| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-261764-04 |

August 6, 2024

BENCHMARK 2024-V9

Mortgage Trust

Free Writing Prospectus

Structural and Collateral Term Sheet

$892,116,230

(Approximate Mortgage Pool Balance)

$812,896,000

(Approximate Offered Certificates)

GS Mortgage Securities Corporation II Depositor |

Commercial Mortgage Pass-Through Certificates

Series 2024-V9

Goldman Sachs Mortgage Company Citi Real Estate Funding Inc. 3650 Real Estate Investment Trust 2 LLC Barclays Capital Real Estate Inc. Bank of Montreal German American Capital Corporation |

As Sponsors and Mortgage Loan Sellers

Goldman Sachs

& Co. LLC | Barclays | BMO Capital

Markets | Deutsche Bank

Securities | Citigroup |

Co-Lead Managers and Joint Bookrunners

| Academy Securities | CastleOak Securities, L.P. |

Co-Managers

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Barclays Capital Inc., BMO Capital Markets Corp., Deutsche Bank Securities Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Barclays Capital Inc., BMO Capital Markets Corp., Deutsche Bank Securities Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-261764) (the “Preliminary Prospectus”) anticipated to be dated August 6, 2024. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Barclays Capital Inc., BMO Capital Markets Corp., Deutsche Bank Securities Inc., Academy Securities, Inc. or CastleOak Securities, L.P. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Barclays Capital Inc., BMO Capital Markets Corp., Deutsche Bank Securities Inc., Academy Securities, Inc. or CastleOak Securities, L.P. provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—General Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 2 | |

CERTIFICATE SUMMARY OFFERED CERTIFICATES |

Offered Class | Expected Ratings

(Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass-Through Rate | Pass-Through Rate Description |

Wtd. Avg. Life (Yrs)(4)

| Principal Window(4) |

| Class A-1 | Aaa(sf) / AAAsf / AAA(sf) | $ | 1,595,000 | | 30.000% | [ ]% | (5) | 2.47 | 09/24 – 04/29 |

| Class A-2 | Aaa(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | [ ]% | (5) | (6) | (6) |

| Class A-3 | Aaa(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | [ ]% | (5) | (6) | (6) |

| Class X-A | NR / AAAsf / AAA(sf) | $ | 722,614,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A |

| Class X-B | NR / A-sf / AAA(sf) | $ | 75,828,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A |

| Class X-D(9) | NR / BBBsf / BBB+(sf) | $ | 14,454,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A |

| Class A-S | NR / AAAsf / AAA(sf) | $ | 98,133,000 | | 19.000% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class B | NR / AA-sf / AA-(sf) | $ | 43,490,000 | | 14.125% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class C | NR / A-sf / A-(sf) | $ | 32,338,000 | | 10.500% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class D(9) | NR / BBBsf / BBB+(sf) | $ | 14,454,000 | | 8.880% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| |

| NON-OFFERED CERTIFICATES |

Non-Offered Class | Expected Ratings

(Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass-Through Rate | Pass-Through Rate Description |

Wtd. Avg. Life (Yrs)(4)

| Principal Window(4) |

| Class E-RR(9) | NR / BBB-sf / BBB(sf) | $ | 13,424,000 | | 7.375% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class F-RR(9) | NR / BB-sf / BB(sf) | $ | 17,844,000 | | 5.375% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class G-RR(9) | NR / B-sf / B+(sf) | $ | 10,037,000 | | 4.250% | [ ]% | (5) | 4.96 | 08/29 – 08/29 |

| Class J-RR(9) | NR / NR / NR | $ | 37,915,230 | | 0.000% | [ ]% | (5) | 5.32 | 08/29 – 05/32 |

| Class R(10) | N/A | | N/A | | N/A | N/A | N/A | N/A | N/A |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA” and, together with Moody’s and Fitch, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B and Class X-D certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR and Class J-RR certificates (collectively, the “principal balance certificates”) as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2 and Class A-3 certificates, are represented in the aggregate. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates of the mortgage loans or whole loans. |

| (5) | For each distribution date, the pass-through rates of each class of principal balance certificates will generally be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs (the “WAC Rate”), (iii) the lesser of a specified pass-through rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 3 | |

| CERTIFICATE SUMMARY (continued) |

| (6) | The exact initial certificate balances of the Class A-2 and Class A-3 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balance, weighted average life and principal window of the Class A-2 and Class A-3 certificates are expected to be within the applicable ranges reflected in the following chart. The initial aggregate certificate balance of the Class A-2 and Class A-3 certificates is expected to be approximately $622,886,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Wtd. Avg. Life (Yrs) | Expected Range of Principal Window |

| Class A-2 | $0 – $250,000,000 | NAP – 4.86 | NAP / 04/29 – 07/29 |

| Class A-3 | $372,886,000 – $622,886,000 | 4.93 – 4.90 | 07/29 – 08/29 / 04/29 – 08/29 |

| (7) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each class of the Class X certificates will be equal to the aggregate certificate balances of the related classes of certificates (the “related Class X class”) indicated below. |

| Class | | Related Class X Class(es) |

| Class X-A | | Class A-1, Class A-2, Class A-3 and Class A-S certificates |

| Class X-B | | Class B and Class C certificates |

| Class X-D | | Class D certificates |

| (8) | The pass-through rate of each class of the Class X certificates for any distribution date will equal the excess, if any, of (i) the WAC Rate, over (ii) the pass-through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X classes for that distribution date, as described in the Preliminary Prospectus. |

| (9) | The initial certificate balance of each of the Class E-RR, Class F-RR, Class G-RR and Class J-RR certificates, and the initial certificate balance of the Class D certificates and, therefore, the initial notional amount of the Class X-D certificates, is subject to change based on final pricing of all certificates and the final determination of the amounts of the Class E-RR, Class F-RR, Class G-RR and Class J-RR certificates (collectively, the “HRR Certificates”) that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of 3650 Real Estate Investment Trust 2 LLC, as retaining sponsor. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the HRR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (10) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate real estate mortgage investment conduits (each, a “REMIC”), as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The Class E-RR, Class F-RR, Class G-RR, Class J-RR and Class R certificates are not offered by this Term Sheet. Any information in this Term Sheet concerning such non-offered certificates is presented solely to enhance your understanding of the offered certificates.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 4 | |

| KEY FEATURES OF THE CERTIFICATES |

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $892,116,230 |

| Number of Mortgage Loans | 32 |

| Number of Mortgaged Properties | 74 |

| Average Cut-off Date Mortgage Loan Balance | $27,878,632 |

| Weighted Average Mortgage Interest Rate | 6.71961% |

| Weighted Average Remaining Term to Maturity Date (months) | 60 |

| Weighted Average Remaining Amortization Term (months) | 360 |

| Weighted Average Cut-off Date LTV Ratio(3) | 58.6% |

| Weighted Average Maturity Date LTV Ratio(4) | 58.5% |

| Weighted Average Underwritten NCF Debt Service Coverage Ratio | 1.65x |

| Weighted Average Debt Yield on Underwritten NOI | 11.8% |

| % of Mortgage Loans with Mezzanine Debt | 3.7% |

| % of Mortgage Loans with Subordinate Debt | 0.0% |

| % of Mortgage Loans with Preferred Equity | 0.0% |

| % of Mortgage Loans with Single Tenants(5) | 1.3% |

| (1) | With respect to four mortgage loans, representing approximately 15.9% of the initial pool balance, with one or more related pari passu companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, rooms or unit calculations presented in this Term Sheet include the related pari passu companion loan(s) unless otherwise indicated. Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value (which in certain cases may reflect a portfolio premium valuation). With respect to two mortgage loans (3.7% of the initial pool balance) the respective Cut-off Date LTV Ratio was calculated based upon a valuation other than an “as-is” value of each related mortgaged property. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 58.8%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Cut-off Date LTV Ratio. |

| (4) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to two mortgage loans (3.7% of the initial pool balance) the respective Maturity Date LTV Ratios were calculated using a valuation other than an “as-is” value of each related mortgaged property. The weighted average Maturity Date LTV Ratio for the mortgage pool without making such adjustments is 58.6%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date LTV Ratio. |

| (5) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 5 | |

| KEY FEATURES OF THE CERTIFICATES (continued) |

Co-Lead Managers and

Joint Bookrunners: | Goldman Sachs & Co. LLC Citigroup Global Markets Inc. Barclays Capital Inc. BMO Capital Markets Corp. Deutsche Bank Securities Inc. |

| Co-Managers: | Academy Securities, Inc. CastleOak Securities, L.P. |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $892,116,230 |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | 3650 REIT Loan Servicing LLC |

| Certificate Administrator: | Computershare Trust Company, National Association |

| Trustee: | Computershare Trust Company, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| U.S. Credit Risk Retention: | For a discussion of the manner by which 3650 Real Estate Investment Trust 2 LLC, as retaining sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| Pricing: | Week of August 12, 2024 |

| Closing Date: | August 29, 2024 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in August 2024 (or, in the case of any mortgage loan that has its first due date after August 2024, the date that would have been its due date in August 2024 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| Determination Date: | The 11th day of each month or next business day, commencing in September 2024 |

| Distribution Date: | The 4th business day after the Determination Date, commencing in September 2024 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | August 2057 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to the Class X-A, Class X-B and Class X-D certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 6 | |

| ■ | $892,116,230 (Approximate) New-Issue Multi-Borrower CMBS: |

| | — | Overview: The mortgage pool consists of 32 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $892,116,230 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $27,878,632 and are secured by 74 mortgaged properties located throughout 26 states |

| | — | LTV: 58.6% weighted average Cut-off Date LTV Ratio |

| | — | DSCR: 1.65x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 11.8% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 |

| ■ | Loan Structural Features: |

| — | Amortization: 3.7% of the mortgage loans by Initial Pool Balance have scheduled amortization as follows: |

| - | 3.7% of the mortgage loans by Initial Pool Balance have scheduled amortization for the entire term with a balloon payment due at maturity |

| — | Hard Lockboxes: 46.0% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 93.3% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.05x DSCR and 6.5% Debt Yield on Underwritten NOI, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| - | Real Estate Taxes: 30 mortgage loans representing 87.2% of the Initial Pool Balance |

| - | Insurance: 20 mortgage loans representing 45.8% of the Initial Pool Balance |

| - | Replacement Reserves: 29 mortgage loans representing 84.6% of the Initial Pool Balance |

| - | Tenant Improvements / Leasing Commissions: 12 mortgage loans representing 92.8% of the portion of the Initial Pool Balance that is secured by retail, office, mixed use and industrial properties only |

| — | Predominantly Defeasance: 87.0% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

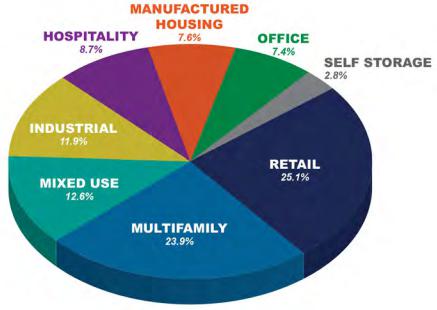

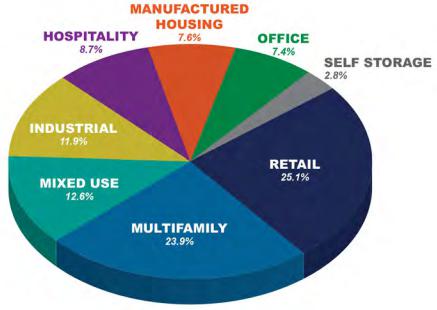

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| | — | Retail: 25.1% of the mortgaged properties by allocated Initial Pool Balance are retail properties (10.5% are anchored retail properties) |

| | — | Multifamily: 23.9% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| | — | Mixed Use: 12.6% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| | — | Industrial: 11.9% of the mortgaged properties by allocated Initial Pool Balance are industrial properties |

| | — | Hospitality: 8.7% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| | — | Manufactured Housing: 7.6% of the mortgaged properties by allocated Initial Pool Balance are manufactured housing properties |

| | — | Office: 7.4% of the mortgaged properties by allocated Initial Pool Balance are office properties |

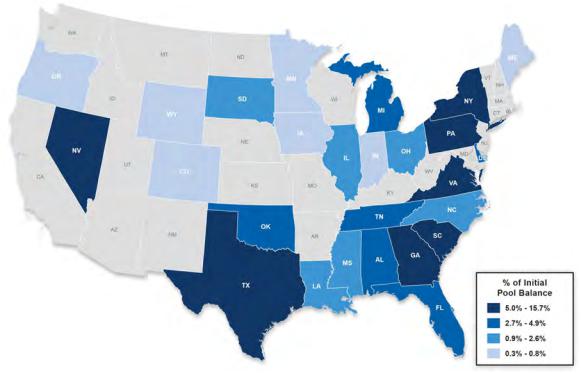

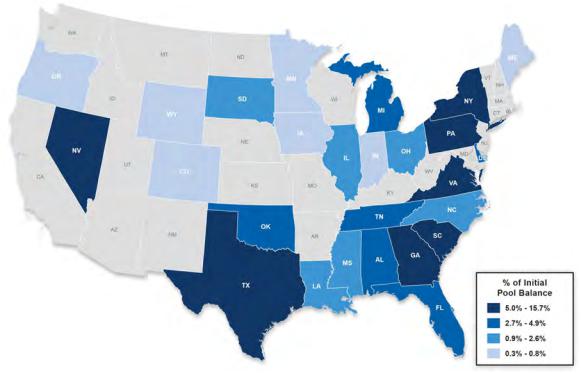

| ■ | Geographic Diversity: The mortgaged properties are located throughout 26 states with two states having greater than 10.0% of the allocated Initial Pool Balance: New York (15.7%) and Texas (15.5%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 7 | |

| COLLATERAL OVERVIEW (continued) |

Mortgage Loans by Mortgage Loan Seller

Mortgage Loan Seller | Mortgage Loans | Mortgaged Properties | Aggregate Cut-off Date Balance | % of Initial Pool Balance |

| Goldman Sachs Mortgage Company | 3 | | 3 | | $136,850,000 | | 15.3 | % |

| Citi Real Estate Funding Inc. | 7 | | 46 | | 246,800,000 | | 27.7 | |

| 3650 Real Estate Investment Trust 2 LLC | 7 | | 8 | | 201,700,000 | | 22.6 | |

| Barclays Capital Real Estate Inc. | 8 | | 9 | | 181,096,230 | | 20.3 | |

| Bank of Montreal | 5 | | 5 | | 69,170,000 | | 7.8 | |

| German American Capital Corporation | 2 | | 3 | | 56,500,000 | | 6.3 | |

| Total | 32 | | 74 | | $892,116,230 | | 100.0 | % |

Ten Largest Mortgage Loans

Mortgage Loan Name | Cut-off Date Balance | % of Initial Pool Balance | Property Type | Property Size

SF/Units/ Rooms | Loan Purpose | UW NCF

DSCR | UW

NOI Debt Yield | Cut-off Date LTV Ratio |

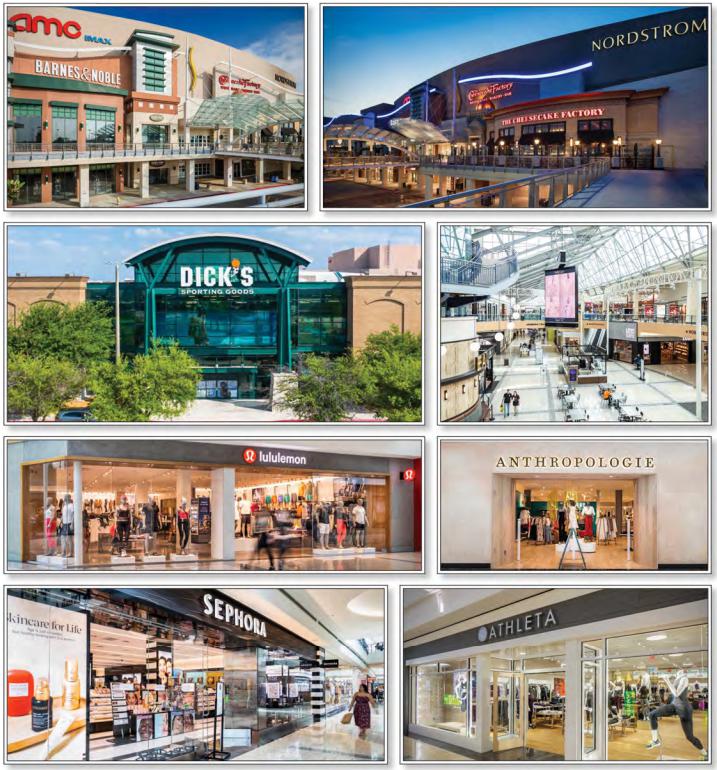

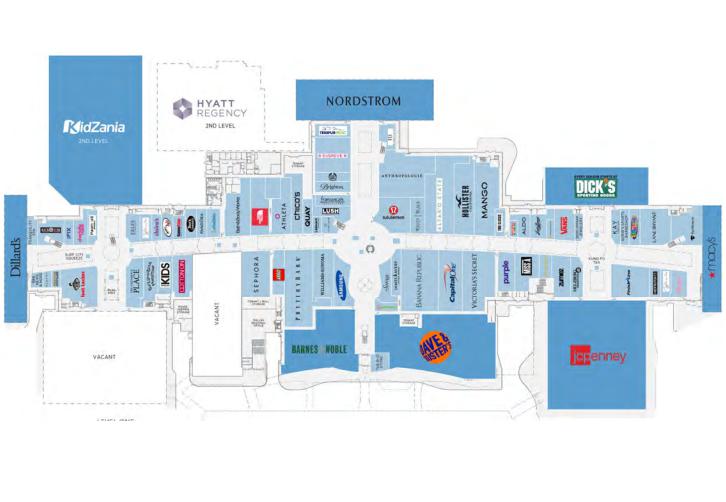

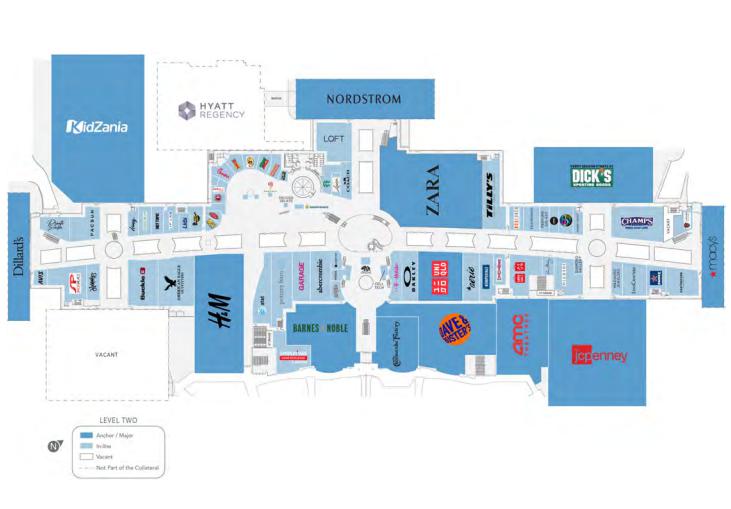

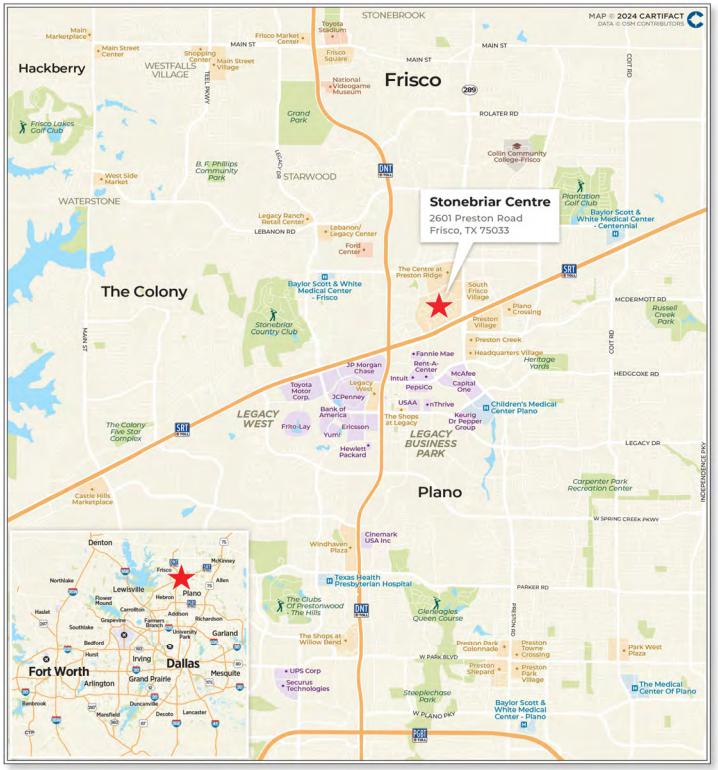

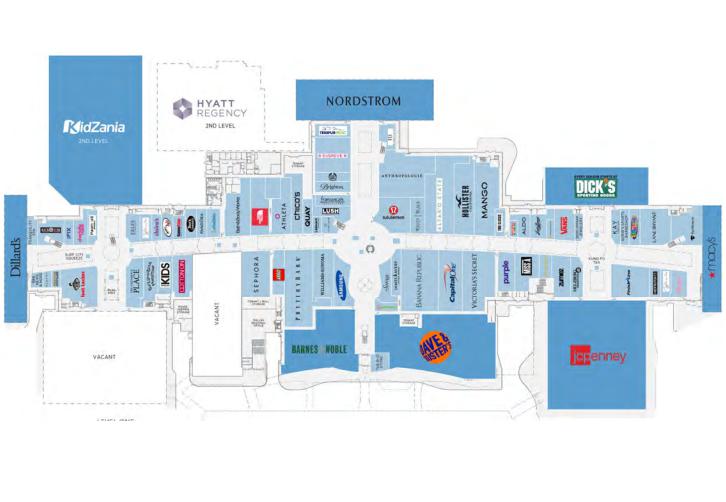

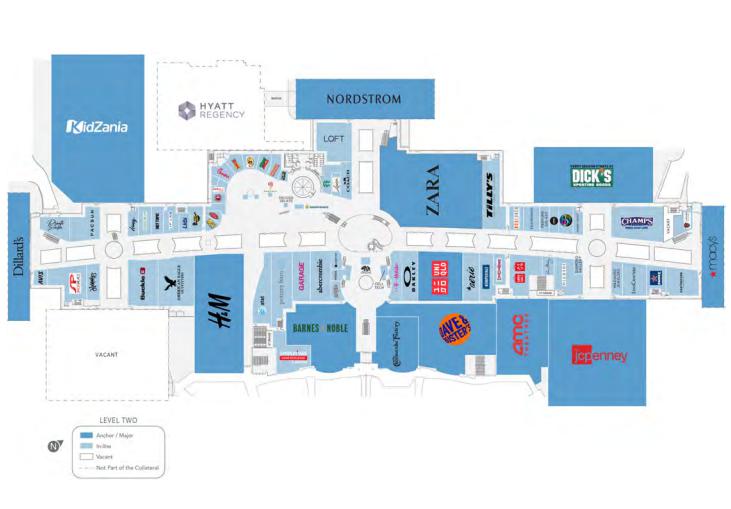

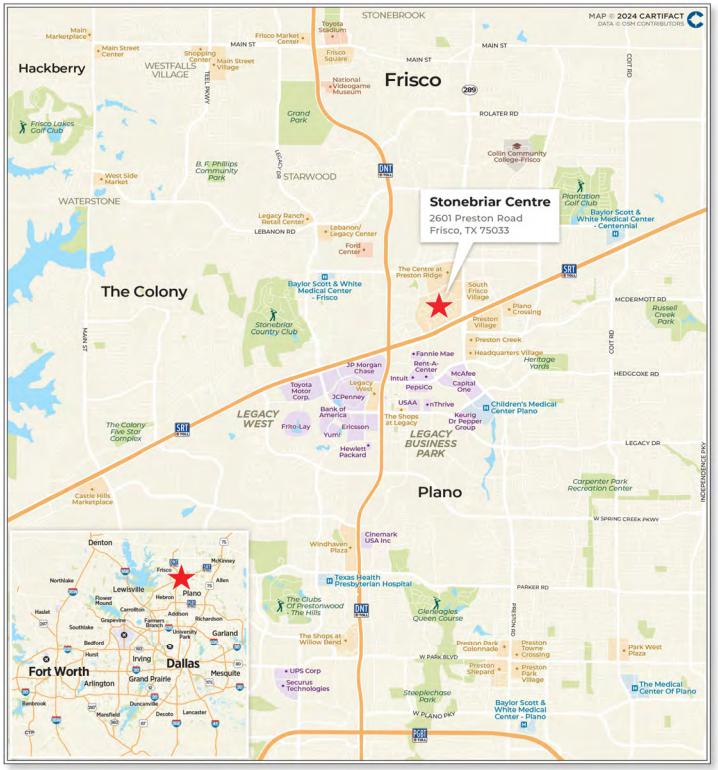

| Stonebriar Centre | $89,000,000 | | 9.98 | % | Retail | 1,096,880 | Refinance | 2.30x | 16.8% | | 42.1% |

| Churchill Portfolio | 85,000,000 | | 9.5 | | Various | 7,254 | Refinance | 1.82x | 10.8% | | 51.1% |

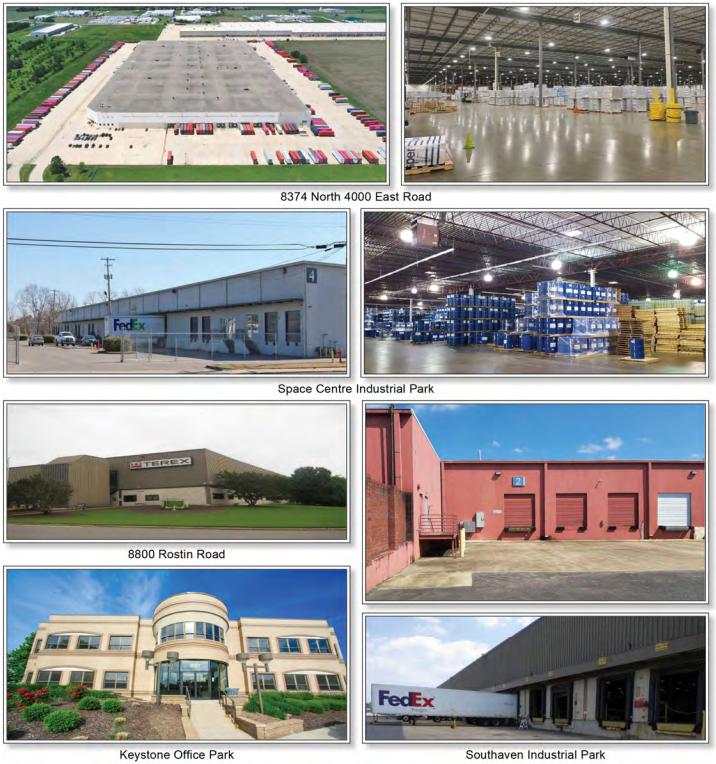

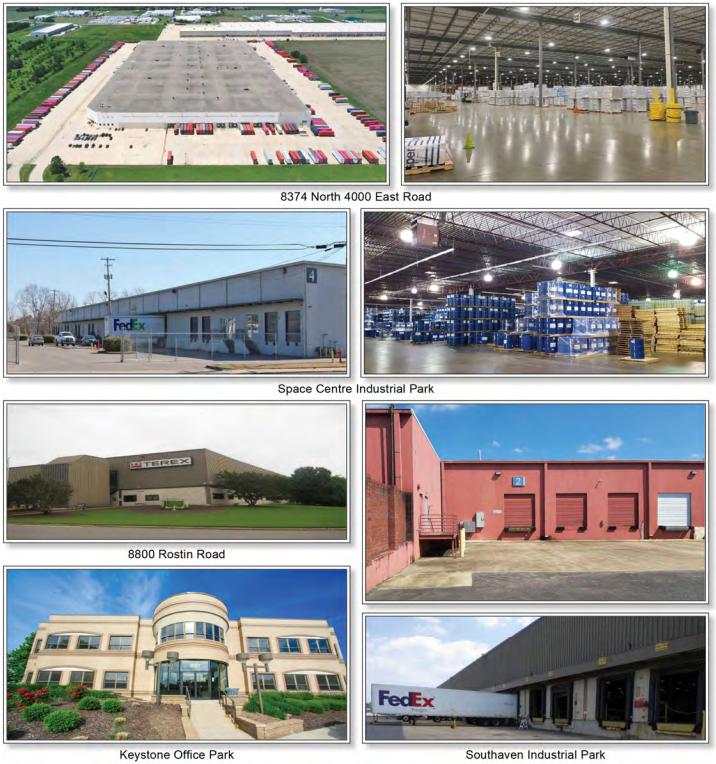

| Memphis and Chicago Industrial Portfolio | 75,000,000 | | 8.4 | | Various | 2,977,028 | Refinance | 1.55x | 11.2% | | 55.8% |

| Quantico Corporate Center | 57,000,000 | | 6.4 | | Office | 409,134 | Refinance | 1.86x | 14.2% | | 60.6% |

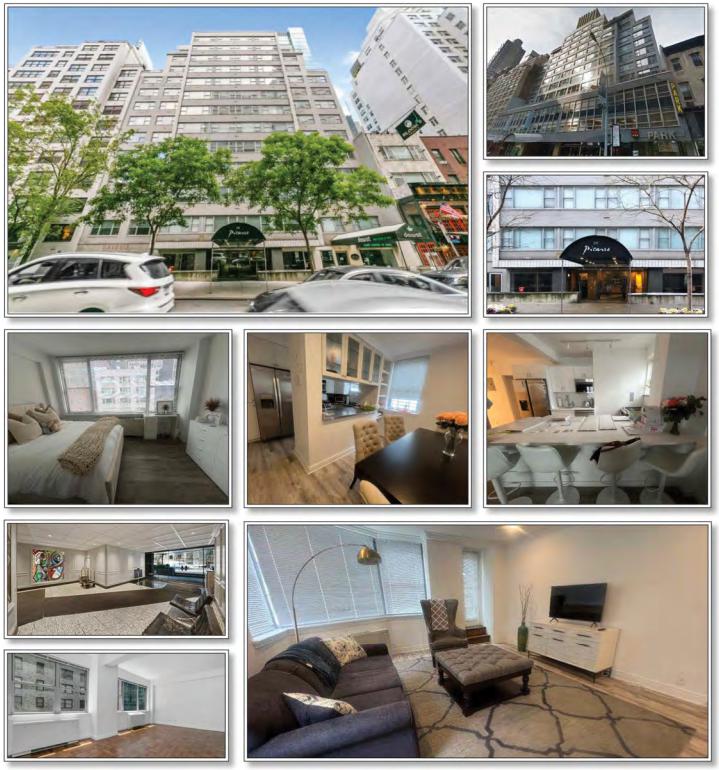

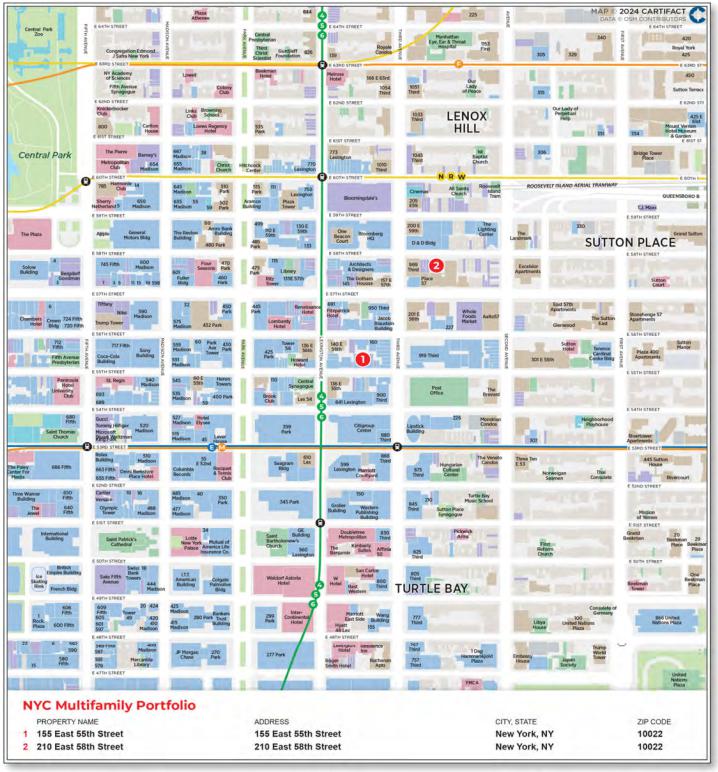

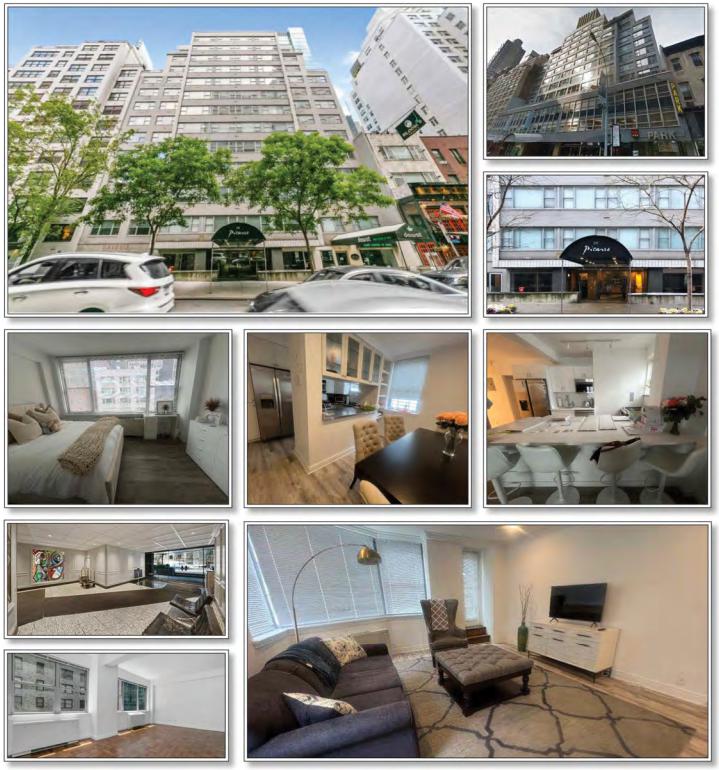

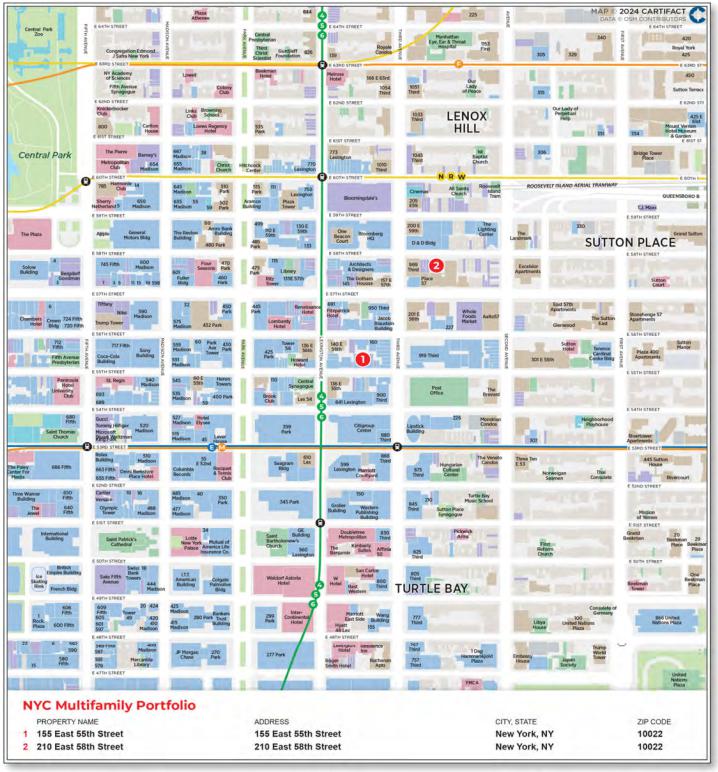

| NYC Multifamily Portfolio | 50,500,000 | | 5.7 | | Mixed Use | 146 | Refinance | 1.36x | 8.7% | | 59.6% |

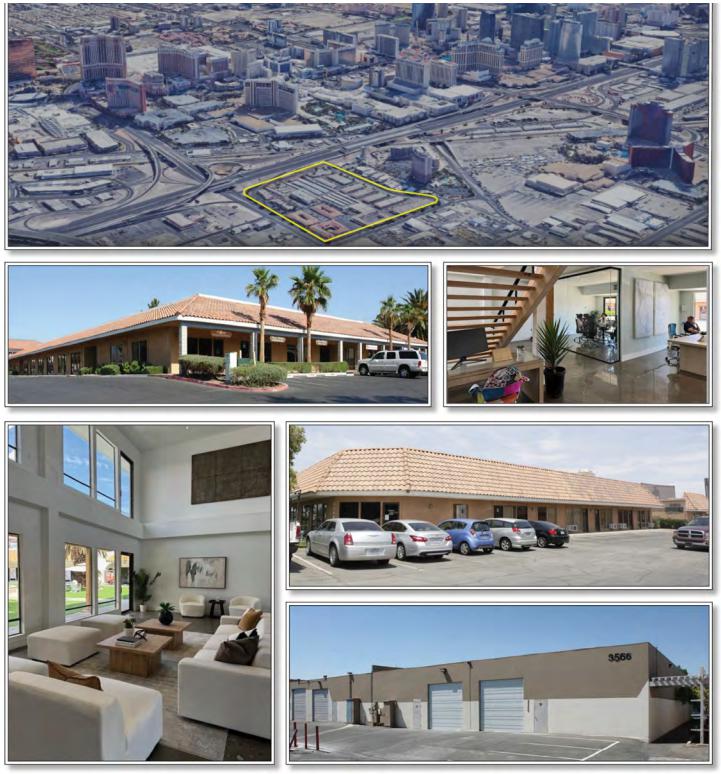

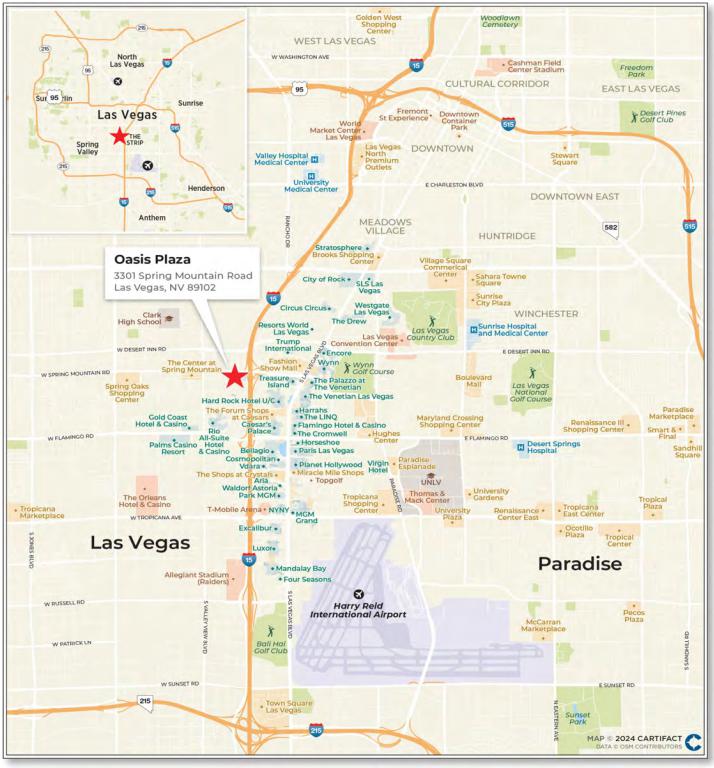

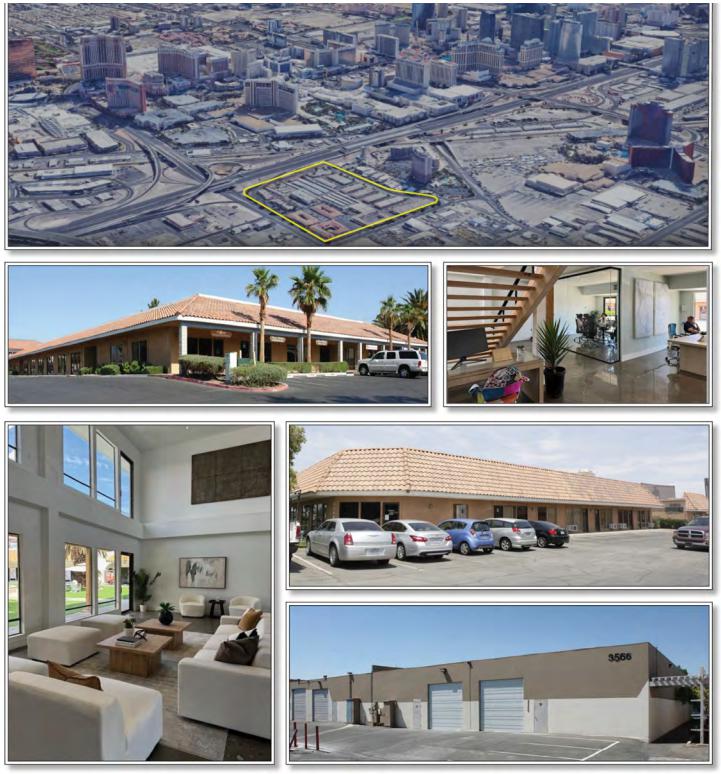

| Oasis Plaza | 45,000,000 | | 5.0 | | Mixed Use | 430,156 | Refinance | 1.36x | 9.8% | | 64.3% |

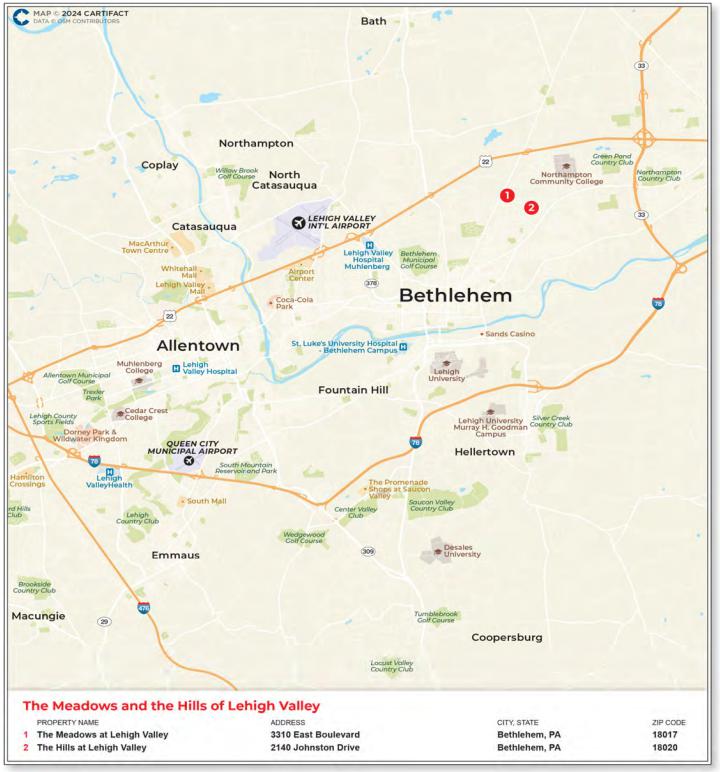

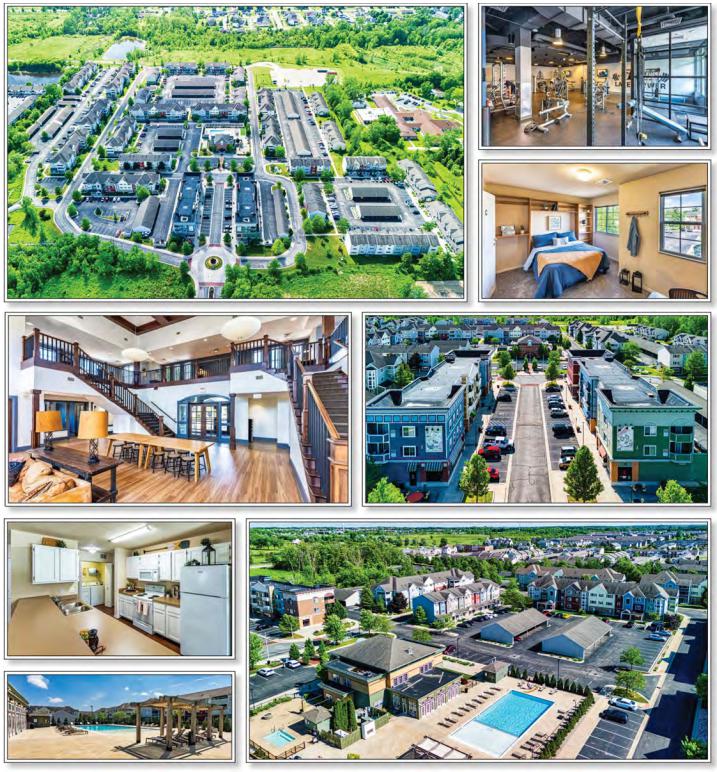

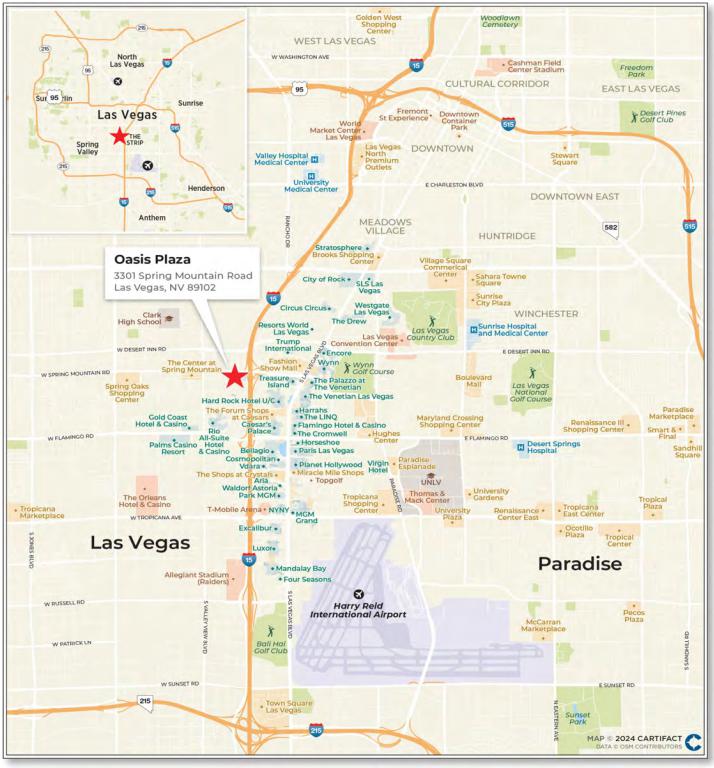

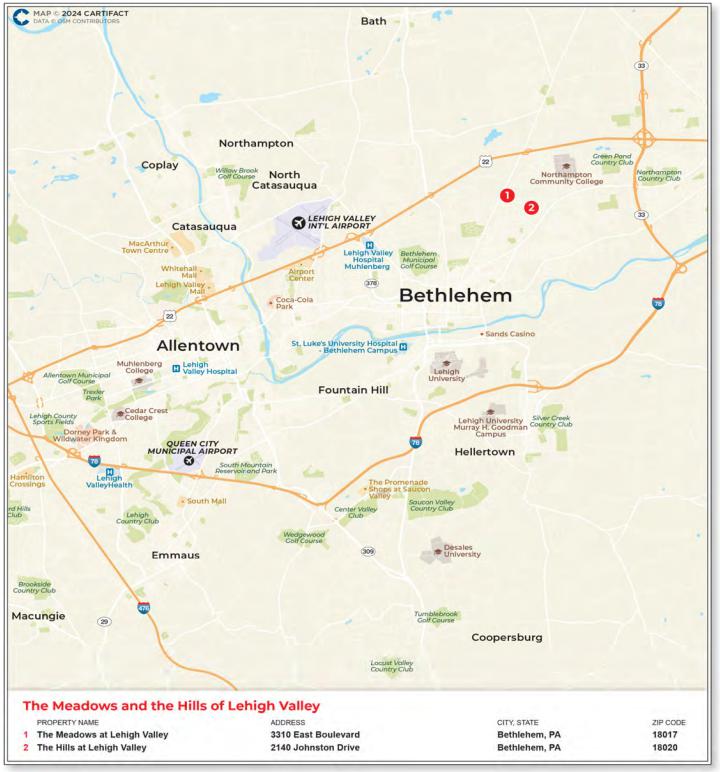

| The Meadows and the Hills of Lehigh Valley | 44,500,000 | | 5.0 | | Multifamily | 348 | Refinance | 1.30x | 8.5% | | 70.0% |

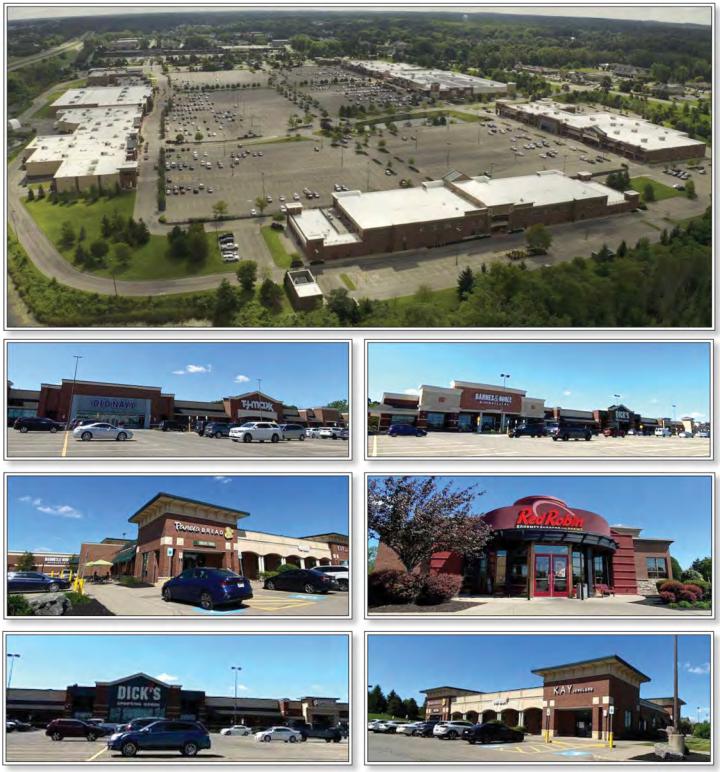

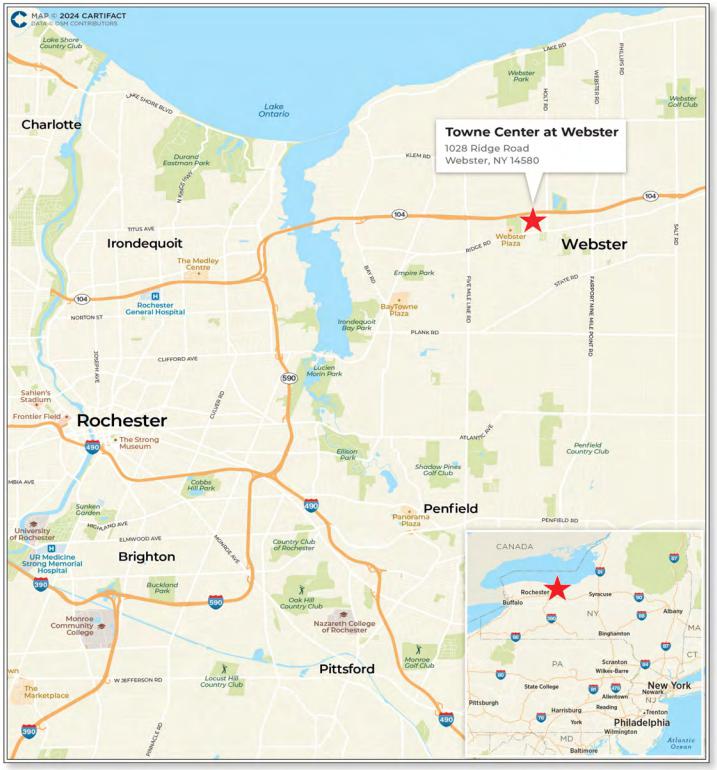

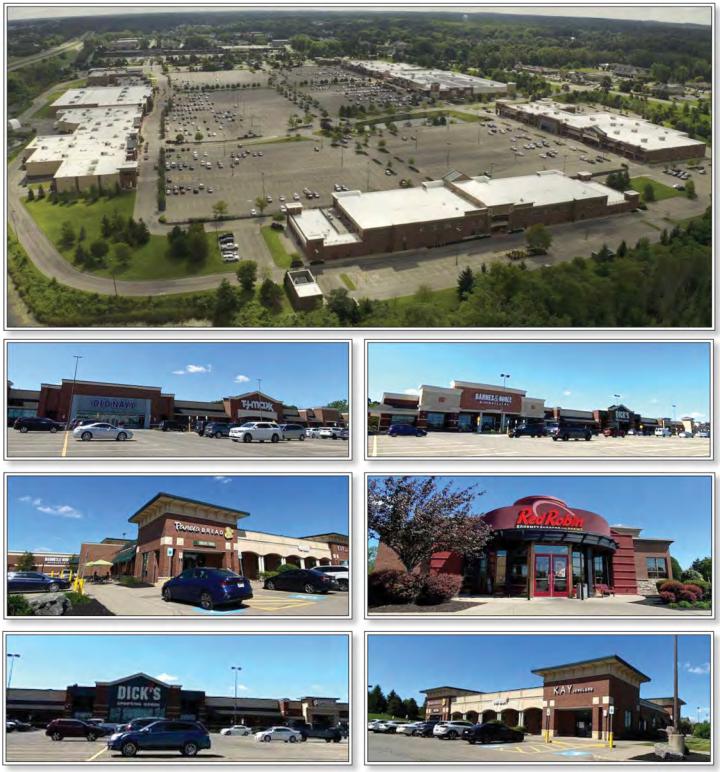

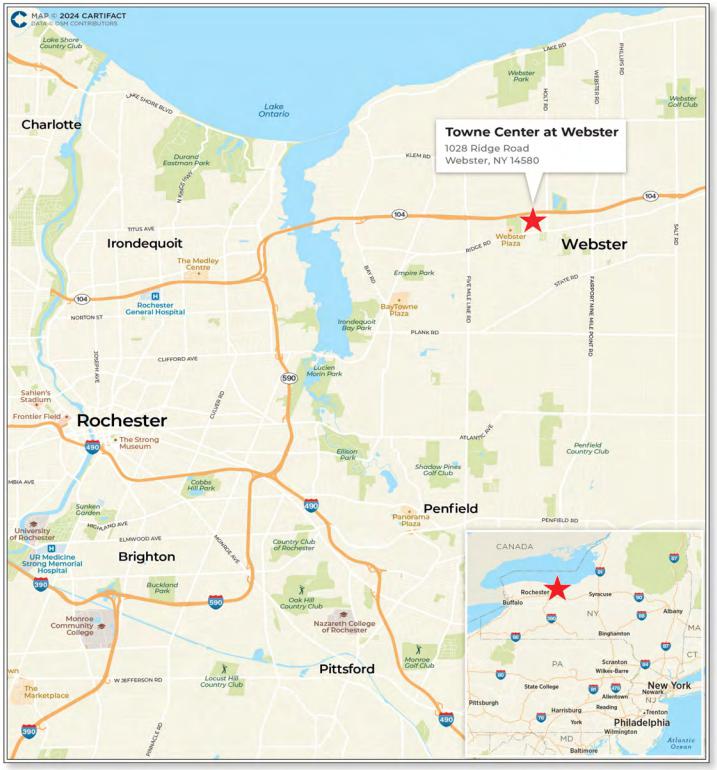

| Towne Center at Webster | 43,000,000 | | 4.8 | | Retail | 365,760 | Refinance | 1.27x | 10.0% | | 66.7% |

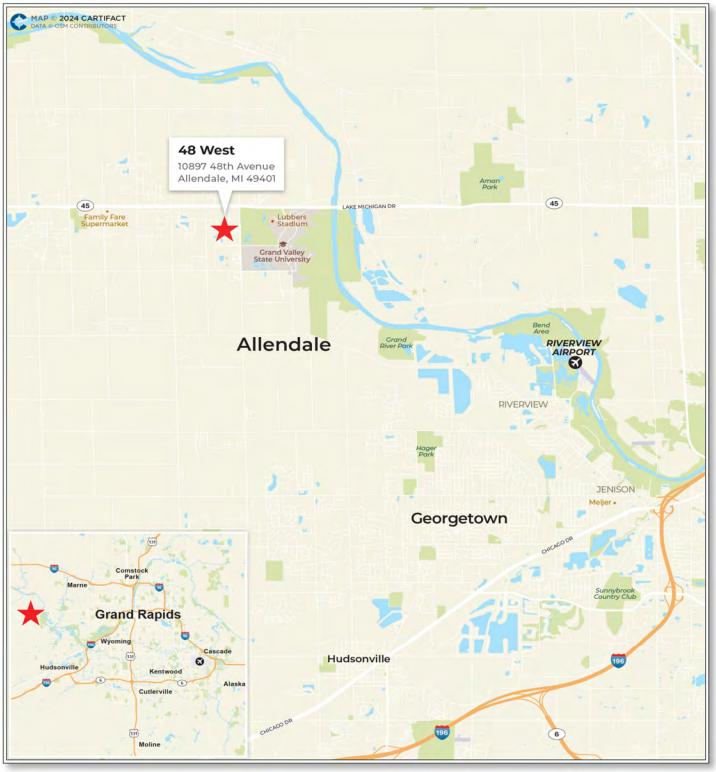

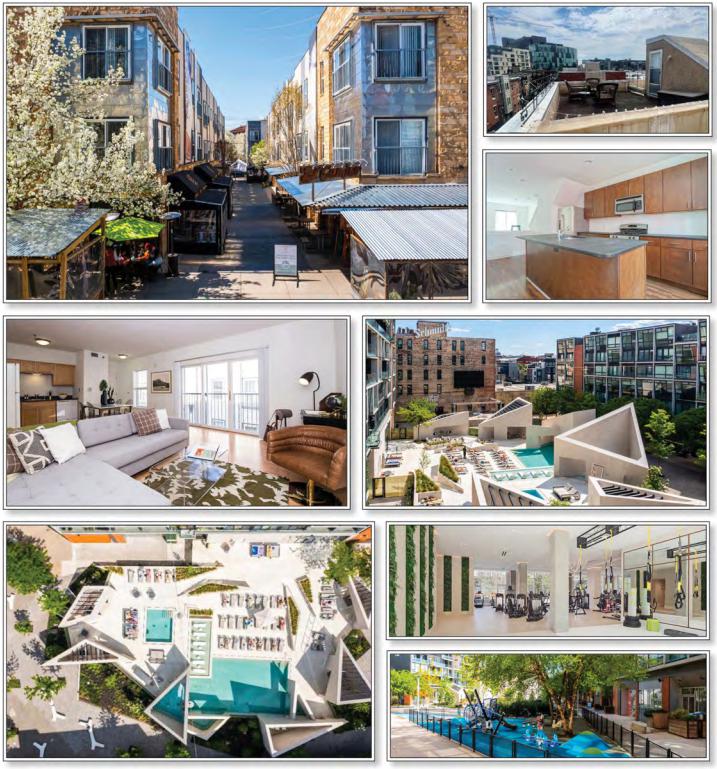

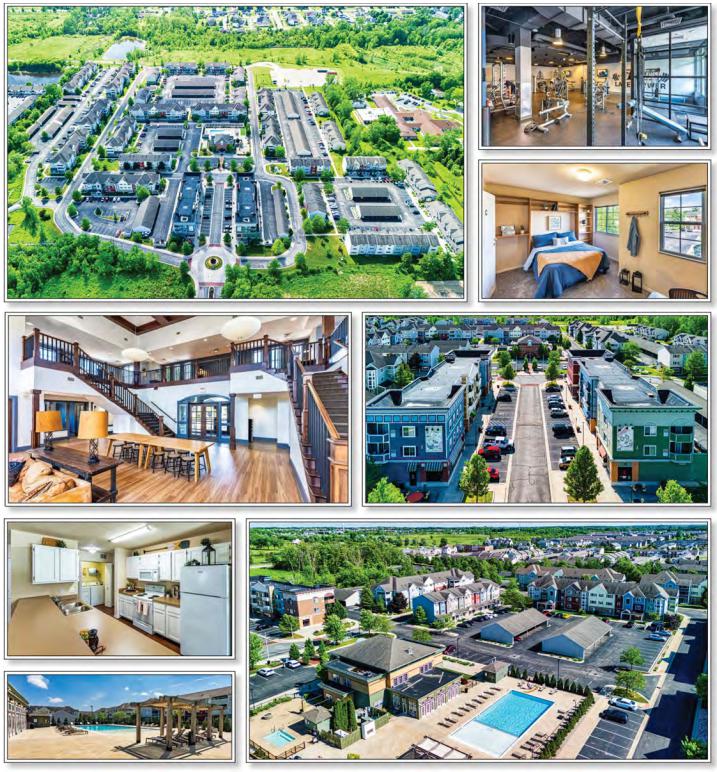

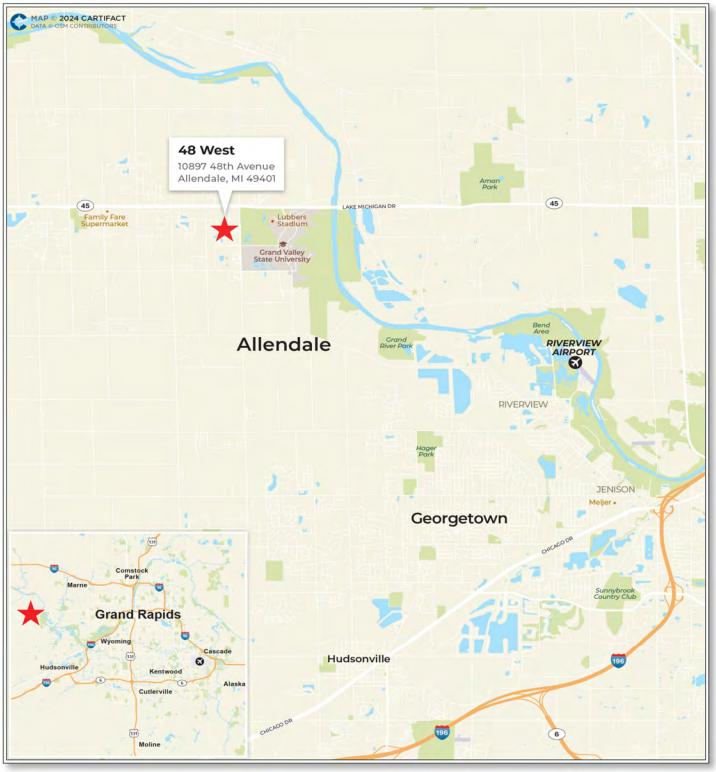

| 48 West | 33,000,000 | | 3.7 | | Multifamily | 920 | Refinance | 1.49x | 11.3% | | 59.2% |

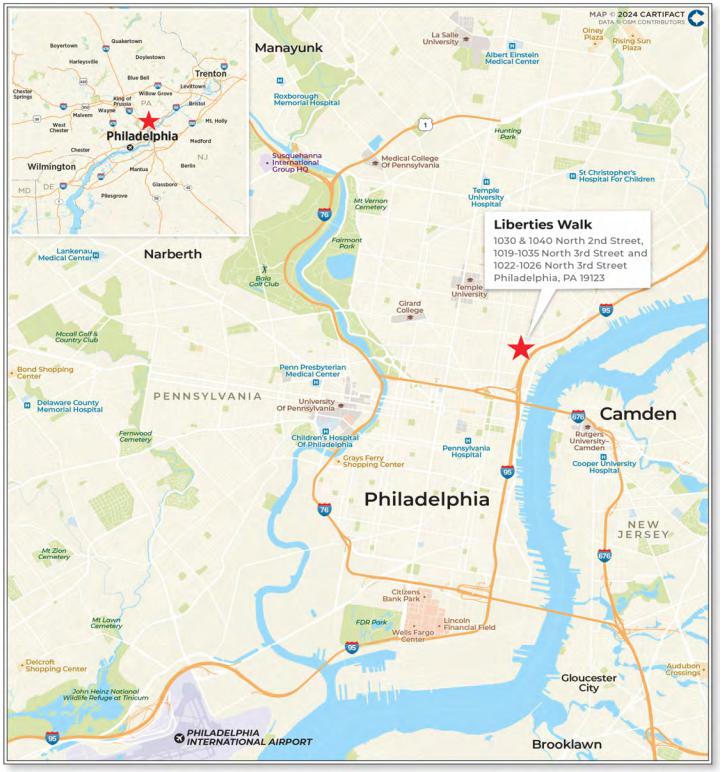

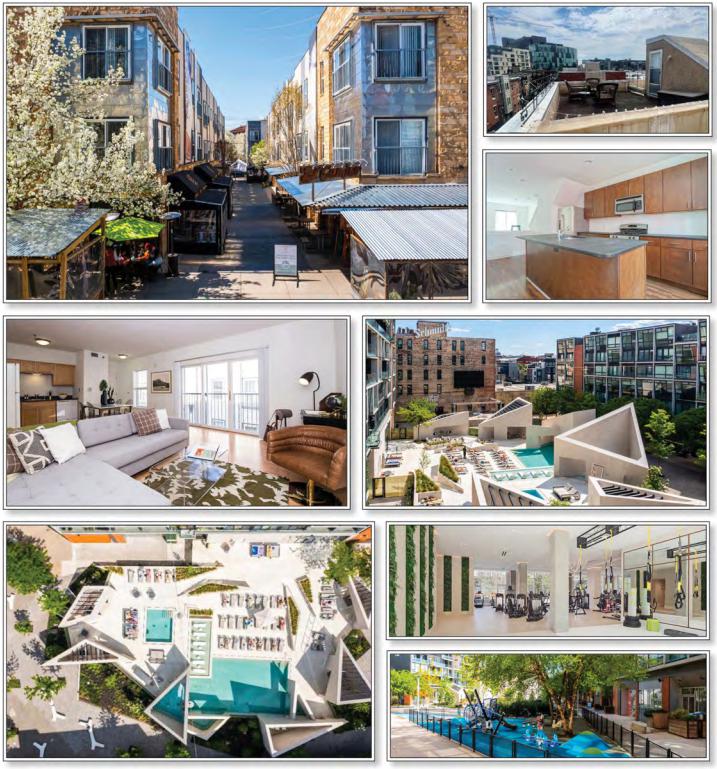

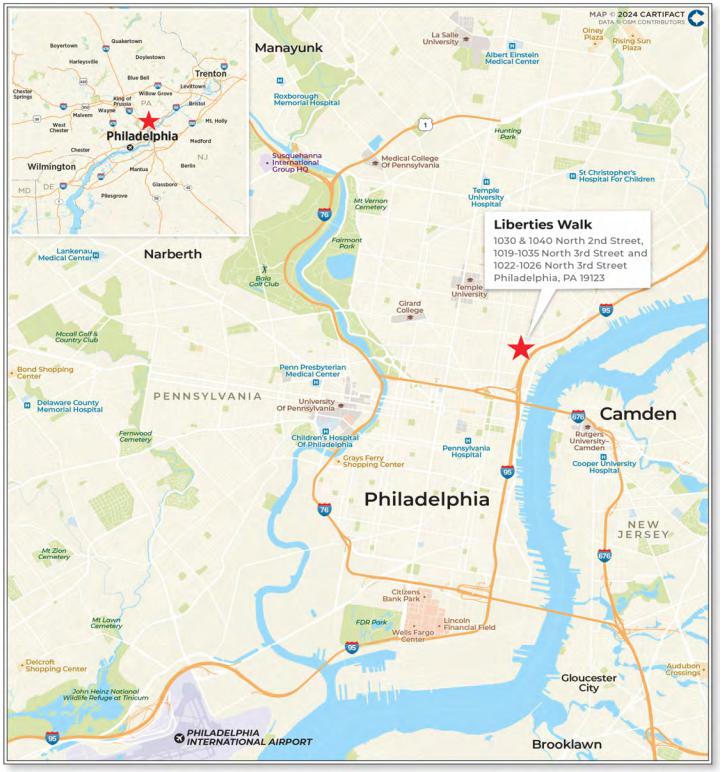

| Liberties Walk | 33,000,000 | | 3.7 | | Multifamily | 88 | Refinance | 1.53x | 9.4% | | 60.3% |

| Top 10 Total / Wtd. Avg. | $555,000,000 | | 62.2 | % | | | | 1.66x | 11.6% | | 56.9% |

| Remaining Total / Wtd. Avg. | 337,116,230 | | 37.8 | | | | | 1.63x | 12.2% | | 61.6% |

| Total / Wtd. Avg. | $892,116,230 | | 100.0 | % | | | | 1.65x | 11.8% | | 58.6% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 8 | |

| COLLATERAL OVERVIEW (continued) |

Whole Loan Summary

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | % of Initial Pool Balance | Number of Pari Passu Companion Loans(1) | Aggregate Pari Passu Companion Loan Cut-off Date Balance(1) | Aggregate Subordinate Companion Loan Cut-off Date Balance(1) | Whole Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement (“Controlling PSA”) | Master Servicer | Special Servicer |

| Stonebriar Centre | $89,000,000 | 9.98% | 6 | $166,000,000 | NAP | $255,000,000 | Benchmark 2023-V9 | Midland | 3650 REIT |

| Baybrook Mall | $25,000,000 | 2.8% | 10 | $195,000,000 | NAP | $220,000,000 | (2) | Midland(2) | 3650 REIT(2) |

| Columbus Business Park | $23,200,000 | 2.6% | 2 | $38,800,000 | NAP | $62,000,000 | Benchmark 2023-V9 | Midland | 3650 REIT |

| 500 Delaware | $5,000,000 | 0.6% | 6 | $80,000,000 | NAP | $85,000,000 | 3650R 2022-PF2 | Midland | 3650 REIT |

| (1) | Each companion loan is pari passu in right of payment to its related mortgage loan. |

| (2) | In the case of the Baybrook Mall mortgage loan, until the securitization of the related controlling pari passu companion loan, the related mortgage loan (and therefore the related whole loan) will be serviced and administered pursuant to the pooling and servicing agreement for the Benchmark 2024-V9 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related mortgage loan (and therefore the related whole loan) will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

Mortgage Loans with Existing Mezzanine Debt

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | Mezzanine Debt Cut-off Date Balance | Total Debt Cut-off Date Balance(1) | Wtd. Avg. Cut-off Date Total Debt Interest Rate(1)(2) | Cut-off Date Mortgage Loan LTV Ratio(3) | Cut-off Date Total Debt LTV Ratio(1) | Cut-off Date Mortgage Loan UW NCF DSCR(3) | Cut-off Date Total Debt UW NCF DSCR(1) |

Liberties Walk | $33,000,000 | $9,200,000 | $42,200,000 | 6.65403% | 60.3% | 77.1% | 1.53x | 1.08x |

| (1) | Calculated including the mezzanine debt and any related pari passu companion loan (and any related subordinate companion loan). |

| (2) | The total debt interest rate for Liberties Walk to full precision is 6.65402843601896%. |

| (3) | Calculated including any related pari passu companion loan (but without regard to any subordinate companion loan or mezzanine debt). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 9 | |

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | City | State | Property Type | Cut-off Date Balance / Allocated Cut-off Date Balance | % of Initial Pool Balance | Previous Securitization |

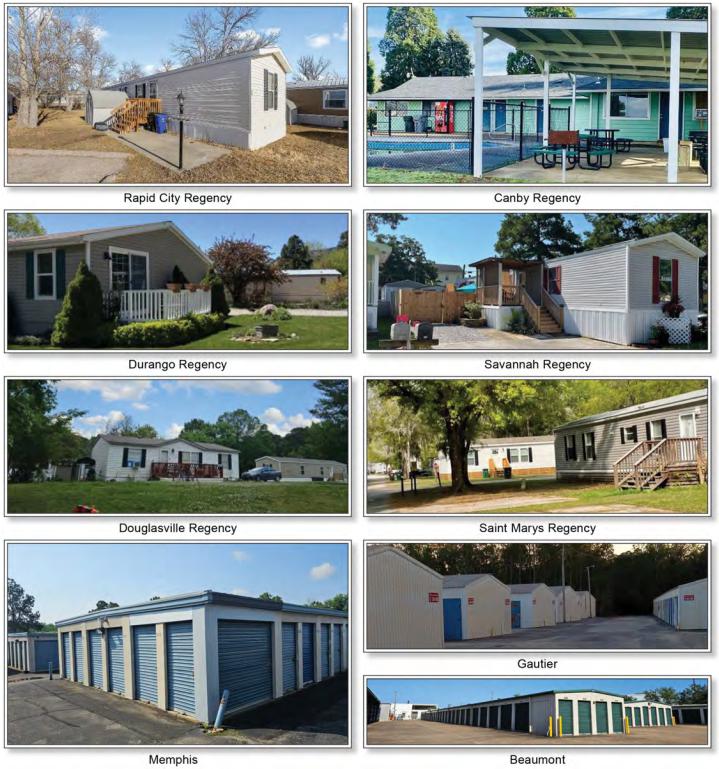

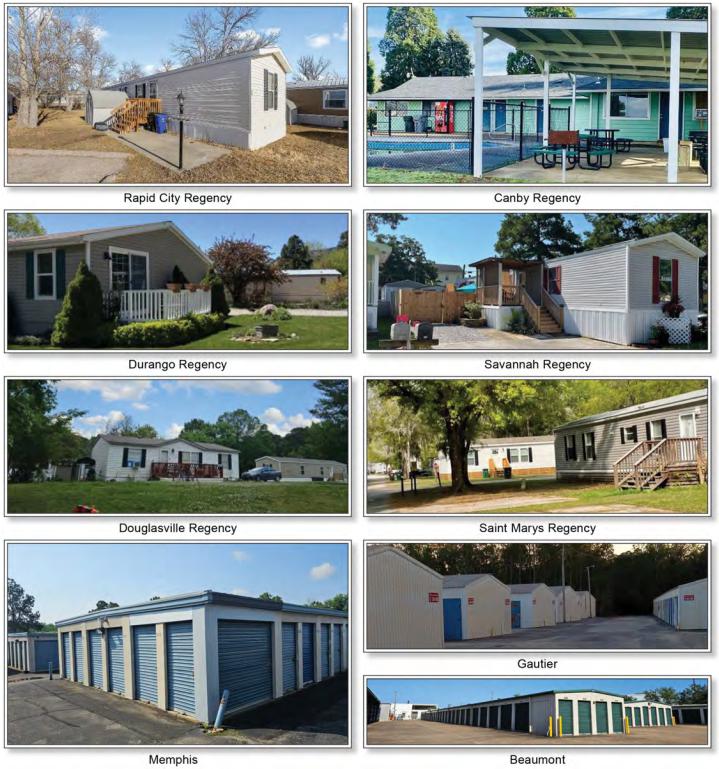

| Rapid City Regency | Rapid City | South Dakota | Manufactured Housing | $8,480,000 | 1.0% | COMM 2014-UBS6 |

| Durango Regency | Durango | Colorado | Manufactured Housing | $7,430,000 | 0.8% | COMM 2014-UBS6 |

| Canby Regency | Canby | Oregon | Manufactured Housing | $6,130,000 | 0.7% | COMM 2014-UBS6 |

| Savannah Regency | Savannah | Georgia | Manufactured Housing | $5,570,000 | 0.6% | COMM 2014-UBS6 |

| Douglasville Regency | Douglasville | Georgia | Manufactured Housing | $5,490,000 | 0.6% | COMM 2014-UBS6 |

| Saint Marys Regency | Saint Marys | Georgia | Manufactured Housing | $5,280,000 | 0.6% | COMM 2014-UBS6 |

| San Marcos Regency | San Marcos | Texas | Manufactured Housing | $4,840,000 | 0.5% | COMM 2014-UBS6 |

| Rock Springs Regency | Rock Springs | Wyoming | Manufactured Housing | $4,700,000 | 0.5% | COMM 2014-UBS6 |

| Oxford Regency | Oxford | Maine | Manufactured Housing | $3,970,000 | 0.4% | COMM 2014-UBS6 |

| Detroit | Detroit | Michigan | Self Storage | $3,430,000 | 0.4% | COMM 2014-UBS6 |

| Alpine Regency | Columbia | South Carolina | Manufactured Housing | $3,220,000 | 0.4% | COMM 2014-UBS6 |

| Dickson Regency | Dickson | Tennessee | Manufactured Housing | $2,970,000 | 0.3% | COMM 2014-UBS6 |

| Baytown | Baytown | Texas | Self Storage | $2,350,000 | 0.3% | COMM 2014-UBS6 |

| Mora Regency | Mora | Minnesota | Manufactured Housing | $2,030,000 | 0.2% | COMM 2014-UBS6 |

| Beaumont | Beaumont | Texas | Self Storage | $2,000,000 | 0.2% | COMM 2014-UBS6 |

| Waveland | Waveland | Mississippi | Self Storage | $1,800,000 | 0.2% | COMM 2014-UBS6 |

| Montgomery Regency | Montgomery | Alabama | Manufactured Housing | $1,790,000 | 0.2% | COMM 2014-UBS6 |

| Hwy 49 | Gulfport | Mississippi | Self Storage | $1,770,000 | 0.2% | COMM 2014-UBS6 |

| San Juan | San Juan | Texas | Self Storage | $1,500,000 | 0.2% | COMM 2014-UBS6 |

| Sioux City Regency | Sioux City | Iowa | Manufactured Housing | $1,430,000 | 0.2% | COMM 2014-UBS6 |

| Iowa City Regency | Iowa City | Iowa | Manufactured Housing | $1,370,000 | 0.2% | COMM 2014-UBS6 |

| Pass Rd. | Gulfport | Mississippi | Self Storage | $1,370,000 | 0.2% | COMM 2014-UBS6 |

| Willmar West Regency | Willmar | Minnesota | Manufactured Housing | $1,200,000 | 0.1% | COMM 2014-UBS6 |

| Semmes | Semmes, Wilmer | Alabama | Self Storage | $1,170,000 | 0.1% | COMM 2014-UBS6 |

| Eagle Lake Regency | Eagle Lake | Minnesota | Manufactured Housing | $1,120,000 | 0.1% | COMM 2014-UBS6 |

| Memphis | Memphis | Tennessee | Self Storage | $1,020,000 | 0.1% | COMM 2014-UBS6 |

| Evansville | Evansville | Indiana | Self Storage | $1,000,000 | 0.1% | COMM 2014-UBS6 |

| Old Town Regency | Old Town | Maine | Manufactured Housing | $470,000 | 0.1% | COMM 2014-UBS6 |

| Gautier | Gautier | Mississippi | Self Storage | $100,000 | 0.0% | COMM 2014-UBS6 |

| Keystone Office Park | Carmel | Indiana | Office | $4,000,000 | 0.4% | MSBAM 2014-C18 |

| 155 East 55th Street | New York | New York | Mixed Use | $32,200,000 | 3.6% | PFP 2021-8 |

| 210 East 58th Street | New York | New York | Mixed Use | $18,300,000 | 2.1% | PFP 2021-8 |

| Liberties Walk | Philadelphia | Pennsylvania | Multifamily | $33,000,000 | 3.7% | FSRIA 2022-FL4 |

| The Plaza at Milford | Milford | Delaware | Retail | $28,500,000 | 3.2% | UBSCM 2017-C1 |

| Union Point Apartments | Tulsa | Oklahoma | Multifamily | $25,000,000 | 2.8% | CSAIL 2015-C4 |

| Eastern Shore Centre | Spanish Fort | Alabama | Retail | $22,500,000 | 2.5% | WBCMT 2006-C26 |

| Centric on 34th | Gainesville | Florida | Multifamily | $17,900,000 | 2.0% | VMC 2019-FL3, RSO 2017-CRE5 |

| Telegraph Budget Storage | Brownstown Charter | Michigan | Self Storage | $3,700,000 | 0.4% | WFCM 2019-C49 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of each such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the related mortgage loan seller. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 10 | |

| COLLATERAL OVERVIEW (continued) |

Property Types

Property Type / Detail | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Wtd. Avg. Underwritten NCF DSCR(2) | Wtd. Avg. Cut-off Date LTV Ratio(2) | Wtd. Avg. Debt Yield on Underwritten NOI(2) |

| Retail | 7 | | $223,639,000 | 25.1 | % | 1.81 | x | 55.5 | % | 13.7 | % |

| Super Regional Mall | 2 | | 114,000,000 | 12.8 | | 2.17 | | 45.1 | | 16.1 | |

| Anchored | 3 | | 94,000,000 | 10.5 | | 1.45 | | 66.8 | | 11.4 | |

| Unanchored | 2 | | 15,639,000 | 1.8 | | 1.32 | | 62.1 | | 9.8 | |

| Multifamily | 12 | | $213,333,000 | 23.9 | % | 1.40 | x | 65.1 | % | 9.5 | % |

| Garden | 8 | | 164,250,000 | 18.4 | | 1.38 | | 67.4 | | 9.1 | |

| Student Housing | 1 | | 33,000,000 | 3.7 | | 1.49 | | 59.2 | | 11.3 | |

| Low Rise | 1 | | 9,500,000 | 1.1 | | 1.31 | | 49.5 | | 10.8 | |

| Mid Rise | 2 | | 6,583,000 | 0.7 | | 1.35 | | 61.2 | | 9.9 | |

| Mixed Use | 8 | | $112,678,000 | 12.6 | % | 1.36 | x | 61.7 | % | 9.3 | % |

| Industrial/Office/Retail/Self Storage | 1 | | 45,000,000 | 5.0 | | 1.36 | | 64.3 | | 9.8 | |

| Multifamily/Retail | 5 | | 32,917,000 | 3.7 | | 1.36 | | 60.3 | | 9.2 | |

| Multifamily/Office/Retail | 1 | | 32,200,000 | 3.6 | | 1.36 | | 59.6 | | 8.7 | |

| Retail/Office | 1 | | 2,561,000 | 0.3 | | 1.35 | | 61.2 | | 9.9 | |

| Industrial | 6 | | $106,200,000 | 11.9 | % | 1.63 | x | 53.0 | % | 11.9 | % |

| Warehouse/Distribution | 4 | | 76,200,000 | 8.5 | | 1.67 | | 51.7 | | 12.4 | |

| Warehouse | 2 | | 30,000,000 | 3.4 | | 1.53 | | 56.3 | | 10.8 | |

| Hospitality | 6 | | $77,566,230 | 8.7 | % | 2.00 | x | 59.0 | % | 16.3 | % |

| Limited Service | 6 | | 77,566,230 | 8.7 | | 2.00 | | 59.0 | | 16.3 | |

| Manufactured Housing | 18 | | $67,490,000 | 7.6 | % | 1.82 | x | 51.1 | % | 10.8 | % |

| Manufactured Housing | 18 | | 67,490,000 | 7.6 | | 1.82 | | 51.1 | | 10.8 | |

| Office | 3 | | $66,000,000 | 7.4 | % | 1.85 | x | 60.8 | % | 13.7 | % |

| Suburban | 2 | | 61,000,000 | 6.8 | | 1.84 | | 60.3 | | 14.0 | |

| CBD | 1 | | 5,000,000 | 0.6 | | 2.03 | | 67.6 | | 10.2 | |

| Self Storage | 14 | | $25,210,000 | 2.8 | % | 1.71 | x | 55.8 | % | 10.4 | % |

| Self Storage | 14 | | 25,210,000 | 2.8 | | 1.71 | | 55.8 | | 10.4 | |

| Total / Wtd. Avg. | 74 | | $892,116,230 | 100.0 | % | 1.65 | x | 58.6 | % | 11.8 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 11 | |

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Aggregate Appraised Value(2) | % of Total Appraised Value | Underwritten NOI(2) | % of Total Underwritten NOI |

| New York | 13 | $140,000,000 | | 15.7 | % | $226,350,000 | | 9.0 | % | $13,270,925 | | 7.6 | % |

| Texas | 7 | 138,690,000 | | 15.5 | | 1,034,404,260 | | 41.2 | | 75,781,495 | | 43.5 | |

| Pennsylvania | 3 | 77,500,000 | | 8.7 | | 118,300,000 | | 4.7 | | 6,861,756 | | 3.9 | |

| Virginia | 1 | 57,000,000 | | 6.4 | | 94,000,000 | | 3.7 | | 8,102,506 | | 4.6 | |

| South Carolina | 5 | 52,190,000 | | 5.9 | | 87,510,000 | | 3.5 | | 8,106,227 | | 4.7 | |

| Georgia | 5 | 50,086,230 | | 5.6 | | 83,500,000 | | 3.3 | | 5,316,127 | | 3.0 | |

| Nevada | 1 | 45,000,000 | | 5.0 | | 70,000,000 | | 2.8 | | 4,424,841 | | 2.5 | |

| Michigan | 5 | 44,130,000 | | 4.9 | | 73,380,000 | | 2.9 | | 4,772,427 | | 2.7 | |

| Tennessee | 4 | 35,490,000 | | 4.0 | | 68,170,000 | | 2.7 | | 3,847,905 | | 2.2 | |

| Delaware | 2 | 33,500,000 | | 3.8 | | 168,700,000 | | 6.7 | | 11,464,518 | | 6.6 | |

| Florida | 2 | 27,300,000 | | 3.1 | | 40,200,000 | | 1.6 | | 2,463,356 | | 1.4 | |

| Alabama | 3 | 25,460,000 | | 2.9 | | 38,640,000 | | 1.5 | | 3,879,720 | | 2.2 | |

| Oklahoma | 1 | 25,000,000 | | 2.8 | | 34,900,000 | | 1.4 | | 2,392,881 | | 1.4 | |

| Ohio | 1 | 23,200,000 | | 2.6 | | 147,000,000 | | 5.9 | | 9,300,303 | | 5.3 | |

| Illinois | 1 | 23,000,000 | | 2.6 | | 41,900,000 | | 1.7 | | 2,488,976 | | 1.4 | |

| Mississippi | 5 | 21,540,000 | | 2.4 | | 34,070,000 | | 1.4 | | 2,237,234 | | 1.3 | |

| North Carolina | 1 | 20,200,000 | | 2.3 | | 38,500,000 | | 1.5 | | 3,631,563 | | 2.1 | |

| Louisiana | 1 | 9,500,000 | | 1.1 | | 19,200,000 | | 0.8 | | 1,028,323 | | 0.6 | |

| South Dakota | 1 | 8,480,000 | | 1.0 | | 13,900,000 | | 0.6 | | 878,514 | | 0.5 | |

| Colorado | 1 | 7,430,000 | | 0.8 | | 14,700,000 | | 0.6 | | 755,520 | | 0.4 | |

| Oregon | 1 | 6,130,000 | | 0.7 | | 11,900,000 | | 0.5 | | 613,063 | | 0.4 | |

| Indiana | 2 | 5,000,000 | | 0.6 | | 8,180,000 | | 0.3 | | 800,865 | | 0.5 | |

| Wyoming | 1 | 4,700,000 | | 0.5 | | 9,400,000 | | 0.4 | | 492,314 | | 0.3 | |

| Maine | 2 | 4,440,000 | | 0.5 | | 10,530,000 | | 0.4 | | 504,048 | | 0.3 | |

| Minnesota | 3 | 4,350,000 | | 0.5 | | 10,200,000 | | 0.4 | | 556,277 | | 0.3 | |

| Iowa | 2 | 2,800,000 | | 0.3 | | 12,000,000 | | 0.5 | | 344,364 | | 0.2 | |

| Total | 74 | $892,116,230 | | 100.0 | % | $2,509,534,260 | | 100.0 | % | $174,316,046 | | 100.0 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for the pari passu companion loan(s). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 12 | |

| COLLATERAL OVERVIEW (continued) |

| Distribution of Cut-off Date Balances |

Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 3,700,000 - 19,999,999 | 14 | | $137,366,230 | | 15.4 | % |

| 20,000,000 - 29,999,999 | 7 | | 169,750,000 | | 19.0 | |

| 30,000,000 - 49,999,999 | 6 | | 228,500,000 | | 25.6 | |

| 50,000,000 - 79,999,999 | 3 | | 182,500,000 | | 20.5 | |

| 80,000,000 - 89,000,000 | 2 | | 174,000,000 | | 19.5 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| Distribution of Underwritten NCF DSCRs(1) |

Range of UW NCF DSCR (x) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 1.26 - 1.40 | 12 | | $311,850,000 | | 35.0 | % |

| 1.41 - 1.60 | 7 | | 200,396,230 | | 22.5 | |

| 1.61 – 2.00 | 9 | | 253,550,000 | | 28.4 | |

| 2.01 - 2.30 | 4 | | 126,320,000 | | 14.2 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | See footnote (1) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Amortization Types(1)(2) |

Amortization Type | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| Interest Only | 30 | | $858,720,000 | | 96.3 | % |

| Amortizing (30 Years) | 2 | | 33,396,230 | | 3.7 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | All of the mortgage loans will have balloon payments at maturity date. |

| | (2) | See footnote (1) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Lockboxes |

Lockbox Type | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| Hard | 11 | | $410,600,000 | | 46.0 | % |

| Springing | 18 | | 378,166,230 | | 42.4 | |

| Soft | 1 | | 45,000,000 | | 5.0 | |

Hard (Commercial); Soft (Residential) | 1 | | 33,000,000 | | 3.7 | |

| None | 1 | | 25,350,000 | | 2.8 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| Distribution of Cut-off Date LTV Ratios(1) |

Range of Cut-off Date LTV (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 42.1 - 50.0 | 3 | | $121,700,000 | | 13.6 | % |

| 50.1 - 60.0 | 10 | | 338,070,000 | | 37.9 | |

| 60.1 - 65.0 | 9 | | 219,550,000 | | 24.6 | |

| 65.1 - 70.0 | 7 | | 155,896,230 | | 17.5 | |

| 70.1 - 74.4 | 3 | | 56,900,000 | | 6.4 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | See footnotes (1) and (3) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Maturity Date LTV Ratios(1) |

Range of Maturity Date LTV (%) | Number of Mortgage Loans | | % of Initial Pool Balance |

| 42.1 - 50.0 | 3 | | $121,700,000 | | 13.6 | % |

| 50.1 - 60.0 | 10 | | 338,070,000 | | 37.9 | |

| 60.1 - 65.0 | 9 | | 219,550,000 | | 24.6 | |

| 65.1 - 70.0 | 7 | | 155,896,230 | | 17.5 | |

| 70.1 - 74.4 | 3 | | 56,900,000 | | 6.4 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | See footnotes (1) and (4) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Loan Purpose |

Loan Purpose | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| Refinance | 27 | | $828,170,000 | | 92.8 | % |

| Acquisition | 5 | | 63,946,230 | | 7.2 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| Distribution of Mortgage Interest Rates |

Range of Mortgage Interest Rates (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 4.840 - 6.000 | 3 | | $123,000,000 | | 13.8 | % |

| 6.001 - 6.500 | 6 | | 155,900,000 | | 17.5 | |

| 6.501 - 7.000 | 8 | | 279,550,000 | | 31.3 | |

| 7.001 - 7.500 | 13 | | 315,770,000 | | 35.4 | |

| 7.501 - 8.000 | 2 | | 17,896,230 | | 2.0 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 13 | |

| COLLATERAL OVERVIEW (continued) |

| Distribution of Debt Yield on Underwritten NOI(1) |

Range of

Debt Yields on Underwritten NOI (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 8.5 - 9.0 | 6 | | $146,450,000 | | 16.4 | % |

| 9.1 - 10.0 | 8 | | 227,900,000 | | 25.5 | |

| 10.1 - 12.0 | 7 | | 223,500,000 | | 25.1 | |

| 12.1 - 16.0 | 8 | | 172,946,230 | | 19.4 | |

| 16.1 - 18.0 | 3 | | 121,320,000 | | 13.6 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | See footnote (1) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Debt Yield on Underwritten NCF(1) |

Range of

Debt Yields on Underwritten NCF (%) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 8.3 - 9.0 | 6 | | $146,450,000 | | 16.4 | % |

| 9.1 - 10.0 | 10 | | 244,900,000 | | 27.5 | |

| 10.1 - 12.0 | 5 | | 206,500,000 | | 23.1 | |

| 12.1 - 15.0 | 9 | | 185,066,230 | | 20.7 | |

| 15.1 - 16.3 | 2 | | 109,200,000 | | 12.2 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | See footnote (1) to the table entitled “Mortgage Pool Characteristics” above. |

| Mortgage Loans with Original Partial Interest Only Periods |

Original Partial Interest Only Period (months) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| None | | | |

| | | | |

| |

| |

| Distribution of Original Terms to Maturity Date (1)(2) |

Original Term to Maturity Date (months) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 60 | 31 | | $887,116,230 | | 99.4 | % |

| 120 | 1 | | 5,000,000 | | 0.6 | |

| Total | 32 | | $892,116,230 | | 100.0 | % |

| | (1) | All of the mortgage loans will have balloon payments at maturity date. |