meeting. Under our Declaration of Trust, amendments to our Declaration of Trust and mergers, consolidations, conversions, or transfers or other dispositions of all or substantially all of our assets, in each case to the extent shareholder approval is required, must be approved by shareholders entitled to cast a majority of all of the votes entitled to be cast on the matter. In addition, shareholders have the power, without the concurrence of the trustees, to remove a trustee from our board of trustees for “cause”, and then only by the affirmative vote of two-thirds of the votes entitled to be cast on such matter. “Cause” is defined in our Declaration of Trust as conviction of (or plea of guilty or no contest to) a felony or a final judgment of a court of competent jurisdiction holding that such trustee caused demonstrable, material harm to the trust through bad faith or active and deliberate dishonesty.

Under our Declaration of Trust, our board of trustees may determine, in its sole discretion and without any action by our shareholders, that we will (i) undertake an internal restructuring transaction (including the conversion of the REIT into another type of legal entity), (ii) conduct a public offering as a non-listed real estate investment trust subject to the Statement of Policy Regarding Real Estate Investment Trusts published by the North American Securities Administrators Association on May 7, 2007, as amended from time to time, or (iii) undertake a listing of any or all of the common shares on a securities exchange registered with the SEC under the Exchange Act or any other internationally recognized securities exchange determined by the board of trustees. In connection with such determination and the conduct of such internal restructuring, public offering or listing, as applicable, our board of trustees may cause us to (A) merge with or into or convert into another entity, (B) consolidate with one or more entities into a new entity, (C) transfer all or substantially all of our assets to another entity or (D) amend our Declaration of Trust and our Bylaws (in each case, a “Conversion Event”), in each case without any action by our shareholders.

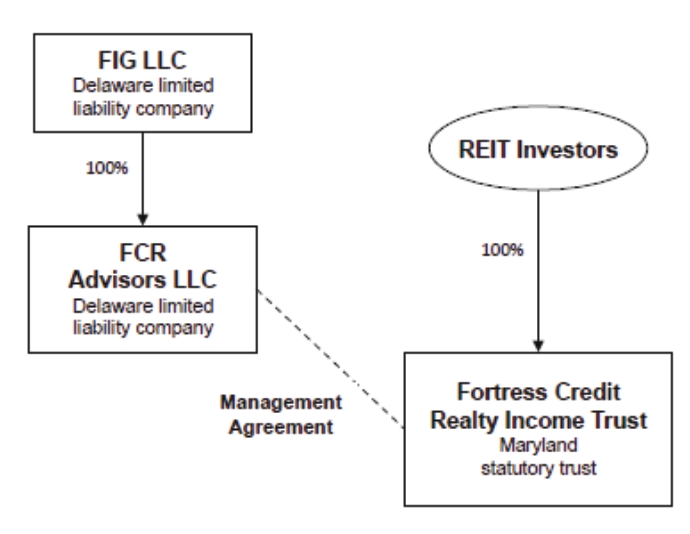

In addition, under our Declaration of Trust, for so long as the Management Agreement is in effect, a change of control of the Adviser (but excluding (A) any pledge, hypothecation, assignment or other transfer of any rights to receive fees or other payments under the Management Agreement to any person or (B) any direct or indirect change of control of Fortress) will require the approval of the holders of a majority of the outstanding Class B shares, voting separately as a class.

Shareholders are not entitled to exercise any appraisal rights or of the rights of an objecting shareholder unless our board of trustees determines that such rights apply, with respect to all or any classes or series of shares of beneficial interests, to one or more transactions occurring after the date of the determination in connection with which shareholders would otherwise be entitled to exercise such rights.

Pursuant to our Declaration of Trust, shareholders may, during usual business hours, inspect and copy our Declaration of Trust and Bylaws and all amendments thereto, minutes of the proceedings of the shareholders, the annual statement of affairs of the trust and any voting trust agreements on file at our principal office.

Restrictions on Ownership and Transfer

Our Declaration of Trust contains restrictions on the number of our shares that a person or group may own. Unless the board otherwise determines, no person or group may acquire or hold, directly or indirectly through application of constructive ownership rules, in excess of 9.8% in value or number of shares, whichever is more restrictive, of our outstanding common shares, 9.8% in value or number of shares, whichever is more restrictive, of any other class or series of our shares outstanding at the time of determination, or 9.8% in value or number of shares, whichever is more restrictive, of our outstanding shares of all classes or series unless they receive an exemption (prospectively or retroactively) from our board of trustees.

Subject to certain limitations, our board of trustees, in its sole discretion, may exempt a person prospectively or retroactively from, or modify, these limits, subject to such terms, conditions, representations and undertakings as required by our Declaration of Trust and as our board of trustees may determine. Prior to the granting of any exemption, the board of trustees may require a ruling from the IRS, or an opinion of counsel, in either case in form and substance satisfactory to the board of trustees in its sole discretion, as it may deem necessary or advisable in order to determine or ensure our qualification as a REIT. Notwithstanding the receipt of any ruling or opinion, the board of trustees may impose such conditions or restrictions as it deems appropriate in connection with granting such exception. Our board of trustees may grant limited exemptions to certain persons who directly or indirectly own our shares, including trustees, officers and shareholders controlled by them or trusts for the benefit of their families.

Our Declaration of Trust further prohibits any person from beneficially or constructively owning our shares that would result in our being “closely held” under Section 856(h) of the Code or otherwise cause us to fail to qualify