile and 2025 Outlook Overview Adjusted EBITDA(1) ($mm) 2025E Projected Adjusted EBITDA and Capex Adjusted EBITDA(1) Capex(3) 80% 20% Growth Maintenance ~80% ~20% Fixed Fees Settlement Margin ~$80mm Source: Management projections. (1) Represents Asset-Level Adjusted EBITDA. (2) Please see Asset-Level Adjusted EBITDA reconciliation in the appendix. (3) Excludes ~$12MM of expected integration and other capital to realize certain operating expense synergies. ~$20mm ➢ Tall Oak is expected to connect 18 to 33 new wells by the end of 2025 ▪ The high end reflects customer completion timing and production targets for well connections based on current commodity prices ▪ The low end assumes gas prices are lower than expected in 2025, resulting in a delay in completion timing and type curve risking ➢ Based on this range of development activity, Tall Oak is expected to generate ~$80 million of Adjusted EBITDA(1) at the mid-point of the range in 2025, generally in-line with 2023 performance ▪ Tall Oak Adjusted EBITDA(1) is ~80% fixed fee ➢ Expect capital expenditures of ~$20MM in 2025, including ~$4 million of maintenance capex ▪ Growth capex is primarily associated with pad connections in close proximity to the gathering system, resulting in a sizeable return on investment and quick payback period Near-Term Development Details ~$80 Midpoint Active Rigs in Area 2025 Expected Well Connections 18 to 33 Wells Estimated Initial Production ~6.0 to ~9.0 (MMcf/d) Estimated NGL Content ~3.0 to ~6.0 (Gallons per Mcf) Other Commercial Activities • Actively pursuing new customer with active rig in the basin • Advanced discussions for new connection with ~20 MMcf/d of production (2)

Appendix

18 Year ended ($s in 000s) December 31, 2023 Net income / (loss) 32.6$ Add: Interest expense, net 7.8 Depreciation and amortization 22.9 Adjustments related to capital reimbursement activity (0.0) Other non-recurring (1) 6.0 Adjusted EBITDA 69.3$ Allocated Corporate G&A (2) 10.2 Asset-Level Adjusted EBITDA 79.5$ Reconciliation of Tall Oak Net Income or Loss to Adjusted EBITDA and Asset-Level Adjusted EBITDA (1) Represents $6.0 million of one-time non-recurring expenses incurred in March 2023. (2) Represents allocated G&A expenses from Tall Oak Midstream Management LLC to Tall Oak Midstream Operating LLC, that is not included in the Transaction.