As filed with the Securities and Exchange Commission on November 6, 2024

Registration Number 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

RedCloud Holdings plc

(Exact Name of Registrant as Specified in its Charter)

| England and Wales | 5990 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

50 Liverpool Street, London, EC2M 7PY, United Kingdom

+44 (0) 207 754 3735

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: (302) 738-6680

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

with copies to:

Barry I. Grossman, Esq. Sarah Williams, Esq. Justin Grossman, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Phone: (212) 370-1300 Fax: (212) 370-7889 | Anthony J. Marsico, Esq. Constantine Karides, Esq. Anne G. Peetz, Esq. Reed Smith LLP 599 Lexington Avenue New York, NY 10022 Phone: (212) 521-5400 |

Approximate date of commencement of proposed sale to public:

As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Explanatory Note

Prior to the effectiveness of this registration statement, all existing security holders of RedCloud Technologies Limited, a private limited company incorporated in England and Wales, will exchange the securities they hold in RedCloud Technologies Limited for an equivalent class and number of securities in RedCloud Holdings plc, a public limited company organized under the laws of England and Wales (the “Formation Transaction”). As a result of the Formation Transaction, 50,000,085 ordinary shares, par value of £0.001 per share, 1 redeemable preference share, par value of £49,999.999 per share, 5,038,667 options to purchase 5,038,667 ordinary shares and £10,500,000 unsecured convertible loan notes of RedCloud Technologies Limited (the “RTL Securities”) will be exchanged for 50,000,084 ordinary shares, 5,038,667 options to purchase 5,038,667 ordinary shares and £10,500,000 unsecured convertible loan notes of RedCloud Holdings plc (the “Company Securities”). The Company Securities issued to the security holders of RedCloud Technologies Limited in exchange for the RTL Securities as part of the Formation Transaction will have identical rights as the corresponding RTL Securities immediately prior to the completion of the Formation Transaction. HRK Participations SA, an entity wholly owned by Chairperson of the Board, Hans Rudolf Kunz, will be issued one less ordinary share and no redeemable preference share in RedCloud Holdings plc as part of the exchange to reflect the fact that HRK Participations SA already holds 1 ordinary share of £0.001 and 1 redeemable preference share of £49,999.999 in RedCloud Holdings plc on incorporation.

The financial statements and summary historical financial data included in this registration statement are those of RedCloud Technologies Limited and do not give effect to the Formation Transaction. All share, option and convertible loan note amounts, and related prices reflected in the accompanying prospectus give effect to the Formation Transaction, however such amounts appearing in Item 7 of Part II of the accompanying registration statement does not give effect to the Formation Transaction.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 6, 2024

PRELIMINARY PROSPECTUS

RedCloud Holdings plc

Ordinary Shares

This is an initial public offering by RedCloud Holdings plc, a public limited company organized under the laws of England and Wales, of ordinary shares, par value £0.001 per share (the “ordinary shares”). We anticipate that the initial public offering price of our ordinary shares will be between $ and $ , and the number of our ordinary shares offered hereby is based upon an assumed offering price of $ per share, the midpoint of such estimated price range.

Prior to this offering, there has been no public market for our ordinary shares. We intend to apply to have our ordinary shares listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “RCT”. No assurance can be given that our application will be approved. If our ordinary shares are not approved for listing on Nasdaq, we will not consummate this offering.

We are a “foreign private issuer” and an “emerging growth company” under the U.S. federal securities laws as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as a result, have elected to comply with certain reduced public company disclosure and reporting requirements. In addition, as long as we remain an emerging growth company, we will qualify for certain limited exceptions from the Sarbanes-Oxley Act of 2002. Additionally, following the offering, we plan to rely on available exemptions from certain corporate governance requirements. See “Risk Factors—Risks Related to Investing Foreign Private Issuer or United Kingdom Company” — “We are a “foreign private issuer” under the rules and regulations of the SEC and, as a result, are exempt from a number of rules under the Exchange Act and are permitted to file less information with the SEC than a company incorporated in the United States.”

The offering is being underwritten on a firm commitment basis. We have granted the underwriters an option to buy up to an additional ordinary shares it to cover over-allotments. The underwriters may exercise this option at any time and from time to time during the 30-day period from the date of this prospectus.

| No Exercise of Over-Allotment | Full Exercise of Over-Allotment | |||||||||||||||

| Per Share | Total | Per Share | Total | |||||||||||||

| Initial public offering price | $ | $ | ||||||||||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||||||||||

| Proceeds to us, before expenses | $ | $ | ||||||||||||||

(1) | In addition, we agreed to reimburse the underwriters for their expenses. We have also agreed to issue to the representative of the underwriters certain warrant compensation in connection with this offering. Please see “Underwriting” beginning on page 113 for additional information regarding underwriters’ compensation. |

Investing in our ordinary shares involves a high degree of risk. Before making any investment decision, you should carefully review and consider all the information in this prospectus including the risks and uncertainties described under “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers on or about , 2024.

Sole Book-Running Manager

Roth Capital Partners

Manager

The Benchmark Company

The date of this prospectus is , 2024

TABLE OF CONTENTS

| -i- |

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment or supplement to this prospectus, or any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell our ordinary shares and are seeking offers to purchase our ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any ordinary shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

We are incorporated under the laws of England and Wales. Under the rules of the Securities and Exchange Commission, or SEC, we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, or Exchange Act. We will also be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act.

This offering is being made in the United States (the “U.S.”) and elsewhere based solely on the information contained in this prospectus.

Notice to Investors Outside the United States. Neither we nor the underwriters, nor any of our or their respective agents have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in connection with this offering in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus, or any such free writing prospectus, must inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus and any such free writing prospectus outside the United States.

Notice to EEA Investors. In any European Economic Area, or EEA, Member State that has implemented the Prospectus Regulation, this communication is addressed only to and is only directed at qualified investors in that Member State within the meaning of Article 2 of the EU Prospectus Regulation. This prospectus has been prepared on the basis that any offer of our ordinary shares in any Member State of the European Economic Area, or EEA (each, a “Relevant Member State”), will be made pursuant to an exemption under the EU Prospectus Regulation from the requirement to publish a prospectus for offers of shares. Accordingly, any person making or intending to make any offer within the EEA of our ordinary shares which are the subject of this offering may only do so in circumstances in which no obligation arises for us or any of the underwriters to publish a prospectus pursuant to Article 3 of the EU Prospectus Regulation in relation to such offer. Neither we nor the underwriters have authorized, nor do they authorize, the making of any offer of our ordinary shares in circumstances in which an obligation arises for us or the underwriters to publish a prospectus for such offer. For the purposes of this provision, the expression “EU Prospectus Regulation” means Regulation (EU) 2017/1129, and includes any relevant implementing measure in each Relevant Member State.

Notice to UK Investors. No ordinary shares have been offered or will be offered pursuant to an offering to the public in the UK prior to the publication of a prospectus in relation to the ordinary shares which has been approved by the Financial Conduct Authority in accordance with the UK Prospectus Regulation (as defined below), except that the ordinary shares may be offered to the public in the UK at any time:

| (a) | to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation; | |

| (b) | to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation); or | |

| (c) | in any other circumstances falling within Section 86 of the Financial Services and Markets Act 2000 (“FSMA”), |

| -ii- |

provided that no such offer of the ordinary shares shall require us or the underwriters to publish a prospectus pursuant to Section 85 of FSMA or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation. For the purpose of this provision, the expression an “offer to the public” in relation to the ordinary shares in the UK means the communication in any form and by any means of sufficient information on the terms of the offer or any ordinary shares to be offered so as to enable an investor to decide to purchase or subscribe for any ordinary shares and the expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic UK law by virtue of the European Union (Withdrawal) Act 2018 as amended and subject to any further amendments made as part of the repeal of retained EU law pursuant to the Financial Services and Markets Act 2023.

In the United Kingdom (the “UK”), this prospectus is addressed only to and directed at “qualified investors” (as defined in the UK Prospectus Regulation) who are (1) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); (2) high net worth companies and other persons, falling within Article 49(2)(a) to (d) of the Order or (3) other persons to whom it may lawfully be communicated (all such persons together being referred to as “relevant persons”). Any investment or investment activity to which this prospectus relates is available only to relevant persons, and will only be engaged with relevant persons. It is not intended that this prospectus be distributed or passed on, directly or indirectly to any person who is not a relevant person. Any person who is not a relevant person should not act or rely on this prospectus or any of its contents.

Unless the context otherwise requires, references in this prospectus to “RedCloud,” “Company,” “we,” “our,” “ours,” “us,” “our Company” or similar terms refer, prior to the Formation Transaction discussed herein, to RedCloud Technologies Limited and its consolidated subsidiaries, and after the Formation Transaction, to RedCloud Holdings plc and its consolidated subsidiaries. In this prospectus, any reference to any provision of any legislation shall include any amendment, modification, re-enactment or extension thereof. Words importing the singular shall include the plural and vice versa, and words importing the masculine gender shall include the feminine or neutral gender.

Presentation of Financial Information

This prospectus includes financial information which has been derived from our audited financial statements as of and for the years ended December 31, 2023 and 2022 and the related notes, which are together referred to as “financial statements,” and can be found beginning on page F-1 of this prospectus. These financial statements have been presented in United States dollars (“$” or “USD”) unless otherwise indicated and are prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) and pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”).

Industry and Market Data

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from third-party industry analysts and publications and our own estimates and research. Some of the industry and market data contained in this prospectus are based on third-party industry publications. This information involves a number of assumptions, estimates and limitations.

The industry publications, surveys and forecasts and other public information generally indicate or suggest that their information has been obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks

We own or have rights to trademarks or trade names that we use in connection with the operation of our businesses, including our major trademarks, our corporate name, logos and website names. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by any other companies. All other trademarks are the property of their respective owners.

| -iii- |

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our ordinary shares and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our ordinary shares, you should read the entire prospectus carefully, including the sections “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” and the financial statements and related notes included in this prospectus.

Prior to the effectiveness of the registration statement of which this prospectus forms a part, we will undertake a formation transaction pursuant to which all existing security holders of RedCloud Technologies Limited, a private limited company incorporated in England and Wales, will exchange the securities they hold in RedCloud Technologies Limited for an equivalent class and number of securities in RedCloud Holdings plc, a public limited company organized under the laws of England and Wales. In this prospectus, we refer to this transaction as the “Formation Transaction.” References in this prospectus to our capitalization and other matters pertaining to our ordinary shares relate to the capitalization and ordinary shares of RedCloud Holdings plc after giving effect to the Formation Transaction. However, the financial statements and summary historical financial data included in this prospectus are those of RedCloud Technologies Limited and do not give effect to the Formation Transaction.

Unless the context indicates otherwise, as used in this prospectus, the terms “we,” “us,” “our,” “our company” and “RedCloud” refer, prior to the Formation Transaction discussed herein, to RedCloud Technologies Limited and its consolidated subsidiaries, and after the Formation Transaction to RedCloud Holdings plc and its consolidated subsidiaries.

Our Company

We have developed and operate the RedCloud platform (the “Platform”), that facilitates the trading of everyday consumer supplies of fast-moving consumer goods (“FMCG”) products across business supply chains. We believe the Platform solves a decades old problem of how to unlock and enable access of key purchase and sales data between brands, distributors and retailers in high growth consumer markets. Through the Platform, we enable retailers in these markets to use data driven insights backed by artificial intelligence (“AI”) to help make faster and easier business-to-business (“B2B”) purchases and inventory decisions from brands and distributors by breaking down complex purchasing behaviors of large product inventory catalogues. We then turn that into meaningful business insights and purchasing opportunities for our retailers. Our Platform is delivered through a consumption-based business model and we only charge brands and distributors for transactions made on the Platform. Our Platform consequently helps brands and distributors to use the same AI driven insights to connect with new local retailers in targeted locations, thereby spending less time searching for outlets to purchase their goods and products from.

Additionally, our Platform has AI and machine learning capabilities that provide our brands, distributors and retailers with trading and product insights and data to help them make better commercial decisions regarding their business operations. For example, our Platform has the capability to (1) inform retailers when they are running low on products, (2) inform retailers what other retailers in the area in which they operate are selling, and (3) inform brands and distributors the type of goods and products retailers are looking for on the Platform. We currently operate in Argentina, Brazil, Nigeria, and South Africa which are high consumer growth markets and plan to expand to additional countries in the future.

Formation Transaction

Prior to the Formation Transaction, our business was operated through RedCloud Technologies Limited, a private limited company incorporated in England and Wales. In connection with the initial public offering, RedCloud Technologies Limited and its subsidiaries (the “RedCloud Group”) will undertake a reorganization of its corporate structure that will result in the Company becoming the ultimate holding company of the RedCloud Group and RedCloud Technologies Limited becoming the Company’s direct subsidiary. On incorporation, the share capital of the Company was £50,000, divided into one ordinary share of £0.001 and one redeemable preference share of £49,999.999, both of which were allotted to HRK Participations SA. The consideration for the issue of the redeemable preference share on incorporation was an undertaking by HRK Participations SA to pay cash of £49,999.999, while the consideration for the issue of the ordinary share on incorporation was £0.001 which was paid in cash.

| 1 |

The reorganization will be effected through a share-for-share exchange (the “Share Exchange”) and convertible loan note exchange (the “CLN Exchange”, and together with the Share Exchange, the “Exchange”). The Company will enter into a share and note exchange agreement (the “Exchange Agreement”) with the existing shareholders and loan note holders of RedCloud Technologies Limited pursuant to which the Company will acquire the entire issued share capital and the convertible loan note capital of RedCloud Technologies Limited and in consideration for this the Company will allot and issue: (1) such number and class of shares in the Company that will result in the shareholders of RedCloud Technologies Limited holding an equivalent number and class of shares in the Company following completion of the Share Exchange as they held in RedCloud Technologies Limited immediately prior to completion of the Share Exchange; and (2) such number of convertible loan notes that will result in the convertible loan note holders of RedCloud Technologies Limited holding an equivalent number of convertible loan notes in the Company as the convertible loan notes they held in the Company immediately prior to completion of the CLN Exchange.

The reorganization will also involve an option exchange (the “Option Exchange”) whereby the Company will enter into an option exchange agreement with the existing option holders of RedCloud Technologies Limited pursuant to which the Company will acquire the existing issued option capital of RedCloud Technologies Limited and in consideration for this the Company will grant options over such number and class of shares in the Company that will result in the optionholders of RedCloud Technologies Limited holding an equivalent number of options over such number and class of shares in the Company following completion of the Option Exchange as they held in RedCloud Technologies Limited immediately prior to completion of the Option Exchange.

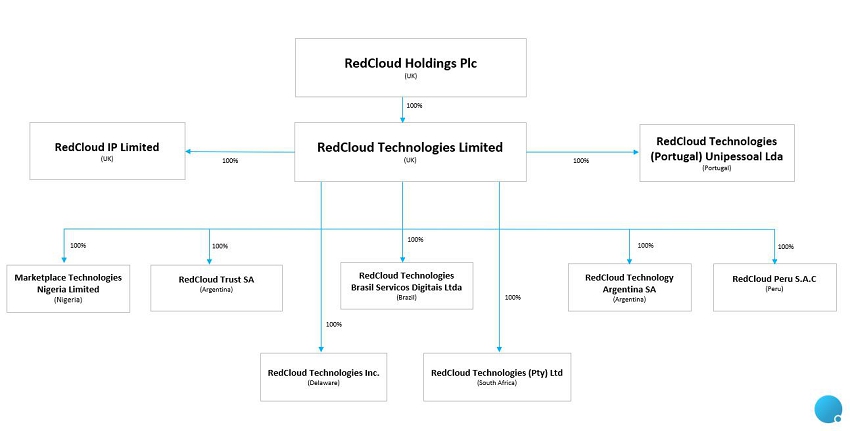

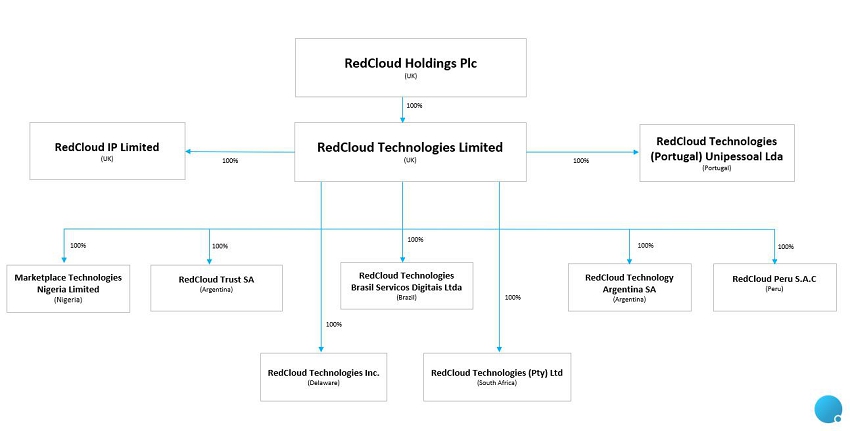

After the consummation of the Exchange, our business will be operating through the following corporate structure:

Following the initial public offering, HRK Participations SA shall pay the £49,999.999 outstanding in respect of its redeemable preference share in the Company, following which the redeemable preference share shall be immediately redeemed by the Company out of the proceeds of the initial public offering receivable by the Company. No dividend will be declared with respect to the redeemable preference share.

| 2 |

RedCloud Platform

Our Platform is an AI-driven “Open Commerce” platform that provides brands, distributors and retailers with a faster, more intuitive and easier way to trade with each other and with products they trust. Our Platform is an end-to-end solution based on the principles of AI led, Open Commerce, enabling offline trading to be brought to a dynamic, digital trading environment that aims to reduce the cost of essential consumer products, improve the quality and choice of products available in the areas we operate, and make it easier to connect to local and global supply chains. Specifically, our Platform is decentralized, meaning the distributors and brands can choose the retailers they sell to directly and vice versa. They are also able to negotiate with each other directly with respect to all aspects of each transaction, including but not limited to, pricing, distribution and delivery timing. The fact that our Platform provides brands, distributors and retailers with this ability, without any input from the Company, is why we consider our Platform to be Open Commerce. Our Platform also offers AI and machine-learning capabilities that analyze the data of our distributors, brands and retailers, and makes recommendations based on such information. Leveraging cloud infrastructure, our Platform also provides data capabilities that enable high frequency trading that reduce the structural costs and difficulties of holding slow moving inventory and enabling faster and smarter trade buying decisions that influence the product cost, availability and success across markets. Our customers benefit from our Platform’s ability to scale with their growth and demand needs, allowing efficient any time trade without the need to invest in costly skills and building their own platform.

We currently host our Platform and support our operations using a sole third-party cloud service provider, Amazon Web Services (“AWS”), and our accompanying Red 101 App is hosted by Google’s Play Store and the Apple App Store.

We believe we have a competitive advantage because we have built significant data warehouse capabilities that support advanced machine learning integration by gathering highly granular information such as product details, purchasing profiles, transactions, and more. This data is sourced from retailers, distributors, and FMCG brands that each seek insight into their performance and strategies for enhancing sales, optimizing discounts, and leveraging campaigns on our Platform. We believe we are uniquely positioned to utilize this data, driving machine learning algorithms to power recommendations, pricing engines, and conversational commerce solutions.

We currently operate our Platform in regions we consider high growth consumer markets: Argentina, Brazil, Nigeria, and South Africa. As of September 30, 2024, we had approximately 511 distributors, 6,114 brands, 154,311 products and 25,311 retailers on our Platform. We generate our revenue from applying a take rate on the total transaction value (“TTV”) of each transaction conducted on our Platform. All revenue we receive is from the brand or distributors. Retailers on the Platform do not pay any fees on the transactions to which they are a party. The take rate ranges from 1% to 5% of the TTV. For the six months ended June 30, 2024, the average take rate equated to approximately 1.7% of the TTV. For the nine months ended September 30, 2024, we had processed approximately 219,209 orders with approximately $1.56 billion in TTV.

Technological Capabilities

Data Enablement

We believe data enablement and integrity is essential for modern business, allowing them to harness the full potential of their data to drive strategic decisions and operational efficiency. Our data enablement tools and services include cloud data warehouses, advanced data search capabilities, intuitive data visualizations, and customer data platforms. We help make these available to distributors and brands which in turn enables them to gain a deeper understanding of their customers’ behaviors, preferences, and needs. With a unified view of data, we can personalize experiences, improve customer satisfaction, and build stronger relationships. We believe this leads to increased loyalty and better customer retention rates.

AI/Machine Learning

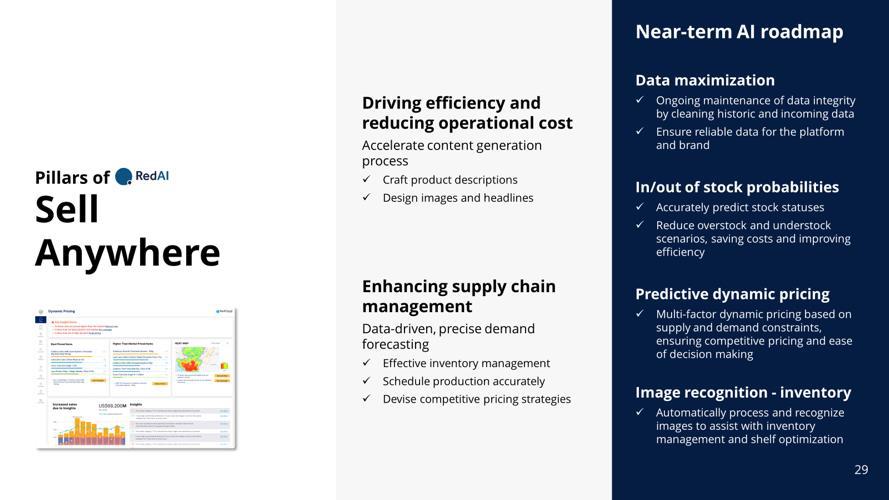

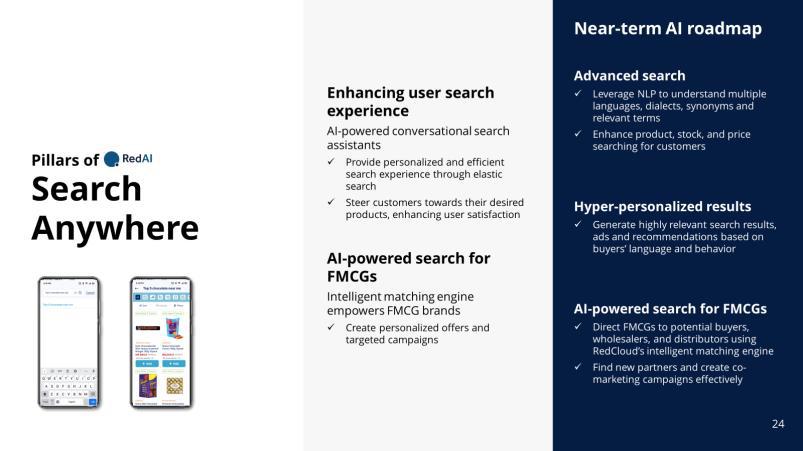

We believe our Platform’s AI and machine learning capabilities provide substantial benefits to our brands, distributors and retailers, including but not limited to, the following:

| 1. | Recommendations – By analyzing the data from our operations, our Platform can make recommendations to brands, distributors and retailers regarding their potential needs to help them purchase and trade more efficiently. For example, our Platform can make recommendations to retailers regarding newly available products that they may be interested in based on their previous purchases. This helps both brands and distributors increase inventory turnover and drive additional sales on our Platform while also alerting retailers to new products that their customers may want to purchase. This feature is available for use on our Platform. |

| 3 |

| 2. | Fraud Detection – Our Platform helps to proactively detect and take actions against potential fraud that the retailers and distributors may face. Specifically, we can identify suspicious behaviors, such as frequent returns by specific customers or returns of high-value items. Once detected, we effect controls on the identified accounts, including but not limited to, account suspensions and trading value or wallet limits. This feature is available for use on our Platform in Nigeria, and we expect it to be available in all jurisdictions in the year 2025. | |

| 3. | Returns – Our Platform can use AI to automate the return authorization process, reducing the time and effort required for all parties, by analyzing return requests and comparing them against return policies. It can quickly approve or deny requests and tailor return policies based on individual customer profiles and buying patterns. This feature is currently in development for future use on our Platform. | |

| 4. | Logistics – Our Platform can provide logistics assistance by determining more cost-effective and efficient ways to handle shipping products and handle returns through reverse logistics. This includes routing to the nearest processing centers, selecting the best shipping methods based on cost and cardon footprint. This feature is available for use on our Platform in Nigeria, and we expect it to be available in all jurisdictions in the year 2025. | |

| 5. | Pricing and Promotions – Our Platform allows distributors and retailers to adjust pricing and promotions based on current inventory levels, demand fluctuations, and competitive factors. This feature is available for use on our Platform. | |

| 6. | RedInsights – Our Platform can use predictive analytics to forecast future demand and return rates based on historical data, product types, customer behavior, and other factors through a feature called RedInsights. This helps our brands, distributors and retailers manage inventory more effectively, anticipate return volumes, and plan for restocking and reselling returned items. This feature is available for use on our Platform. |

We also plan to build AI capabilities to make trade smooth for our retailers that are used to using conversation channels such as WhatsApp to discover and place orders. This will enable shopping from anywhere at any time, fitting seamlessly into retailers’ daily routines. They would be able to add items to their cart, check order status, and receive recommendations using simple commands, enhancing convenience and accessibility.

Our Market Opportunity

The FMCG market is currently valued at over $11 trillion globally and growing at over 5% CAGR, According to Acumen Research, the FMCG market was valued at $11.7 trillion as of 2022 and is expected to grow to $14.5 trillion by 2026.1 FMCG products are the largest group of consumer products spread across various categories and represent those required in everyday life ranging from foods and beverages, non-prescription medicines and office supplies.2 In Nigeria, South Africa, Brazil and Argentina, the FMCG market is collectively valued at over $300 billion.3 Additionally, according to Euromonitor, market weight and share of growth are increasingly moving to emerging markets, which include the countries we currently operate in. Emerging markets are expected to account for 47% to 75% of the sales growth (across verticals) in FMCG products. As of December 31, 2023, we had a share of 2.71% in Nigeria, 0.01% in South Africa, 0.0004% in Brazil and 0.12% in Argentina for the FMCG markets in each country.

Additionally, as of now, the majority of B2B buying and selling occurs offline, relying on what we believe to be outdated legacy technology. Globally, distributors cater to around 500 million micro, small and medium-sized retailers.4 These businesses face immense costs, with three out of four FMCG product launches ending in failure5, an annual inventory shortfall exceeding $2 trillion, and escalating expenses in bringing FMCG products to market. The physical availability of products presents a trillion-dollar opportunity; having the right product at the right price at the point of purchase is crucial for the success of future commerce. We believe that our Platform can be useful in providing distributors with access to retailers looking for their products and vice versa.

Our Growth Strategy

Our strategy is to enable the development of strong brand recognition, data engagement, and distribution at scale through a platform-led economic model that competes against traditional B2B marketplaces. We approach markets with a proactive method for engaging distributors and retailers, aiming to rapidly gather essential data on key product information, inventory, and purchasing cycles. This data is instrumental in assisting distributors to optimize their market routes effectively. This data allows us to continually provide superior discovery, search, and trading and expand key FMCG products and services.

1 Acumen Research and Consulting, FMCG Market Size to Reach USD 19,602.6 Billion by 2032 growing at 5.3% CAGR (July 28, 2024) https://www.acumenresearchandconsulting.com/press-releases/fmcg-market.

2 Allied Market Research, FMCG Market Size, Share, Competitive Landscape and Trend Analysis Report (Jan. 2023).

3 KPMG, Fast-Moving Consumer Goods Sector Report; Statista, Consumer Goods – Brazil; NielsenIQ State of the Nation Report: South Africa (July 2023).

4 ITC News, “MSMEs make the economic world go round”, Article (July 2017).

5 https://www.marketingweek.com/3-in-4-fmcg-launches-fail-within-a-year/.

| 4 |

The key elements of our strategy to grow our business include:

Increase Active Retailers and Trading Share

As of September 30, 2024, we had approximately 25,311 retailers and 511 distributors active on our Platform. Moving forward, we are committed to enhancing and promoting the value proposition of our Platform. Our focus lies on attracting new retailers while also expanding their buying frequency and product categories. This growth strategy will be driven by customer loyalty programs, top-tier customer service, targeted marketing initiatives, promotional campaigns, and the continuous expansion of our marketing affiliates. Additionally, we will encourage the use of our diverse range of mobile commerce apps.

Expand Products and Brands

We believe that the growth in both the number of product categories and brands purchased within each category will contribute to higher average spending per customer, ultimately driving gross merchandise value upwards. As of September 30, 2024, our Platform featured 154,311 products from 6,114 brands. Our primary objective is to elevate the retailer shopping experience, boost retailer engagement, and create new avenues for retailers by expanding and highlighting additional products and brands.

Enhance the Success of Retailers on a Broad Basis

Our goal is to enhance the success of a diverse range of retailers on our Platform by amplifying their visibility to pertinent buyer demand and equipping them with enhanced tools, such as data science applications, to foster personalized buyer interactions. Leveraging advanced data science and analytics to develop our own AI capabilities, we will assist distributors in pinpointing products and enhancing the conversion rate from visitor engagements to completed transactions.

Generate Data and Cloud Computing Technologies

We believe that the data generated within our Platform holds substantial value for our customers and various ecosystem participants. Our ongoing strategy involves the strategic application of data intelligence and deep learning technologies across multiple areas such as marketplace design, user interface optimization, search functionalities, targeted marketing initiatives, logistics efficiency, location-based services, and financial services enhancements. This data can be used in numerous ways, including but not limited to creating new product offerings and monetization channels with commercial partners that improve access to finance, enhance cash-flow or increase product turnover for our customers.

We foresee AI evolving into a fundamental element of e-commerce infrastructure. Over the past five years, we have dedicated significant resources to developing our proprietary cloud infrastructure, not only to bolster our own operations but also to support the endeavors of third parties, including our valued brands and distributors. Moving forward, we remain committed to substantial investments in our cloud computing Platform to fortify both our internal operations and those of our partners. We have a dedicated research and development (“R&D”) data team focusing on innovation in deep learning and machine learning technologies with the primary aim of increasing transaction size and enhancing customer retention. This innovation combined with data gathered through our Platform can be used to create reports on market intelligence and trends around regional consumption, demand and inventory flows. We believe these reports can be commercialized and are valuable to retailers, distributors, brands and other trade bodies.

Sales and Partnerships

We currently have sales teams located in Nigeria, South Africa, Brazil and Argentina. We plan to expand our teams in each of these jurisdictions to focus on driving sales growth across these jurisdictions by retaining more brands, distributors and retailers and entering into partnerships with leading FMCG companies. We are particularly focused on new partnerships with leading FMCG companies as we believe this can cause substantial growth by also attracting their retailers throughout the jurisdictions in which we operate. We also plan to create a sales force in the United States to begin retaining brands, distributors and retailers for when we launch our Platform in the United States.

| 5 |

Our Competitive Strengths

Experienced Management Team

Our Chief Executive Officer and Founder, Justin Floyd, has a 30-year track record of founding and scaling technology companies in what he considers underserved industries. He is a pioneer in the Open Commerce movement which seeks to bring trust to today’s global B2B supply chains. Additionally, the rest of our senior management have experience in technology and finance, having previously worked at Orange Money, Meta, and SoftBank.

Trusted Partner in Our Jurisdictions of Operation

As of September 30, 2024, we had approximately 511 national, regional, and local distributors, that collectively represent approximately 6,114 brands, work with RedCloud. We believe this represents the broadest selection of FMCG products through a single platform in the markets we operate and provides a competitive edge over international giants like Alibaba by fostering local trade and business ecosystems. This focus on regional transactions translates to a smaller carbon footprint due to reduced reliance on lengthy global supply chains. We also believe this strengthens the resilience of local economies by promoting internal trade networks and lessening dependence on outside sources.

Based on our experience, we believe the jurisdictions in which we operate have historically had issues with online fraud and retailers are skeptical of purchasing products online due to fear of fraud. Our Platform has been built and developed specifically for markets where brands want to establish a trusted presence and local supply chain for their inventory to help alleviate this fear. We believe our Platform is recognized in our jurisdictions of operation as a reliable source for brands and retailers to trade their inventory in a secure environment where products can be tracked efficiently. Additionally, we require all third-party brands and distributors to meet our standards for product authenticity and service reliability to provide credibility and appeal to our Platform. We believe our retailers can then confidently navigate through our Platform and trust the strength and authenticity of the offered brands, ensuring a superior product selection, convenience, and cost. We believe this provides us with an advantage over larger competitors who do not have the network or reputation to meet these standards.

AI and Machine Learning Capabilities

Our Platform’s AI and machine learning algorithms can process millions of data points each day to optimize a range of purchasing behavior by retailers, including order build, inventory turn ratios, restock and out of stock, personalization, ads quality, inventory forecasting, order fulfillment, delivery mobilization, rebates and payment. We believe our data-first approach is a key driver of our customer engagement across the markets in which we operate and provides our brands and distributors with an advantage over other local distributors that do not have these capabilities.

Connectivity

Brands, distributors, and retailers can directly connect on our Platform, which distinguishes our Platform from our competitors, like Amazon and Alibaba. This allows brands, distributors and retailers several advantages, including but not limited to, the following:

| ● | Retailers can source inventory from local brands and distributors directly to expedite the delivery process. | |

| ● | Brands and distributors can obtain higher returns on investment through improved product launches due to having discussions with retailers about what they really need. |

| 6 |

Scalable Logistics Platform

We have invested significantly in our proprietary technology, including a distributed relational database, computing clusters, and personalized product search engines. This infrastructure supports our high volume of transactions and ensures reliability, scalability, and cost-effectiveness. We believe our scalability allows distributors to offer retailers the best selection, quality, value, and convenience, which helps them attract more customers and drives higher engagement. This results in more orders and increased retailer spending compared to the traditional methods previously utilized by our brands and distributors.

Third-Party Platform Business Model

Our exclusively third-party platform model allows for rapid scaling without the risks of providing such products ourselves, including but not limited to, inventory management, logistical operations and warehouse storage. We believe this approach drives profitability, strong cash flow, and enables us to aggressively invest in our technology, product innovation, and ecosystem expansion instead of having to resources on inventory management, logistical operations and warehouse storage.

Summary of Risk Factors

Investing in our ordinary shares involves a high degree of risk. Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our ordinary shares. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors” in this prospectus:

Risks Relating to Our Platform

| ● | We currently rely on a single third-party cloud service provider to host or support a significant portion of our Platform, and any interruptions or delays in services from this third party could impair our Platform and harm our business. | |

| ● | Our dependency on a single cloud service provider for technology services and deployment could restrict our flexibility and deployment options, leading to overreliance on a single provider. | |

| ● | Our company faces a risk of increased latency due to cloud providers’ limited point-of-presence (“PoP”) coverage. | |

| ● | We rely on third-party mobile operating systems to make our Red 101 App and Platform available to registered users and if those systems are adversely impacted, we may not effectively operate as our usage could decline and our business, financial condition, and results of operations could be adversely affected. | |

| ● | We rely on mobile operating systems and app marketplaces to make portions of our Platform available to registered users and if we do not effectively operate with such app marketplaces, our usage or brand recognition could decline and our business, financial condition, and results of operations could be adversely affected. | |

| ● | We rely on software and services from third parties. Defects in, or the loss of access to, software or services from such third parties could harm our business and adversely affect the quality of our Platform. | |

| ● | We rely on third parties for our payment processing infrastructure underlying our Platform. If these third-parties become unavailable or their terms become unfavorable, our business could be adversely affected. | |

| ● | Use of AI and machine learning in our operations may present additional legal, regulatory, and social risks, which could lead to additional costs and impact our business. |

| 7 |

Risks Related to our Financial Condition and Capital Requirements

| ● | We have incurred significant net losses to date and we may continue to experience significant losses in the future. | |

| ● | The reports of our independent registered public accounting firm for the fiscal years ended December 31, 2022 and 2023 contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. | |

| ● | We will need additional capital, and financing may not be available on terms favorable to us, or at all. | |

| ● | We are currently heavily dependent on insiders to fund our operations. |

Risks Relating to Our Business, Strategy and Industry

| ● | We have experienced rapid growth, operational and strategic expansion, and related impacts to margin and profitability in recent periods. Such historical trends, including growth rates, may not continue in the future. | |

| ● | We have a limited history operating our business at its current scale, scope, and complexity in an evolving market and economic environment, which makes it difficult to plan for future operations and strategic initiatives, predict future results, and evaluate our future prospects and the risks and challenges we may encounter. | |

| ● | If we fail to manage and expand our relationships with brands, distributors and retailers, our business and growth prospects may suffer. | |

| ● | Our industry is highly competitive, with well-capitalized and better-known competitors. If we are unable to compete effectively, our business and financial prospects could be adversely impacted. | |

| ● | Our expansion into new product ranges and the substantial increase in the number of products sold on our Platform may expose us to new challenges and more risks. | |

| ● | If we are unable to conduct our marketing activities more cost-effectively, our results of operations and financial condition may be materially and adversely affected. | |

| ● | We depend on highly skilled personnel to grow and operate our business, and if we are unable to hire, retain, and motivate our personnel, our business may be severely disrupted. | |

| ● | Security breaches and attacks against our systems and network, and any potentially resulting breach or failure to otherwise protect confidential and proprietary information, could damage our reputation and negatively impact our business, as well as materially and adversely affect our financial condition and results of operations. |

Risks Related to our Intellectual Property and Trademarks

| ● | We may not be able to prevent others from the unauthorized use of our intellectual property or trademarks, which could harm our business and competitive position. | |

| ● | We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations. |

Risks Related to this Offering

| ● | No active trading market for our ordinary shares currently exists, and an active trading market may not develop or be sustained following this offering. |

| ● | The trading price of our ordinary shares may be volatile, and you could lose all or part of your investment. |

| ● | Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our ordinary shares. |

| 8 |

| ● | Our management will have broad discretion in how we use the net proceeds of this offering and might not use them effectively. |

| ● | You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future. |

| ● | Future sales of our ordinary shares or securities convertible into our ordinary shares may depress our share price. |

Corporate Information

We currently operate as a private limited company organized under the laws of England and Wales under registered number 08872820. Prior to the consummation of our initial public offering and following the consummation of the Formation Transaction, RedCloud Holdings plc (a public limited company organized under the laws of England and Wales under registered number of 15647424) will become the holding company of the RedCloud Group. Our principal executive office is located at 50 Liverpool Street, London, EC2M 7PY, and our phone number is +44 (0) 207 754 3735. We maintain a website at https://redcloudtechnology.com. The references to our website are intended to be inactive textual references only. The information contained on, or that can be accessed through, our website is not incorporated by reference into, and is not part of this prospectus and investors should not rely on such information in deciding whether to purchase shares of our ordinary shares. Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, DE 19711.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We qualify as an “emerging growth company” as defined under the Securities Act of 1933, as amended (which we refer to as “the Securities Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved; and |

| ● | exemption from complying with recently enacted “pay versus performance” reporting obligations. |

In addition, an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period. We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1.235 billion or more in annual gross revenues; (ii) the end of fiscal year 2029; (iii) our issuance, in a three year period, of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our ordinary shares held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

| 9 |

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

Implications of Being a Smaller Reporting Company

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Exchange Act, as amended, after we cease to qualify as an “emerging growth company,” certain of the exemptions available to us as an “emerging growth company” may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act; (2) scaled executive compensation disclosures; and (3) the ability to provide only two years of audited financial statements, instead of three years.

Foreign Private Issuer

Upon the completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under U.S. GAAP; |

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events. |

Initially, we intend to rely on the “foreign private issuer exemption” with respect to the following requirements:

| ● | We do not intend to follow Nasdaq Rule 5620(c) regarding quorum requirements applicable to meetings of shareholders. Such quorum requirements are not required under English law. In accordance with generally accepted business practice, our amended and restated articles of association and the Companies Act 2006 (the “Companies Act”) provide alternative quorum requirements that are generally applicable to meetings of shareholders. | |

| ● | We do not intend to follow Nasdaq Rule 5635(c) regarding shareholder approval requirements for the issuance of securities in connection with a share option or purchase plan that is established or materially amended or other equity compensation arrangement is made or materially amended. Pursuant to the Companies Act, we cannot allot shares or grant rights to subscribe for or to convert any security into shares in the Company without an ordinary resolution of the shareholders. | |

| ● | We do not intend to follow Nasdaq Rule 5635(d) regarding shareholder approval requirements for the issuance of more than 20% of the outstanding ordinary shares of the issuer. Pursuant to the Companies Act, we cannot allot ordinary shares or grant rights to subscribe for or to convert any security into ordinary shares in the Company without an ordinary resolution of the shareholders. |

Notwithstanding these exemptions, we will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies also are exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

| 10 |

| Ordinary shares offered by us | shares | |

| Ordinary shares to be outstanding after this offering(1) | shares (or shares if the underwriters exercise their over-allotment option in full). | |

| Over-allotment option | We have granted the underwriters a 30-day option to purchase up to an additional ordinary share at the initial public offering price to cover over-allotments, if any. | |

| Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million, based on the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus.

The net proceeds received by us from this offering will be used for (1) repaying up to £2,500,000 (or approximately $3,500,000) of outstanding debt obligations (2) market expansion efforts in Nigeria, Argentina, South Africa and Brazil, (3) further development of our AI capabilities, (4) investment in Platform upgrades and (5) working capital and general purposes. We may also use a portion of the net proceeds to acquire, license and invest in complementary products, technologies or additional businesses; however, we currently have no agreements or commitments to complete any such transaction. See “Use of Proceeds.” | |

| Proposed Nasdaq symbol | “RCT” | |

| Risk Factors | Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 13 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our ordinary shares. | |

| Lock-Up | In connection with this offering, we, our directors, executive officers, and certain shareholders holding percent ( %) or more of our ordinary shares have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of ( ) months following the closing of the offering of the shares. See “Underwriting” for more information. |

| (1) | The number of ordinary shares to be outstanding upon completion of this offering is based on ordinary shares outstanding as of , 2024, which gives effect to the conversion of outstanding convertible loan notes (the “CLNs”) into ordinary shares, and excludes: |

| ● | 5,038,667 ordinary shares issuable upon exercise of share options, at a weighted average exercise price of $ per share; and |

| ● | ordinary shares reserved for future issuance under our 2024 Equity Incentive Plan (which is equal to 20% of our issued and outstanding ordinary shares immediately after the consummation of this offering, less the number of outstanding option grants). |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| ● | No exercise by the underwriters of its over-allotment option; and |

| ● | Conversion of CLNs upon the closing of this offering into an aggregate of ordinary shares at a conversion price of $ per share. |

| 11 |

The following table sets forth summary financial and other data for the periods ended and at the dates indicated below. Our summary financial information for has been derived from our audited financial statements included in this prospectus. The unaudited summary financial data as of have been derived from our unaudited interim financial statements, which are included elsewhere in this prospectus and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our financial position and results of operations for these periods. The financial data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and notes thereto included elsewhere in this prospectus.

| RedCloud Holdings plc | ||||||||

| For the Year Ended December 31, | ||||||||

| 2023 | 2022 | |||||||

| (in thousands) | ||||||||

| Total operating revenues | $ | 19,807 | $ | 2,809 | ||||

| Total operating expenses | 45,453 | 15,988 | ||||||

| Total operating loss | (25,646 | ) | (13,179 | ) | ||||

| Net loss | (32,386 | ) | (16,560 | ) | ||||

| For the Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| (in thousands) | ||||||||

| Total operating revenues | $ | 16,075 | $ | 6,176 | ||||

| Total operating expenses | 32,666 | 20,183 | ||||||

| Total operating loss | (16,590 | ) | (14,008 | ) | ||||

| Net loss | (23,888 | ) | (16,284 | ) | ||||

| 12 |

Investing in our ordinary shares involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this prospectus, including our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision. The risks described below are not the only ones we face. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition, or results of operations. In such case, the trading price of our ordinary shares could decline, and you may lose some or all of your original investment.

Risks Relating to Our Platform

We currently rely on a single third-party cloud service provider to host or support a significant portion of our Platform, and any interruptions or delays in services from this third party could impair our Platform and harm our business.

We currently host our Platform and support our operations using a sole third-party cloud service provider, Amazon Web Services, and our accompanying Red 101 App is hosted by Google’s Play Store and the Apple App Store. We do not, and will not, have control over the operations of the facilities or infrastructure of the third-party service providers that we use. Such third parties’ facilities may experience break-ins, computer viruses, denial-of-service or other cyber-attacks, sabotage, acts of vandalism, and other misconduct. These facilities may also be vulnerable to damage or interruption from power loss, telecommunications failures, fires, floods, earthquakes, hurricanes, tornadoes, and similar events. Our Platform’s continuing and uninterrupted performance is critical to our success.

We have experienced, and expect that in the future we will experience, interruptions, delays, and outages in service and availability from these third-party service providers from time to time due to a variety of factors, including infrastructure changes, human or software errors, website hosting disruptions and capacity constraints. Any such limitation on the capacity of our third-party service providers could impede our ability to onboard new registered users or expand the usage of our existing registered users, which could adversely affect our business, financial condition, and results of operations. In some instances, we may not be able to identify the cause or causes of these performance problems within a period of time acceptable to our registered users. A prolonged service disruption affecting our service for any of the foregoing reasons would negatively impact our ability to serve our registered users and could damage our reputation with current and potential registered users, expose us to liability, cause us to lose registered users, or otherwise harm our business. We may also incur significant costs for using alternative equipment or taking other actions in preparation for, or in reaction to, events that damage the third-party service providers we use.

In addition, any changes in our hosting provider’s service levels may adversely affect our ability to meet the expectations of registered users. Our systems do not provide complete redundancy of data storage or processing, and as a result, the occurrence of any such event, or other unanticipated problems may result in our inability to serve data reliably or require us to migrate our data. This could be time-consuming and costly and may result in the loss of data, any of which could significantly interrupt the provision of our offerings and harm our reputation and brand. We may not be able to easily switch to another public cloud or to a data center provider in the event of any disruptions or interference to the services we use, and even if we do, other public cloud or data center providers are subject to the same risks.

Elements of our Platform make use of legacy applications which do not permit us to make full use of the robustness of the cloud. We are constantly evaluating our technology stack and replacing with technologies which make full use of cloud technologies to provide scaling.

Our dependency on a single cloud service provider for technology services and deployment could restrict our flexibility and deployment options, leading to overreliance on a single provider.

Currently, we solely depend on a single cloud service provider, AWS, for technology services and deployment. Relying exclusively on a single cloud service provider can pose significant risks for businesses. It can result in vendor lock-in, where organizations become tightly bound to proprietary technologies and contractual terms, making it challenging and costly to switch providers. Dependency on a sole provider also exposes businesses to potential disruptions or outages, which could lead to downtime, data loss, or service unavailability. Moreover, it limits flexibility in adopting specialized services, pricing models, or geographic coverage that might better align with organizational needs or regulatory requirements.

| 13 |

We may try to mitigate these risks by implementing a multi-cloud strategy that leverages services from multiple cloud providers. Nevertheless, multi-cloud strategies are complex endeavors that involve inherent risks. They necessitate sophisticated tooling and entail increased operational complexity, which we must carefully manage to realize the anticipated benefits. Our failure to do so may negatively impact the operations of our Company.

Our company faces a risk of increased latency due to cloud providers’ limited point-of-presence (“PoP”) coverage.

Cloud providers may not have a PoP in each of the countries we operate in. If PoP locations are not positioned close to or within the countries in which we operate, it can result in slower response times for customers interacting with our services. This latency can negatively impact the user experience, potentially leading to reduced customer satisfaction, increased bounce rates, and lower engagement levels on our platforms.

We rely on third-party mobile operating systems to make our Red 101 App and Platform available to registered users and if those systems are adversely impacted, we may not effectively operate as our usage could decline and our business, financial condition, and results of operations could be adversely affected.

Our technology systems are not located locally within each territory in which we operate. Instead, they are principally run out of two main regions, Brazil and Europe, with our Platform being hosted over the public internet. Some of the territories in which we operate have experienced issues with global connectivity, which can create uptime issues as well as other specific risks which may impact our registered users from accessing and using our Platform and the Red 101 App, which could adversely affect our business, financial condition, and results of operations.

In some of the territories in which we operate, principally Nigeria and South Africa, mobile coverage is generally sufficient but can sometimes suffer from overloaded networks and outdated infrastructure. This causes the mobile networks to become congested or fail. Additionally, in South Africa, the electrical grid has scheduled power outages resulting in local networks going down when their emergency backup power supply is depleted. For example, there have been several incidences in Africa this year, arising from damage to underwater cables, which have impacted the continent’s internet connectivity. In May 2024, two underwater cables off the coast of Durban in South Africa, which carry data around the continent, were cut and caused disruption to the internet to parts of eastern Africa and South Africa. In March 2024, damage to four underwater cables off the West African coast caused similar problems, and in February 2024, three cables in the Red Sea were similarly damaged. Anchor dragging from ships close to shore is one of the most common causes of damage, but underwater rockfalls, as was believed to be the case in West Africa in March, and seismic activity can also affect the cables. Repairing the damage, which requires specialized equipment and expertise, can take days or weeks, depending on the weather, sea conditions and the extent of the problem.

These disruptions to the mobile and or internet third-party networks or facilities that we rely upon could delay our expansion into other countries and prevent registered users from accessing our Platform and the Red 101 App.

We rely on mobile operating systems and app marketplaces to make portions of our Platform available to registered users and if we do not effectively operate with such app marketplaces, our usage or brand recognition could decline and our business, financial condition, and results of operations could be adversely affected.

We depend in part on mobile operating systems, such as Android and iOS, and their respective app marketplaces to make our Platform available to our registered users. As the markets within which we operate are extensive users of Android as opposed to iOS, we currently provide an Android mobile application (the Red 101 App) released through Google’s Play Store and the Apple App Store. We also provide a mobile web interface for devices which cannot use Android applications or are unable to download apps from Google Play Store and the Apple App Store. The Red 101 App is the main entry point for a retailer to purchase goods and services through our Platform from distributors. Any changes in such systems and app marketplaces that degrade the functionality of our Red 101 App or give preferential treatment to our competitors’ apps could adversely affect our registered user’s usage and engagement on mobile devices.

| 14 |

If such mobile operating systems or app marketplaces limit or prohibit us from making our apps available to our registered users, make changes that degrade the functionality of our app, change the way we collect or use data, increase the cost of using our app, impose terms of use unsatisfactory to us, alter how payments can be made, increase our compliance costs, or modify their search or ratings algorithms in ways that are detrimental to us, or if our competitors’ placement in such mobile operating systems’ app marketplace is more prominent than the placement of our app, our growth could slow.

We are subject to requirements imposed by app marketplaces such as those operated by Google, who may change their technical requirements or policies in a manner that adversely impacts the way in which a registered user can use our Platform and how we collect, use and share data from registered users. The long-term impact of these and any other changes remains uncertain. If we do not comply with applicable requirements imposed by app marketplaces, we could lose access to the app marketplaces and users, and our business would be harmed. Any of the foregoing risks could adversely affect our business, financial condition, and results of operations.

As new mobile devices and mobile platforms are released in to the marketplace, we are unable to guarantee that certain mobile devices will continue to support our Red 101 App or that we can effectively roll out updates to our Red 101 App. Additionally, in order to deliver high-quality apps, we need to ensure that our Platform is designed to work effectively with a range of mobile technologies, systems, networks, and standards. If our registered users encounter any difficulty accessing or using our apps on their mobile devices or if we are unable to adapt to changes in popular mobile operating systems, we expect that our growth and engagement would be adversely affected.

We rely on software and services from third parties. Defects in, or the loss of access to, software or services from such third parties could harm our business and adversely affect the quality of our Platform.