As filed with the Securities and Exchange Commission on September 16, 2024.

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Moove Lubricants Holdings

(Exact Name of Registrant as Specified in Its Charter)

| The Cayman Islands | 2992 | N/A |

(State or other jurisdiction of

incorporation or organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

| | Av. Brigadeiro Faria Lima, 4,100 –

8th floor São Paulo – SP, 04538-132, Brazil +55 11 4517-1546 | |

| (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| | Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200 | |

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

| Copies to: |

Manuel Garciadiaz Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 | Jonathan E. Kellner

Colin J. Diamond Grissel Mercado

Alex M. Herman

Paul Hastings LLP

200 Park Avenue New York, NY 10166

(212) 318-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant will file a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement will become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 16, 2024

PRELIMINARY PROSPECTUS

Common Shares

Moove Lubricants Holdings

(incorporated in the Cayman Islands)

This is an initial public offering of common shares of Moove Lubricants Holdings. We are offering common shares, and the selling shareholders identified in this prospectus are offering an additional common shares. We will not receive any proceeds from the sale of common shares by the selling shareholders.

Prior to this offering, there has been no public market for our common shares. It is currently estimated that the initial public offering price per common share will be between US$ and US$ .

We have applied to list our common shares on the New York Stock Exchange under the symbol “MOOV.”

Following this offering, Cosan S.A., or Cosan, will beneficially own % of our outstanding share capital, assuming no exercise of the underwriter’s option to purchase additional shares as further described below.

Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the NYSE and as such plan to rely on available exemptions from certain NYSE corporate governance requirements.

Investing in our common shares involves risks. See “Risk Factors” beginning on page 21 of this prospectus.

| | Per common share | Total |

| Initial public offering price | US$ | US$ |

| Underwriting discounts and commissions (1) | US$ | US$ |

| Proceeds, before expenses, to the selling shareholders (2) | US$ | US$ |

| Proceeds, before expenses, to Moove Lubricants Holdings (2) | US$ | US$ |

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

| (2) | Assumes no exercise of the underwriters’ over-allotment option. |

We and the selling shareholders have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional common shares from us and up to an additional common shares from the selling shareholders at the initial public offering price, less underwriting discounts and commissions.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares to purchasers on or about , 2024.

Global Coordinators

| J.P. Morgan | BofA Securities | Citigroup | Itaú BBA | BTG Pactual | Santander |

Joint Bookrunners

| Goldman Sachs & Co. LLC | Jefferies | Morgan Stanley |

The date of this prospectus is , 2024.

table of contents

Page

This prospectus has been prepared by us solely for use in connection with the proposed offering of common shares in the United States and, to the extent described below, elsewhere. Neither we, the selling shareholders nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we, the selling shareholders nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or any applicable free writing prospectus is current only as of the date of this prospectus or of any such free writing prospectus, as applicable, regardless of its time of delivery or of any sale of our common shares.

Neither we, the selling shareholders nor any of the underwriters have taken any action that would permit a public offering of our common shares or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common shares and the distribution of this prospectus outside the United States and in their jurisdiction (including Brazil). However, we may make offers and sales outside the United States in circumstances that do not constitute a public offer or distribution under applicable laws and regulations.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Moove” or the “Company,” the “Issuer,” “we,” “our,” “ours,” “us” or similar terms refer to Moove Lubricants Holdings, together with its consolidated subsidiaries.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners.

Presentation of Financial and Other Information

Financial Statements

We maintain our books and records in Brazilian reais, the presentation currency for our financial statements. Our annual consolidated financial statements were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standard Board, or IASB. Unless otherwise noted, our consolidated statement of financial position information presented herein as of June 30, 2024 and December 31, 2023 and 2022 and the consolidated statements of profit or loss for the six months ended June 30, 2024 and 2023 and the years ended December 31, 2023, 2022 and 2021 are stated in Brazilian reais, our reporting currency.

Our consolidated financial information contained in this prospectus is derived from (i) our unaudited interim condensed consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2024 and 2023, together with the notes thereto, included elsewhere in this prospectus, or our unaudited interim condensed consolidated financial statements, and (ii) our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and 2021, together with the notes thereto, or our audited consolidated financial statements. All references herein to “our financial statements,” “our consolidated financial information,” “our unaudited interim condensed consolidated financial statements” and “our audited consolidated financial statements” are to our consolidated financial statements included elsewhere in this prospectus.

This financial information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, including the notes thereto, included elsewhere in this prospectus.

As a result of certain acquisitions we have undertaken, our results of operations for the year ended December 31, 2023 are not directly comparable to our results of operations for the years ended December 31, 2022 and 2021, which may make it difficult for you to evaluate our business, financial condition, results of operations and prospects. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Factors Affecting Our Results of Operations—Acquisitions.”

Our fiscal year ends on December 31. References in this prospectus to a fiscal year, such as “fiscal year 2023,” relate to our fiscal year, the 12 months ended December 31, 2023.

Corporate Events

Corporate Reorganization

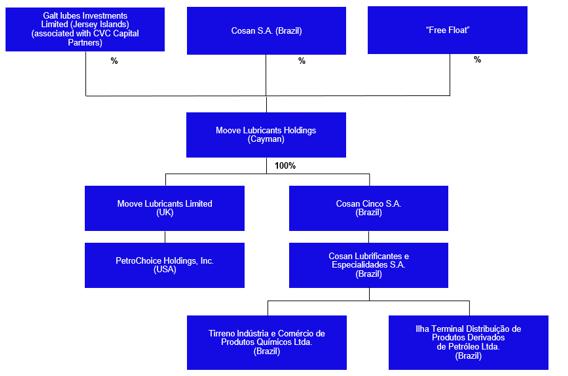

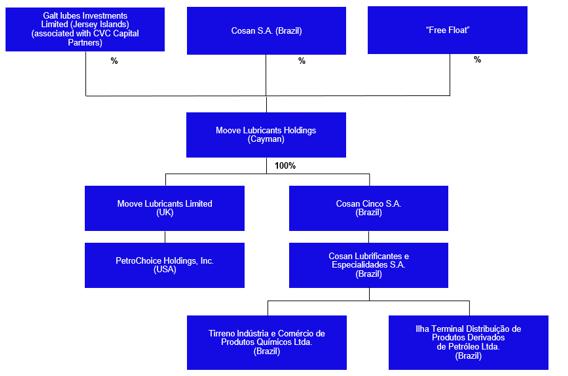

We are a Cayman Islands exempted company incorporated with limited liability on September 5, 2023. On October 31, 2023, we completed a corporate reorganization whereby Cosan Lubes Investments Limited, a private limited company incorporated under the laws of England and Wales, or CLI, and our previous holding company, contributed its interest in its subsidiaries and remaining cash to Moove Lubricants Holdings, in consideration for the issuance of Moove Lubricants Holdings common shares. As a result of our corporate reorganization, our functional currency was changed from pounds sterling to U.S. dollars, and Moove Lubricants Holdings became our new holding company.

We accounted for the corporate reorganization using the predecessor method of accounting, and the consolidated financial statements are presented “as if” CLI is the predecessor of the Company. Under the predecessor method, the historical operations of CLI are deemed to be those of the Company. Thus, our consolidated financial statements reflect: (i) the historical operating results and financial position of CLI prior to the corporate reorganization; (ii) the consolidated results and financial position of the Company following the corporate reorganization; (iii) the assets and liabilities of the Company at their historical cost; and (iv) that the number of ordinary shares outstanding of the Company is the same as CLI’s. For further information on the accounting for the corporate reorganization, see note 1.2 to our audited consolidated financial statements, included elsewhere in this prospectus.

Please read the information in the section entitled “Business—Our Corporate Structure” for a more thorough description of the operations of our material operating subsidiaries.

Acquisitions of PetroChoice and Tirreno

In May 2022, we completed two acquisitions—one in the United States and one in Brazil. Our wholly owned subsidiary Millennium Moove Corp. acquired 100% of PetroChoice for R$2,342.8 million. Moreover, Moove Brazil acquired 100% of the shares of Tirreno for R$85.2 million. As a result of the aforementioned acquisitions, our results of operations for the year ended December 31, 2023 are not directly comparable to our results of operations for the years ended December 31, 2022 and 2021, which may make it difficult for you to evaluate our business, financial condition, results of operations and prospects.

Financial Information in U.S. Dollars

Solely for the convenience of the reader, we have translated some of the real amounts included in this prospectus from reais into U.S. dollars. You should not construe these convenience translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$5.5589 to US$1.00, the commercial selling rate for U.S. dollars at June 30, 2024 as reported by the Central Bank.

Special Note Regarding Non-GAAP Financial Measures

This prospectus presents our Adjusted EBITDA, Adjusted EBITDA Margin, Unit Adjusted EBITDA, Cash Flow Conversion, Net Debt, Net Debt to Adjusted EBITDA Ratio, ROIC and Operating Working Capital and their respective reconciliations for the convenience of investors, which are non-GAAP financial measures. A non-GAAP financial measure is generally defined as a numerical measure of historical or future financial performance, financial position, or cash flow that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure.

We use these non-GAAP financial measures for decision-making purposes and to assess our financial and operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. We believe that the disclosure of our non-GAAP measures provides useful supplemental information to investors and financial analysts and other interested parties in their review of our operating performance. Additionally, we believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance and facilitates period-to-period comparisons of results of operations. The non-GAAP financial measures described in this prospectus are not a substitute for the IFRS measures of earnings, income, profitability, indebtedness or cash flow.

Additionally, our calculations of Adjusted EBITDA, Adjusted EBITDA Margin, Unit Adjusted EBITDA, Cash Flow Conversion, Net Debt, Net Debt to Adjusted EBITDA Ratio and ROIC may be different from the calculation used by other companies, including our competitors in the industry, and therefore, our measures may not be comparable to those of other companies. For a reconciliation of Adjusted EBITDA, Adjusted EBITDA Margin, Unit Adjusted EBITDA, Cash Flow Conversion, Net Debt, Net Debt to Adjusted EBITDA Ratio and ROIC, the most directly comparable IFRS measure, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures.”

Adjusted EBITDA and Adjusted EBITDA Margin

We calculate Adjusted EBITDA as profit (loss) for the period/year plus income taxes (current and deferred), financial results, net, depreciation and amortization, non-recurring expenses related to our initial public offering and expenses incurred in connection with our equity-compensation plan linked to the occurrence of our initial public offering.

We calculate Adjusted EBITDA Margin by dividing Adjusted EBITDA by our revenue.

Our management believes that Adjusted EBITDA and Adjusted EBITDA Margin are meaningful for investors because they provide an analysis of our operating results and profitability, a proxy for operating cash generation, and ability to service debt and because Adjusted EBITDA and Adjusted EBITDA Margin are used by our chief

operating decision-makers to track our business evolution, establish operational and strategic targets and capital allocation, and make other important business decisions. Adjusted EBITDA and Adjusted EBITDA Margin are also measures commonly reported and widely used by analysts, investors and other interested parties in our industry to evaluate performance in the ordinary course of business without the impact of one-off and non-recurring events.

Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. Adjusted EBITDA and Adjusted EBITDA Margin are not substitutes for their component IFRS measures or IFRS measures of earnings or profit (loss) for the period/year. Additionally, our calculations of Adjusted EBITDA and Adjusted EBITDA Margin may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to our profit (loss) for the period/year, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—Adjusted EBITDA and Adjusted EBITDA Margin.”

Unit Adjusted EBITDA

We calculate Unit Adjusted EBITDA as profit (loss) for the period/year plus income taxes (current and deferred), financial results, net, depreciation and amortization, non-recurring expenses related to our initial public offering and expenses incurred in connection with our equity-compensation plan linked to the occurrence of our initial public offering, and divided by volume of lubricants sold.

Our management believes that Unit Adjusted EBITDA is meaningful for investors because it provides an analysis of our operating results and profitability and because Unit Adjusted EBITDA is used by our chief operating decision-makers to track our business evolution, establish operational and strategic targets and capital allocation, and make other important business decisions as well as to evaluate performance in the ordinary course of business without the impact of one-off and non-recurring events.

Unit Adjusted EBITDA is a non-GAAP measure. Unit Adjusted EBITDA is not a substitute for its component IFRS measures or IFRS measures of earnings or profit (loss) for the period/year. Additionally, our calculation of Unit Adjusted EBITDA may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of Unit Adjusted EBITDA to our profit (loss) for the period/year, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—Unit Adjusted EBITDA.”

Cash Flow Conversion

We calculate Cash Flow Conversion as free cash flow divided by Adjusted EBITDA.

We calculate free cash flow as net cash flows from operating activities plus acquisition of property, plant and equipment and intangible assets.

Our management believes that Cash Flow Conversion is meaningful for investors because it provides an analysis of our cash flows and liquidity and because Cash Flow Conversion is used by our chief operating decision-makers to track our business evolution, establish operational and strategic targets and capital allocation, and make other important business decisions.

Cash Flow Conversion is a non-GAAP measure. Cash Flow Conversion is not a substitute for its component IFRS measures or IFRS measures of cash flow or liquidity for the period. Additionally, our calculation of Cash Flow Conversion may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of Cash Flow Conversion to our net cash flows from operating activities for the period/year, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—Cash Flow Conversion.”

Net Debt and Net Debt to Adjusted EBITDA Ratio

We calculate Net Debt as gross debt less cash and cash equivalents and current marketable securities.

We calculate gross debt as the sum of current and non-current loans and borrowings and current derivative financial instruments.

We calculate Net Debt to Adjusted EBITDA Ratio by dividing Net Debt by our Adjusted EBITDA. We calculate Adjusted EBITDA as profit for the period/year plus income taxes (current and deferred), financial results, net, depreciation and amortization, non-recurring expenses related to our initial public offering and expenses incurred in connection with our equity-compensation plan linked to the occurrence of our initial public offering.

Our management believes that Net Debt and Net Debt to Adjusted EBITDA Ratio are meaningful for investors because they provide an analysis of our earnings, profit for the period/year and ability to service debt and because Net Debt and Net Debt to Adjusted EBITDA Ratio are used by our chief operating decision-makers to track our business evolution, establish operational and strategic targets and capital allocation, and make other important business decisions. Net Debt and Net Debt to Adjusted EBITDA Ratio are also a measure commonly reported and widely used by analysts, investors and other interested parties in our industry.

Net Debt and Net Debt to Adjusted EBITDA Ratio are non-GAAP measures. Net Debt and Net Debt to Adjusted EBITDA Ratio are not a substitute for their component IFRS measures or IFRS measures of earnings or profit (loss) for the period/year, or of indebtedness. Additionally, our calculation of Net Debt and Net Debt to Adjusted EBITDA Ratio may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of Net Debt and Net Debt to Adjusted EBITDA Ratio to our loans and borrowings (current and non-current) and derivative financial instruments (current), see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—Net Debt and Net Debt to Adjusted EBITDA Ratio.”

ROIC

We calculate ROIC as net operating profit after taxes, or NOPAT, divided by average invested capital.

We calculate NOPAT as the sum of our profit before finance results and taxes, fair value amortization, non-recurring expenses related to our initial public offering and expenses incurred in connection with our equity-compensation plan, less weighted income taxes – nominal.

We calculate weighted income taxes – nominal by multiplying the nominal income tax rate of each country by the sum of profit before finance results and taxes, fair value amortization and non-recurring events.

We calculate average invested capital as the average of the sum of our total equity and our Net Debt between the current period and the prior period.

Our management believes that ROIC is meaningful for investors because it provides an analysis of our cash flows and liquidity and because ROIC is used by our chief operating decision-makers to track our business evolution, establish operational and strategic targets and capital allocation, and make other important business decisions. ROIC is also a measure commonly reported and widely used by analysts, investors and other interested parties in our industry.

ROIC and NOPAT are not substitutes for their respective component IFRS measures or IFRS measures of earnings or profit for the period/year. Additionally, our calculation of ROIC and NOPAT may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of ROIC to our profit for the period/year, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—ROIC.”

Operating Working Capital

We calculate Operating Working Capital as the sum of current trade receivables and inventory less current trade payables. Our definition of Operating Working Capital excludes balance sheet items that are related to the capital structure of the business, such as the current portion of long-term debt, which are influenced to a large extent by long-term capital structuring decisions.

Our management believes that Operating Working Capital is meaningful for investors because it provides an analysis of capital structure items that tend to fluctuate on a monthly basis based on decisions made by management and the operation of our business. As a result, management uses operating working capital when measuring the effectiveness with which these key balance sheet items are being managed on a real-time basis.

Operating Working Capital is a non-GAAP measure. Operating Working Capital is not a substitute for its component IFRS measures or IFRS measures of our capital structure or liquidity. Additionally, our calculation of Operating Working Capital may be different from the calculation used by other companies, including competitors in our industry, and may therefore not be comparable to similarly named metrics of other companies.

For a reconciliation of Operating Working Capital to our trade receivables and inventory, see “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures—Operating Working Capital.”

Market Share and Other Information

We obtained the information included in this prospectus relating to the industry in which we operate, as well as the estimates concerning market shares, from third-party sources including a report by Kline & Company, Inc., or Kline, an independent market research firm commissioned by us that we refer to as the Kline Report, as well as public information and publications on the industry prepared by official public sources, as well as private sources, such as the Central Bank.

We are responsible for all of the disclosure in this prospectus and we believe that each of the publications, studies and surveys used throughout this prospectus are prepared by reputable sources and are generally reliable, though we have not independently verified market and industry data from third-party sources. Other than the Kline Report, none of the publications, reports or other published industry sources referred to in this prospectus were commissioned by us or prepared at our request. We have not sought or obtained the consent of any of these sources other than the Kline Report to include such market data in this prospectus. All of the market data used in this prospectus involves a number of assumptions and limitations and therefore is inherently uncertain and imprecise, and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

Rounding

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Certain Definitions

The following industry and other defined terms are used in this prospectus:

“Brazil” means the Federative Republic of Brazil and the “Brazilian government” means the federal government of Brazil.

“CDI Rate” means the Brazilian interbank deposit (certificado de depósito interbancário) rate, which is an average of interbank overnight rates in Brazil.

“Central Bank” means the Brazilian Central Bank (Banco Central do Brasil).

“Cosan” means Cosan S.A., a corporation (sociedade anônima) incorporated under the laws of Brazil and our controlling shareholder.

“Cosan Group” means Cosan and its consolidated subsidiaries.

“CVC” means CVC Capital Partners plc.

“CVC Fund VII” means Galt Lubes Investments Limited, which is indirectly majority owned by CVC Capital Partners VII Associates L.P., CVC Capital Partners Investment Europe VII L.P., and CVC Capital Partners VII (A), L.P., a group of investment limited partnerships indirectly managed or advised by CVC.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“ExxonMobil” means ExxonMobil Lubricants Trading Company, a company incorporated under the laws of the State of Delaware.

“IASB” means the International Accounting Standards Board.

“IBP” means Brazilian Petroleum and Gas Institute (Instituto Brasileiro de Petróleo e Gás).

“IFRS” means the International Financial Reporting Standards, as issued by the IASB.

“Moove Brazil” means Cosan Lubrificantes e Especialidades S.A., a corporation (sociedade anônima) incorporated under the laws of Brazil and our subsidiary.

“Moove Corp.” means Moove USA Corp. (formerly known as Commercial Lubricants Moove Corp.), a Delaware corporation and our subsidiary.

“Moove UK” means Moove Lubricants Limited, a private limited company incorporated under the laws of England and Wales and our subsidiary.

“real,” “reais” or “R$” means the Brazilian real, the official currency of Brazil.

“PetroChoice” means Petrochoice Holdings, Inc., a Delaware corporation and our subsidiary, including its operating subsidiaries.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SELIC rate” means the Brazilian base interest rate established by the Brazilian Special Clearance and Custody System (Sistema Especial de Liquidação e Custódia).

“Tirreno” means Tirreno Indústria e Comércio de Produtos Químicos Ltda., a limited liability company (sociedade limitada) incorporated under the laws of Brazil.

“U.S. dollar,” “U.S. dollars” or “US$” means U.S. dollars, the official currency of the United States.

“United Kingdom” or “UK” means the United Kingdom of Great Britain and Northern Ireland.

“United States” or “U.S.” means the United States of America.

Prospectus Summary

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common shares. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included elsewhere in this prospectus, before deciding to invest in our common shares.

Overview

Moove is a global lubricants solutions provider. We specialize in the formulation, manufacturing, distribution, marketing, selling and servicing of lubricant products across a diverse range of end markets and customers. We offer a comprehensive portfolio of products and technical support that is highly tailored to our end markets, while optimizing our cost base, physical footprint and working capital needs to drive unit profitability and cash flow generation.

Lubricants are everywhere. We operate in a complex and dynamic market that is critical to the customers we serve, across industrial, commercial and consumer segments. Our customers’ needs are constantly evolving as technology continues to influence the requirements for, and applications of, lubricants. While our products generally represent a small component of our customers’ total running costs, they are crucial to driving efficiencies and maintaining operations, establishing a clear need in the market for our capabilities.

Our business was formed following Cosan’s acquisition of ExxonMobil’s Brazilian lubricant manufacturing and distribution assets in 2008. We have diversified the business significantly over more than 15 years—across suppliers, customers, end markets and geographies—and have maintained and strengthened a highly strategic alliance with ExxonMobil that drives mutual value creation. ExxonMobil’s brand, premium research and development capabilities, proprietary product technology and base oils production are important factors to our marketing strategy and supply chain. We believe that our market intelligence, efficient operations, market know-how and close physical proximity to customers make us a powerful partner of choice for them.

We have pursued a growth-oriented strategy with an intentional focus on lubricants, distinguishing us from other scaled market participants. Our expertise in sourcing, insights into market prices and deep knowledge across the supply chain truly differentiate our model, allowing us to access and optimize raw materials to formulate high-performance products at a lower cost. Furthermore, we believe that our service-oriented and high-touch approach with our customers has strengthened our position with our core clients. Our capabilities and relationships, along with our corporate culture centered around high-performance teams to drive efficiency and business expansion, have translated into margin expansion at the unit level and high cash return on the capital investments we make.

We operate a model requiring low levels of capital expenditures (our total capital expenditures as a percentage of revenue amounted to 1.8%, 1.7%, 1.9%, 1.2% and 0.7% for the six months ended June 30, 2024 and 2023 and for the years ended December 31, 2023, 2022 and 2021, respectively),focused on cost-effective formulation, manufacturing, logistics and services. In contrast, the production of raw materials such as base oils, which is not in our scope, requires intensive capital investments and other capabilities, resulting in a different scale and margin profile within our industry. We believe that our model underpins our ROIC and allows us to optimize our cost base and capital expenditures to support our profitability, Adjusted EBITDA Margin and cash flow generation as we scale and penetrate a market.

The ongoing industry-wide mix shift into premium products that require more technical know-how also provides a meaningful tailwind for our business. We believe we have a competitive advantage in the formulation and supply of these products and have consistently grown at a significantly higher rate than the broader lubricants market. Importantly, our profit pool is only partially influenced by end market volumes.

Our track record of financial performance is reflected in our metrics. Our revenue for the six months ended June 30, 2024 was R$5,024.8 million (US$903.9 million), a decrease of 1.6% compared to the six months ended June 30, 2023, while our profit for the period was R$237.6 million (US$42.7 million), compared to a loss of R$58.4 million (US$10.5 million) in the six months ended June 30, 2023. Our Adjusted EBITDA for the six months ended June 30, 2024 was R$690.2 million (US$124.2 million), a 9.0% increase from R$633.4 million for the six months ended June 30, 2023. Our revenue for the year ended December 31, 2023 was R$10,074.2 million (US$1,812.3

million), while our profit for the year was R$266.0 million (US$47.9 million), an increase of 66.9% and a decrease of 8.3%, respectively, compared to the year ended December 31, 2021. Adjusted EBITDA for the year ended December 31, 2023 was R$1,243.1 million (US$223.6 million), an increase of 107.5% compared to the year ended December 31, 2021. Our profit (loss) margin was 4.7% in the six months ended June 30, 2024 and negative 1.1% in the six months ended June 30, 2023, and our Adjusted EBITDA Margin was 13.7% in the six months ended June 30, 2024 and 12.4% in the six months ended June 30, 2023. From 2021 to 2023, our profit margin decreased from 4.8% for the year ended December 31, 2021 to 2.6% for the year ended December 31, 2023, our Adjusted EBITDA Margin increased to 12.3% for the year ended December 31, 2023 from 9.9% in the year ended December 31, 2021, and our Unit Adjusted EBITDA increased to R$1.87 (US$0.34) per liter for the year ended December 31, 2023 from R$1.54 per liter for the year ended December 31, 2021. These increases were a result of organic growth of 22.5% in our revenue and 74.6% in our Adjusted EBITDA compared to the year ended December 31, 2021, which added to the acquisitions made in the period. The growth of our business from 2021 to 2023 was driven substantially by the acquisitions of PetroChoice in the United States and Tirreno in Brazil, which we completed in May 2022, as further discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Factors Affecting Our Results of Operations—Acquisitions.” See “Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures” for a reconciliation of Adjusted EBITDA, Unit Adjusted EBITA and Adjusted EBITDA Margin to the most directly comparable GAAP financial measure.

Our revenue for the six months ended June 30, 2024 was generated in the following regions: 47.3% in South America, 29.2% in Europe and 23.5% in North America. For the six months ended June 30, 2024, our Adjusted EBITDA was generated in the following regions: 70.8% in South America, 8.0% in Europe and 21.2% in North America. Our revenue for the year ended December 31, 2023 was generated in the following regions: 45.4% in South America, 30.2% in Europe and 24.4% in North America. For the year ended December 31, 2023, our Adjusted EBITDA was generated in the following regions: 66.4% in South America, 22.0% in North America and 11.6% in Europe.

Our Business

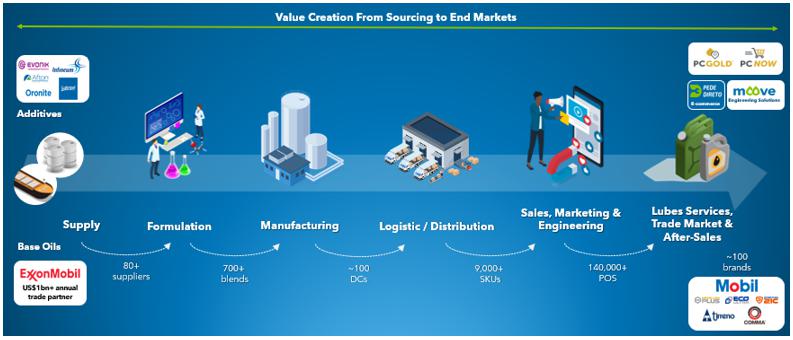

Moove is a global lubricants solutions provider to a wide range of customers, which demand lubricants to an even wider range of applications. We are focused on developing the supply chain needed to service our customers with the best solution possible, leveraging our production facilities and formulation capabilities. We transform base oils and additives into customized, high-performing and high-value lubricant formulations with which we service our customers. This focus allows us to operate with significantly fewer production assets and to direct our capital and expertise on the most attractive “profit pools” in the lubricants value chain. Our high-touch, intimate and service-oriented go-to-market strategy enables us to grow with customers as their needs evolve and their procurement increases in scale or complexity.

Our customers operate across industrial, consumer and commercial channels—including in industrial and manufacturing equipment, passenger and commercial vehicles, marine and aviation. These applications demand the full range of lubricants, including engine oils, automotive and industrial fluids, as well as special application products such as greases, cutting oils, insulating oils, process oils, and car care products. Specifically in the industrial segment, lubricants are essential for production productivity and efficiency. The level of specialization required to properly serve all market segments creates a significant market opportunity for our high-touch, full-service customer relationships.

Our global footprint consists of six production plants and approximately 100 distribution centers, providing us with both a scaled manufacturing base and an optimized distribution network through which we access and service our customers. It is critical in our market to be able to move product quickly and efficiently—and we have been deliberate in configuring a physical footprint that aligns closely with customer and industrial demand. Our largest plant is located in the State of Rio de Janeiro, Brazil, with an annual production capacity of approximately 400 million liters. Our other plants are located in the State of São Paulo, Brazil, where our “Tirreno” products are manufactured (approx. 27 million liters), the United Kingdom (approx. 70 million liters) and the United States (Kansas, approx. 75 million liters; South Carolina, approx. 20 million liters; Indiana, approx. 15 million liters).

We sell lubricants in 10 countries across three regions: South America (Argentina, Brazil, Bolivia, Uruguay and Paraguay), North America (the United States) and Europe (Spain, France, Portugal and the United Kingdom) and our products are exported to over 60 other countries in Europe and Asia. Our continued investment in physical assets, including manufacturing sites, trucking capabilities, information technology systems and an increased distribution center footprint, is a distinct competitive advantage for Moove and provides the business, and by extension our customers, with increased logistics optionality and optimization opportunities as well as reliability of supply. Our operations are supported by a global workforce of over 2,100 employees as of June 30, 2024, many of whom are in highly skilled roles and have significant tenure with the organization.

We blend and produce over 700 different formulations of lubricant products that are distributed through a number of delivery systems and formats. In total, we supply more than 9,000 stock keeping units, or SKUs, across our global network. In support of our production, we purchase hundreds of different raw materials, including base oils, additives and packaging, and have developed long-standing relationships with our key suppliers.

We commenced independent operations in 2008, when Cosan acquired ExxonMobil’s lubricants assets in Brazil and obtained the right to blend, distribute and market premium Mobil branded products in the country. The ability to develop our business pursuant to this arrangement enabled us to expand our footprint to Bolivia, Uruguay and Paraguay in 2011. In 2018, recognizing the success accomplished and strategically aligned plans for future growth, ExxonMobil and Moove signed a 20-year contract extension and added Argentina to the footprint.

Beyond Mobil branded products, we chose to leverage our technical expertise and capabilities in sourcing and formulation to develop specific lubricants for different end uses, enabling us to offer an extensive catalog of lubricants, fluids, greases, insulating oils and process oils. Our more significant proprietary brands include “Comma” (Europe and Asia), “EcoUltra,” “Medallion Plus” and “Dyna-Plex 21C” (North America) and “Tirreno” (South America), which add to a comprehensive portfolio of around 100 brands across all regions.

Focusing on our key strengths gives us the discipline to capitalize on both organic and inorganic growth opportunities with low execution risk. We entered into the European lubricants and specialties market in 2012 through the acquisition of Comma Oil & Chemicals Limited, a former ExxonMobil affiliate in the UK, primarily serving customers in the passenger cars end market. In 2016, we commenced operations in Spain with the focus of developing the Mobil brand and, in 2018, we strengthened our strategic footprint in Europe through the acquisition of Mobil Lubricants Distributors in France (TTA), Portugal (Lubrigrupo), and the UK (WP). The UK is our largest European operation, where we also inherited a niche fuels business serving business-to-business customers.

Following this series of acquisitions and after establishing a relevant position in the lubricants industry in South America and a robust footprint in Europe, we entered into an investment agreement with CVC Fund VII, which we refer to as the CVC investment agreement, for the acquisition of 30% of our equity in 2018, welcoming CVC as a strategic partner in our journey. In addition to providing expertise and a global network of resources, this strategic partnership has acted as a robust governance enabler, providing additional corporate independence from Cosan.

An important strategic milestone for us was to enter the North American lubricants market. In December 2018, we acquired MetroLube, giving us access to market intelligence and the opportunity to establish commercial relationships without making a significant capital investment. In May 2022, we acquired PetroChoice, expanding our Mobil branded footprint in the United States with three lubricant blending plants and more than 50 distribution centers across 25 states, giving us a meaningful presence in the world’s largest market.

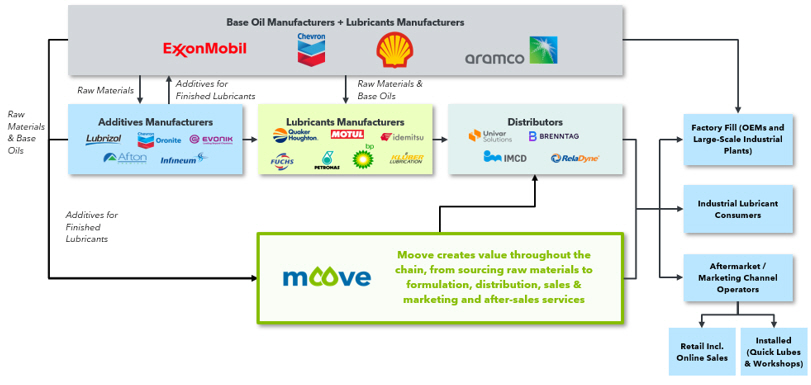

Our Industry

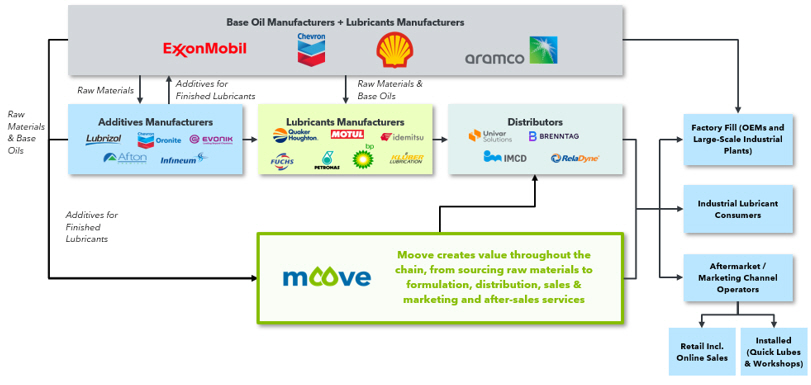

The lubricants’ value chain spans from raw materials and base oil manufacturers through to the blending, distribution, sales and marketing and after-market services provided to end customers. The industry is incredibly complex and dynamic, with specialized needs tailored to both the initial raw materials and ultimate end customer.

Base oil and additives are the primary raw materials for lubricants, mainly provided by oil and gas companies. Base oils and additives are then blended by lubricant manufacturers to create specific formulations. Manufacturers require high levels of research and development to create precise formulations that meet the end customers’ ever-evolving needs. Distributors then purchase the lubricants and leverage their supply chain expertise to manage warehousing, storage logistics and inventory management, as well as provide technical support.

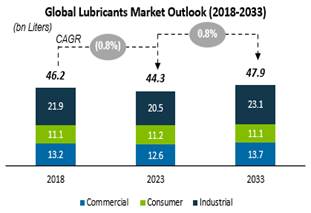

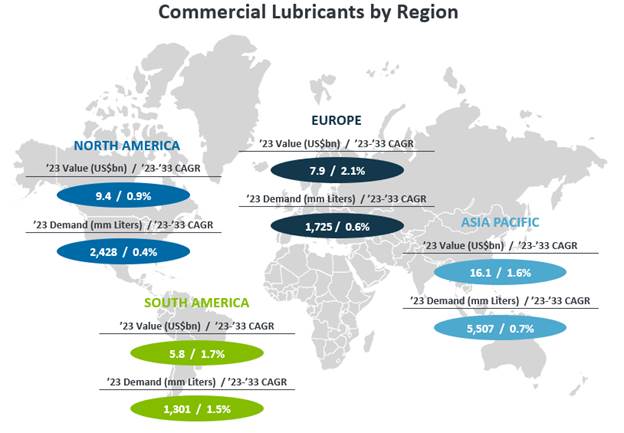

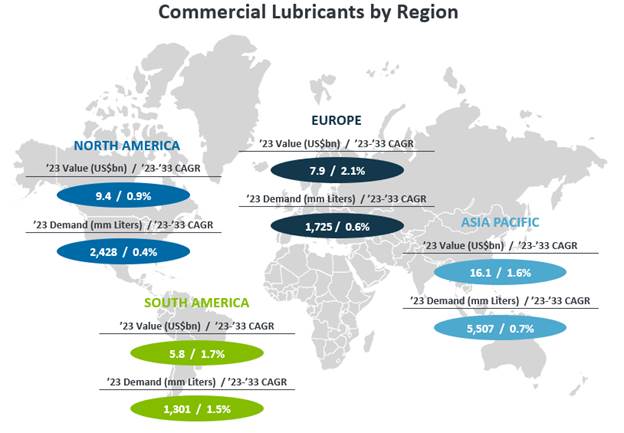

The value of the global lubricants market is expected to grow at 1.3% per annum from 2023 to 2033 in real terms, according to Kline, and Moove is focused on specific profit pools within the broader industry. The profit pool of raw material suppliers, in which Moove is not present, expects only marginal growth from 2023 to 2033, according to Kline. Conversely, the profit pool of lubricant manufacturers and distributors is forecast to grow at higher rates, driven by a number of trends including the adoption of higher-value synthetic and semi-synthetic lubricants and consolidation within the highly fragmented distribution market.

With key capabilities in the highest growth lubricant blending and intermediary distribution segments of the value chain, Moove is well positioned to capitalize on these key industry tailwinds.

Our Competitive Strengths

We believe that as a scaled service provider to the lubricants value chain, we can capitalize on a number of favorable trends, particularly in light of the following competitive strengths:

We Have a Pure Strategic Focus on the Lubricants Market, Which We Believe Is Distinctive in Our Industry and Highly Valuable to Our Customers: Unlike many of our competitors, lubricants have been our exclusive focus for the last 15 years, enabling us to shape our operations to the evolving demands of our industry. As the market has grown, there has been an increase in product complexity and end-use requirements for lubricants, raising the barriers to entry for new market participants. The continued proliferation of customer needs and the associated technical expertise required are pushing lubricants producers to supply a broader and more technical range of products. In particular, the required investments in physical assets (plants, distribution centers, transport vehicles and information technology platforms) and working capital to consistently and efficiently service customers at attractive margins are meaningful in our industry.

Our strategic prioritization of lubricants has directed us to make investments that best address the specific needs of our customers – we have established supply chain, engineering, marketing and technical expertise to facilitate them. We have also accrued significant market intelligence and industry relationships through our operating history across our core markets, supporting our ability to determine how best to deploy capital within our portfolio.

As the marketplace has evolved, achieving the appropriate scale to fully address customers’ lubricants needs has also become more important. We are committed to allocating capital that is required for specialized equipment and a more sophisticated sourcing function is needed to offer a comprehensive product portfolio to the largest consumers. Our market penetration and business maturity are higher where we have operated for longer, but we have been thoughtful where and how we have entered markets, focusing on regions where we see clear growth opportunities. We have developed a robust understanding of how lubricants are used and marketed to ensure we can add real value to customers across all segments, such as industrial, consumer and commercial vehicles.

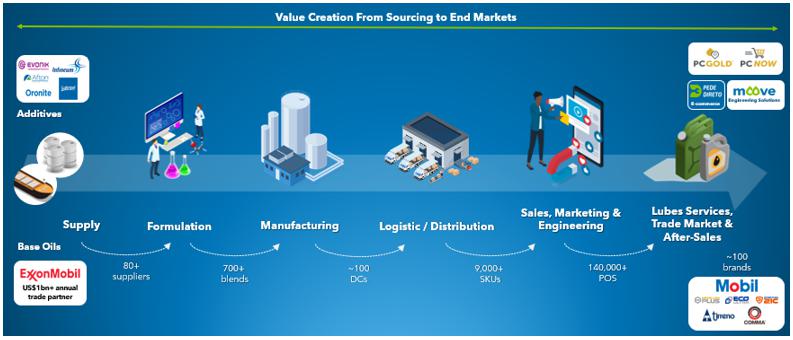

We Are a Customer-Orientated Specialty Lubricants Provider and Are Integrated Across the Value Chain: We focus on creating value from sourcing to end market and have capabilities in the supply of raw materials, formulation, manufacturing, distribution, sales, marketing and after-market services for our products. We operate in a complex industry and believe that our integrated value chain is a key competitive advantage that gives us scale, flexibility and efficiency.

We view product development and supplier relationships as two key enablers of our ability to supply our customers. The wide range of use cases for lubricants necessitates the ability to source a wide range of base stocks and additives to meet customers’ demands. By combining formulation capabilities and strategically selected relationships with both global and local suppliers, we are able to customize formulation, which is a key element to optimize production costs. We believe that our knowledge of and access to raw materials also allow us to capitalize on favorable pricing trends for our input chemicals, lowering our cost of production while maintaining our pricing model.

We have a dedicated team of engineers focused on developing and implementing customized solutions for each customer and industry we serve. We believe that our extensive knowledge of the entire value chain and vast experience in the lubricants market enable us to enhance productivity and improve service levels. Our customers are accustomed to a high level of service, with supply reliability being critical to their own operations, as well as logistical requirements and demand for high-touch service and performance. We believe that our experience, reliability and commitment to service are recognized differentiators in the market.

We Are a Natural Consolidator and Are Positioned to Capture the Tailwinds of a Massive Addressable Market: In our journey so far, we have proven our ability and commitment to also grow inorganically through acquisitions to extend our geographic reach and expand the capabilities that are most relevant to our customers. We actively maintain and monitor a pipeline of potential future acquisition opportunities that we believe could be additive to our business in the long term.

The complexity of the lubricants industry has increased as technology evolves, with the adoption of higher-value synthetic lubricants, and global economic development calls continuously for specialized products and services to meet new demand for the consumer, commercial and industrial sectors. The investments required to bring high-grade services to such a diversified customer portfolio have been one of the key consolidation factors. We believe that this need to invest is likely to reshape this highly fragmented industry, in which the five largest integrated producers represent only 35% of global market share and the remainder of the market is fragmented in over 1,000 independent lubricants producers, with just a few scaled, multinational platforms like our own.

While we have achieved scale across a number of our markets, we believe there is a significant opportunity ahead supported by a large addressable market relative to our current aggregate volume. According to the Kline Report, the global addressable market for lubricants was 44 billion liters and US$162 billion in 2023, of which 21 billion liters and US$92 billion were accounted for by our core markets: North America, Europe and South America. We produced 0.7 billion liters, 0.5 billion liters and 0.4 billion liters in the years ended December 31, 2023, 2022 and 2021, respectively.

Over the next nine years up to 2033, according to the Kline Report, the global lubricants market is expected to grow to 48 billion liters, or to US$184.3 billion, with a total value increase of 14% in real terms over the same period related to a shift in products mix towards more sophisticated, premium formulations.

Our Unique Culture Has Been Fundamental in Delivering Strong Results: Moove has deliberately cultivated a culture that values people as its biggest asset, which we believe empowers us to achieve even greater potential across all the markets in which we operate. With a clear strategy and vision to become a global reference in lubricants, we have aimed to build a culture focused on three main strategic drivers, which support our ability to achieve our results:

| · | High Performance Teams: We foster an environment of trust and full business alignment across all areas of our company, with the appropriate incentives, which enables us to be productive, adaptable, flexible and agile. |

| · | Culture of Efficiency: We are constantly seeking the simplest and most efficient ways to achieve our goals, and we have a continuous improvement mindset that enables us to eliminate inefficiencies and to add value to the products and services we offer to our customers. |

| · | Business Expansion: We have clarity on where, when and how much to invest in human capital, operating assets and market intelligence, which allows us to consistently enhance our core processes and capabilities. |

We are led by a senior leadership team with best-in-class industry experience, including our Chief Executive Officer, Filipe Affonso Ferreira, who has almost eight years’ experience at the company, and our Chief Financial Officer, Lineu Paulo Moran Filho, who has more than two decades’ experience in the industry, including over a decade with Moove. Collectively, the full leadership team consists of eight seasoned professionals with over 80 years of combined industry experience.

We believe that our cultural pillars, which we refer to as the “Moove attitudes,” foster an environment of trust and are conducive to high performance at the senior leadership level and throughout the entire business. The Moove attitudes are: (i) “We are in this together,” a conviction that teamwork beats individualism every time, (ii) “Open Mind,” we encourage decision-makers at all levels to think outside the box, (iii) “Real Talk,” everyone’s frank and unvarnished opinion is expected and encouraged in the spirit of reaching the best outcomes for our business as a whole, (iv) “Always Safe,” we focus on safety across our production, marketing, systems, distribution processes and finance, and (v) “Think Big, Keep it Simple,” we aim high but keep our feet on the ground, with focus on execution.

We Have Instituted a Proprietary Operating Model Across Our Portfolio to Drive Consistency and Aid New Market Penetration—the Moove Performance System: We have developed a proprietary performance methodology, the Moove Performance System, or MPS, which allows us to deliver quality and consistent service and support our financial objectives across all of our markets. MPS starts with the deployment of our culture, the “walk the talk” of our values and principles, and the expected behaviors of our employees, our Moovers. MPS serves as a guideline of value drivers for both customers and the business, constantly striving for continuous improvement and growth, and is centered around the primary value creation levers in our business and our people.

As a business we invest in strategies that create value for all of our stakeholders, in product supply, manufacturing and marketing through a robust portfolio, as well as in enhancing our corporate governance and strengthening our assets—our people, operations and intelligence. This model serves as a blueprint for how we can go to market across new geographies, product lines and services, tailoring our past experiences to the maturity and specific needs of each business and local market to efficiently expand our operations.

Underpinning MPS are four key value creation levers:

| (i) | Supply Intelligence: We strive to achieve predictability across an integrated value chain by using data to increase efficiency and value extraction. Our strategy includes tools for differentiation, connecting global and national chains, and integrating all areas of the business to access strategic market information, product availability, customer diversification and geographic reach. |

| (ii) | Lean Methodology and Sales and Operations Planning, or S&OP: We value our assets, promote operational dynamism, synchronicity and alignment through S&OP, and believe we have the capacity for analysis, response and agile decision-making. Our lean program serves as the model guiding us toward efficiency, supported by six key tools: 5S, Kaizen, Value Stream Mapping, or VSM, PDCA A3, Standardized Work, or TP, and SMED. |

| (iii) | Revenue Management: We manage revenue by enhancing our customers’ perception of value, through appropriate marketing propositions and intelligent market-back pricing by product, by channel and by region. |

| (iv) | Sales and Marketing Execution: We focus on long-term relationships with our customers, on strong brand communication and on having our sales and marketing people appropriately allocated on the field. Thus, we can provide high service levels, which includes delivering product availability and performance, as well as technical and/or marketing support required to meet and exceed their needs. |

The impact of MPS on our operations is also reflected in our financial performance and the incremental margin we are able to deliver through our network. For example, in our South America business, where we have been able to implement our core initiatives over a longer period, we were able to reach a significant market share (20% in Brazil in 2023, from 10.6% in 2008, according to IBP) and achieve higher margins with strong cash flow generation.

We Have a Highly Strategic Partnership with ExxonMobil and Key Partners That Has Helped Underpin Our Growth in New Markets: ExxonMobil is the largest finished lubricants synthetic marketer, one of the largest and the most reliable supplier of base oils and a global leader in research and development in our industry. Our long-standing relationship with ExxonMobil has given Moove a differentiated knowledge, experience and ability to service Mobil branded products across the value chain, including manufacturing, distribution, sales and marketing. The success of the Strategic Alliance Model in South America, which can be illustrated by the Mobil market share growth in Brazil in the past 15 years, revealed the complementary strengths of both companies and paved the route for Moove’s international expansion.

In our history, we were able to develop long-term-oriented relationships with additive suppliers, which has been fundamental in our growth and international expansion journey. As an example, Moove today is a relevant customer for Infineum and Lubrizol, two of the main global suppliers of additives. In the base oils and specialties universe, beyond the ExxonMobil relationship, we have established strong relationships with Ergon Specialty Oils, S-Oil Corporation and SK Enmove, among others. Focused on servicing all segments, we rely on the joint work among these partners and our technology team to develop and improve our proprietary brands offering, which complements the Mobil branded portfolio, allowing us to provide lubricants solutions to all end markets.

Our Growth Strategy

Our vision is to become a global reference in the lubricants market. To that end, the principal components of our growth strategy are:

MPS Deployment in All Markets in Which We Operate, to Drive Organic Growth, Incremental Adjusted EBITDA and Cash Flow Generation: We are focused on continually improving our core processes and enhancing our capabilities so that our MPS operating model can be enhanced and applied globally in all markets. Our model includes driving incremental value at the unit level by rapidly building market intelligence after entering a new market, adjusting our cost base and working capital requirements to the specific needs of the customers and unlocking incremental profit through revenue management, marketing programs and engineering solutions. This approach has long been active in South America and has translated into significant organic Adjusted EBITDA and ROIC expansion, as well as facilitating an increase of our market share in Brazil.

We are now in the process of enhancing and implementing MPS in all regions in which we operate, including in our recently acquired PetroChoice assets in the United States, where scale and portfolio will offer meaningful opportunities in the short, mid and long term. Also, we are focused on potentializing the impact of the MPS in our operations in Europe, where we just finalized the implementation of a common enterprise resource planning for the region, where the simplification of processes and business will unlock several value creation opportunities.

Expansion through “Organic-Like” M&A Can Unlock Differentiated Growth: In our path to becoming a global reference in lubricants, we prioritize acquisitions to complement organic growth in our current markets and to expand into new markets. This approach is supported by a market structure that remains very regional and fragmented, and that requires deep insights into how to service customers when regulations and product needs can vary between jurisdictions. We have built a robust M&A function to identify potential acquisitions and have invested in personnel experienced in business integration, evidenced by repeated market entry success. We actively monitor potential future acquisition opportunities that we believe could be additive to our business in the long term.

We believe there is a large market opportunity in Europe where our existing systems make operations scalable and able to integrate smaller players. Our focus is on predictable and profitable businesses that are respected by their customers, with opportunities to grow margins through our MPS model. We see a similar opportunity to deploy our expertise at a high return with larger customers with complex procurement needs in North America. We believe that our existing asset base in North America, with a network of 48 distribution centers, will position us to pursue an inorganic growth strategy centered on optimization of supply chains and expansion of our product and customer channels.

Capitalizing on the Increasing Adoption of High-Margin Synthetic Lubricants and E-Fluids: As innovations in the internal combustion engine (in particular) continue to drive greater input requirements across the supply chain, equipment operators are increasingly moving toward lower viscosity synthetic lubricants due to their superior performance, increased efficiency, extended life and better protection. We have technical expertise across the value chain, allowing us to service the premium products applications our customers need. Customers look for our close collaboration for a broader suite of products as their needs evolve. Synthetic lubricants command premium pricing, and as the mix shift in the market plays out, we are able to generate higher unit margins within our portfolio.

A similar effect is evident in the electric vehicle value chain. While these vehicles have fewer moving parts, they require more specialized and higher-performing lubricants and coolants. We have the optionality to leverage our ExxonMobil relationship to access proprietary edge technology and develop solutions in this nascent market.

These premium products command unit margins considerably higher than conventional lubricant products. According to the Kline Report, premium lubricants (that have fully synthetic and semi-synthetic components in their composition) are projected to achieve a market share of 37% by volume globally by 2040 (from 29% in 2023), and account for 56% of the sales revenue (from 43% in 2023), owing to their higher retail prices. This growth in market share of premium lubricants will be the key driver behind global market growth over the forecast period. We believe that our intimate relationships with customers, our deep supplier relationships, our specific formulation and manufacturing capabilities and our infrastructure and logistics expertise will allow us to best serve the premium market.

Recent Developments

On September 4, 2024, our subsidiary Millennium Moove Corp. signed an amendment to our syndicated loan, entered into on May 23, 2022 in connection with our acquisition of PetroChoice. The amendment provides: (i) that the outstanding principal amount will be due in a single installment on the maturity date (May 3, 2027), instead of six bi-annual instalments; (ii) that the interest rate will be equal to term SOFR plus an additional applicable rate which ranges from 1.50% to 1.75% depending on the net leverage ratio (as defined in the facility), instead of ranging from 1.50% to 2.75% depending on the net leverage ratio and the time remaining to maturity; and (iii) for the removal of a mandatory prepayment requirement in the event we raise funds in excess of US$300 million in the capital markets. As a result, the maturity profile of our consolidated outstanding indebtedness increased to 2.7 years from 1.8 years, as of August 31, 2024. See also “Business—Material Agreements—PetroChoice Acquisition Facility.”

Risk Factors Summary

Investing in our common shares involves risks. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our common shares. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common shares would likely decline, and you could lose all or part of your investment. The following is a summary of some of the principal risks we face:

Risks Relating to Our Business and Industry

| · | Our rights to blend, market and sell ExxonMobil products are dependent on our agreements with ExxonMobil, the expiration or termination of which would adversely affect our business, results of operations, financial condition and prospects. |

| · | Our business depends on our relationship with ExxonMobil and changes in this relationship may adversely affect our business, results of operations and financial condition. |

| · | Loss of a significant manufacturing facility or disruptions within our supply chain or in transportation could have a material adverse effect on our business, financial position and results of operations. |

| · | Our ability to maintain and to continue to expand our margins depends, in part, on our ability to pass on raw material costs to our customers, and our inability to do so would harm our margins and prospects. |

| · | We have been and could in the future be the target of attempted cyberattacks, which may adversely affect our business. |

| · | Reliance on a limited base of third-party contract manufacturers, logistics providers and suppliers of raw materials and components may result in disruption to our business and this could adversely affect our financial condition and results of operations. |

| · | We may not be able to maintain or renew certain other agreements with third parties which are important to our business. |

| · | The modification, suspension, cancellation or non-renewal of the tax benefits which we have been granted, changes to current interpretations of tax laws as these apply to us, or any restrictions on the offsetting of tax credits could have a material adverse effect on us. |

| · | Any failure of our information technology systems could adversely affect our operating results and make us more susceptible to cyber threats, adversely affecting our business. |

| · | In certain markets, we rely on our distributor network and third-party delivery services for the distribution and export of certain of our products. A significant disruption in these services due to external competition or factors outside of our control or significant increases in the prices for these services may disrupt our ability to export material or increase our costs. |

| · | We are exposed to the possibility of losses related to natural disasters, catastrophes, accidents, fire, political, social and economic events, terrorist acts, wars, and other events not in our control, which may have a material adverse effect on our business, financial condition and results of operations. |

Risks Relating to the Countries in Which We Operate

| · | Difficult market and geopolitical conditions can adversely affect our business in many ways, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition. |

| · | Our business may be materially adversely affected by unfavorable economic, political, social or other developments and risks in the countries in which we operate. |

| · | Inflation and government measures to curb inflation may adversely affect the economies and capital markets in some of the countries in which we operate, and as a result, harm our business, financial condition and results of operations, as well as the trading price of our common shares. |

| · | Changes and uncertainties in the tax system in the countries in which we have operations could materially adversely affect our financial condition and results of operations, and reduce net returns to our shareholders. |

| · | We are subject to financial risks as a result of our operations, including exposure to foreign currency fluctuations and the impact of foreign currency restrictions. |

| · | Political events in the countries in which we operate, particularly in South America, may have an influence on the performance of the local economy and the confidence of investors and the general public. |

| · | Developments and the perception of risk may adversely affect the economies of the countries in which we operate and the trading price of our securities. |

| · | Our operations expose us to political and economic risks in the countries in which we operate. |

| · | We are subject to extensive regulation of our operations that could adversely affect our business and results of operations. |

Risks Relating to Our Common Shares and the Offering

| · | There is no existing market for our common shares, and we do not know whether one will develop to provide you with adequate liquidity. If the trading price of our common shares fluctuates after this offering, you could lose a significant part of your investment. |

| · | Cosan will own % of our common shares after this offering. This concentration of ownership and voting power will limit your ability to influence corporate matters. |

| · | Future sales of a substantial number of common shares in the public market following this offering, or the perception that such sales could occur, could cause the price of our common shares to decline. |

| · | Our Memorandum and Articles of Association contain anti-takeover provisions that may discourage a third party from acquiring us and adversely affect the rights of holders of our common shares. |

| · | If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, the price of our common shares and our trading volume could decline. |

| · | We may not pay any cash dividends in the foreseeable future. |

| · | New investors in our common shares will experience immediate and substantial dilution after this offering. |

Corporate Information

We are a Cayman Islands exempted company incorporated with limited liability. We were incorporated as Moove Lubricants Holdings on September 5, 2023. Our principal executive offices are located at Av. Brigadeiro Faria Lima, 4,100 – 8th floor São Paulo – SP, 04538-132, Brazil, and our telephone number at this address is +55 11 4517-1546. Our website address is https://moovelub.com/en.php. Information contained on, or that can be accessed through, our website is not part of, or incorporated by reference into, this prospectus, and inclusions of our website address in this prospectus are inactive textual references only.

Implications of Being a Controlled Company

Upon the completion of this offering, Cosan will continue to control a majority of the voting power of our common shares. As a result, we will be a “controlled company” as defined under the NYSE listing rules because our controlling shareholder will hold more than 50% of the voting power for the election of directors. As a “controlled company,” we may elect not to comply with certain corporate governance standards. See “Risk Factors—Risks Relating to Our Common Shares and the Offering—We are a ‘controlled company’ within the meaning of the NYSE listing standards and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements.”

The Offering

This summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider before investing in our common shares. You should carefully read this entire prospectus before investing in our common shares, including “Risk Factors” and our consolidated financial statements and notes thereto included elsewhere in this prospectus.

| Issuer | Moove Lubricants Holdings |

| Common shares offered by us | common shares (or common shares if the underwriters exercise in full their over-allotment option). |

| Common shares offered by the selling shareholders | common shares (or common shares if the underwriters exercise in full their over-allotment option). |

| Common shares to be outstanding immediately after this offering | common shares (or common shares if the underwriters exercise in full their over-allotment option). |

Option to purchase additional common

shares | We and the selling shareholders have granted the underwriters the right to purchase up to an additional common shares from us and up to an additional common shares from the selling shareholders within 30 days of the date of this prospectus, at the public offering price, less underwriting discounts and commissions, on the same terms as set forth in this prospectus. We will not receive any proceeds from the sale of common shares by the selling shareholders. |

| Use of proceeds | We estimate that the net proceeds from the sale of our common shares in this offering will be approximately R$ (or approximately R$ if the underwriters’ option to purchase additional common shares is exercised in full), based upon the assumed initial public offering price of R$ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, including working capital. Additionally, we may use a portion of the net proceeds to acquire or invest in businesses, products, services or technologies. However, we do not have agreements or commitments for any material acquisitions or investments at this time. We will not receive any proceeds from the sale of common shares by the selling shareholders. See the section titled “Use of Proceeds” for additional information. |

| Concentration of ownership | Upon completion of this offering, Cosan, our executive officers and directors, and holders of 5% or more of our common shares will beneficially own, in the aggregate, approximately % of our outstanding common shares. |

| Voting rights | The common shares will be entitled to one vote per share. |

| Listing | We have applied to list our common shares on the NYSE, under the symbol “MOOV.” |