Exhibit 96.1

Bulawayo Mining Company Limited

How Mine

S-K 1300 Technical Report Summary

January 2025

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited

WSP

Level 3, 51-55 Bolton St

Newcastle NSW 2300

PO Box 1162

Newcastle NSW 2300

Tel: +61 2 4929 8300

Fax: +61 2 4929 8382

wsp.com

| Rev | Date | Details |

| C | 09/01/2025 | Final report |

| | Name | Date | Signature |

| Prepared by: | Aaron Radonich | 09/01/2025 | /s/ Aaron Radonich |

| Allan Blair | /s/ Allan Blair |

| Reviewed by: | Jerry DeWolfe | 09/01/2025 | /s/ Jerry DeWolfe |

This document may contain confidential and legally privileged information, neither of which are intended to be waived, and must be used only for its intended purpose. Any unauthorised copying, dissemination or use in any form or by any means other than by the addressee, is strictly prohibited. If you have received this document in error or by any means other than as authorised addressee, please notify us immediately and we will arrange for its return to us.

| PS213686-WSP-NTL-MNG-REP-001 RevC (How Mine)1.docx | | January 2025 |

Table of contents

| 1 | Executive summary | 1 |

| | | |

| 1.1 | Property description and ownership | 1 |

| | | |

| 1.2 | Geology and mineralisation | 1 |

| | | |

| 1.3 | Exploration | 2 |

| | | |

| 1.4 | Mineral Resources estimates | 2 |

| | | |

| 1.5 | Mineral Reserves estimates | 3 |

| | | |

| 1.6 | Capital and operating costs | 4 |

| | | |

| 1.7 | Economic evaluation | 4 |

| | | |

| 1.8 | Permitting requirements | 4 |

| | | |

| 1.9 | QPs’ conclusions and recommendations | 5 |

| 1.9.1 | Mineral Resources | 5 |

| 1.9.2 | Mineral Reserves | 6 |

| | | |

| 2 | Introduction | 10 |

| | | |

| 2.1 | Registrant information | 10 |

| | | |

| 2.2 | Terms of reference and purpose | 12 |

| | | |

| 2.3 | Sources of information | 16 |

| | | |

| 2.4 | Personal inspection | 16 |

| | | |

| 2.5 | Previously filed Technical Report Summaries | 16 |

| | | |

| 2.6 | WSP declaration | 16 |

| | | |

| 2.7 | Statement of Independence | 17 |

| | | |

| 3 | Property description | 18 |

| | | |

| 3.1 | Property location | 18 |

| | | |

| 3.2 | Title and mineral rights | 18 |

| | | |

| 3.3 | Encumbrances | 19 |

| | | |

| 3.4 | Risks to access, title or right to perform work | 19 |

| | | |

| 3.5 | Agreements and royalties | 20 |

| | | |

| 4 | Accessibility, climate, local resources, infrastructure, and physiography | 21 |

| | | |

| 4.1 | Topography, elevation and vegetation | 21 |

| | | |

| 4.2 | Access | 21 |

| | | |

| 4.3 | Proximity to population centres | 21 |

| | | |

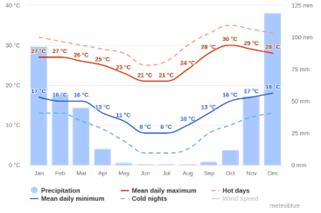

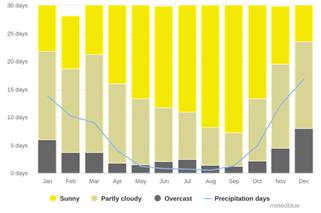

| 4.4 | Climate | 21 |

| | | |

| 4.5 | Local resources and existing infrastructure | 23 |

| 4.5.1 | Power supply | 23 |

| CONTENTS (Continued) | |

| | |

| 4.5.2 | Water supply | 23 |

| 4.5.3 | Personnel | 23 |

| 4.5.4 | Suppliers | 23 |

| | | |

| 5 | History | 24 |

| | | |

| 5.1 | Exploration and ownership history | 24 |

| | | |

| 5.2 | Production history | 24 |

| | | |

| 5.3 | Production reconciliation | 26 |

| | | |

| 5.4 | Aggregate fiscal year production | 29 |

| | | |

| 5.5 | Exploration and development by previous owners or operators | 29 |

| | | |

| 6 | Geological setting, mineralisation, and deposit | 30 |

| | | |

| 6.1 | Regional geology | 30 |

| | | |

| 6.2 | Structural setting | 32 |

| | | |

| 6.3 | Local and Property geology | 32 |

| | | |

| 6.4 | Deposit type and geology | 34 |

| | | |

| 6.5 | Mineralisation | 34 |

| | | |

| 7 | Exploration | 37 |

| | | |

| 7.1 | Diamond drilling | 37 |

| | | |

| 7.2 | Sludge drilling | 40 |

| | | |

| 7.3 | QP’s opinion | 40 |

| | | |

| 8 | Sample preparation, analyses, and security | 41 |

| | | |

| 8.1 | Sampling techniques | 41 |

| 8.1.1 | Core sampling | 41 |

| 8.1.2 | Drive face and stope-bench sampling | 41 |

| 8.1.3 | Channel sampling | 41 |

| 8.1.4 | Grab sampling | 41 |

| 8.1.5 | Level assay plans | 41 |

| 8.1.6 | Sample security | 41 |

| | | |

| 8.2 | Dry bulk density determination | 42 |

| | | |

| 8.3 | Sample preparation, analysis and procedures | 42 |

| | | |

| 8.4 | Quality Assurance Quality Control | 42 |

| CONTENTS (Continued) | |

| | |

| 8.4.1 | Channel sampling | 42 |

| 8.4.2 | Core sampling | 43 |

| 8.4.3 | Grab sampling | 43 |

| 8.4.4 | General guidelines | 43 |

| | | |

| 8.5 | QP’s opinion on adequacy | 43 |

| | | |

| 9 | Data verification | 44 |

| | | |

| 9.1 | Mineral Resources data verification | 44 |

| 9.1.1 | Data verification conducted by BMC Zimbabwe | 44 |

| 9.1.2 | Data verification conducted by WSP | 44 |

| 9.1.3 | Limitations on Mineral Resources data verification | 44 |

| | | |

| 9.2 | Mining and Mineral Reserves data verification | 45 |

| | | |

| 9.3 | Geotechnical data verification | 45 |

| | | |

| 9.4 | Hydrology and hydrogeology data verification | 46 |

| 9.4.1 | Hydrology | 48 |

| 9.4.2 | Hydrogeology | 48 |

| | | |

| 9.5 | Processing and recovery methods data verification | 48 |

| | | |

| 10 | Mineral processing and metallurgical | 49 |

| | | |

| 10.1 | Nature and extent of mineral processing and metallurgical testing | 49 |

| | | |

| 10.2 | Spatial representativity of metallurgical sampling | 49 |

| 10.2.1 | Types of testwork | 49 |

| | | |

| 10.3 | Details of analytical or testing laboratories | 49 |

| | | |

| 10.4 | Predictions and assumptions in mineral processing | 49 |

| | | |

| 10.5 | QP’s opinion on adequacy of the data collected | 49 |

| | | |

| 11 | Mineral Resource estimates | 50 |

| | | |

| 11.1 | Key assumptions, parameters, and methods | 50 |

| 11.1.1 | Resource database | 50 |

| 11.1.2 | Geological interpretation | 50 |

| 11.1.3 | Data preparation | 50 |

| 11.1.4 | Exploratory data analysis | 51 |

| 11.1.5 | Dry bulk density | 54 |

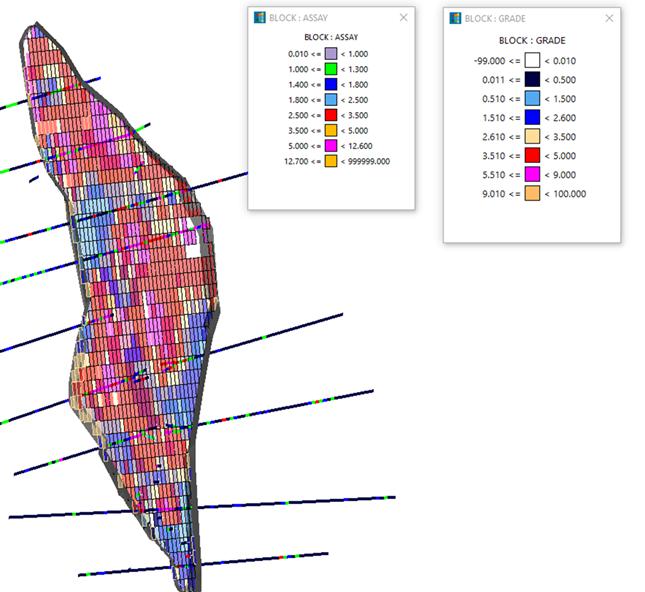

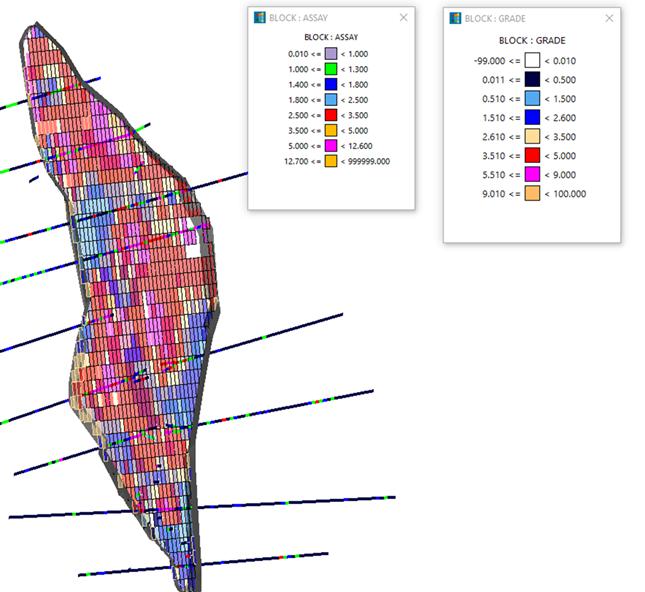

| 11.1.6 | Block models | 54 |

| 11.1.7 | Grade interpolation parameters | 56 |

| 11.1.8 | Grade estimation | 56 |

| 11.1.9 | Model validation | 56 |

| CONTENTS (Continued) | |

| | |

| 11.2 | Mineral Resources classification | 57 |

| 11.2.1 | Measured Mineral Resources | 58 |

| 11.2.2 | Indicated Mineral Resources | 58 |

| 11.2.3 | Inferred Mineral Resources | 59 |

| | | |

| 11.3 | Cut-off grade, price, and justification | 59 |

| 11.3.1 | Tonnage-grade factors | 60 |

| | | |

| 11.4 | Mineral Resources statement | 60 |

| | | |

| 11.5 | Uncertainty in the estimates of Inferred, Indicated, and Measured Mineral Resources | 62 |

| | | |

| 11.6 | QP’s opinion on factors likely to influence the prospect of economic extraction | 62 |

| | | |

| 12 | Mineral Reserve estimates | 63 |

| | | |

| 12.1 | Key assumptions, parameters, and methods | 63 |

| | | |

| 12.2 | Metallurgical and processing recoveries | 64 |

| | | |

| 12.3 | Methodology | 64 |

| | | |

| 12.4 | Modifying factors | 65 |

| | | |

| 12.5 | Cut-off grade estimate | 66 |

| | | |

| 12.6 | Mineral Reserve estimate | 67 |

| | | |

| 12.7 | Mineral Reserve classification | 67 |

| 12.7.1 | Proved Mineral Reserves | 67 |

| 12.7.2 | Probable Mineral Reserves | 68 |

| 12.7.3 | Mineral Reserve statement | 68 |

| | | |

| 12.8 | QP’s opinion on risk factors that may materially affect the Mineral Reserve estimates | 70 |

| | | |

| 13 | Mining methods | 71 |

| | | |

| 13.1 | Introduction | 71 |

| | | |

| 13.2 | Parameters relevant to the design and schedule | 71 |

| 13.2.1 | Geotechnical | 71 |

| 13.2.2 | Hydrogeological | 72 |

| | | |

| 13.3 | Production parameters | 73 |

| 13.3.1 | Production rates | 73 |

| 13.3.2 | Expected mine life | 73 |

| 13.3.3 | Mining model | 73 |

| 13.3.4 | Mining dilution and recovery factors | 77 |

| CONTENTS (Continued) | |

| | |

| 13.4 | Mining fleet, machinery, and personnel requirements | 77 |

| 13.4.1 | Mining fleet and machinery | 77 |

| 13.4.2 | Personnel | 77 |

| | | |

| 13.5 | Scheduling process | 77 |

| | | |

| 13.6 | Mining schedule | 78 |

| | | |

| 13.7 | Mining unit dimensions | 79 |

| | | |

| 13.8 | Mine layout | 79 |

| | | |

| 14 | Processing and recovery methods | 80 |

| | | |

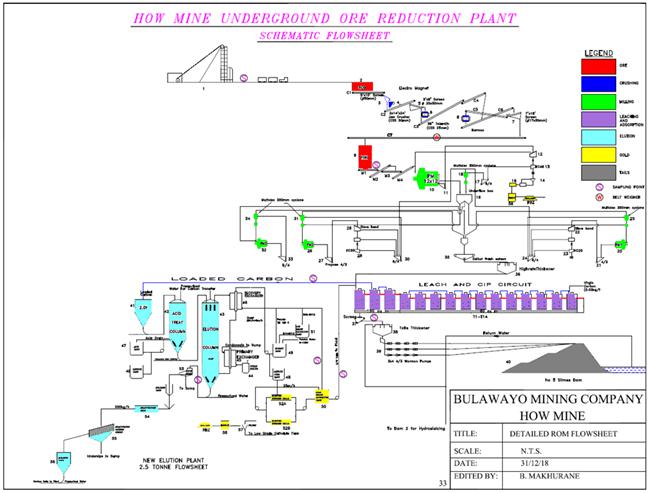

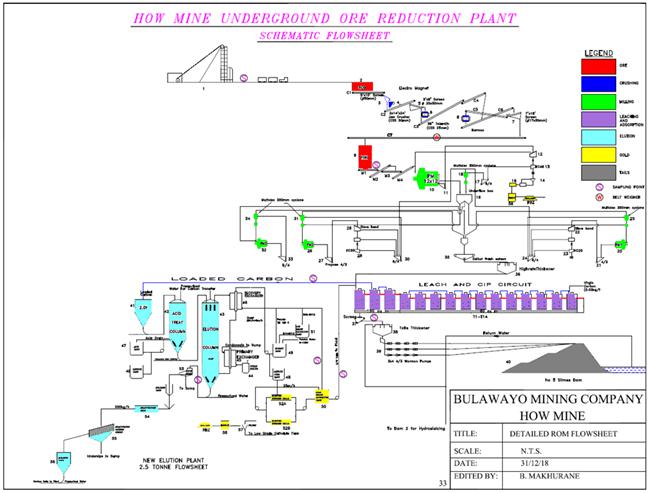

| 14.1 | Processing methodologies and flowsheets | 80 |

| | | |

| 14.2 | Processing plant throughput and characteristics | 80 |

| 14.2.1 | Run of Mine crushing plant | 80 |

| 14.2.2 | Grinding and gravity concentration plant | 81 |

| 14.2.3 | Run of Mine CIP plant | 81 |

| 14.2.4 | Elution plant | 81 |

| 14.2.5 | Clean-up and smelting | 81 |

| | | |

| 14.3 | Product sampling | 81 |

| 14.3.1 | Mill feed | 81 |

| 14.3.2 | Feed tonnage | 82 |

| 14.3.3 | Residues | 82 |

| | | |

| 14.4 | Product stockyard | 82 |

| 14.5 | Energy and water process materials requirements | 82 |

| 14.5.1 | Mine power plant | 82 |

| 14.5.2 | Mine water management system | 83 |

| | | |

| 14.6 | QP’s opinion | 83 |

| | | |

| 15 | Infrastructure | 84 |

| | | |

| 15.1 | Rail access | 84 |

| | | |

| 15.2 | Port access | 85 |

| | | |

| 15.3 | Roads | 85 |

| | | |

| 15.4 | Camp | 85 |

| | | |

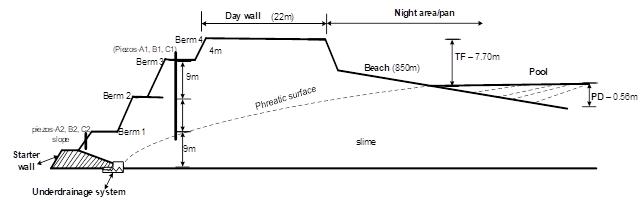

| 15.5 | Tailings | 85 |

| | | |

| 15.6 | Potable water and wastewater | 85 |

| | | |

| 15.7 | Accommodation and offices | 86 |

| | | |

| 15.8 | Non-process infrastructure | 86 |

| | | |

| 15.9 | Information and communications technology systems | 86 |

| | | |

| 15.10 | Other support facilities and utilities | 86 |

| CONTENTS (Continued) | |

| | |

| 16 | Market studies | 87 |

| | | |

| 16.1 | Nature and material terms of agency relationships | 87 |

| | | |

| 16.2 | Results of relevant market studies | 87 |

| | | |

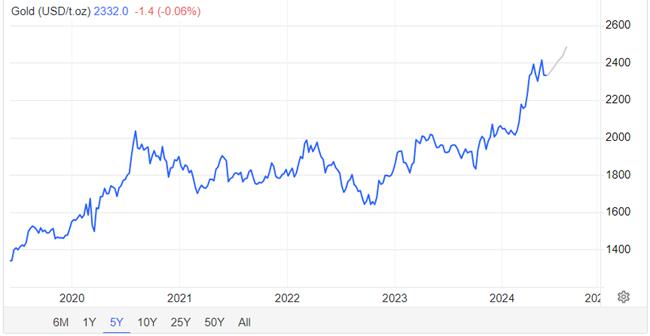

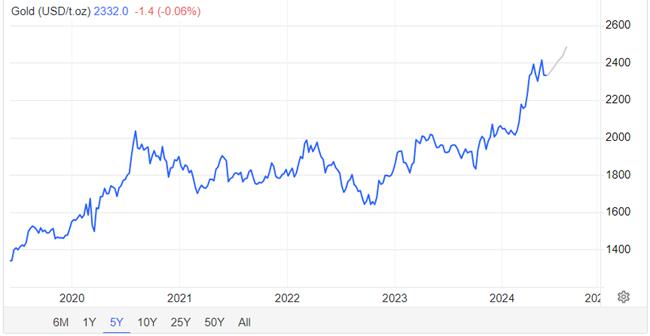

| 16.3 | Commodity price projections | 87 |

| | | |

| 16.4 | Mining and processing | 89 |

| | | |

| 16.5 | Product transport and handling | 89 |

| | | |

| 16.6 | Hedging arrangements | 89 |

| | | |

| 16.7 | Forward sales contracts | 89 |

| | | |

| 16.8 | Contracts with affiliated parties | 89 |

| | | |

| 17 | Environmental studies, permitting and plans, negotiations, or agreements with local individuals or groups | 90 |

| | | |

| 17.1 | Introduction | 90 |

| | | |

| 17.2 | Environmental management and corporate responsibility | 90 |

| | | |

| 17.3 | Property context | 91 |

| | | |

| 17.4 | Property permitting | 92 |

| | | |

| 17.5 | Environmental and Social Impact Assessment | 93 |

| 17.5.1 | Biodiversity and natural resources | 93 |

| 17.5.2 | Managing impacts on water | 93 |

| 17.5.3 | Acid and metalliferous drainage | 93 |

| 17.5.4 | Erosion and protection of soils | 94 |

| 17.5.5 | Noise and vibration | 94 |

| 17.5.6 | Air quality | 94 |

| 17.5.7 | Local climate impacts | 94 |

| 17.5.8 | Greenhouse gas emissions | 94 |

| 17.5.9 | Resources use and non-mineral waste | 94 |

| 17.5.10 | Regulatory Accreditation | 94 |

| | | |

| 17.6 | Property standards | 95 |

| | | |

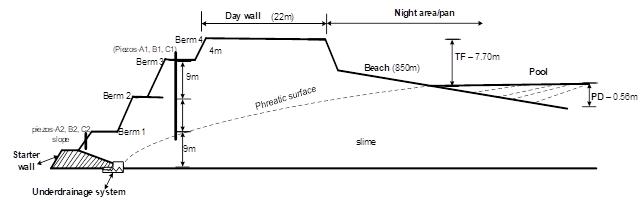

| 17.7 | Waste and Tailings Disposal Plans | 95 |

| 17.7.1 | Waste Disposal | 95 |

| 17.7.2 | Tailings Disposal | 95 |

| | | |

| 17.8 | Site Monitoring | 98 |

| | | |

| 17.9 | Water Management | 98 |

| | | |

| 17.10 | Stakeholder engagement | 98 |

| 17.10.1 | Stakeholder engagement plan | 98 |

| 17.10.2 | Consultation | 99 |

| | | |

| 17.11 | Cultural, economic, and social conditions | 99 |

| 17.11.1 | Cultural heritage | 99 |

| 17.11.2 | Contributing to the national and local economy | 99 |

| 17.11.3 | Establishing a social management framework | 99 |

| 17.11.4 | Stakeholder engagement | 99 |

| 17.11.5 | Impacts on land use and access | 99 |

| 17.11.6 | Protecting community health and safety | 99 |

| 17.11.7 | Protecting the workforce | 100 |

| 17.11.8 | Commitment to local procurement and hiring | 100 |

| | | |

| 17.12 | Mine closure | 101 |

| CONTENTS (Continued) | |

| | |

| 17.13 | Translating the ESIA into environmental and social management | 102 |

| | | |

| 17.14 | QP’s opinion | 102 |

| 17.14.1 | Legal | 102 |

| 17.14.2 | Social and environment | 102 |

| | | |

| 18 | Capital and operating costs | 103 |

| | | |

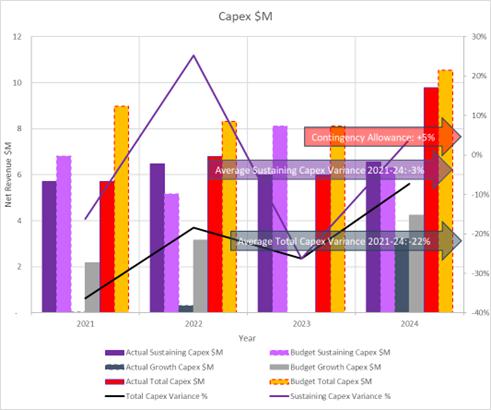

| 18.1 | Capital costs | 103 |

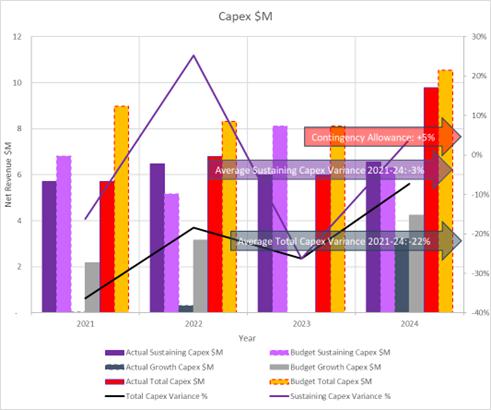

| 18.1.1 | Growth and sustaining capital | 103 |

| 18.1.2 | Mine closure costs | 105 |

| | | |

| 18.2 | Operating costs | 105 |

| | | |

| 18.3 | Contingency | 106 |

| | | |

| 19 | Economic analysis | 108 |

| | | |

| 19.1 | Summary | 108 |

| | | |

| 19.2 | Methodology | 108 |

| 19.2.1 | Modelling approach | 108 |

| 19.2.2 | Sources of assumptions | 109 |

| 19.2.3 | Financial | 109 |

| 19.2.4 | Pricing and revenue | 109 |

| 19.2.5 | Taxes and royalties | 109 |

| | | |

| 19.3 | Capital costs | 110 |

| | | |

| 19.4 | Operating costs | 110 |

| | | |

| 19.5 | Cash flow | 110 |

| | | |

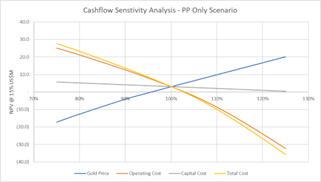

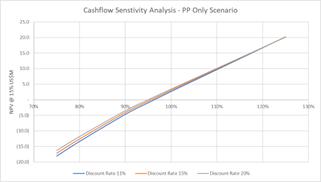

| 19.6 | Economic evaluation and sensitivity analysis | 114 |

| | | |

| 20 | Adjacent properties | 115 |

| | | |

| 21 | Other relevant data and information | 116 |

| | | |

| 22 | Interpretation and conclusions | 117 |

| | | |

| 22.1 | Mineral Resources interpretations and conclusions | 117 |

| | | |

| 22.2 | Mineral Reserves interpretations and conclusions | 117 |

| | | |

| 23 | Recommendations | 120 |

| | | |

| 23.1 | Mineral Resources recommendations | 120 |

| | | |

| 23.2 | Mineral Reserves recommendations | 121 |

| | | |

| 24 | References | 124 |

| | | |

| 25 | Reliance on information provided by the Registrant | 125 |

List of tables

| Table 1-1 | | HGM underground Measured and Indicated Mineral Resources estimate as at 31 December 2023 | | 2 |

| Table 1-2 | | HGM underground Inferred Mineral Resources estimate as at 31 December 2023 | | 2 |

| Table 1-3 | | HGM sands (tailings) Inferred Mineral Resources estimate as at 31 December 2023 | | 3 |

| Table 1-4 | | Mineral Reserves estimate as at 31 December 2023 | | 3 |

| Table 2-1 | | List of acronyms and abbreviations used in this TRS | | 12 |

| Table 2-2 | | List of QPs | | 16 |

| Table 4-1 | | Mean temperatures in Bulawayo (World Meteorological Organization) | | 22 |

| Table 5-1 | | MRMR summary comparison end December 2022 to end December 2023 | | 27 |

| Table 5-2 | | Proved Mineral Reserves reconciliation end December 2022 to end December 2023 | | 27 |

| Table 5-3 | | Probable Mineral Reserves reconciliation end December 2022 to end December 2023 | | 27 |

| Table 5-4 | | Measured Mineral Resources reconciliation end December 2022 to end December 2023 | | 28 |

| Table 5-5 | | Indicated Mineral Resources reconciliation end December 2022 to end December 2023 | | 28 |

| Table 5-6 | | Inferred Mineral Resources reconciliation end December 2022 to end December 2023 | | 28 |

| Table 5-7 | | Aggregate fiscal year production ending December 2021–2023 | | 29 |

| Table 11-1 | | Univariate statistics for samples within the economic mineralisation envelope (BMC 2023b) | | 52 |

| Table 11-2 | | Univariate statistics for samples within the economic mineralisation envelope (BMC 2023b) | | 53 |

| Table 11-3 | | Block dimension schemes for 31 December 2023 block models (BCM 2023b) | | 55 |

| Table 11-4 | | Grade interpolation parameters (BMC 2023b) | | 56 |

| Table 11-5 | | 31 December 2023 Mineral Resource conversion parameters | | 59 |

| Table 11-6 | | HGM underground Measured and Indicated Mineral Resources estimate as at 31 December 2023 | | 61 |

| Table 11-7 | | HGM underground Inferred Mineral Resources estimate as at 31 December 2023 | | 61 |

| Table 11-8 | | HGM sands (tailings) Inferred Mineral Resources estimate as at 31 December 2023 | | 61 |

| Table 12-1 | | Estimation parameters | | 63 |

| Table 12-2 | | HGM Mineral Reserve estimate as at 31 December 2023 | | 69 |

| Table 12-3 | | HGM UG Mineral Reserve distribution by category and elevation (December 2023) | | 70 |

| Table 13-1 | | HGM shaft collars and depths | | 76 |

| Table 13-2 | | HGM production for FY 2024 to 2026 – Mineral Reserves Only (WSP) | | 78 |

| Table 14-1 | | Mill feed sampling specifications | | 82 |

| Table 14-2 | | Feed tonnage sampling specifications | | 82 |

| Table 14-3 | | Residues sampling specifications | | 82 |

| Table 16-1 | | Zimbabwean inflation rate and economic indicators (Trading Economics, 30 May 2024) | | 88 |

| Table 18-1 | | Mineral Reserves summary capital expenditure for FY 2024-2027 | | 104 |

| Table 18-2 | | HGM present closure obligation (Enmin 2024) | | 105 |

| Table 18-3 | | HGM Mineral Reserves only key operating physicals and costs | | 106 |

| Table 19-1 | | HGM cashflow modelling assumptions | | 109 |

| Table 19-2 | | HGM cashflow analysis prior to depreciation, financing and tax – Mineral Reserves (Proved and Probable only) | | 112 |

List of figures

| Figure 2.1 | | BMC Limited corporate structure | | 11 |

| Figure 3.1 | | Property location map | | 18 |

| Figure 3.2 | | HGM ML 28 boundary | | 19 |

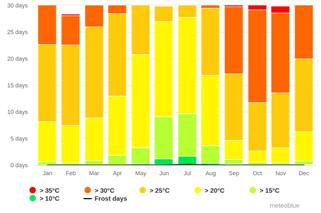

| Figure 4.1 | | Climate statistics for Bulawayo, Zimbabwe (Meteoblue 2023) | | 22 |

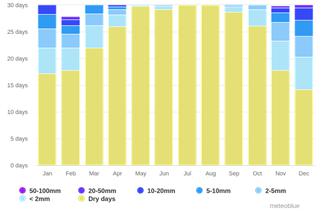

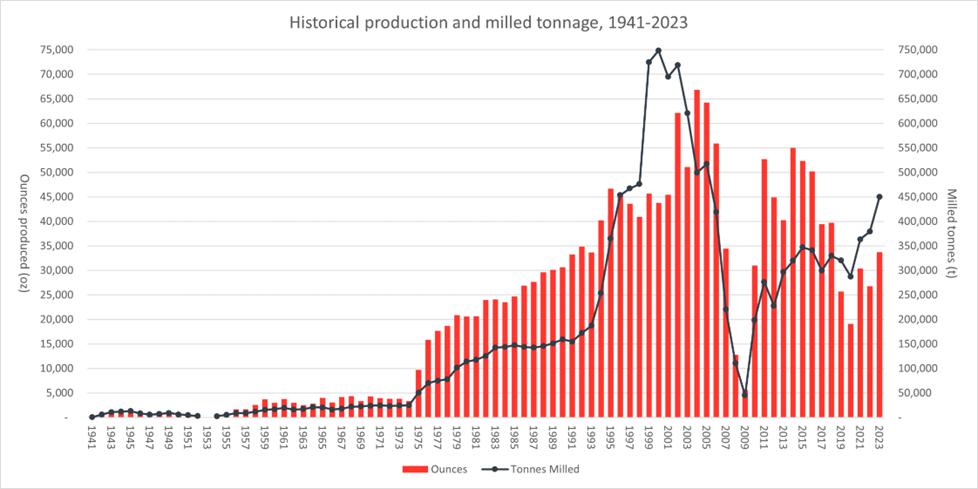

| Figure 5.1 | | HGM total gold production 1941–2023 | | 25 |

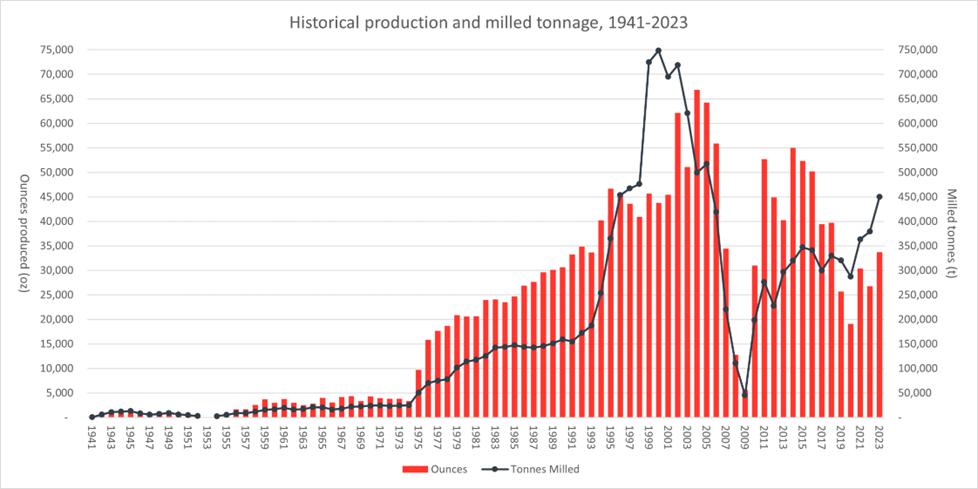

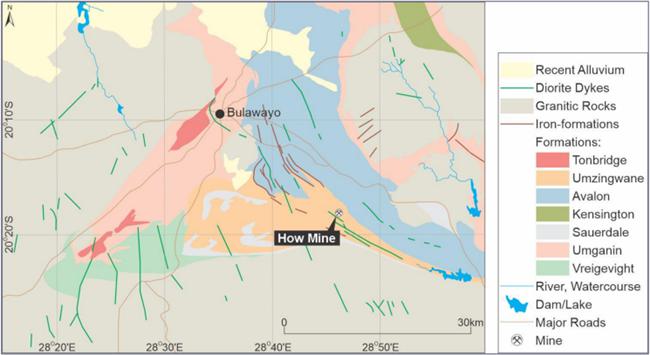

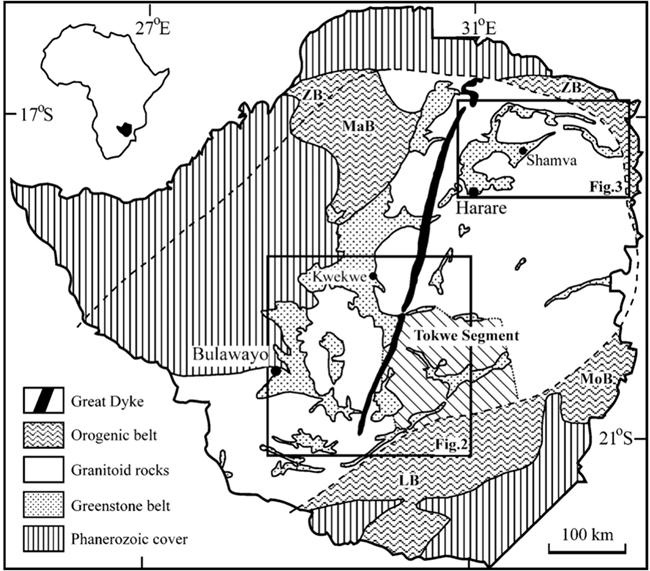

| Figure 6.1 | | Regional geology of Zimbabwe showing location of Greenstone Belts (Prendergast 2004) | | 31 |

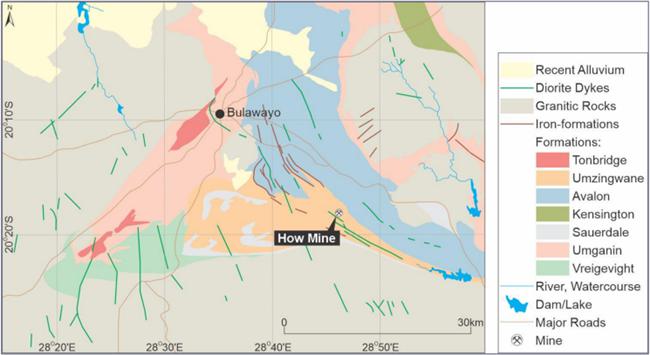

| Figure 6.2 | | Regional geology of the HGM area (BMC Limited) | | 32 |

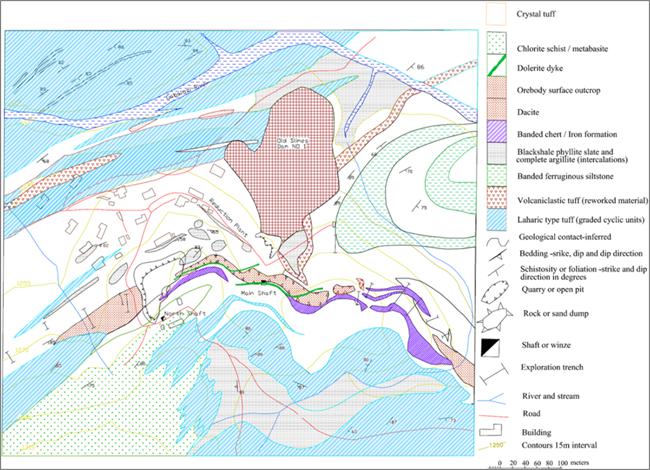

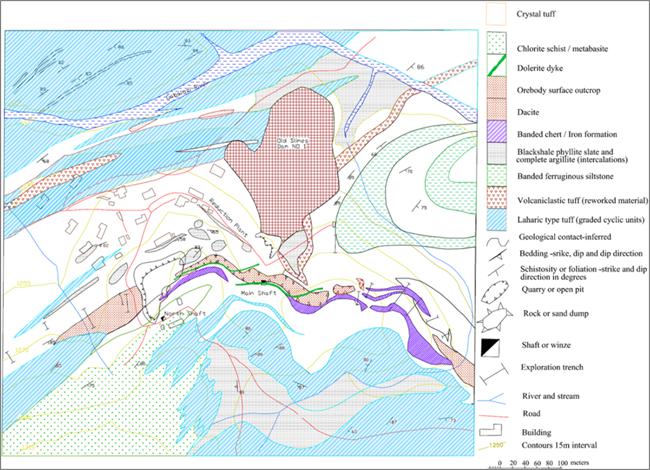

| Figure 6.3 | | Local geology of the HGM area (BMC 2023b) | | 33 |

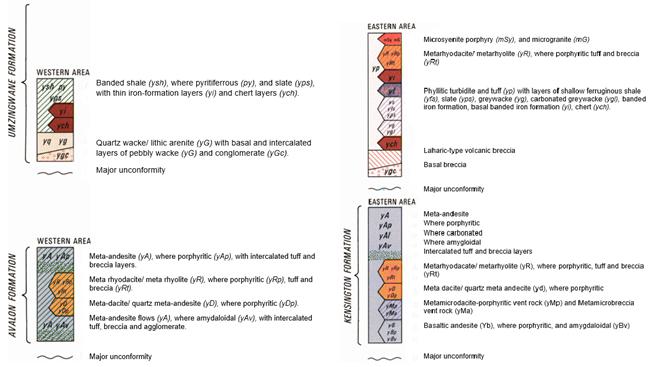

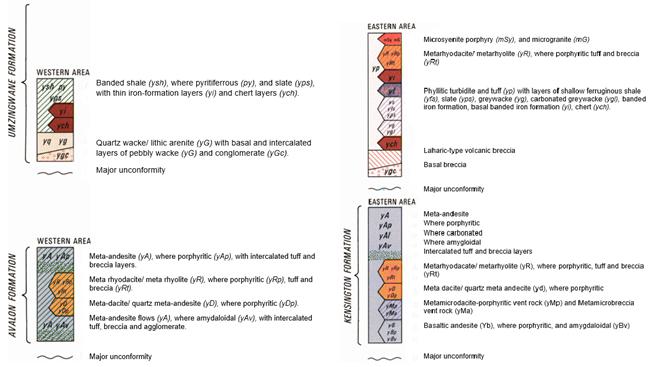

| Figure 6.4 | | Simplified stratigraphic columns for the Umzingwane, Avalon, and Kensington formations (BMC Limited) | | 34 |

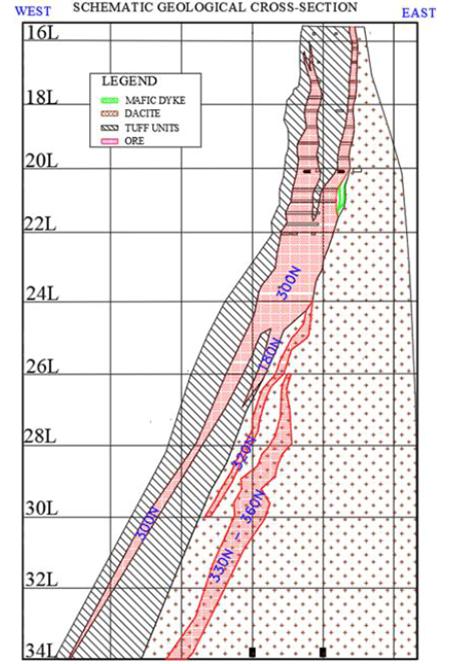

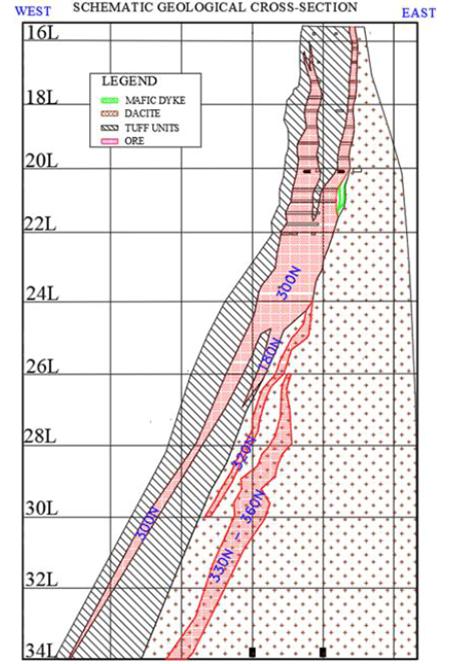

| Figure 6.5 | | Typical cross-section of ore zones within tuff (Edelrod 2024) | | 36 |

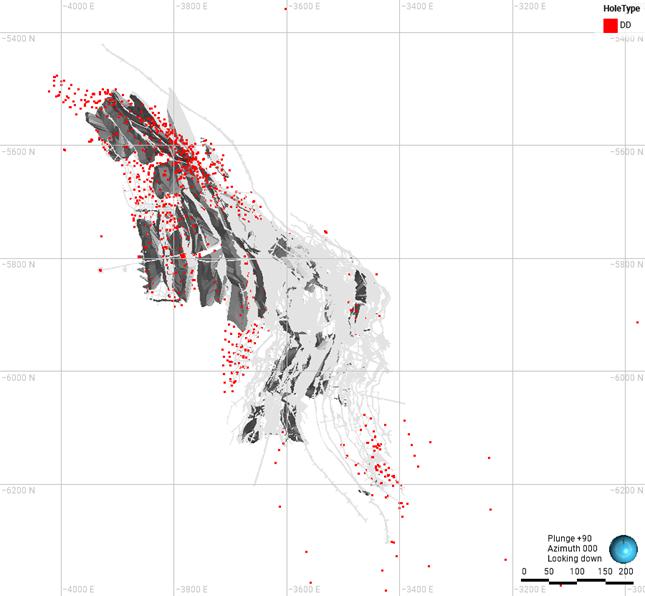

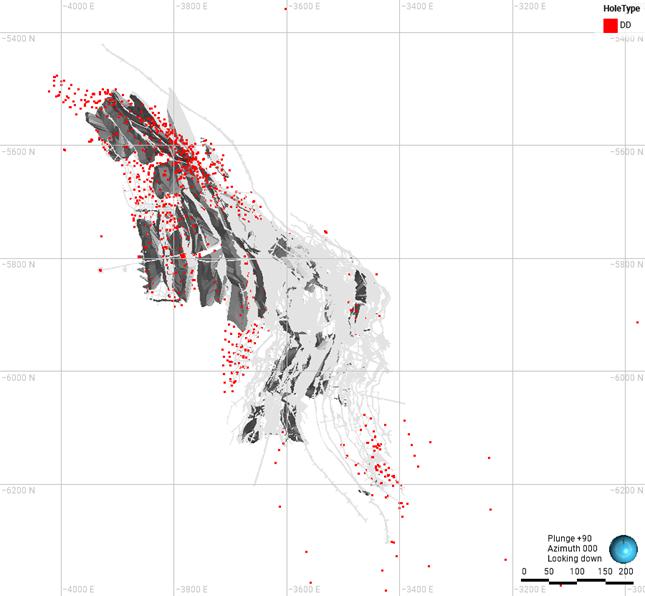

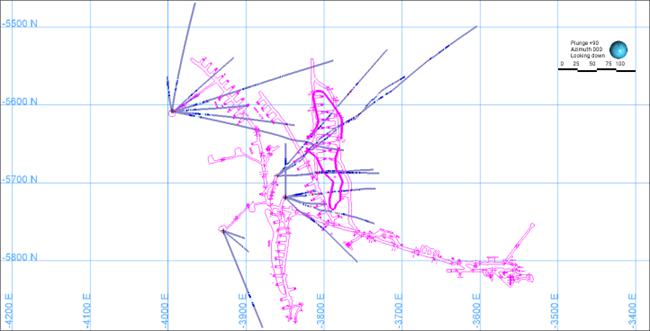

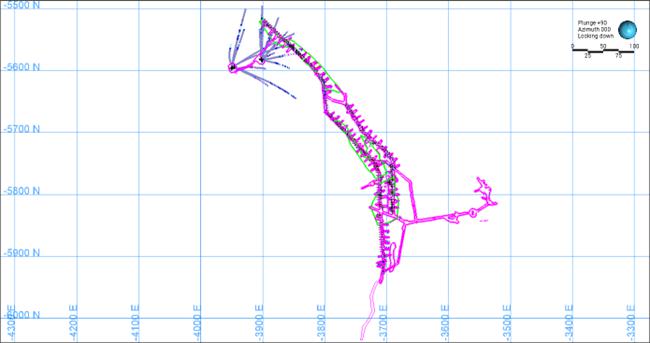

| Figure 7-1 | | Plan view of all HGM drill hole collars and existing mine development | | 38 |

| Figure 9-1 | | Catchment boundaries of Zimbabwe (BMC Limited) | | 46 |

| Figure 9-2 | | Sub-catchment boundaries of Mzingwane, Zimbabwe (BMC Limited) | | 47 |

| Figure 11.1 | | 29L 330N block grade and drill hole comparison | | 57 |

| Figure 12-1 | | HGM UG Mineral Reserve distribution by category and elevation (December 2023) | | 69 |

| Figure 13-1 | | Figure showing general mining method (Mining – blasthole stoping, ore extraction, drilling | Britannica) | | 71 |

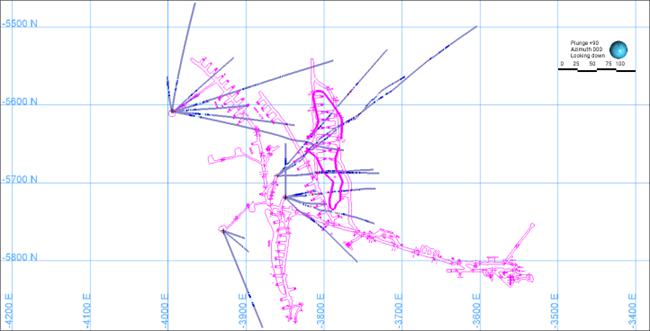

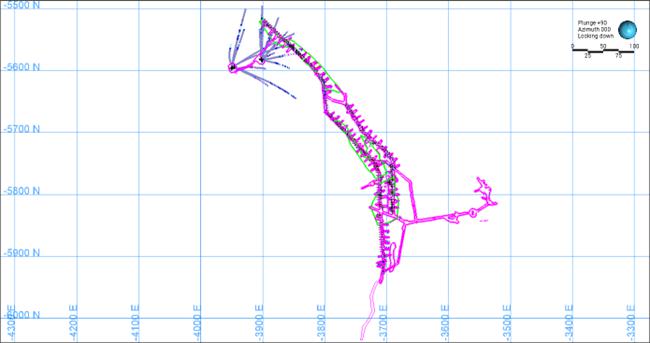

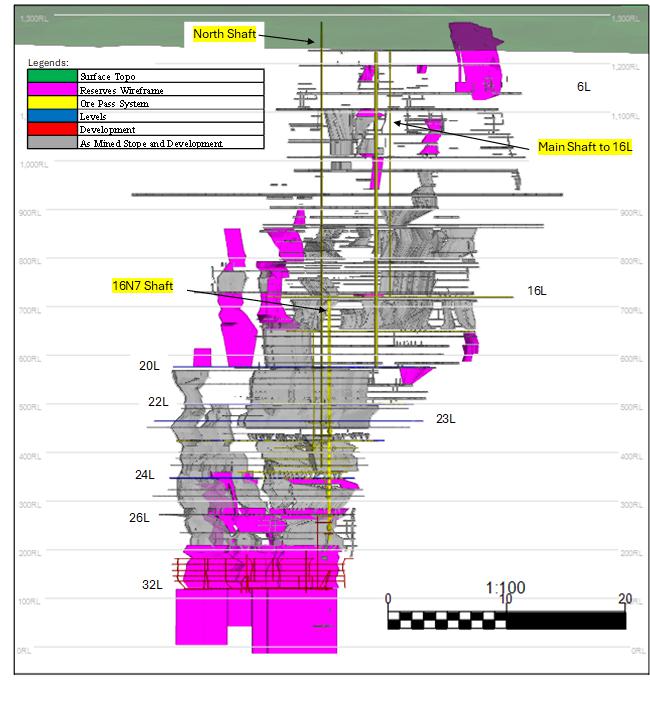

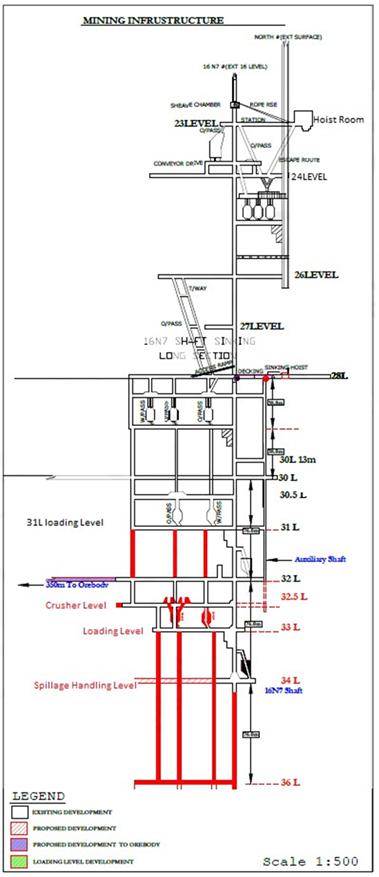

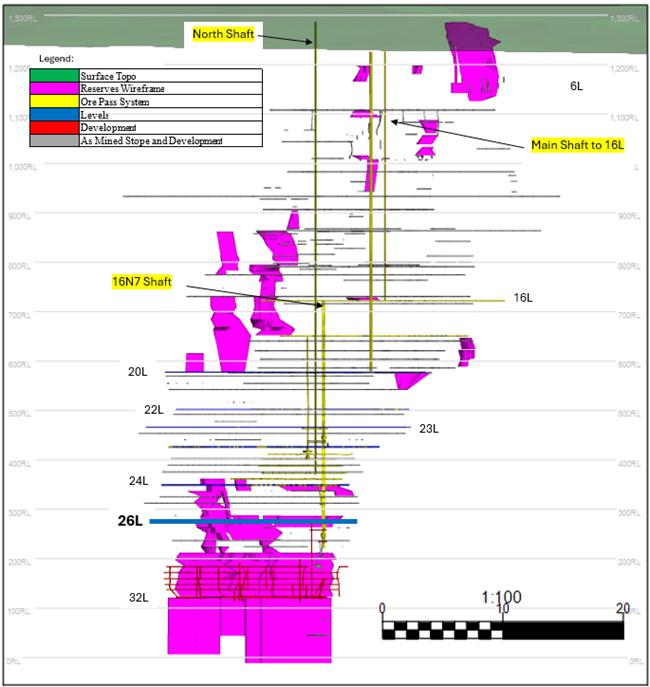

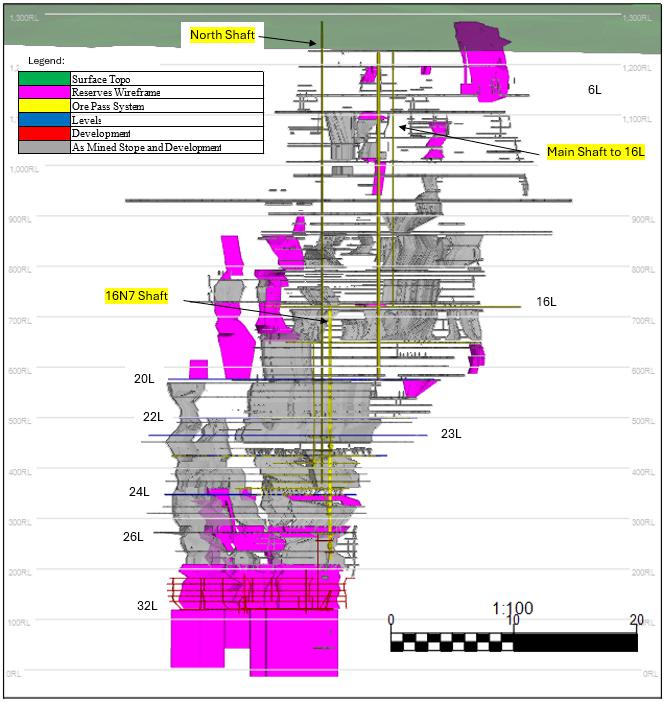

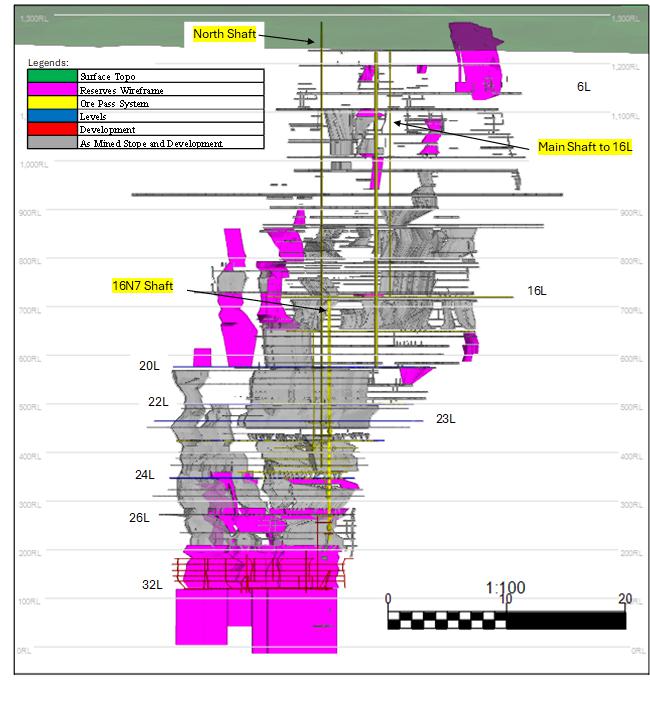

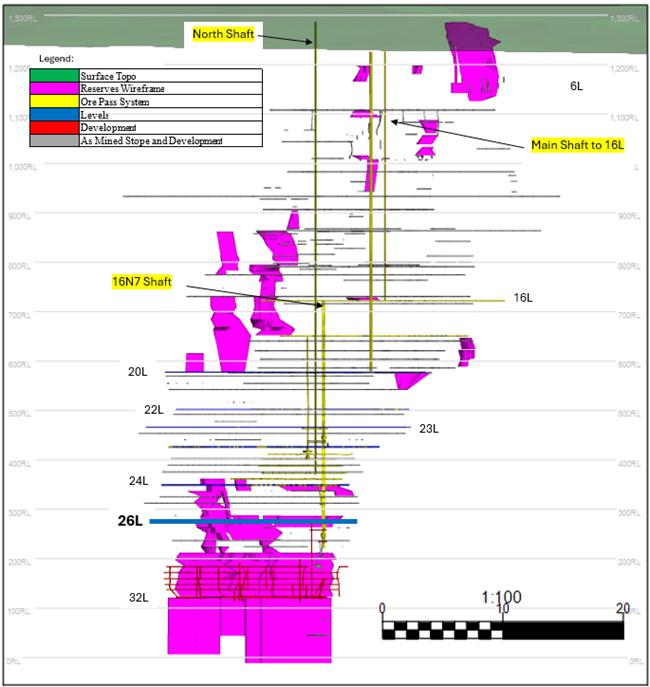

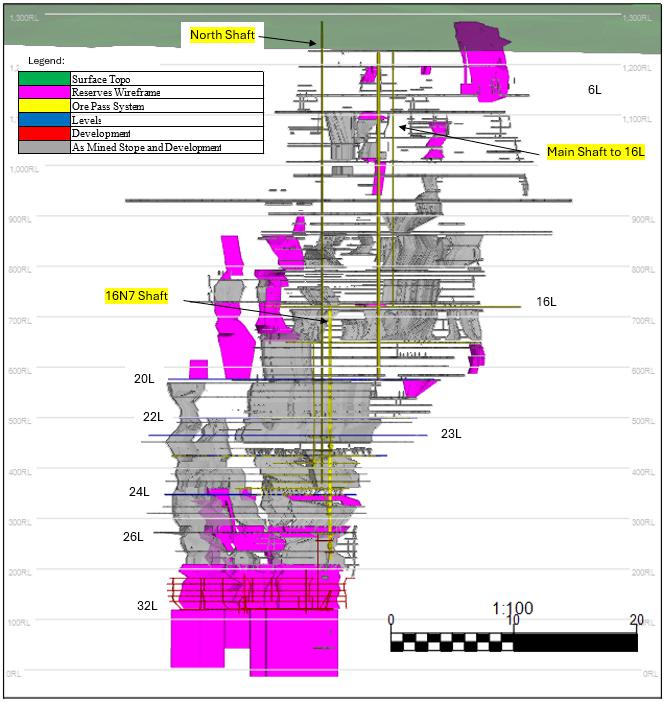

| Figure 13-2 | | HGM mine access, and transfer and hoisting systems | | 74 |

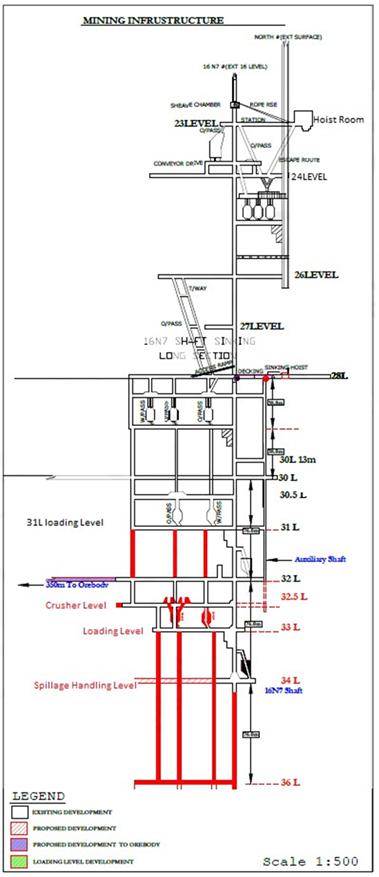

| Figure 13-3 | | HGM underground mining infrastructure end 2024 | | 75 |

| Figure 13-4 | | HGM general mine layout | | 76 |

| Figure 14-1 | | HGM processing flowsheet (KDM 2018) | | 80 |

| Figure 15-1 | | NRZ rail network schematic (NRZ 2024c) | | 84 |

| Figure 16.1 | | Historical (blue) gold spot price and forecast (grey) in US$/oz. Source: Trading Economics 30 May 2024 | | 88 |

| Figure 16.2 | | Zimbabwean gold currency exchange rate ZiG/USD (Trading Economics, 30 May 2024) | | 89 |

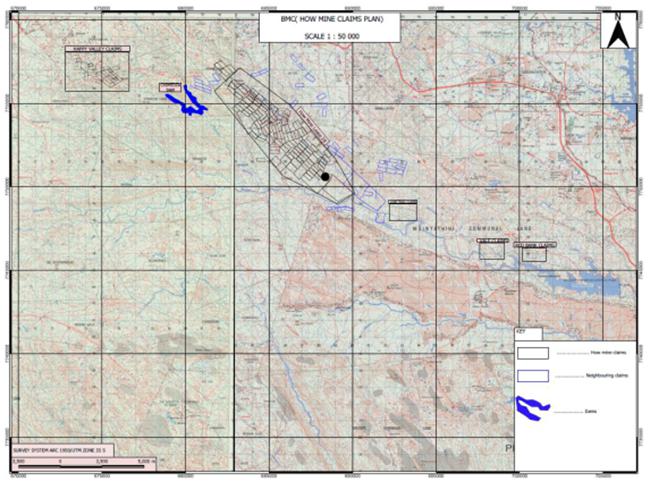

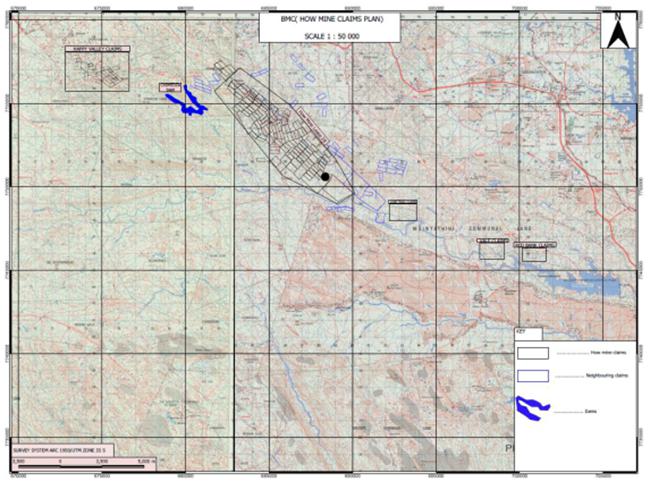

| Figure 17-1 | | BMC Zimbabwe ML and other claims | | 92 |

| Figure 18-1 | | Capital cost review and contingency 2021 – Q1 2024 | | 107 |

| Figure 18-2 | | Operating cost review and contingency 2021 – Q1 2024 | | 107 |

| Figure 19.1 | | Scenario 1: Total inventory project NPV and sensitivity analysis | | |

| Figure 19.2 | | Scenario 2: Mineral Reserves only project NPV and sensitivity analysis | | 111 |

List of appendices

Appendix A Limitations statement

| 1.1 | Property description and ownership |

The How Gold Mine (HGM) [or the Property] is located in the Matabeleland South Province, Zimbabwe, approximately 30 kilometres (km) southeast of the city of Bulawayo (latitude 20°18’S and longitude 28°46’E), in the Bulawayo Mining District of Zimbabwe.

The HGM is situated within the Mining Lease (ML) 28 tenement, which has a surface area of 2,408 hectares (ha) [Figure 3-2].

Bulawayo Mining Company (Private) Limited Zimbabwe (BMC Zimbabwe), a wholly owned subsidiary of Bulawayo Mining Company (UK) Limited (BMC UK), which is a wholly owned subsidiary of BMC Limited, currently holds ML 28.

The Property is accessible via a sealed road from Bulawayo, approximately 30 kilometres (km) west-northwest, which is in good condition. Access to the mine site and ore is authorised by the applicable mining legislation, and BMC Zimbabwe’s title and mining rights. Mining exploration and exploitation works conducted, or to be conducted on site are authorised in accordance with the applicable legislation, and BMC Zimbabwe’s title and mining rights.

| 1.2 | Geology and mineralisation |

The HGM is located in the Umzingwane Formation of the Bulawayo Greenstone Belt (BGB). The lithological units characteristic of the Umzingwane Formation include clastic metasediments, fine-grained tuffaceous rocks, banded shales and siltstones, ferruginous cherts or Banded Iron Formation (BIF), and rhyodacites and andesitic lavas. This assemblage has been subjected to metamorphism of lower greenschist facies.

The local geology around HGM consists of a sequence talc-chlorite schist, laminated black shale, silicate facies BIF, tuffaceous units, and siltstone from southwest to northeast with the occurrence of felsic porphyry intrusions and mafic dykes.

Mineralisation at the HGM is thought to have been formed by hydrothermal solutions migrating along structurally controlled channels, predominantly caused by an extensional duplex, with its long axis parallel to the direction of extension.

The deposit shows significant hydrothermal alteration, commonly with associated sulphide mineralisation. Strong carbonation, silicification, and in extreme cases propylitisation occur together with sulphides. Pyrite is the dominant sulphide, with significantly less chalcopyrite and occasional pyrrhotite present. Chalcocite and arsenopyrite have also been reported. Ore microscopy has shown that gold is associated with a late generation of pyrite and chalcocite.

Orebodies are generally elliptical in plan, strike to the north, and dip steeply at approximately 80 degrees (°) to the west, with a steep northerly plunge. The major orebodies are the 300N, 180N, 350N, 400N, and 10S, which have a combined strike length of approximately 500 metres (m). Additional orebodies, 320N, 330N, and 360N have been identified at depth.

The mineralised zones at the HGM have sharp grade boundaries, that in most cases can be defined with confidence.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 1 |

Exploration is based on detailed geological mapping that established the following sequence from southwest to northeast: talc-chlorite schist, laminated black shale, silicate facies BIF, tuffaceous units, and siltstone. The occurrence of felsic porphyry intrusions and mafic dykes was observed in historical quarries.

Channel sampling, diamond drilling, and sludge drilling samples were used for the purposes of geological modelling and Mineral Resource estimation.

| 1.4 | Mineral Resources estimates |

This report is prepared as a Technical Report Summary (TRS) for the Property, in accordance with the United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601(b)(96).

The Mineral Resources estimate has been defined, classified and reported by BMC Zimbabwe according to the guiding principles and minimum standards set out in SAMREC (2016). WSP’s view is that there are no material differences between SAMREC (2016), and S-K 1300 requirements for the reporting of Mineral Resources.

The relevant Qualified Persons (QPs) are satisfied that there has been sufficient orebody knowledge work completed to support Reasonable Prospects for Economic Extraction (RPEE) at the Property from a Mineral Resources perspective.

In the QPs’ opinion the assumptions for definition of the resource base are current.

For the purpose of demonstrating the capacity to exploit the resource and define Mineral Resources as required under S-K 1300, the QPs prepared a high level cashflow model and are satisfied that the scale of the resource and free cashflow after operating costs will cover the cost of capital and a suitable hurdle rate for investment. A process recovery of 89.5% for gold was applied for cashflow modelling consistent with recent historical averages and fixed tail estimates. Further assumptions are provided under Section 11.3 and Table 11-5.

Table 1-1 presents the underground Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) reported as at 31 December 2023. This is considered a conservative estimate due to the use of an Au COG of 1.4 g/t (refer to Section 11.3 for further information).

Mineral Resources are reported on an in-situ basis.

| Table 1-1 | HGM underground Measured and Indicated Mineral Resources estimate as at 31 December 2023 |

| Category | Tonnage (Mt) | Au Grade (g/t) | Au Metal (koz) |

| Underground |

| Measured Resources | 0.41 | 2.51 | 33 |

| Indicated Resources | 1.66 | 2.14 | 114 |

| Grand Total | 2.07 | 2.21 | 147 |

Notes: Mt = Million tonnes; Au Grade g/t = gold grams per tonne; koz = thousand ounces.

Table 1-2 presents the underground Inferred Mineral Resources (exclusive of Mineral Reserves) reported as at 31 December 2023. This is considered a conservative estimate due to the use of an Au COG of 1.4 g/t (refer to Section 11.3 for further information).

| Table 1-2 | HGM underground Inferred Mineral Resources estimate as at 31 December 2023 |

| Category | Tonnage (Mt) | Au Grade (g/t) | Au Metal (koz) |

| Underground | | | |

| Inferred Resources | 2.01 | 2.82 | 182 |

| Grand Total | 2.01 | 2.82 | 182 |

Notes: Mt = Million tonnes; Au Grade g/t = gold grams per tonne; koz = thousand ounces.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 2 |

Table 1-3 presents the sands (tailings) Inferred Mineral Resources (exclusive of Mineral Reserves) reported as at 31 December 2023.

| Table 1-3 | HGM sands (tailings) Inferred Mineral Resources estimate as at 31 December 2023 |

| Category | Tonnage (Mt) | Au Grade (g/t) | Au Metal (koz) |

| Sands (Tailings) |

| Inferred Resources | 11.07 | 0.60 | 213 |

| Grand Total | 11.07 | 0.60 | 213 |

Notes: Mt = Million tonnes; Au Grade g/t = gold grams per tonne; koz = thousand ounces.

It should be noted that the underground and surface Mineral Resources estimate for the Property is reported exclusive of Mineral Reserves.

The Mineral Resources presented in this Section are not Mineral Reserves, and do not reflect demonstrated economic viability. The reported Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves. There is no certainty that all or any part of this Mineral Resource will be converted into Mineral Reserve.

All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

Based on the geological results presented in this TRS and supported by the assumptions made by BMC Zimbabwe (presented in Section 11.3), it is the QP’s opinion that the Mineral Resources have RPEE.

| 1.5 | Mineral Reserves estimates |

The Mineral Reserves have been defined, classified and reported by BMC Zimbabwe according to the guiding principles and minimum standards set out in SAMREC (2016).

The QP is satisfied that there has been sufficient standard of evaluation to support estimation of a Mineral Reserve that has been demonstrated to be technically and economically viable.

It is the QP’s view is that there are material difference between the SAMREC and S-K 1300 requirements for reporting Mineral Reserves. WSP has adjusted the SAMREC estimate reported by BMC for the HGM to reflect the extractable (92% recovered) portion adjusted for the average Mine Call Factor (MCF) applied to grade (101.06% of resource grade), reflecting both plan dilution and positive reconciliation as a 3-year trailing average excluding outliers (+10%) as at end December 2023 (BCF = 103.9%). Mineral Reserves are reported on a plant feed basis, inclusive of dilution and ore loss modifying factors, assuming a gold metallurgical recovery of 89.5%.

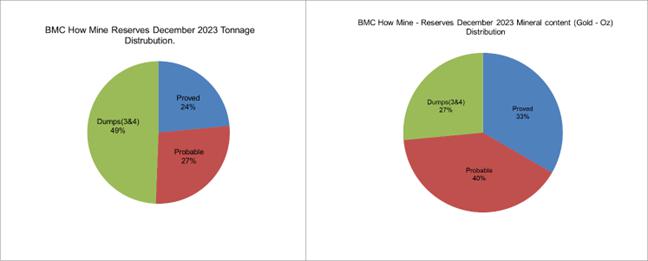

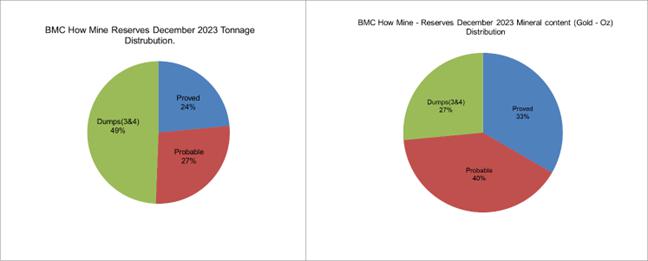

Table 1-4 presents the HGM Mineral Reserves estimate as at 31 December 2023.

| Table 1-4 | Mineral Reserves estimate as at 31 December 2023 |

| Category | Tonnage (kt) | Au Grade (g/t) | Au Metal (koz) | % Contribution |

| Underground |

| Proved Reserve | 390 | 2.35 | 29 | 33% |

| Probable Reserve | 450 | 2.42 | 35 | 40% |

| Total Proved & Probable | 840 | 2.39 | 64 | 73% |

| Surface |

| Probable Reserve | 820 | 0.88 | 23 | 27% |

| Grand Total | 1,650 | 1.66 | 88 | 100% |

Notes: UG = Underground, SF = Surface Stockpile Dam 3 and 4.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 3 |

The estimates are rounded to reflect the order of accuracy, to the nearest ten thousand tonnes (10 kt) for tonnage, to two decimal places for grade and density, and to the nearest thousand ounces (koz) for contained gold. Estimates are prepared carrying relevant decimal place accuracy to derive subtotals and totals that are subsequently rounded. Minor rounding errors may occur as a result.

| 1.6 | Capital and operating costs |

Capital and operating cost estimates have been prepared by HGM to generate a 3-year Mineral Reserves only LOM plan, plus 1 year for mine closure. WSP has analysed historical physical quantities, operating and capital costs of operation over the past 3 years 2021 – Q1 2024, and estimated an additional 5% contingency which has been applied to all operating and capital costs. Mine closure includes a contingency of 12.63%. The Mineral Reserve accounts for 17% by tonnage of the Measured, Indicated and Inferred inventory (inclusive of dilution, ore loss and low grade blocks) that HGM adopts for a 10 year strategic LOM plan.

Capital costs total US$22.3 M comprising sustaining capital of US$11.0 M, growth capital of US$3.7 M (only in 2024 for underground and process plant production upgrades) and mine closure of US$7.6 M (assuming a planned closure scenario). The mine closure cost estimate of $7.6 M was updated June 2024 in a review undertaken by Enmin Consulting (Private) Limited (Enmin).

Operating costs total US$74.4 M (US$89.08/t processed) comprising operating C1 costs of US$63.3 M (US$75.75/t processed) and fixed overheads US$35.2 M (US$7.15/t processed). Costs are prepared by HGM as ‘zero based’ estimates based on a track record of mine historical performance, current pricing and forecasts for key inputs (labour, consumables, power, fuel). There is potential for business improvement initiatives (power and water supply) to reduce unit operating C1 costs from $72/t to $68/t, and as a function of scale as production is increased from 40 ktpm to 47 ktpm in 2025. This in line with a capital upgrade program for the process plant and underground currently underway and due for completion in 2024, however, a conservative position has been adopted for cashflow modelling whereby a direct unit operating cost of US$72.15/t has been adopted, in line with 2021-23 average estimates, some 11% higher than forecast.

Given the historical track record of operation of the HGM, and a 5% contingency allowance for both operating and capital costs, WSP views the cost estimates comply with the level of accuracy required by § 229.1302 (Item 1302 of Regulation S–K). The capital and operating cost estimate accuracy is assessed at +15% while a 5% contingency allowance on all costs is consistent with recent historical variability as a provision for any additional, unforeseen costs associated with unanticipated geologic circumstances, engineering conditions and unanticipated geopolitical conditions.

Key outcomes of the cashflow evaluation and sensitivity analysis on an after tax basis, considering Mineral Reserves only are:

| — | A positive project NPV of US$3.1 M when Mineral Reserves only (PP) are considered over a 3-year LOM. |

| — | The project value is most sensitive to operating costs then gold price, but relatively less sensitive to capital cost. |

| — | The project value is relatively less sensitive to discount rate over a 11% – 20% range and gold price range from -25% (US$1,388/oz) and +25% (US$2,313/oz). |

| — | Project breakeven for the Mineral Reserve only inventory is a 4% fall in gold price (US$1,795/oz) or a 3% increase in total cost. |

The evaluation concludes that on a Mineral Reserves only basis, the project is economically viable with an NPV of $3.1 M at a discount rate of 15%, confirming the economic viability of the reserve base. The economic viability is most sensitive to operating costs and gold price, which is mitigated under the modelling by the assumption of:

| — | Unit costs of US75.75/t that are 11.4% higher than Q1 2024 average unit cost of US$68/t. |

| — | Gold price of US1850/oz which is 20% lower than Q1 2024 average spot price of $2,300/oz. |

On this basis, the economics are judged sufficiently robust to provide breakeven economics within a +10% level of accuracy and <15% contingency.

| 1.8 | Permitting requirements |

The ML is renewed on an annual basis with the Government of Zimbabwe. The area covered by ML 28 was surveyed and declared to be 2,408 ha. Isolated cases of illegal gold mining activities have been reported along some streams, and historical mine workings in the ML 28 area. Higher artisanal activity is concentrated along the Mzingwane River, on the southern margins of the ML 28 area. The ML is renewed annually, and the current certificate is valid to 17 August 2025.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 4 |

| 1.9 | QPs’ conclusions and recommendations |

Based on the information presented in this TRS, the QP’s key conclusions are as follows:

| — | The levels of understanding of the regional geology, local geology, and the nature and controls on mineralisation are high, and provide a solid foundation for geological modelling, Mineral Resource estimation, and mining and exploration geology. |

| — | The drilling, sampling, assay and Quality Assurance Quality Control (QAQC) techniques used for both exploration, and resource definition are consistent with standard industry practice, and are considered appropriate for the purposes of geological modelling and Mineral Resource estimation. |

| — | The on-site assay laboratory is well-equipped and maintained and is considered suitable for the work it is being utilised for. |

| — | Mineral Resource estimates used a combination of paper-based estimation methods, and digital (computer-based) estimation prior to 2023 MRMR estimation and reporting (Edelrod 2024). |

| — | Grade estimates were not constrained to orebody wireframes during grade estimation but were constrained to orebody wireframes during Mineral Resource estimate reporting. |

| — | Estimates utilise all available samples i.e., channel, sludge, and diamond drill core samples etc. |

| — | Dry (BD) of 2.8 tonnes per cubic metre (t/m3) assigned for all mineralised domains. |

| — | Statistical validation of the Mineral Resource estimates has not been reported. Standard industry practice is to conduct both visual, and statistical validation of estimates and present the findings of this work in the Mineral Resource report to provide the reader an appreciation of the robustness of the estimates. |

| — | Grade estimation within modelled mineralisation domains (constrained estimate) would likely result in an increase in contained metal. |

| — | Work is currently in progress to rationalise and streamline the process for Mineral Resource and Mineral Reserve estimation. This will include consolidation of individual resource models into a single resource model. |

| — | RPEE have been considered, and the parameters used are considered reasonable. |

| — | The Mineral Resource classification that has been applied is considered appropriate. |

| — | Based on the dimensions of the deposit, and the size of the mine workings, the Mineral Resource estimate appears reasonable, and consistent with historical mined gold grades. |

| — | The MRMR technical report developed by BMC Zimbabwe covers a number of areas in sufficient detail; however, some areas require more detail to give the reader a more thorough understanding of the work that has been conducted, the results of the work and any inherent risks to the Mineral Resource estimate. |

| — | Mining, processing, and market modifying factors, study assumptions and parameters are used to establish RPEE for the reporting of Mineral Resources. No significant risks exist that could impact the reliability and/or confidence of Mineral Resources estimates. |

Based on the information presented in this TRS, the QP’s key recommendations are as follows:

| — | Data and database management is an area that requires further work. The HGM would benefit from the introduction of a corporate database, with inbuilt validation routines and reporting functionality, to assist with what is a large quantity of geological information. |

| — | The estimated cost of this recommendation is US$1,000,000 across the BMC Limited portfolio of assets. |

| — | A review of lithology, structural, and mineralisation modelling practices. |

| — | It is recommended that studies to characterise the hydrogeology are included in future exploration programs. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 5 |

| — | Data analysis is conducted; however, it is recommended that for future Mineral Resource estimates, deposit wide Exploratory Data Analysis (EDA) is undertaken prior to estimation, to ensure data is fit for purpose for geological modelling and Mineral Resource estimation. |

| — | It is recommended that a succinct geological modelling and Mineral Resource estimation process flow is developed and followed for future Mineral Resource estimates. |

| — | It is recommended that Mineral Resource estimation is constrained to modelled mineralisation domain wireframes, using an appropriate Au Cut-off Grade (COG). |

| — | A comparison between dry BD values determined from underground grab samples, and drill core should be undertaken to ensure that the mean values used for Mineral Resource estimation are appropriate, and that bias is not being incorporated into the Mineral Resource estimate. |

| — | Validation of the Mineral Resource estimates produced, or at least the documentation of validation work undertaken is an area that requires further work. Standard industry practice is to conduct both visual and statistical validation of estimates and present the findings of this work in the Mineral Resource report, to give the reader an appreciation of the robustness of the estimates. |

| — | A review of the Mineral Resource classification methodology, and block assignment. |

| — | Mineral Resource reconciliation practices should be reviewed, and a system implemented that provides a measure of Mineral Resource estimate performance. Planned versus actual resource tonnages and grades should be developed and updated each time a Mineral Resource estimate is completed. It is recommended that mined development and production be reconciled monthly, and stope close-out reports be developed for each completed stope. |

The QP is satisfied with the basis for estimation and update of the 2023 Mineral Reserves. The outlook for the Mineral Reserve and LOM has improved on a number of fronts, these being:

| — | Capital upgrades to increase underground production and process throughput to 47 ktpm due to be completed by end 2024. |

| — | Completion of the shaft deepening to the shaft sump below the 33 Level during 2023 to allow access to target mining blocks and installation of a loading pocket. Further shaft deepening to the 36 is planned. |

| — | Process plant capital upgrades and improvements that are ongoing to provide improved plant reliability and performance. |

| — | Work currently in progress to rationalise and streamline the process for Mineral Resource and Mineral Reserve estimation. This will include consolidation of individual resource models into a single resource model. |

| — | Recent increase in gold price to average above US2 300/oz spot pricing approximately 25% above the US$1,850/oz assumed for cashflow evaluation and US$1,800/oz assumed for cut-off grade (pay limit) determination. |

Based on the information presented in this TRS, the QP’s key conclusions are as follows:

| — | The Mineral Resource and Mineral Reserve report (BMC 2023b) is incomplete in terms of presenting detailed underground designs, provision of a Table 1, adequately accounting for block recovery and maintaining an accurate record of underground and surface broken ore stocks. |

| — | The Mineral Reserve estimate (BMC 2023b) prepared by HGM appropriately accounts for a mine call factor based on historical gold metal production assessed as a 3-year trailing average excluding +10% outliers, however: |

| — | While 4 of 36 monthly estimates are excluded from calculation of the BF, 20 of 36 monthly estimates are excluded from estimation of the APF, indicating a higher level of uncertainty in these estimates since the outliers represent a high proportion of the data. |

| — | The mine call factor based on gold metal reconciliation is only applied to grade. |

| — | No recovery factor is applied to tonnage reported as Mineral Reserves by HGM, however, an extractable reserve is implemented on transfer to the LOM schedule estimated at 92%. |

| — | The estimate does not appropriately account for significant contribution from the Mineral Resource, including Inferred material on an annual basis for reconciliation purposes. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 6 |

| — | The level of overall plan dilution appears low but the manner in which the MCF, dilution and extraction are applied adequately account for both excess dilution and ore loss in the stopes. There is no separate account for unplanned or operational ore loss. The Assay Plan Factor (APF) and Block Factor (BF) estimated from gold content are applied as Mine Call Factors (MCF) only on the grade. In effect, the adoption of APF and BF factoring of grades accounts for historical production performance as call factors that take account of both dilution and ore loss, however, the relatively high level of contribution from Inferred resource category (20-50% historically) may be masking the overall reconciliation. |

| — | Diluted tonnage and grade estimates in the block listings are hard coded and not readily auditable. The QP understands that some estimates above the 20L are based on manual methods, but most estimates are derived from reporting from block models using design wireframes. WSP check reporting has found inconsistencies related to grade and classification; however, the QP is of the view that adjustments implemented by WSP appropriately account for the stated Mineral Reserve. |

| — | Ore tonnages are reported on a dry basis. Recent inspection in May 2024 indicates that the mine is relatively dry. Density estimates are applied at one significant decimal place. WSP recommends estimating average densities either by interpolation within the resource model by lithology or by reconciliation to derive an average dry density estimate to two significant decimal places. |

| — | The system of application of mining modifying factors based on reconciliation is a conventional approach, however, consideration should be given to separate estimation of tonnage and grade factors, particularly where there is significant contribution to production from MII category resources (non-PP). Spot checks reveal some inconsistencies and inaccuracy in reporting of volumes, classification, grade averaging and modifying factor evaluation, but these are judged to not unduly impact the level of accuracy for the reserve base estimated. WSP recommends: |

| — | Independent assessment of the resource and reserve block estimates utilising modern CAD techniques to facilitate complete transition from a manual approach. |

| — | Maintenance of underground stope block files to facilitate reconciliation and dilution/loss estimation on a stope block-by-block basis. |

| — | Preparation of development and stope block design wireframes for inventory interrogation that fully accounts for crown, sill, rib and extraction cone pillars. |

| — | Review of application APF, BF and BCF modifying factors based on gold metal content and applied solely as a grade factor. |

| — | Review of stope block Mineral Reserve, break, hoist, mill feed and reconciled mill production to confirm reconciliation factors calculated monthly. |

| — | Review of average mineralisation width, stope block width and diluent grade to ensure that appropriate account is made for both practically achievable mining widths and dilution estimates. |

| — | Inspection of estimates for the BF, APF and BCF over the past three years indicates a strongly positive reconciliation of +32% metal content between the depleted inventory and the reconciled Mill Feed, justified by BMC as largely resulting from a high proportion of Inferred and non-Mineral Reserve material (47% in 2023). In addition, historical forecast tonnage and grades have been relatively consistent, providing some justification to the modifying factors applied. While the operating performance provides confidence in the overall Mineral Reserve, the high contribution from Non-Mineral Reserve sources may be both masking lower tonnage recovery and under-estimating grade for Mineral Reserve blocks. For these reasons, WSP recommends: |

| — | Reconciliation of Depleted Blocks, Break, Hoist, Claim Mill Feed, Reconciled Mill Feed, Underground Stocks (Break less Extraction/Hoist), Surface Stocks and Written Off Stocks (corrections) on a monthly basis, in terms of tonnage, grade and metal content. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 7 |

| — | Establishment and maintenance of detailed stope files. |

| — | Application of dilution and ore loss on a block-by-block basis from updated reconciliation. |

| — | Review of Mineral Reserve definition and stope design practices. |

| — | BMC Zimbabwe should be using the extractable reserve tonnes and grade for scheduling. The reason HGM do not is to provide a comparison for APF and BF estimation. BMC should maintain two sets of figures – one for reconciliation and one for scheduling and cashflow analysis. Mining schedules and cashflow models should adopt the extractable Mineral Reserve tonnage and grades. |

| — | The 1.5 g/t pay limit for ROM is estimated based on US$1,800/oz Gold, process recovery assuming a fixed tail residual grade of 0.24 g/t (84% recovery at 1.5 g/t), and representative operating and sustaining capital cost estimates (US$72/t). Pricing represents a discount on the 3-year trailing average (US$1,848/oz) and spot price (US$2,329/oz as at 31/05/2024). The pay limit for Tailings Dump (Sands) is estimated at 0.8 g/t based on a higher fixed tail residual grade of 0.40 g/t (50% recovery at 0.8 g/t) and lower cost structure (US$20/t). These estimates were reviewed in detail by the QP and judged appropriate. |

| — | Three marginal blocks were included in the reserve base (15L10_300N, 17L10_300N, 17L10_300FW) for 70 kt at 1.41 g/t. These blocks were included by the QP on the basis of a reduction in the pay limit to 1.39 g/t once a 3-year trailing average price of US$1,850/t is assumed and 1.17 g/t where the spot price of US$2,300/oz (May 2024) is assumed. |

| — | How mine adopts a complex spreadsheet system for preparation of the LOM plan that utilizes extractable Mineral Reserve and Mineral Resource block tonnages in combination with the original Mineral Resource grade. While adoption of extractable tonnage estimates is appropriate and should also be included in the Mineral Reserve estimate, the use of undiluted resource grades for mine scheduling is not acceptable practice. Furthermore, the approach adopted for mine scheduling requires improved QAQC since inconsistencies were noted and corrected for start and end year stocks for scheduling. |

| — | Underground and surface broken ore stocks are not reconciled. Starting stocks for the LOM plan end December 2023 assume nil stocks. |

| — | The surface Dam Sands #3 & #4 reserve estimates are appropriately based on survey solid wireframes, resource models and pay limit estimates (0.8 g/t). The Dam Sands reserve is not currently included in the LOM plan since it would displace higher grade underground resource but remains as potential project upside at the conclusion of underground mining and processing. |

| — | Capital and operating costs for the operation are considered appropriate and compare well with historical benchmarks, contracts and quotations. No contingency allowance is included in HGM estimates. |

| — | Completion of the plant upgrade from 40 thousand tonnes per annum (ktpa) to 47 ktpa in 2024 should also facilitate improved plant availability and utilisation and allow increased focus on reducing residue. |

| — | WSP notes that the LOM plan forecasts throughputs of up to 54 ktpm which is higher than the planned production upgrade to 47 ktpm. The capacity to meet these planned throughput rates needs to be justified given a growth capital allocation only for 2024. |

| — | The mine should prepare a consolidated resource block model to allow ease of interrogation and analysis. |

| — | Resource models be reviewed, upgraded, and integrated to allow much easier reporting based on design wireframes and as-mined surfaces. Issues with classification should be resolved. The resource model should be flagged by stoping block to allow ease in reporting. |

| — | Design wireframes should be prepared for all Mineral Reserve blocks that appropriately account for design constraints in terms of resource mineralisation widths, stope widths, crown/sill/rib pillars and any geotechnical constraints particularly as the mining extends at depth. Integrated as-mined and design wireframe models should be prepared with all wireframes flagged to allow ease in reporting. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 8 |

| — | Detailed stope files or stope notes should be maintained for each stope block that records the design and production performance to allow estimation of dilution, loss, reconciliation statistics, and broken stock inventories. |

| — | Ore production from development should be monitored, recorded, and reconciled on an ongoing basis. |

| — | A complete review of the reconciliation process should be undertaken to confirm the gross level of dilution and ore loss, planned (via stope design), unplanned (operational) and actual. |

| — | The manner of application of the MCF to grade alone should be reviewed in concert with the reconciliation review. Recovery factors should be applied to tonnage estimates to derive extractable reserves for all Mineral Reserve blocks. |

| — | Dam Sands process amenability should be reviewed with respect to potential for impurities, deleterious elements and pregnant solution robbing materials. Process variability testwork should be revisited. |

| — | Gold and silver prices selected for estimation of pay limits and the LOM financial model should be based on a review of spot prices, forecast price estimates and/or 3-year trailing average of spot pricing. These estimates should be modified to reflect net price received as a consequence of the Zimbabwean governments requirement for Real Time Gross Settlement (RTGS) which currently requires that 75% of gold is paid in United States Dollars (USD) whilst the remaining 25% in local currency with effect from February 2023 (previously 60% USD and 40% in local currency). Sale of gold under these terms has been mandated by the Zimbabwean Government since the start of 2020. |

The QP recommends providing further support to the Mineral Reserve estimate in terms of:

| — | Unit operating costs should be reviewed on a fixed and variable basis to confirm forecast cost savings from economies of scale. |

| — | The capital and operating costs and the process recovery for sands tailing treatment should be confirmed by at least a pre-feasibility level study in order to confirm viability. A trial sands retreatment project was conducted during 2023 (BMC How Mine, July 2023) which concluded that additional plant upgrades (increased residence time, expanded leach capacity, mixers, pipework, and pumps) are required to lift throughput above 1350 tpd as a blend with underground ore. The QP recommends further assessment of the economic viability for processing the surface sands stockpile, given the low grade and estimated pay limit. Based on a preliminary evaluation from inspection of the HGM 2020 cost report and LOM plan, the viability of processing sands and inclusion as a Mineral Reserve depends on achieving reduced marginal unit processing costs and improved process recovery. The mining method, for example via conventional excavator/truck or monitor mining, needs to be identified and mining costs and capital costs estimated for the project to at least a PFS level of evaluation. |

| — | The mining methods are appropriate to the style and type of mineralisation and are based on a history of successful implementation. Subject to capital constraints, the QP recommends consideration be given to implementing more modern, mechanised mining techniques to improve productivity and production tonnage per personnel-shift. This will need to take appropriate account of the existing underground infrastructure and constraints. It could include the use of diesel, electric or battery powered boggers and electric-hydraulic drill rigs. |

| — | The calculation and the data underlying the APF and BF factors estimates should be reviewed. The variance and compliance between what were scheduled for mining and what was actually mined and processed should also be checked. HGM could consider adopting an “F Factors” reconciliation approach. |

| — | The underground stope block assessment appears to be supported by technical work and methodology to the required level to estimate a Mineral Reserve. A complete audit and independent estimation of the Mineral Resource and Mineral Reserve estimates is recommended. |

| — | Detailed stope block reconciliation should be completed on a regular monthly basis comparing by stoping block for the scheduled Mineral Resource, Mineral Reserve, break, hoist, mill feed (reconciled) and metal production. Stope files should be maintained that provide a detailed reconciliation record. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 9 |

| 2.1 | Registrant information |

This Technical Report Summary (TRS) is for the Bulawayo Mining Company Limited (BMC Limited) owned How Gold Mine (HGM) [or the Property], located in Matabeleland South Province, southwestern Zimbabwe, and was prepared by the Qualified Persons (QPs) for BMC Limited.

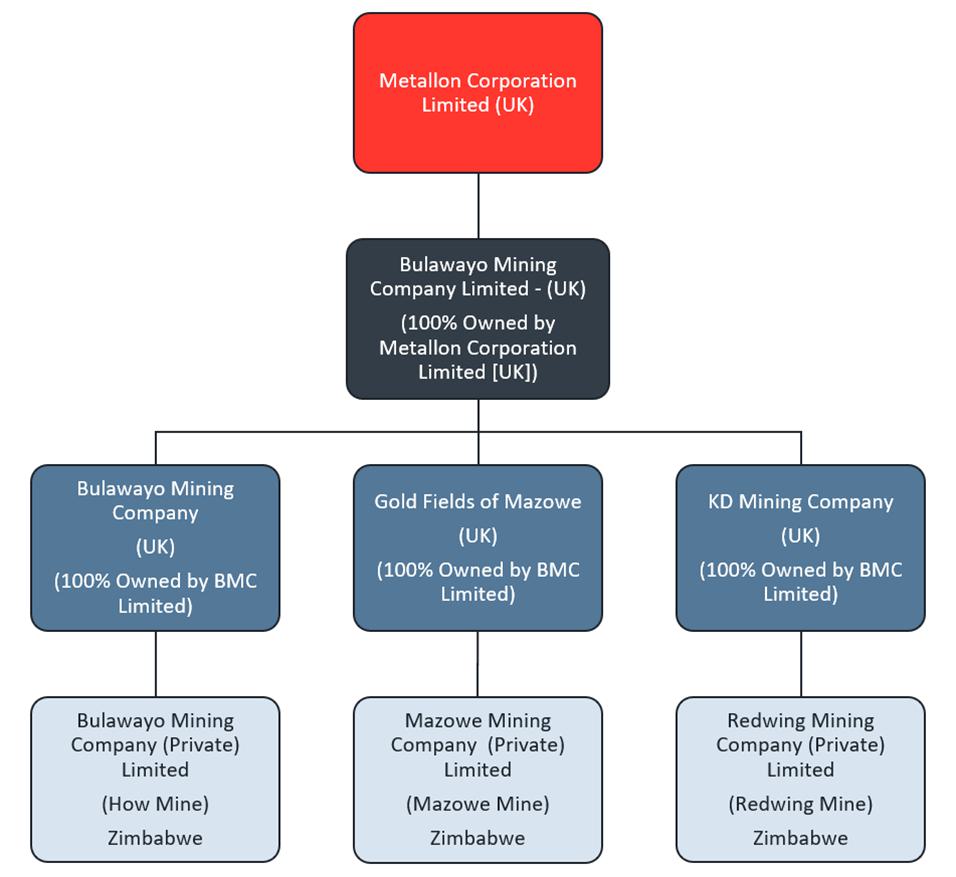

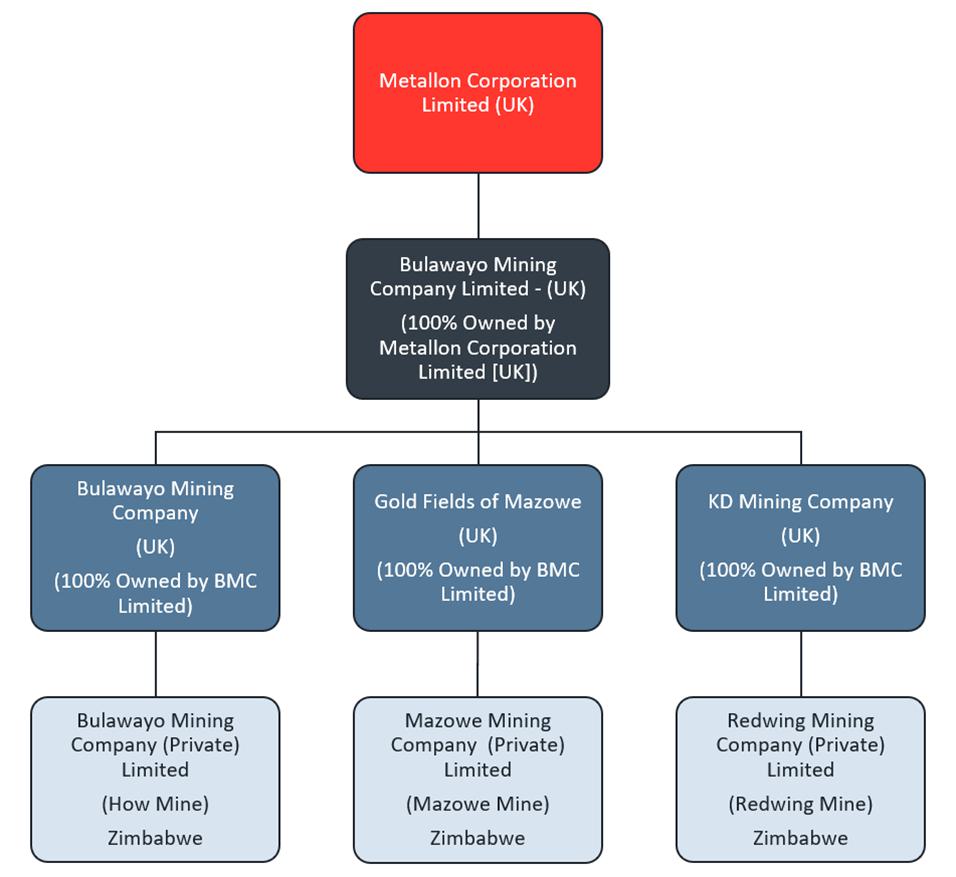

BMC Limited is a private company incorporated in the United Kingdom (UK) and is a wholly owned subsidiary of Metallon Corporation Limited (UK) [Metallon]. Bulawayo Mining Company (UK) Limited (BMC UK) is a private company incorporated in the UK and is a wholly owned subsidiary of BMC Limited.

Bulawayo Mining Company (Private) Limited Zimbabwe (BMC Zimbabwe), Mazowe Mining Company (Private) Limited Zimbabwe (MMC Zimbabwe), and Redwing Mining Company (Private) Limited Zimbabwe (RMC Zimbabwe) are responsible for the management of mineral assets located in Zimbabwe, the principal activities of which include exploration, development and operation of precious metals mineral assets.

BMC Zimbabwe is directly responsible for the day-to-day management of mining operations and holds ML 28. The area covered by ML 28 has a surface area of 2,408 hectares (ha) [Figure 3-2] (BMC 2023b).

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 10 |

Figure 2-1 presents the corporate structure of BMC Limited.

Figure 2-1 BMC Limited corporate structure

In October 2002, Metallon (herein referred to as BMC Limited) acquired a portfolio of mineral assets from a holding subsidiary of Lonmin plc (Lonmin), known as Independence Mining (Private) Limited (IML).

This portfolio of mineral assets located in Zimbabwe consists of three mining properties located within a significant land package consisting of some 66.02 square kilometres (km2) in area. The mining properties comprise three separate underground gold mines, namely: How, Mazowe, and Redwing. Each mining property is serviced by its own dedicated processing facilities and accompanying infrastructure. BMC Limited considers there to be significant exploration potential at each of the mining properties.

From acquisition of the assets in 2002 until 2006, gold production steadily increased, with gold production peaking in 2005 at approximately 156,000 ounces (oz) of gold, making BMC Limited Zimbabwe’s largest gold producer.

Due to political unrest and hyperinflation in 2007, BMC Limited’s mining activities in Zimbabwe ceased, and all mines were placed on Care and Maintenance (C&M). In 2009, mining activities recommenced, with several of the mines requiring rehabilitation work.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 11 |

Operations were suspended at the Mazowe Gold Mine (MGM) on 31 December 2018, and at the Redwing Gold Mine (RGM) on 30 March 2019 due to general economic challenges.

Gold production from the HGM since 2018 is as follows (BMC Zimbabwe Operation Reports):

BMC Limited’s forward strategy is to produce 300,000 oz of gold per annum through expansion across all mines, and through a broader acquisition strategy across Africa.

BMC Limited is pursuing a focused expansion strategy throughout Africa, with the aim of securing prospective green minerals assets in Zimbabwe, and the Democratic Republic of Congo (DRC).

| 2.2 | Terms of reference and purpose |

The purpose of this TRS is to report Mineral Resources, and Mineral Reserves for the Property effective 31 December 2023. Mineral Resources and Mineral Reserves reported herein are supported by annual report statements prepared by BMC Limited in accordance with SAMREC (2016) and rely on Feasibility Study (FS) level assessments based on the HGM’s continued operation as a going concern.

The TRS utilises:

| — | Australian English spelling. |

| — | Metric units of measure. |

| — | grades presented in grams per tonne (g/t). |

| — | co-ordinate system presented in metric units using Cape/Lo29. |

| — | United States Dollars (USD). |

Summary Mineral Resources and Mineral Reserves in Table 1-1, Table 1-2, Table 1-3, and Table 1-4 are presented based on a BMC Limited equity ownership basis (100%).

Key acronyms and definitions used in this TRS include those items listed in Table 2-1.

Table 2-1 List of acronyms and abbreviations used in this TRS

| Acronym/Abbreviation | Description |

| ° | Degrees |

| °C | Degrees Celsius |

| ACZ | Airport Company of Zimbabwe (Private) Limited |

| AMD | Acid Mine Drainage |

| amsl | Above mean sea level |

| APF | Assay Plan Factor |

| ASCII | American Standard Code for Information Interchange |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 12 |

| Acronym/Abbreviation | Description |

| Attica | Attica Mines (Pvt) Ltd. |

| Ballarat | Ballarat Mines (Pvt) Ltd |

| BBR | Beitbridge Bulawayo Railway (PVT) LTD |

| BCF | Block Call Factor (a mine call factor) |

| BGB | Bulawayo Greenstone Belt |

| BIF | Banded Iron Formation |

| BF | Block Factor |

| BMC Limited | Bulawayo Mining Company Limited |

| BMC Zimbabwe | Bulawayo Mining Company (Private) Limited Zimbabwe |

| BMC UK | Bulawayo Mining Company (UK) Limited |

| CAD | Computer-Aided Design |

| Capex | Capital Expenditure |

| CFM | Cubic Feet per Metre |

| CIP | Carbon in Pulp |

| C&M | Care and Maintenance |

| COG | Cut Off Grade |

| CPR | Competent Person’s Report |

| CRM | Certified Reference Material |

| CV | Coefficient of Variation |

| DRC | Democratic Republic of Congo |

| DXF | Drawing Exchange Format |

| EBIT | Earnings Before Interest and Taxes |

| EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization |

| EDA | Exploratory Data Analysis |

| EIA | Environmental Impact Assessment |

| EMA | Environmental Management Agency |

| EMP | Environmental Management Plan |

| Enmin | Enmin Consulting (Private) Limited. |

| ESIA | Environmental and Social Impact Assessment |

| FGB | Filabusi Greenstone Belt |

| Frobisher | Frobisher Ltd. |

| FS | Feasibility Study |

| Goldfields | Goldfields Development Co. Ltd |

| g | Grams |

| g/l | Grams per litre |

| g/t | Grams per tonne |

| ha | Hectares |

| Halo | Halo Co. Ltd |

| HGM | How Gold Mine |

| IML | Independence Mining (Private) Limited |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 13 |

| Acronym/Abbreviation | Description |

| ISO | International Organization for Standardization |

| Independence | Independence Mining (Pvt) Ltd. |

| JMN | Joshua Mqabuko Nkomo International Airport |

| kg | Kilograms |

| km | Kilometres |

| km2 | Square kilometres |

| koz | Thousand ounces |

| kt | Thousand tonnes |

| ktpa | Thousand tonnes per annum |

| ktpm | Thousand tonnes per month |

| kV | Kilovolts |

| l/s | Litres per second |

| LOM | Life of Mine |

| Lonmin plc | Lonmin |

| Lonrho | Lonrho Zimbabwe (Pvt) Ltd. |

| m | Metres |

| M | Million |

| MAR | Mean annual run-off |

| MCF | Mine Call Factor |

| Ml | Megalitre |

| ML | Mining Lease |

| mm | millimetre |

| MMC Zimbabwe | Mazowe Mining Company (Private) Limited Zimbabwe |

| MPa | Megapascal |

| Middindi | Middindi Consulting Pty Ltd |

| Mt | Million tonnes (metric) |

| mVA | Megavolt-ampere |

| NPV | Net Present Value |

| NRZ | National Railways of Zimbabwe |

| OK | Ordinary Kriging |

| opex | Operating Expenditure |

| oz | Ounce |

| PSA | Pressure Swing Absorption |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 14 |

| Acronym/Abbreviation | Description |

| QAQC | Quality Assurance Quality Control |

| QP | Qualified Person |

| Rhodesian | Rhodesian Gemstones (Pvt) Ltd. |

| RMC Zimbabwe | Redwing Mining Company (Private) Limited Zimbabwe |

| RMR | Rock mass rating |

| ROB | Rough-Ore-Bin |

| ROM | Run of Mine |

| RPEE | Reasonable Prospects for Economic Extraction |

| RTGS | Real Time Gross Settlement |

| SAMREC | South African Mineral Resource Committee |

| SD | Standard Deviation |

| SG | Specific Gravity |

| SHEQ | Safety, Health, Environment and Quality |

| SRK | SRK Consulting (South Africa) (Pty) Ltd |

| t | Tonne |

| t/m3 | Tonnes per cubic metre |

| tpm | Tonnes per month |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| UK | United Kingdom |

| μm | Micrometre |

| USD | United States Dollar |

| WSP | WSP Australia Pty Limited |

| Wt.% | Weight percent |

| ZESA | Zimbabwe Electricity Supply Authority |

| ZETDC | Zimbabwe Electricity Transmission and Distribution Company |

| ZiG | Zimbabwe gold currency |

| ZINIRE | Zimbabwe National Institute of Rock Engineering |

| ZWL | Zimbabwean Dollar |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 15 |

| 2.3 | Sources of information |

This TRS relies upon various reports and other material prepared by BMC Limited, and BMC Limited’s staff and consultants as provided to WSP. This data and information have been supplemented with information in the public domain, and through information gathered during a site inspection by WSP in May 2024 (Section 2.4).

While WSP has reviewed the data and other information contained in the reports and other material provided to it and is not aware of any reason to doubt that such data and information is complete and accurate, excluding Golder (2021), WSP was not responsible for the preparation of those reports and other material.

WSP has taken reasonable care to ensure that the information contained in this TRS is in accordance with the facts and information available to it and is unaware of any omission likely to affect its import. In this regard, the attention of any reader of the TRS is specifically directed to Section 24, and Appendix A.

Information in this TRS has been prepared under the supervision of the WSP QPs:

| — | Aaron Radonich, Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM, Member Number 221172), Principal Geologist, WSP. Aaron is responsible for HGM Mineral Resources. The date of the last personal inspection was May 2024. |

| — | Allan Blair, Member of the Australasian Institute of Mining and Metallurgy (FAusIMM, Member Number 102240), Principal Mining Engineer, WSP. Allan is responsible for HGM Mineral Reserves. The date of the last personal inspection was May 2024. |

Table 2-2 presents a tabulation of the QPs, their personal inspections, and their areas of responsibility.

| QP | Qualifications/Affiliation | Date of Personal Inspection | Areas of Responsibility |

| Aaron Radonich | Fellow AusIMM, PGCert Geostatistics, BSc (Hons.), BSc | May 2024 | Sections 1.1, 1.2, 1.3, 1.4, 1.7, 1.8.1, 2, 3, 4, 5, 6, 7, 8, 9.1, 11, 20, 21, 22,1, 23.1, 24 and 25. |

| Allan Blair | FAusIMM, MBA, BSc, BAppSc Mining Engineering | May 2024 | Sections 1.5, 1.6, 1.7, 1.8.2, 5, 9.2, 9.3, 9.4, 9.5, 10, 12, 13, 14, 15, 16, 17, 18, 19, 22.2, and 23.2. |

During the personal inspection, Aaron Radonich and Allan Blair reviewed the regional and deposit geology with senior personnel from the management, geology and mining teams. Aaron Radonich and Allan Blair visited the core storage facility to review the deposit geology, core logging, sampling, analytical, QAQC, and core/sample chain of custody and archiving processes.

Aaron Radonich and Allan Blair visited the operating underground mine (active mining areas) and surrounding area and observed short-term (pre-production) and grade control (production) drilling.

During the personal inspection, Aaron Radonich and Allan Blair interviewed senior personnel from the management, geology and mining teams regarding recent mine performance, and geological modelling, and MRMR estimation and reporting practices.

Aaron Radonich and Allan Blair visited and inspected the Tailings Storage Facility (TSF) and associated impoundment dams, processing facility, surface water (stormwater) drainage systems, and site support infrastructure (workshops and maintenance facilities, warehouses, explosive magazines, site access fuel storage and power supply).

| 2.5 | Previously filed Technical Report Summaries |

This is the first TRS filed for the Property, and therefore does not update a previously filed TRS.

The opinions of QPs in the employ of WSP contained herein and effective 31 December 2023, are based on information collected throughout the course of investigations by the QPs. The information in turn reflects various technical and economic conditions at the time of preparing the TRS. Given the nature of the mining business, these conditions can change significantly over relatively short periods of time. Consequently, actual results may be significantly more or less favourable.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 16 |

This TRS may include technical information that requires subsequent calculations to derive sub-totals, totals, and weighted averages. Such calculations inherently involve a degree of rounding, and consequently introduce a margin of error. Where these occur, the QPs do not consider them to be material.

Neither WSP, nor the QPs responsible for this TRS, are insiders, associates, or affiliates of BMC Limited or any of its subsidiaries. The results of the technical review by the QPs are not dependent on any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings.

| 2.7 | Statement of Independence |

WSP has provided and continues to provide technical consulting services to BMC with respect to its mineral assets; some of that work is referred to in this report. The work is carried out independently on a fee for service basis. Fees generated from BMC are not material to WSP either locally or globally. The QPs have previously worked on projects for BMC and in our opinion, WSP’s association with BMC does not impact on the independence of this report. Furthermore:

| — | WSP and the authors of this report have no material present or contingent interest in or association with BMC, and their subsidiaries or the assets under review. Individual employees of WSP may hold non-material securities holdings in these entities either directly or indirectly. |

| — | WSP has had no material association during the previous two years with the owners/promoters of the mineral assets, the company acquiring the assets or any of the assets to be acquired and has no material interest in the projects. |

| — | There are no business relationships between WSP and BMC. WSP or its employees and associates are not, nor intend to be a director, officer or other direct employee of BMC. The relationship with BMC is solely one of professional association between client and independent consultant. |

| — | WSP does not hold and has no interest in the securities of BMC and its subsidiaries under review. |

| — | WSP has no relevant pecuniary interest, association or employment relationship with BMC and its subsidiaries. |

| — | WSP has no interest in the material tenements, the subject of the Report. |

| — | WSP is not a substantial creditor of an interested party, nor has WSP a financial interest in the outcome of the proposal. The review work and this report are prepared in return for professional fees based upon agreed commercial rates and the payment of these fees is in no way contingent on the results of this report. |

| — | The Report has been prepared in compliance with the Australian Corporations Act and ASIC Regulatory Guide 112 with respect to WSP’s independence as experts. |

| — | Fees for the preparation of this report are being charged at WSP’s standard schedule of rates, with expenses being reimbursed at cost plus a handling charge. Payment of fees and expenses is in no way contingent upon the conclusions of this report. |

| — | Based on the information provided to WSP and to the best of its knowledge, WSP has not become aware of any material change or matter affecting the validity of the report. |

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 17 |

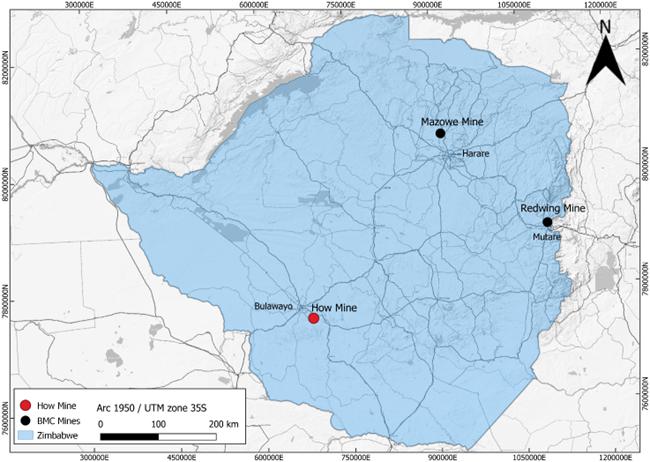

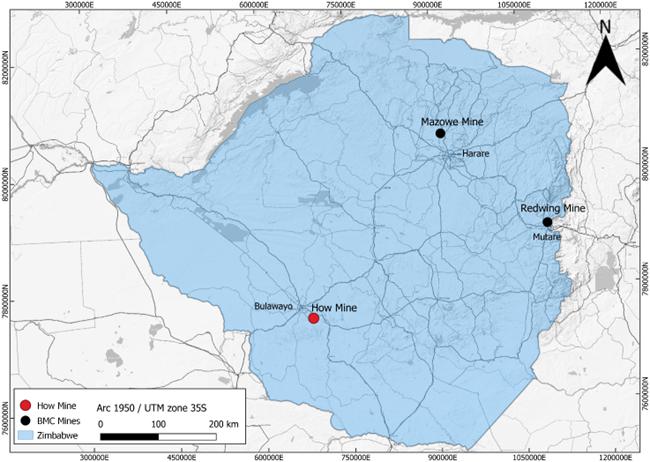

The Property is located in Matabeleland South Province, Zimbabwe, approximately 30 km southeast of the city of Bulawayo (latitude 20°18’S and longitude 28°46’E), in the Bulawayo Mining District of Zimbabwe.

The location of the Property and its proximity to major infrastructure is presented in Figure 3-1.

Figure 3-1 Property location map

| 3.2 | Title and mineral rights |

BMC Zimbabwe, a wholly owned subsidiary of BMC UK, which is a wholly owned subsidiary of BMC Limited, holds ML 28. The area covered by ML 28 has a surface area of 2,408 ha. ML 28 is renewed annually, and the current certificate is valid until 17 August 2025 (BMC 2023b).

Isolated cases of artisanal gold mining activities have been reported along some streams, and historical workings within the ML area. Artisanal activity is largely concentrated along the Mzingwane River, on the southern margins of the ML area (BMC 2023b).

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 18 |

Figure 3-2 presents the ML 28 boundary.

Figure 3-2 HGM ML 28 boundary

While WSP has referred to tenement holdings in this TRS, such reference is for convenience only and may not be complete or accurate. WSP is not expert in tenement management and the reader should not rely on information in this TRS relating to the current ownership and legal standing of the tenements or any encumbrances impacting on those tenements. This TRS assumes that all tenements and tenement applications are in good standing and free of all encumbrances other than those set out in this TRS.

There are no known significant encumbrances to the Property that would impact the current Mineral Resources or Mineral Reserves.

| 3.4 | Risks to access, title or right to perform work |

Access to the mine site and to the ore is authorised by the applicable mining legislation, and BMC Zimbabwe’s title and mining rights (Section 3.2). Mining exploration and exploitation works conducted or to be conducted on site are authorised in accordance with the applicable legislation, and BMC Zimbabwe’s title and mining rights (Section 3.2). Other required permits and authorisations (e.g., environmental, building, etc.) are applied for by BMC Zimbabwe in accordance with the applicable legislation.

Project No PS213686

How Mine

S-K 1300 Technical Report Summary

Bulawayo Mining Company Limited | WSP

January 2025

Page 19 |

| 3.5 | Agreements and royalties |

In 2022, the government of Zimbabwe has promulgated new regulations through Statutory Instrument 189 of 2022 to the effect that mineral royalties are to be paid partly in kind and partly in monetary form. The mineral royalties are collected from minerals specified in terms of section 49(1)(c1) of the Reserve Bank of Zimbabwe Act [Chapter 11:15] deemed to be components of the reserves maintained by the Reserve Bank of Zimbabwe. Minerals include but are not limited to gold, diamonds, platinum group metals and lithium. These regulations have also caused timeous amendments to the Finance Act and the Reserve Bank of Zimbabwe Act to ensure the cooperation in application of legislation (BMC 2023b).

In 2024, the monetary component was revised.

Royalties remitted to the Zimbabwe Revenue Authority in respect of gold and those minerals specified are paid based on 50% in kind and 50% in monetary form. With regards the “in kind component”, miners submit actual minerals they would have extracted. The 50% monetary component would be paid as follows:

| — | 37.5% in the Zimbabwe Gold (ZiG) currency. |

| — | 12.5% in foreign currency (RBZ 2024). |

Prior to the promulgation of these regulations, royalties were paid only in monetary form.

A US$21 per kilogram (/kg) realisation fee is also charged for gold lodged with Fidelity Printers and Refiners (BMC 2023b).

Project No PS213686

How Mine

S-K 1300 Technical Report Summary