As filed with the Securities and Exchange Commission on August 2, 2024.

Registration No. 333-280945

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Danam Health, Inc.

(Exact name of registrant as specified in its charter.)

| Delaware | | 8090 | | 93-3264234 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial

Classification Number) | | (IRS Employer Identification No.) |

3000 Bayport Drive

Suite 950

Tampa, FL 33607

844-203-6092

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Timothy Canning

3000 Bayport Drive

Suite 950

Tampa, FL 33607

844-203-6092

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Kate L. Bechen

Louis D. Kern

Dykema Gossett PLLC

111 E. Kilbourn Ave., Suite 1050

Milwaukee, WI 53202

(414) 488-7300

Ross David Carmel, Esq.

Thiago Spercel, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

Tel: (212) 930-9700

Fax: (212) 930 9725

As soon as practicable after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The registrant named in this preliminary prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and the selling stockholder named in this preliminary prospectus are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY - SUBJECT TO COMPLETION, DATED AUGUST 2, 2024

PRELIMINARY PROSPECTUS Dated [●], 2024

Danam Health, Inc.

[●] Shares of Common Stock

This prospectus relates to the initial public offering (“Offering”) of common stock, par value $.001 per share (“Common Stock”) of Danam Health, Inc. We are offering [●] shares of Common Stock. Currently, no public market exists for our Common Stock. No established public trading market for our Common Stock currently exists. We have applied to list our Common Stock on the Nasdaq Capital Market LLC (“Nasdaq”) under the symbol “[●].” We expect our Common Stock to begin trading on or about [●], 2024. We will not proceed with the Offering if the Common Stock is not approved for listing on Nasdaq. We estimate that the initial public offering price of our Common Stock will be between $[●] per share and $[●] per share. We believe that upon completion of the Offering, we will meet the standards for listing on Nasdaq.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our Common Stock involves risks. Before buying any shares of Common Stock, you should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 of this prospectus and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We have retained EF Hutton, a division of Benchmark Investments, LLC to act as our underwriter (the “underwriter”) in connection with this Offering. See “Underwriting” in this prospectus for more information regarding the underwriting arrangements.

| | | Per Share | | | Total | |

| | | | | | | |

| Public offering price | | $ | | | | $ | | |

| | | | | | | | | |

| Underwriting discount (1) | | $ | | | | $ | | |

| | | | | | | | | |

| Proceeds, before expenses, to us (2) | | $ | | | | $ | | |

(1) We have agreed to pay the underwriter a discount equal to 7% of the gross proceeds of the Offering. For a description of the other compensation to be received by the underwriter, see “Underwriting” beginning on page 104.

(2) Excludes fees and expenses payable to the underwriter and other expenses of this Offering.

The underwriter is offering the units on a firm commitment basis and expects to deliver the Common Stock to purchasers on or about [●], 2024.

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus is [●], 2024

TABLE OF CONTENTS

DEALER PROSPECTIVE DELIVERY OBLIGATION

Until [●], all dealers that effect transactions in these securities, whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We and the underwriter have not authorized anyone to provide you with information or to make any representations other than contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the underwriter take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it.

You should assume that the information appearing in this prospectus, any post-effective amendment, and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not making an offer to sell our Common Stock in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information appearing in this prospectus any post-effective amendment, and any applicable prospectus supplement to this prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read carefully the entirety of this prospectus before making an investment decision.

The registration statement we filed with the Securities and Exchange Commission (“SEC”), of which this prospectus forms a part, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus, any post-effective amendment, and any applicable prospectus supplement and the related exhibits filed with the SEC before making your investment decision. The registration statement and the exhibits can be obtained from the SEC, as indicated under the section entitled “Where You Can Find More Information.”

In the registration statement of which this prospectus forms a part, “Danam,” the “Company,” “we,” “us,” “our” and similar terms refer to Danam Health, Inc., a Delaware corporation and its consolidated subsidiaries. References to our “Common Stock” refer to the common stock, par value $0.001 per share, of Danam Health, Inc.

Certain amounts, percentages and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them.

MARKET AND INDUSTRY DATA

We obtained the statistical data, market data and other industry data and forecasts described in this prospectus from market research, publicly available information and industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data. We have not sought the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

On May 11, 2023, Danam entered into separate definitive agreements with the owners of Wood Sage and Wellgistics whereby Danam would acquire all of the outstanding membership interests of Wood Sage and Wellgistics. In June 2024, Danam and Wood Sage entered into an amended and revised definitive agreement and closed on the Wood Sage Acquisition, thereby making Wood Sage a wholly owned subsidiary of Danam. In connection with the Wood Sage Acquisition, Danam acquired Wood Sage’s two operating subsidiaries, APS—a pharmaceutical technology hub—and CSP—a retail community specialty pharmacy. As such, Danam currently exists as a holding company with Wood Sage as a directly held intermediate holding company subsidiary and APS and CSP as indirect operating subsidiaries. For more information about the Wood Sage Acquisition, Wood Sage, APS, and CSP, see the sections entitled “Business” beginning on page 68 of this prospectus and “Wood Sage Management’s Discussion and Analysis of Financial Condition and Results of Operation” beginning on page 56 of this prospectus.

Danam expects to finalize the Wellgistics Acquisition during the third quarter of 2024. Closing of the Wellgistics Acquisition is subject to certain terms and conditions contained within a Membership Interest Purchase Agreement dated May 11, 2023, as amended, by and among Danam, Wellgistics, Strategix, Nomad, Jouska, and Brian Norton. Under this Agreement, Danam will acquire all of the issued outstanding membership interests of Wellgistics, an operating company focused on wholesale operations including distribution, and fulfillment to a network of independent pharmacies meant to improve market access to and patient outcomes regarding certain pharmaceutical medications. For more information about Wellgistics and the Wellgistics Acquisition, see the sections entitled “Business” beginning on page 68 of this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” beginning on page 61 of this prospectus.

Because Danam only recently closed the Wood Sage Acquisition during the second quarter of 2024 and second quarter financial information is not yet available, the financial conditions of Danam and Wood Sage are presented separately throughout this prospectus. This prospectus also presents the financial condition of Danam and Wellgistics separately because closing of the Wellgistics Acquisition has not yet occurred. Despite that Danam only recently closed the Wood Sage Acquisition and has not yet closed the Wellgistics Acquisition, the three companies have shared common office space, comarketed solutions to the marketplace, and leveraged financial and back-office support prior to June 2024.

FREQUENTLY USED TERMS

Unless otherwise stated or the context otherwise requires, in this proxy statement/prospectus:

“3PL” means third-party logistics.

“ACHC” means the Accreditation Commission for Health Care.

“ACOs” means Account Care Organizations.

“ADD” means Accredited Drug Distributor (formerly known as “Verified Accredited Wholesale Distributor”), which is an accreditation with the NABP.

“APD” means American Pharmaceutical Ingredients, LLC, a subsidiary of Wellgistics.

“API” means advanced programming interface.

“APS” means Alliance Pharma Solutions LLC d/b/a DelivMeds, a Florida limited liability company.

“ASC” means Accounting Standards Codification.

“AWS” means Amazon Web Services.

“CMS” means the Centers for Medicare & Medicaid Services.

“CRM” means customer relationship management.

“CSP” means Community Specialty Pharmacy, LLC, a Florida limited liability company.

“Danam” means Danam Health, Inc., a Delaware corporation.

“DEA” means the Drug Enforcement Agency.

“DGCL” means the Delaware General Corporation Law, as amended.

“DHS” means designated health services.

“Equity Securities” means, with respect to any Person, (a) any share of capital or capital stock, partnership, membership, joint venture or similar interest, or other voting securities of, or other ownership interest in, any such Person, (b) any securities of such Person convertible into or exchangeable for cash or shares of capital or capital stock or other voting securities of, or other ownership interests in, such Person, (c) any warrants, calls, options, contingent value rights or other rights to acquire from such Person, or other obligations of such Person to issue, any shares of capital or capital stock or other voting securities of, or other ownership interests in, or securities convertible into or exchangeable for shares of capital or capital stock or other voting securities of, or other ownership interests in, such Person, (d) any restricted shares, stock appreciation rights, restricted units, performance units, contingent value rights, “phantom” stock, equity or equity-based rights or similar securities or rights issued by or with the approval of such Person that are derivative of, or provide economic benefits based, directly or indirectly, on the value or price of, any shares of capital or capital stock or other voting securities of, other ownership interests in, or any business, products or assets of, such Person and (e) any securities issued or issuable with respect to the securities or interests referred to in clauses (a) through (d) above in connection with a combination of shares, recapitalization, merger, consolidation or other reorganization.

“ETASU” means Elements to Assure Safe Use.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FCA” means the False Claims Act, 31 U.S.C. §§ 3729–33.

“FDA” means the Food & Drug Administration.

“GDP” means Gross Domestic Product.

“GPOs” means group purchasing organizations.

“Health Reform Laws” means the Patient Protection and Affordable Care Act, as amended by the Healthcare and Education Reconciliation Act of 2010.

“HEDIS” means the Healthcare Effectiveness Data and Information Set.

“HHS” means the U.S. Department of Health and Human Services.

“HIPAA” means the Health Insurance Portability and Accountability Act of 1996.

“HMA” means Healthcare Merchant Accreditation (formerly known as “Safe Pharmacy”), which is an accreditation with the NABP.

“Integral” means Integral Health, Inc. a Delaware corporation.

“IRA” means the Inflation Reduction Act of 2022.

“IRS” means the Internal Revenue Service.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Jouska” means Jouska Holdings LLC, a Delaware limited liability company.

“LTV” means lifetime value.

“MSA” means that certain Management Services Agreement dated October 17, 2022, by and between Wood Sage and TRxADE.

“MTM” means medication therapy management.

“NABP” means the National Association of Boards of Pharmacy.

“NACDS” means the National Association of Chain Drug Stores.

“Nasdaq” means the Nasdaq Capital Market LLC.

“NCQA” means National Committee for Quality Assurance.

“NEO” means a named executive officer of Danam.

“Nomad” means Nomad Capital LLC, a Utah limited liability company.

“NPI” means National Provider Identifier.

“NPS” means net promoter score.

“OIG” means the Office of the Inspector General.

“PBM” means pharmacy benefit plan.

“PCAOB” means U.S. Public Company Accounting Oversight Board.

“Person” means an individual, partnership, corporation, limited liability company, joint stock company, unincorporated organization or association, trust, joint venture or other similar entity, whether or not a legal entity.

“PHI” means patient health information.

“PMS” means pharmacy management software.

“Privacy Rule” means the privacy regulations issued by the Office of Civil Rights of HHS pursuant to HIPAA.

“PSAO” means Pharmacy Services Administration Organization.

“RDS” means Amazon Relational Database Services.

“REMS” means Risk Evaluation and Mitigation Strategy.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Security Rules” means the security regulations issued by the Office of Civil Rights of HHS pursuant to HIPAA.

“Strategix” means Strategix Global LLC, a Utah limited liability company.

“TRxADE” means TRxADE HEALTH, Inc., a Delaware corporation and publicly traded company listed on Nasdaq under the ticker MEDS.

“TRxADE Nevada” means TRxADE Group, Inc., a Nevada corporation.

“URAC” means Utilization Review Accreditation Commission.

“Wellgistics” means Wellgistics, LLC, a Florida limited liability company.

“Wellgistics Acquisition” means the acquisition of Wellgistics by Danam pursuant to that certain Membership Interest Purchase Agreement dated [●], 2024, as amended, by and among Danam, Wellgistics, Strategix, Nomad, Jouska, and Brian Norton.

“Wood Sage” means Wood Sage LLC, a Florida limited liability company.

“Wood Sage Acquisition” means the acquisition of Wood Sage by Danam pursuant to that certain Amended and Restated Membership Interest Purchase Agreement dated June 16, 2024, by and between Danam and Wood Sage.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus or that is incorporated by reference herein. This summary does not contain all of the information you should consider before investing in our Common Stock. Before deciding to invest in our Common Stock, you should read this entire prospectus carefully, including the section of this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. As used in this prospectus, unless the context requires otherwise, the terms “Danam,” “we,” “our” and “us” refer to Danam Health, Inc. and its consolidated subsidiaries.

Overview

Founded in 2022, Danam Health, Inc. is a holding company for various existing and planned strategic businesses centered around pharmaceuticals and healthcare services. As a micro health ecosystem, our portfolio of companies consists of a pharmacy, wholesale operations, and a technology division with a novel platform for hub and clinical services. We are focused on improving the lives of patients while delivering unique solutions for pharmacies, providers, pharmaceutical manufacturers, and payors. For more information about us, see the sections entitled “Business” beginning on page 68 of this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operation of Danam” beginning on page 51 of this prospectus.

On May 11, 2023, Danam entered into separate definitive agreements with the owners of Wood Sage and Wellgistics whereby Danam would acquire all of the outstanding membership interests of Wood Sage and Wellgistics. In June 2024, Danam and Wood Sage entered into an amended and revised definitive agreement and closed on the Wood Sage Acquisition, thereby making Wood Sage a wholly owned subsidiary of Danam. In connection with the Wood Sage Acquisition, Danam acquired Wood Sage’s two operating subsidiaries, APS—a pharmaceutical technology hub—and CSP—a retail community specialty pharmacy. As such, Danam currently exists as a holding company with Wood Sage as a directly held intermediate holding company subsidiary and APS and CSP as indirect operating subsidiaries. For more information about the Wood Sage Acquisition, Wood Sage, APS, and CSP, see the sections entitled “Business” beginning on page 68 of this prospectus and “Wood Sage Management’s Discussion and Analysis of Financial Condition and Results of Operation” beginning on page 56 of this prospectus.

Danam expects to finalize the Wellgistics Acquisition during the third quarter of 2024. Closing of the Wellgistics Acquisition is subject to certain terms and conditions contained within a Membership Interest Purchase Agreement dated May 11, 2023, as amended, by and among Danam, Wellgistics, Strategix, Nomad, Jouska, and Brian Norton. Under this Agreement, Danam will acquire all of the issued outstanding membership interests of Wellgistics, an operating company focused on wholesale operations including distribution, and fulfillment to a network of independent pharmacies meant to improve market access to and patient outcomes regarding certain pharmaceutical medications. The purchase price that Danam will pay to the existing owners of Wellgistics according to the Membership Interest Purchase Agreement consists of a closing cash payment equal to $7 million, promissory notes in the amount of $10 million, Danam common shares equal to $3 million issued at a 20% discount, and possible contingent earn-out and bonus payments consisting of cash and Danam common stock based on certain financial metrics. The parties currently anticipate that the purchase payment will be amended prior to closing of the Wellgistics Acquisition. For more information about Wellgistics and the Wellgistics Acquisition, see the sections entitled “Business” beginning on page 68 of this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” beginning on page 61 of this prospectus.

Because Danam only recently closed the Wood Sage Acquisition during the second quarter of 2024 and second quarter financial information is not yet available, the financial conditions of Danam and Wood Sage are presented separately throughout this prospectus. This prospectus also presents the financial condition of Danam and Wellgistics separately because closing of the Wellgistics Acquisition has not yet occurred. Despite that Danam only recently closed the Wood Sage Acquisition and has not yet closed the Wellgistics Acquisition, the three companies have shared common office space, comarketed solutions to the marketplace, and leveraged financial and back-office support prior to June 2024. As such, Danam’s management believes that its close business relationships have and will continue to limit the need for post-closing integration.

Risk Factors

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Summary of Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include the following:

| ● | Our limited operating history as a combined company and our evolving business make it difficult to evaluate our current business and future prospects and increases the risk of your investment. |

|

| | ● | Danam may not be successful in completing the Wellgistics Acquisition, and, even if it is, Danam may experience difficulties in integrating the operations of Wellgistics and continuing to integrate the operations of Wood Sage thereby hindering Danam from realizing the expected benefits of these transactions. |

| | ● | Reductions in third-party reimbursement levels, from private or governmental agency plans, and potential changes in industry pricing benchmarks for prescription drugs could materially and adversely affect Danam’s results of operations. |

| | ● | A shift in pharmacy mix toward lower margin plans, margin compression on branded medications, increased offering of specialty products, direct and indirect remuneration, “DIR” fees, mail order pharmacy steering, and programs could adversely affect Danam’s results of operations. |

| | ● | Danam will derive a portion of its sales from prescription drug sales reimbursed by pharmacy benefit management companies and Danam’s participation in the pharmacy provider networks of these companies may be restricted or terminated. |

| | ● | Danam could be adversely affected by a decrease in the introduction of new brand name and generic prescription drugs as well as increases in the cost to procure prescription drugs. |

| | ● | Consolidation and strategic alliances in the healthcare industry could adversely affect Danam’s business operations, competitive positioning, financial condition and results of operations. |

| | ● | Changes in economic conditions could adversely affect consumer/client buying practices and market adoption of Danam’s DelivMeds mobile application and the accompanying revenues to premium access/services. |

| | ● | The industries in which Danam will operate are highly competitive and constantly evolving and changes in market dynamics could adversely impact us. |

| | ● | If Danam does not successfully create and implement relevant omni-channel experiences for Danam’s customers, Danam’s businesses and results of operations could be adversely impacted. |

| | ● | Danam may be unable to achieve Danam’s environmental, social and governance goals. |

| | ● | Danam’s business results will depend on Danam’s ability to successfully manage ongoing organizational change and business transformation and achieve cost savings and operating efficiency initiatives through Danam’s healthcare ecosystem. |

| | ● | Disruption in Danam’s global supply chain could negatively impact Danam’s businesses. |

| | ● | Danam’s business and operations will be subject to risks related to climate change. |

| | ● | Danam’s business is primarily focused on certain targeted geographic regions and therapeutic targets, making it vulnerable to risks associated with having geographically and therapeutic concentrated operations. |

| | ● | Failure to retain and recruit, or failure to manage succession of, key personnel could have an adverse impact on Danam’s future performance. |

| | ● | We are highly dependent on the continued service of our directors and officers, whose financial interests may conflict with the interests of investors. |

| | ● | Failure to renew facility leases in a timely manner could have an adverse impact on Danam’s business operations. |

| | ● | Danam may not be able to maintain business, scale for growth, renew pharmacy and wholesale state licenses, and retain commercial and federal contracts while preventing restrictions and termination. |

| | ● | Danam’s relationships with Danam’s primary wholesaler for pharmacy operations and Danam’s manufacturer relationships for Danam’s wholesale and hub technology platform entities will be critical to Danam’s success. |

| | ● | Danam will outsource certain business processes to third-party vendors that subject us to risks, including disruptions in business and increased costs. |

| | ● | Danam may not be successful in executing elements of Danam’s business strategy, which may have a material adverse impact on Danam’s business and financial results. |

| | ● | Danam’s growth strategy is partially dependent upon Danam’s ability to identify and successfully complete acquisitions, joint ventures and other strategic partnerships and alliances. |

| | ● | Businesses acquired by Danam could experience losses or liabilities that would result in a material adverse effect on Danam’s business operations, results of operation and financial condition. |

| | ● | Danam may make investments in companies over which Danam does not have sole control and some of these companies may operate in sectors that differ from Danam’s operations and have different risks. |

| | ● | The success of Danam’s hub technology platform and clinical services depends on the willingness of participants in the network of independent partner pharmacies to continue receiving prescriptions and enrolling in a-la-carte services for outsourced work. |

| | ● | A significant disruption in Danam’s information technology and computer systems or those of businesses Danam relies on could harm Danam. |

| | ● | Privacy and data protection laws will increase Danam’s compliance burden and any failure to comply could harm Danam. |

| | ● | Danam and businesses with which Danam will interact may experience cybersecurity incidents and might experience significant computer system compromises or data breaches. |

| | ● | Danam will be subject to electronic payment-related and other financial services risks that could increase Danam’s operating costs, expose Danam to fraud or theft, subject Danam to potential liability and potentially disrupt Danam’s business operations. |

| | ● | Danam and its subsidiaries have, and entities that Danam may acquire could have, significant outstanding debt. The debt and associated payment obligations of Danam and its current and future subsidiaries could significantly increase in the future if Danam and its current or future subsidiaries incur additional debt and do not retire existing debt. |

| | ● | Danam’s quarterly results may fluctuate significantly based on seasonality and other factors. |

| | ● | Danam has a substantial amount of goodwill and other intangible assets which could, in the future, become impaired and result in material non-cash charges to Danam’s results of operations. Danam may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations, and stock price. |

| | ● | Acquisitions Danam pursues in its industry and related industries could result in operating difficulties, dilution to Danam’s shareholders and other consequences harmful to Danam’s business. |

| | ● | Danam may incur non-cash impairment charges in the future associated with its portfolio of intangible assets, including goodwill. |

| | ● | Danam’s level of debt may negatively impact its liquidity, restrict its operations and ability to respond to business opportunities, and increase its vulnerability to adverse economic and industry conditions. |

| | ● | Danam’s existing credit agreement and any other credit or similar agreements into which Danam may enter in the future may restrict its operations, particularly Danam’s ability to respond to changes or to take certain actions regarding its business. |

| ● | Danam’s business is subject to substantial governmental regulation. |

| | ● | Changes in the healthcare industry and regulatory environments may adversely affect Danam’s businesses. |

| | ● | Danam will be exposed to risks related to litigation and other legal proceedings. |

| | ● | A significant change in, or noncompliance with, governmental regulations and other legal requirements could have a material adverse effect on Danam’s reputation and profitability. |

| | ● | Danam could be adversely affected by product liability, product recall, personal injury or other health and safety issues. |

| | ● | Danam could be subject to adverse changes in tax laws, regulations and interpretations or challenges to Danam’s tax positions. |

|

| | ● | Despite the actions Danam will take to defend and protect its intellectual property, Danam may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its solutions. Danam’s efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly. |

| | ● | Third-party claims that Danam is infringing intellectual property, whether successful or not, could subject it to costly and time-consuming litigation or expensive licenses, and its business could be adversely affected. |

| | ● | Danam’s intellectual property applications for registration may not issue or be registered, which may have a material adverse effect on Danam’s ability to prevent others from commercially exploiting products similar to Danam’s. |

| | ● | In addition to patented technology, Danam will rely on its unpatented proprietary technology, trade secrets, designs, experiences, work flows, data, processes, software and know-how. |

| | ● | Danam may be subject to damages resulting from claims that it or its current or former employees have wrongfully used or disclosed alleged trade secrets of its employees’ former employers. Danam may be subject to damages if its current or former employees wrongfully use or disclose Danam’s trade secrets. |

| | ● | Danam will incur increased costs as a result of operating as a public company, and its management will devote substantial time to compliance with its public company responsibilities and corporate governance practices. |

| | ● | Danam’s management team has limited experience managing a public company. |

| | ● | Danam’s ability to be successful will depend upon the efforts of Danam’s board of directors and key personnel and the loss of such persons could negatively impact the operations and profitability of Danam’s business. |

| | ● | Delaware State Law includes anti-takeover provisions. |

| | ● | Claims for indemnification by Danam’s directors and officers may reduce Danam’s available funds to satisfy successful third-party claims against Danam and may reduce the amount of money available to Danam. |

| | ● | If securities or industry analysts do not publish or cease publishing research or reports about Danam, its business, or its market, or if they change their recommendations regarding Danam’s securities adversely, the price and trading volume of Danam’s securities could decline. |

| | ● | There can be no assurance that Danam Common Stock will be approved for listing on Nasdaq or, if approved, will continue to be so listed, or that Danam will be able to comply with the continued listing standards of Nasdaq. |

| | ● | If and when our Common Stock is publicly traded, it may be subject to the penny stock rules which may make it more difficult to sell our Common Stock. |

| | ● | An active market for Danam’s securities may not develop, which would adversely affect the liquidity and price of Danam’s securities. |

| | ● | The market price of Danam Common Stock may decline as a result of sales, or perceived sales, by Danam in the public market or otherwise. |

| | ● | Future sales, or the perception of future sales, by Danam or its shareholders in the public market could cause the market price for Danam Common Stock to decline. |

| | ● | Danam will qualify as an “emerging growth company” and a “smaller reporting company” within the meaning of the Securities Act. If Danam takes advantage of certain exemptions from disclosure requirements available to emerging growth companies or smaller reporting companies, Danam’s securities may be less attractive to investors and, therefore, may make it more difficult to compare Danam’s performance with other public companies. |

| | ● | Our management team will have immediate and broad discretion over the use of the net proceeds from this Offering and we may use the net proceeds in ways with which you disagree. |

| | ● | The unaudited pro forma financial information included herein may not be indicative of what Danam’s actual financial position or results of operations would have been. |

| ● | Certain existing stockholders acquired our securities at a price below the current trading price of such securities and may experience a positive rate of return based on the current trading price. |

| ● | Investors in this Offering will experience immediate and substantial dilution in net tangible book value. |

Corporate Information

The mailing address of our principal executive office is 3000 Bayport Drive, Suite 950 Tampa, FL 33607, and the office’s telephone number is (844) 203-6092. Our website is located at www.danamhealth.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus supplement, and you should not consider it part of the prospectus or part of any prospectus supplement.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. Accordingly, we may provide less public disclosure than larger public companies, including the inclusion of only two years of audited consolidated financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure and the inclusion of reduced disclosure about our executive compensation arrangements. As a smaller reporting company, we are also exempt from compliance with the auditor attestation requirements pursuant to the Sarbanes-Oxley Act. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our Common Stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float or a public float (based on our Common Stock) that is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our Common Stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our Common Stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include: (i) being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; (ii) not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; (iii) not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; (iv) reduced disclosure obligations regarding executive compensation; and (v) not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

THE OFFERING

| Issuer | Danam Health, Inc. |

| | |

| Securities Offered | [●] shares of Common Stock, at a public offering price of $[●] per share. |

| | |

| Common Stock issued and outstanding prior to the Offering | [●] shares of Common Stock (as of [●], 2024). |

| | |

| Common stock issued and outstanding after the Offering | [●] shares of Common Stock. |

| | |

| Use of proceeds | We estimate that the net proceeds to us from the Offering will be approximately $[●] million assuming an offering price of $[●] per share, after deducting underwriting discounts and commissions and estimated Offering expenses payable by us. We intend to use the net proceeds of the Offering primarily for [●] and general corporate purposes. |

| | |

| Proposed Nasdaq Capital Market Trading Symbol and Listing | We have applied to list our Common Stock on the Nasdaq Capital Market under the symbol “[●].” We believe that upon completion of the Offering, we will meet the standards for listing on Nasdaq. The closing of this Offering is contingent upon the successful listing of our Common Stock on the Nasdaq Capital Market. |

| | |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock. |

| | |

| Transfer Agent | [●] |

| | |

| Lock-up Agreements | We and our directors, officers and certain shareholders have agreed with the underwriter not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 90 days after the closing of this Offering as described in further detail in this prospectus. See “Underwriting—Lock-Up Agreements.” |

| | |

| Dividend Policy | We do not intend to pay any dividends on our Common Stock for the foreseeable future. Instead, we anticipate that all of our earnings, if any, will be used for the operation and growth of our business. See “Dividend Policy” for more information. |

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. In addition to the information, documents or reports included or incorporated by reference in this prospectus and, if applicable, any prospectus supplement or other offering materials, you should carefully consider the risks described below in addition to the other information contained in this prospectus, before making an investment decision. Our business, financial condition or results of operations could be harmed by any of these risks. As a result, you could lose some or all of your investment in our Common Stock. The risks and uncertainties described below are not the only ones we face. Additional risks not currently known to us or other factors not perceived by us to present significant risks to our business at this time also may impair our business operations. For purposes of this “Risk Factors” section, references to Danam include both Danam’s current operations and Danam’s operations as they may exist after closing of the Wellgistics Acquisition.

Risks Related to Danam’s Business

Our limited operating history as a combined company and our evolving business make it difficult to evaluate our current business and future prospects and increase the risk of your investment.

We were incorporated in 2022 for the purpose of acquiring and integrating various companies in the health care industry. Our limited operating history and rapidly evolving business make it difficult to evaluate our current business, future prospects and plan for growth. We will continue to encounter significant risks and uncertainties frequently experienced by growing companies in rapidly changing and heavily regulated industries, such as attracting new customers to our products and services; retaining customers and encouraging them to utilize new products and services that we make available; competition from other companies; hiring, integrating, training and retaining skilled personnel; developing new solutions; determining prices for our solutions; unforeseen expenses; challenges in forecasting accuracy; and new or adverse regulatory developments affecting aspects of the aerospace and defense industry. Further, because we depend, in part, on market acceptance of our newer and future products and services, it is difficult to evaluate trends that may affect our business and whether our expansion will be profitable. If we have difficulty launching new products or services, then our reputation may be harmed and our business, financial condition and results of operations may be adversely affected. If our assumptions regarding these and other similar risks and uncertainties that relate to our business, which we use to plan our business, are incorrect or change as we gain more experience operating as a combined company, or if we do not address these challenges successfully, our operating and financial results could differ materially from our expectations and our business could suffer.

Danam may not be successful in completing the Wellgistics Acquisition, and, even if it is, Danam may experience difficulties in integrating the operations of Wellgistics and continuing to integrate the operations of Wood Sage thereby allowing Danam to realize the expected benefits of these transactions.

Danam’s success depends on Danam’s ability to successfully complete the Wellgistics Acquisition and to realize the anticipated benefits of combining the operations of the Wellgistics and Wood Sage with Danam in an efficient and effective manner. The integration process could take longer than anticipated and could result in the loss of key employees from either of Wood Sage or Wellgistics, the disruption of each company’s ongoing businesses, tax costs or inefficiencies, or inconsistencies in standards, controls, information technology systems, procedures and policies, any of which could adversely affect Danam’s ability to continue relationships with the Wood Sage’s or Wellgistics’ customers, employees or other third parties, or Danam’s ability to achieve the anticipated benefits of the Wood Sage Acquisition and Wellgistics Acquisition and could harm Danam’s financial performance. If Danam is unable to successfully or timely integrate the operations of the Wood Sage or Wellgistics with its business, Danam may incur unanticipated liabilities and be unable to realize the revenue growth, operating efficiencies, synergies and other anticipated benefits resulting from such transactions and Danam’s business, results of operations, and financial condition could be materially and adversely affected.

Reductions in third-party reimbursement levels, from private or governmental agency plans, and potential changes in industry pricing benchmarks for prescription drugs could materially and adversely affect Danam’s results of operations.

The substantial majority of the prescriptions Danam will fill at Danam’s CSP division will be reimbursed by third-party payers, including private and governmental agency payers. The continued efforts of health maintenance organizations, managed care organizations, PBM companies, governmental agencies, and other third-party payers to reduce prescription drug costs and pharmacy reimbursement rates, as well as litigation and other legal proceedings relating to how drugs are priced, may adversely impact Danam’s results of operations. In the U.S., plan changes with rate adjustments often occur in January and July and Danam’s reimbursement arrangements may provide for rate adjustments at prescribed intervals during their term. In addition, the timing and amount of periodic contractual reconciliations payments can vary significantly and may not follow a predictable path. Further, in an environment where some PBM clients utilize narrow or restricted pharmacy provider networks, some of these entities may offer pricing terms that Danam may not be willing to accept or otherwise restrict Danam’s participation in their networks of pharmacy providers. This may also impact the ability for Danam’s pharmacy network partners to adjudicate certain prescription claims received via transfer from the DelivMeds hub platform technology which may impact several revenue generating channels in the form of technology-related fees. Further, Danam’s wholesale operations may be impacted as pharmacy coverage/ margin is diminished on certain products effecting the ability to carry and move this inventory thereby affecting buying patterns.

In addition, many payers in the U.S. are increasingly considering new metrics as the basis for reimbursement rates. It is possible that the pharmaceutical industry or regulators may evaluate and/or develop an alternative pricing reference to replace wholesale acquisition price (WAC) and average wholesale price (AWP), which will be the pricing reference used for Danam’s pharmacy and network partner pharmacies contracts. This will also have a direct impact on Danam’s secondary wholesalers sourcing and procurement strategies. Future changes to the pricing benchmarks used to establish pharmaceutical pricing, including changes in the basis for calculating reimbursement by third-party payers, could adversely affect Danam.

A shift in pharmacy mix toward lower margin plans, margin compression on branded medications, increased offering of specialty products, DIR fees, mail order pharmacy steering, and programs could adversely affect Danam’s results of operations.

Danam’s CSP division and network of independent partner pharmacies will seek to grow prescription volume while operating in a marketplace with continuous reimbursement pressure. A shift in the mix of pharmacy prescription volume towards programs offering lower reimbursement rates could adversely affect Danam’s results of operations both from an in-house prescription fulfillment perspective and also technology and transactional fees from Danam’s network of independent partner pharmacies. General trends Danam may observe impacting independent pharmacies include but are not limited to: a shift in pharmacy mix towards 90-day fills which are often reimbursed at lower amounts compared to 30-day fills, DIR fees from PBMs on Medicare Part D prescriptions often leading to negative reimbursements, lower plan paid amounts for branded and specialty medications while simultaneously observing an increase in the number of patients requiring a “specialty-lite” or full specialty medication, narrow networks with unfavorable contract pricing, delivery and shipping-related restrictions impacting the pharmacies ability to gain additional market share, enhanced PBM tactics to steer patients to mail order pharmacies thereby reducing market opportunities, and little to no remuneration for in-demand consumer-driven concierge services from pharmacists. Danam’s pharmacy division retains access to all major plans with as expected market competitive reimbursement rates for an independent pharmacy. In-network coverage for PBMs and payors at the independent network partner pharmacy level will vary from store-to-store and Danam continue to add more network participants to provide robust coverage.

If Danam is not able to generate prescription volume and other business from patients participating in these programs that is sufficient to offset the impact of lower reimbursement, or if the degree or terms of Danam’s participation in such preferred networks declines in future years, Danam’s results of operations could be materially and adversely affected. Furthermore, changes in political, economic, and regulatory influences, as well as industry-wide changes in business practices, including with respect to the imposition of DIR fees by PBMs, may significantly affect Danam’s business. Danam’s failure to successfully anticipate and respond to, or appropriately adapt to, evolving industry conditions or any of these changes or trends, none of which are within Danam’s control, in a timely and effective manner could have a significant negative impact on Danam’s competitive position and materially adversely affect Danam’s business, financial condition and results of operations.

Danam will derive a portion of its sales from prescription drug sales reimbursed by PBM companies and Danam’s participation in the pharmacy provider networks of these companies may be restricted or terminated.

Danam will derive a portion of Danam’s sales from prescription drug sales reimbursed through prescription drug plans administered by PBM companies. PBM companies typically administer multiple prescription drug plans that expire at various times and provide for varying reimbursement rates, and often limit coverage to specific drug products on an approved list, known as a formulary, which might not include all of the approved drugs for a particular indication. Changes in pricing and other terms of Danam’s contracts with PBM companies can significantly impact Danam’s results of operations. There can be no assurance that Danam will participate in any particular PBM company’s pharmacy provider network in any particular future time period or on terms reasonably acceptable to Danam. If Danam’s participation in the pharmacy provider network for a prescription drug plan administered by one or more of the large PBM companies is restricted or terminated, Danam expects that Danam’s sales would be adversely affected, at least in the short-term. If Danam is unable to replace any such lost sales, either through an increase in other sales or through a resumption of participation in those plans, Danam’s operating results could be materially and adversely affected. If Danam exits a pharmacy provider network and later resumes participation, there can be no assurance that Danam will achieve any particular level of business on any particular pace, or that all clients of the PBM company will choose to include us again in the pharmacy network for their plans, initially or at all. In addition, in such circumstances Danam may incur increased marketing and other costs in connection with initiatives to regain former patients and attract new patients covered by such plans.

Danam could be adversely affected by a decrease in the introduction of new brand name and generic prescription drugs as well as increases in the cost to procure prescription drugs.

The profitability of Danam’s healthcare ecosystem business model depends upon the utilization of prescription drugs. Utilization trends are affected by, among other factors, the introduction of new and successful prescription drugs, coverage on payor/PBM formularies, as well as lower-priced generic alternatives to existing brand name drugs. Inflation in the price of drugs also can adversely affect utilization, particularly given the increased prevalence of high-deductible health insurance plans and related plan design changes. New brand name drugs with coverage on formularies can result in increased drug utilization and associated sales, while the introduction of lower priced generic alternatives typically results in relatively lower sales, but relatively higher gross profit margins.

In addition, if Danam experiences an increase in the amounts it pays to procure pharmaceutical drugs, including generic drugs, Danam’s gross profit margins would be adversely affected to the extent Danam is not able to offset such cost increases. Any failure to fully offset any such increased prices and costs or to modify Danam’s activities to mitigate the impact could have a material adverse effect on Danam’s results of operations. Also, any future changes in drug prices could be significantly different than Danam’s expectations.

A 2019 study performed by NACDS entitled “Cost of Dispensing Study” found that the overall cost of dispensing for all drugs was $12.40 per fill. After factoring inflation, that same cost is estimated to be $14.68 per fill. The latter does not account for other costs associated with medication dispensing noted in this “Risk Factors” section which clearly demonstrates further strain to gross profit margin on prescription-related fills.

Accordingly, a decrease in the number or magnitude of significant new brand name drugs or generics successfully introduced, delays in their introduction, a decrease in the utilization of previously introduced prescription drugs, and or rising costs associated with medication dispensing could materially and adversely affect Danam’s business, financial condition and results of operations.

Consolidation and strategic alliances in the healthcare industry could adversely affect Danam’s business operations, competitive positioning, financial condition and results of operations.

Many organizations in the healthcare industry, including PBM companies, have consolidated in recent years to create larger healthcare enterprises with greater bargaining power, which has resulted in greater pricing pressures. If this consolidation trend continues, it could give the resulting enterprises even greater bargaining power, which may lead to further pressure on the prices for Danam’s products and services. If these pressures result in reductions in Danam’s prices, Danam’s businesses would become less profitable unless Danam are able to achieve corresponding reductions in costs or develop profitable new revenue streams.

Changes in economic conditions could adversely affect consumer/client buying practices and market adoption of Danam’s DelivMeds mobile application and the accompanying revenues to premium access/services.

Danam’s performance may be adversely impacted by changes in global, national, regional or local economic conditions and consumer confidence. These conditions can also adversely affect Danam’s key vendors and customers. External factors that affect consumer confidence and over which Danam exercises no influence include unemployment rates, inflation, levels of personal disposable income, levels of taxes and interest and global, national, regional or local economic conditions, health epidemics or pandemics (such as COVID-19), as well as looting, vandalism, acts of war or terrorism. Changes in economic conditions and consumer confidence could adversely affect consumer preferences, purchasing power and spending patterns, which could lead to a decrease in overall consumer spending as well as in prescription drug, services, and digital health services utilization and which could be exacerbated by the increasing prevalence of high-deductible health insurance plans and related plan design changes. From a client perspective, increasing pressures from margin compression, inflation, prescription pricing negotiations, and other known stressors as outlined in this “Risk Factors” section may negatively impact a manufacturer’s willingness to adopt and utilize various a-la-carte services Danam will provide through Danam’s hub platform and clinical services.

In addition to general levels of inflation, Danam will also be subject to risk of specific inflationary pressures on product prices due to, for example, the continuing impacts of COVID-19, related global supply chain disruptions, and the uncertain economic and geopolitical environment. If inflation continues to increase, Danam may not be able to adjust prices sufficiently to offset the effect without negatively impacting consumer demand or Danam’s gross margin. Furthermore, reduced or flat consumer spending may affect Danam’s ability to convert users of Danam’s DelivMeds mobile technology from free to various subscription model offerings which will impact financial condition. Further threats from market competitors to offer additional products at promotional pricing could lead to lower pricing floors as well. All of these factors could materially and adversely impact Danam’s business operations, financial condition and results of operations.

The industries in which Danam will operate are highly competitive and constantly evolving and changes in market dynamics could adversely impact us.

The level of competition in the pharmacy (i.e., retail, independent, specialty, and digital), healthcare and clinical concierge like services, and pharmaceutical wholesale industries is high. Changes in market dynamics or actions of competitors or manufacturers, including industry consolidation and the emergence of new competitors and strategic alliances, could materially and adversely impact us. Disruptive innovation, or the perception of potentially disruptive innovation, by existing or new competitors could alter the competitive landscape in the future and require us to accurately identify and assess such changes and if required make timely and effective changes to Danam’s strategies and business model to compete effectively.

All of Danam’s businesses will face intense competition from multiple existing and new businesses, some of which are aggressively expanding in markets Danam will serve. Danam will develop Danam’s offerings to respond to market dynamics; however, if Danam’s customers are not receptive to these changes, if Danam is unable to expand successful programs in a timely manner, or Danam otherwise does not effectively respond to changes in market dynamics, Danam’s businesses and financial performance could be materially and adversely affected.

There are a significant number of competitors that provide one or more comprehensive services, including distribution, with respect to specialty pharmacy drugs, hub and clinical services to perform patient financial assistance; prior authorization coordination; copay tiered reductions; tele-pharmacy; and access to digital health resources, some of whom have greater resources than Danam does, including: PBMs; retail pharmacy chains and independent retail pharmacies; digital pharmacies; national, regional and niche specialty pharmacies; home and specialty infusion therapy companies; provider practices and systems; and GPOs.

The four leading specialty pharmacies, Express Scripts (Cigna); CVS Caremark (Aetna); Walgreens (Prime Therapeutics); and OptumRx (United Healthcare), all of whom have a great degree of vertical integration, have significantly greater market share, resources and purchasing power than Danam does and, in the aggregate, these competitors generally have access to substantially the same limited distribution drugs that will be in Danam’s portfolio. These companies also benefit from their acquisition activity with healthcare organizations, as Danam has seen recent acquisitions in the home healthcare and primary care services arena (i.e., One Medical, Signify Health, Village MD, Summit Health, CareCentrix, among others).

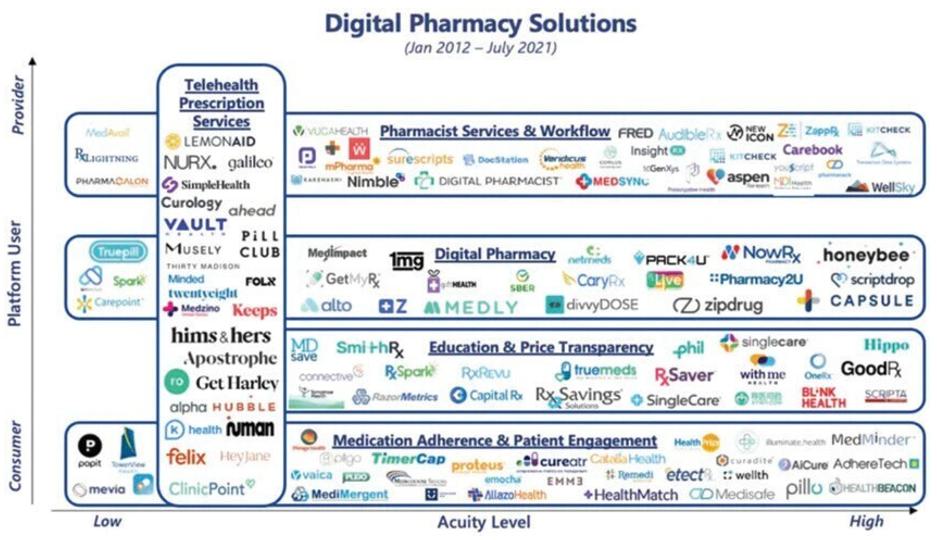

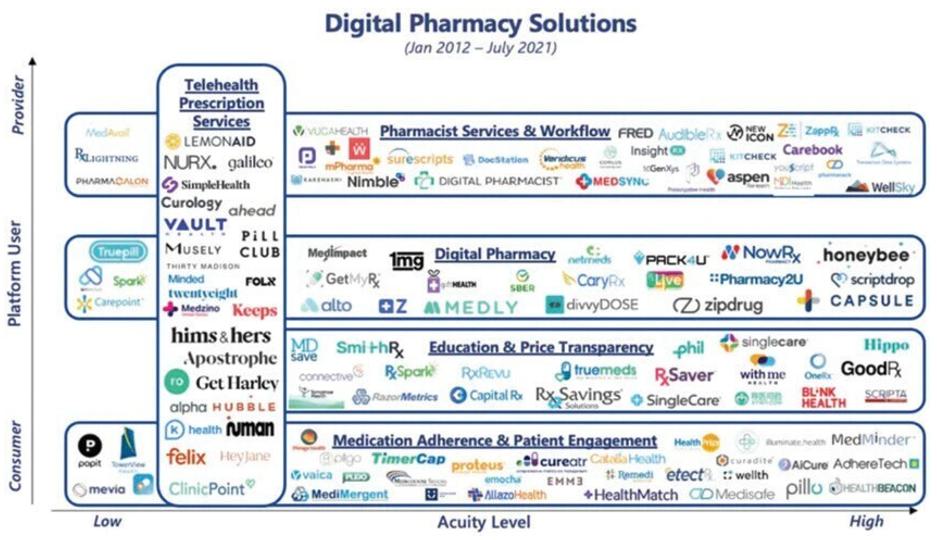

Digital pharmacies both national and regional have been increasingly entering the market over the course of the last decade with well-known players such as Roman, Lemonaid Health, ForHims, TruePill, and Amazon’s acquisition of PillPack. At the regional level, Danam has seen the emergence of companies like Capsule, Alto, and many others outlined below looking to penetrate markets and gain access to lives by looking for additional points of differentiation. The competitive healthcare landscape along with macroeconomic pressures has also seen increased chapter 11 filings for bankruptcy and or other means of dissolution including Medley, NowRx, AmazonCare, Haven (i.e., joint venture of Amazon, Berkshire Hathaway, and JPMorgan Chase) over recent years. Many of these companies leverage access to telehealth services and backend partnerships with mail order pharmacies to provide consumers with cash-paying models for access to niche services. The evolution of centralized digital patient support networks with network pharmacies has also recently been gaining steam.

As Danam will increase in scale and market share, or provide additional healthcare services, Danam expects more direct competition for certain drugs, payer and patient access, and services from this myriad of companies. These factors together with the impact of the competitive marketplace or other significant differentiating factors between us and Danam’s competitors may make it difficult to gain market access and penetration all of which could materially and adversely impact Danam’s business operations, financial condition and results of operations.

Below is a 2021 Snapshot of Digital Pharmacy Solutions amongst key healthcare stakeholders/entities:

If Danam does not successfully create and implement relevant omni-channel experiences for Danam’s customers, Danam’s businesses and results of operations could be adversely impacted.

The portion of total consumer expenditures from various business sectors completing online shopping has drastically changed over the last two decades. Danam is seeing a complete paradigm shift, as consumer sentiment and behavior has moved towards mobile application use. The COVID-19 pandemic was the accelerant, and Danam expects this pace of increase exponentially. Consumers are now able to have more have more and more services delivered to their homes or work and more recently Danam is seeing this same push with healthcare services. Moreover, prescription related deliveries have become the new normal versus waiting for pharmacy pick-up which is often not as efficient or convenient for this everchanging mindset and expectation of the consumer.

In order to be successful with executing on this service delivery, Danam’s strategy must offer enhanced value services while also being convenient to the consumer. To accomplish this, an omni-channel approach, intelligent user experience, and home health differentiated model is a necessity to keep up with the rapidly evolving pace of changing customer expectations and new developments by Danam’s competitors. Danam must compete by offering a consistent and convenient shopping experience for Danam’s customers regardless of the ultimate sales channel and by investing in, providing and maintaining digital tools for Danam’s customers. If Danam is unable to make, improve, or develop relevant customer-facing technology in a timely manner that keeps pace with technological developments and dynamic customer expectations, Danam’s ability to compete and Danam’s results of operations could be materially and adversely affected. In addition, if Danam’s online activities or Danam’s other customer-facing technology systems do not function as designed, Danam may experience a loss of customer confidence, data security breaches, lost sales, or be exposed to fraudulent purchases, any of which could materially and adversely affect Danam’s business operations, reputation and results of operations.

Danam may be unable to achieve Danam’s environmental, social and governance goals.

Danam recognizes the rising importance of environmental, social, and governance matters among Danam’s team members, customers, and certain shareholders and will be committed to upholding a culture dedicated to corporate responsibility. Danam will establish certain goals that allow us to better communicate and align to Danam’s environmental, social, and governance strategy. However, these goals are subject to risks and uncertainties, which are outside of Danam’s control and might prohibit us from meeting the goals.

Further, there is a risk that team members, customers, or certain shareholders might not be satisfied with Danam’s goals or strategy and efforts to meet the goals. Some of the risks that Danam will be subject to include, but are not limited to: Danam’s ability to execute Danam’s operational strategy within the timeframe or costs projected; the availability or cost of renewable energy, materials, goods, and/or services required, and evolving regulations or requirements that change or limit Danam’s ability to set standards or gather information from Danam’s supplier partners or third party contractors. Failure to meet Danam’s goals could negatively impact public perception of Danam’s company with interested stakeholders.

Environmental, social, and governance matters are also increasingly important to current and potential employees. In order to retain and attract talent Danam knows that it is critical that Danam clearly communicate Danam’s environmental, social, and governance strategy, and a delay or inability to meet Danam’s goals on time could impact Danam’s reputation as a desirable place to work. With increased interest from certain shareholders, an inability to meet Danam’s goals could also have a negative impact on New Danam’s stock price. These impacts could make it more difficult for us to operate efficiently and effectively and could have a negative effect on Danam’s business, operating results and financial conditions.

Danam’s business results will depend on Danam’s ability to successfully manage ongoing organizational change and business transformation and achieve cost savings and operating efficiency initiatives through Danam’s healthcare ecosystem.

The key to Danam’s success will be executing on Danam’s win-win strategy for all stakeholders in the healthcare delivery model. Through leveraging Danam’s portfolio of subsidiaries, Danam’s leadership will need to deliver on a value proposition to patients, pharmacies, providers, payors/ PBMs, and pharmaceutical manufacturers. This is obtained by making healthcare services affordable and convenient in a centralized model. Danam’s success will hinge on the Danam’s leadership team to improve operational efficiency, decreasing costs, market access and insights, data transparency, value-based outcomes, and innovative technology via automation.

There can be no assurance that Danam will realize, in full or in part, the anticipated benefits of leveraging these subsidiaries and what that market adoption will be like. Danam’s financial goals assume a level of productivity improvement and other business optimization initiatives. If Danam is unable to implement the programs or deliver these expected productivity improvements, while continuing to invest in business growth, or if the volume and nature of change overwhelms available resources, Danam’s business operations, financial condition and results of operations could be materially and adversely impacted.

Risks Relating to Danam’s Operations

Disruption in Danam’s global supply chain could negatively impact Danam’s businesses.

The pharmaceutical products for Danam’s wholesale division upon closing of the Wellgistics Acquisition will be sourced from pharmaceutical manufacturers with a wide variety of domestic and international vendors, and any future disruption in Danam’s supply chain or inability to find qualified vendors and access products that meet requisite quality and safety standards in a timely and efficient manner could adversely impact Danam’s businesses. The loss or disruption of such supply arrangements for any reason, including for issues such as COVID-19 or other health epidemics or pandemics, labor disputes, loss or impairment of key manufacturing sites, inability to procure sufficient raw materials, quality control issues, ethical sourcing issues, a supplier’s financial distress, natural disasters, looting, vandalism or acts of war (such as the conflict in Ukraine) or terrorism, trade sanctions or other external factors over which Danam has no control, could interrupt product supply and, if not effectively managed and remedied, have a material adverse impact on Danam’s business operations, financial condition and results of operations.

Danam’s pharmacy division and to the greater extent, Danam’s independent network of partner pharmacies, may also be impacted by disruptions in global supply chain as listed above based on primary wholesaler and direct pharmaceutical manufacturing contracts.

Danam’s business and operations will be subject to risks related to climate change.

The long-term effects of global climate change present both physical risks (such as extreme weather conditions or rising sea levels) and transition risks (such as regulatory or technology changes), are expected to be widespread and unpredictable. These changes could over time affect, for example, the availability and cost of products, commodities and energy (including utilities), which in turn may impact Danam’s ability to procure goods or services required for the operation of Danam’s business at the quantities and levels Danam require. In addition, Danam’s facilities may be in locations that may be impacted by the physical risks of climate change, and Danam may face the risk of losses incurred as a result of physical damage to stores, distribution or fulfillment centers, loss or spoilage of inventory and business interruption caused by such events. Danam will also use natural gas, diesel fuel, gasoline and electricity in Danam’s operations, all of which could face increased regulation as a result of climate change or other environmental concerns.

Whether internally or via Danam’s third-party relationships with Danam’s national and regional ride- sharing partners (i.e., Lyft and Roadie) for prescription delivery; and shipping carriers (i.e., USPS, UPS, FedEx), rising fuel costs will lead to an increase in tiered rates for mileage/distance which will increase Danam’s costs associated with prescription delivery or shipping. Regulations limiting greenhouse gas emissions and energy inputs may also increase in coming years, which may increase Danam’s costs associated with compliance and merchandise. These events and their impacts could otherwise disrupt and adversely affect Danam’s operations and could materially adversely affect Danam’s financial performance.

Danam’s business is primarily focused on certain targeted geographic regions and therapeutic targets, making it vulnerable to risks associated with having geographically and therapeutic concentrated operations.

Failure to retain and recruit, or failure to manage succession of, key personnel could have an adverse impact on Danam’s future performance.

Danam’s ability to attract, engage, develop and retain qualified and experienced employees at all levels, including in executive and other key strategic positions, is essential for us to meet Danam’s objectives. Competition among potential employers might result in increased salaries, benefits or other employee-related costs, or in Danam’s failure to recruit and retain employees which could have a materially adverse impact on Danam’s business operations, financial condition and results of operations.

Additionally, any failure to adequately plan for and manage succession of key management roles or the failure of key employees to successfully transition into new roles could have a material adverse effect on Danam’s business and results of operations. While Danam has succession plans in place and employment arrangements with certain key executives, these do not guarantee the services of these executives will continue to be available to us.