UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

CINCINNATI FINANCIAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies: ______________________________________

2) Aggregate number of securities to which transaction applies: _____________________________________

3) Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ________________________________

4) Proposed maximum aggregate value of transaction: _______________________________________

5) Total fee paid: _____________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid: _____________________________________________________________

2) Form, Schedule or Registration Statement No.:. ____________________________________________

3) Filing Party: _______________________________________________________________________

4) Date Filed: ________________________________________________________________________

|

Cincinnati Financial Corporation 2013 Shareholder Meeting Notice and Proxy Statement |

March 15, 2013

To the Shareholders of Cincinnati Financial Corporation:

You are cordially invited to attend the Annual Meeting of Shareholders of Cincinnati Financial Corporation, which will take place at 9:30 a.m. on Saturday, April 27, 2013, at the Cincinnati Art Museum, located in Eden Park, Cincinnati, Ohio. The business to be conducted at the meeting includes:

| 1. | Electing 15 directors for one-year terms; |

| 2. | Ratifying the selection of Deloitte & Touche LLP as the company’s independent registered public accounting firm for 2013; |

| 3. | Voting on a nonbinding proposal to approve compensation for the company’s named executive officers; |

| 4. | Voting on a shareholder proposal, if introduced at the meeting; |

| 5. | Transacting such other business as may properly come before the meeting. |

Shareholders of record at the close of business on March 1, 2013, are entitled to vote at the meeting.

Whether or not you plan to attend the meeting, please cast your vote as promptly as possible. We encourage convenient online voting, which saves your company significant postage and processing costs. If you prefer, you may submit your vote by telephone or by mail.

Your Internet or telephone vote must be received by 11:59 p.m. EDT on April 26, 2013, to be counted in the final tabulation. If you choose to vote by mail, please be sure to return your proxy card in time to be received and counted before the Annual Meeting. Thank you for your interest and participation in the affairs of the company.

/S/ Lisa A. Love

Lisa A. Love

Senior Vice President, General Counsel and Corporate Secretary

This proxy statement, the Annual Report on Form 10-K, Letter From the Chairman and the Chief Executive Officer and voting instructions were first made available to Cincinnati Financial Corporation shareholders on March 15, 2013.

| Page 1 |

Table of Contents

| Proxy Summary | 3 |

| 2013 Annual Meeting of Shareholders | 3 |

| Voting Matters and Board Recommendations | 3 |

| 2012 Business Highlights | 3 |

| Director Nominees | 4 |

| Executive Compensation Highlights | 5 |

| Important Dates for the 2014 Annual Meeting of Shareholders | 6 |

| Frequently Asked Questions | 6 |

| Security Ownership of Principal Shareholders and Management | 8 |

| Section 16(A) Beneficial Ownership Reporting Compliance | 10 |

| Information About the Board of Directors | 10 |

| Proposal 1 – Election of Directors | 10 |

| Nominees for Director of Your Company | 11 |

| Governance of Your Company | 19 |

| Certain Relationships and Transactions | 21 |

| Audit-Related Matters | 23 |

| Proposal 2 – Management’s Proposal to Ratify Appointment of the Independent Registered Public Accounting Firm | 23 |

| Report of the Audit Committee | 23 |

| Fees Billed by the Independent Registered Public Accounting Firm | 24 |

| Services Provided by the Independent Registered Public Accounting Firm | 24 |

| Compensation of Named Executive Officers and Directors | 26 |

| Proposal 3 – Advisory Vote on Compensation of Our Named Executive Officers | 26 |

| Report of the Compensation Committee | 28 |

| Compensation Committee Interlocks and Insider Participation | 28 |

| Compensation Discussion and Analysis | 28 |

| Other Business | 56 |

| Proposal 4 – Shareholder Proposal for Sustainability Reporting | 56 |

| Conclusion | 59 |

| Shareholder Proposals for Next Year | 59 |

| Cost of Solicitation | 59 |

| Other Business | 59 |

| Appendix A | 60 |

| Definitions of Non-GAAP Information and Reconciliation to Comparable GAAP Measures | 60 |

| Page 2 |

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information that you should consider; and you should read the entire proxy statement before voting. For more complete information about the company’s 2012 performance, please review the company’s Annual Report on Form 10-K.

2013 Annual Meeting of Shareholders

| Date and Time: | April 27, 2013, 9:30 a.m. EDT |

| Place: | Cincinnati Art Museum, Eden Park, Cincinnati, Ohio |

| Record Date: | March 1, 2013 |

| Meeting Webcast: | www.cinfin.com/investors |

Voting Matters and Board Recommendations

| Our Board’s Recommendation | |

| Election of Directors (Page 10) | FOR Each Director Nominee |

| Ratification of Auditors (Page 23) | FOR |

| Advisory Vote to Approve Executive Compensation (Page 26) | FOR |

| Vote on a Shareholder Proposal (Page 56) | AGAINST |

2012 Business Highlights

In 2012, the company delivered strong operating and financial results. Highlights included:

| · | Strong growth of 12 percent in consolidated property casualty net written premiums, reflecting improved pricing, rising insured exposures and new business from agencies appointed as a part of our growth strategy to write $5 billion in annual direct written premiums by the end of 2015. |

| · | Marked improvement in the profitability of our property casualty insurance business, with a combined ratio of 96.1 percent, 13.2 points better than the 109.3 percent combined ratio reported for 2011, as long-term initiatives to improve underwriting and pricing that began several years ago continued to mature and deliver results. Results also were helped by lower catastrophe losses during the year. |

| · | Healthy growth in pretax investment income of 1 percent, and a 6 percent increase in the fair value of our invested assets plus cash. |

| · | A 157 percent increase in net income to $421 million, with operating income of $393 million, or $2.40 per share, up 230 percent. |

| · | Book value increase of 8 percent, to $33.48 per share. |

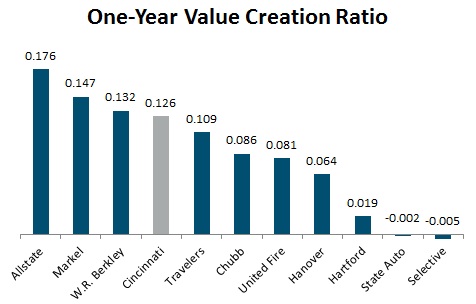

| · | Value Creation Ratio (VCR) of 12.6 percent, within our announced goal of producing an annual average VCR of 12 percent to 15 percent for the five-year period from 2010 to 2014. |

| · | Increase in cash dividends paid to shareholders for the 52ndconsecutive year, to an indicated annual dividend of $1.63 per share. |

| · | At December 31, 2012, our one-year total shareholder return of 34.2 percent, exceeded that of eight of the 10 members of our peer group. Our three-year total shareholder return of 73.6 percent exceeded that measure for each of the 10 peer companies. |

| Page 3 |

Director Nominees

The following table provides summary information about each director nominee. Complete information about each director’s background and experience begins on Page 59. Each director stands for election annually.

| Name | Age | Director Since | Primary Occupation | Committee Memberships | Other Public Company Boards | |||||

| William F. Bahl* | 61 | 1995 | Chairman, Bahl & Gaynor Investment Counsel Inc. | A, C, E, I, N (Chair) | 1 | |||||

| Gregory T. Bier* | 66 | 2006 | Managing Partner (Retired), Deloitte & Touche LLP | A, C, I | 1 | |||||

| Linda W. Clement-Holmes* | 50 | 2010 | Senior Vice President, The Procter & Gamble Company | A | 0 | |||||

| Dirk J. Debbink* | 57 | 2012 | Chairman and Chief Executive Officer, MSI General Corporation | A | 0 | |||||

| Steven J. Johnston | 53 | 2011 | President and Chief Executive Officer, Cincinnati Financial Corporation | E, I | 0 | |||||

| Kenneth C. Lichtendahl* | 64 | 1988 | Director of Development and Sales, Heliosphere Designs | A (Chair), N | 0 | |||||

| W. Rodney McMullen* | 52 | 2001 | President and Chief Operating Officer, The Kroger Co. | C (Chair), E, I | 0 | |||||

| Gretchen W. Price* | 58 | 2002 | Executive Vice President, Chief Financial and Administrative Officer, Arbonne International LLC | A, C, N | 1 | |||||

| John J. Schiff, Jr. | 69 | 1968 | Chairman of the Executive Committee, Cincinnati Financial Corporation | E (Chair), I | 2 | |||||

| Thomas R. Schiff | 65 | 1975 | Chairman and Chief Executive Officer, John J. & Thomas R. Schiff & Co. Inc. | I | 0 | |||||

| Douglas S. Skidmore* | 50 | 2004 | President and Chief Executive Officer, Skidmore Sales & Distributing Company Inc. | A, N | 0 | |||||

| Kenneth W. Stecher | 66 | 2008 | Chairman, Cincinnati Financial Corporation | E, I (Chair) | 0 | |||||

| John F. Steele, Jr.* | 59 | 2005 | Chairman and Chief Executive Officer, Hilltop Basic Resources Inc. | A, E | 0 | |||||

| Larry R. Webb | 57 | 1979 | President, Webb Insurance Agency Inc. | E | 0 | |||||

| E. Anthony Woods* | 72 | 1998 | Chairman and Chief Executive Officer, SupportSource LLC | C, E, I | 1 |

| * | Independent Director |

| A | Audit Committee |

| C | Compensation Committee |

| E | Executive Committee |

| I | Investment Committee |

| N | Nominating Committee |

| Page 4 |

Executive Compensation Highlights

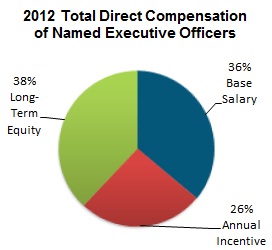

As discussed in Compensation, Discussion and Analysis beginning on Page 28, we seek to align the interests of our named executive officers with the interests of our shareholders. The compensation committee endeavors to ensure that overall compensation paid to our executive officers is appropriate and in line with our overall compensation objective to attract, motivate, reward, develop and retain the executive talent required to achieve the company’s business objectives, with the ultimate goal of increasing shareholder value.

Generally, the committee expects that when the company’s performance adds or preserves more value for shareholders than its peers, the named executive officers’ compensation, including the chief executive officer, will be higher than when the company’s performance lags its peers. The following graphs illustrate the directional relationships between company performance, based on the two performance metrics used in our performance-based awards, and the compensation of our chief executive officer for the three years ending 2012.

|  |  |

Set forth below is the 2012 compensation for each named executive officer as determined under Securities and Exchange Commission (SEC) rules. See the notes accompanying the Summary Compensation Table on Page 44 for more information.

| Name and Principal Position | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non- Equity Incentive Plan Compen- sation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total Compensation ($) | ||||||||||||||||||||||||

| Steven J. Johnston Chief Executive Officer & President | $ | 800,000 | $ | - | $ | 470,193 | $ | 95,277 | $ | 640,000 | $ | - | $ | 63,446 | $ | 2,068,916 | ||||||||||||||||

| Jacob F. Scherer, Jr. Chief Insurance Officer | 750,000 | - | 358,430 | 72,575 | 487,500 | 613,312 | 15,299 | 2,297,116 | ||||||||||||||||||||||||

| Michael J. Sewell Chief Financial Officer | 700,000 | - | 334,215 | 67,738 | 455,000 | - | 81,613 | 1,638,566 | ||||||||||||||||||||||||

| Martin F. Hollenbeck Chief Investment Officer | 558,077 | - | 270,124 | 54,675 | 367,250 | - | 64,045 | 1,314,171 | ||||||||||||||||||||||||

| Kenneth W. Stecher Chairman of the Board | 500,000 | - | 294,163 | 59,548 | 400,000 | 1,456,749 | 9,276 | 2,719,736 | ||||||||||||||||||||||||

| Thomas A. Joseph Former Senior Vice President | 446,326 | - | 272,247 | 55,184 | 277,995 | 560,998 | 220,991 | 1,833,741 | ||||||||||||||||||||||||

| Page 5 |

Important Dates for the 2014 Annual Meeting of Shareholders

| · | Shareholder proposals submitted for inclusion in our 2014 proxy statement pursuant to SEC Rule 14a-8 must be received by us by November 16, 2013. |

| · | Notice of shareholder proposals to be raised from the floor of the 2014 Annual Meeting of Shareholders outside of SEC Rule 14a-8 must be received by us between January 17, 2014, and February 26, 2014. |

More information about submitting shareholder proposals for the 2014 Annual Meeting of Shareholders begins on Page 59.

Frequently Asked Questions

Who is soliciting my vote? – The board of directors of Cincinnati Financial Corporation is soliciting your vote for the 2013 Annual Meeting of Shareholders.

Who is entitled to vote? – Shareholders of record at the close of business on March 1, 2013, may vote.

How many votes do I have? – You have one vote for each share of common stock you owned on March 1, 2013.

How many votes can be cast by all shareholders? – 163,291,707 outstanding shares of common stock can be voted as of the close of business on March 1, 2013.

How many shares must be represented to hold the meeting? – A majority of the outstanding shares, or 81,645,854 shares, must be represented to hold the meeting.

How many votes are needed to elect directors and to approve the proposals? –

| · | The nominees for director receiving the 15 highest vote totals are elected as directors. |

| · | Selection of our independent registered public accounting firm is ratified and the shareholder proposal is approved if votes cast in favor of these proposals exceed votes cast against them. |

| · | Compensation paid to our named executive officers is approved if the majority of the shares present and entitled to vote are cast in favor of the proposal. |

How do I vote? – You may vote by proxy, whether or not you attend the meeting, in one of three ways:

| · | Internet (www.proxyvote.com) |

| · | Telephone (800-690-6903) |

| · | Mail: Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 |

Even if you plan to attend the annual meeting, we ask that you vote by Internet, telephone or mail. Attending the meeting does not constitute a revocation of a previously submitted vote.

Instructions for voting via the Internet, by telephone or by mail, along with the required Control Number (the Control Number is unique to each account), are provided to you by mail or by email in late March or early April.

The deadline for online and telephone voting is 11:59 p.m. EDT April 26, 2013. If you choose to vote by mail, be sure to return your proxy card in time to be received and counted before the Annual Meeting.

Where do I locate my Control Number so I can vote? – If you receive our information in the mail, the Control Number is on the notice or proxy card that also gives your name and the number of shares you hold. If you receive our information in emails, the Control Number is in the text of the email.

What if I cannot locate my Control Number? – If you hold shares directly in your name, you may obtain your Control Number by calling 866-638-6443. If your shares are registered in the name of a bank, broker or other nominee, that firm can supply the Control Number.

| Page 6 |

Can I obtain another proxy card so I can vote by mail? – If you hold shares directly in your name, you may obtain another proxy card by calling 800-579-1639. If your shares are registered in the name of a bank, broker or other nominee, that firm can supply another proxy card.

What if I vote “withhold” or “abstain?” – “Withhold” or “abstain” votes have no effect on the votes required to elect directors, to ratify the independent registered public accounting firm or to approve the shareholder proposal. Votes to abstain have the same effect as votes “against” the nonbinding proposal to approve compensation paid to our named executive officers.

Can my shares be voted if I don’t return my proxy and don’t attend the annual meeting? – If your shares are registered in your name, the answer is no. If your shares are registered in the name of a bank, broker or other nominee and you do not direct your nominee as to how to vote your shares, applicable rules provide that the nominee generally may vote your shares on any of the routine matters scheduled to come before the meeting. The proposal to ratify the selection of the independent registered public accounting firm and the shareholder proposal are believed to be the only routine matters scheduled to come before this year’s annual meeting. If a bank, broker or other nominee indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, these shares (called broker nonvotes) are counted as present in determining whether we have a quorum but have no effect on the votes required to elect directors, or the advisory vote to approve compensation for our named executive officers.

Can I change my vote or revoke my proxy? – Yes. Just cast a new vote by Internet or telephone or send in a new signed proxy card with a later date. If you hold shares directly in your name, you may send a written notice of revocation to the corporate secretary of the company. If you hold shares directly in your name and attend the annual meeting, you also may choose to vote in person. At the meeting, you can request a ballot and direct that your previously submitted proxy not be used. Otherwise, your attendance itself does not constitute a revocation of your previously submitted proxy.

How are the votes counted? – Votes cast by proxy are tabulated prior to the meeting by the holders of the proxies. Inspectors of election appointed at the meeting count the votes and announce the preliminary results at the meeting. The proxy agent reserves the right not to vote any proxies that are altered in a manner not intended by the instructions contained in the proxy. The company publicly discloses the final voting results in a Form 8-K filing after the vote count is certified, usually within a week of the meeting.

Could other matters be decided at the meeting? – We do not know of any matters to be considered at the annual meeting other than the election of directors and the proposals described in this proxy statement. For any other matters that do properly come before the meeting, your shares will be voted at the discretion of the proxy holder.

Who can attend the meeting? – The meeting is open to all interested parties.

Can I listen to the meeting if I cannot attend in person? – You can listen to a live webcast of the meeting over the Internet. Instructions are available on the Investors page ofwww.cinfin.comapproximately two weeks before the meeting. An audio replay is available on the website within two hours after the close of the meeting.

Why did my materials arrive in different envelopes? – Our paper mailings are timed to meet regulatory standards and to help us keep mailing and paper costs low. Most shareholders who have not elected to receive information using electronic delivery receive three mailings:

| · | In late March: you receive a card notifying you that you can cast your vote after reviewing your company’s year-end 2012 financial materials and proxy statement online. You also can request paper materials. |

| · | In early April: if you haven’t yet voted, you receive a second notification that your company’s information is available. You can access materials and vote online, or you can use this notice as your paper proxy card. |

| · | A few days later: you may receive this proxy statement along with management’s annual letter on performance, issues, events and trends. |

| Page 7 |

If you are enrolled in electronic delivery, you will receive an email notifying you of the availability of the information on the Internet and providing online voting instructions. Shareholders who request paper delivery of all materials receive the Annual Report on Form 10-K, the Letter From the Chairman and the Chief Executive Officer and the 2013 Shareholder Meeting Notice and Proxy Statement in early April.

How can I obtain a 2012 Annual Report? – You can obtain our 2012 Annual Report on Form 10-K as filed with the SEC at no cost in several different ways. You may view, search or print the document online fromwww.cinfin.com/investors. You may ask that a copy be mailed to you by contacting the corporate secretary of Cincinnati Financial Corporation. Or, you may request it directly from Shareholder Services. Please see the Investor Contacts page ofwww.cinfin.com/investorsfor details. These contacts are also listed at the end of this proxy statement.

Security Ownership of Principal Shareholders and Management

Under Section 13(d) of the Securities Exchange Act of 1934 (Exchange Act), a beneficial owner of a security is any person who directly or indirectly has or shares voting power or investment authority over such security. A beneficial owner under this definition need not enjoy the economic benefit of such securities. The following are the only shareholders known to the company who are deemed to be beneficial owners of at least 5 percent of our common stock as of March 1, 2013. John J. Schiff, Jr. and Thomas R. Schiff, directors of the company, are brothers.

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Footnote Reference | Percent of Class |

| Common stock | John J. Schiff, Jr., CPCU | 11,852,507 | (1)(2)(3)(4)(5) | 7.26 |

| Cincinnati Financial Corporation | ||||

| 6200 South Gilmore Road | ||||

| Fairfield, OH 45014 | ||||

| Common stock | First Eagle Investment Management LLC | 11,142,842 | (6) | 6.85 |

| 1345 Avenue of the Americas | ||||

| New York, NY 10105 | ||||

| Common stock | State Street Corporation | 10,945,065 | (7) | 6.70 |

| State Street Financial Center | ||||

| One Lincoln Street | ||||

| Boston, MA 02111 | ||||

| Common stock | BlackRock Inc. | 10,294,407 | (8) | 6.33 |

| 40 East 52nd Street | ||||

| New York, NY 10022 | ||||

| Common stock | Thomas R. Schiff | 9,621,582 | (1)(2)(5)(9) | 5.89 |

| Cincinnati Financial Corporation | ||||

| 6200 South Gilmore Road | ||||

| Fairfield, OH 45014 | ||||

| Common stock | The Vanguard Group Inc. | 8,846,038 | (10) | 5.43 |

| 100 Vanguard Blvd. | ||||

| Malvern, PA 19355 |

| Page 8 |

The outstanding common shares beneficially owned by each other director and our named executive officers and total outstanding shares for all directors and executive officers as a group as of March 1, 2013, are shown below:

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Footnote Reference | Percent of Class | |

| Other Directors | ||||

| William F. Bahl, CFA, CIC | 221,930 | (11) | 0.14 | |

| Gregory T. Bier | 17,530 | 0.01 | ||

| Linda W. Clement-Holmes | 4,331 | 0.00 | ||

| Dirk J. Debbink | 15,167 | 0.01 | ||

| Martin F. Hollenbeck | 59,870 | (3)(4)(5) | 0.04 | |

| Thomas A. Joseph | 107,034 | (3)(5) | 0.07 | |

| Steven J. Johnston | 81,960 | (3)(4) | 0.05 | |

| Kenneth C. Lichtendahl | 28,974 | 0.02 | ||

| W. Rodney McMullen | 42,865 | 0.03 | ||

| Gretchen W. Price | 20,692 | 0.01 | ||

| Jacob F. Scherer, Jr | 216,053 | (3)(4)(5) | 0.13 | |

| Michael J. Sewell | 25,123 | (3) | 0.02 | |

| Douglas S. Skidmore | 30,487 | (12) | 0.02 | |

| Kenneth W. Stecher | 265,283 | (3)(5) | 0.16 | |

| John F. Steele, Jr. | 16,950 | 0.01 | ||

| Larry R. Webb, CPCU | 492,560 | (13) | 0.30 | |

| E. Anthony Woods | 45,905 | 0.03 | ||

| All directors and nondirector executive officers as a group (29 individuals) | 16,323,825 | (1)(2)(3)(4)(5)(9) (11)(12)(13) | 10.00 | |

Except as otherwise indicated in the notes below, each person has sole voting and investment power with respect to the common shares noted.

| (1) | Includes 6,056,919 shares owned of record by The Mary R. Schiff and John J. Schiff Foundation and 1,412,599 shares owned of record by the John J. Schiff Charitable Lead Trust, the trustees of which are Messrs. J. Schiff, Jr. and T. Schiff and Suzanne S. Reid, who share voting and investment power equally. |

| (2) | Includes 107,186 shares owned of record by the John J. & Thomas R. Schiff & Co. Inc. pension plan, the trustees of which are Messrs. J. Schiff, Jr. and T. Schiff, who share voting and investment power; and 124,249 shares owned by John J. & Thomas R. Schiff & Co. Inc. for which Messrs. J. Schiff, Jr. and T. Schiff share voting and investment power. |

| (3) | Includes shares available within 60 days from exercise of stock options in the amount of 37,683 shares for Mr. Johnston; 106,273 shares for Mr. Scherer; 262,159 shares for Mr. J. Schiff, Jr.; 6,534 shares for Mr. Sewell; 40,279 shares for Mr. Hollenbeck; 153,638 shares for Mr. Stecher; 83,102 shares for Mr. Joseph and 709,968 shares for the nondirector executive officers as a group. |

| (4) | Includes shares held in the company’s nonqualified savings plan for highly compensated associates in the amounts of 16,295 shares for Mr. Johnston; 4,114 shares for Mr. Hollenbeck; 2,088 shares for Mr. Sewell; 15,763 shares for Mr. J. Schiff; Jr. and 24,904 shares for the nondirector executive officers as a group. Individuals participating in this plan do not have the right to vote these shares. |

| (5) | Includes shares pledged as collateral as of December 31, 2012, in the amounts of 2,915 for Ms. Clement-Holmes; 8,957 for Mr. Hollenbeck; 15,524 for Mr. Joseph; 102,339 for Mr. Scherer; 1,363,521 for Mr. J. Schiff, Jr.; 1,043,223 for Mr. T. Schiff; 41,975 for Mr. Stecher and 341,778 for the nondirector executive officers as a group. |

| (6) | Reflects ownership as of December 31, 2012, according to Form 13G/A filed by First Eagle Investment Management LLC on February 11, 2013. |

| (7) | Reflects ownership as of December 31, 2012, according to Form 13G filed by State Street Corporation on February 8, 2013. |

| (8) | Reflects ownership as of December 31, 2012, according to Form 13G/A filed by BlackRock Inc. on February 4, 2013. |

| (9) | Includes 76,118 shares held in Thomas R. Schiff Foundation and 259,767 shares held in TRS Investments LLC., of which Mr. T. Schiff has voting and investment power. |

| (10) | Reflects ownership as of December 31, 2012, according to Form 13G/A filed by The Vanguard Group Inc. on February 7, 2013. |

| (11) | Includes 8,821 shares held in the Bahl Family Foundation, of which Mr. Bahl is president. |

| (12) | Includes 7,035 shares owned of record by Skidmore Sales Profit Sharing Plan, of which Mr. Skidmore is an administrator and shares investment authority. |

| (13) | Includes 186,257 shares owned of record by a limited partnership of which Mr. Webb is a general partner and 43,478 shares owned of record by an IRR marital trust for the benefit of his wife and children. |

| Page 9 |

Section 16(A) Beneficial Ownership Reporting Compliance

Directors, executive officers and 10 percent shareholders are required to report their beneficial ownership of our stock according to Section 16 of the Exchange Act. Those individuals are required by SEC regulations to furnish the company with copies of all Section 16(a) forms they file.

SEC regulations require us to identify in this proxy statement anyone who filed a required report late during the most recent calendar year. Based on our review of forms we received, or written representations from reporting persons stating that they were not required to file these forms, we believe that, during the calendar year 2012, all Section 16(a) filing requirements were satisfied on a timely basis except for the following:

Teresa Cracas acquired 2,205 shares from a nonqualified stock option on August 22, 2012. Of those shares, 1,947 were withheld to satisfy tax obligations and as part of a stock swap. A Form 4 was filed on August 27, 2012, reporting this transaction.Her spouse, a nonofficer associate of the company, was granted 75 stock options and 85 restricted stock units on February 17, 2012. A Form 4 was filed on September 25, 2012, reporting these transactions.

Dirk Debbink was appointed to the board of directors of Cincinnati Financial Corporation on November 16, 2012. A Form 3 was filed on November 29, 2012, reporting his holdings as of the date of his appointment.

John Kellington acquired 3,711 shares and 1,698 shares from two nonqualified stock options on November 20, 2012. A Form 4 was filed on November 26, 2012, reporting these transactions.

Due to the number of untimely filings for 2012, the company has reviewed and revised its policies and procedures. Changes have been made to ensure future filings will be timely and in compliance with Section 16(A) reporting requirements.

Information About the Board of Directors

The mission of the board is to encourage, facilitate and foster the long-term success of Cincinnati Financial Corporation. The board oversees management in the performance of the company’s obligations to our independent agents, policyholders, associates, communities and suppliers in a manner consistent with the company’s mission and with the board’s responsibility to shareholders to achieve the highest sustainable shareholder value over the long term.

Proposal 1 – Election of Directors

The board of directors currently consists of 15 directors. In 2010, shareholders voted to amend our Articles of Incorporation to declassify the structure of the board of directors. The transition to a fully declassified board is completed this year with all directors standing for election for one-year terms.

The board of directors recommends a vote FOR William F. Bahl, Gregory T. Bier, Linda W. Clement-Holmes, Dirk J. Debbink, Steven J. Johnston, Kenneth C. Lichtendahl, W. Rodney McMullen, Gretchen W. Price, John J. Schiff, Jr., Thomas R. Schiff, Douglas S. Skidmore, Kenneth W. Stecher, John F. Steele, Jr., Larry R. Webb and E. Anthony Woods as directors to hold office until the 2014 Annual Meeting of Shareholders and until their successors are elected and seated.

We do not know of any reason that any of the nominees for director would not accept the nomination, and it is intended that votes will be cast to elect all 15 nominees as directors. In the event, however, that any nominee should refuse or be unable to accept the nomination, the people acting under the proxies intend to vote for the election of such person or people as the board of directors may recommend.

| Page 10 |

Nominees for Director of Your Company

Each of our directors brings to our board extensive management and leadership experience gained through their service as executives and, in several cases, chief executive officers of diverse businesses. In these executive roles, they have taken hands-on, day-to-day responsibility for strategy and operations, including management of capital, risk and business cycles. In addition, most current directors bring public company board experience – either significant experience on other boards or long service on our board – that broadens their knowledge of board policies and processes, rules and regulations, issues and solutions. Further, each director has civic and community involvement that mirrors our company’s values emphasizing personal service and relationships and local decision making. The nominating committee’s process to recommend qualified director candidates is described on Page 20 under Director Nomination Considerations and Process.

Below are the names of the nominees for election to the office of director along with their ages, the year first elected as a director, their present positions, principal occupations and public company directorships held in the past five or more years. For each nominee, we also describe specific individual qualifications and skills of our directors that contribute to the overall effectiveness of our board and its committees.

Nominees for Director for Terms to Expire in 2014

(Data as of February 27, 2013)

William F. Bahl, CFA, CIC, age 61, has been a director of the company since 1995 and currently is our lead director and chairman of the nominating committee. He is a member of the audit, compensation, executive and investment committees. He is a director on our insurance subsidiary boards.

Mr. Bahl co-founded a firm that performs financial analysis of publicly held securities, advising and managing portfolios for high-net-worth individuals and institutional clients. His expertise helps support the board’s oversight of our investment operations, which continue to be our main source of profits. His familiarity with public company governance structures and policies beyond our own contributes to full discussion and evaluation of our options.

Mr. Bahl is chairman of the board of Bahl & Gaynor Investment Counsel Inc., an independent registered investment adviser based in Cincinnati. Before co-founding Bahl & Gaynor in 1990, he was senior vice president and chief investment officer at Northern Trust Company in Chicago and held prior positions for Fifth Third Bank and Mellon Bank. Mr. Bahl is a director of LCA-Vision Inc. since 2005, serving as chair of this publicly traded company’s compensation committee and a member of its audit and nominating committees. He was a trustee until 2006 of The Preferred Group of Funds and a board member from 2000 to 2006 of The Hennegan Company, a privately owned, Cincinnati-based printing business. Mr. Bahl earned a Master of Business Administration from the University of Michigan after graduating from the University of Florida. He has qualified for the Chartered Financial Analyst designation since 1979 and the Chartered Investment Counselor designation since 1991. His activities have included leadership and service on nonprofit community boards and foundations benefitting parks, schools, a hospital association and youth organizations.

Gregory T. Bier, CPA (Ret.), age 66, has been a director of the company since 2006 and currently is a member of the audit, compensation and investment committees. He is a director on our insurance subsidiary boards.

As a former lead partner for a respected independent registered public accounting firm, Mr. Bier brings to our board relevant experience with accounting and financial reporting issues, SEC filings, complex corporate transactions and mergers and acquisitions for public companies including Fifth Third Bancorp, The Procter & Gamble Company, The Midland Company, Cincinnati Financial Corporation and The E.W. Scripps Company.

| Page 11 |

Mr. Bier was the managing partner of the Cincinnati office of Deloitte & Touche LLP, an independent registered public accounting firm, from 1998 to 2002. He retired in 2002 after 23 years as a partner of the firm and 35 years of service, beginning in 1967 when he joined Haskins & Sells, which later became part of Deloitte. In 2008, he became a director of LifePoint Hospitals Inc., a public company with $3 billion of revenues that is a leading provider of healthcare services in nonurban communities in 19 states. He chairs LifePoint’s audit and compliance committee and is a member of its compensation, corporate governance and nominating, and quality committees. From 2002 to 2007, Mr. Bier was an audit committee member for Catholic Healthcare Partners, one of the largest not-for-profit health systems in the United States. A graduate of Xavier University, he became a CPA in 1970 and is a member with retired status of the American Institute of Certified Public Accountants and the Ohio Society of Certified Public Accountants. His activities have included leadership and service on nonprofit community boards and foundations benefitting several schools, social services and civic organizations.

Linda W. Clement-Holmes, age 50, has been a director of the company since 2010 and is a member of the audit committee.

Ms. Clement-Holmes ensures full leverage of emerging business technologies to support and speed The Procter & Gamble Company’s innovation and product supply efforts. Her aptitude and accomplishments in these areas help our board to effectively evaluate our business processes and technology initiatives, supporting alignment of those initiatives with our strategic goals.

Ms. Clement-Holmes is senior vice president, since 2010, of Global Business Services for the publicly traded The Procter & Gamble Company. She also served as chief diversity officer from 2010 to 2012. She was vice president of Global Business Services from 2007 to 2010, with responsibility from 2007 to 2009 for Central and Eastern Europe, Middle East and Africa and, in 2009, for External Strategic Alliances, Flow-to-the-Work Resources & Employee Solutions. From 2006 to 2007, she was manager, Global Business Services, Central and Eastern Europe, Middle East and Africa; and in 2005, manager of Information & Decision Solutions, Infrastructure Services & Governance. Prior management positions since 1983 included service in various business areas: IT Outsourcing Initiative, Global Engineering & Development and Communications, Knowledge & Innovation Center of Expertise, New Initiatives and E-commerce, Sales Management Systems, and Management Systems Operations and Development. Ms. Clement-Holmes holds a Bachelor of Science degree in industrial management and computer science from Purdue University. Her activities have included leadership and service with academic councils and nonprofit community boards supporting families and child care, educational and civic organizations, and professional organizations.

Dirk J. Debbink,age 57, returned as a director of the company in 2012 after a four-year recall to active duty with the U.S. Navy in Washington, D.C. He previously served as a director from 2004 to 2008. He is a member of the audit committee.

Mr. Debbink has served as chief executive officer and board member in private companies, nonprofit entities and government organizations ranging from small firms typical of the company’s commercial policyholders to extremely large organizations, including Reserve deputy commander of U.S. Pacific Fleet (170,000 sailors) and Commander, Navy Reserve Force (64,000 sailors). While on active duty with the U.S. Navy, he served as a senior member on the staff of the chief of naval operations in the Pentagon. He has extensive experience in strategic planning and execution, sales, marketing, information technology for a worldwide dispersed workforce, human resources including pension and profit-sharing plans and government relationships at the federal level. A founder of both private and public nonoperating foundations, he understands the benefits of a long-term perspective toward serving others.

Mr. Debbink is chairman since 2007 and chief executive officer since September 2012 of MSI General Corporation, a privately owned design/build construction firm. Mr. Debbink first joined MSI General in 1983, holding various positions of increasing leadership responsibility and serving as the company’s president from 1991 to 2007 and its chairman since 2007. From 2008 until September 2012, he served in active military duty as Vice Admiral, Chief of Navy Reserve and Commander,

| Page 12 |

Navy Reserve Force. Mr. Debbink earned a Bachelor of Science in systems engineering from the U.S. Naval Academy and a Masters of Business Administration from the University of Chicago. He holds Professional Engineer and Real Estate Broker licenses in the state of Wisconsin. Mr. Debbink has served the Oconomowoc, Wisconsin, area as a member of various community bank, hospital and other nonprofit boards.

Steven J. Johnston, FCAS, MAAA, CFA, CERA, age 53, has been a director since 2011. He is a member of the executive and investment committees. He is a director on all subsidiary boards.

As chief executive officer of the company, Mr. Johnston provides the board with information gained from hands-on management of our operations, identifying our near-term and long-term challenges and opportunities. His management and actuarial expertise and his experience driving technology and efficiency improvements combine with his strong communication skills to aid in his role as liaison between the board and the company management team.

Mr. Johnston has been chief executive officer of the company and all subsidiaries, and president of the company and its lead subsidiary, The Cincinnati Insurance Company, since 2011. From 2008 to 2011, he was chief financial officer, senior vice president and secretary for both the company and The Cincinnati Insurance Company, and treasurer of the company. Former chief financial officer of State Auto Insurance Company, he has more than 25 years of property casualty insurance experience, including a broad background in accounting, finance, actuarial, reinsurance, technology, investments and management of investor and ratings agency relationships. He also served as a director and chairman of the investment committee for State Automobile Mutual Insurance Company. A graduate of Otterbein University, he is a Fellow of the Casualty Actuarial Society, where he served as a member of the audit committee and chairman of the investment and enterprise risk committees. He is a member of the American Academy of Actuaries, a Chartered Financial Analyst and a Chartered Enterprise Risk Analyst.

Kenneth C. Lichtendahl, age 64, has been a director of the company since 1988, is chairman of the audit committee and serves on the nominating committee.

Mr. Lichtendahl has served for more than 20 years on our board and audit committee, supporting institutional continuity with company and industry knowledge accumulated through all phases of industry and economic cycles and through our expansion over that period. He brings valuable insights gained in developing customer relationships, ethical practices, high-quality staff and product differentiation that helped turn his company, Hudepohl-Schoenling Brewing Co., into the 10th largest brewer in the United States before its sale in 1996.

Mr. Lichtendahl is the director of development and sales for Heliosphere Designs, a private company marketing a solar timepiece. From 2010 to 2012, he served as a senior adviser for Nestle Waters of North America. He served as senior adviser after Tradewinds Beverage Company was acquired in 2010 by Sweet Leaf Tea, which was acquired in 2011 by Nestle Waters of North America. He was president and a director from 1996 to 2010 of Tradewinds, a privately owned, Cincinnati-based company formed following the sale of Hudepohl-Schoenling. He was president from 1978 to 1996 of Hudepohl-Schoenling, where he held various management positions. He also was a director for 12 years of Centennial Savings Bank in Cincinnati, which had grown to 11 offices and $700 million of deposits before its sale to National City Bank in 2000. A graduate of the University of Cincinnati, Mr. Lichtendahl has contributed his leadership and service on nonprofit community boards supporting youth and civic organizations, as well as land, water and wildlife preservation.

| Page 13 |

W. Rodney McMullen, age 52, has been a director of the company since 2001 and is chairman of the compensation committee and a member of the executive and investment committees. He is a director on our insurance subsidiary boards.

Mr. McMullen has worked with The Kroger Co.’s board on business strategy initiatives and transactions including business model transformation, mergers and acquisitions, divestitures and management transitions. His daily experience leading a large public company equips him to understand and guide management decisions and actions related to planning, risk management, investor relations, marketing and capital management.

Since 2009, Mr. McMullen has been president and chief operating officer of Kroger, a publicly traded, Cincinnati-based company that is the nation’s second largest retail grocery chain. He has been a director of Kroger since 2003, when he was promoted to vice chairman of the board. Prior to his appointment as vice chairman, Mr. McMullen was executive vice president of strategy, planning and finance from 2000 to 2003. He joined Kroger as a part-time store clerk in 1978 and has held key financial positions, including corporate controller and chief financial officer. He is a member since 2007 of the board of Global Standards 1, a privately owned company that owns UPC and RFID codes; and, beginning in 2010, chairman of GS1 US, a not-for-profit organization that develops supply-chain standards, solutions and services for 25 industries. He also is a director since 2011 of dunnhumby LTD, a privately owned, UK-based company that analyzes customer data to improve customer experience and a director since 2003 of dunnhumby USA LLC. He is chairman since 2012 of 1WorldSync, a nonprofit supporting retailers and consumer product manufacturers across the world. Mr. McMullen holds a Master of Science degree in accounting from the University of Kentucky, where he also completed his undergraduate degrees. His activities have included leadership and service on nonprofit community boards and committees that support a private university and independent living for the disabled and disadvantaged.

Gretchen W. Price, age 58, has been a director of the company since 2002 and is a member of our audit, compensation and nominating committees.

Ms. Price’s current and past executive positions have developed her expertise in areas of focus for our board, including accounting, auditing and financial reporting, investor relations, capital management, human resources, information technology, strategic planning and business planning. Board discussions and decisions benefit from her knowledge of customer relationship management and distribution chains.

Ms. Price is executive vice president, chief financial and administrative officer since 2011 of Arbonne International LLC, a beauty and nutritional product company headquartered in Irvine, California. She leads the firm’s financial, accounting, strategy and business planning, operations, information technology, human resources and international functions. She was executive vice president and chief financial officer from 2008 to 2011 of Philosophy Inc., an international prestige beauty brand based in Phoenix, Arizona. Prior to 2008, she held positions with expanding responsibility over her 31-year tenure at publicly traded The Procter & Gamble Company: vice president and general manager from 2006 to 2007, responsible for Go-To-Market Reinvention Strategy for Global Operations and for Gillette acquisition integration; vice president of finance and accounting for Global Operations from 2001 to 2005, responsible for Worldwide Financial Leadership; vice president and treasurer from 1998 to 2001, responsible for Global Treasury, investor relations and mergers and acquisitions; and vice president of Global Internal Audit from 1996 to 1998. In 2012, Ms. Price became a director and audit committee member for Beam Inc., a publicly traded, leading global premium spirits company. A graduate of the University of Kentucky, she earned the Certified Internal Auditor designation in 1996. She has been a member of the Financial Executives Institute and the Board of Governors of the Institute of Internal Auditors. Her activities have included leadership and service on nonprofit community boards and committees that provide funding for fine arts and music, human service programs and student scholarships.

| Page 14 |

John J. Schiff, Jr., CPCU, age 69, has been a director of the company since 1968. He is chairman of our executive committee and a member of our investment committee.

Mr. Schiff’s long tenure in our executive and board leadership strongly links us to the mission and values established by our founding agents. As our former chairman of the board, chief executive officer and a licensed insurance agent, he brings a blended perspective, assuring leadership and cultural continuity through agent-centered decisions that differentiate us from competitors. His insights gained from years of service on multiple public company boards help preserve our business model’s long-term approach to creating shareholder value.

Mr. Schiff has been chairman of the executive committee since 1998. From 1986 to 2011, Mr. Schiff also was chairman of the company’s board of directors and, except 2006 to 2008, chairman of its lead subsidiary, The Cincinnati Insurance Company. In addition, he was president and chief executive officer of the company and of its lead subsidiary from 1999 to 2006. He retained only the company-level chairman and chief executive officer roles from 2006 to 2008 when he resumed the subsidiary chairman title. From 1983 to 1996, Mr. Schiff was chairman, chief executive officer and an agent with John J. & Thomas R. Schiff & Co. Inc., a privately owned, Cincinnati-based independent insurance agency. Prior to 1983, he was an agent, vice president and secretary of John J. Schiff & Company Inc., which he joined in 1965 after earning a Bachelor of Science in risk and insurance management from The Ohio State University. He earned the Chartered Property Casualty Underwriter designation in 1972 and is a member of The American Institute for Chartered Property Casualty Underwriters, serving as a trustee from 1992 to 2004 and as an executive committee member. Mr. Schiff has experience as a director of publicly traded Cincinnati-based companies: Fifth Third Bancorp and The Fifth Third Bank since 1983, including periods of service on compensation, executive and trust committees; The Standard Register Company, a document management services company, since 1982, including periods of service on its audit and pension advisory committees; Cinergy Corporation, from 1994 to 2005 when it was acquired by Duke Energy Corporation; and Cinergy’s predecessor, Cincinnati Gas & Electric Company, from 1986 to 1995. He served at various times on Cinergy’s audit and compensation committees. Mr. Schiff also is a director of two privately owned companies, the Cincinnati Bengals Inc. and the independent insurance agency named above. His activities have included leadership and service to nonprofit community boards and foundations that support arts education, high school and university education, a hospital and general philanthropy.

Thomas R. Schiff, age 65, has been a director of the company since 1975 and is a member of our investment committee. He is a director on our insurance subsidiary boards.

Mr. Schiff’s long tenure on our board helps provide ongoing insight into how we are serving our primary customer, the independent insurance agent. He contributes to board assessments of the impacts of our decisions on agency operations, including sales, claims, professional advising and financial management. Additionally, he brings the perspective of a large shareholder to our board discussions and decisions.

Mr. Schiff has been chairman and chief executive officer since 1996 and a director and an agent with John J. & Thomas R. Schiff & Co. Inc., a privately owned, Cincinnati-based independent insurance agency. He was its president from 1983 to 1996 and sales manager from 1970 to 1983. He also is chief executive officer and chairman of Lightborne Properties and Lightborne Communications, privately owned media companies based in the Cincinnati area. Mr. Schiff is a graduate of Ohio University. His activities have included leadership and service to nonprofit community boards and foundations that support fine and performing arts, arts education, a hospital and children’s dental services.

| Page 15 |

Douglas S. Skidmore, age 50, has been a company director since 2004 and is a member of our audit and nominating committees.

Mr. Skidmore has been responsible in his executive roles for strategic direction, marketing, human resources and overall growth and performance of his second-generation family business, which shares many characteristics with our typical commercial policyholders. In addition to providing a policyholder view of our products and services, he has management experience that equips him to contribute to the board’s oversight of business processes and technology initiatives.

Mr. Skidmore has been chief executive officer since 2003 and president and director since 1994 of Skidmore Sales & Distributing Company Inc., a privately owned, Cincinnati-based full-service independent distributor and broker of quality industrial food ingredients. He was marketing manager from 1990 to 1994. Mr. Skidmore was an account marketing representative for IBM Corporation from 1987 to 1990, with early experiences at Intellitech Corporation and at The Procter & Gamble Company’s Food Process and Product Development Lab. He earned a Master of Business Administration degree in management and operations from the J.L. Kellogg School of Management at Northwestern University after graduating from Purdue University. He is a trustee since 2005 and a past president of the Food Ingredient Distributors Association. He is a member of the Institute of Food Technologists since 1990, with experience on its information systems committee.

Kenneth W. Stecher, age 66, has been a company director since 2008 and chairman of the board since 2011. He is chairman of the investment committee and a member of the executive committee. He is the chairman of all subsidiary boards.

Mr. Stecher facilitates and guides the business of the board, supporting its effectiveness by bringing his deep knowledge of the company as well as industry challenges and opportunities. Over his long tenure in management, he was our president and chief executive officer responsible for operations, our chief financial officer responsible for capital management, our face to the analyst and investor communities and our corporate secretary conversant in governance trends. In the course of his financial leadership, he developed business knowledge and relationships across our operations.

Mr. Stecher was the president and chief executive officer of the company and its lead subsidiary, The Cincinnati Insurance Company, from 2008 to 2011. For both companies, he was chief financial officer from 2001 to 2008 and executive vice president from 2006 to 2008. He also was chairman of the lead subsidiary from 2006 to 2008. He served as senior vice president for both companies until 2006, beginning in 1999 for the company and in 1997 for its lead subsidiary. He was secretary of both companies from 1999 to 2008, and treasurer for the company from 1999 to 2008. Mr. Stecher advanced through the ranks of the company’s life insurance subsidiaries from 1967 to 1982, when his responsibilities within the accounting area broadened to include property casualty insurance accounting. He is a trustee since 2009 of the American Institute for Chartered Property Casualty Underwriters, and past president of the Insurance Accounting & Systems Association, Southwestern Ohio Chapter. He earned a Master of Business Administration in finance from Xavier University after graduating from the University of Cincinnati with a Bachelor of Science degree in Accounting. His activities have included service and leadership on nonprofit community boards that support high school and college institutions.

John F. Steele, Jr., age 59, has been a company director since 2005 and is a member of our audit and executive committees. He is a director on our property casualty insurance subsidiary boards.

Mr. Steele has provided his firm with corporate oversight and strategic direction of all aspects of business ownership, operations and customer relationships. He brings to our board a policyholder perspective, including intimate knowledge of family-run corporations and the construction industry, which is the source of 34 percent of our commercial general liability insurance premiums.

| Page 16 |

Mr. Steele is chairman since 2004, chief executive officer since 1994 and a director since 1985 of Hilltop Basic Resources Inc., a privately owned, Cincinnati-based aggregates and ready mixed concrete supplier to the construction industry. He started his career at Hilltop in 1978 in sales and assumed responsibility for operations over time, becoming president in 1991 and holding that title until 2004. Prior to joining Hilltop, he was a sales executive for William Powell Company, a privately owned industrial valve manufacturer for which he has been a director since 2004. In 2012, Mr. Steele joined the board of advisers of Lykins Companies Inc., a privately owned full-service oil company. He was a director for privately owned Smook Bros. Inc., a Canadian construction company from 2006 to 2010. He has served on professional boards including the National Stone, Sand & Gravel Association, the Ohio Aggregates Association and the Ohio Ready Mixed Concrete Association. Mr. Steele has a Master of Business Administration from Xavier University and a Bachelor of Arts from Rollins College. His activities have included leadership and service on nonprofit boards for a youth mentoring organization, a university center for the study of family businesses and a community college.

Larry R. Webb, CPCU, age 57, has been a director of the company since 1979 and is a member of the executive committee. He is a director on our property casualty insurance subsidiary boards.

Mr. Webb brings to our board his insights as a principal owner of an independent insurance agency, with duties in financial management and accounting oversight, information technology, human resources, sales and marketing, risk management and relationship development with insurance companies and clients. His long tenure on our board and as a large shareholder, as well as his agency’s representation of our products and services since 1951, brings the board deep institutional knowledge, promoting continuity of the agent-centered mission and values essential to our business model. His agency does not advise the company on our insurance needs or sell insurance products or services to the company.

Mr. Webb has been president since 1994 and director since 1980 of Webb Insurance Agency Inc., a privately owned independent insurance agency based in Lima, Ohio. Prior to becoming president, he was treasurer of the agency from 1981 to 1994. He has been a licensed insurance agent since 1977. He is a director since 2010 of SWD Corporation, a privately owned wholesaler serving small business owners. A graduate of Ohio University, Mr. Webb earned the Chartered Property Casualty Underwriter designation in 1982 and served as president from 1987 to 1988 and director from 1986 to 1992 of the Grand Lake Chapter of CPCU. His activities have included leadership and service to nonprofit community boards that support business ethics, cancer research, an airport authority and cultural organizations.

E. Anthony Woods, age 72, has been a director of the company since 1998 and is a member of the compensation, executive and investment committees. He is a director on our insurance subsidiary boards.

Mr. Woods gained board and executive experience by leading high-growth organizations, enhancing his business development skills, financial acumen and sensitivity to shareholder expectations. His board and board committee service for multiple public and private companies in the healthcare and financial services sectors gives him a wide breadth of exposure to strategic, legal, investing, financing and operating issues and facilitates his contributions to oversight in these areas.

Mr. Woods is chairman and chief executive officer of his privately owned firm, SupportSource LLC, which offers management, financial and investment consulting. He has been chairman since 2003 of Deaconess Associations Inc., a Cincinnati-based, nonprofit healthcare services organization. From 1987 to 2003, he served as its president and chief executive officer, with prior experience from 1997 to 2003 as its chief financial officer. He has been chairman since 2006 and director since 2004 of LCA-Vision Inc., a publicly traded company, serving on its audit, compensation, governance and nominating committees. He has been a director since 2006 of Phoenix Health Systems, a privately owned information technology company serving hospitals and related organizations. He was a director from 2008 to 2012 and an audit committee member of Anchor Funding Services LLC, a

| Page 17 |

financial services company serving small businesses; and a director from 2008 until its sale in 2010 of Critical Homecare Solutions Inc., a privately owned company providing home health care services. Mr. Woods has Bachelor and Master of Science degrees in engineering from the University of Tennessee and a Master of Business Administration in marketing and finance from Samford University.

Committees of the Board and Meetings

There are five standing committees of the board: audit, compensation, executive, investment and nominating. Each committee operates pursuant to a written charter adopted by the board, copies of which are posted on our website atwww.cinfin.com/investors. Each year the board considers changes to the charters recommended by each committee, if any, and reapproves them.

The following table summarizes the current membership of the board and each of its committees, as well as the number of times the board and each committee met during 2012:

| Board | Audit | Compensation | Executive | Investment | Nominating | |||||||

| Mr. Bahl | X | X | X | X | X | Chair | ||||||

| Mr. Bier | X | X | X | X | ||||||||

| Ms. Clement-Holmes | X | X | ||||||||||

| Mr. Debbink | X | X | ||||||||||

| Mr. Johnston | X | X | X | |||||||||

| Mr. Lichtendahl | X | Chair | X | |||||||||

| Mr. McMullen | X | Chair | X | X | ||||||||

| Ms. Price | X | X | X | X | ||||||||

| Mr. J. Schiff, Jr. | X | Chair | X | |||||||||

| Mr. T. Schiff | X | X | ||||||||||

| Mr. Skidmore | X | X | X | |||||||||

| Mr. Stecher | Chair | X | Chair | |||||||||

| Mr. Steele, Jr. | X | X | X | |||||||||

| Mr. Webb | X | X | ||||||||||

| Mr. Woods | X | X | X | X | ||||||||

| Number of 2012 meetings | 4 | 4 | 5 | 4 | 6 | 4 |

Board members are encouraged to attend the Annual Meeting of Shareholders, all meetings of the board and the meetings of committees of which they are a member. In 2012, all directors attended 100 percent of the meetings indicated above for the board and committees of which they were members.

The annual meeting of directors is held immediately following the annual shareholders’ meeting at the same location. In April 2012, all of the company’s then 14 directors attended the Annual Meeting of Shareholders. The board of directors will review committee assignments at its meeting on April 27, 2013.

Audit Committee – The audit committee oversees the process of accounting and financial reporting, audits and financial statements of the company. The report of the audit committee begins on Page 23.

All of the members of the audit committee are believed to meet the Nasdaq criteria for independence and audit committee membership and the independence criteria of Section 10A-3 of the Exchange Act. Further, Mr. Bahl, Mr. Bier and Ms. Price qualify as financial experts according to the SEC definition and meet the standards established by Nasdaq for financial expertise.

| Page 18 |

Compensation Committee – The compensation committee discharges the responsibility of the board of directors relating to compensation of the company’s directors, its principal executive officers and its internal audit officer. The committee also administers the company’s stock- and performance-based compensation plans. The report of the compensation committee begins on Page 28.

All of the members of the compensation committee are believed to meet the Nasdaq criteria for independence, qualify as “nonemployee directors” for purposes of Rule 16b-3 of the Exchange Act and as “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986 (Section 162(m)).

Executive Committee – The executive committee exercises the powers of the board of directors in the management of the business and affairs of the company between meetings of the board of directors. Independence requirements do not apply to the executive committee.

Investment Committee – The investment committee provides oversight of the policies and procedures of the investment department of the company and its subsidiaries and reviews the invested assets of the company. The objective of the committee is to oversee the management of the portfolio to ensure the long-term security of the company. Independence requirements do not apply to the investment committee.

Nominating Committee – The nominating committee identifies, recruits and recommends qualified candidates for election as directors and officers of the company and as directors of its subsidiaries. The committee also nominates directors for committee membership. Further, the committee oversees compliance with the corporate governance policies for the company.

All of the members of the nominating committee are believed to meet the Nasdaq criteria for independence.

Governance of Your Company

Our primary governance policies and practices are set forth in our Corporate Governance Guidelines, Code of Ethics for Senior Financial Officers and Code of Conduct applicable to all associates of the company. The nominating committee reviews these documents annually, and occasionally recommends changes for the board’s consideration and approval. These guidelines and codes are available on our website atwww.cinfin.com/investors.

Certain of the board’s governance policies and practices are summarized below:

Code of Conduct – Our Code of Conduct applies to all of our associates, including our officers and directors. It establishes ethical standards for a variety of topics, including complying with laws and regulations, observing blackout periods for trading in the company’s securities, accepting and giving gifts, handling conflicts of interest, handling the company’s confidential information and personal data of consumers, and reporting illegal or unethical behavior.

Governance Hotline – Our audit committee oversees a governance hotline for the reporting of concerns about the company’s auditing, accounting and financial reporting activities. Callers can remain anonymous or identify themselves. The hotline is maintained by a third-party vendor. Transcripts of all calls are reported to the audit committee.

Board Leadership and Executive Sessions – The chairman of the board presides at all meetings of the board of directors. The chairman is appointed on an annual basis by at least a majority vote of the remaining directors. Currently, the offices of chairman of the board and chief executive officer are separated. The company has no fixed policy with respect to the separation of the offices of the chairman of the board and chief executive officer. The board believes that the separation of the offices of the chairman of the board and chief executive officer is part of the succession planning process and that it is in the best interests of the company to make this determination from time to time.

When the chairman of the board is not an independent director, the board appoints the chairman of the nominating committee as the board’s lead director. The company’s Corporate Governance Guidelines describe the authority and duties of the lead director. These include chairing the executive sessions of board meetings without management present, facilitating the communication between the independent directors and management on matters of interest and participating in the

| Page 19 |

preparation of meeting agendas and materials sent to directors. The independent directors meet in executive session, outside of the presence of management, at every regularly scheduled meeting of the board of directors. Our Corporate Governance Guidelines are available on our website atwww.cinfin.com/investors.

Stock Ownership Guidelines – Our directors and officers are subject to stock ownership guidelines that set targets for levels of ownership at a multiple of the officer’s salary or director’s meeting fees. Director and Officer Ownership Guidelines are available on our website atwww.cinfin.com/investors.

Risk Management – The board believes that oversight of our risk management efforts is the responsibility of the entire board. It views enterprise risk management as an integral part of our strategic planning process. The subject of risk management is a recurring agenda item for which the board receives a report at each regularly scheduled board meeting from the chief risk officer, including in-person reports twice each year. The chief risk officer has direct access to all members of the board of directors.

Additionally, the charters of certain of the board’s committees assign oversight responsibility for particular areas of risk. For example, our audit committee oversees management of risks related to accounting, auditing and financial reporting and maintaining effective internal controls for financial reporting. Our nominating committee oversees risk associated with our corporate governance guidelines and legal, regulatory and compliance risks. Our compensation committee oversees the risk related to our executive compensation plans and arrangements. Our investment committee oversees the risks related to managing our investment portfolio. All of these risks are discussed with the entire board in the ordinary course of the chairperson’s report of committee activities at regular board meetings.

Director Independence – Each year, based on all relevant facts and circumstances, the board determines which directors satisfy the criteria for independence. To be found independent, a director must not have a material relationship with the company, either directly or indirectly as a partner (other than a limited partner), controlling shareholder or executive officer of another organization that has a relationship with the company that could affect the director’s ability to exercise independent judgment.

Directors deemed independent are believed to satisfy the definitions of independence required by the rules and regulations of the SEC and the listing standards of Nasdaq. The board has determined that these directors and nominees meet the applicable criteria for independence as of February 1, 2013: William F. Bahl, Gregory T. Bier, Linda Clement-Holmes, Dirk J. Debbink, Kenneth C. Lichtendahl, W. Rodney McMullen, Gretchen W. Price, Douglas S. Skidmore, John F. Steele, Jr. and E. Anthony Woods.

Following the re-election of the directors included in this proxy, a majority (10) of the 15 directors would meet the applicable criteria for independence under Nasdaq listing standards.

Director Nomination Considerations and Process – The nominating committee considers many factors when determining the eligibility of candidates for nomination as director. The committee does not have a diversity policy; however, the committee’s goal is to nominate candidates from a broad range of experiences and backgrounds who can contribute to the board’s overall effectiveness in meeting its mission. The committee is charged with identifying nominees with certain characteristics:

| · | Demonstrated character and integrity |

| · | An ability to work with others |

| · | Sufficient time to devote to the affairs of the company |

| · | Willingness to enter into a long-term association with the company, in keeping with the company’s overall business strategy |

The nominating committee also considers the needs of the board in accounting and finance, business judgment, management, industry knowledge, leadership and such other areas as the board deems appropriate. The committee further considers factors included in the Corporate Governance Guidelines that might preclude nomination or re-nomination.

| Page 20 |

In particular, the nominating committee seeks to support our unique, agent-centered business model. The committee believes that the board should include a variety of individuals and should include independent insurance agents who bring a special knowledge of policyholders and agents in the communities where we do business.

Potential board nominees generally are identified by referral. The nominating committee follows a five-part process to evaluate nominees for director. The committee first performs initial screening that includes reviewing background information on the candidates, evaluating their qualifications against the criteria set forth in the company’s Corporate Governance Guidelines and, as the committee believes is appropriate, discussing the potential candidates with the individual or individuals making the referrals. Second, for candidates who qualify for additional consideration, the committee interviews the potential nominees as to their background, interests and potential commitment to the company and its operating philosophy. Third, the committee may seek references from sources identified by the candidates as well as sources known to the committee members. Fourth, the committee may ask other members of the board for their input. Finally, the committee develops a list of nominees who exhibit the characteristics desired of directors that satisfy the needs of the board.

The nominating committee will consider candidates recommended by shareholders. Shareholders wishing to propose a candidate for consideration may provide information about such a candidate in writing to the secretary of the company, giving the candidate’s name, biographical data and qualifications, and emphasizing the characteristics set forth in our Corporate Governance Guidelines available on our website atwww.cinfin.com/investors. Preferably, any such referral would contain sufficient information to enable the committee to preliminarily screen the referred candidate for the needs of the board, if any, in accounting and finance, business judgment, management, industry knowledge, leadership and the board’s independence requirements.

Since the 2012 annual shareholders’ meeting, no fees were paid to any third party to identify, evaluate or assist in identifying and evaluating potential nominees.

Communicating with the Board – Shareholders may direct a communication to board members by sending it to the attention of the corporate secretary of the company, Cincinnati Financial Corporation, P.O. Box 145496, Cincinnati, Ohio, 45250-5496. The company and board of directors have not established a formal process for determining whether all shareholder communication received by the corporate secretary will be forwarded to directors. Nonetheless, the board welcomes shareholder communication and has instructed the corporate secretary of the company to use reasonable criteria to determine whether correspondence should be forwarded. The board believes that correspondence has been and will continue to be forwarded appropriately. However, exceptions may occur, and the board does not intend to provide management with instructions that limit its ability to make reasonable business decisions. Examples of exceptions would be routine items such as requests for publicly available information that can be provided by company associates; vendor solicitations that appear to be mass-directed to board members of a number of companies; or correspondence that raises issues related to specific company transactions (insurance policies or claims) where there may be privacy concerns or other issues.

In some circumstances, the board anticipates that management would provide the board or board members with summary information regarding correspondence.

Certain Relationships and Transactions

The audit committee follows a written policy for review and approval of transactions involving the company and related persons, defined as directors and executive officers or their immediate family members, or shareholders owning 5 percent or greater of our outstanding stock. The policy covers any related-party transaction that meets the minimum threshold for disclosure in the proxy statement under the relevant SEC rules, generally transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest.

| Page 21 |

As it examines individual transactions for approval, the committee considers:

| · | Whether the transaction creates a conflict of interest or would violate the company’s Code of Conduct |

| · | Whether the transaction would impair the independence of a director |

| · | Whether the transaction would be fair |

| · | Any other factor the committee deems appropriate |