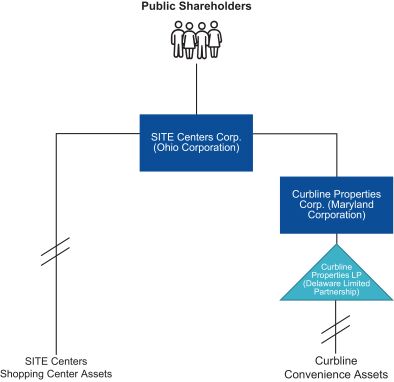

| | SITE Centers’ convenience separation and distribution strategy, including the acquisition of 12 shopping centers in 2023 for an aggregate price of approximately $165.1 million. |

Based on Operating FFO results and qualitative assessments, the SITE Centers’ Committee determined that Messrs. Lukes, Fennerty, and Cattonar had achieved the maximum overall level of performance under the 2023 incentive compensation program (in other words, 5 points in the scoring system described above), thereby entitling Messrs. Lukes, Fennerty and Cattonar to 2023 incentive payments of $2,250,000, $900,000, and $750,000, respectively (which represented the maximum incentive award opportunity under their respective employment agreements as in effect with SITE Centers in 2023).

Mr. Lukes’ employment agreement (as in effect with SITE Centers in 2023) entitled him to elect to receive all or a portion his annual incentive compensation in the form of RSUs (in lieu of cash), which RSUs would be subject to a ratable three-year vesting schedule and a 20% increase. In October 2023, Mr. Lukes elected to receive his 2023 annual incentive compensation payout entirely in the form of cash. In accordance with their employment agreements (as in effect with SITE Centers in 2023), annual incentive payments were provided to Messrs. Fennerty and Cattonar in cash.

2023 Retention-Based and Performance-Based Equity Grants and Results

RSU and PRSU amounts reflected in this section do not take into account SITE Centers’ one-for-four reverse stock split on August 16, 2024.

Service-Based RSUs Awarded in Connection with the Execution of September 2023 Employment Agreements. Each of Messrs. Fennerty and Cattonar received an award of 74,187 service-based RSUs in connection with the execution of his September 15, 2023 employment agreement with SITE Centers. Both of these awards generally vest 10%, 10%, 10%, 10% and 60% on each of the first five anniversaries of the grant date, in order to promote SITE Centers’ retention of such officers, and had a value at inception of approximately $1,000,000. Dividend equivalents credited with respect to these RSUs will be paid in cash on a current basis.

Annual Service-Based RSU Awards. Pursuant to the terms of their employment agreements (as in effect with SITE Centers in 2023), on February 22, 2023, Messrs. Lukes, Fennerty and Cattonar were granted 72,915, 18,231 and 9,117 service-based RSUs, respectively, having a value of approximately $1 million, $250,000 and $125,000, respectively, which grants generally vest in substantially equal installments on each of the first three anniversaries of the grant date. Dividend equivalents credited with respect to these RSUs will be paid in cash on a current basis.

2023 Performance-Based RSU Awards. Pursuant to the terms of their employment agreements (as in effect with SITE Centers in 2023), on March 1, 2023, Messrs. Lukes, Fennerty and Cattonar were granted 147,373, 36,843, and 18,422 PRSUs, respectively, subject generally to a performance period beginning on March 1, 2023 and ending on February 28, 2026 and having “target” values of approximately $2,000,000, $500,000, and $250,000, respectively (excluding accrued dividends). These PRSUs become payable to the NEOs at the end of the performance period, if at all, based on the percentile rank of the total shareholder return (or TSR) of SITE Centers measured over the performance period as compared to the total shareholder return of a particular set of peer companies during such period as shown below (with straight-line interpolation between levels):

| | | | | | |

PERFORMANCE LEVEL | | RELATIVE TSR | | PERCENTAGE

EARNED | |

Below Threshold | | Below 33rd percentile | | | 0 | % |

Threshold | | 33rd percentile | | | 50 | % |

Target | | 55th percentile | | | 100 | % |

Maximum | | 70th percentile or above | | | 200 | % |

For these purposes, SITE Centers’ peer companies consist of Acadia Realty Trust, Brixmor Property Group Inc., Federal Realty Investment Trust, Kimco Realty Corporation, Kite Realty Group Trust, Phillips Edison & Company Inc., Regency Centers Corporation, Retail Opportunity Investments Corp., RPT Realty, Saul Centers

103