As filed with the U.S. Securities and Exchange Commission on November 8, 2024.

Registration No. 333-280972

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Aurous Resources

(Exact name of registrant as specified in its charter)

| Cayman Islands | | 1000 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS Employer

Identification Number) |

Inanda Greens Business Park, Block A

Wierda Gables

54 Wierda Rd West, Wierda Valley

Sandton, 2196

South Africa

+27 67 166 4397

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Rigel Resource Acquisition Corp

7 Bryant Park

1045 Avenue of the Americas, Floor 25

New York, NY 10018

(646) 453-2672

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Blyvoor Gold Resources Proprietary Limited (Exact name of co-registrant as specified in its charter) | | Blyvoor Gold Operations Proprietary Limited (Exact name of co-registrant as specified in its charter) |

Inanda Greens Business Park, Block A Wierda Gables 54 Wierda Rd West, Wierda Valley Sandton, 2196 South Africa +27 67 166 4397 | | Inanda Greens Business Park, Block A Wierda Gables 54 Wierda Rd West, Wierda Valley Sandton, 2196 South Africa +27 67 166 4397 |

| South Africa | | 1000 | | Not Applicable | | South Africa | | 1000 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS Employer

Identification Number) | | (State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS Employer

Identification Number) |

Copies of all correspondence to:

David Dixter

Iliana Ongun

Milbank LLP

100 Liverpool Street

London, UK EC2M 2AT

Tel: +44 20 7615 3000 | | Joshua G. DuClos

George J. Vlahakos

Zach Shub-Essig

John W. Stribling

Sidley Austin LLP

787 7th Avenue

New York, NY 10019

Tel: (212) 839-5300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement and all other conditions to the Business Combination described herein have been satisfied or waived.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Each of the registrants hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, pursuant to said Section 8(a), may determine.

The information contained in this document is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document is not an offer to sell these securities and it is not soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY—SUBJECT TO COMPLETION, November 8, 2024

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

RIGEL RESOURCE ACQUISITION CORP

AND

PROSPECTUS FOR 30,704,558 ORDINARY SHARES, AND 15,000,000 WARRANTS, IN EACH CASE, OF

AUROUS RESOURCES

LETTER TO SHAREHOLDERS OF RIGEL RESOURCE ACQUISITION CORP

Rigel Resource Acquisition Corp

7 Bryant Park, 1045 Avenue of the Americas, Floor 25

New York, NY 10018

Dear Rigel Shareholder:

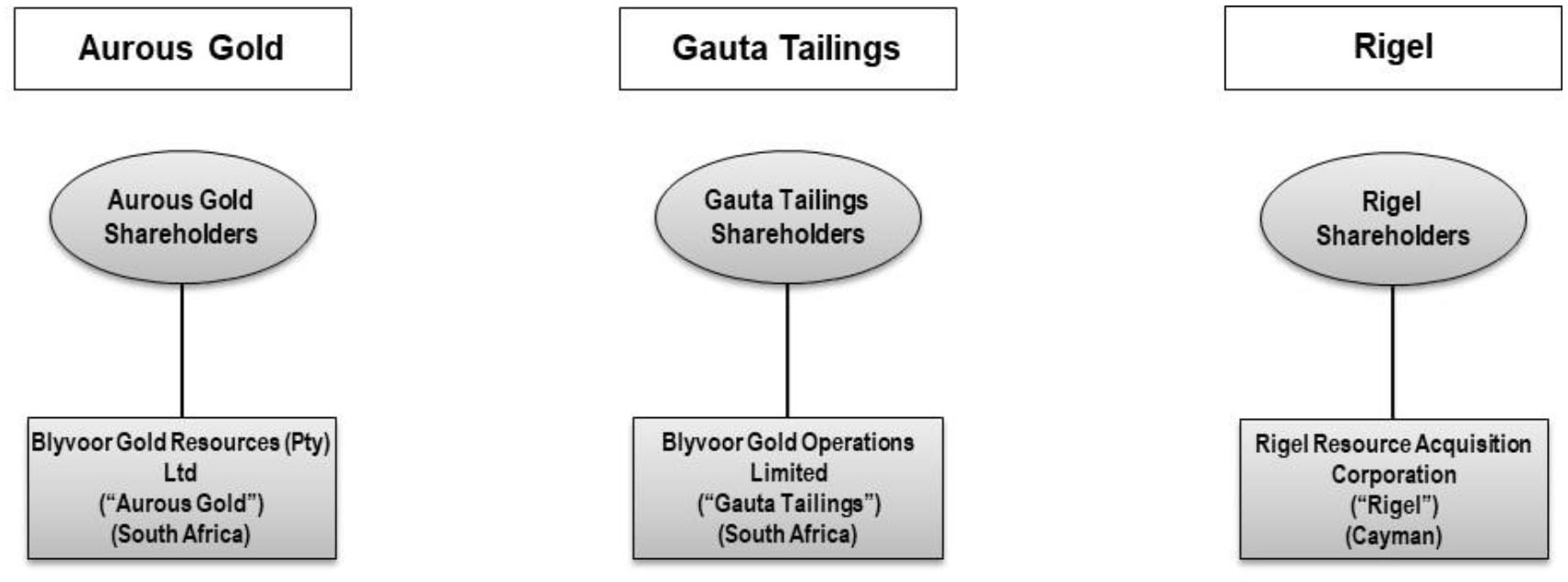

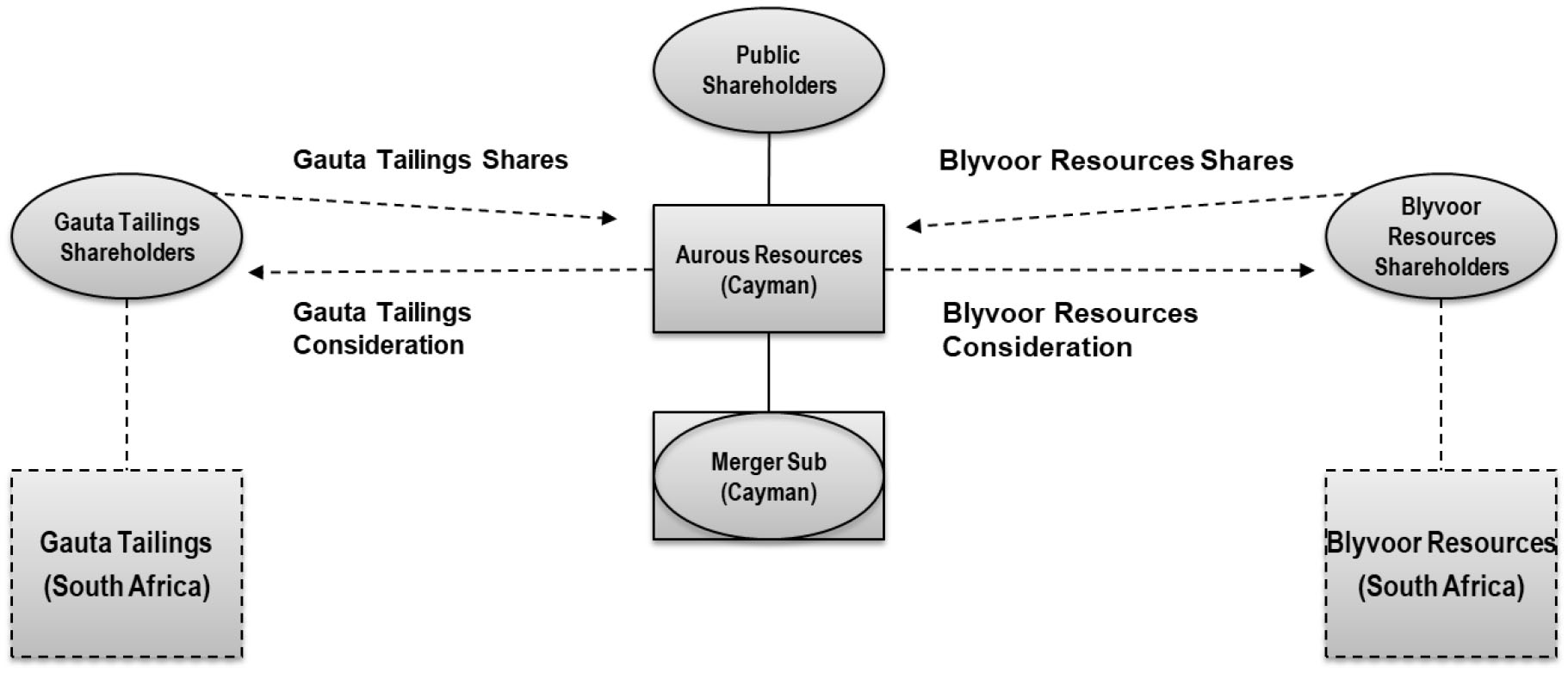

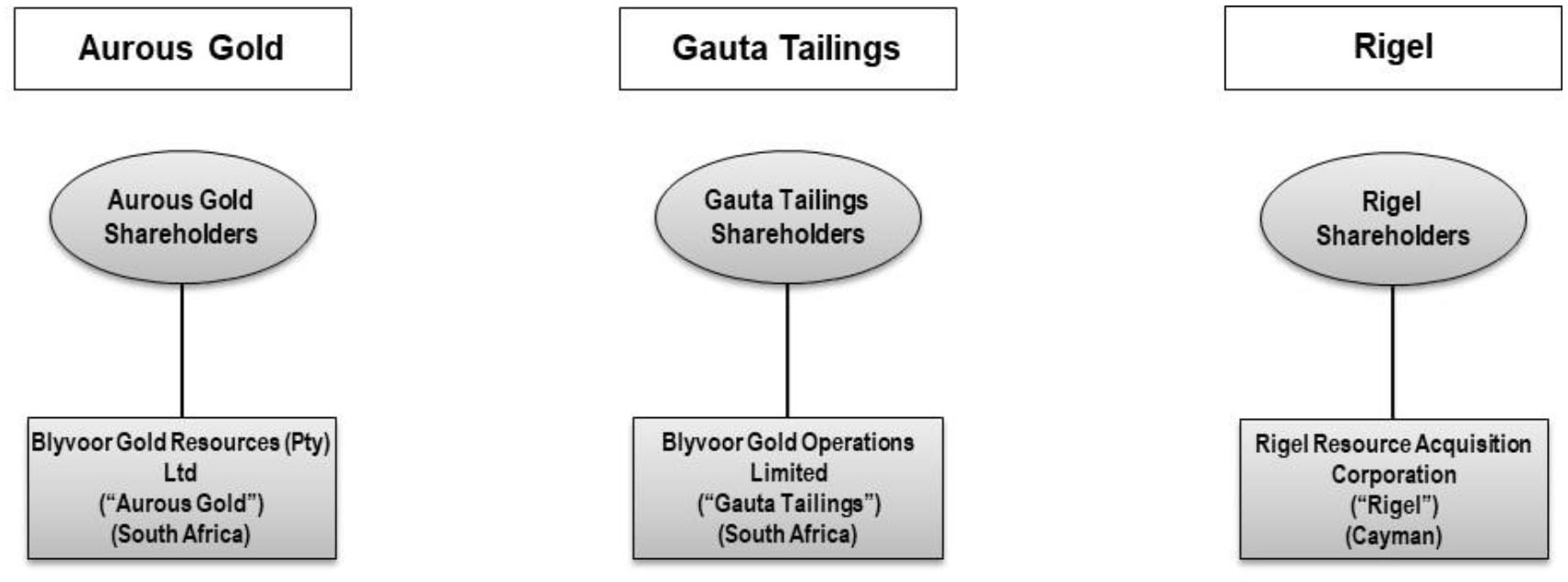

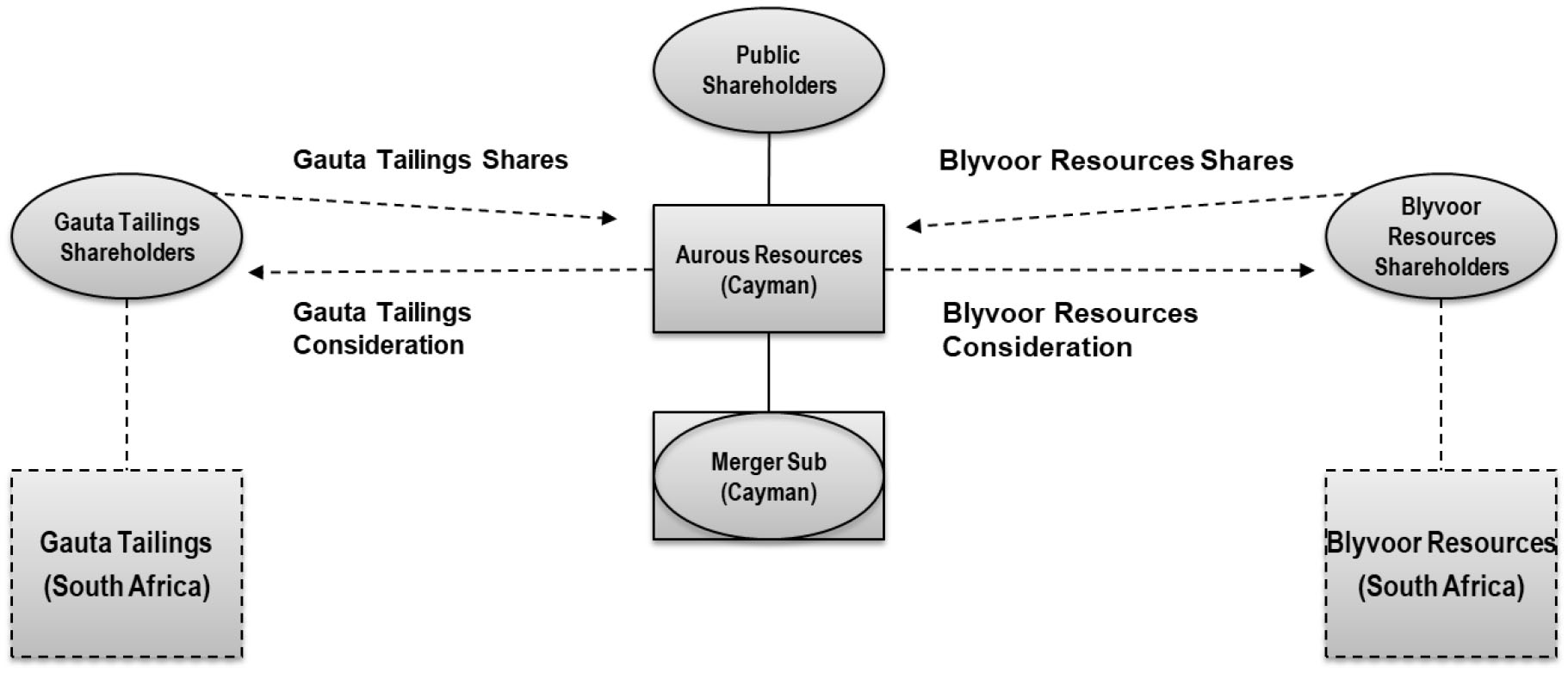

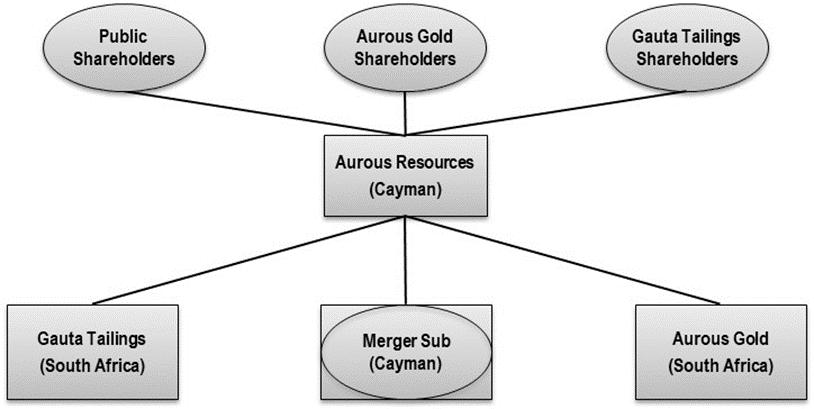

On March 11, 2024, Rigel Resource Acquisition Corp, a Cayman Islands exempted company (“Rigel”), entered into a Business Combination Agreement (as may be amended from time to time, the “Business Combination Agreement”), by and among Rigel, Blyvoor Gold Resources Proprietary Limited, a South African private limited liability company (“Aurous Gold”), Blyvoor Gold Operations Proprietary Limited, a South African private limited liability company (“Gauta Tailings” and, together with Aurous Gold, “Blyvoor” or the “Target Companies,” each, a “Target Company”), Aurous Resources (f/k/a RRAC NewCo), a Cayman Islands exempted company and wholly owned subsidiary of Rigel (“Aurous Resources”), and RRAC Merger Sub, a Cayman Islands exempted company and wholly owned subsidiary of Aurous Resources (“Merger Sub”). Each of Aurous Resources and Merger Sub is a newly formed entity that was formed for the sole purpose of entering into and consummating the transactions contemplated by the Business Combination Agreement (the “Business Combination”). Concurrently with the execution of the Business Combination Agreement, Aurous Resources also entered into an Exchange Agreement (the “Exchange Agreement”), by and among Aurous Resources, Blyvoor Gold Proprietary Limited, a South African private limited liability company (“Blyvoor Gold”), Orion Mine Finance Fund II L.P., a Bermuda limited partnership (“Orion Fund II” and, together with Blyvoor Gold, the “Sellers”), and the Target Companies. The Business Combination Agreement was subsequently amended by that certain Omnibus Amendment, dated as of October 17, 2024 (the “Omnibus Amendment”). For more information on the Business Combination, see “Questions and Answers about the Business Combination and the General Meeting of the Shareholders.” The Business Combination Agreement is attached to this proxy statement/prospectus as Annex A. The Omnibus Amendment is attached to this proxy statement/prospectus as Annex A-1.

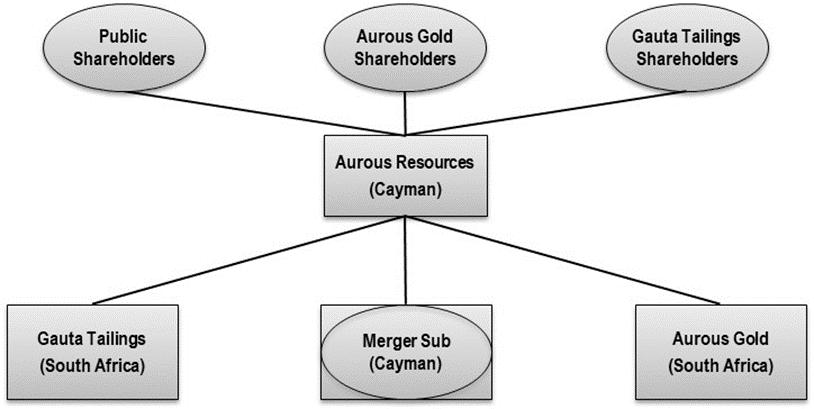

Pursuant to the terms, and subject to the conditions, set forth in the Business Combination Agreement, the parties thereto will enter into the Business Combination, pursuant to which, among other things, (i) Rigel will merge with and into Merger Sub (the “Merger”), with Merger Sub being the surviving company of the Merger and the separate corporate existence of Rigel ceasing, and (ii) Aurous Resources will acquire all of the issued and outstanding equity interests of each Target Company (the “Share Exchange”). Following the consummation of the Merger and the Share Exchange, each of the Target Companies and Merger Sub will be a wholly owned subsidiary of Aurous Resources, and Aurous Resources will become a publicly traded company. At the closing of the Business Combination (the “Closing” and, such date on which the Closing occurs, the “Closing Date”), Aurous Resources’ ordinary shares, par value $0.0001 (the “Aurous Resources Ordinary Shares”), are expected to be listed on the Nasdaq. The Business Combination Agreement stipulates, among other things and conditions, that the obligation of Blyvoor to consummate the Business Combination is subject to the availability of Aggregate Cash Proceeds (as defined in the Business Combination Agreement) of not less than $50 million at the Closing; provided that the aggregate amount of Target Group Company Transaction Expenses and Rigel Transaction Expenses to be paid in cash by Aurous Resources in connection with the Closing shall not be in excess of $17 million (the “Available Cash Condition”).

To effectuate the Business Combination, among other things and subject to the terms and conditions therein, the Business Combination Agreement provides that:

| ● | each Class A ordinary share of Rigel (a “Rigel Class A Ordinary Share”) issued and outstanding as of immediately prior to the effective time of the Merger (the “Merger Effective Time”) (other than shares to be cancelled in accordance with the Business Combination Agreement and any Redemption Shares (as defined below)) will be automatically cancelled and converted into the right to receive (i) cash consideration in an amount per share equal to the sum of (A) the cash value per share as of the Closing Date to be received in respect of a Rigel Class A Ordinary Share redeemed in the Rigel Shareholder Redemption (as defined below) minus (B) $10.00 (the “Cash Consideration”) and (ii) one Aurous Resources Ordinary Share (the “Equity Consideration” and together with the Cash Consideration, the “Class A Merger Consideration”); |

| ● | each Rigel Class A Ordinary Share issued and outstanding as of immediately prior to the Merger Effective Time with respect to which a Rigel shareholder has validly exercised its redemption rights (collectively, the “Redemption Shares”) will not be converted into and become the Class A Merger Consideration, and instead will, at the Merger Effective Time, be redeemed for an amount in cash per share calculated in accordance with such shareholder’s redemption rights (such redemption, the “Rigel Shareholder Redemption”); |

| ● | each Class B ordinary share of Rigel (a “Rigel Class B Ordinary Share” and collectively, together with the Rigel Class A Ordinary Shares, the “Rigel Ordinary Shares”) issued and outstanding immediately prior to the Merger Effective Time (other than shares to be cancelled in accordance with the Business Combination Agreement) will be automatically cancelled and converted into the right to receive one Aurous Resources Ordinary Share; and |

| ● | each issued and outstanding public warrant of Rigel (the “Rigel Public Warrants”) will be converted automatically into the right of the holder thereof to receive one public warrant of Aurous Resources (the “Aurous Resources Public Warrants”), and each issued and outstanding private warrant of Rigel (the “Rigel Private Warrants”) will be converted automatically into the right of the holder thereof to receive one private warrant of Aurous Resources (the “Aurous Resources Private Warrants” and, together with the Aurous Resources Public Warrants, the “Aurous Resources Warrants”). Each Aurous Resources Public Warrant will have, and be subject to, substantially the same terms and conditions as are in effect with respect to the Rigel Public Warrants, and each Aurous Resources Private Warrant will have, and be subject to, substantially the same terms and conditions as are in effect with respect to the Rigel Private Warrants, except that in each case they will represent the right to acquire Aurous Resources Ordinary Shares. |

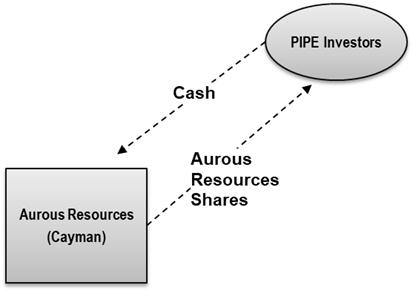

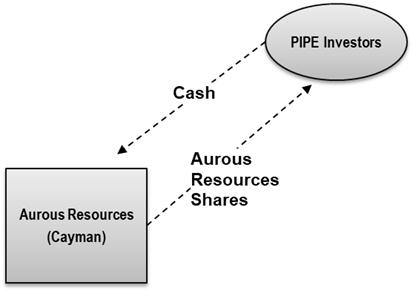

On March 11, 2024, concurrently with the execution of the Business Combination Agreement, Rigel, Aurous Resources, Blyvoor Gold and Rigel Resource Acquisition Holding LLC, a Cayman Islands limited liability company (the “Sponsor”) entered into subscription agreements with certain institutional and accredited investors (the “PIPE Investors,” and each a “PIPE Investor,” and the subscription agreements, the “Subscription Agreements”) pursuant to which the PIPE Investors have agreed, subject to the terms and conditions set forth therein, to subscribe for and purchase from Aurous Resources at the Closing, an aggregate of 750,000 Aurous Resources Ordinary Shares (the “PIPE Investment Shares”), at a purchase price of $10 per share, for an aggregate cash amount of $7,500,000 (the “PIPE Investment”).

Pursuant to the Subscription Agreements, a PIPE Investor may elect to reduce the number of PIPE Investment Shares it is obligated to purchase under its Subscription Agreement, on a one-for-one basis, up to the total amount of PIPE Investment Shares subscribed thereunder, to the extent such PIPE Investor (i) purchases Rigel Class A Ordinary Shares (the “Open-Market Purchase Shares”) in open market transactions at a price of less than or equal to the Closing redemption price per share, as established prior to the record date for voting at the Rigel shareholder meeting held to approve the Business Combination (the “General Meeting”),or (ii) beneficially owned any Rigel Class A Ordinary Shares as of the date of its Subscription Agreement (the “Currently Owned Shares” and together with the Open-Market Purchase Shares and the PIPE Investment Shares, the “Total PIPE Investment Shares”). This reduction right is subject to any PIPE Investor agreeing, with respect to such Open-Market Purchase Shares, to (A) not sell or transfer any such Open-Market Purchase Shares prior to the Closing, (B) not vote any such Open-Market Purchase Shares in favor of approving the Business Combination and instead submits a proxy abstaining from voting thereon and (C) to the extent such PIPE Investor has the right to have all or some of its Open-Market Purchase Shares redeemed for cash in connection with the Closing, not exercise any such redemption rights, and with respect to such Currently Owned Shares, to (X) not sell or transfer any such Currently Owned Shares prior to the Closing, (Y) vote all of its Currently Owned Shares in favor of approving the Business Combination at the General Meeting, and (Z) to the extent such PIPE Investor has the right to have all or some of its Currently Owned Shares redeemed for cash in connection with the Closing, not exercise any such redemption rights.

In addition, in connection with the Closing and pursuant to the Subscription Agreements:

| ● | the Sponsor shall surrender an aggregate number of Rigel Class B Ordinary Shares it holds in an amount equal to (i) (A) four, multiplied by (B) the aggregate number of Total PIPE Investment Shares, divided by (ii) ten (the “Sponsor Forfeit Shares”); |

| ● | Blyvoor Gold shall surrender an aggregate number of Aurous Resources Ordinary Shares it receives as Exchange Consideration (as defined below) in an amount equal to (i) (A) one, multiplied by (B) the aggregate number of Total PIPE Investment Shares, divided by (ii) ten (the “Blyvoor Forfeit Shares”); and |

| ● | each PIPE Investor shall receive, following the Closing, a number of Aurous Resources Ordinary Shares equal to its proportion of the sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares (pro rata for such PIPE Investor’s Total PIPE Investment Shares), for no additional cash consideration, other than their par value. |

In connection with the execution of the Business Combination Agreement, Rigel, Aurous Resources, the Target Companies, the Sponsor and the persons set forth on Schedule I thereto (collectively with the Sponsor, the “Sponsors”) have entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”). The Sponsor Support Agreement was subsequently amended by the Omnibus Amendment. The Sponsor Support Agreement provides that, among other things, the Sponsors agree (i) to vote in favor of the Business Combination Agreement and the Business Combination, (ii) to appear at certain Rigel shareholder meetings for purposes of constituting a quorum, (iii) to vote against any proposals that could reasonably be expected to prevent or materially impede, frustrate, inhibit, interfere with, delay, discourage or adversely affect the timely consummation of the Business Combination, (iv) to waive any anti-dilution adjustment to the conversion ratio with respect to their existing Rigel Class B Ordinary Shares that would result from the issuance of Aurous Resources Ordinary Shares or Rigel Class A Ordinary Shares, (v) subject to certain conditions, to sell to Aurous Resources a certain number of either Rigel Public Warrants or Rigel Private Warrants, at a price per warrant equal to the volume-weighted average price of the Rigel Public Warrants for the 30-day period preceding the Closing, (vi) subject to certain conditions, to extend, or cause their respective affiliate to extend, the maturity date of each of the Working Capital Loans (as defined in the Omnibus Amendment) and, in connection with the Sponsor Warrant Redemption (as defined below), if any, prepare and issue a non-interest bearing promissory note in favor of each Sponsor with a principal amount equal to such Sponsor’s pro rata portion of the warrant purchase price and (vii) to exercise, or cause its affiliates to exercise, either of the Rigel Public Warrants or Rigel Private Warrants only on a “cashless basis” and forgo any right of conversion with respect to the Working Capital Loans (as defined in the Omnibus Amendment), in each case, on the terms and subject to the conditions set forth in the Sponsor Support Agreement.

In addition, pursuant to the Sponsor Support Agreement, the Sponsors have agreed, subject to certain customary exceptions, not to transfer (i) any Aurous Resources Ordinary Shares owned by such Sponsor until the 12-month anniversary of the Closing, (ii) a number of Aurous Resources Private Warrants equal to 40% of all Aurous Resources Private Warrants owned by such Sponsor (including any Aurous Resources Ordinary Shares issuable upon the exercise of such warrants) until the 12-month anniversary of the Closing and (iii) a number of Aurous Resources Private Warrants equal to 60% of all Aurous Resources Private Warrants owned by such Sponsor (including any Aurous Resources Ordinary Shares issuable upon the exercise of such warrants) until the 24-month anniversary of the Closing. The foregoing restrictions on transfer with respect to Aurous Resources Ordinary Shares shall be released if the last reported sale price of the Aurous Resources Ordinary Shares equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 180 days after Closing. For more information on the Sponsor Support Agreement and the Omnibus Amendment, see “Proposal No. 1—The Business Combination Proposal—Ancillary Agreements—Sponsor Support Agreement” and “Proposal No. 1—The Business Combination Proposal—Ancillary Agreements—Omnibus Amendment to the Business Combination Agreement and the Sponsor Support Agreement.”

Compensation of the Sponsor, its affiliates and promoters in connection with the Business Combination: The Sponsor, its affiliates and promoters will receive (i) 7,500,000 Aurous Resources Ordinary Shares upon the conversion of the 7,500,000 Founder Shares, for which they paid $25,000 in the aggregate, (ii) subject to any Rigel Warrant sales (if any) pursuant to the Sponsor Warrant Redemption (as defined below), 14,000,000 Aurous Resources Private Warrants upon the conversion of 14,000,000 Rigel Private Warrants, which were purchased for $1.00 per warrant and (iii) other compensation in the amount of approximately $10.8 million. In addition, commencing on the date the Rigel Public Units were first listed on the New York Stock Exchange (the “NYSE”), Rigel has agreed to pay the Sponsor a total of $10,000 per month for office space, utilities and secretarial and administrative support. This compensation and securities issuances may result in a material dilution of the equity interests of non-redeeming public shareholders. See the section entitled “Proposal No. 1—Business Combination—Compensation Received by the Sponsor” for more information.

Conflicts of interest in connection with the Business Combination: There may be actual or potential material conflicts of interest between or among (i) the Sponsor, its affiliates, Rigel officers, Rigel directors, or promoters, Blyvoor, Blyvoor officers, Blyvoor directors, Aurous Resources officers or Aurous Resources directors and (ii) unaffiliated security holders of Rigel. In addition, Rigel’s co-placement agents and advisors, Citi and Hannam, have a financial interest that may conflict with your interests. Such conflicts of interest may include a material conflict of interest arising in determining whether to proceed with the Business Combination and a material conflict of interest arising from the interests that the Sponsor and affiliates have in the Business Combination. See the section entitled “Proposal No. 1—Business Combination— Interests of Certain Persons in the Business Combination and Conflicts of Interest” for more information.

At the General Meeting, Rigel’s shareholders will be asked to consider and vote upon a proposal, as an ordinary resolution, to approve the Business Combination Agreement, attached hereto as Annex A, as amended by the Omnibus Amendment, attached hereto as Annex A-1, and the Business Combination (the “Business Combination Proposal” or “Proposal No. 1”).

Rigel’s shareholders will also be asked to consider and vote upon a proposal, as a special resolution, to approve the Merger and the related plan of merger, attached hereto as Annex B (the “Plan of Merger”), pursuant to which the Merger will be consummated (the “Merger Proposal” or “Proposal No. 2”).

At the General Meeting, Rigel’s shareholders will be asked to consider and vote upon a proposal, as an ordinary resolution, to approve a proposed 2024 Equity Incentive Plan, attached hereto as Annex C (the “2024 Equity Incentive Plan Proposal” or “Proposal No. 3”).

Rigel’s shareholders will also be asked to consider and vote upon a proposal, as an ordinary resolution, to adjourn the General Meeting to a later date or dates, if necessary, (i) to ensure that any supplement or amendment to this proxy statement/prospectus is provided to Rigel’s shareholders, (ii) in order to solicit additional proxies from Rigel’s shareholders in favor of any of the other proposals being presented or (iii) only with the prior written consent of the Target Companies, for the purposes of satisfying the Available Cash Condition (the “Adjournment Proposal” or “Proposal No. 4”).

Each of Proposal No. 1, Proposal No. 2, Proposal No. 3 and Proposal No. 4 is more fully described in this proxy statement/prospectus, which each shareholder is encouraged to read carefully.

Pursuant to Rigel’s amended and restated memorandum and articles of association, Rigel is providing each of its public shareholders with the opportunity to redeem, upon the Closing, any Rigel Class A Ordinary Shares then held by such shareholder for cash equal to such Rigel shareholder’s respective pro rata share of the aggregate amount on deposit (as of two business days prior to the Closing) in the trust account of Rigel, which holds the proceeds (including interest accrued thereon, which shall be net of taxes payable) of Rigel’s Initial Public Offering (as defined below) and certain of the proceeds of the Private Placement (the “Trust Account”). Public shareholders may elect to redeem their Rigel Class A Ordinary Shares even if they vote in favor of the Business Combination Proposal.

Rigel is providing this proxy statement/prospectus and accompanying proxy card to its shareholders in connection with the solicitation of proxies to be voted at the General Meeting and at any adjournments or postponements of the General Meeting. Information about the General Meeting, the Business Combination and other related business to be considered by Rigel’s shareholders at the General Meeting is included in this proxy statement/prospectus. Whether or not you plan to attend the General Meeting, all Rigel’s shareholders are urged to read this proxy statement/prospectus, including the Annexes and the accompanying financial statements of Blyvoor, carefully and in its entirety. In particular, you are urged to read carefully the section entitled “Risk Factors.”

After careful consideration, the board of directors of Rigel (the “Rigel Board”) has approved the Business Combination Agreement and the Business Combination, and recommends that Rigel’s shareholders vote “FOR” adoption of the Business Combination Agreement and approval of the Business Combination and “FOR” any other proposal presented to Rigel’s shareholders in this proxy statement/prospectus. When considering the Rigel Board’s recommendation of these proposals, you should keep in mind that certain Rigel directors and officers have interests in the Business Combination that may conflict with your interests as shareholders. Such conflicts of interest may include a material conflict of interest arising in determining whether to proceed with the Business Combination and a material conflict of interest arising from the manner in which Rigel compensates Rigel’s Sponsor, officers and directors or the manner in which Rigel’s Sponsor compensates its officers and directors. Please see the section entitled “Proposal No. 1—The Business Combination Proposal—Interests of Certain Persons in the Business Combination and Conflicts of Interest” for additional information. Rigel’s Sponsor, its affiliates and certain officers and directors will receive Aurous Resources Ordinary Shares in connection with the Business Combination. This securities issuance may result in a material dilution of the equity interests of non-redeeming shareholders who hold the securities until the consummation of the Business Combination. See the section entitled “Risk Factors—Risks Related to the Redemption of Rigel’s Shares—Rigel’s public shareholders will experience immediate dilution as a consequence of the issuance of Aurous Resources Ordinary Shares as consideration in the Business Combination and due to future issuances pursuant to the 2024 Equity Incentive Plan and in the form of the Gauta Tailings Deferred Consideration and any Earnout Shares, as applicable. Having a minority share position may reduce the influence that Rigel’s current shareholders have on the management of the combined company.”

The Rigel Board considered the opinion, dated March 11, 2024, of Kroll, LLC (operating through its Duff & Phelps Opinions Practice) to the Rigel Board as to the fairness, from a financial point of view and as of the date of such opinion, to holders of Rigel Class A Ordinary Shares (other than as specified therein) of the Aggregate Consideration (as defined in this proxy statement/prospectus) to be paid by Rigel in the Business Combination, which opinion was based on and subject to various assumptions made, procedures followed, matters considered and limitations and qualifications on the review undertaken by Duff & Phelps as set forth in such opinion. For additional information, see “Proposal No. 1—The Business Combination Proposal—Opinion of Kroll, LLC to the Rigel Board.” This opinion was only one of many factors considered by the Rigel Board in its evaluation of the Business Combination and should not be viewed as determinative of the views of the Rigel Board or Rigel management with respect to the Business Combination or the Aggregate Consideration.

Approval of each of the Business Combination Proposal, the 2024 Equity Incentive Plan Proposal and the Adjournment Proposal requires the affirmative vote of holders of a majority of the Rigel Ordinary Shares that are entitled to vote and are voted at the General Meeting. Approval of the Merger Proposal requires the affirmative vote of holders of at least two-thirds of the Rigel Ordinary Shares that are entitled to vote and are voted at the General Meeting. The Business Combination Agreement was not structured to require the approval of at least a majority of unaffiliated security holders of Rigel.

Rigel is and, upon consummation of the Business Combination, Aurous Resources will be, an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

Upon consummation of the Business Combination, Aurous Resources will also be a “foreign private issuer” as defined in the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, Aurous Resources’ directors, senior management and holders of more than 10% of the issued and outstanding Aurous Resources Ordinary Shares will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, Aurous Resources will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

This proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the General Meeting of Rigel’s shareholders. We encourage you to carefully read this entire document, including the annexes and other documents referred to therein. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 91 of this proxy statement/prospectus.

Your vote is very important. Whether or not you plan to attend the General Meeting, please vote as soon as possible by following the instructions in this proxy statement/prospectus to ensure that your Rigel Ordinary Shares are represented at the General Meeting. If you hold your Rigel Ordinary Shares in “street name” through a broker, bank or other nominee, you will need to follow the instructions provided to you by your broker, bank or other nominee to ensure that your Rigel Ordinary Shares are represented and voted at the General Meeting. The Business Combination will be consummated only if the Business Combination Proposal and the Merger Proposal are approved at the General Meeting. The Closing of the Business Combination is conditioned upon the approval of the Business Combination Proposal and the Merger Proposal. The Adjournment Proposal is not conditioned on the approval of any other proposal set forth in this proxy statement/prospectus.

If you sign, date and return your proxy card without indicating how you wish to vote, your proxy will be voted “FOR” each of the proposals presented at the General Meeting. If you fail to return your proxy card or fail to instruct your broker, bank or other nominee how to vote, and you do not attend the General Meeting in person, your Rigel Ordinary Shares will not be counted for purposes of determining whether a quorum is present at the General Meeting. If you are a shareholder of record and you attend the General Meeting and wish to vote in person, you may withdraw your proxy and vote in person.

ALL HOLDERS OF RIGEL CLASS A ORDINARY SHARES ISSUED IN RIGEL’S INITIAL PUBLIC OFFERING (THE “PUBLIC SHARES”), OTHER THAN THE SPONSOR, SHAREHOLDERS OF RIGEL PRIOR TO RIGEL’S INITIAL PUBLIC OFFERING AND RIGEL’S OFFICERS AND DIRECTORS (TO THE EXTENT THAT THEY HOLD THE PUBLIC SHARES), HAVE THE RIGHT TO HAVE THEIR PUBLIC SHARES REDEEMED FOR CASH IN CONNECTION WITH THE BUSINESS COMBINATION. RIGEL PUBLIC SHAREHOLDERS ARE NOT REQUIRED TO AFFIRMATIVELY VOTE FOR OR AGAINST THE BUSINESS COMBINATION PROPOSAL OR THE MERGER PROPOSAL, TO VOTE ON THE BUSINESS COMBINATION PROPOSAL OR THE MERGER PROPOSAL AT ALL, OR TO BE HOLDERS OF RECORD ON THE RECORD DATE IN ORDER TO HAVE THEIR PUBLIC SHARES REDEEMED FOR CASH.

TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST DEMAND THAT RIGEL REDEEM YOUR RIGEL CLASS A ORDINARY SHARES FOR A PRO RATA PORTION OF THE FUNDS HELD IN THE TRUST ACCOUNT AND TENDER YOUR RIGEL CLASS A ORDINARY SHARES TO THE TRANSFER AGENT AT LEAST TWO BUSINESS DAYS PRIOR TO THE INITIALLY SCHEDULED VOTE AT THE GENERAL MEETING. YOUR REDEMPTION RIGHTS INCLUDE THE REQUIREMENT THAT A HOLDER MUST IDENTIFY ITSELF IN WRITING AS A BENEFICIAL HOLDER AND PROVIDE ITS LEGAL NAME, PHONE NUMBER AND ADDRESS TO THE TRANSFER AGENT IN ORDER TO VALIDLY REDEEM ITS RIGEL CLASS A ORDINARY SHARES. YOU MAY TENDER YOUR RIGEL CLASS A ORDINARY SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATE TO THE TRANSFER AGENT OR BY DELIVERING YOUR RIGEL CLASS A ORDINARY SHARES ELECTRONICALLY USING DEPOSITORY TRUST COMPANY’S (“DTC”) DEPOSIT WITHDRAWAL AT CUSTODIAN (“DWAC”) SYSTEM. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN YOUR RIGEL CLASS A ORDINARY SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD YOUR RIGEL CLASS A ORDINARY SHARES IN “STREET NAME,” YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE RIGEL CLASS A ORDINARY SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

On behalf of the Rigel Board, I would like to thank you for your support of Rigel and look forward to a successful completion of the Business Combination.

| | Sincerely, |

| | |

| | Jonathan Lamb |

| | Chief Executive Officer |

, 2024

Important Notice Regarding the Availability of Proxy Materials for the General Meeting to be held on , 2024.

The notice of the General Meeting and the related proxy statement will be available at www.cstproxy.com/[ ].

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES OR REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE BUSINESS COMBINATION DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED PARTY TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated , 2024 and is expected to be first mailed or otherwise delivered to Rigel’s shareholders on or about , 2024.

NOTICE OF THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

OF RIGEL RESOURCE ACQUISITION CORP

TO BE HELD ON , 2024

To Shareholders of Rigel:

NOTICE IS HEREBY GIVEN that an extraordinary general meeting of shareholders of Rigel, will be held on [ ], 2024 at [ ], New York City time, at Sidley Austin LLP, located at 787 Seventh Avenue New York, New York 10019, and via a live webcast at www.cstproxy.com/[ ], or at such other time, on such other date and at such other place to which the meeting may be adjourned. You are cordially invited to attend the General Meeting to conduct the following items of business and/or consider, and if thought fit, approve the following items:

| ● | Business Combination Proposal – a proposal, as an ordinary resolution, to approve the Business Combination Agreement, attached hereto as Annex A, as amended by the Omnibus Amendment, attached hereto as Annex A-1, and the Business Combination; |

| ● | Merger Proposal – a proposal, as a special resolution, to approve the Merger and the Plan of Merger, attached hereto as Annex B, pursuant to which the Merger will be consummated; |

| ● | 2024 Equity Incentive Plan Proposal – a proposal, as an ordinary resolution, to approve a proposed 2024 Equity Incentive Plan, attached hereto as Annex C; and |

| ● | Adjournment Proposal – a proposal, as an ordinary resolution, to adjourn the General Meeting to a later date or dates, if necessary, (i) to ensure that any supplement or amendment to this proxy statement/prospectus is provided to Rigel’s shareholders, (ii) in order to solicit additional proxies from Rigel’s shareholders in favor of any of the other proposals being presented or (iii) only with the prior written consent of the Target Companies, for the purposes of satisfying the Available Cash Condition. |

To attend the meeting virtually, please visit www.cstproxy.com/[ ] and use a control number assigned by Continental Stock Transfer & Trust Company. To register and receive access to the virtual meeting, registered shareholders and beneficial shareholders (i.e., those holding shares through a stock brokerage account or by a bank or other holder of record) will need to follow the instructions applicable to them provided in this proxy statement/prospectus.

The record date for the General Meeting for Rigel shareholders is [ ], 2024. For Rigel shareholders holding their Rigel Ordinary Shares in “street name,” only shareholders holding such Rigel Ordinary Shares at the close of business on the record date may vote at the General Meeting or any adjournment thereof. Rigel shareholders that hold their Rigel Ordinary Shares in registered form are entitled to one vote on each proposal presented at the General Meeting for each Rigel Ordinary Share held on the record date of the General Meeting.

Pursuant to the terms, and subject to the conditions, set forth in the Business Combination Agreement, the parties thereto will enter into the Business Combination, pursuant to which, among other things, (i) Rigel will merge with and into Merger Sub, with Merger Sub being the surviving company of the Merger and the separate corporate existence of Rigel ceasing, and (ii) Aurous Resources will acquire all of the issued and outstanding equity interests of the Target Companies. Following the Merger and the Share Exchange, each of the Target Companies and Merger Sub will be a wholly owned subsidiary of Aurous Resources, and Aurous Resources will become a publicly traded company. At the Closing, the Aurous Resources Ordinary Shares are expected to be listed on the Nasdaq.

To effectuate the Business Combination, among other things and subject to the terms and conditions therein, the Business Combination Agreement provides that:

| ● | each Rigel Class A Ordinary Share issued and outstanding as of immediately prior to the Merger Effective Time (other than shares to be cancelled in accordance with the Business Combination Agreement and any Redemption Shares) will be automatically cancelled and converted into the right to receive the Class A Merger Consideration; |

| ● | the Redemption Shares will not be converted into and become the Class A Merger Consideration, and instead will at the Merger Effective Time be redeemed for an amount in cash per share calculated in accordance with such shareholder’s redemption rights; |

| ● | each Rigel Class B Ordinary Share issued and outstanding as of immediately prior to the Merger Effective Time (other than shares to be cancelled in accordance with the Business Combination Agreement) will be automatically cancelled and converted into the right to receive one Aurous Resources Ordinary Share; and |

| ● | each issued and outstanding Rigel Public Warrant will be converted automatically into the right of the holder thereof to receive one Aurous Resources Public Warrant, and each issued and outstanding Rigel Private Warrant will be converted automatically into the right of the holder thereof to receive one Aurous Resources Private Warrant. Each Aurous Resources Public Warrant will have, and be subject to, substantially the same terms and conditions as are in effect with respect to the Rigel Public Warrants, and each Aurous Resources Private Warrant will have, and be subject to, substantially the same terms and conditions as are in effect with respect to the Rigel Private Warrants, except that in each case they shall represent the right to acquire Aurous Resources Ordinary Shares. |

On March 11, 2024, concurrently with the execution of the Business Combination Agreement, Rigel, Aurous Resources, Blyvoor Gold and the Sponsor, as part of the PIPE Investment, entered into the Subscription Agreements with the PIPE Investors, pursuant to which the PIPE Investors have agreed, subject to the terms and conditions set forth therein, to subscribe for and purchase from Aurous Resources at the Closing, an aggregate of 750,000 Aurous Resources Ordinary Shares, at a purchase price of $10 per share, for an aggregate cash amount of $7,500,000 (subject to certain adjustments further described herein).

Pursuant to the Subscription Agreements, a PIPE Investor may elect to reduce the number of PIPE Investment Shares it is obligated to purchase under its Subscription Agreement, on a one-for-one basis, up to the total amount of PIPE Investment Shares subscribed thereunder, to the extent such PIPE Investor (i) purchases Open-Market Purchase Shares in open market transactions at a price of less than or equal to the Closing redemption price per share, as established prior to the record date for voting at the General Meeting, or (ii) beneficially owned any Rigel Class A Ordinary Shares as of the date of its Subscription Agreement. This reduction right is subject to PIPE Investor agreeing, with respect to such Open-Market Purchase Shares, to (A) not sell or transfer any such Open-Market Purchase Shares prior to the Closing, (B) not vote any such Open-Market Purchase Shares in favor of approving the Business Combination and instead submit a proxy abstaining from voting thereon and (C) to the extent such PIPE Investor has the right to have all or some of its Open-Market Purchase Shares redeemed for cash in connection with the Closing, not exercise any such redemption rights, and with respect to such Currently Owned Shares, to (X) not sell or transfer any such Currently Owned Shares prior to the Closing, (Y) vote all of its Currently Owned Shares in favor of approving the Business Combination at the General Meeting and (Z) to the extent such PIPE Investor has the right to have all or some of its Currently Owned Shares redeemed for cash in connection with the Closing, not exercise any such redemption rights.

In addition, in connection with the Closing and pursuant to the Subscription Agreements:

| ● | the Sponsor shall surrender an aggregate number of Rigel Class B Ordinary Shares it holds in an amount equal to (i) (A) four, multiplied by (B) the aggregate number of Total PIPE Investment Shares, divided by (ii) ten; |

| ● | Blyvoor Gold shall surrender an aggregate number of Aurous Resources Ordinary Shares it receives as Exchange Consideration in an amount equal to (i) (A) one, multiplied by (B) the aggregate number of Total PIPE Investment Shares, divided by (ii) ten; and |

| ● | each PIPE Investor shall receive, following the Closing, a number of Aurous Resources Ordinary Shares equal to its proportion of the sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares (pro rata for such PIPE Investor’s Total PIPE Investment Shares), for no additional cash consideration, other than their par value. |

In connection with the execution of the Business Combination Agreement, Rigel, Aurous Resources, the Target Companies and the Sponsors have entered into the Sponsor Support Agreement. The Sponsor Support Agreement was subsequently amended by the Omnibus Amendment. The Sponsor Support Agreement provides that, among other things, the Sponsors agree (i) to vote in favor of the Business Combination Agreement and the Business Combination, (ii) to appear at certain Rigel shareholder meetings for purposes of constituting a quorum, (iii) to vote against any proposals that could reasonably be expected to prevent or materially impede, frustrate, inhibit, interfere with, delay, discourage or adversely affect the timely consummation of the Business Combination, (iv) to waive any anti-dilution adjustment to the conversion ratio with respect to their existing Rigel Class B Ordinary Shares that would result from the issuance of Aurous Resources Ordinary Shares or Rigel Class A Ordinary Shares, (v) subject to certain conditions, to sell to Aurous Resources a certain number of either Rigel Public Warrants or Rigel Private Warrants, at a price per warrant equal to the volume-weighted average price of the Rigel Public Warrants for the 30-day period preceding the Closing, (vi) subject to certain conditions, to extend, or cause their respective affiliate to extend, the maturity date of each of the Working Capital Loans (as defined in the Omnibus Amendment) and, in connection with the Sponsor Warrant Redemption (as defined below), if any, prepare and issue a non-interest bearing promissory note in favor of each Sponsor with a principal amount equal to such Sponsor’s pro rata portion of the warrant purchase price and (vii) to exercise, or cause its affiliates to exercise, either of the Rigel Public Warrants or Rigel Private Warrants only on a “cashless basis” and forgo any right of conversion with respect to the Working Capital Loans (as defined in the Omnibus Amendment), in each case, on the terms and subject to the conditions set forth in the Sponsor Support Agreement.

In addition, pursuant to the Sponsor Support Agreement, the Sponsors have agreed, subject to certain customary exceptions, not to transfer (i) any Aurous Resources Ordinary Shares owned by such Sponsor until the 12-month anniversary of the Closing, (ii) a number of Aurous Resources Private Warrants equal to 40% of all Aurous Resources Private Warrants owned by such Sponsor (including any Aurous Resources Ordinary Shares issuable upon the exercise of such warrants) until the 12-month anniversary of the Closing and (iii) a number of Aurous Resources Private Warrants equal to 60% of all Aurous Resources Private Warrants owned by such Sponsor (including any Aurous Resources Ordinary Shares issuable upon the exercise of such warrants) until the 24-month anniversary of the Closing. The foregoing restrictions on transfer with respect to Aurous Resources Ordinary Shares shall be released if the last reported sale price of the Aurous Resources Ordinary Shares equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 180 days after Closing. For more information on the Sponsor Support Agreement and the Omnibus Amendment, see “Proposal No. 1—The Business Combination Proposal—Ancillary Agreements—Sponsor Support Agreement” and “Proposal No. 1—The Business Combination Proposal—Ancillary Agreements—Omnibus Amendment to the Business Combination Agreement and the Sponsor Support Agreement.”.

The above matters are more fully described in this proxy statement/prospectus, which includes, as Annex A, a copy of the Business Combination Agreement and as Annex A-1, a copy of the Omnibus Amendment. You are urged to read carefully this proxy statement/prospectus in its entirety, including each of the Annexes hereto and the accompanying financial statements provided herein.

Pursuant to Rigel’s amended and restated memorandum and articles of association, Rigel is providing each of its public shareholders with the opportunity to redeem, upon the Closing, any Rigel Class A Ordinary Shares then held by such shareholder for cash equal to such Rigel shareholder’s respective pro rata share of the aggregate amount on deposit (as of two business days prior to the Closing) in the Trust Account, which holds the proceeds (including interest accrued thereon, which shall be net of taxes payable) of Rigel’s Initial Public Offering and certain of the proceeds of the Private Placement. Public shareholders may elect to redeem their Rigel Class A Ordinary Shares even if they vote in favor of the Business Combination Proposal.

The Closing of the Business Combination is conditioned upon the approval of each of the Business Combination Proposal and the Merger Proposal. The Adjournment Proposal is not conditioned on the approval of any other proposal set forth in this proxy statement/prospectus.

Approval of each of the Business Combination Proposal, the 2024 Equity Incentive Plan Proposal and the Adjournment Proposal requires an ordinary resolution under Cayman Islands law, which requires the affirmative vote of the holders of a majority of the Rigel Class A Ordinary Shares and the Rigel Class B Ordinary Shares (together, the “Rigel Ordinary Shares”) represented in person or by proxy and entitled to vote thereon and who vote at the General Meeting. Approval of the Merger Proposal requires a special resolution under Cayman Islands law, which requires the affirmative vote of the holders of at least two-thirds of the Rigel Ordinary Shares represented in person or by proxy and entitled to vote thereon and who vote at the General Meeting.

| | By Order of the Board of Directors, |

| | |

| | Oskar Lewnowski |

| | Chairman of the Board of Directors |

, 2024

New York, New York

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form F-4 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Aurous Resources constitutes a prospectus of Aurous Resources under Section 5 of the Securities Act (as defined below) with respect to the shares of Aurous Resources to be issued to Rigel’s shareholders if the Business Combination described herein is consummated. This document also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Exchange Act with respect to the General Meeting of Rigel’s shareholders, at which such shareholders will be asked to consider and vote upon a proposal to approve and adopt the Business Combination Agreement, among other matters and proposals.

No person is authorized to give any information or to make any representation with respect to the matters that this proxy statement/prospectus describes other than those contained in this proxy statement/prospectus. None of Rigel, Blyvoor or Aurous Resources takes any responsibility for, and can provide no assurances as to the reliability of, any other information or representation others may give you. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this proxy statement/prospectus nor any distribution of securities under this proxy statement/prospectus will, under any circumstances, create an implication that there has been no change in the affairs of Rigel, Blyvoor or Aurous Resources since the date of this proxy statement/prospectus or that any information contained herein is correct as of any time subsequent to such date.

ADDITIONAL INFORMATION

This proxy statement/prospectus incorporates important business and financial information that is not included in or delivered with this proxy statement/prospectus. This information is available for you to review through the SEC’s website at www.sec.gov.

You may request copies of this proxy statement/prospectus and any of the documents incorporated by reference into this proxy statement/prospectus or other publicly available information concerning Rigel, free of charge, by written request to 7 Bryant Park, 1045 Avenue of the Americas, Floor 25, New York, NY 10018.

In order for Rigel’s shareholders to receive timely delivery of the documents in advance of the General Meeting, you must request the information no later than , 2024, or five business days prior to the date of the General Meeting.

CONVENTIONS WHICH APPLY TO THIS PROXY STATEMENT/PROSPECTUS

In this proxy statement/prospectus, unless otherwise specified or the context otherwise requires:

| ● | “$,” “USD” and “U.S. dollar” each refer to the United States dollar; and |

| ● | “R,” “ZAR” and “rand” each refer to the South African rand. |

Certain amounts described herein have been expressed in U.S. dollars for convenience, and when expressed in U.S. dollars in the future, such amounts may be different from those set forth herein due to intervening exchange rate fluctuations. For further information see below under “Important Information About IFRS and Non-IFRS Financial Measures—Convenience Translation of rand into U.S. Dollars.”

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES

This proxy statement/prospectus contains non-IFRS measures that are not required by, or presented in accordance with, IFRS. Aurous Gold and Gauta Tailings present non-IFRS measures because they are used by Aurous Gold’s and Gauta Tailings’ management in monitoring their businesses and because Aurous Gold and Gauta Tailings believe that they and similar measures are frequently used by securities analysts, investors and other interested parties in evaluating companies in their industry.

Presentation of Financial Information

This proxy statement/prospectus contains:

| (i) | the audited financial statements of Rigel as of and for the years ended December 31, 2023 and 2022, prepared in accordance with U.S. GAAP; |

| (ii) | the unaudited financial statements of Rigel as of and for the quarters ended June 30, 2024 and 2023, prepared in accordance with U.S. GAAP (together with the audited financial statements of Rigel referred to above, the “Rigel Historical Financial Information”); |

| (iii) | the audited consolidated financial statements of Aurous Gold as of and for the years ended February 29, 2024 and February 28, 2023, prepared in accordance with IFRS; |

| (iv) | the audited financial statements of Gauta Tailings as of and for the years ended February 29, 2024 and February 28, 2023, prepared in accordance with IFRS (together with the financial statements of Aurous Gold referred to above, the “Blyvoor Historical Financial Information”); |

| | | |

| | (v) | the audited balance sheet of Aurous Resources as of September 30, 2024, prepared in accordance with U.S. GAAP (the “Aurous Resources Historical Financial Information”) and |

| (vi) | the unaudited pro forma condensed combined financial information of Aurous Resources as of and for the year ended February 29, 2024, prepared in accordance with Article 11 of Regulation S-X. |

The Blyvoor Historical Financial Information included in this proxy statement/prospectus have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and audited in accordance with the standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and are reported in rand.

Aurous Resources

Aurous Resources was incorporated on February 8, 2024, for the purpose of effectuating the Business Combination described herein. Aurous Resources has no material assets and does not operate any businesses. The balance sheet of Aurous Resources included in this proxy statement/prospectus has been prepared in accordance with U.S. GAAP. Following the Business Combination, Aurous Resources will qualify as a foreign private issuer as defined under Rule 405 under the Securities Act and will prepare its financial statements denominated in rand and in accordance with IFRS. Accordingly, the unaudited pro forma combined financial information presented in this proxy statement/prospectus has been prepared in accordance with IFRS and is denominated in rand.

IFRS

Unless otherwise stated, the financial information in this proxy statement/prospectus has been prepared in accordance with IFRS as issued by the IASB.

Other Non-IFRS Financial Measures

This proxy statement/prospectus contains certain unaudited financial and operating measures that are not defined or recognized under IFRS that we use to assess the performance of our business. Explanations of these measures are set out under “Aurous Gold’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Significant Factors Affecting Aurous Gold’s Results of Operations—Costs and effects of inflation—Non-IFRS Cost Indicators.” For example, in this proxy statement/prospectus, we present non-IFRS financial measures such as all-in sustaining cost, all-in cost, adjusted all-in sustaining cost, and adjusted all-in cost which we use to, among other things, evaluate the performance of our operations, develop budgets, and measure our performance against those budgets. As there are no generally accepted accounting principles governing the calculation of non-IFRS financial and operating measures, other companies may calculate such measures differently or may use such measures for different purposes than we do, and such measures should therefore not be used to compare us against another company.

We believe that the above non-IFRS financial measures assist in evaluating our trading performance, as these measures are regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. These non-IFRS measures are used by different companies for differing purposes and are often calculated in ways that reflect the particular circumstances of those companies. You should exercise caution in comparing these measures reported by us to such measures or other similar measures as reported by other companies. Investors should not consider these non-IFRS measures (i) as a substitute for operating results (as determined in accordance with IFRS) or as a measure of our operating performance, (ii) as a substitute for cash flow from or used in operating, investing and financing activities (as determined in accordance with IFRS) or as a measure of our ability to meet cash needs or (iii) as a substitute for any other measure of performance under IFRS. These measures may not be indicative of our historical operating results or financial condition, nor are such measures meant to be predictive of our future results or financial condition.

Rounding and Negative Amounts

Certain figures in this proxy statement/prospectus, including financial data, have been rounded. Accordingly, figures shown for the same category presented in different tables may vary slightly, and figures shown as totals in certain tables may not be an exact arithmetic aggregation of the figures which precede them.

In presenting the Blyvoor Historical Financial Information, as well as other information, of Aurous Gold and Gauta Tailings, most numerical figures are presented in thousands of rand or millions of rand, and in presenting the Rigel Historical Financial Information, as well as other information, of Rigel, and the Aurous Resources Historical Financial Information, as well as other information of, Aurous Resources, most numerical figures are presented in thousands of U.S. dollars or millions of U.S. Dollars. For the convenience of the reader of this proxy statement/prospectus, certain numerical figures in this proxy statement/prospectus are rounded to the nearest one thousand or nearest one hundred thousand. As a result of this rounding, certain numerical figures presented herein may vary slightly from the corresponding numerical figures presented in the Blyvoor Historical Financial Information, Rigel Historical Financial Information and Aurous Resources Historical Financial Information.

In tables, negative financial amounts are shown between brackets. Otherwise, negative financial amounts may also be shown by “–” or “negative” before the amount.

Convenience Translation of rand into U.S. Dollars

Certain amounts in rand included elsewhere in this proxy statement/prospectus have been expressed in U.S. dollars for convenience. Except as otherwise expressly indicated, the rate we used to convert these amounts was R19.1884 to $1.00 (the “Reference Rate”), subject to rounding adjustments, which was the noon buying rate as of February 29, 2024 in the City of New York as announced for custom purposes by the Federal Reserve Bank of New York. The U.S. dollar equivalent information included elsewhere in this proxy statement/prospectus is provided solely for convenience of investors, is not in accordance with any generally accepted accounting principles and should not be construed as implying that the real amounts represent, or could have been or could be converted into, U.S. dollars at this rate or at any other rate.

INDUSTRY AND MARKET DATA

In this proxy statement/prospectus, we present industry data, information and statistics regarding the markets in which Blyvoor competes as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with Blyvoor’s own internal estimates and information obtained from discussions with its customers, taking into account publicly available information about other industry participants and Blyvoor management’s judgment where information is not publicly available. This information appears in “Summary of the Proxy Statement/Prospectus,” “Business of Aurous Gold and Gauta Tailings and Certain Information About Aurous Gold and Gauta Tailings” and other sections of this proxy statement/prospectus.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this proxy statement/prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

TECHNICAL MINING INFORMATION

Cautionary Note Regarding Presentation of Mineral Reserve and Mineral Resource Estimates

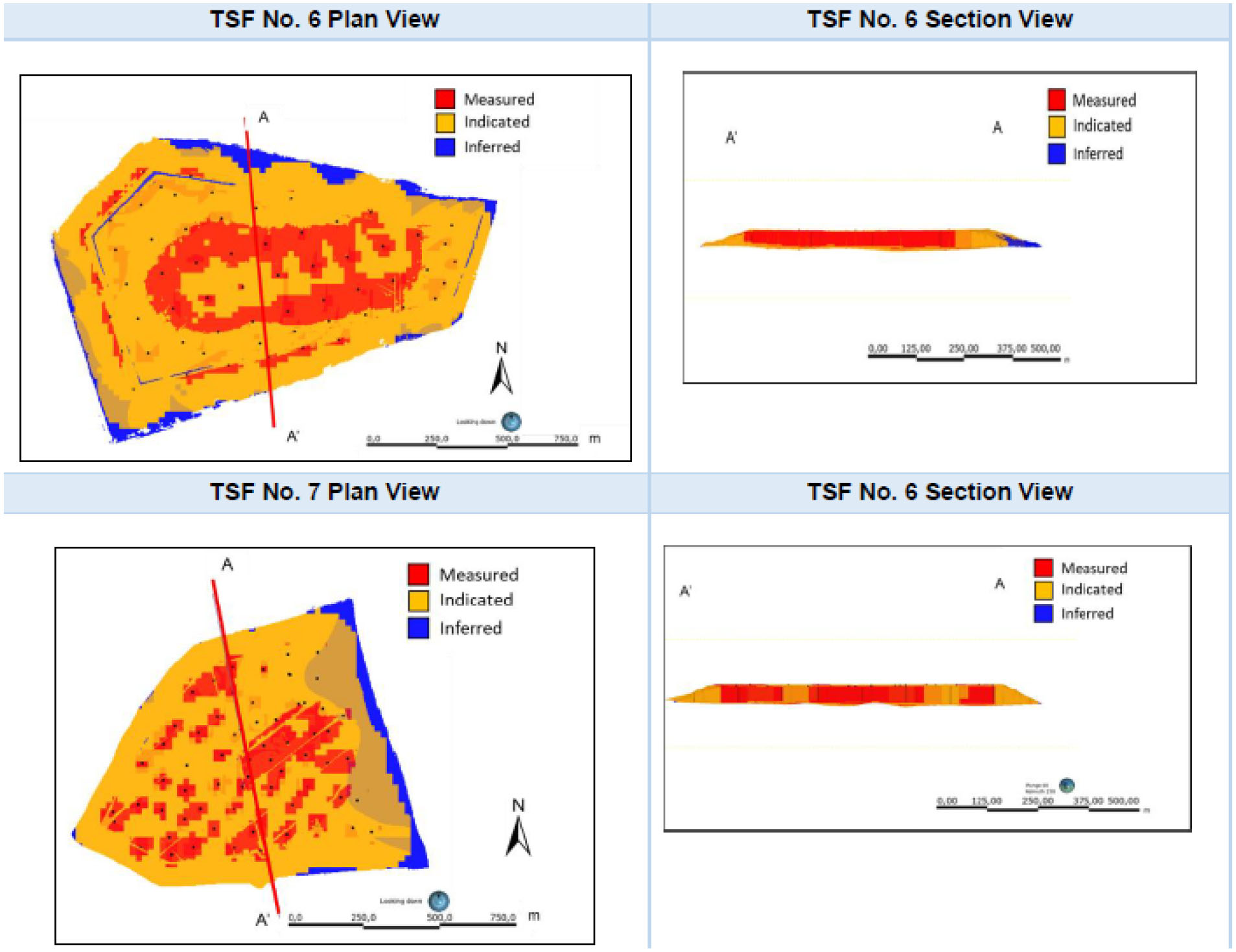

The SEC adopted new mineral property disclosure requirements in subpart 1300 of Regulation S-K (the “S-K 1300”) effective January 2021 that are applicable to all mining companies filing registration statements with the SEC. Blyvoor has inferred, indicated and measured mineral resources and probable and proven mineral reserves. Investors should understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. An inferred mineral resource has a lower level of confidence than that applying to an indicated or measured mineral resource and may not be converted to a mineral reserve.

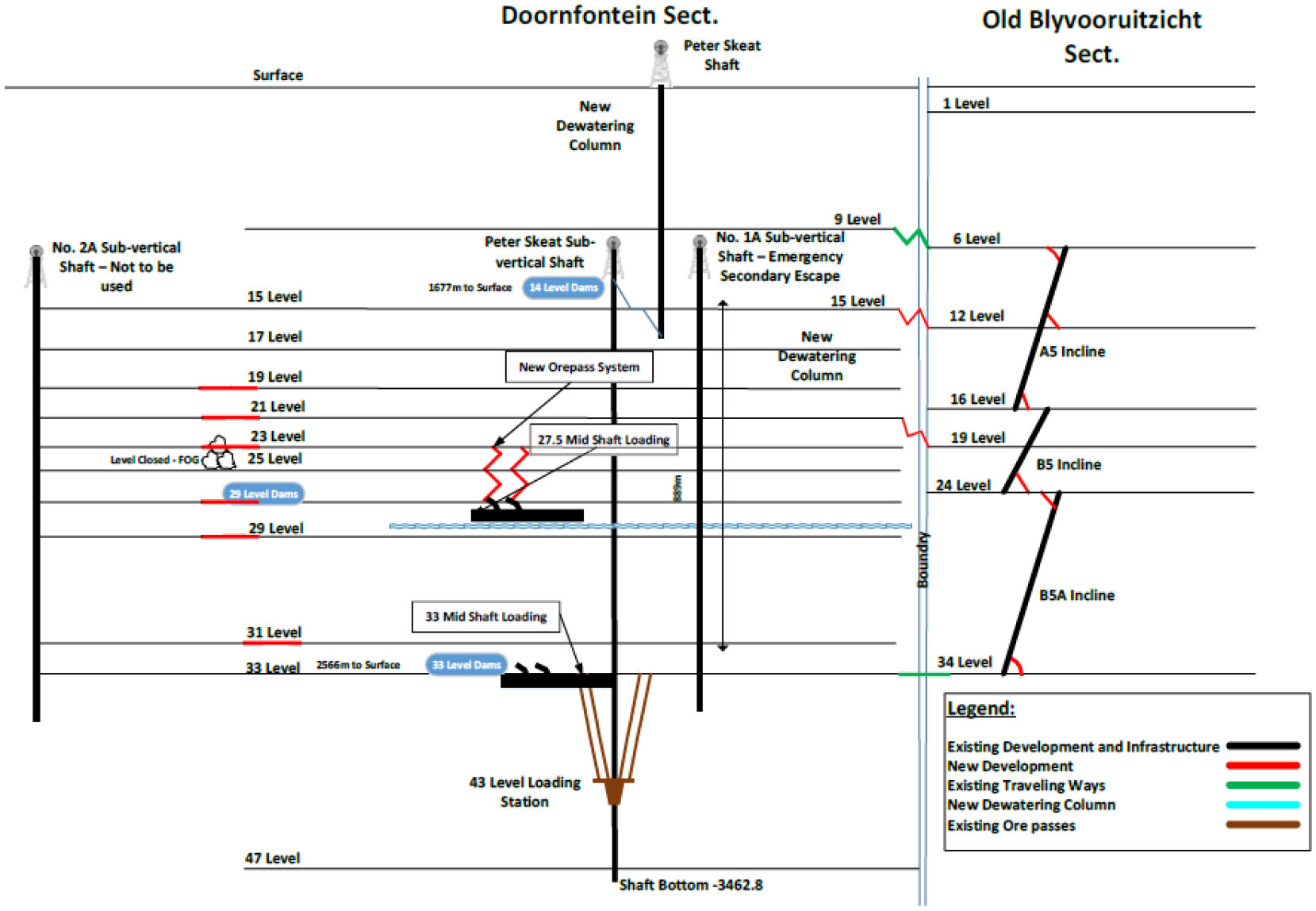

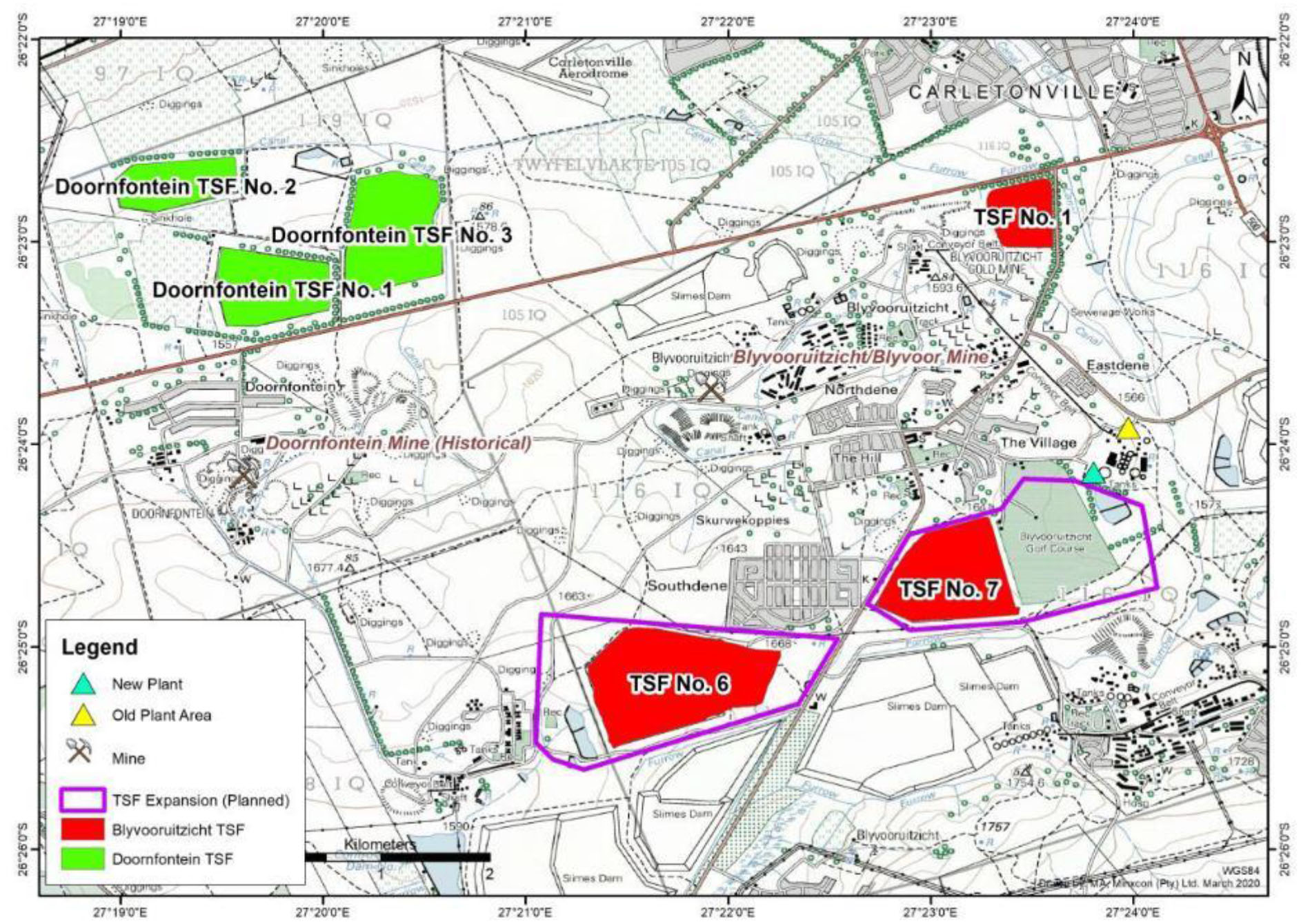

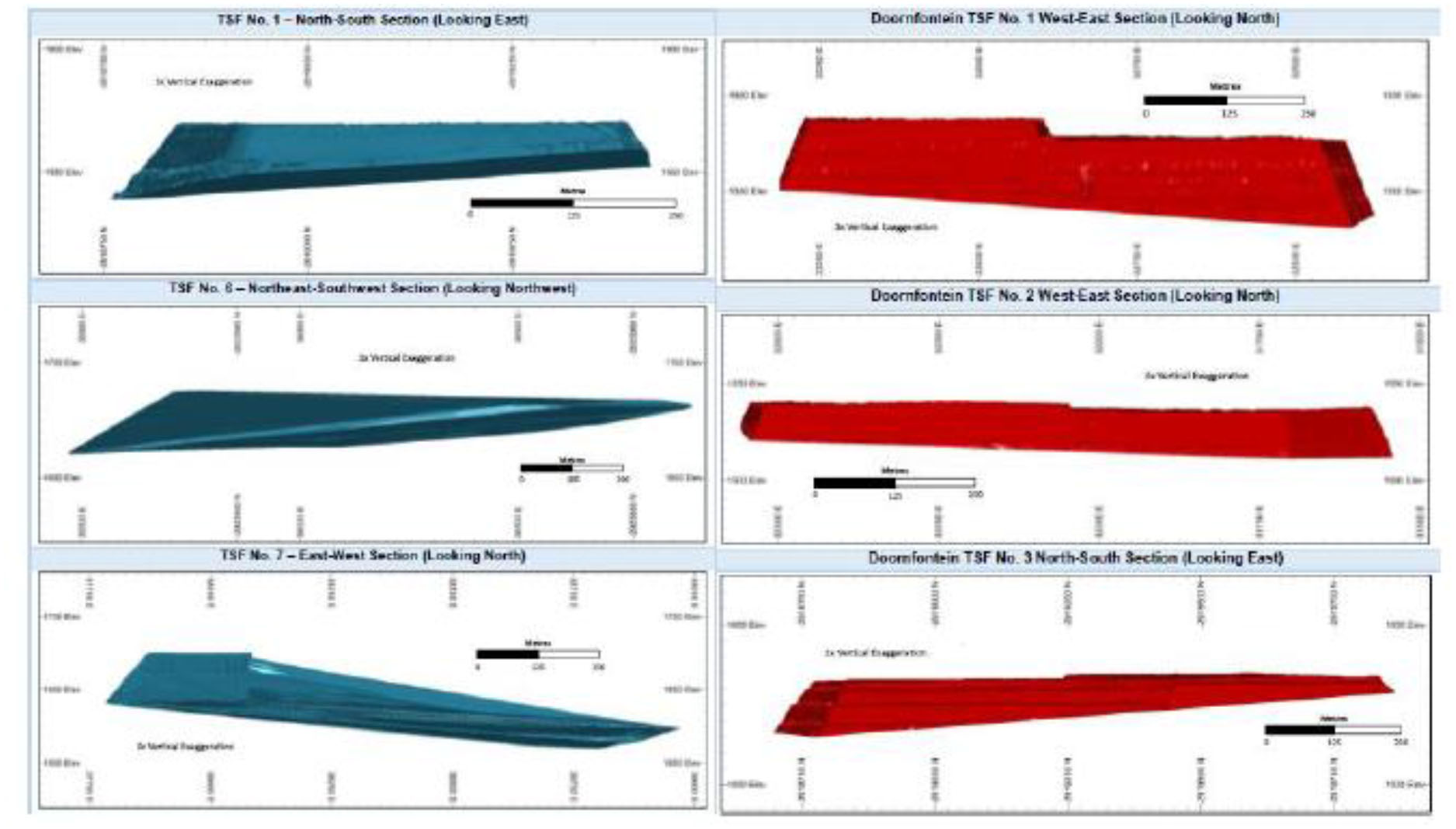

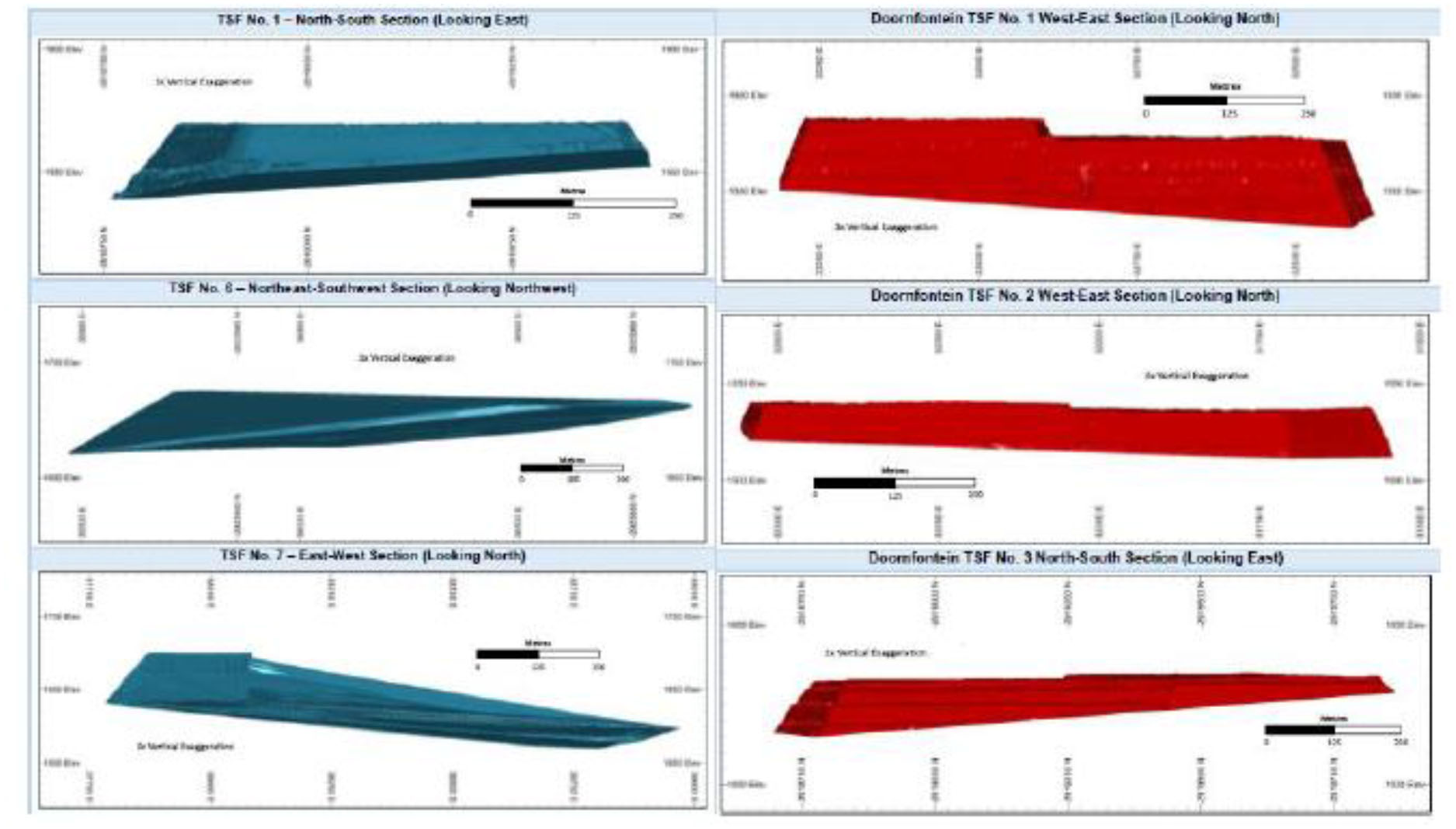

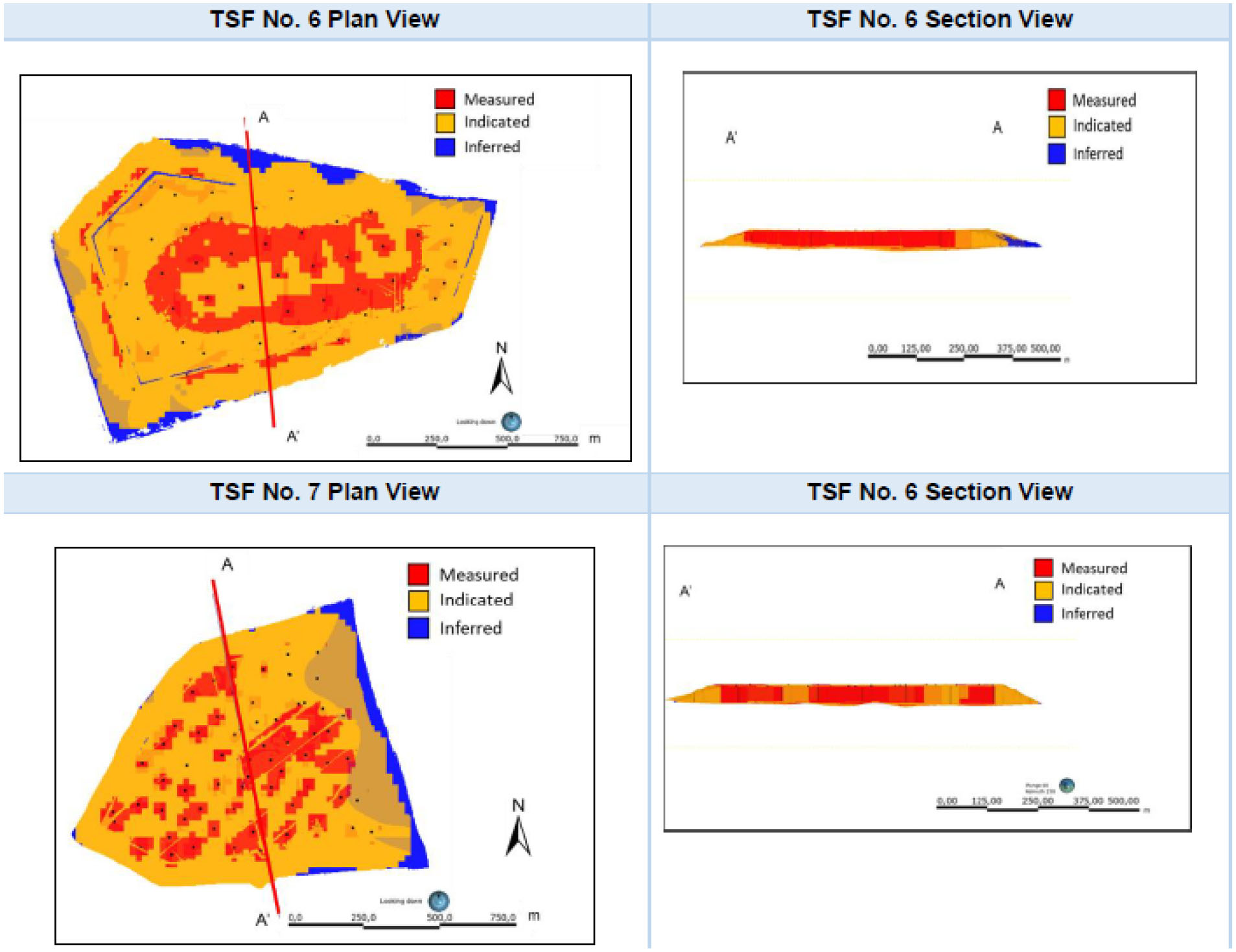

The Blyvoor Gold Mine is currently in commercial operation, but is expected to enter a ramp-up phase in order to reach steady-state production. There is currently no commercial production at the Gauta Tailings Project. A feasibility study level report titled “S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa” with respect to the Blyvoor Gold Mine has been prepared for Aurous Gold with an effective date of February 29, 2024 (referred to herein as “Mine TRS”). A prefeasibility study level report titled “S-K 1300 Technical Report Summary on the Blyvoor Tailings Retreatment Project, South Africa” with respect to the Gauta Tailings Project has been prepared for Gauta Tailings with an effective date of February 29, 2024 (referred to herein as “Tailings TRS”). Gauta Tailings intends to commission a formal feasibility study level report for the Gauta Tailings Project (the “Gauta Feasibility Study”). The Gauta Feasibility Study has not yet been started and is not expected to be completed until fiscal 2026.

You are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. Under S-K 1300, estimates of inferred mineral resources may not form the basis of an economic analysis. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. A significant amount of exploration must be completed in order to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded to mineral reserves.

Qualified Person Statement

Some technical mining information contained herein with respect to the Blyvoor Gold Mine and the Gauta Tailings Project is derived from the Mine TRS, and the Tailings TRS. Each of Mr. Uwe Engelmann BSc (Zoo. & Bot.), BSc Hons (Geol.), Pr.Sci.Nat., FGSSA and Mr. Daniel (Daan) van Heerden B Eng (Min.), MCom (Bus. Admin.), MMC, Pr.Eng., FSAIMM, AMMSA have approved and verified the technical mining information related to the Blyvoor Gold Mine and Gauta Tailings Project contained in the Mine TRS and Tailings TRS, respectively, and reproduced in this proxy statement/prospectus.

SELECTED DEFINITIONS

In this proxy statement/prospectus unless stated otherwise or the context otherwise requires, a reference to:

| ● | “2024 Equity Incentive Plan” means the proposed equity incentive plan of Aurous Resources, further described under “Proposal No. 3—The 2024 Equity Incentive Plan Proposal”; |

| ● | “Additional PIPE Investors” means additional investors participating in the PIPE Funding pursuant to a Subscription Agreement, other than the PIPE Investors; |

| ● | “AEL” means atmospheric emissions license; |

| ● | “Aggregate Cash Proceeds” shall have the meaning set forth in the Business Combination Agreement; |

| ● | “Aggregate Consideration” means, in the aggregate, the Exchange Consideration, the Gauta Tailings Deferred Consideration (as defined below) and the Earnout Shares (as defined below); |

| ● | “AMCU” means the Association of Mineworkers and Construction Union; |

| ● | “Ancillary Agreements” means, collectively, the Exchange Agreement, the Sponsor Support Agreement, the Registration Rights Agreement, the Subscription Agreements, the Orion Forward Purchase Agreement, the Assumed Warrant Agreement, the Side Letter, the Proposed Organizational Documents and, as applicable, any subscription agreements entered into with respect to the PIPE Financing; |

| ● | “Assumed Warrant Agreement” means the Warrant Assignment, Assumption and Amendment Agreement, into which Aurous Resources, Rigel and Continental Stock Transfer & Trust Company intend to enter at the Closing, amend the Original Warrant Agreement in order to effectuate the transfer of Rigel Warrants into Aurous Resources Warrants; |

| ● | “August 2024 Working Capital Loan” means the promissory note between Rigel, as maker, and the Sponsor, as payee, dated August 23, 2024; |

| ● | “Aurous Gold” means Blyvoor Gold Resources Proprietary Limited, a South African private limited liability company; |

| ● | “Aurous Gold Consideration” means 28,017,500 Aurous Resources Ordinary Shares issuable to Blyvoor Gold in exchange for its shares of Aurous Gold; |

| ● | “Aurous Resources” means Aurous Resources, a Cayman Islands exempted company and wholly owned subsidiary of Rigel; |

| ● | “Aurous Resources Board” means the board of directors of Aurous Resources; |

| ● | “Aurous Resources Ordinary Shares” means ordinary shares, par value $0.0001 per share, in the share capital of Aurous Resources; |

| ● | “Aurous Resources Private Warrant” means one warrant of Aurous Resources entitling the holder thereof to purchase one Aurous Resources Ordinary Share on substantially the same terms and conditions described in the Final Prospectus with respect to the Rigel Private Warrants; |

| ● | “Aurous Resources Public Warrant” means one warrant of Aurous Resources entitling the holder thereof to purchase one Aurous Resources Ordinary Share on substantially the same terms and conditions described in the Final Prospectus with respect to the Rigel Public Warrants; |

| ● | “Aurous Resources Warrants” means, collectively, the Aurous Resources Public Warrants and the Aurous Resources Private Warrants; |

| ● | “AURS” means the ticker symbol that Aurous Resources Ordinary Shares are expected to be traded under on Nasdaq; |

| ● | “AURSW” means the ticker symbol that Aurous Resources Public Warrants are expected to be traded under on Nasdaq; |

| ● | “Available Cash Condition” means the closing condition, set forth in the Business Combination Agreement, whereby the obligation of Blyvoor to consummate the Business Combination is subject to the availability of Aggregate Cash Proceeds of not less than $50 million at the Closing; provided that the aggregate amount of Target Group Company Transaction Expenses and Rigel Transaction Expenses to be paid in cash by Aurous Resources in connection with the Closing shall not be in excess of $17 million; |

| ● | “BEE” means Black Economic Empowerment; |

| ● | “Benoryn” means Benoryn Investment Holdings Proprietary Limited, a South African private limited liability company; |

| ● | “Blyvoor” or “Target Companies” means Aurous Gold and Gauta Tailings, together; |

| ● | “Blyvoor Capital” means Blyvoor Gold Capital Proprietary Limited, a South African private limited liability company; |

| ● | “Blyvoor Forfeit Shares” means the Aurous Resources Ordinary Shares Blyvoor Gold receives as Exchange Consideration in an amount equal to (i) (A) one, multiplied by (B) the aggregate number of Total PIPE Investment Shares, divided by (ii) ten that Blyvoor Gold shall surrender in connection with the Closing and pursuant to the Subscription Agreements; |

| ● | “Blyvoor Gold” means Blyvoor Gold Proprietary Limited, a South African private limited liability company, a shareholder of Aurous Gold and the sole shareholder of Gauta Tailings; |

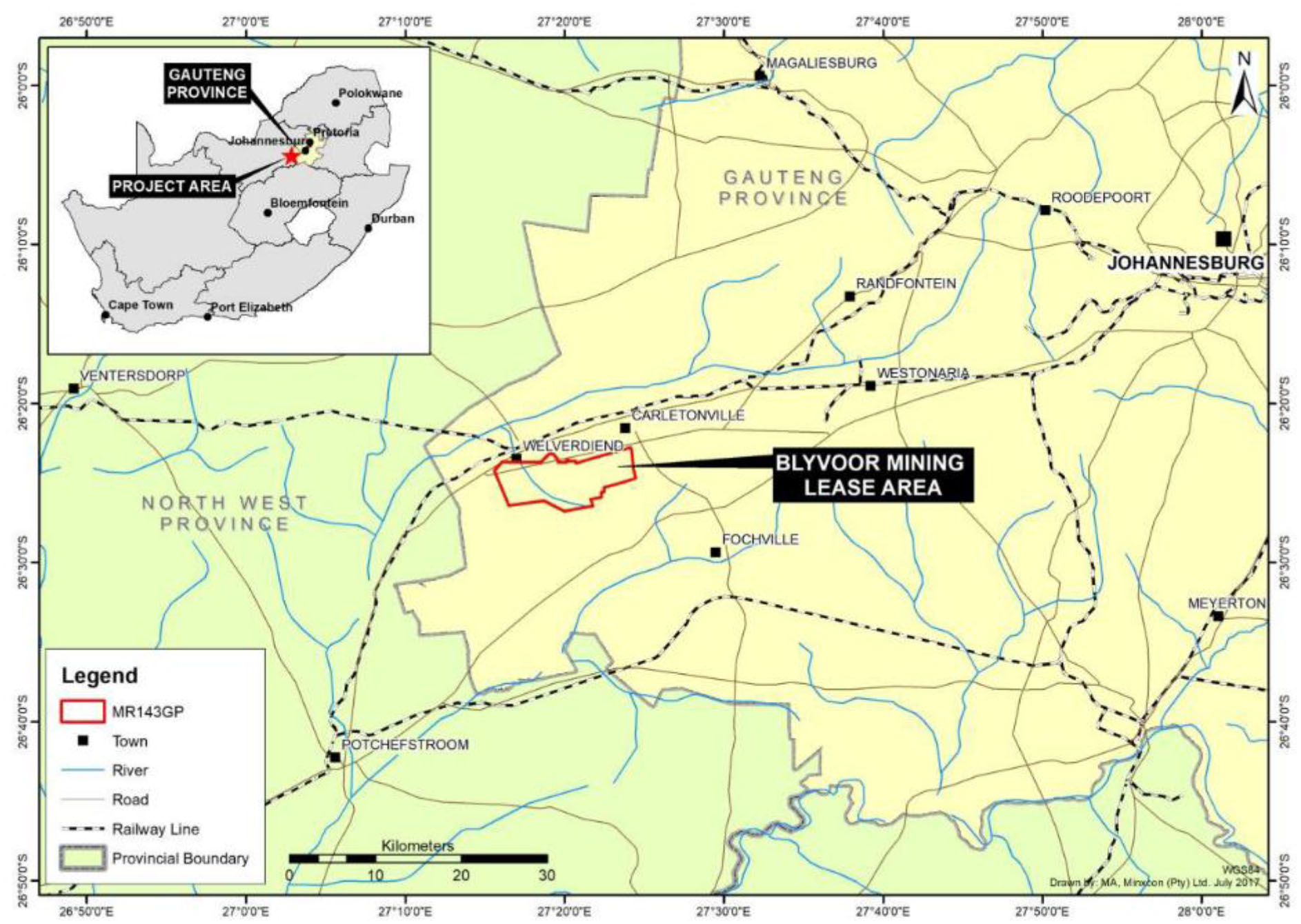

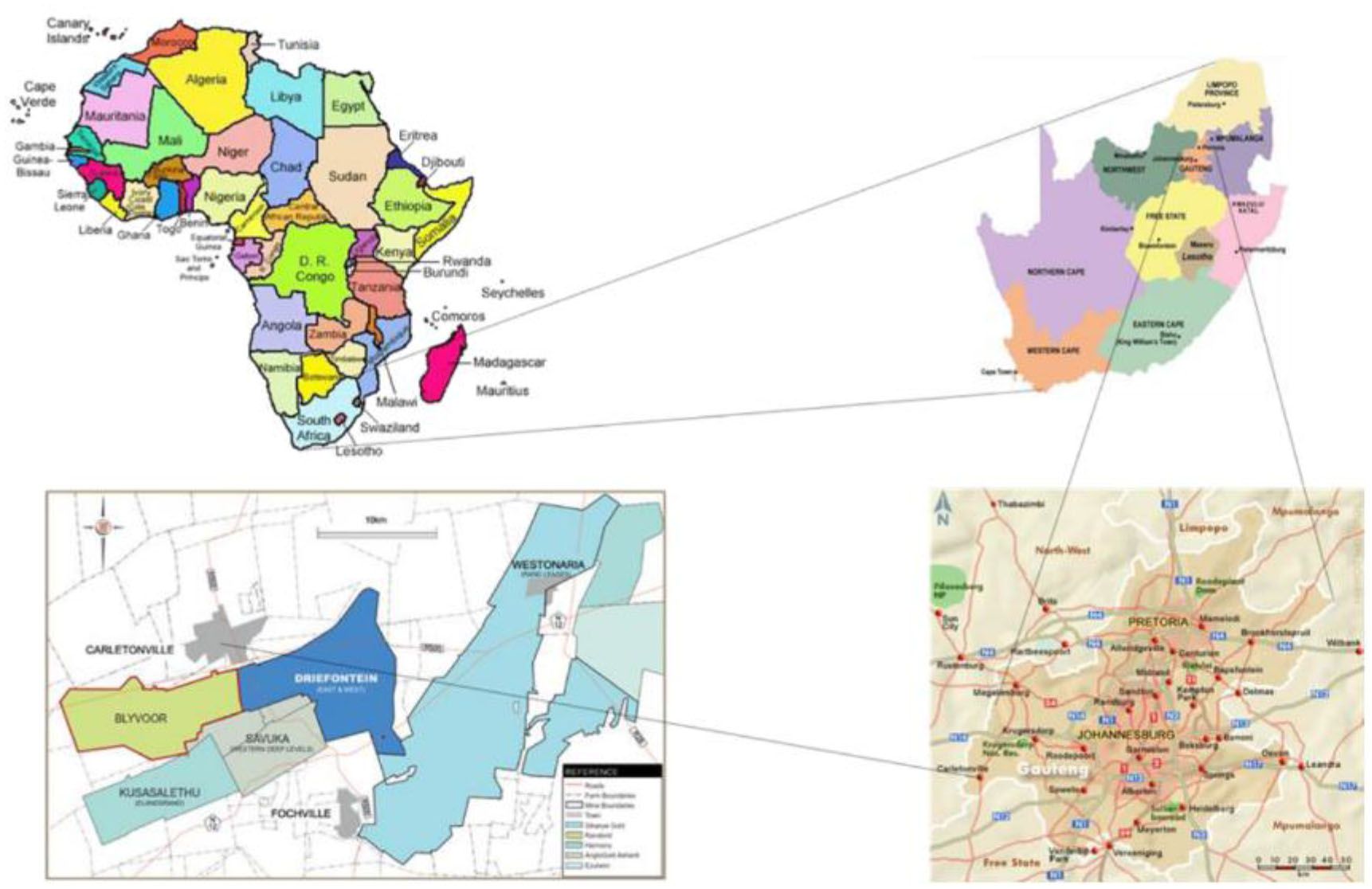

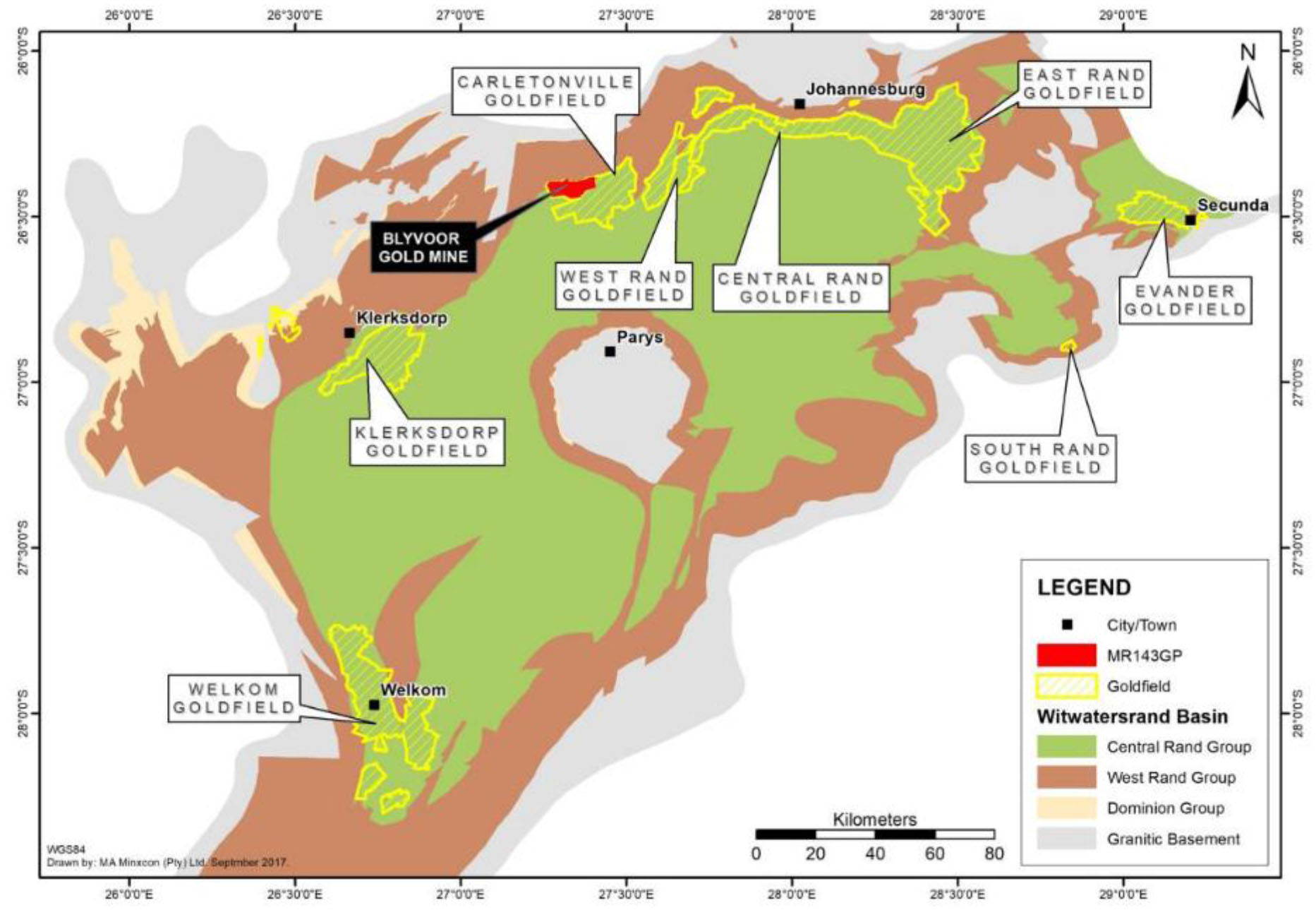

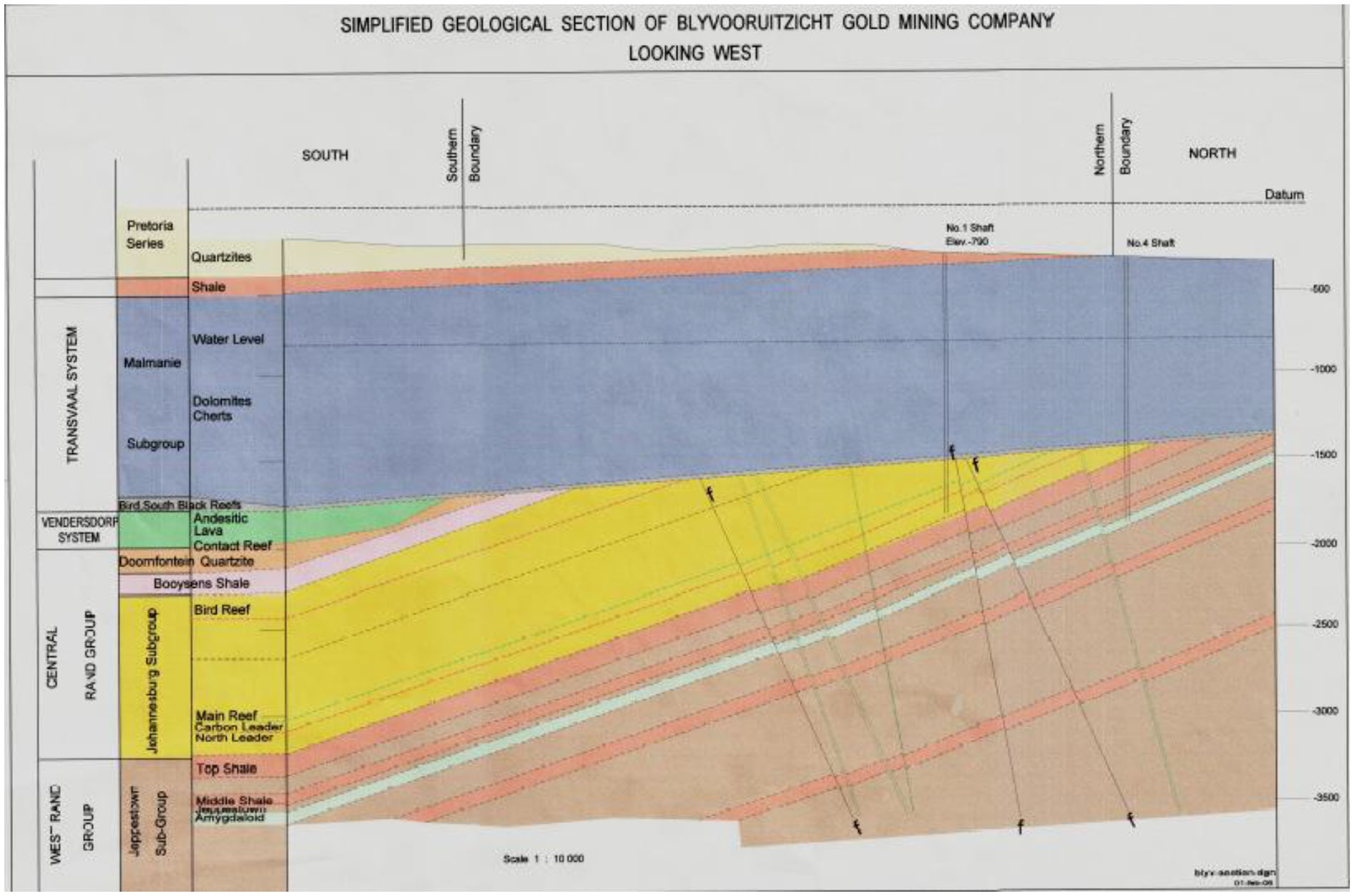

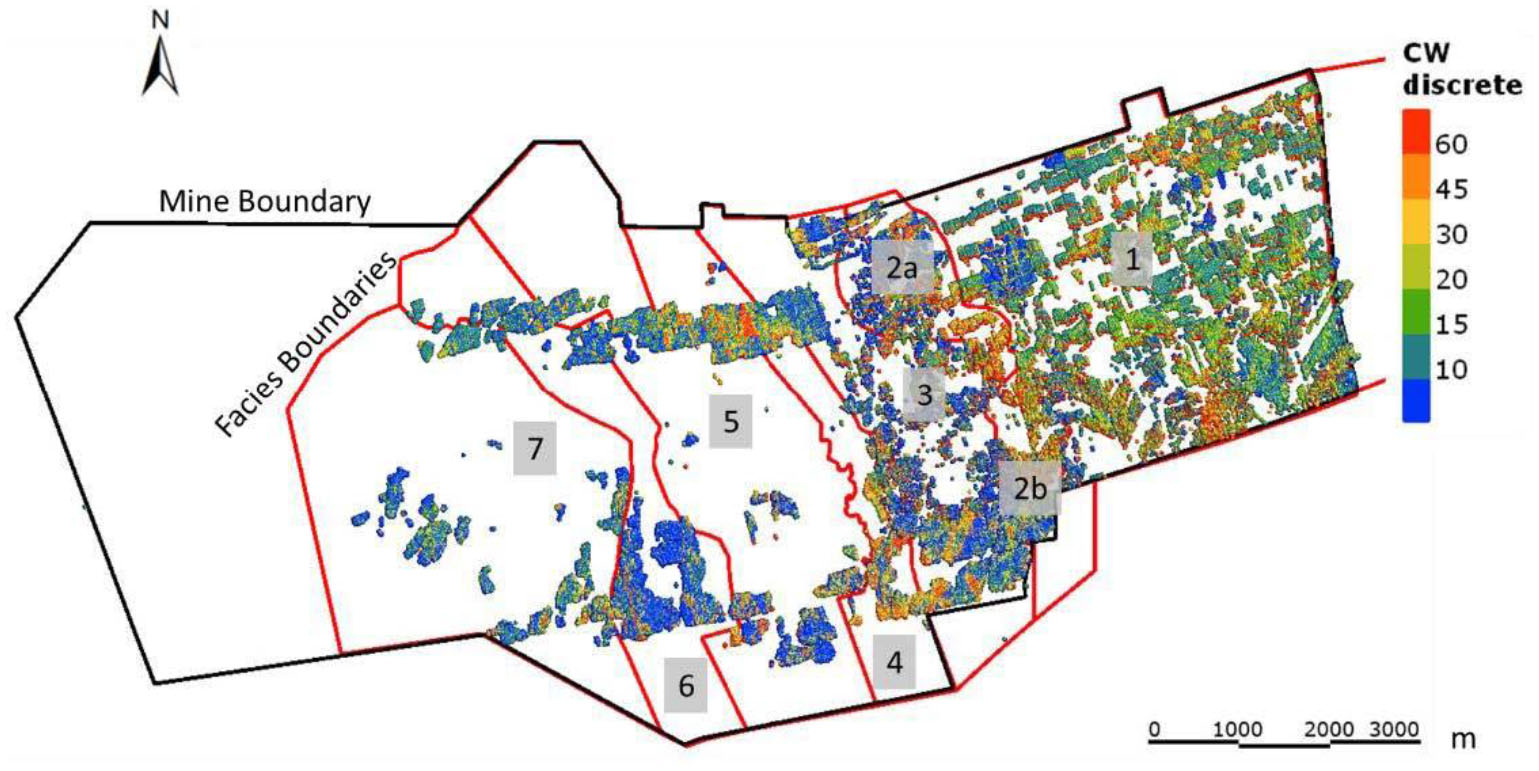

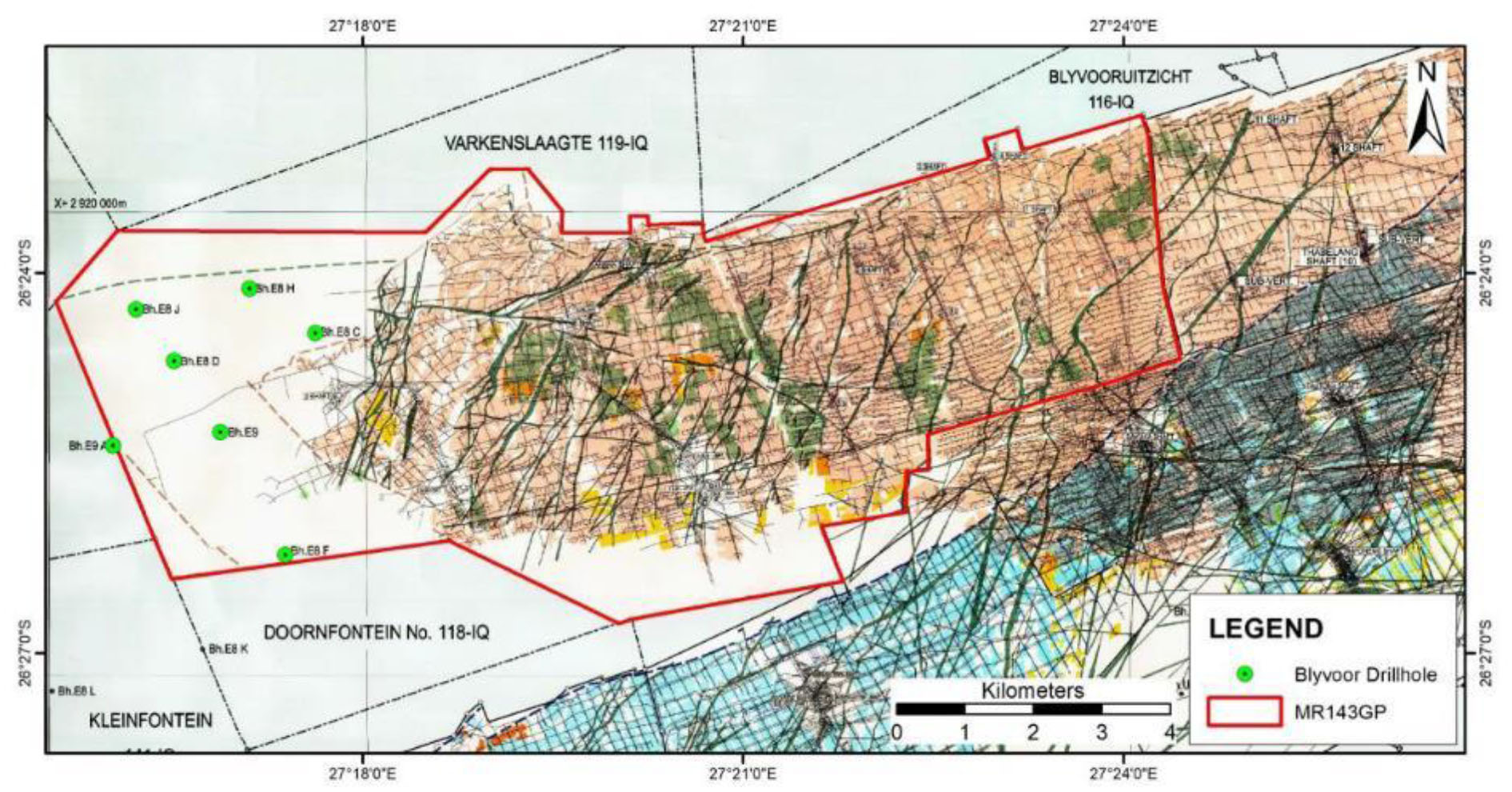

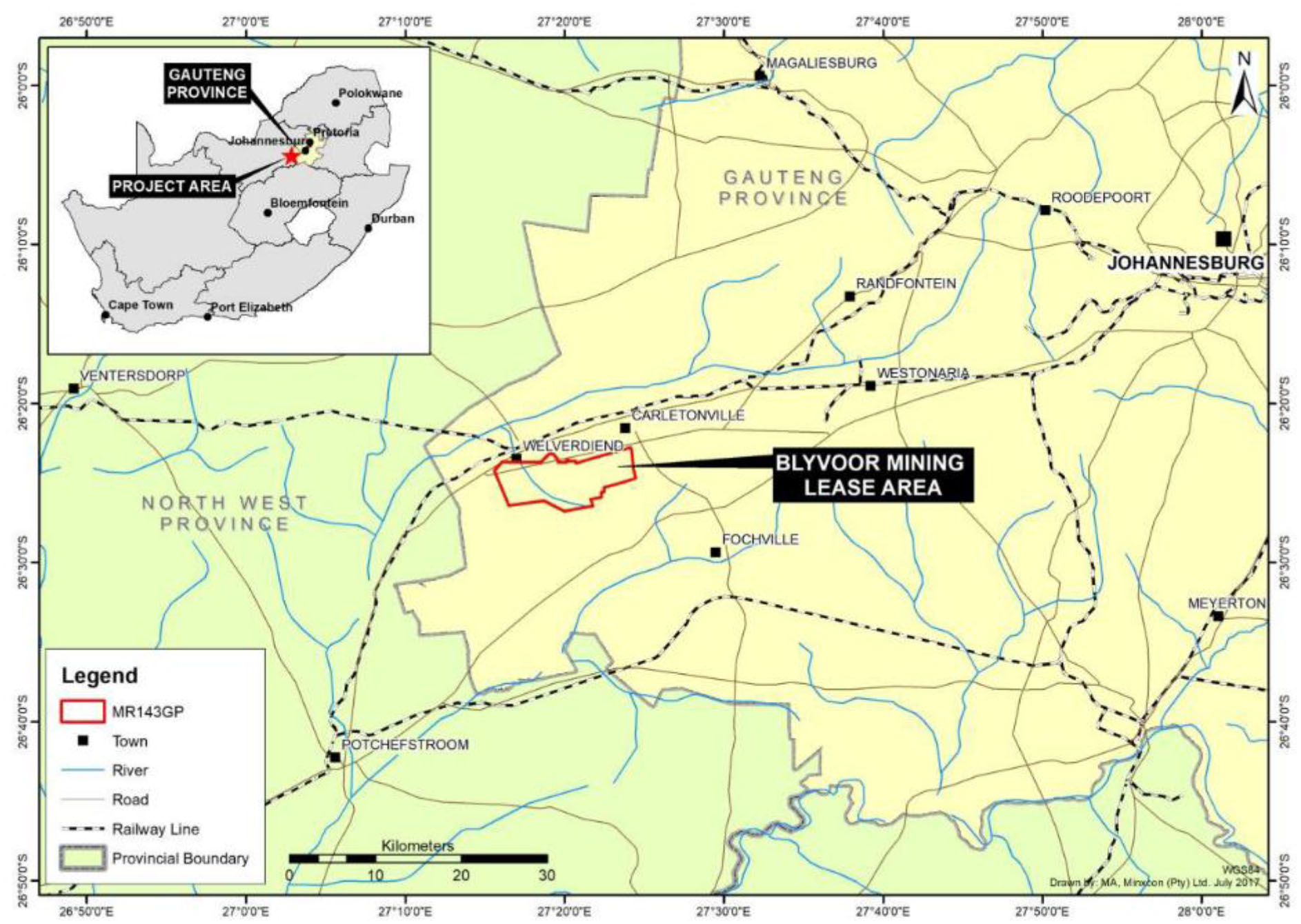

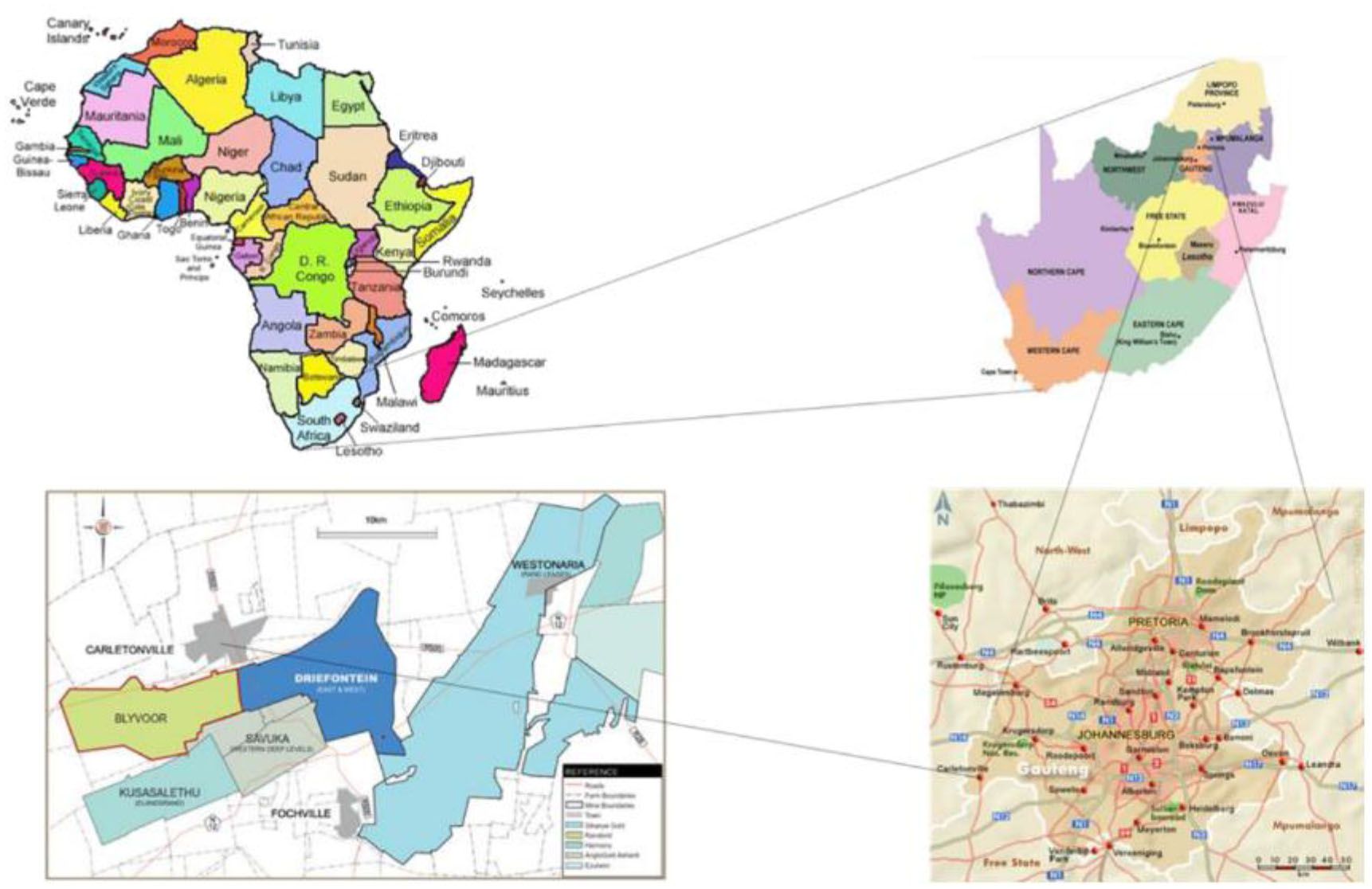

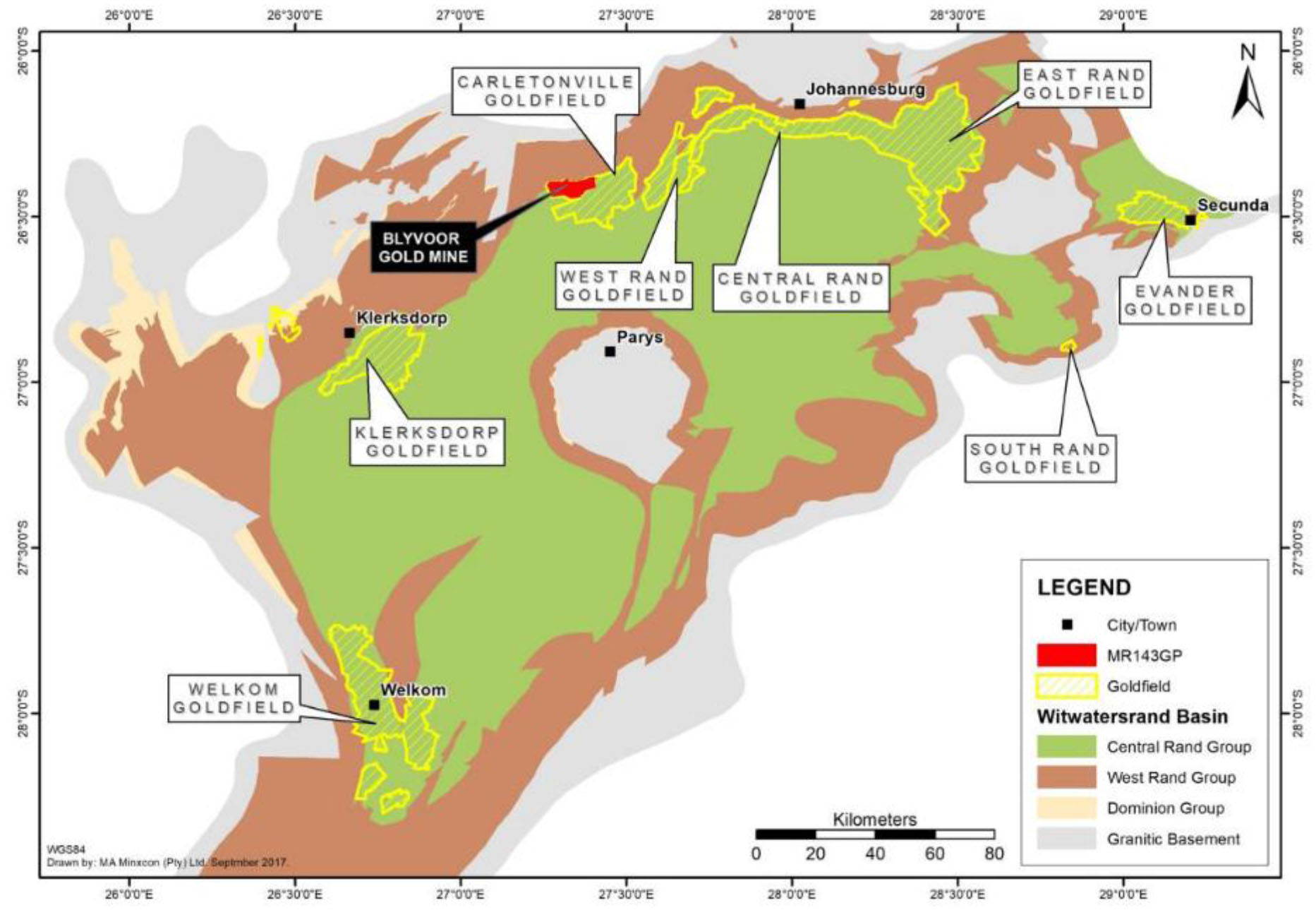

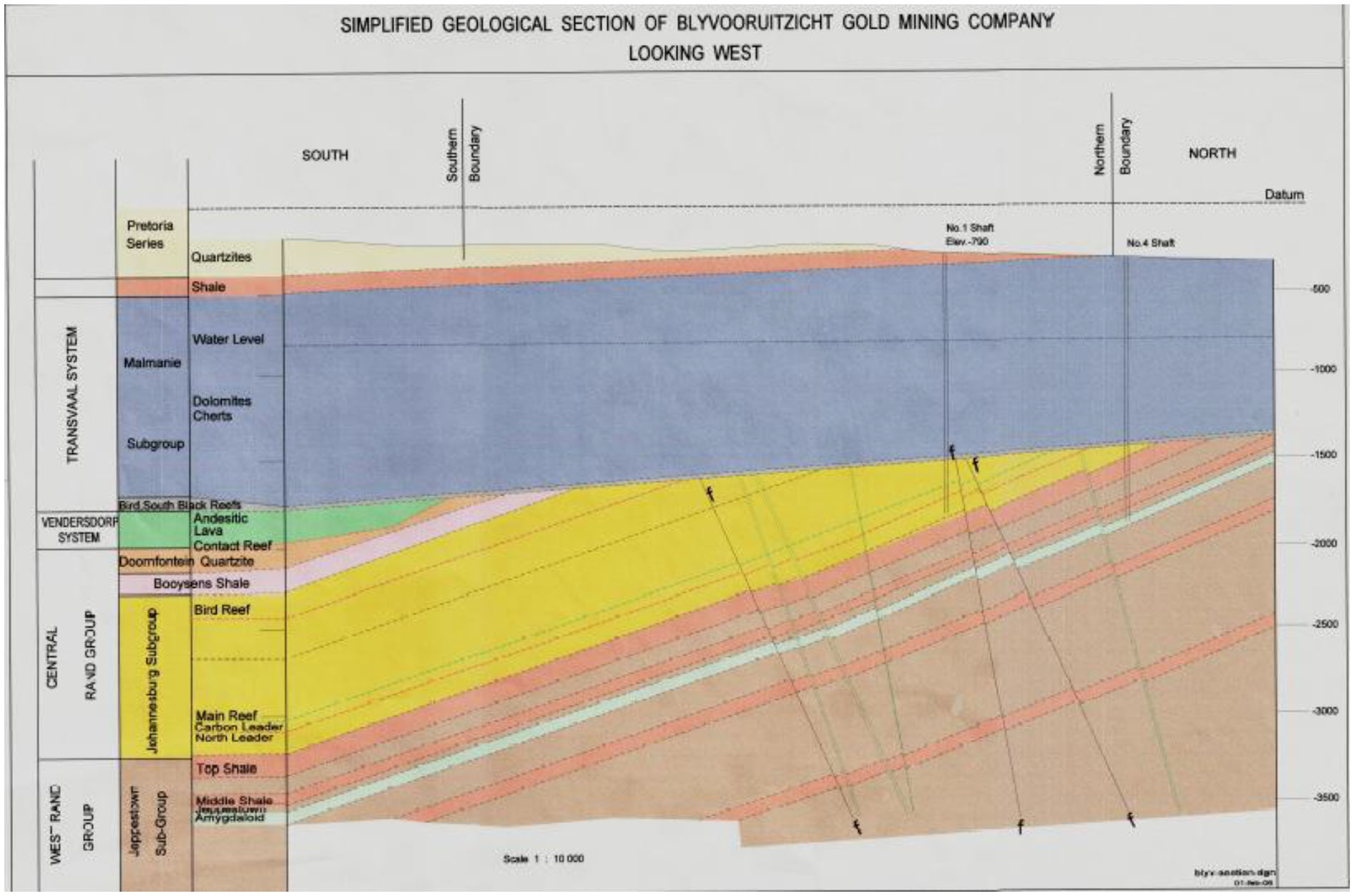

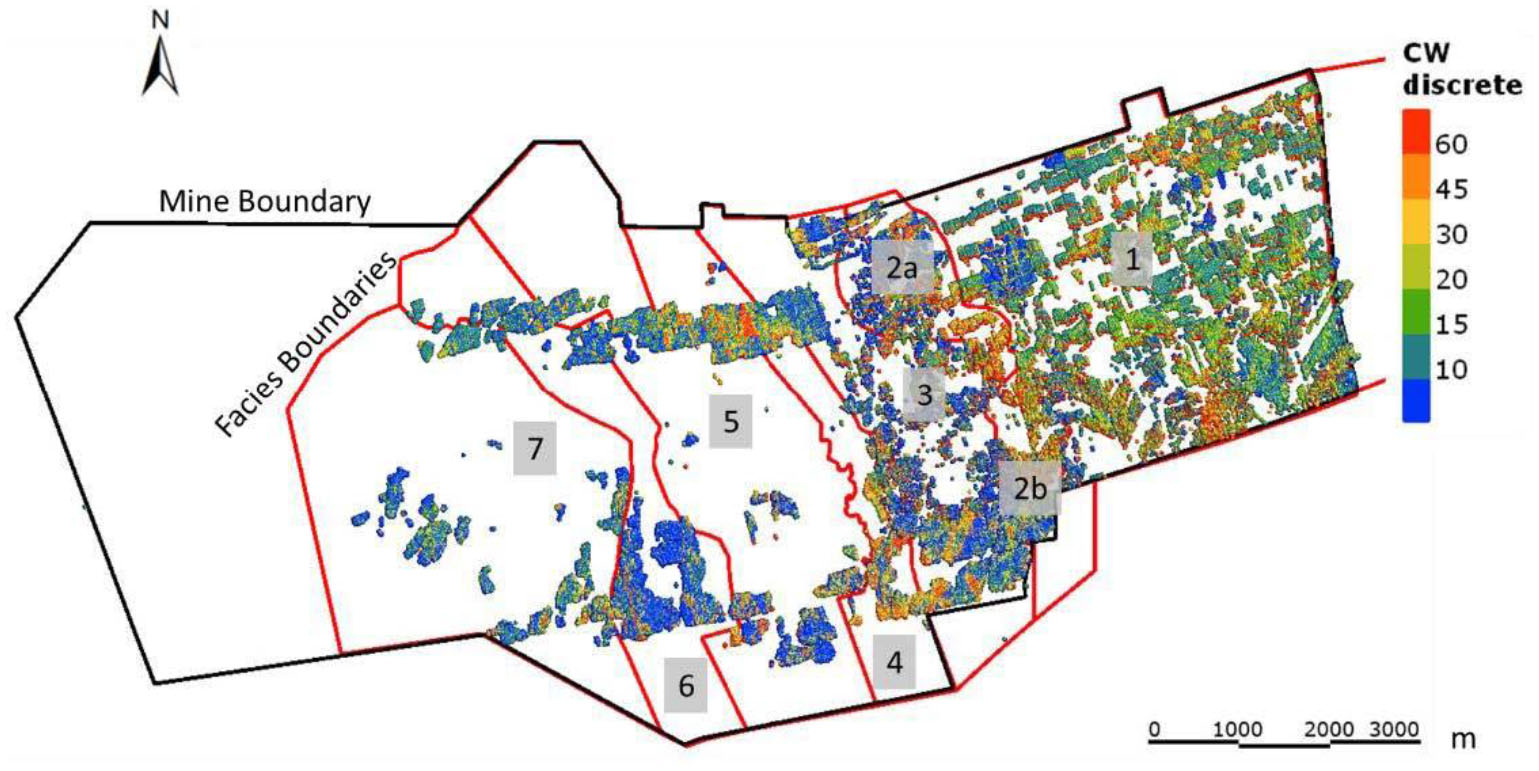

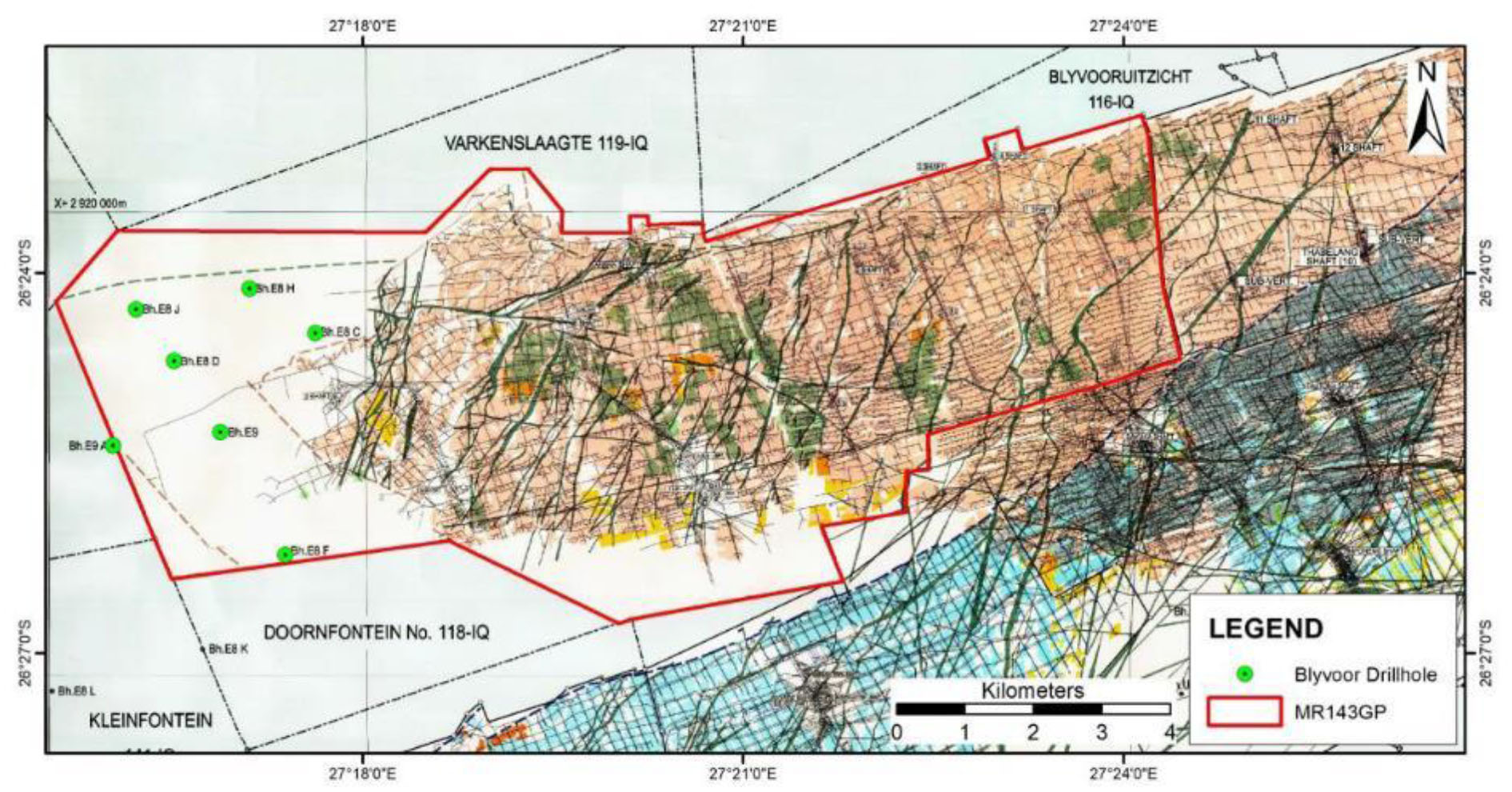

| ● | “Blyvoor Gold Mine” means the underground gold mine situated in the Carletonville Goldfield of the Witwatersrand Basin in South Africa, the main asset of Aurous Gold; |

| ● | “Blyvoor Group” or “Target Group Companies” means Aurous Gold and Gauta Tailings, together with their respective subsidiaries (if any); |

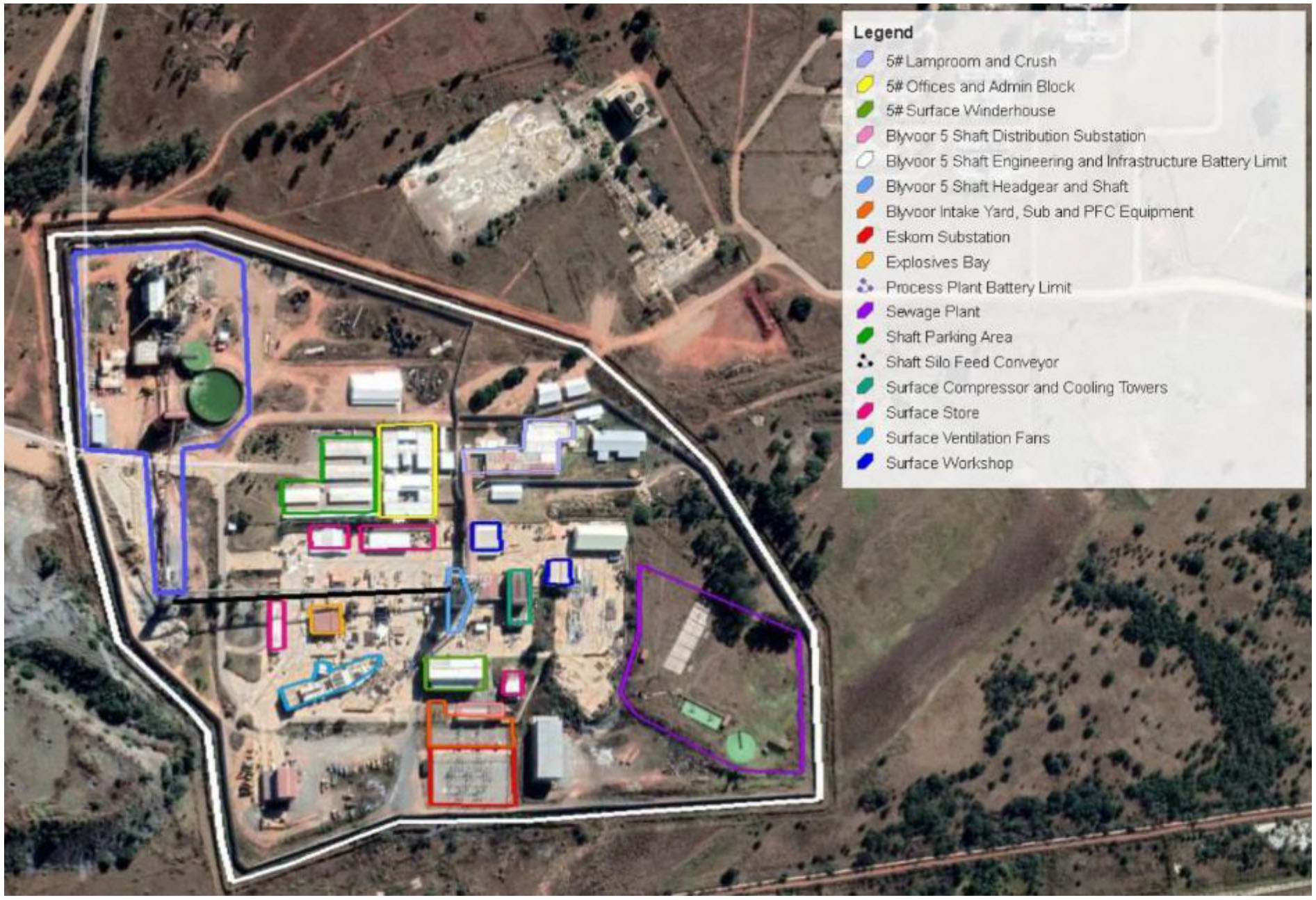

| ● | “Blyvoor Processing Plant” means the processing/metallurgical plant to treat orebodies at the Blyvoor Gold Mine; |

| ● | “BWU” means the Blyvoor Workers Union; |

| ● | “Business Combination” means all of the transactions contemplated by the Business Combination Agreement and the other transaction documents contemplated therein; |

| ● | “Business Combination Agreement” means that certain Business Combination Agreement, dated as of March 11, 2024 by and among Aurous Gold, Gauta Tailings, Rigel, Aurous Resources, and Merger Sub, which is attached hereto as Annex A, as it may be amended from time to time, including pursuant to the Omnibus Amendment, a copy of which is attached to this proxy statement/prospectus as Annex A-1; |

| ● | “capital expenditure” means capital expenditures or capital costs; |

| ● | “Carbon Tax Act” means the Carbon Tax Act, 15 of 2019 of the Republic of South Africa as amended; |

| ● | “Carletonville Goldfield” means the goldfield located in the Witwatersrand Basin near the town of Carletonville, Gauteng, South Africa; |

| ● | “Cash Consideration” means cash consideration in an amount per share equal to the sum of (i) the cash value per share as of the Closing Date to be received in respect of a Rigel Class A Ordinary Share redeemed in the Rigel Shareholder Redemption minus (ii) $10.00; |

| ● | “Cash Redemption Amount” means the aggregate amount of cash required to satisfy any valid exercise by Rigel public shareholders of their right to have Rigel redeem their Rigel Class A Ordinary Shares in connection with the Business Combination; |

| ● | “Citi” means Citigroup Global Markets Inc.; |

| ● | “Class A Merger Consideration” means the Equity Consideration and the Cash Consideration; |

| ● | “Closing” means the consummation of the transactions contemplated by the Business Combination Agreement; |

| ● | “Closing Date” means the date on which the Closing will occur; |

| ● | “CMA” means the Common Monetary Area, which includes South Africa, Namibia, Lesotho and Eswatini; |

| ● | “Code” means the Internal Revenue Code of 1986, as may be amended from time to time; |

| ● | “Companies Act” means the Cayman Islands Companies Act (As Revised); |

| ● | “Company Benefit Plan” has the meaning set forth in the Business Combination Agreement; |

| ● | “Converted Mining Right” means converted mining right GP 30/5/1/2/2/143 MR granted to Blyvoor Capital; |

| ● | “CPI” means consumer price index; |

| ● | “Currently Owned Shares” means beneficially owned Rigel Class A Ordinary Shares by each PIPE Investor as of the date of its Subscription Agreement; |

| ● | “December 2023 Working Capital Loan” means the promissory note between Rigel, as maker, and the Sponsor, as payee, dated December 28, 2023; |

| ● | “DMRE” means the Department of Mineral Resources and Energy of the Republic of South Africa; |

| ● | “DTC” means Depository Trust Company; |

| ● | “DWAC” means the Deposit Withdrawal At Custodian system operated by DTC; |

| ● | “DWS” means the Department of Water and Sanitation of the Republic of South Africa; |

| ● | “EA” means environmental authorization, construed in accordance with the laws of the Republic of South Africa; |

| ● | “Earnings Threshold” means the threshold which is determined by the Minister of Employment and Labour from time to time pursuant to section 6(3) of the Basic Conditions of Employment Act, 1997 as amended, together with the rules and regulations promulgated thereunder; |

| ● | “EBIT” means earnings before interest and taxes; |

| ● | “EEAA” means the Employment Equity Amendment Act No. 4 of 2022 of the Republic of South Africa, as amended, together with the rules and regulations promulgated thereunder; |

| ● | “Emergent” means Emergent Capital Solutions 3 Proprietary Limited; |

| ● | “Equity Consideration” means one Aurous Resources Ordinary Share to be received by each holder of Rigel Class A Ordinary Shares at the Merger Effective Time for each Rigel Class A Ordinary Share it owns; |

| ● | “EU” means the European Union; |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder; |

| ● | “Exchange Agent” means [ ]; |

| ● | “Exchange Agreement” means that certain Exchange Agreement dated March 11, 2024, by and among Aurous Resources, Blyvoor Gold, Orion Fund II, Aurous Gold and Gauta Tailings; |

| ● | “Exchange Consideration” means, collectively, the Gauta Tailings Consideration, the Aurous Gold Consideration and the Orion Resources Consideration; |

| | ● | “Exchange Control Regulations” means the Exchange Control Regulations, 1961 made in terms of the Currency and Exchanges Act No. 9 of 1993 (and all directives and rulings issued thereunder); |

| ● | “Exotix” means Exotix Partners LLP; |

| ● | “Final Prospectus” means Rigel’s final prospectus dated November 4, 2021 and filed with the SEC on November 8, 2021; |

| ● | “FinSurv” means the Financial Surveillance Department of the SARB; |

| ● | “First Extension Loan” means the convertible promissory note between Rigel, as maker, and the Sponsor and Orion GP, each as payee, dated May 8, 2023, as amended and restated on December 28, 2023; |

| ● | “fiscal” when followed by a year means the fiscal year of the entity referenced, with the fiscal year of Aurous Gold, Gauta Tailings and Aurous Resources running from March 1 to February 28 (or to February 29 if a leap year, such as 2024) on each year, and the fiscal year of Rigel ending on December 31 on each year; |

| ● | “Founder Shares” means the Rigel Class B Ordinary Shares purchased by the Sponsor in a private placement prior to Rigel’s Initial Public Offering; |

| ● | “FPR” means the Financial Provisioning Regulations of the Republic of South Africa that were published on November 20, 2015; |

| ● | “Gauta Feasibility Study” means the feasibility accuracy level study, which Gauta Tailings expects to commission for the Gauta Tailings Project; |

| ● | “Gauta Tailings” means Blyvoor Gold Operations Proprietary Limited, a South African private limited liability company; |

| ● | “Gauta Tailings Consideration” means 600,000 Aurous Resources Ordinary Shares issuable to Blyvoor Gold in exchange for its shares of Gauta Tailings; |

| ● | “Gauta Tailings Deferred Consideration” means a number of Aurous Resources Ordinary Shares equal to the product of (i) the quotient of (A) the aggregate amount of proceeds from the PIPE Investment (as defined in the Business Combination Agreement), divided by (B) 100,000, multiplied by (ii) 346.6666667, which Blyvoor Gold will be entitled to receive, as promptly as practicable after the date that is 90 days following the Closing; |

| ● | “Gauta Tailings Project” means the surface Gauta Tailings’ planned tailings retreatment project, which is currently in pre-development phase; |

| ● | “GDPR” means the European General Data Protection Regulation; |

| ● | “General Meeting” means the extraordinary general meeting of the shareholders of Rigel that is the subject of this proxy statement/prospectus; |

| ● | “General Notarial Covering Bond” means the mortgage granted by Blyvoor Capital, as mortgagor, to the Security Agent, as mortgagee, securing an amount of R842.4 million over all of its movable property, including its plant, equipment and machinery; |

| ● | “Goldman” means Goldman Sachs & Co. LLC, as the underwriter in Rigel’s Initial Public Offering consummated on November 9, 2021; |

| ● | “Hannam” means H&P Advisory Ltd; |

| ● | “HDP” means Historically Disadvantaged Persons, as construed in accordance with the laws of the Republic of South Africa; |

| ● | “IDC” means the Industrial Development Corporation of South Africa Limited; |