| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-257991-11 |

Free Writing Prospectus

Structural and Collateral Term Sheet

$731,866,360

(Approximate Initial Pool Balance)

$646,786,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2024-5C1

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Argentic Real Estate Finance 2 LLC

Citi Real Estate Funding Inc.

LMF Commercial, LLC

Goldman Sachs Mortgage Company

UBS AG

BSPRT CMBS Finance, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2024-5C1

July 8, 2024

WELLS FARGO

SECURITIES | CITIGROUP | GOLDMAN SACHS &

CO. LLC | UBS SECURITIES |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and

Joint Bookrunner | Co-Lead Manager and

Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

Academy Securities, Inc. Co-Manager | Drexel Hamilton Co-Manager | Siebert Williams Shank Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-257991) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. Eastern Time) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, UBS Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Certificate Structure |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Available Certificate Balance or Notional Amount(2) | Approximate Initial Retained Certificate Balance or Notional Amount(2)(3) | Approx. Initial Credit Support(4) | Pass-Through Rate Description | Weighted Average Life (Years)(5) | Expected Principal Window(5) | Certificate Principal to Value Ratio(6) | Certificate Principal U/W NOI Debt Yield(7) |

| Offered Certificates |

| A-1 | AAAsf/AAA(sf)/Aaa(sf) | $9,386,000 | $9,174,000 | $212,000 | 30.000% | (8) | 2.40 | 08/24-02/29 | 41.1% | 17.0% |

| A-2 | AAAsf/AAA(sf)/Aaa(sf) | (9) | (9) | (9) | 30.000% | (8) | (9) | (9) | 41.1% | 17.0% |

| A-3 | AAAsf/AAA(sf)/Aaa(sf) | (9) | (9) | (9) | 30.000% | (8) | (9) | (9) | 41.1% | 17.0% |

| X-A | AAAsf/AAA(sf)/Aaa(sf) | $512,306,000(10) | $500,779,000(10) | $11,527,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| X-B | A-sf/AAA(sf)/NR | $134,480,000(12) | $131,454,000(12) | $3,026,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A |

| A-S | AAAsf/AAA(sf)/Aa2(sf) | $68,612,000 | $67,068,000 | $1,544,000 | 20.625% | (8) | 4.97 | 07/29-07/29 | 46.6% | 15.0% |

| B | AA-sf/AA(sf)/NR | $37,509,000 | $36,665,000 | $844,000 | 15.500% | (8) | 4.97 | 07/29-07/29 | 49.6% | 14.0% |

| C | A-sf/A(sf)/NR | $28,359,000 | $27,720,000 | $639,000 | 11.625% | (8) | 4.97 | 07/29-07/29 | 51.8% | 13.4% |

| Non-Offered Certificates |

| X-D | BBB-sf/BBB+(sf)/NR | $25,616,000(14) | $25,039,000(14) | $577,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A |

| X-F | BB-sf/BB+(sf)/NR | $16,467,000(16) | $16,096,000(16) | $371,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A |

| D | BBBsf/BBB+(sf)/NR | $17,382,000 | $16,990,000 | $392,000 | 9.250% | (8) | 4.97 | 07/29-07/29 | 53.2% | 13.1% |

| E | BBB-sf/BBB+(sf)/NR | $8,234,000 | $8,048,000 | $186,000 | 8.125% | (8) | 4.97 | 07/29-07/29 | 53.9% | 12.9% |

| F | BB-sf/BB+(sf)/NR | $16,467,000 | $16,096,000 | $371,000 | 5.875% | (8) | 4.97 | 07/29-07/29 | 55.2% | 12.6% |

| G-RR | B-sf/BB-(sf)/NR | $10,978,000 | $10,730,000 | $248,000 | 4.375% | (8) | 4.97 | 07/29-07/29 | 56.1% | 12.4% |

| J-RR | NR/NR/NR | $32,019,359 | $31,298,359 | $721,000 | 0.000% | (8) | 4.97 | 07/29-07/29 | 58.6% | 11.9% |

Notes:

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated July 8, 2024 (the “Preliminary Prospectus”). Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller in connection with any variation in the Certificate Balance of the VRR Interest and/or the Horizontal Risk Retention Certificates following the calculation of the actual fair value of all of the ABS interests (as such term is defined in the Credit Risk Retention Rules) issued by the issuing entity, as described under “Credit Risk Retention” in the Preliminary Prospectus. The actual initial Certificate Balances and Notional Amounts also depend on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, X-B, X-D and X-F Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) and, if, as a result of such pricing, the pass-through rate of any of the Class X-A, X-B, X-D and X-F Certificates, as applicable, would be equal to zero at all times, such Class of Certificates may not be issued on the closing date of this securitization. |

| (3) | On the closing date, the Certificates with the initial Certificate Balances or Notional Amounts, as applicable, set forth in the table above under “Approximate Initial Retained Certificate Balance or Notional Amount” (such Certificates, collectively the “VRR Interest”) are expected to be purchased for cash from the underwriters by a majority-owned affiliate of Argentic Real Estate Finance 2 LLC (a sponsor and affiliate of the special servicer), as the “retaining sponsor” (as such term is defined in the Credit Risk Retention Rules), as further described in “Credit Risk Retention” in the Preliminary Prospectus. |

| (4) | The approximate initial credit support with respect to the Class A-1, A-2 and A-3 Certificates represents the approximate credit enhancement for the Class A-1, A-2 and A-3 Certificates in the aggregate. |

| (5) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (6) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2 and A-3 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-2 and A-3 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (7) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2 and A-3 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2 and A-3 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of such Classes of Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Certificate Structure |

| (8) | The pass-through rates for the Class A-1, A-2, A-3, A-S, B, C, D, E, F, G-RR and J-RR Certificates (collectively, the “Principal Balance Certificates”) for any distribution date, in each case, will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (9) | The exact initial Certificate Balances of the Class A-2 and A-3 Certificates are unknown and will be determined based on the final pricing of the Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-2 and A-3 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-2 and A-3 Certificates is expected to be approximately $502,920,000, subject to a variance of plus or minus 5%. In the event that the Class A-3 Certificates are issued with the maximum certificate balance (i.e., with an initial certificate balance of $502,920,000), the Class A-2 Certificates will not be issued. |

| | Class of Certificates | Expected Range of Approximate Initial Certificate Balance | Expected Range of Weighted Average Life (Years) | Expected Range of Principal Window |

| | Class A-2 | $0 – $225,000,000 | N/A – 4.87 | N/A / 02/29 – 06/29 |

| | Class A-3 | $277,920,000 – $502,920,000 | 4.91 – 4.94 | 02/29 – 07/29 / 06/29 – 07/29 |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2 and A-3 Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2 and A-3 Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and E Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and E Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (16) | The Class X-F Certificates are notional amount certificates. The Notional Amount of the Class X-F Certificates will be equal to the Certificate Balance of the Class F Certificates outstanding from time to time. The Class X-F Certificates will not be entitled to distributions of principal. |

| (17) | The pass-through rate for the Class X-F Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate Cut-off Date Balance | % of Initial Pool

Balance |

| Wells Fargo Bank, National Association | 6 | 15 | $183,422,953 | 25.1 | % |

| Argentic Real Estate Finance 2 LLC | 6 | 6 | 141,400,000 | 19.3 | |

| Citi Real Estate Funding Inc. | 5 | 6 | 90,200,000 | 12.3 | |

| Wells Fargo Bank, National Association / Argentic Real Estate Finance 2 LLC | 1 | 1 | 73,000,000 | 10.0 | |

| LMF Commercial, LLC | 4 | 4 | 67,200,000 | 9.2 | |

| Goldman Sachs Mortgage Company | 2 | 2 | 61,650,000 | 8.4 | |

| UBS AG | 4 | 10 | 42,200,000 | 5.8 | |

| BSPRT CMBS Finance, LLC | 3 | 3 | 40,543,407 | 5.5 | |

| Citi Real Estate Funding Inc. / Argentic Real Estate Finance 2 LLC | 1 | 1 | 32,250,000 | 4.4 | |

Total | 32 | 48 | $731,866,360 | 100.0% | |

Loan Pool:

| Initial Pool Balance: | $731,866,360 |

| Number of Mortgage Loans: | 32 |

| Average Cut-off Date Balance per Mortgage Loan: | $22,870,824 |

| Number of Mortgaged Properties: | 48 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $15,247,216 |

| Weighted Average Mortgage Interest Rate: | 6.9082% |

| Ten Largest Mortgage as % of Initial Pool Balance: | 61.8% |

| Weighted Average Original Term to Maturity (months): | 60 |

| Weighted Average Remaining Term to Maturity (months): | 59 |

| Weighted Average Original Amortization Term (months)(2): | 351 |

| Weighted Average Remaining Amortization Term (months)(2): | 351 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize and 640 5th Avenue which is on a planned amortization schedule. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.53x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 11.9% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 58.6% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 58.0% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 6.9% |

| % of Mortgage Loans with Single Tenants(3): | NAP |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 24.0% of the mortgage pool (5 mortgage loans) has scheduled amortization, as follows:

4.4% (1 mortgage loan) provide for an interest-only period followed by an amortization period; and

19.6% (4 mortgage loans) require amortization during the entire loan term.

Interest-Only: Based on the Initial Pool Balance, 76.0% of the mortgage pool (27 mortgage loans) provide for interest-only payments during the entire loan term through maturity. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 61.1% and 1.50x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 39.5% of the mortgage pool (11 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 93.1% of the pool |

| Insurance: | 41.7% of the pool |

| Capital Replacements: | 87.7% of the pool |

| TI/LC: | 68.4% of the pool(1) |

| | (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, retail, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

93.4% of the mortgage pool (29 mortgage loans) feature a lockout period, then defeasance only until an open period;

6.6% of the mortgage pool (3 mortgage loans) feature a lockout period, then the greater of a prepayment premium (1%) or yield maintenance until an open period;

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Issue Characteristics |

| III. | Issue Characteristics |

| | Securities Offered: | $646,786,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eight classes (Classes A-1, A-2, A-3, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| | Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Argentic Real Estate Finance 2 LLC (“AREF2”), Citi Real Estate Funding Inc. (“CREFI”), LMF Commercial, LLC (“LMF”), Goldman Sachs Mortgage Company (“GSMC”), UBS AG (“UBS”) and BSPRT CMBS Finance, LLC (“BSPRT”) |

| | Joint Bookrunners and Co-

Lead Managers: | Wells Fargo Securities, LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC and UBS Securities LLC |

| | Co-Managers: | Academy Securities, Inc., Drexel Hamilton, LLC and Siebert Williams Shank & Co., LLC |

| | Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and Moody’s Investors Service, Inc. |

| | Master Servicer: | Wells Fargo Bank, National Association |

| | Special Servicer: | Argentic Services Company LP |

| | Certificate Administrator: | Computershare Trust Company, N.A. |

| | Trustee: | Computershare Trust Company, N.A. |

| | Operating Advisor: | Pentalpha Surveillance LLC |

| | Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| | Initial Majority Controlling

Class Certificateholder: | Argentic Securities Holdings 2 Cayman Limited, an affiliate of Argentic Real Estate Finance 2 LLC and Argentic Services Company LP |

| | U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Argentic Real Estate Finance 2 LLC, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. Argentic Real Estate Finance 2 LLC, the retaining sponsor, intends to cause Argentic Securities Holdings 2 Cayman Limited, a majority-owned affiliate, to retain (i) an “eligible horizontal residual interest”, in the form of certificates representing approximately 2.80% of the fair value of all of the ABS interests issued, which will be comprised of the Class G-RR and J-RR certificates (other than the portion that comprises the VRR Interest) and (ii) an “eligible vertical interest”, in the form of certificates representing approximately 2.25% of the certificate balance, notional amount or percentage interest of each class of certificates (other than the Class R certificates) in a manner that satisfies the U.S. credit risk retention requirements. Under the U.S. credit risk retention rules, Argentic Real Estate Finance 2 LLC or the applicable majority-owned affiliate will be permitted to transfer the horizontal risk retention certificates to a subsequent third-party purchaser. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| | EU/UK Credit Risk Retention | None of the sponsors, the depositor, the underwriters, or their respective affiliates, or any other party to the transaction intends to retain a material net economic interest in the securitization constituted by the issue of the Certificates, or take any other action in respect of such securitization, in a manner prescribed or contemplated by (i) Regulation (EU) 2017/2402, or (ii) such Regulation as it forms part of UK domestic law. In particular, no such person undertakes to take any action which may be required by any investor for the purposes of its compliance with any applicable requirement under either such Regulation. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirements of either such Regulation. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Regulation and UK Securitization Regulation Due Diligence Requirements” in the Preliminary Prospectus. |

| | Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the payment due date for the monthly debt service payment that is due in July 2024 (or, in the case of any mortgage loan that has its first payment due date in July 2024, the date that would have been its payment due date in July 2024 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | Expected Closing Date: | On or about July 25, 2024. |

| | Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in August 2024. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Issue Characteristics |

| | Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in August 2024. |

| | Rated Final Distribution Date: | The Distribution Date in July 2057. |

| | Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| | Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| | Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | Clean-up Call: | 1.0% |

| | Delivery: | DTC, Euroclear and Clearstream Banking |

| | ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| | Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., CRED iQ, Trepp, LLC, Intex Solutions, Inc., Interactive Data Corp., Markit Group Limited, BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., Morningstar Credit Information & Analytics, LLC, KBRA Analytics, LLC, MBS Data, LLC, Thomson Reuters Corporation and RealINSIGHT. |

| | Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of one or more REMICs arranged in a tiered structure and a trust (the “grantor trust”). The Offered Certificates will represent REMIC regular interests. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

Mortgage Loan

Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance(%) | Property

Type | Number

of

SF/Units

/Rooms | Cut-off Date Balance

Per SF/Unit/Room ($) | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | U/W

NCF

DSCR

(x) | U/W NOI Debt

Yield (%) |

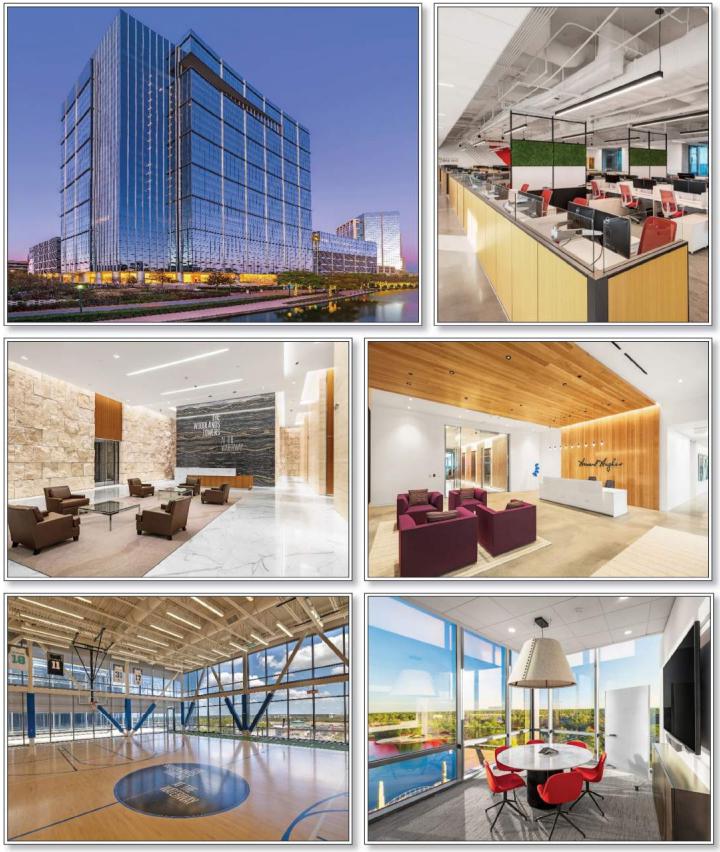

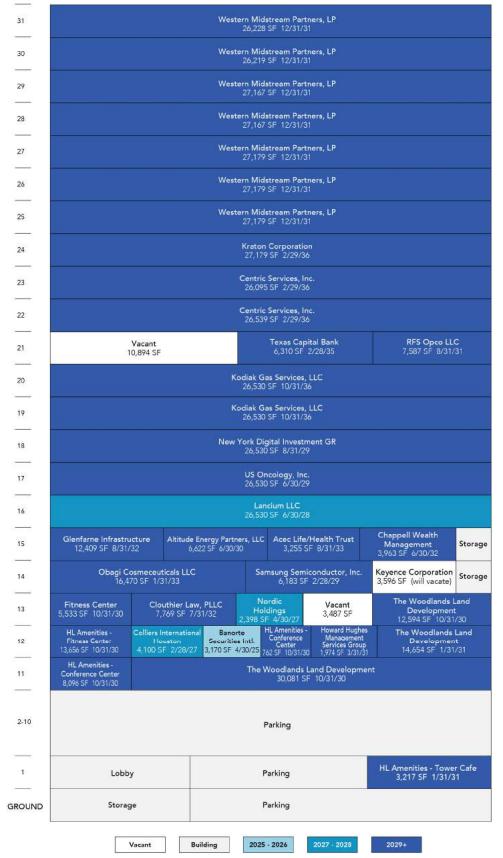

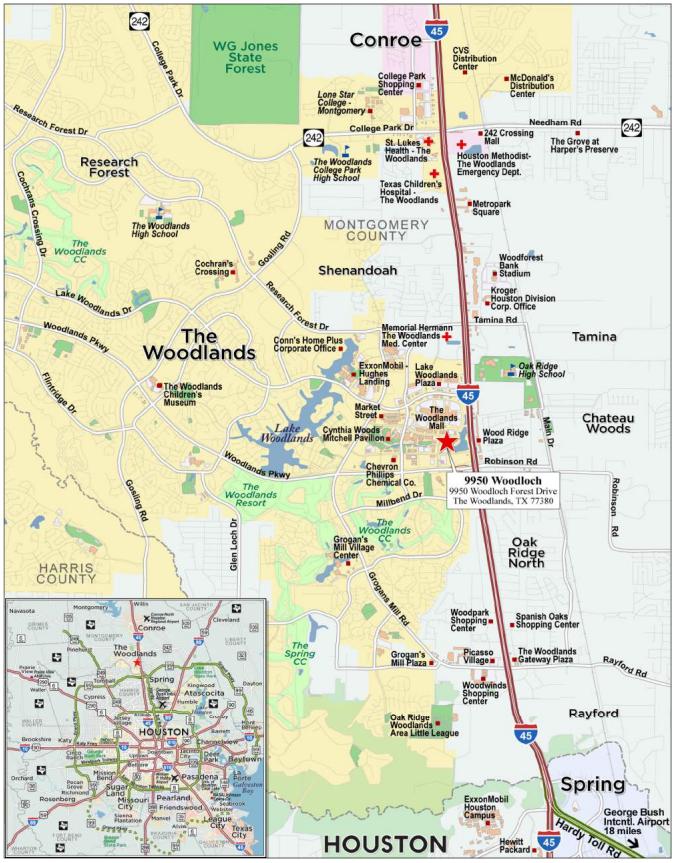

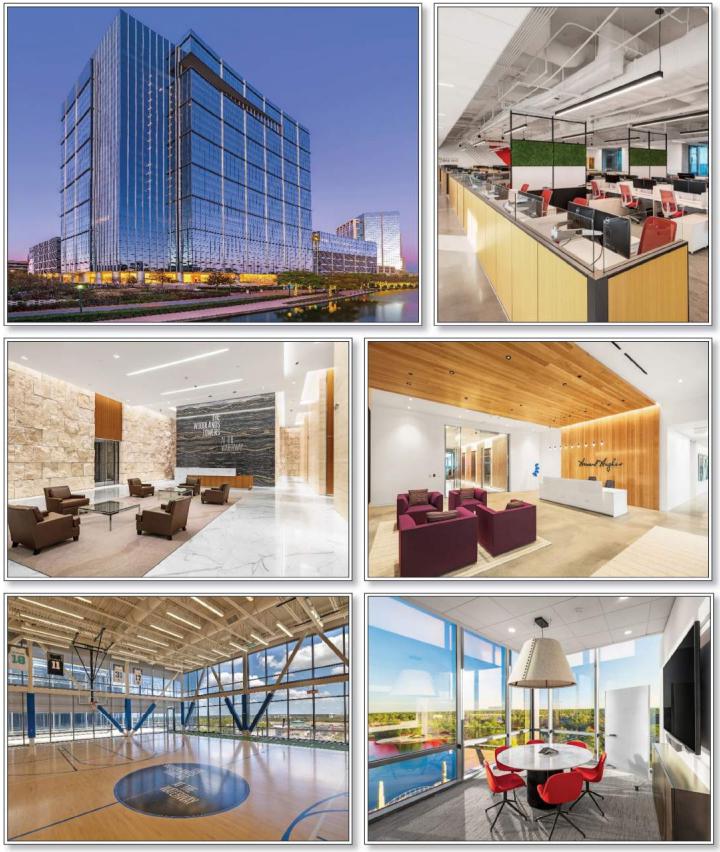

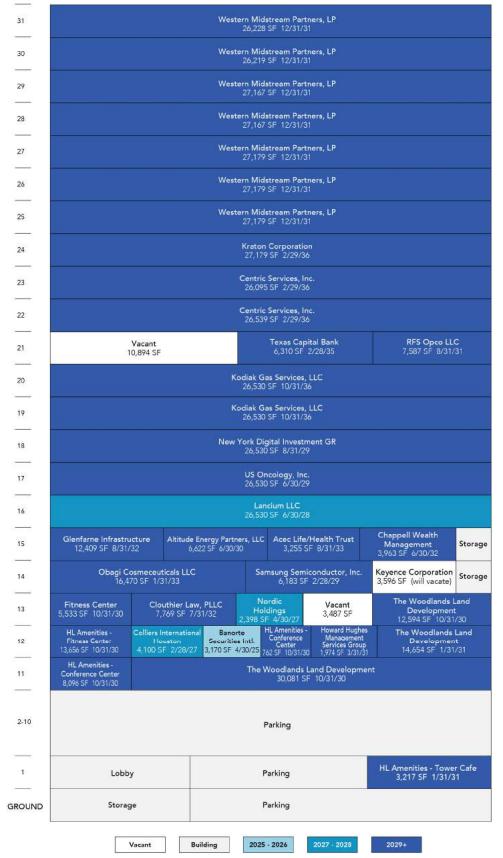

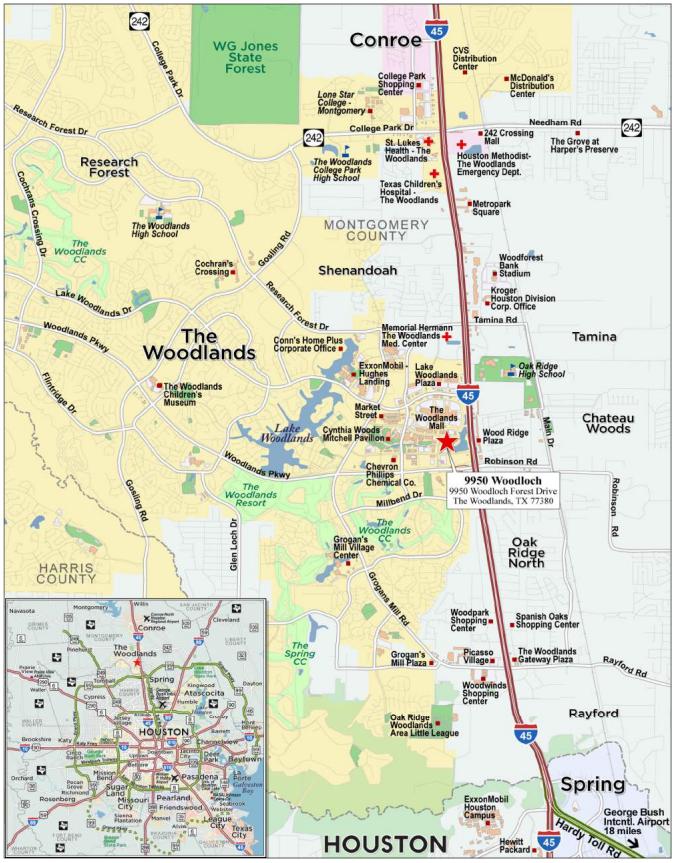

| WFB, AREF2 | 9950 Woodloch | The Woodlands | TX | 1 / 1 | $73,000,000 | 9.9 | 7% | Office | 601,151 | $216 | 56.2% | 53.3 | % | 1.50 | x | 13.1 | % |

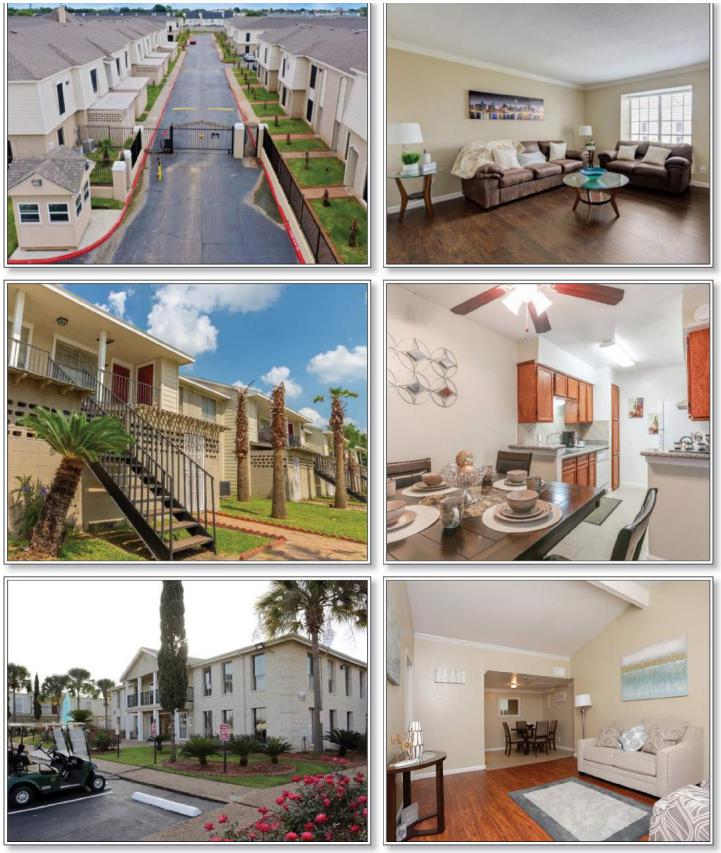

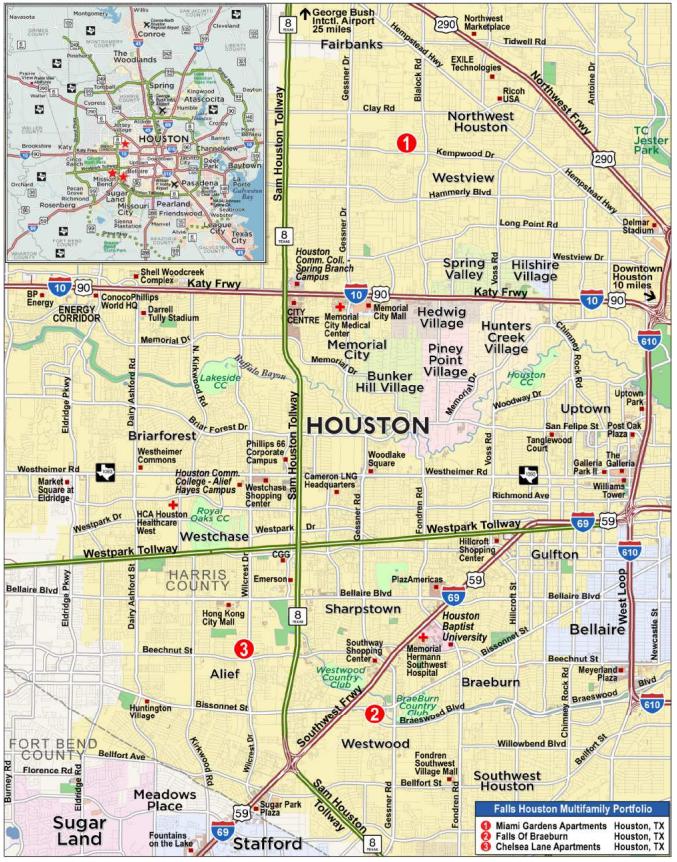

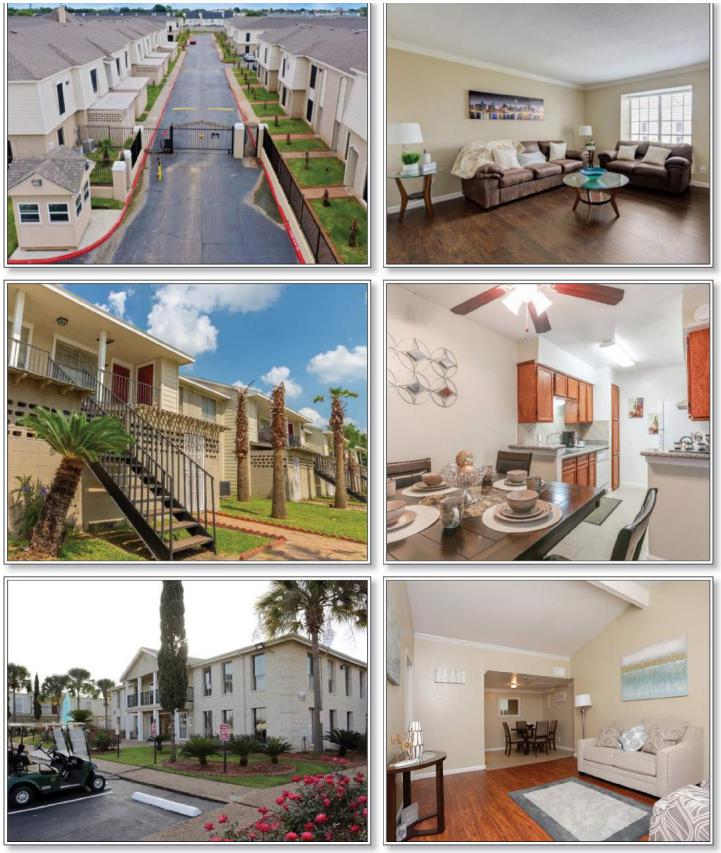

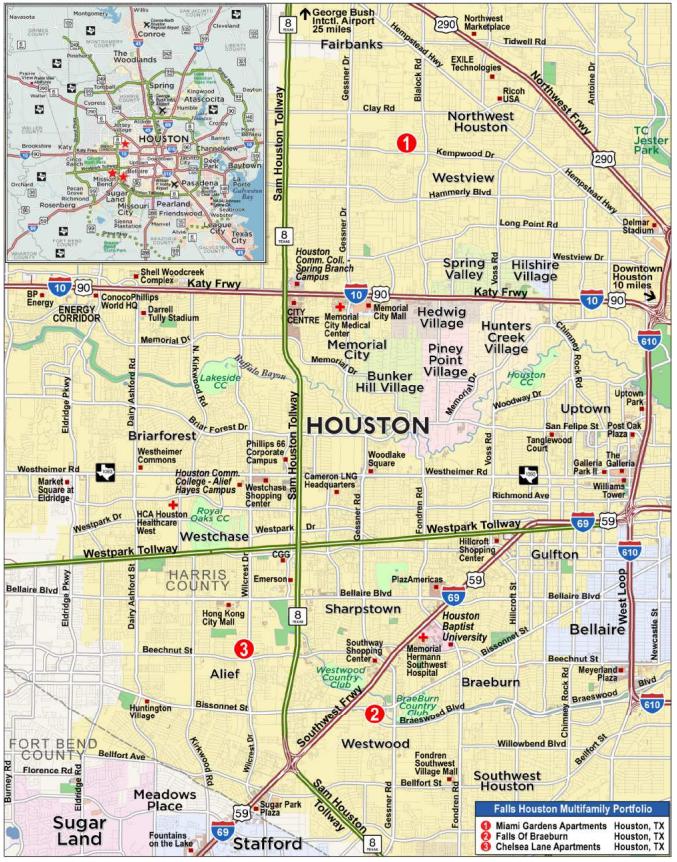

| WFB | Falls Houston Multifamily Portfolio | Houston | TX | 1 / 3 | 64,500,000 | 8.8 | | Multifamily | 942 | 68,471 | 62.4 | 62.4 | | 1.35 | | 9.9 | |

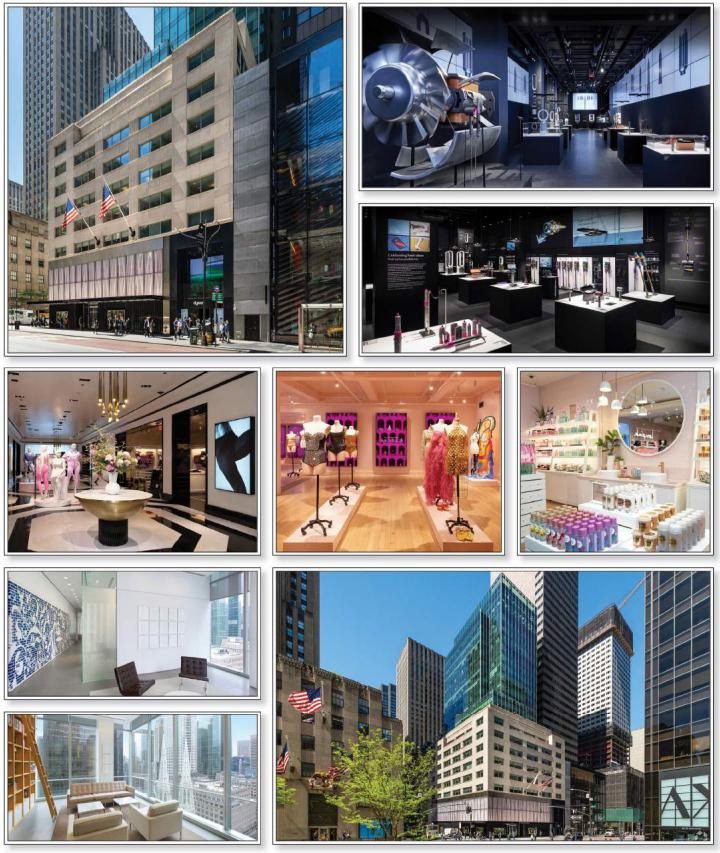

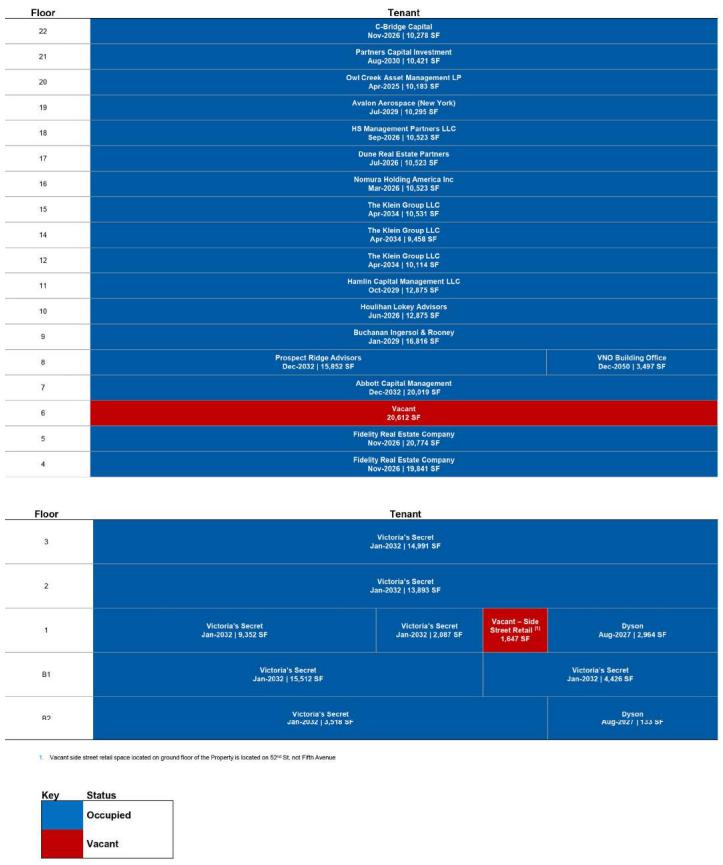

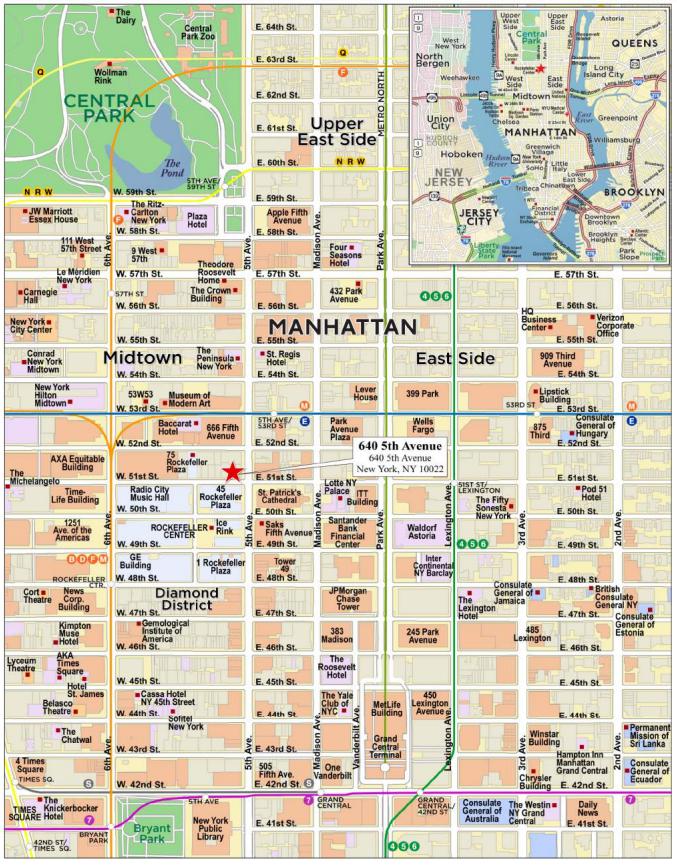

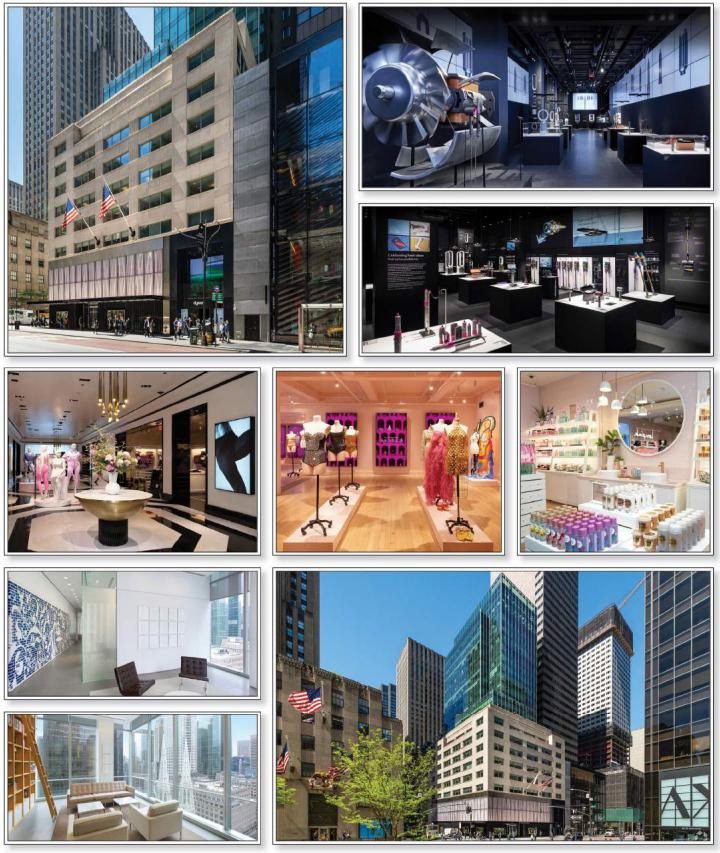

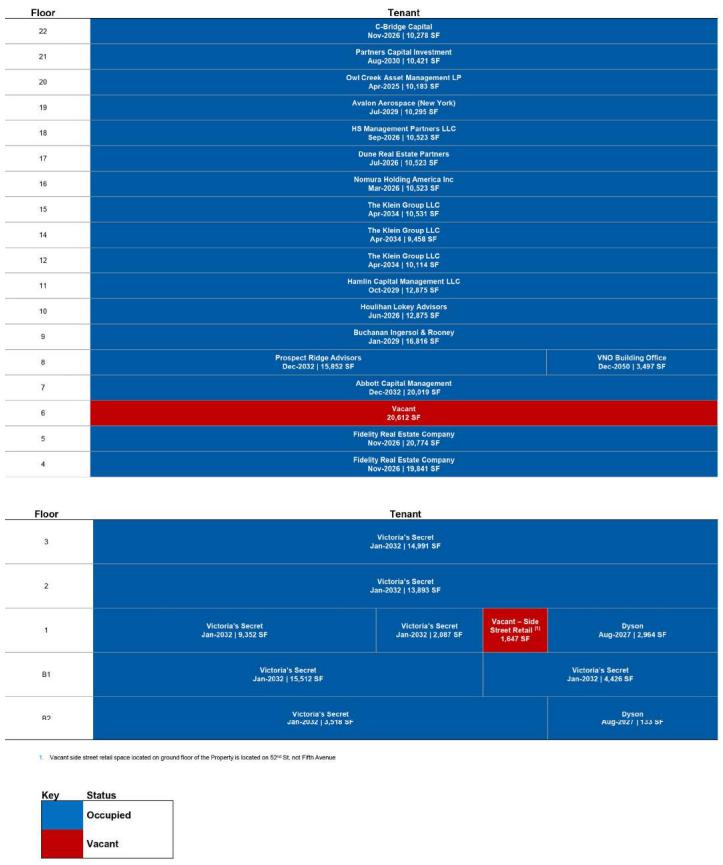

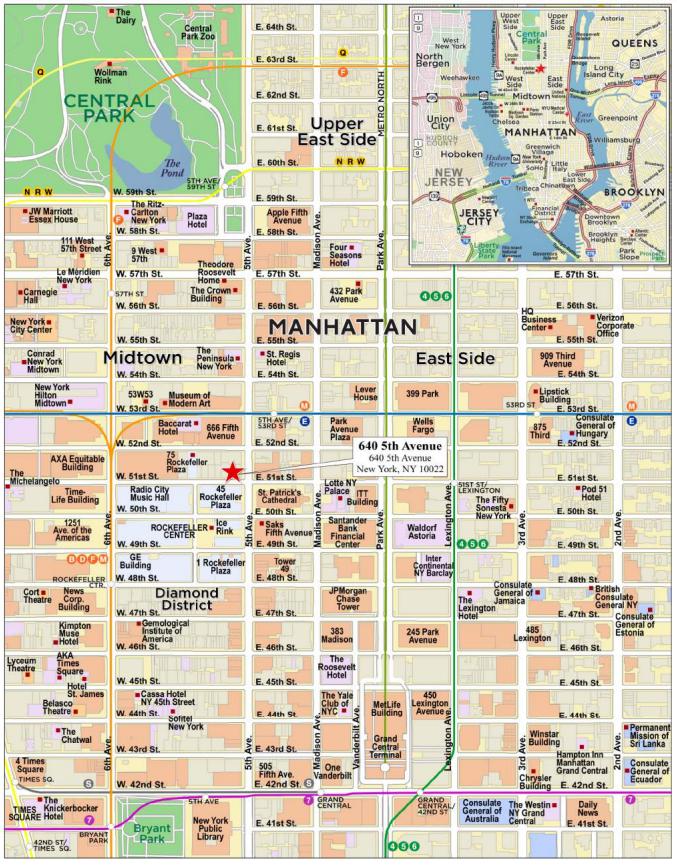

| GSMC | 640 5th Avenue | New York | NY | 1 / 1 | 50,400,000 | 6.9 | | Mixed Use | 314,533 | 954 | 41.7 | 38.1 | | 2.04 | | 18.7 | |

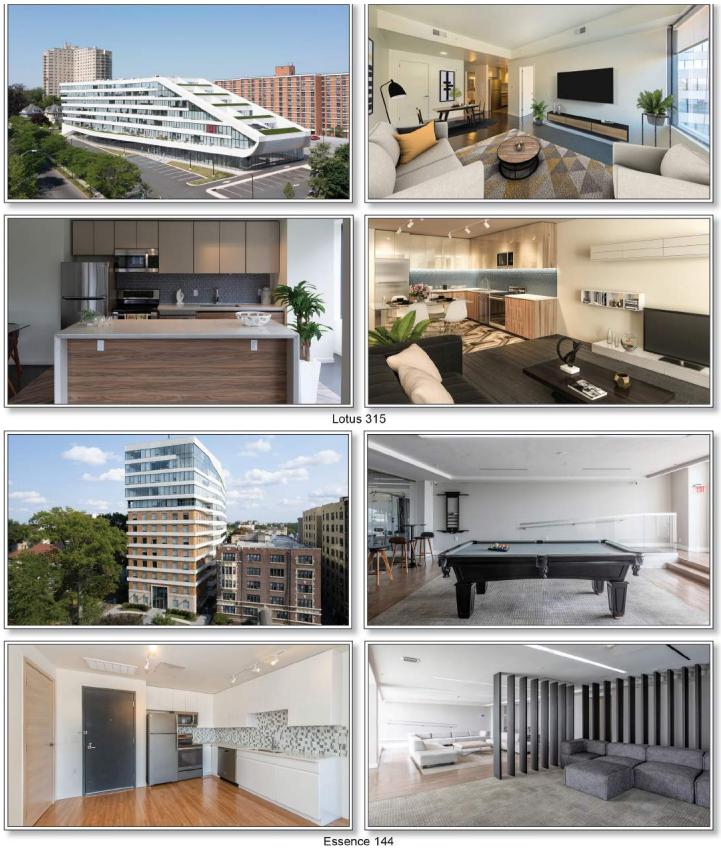

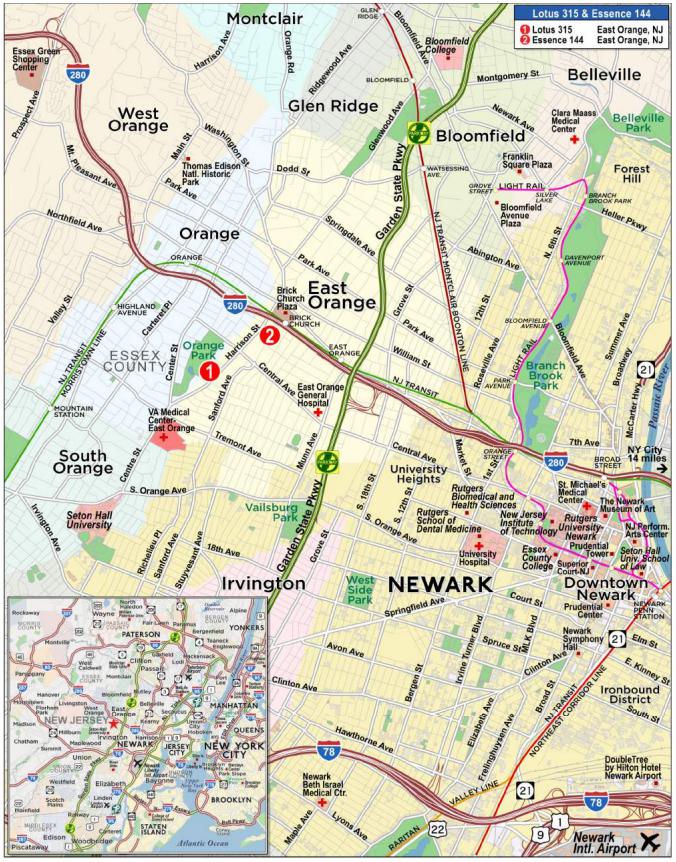

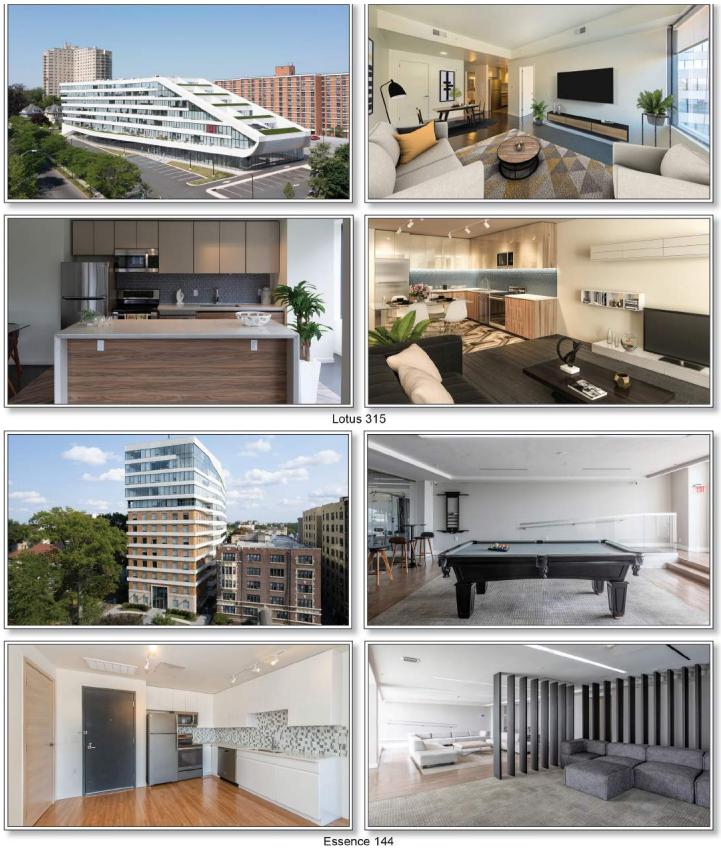

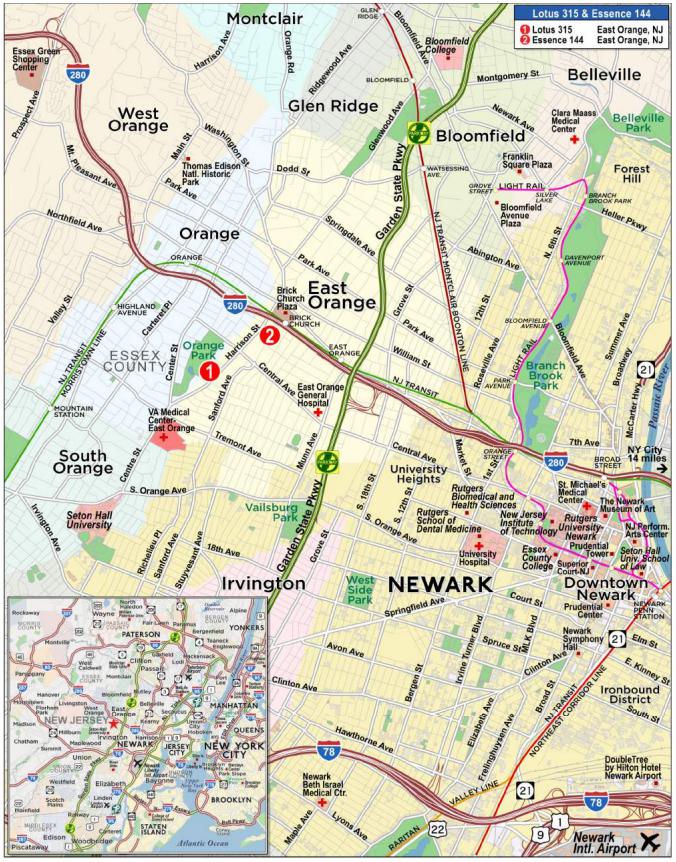

| CREFI | Lotus 315 & Essence 144 | East Orange | NJ | 1 / 2 | 50,000,000 | 6.8 | | Multifamily | 336 | 256,250 | 69.6 | 69.6 | | 1.23 | | 8.1 | |

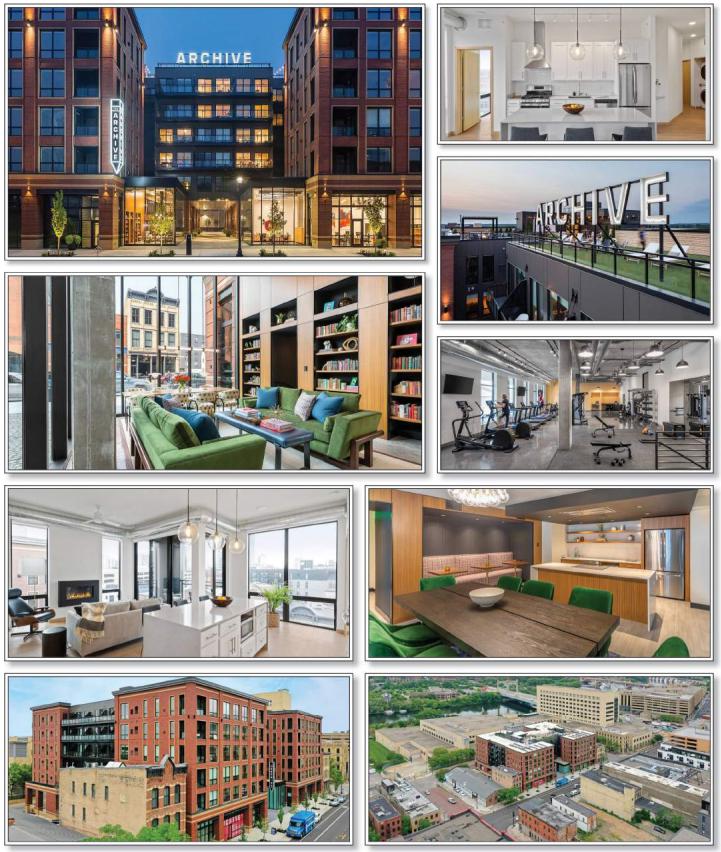

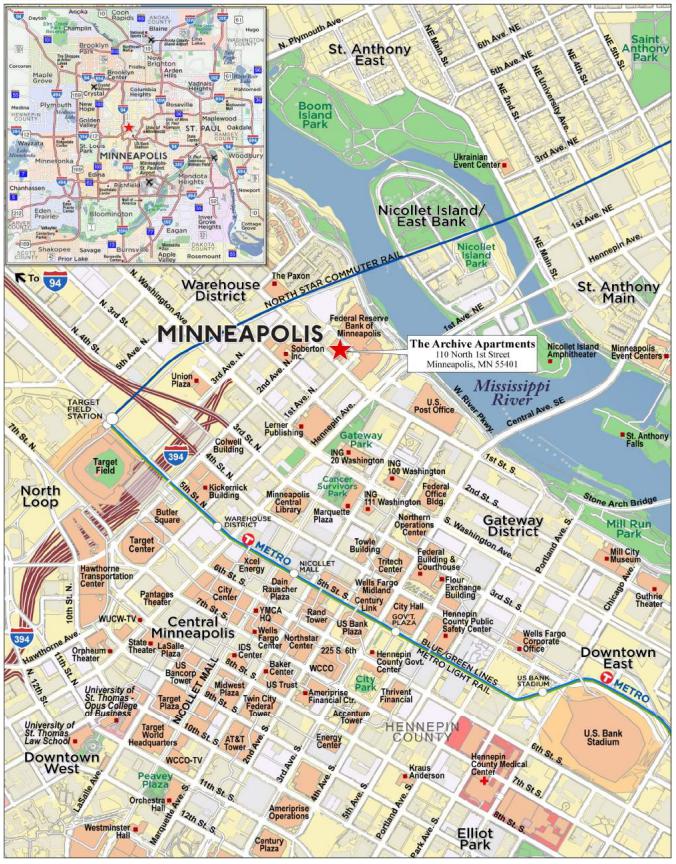

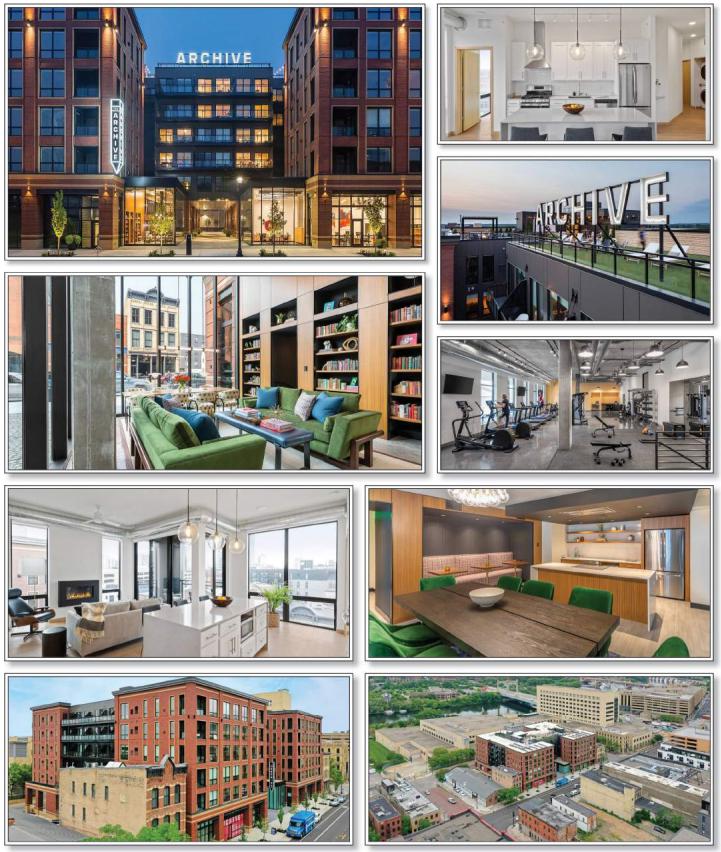

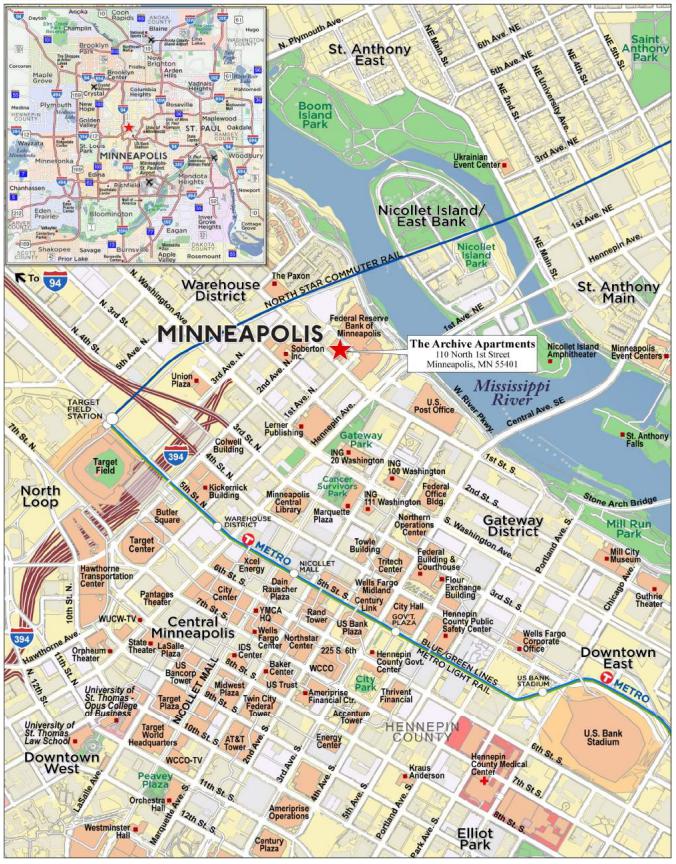

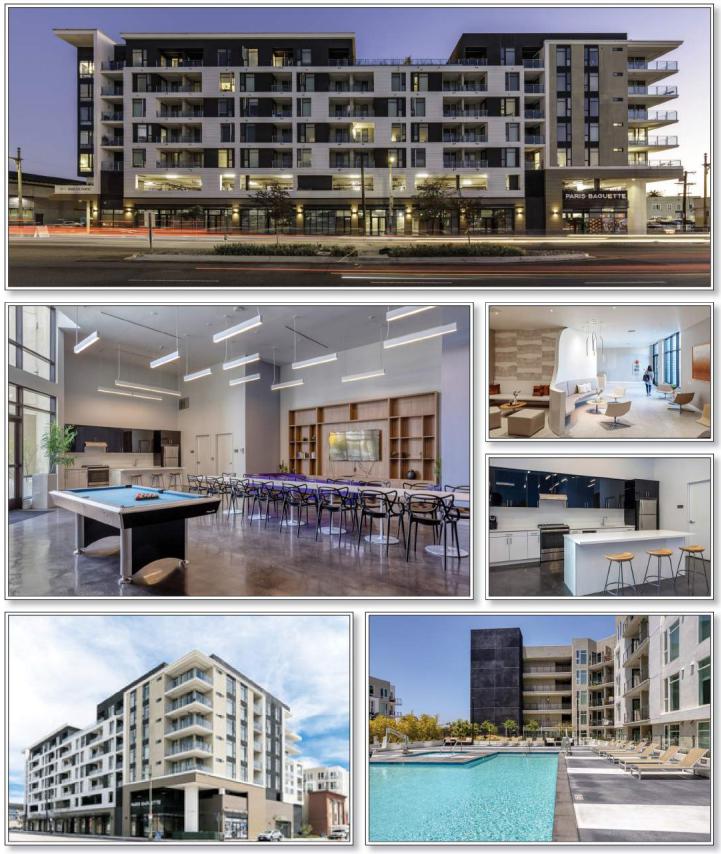

| AREF2 | The Archive Apartments | Minneapolis | MN | 1 / 1 | 47,850,000 | 6.5 | | Multifamily | 200 | 239,250 | 67.4 | 67.4 | | 1.23 | | 8.8 | |

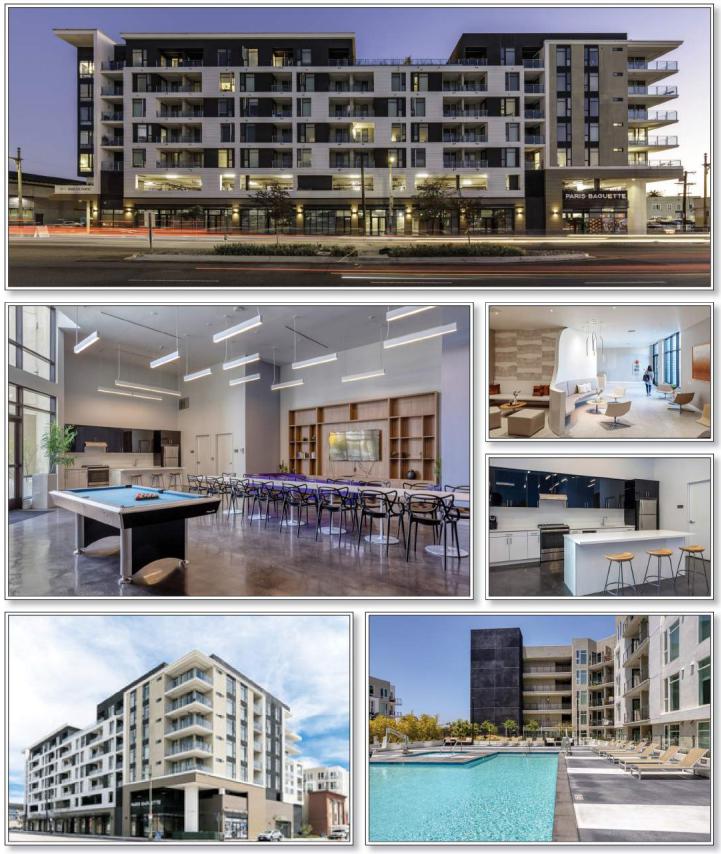

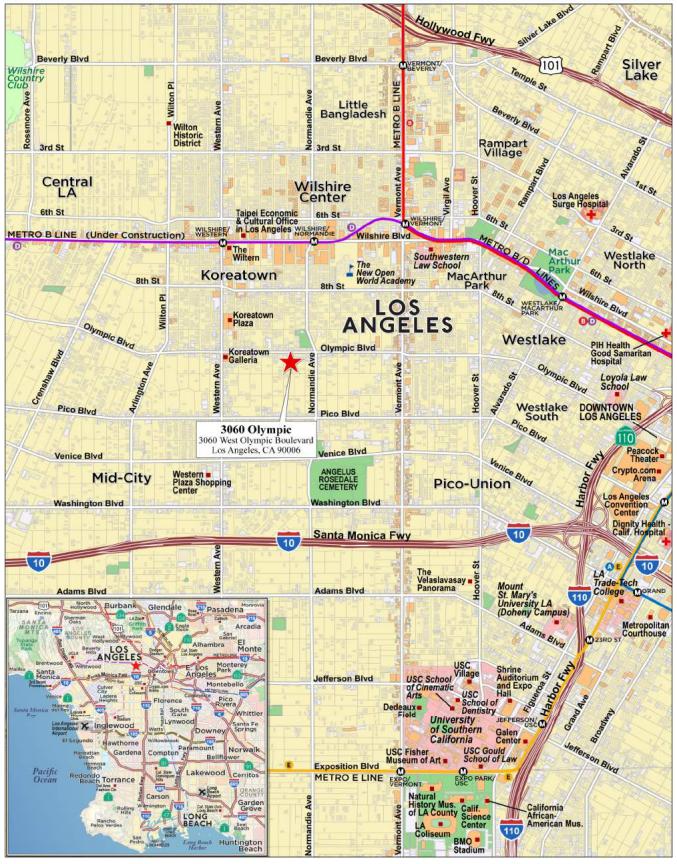

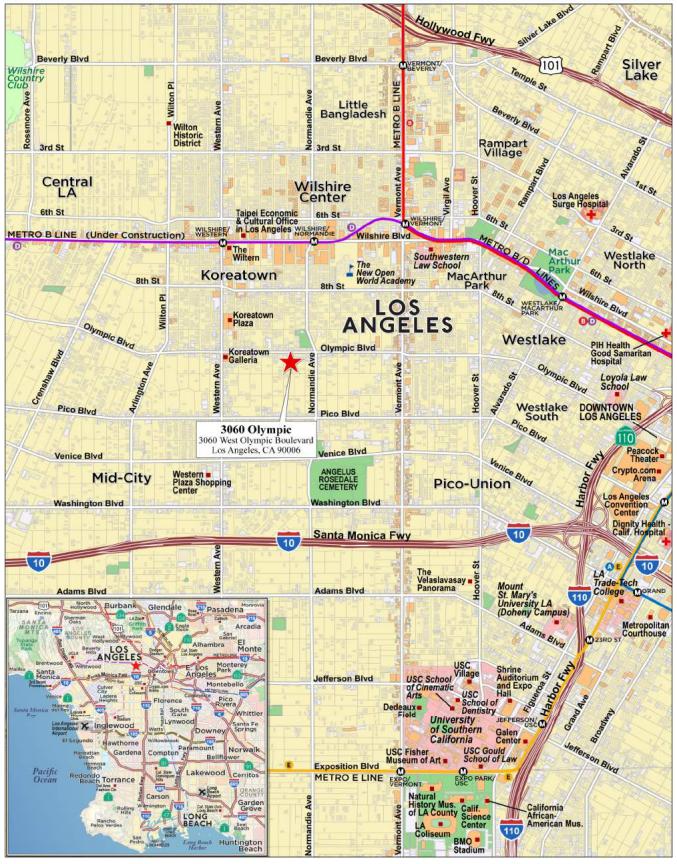

| AREF2 | 3060 Olympic | Los Angeles | CA | 1 / 1 | 45,500,000 | 6.2 | | Multifamily | 226 | 201,327 | 62.1 | 62.1 | | 1.26 | | 8.4 | |

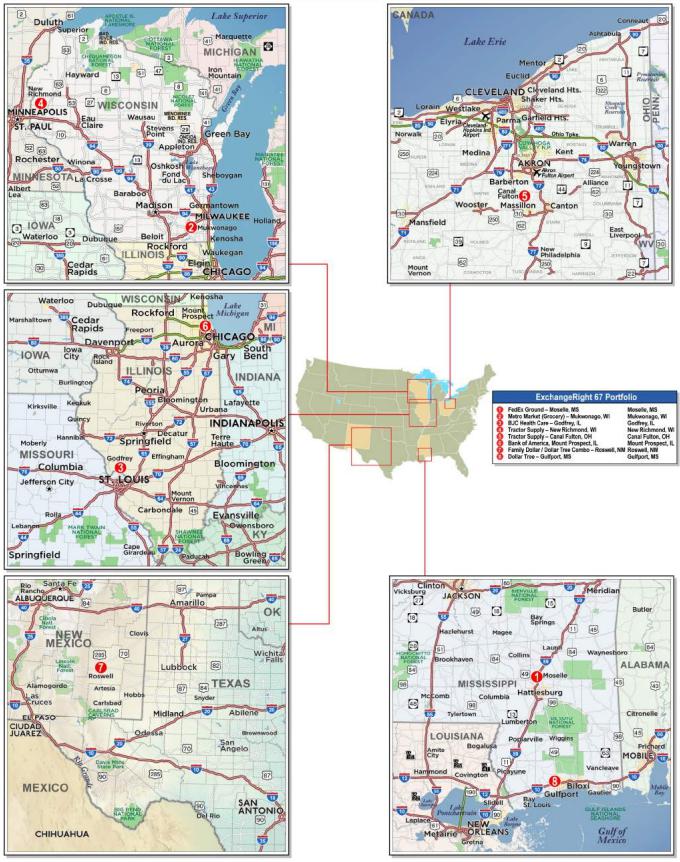

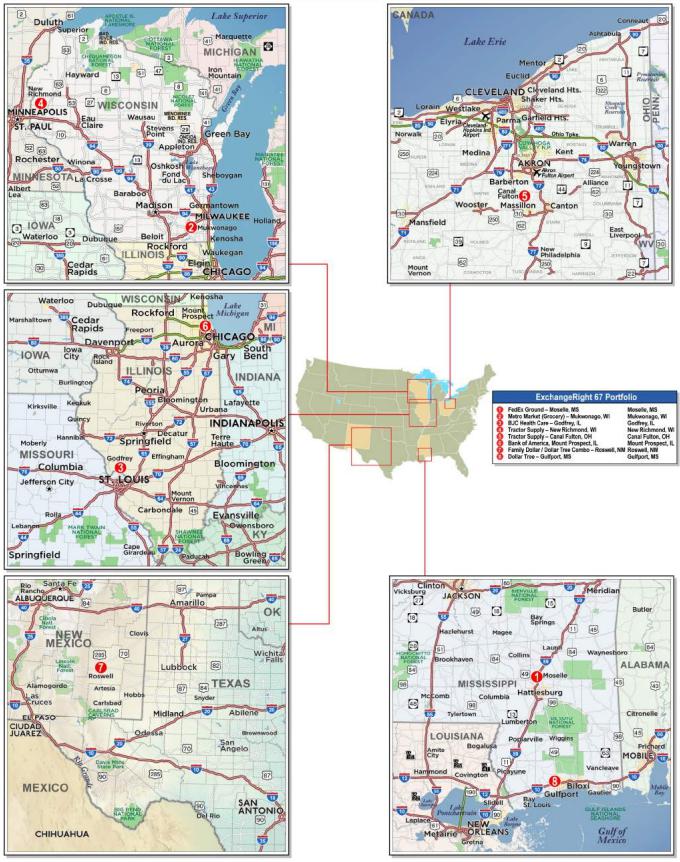

| WFB | ExchangeRight 67 | Various | Various | 1 / 8 | 33,522,953 | 4.6 | | Various | 369,844 | 91 | 46.8 | 46.8 | | 1.90 | | 12.9 | |

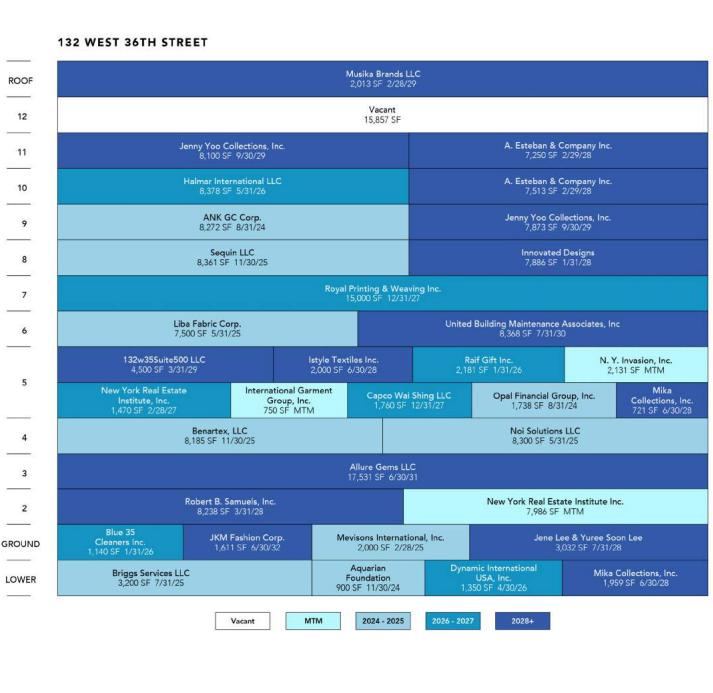

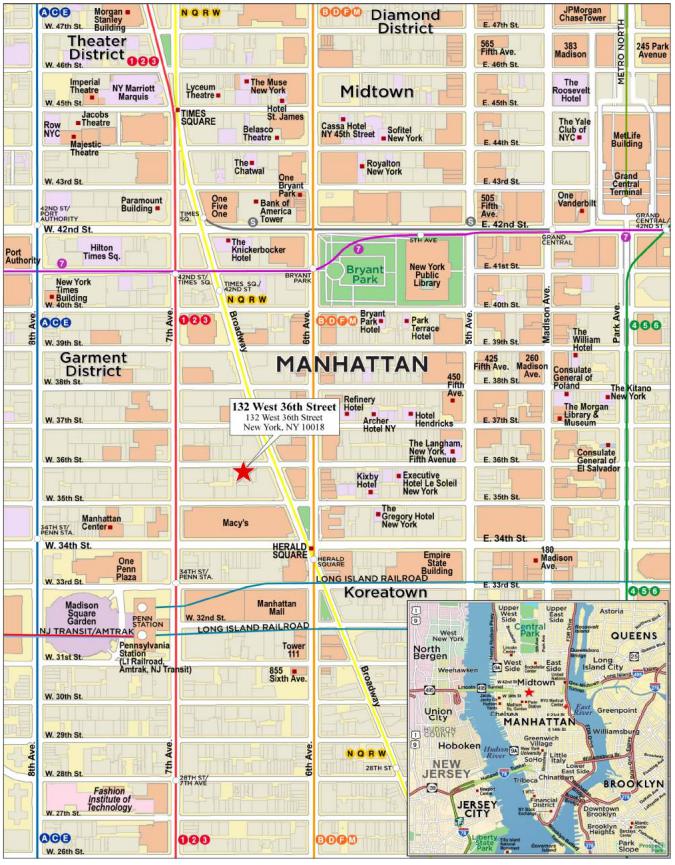

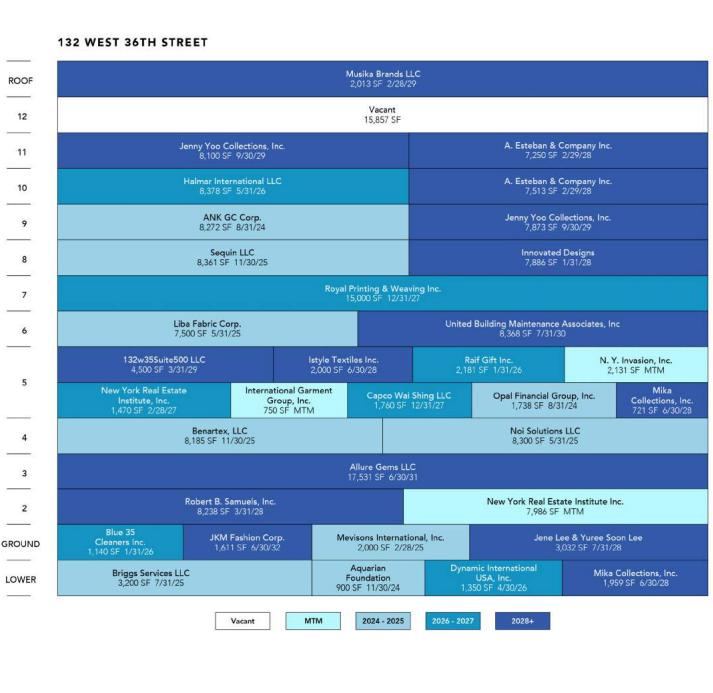

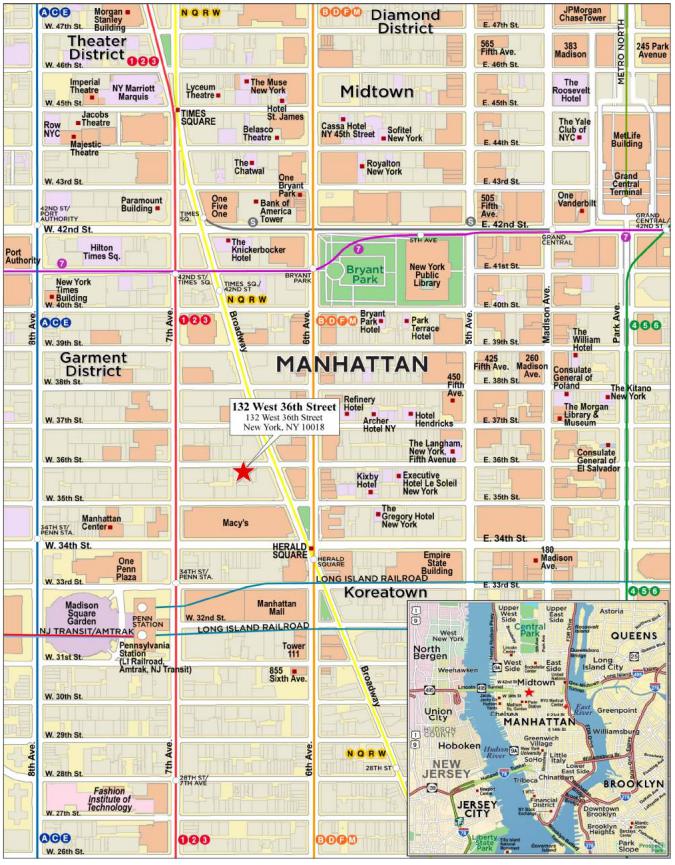

| CREFI, AREF2 | 132 West 36th Street | New York | NY | 1 / 1 | 32,250,000 | 4.4 | | Office | 195,054 | 165 | 53.8 | 52.4 | | 1.26 | | 11.6 | |

| AREF2 | Solon Park Apartments | Solon | OH | 1 / 1 | 28,000,000 | 3.8 | | Multifamily | 240 | 116,667 | 74.9 | 74.9 | | 1.31 | | 9.1 | |

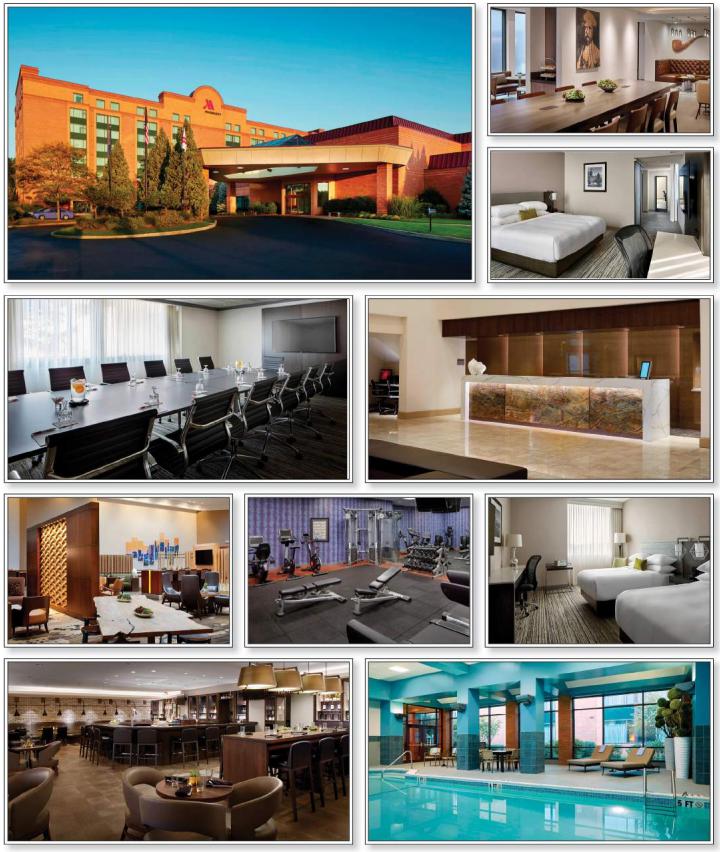

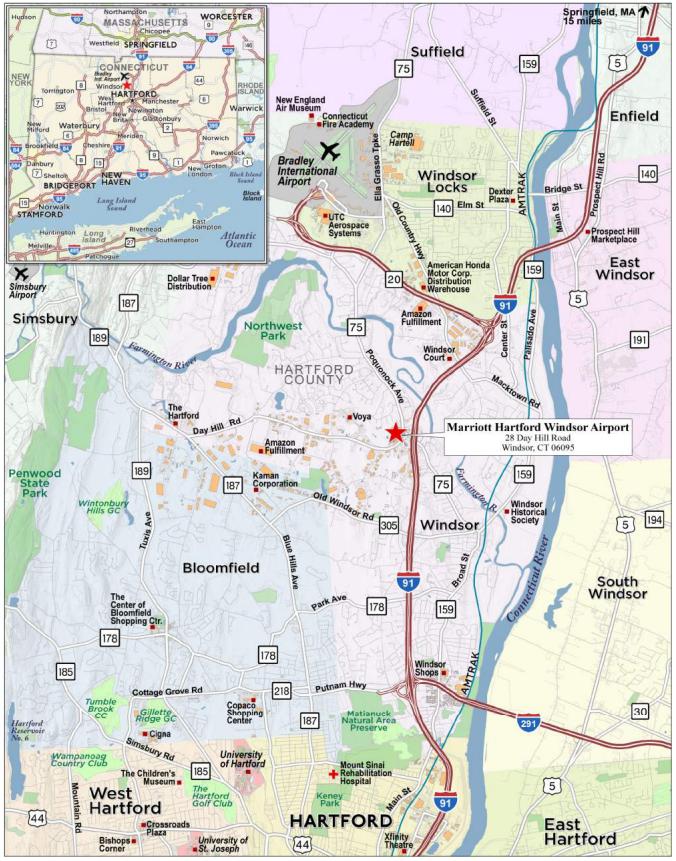

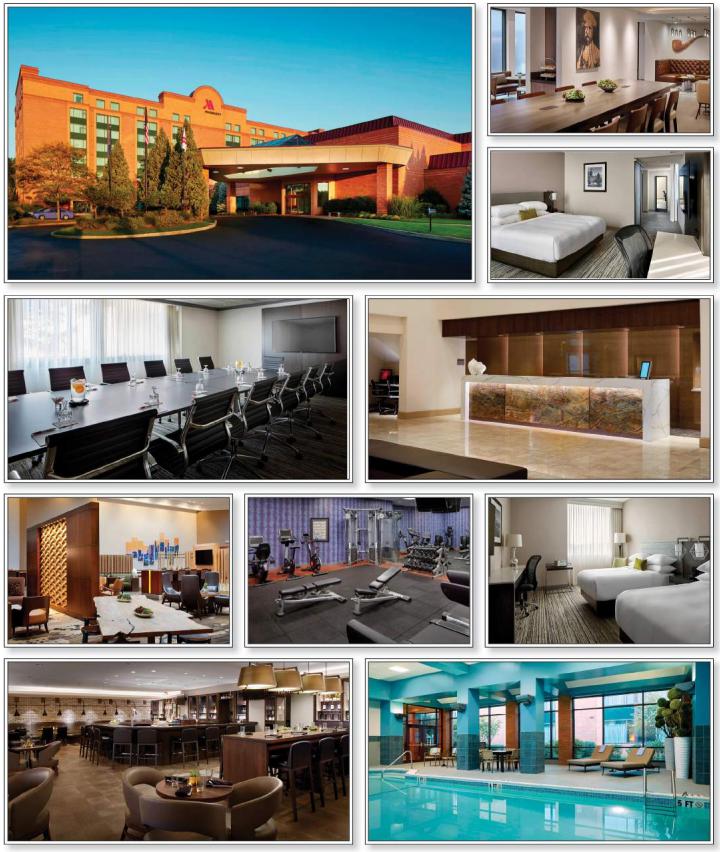

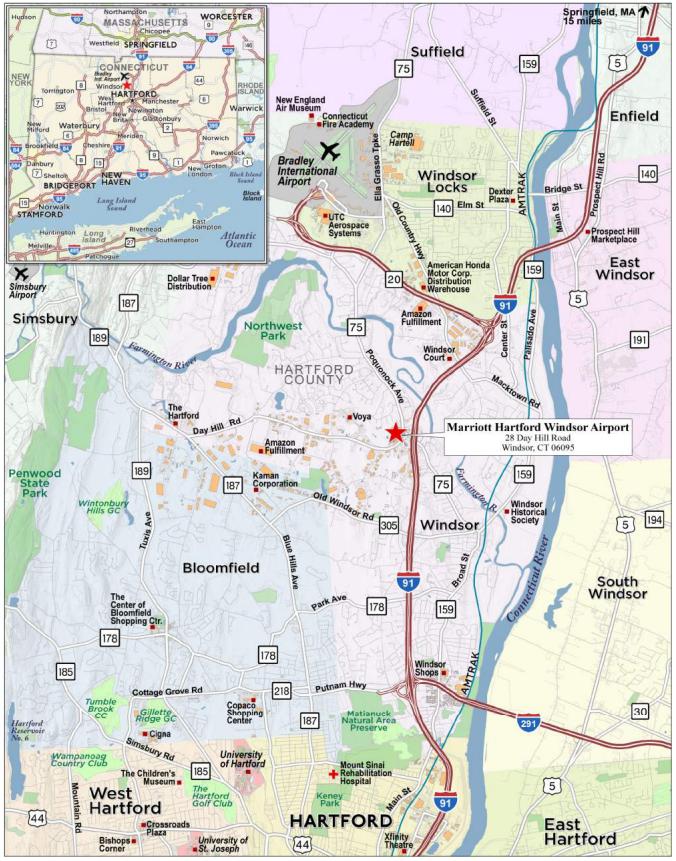

| LMF | Marriott Hartford Windsor Airport | Windsor | CT | 1 / 1 | 27,000,000 | 3.7 | | Hospitality | 302 | 89,404 | 48.8 | 48.8 | | 2.03 | | 17.2 | |

| Top Three Total/Weighted Average | | 3 / 5 | $187,900,000 | 25.7 | % | | | | 54.4% | 52.3 | % | 1.59 | x | 13.5 | % |

| Top Five Total/Weighted Average | | 5 / 8 | $285,750,000 | 39.0 | % | | | | 59.3% | 57.9 | % | 1.47 | x | 11.8 | % |

| Top Ten Total/Weighted Average | | 10 / 20 | $452,022,953 | 61.8 | % | | | | 58.6% | 57.6 | % | 1.49 | x | 11.7 | % |

| Non-Top Ten Total/Weighted Average | | 22 / 28 | $279,843,407 | 38.2 | % | | | | 58.8% | 58.5 | % | 1.59 | x | 12.2 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| No. | Property Name | Mortgage Loan Seller in WFCM 2024-5C1 | Mortgage Loan Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Combined Cut-off Date Balance | Controlling Pooling / Trust and Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Combined UW NCF DSCR(2) | Combined UW NOI Debt Yield(2) | Combined Cut-off Date LTV(2) |

| 1 | 9950 Woodloch | WFB, AREF2 | $73,000,000 | $57,000,000 | $130,000,000 | WFCM 2024-5C1 | Wells Fargo Bank, National Association | Argentic Services Company LP | Future Securitization | 1.50x | 13.1% | 56.2% |

| 3 | 640 5th Avenue | GSMC | $50,400,000 | $249,600,000 | $300,000,000 | Future Securitization | Wells Fargo Bank, National Association | LNR Partners, LLC | BBCMS 2024-5C27; Benchmark 2024-V8 | 2.04x | 18.7% | 41.7% |

| 4 | Lotus 315 & Essence 144 | CREFI | $50,000,000 | $36,100,000 | $86,100,000 | WFCM 2024-5C1 | Wells Fargo Bank, National Association | Argentic Services Company LP | Benchmark 2024-V8 | 1.23x | 8.1% | 69.6% |

| 11 | Cummins Station | WFB | $25,000,000 | $110,000,000 | $135,000,000 | Future Securitization | Wells Fargo Bank, National Association | Argentic Services Company LP | Future Securitization | 1.40x | 10.2% | 58.8% |

| 14 | Park Parthenia | BSPRT | $22,500,000 | $10,000,000 | $32,500,000 | WFCM 2024-5C1 | Wells Fargo Bank, National Association | Argentic Services Company LP | Future Securitization | 2.14x | 16.4% | 33.2% |

| 19 | Euclid Apartments | LMF | $13,000,000 | $40,000,000 | $53,000,000 | WFCM 2024-5C1 | Wells Fargo Bank, National Association | Argentic Services Company LP | BMO 2024-5C4; BBCMS 2024-C26 | 1.64x | 12.1% | 68.8% |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes any related Subordinate Companion Loans. |

| (2) | DSCR, Debt Yield and LTV calculations include any related pari passu companion loans and exclude any subordinate companion loans and/or mezzanine loans, as applicable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 3 | GSMC | 640 5th Avenue | $50,400,000 | 6.9% | NAP | $100,000,000 | 7.4720% | 2.04x | 1.31x | 18.7% | 14.0% | 41.7% | 55.6% |

| Total/Weighted Average | $50,400,000 | 6.9% | | $100,000,000 | 7.4720% | 2.04x | 1.31x | 18.7% | 14.0% | 41.7% | 55.6% |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Previous Securitization |

| 2.02 | WFB | Falls Of Braeburn | Houston | TX | Multifamily | $18,226,279 | 2.5 | % | FREMF 2022-KF142 |

| 4.01 | CREFI | Lotus 315 | East Orange | NJ | Multifamily | 29,529,617 | 4.0 | | ARCLO 2021-FL3 |

| 4.02 | CREFI | Essence 144 | East Orange | NJ | Multifamily | 20,470,383 | 2.8 | | UBSCM 2017-C4 |

| 9.00 | AREF2 | Solon Park Apartments | Solon | OH | Multifamily | 28,000,000 | 3.8 | | AREIT 2022-CRE6; AM1006 |

| 14.00 | BSPRT | Park Parthenia | Northridge | CA | Multifamily | 22,500,000 | 3.1 | | LBUBS 2004-C4 |

| 16.00 | CREFI | Escarlata 31 | Phoenix | AZ | Multifamily | 15,000,000 | 2.0 | | FRESB 2019-SB63, RCMT 2021-FL5 |

| 17.00 | WFB | Dadeland West Office Park | Miami | FL | Office | 14,100,000 | 1.9 | | GSMS 2015-GC28 |

| 19.00 | LMF | Euclid Apartments | Euclid | OH | Multifamily | 13,000,000 | 1.8 | | ARBOR 2022-Q021 |

| 21.00 | CREFI | Escarlata 29 | Phoenix | AZ | Multifamily | 12,000,000 | 1.6 | | RCMT 2021-FL5 |

| 23.00 | BSPRT | Holiday Inn Hammond | Hammond | LA | Hospitality | 10,843,407 | 1.5 | | WFRBS 2013-C16 |

| 27.00 | BSPRT | Mitchell Lofts | Dallas | TX | Multifamily | 7,200,000 | 1.0 | | FREMF 2014-K38 |

| 28.00 | UBS | 220 Jackson Street | San Francisco | CA | Mixed Use | 6,200,000 | 0.8 | | JPMBB 2014-C22 |

| 30.00 | LMF | Extra Space Self Storage Baca Lane | Santa Fe | NM | Self Storage | 5,200,000 | 0.7 | | JPMBB 2014-C23 |

| | Total | | | | | $202,269,686 | 27.6 | % | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

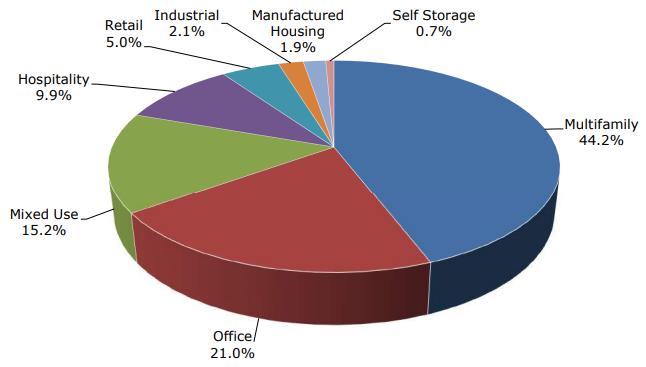

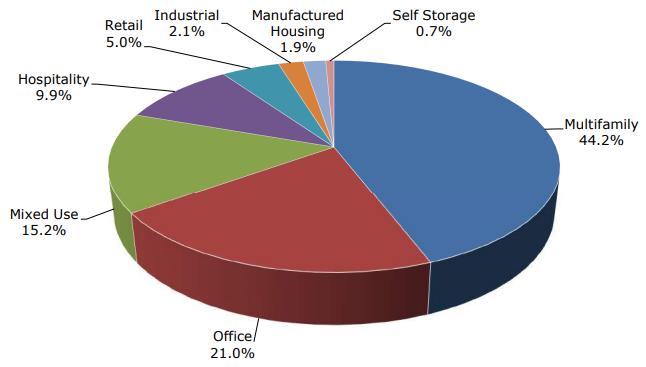

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date

Balance ($) | % of Initial

Pool

Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV

Ratio (%) | Weighted Average

U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Multifamily | 16 | $323,200,000 | 44.2 | % | 63.9 | % | 63.9 | % | 1.35 | x | 9.6 | % | 9.4 | % | 6.8070 | % |

| Garden | 9 | 160,000,000 | 21.9 | | 61.9 | | 61.9 | | 1.45 | | 10.6 | | 10.2 | | 6.9012 | |

| Mid Rise | 6 | 142,729,617 | 19.5 | | 65.3 | | 65.3 | | 1.26 | | 8.8 | | 8.7 | | 6.7570 | |

| High Rise | 1 | 20,470,383 | 2.8 | | 69.6 | | 69.6 | | 1.23 | | 8.1 | | 8.0 | | 6.4200 | |

| Office | 6 | 153,411,037 | 21.0 | | 56.5 | | 54.9 | | 1.50 | | 12.5 | | 11.7 | | 7.1452 | |

| Suburban | 2 | 78,600,000 | 10.7 | | 56.8 | | 54.1 | | 1.53 | | 13.2 | | 12.2 | | 7.0598 | |

| CBD | 3 | 71,350,000 | 9.7 | | 56.7 | | 56.1 | | 1.44 | | 11.7 | | 11.0 | | 7.2730 | |

| Medical | 1 | 3,461,037 | 0.5 | | 46.8 | | 46.8 | | 1.90 | | 12.9 | | 12.4 | | 6.4500 | |

| Mixed Use | 5 | 111,600,000 | 15.2 | | 53.9 | | 52.3 | | 1.70 | | 14.0 | | 12.7 | | 6.5445 | |

| Office/Retail | 2 | 56,600,000 | 7.7 | | 41.7 | | 38.5 | | 2.13 | | 18.9 | | 16.4 | | 6.1433 | |

| Medical Office/Retail | 1 | 23,000,000 | 3.1 | | 69.9 | | 69.9 | | 1.21 | | 8.4 | | 8.2 | | 6.7050 | |

| Office/Retail/Multifamily | 1 | 22,000,000 | 3.0 | | 62.9 | | 62.9 | | 1.29 | | 9.7 | | 9.5 | | 7.2700 | |

| Multifamily/Retail | 1 | 10,000,000 | 1.4 | | 66.7 | | 66.7 | | 1.26 | | 9.1 | | 8.8 | | 6.8500 | |

| Hospitality | 4 | 72,393,407 | 9.9 | | 54.3 | | 53.9 | | 1.95 | | 16.5 | | 14.7 | | 7.4158 | |

| Full Service | 2 | 37,843,407 | 5.2 | | 53.1 | | 52.4 | | 1.86 | | 16.5 | | 14.5 | | 7.6110 | |

| Select Service | 1 | 23,300,000 | 3.2 | | 57.2 | | 57.2 | | 1.91 | | 15.6 | | 14.1 | | 7.2890 | |

| Extended Stay | 1 | 11,250,000 | 1.5 | | 52.3 | | 52.3 | | 2.33 | | 18.3 | | 16.6 | | 7.0220 | |

| Retail | 8 | 36,440,477 | 5.0 | | 46.3 | | 45.2 | | 1.80 | | 14.1 | | 13.6 | | 6.9516 | |

| Anchored | 2 | 22,000,000 | 3.0 | | 46.0 | | 44.2 | | 1.73 | | 14.9 | | 14.4 | | 7.2809 | |

| Single Tenant | 6 | 14,440,477 | 2.0 | | 46.8 | | 46.8 | | 1.90 | | 12.9 | | 12.4 | | 6.4500 | |

| Industrial | 1 | 15,621,439 | 2.1 | | 46.8 | | 46.8 | | 1.90 | | 12.9 | | 12.4 | | 6.4500 | |

| Warehouse | 1 | 15,621,439 | 2.1 | | 46.8 | | 46.8 | | 1.90 | | 12.9 | | 12.4 | | 6.4500 | |

| Manufactured Housing | 7 | 14,000,000 | 1.9 | | 66.3 | | 66.3 | | 1.31 | | 9.4 | | 9.3 | | 7.0340 | |

| Manufactured Housing | 5 | 9,805,404 | 1.3 | | 66.3 | | 66.3 | | 1.31 | | 9.4 | | 9.3 | | 7.0340 | |

| Manufactured Housing/RV Park | 2 | 4,194,596 | 0.6 | | 66.3 | | 66.3 | | 1.31 | | 9.4 | | 9.3 | | 7.0340 | |

| Self Storage | 1 | 5,200,000 | 0.7 | | 56.5 | | 56.5 | | 1.34 | | 10.5 | | 10.5 | | 7.6800 | |

| Self Storage | 1 | 5,200,000 | 0.7 | | 56.5 | | 56.5 | | 1.34 | | 10.5 | | 10.5 | | 7.6800 | |

| Total/Weighted Average | 48 | $731,866,360 | 100.0 | % | 58.6 | % | 58.0 | % | 1.53 | x | 11.9 | % | 11.2 | % | 6.9082 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

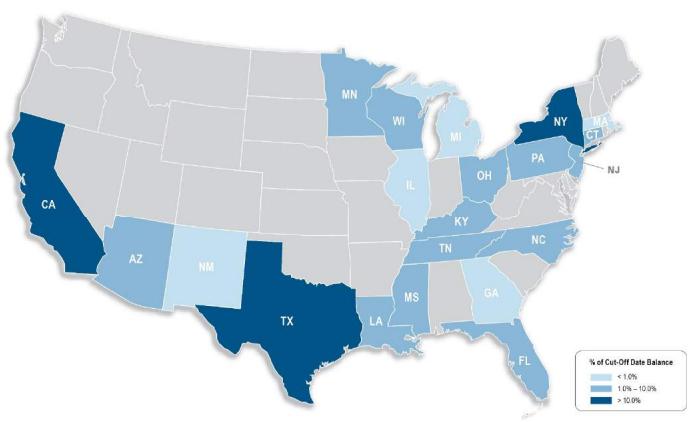

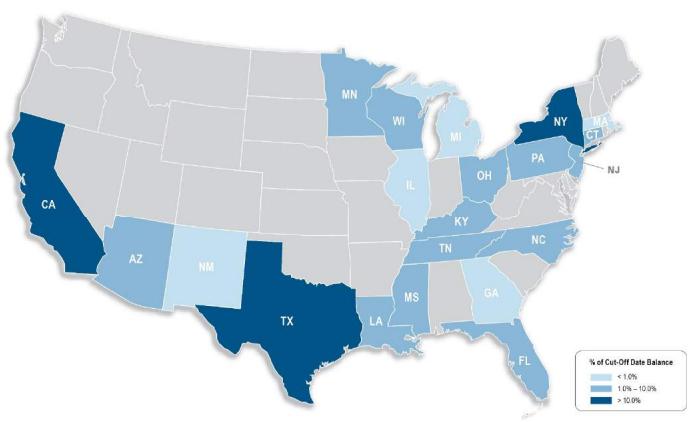

| G. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate Cut-off

Date Balance ($) | % of Initial Pool

Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Texas | 5 | $144,700,000 | 19.8 | % | 58.3 | % | 56.8 | % | 1.42 | x | 11.5 | % | 10.8 | % | 7.0348 | % |

| New York | 6 | 140,850,000 | 19.2 | | 54.8 | | 53.2 | | 1.54 | | 13.1 | | 11.9 | | 6.7688 | |

| California | 4 | 83,200,000 | 11.4 | | 49.8 | | 49.3 | | 1.69 | | 12.4 | | 12.1 | | 6.7644 | |

| Southern California | 3 | 77,000,000 | 10.5 | | 50.5 | | 49.9 | | 1.59 | | 11.8 | | 11.6 | | 6.8052 | |

| Northern California | 1 | 6,200,000 | 0.8 | | 41.3 | | 41.3 | | 2.90 | | 20.2 | | 18.4 | | 6.2570 | |

| New Jersey | 2 | 50,000,000 | 6.8 | | 69.6 | | 69.6 | | 1.23 | | 8.1 | | 8.0 | | 6.4200 | |

| Minnesota | 1 | 47,850,000 | 6.5 | | 67.4 | | 67.4 | | 1.23 | | 8.8 | | 8.7 | | 6.9200 | |

| Ohio | 3 | 43,432,080 | 5.9 | | 71.5 | | 71.5 | | 1.44 | | 10.2 | | 9.9 | | 6.7744 | |

| Connecticut | 2 | 36,450,000 | 5.0 | | 55.0 | | 55.0 | | 1.87 | | 15.7 | | 14.0 | | 7.4156 | |

| Other(3) | 25 | 185,384,280 | 25.3 | | 58.3 | | 58.2 | | 1.64 | | 12.4 | | 11.7 | | 7.0403 | |

| Total/Weighted Average | 48 | 731,866,360 | 100.0 | % | 58.6 | % | 58.0 | % | 1.53 | x | 11.9 | % | 11.2 | % | 6.9082 | % |

| (1) | The mortgaged properties are located in 21 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 14 other states. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 3,200,000 - 5,000,000 | 2 | $8,200,000 | 1.1 | % |

| 5,000,001 - 15,000,000 | 15 | 155,843,407 | 21.3 | |

| 15,000,001 - 30,000,000 | 7 | 170,800,000 | 23.3 | |

| 30,000,001 - 50,000,000 | 5 | 209,122,953 | 28.6 | |

| 50,000,001 - 70,000,000 | 2 | 114,900,000 | 15.7 | |

| 70,000,001 - 73,000,000 | 1 | 73,000,000 | 10.0 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Average: | $22,870,824 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.23 - 1.50 | 18 | $419,150,000 | 57.3 | % |

| 1.51 - 2.00 | 6 | 152,366,360 | 20.8 | |

| 2.01 - 3.19 | 8 | 160,350,000 | 21.9 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 1.62x | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 8.1 - 12.0 | 18 | $419,150,000 | 57.3 | % |

| 12.1 - 16.0 | 8 | 186,366,360 | 25.5 | |

| 16.1 - 20.0 | 5 | 120,150,000 | 16.4 | |

| 20.1 - 20.2 | 1 | 6,200,000 | 0.8 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 11.9% | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Refinance | 28 | $659,993,407 | 90.2 | % |

| Acquisition | 3 | 48,572,953 | 6.6 | |

| Recapitalization | 1 | 23,300,000 | 3.2 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| MORTGAGE RATE |

Range of Mortgage

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 6.1293 - 6.5000 | 7 | $203,822,953 | 27.8 | % |

| 6.5001 - 7.0000 | 8 | 199,950,000 | 27.3 | |

| 7.0001 - 7.5000 | 13 | 289,600,000 | 39.6 | |

| 7.5001 - 8.0000 | 3 | 27,650,000 | 3.8 | |

| 8.0001 - 8.4850 | 1 | 10,843,407 | 1.5 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 6.9082% | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.21 - 1.50 | 20 | $502,993,407 | 68.7 | % |

| 1.51 - 2.00 | 7 | 111,522,953 | 15.2 | |

| 2.01 - 2.90 | 5 | 117,350,000 | 16.0 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 1.53x | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 8.0 | 2 | $65,000,000 | 8.9 | % |

| 8.1 - 12.0 | 17 | 367,150,000 | 50.2 | |

| 12.1 - 16.0 | 8 | 200,366,360 | 27.4 | |

| 16.1 - 18.4 | 5 | 99,350,000 | 13.6 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 11.2% | | |

| (1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity) and may be currently prepayable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Original Terms to

Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 60 | 32 | $731,866,360 | 100.0% |

| Total: | 32 | $731,866,360 | 100.0% |

| Weighted Average: | 60 months | | |

| REMAINING TERM TO MATURITY |

Range of Remaining

Terms to Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 55 - 60 | 32 | $731,866,360 | 100.0 | % |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 59 months | | | |

| ORIGINAL AMORTIZATION TERM(1) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 27 | $556,372,953 | 76.0 | % |

| Planned Amortization | 1 | 50,400,000 | 6.9 | |

| 240 | 1 | 9,000,000 | 1.2 | |

| 360 | 3 | 116,093,407 | 15.9 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average(3): | 351 months | | | |

| REMAINING AMORTIZATION TERM(2) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 27 | $556,372,953 | 76.0 | % |

| Planned Amortization | 1 | 50,400,000 | 6.9 | |

| 240 | 1 | 9,000,000 | 1.2 | |

| 359 - 360 | 3 | 116,093,407 | 15.9 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average(3): | 351 months | | |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Springing | 16 | $256,943,407 | 35.1 | % |

| Hard/ Springing Cash Management | 9 | 213,672,953 | 29.2 | |

| Soft/ Springing Cash Management | 5 | 185,850,000 | 25.4 | |

| Hard/ In Place Cash Management | 2 | 75,400,000 | 10.3 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Lockout / Defeasance / Open | 29 | $683,216,360 | 93.4 | % |

| Lockout / GRTR 1% or YM / Open | 3 | 48,650,000 | 6.6 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| | | | |

CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off

Date LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 33.2 - 40.0 | 2 | $31,500,000 | 4.3 | % |

| 40.1 - 50.0 | 5 | 124,322,953 | 17.0 | |

| 50.1 - 60.0 | 8 | 197,100,000 | 26.9 | |

| 60.1 - 70.0 | 15 | 341,493,407 | 46.7 | |

| 70.1 - 74.9 | 2 | 37,450,000 | 5.1 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 58.6% | | |

| BALLOON LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 30.2 - 40.0 | 3 | $81,900,000 | 11.2 | % |

| 40.1 - 50.0 | 4 | 73,922,953 | 10.1 | |

| 50.1 - 60.0 | 8 | 197,100,000 | 26.9 | |

| 60.1 - 70.0 | 15 | 341,493,407 | 46.7 | |

| 70.1 - 74.9 | 2 | 37,450,000 | 5.1 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 58.0% | | |

| AMORTIZATION TYPE |

| Amortization Type | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Interest Only | 27 | $556,372,953 | 76.0 | % |

| Amortizing Balloon | 4 | 143,243,407 | 19.6 | |

| Interest Only, Amortizing Balloon | 1 | 32,250,000 | 4.4 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 24 | 1 | $32,250,000 | 4.4% |

| Total: | 1 | $32,250,000 | 4.4% |

| Weighted Average: | 24 months | | |

| SEASONING |

| Seasoning (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 0 | 14 | $391,450,000 | 53.5 | % |

| 1 | 16 | 320,216,360 | 43.8 | |

| 2 | 1 | 7,200,000 | 1.0 | |

| 5 | 1 | 13,000,000 | 1.8 | |

| Total: | 32 | $731,866,360 | 100.0 | % |

| Weighted Average: | 1 month | | |

(1) | The original amortization term shown for any mortgage loan that is interest only for part of its term does not include the number of months in its interest only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (2) | The remaining amortization term shown for any mortgage loan that is interest only for part of its term does not include the number of months in its interest only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period |

| (3) | Excludes the non-amortizing mortgage loans and 640 5th Avenue which is on a planned amortization schedule. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Certain Terms and Conditions |

| V. | Certain Terms and Conditions |

| Interest Entitlements: | The interest entitlement of each Class of Certificates on each Distribution Date generally will be the interest accrued during the related Interest Accrual Period on the related Certificate Balance or Notional Amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that Class for such Distribution Date as described below. If prepayment interest shortfalls arise from voluntary prepayments (without the Master Servicer’s consent) on particular non-specially serviced loans during any collection period, the Master Servicer is required to make a compensating interest payment to offset those shortfalls, generally up to an amount equal to the portion of its master servicing fees that accrue at 0.25 basis points per annum. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all Classes of Certificates that are entitled to interest, on a pro rata basis, based on their respective amounts of accrued interest for the related Distribution Date. If a Class receives less than the entirety of its interest entitlement on any Distribution Date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding Distribution Date. |

| Principal Distribution Amount: | The Principal Distribution Amount for each Distribution Date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and workout-delayed reimbursement amounts that are reimbursed to the Master Servicer, the Special Servicer or the Trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections and advances before reimbursement from other amounts. Workout-delayed reimbursement amounts are reimbursable from principal collections. |

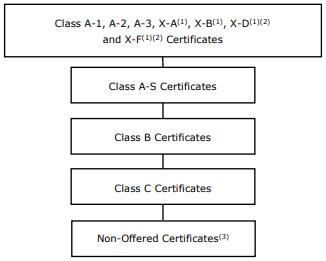

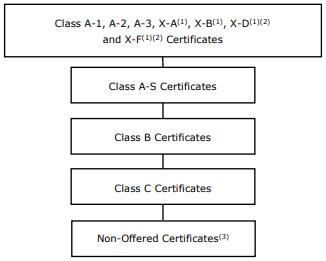

| Subordination, Allocation of Losses and Certain Expenses | The chart below describes the manner in which the payment rights of certain Classes of Certificates will be senior or subordinate, as the case may be, to the payment rights of other Classes of Certificates. The chart also shows the corresponding entitlement to receive principal and/or interest of certain Classes of Certificates on any distribution date in descending order. It also shows the manner in which losses are allocated to certain Classes of Certificates in ascending order (beginning with the Non-Offered Certificates, other than the Class X-D, X-F and Class R Certificates) to reduce the Certificate Balance of each such Class to zero; provided that no principal payments or mortgage loan losses will be allocated to the Class X-A, X-B, X-D, X-F or R Certificates, although principal payments and losses may reduce the Notional Amounts of the Class X-A, X-B, X-D and X-F Certificates and, therefore, the amount of interest they accrue. |

| |  |

| | (1) | The Class X-A, X-B, X-D and X-F Certificates are interest-only certificates. |

| | (2) | Non-Offered Certificates. |

| | (3) | Other than the Class X-D, X-F and R Certificates |

| Distributions: | On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust fees, expenses and reimbursements will generally be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| | 1. Class A-1, A-2, A-3, X-A, X-B, X-D and X-F Certificates: To interest on the Class A-1, A-2, A-3, X-A, X-B, X-D and X-F Certificates, pro rata, according to their respective interest entitlements. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

| Wells Fargo Commercial Mortgage Trust 2024-5C1 | Certain Terms and Conditions |

| | 2. Class A-1, A-2 and A-3 Certificates: To principal on the Class A-1, A-2 and A-3 Certificates in the following amounts and order of priority: (i) first, to principal on the Class A-1 Certificates until their Certificate Balance is reduced to zero; (ii) second, to principal on the Class A-2 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; (iii) third, to principal on the Class A-3 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date. However, if the Certificate Balance of each and every Class of Principal Balance Certificates, other than the Class A-1, A-2 and A-3 Certificates, has been reduced to zero as a result of the allocation of Mortgage Loan losses and expenses and any of the Class A-1, A-2 and A-3 Certificates remains outstanding, then the Principal Distribution Amount will be distributed to the Class A-1, A-2 and A-3 Certificates, pro rata, based on their respective outstanding Certificate Balances, until their Certificate Balances have been reduced to zero. |

| | 3. Class A-1, A-2 and A-3 Certificates: To reimburse the holders of the Class A-1, A-2 and A-3 Certificates, pro rata, on the basis of previously allocated unreimbursed losses, for any previously unreimbursed losses (plus interest thereon) on the mortgage loans that were previously allocated in reduction of the Certificate Balances of such Classes. |

| | 4. Class A-S Certificates: To make distributions on the Class A-S Certificates as follows: (a) first, to interest on the Class A-S Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1, Class A-2 and A-3 Certificates), to principal on the Class A-S Certificates until their Certificate Balance is reduced to zero; and (c) next, to reimburse the holders of the Class A-S Certificates for any previously unreimbursed losses (plus interest thereon) on the mortgage loans that were previously allocated to that Class in reduction of their Certificate Balance. 5. Class B Certificates: To make distributions on the Class B Certificates as follows: (a) first, to interest on the Class B Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1, A-2, A-3 and A-S Certificates), to principal on the Class B Certificates until their Certificate Balance is reduced to zero; and (c) next, to reimburse the holders of the Class B Certificates for any previously unreimbursed losses (plus interest thereon) on the mortgage loans that were previously allocated to that Class in reduction of their Certificate Balance. 6. Class C Certificates: To make distributions on the Class C Certificates as follows: (a) first, to interest on the Class C Certificates in the amount of the interest entitlement for that Class; (b) next, to the extent of the portion of the Principal Distribution Amount remaining after distributions in respect of principal to each Class with a higher distribution priority (in this case, the Class A-1, A-2, A-3, A-S and B Certificates), to principal on the Class C Certificates until their Certificate Balance is reduced to zero; and (c) next, to reimburse the holders of the Class C Certificates for any previously unreimbursed losses (plus interest thereon) on the mortgage loans that were previously allocated to that Class in reduction of their Certificate Balance. 7. After the Class A-1, A-2, A-3, A-S, B and C Certificates are paid all amounts to which they are entitled, the remaining funds available for distribution will be used to pay interest, principal and loss reimbursement amounts on the Class D, E, F, G-RR and J-RR Certificates sequentially in that order in a manner analogous to the Class C Certificates. |

| Allocation of Yield Maintenance Charges and Prepayment Premiums: | If any Yield Maintenance Charge or Prepayment Premium is collected during any particular collection period with respect to any mortgage loan, then on the Distribution Date corresponding to that collection period, the certificate administrator will pay that Yield Maintenance Charge or Prepayment Premium (net of liquidation fees payable therefrom) in the following manner: (1) to each class of the Class A-1, A-2, A-3, A-S, B, C, D and E Certificates, the product of (a) such Yield Maintenance Charge or Prepayment Premium, (b) the related Base Interest Fraction for such class and the applicable principal prepayment, and (c) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that Distribution Date, and the denominator of which is the total amount of principal distributed to the Class A-1, A-2, A-3, A-S, B, C, D, E, F, G-RR and J-RR Certificates for that Distribution Date, |