Free writing prospectus dated February 20, 2025

File pursuant to Rule 433 of the securities Act of 1933, as amended

Relating to Preliminary Prospectus dated February 18, 2025

(Registration No. 333-282786)

Kandal M Venture Limited Proposed Nasdaq Symbol: FMFC | February 2025 FREE WRITING PROSPECTUS 0

Disclaimer / Forward - Looking Statements This presentation pertains to the proposed public offering of Class A ordinary shares ("Class A Ordinary Shares") of Kandal M Venture Limited (the "Company"), an exempted company incorporated under the laws of the Cayman Islands with limited liability, which are being registered in accordance with U . S . law . It should be read in conjunction with the preliminary prospectus included in the registration statement filed by the Company with the Securities and Exchange Commission (the “SEC”) for the offering related to this presentation . The registration statement has not yet become effective . Before you invest, it is advisable to read the prospectus in the registration statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more comprehensive information about us and the offering . You can access these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . Alternatively, electronic copies of the prospectus relating to the Offering may be obtained, when available, if you contact, Dominari Securities LLC, https : //www . dominarisecurities . com/contact or Revere Securities LLC, https : //www . reveresecurities . com/contacts/ or Kandal M Venture Limited by email at enquiry@fmfco . com . kh . This presentation does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with the Company or its affiliates in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation in such jurisdiction . The information in this presentation is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . This presentation contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other data about our industry . This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . In addition, projections, assumptions, and estimates of the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk . We undertake no duty to update such estimates . This presentation contains forward - looking statements . All statements in this presentation, other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward - looking statements . The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “goal,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “ongoing” and similar expressions are intended to identify forward - looking statements . In addition, from time to time, we or our representatives may make forward - looking statements orally or in writing . We have based these forward - looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short - term and long - term business operations and objectives, and financial needs . These forward - looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in the "Risk Factors" section of the Company’s preliminary prospectus . Furthermore, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements we may make . In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this prospectus may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward - looking statements . In evaluating these forward - looking statements, you should consider various factors, including our ability to change the direction of the Company, our ability to keep pace with new technology and changing market needs, and the competitive environment of our business . These and other factors may cause our actual results to differ materially from any forward - looking statement . Forward - looking statements are only predictions . Thus, you should not rely upon forward - looking statements as predictions of future events . The events and circumstances reflected in the forward - looking statements may not be achieved or occur . Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements . Except as required by applicable law, we undertake no duty to update any of these forward - looking statements after the date of this prospectus or to conform these statements to actual results or revised expectations . CZ0 1

Free Writing Prospectus Statement This free writing prospectus relates to the proposed initial public offering of the Class A ordinary shares (the “Class A Ordinary Shares"), par value US $ 0 . 00001 per share, of Kandal M Venture Limited (the "Company"), which are being registered on the Registration Statement and should be read together with the preliminary prospectus included in the Registration Statement filed by the Company with the SEC for the offering to which this presentation relates and may be accessed through the following web link : https : //www . kandalmv . com This presentation highlights basic information about the Company and the offering to which this presentation relates . As this is a summary, it may not include all the details you should take into account before investing in our securities . The Company has filed the Registration Statement (including a preliminary prospectus) with the SEC for the proposed offering to which this communication relates . The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the proposed offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov/ . Alternatively, electronic copies of the prospectus relating to the Offering may be obtained, when available, if you contact, Dominari Securities LLC, https : //www . dominarisecurities . com/contact or Revere Securities LLC, https : //www . reveresecurities . com/contacts/ or Kandal M Venture Limited by email at enquiry@fmfco . com . kh . Please refer to the offering documents for additional risks and disclosures . There is no guarantee that any specific outcome will be achieved . Investments may be speculative, illiquid, and could result in a loss .

Offering Summary Kandal M Venture Limited Issuer FMFC Proposed Nasdaq Capital Market Symbol 16,000,000 Ordinary Shares (including 13,000,000 Class A Ordinary Shares and 3,000,000 Class B Ordinary Shares) Ordinary Shares Issued and Outstanding Prior To This Offering • 2,000,000 Class A Ordinary Shares being offered by the Company (or 2,300,000 Class A Ordinary Shares if the underwriters exercise their over allotment option in full) Number of Shares Being Offered • 18,000,000 Ordinary Shares (including 15,000,000 Class A Ordinary Shares and 3,000,000 Class B Ordinary Shares ) or • 18,300,000 Ordinary Shares (including 15,300,000 Class A Ordinary Shares and 3,000,000 Class B Ordinary Shares, if full exercise of the underwriter’s over allotment option) Ordinary Shares Issued and Outstanding After This Offering • Class A Ordinary Shares are entitled to one (1) vote per share • Class B Ordinary Shares are entitled to twenty (20) votes per share Voting Rights US$4 - US$5 per Share Offering Price Per Class A Ordinary Share US$8,000,000 to US$11,500,000 Offering Size • ~10% for broadening our customer base by expanding our geographical reach to other key market, including the European markets; • ~50% for enhancing our production capacity; • ~10% for establishing a new design and development center for enhancing our product development capabilities; and • ~30% for additional working capital and other general corporate purposes. Use of Net Proceeds Dominari Securities LLC, Revere Securities LLC Underwriter

Company Overview Through FMF Manufacturing Co,. Ltd. (“FMF”), our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bags, crossbody bags, tote bags, backpacks, top - handle handbags, satchels and other smaller leather goods, such as wallets. Our customers are well - known global fashion brands that are headquartered in the United States. With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. CZ0

Product Development Pre - Production Production Inventory and Logistics Management Business Operations Our business operations consist of four main segments:

Design Overview Product Development Customer provides design package including designs, technical drawings, specifications, and type of possible raw material choices. Customer Collaboration Kandal M Venture Limited (“KMV”) collaborates with customer to refine pre - production sample until it fully aligns with customer design. Sample Finalization KMV produces pre - production sample and sends it to customer for approval. 01 02 03 CZ0

Calculate Raw Materials Pre - Production Our purchasing team calculates the consumption of each type of raw materials required. Provide Pilot Sample We produce a pilot sample for customer approval for mass production. Once a customer is satisfied with the pre - production sample and places an order with us: 01 02 Once a customer approves the pilot sample, we plan our production method and process.

Material Quality Check Production Perform incoming quality control on all raw materials to ensure their quality meets the specifications and standards of our products. Product Quality Check Manufacture products in our Cambodia factory with our quality control team monitoring each production phase. Final On - Site Inspection Perform final visual inspection on finished goods together with customer’s on - site inspection personnel. 01 02 03 Before our production process begins, we:

Branded Packaging Inventory & Logistics Management Pack them with their product labels, merchant cards and shipping marks. Quantity Assurance Verify and number the finished product packages according to customer delivery notices and packing notes. Logistics & Transport Engage a third - party logistics and transportation company to deliver product packages to the location designated by our customer. 01 02 03 After the finished goods pass our endline quality control, we:

Location Headquarters and main production facility located in Kandal Province, Cambodia. Facility Structure Includes two factory buildings, an office complex, and a dormitory. Operations All production activities conducted at the Cambodia Factory. Production Facility Lease Details Total land size: 13,759 square meters. Lease term: April 1, 2017, to March 31, 2027. Monthly rent: US$8,470, leased from an independent third party.

According to Bain & Company, the global personal luxury goods market is projected to reach US$560 - 610 billion by 2030, more than double its 2020 size. $560B - $610B The global luxury handbag market size is Estimated to reach US$ 50.9 billion by 2031, growing at a CAGR of 6.01% during the forecast period (2023 – 2031) according to Straits Research. Industry & Market Data Cambodia’s handbag market is Projected to generate US$138.70 million in revenue in 2024. According to the General Department of Customs and Excise (GDCE), the country’s total international trade accounted for US$47.88 billion in 2023 in which export of articles of leather, saddlery and harness; travel goods, handbags and similar containers were valued at US$1.7 billion in 2023, accounting for about 7.5% of the country’s total exports. Cambodian exports to the US were valued at US$8.9 billion in 2023. Source: https://www.bain.com/about/media - center/press - releases/2023/global - luxury - goods - market - accelerated - after - record - 2022 - and - is - set - for - further - growth -- despite - slowing - momentum - on - economic - warning - signs https://finance.yahoo.com/news/global - luxury - handbag - market - size - 143500340.html PS0 CZ1 CZ2

Recovery of Developed Economies Increasing Online Shopping and Social Media Influence Youth - Oriented Demographic Structure Favorable Tariff Preferences and Trade Agreements Major Market Drivers

Long - Term Relationships with Renowned Global Fashion Brands Expertise in Manufacturing Process and Efficient Operations Collaborative Supplier Relationships Experienced Management Team Competitive Strengths

Broadening Our Customer Base and Geographical Market Reach Growth Strategies Enhancing Production Capacity Establishing a New Design and Development Center 01 02 03

Financial Highlights (All amounts expressed in US dollars) September 30, 2024 September 30, 2023 Period 9,523,465 8,008,988 Revenue 2,266,692 1,868,340 Gross Profit 651,621 765,156 Profit 23.8% 23.3% Gross Profit Margin September 30, 2024 March 31, 2024 Period 10,410,899 10,179,105 Total Assets 146,525 3,786,495 Net Current Assets CZ0

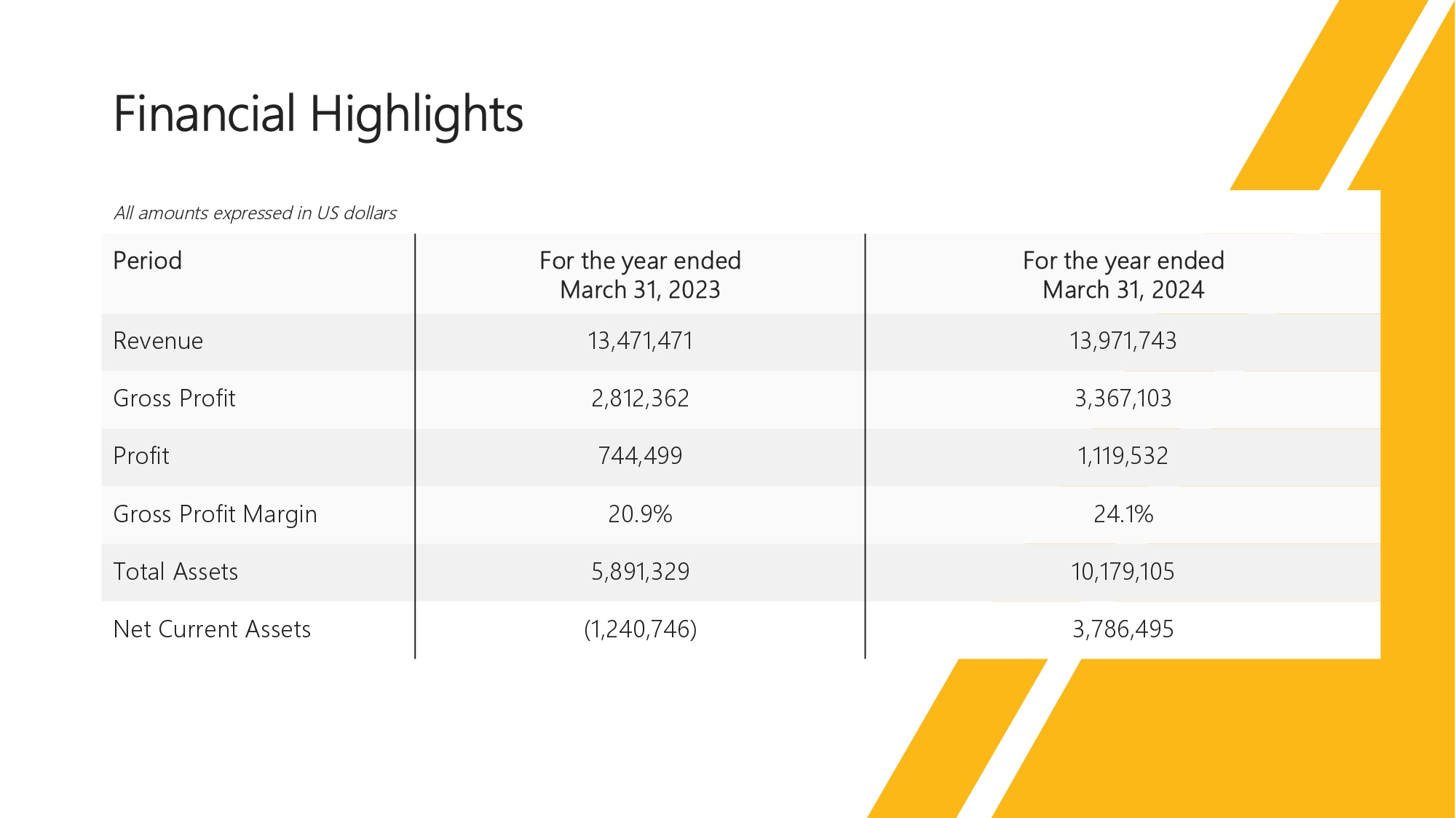

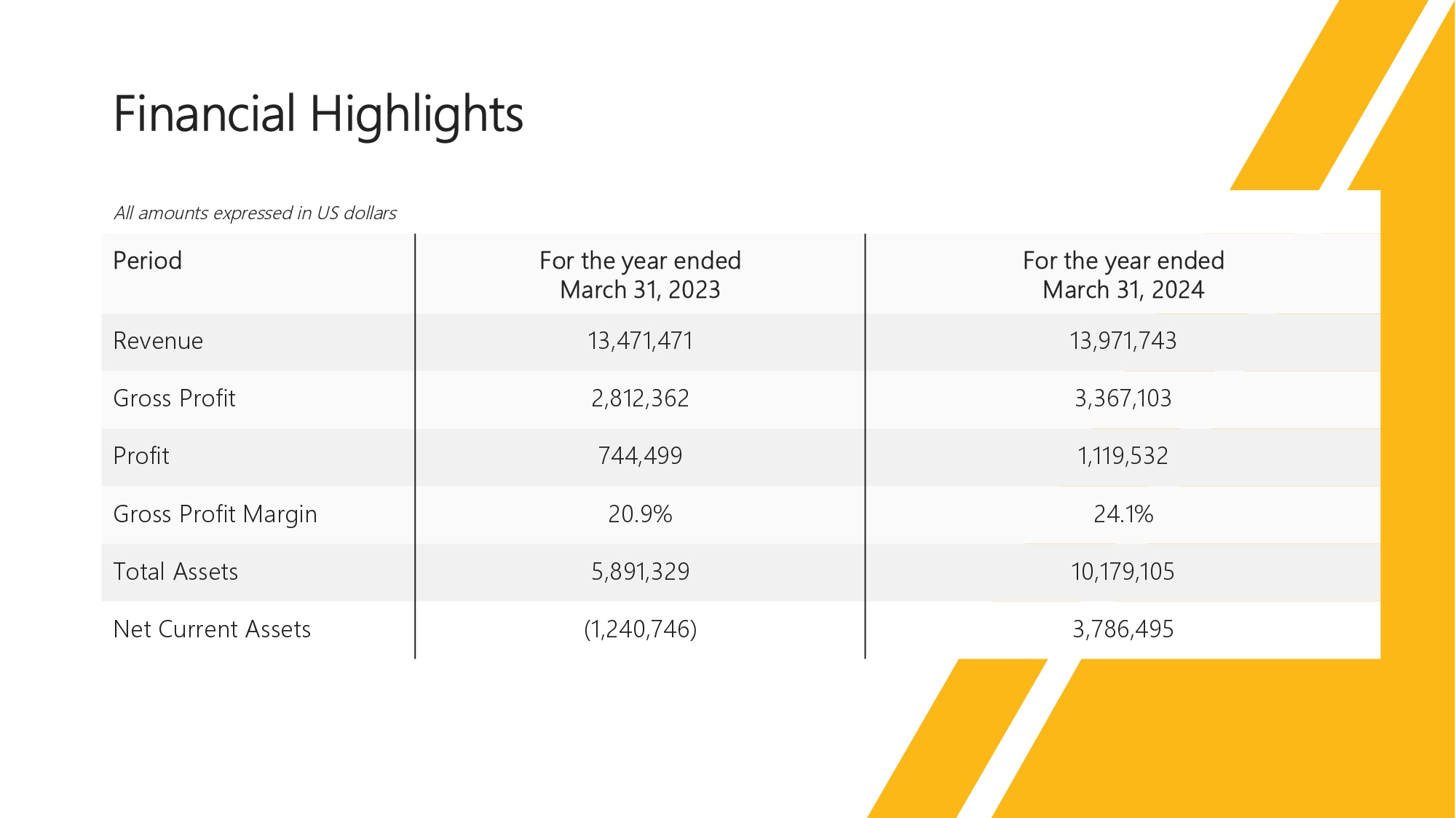

Financial Highlights (All amounts expressed in US dollars) For the years ended March 31 2024 2023 Period 13,971,743 13,471,471 Revenue 3,367,103 2,812,362 Gross Profit 1,119,532 744,499 Profit 24.1% 20.9% Gross Profit Margin 10,179,105 5,891,329 Total Assets 3,786,495 (1,240,746) Net Current AssetsPS0PS1

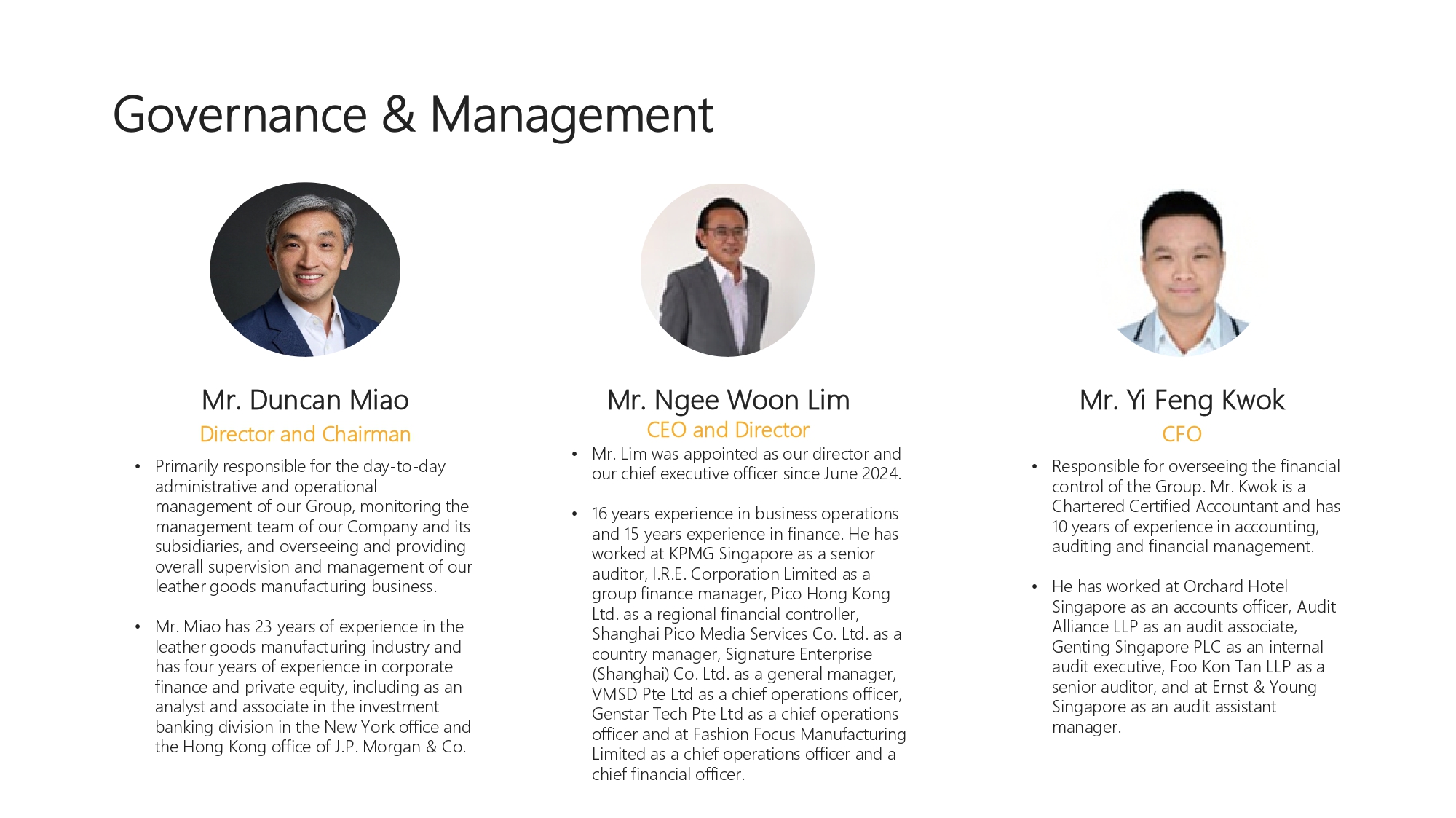

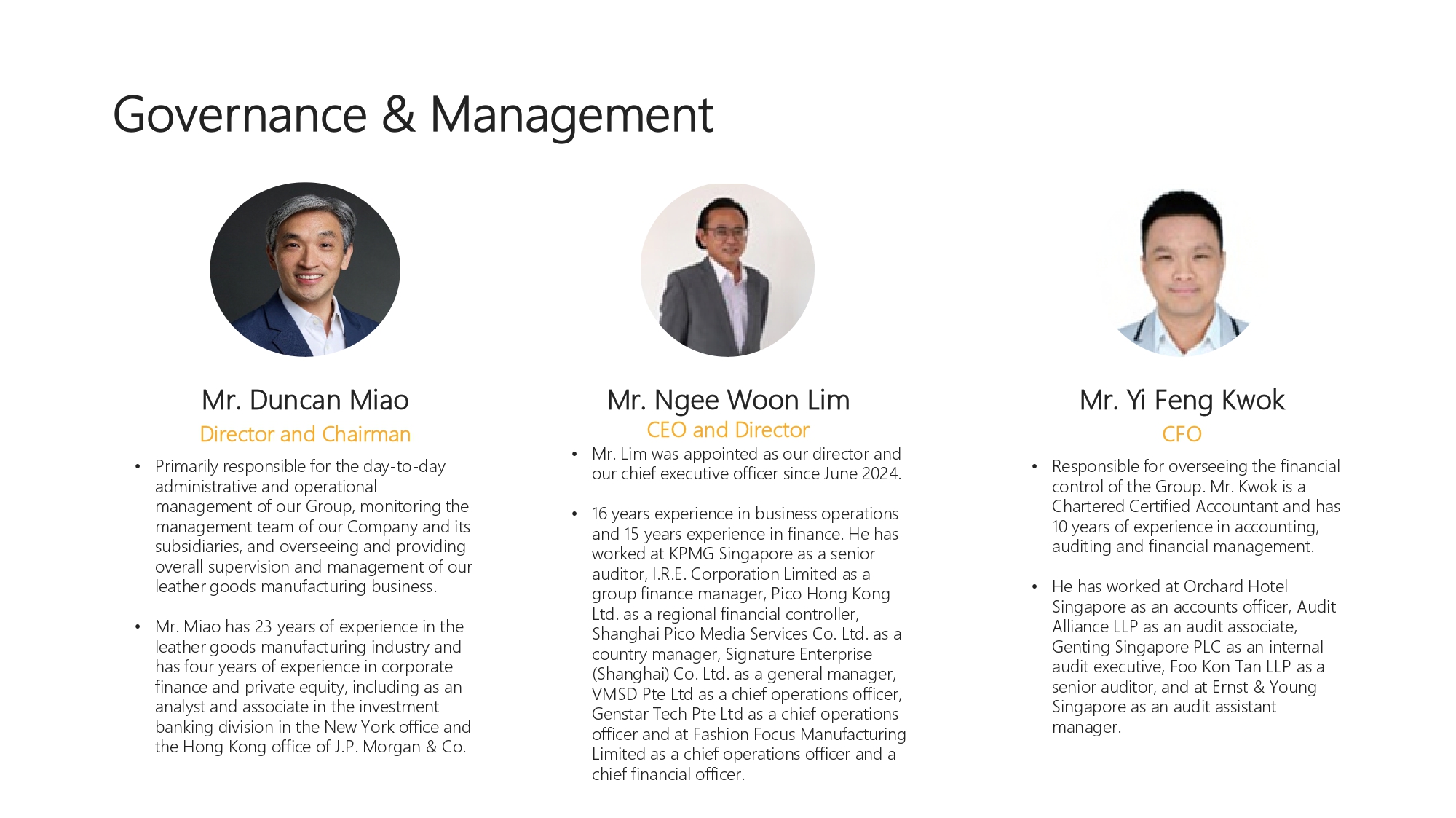

Governance & Management • Primarily responsible for the day - to - day administrative and operational management of our Group, monitoring the management team of our Company and its subsidiaries, and overseeing and providing overall supervision and management of our leather goods manufacturing business. • Mr. Miao has 23 years of experience in the leather goods manufacturing industry and has four years of experience in corporate finance and private equity, including as an analyst and associate in the investment banking division in the New York office and the Hong Kong office of J.P. Morgan & Co. Director and Chairman Mr. Duncan Miao • Mr. Lim was appointed as our director and our chief executive officer since June 2024. • 16 years experience in business operations and 15 years experience in finance. He has worked at KPMG Singapore as a senior auditor, I.R.E. Corporation Limited as a group finance manager, Pico Hong Kong Ltd. as a regional financial controller, Shanghai Pico Media Services Co. Ltd. as a country manager, Signature Enterprise (Shanghai) Co. Ltd. as a general manager, VMSD Pte Ltd as a chief operations officer, Genstar Tech Pte Ltd as a chief operations officer and at Fashion Focus Manufacturing Limited as a chief operations officer and a chief financial officer. CEO and Director Mr. Ngee Woon Lim • Responsible for overseeing the financial control of the Group. Mr. Kwok is a Chartered Certified Accountant and has 10 years of experience in accounting, auditing and financial management. • He has worked at Orchard Hotel Singapore as an accounts officer, Audit Alliance LLP as an audit associate, Genting Singapore PLC as an internal audit executive, Foo Kon Tan LLP as a senior auditor, and at Ernst & Young Singapore as an audit assistant manager. CFO Mr. Yi Feng Kwok

Independent Director Nominees • Will serve as Chairlady of the Audit Committee and member of the Compensation and Nominating and Corporate Governance Committees. • Ms. Yeung has over 20 years experience in accounting, auditing, financial management, internal control and corporate governance. She graduated from The Hong Kong University of Science and Technology in November 2003 with a Bachelor of Business Administration in Accounting degree. She is a member and fellow of the Association of Chartered Certified Accountants and the Hong Kong Institute of Certified Public Accountants. Director Ms. Josephine Yan Yeung • 25 years experience in designing prestigious hospitality and residential interiors and store planning and design. • From 2009 to 2023, Mr. Leung worked at Gucci as the director of store planning and facilities of Greater China. He graduated from the University of California, Berkeley with a bachelor of arts degree with a major in architecture in 1999. Director Mr. Hiu Ming Eddie Leung • Served as a vet surgeon at Stracham Tyson Hamilton Veterinary Clinic, and East Island Animal Hospital. • Dr. Yung graduated from University of Glasgow School of Veterinary Medicine with a bachelor of veterinary medicine and surgery in July 2001. Director Dr. Man Ying Angela Yung

Investment Considerations • Well - positioned to benefit from increasing global luxury goods consumption • Improved cost management produced higher gross profit margins and earnings • Expert management with extensive experience in leather goods industry and finance • Long - term relationships with renowned global fashion brands • Planning geographic expansion to Europe • IPO proceeds to be used to fuel further growth

APPENDIX Kandal M Venture Limited

Corporate Structure Kandal M Venture Limited (“KMV”) (Cayman Islands) Padachi M Venture Limited (“PMV”) (BVI) Prospect Focus Limited (“PFL”) (Hong Kong) FMF Manufacturing Co., Ltd. (“FMF”) (Cambodia)

Issuer Contact Kandal M Venture Limited Executive Office Padachi Village, Prek Ho Commune, Takhmao Town, Kandal Province, Kingdom of Cambodia Telephone Number +855 23425205 Office in the Cayman Islands Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman, KY1 - 1111, Cayman Islands Lead Underwriter Dominari Securities LLC 725 Fifth Avenue 23 rd Floor New York, NY 10022 1 - 212 - 393 - 4500 Co – Underwriter Revere Securities LLC 560 Lexington Ave 16th Floor New York, NY 10022 1 - 212 - 688 - 2350 Kandal M Venture Limited Kandal M Venture Limited RB0