As filed with the U.S. Securities and Exchange Commission on December 10, 2024.

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LEIFRAS Kabushiki Kaisha

(Exact name of registrant as specified in its charter)

LEIFRAS Co., Ltd.

(Translation of Registrant’s name into English)

| Japan | | 8200 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

Ebisu Garden Place Tower Floor 17

4-20-3, Ebisu, Shibuya-ku

Tokyo, Japan

+81-30-6451-1341

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

Ying Li, Esq.

Brian B. Margolis, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2206 | | Mitchell S. Nussbaum, Esq.

Angela Dowd, Esq.

Vivien Bai, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, NY 10154 212-407-4000 |

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED DECEMBER 10, 2024

LEIFRAS Co., Ltd.

1,600,000 American Depositary Shares

Representing 1,600,000 Ordinary Shares

This is a firm commitment initial public offering of the American depositary shares (the “ADSs”) representing our ordinary shares (“Ordinary Shares” or individually, an “Ordinary Share”). Each ADS represents one Ordinary Share. We are offering 1,600,000 ADSs. We expect the initial public offering price of the ADSs to be in the range of $4.00 to $5.00 per ADS. For purposes of this prospectus, the assumed initial public offering price per ADS is $5.00. The actual number of ADSs we will offer will be determined based on actual public offering price, which will be determined between us and the underwriters at the time of pricing. Prior to this offering, there has been no public market for the ADSs or our Ordinary Shares.

We have applied to list the ADSs on the Nasdaq Capital Market (“Nasdaq”) under the symbol “LFS”. It is a condition to the closing of this offering that the ADSs are approved for listing on Nasdaq. At this time, Nasdaq has not yet approved our application to list the ADSs and there is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq.

Investing in the ADSs involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 11 to read about factors you should consider before buying the ADSs.

We are an “emerging growth company” as defined under the federal securities laws and will be subject to reduced public company reporting requirements. Please read the disclosures beginning on page 5 of this prospectus for more information.

Mr. Kiyotaka Ito is currently the beneficial owner of 53.88% of our issued and outstanding Ordinary Shares. Following the consummation of this offering, we expect Mr. Ito will hold less than 50% of our total outstanding Ordinary Shares. Hence, though share ownership will remain concentrated in the hands of our directors and major shareholders, who will continue to be able to exercise a direct or indirect controlling influence on us, we expect that we will not be a “controlled company” under Nasdaq Listing Rule 5615(c)after the completion of this offering. Our directors and executive officers, and major shareholders, acting together, will have significant influence over all matters that require approval by our shareholders, including the election of directors and approval of significant corporate transactions.

| | | Per ADS | | | Total Without

Over-Allotment

Option | | | Total With

Over-Allotment

Option | |

| Initial public offering price | | $ | | | | $ | | | | $ | | |

| Underwriters’ discounts(1) | | $ | | | | $ | | | | $ | | |

| Proceeds to our company before expenses(2) | | $ | | | | $ | | | | $ | | |

| (1) | Represents underwriting discounts equal to 7% per ADS. |

| (2) | In addition to the underwriting discounts listed above, we have agreed to: (i) reimburse the underwriters for certain expenses; (ii) provide a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Kingswood Capital Partners, LLC, the representative of several underwriters of this offering (the “Representative”); and (iii) issue, upon closing of this offering, warrants to the Representative, exercisable during the four and a half-year period commencing six months after the closing date of this offering, entitling the Representative to purchase 3% of the total number of ADSs sold in this offering (including any ADSs sold as a result of the exercise of the Representative’s over-allotment option) at an exercise price per ADS equals to 120% of the initial public offering price of the ADSs sold in this offering (the “Representative’s Warrants”). The registration statement of which this prospectus is a part also covers the Representative’s Warrants, the ADSs issuable upon the exercise thereof, and the underlying Ordinary Shares. See “Underwriting” for additional information regarding total underwriter compensation. |

We have granted the Representative an option, exercisable for 45 days after the closing of this offering, to purchase up to an additional 15% of the ADSs offered in this offering on the same terms to cover over-allotments.

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on or about [ ], 2024.

Neither the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Kingswood Capital Partners, LLC

Prospectus dated [ ], 2024

TABLE OF CONTENTS

About this Prospectus

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the ADSs offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations, and prospects may have changed since that date.

Our functional currency and reporting currency are the Japanese yen (“JPY” or “¥”), the legal currency of Japan. The terms “dollar”, “US$,” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this prospectus are based on the exchange rate of JPY to U.S. dollars of ¥160.88=$1.00. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars, which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

Conventions that Apply to this Prospectus

Unless otherwise indicated or the context requires otherwise, references in this prospectus to:

| ● | “Apicos” are to Apicos Co., Ltd., a joint-stock corporation with limited liability organized under Japanese law and a wholly owned subsidiary of Leifras (as defined below); |

| ● | “Companies Act” are to the Companies Act of Japan (Act No. 86 of 2005, as amended); |

| ● | “FINRA” are to the Financial Industry Regulatory Authority; |

| ● | “LEIF” are to LEIF Ltd., a joint-stock corporation with limited liability organized under Japanese law and a former wholly owned subsidiary of Leifras (as defined below), which was liquidated on June 28, 2024; |

| ● | “Leifras,” “LEIFRAS,” “we,” “us,” “our,” “our Company,” or the “Company” are to LEIFRAS Co., Ltd., a joint-stock corporation with limited liability organized under Japanese law; |

| ● | “Leifras Travel” are to Leifras Travel Co., Ltd., a joint-stock corporation with limited liability organized under Japanese law and a wholly owned subsidiary of Leifras; |

| ● | “Regional Collaboration Department” are to Regional Collaboration Department Ltd., a joint-stock corporation with limited liability organized under Japanese law and a wholly owned subsidiary of Leifras (as defined below); |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; and |

| ● | “Sky Earth Sport Co.” are to Hokkaido Tokachi Sky Earth Sport Co., Ltd., a joint-stock corporation with limited liability organized under Japanese law. |

Unless the context indicates otherwise, all information in this prospectus assumes no exercise by the Representative of its over-allotment option.

Unless otherwise indicated, all share numbers and share values in this prospectus have been presented giving effect to a forward split of our outstanding Ordinary Shares at a ratio of 1-to-20 which became effective on November 1, 2024. For details, see “Description of Share Capital—History of Share Capital.”

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the ADSs, discussed under “Risk Factors,” before deciding whether to buy the ADSs.

Unless otherwise indicated, all share numbers and share values in this prospectus have been presented giving effect to a forward split of our outstanding Ordinary Shares at a ratio of 1-to-20 which became effective on November 1, 2024. For details, see “Description of Share Capital—History of Share Capital.”

Overview

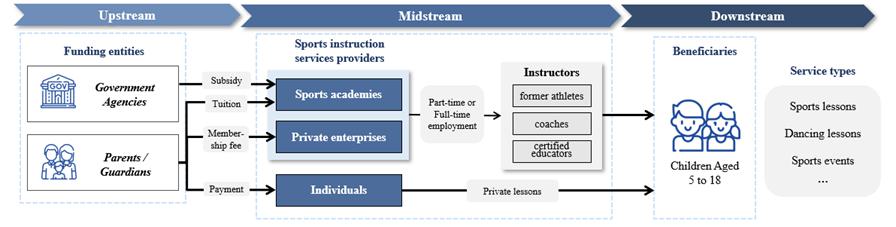

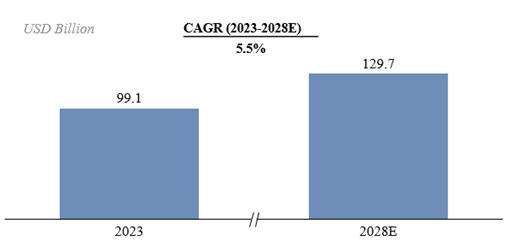

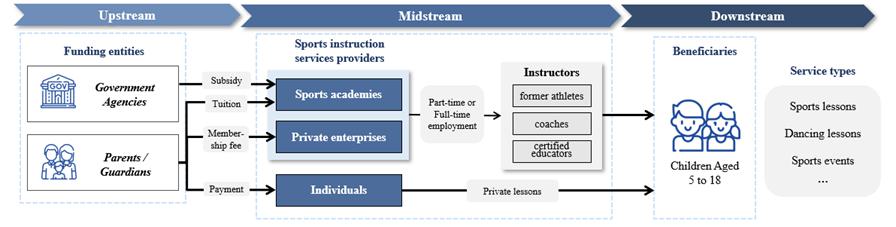

Headquartered in Shibuya-ku, Tokyo, we are a sports and social business company dedicated to youth sports and community engagement. We primarily provide services related to the organization and operations of sports schools and sports events for children. Building upon our experience and know-how in sports education, we also operate a robust social business sector, dispatching sports coaches to meet various community needs.

At the core of our operations is the children’s sports school business. When we refer to a sports school, it refers to a series of courses and programs that we offer to teach a sport, instead of a physical location. We are recognized as one of Japan’s largest operators of children’s sports schools in terms of both membership and facilities. As of the date of this prospectus, we hold our sports classes at more than 4,500 facility locations in Japan nationwide, serving over 65,000 members. The number of members is based on the number of students taking classes; if a student is enrolled in two different classes, this student is counted as two members. We provide 13 sports schools, from soccer school “Liberta” and basketball school “Porte,” to rhythmic karate school “Quore” and kendo school “Kokoro.” We also offer classes that cater to the various needs of different age groups and sports capability levels. For instance, our “JJMIX” classes offer beginners from the age of two and up the opportunity to experience multiple sports, and our “Rugina” classes are designed specifically for girls. Approximately 87% of our sports school members are elementary school students, with additional programs for preschoolers, nursery school children, kindergarteners, and junior high school students. These classes are taught by professional coaches who bring their expertise and passion to each session, ensuring that students receive high-quality coaching in safe environments. Our sports school business also extends to sports merchandise sales and commissioned special guidance services.

Our approach to sports education emphasizes the development of non-cognitive skills, which are crucial for success both inside and outside the sports arena. Following our teaching principle “acknowledge, praise, encourage, and motivate,” our classes integrate non-cognitive skills, such as motivation, teamwork, strategic thinking, and sportsmanship, into our sports curriculum. For instance, our soccer program focuses on developing technical skills, tactical understanding, and teamwork, and our martial arts programs in karate and kendo promote physical fitness and self-discipline. Our holistic approach integrates physical and mental development, setting us apart in the industry.

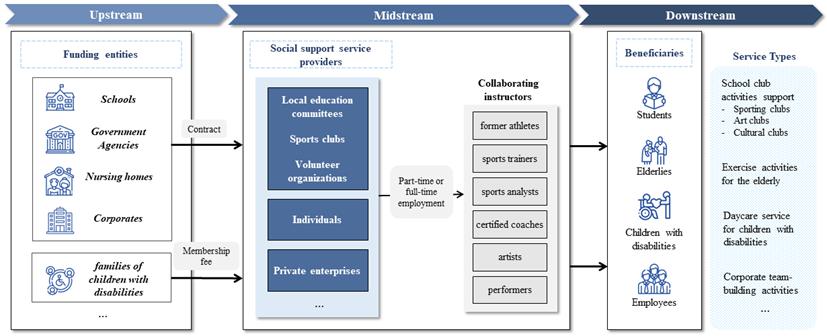

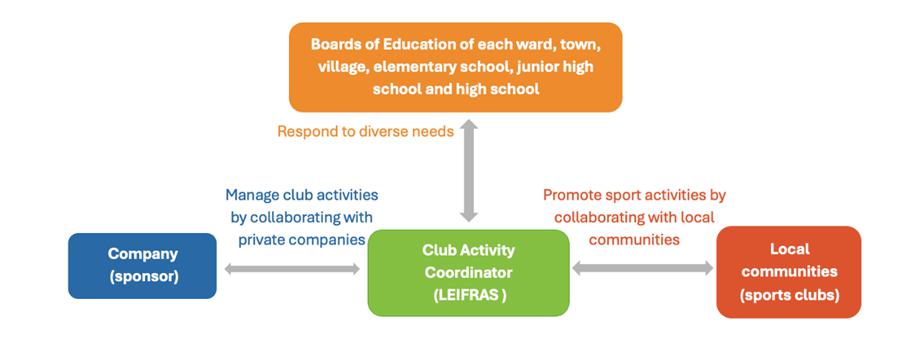

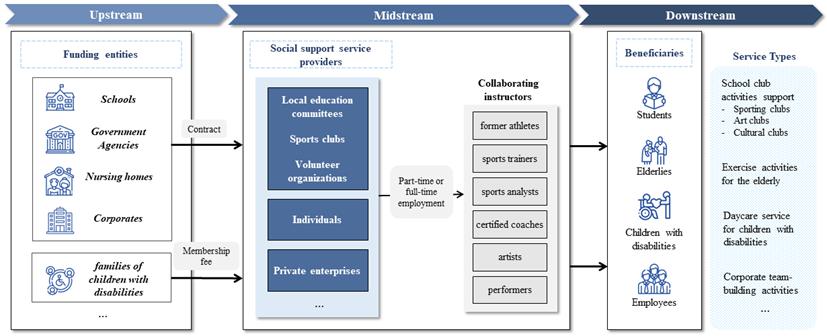

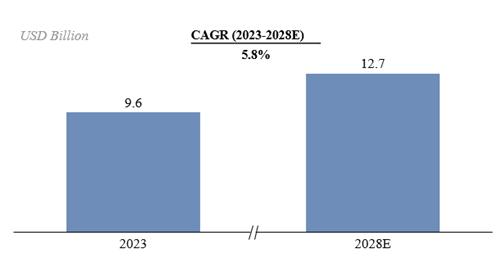

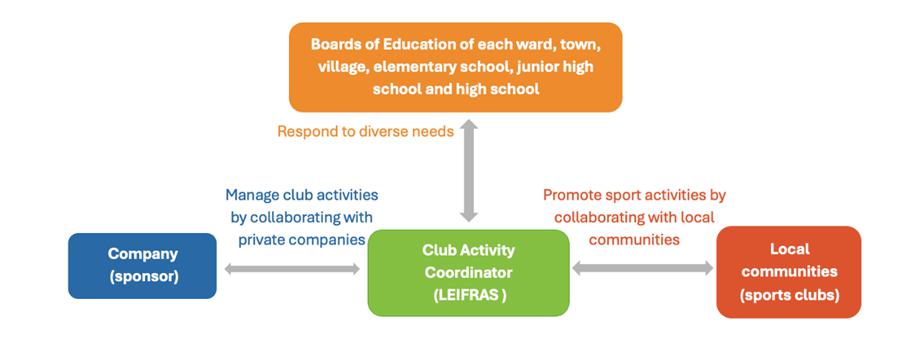

Building upon our experience and know-how in sports education, our social business mainly dispatches sports coaches to meet various community needs. Our school club support business provides sports coaching in school club activities and physical education classes and coordinates collaborations between school clubs and private companies. Our LEIF after-school daycare service supports children with disabilities or developmental characteristics through soccer therapy, promoting independence and improving life skills. Our involvement also extends to facility management services at public sports facilities, focusing on providing sports coaching for people of all ages. Our elderly healthcare initiative offers exercise programs for the elderly, including exercise instruction such as preventive nursing care exercises, yoga, and other health promotion services at community centers and healthcare facilities. By addressing these diverse needs, we aim to promote physical health, social inclusion, and community well-being across different demographics.

Our revenue for the fiscal year ended December 31, 2022 was JPY7,688.5 million ($47.79 million), with net cash flows generated from operating activities of JPY401.5 million ($2.50 million), compared to revenue of JPY9,291.5 million ($57.75 million), with net cash flows generated from operating activities of JPY677.94 million ($4.21 million), for the fiscal year ended December 31, 2023. Our revenue for the six months ended June 30, 2024 was JPY4,767.8 ($29.64 million), with net cash flows used from operating activities of JPY212.3 million ($1.32 million). We had net income of JPY178.0 million ($1.11 million), JPY237.1 million ($1.47 million), and JPY39.0 million ($0.24 million) for the fiscal years ended December 31, 2022 and 2023 and the six months ended June 30, 2024, respectively. As of June 30, 2024, we had JPY700,000,000 ($4,351,069) of short-term loans, JPY317,535,000 ($1,973,738) of current portion of long-term loans, and JPY250,132,000 ($1,554,774) of long-term loans outstanding.

Competitive Strengths

We believe the following competitive strengths are essential for our success and differentiate us from our competitors:

| ● | unique sports education philosophy that fosters non-cognitive abilities, benefiting students, parents, and schools; |

| ● | a distinctive team of full-time long-term sports school coaches; |

| ● | expertise in identifying, training, and managing coaches; |

| ● | strong market position and respected brand known for high-quality youth sports education; and |

| ● | a visionary and experienced management team with industrial expertise. |

Growth Strategies

We intend to grow our business using the following key strategies:

| ● | continue expansion of sports schools and grow student enrollment; |

| ● | further expand business through mergers and acquisitions and global expansion; |

| ● | continuously enhance the quality of our class offerings and customer services; and |

| ● | further enhancement of productivity. |

Our Challenges

We face risks and uncertainties in realizing our business objectives and executing our strategies, including but not limited to the following major challenges:

| ● | our businesses are all operated in Japan and a downturn in the Japanese economy may affect consumer’s willingness to spend on extracurricular sports activities, delaying our growth strategy and having a material adverse effect on our business, financial condition, profitability, and cash flows; |

| ● | we do not own any sports facilities but pay for the usage of public facilities for our sports schools, while the legality of this usage remains unsettled; |

| | ● | we have had customer concentration, with a limited number of customers accounting for a significant portion of our total revenue; |

| ● | if we are unable to recruit, train, and retain qualified and experienced coaches that embody our culture, we may not be able to grow or successfully operate our business; |

| ● | we own a team of long-term and full-time coaches, and this makes our employment policy less flexible, which may materially and adversely impact the business and operations of our Company; and |

| ● | our business depends significantly on the market recognition of our “Leifras” brand and any incident that erodes consumer trust in our brand could significantly reduce our brand value and hence affect our business, results of operations, and prospects. |

Corporate Information

Our headquarters are located at Ebisu Garden Place Tower Floor 17, 4-20-3, Ebisu, Shibuya-ku, Tokyo, Japan and our phone number is +81-30-6451-1341. Our website address is https://leifras.co.jp. The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus or the registration statement of which it forms a part. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY 10168.

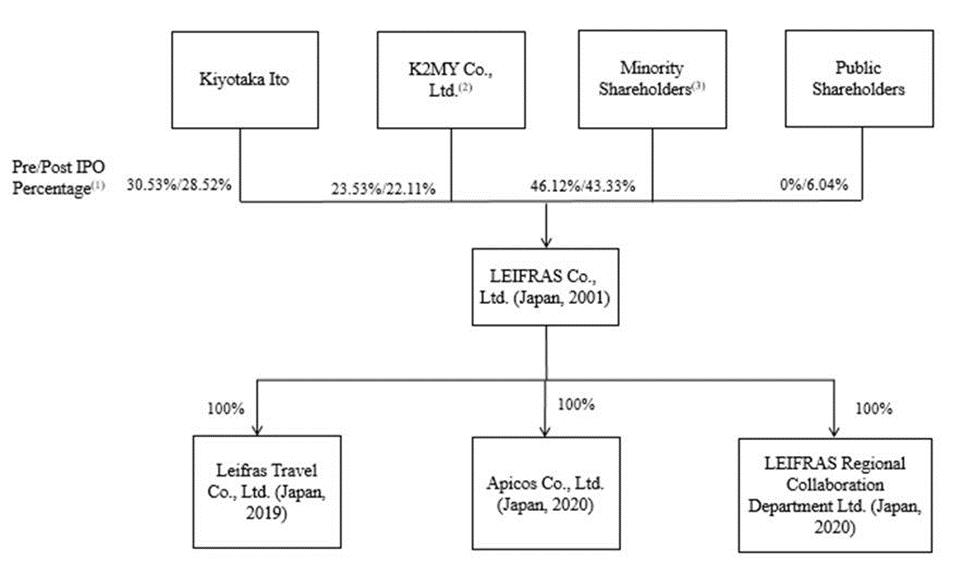

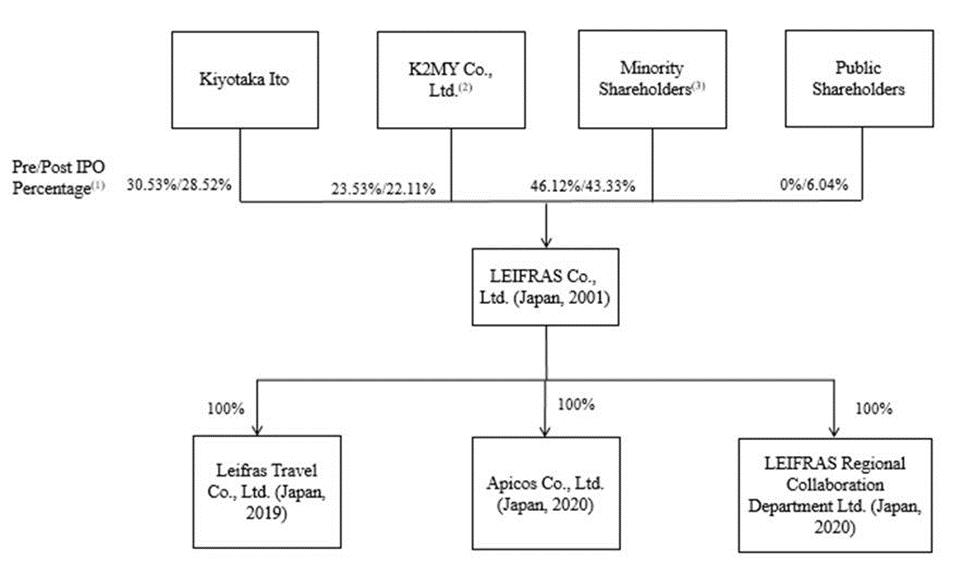

Corporate Structure

Leifras was incorporated as a joint-stock corporation (kabushiki kaisha) with limited liability under Japanese law on August 28, 2001, in Tokyo, Japan. The following chart illustrates our corporate structure as of the date of this prospectus and upon completion of this offering.

| (1) | The pre-IPO percentages are based upon 24,910,619 Ordinary Shares issued and outstanding as of the date of this prospectus and excludes 300,000 Ordinary Shares issuable upon full exercise of the Company’s outstanding stock options issued to its directors and employees as of the date of this prospectus. See “Description of Share Capital—Ordinary Shares.” The post-IPO percentages are based on 26,510,619 Ordinary Shares issued and outstanding after this offering, assuming no exercise of the over-allotment option. |

| (2) | Represents 5,861,640 Ordinary Shares held by K2MY Co., Ltd., a Japanese joint-stock corporation with limited liability. Mr. Kiyotaka Ito, our representative director and chief operating officer, controls and serves as a representative director of K2MY Co., Ltd. |

| (3) | Represents an aggregate of 11,487,899 Ordinary Shares held by 237 shareholders of Leifras, each one of which holds less than 5% of our equity interests, as of the date of this prospectus. |

Mr. Kiyotaka Ito, our representative director and CEO, is currently the beneficial owner of 53.88% of our issued and outstanding Ordinary Shares. Following the consummation of this offering, we expect Mr. Ito to hold less than 50% of our total outstanding Ordinary Shares. Hence, though share ownership will remain concentrated in the hands of our directors, executive officers, and major shareholders, who will continue to be able to exercise a direct or indirect controlling influence on us, we expect that we will not be a “controlled company” under Nasdaq Listing Rule 5615(c)after the completion of this offering. For more details on our corporate history, please refer to “Corporate History and Structure,” “Risk Factors—Risks Relating to this Offering and the Trading Market—After the completion of this offering, share ownership will remain concentrated in the hands of our management, who will continue to be able to exercise a direct or indirect controlling influence on us,” and “Risk Factors—Risks Relating to this Offering and the Trading Market—Our founder, representative director, and Chief Executive Officer has substantial influence over our Company. His interests may not be aligned with the interests of our other shareholders.”

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives, and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002; |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency,” and “say-on-golden-parachute” votes); |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the effectiveness of our initial public offering. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have a public float of $700 million or more, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material non-public information; |

| ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and |

| ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

As a foreign private issuer, Nasdaq corporate governance rules allow us to follow corporate governance practice in our home country, Japan, with respect to appointments to our board of directors and committees. We intend to comply with Nasdaq listing rules regarding the independence of the majority of our board members, and the audit committee, compensation committee, and nominating / corporate governance committee requirements. Nevertheless, we intend to follow home country practice regarding the voting quorum. Accordingly, you would not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. See “Risk Factors—Risks Relating to this Offering and the Trading Market—Because we are a foreign private issuer and intend to take advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer” beginning on page 33 of this prospectus.

Summary of Risk Factors

Investing in the ADSs involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in the ADSs. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more fully in the section titled “Risk Factors.”

Risks Related to Our Business and Industry

The following summarizes some of the more important risks and uncertainties related to an investment in the securities offered hereby. It is not a summary of all of the risks we face. For a more detailed discussion of risks related to our securities, please see the section captioned “Risk Factors” beginning on page 11 of the prospectus.

Risks and uncertainties related to our business include, but are not limited to, the following:

| ● | If we are not able to continue to attract students to enroll and reenroll existing students in our sports schools, our business and prospects will be materially and adversely affected (see the disclosure beginning on page 11 of this prospectus); |

| ● | If we are not able to maintain the diversity and quality of our sports school class offerings, our business and prospects will be materially and adversely affected (see the disclosure beginning on page 12 of this prospectus); |

| ● | We have a limited operating history in social business, which makes it difficult to predict our future business prospects and financial performance (see the disclosure beginning on page 13 of this prospectus); |

| ● | Competition in the youth sports education market could reduce enrollments, increase our cost of recruiting and retaining students and coaches, and put downward pressure on our membership fees and profitability (see the disclosure beginning on page 13 of this prospectus); |

| ● | Accidents or injuries suffered by our students or other people on our premises may adversely affect our reputation, subject us to liability, and cause us to incur substantial costs (see the disclosure beginning on page 14 of this prospectus); |

| ● | Our management has a limited history of managing rapid expansion. If we cannot effectively and efficiently manage our growth strategy, our results of operation or profitability could be materially and adversely affected (see the disclosure beginning on page 14 of this prospectus); |

| ● | If we are unable to recruit, train, and retain qualified and experienced coaches who embody our culture, we may not be able to grow or successfully operate our business (see the disclosure beginning on page 15 of this prospectus); |

| ● | If we are unable to attract, develop, retain, or replace our senior management or key personnel, our business, financial condition, and results of operations may be adversely affected (see the disclosure beginning on page 16 of this prospectus); |

| ● | We do not own any sports facilities but pay for the usage of public facilities for our sports schools, but the legality of this usage remains unsettled (see the disclosure beginning on page 17 of this prospectus); |

| ● | Our business depends on the market recognition of our brand, and if we are unable to maintain or enhance our brand recognition, our business, financial condition, and results of operations may be materially and adversely affected (see the disclosure beginning on page 20 of this prospectus); |

| ● | Our businesses are all operated in Japan and a downturn in the Japanese economy may affect consumer’s willingness to spend on extracurricular sports activities, which could delay our growth strategy and have a material adverse effect on our business, financial condition, profitability, and cash flows (see the disclosure beginning on page 21 of this prospectus); and |

| ● | We rely on consumer discretionary spending and public funding, which may be adversely affected by economic downturns and other macroeconomic conditions or trends (see the disclosure beginning on page 22 of this prospectus). |

Risks Relating to this Offering and the Trading Market

In addition to the risks described above, we are subject to general risks and uncertainties related to this offering and the trading market of the ADSs, including, but are not limited to, the following:

| ● | You will experience immediate and substantial dilution in the net tangible book value of Ordinary Shares underlying the ADSs purchased (see the disclosure beginning on page 25 of this prospectus); |

| ● | After the completion of this offering, share ownership will remain concentrated in the hands of our management, who will continue to be able to exercise a direct or indirect controlling influence on us (see the disclosure beginning on page 25 of this prospectus); |

| ● | Our founder, representative director, and Chief Executive Officer has substantial influence over our Company. His interests may not be aligned with the interests of our other shareholders (see the disclosure beginning on page 26 of this prospectus); |

| ● | Future issuances of the ADSs or Ordinary Shares or securities convertible into, or exercisable or exchangeable for, the ADSs or Ordinary Shares could cause the market price of the ADSs to decline and would result in the dilution of your holdings (see the disclosure beginning on page 25 of this prospectus); |

| ● | The market price of the ADSs may be volatile or may decline regardless of our operating performance, and you may not be able to resell your ADSs at or above the initial public offering price (see the disclosure beginning on page 27 of this prospectus); |

| ● | If we fail to implement and maintain an effective system of internal control, we may fail to meet our reporting obligations or be unable to accurately report our results of operations or prevent fraud, and investor confidence and the market price of the ADSs may be materially and adversely affected (see the disclosure beginning on page 28 of this prospectus); |

| | ● | Because we are a foreign private issuer and intend to take advantage of exemptions from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer (see the disclosure beginning on page 33 of this prospectus); and |

| | ● | If we cannot satisfy, or continue to satisfy, the listing requirements and other rules of Nasdaq, the ADSs may not be listed or may be delisted, which could negatively impact the price of the ADSs and your ability to sell them (see the disclosure beginning on page 33 of this prospectus). |

THE OFFERING

| Securities offered by us | | 1,600,000 ADSs, representing 1,600,000 Ordinary Shares, excluding the 240,000 ADSs, representing 240,000 Ordinary Shares, underlying the over-allotment option |

| | | |

| Over-allotment option | | We have granted to the Representative an option, exercisable within 45 days after the closing of this offering, to purchase up to an additional 15% of the total number of ADSs to be offered hereby, solely for the purpose of covering the over-allotments. The Representative may exercise this option in full or in part at any time and from time to time until 45 days after the closing of this offering. |

| | | |

| Initial Public Offering Price per ADS | | We currently estimate that the initial public offering price will be in the range of $4.00 to $5.00 per ADS. For purposes of this prospectus, the assumed initial public offering price per ADS is $5.00. The actual initial public offering price may be at, above, or below this assumed initial public offering price and will be determined at pricing based on, among other factors, the general condition of the securities markets at the time of this offering. |

| | | |

| Ordinary Shares outstanding prior to completion of this offering | | 24,910,619 Ordinary Shares |

| | | |

| ADSs outstanding immediately after this offering | | 1,600,000 ADSs, assuming no exercise of the Representative’s over-allotment option and excluding 48,000 ADSs underlying the Representative’s Warrants |

| | | |

| | | 1,840,000 ADSs, assuming full exercise of the Representative’s over-allotment option and excluding 55,200 ADSs underlying the Representative’s Warrants |

| | | |

| Ordinary Shares outstanding immediately after this offering(1) | | 26,510,619 Ordinary Shares, assuming no exercise of the Representative’s over-allotment option or 26,750,619 Ordinary Shares, assuming full exercise of the Representative’s over-allotment option |

| | | |

| Representative’s Warrants | | The registration statement of which this prospectus forms a part also registers for sale the Representative’s Warrants to purchase up to an aggregate of 55,200 ADSs, representing 3% of the total number of the ADSs sold in this offering, including ADSs sold to cover over-allotments, if any (based on an assumed initial public offering price of $5.00 per ADS), as a portion of the underwriting compensation payable to the Representative in connection with this offering, as well as the Ordinary Shares underlying the ADSs issuable upon exercise of such Representative Warrants. |

| | | |

| | | The Representative’s Warrants will be exercisable at any time, and from time to time, in whole or in part, commencing six months after the closing date of this offering for a period of four and a half years, at an exercise price of $6.00 per ADS (120% of the assumed initial public offering price per ADS in this offering). See “Underwriting—Representative’s Warrants” for more information. |

| | | |

| Listing | | We have applied to list the ADSs on Nasdaq. The closing of this offering is conditioned upon Nasdaq’s approval of the listing of the ADSs on Nasdaq. As of the date of this prospectus, Nasdaq has not yet approved our application to list our ADSs. There is no guarantee or assurance that the ADSs will be approved for listing on Nasdaq. |

| Proposed ticker symbol | | “LFS” |

| | | |

| The ADSs | | Each ADS represents one Ordinary Share. |

| | | |

| | | The depositary or its nominee will be the holder of the Ordinary Shares underlying the ADSs and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and all holders and beneficial owners of ADSs issued thereunder. |

| | | We do not expect to pay dividends in the foreseeable future, though our policy may be subject to change. If, however, we declare dividends on our Ordinary Shares, the depositary will distribute the cash dividends and other distributions it receives on our Ordinary Shares after deducting its fees and expenses in accordance with the terms set forth in the deposit agreement. |

| | | |

| | | You may surrender your ADSs to the depositary to withdraw the Ordinary Shares underlying your ADSs. The depositary will charge you a fee for such exchange. |

| | | |

| | | We may amend or terminate the deposit agreement for any reason without your consent. Any amendment that imposes or increases fees or charges or which materially prejudices any substantial existing right you have as an ADS holder will not become effective as to outstanding ADSs until 30 days after notice of the amendment is given to ADS holders. If an amendment becomes effective, you will be bound by the deposit agreement as amended if you continue to hold your ADSs. |

| | | |

| | | To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which will be filed as an exhibit to the registration statement of which this prospectus forms a part. |

| | | |

| Depositary | | [ ] |

| | | |

| Use of proceeds | | We estimate that we will receive aggregate net proceeds of approximately $5.48 million (or $6.59 million if the Representative exercises its option to purchase additional ADSs in full) from this offering, based on the assumed initial public offering price of $5.00 per ADS, after deducting the estimated underwriting discounts, non-accountable expense allowance, and estimated offering expenses payable by us. |

| | | |

| | | We intend to use the net proceeds from this offering for (i) investing in full-time human resources to expand the market shares of our sports school and social businesses; (ii) expanding our sports school business, including securing sports facilities and hiring part-time school assistance; (iii) expanding our social business, including hiring part-time personnel for our social business; and (iv) other working capital uses. See “Use of Proceeds” on page 37 for more information. |

| Lock-up | | We and each of our officers, directors, and holder(s) of 3% of the outstanding shares of Ordinary Shares as of the effective date of the registration statement of which this prospectus forms a part have agreed and will enter into lock-up agreements with the Representative not to offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of the Company or securities convertible into or exercisable or exchangeable for shares of the Company, during the engagement period with the Representative and for a period of 180 days after closing of this offering. See “Underwriting—Lock-Up Agreements” for more information. |

| | | |

| Risk factors | | The ADSs offered hereby involve a high degree of risk. You should read “Risk Factors,” beginning on page 11 for a discussion of factors to consider before deciding to invest in the ADSs. |

| | | |

| Payment and Settlement | | The underwriters expect to deliver the ADSs against payment therefor through the facilities of the Depository Trust Company (“DTC”) on [ ], 2024. |

| (1) | The number of Ordinary Shares outstanding as of the date of this prospectus excludes 55,200 Ordinary Shares issuable upon the exercise of the Representative’s Warrants and 300,000 Ordinary Shares issuable upon the exercise of director and employee stock options at a weighted average exercise price of JPY52.55 per Ordinary Share as of June 30, 2024. Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of the over-allotment option. |

RISK FACTORS

An investment in the ADSs involves a high degree of risk. Before deciding whether to invest in the ADSs, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations, or cash flow could be materially and adversely affected, which could cause the trading price of the ADSs to decline, resulting in a loss of all or part of your investment. The risks described below and discussed in other parts of this prospectus are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in the ADSs if you can bear the risk of loss of your entire investment.

Risks Related to Our Business and Industry

If we are not able to continue to attract students to enroll and reenroll existing students in our sports schools, our business and prospects will be materially and adversely affected.

For the fiscal years ended December 31, 2022 and 2023 and the six months ended June 30, 2024, we derived 54.17%, 51.64%, and 58.96% of our total revenue, respectively, from the membership fees our sports school students paid to us. In addition, for the fiscal years ended December 31, 2022 and 2023 and the six months ended June 30, 2024, we derived 15.89%, 17.29%, and 15.14% of our total revenue, respectively, from the events we organized primarily for our sports school students.

The success of our sports school business depends substantially on the number of students enrolled in our sports schools. While we enter into monthly or annual membership contracts with our students and their parents, the students may not renew these contracts. Therefore, our ability to continue to attract new students to enroll and to reenroll our existing students without significantly decreasing membership fees or increasing membership fee discounts in our sports schools is critical to the continued success and growth of our business. Our ability to attract and retain students depends mainly on the membership fees we charge, the convenience of the locations of our facilities, the infrastructure of our sports schools, the quality of our sports coaching as perceived by our existing and potential students, the relationships among our professional coaches and students and parents, and our sales and marketing strategies. These factors are affected by, among other things, our ability to (i) respond to increasing competitive pressures, (ii) develop new courses and enhance existing courses to respond to changes in market trends and student demands, (iii) expand our school network and geographic footprint, (iv) recruit, train, and retain qualified coaches, (v) manage our growth while maintaining consistent and high physical education quality, (vi) develop our relationships with professional sports teams in Japan, and (vii) market our sports school business effectively to a broader base of prospective students; as well as things beyond our control, such as (i) the outbreak of a pandemic, (ii) Japan’s overall economic situation, and (iii) the rising competition from our competitors. Furthermore, our ability to attract parents and students also depends on our ability to provide sports coaching that is perceived as embodying the culture that our competitors do not embrace in Japan, which rejects the victory supremacy that prevails in traditional youth sports teams and school club activities. However, it is equally likely that this education philosophy may not be accepted by the market anymore at some point in the future.

If we are unable to continue to attract students to enroll or reenroll in our sports schools, our net revenue may decline, which may have a material adverse effect on our business, financial condition, and results of operations. For example, unlike many competitors, we enter into long-term and full-time employment agreements with our coaches. In the event that student enrollments fall, we may have a substantial labor surplus and need to reduce our workforce, which will have a material and adverse impact on our growth and morale.

Our substantial indebtedness could materially and adversely affect our business, financial condition, results of operations, and cash flows.

As of June 30, 2024, we had JPY700,000,000 ($4,351,069) of short-term loans, JPY317,535,000 ($1,973,738) of current portion of long-term loans, and JPY250,132,000 ($1,554,774) of long-term loans outstanding.

The amount of our debt could have significant consequences on our operations, including:

| ● | reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions, and other general corporate purposes as a result of our debt service obligations; |

| ● | limiting our ability to obtain additional financing; |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business, the industry in which we operate, and the general economy; |

| ● | increasing the cost of any additional financing; and |

| ● | limiting the ability of our subsidiaries to pay dividends to us for working capital or return on our investment. |

Any of these factors and other consequences that may result from our substantial indebtedness could have a material adverse effect on our business, financial condition, results of operations, and cash flows impacting our ability to meet our payment obligations under our debts and our other cash flow needs. Our ability to meet our payment obligations under our outstanding indebtedness depends on our ability to generate significant cash flow in the future. This, to some extent, is subject to general economic, financial, competitive, legislative, and regulatory factors as well as other factors that are beyond our control.

If we are not able to maintain the diversity and quality of our sports school class offerings, our business and prospects will be materially and adversely affected.

Currently, we operate 13 sports schools, from soccer school “Liberta” and basketball school “Porte” to rhythmic karate school “Quore” and kendo school “Kokoro.” We have been spending and will continue to spend efforts in designing courses that cater to the various needs of different age groups and sports capability levels. These efforts have expanded our client base, contributed to our client loyalty, and enabled us to explore adjacent business areas. We have also been enhancing and will continue to enhance all aspects of our class offerings, including the quality of our coaches, content, infrastructure, and operational efficiency, in order to maintain our high educational standards and drive premium membership fees and other fees. However, there is no guarantee that we will be able to successfully maintain our current level of class offering diversity or quality without incurring substantial additional expenses, or at all. The diversity and quality of our class offerings is impacted by, among other things, our ability to (i) enroll enough students in each sports school, (ii) recruit, train, and retain qualified coaches for each sports school, (iii) identify and secure appropriate sites for each sports school, and (iv) generate enough cashflow to fund course development and improvement efforts. If insufficient students enroll in a particular course, we may have to suspend or close a sports school and thus, compromise our class offering diversity and customer loyalty. If we cannot maintain the quality of our class offerings, students and parents may choose not to renew their memberships with us. As such, failure to maintain the diversity and quality of our class offerings will materially and adversely impact our sports school business and prospects.

If we fail to develop and introduce new sports schools and new classes in anticipation of market demand in a timely and cost-effective manner, our competitive position and ability to generate revenue may be materially and adversely affected.

Since inception, the primary focus of our sports school business has been on sports coaching. We have since expanded our class offerings to 13 sports schools, including cheerleading, dancing, and table tennis. We intend to continue developing new sports schools and classes in anticipation of market demand. While the introduction of new sports schools has substantially contributed to our market share in recent years—for example, membership in dance and cheerleading schools has grown steadily in recent years—it is subject to risks and uncertainties that we may not be familiar with. Unexpected technical, operational, logistical, regulatory, or other problems could delay or prevent the introduction of one or more new sports schools and classes. Moreover, we cannot assure you that any of these new sports schools and classes will match the quality or popularity of our existing courses or those developed by our competitors, achieve widespread market acceptance, or generate the desired level of income for our business.

Offering new sports schools and classes requires us to make investments in content development, recruit and train additional qualified coaches and teaching assistants, increase marketing efforts and re-allocate resources away from other uses. We may have limited experience with the content of new sports schools and classes and may need to spend substantial efforts in modifying our systems and strategies to incorporate new sports schools and classes into our existing offerings. Furthermore, we may experience difficulties in recruiting or otherwise identifying qualified coaches to develop the content for these new sports schools and classes. If we are unable to offer new sports schools and classes in a timely and cost-effective manner, our competitors will gain a substantial competitive advantage in a new business area, and our results of operations and financial condition could be adversely affected.

We have a limited operating history in social business, which makes it difficult to predict our future business prospects and financial performance.

We launched our social business in 2007 and started to focus on school club support services in collaboration with municipalities and public schools in 2013. During the fiscal years ended December 31, 2022 and 2023 and the six months ended June 30, 2024, the revenue generated from our social business was approximately JPY1,837.5 million ($11.4 million), JPY2,260.9 million ($14.1 million), and JPY1,145.6 million ($7.1 million), respectively, accounting for approximately 23.9%, 24.3%, and 24.0% of our total revenue for those periods, respectively. Given our limited operating history in school club support services, we cannot assure you that our business model will be successful or that we will be able to promptly adjust our operating model from time to time. We cannot assure you that the municipalities and public schools that we are in collaboration with will enter into new outsourcing agreements with us when the current agreements terminate. In addition, we have limited experience in operating other services that we provide under the social business sector, including after-school daycare services and elderly healthcare. We have encountered, and may continue to encounter in the future, risks, challenges, and uncertainties associated with the development of our social business, such as maintaining and developing relationships with municipalities and public schools, managing complex projects, retaining existing customers and attracting potential customers, addressing regulatory compliance and uncertainty, engaging, training, and retaining high-quality employees, and building brand reputation and awareness. Furthermore, we may have limited insights into trends that affect our business and may make mistakes in predicting and reacting to market trends or the evolving needs of our customers. If we do not manage these risks and challenges successfully, our operating and financial results may differ materially from our expectations and our business and financial performance may suffer. Furthermore, our recent results of operations in this business may not serve as an adequate basis for evaluating our prospects and results of operations, including gross billings, net revenue, cash flows, and operating margins for our social business.

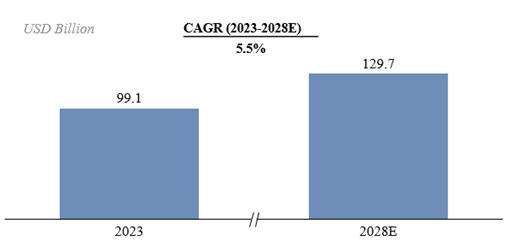

Competition in the youth sports education market could reduce enrollments, increase our cost of recruiting and retaining students and coaches, and put downward pressure on our membership fees and profitability.

The youth sports education markets in Japan are fragmented and highly competitive, and the competition has become more severe in recent years due to the falling birthrate and the resulting population decline, among other reasons. We face competition from other sports schools in the locations in which we operate that target elementary school children, who constitute approximately 88% of our sports school members. Some of our existing and potential competitors may be able to devote greater resources than we can to the development of courses and offer courses similar to or better than those offered by us, have access to more funds, be more prestigious or well-regarded within the sports coaching community, have more conveniently located venues with better infrastructure or charge lower membership fees, and respond more quickly to changes in students’ and parents’ demands, market needs, or new technologies. Moreover, our competitors may increase capacity in any of our markets to an extent that leads to an over-supply. If we are unable to differentiate our sports schools from those of our competitors and successfully market our sports schools to parents and students, we may face competitive pressures that reduce enrollments, which could substantially increase the venue rental cost and labor cost per student. Furthermore, if our enrollments fall, we may be required to reduce our membership fee or increase spending in order to attract and retain students, which could materially and adversely affect our business, prospects, results of operations, and financial condition.

We cannot assure you that we will be able to maintain our competitive advantage in the future. Our current or potential competitors may leverage their brand recognition, industry experience, and networking resources to compete with us. As a result, the municipalities and public schools we are in collaboration with may grant our current contracts with them to our competitors in the future.

We cannot assure you that we will be able to compete successfully against our current or future competitors. Certain things are beyond our control. For example, although our approach to sports education emphasizes the development of non-cognitive skills and our courses are dedicated to eliminating the victory supremacy that has been prevalent in traditional youth sports teams, this education philosophy may not be accepted by parents and students anymore at some point in the future. If we are unable to maintain our competitive position or otherwise respond to competitive pressures effectively, we may lose our market share, our profits may decrease, and we may be adversely affected.

Accidents or injuries suffered by our students or other people on our premises may adversely affect our reputation, subject us to liability, and cause us to incur substantial costs.

As of the date of this prospectus, no fatal accidents or serious accidents have occurred on our premises since the opening of our first sports school. However, we cannot assure you that we will be able to keep the current safety record as our business expands in the future, considering that approximately 87% of our sports school members are elementary school students. For example. we emphasize the role played by interactions among different age groups in enhancing cooperation and empathy among students. We also organize seasonal camps three times a year where students practice sports together, are guided to cook, and prepare bedding for themselves. The nature of such interactions and activities substantially increases the likelihood of injury, both physical and emotional, suffered by our students. In the event of accidents, injuries, or other harm to students or other people on our premises, including those caused by or otherwise arising from the actions of our employees on our premises, our facilities may be perceived to be unsafe, which may discourage prospective students from attending our schools. We may be held responsible for the health and safety of our students and staff. If personal injuries or accidents occur, we may face claims from parents, government officials or other parties alleging that we were negligent, provided inadequate supervision, or were otherwise responsible for causing injury. We may also face allegations that teachers or other personnel committed unlawful acts. The occurrence or alleged occurrence of these events and others that impact our students or staff could expose us to financial liability or harm our reputation, even if we are not at fault. This would be especially true if the potential liability exceeds our insurance coverage. A successful liability claim against us for injuries or other harm suffered by students, employees, or other people could materially and adversely affect our reputation and results of operations. Even if such a claim is unsuccessful or unwarranted, it could divert management attention from our operations, cause us to incur substantial costs in defending the claim, and harm our reputation, all of which could materially and adversely affect our business, prospects, results of operations, and financial condition.

Our management has a limited history of managing rapid expansion. If we cannot effectively and efficiently manage our growth strategy, our results of operation or profitability could be materially and adversely affected.

Other than during the fiscal year ended December 31, 2020, in which our revenue was impacted by the COVID-19 pandemic, our business has grown steadily over the years. In particular, we have experienced high growth in our sports school business, and we have become one of the leading providers of school club support services in Japan. In recent years, we have also ventured into new business areas, such as elder healthcare and after-school daycare, and capitalized on our brand recognition by selling affiliated sports brand wear. We are actively seeking acquisition opportunities of other sports education businesses that syndicate with our current business to ensure talent acquisition and market share. We are also planning to develop educational applications that combine information technology and non-cognitive methods to enable distance learning by acquiring other companies. Since our management has limited or no history in operating those new businesses, we cannot assure you that our future operation of those businesses will be successful. Furthermore, there are significant risks associated with our ability to continue to grow and our growth rate may decline for reasons that are beyond our control, such as changing consumer needs and preferences, evolving industry standards and competitive landscape, emergence of alternative business models, outbreaks of pandemics and occurrences of natural disasters, actions taken by governments, businesses, and individuals in response to pandemics and natural disasters, or adverse changes in laws, regulations, government policies, and general economic conditions. Therefore, there is no assurance that we will be able to maintain our historical growth rates in future periods, and our historical operating and financial results may not be indicative of our future performance.

As we continue to grow rapidly, the complexity of our operations may further increase, and we may encounter greater challenges in implementing our managerial, operating, and financial strategies in order to keep up with our growth. The major challenges in managing our business growth include, among other things:

| ● | attracting and retaining customers with high-quality services that cater to their evolving needs and preferences. |

| ● | growing our sports school business and social businesses while controlling employment expenses, promotional expenses, and event hosting expenses; |

| ● | increasing our brand awareness; |

| ● | maintaining and upgrading our various class offerings in a cost-effective manner; |

| ● | attracting, training, and retaining a growing workforce to support our operations, especially in those new business areas; |

| ● | implementing a variety of new and upgraded internal systems and procedures as our business continues to grow; |

| ● | ensuring that our centralized recruiting, training, and program developing system continues to allow us to train our coaches effectively; |

| ● | building and maintaining our relationships with both private and public sector customers; |

| ● | identifying and securing appropriate sites and timely developing and expanding our operations in existing and new markets. |

| ● | achieving synergy in future mergers and acquisitions; |

| ● | enhancing our knowledge management system and capitalizing on our industry know-how; and |

| ● | adapting to changing regulatory and economic environments. |

All efforts to address the challenges of our growth require significant managerial, financial, and human resources. Our current and planned personnel, systems, procedures, and controls may not be adequate to support our future operations. If our management cannot manage our growth or execute our strategies effectively, we may not continue to achieve the growth we expect, and our results of operations or profitability may be materially and adversely affected.

If we are unable to recruit, train, and retain qualified and experienced coaches who embody our culture, we may not be able to grow or successfully operate our business.

Our coaches are critical to maintaining the quality of our sports courses and our reputation. For a detailed discussion of how our full-time coaches contribute to high-quality courses and long-lasting relationships with students, parents, and schools, please see “Business—Social Business—Sports School Business—Professional Coaches.” We seek to hire highly qualified coaches with rich industry experience and strong teaching skills. However, in Japan, with a declining workforce due to the falling birthrate and aging population, intensifying competition among companies for specialized talent and rising labor costs may significantly increase the difficulty of securing the necessary talent with those attributes, and we must provide competitive compensation packages to attract and retain our qualified coaches. We must also provide ongoing training to our coaches to ensure that they stay abreast of our culture and core values, changes in curriculum, student demands, safety precautions, industry standards, and other trends necessary to teach safely and effectively.

We have not experienced major difficulties in recruiting, training, or retaining qualified coaches in the past. Our coaches have demonstrated high loyalty as evidenced by our annual retention rate of approximately 87.8% and 87.1% in the past two fiscal years. During the six months ended June 30, 2024, our half-year retention rate was 99.2%. We are providing our coaches with full-time employee benefits, as well as a competitive performance-based compensation package. However, we may not always be able to recruit, train, and retain enough qualified coaches in the future to keep pace with our growth and maintain consistent teaching quality. For example, we centralize our training efforts so that each coach can receive consistent training. However, our centralized training system may not be able to adapt to the specific needs of each coach at each facility. Moreover, although regular customer feedback and open communication provides the benchmark for our training, information gaps may still be unavoidable. A shortage of qualified coaches meeting our customers’ expectations, a decrease in the quality of our coaches’ classroom performance, whether actual or perceived, or a significant increase in compensation to retain qualified coaches would have a material adverse effect on our business, financial condition, and results of operations.

Our growth also heavily relies on qualified coaches who understand and appreciate our culture, are able to represent our brand effectively, and establish credibility and long-lasting relationships with our customers. Our growth strategy will require us to attract, train, and assimilate even more such employees. If we are unable to hire and retain employees capable of consistently providing a high level of customer service, as demonstrated by their enthusiasm for our culture and values, understanding of our customers, patience with children, and knowledge of the services we offer, our ability to expand our business may be impaired, the performance of our existing and new business could be materially adversely affected, and our brand image may be negatively impacted. Furthermore, our efforts to retain and develop personnel may also result in significant additional expenses that could adversely affect our business and results of operations.

We own a team of long-term and full-time coaches, and this makes our employment policy less flexible, which may materially and adversely impact the business and operations of our Company.

Unlike many competitors who rely on part-time staff to minimize labor costs, we believe a team of long-term, full-time coaches contributes to high-quality classes and long-lasting relationships with students, parents, and schools. We offer our coaches full-time employee benefits, as well as a competitive performance-based compensation package. As we believe that developing and maintaining highly capable and motivated coaches is critical to our success, we continuously devote significant efforts to recruiting, training, and managing high-quality coaches. As of June 30, 2024, we had a total of 1,011 full-time employees.

Generally, subject to extensive procedural and substantive requirements, it is substantially harder for us to terminate an employment agreement with our employee. For a detailed discussion of the employment agreements we enter into with our employees and Japanese labor laws and policies, please see “Business—Employees.” In the event that a particular sports school turns out to be unprofitable and we decide to close it, we will not be able to recover the sunk cost we have already incurred in recruiting and training our coaches. We may incur substantial relocation and training fees, if we decide to provide the impacted coaches with alternative employment arrangements. We may also incur substantial severance fees if we decide not to hire the impacted coaches anymore. Either of those events will materially and adversely impact the business and operations of our Company.

If we are unable to attract, develop, retain, or replace our senior management or key personnel, our business, financial condition, and results of operations may be adversely affected.

We are dependent upon the continued skills, ability, and experience of our senior management and key personnel who have substantial experience with our operations. Many of our key personnel have worked for us for a significant amount of time or were recruited by us specifically due to their industry experience. We place substantial reliance on the physical education industry experience and knowledge of our senior management team, as well as their relationships with other industry participants. Mr. Kiyotaka Ito, our Chief Executive Officer, Mr. Michio Nagatsu, our Chief Financial Officer, and Mr. Takamichi Kon, our Chief Operating Officer, are particularly important to our current and future success due to their substantial experience, competency, and reputation in the physical education industry in Japan.

We have in the past, and may in the future, experience changes in our senior management or key personnel for a variety of reasons, including restructuring, medical problems, retirement, and resignations. Our employment agreements with full-time employees allow them to terminate the agreements with a 60-day advance notice only. If one or more members of our senior management team or key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all. We do not currently carry any key man insurance against such risks. Our inability to attract and retain qualified senior management or key personnel in a timely manner could materially adversely affect our business, prospects, results of operations, and financial condition.

In addition, our senior management or key personnel could leave us to join our competitors with our current customers, industry know-how, and their networking resources. Although we enter into confidentiality and non-compete agreements with our employees before they leave our Company, such employment arrangements are not mandatory to our employees and may not be legally enforceable to its full extent. Losing our senior management or key personnel to our competitors may put us at a competitive disadvantage and cause substantial disruption and uncertainty to the execution of our future growth strategies.

We have had customer concentration, with a limited number of customers accounting for a significant portion of our total revenue.

For the fiscal years ended December 31, 2022 and 2023 and the six months ended June 30, 2024, the Nagoya City Board of Education, which is a municipality in the public sector, accounted for approximately 14.5%, 12.8%, and 10.0% of our total revenue, respectively. For material terms of our agreements with the Nagoya City Board of Education, see “Business—Social Business—School Club Support—Case Study: Nagoya City.”

There are inherent risks whenever a large percentage of revenue is concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers or the future demand for the products and services of these customers in the end-user marketplace. In addition, revenue from our top customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other factors, some of which may be outside of our control. Further, some of our contracts with our top customers permit them to terminate our services at any time (may subject to notice and certain other provisions). Any such development could have an adverse effect on our margins and financial position and would negatively affect our revenue and results of operations and/or trading price of our ADSs.

We provide services to municipalities as well as other governmental authorities. As a result, the nature of governmental bidding process and the change in public educational policies and governmental budgeting could decrease the amount of revenue we generate, thereby adversely impacting our business, results of operations, and financial condition.

In our social business, we provide services to municipalities as well as other governmental authorities, such as the Japan Sports Agency. We acquire these customers through the public bidding process. After winning the bid, we enter into contracts with such customers. In general, such contracts are based on a conventional government procurement contract template. We, therefore, may have little bargaining power over the terms of the contracts with these customers. Additionally, if these governmental customers lower their budgets relating to education or school clubs or discontinue certain educational policies favorable to our business, our revenue from these customers may be negatively affected, thereby adversely impacting our business, results of operations, and financial condition.

Our growth in school club support services stems from our decade-long expertise in the sports school business, establishing us as a pioneering player in extracurricular activities outsourcing business. Successful bidding records with other governmental authorities in public procurement is one of the determinative factors an authority may take into consideration when selecting a winning bidder. Therefore, our well-established track record with several municipalities helps us maintain a competitive position, increase the probability of being invited to government bids, and enhance our successful bidding rate. However, if our market share were to decline, we may no longer enjoy the benefits of being a first mover, potentially leading to a decrease in revenue.

We do not own any sports facilities but pay for the usage of public facilities and private venues for our sports schools, but the legality of the usage of public facilities remains unsettled.

We use public facilities, such as schools, parks, and gymnasium, and private venues, and, in some cases, pay facility usage fees to operate children’s sports schools. Although we have never used public facilities without permission of the facility managers and have always conducted our activities with the necessary regulatory approval, commercial use of public sports facilities in Japan is not always allowed. Furthermore, there is no uniform law providing guidance on what constitutes commercial use of public facilities, and regulations vary by municipalities and individual facilities. In some cases, whether a usage is deemed to be commercial is subject to the discretion of the managers of each facility.

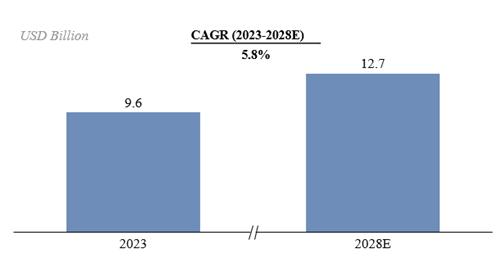

Although the Japanese government and relevant laws, including the Sport Promotion Act of Japan, encourage municipal governments to allow public facilities to be used for sports activities, the law and regulations regarding usage of public facilities remain fragmented and are subject to future change. In the event that we can no longer lawfully use public sports facilities for our sports school business, and we fail to find suitable replacement sites in a timely manner or on terms acceptable to us, our business and results of operations could be materially and adversely affected.