Exhibit 99.3

Dynamix Corporation Dynamix Corporation November 2024

Dynamix Corporation 2 Disclaimer This information is being presented to a limited number of parties who may be interested in receiving information regarding D yna mix Corporation (the “Company”). This presentation is being made for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any securities of the Company in any jurisdiction where the offer o r s ale is not permitted. Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its co nte nts, without the prior written consent of the Company is prohibited. By accepting this presentation solely for use during our meeting, eac h r ecipient agrees: (i) to maintain the confidentiality of all information that is contained in this presentation and not alread y i n the public domain, and (ii) to use this presentation for the sole purpose of evaluating the Company. This presentation does not purport to contain all of the information that may be required to evaluate a possible investment. Thi s presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by the Company or any of its affiliates, directors, officers, employees or advisors or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available t o a ny party in the course of its evaluation of a possible investment, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. Acc ordingly, none of the Company or any of its affiliates, directors, officers, employees or advisors or any other person shall be liable for any direct, indirect or consequential loss or damages suffered by any person as a result of relying on any stateme nt in or omission from this presentation and any such liability is expressly disclaimed. Certain statements in this presentation may constitute “forward looking statements” for purposes of the federal securities la ws. The Company’s forward looking statements include, but are not limited to, statements regarding its or its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projec tio ns, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “pl an,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward looking st ate ments, but the absence of these words does not mean that a statement is not forward looking. Forward looking statements in this pres ent ation may include, for example, statements about: the Company’s ability to select an appropriate target business or businesses; the Company’s ability to complete its initial business combination; the Company’s expectations around the potential opportunities in energy and power industries, and the performance of a prospe cti ve target business or businesses; the Company’s pool of prospective target businesses; the Company’s management’s ability to leverage its experience and investor relationships to generate a number of potential bu sin ess combination opportunities; the use of proceeds not held in the trust account or available to the Company from interest income on the trust account balan ce; or the Company’s financial performance following its initial public offering. The forward looking statements contained in this presentation are based on the Company’s current expectations and beliefs con cer ning future developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will be those that the Company has anticipated. These forward looking statements involve a nu mber of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward looking statements. Sh ould one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary in material respects from those contemplated or anticipated by these forward looking statements. The Com pany cautions you therefore against relying on these forward looking statements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward looking statements. The Company undertak es no obligation to update or revise any forward looking statements contained herein, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. A registration statement on Form S - 1 (File No. 333 - 280719) relating to these securities has been filed with the Securities and E xchange Commission (the “SEC”) and has become effective. The information in this presentation may not be complete and may be changed at any time. Before you invest, you should read the final prospectus in the registration statement and other d ocu ments the Company has filed with the SEC for more complete information about the Company and this offering. Copies of the final prospectus related to the offering may be obtained for free by vising the SEC website at www.sec.gov. Alternatively , c opies of the final prospectus related to the offering may be requested from Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC at bsun@cohencm.com and Seaport Global Securities LLC, 360 Madison Avenue, 22nd Floor, New York, NY 10017, Attention: Prospectus SPAC Department, Email: SPACCapitalMarkets@seaportglobal.com. The Company is an “emerging growth company” within the meaning of the Jumpstart Our Business Startups Act of 2012. As a resul t, the Company will be subject to reduced public company reporting requirements. This presentation is made pursuant to Section 105 of the Jumpstart Our Business Startups Act of 2012 and Section 5 of the Securities Act of 1933 as amended (the “S ecu rities Act”), and is intended solely for investors that are either “qualified institutional buyers” or institutions that are “accredited investors” (as such terms are defined under SEC rules), solely for the purposes of familiarizing such investors w ith the Company and determining whether such investors might have an interest in a securities offering contemplated by the Company.

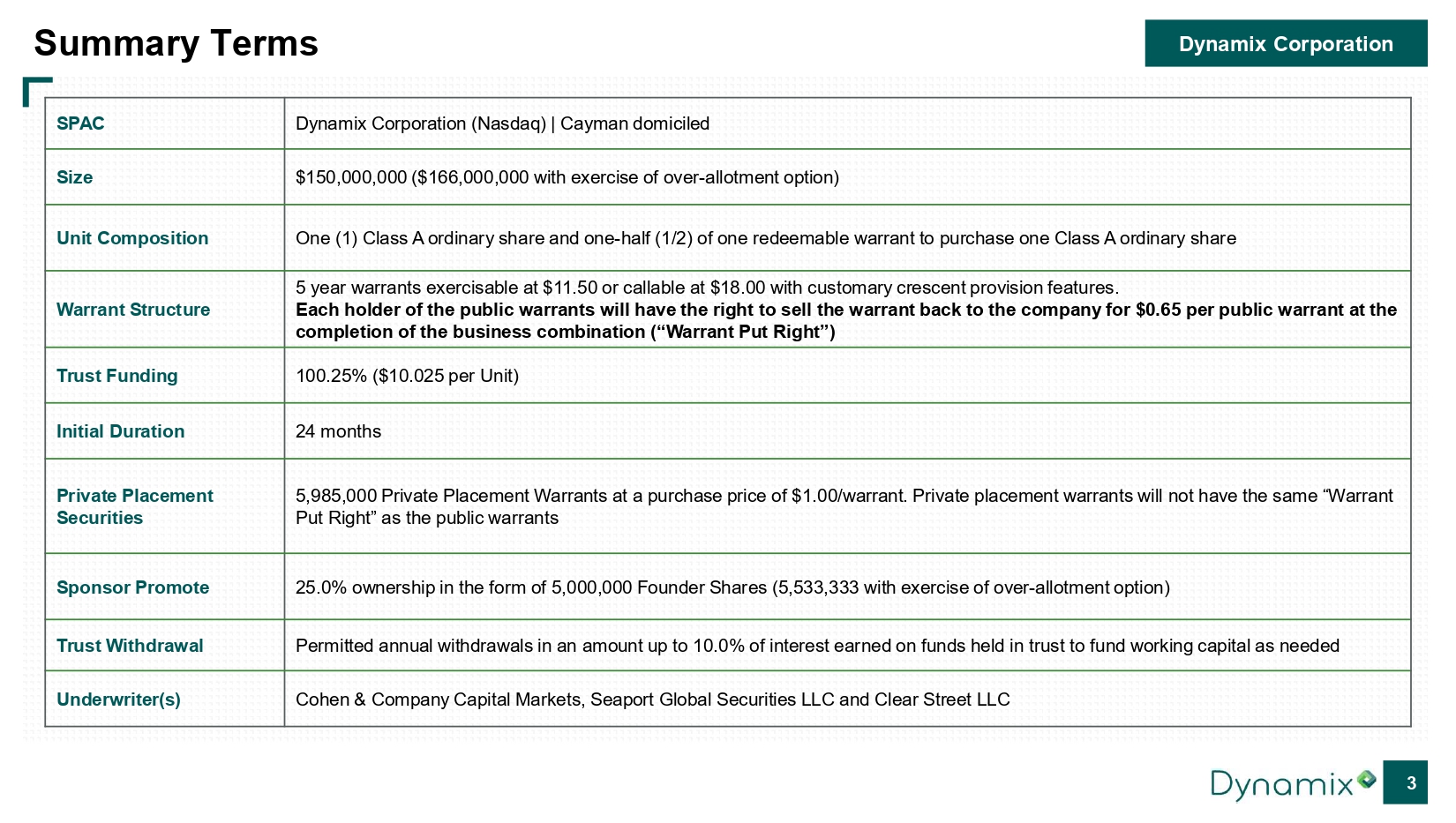

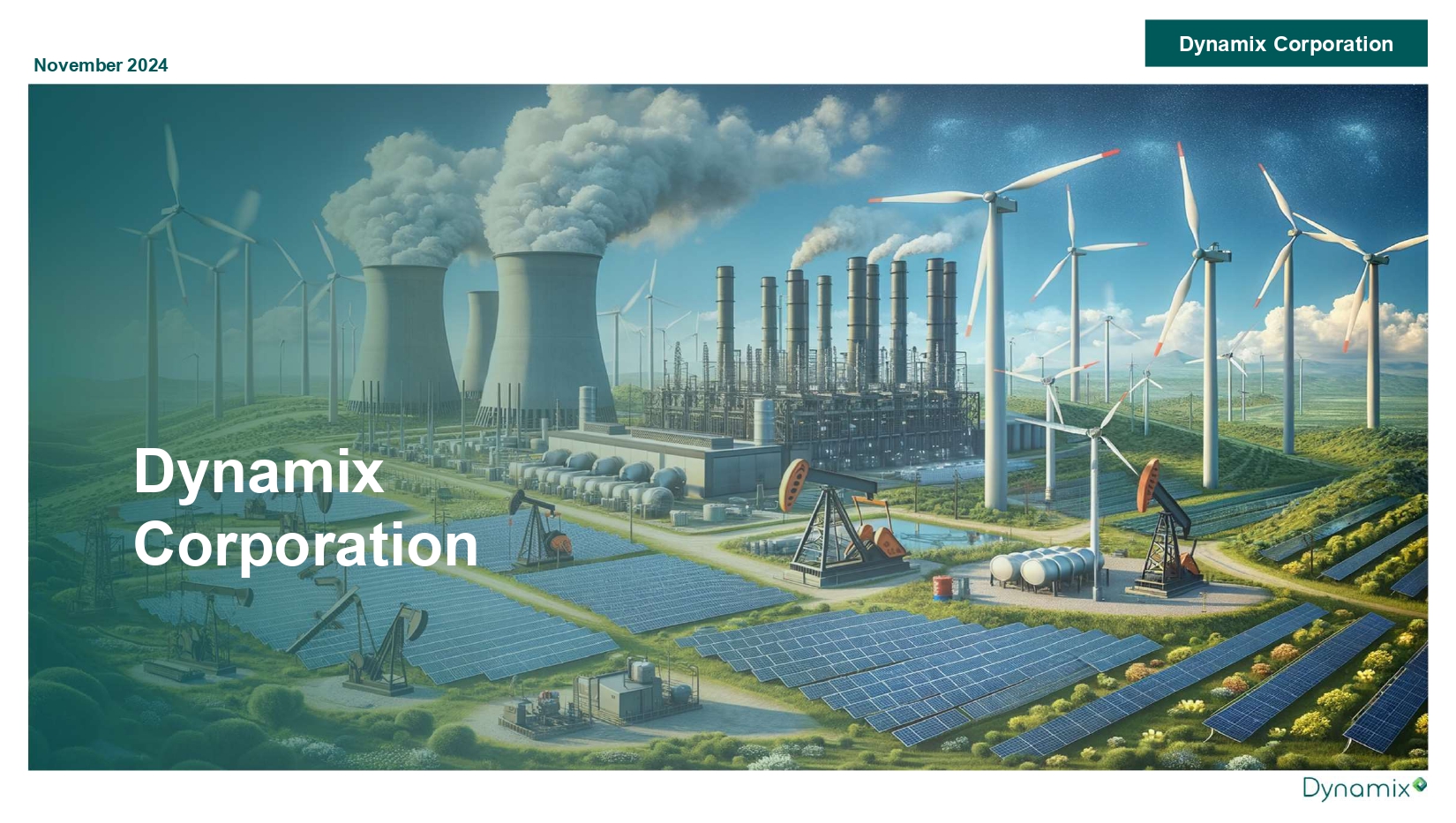

Dynamix Corporation 3 Summary Terms Dynamix Corporation (Nasdaq) | Cayman domiciled SPAC $150,000,000 ($166,000,000 with exercise of over - allotment option) Size One (1) Class A ordinary share and one - half (1/2) of one redeemable warrant to purchase one Class A ordinary share Unit Composition 5 year warrants exercisable at $11.50 or callable at $18.00 with customary crescent provision features. Each holder of the public warrants will have the right to sell the warrant back to the company for $0.65 per public warrant a t t he completion of the business combination (“Warrant Put Right”) Warrant Structure 100.25% ($10.025 per Unit) Trust Funding 24 months Initial Duration 5,985,000 Private Placement Warrants at a purchase price of $1.00/warrant. Private placement warrants will not have the same “Wa rrant Put Right” as the public warrants Private Placement Securities 25.0% ownership in the form of 5,000,000 Founder Shares (5,533,333 with exercise of over - allotment option) Sponsor Promote Permitted annual withdrawals in an amount up to 10.0% of interest earned on funds held in trust to fund working capital as ne ede d Trust Withdrawal Cohen & Company Capital Markets, Seaport Global Securities LLC and Clear Street LLC Underwriter(s)

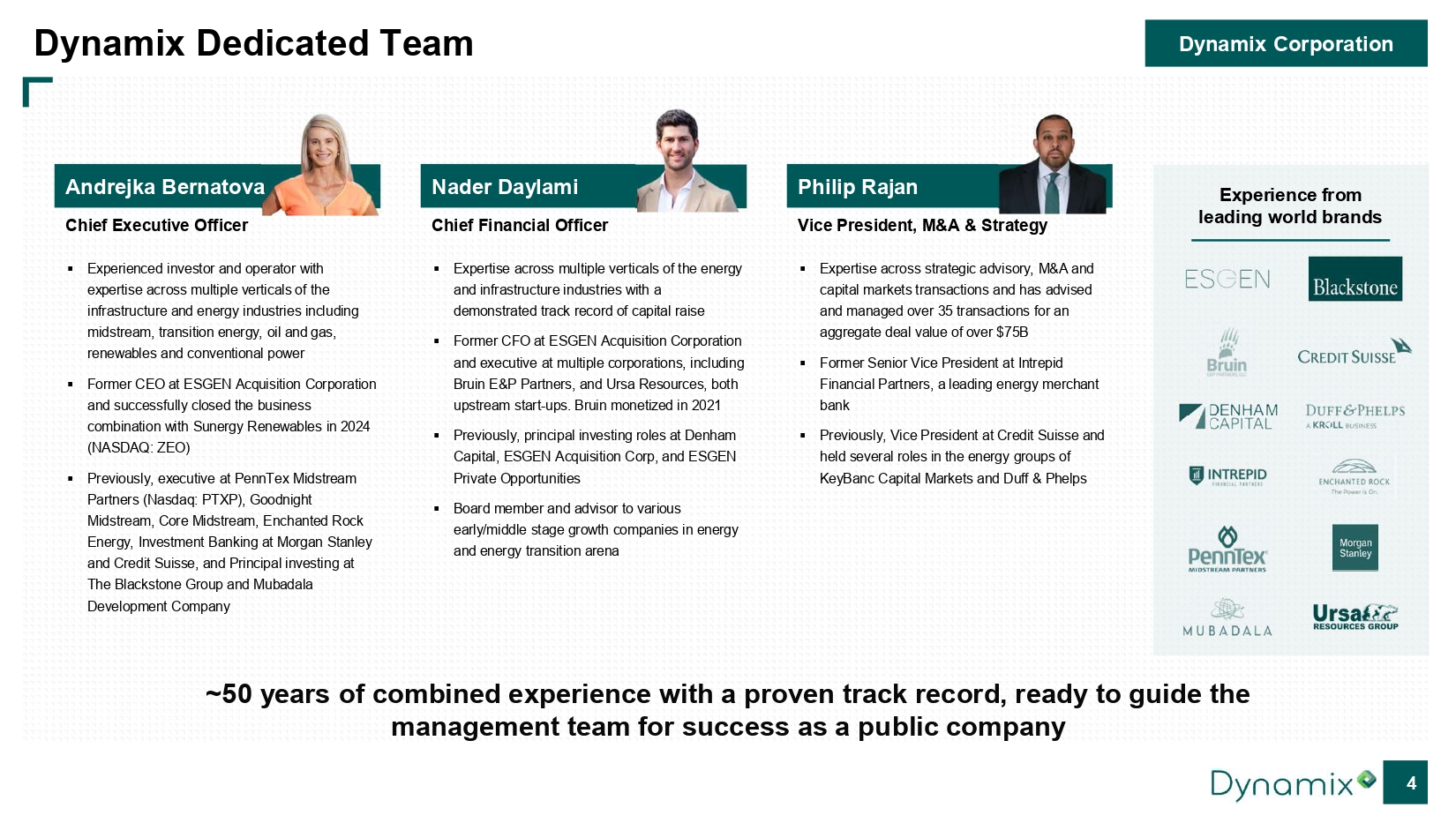

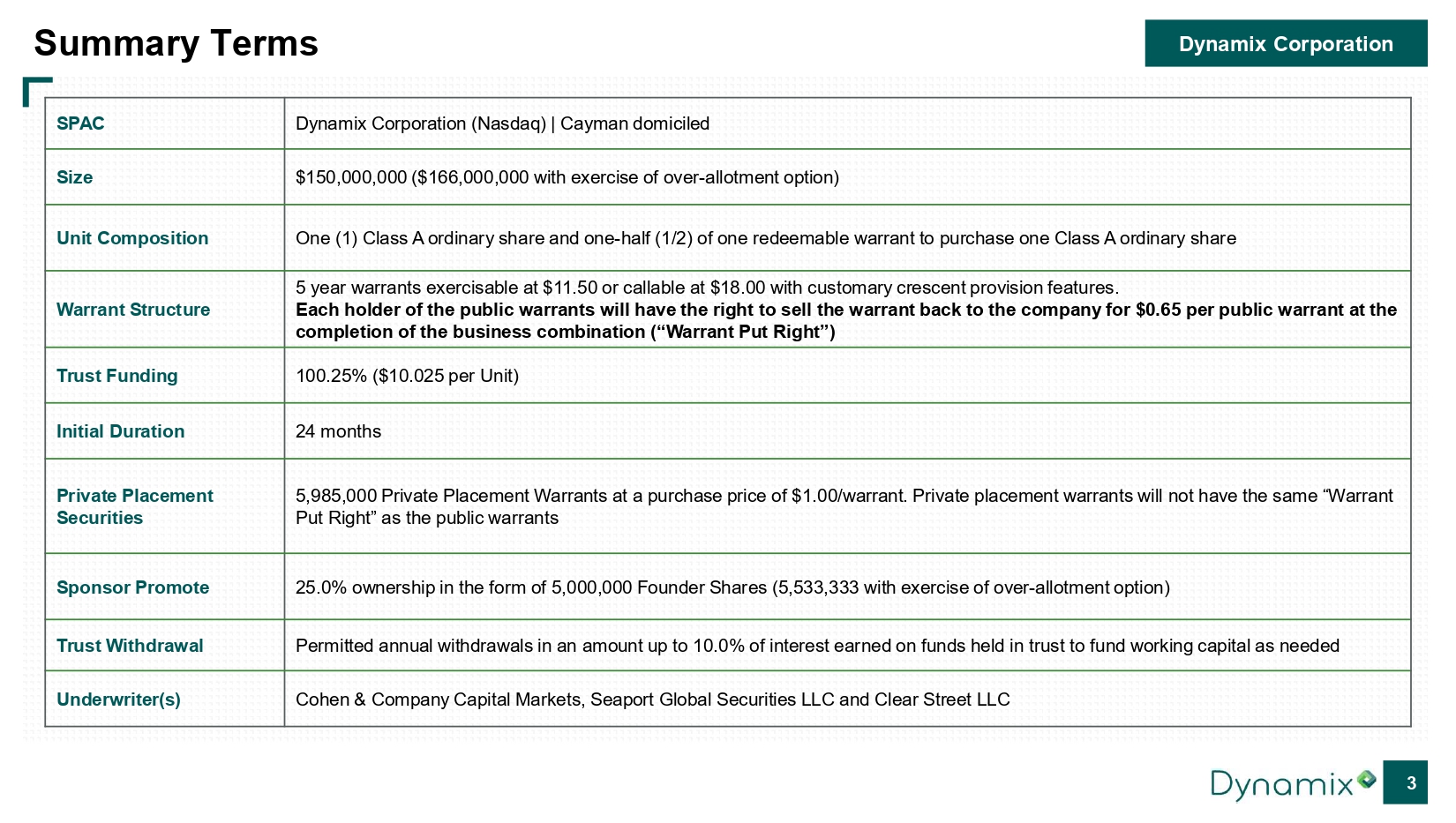

Dynamix Corporation Andrejka Bernatova 4 Dynamix Dedicated Team Nader Daylami ▪ Experienced investor and operator with expertise across multiple verticals of the infrastructure and energy industries including midstream, transition energy, oil and gas, renewables and conventional power ▪ Former CEO at ESGEN Acquisition Corporation and successfully closed the business combination with Sunergy Renewables in 2024 (NASDAQ: ZEO) ▪ Previously, executive at PennTex Midstream Partners (Nasdaq: PTXP), Goodnight Midstream, Core Midstream, Enchanted Rock Energy, Investment Banking at Morgan Stanley and Credit Suisse, and Principal investing at The Blackstone Group and Mubadala Development Company ▪ Expertise across multiple verticals of the energy and infrastructure industries with a demonstrated track record of capital raise ▪ Former CFO at ESGEN Acquisition Corporation and executive at multiple corporations, including Bruin E&P Partners, and Ursa Resources, both upstream start - ups. Bruin monetized in 2021 ▪ Previously, principal investing roles at Denham Capital, ESGEN Acquisition Corp, and ESGEN Private Opportunities ▪ Board member and advisor to various early/middle stage growth companies in energy and energy transition arena Experience from leading world brands ~50 years of combined experience with a proven track record, ready to guide the management team for success as a public company Chief Executive Officer Chief Financial Officer Philip Rajan Vice President, M&A & Strategy ▪ Expertise across strategic advisory, M&A and capital markets transactions and has advised and managed over 35 transactions for an aggregate deal value of over $75B ▪ Former Senior Vice President at Intrepid Financial Partners, a leading energy merchant bank ▪ Previously, Vice President at Credit Suisse and held several roles in the energy groups of KeyBanc Capital Markets and Duff & Phelps

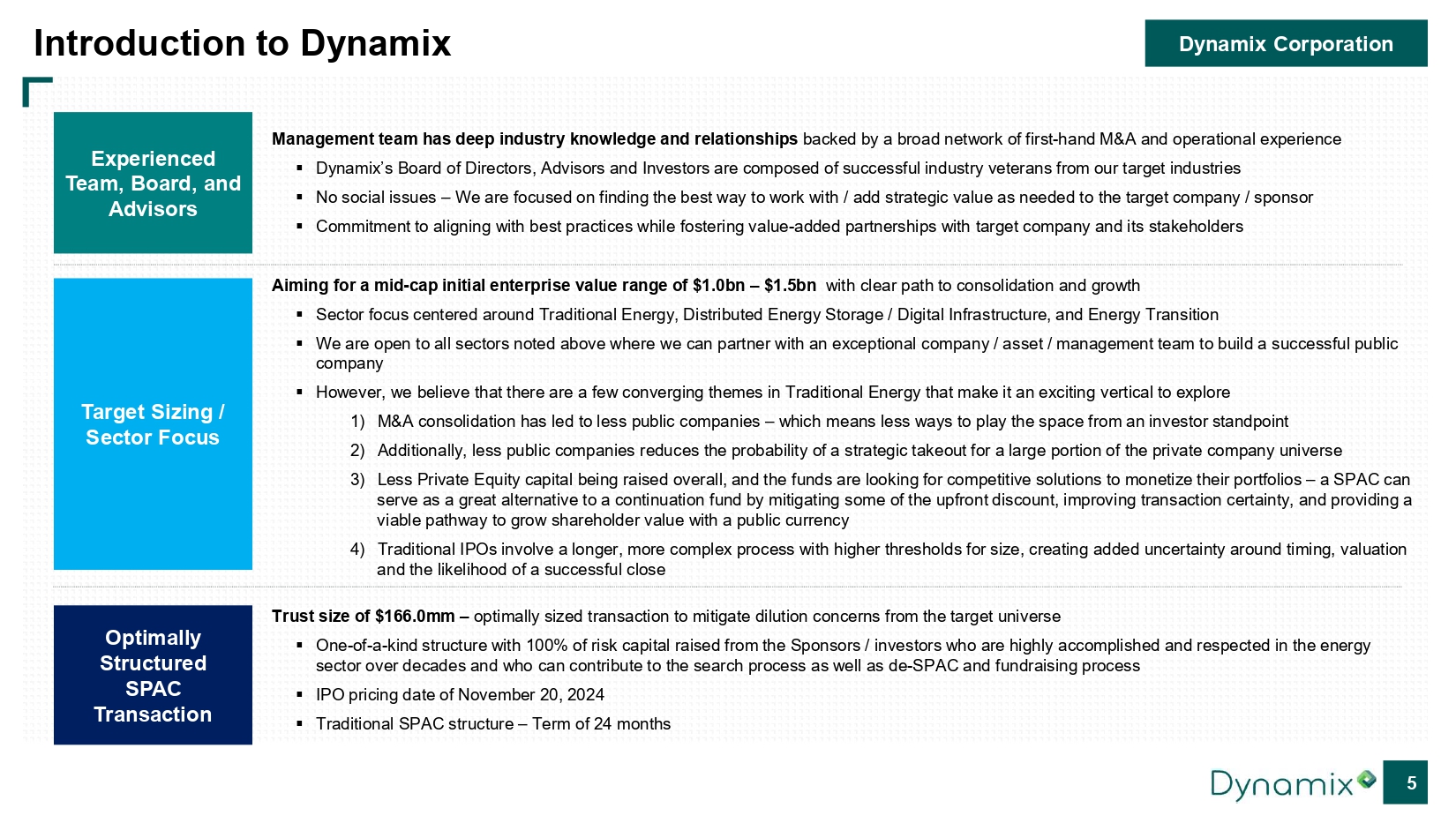

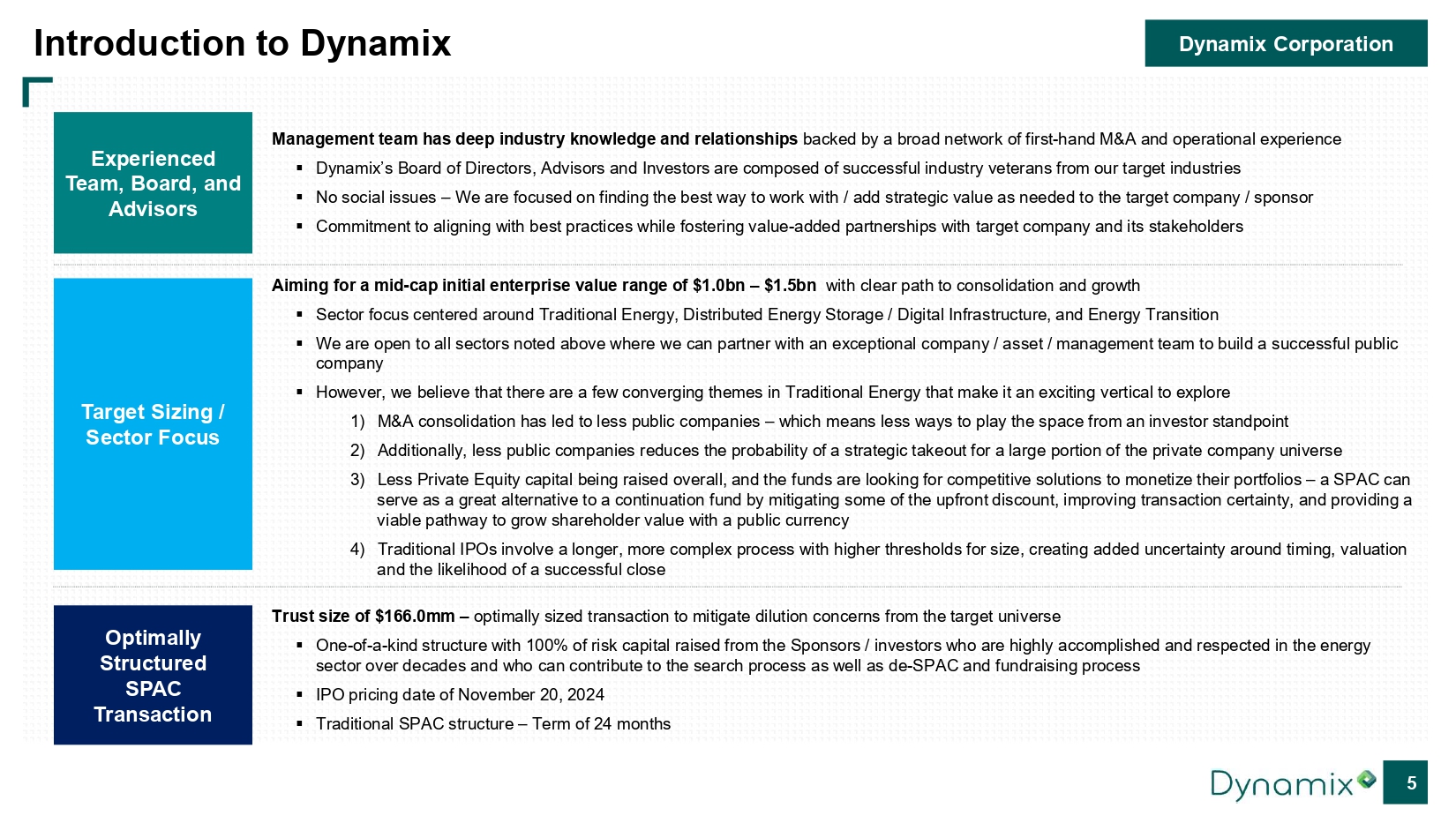

Dynamix Corporation 5 Introduction to Dynamix Management team has deep industry knowledge and relationships backed by a broad network of first - hand M&A and operational experience ▪ Dynamix’s Board of Directors , Advisors and Investors are composed of successful industry veterans from our target industries ▪ No social issues – We are focused on finding the best way to work with / add strategic value as needed to the target company / sponsor ▪ Commitment to aligning with best practices while fostering value - added partnerships with target company and its stakeholders Aiming for a mid - cap initial enterprise value range of $ 1.0bn – $1.5bn with clear path to consolidation and growth ▪ Sector focus centered around Traditional Energy, Distributed Energy Storage / Digital Infrastructure, and Energy Transition ▪ We are open to all sectors noted above where we can partner with an exceptional company / asset / management team to build a successful public company ▪ However, we believe that there are a few converging themes in Traditional Energy that make it an exciting vertical to explore 1) M& A consolidation has led to less public companies – which means less ways to play the space from an investor standpoint 2) Additionally, less public companies reduces the probability of a strategic takeout for a large portion of the private company un iverse 3) Less Private Equity capital being raised overall, and the funds are looking for competitive solutions to monetize their portf oli os – a SPAC can serve as a great alternative to a continuation fund by mitigating some of the upfront discount, improving transaction certain ty, and providing a viable pathway to grow shareholder value with a public currency 4) Traditional IPOs involve a longer, more complex process with higher thresholds for size, creating added uncertainty around ti min g, valuation and the likelihood of a successful close Target Sizing / Sector Focus Experienced Team, Board, and Advisors Trust size of $166.0mm – optimally sized transaction to mitigate dilution concerns from the tar get universe ▪ One - of - a - kind structure with 100% of risk capital raised from the Sponsors / investors who are highly accomplished and respected in the energy sector over decades and who can contribute to the search process as well as de - SPAC and fundraising process ▪ IPO pricing date of November 20, 2024 ▪ Traditional SPAC structure – Term of 24 months Optimally Structured SPAC Transaction

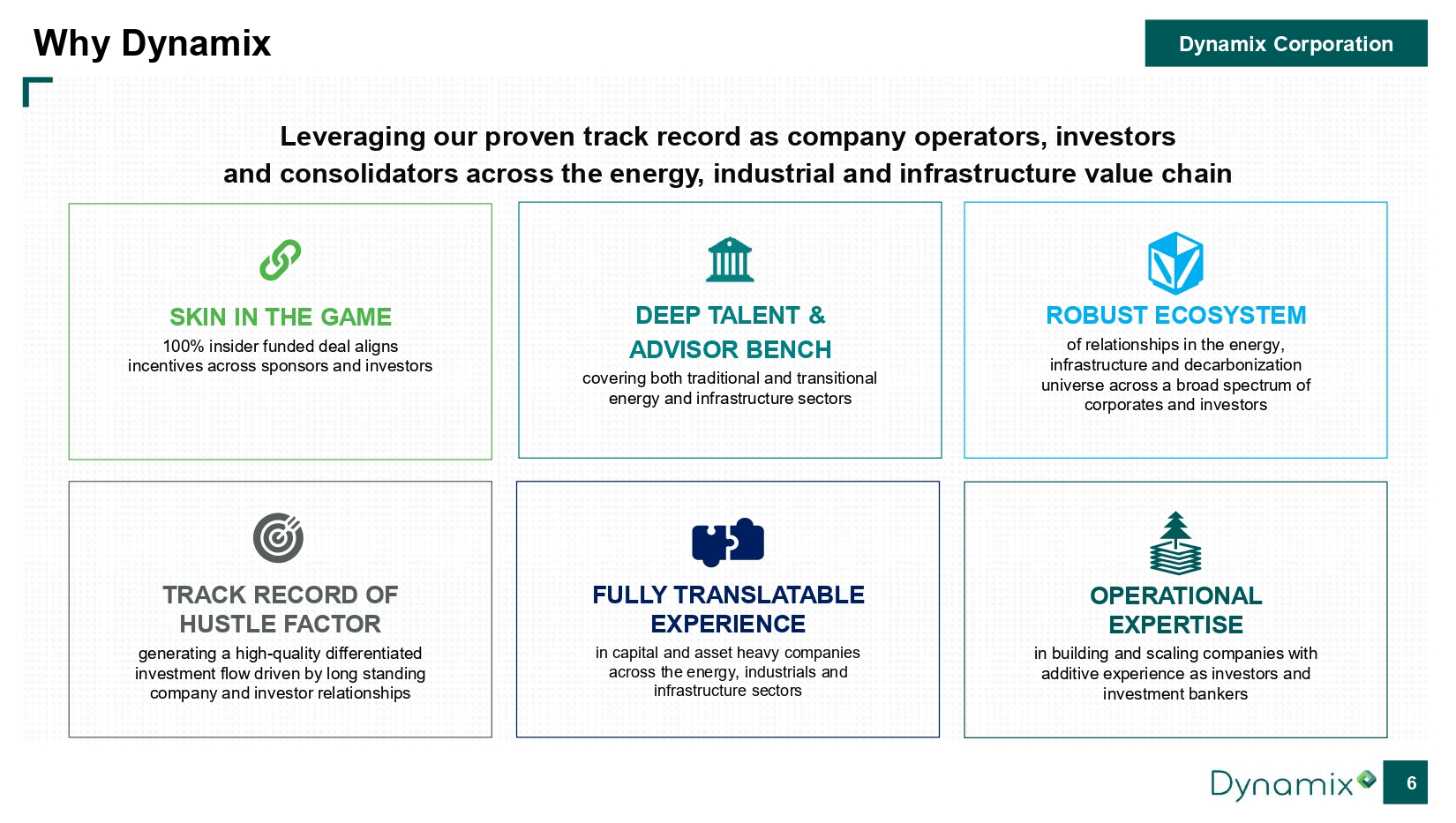

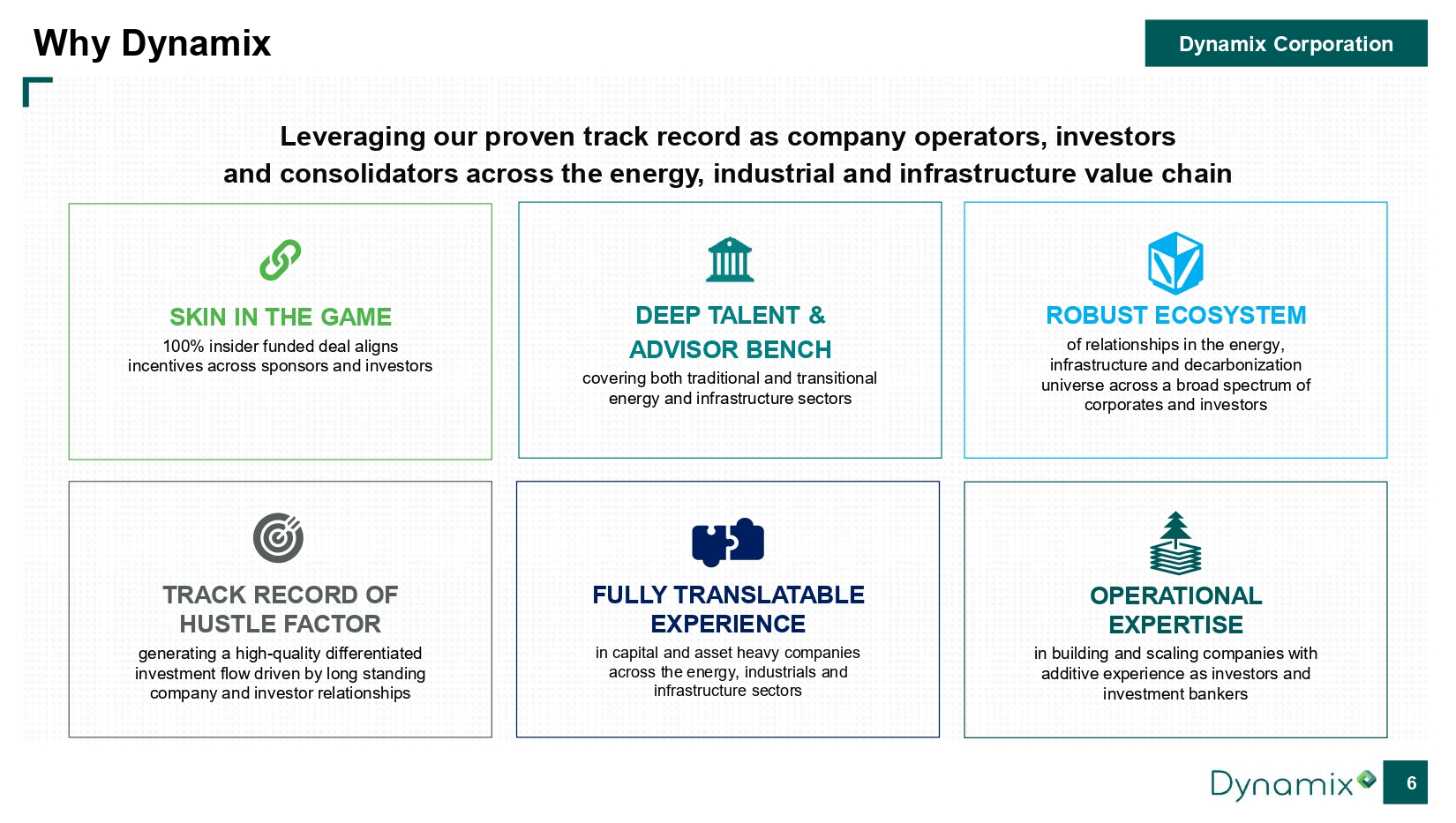

Dynamix Corporation 6 Why Dynamix Leveraging our proven track record as company operators, investors and consolidators across the energy, industrial and infrastructure value chain OPERATIONAL EXPERTISE in building and scaling companies with additive experience as investors and investment bankers TRACK RECORD OF HUSTLE FACTOR generating a high - quality differentiated investment flow driven by long standing company and investor relationships FULLY TRANSLATABLE EXPERIENCE in capital and asset heavy companies across the energy, industrials and infrastructure sectors DEEP TALENT & ADVISOR BENCH covering both traditional and transitional energy and infrastructure sectors ROBUST ECOSYSTEM of relationships in the energy, infrastructure and decarbonization universe across a broad spectrum of corporates and investors SKIN IN THE GAME 100% insider funded deal aligns incentives across sponsors and investors

Dynamix Corporation 7 Backed by an Experienced and Successful Board of Directors and Advisors Board of Directors Advisors Diaco Aviki ▪ Previously, Chief Operating Officer at Crestwood (sold to Energy Transfer for ~$7.1B). Former Director at Piñon Midstream (sold to Enterprise Product Partners for $950mm) ▪ Previously, President of various midstream assets at BHP and various domestic and international positions at ExxonMobil Tyler Crabtree ▪ CEO of CarbonPath ▪ Previously, launched and sold Bruin, a North American focused, CFO of Ursa Resources Group II, LLC, and investor at Denham Capital Lynn A. Peterson ▪ Previously, Executive Chairman of the Board at Chord Energy Corp. (NYSE: CHRD) and President and CEO of Whiting Petroleum Corp. (NYSE: WLL) until its merger with Oasis Petroleum ▪ Previously CEO at Kodiak Oil & Gas Corporation and SRC Energy, and Board Member of Denbury Inc. (NYSE: DEN) Peter Gross ▪ Presently the Managing Partner of PMG Associates, Inc., Board of Director Chairman of Cato and Board of Director member of Chilldyne , Inc. ▪ Previously, Mission Critical Systems group at Bloom Energy and was Managing Partner for HP Consulting Services PMG Associates, Inc. Jimmy Henderson ▪ Currently, Chief Financial Officer of Vitesse Energy Inc. ▪ Previously, Executive Vice President Finance and CFO of Whiting Petroleum Corp. (NYSE: WLL) and SRC Energy Inc. Tommy Stone ▪ Previously, Chief Operating Officer & Chief Administrative Officer of Midcoast Energy, LLC and Senior Vice President of PennTex Midstream Partners, LP, Energy Transfer Partners LP and Southern Union Company Steven A. Webster ▪ Managing Partner at AEC Partners. Co - founded Avista Capital Partners. Previously CEO of R&B Falcon Corporation ▪ Currently serving as a Director for Oceaneering (NYSE: OII), and Trust Manager at Camden Property Trust (NYSE: CPT). Previously, Board Member of Callon Petroleum (sold to APA Corp. for ~$4.5B) Joe C. Gatto ▪ Recently, President and CEO of Callon Petroleum (sold to APA Corp. for ~$4.5B) ▪ Former energy Managing Director of Merrill Lynch & Co. and Barclays Capital Ralph Alexander ▪ Currently Interim Chairman of the Board of Enviva Inc and Director at NetPower (NASDAQ: NPWR). Former CEO and Director at Talen Energy (NASDAQ: TLN). Former Director at El Paso Corporation ▪ Former CEO of Innovene , CEO at BP Gas, Power and Renewables, Affiliated with Riverstone Holdings from 2007 - 2016.

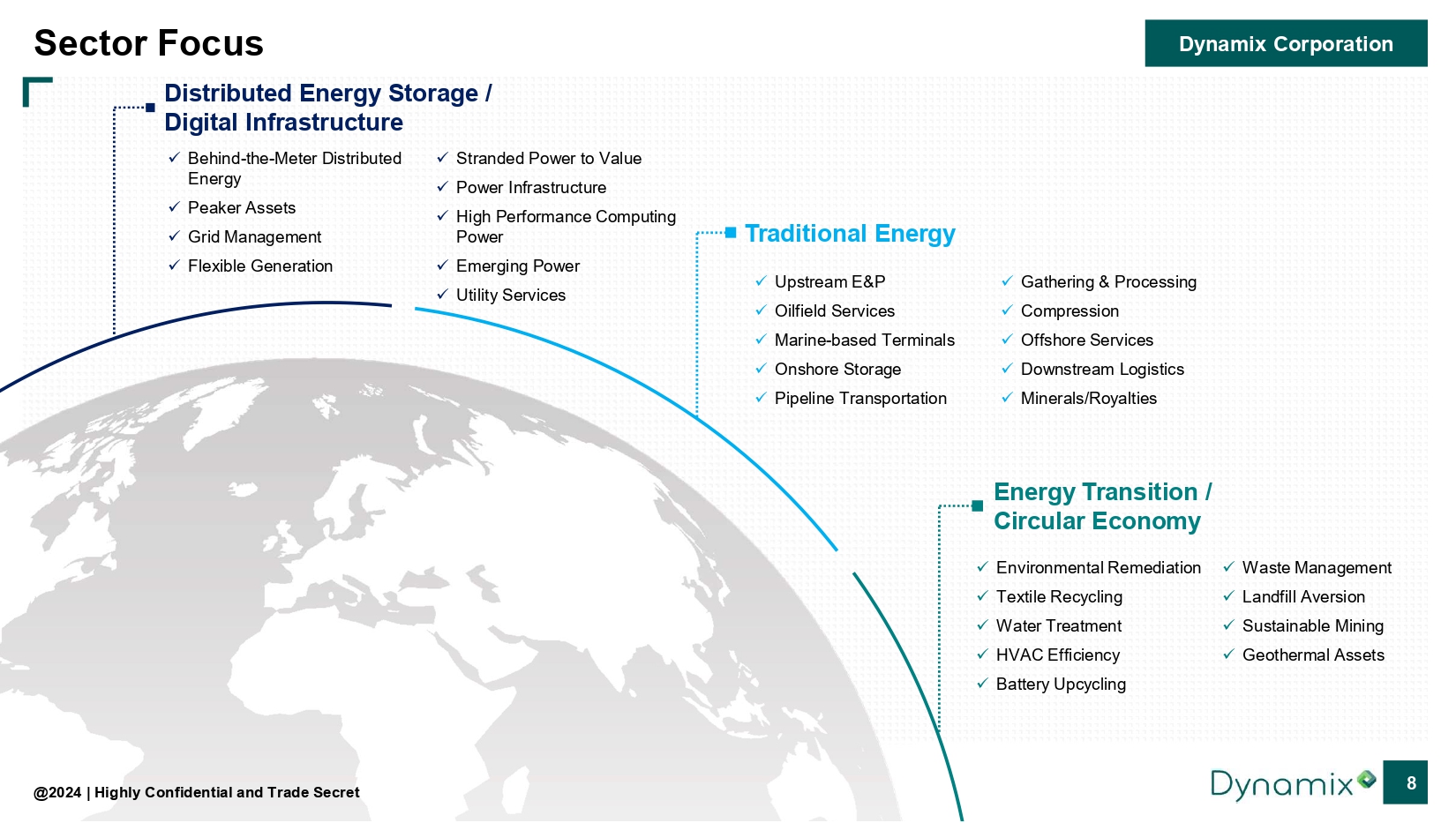

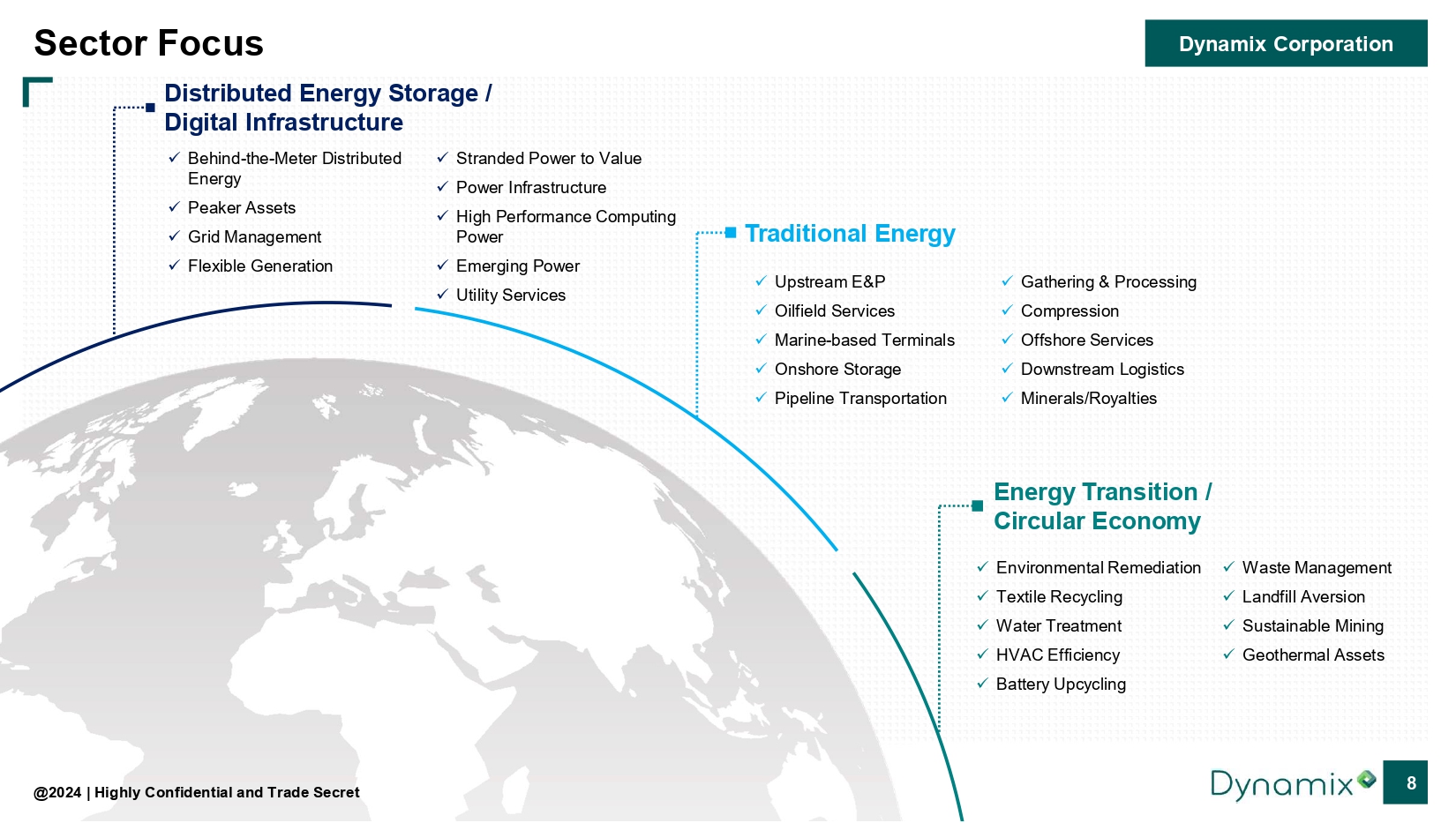

Dynamix Corporation @2024 | Highly Confidential and Trade Secret 8 Sector Focus Distributed Energy Storage / Digital Infrastructure Traditional Energy Energy Transition / Circular Economy x Behind - the - Meter Distributed Energy x Peaker Assets x Grid Management x Flexible Generation x Stranded Power to Value x Power Infrastructure x High Performance Computing Power x Emerging Power x Utility Services x Upstream E&P x Oilfield Services x Marine - based Terminals x Onshore Storage x Pipeline Transportation x Gathering & Processing x Compression x Offshore Services x Downstream Logistics x Minerals/Royalties x Environmental Remediation x Textile Recycling x Water Treatment x HVAC Efficiency x Battery Upcycling x Waste Management x Landfill Aversion x Sustainable Mining x Geothermal Assets

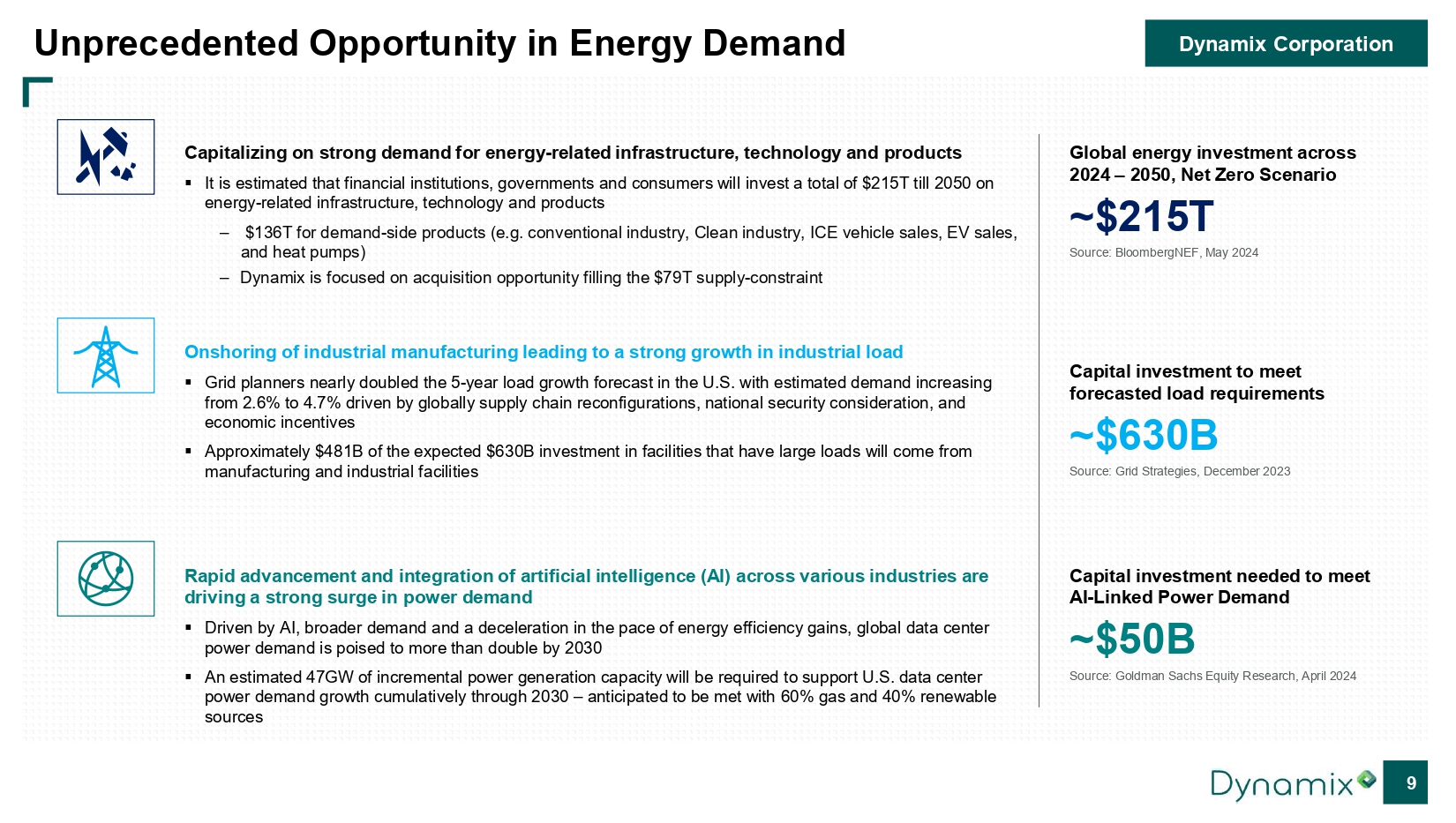

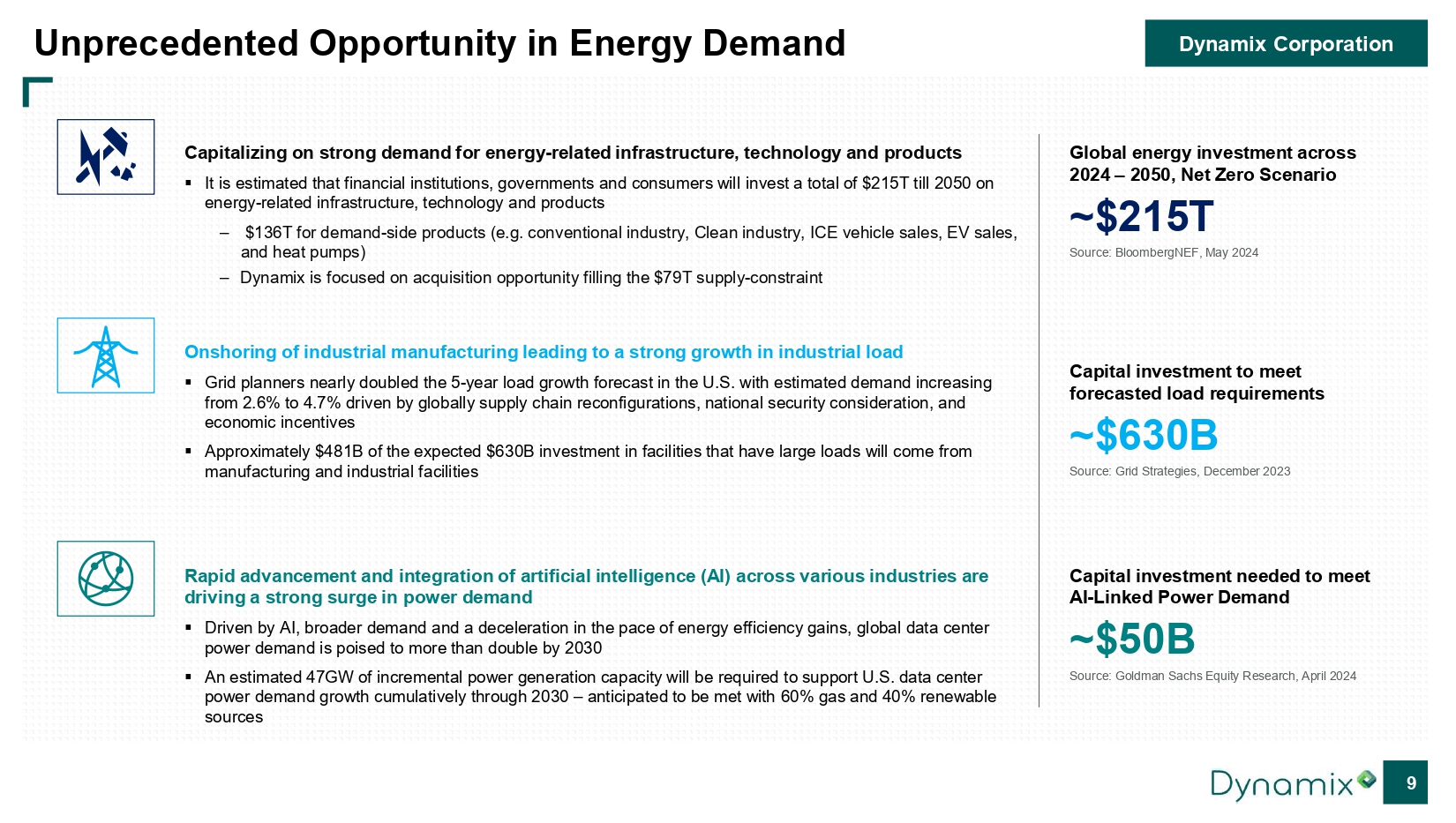

Dynamix Corporation 9 Unprecedented Opportunity in Energy Demand Capitalizing on strong demand for energy - related infrastructure, technology and products ▪ It is estimated that financial institutions, governments and consumers will invest a total of $215T till 2050 on energy - related infrastructure, technology and products – $136T for demand - side products (e.g. conventional industry, Clean industry, ICE vehicle sales, EV sales, and heat pumps) – Dynamix is focused on acquisition opportunity filling the $79T supply - constraint Capital investment needed to meet AI - Linked Power Demand ~$50B Source: Goldman Sachs Equity Research, April 2024 Capital investment to meet forecasted load requirements ~$630B Source: Grid Strategies, December 2023 Global energy investment across 2024 – 2050, Net Zero Scenario ~$215T Source: BloombergNEF , May 2024 Onshoring of industrial manufacturing leading to a strong growth in industrial load ▪ Grid planners nearly doubled the 5 - year load growth forecast in the U.S. with estimated demand increasing from 2.6% to 4.7% driven by globally supply chain reconfigurations, national security consideration, and economic incentives ▪ Approximately $481B of the expected $630B investment in facilities that have large loads will come from manufacturing and industrial facilities Rapid advancement and integration of artificial intelligence (AI) across various industries are driving a strong surge in power demand ▪ Driven by AI, broader demand and a deceleration in the pace of energy efficiency gains, global data center power demand is poised to more than double by 2030 ▪ An estimated 47GW of incremental power generation capacity will be required to support U.S. data center power demand growth cumulatively through 2030 – anticipated to be met with 60% gas and 40% renewable sources

Dynamix Corporation Select Energy Companies Market Cap at Announcement IPO DeSPAC Δ Change (%) Mkt. Cap Today Mkt. Cap at Ann. Date Company Redemption (%) Δ Change (%) Mkt. Cap Today Mkt. Cap at Ann. Date Company (7.8%) $1,147M $1,244 Sep - 24 BKV Corp 61.4% 26.5% $2,522M $1,994M Dec - 22 Net Power 125.6% $2,890M $1,281 Jun - 24 LandBridge 79.3% 169.6% $1,653M $613M Nov - 22 Sable Offshore (5.9%) $1,698M $1,805 Oct - 23 Mach Natural Resources 99.6% 93.5% *$1,600M $961M Sep - 22 Hammerhead Resources 108.6% $2,583M $1,238 Jun - 23 Kodiak Gas Services 95.0% (53.1%) $808M $1,723M May - 22 Granite Ridge Resources 37.0% $2,465M $1,800 Mar - 23 Atlas Energy Solutions 0.2% 253.8% *$3,300M $1,159M Apr - 21 Archaea Energy 23.9% $762M $615 Jan - 23 TXO Energy Partners 97.0% 156.5% $1,923M $750M Jun - 20 Highpeak Energy (52.4%) $1,220M $2,563 May - 22 ProFrac Holding 82.1% (87.3%) $139M $1,097M Apr - 19 Brooge Holdings (13.8%) $2,240M $2,599 Apr - 22 Excelerate Energy 0.0% 109.7% $5,227M $2,493M Mar - 18 Magnolia Oil & Gas ( Fka Enervest ) 108.7% $2,200M $1,054 Mar - 21 Vine Energy 0.0% 448.5% $10,065M $1,835M Oct - 16 Permian Resources ( fka Centennial Resource) 23.9% $2,200M $1,281M MEDIAN 79.3% 109.7% $1,923M $1,159M MEDIAN 10 Dynamix is Well Positioned for its Target Universe Through the end of April 2024, $150B+ of deal value has been announced , ~2x the value through the same period in 2023 Active Sector Source: FactSet data as of October 3, 2024, Dealogic, SPAC Research, and Boston Consulting Group (“What’s Igniting the Energy M& A Boom”) * Represents announced purchase price Deep relevant sector familiarity backed by a broad network of first - hand M&A and operational experience within the energy sector Experienced Team, Board and Advisors Dynamix Trust size is optimally positioned for its target universe , mitigating dilution concerns while providing top - tier leadership expertise Optimal Size

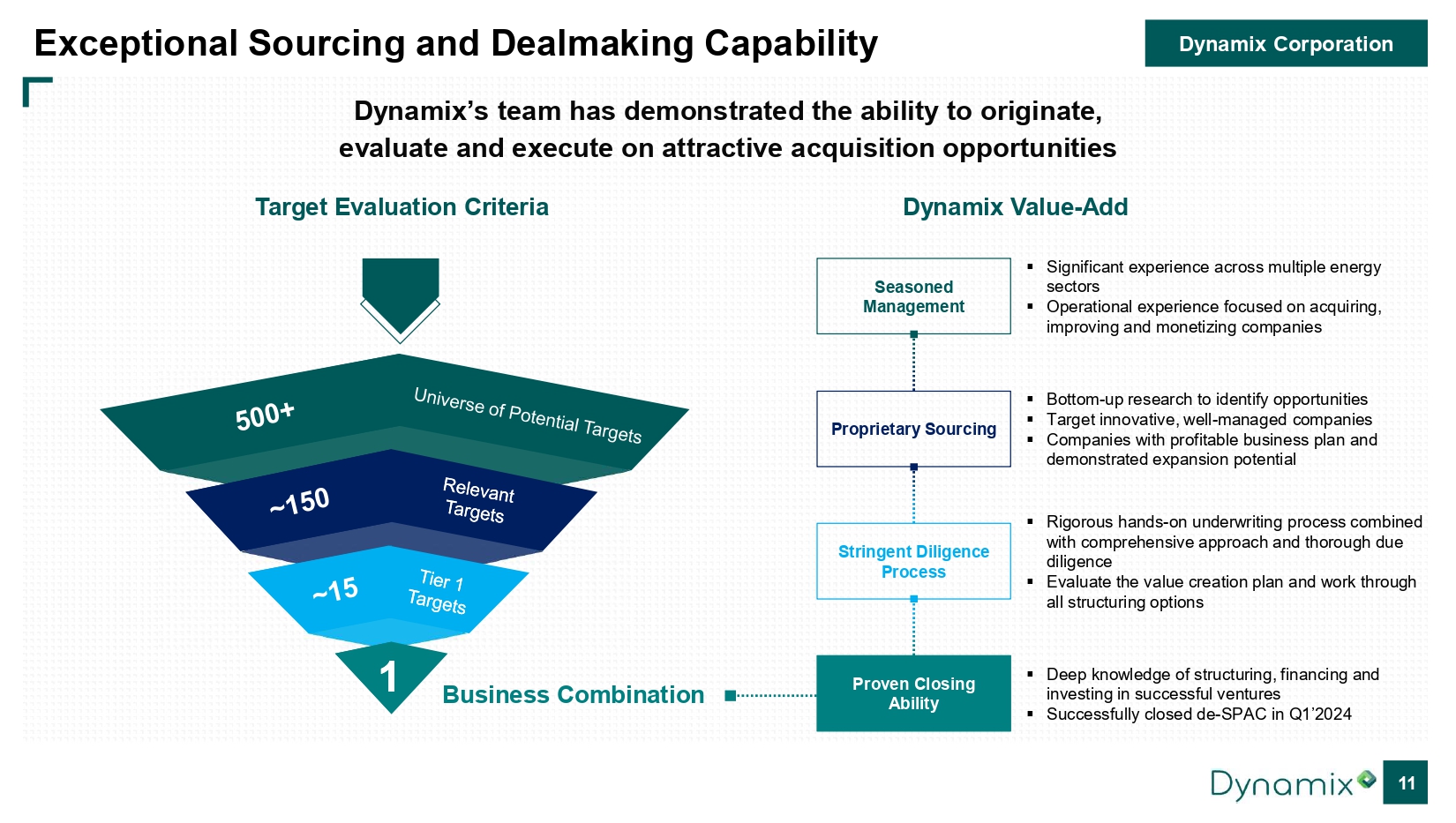

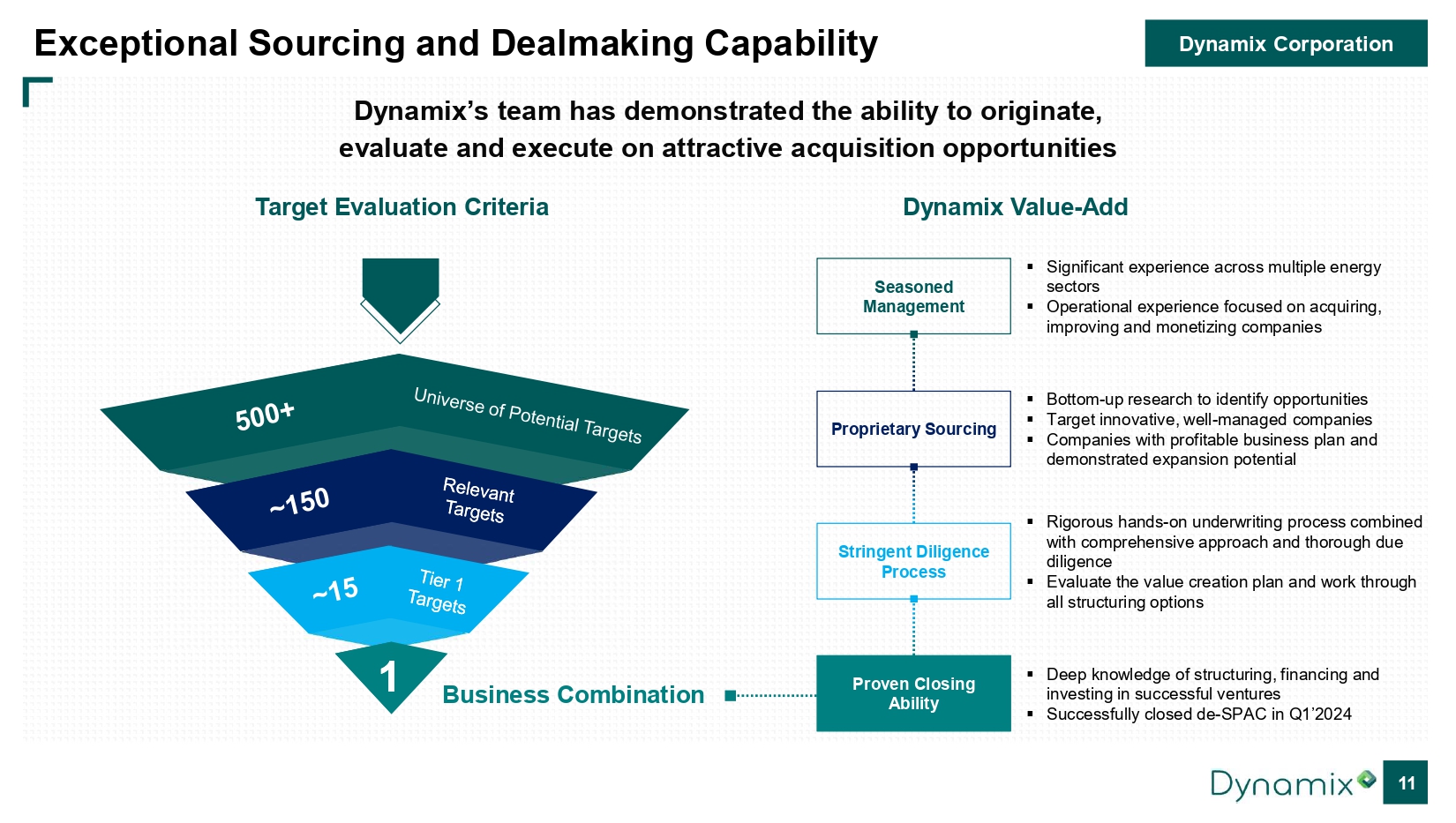

Dynamix Corporation Seasoned Management 11 Exceptional Sourcing and Dealmaking Capability Dynamix’s team has demonstrated the ability to originate, evaluate and execute on attractive acquisition opportunities 1 Business Combination Target Evaluation Criteria Dynamix Value - Add Proprietary Sourcing Stringent Diligence Process Proven Closing Ability ▪ Significant experience across multiple energy sectors ▪ Operational experience focused on acquiring, improving and monetizing companies ▪ Bottom - up research to identify opportunities ▪ Target innovative, well - managed companies ▪ Companies with profitable business plan and demonstrated expansion potential ▪ Rigorous hands - on underwriting process combined with comprehensive approach and thorough due diligence ▪ Evaluate the value creation plan and work through all structuring options ▪ Deep knowledge of structuring, financing and investing in successful ventures ▪ Successfully closed de - SPAC in Q1’2024

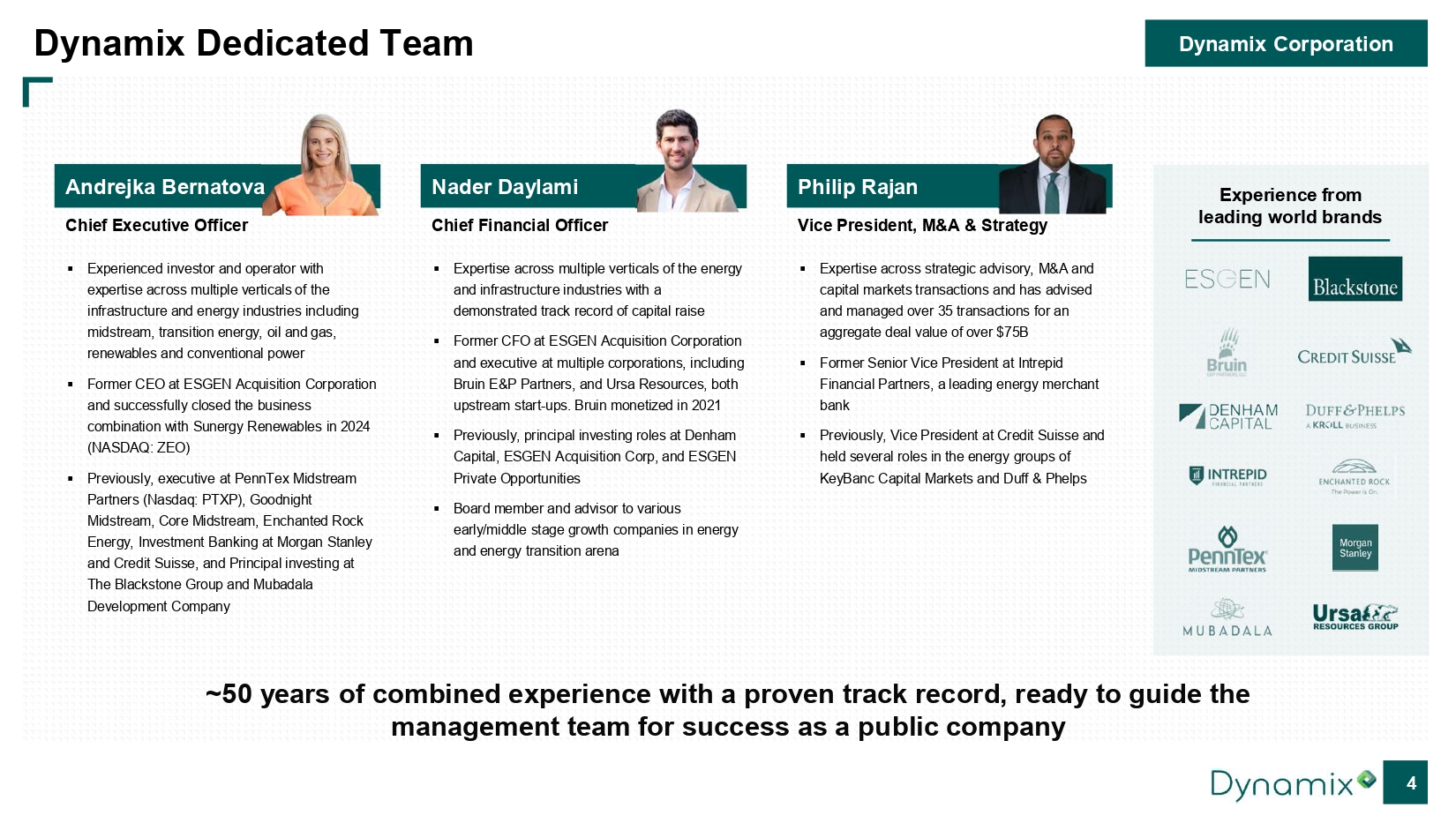

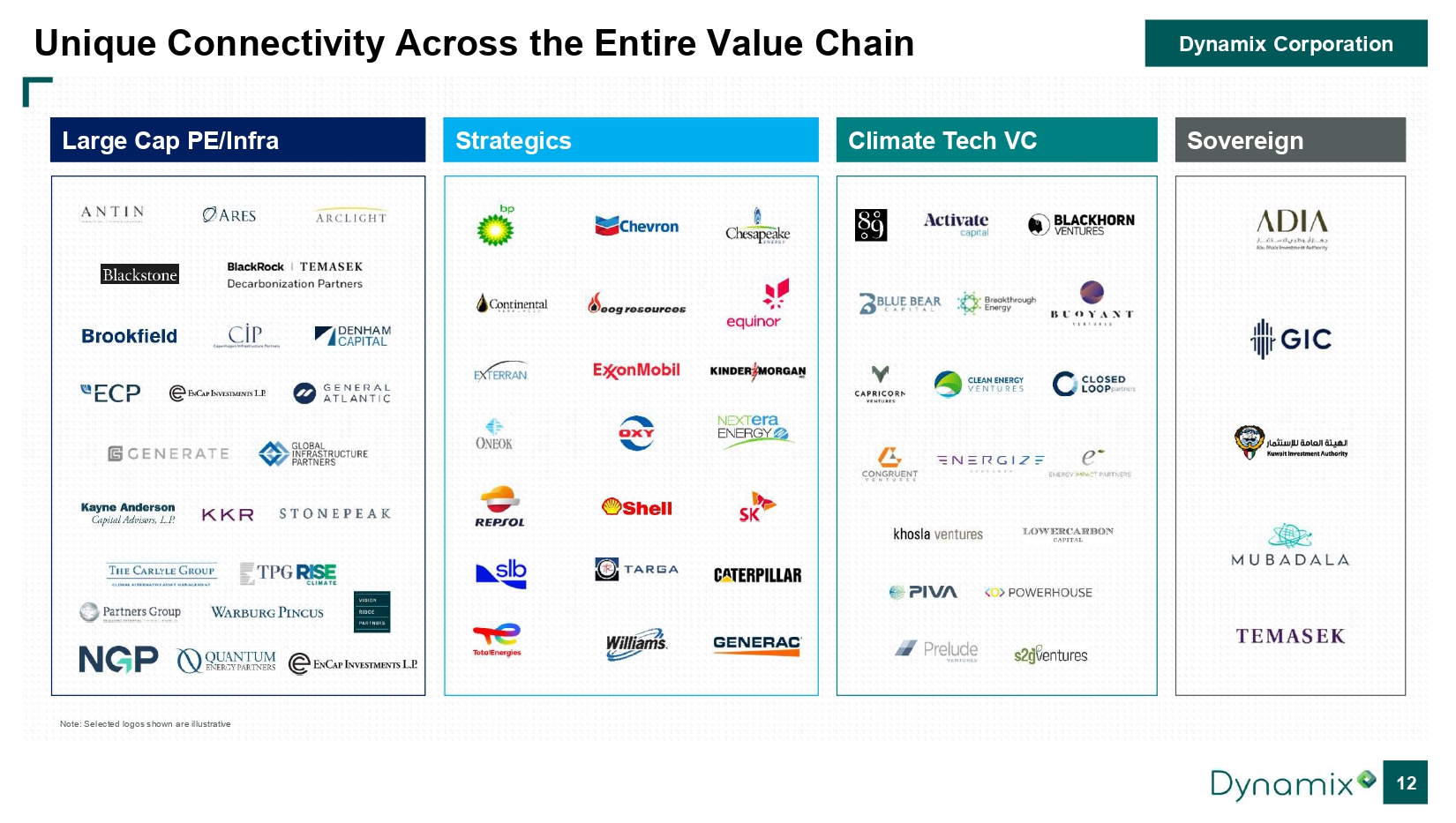

Dynamix Corporation 12 Unique Connectivity Across the Entire Value Chain Large Cap PE/Infra Strategics Climate Tech VC Sovereign Note: Selected logos shown are illustrative

Dynamix Corporation Dynamix is Favorably Positioned to Maximize Value in the Energy Evolution 13 Seasoned Management Team with Track Record of Success Early Mover to Capitalize on Strong Industry Demand Thought Leader with Unique Connectivity across Entire Value Chain

THANK YOU