| | The Honourable Rod Gantefoer Minister of Finance | |

| |  | |

| | SASKATCHEWAN PROVINCIAL BUDGET | |

| | 10-11 | |

| | BALANCED. FORWARD-LOOKING. RESPONSIBLE. | |

| |

| | BUDGET SUMMARY | |

Minister’s Message

It is with great pleasure that I table the 2010-11 Budget and supporting documents for public review and discussion.

Today, Saskatchewan faces both significant challenges and great opportunities. We all know the story of the past year in which we were faced with an unprecedented collapse in global potash markets.

While serious, it’s a circumstance that has given us the opportunity to rethink our approach to governing. This Budget is not about potash. It is about making the right decisions – balanced, forward-looking, responsible decisions – to keep our province on the path of steady, long-term growth.

Like other jurisdictions across the country, our spending has increased in recent years, and for good reasons. We have made record investments in infrastructure and tax cuts to maintain economic growth. And we have been fulfilling the commitments made in the 2007 election campaign.

But that trajectory of spending growth is unsustainable. We must now think about spending smarter, not just bigger.

We’re not alone in this. Governments across the country and around the globe are engaged in a similar process. While their particular challenges might differ, governments everywhere are looking for ways to reduce spending and to shrink the footprint of government.

Overall, this Budget will actually see Saskatchewan reduce its spending in 2010-11, something no other province has so far managed to do in this budget season.

In the coming year, we will also reduce the size of government through a process of attrition. This will mean adjustments to what we do and how we do it but we believe we can achieve an orderly reduction in the size of the government workforce and improve our efficiency at the same time.

This is just part of finding a different way to conduct government business. We have achieved real spending reductions in most government ministries this year, while maintaining the core services that people expect their government to provide. This balanced approach preserves our social programs, our health care priorities and the post-secondary programs that are key to our province’s economic prosperity.

At the same time, we have increased spending in the key areas where it’s needed. For example, we are spending $10.5 million on the first year of a four-year effort to reduce health care wait lists to three months even while we have found savings throughout the system.

At the same time, we have not forgotten our government’s commitment to a growth agenda that promotes innovation and diversification. That’s why we are supporting projects like the Canadian Light Source, Canada’s only synchrotron.

Nor are we forgetting the fact that Saskatchewan remains an outward-looking, export-driven province. In order to capitalize on the huge successes of our farmers and manufacturers, we are investing an additional 11 per cent in the Saskatchewan Trade and Export Partnership, so that it can do even more to promote our trading interests abroad.

In the past two years, we have made huge investments in our infrastructure in order to foster the economic growth we see all around us. But more needs to be done. This year, we will make $632 million in capital expenditures, to continue making investments in highways, health care and education facilities.

We think this is a budget to be proud of, a balanced budget. While other provinces continue to increase spending, we’re reducing our expenditures. Where some governments are laying off hundreds of government workers, we are reducing government primarily through attrition.

There’s no doubt that in facing contemporary challenges, Saskatchewan is taking a different path. We think it’s the right one.

/s/ Rod Gantefoer

Honourable Rod Gantefoer

Minister of Finance

Table of Contents

MINISTER’S MESSAGE | |

| GOVERNMENT DIRECTION FOR 2010-11 | 6 |

| TECHNICAL PAPERS | |

| | Saskatchewan’s Economic Outlook | 28 |

| | General Revenue Fund Financial Outlook | 37 |

| | General Revenue Fund 2009-10 Financial Update | 50 |

| | Saskatchewan’s Tax Expenditures | 51 |

| | 2010 Intercity Comparison of Taxes, Utilities and Housing | 55 |

| | 2010-11 Borrowing and Debt | 61 |

| | Growth and Financial Security Fund | 66 |

| | Debt Retirement Fund | 67 |

| | Saskatchewan’s Tobacco Control Strategy | 68 |

| | Canada’s Retirement Income System | 70 |

GENERAL REVENUE FUND (GRF) FINANCIAL TABLES | |

| | GRF – Statement of Operations and Accumulated Deficit | 74 |

| | GRF – Statement of Change in Net Debt | 74 |

| | GRF – Statement of Cash Flow | 75 |

| | GRF – Schedule of Revenue | 76 |

| | GRF – Schedule of Expense | 77 |

| | GRF – Schedule of Debt | 78 |

| | GRF – Schedule of Borrowing Requirements | 79 |

| | GRF – Schedule of Guaranteed Debt | 80 |

SUMMARY FINANCIAL STATEMENT (SFS) FINANCIAL TABLES | |

| | Summary Statement of Surplus | 82 |

| | Summary Statement of Accumulated Surplus | 83 |

| | Summary Statement of Change in Net Debt | 84 |

| | Summary Schedule of Pension Liabilities | 84 |

| | Summary Schedule of Tangible Capital Assets | 85 |

| | Summary Schedule of Debt | 86 |

| | Notes to the Summary Financial Budget | 87 |

| | | |

| | | |

| | SASKATCHEWAN PROVINCIAL BUDGET | |

| | 10-11 | |

| | GOVERNMENT DIRECTION FOR 2010-11 | |

| |

Government Direction for 2010-11:

BALANCED. FORWARD-LOOKING. RESPONSIBLE.

The 2010-11 Budget sets a course for the Saskatchewan government that is balanced, forward-looking and responsible. This Budget ensures future prosperity, making important investments where necessary to position the province for future growth and opportunity.

In order to achieve a balanced budget and ensure that Saskatchewan keeps moving forward, this Budget reduces government spending while focusing on key priorities and reducing direct government involvement.

To achieve this, some difficult decisions had to be made. This was not the easy path. The easy path is to keep spending more, keep government growing, and put the burden of these choices on future governments and future generations.

A responsible government does not do that. This government will take a different path – smaller government, less spending, and a balanced budget.

Government’s plan presents a path to a more efficient government that operates with fiscal prudence, innovation and integrity; all the while remaining true to the Government’s vision for:

A secure and prosperous Saskatchewan, leading the country in economic and population growth, while providing opportunity for a high quality of life for all.

Government’s vision is supported by three goals:

Sustain economic growth for the benefit of Saskatchewan people, ensuring the economy is ready for growth and positioning Saskatchewan to meet the challenges of economic and population growth and development;

Secure Saskatchewan as a safe place to live and raise a family where people are confident in their future, ensuring the people of Saskatchewan benefit from the growing economy; and,

Keep Government’s promises and fulfill the commitments of the election, operating with integrity and transparency, accountable to the people of Saskatchewan.

A STRONG AND GROWING ECONOMY

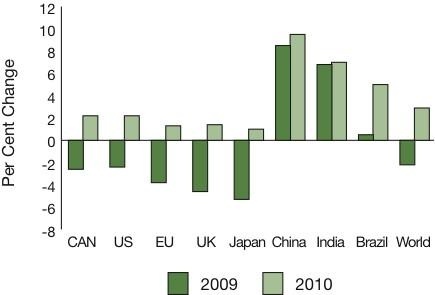

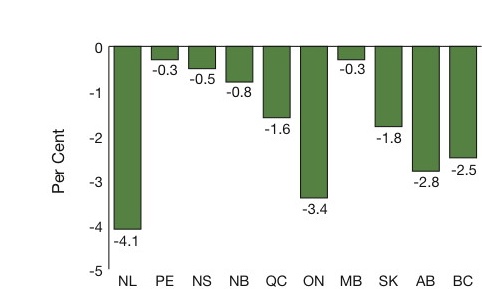

After record breaking growth rates in 2008, 2009 was a difficult year across most of the globe. While China, India and Brazil recorded positive growth in real Gross Domestic Product (GDP), Canada, the United States, the United Kingdom, the European Union and Japan all suffered decreases in real GDP. Overall, world GDP contracted by 2.2 per cent.

6 Budget 2010-11 | Budget Summary

INTERNATIONAL GDP GROWTH RATES

Source: For world data – Conference Board of Canada, Consensus

Economics; other countries – Saskatchewan Ministry of

Finance, various sources

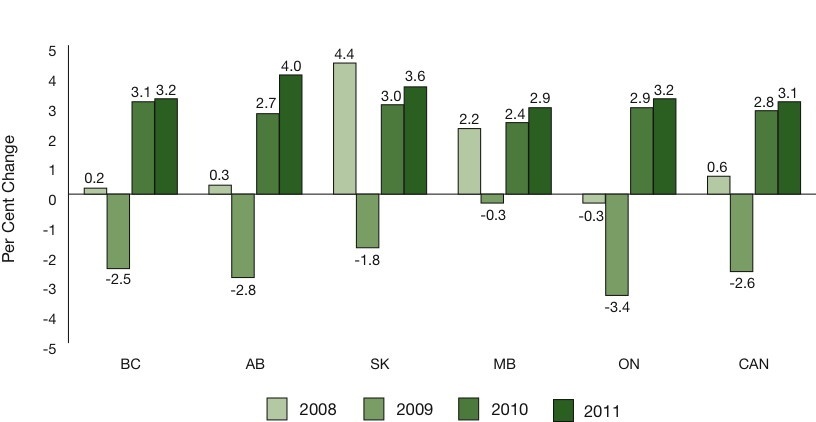

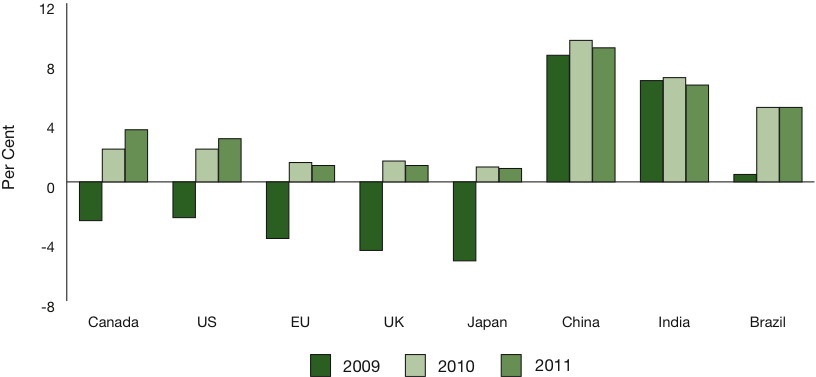

Saskatchewan was not immune and while the severity of the impact on the potash sector was unexpected, Saskatchewan fared much better than most other provinces.

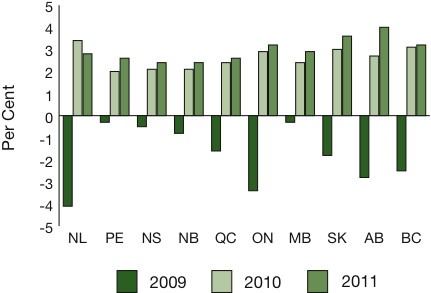

REAL GDP 2008-2011

WESTERN PROVINCES, ONTARIO & CANADA

Source: For 2008 – Statistics Canada; for 2009-11 – Saskatchewan Ministry of Finance, average of private sector forecasters

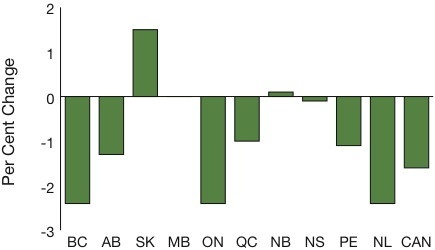

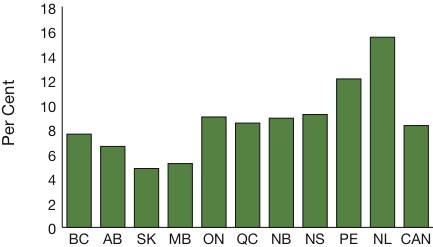

There were many positive indicators of relative economic strength. Saskatchewan was the only province to experience significant growth in employment in 2009.

CHANGE IN EMPLOYMENT

ACROSS CANADA – 2009

| | Source: Statistics Canada |

� 60; Budget Summary | Budget 2010-11 7

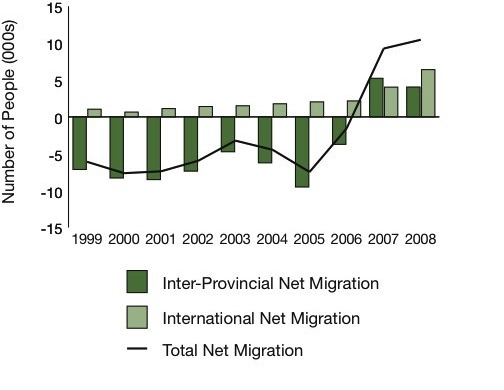

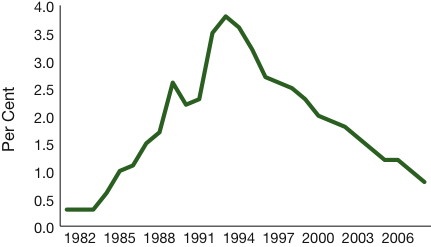

The province continues to attract people from other jurisdictions seeking opportunities. At October 2009, Saskatchewan’s population hit an all-time high of 1,034,974, breaking the record set in 1987.

NET MIGRATION

| | Source: Statistics Canada |

Independent forecasters say Saskatchewan is poised for a strong recovery, with improved conditions and growth expected in 2010 and 2011.

BALANCED

The job of our Government is to ensure this momentum continues and that Saskatchewan and its economy keeps growing and moving forward. The foundation of a growing economy is a strong fiscal framework.

Our Government made a commitment to balanced budgets and this promise is being kept. The General Revenue Fund (GRF) is budgeting a $20 million surplus and debt is to remain flat. Government spending will decrease by 1.2 per cent in 2010-11.

Debt reduction in this Government’s first two years in office has improved the Province’s fiscal flexibility, as demonstrated in the graph below:

INTEREST COSTS AS A % OF GDP

1981-82 TO 2008-09

| | Source: Ministry of Finance |

Developing a balanced budget with such uncertain economic conditions across the globe required some tough choices. Decisions needed to be made between funding worthwhile and growing program needs across all ministries, controlling government spending, and maintaining a competitive tax structure within the existing tax base.

This Government has committed to sharing the benefits of a growing economy with all of Saskatchewan’s citizens. The expenditure highlights presented in this document represent the programs and services that meet the Government’s priorities and its goal:

Secure Saskatchewan as a safe place to live and raise a family where people are confident in their future, ensuring the people of Saskatchewan benefit from the growing economy.

8 Budget 2010-11 | Budget Summary

Health Care – A Priority

Health care funding continues to be one of the highest priority expenditures of this Government. While most ministries were expected to stay at or below zero growth, the government set boundaries for health funding to grow – but only modestly. This ensures that priority programs are funded while asking the health sector to find innovative ways to alter the historical increase in health care spending.

Health ministries represent the largest component of most public sector budgets (over 40 per cent of the total expense budget in Saskatchewan) and these budgets are expected to continue growing. If meaningful spending restraint is to occur, then health care costs must be controlled; programs and services must be made more efficient.

The Regional Health Authorities (RHAs) have been asked to find ways to reduce costs and improve efficiencies and to implement “LEAN” innovations wherever possible.

LEAN is a quality improvement philosophy used to examine a system or a process, with the intention of improving customer experience, outcomes and efficiency.

A customer focused approach is taken in evaluating an entire system or process, from its beginning to its end. The goal may be to make the process more effective (thereby improving services) and/or make it more efficient (eliminating waste).

The primary focus is to create value from the customer’s perspective. In the health care system, this equates to the patient and their family, therefore these efforts co-ordinate very well with a “Patient First” approach – a cultural shift that is taking place across the health sector, including the Ministry of Health, and which is beginning to show tangible results.

RHAs and the Saskatchewan Cancer Agency are being asked to reduce their operating costs, through such things as reduced employee sick time, overtime management, less time lost due to injuries, and through increased use of shared administrative services and bulk purchasing.

RHA operating funding will increase by $123 million, for a total of $2.56 billion, a 5 per cent increase over last year, providing necessary funding for drugs and medical supplies, operating costs and health care worker salaries.

RHAs will receive funding from the Ministry in 2010-11 for the ongoing salary costs of increased nursing staff. RHAs are employing 600 more nursing full time equivalents (FTEs) than in 2007-08, well ahead of the schedule to meet the election and throne speech commitments to hire 800 nurses over four years.

The Saskatchewan Cancer Agency will receive $10 million in new funding to accommodate increases in chemotherapy, radiation and other treatments for new and existing cancer patients. This funding will also allow the Agency to continue to provide screening services for early detection of breast and cervical cancers, as well as continue implementation of the colorectal cancer screening program.

Additional funding will address utilization and cost increases for Canadian Blood Services, Fee-for-Service, and Out-of-Province payments.

The Fall 2009 Throne Speech

… Government has set a bold, new goal. Over the next four years, we will reduce surgical wait times in Saskatchewan to no longer than three months. The plan to achieve this goal will be outlined during this session.

� 60; Budget Summary | Budget 2010-11 9

The 2010-11 Budget moves forward on this commitment and provides $10.5 million to begin planning and implementing the necessary surgical capacity improvements within the system.

Patient First Review

Recommendation #1: that the health system make patient- and family-centred care the foundation and principal aim of the Saskatchewan health system…

To support the health system in adopting a patient- and family-centred care approach, the 2010-11 Budget provides $7 million for a Patient First Initiatives Fund.

Total funding of $382.7 million, an increase of $6.8 million will support the continuation of prescription drugs and extended benefit programs including the Seniors’ and Children’s Drug plans, Family Health and Supplementary Health benefits and Saskatchewan Aids to Independent Living.

Investments have also been made to ensure people in Saskatchewan get the care they need:

| · | $2.5 million in new funding to enhance Autism services; |

| · | $10.6 million to continue Early Childhood Development programming, supporting mental health and addictions services for 670 new pre- and post-natal families in targeted communities and initiatives to reduce infant mortality and Fetal Alcohol Spectrum Disorder; |

| · | $2.6 million in new funding to address increased cardiac care volumes including expansion of electrophysiology services in the province; |

| · | $3.8 million operating funding increase for the Irene and Leslie Dubé Centre for Mental Health; |

| · | $3.6 million in new funding for kidney disease and hemodialysis volume increases; and, |

| · | $2.4 million in new funding to continue infant, and pre-school vaccinations, and seasonal influenza immunization. |

Funding these priority programs meant making some difficult choices and balancing priorities. Funding for some of our partner agencies, the Health Quality Council, the Health Research Foundation and the Saskatchewan Association of Health Organizations (SAHO) will decrease.

Capital funding provided in previous years will allow progress to continue for the Children’s Hospital, the Surgical Care Centre and long-term care facilities.

The difficult choice of de-insuring universal chiropractic services was made in this Budget, saving the Province $10.4 million annually. Low income people will continue to receive full coverage for up to 12 treatments per year, under Family and Supplementary Health benefit programs. This policy change is consistent with most other provinces which do not pay for chiropractic services and/or which limit these treatments.

The effects of tobacco use and second-hand smoke have serious health consequences, yet these are entirely preventable.

The Fall 2009 Throne Speech placed emphasis on the need to reduce tobacco use, particularly use amongst our Province’s young people. The Province committed to the implementation of a tobacco control strategy and legislation to strengthen these efforts.

10 Budget 2010-11 | Budget Summary

The Ministry of Health will continue the Government’s Tobacco Control Strategy in 2010-11 through a combination of legislation and investment in prevention and cessation programming.

The Saskatchewan Coalition for Tobacco Reduction has recommended that an increase in the real price of tobacco products is one of the surest and most cost-effective ways to enhance the Government’s plan to reduce tobacco use.

Effective midnight March 24th, the Tobacco Tax will increase by 2.7 cents per cigarette to $5.25 per package of 25 cigarettes, with a comparable increase for other tobacco products.

First Nations persons continue to smoke at a rate that is significantly higher than the rest of the population. The Coalition for Tobacco Reduction has indicated that the public health impact of Saskatchewan’s high tobacco taxation policy has been limited by the lack of taxation on tobacco products sold to First Nations.

The Government will address this important health concern, while continuing to respect First Nations rights, by limiting the purchase of tax-free cigarettes by First Nations individuals from three cartons per week to one carton per week.

This change to the allowance for tax-free tobacco for First Nations individuals will take effect once enacting legislation is proclaimed.

For more information on this change to the Tobacco Control Strategy, see the Budget Summary Book, page 68.

Protecting Saskatchewan People

Safety in our Communities

The Government continues to move forward on its commitment to increase the number of police officers by 120 new officers over four years. Funding provided in 2010-11 will allow for an additional 30 police officers to be hired across the province.

This Budget increases funding commitments to the Royal Canadian Mounted Police to $138.4 million and continues programming and operations in community programs, correctional centres and young offender facilities.

In addition, there is a $700,000 increase in the municipal policing grants for continued support of our specialized officers, such as those that deal with the suppression of gang-related activity and exploitation of children through the Internet.

The Provincial Public Safety Telecommunications Network-Subscriber Radio Purchase Program receives funding of $4.3 million, which will be augmented by $2.6 million from the Sask911 Fund. Capital funding of $13.8 million is provided to complete construction of the network and an additional $2.3 million in funding will allow the program to begin operating.

The 2010-11 Budget contains $4.5 million in capital funding, which includes $2.5 million to complete construction of the Meadow Lake Court House and $1.5 million to continue replacement of the Maintenance Enforcement computer system which will improve the collection of family support payments ordered by the court.

� 60; Budget Summary | Budget 2010-11 11

Social Assistance, Housing and Child Protection

This Budget invests $345 million for income assistance programs – an increase of approximately $35 million.

The Fall 2009 Throne Speech

“...Government has made significant investments towards protecting vulnerable children, foster families and supporting extended family caregivers

...will continue this work with a thorough review

of the Child and Family Services Act and the Adoption Act

...will also begin implementing a new electronic case management system, to provide better monitoring and protection of children and youth in its care”

In November of 2009, the Minister of Social Services announced a comprehensive child welfare review to be undertaken that would go beyond the examination of legislation. The review will examine all aspects of child welfare: foster care, adoption, prevention of abuse and neglect, and child protection.

Consultations are set to begin in the spring of 2010. New funding of $831,000 is provided in 2010-11 to support the child welfare review.

Child and Family Services will receive a funding increase for caseload pressures and to support a comprehensive multi-year strategy, announced last year, that will continue to improve the lives of children in care.

Highlights of these investments include:

| · | providing $8.2 million to fully fund the operating costs associated with residential spaces developed in 2009-10; |

| · | investing $4.5 million in capital and operating funding to develop additional out-of-home residential spaces in 2010-11; |

| · | providing a 1.5 per cent cost-of-living increase to foster parents and other caregivers; |

| · | providing $1.6 million to increase respite funding for foster parents; |

| · | investing an additional $1.1 million to enhance intensive family support services; and, |

| · | providing annualized funding of $1.3 million to support Family Finders, a program initiated in 2009-10 and operated in partnership with our First Nations Agencies to enhance the Ministry’s efforts to place children with extended family; and, |

| · | providing $9 million to address pressures in family-based care. |

Significant investments in Child and Family Services over the past two years have helped support the province’s child welfare system, as demonstrated through the development of 144 new residential spaces across Saskatchewan in 2009-10, as well as by a 36 per cent decrease in 2009 in the number of children living in foster homes with more than four children.

The Ministry is moving forward on the commitment to better track and monitor children in the province’s care. Funding of $9 million is provided for a new automated case management system.

A commitment was made in the 2008 Throne Speech to address the 440-person waitlist for individuals with intellectual disabilities. Following through on this commitment, people with intellectual disabilities will get support from this Budget. By the start of the 2010-11 fiscal year, projects will be underway to serve 264 Saskatchewan people with intellectual disabilities – 60 per cent of the waitlist. In 2010-11 work will continue on the four-year plan with $1.5 million of additional funding.

12 Budget 2010-11 | Budget Summary

A commitment was also made in the 2009 Throne Speech to address the shortage of low income housing.

In this Budget, the Province continues to invest in rejuvenation of the housing portfolio, including new housing for families, seniors and single persons. The province will leverage its $77.2 million in investments between 2009 and 2011 to generate a total provincial/federal investment of $161.2 million for housing across Saskatchewan.

The Budget provides $1.5 million to continue to index shelter rates semi-annually for benefits provided to low-income families and individuals to offset the inflationary pressure of the cost of rental housing.

The Ministry of Social Services is receiving a 13 per cent ($30.2 million) increase to offset caseload and cost increases in the Saskatchewan Assistance Program, the Saskatchewan Assured Income for Disability Program, and the Transitional Employment Allowance, as part of government’s resolve to maintain core services while ensuring fiscal responsibility.

Funding is being provided to support our Community Based Organizations (CBOs) that help deliver some of the province’s most needed supports. New funding of $3.2 million across all ministries with CBO partners will provide a one per cent operating increase to these agencies, bringing the total operating increase to 13.3 per cent since 2007.

Including program enhancements as well as operating increases, funding provided to the province’s CBOs to deliver public services has increased by 39.9 per cent since 2007.

Environmental Sustainability

The government committed to spend $70 million over four years on green initiatives as part of the “Go Green” program. The $40 million ($10 million per year) incremental commitment by the government in the 2008-09 Budget was in addition to the funding already committed to green projects.

Go Green funding of over $2.5 million in 2010-11 will establish the foundational elements of the provincial climate change plan, including the Office of Climate Change, the Climate Change Foundation, and the Technology Fund.

The 2010-11 Budget provides a total of $16.7 million:

| · | $15.3 million in Environment; and, |

| · | $1.4 million in Energy and Resources, a reduction of $800,000 from the 2009-10 Budget levels, as a number of projects have been completed. |

More than $15 million in grants will be provided through programs and measures aimed at mitigating or avoiding the negative impacts of some of Saskatchewan’s most important environmental challenges.

Government’s long standing partnership with SARCAN continues to ensure environmental benefits to our province while providing important employment opportunities. A $21.7 million grant is being provided to SARCAN in 2010-11 to support their operations in the Beverage Container Collection and Recycling Program. A portion of this funding, $4 million, is provided through the “Go Green” program.

The Crown Investments Corporation (CIC) and its subsidiary Crowns continue to demonstrate environmental leadership through a variety of initiatives and programs as part of the Government’s commitment to help Saskatchewan people “Go Green.”

Budget Summary | Budget 2010-11 13

Programs are designed to enhance environmental sustainability in the sector and the province in general. All Crowns, even those that do not produce significant greenhouse gas emissions, are required to identify performance measures, which are monitored and reported on annually, as part of the Crown

Sector Performance Management System.

The Fall 2009 Throne Speech

Over the course of next year, SaskPower will develop an electrical power generation strategy to meet our province’s future needs. This strategy will include a significant commitment to increased wind power.

SaskPower plans to add 200 megawatts of wind power to its generation profile as early as 2013. Wind power will help to satisfy a portion of the province’s future power generation needs as well as provide a source of renewable, clean power.

Consistent with the Government’s direction to facilitate private sector involvement in the economy, all of this generation will be procured from the private sector. SaskPower’s Green Options Partners Program will purchase up to 25 megawatts of wind power from small, renewable power producers. The balance, up to 175 megawatts, will be procured through SaskPower’s large-scale generation procurement process.

200 megawatts will supply power for approximately 200,000 homes for a year. Currently wind power constitutes just under 5 per cent of SaskPower’s generating capacity. This additional capacity will move the wind power component to 8.5 per cent making Saskatchewan second in Canada in percentage of wind power to total generating capacity.

SaskEnergy will continue to provide incentive programs such as the Programmable Thermostat Rebate Program and the ENERGY STAR® Prime Rate Loan Program, which could impact up to 7,500 customers in 2010. It is anticipated that approximately 15,500 customers will also participate in programs indirectly administered by SaskEnergy such as the EnerGuide for Houses grant and the Energy Efficient Rebate for New Homes.

Saskatchewan Government Insurance (SGI) is meeting an election commitment by continuing to provide a 20 per cent rebate on insurance premiums and registration fees for hybrid and other fuel efficient vehicles, providing incentives for the purchase and use of more environmentally-friendly vehicles on our roads.

The SGI Auto Fund will begin paying for the full costs of delivering the Driver Licence and Registration Administration Program, including $1.3 million which had been previously funded through the Ministry of Finance.

Quality of Life

The Community Vitality Program is a new program designed to enhance the culture and quality, accessibility and use of facilities in communities across the province. The Program also encourages volunteerism and community involvement; engages Aboriginal and young people as leaders in community activities; and improves access and inclusion for those who experience barriers to community involvement.

This Program will run over the next three years, funded through the Community Initiatives Fund. More details on this new program will be available over the coming weeks.

The recently announced Cultural Policy will serve as a foundation for planning and enhancement of our cultural programs. As a first step, the new Saskatchewan Capital Commission has been established with a mandate to promote the culture and heritage of the Province’s capital.

14 Budget 2010-11 | Budget Summary

The Building Communities Program will continue with a total budget of $13.7 million, to reflect the estimated cost of projects in 2010-11. This Program advances grants to communities for construction of recreational facilities, adding to the quality of life of people in communities around the province.

Saskatchewan families can now take advantage of the Active Families Benefit, an election commitment that was announced last year. This Benefit provides a tax credit of up to $150/child for cultural, recreational and sport activities. This program serves as an incentive to keep our young people active and supports families with the associated costs of these programs.

Families can now submit receipts to the program with their 2009 tax forms. The tax credit is estimated to cost $11 million in 2010-11, reflecting revised estimates of up-take in the program.

The 2010-11 Budget maintains stable funding to most of our major third parties.

Capital funding for provincial parks will be reduced in this year’s budget by $4.4 million. However, sufficient funding in the budget will allow for 240 new camping sites to be upgraded to electrified sites in the upcoming year, keeping the Government on track to meet its commitment of 1,000 new electrified sites over four years. $515,000 is also being provided to regional parks.

While steps will be taken to maintain distance education and satellite services, the Saskatchewan Communications Network will cease operation before the end of the 2010-11 fiscal year, for savings of $2.4 million.

FORWARD-LOOKING

The Fall 2009 Throne Speech

[quoting Albert Einstein] … “Life is like riding a bicycle. To keep your balance, you must keep moving.”

In 2009, our province faced the challenge of a global economic recession. Saskatchewan has met this challenge and kept its balance because we kept moving – moving forward.

As choices were being made in this Budget about government spending, specific attention was placed on making investments in Saskatchewan’s future and ensuring economic stimulus funding was maintained.

This Budget encourages innovation, and focuses on preparing our youth with a solid education, which increases their career opportunities within the province. Initiatives in this section relate closely to Government’s goal to:

Sustain economic growth for the benefit of Saskatchewan people, ensuring the economy is ready for growth and positioning Saskatchewan to meet the challenges of economic and population growth and development

Innovation – Key to a Growth Agenda

Saskatchewan holds some of the country’s most important research and development institutions on our university campuses. This Government recognizes the importance of providing funding to these organizations so that they can continue to find innovative and leading edge scientific solutions to some of our greatest challenges.

� 60; Budget Summary | Budget 2010-11 15

In the past, the Province has provided capital funding support to the Canada Light Source Synchrotron. This Budget commits new operating funding of $1 million to the Synchrotron on the University of Saskatchewan (U of S) campus to support the facilities’ 13 beam lines in the operational and commissioning stage and nine beam lines in development.

The InterVac facility in Saskatoon provides capacity for animal and human disease research on current and emerging infectious diseases. Funding is being provided to InterVac through the Innovation and Science Fund. The Province’s total multi-year commitment is $57.1 million, which is approximately 40 per cent of the total cost. The remainder of the cost is funded by the federal government and other partners.

The Petroleum Technology Research Centre (PTRC) located on the University of Regina campus receives $2.5 million in continued funding for its petroleum-related research projects, including CO2 storage and enhanced oil recovery.

In addition, $1.6 million in “Go Green” funding is also being provided to the PTRC for its important contributions to carbon capture research and finding solutions to reduce to greenhouse gas emissions.

This Budget establishes Innovation Saskatchewan with a base budget of $1.3 million. A significant portion of this funding ($480,000) will go to TRLabs in Saskatoon to support the work they do in telecommunications research.

Government continues its support for the Saskatchewan Research Council (SRC) to further its research and development projects in most of the province’s key economic sectors including agriculture; biotechnology and food; energy; environment and forestry; alternative energy and manufacturing; and mining and minerals.

SRC’s budget increases year over year by $1.6 million, to accommodate new forestry responsibilities, bio-energy and other related research.

Other research funding contained in this Budget includes:

| · | $16 million for grants to support agricultural research and development; and, |

| · | $11.5 million for the Innovation and Science Fund. This Fund provides matching funding for post-secondary institution projects that have received approval for federal funding from the Canada Foundation for Innovation, the Canada Research Chairs Foundation, or the Canadian Institute for Health Research. |

The Saskatchewan Trade and Export Partnership (STEP) works hard to expand trade and develop new markets for Saskatchewan products throughout the world. To continue and improve upon this success, STEP will receive increased funding of $325,000 or 11 per cent more in 2010-11 to increase markets for our province’s exporters.

Carbon Capture and Storage

SaskPower is leading the development of one of the world’s first and largest integrated Carbon Capture and Storage (CCS) commercial projects at Boundary Dam Power Station in Estevan.

16 Budget 2010-11 | Budget Summary

This innovative $1.4 billion partnership between the Governments of Canada and Saskatchewan, SaskPower and private industry will transform Unit 3 at Boundary Dam Power Station into a reliable, long-term producer of 115 to 120 megawatts of clean base-load electricity, while enhancing provincial oil production and reducing greenhouse gas emissions by capturing one million tonnes of CO2 per year.

This leading-edge project will determine the technical, economic and environmental performance of clean coal/carbon capture and storage technology.

Infrastructure – Investments in our Future

The Government has made an unprecedented commitment to infrastructure funding over the past two years – investing $2.3 billion in hospitals, schools, highways, municipal projects and other much-needed initiatives.

This funding was directed to provincial projects which addressed needed capital improvements and generated employment opportunities across the province.

These decisions served the province well as the momentum of projects underway throughout last year allowed Saskatchewan to realize continued growth in employment in 2009.

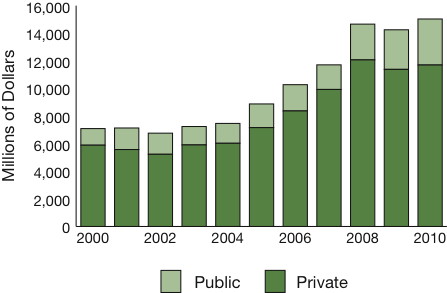

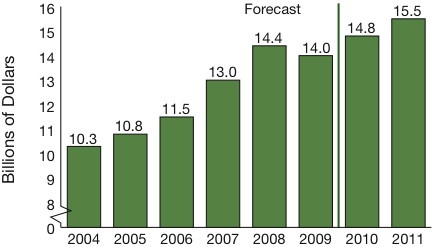

Statistics Canada released its Private and Public Investment Intentions Survey in February of 2010. Saskatchewan’s total capital investment from both the private sector and the public sector is growing significantly.

While investment in 2009 was lower than 2008, investment is expected to grow by 5.5 per cent in 2010 reaching a record high level of $15 billion next year.

PRIVATE AND PUBLIC CAPITAL

INVESTMENT INTENTIONS

The federal government has made a commitment to maintain the economic stimulus programs introduced under Canada’s Action Plan. Saskatchewan is following suit – continuing to fund stimulus projects as a priority and phasing out of projects as appropriate and in accordance with the design of the projects.

The Government will make a significant capital investment of $632 million in 2010-11, bringing the total infrastructure investment to nearly $3 billion over three years.

The majority of this funding is dedicated to Highways and Infrastructure projects ($302 million) and another large portion goes to Municipal Affairs ($177 million).

The Conference Board of Canada

Winter 2010 – Provincial Outlook

“Saskatchewan – Geared Up for a Recovery

... commodity markets are rebounding and are expected to serve as the engine for growth in 2010

... potash sales are expected to climb

... housing starts will jump by 15.4 per cent

... several private construction projects – including Loblaw’s $200-million Regina warehouse and distribution facility – are also entering their peak development period.”

� 60; Budget Summary | Budget 2010-11 17

Highways and Infrastructure

The Budget provides the Ministry of Highways and Infrastructure government-owned capital funding of $250.3 million, which optimizes all potentially available Infrastructure Stimulus Fund (ISF) revenues. Total revenue from ISF and the Building Canada Plan related to highways is estimated at $112.5 million for 2010-11.

This funding will:

| · | continue twinning of Highway 11; |

| · | continue work on the Lewvan Drive interchange in Regina; |

| · | construct the Yorkton Truck Bypass; |

| · | proceed with contracts under the Rural Highway Strategy, resulting in approximately 470 kilometres of highway construction on the market; |

| · | commence or complete resurfacing on approximately 600 kilometres of highway; and, |

| · | undertake construction to replace 36 bridges. |

At this level of funding the Province is on track to complete its commitment to dedicate funding equivalent to fuel taxes as well as meet the commitment to $1.8 billion in highway funding over four years.

The Highways and Infrastructure operations budget includes:

| · | a $2.8 million enhancement to the Urban Connectors Program (total program budgeted at $17.5 million in 2010-11); and, |

| · | $600,000 to purchase radios to access the new Provincial Public Safety Telecommunications Network. |

This level of funding maintains:

| · | the Winter Maintenance Program at $25.4 million; |

| · | the Municipal Roads for the Economy Program with $20.5 million in the base budget, plus a $3 million enhancement to the Program; |

| · | ferry services – $3.5 million; |

| · | airports – $2.5 million; and, |

| · | the Shortline Railway Sustainability Program at $500,000. |

The Global Transportation Hub Authority begins its first full year of operations in 2010-11. The Ministry of Highways and Infrastructure will be investing $26 million this year on the Regina West By-Pass in support of the Hub and growth in Regina.

The Western Canadian Distribution Centre to serve Loblaw’s will start operations in late 2010, creating up to 750 jobs. The Canadian Pacific Intermodal facility will complete its pre-construction work and obtain regulatory approvals in 2010 and begin construction in early 2011. This facility allows for the efficient transfer of containers between rail, truck and ship for both import and export purposes.

Vision for the Global Transportation Hub Authority

A major transportation and logistics hub that is private-sector driven and will effectively and efficiently distribute goods regionally, nationally and internationally, providing economic benefits to Saskatchewan people and business.

The Hub will provide the public infrastructure required to offer efficient distribution solutions and create business opportunities, optimizing returns to the Province.

18 Budget 2010-11 | Budget Summary

In order to fund priority infrastructure programs, some highways programs needed to be delayed or reduced:

| · | A $16.9 million decrease in the Surface Preservation Program will be achieved by reducing the amount of maintenance done to the provincial highway system; |

| · | The $20 million in one-time funding provided for the Municipal Roads for the Economy Program has been removed; |

| · | The Ministry will defer the purchase of new machinery, reduce sign rehabilitation and pavement marking and provide a smaller summer mowing program; |

| · | The First Nations Pilot Projects budgeted at $5 million will be delayed; and, |

| · | No funding is provided for new loans under the Railway Line Loan Program. |

Municipal Partners

In recent years, as provincial revenues were increasing, the Government provided significant new funding to its municipal partners. Municipal leaders are aware of the fiscal challenges facing the Province and have been consulted on the impact of budget decisions on the municipal sector.

As communicated to municipal leaders, $167.4 million is provided in the 2010-11 Budget to maintain funding for revenue sharing at the record-setting level provided in 2009-10.

Total funding for federal-provincial-municipal infrastructure programs increases by $48.3 million to $115.8 million, a 71.7 per cent increase from 2009-10. This includes:

| · | $60.6 million for stimulus programs that need to be completed before March of 2011; and, |

| · | $51.9 million for longer-term programs that expire in 2014 or later. |

In 2010-11, $58.3 million in federal flow-through funding for the Gas Tax Program will allow more municipal infrastructure projects to proceed.

Funding of $2.3 million is provided to maintain commitments under the Saskatchewan Infrastructure Growth Initiative, providing assistance to growing communities that are facing increasing costs for infrastructure development.

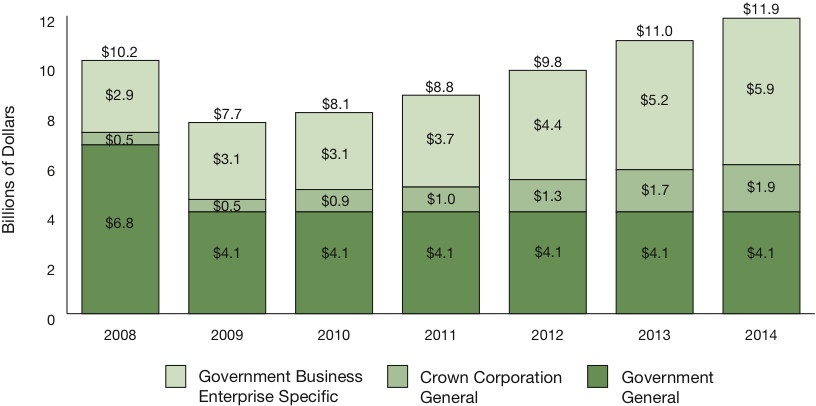

Crown Capital Investments

In 2010 the Crown sector is forecast to reinvest $1.3 billion in capital infrastructure, led by requirements in SaskPower, SaskTel, and SaskEnergy.

SaskPower is faced with the challenge of replacing aging infrastructure with more expensive, cleaner technologies during a period where Saskatchewan is expected to experience economic growth and require more electricity.

The challenge will require a major re-investment in the Province’s electrical infrastructure and SaskPower intends to partner with the private sector to ensure the reliability and long-term security of the system.

SaskTel will focus on capital investments to enhance infrastructure, providing leading edge products and services to the people of Saskatchewan.

SaskTel will also continue to implement the Rural Infrastructure Program to deliver 100 per cent high speed internet and improved wireless coverage across the province, advancing the Government’s commitment to expand these services.

SaskTel will also construct a new wireless network based on the Global System for Mobile Communications technology, and plans to expand Max Entertainment Services to 14 more Saskatchewan communities over the next two years.

� 60; Budget Summary | Budget 2010-11 19

SaskEnergy will continue to expand the utility infrastructure required to service the growing Saskatchewan population by upgrading technology, increasing storage capacity, and putting new pipelines in the ground, while also supporting various growth initiatives. Growth initiatives such as waste heat recovery and the transportation of CO2 will continue to be the focus in 2010.

Investments in Education and Training

Prekindergarten to Grade 12 Education

Over the last two years, significant investments were made in school capital.

In 2008-09, $117.6 million was provided for school capital under the Ready for Growth Initiative and $142.4 million as part of the “economic booster shot” in February of 2009.

In 2009-10, $31 million was provided for K-12 major and block capital projects and $5.4 million for early learning and child care space development capital funding. In addition, capital funding of $22 million was provided in the fourth quarter of 2009-10 to proceed with projects nearing completion, to address immediate capital needs, and to provide additional school maintenance and planning.

In 2010-11, capital funding for the K-12 sector is $17.2 million, bringing total new school capital

funding to more than $328 million over three years.

The overall funding for school divisions will increase by $33 million or 2.1 per cent in 2010-11. Education Property Tax rates will remain at the 2009-10 level: 7.08 mills for agriculture, 10.08 mills for residences, and an average of 15.42 mills for commercial property.

A commitment was made in the 2009 Throne Speech to increase the number of licensed child care spaces funded by the Province. In response to this commitment, this budget provides $2 million for 235 additional child care spaces and 18 Prekindergarten programs. This brings the total number of licensed child care spaces, that are operational or in development at the end of the 2010-11 fiscal year to approximately 11,650, and the number of Prekindergarten programs to 230.

The Ministry of Education will continue its implementation of the Career Development Action Plan, helping students become self-reliant, self-motivated career managers as they transition between learning and work. In 2010-11 the Ministry will continue to work with local school boards, the business community, and CBOs to enhance business literacy, entrepreneurship, and career education for students.

The Ministry’s new video streaming service – Recommended Online Video Education Resources – will continue to be implemented in all provincially funded schools. This resource benefits educators by delivering high-quality services and greater access to curriculum-based video, streaming directly into the classroom.

Post-Secondary Education

Additional funding of $16.3 million will be provided to universities, federated and affiliated colleges to support the core base of programming and enable institutions to limit potential increases to tuition.

In addition, $7.9 million will be provided to post-secondary institutions for the continuation of health care provider training seat expansion.

Capital funding of $6.2 million will be provided through the Knowledge Infrastructure Program to fund the nursing expansion at Saskatchewan Institute of Applied Science and Technology’s (SIAST) Kelsey Campus and the electrical shop expansion at Woodland Campus.

20 Budget 2010-11 | Budget Summary

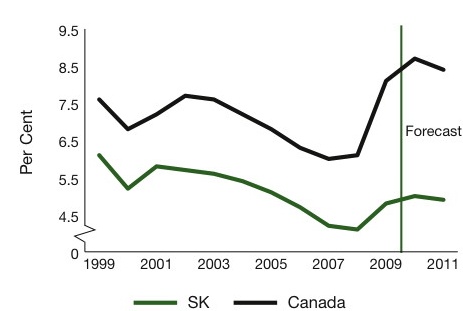

Saskatchewan’s unemployment rate was the lowest across Canada in 2009.

UNEMPLOYMENT RATE ACROSS CANADA –

2009

| | Source: Statistics Canada |

Job opportunities are available in the province, however, a challenge for post-secondary sectors is to stay ahead of the changing needs in the market place.

Post-secondary institutions are being asked to examine program priorities and find efficiencies in their operations, as is being done across government, in the health sector, and in the Crown sector.

Institutions will receive $16.9 million to fund sustaining capital and maintenance projects, which is a $12.4 million or 42 per cent decrease from last year.

The Ministry of Advanced Education, Employment and Labour continues to examine the effectiveness of its current array of training and employment programs and evaluate if they are achieving desired outcomes. Some funding will be discontinued or reduced while other funding will be repositioned to be more responsive to the training and retraining needs of the labour market.

Although there are training and employment program reductions, federal stimulus initiatives will ensure a comparable level of training and employment opportunities.

This Budget provides needed support to students and responds to the 2008 Throne Speech commitment to enhance student loans. New funding of $1.8 million will provide for enhancements to student support programs, including lower interest rates for student loans in repayment. Enhancements also include consistent levels of assistance for students through the student loan program and the elimination of vehicle value and in-study income in the assessment of eligibility for the student loan program and the Provincial Training Allowance.

A $4.6 million increase is being provided for the third year of the Graduate Retention Program, for total program funding of $23.1 million, helping to keep our students in the province and to attract graduates from other provinces.

The Gradworks program through the Crown Investment Corporation (CIC) provides 12-month internships in the Crowns for recent post-secondary graduates who have little or no work experience.

Since the program was implemented, there have been 340 internships provided within the Crown sector. In 2009, 72 people obtained new internships through this program. Nearly 84 per cent of those who have completed their internships have stayed in Saskatchewan, with 54 per cent employed in the Crowns and 30 per cent employed in other companies.

The CIC Aboriginal Bursary Program provides financial assistance for qualifying students at the University of Regina and affiliated colleges.

Beginning in the fall of 2009 the bursary program was expanded to include the University of Saskatchewan, the Saskatchewan Institute of Indian Technologies and SIAST. Under the program, students can receive $2,500 per semester or $5,000 per full academic year.

� 60; Budget Summary | Budget 2010-11 21

In 2009, there were 67 bursaries awarded for the winter semester and 50 for the fall semester. From the program’s inception in 2004 to the end of 2009, 531 bursaries had been awarded, with some students receiving multiple bursaries.

Health Care Providers –

Recruitment and Retention

The Province continues to place priority on increasing the number of seats provided in health related training. This Budget provides $6.6 million to continue medical education enhancements including the physician training seat expansion, with 12 new post-graduate seats. This fulfills government’s commitment to fund 60 additional residency seats (120 in total).

To complement these training seats, efforts are also being made to retain Saskatchewan-trained physicians once their residencies are complete. Funding of $3.5 million will continue for implementation of the physician recruitment strategy and agency, another 2009 Throne Speech commitment that is being funded in this Budget.

Given the province’s strong economy, competitive wages and success in meeting and exceeding recruitment and retention targets, non-physician recruitment and retention activities will be scaled back.

The 10-Year Health Human Resource Plan, upon its completion later this year, will provide insights into what the Province may need to do to ensure the required number of health professionals are available over the next decade.

Investments in Agriculture

The 2010-11 Budget provides $283.4 million to fulfill the commitment to deliver and fully fund the Province’s 40 per cent share of farm income stabilization programs. This includes $234.1 million for the Province’s share of program payments to AgriStability, AgriInvest, and Crop Insurance premiums, based on current forecasts.

As committed, a review was undertaken on the Crop Insurance Program that has led to enhancements that improve upon the program, such as improvements made to the Wildlife Damage Compensation Program.

Crop insurance coverage has been broadened for 2010 to include camelina, soybeans, navy beans and honey, supporting more diversified crops across the province.

Yield cushioning is also being made a permanent feature of the program, after being studied under a pilot program in 2009. This feature limits the impact of consecutive poor growing seasons, such as a prolonged drought, on the level of coverage available to a producer.

The transfer of AgriStability administration to the Crop Insurance Corporation in Melville will be completed this year, leading to improved services to farmers.

This Budget also includes $6 million to continue the second year of the Crown Land Sale Program and $2.6 million for the Comprehensive Pest Control Program.

22 Budget 2010-11 | Budget Summary

Further Engagement with First Nations and Métis People

The Ministry of First Nations and Métis Relations (FNMR) manages the Government’s approach to First Nations and Métis issues by building and maintaining partnerships and relationships, and providing leadership within government.

The Ministry also manages the $3 million First Nation and Métis Consultation Participation Fund to ensure that the Province’s duty to consult obligations are met and relationships are strengthened.

Government will meet its financial obligations pursuant to Treaty Land Entitlement (TLE) Agreements with $4.9 million in funding in 2010-11.

In addition, $68.1 million will meet obligations under gaming agreements. The funding includes an increase of $1.4 million for the Clarence Campeau Development Fund which supports improving the economic circumstances of Saskatchewan’s Métis people.

New funding of $3 million is set aside for a program through the Crown Investments Corporation, to be available to support economic development for First Nations people.

In 2010-11, First Nations and Métis Relations will develop a new Northern Social Policy Unit that will work with other ministries to improve the lives of northern Saskatchewan people through the development of a Northern Action Plan.

Funding of $1.4 million is provided for the first full year of funding for three Northern Enterprise Regions. This new structure will assist stakeholders in key sectors of the north, increasing business and industry competitiveness and supporting the north to reach its full economic potential.

The Ministry reconfigured a number of its programs and reviewed their effectiveness in delivering results. As a result, a decision was made to discontinue the Aboriginal Employment Development Program, achieving savings of $786,000, allowing funding to be directed to other program areas, such as the Northern Enterprise regions.

FNMR will support northern Saskatchewan’s (estimated 600+) commercial fishers’ efforts to transition from a monopoly marketing agreement with Canada to an open, competitive market. FNMR will support the exploration and implementation of alternative models that will broaden processing and marketing options for their catch.

The Ministry will also work to ensure that all First Nations children with intensive medical needs get care similar to that of other children through the development of a joint plan with Canada and the Federation of Saskatchewan Indian Nations to implement Jordan’s Principle.

RESPONSIBLE

Keep Government’s promises and fulfill the commitments of the election, operating with integrity and transparency, accountable to the people of Saskatchewan

In order to reduce spending and achieve a balanced budget, the Government is outlining its plan to make government more efficient.

Efforts taken by ministries and agencies in the latter half of 2009 and through the 2010-11 Budget process resulted in a 1.2 per cent reduction in the expense budget over the previous year. This is significant in that Saskatchewan may be the only province in Canada to reduce government spending this year.

� 60; Budget Summary | Budget 2010-11 23

Ministries have achieved this through:

| · | vacancy management, either by eliminating vacant positions and/or not filling positions; |

| · | eliminating travel and unnecessary operational costs; |

| · | reducing the scope of programs that are under-utilized or not achieving results; |

| · | scaling back on program expansions, refining program eligibility, or deferring projects and program investments where possible; and, |

| · | eliminating programs which have the least direct impact on the public. |

Improving Service Delivery

Government is already taking steps to work more effectively, engaging in joint service delivery with key partners to improve services delivered to the public.

Improving service to industry and increasing ministry efficiency is the goal behind the Process Renewal and Infrastructure Management Enhancements (PRIME) Project, in the Ministry of Energy and Resources.

This Budget provides $10.5 million in capital and $1.9 million in expense funding to continue the second year of the PRIME project.

The Information Services Corporation (ISC), in collaboration with the Ministry of Energy and Resources, is implementing the Mineral Administration Registry of Saskatchewan (MARS) in 2010 which will assist in the improved management of land dispositions. The MARS project will assist in handling greater volumes, reduce processing time and provide better information for the management of Crown mineral lands.

Effective October 2010, the Corporations Branch will transfer from the Ministry of Justice to ISC. This move will leverage ISC’s registry expertise, core competencies and infrastructure to enhance and further evolve service delivery to the business community in the future. This move will mark the start of a one-stop business registry for Saskatchewan, thereby increasing the efficiency of the process and making it easier for new businesses to get started in the province.

The Ministry of Environment is provided with $6.7 million in operating and capital funding to continue implementation of the Results-Based Regulatory framework. This new approach is intended to streamline and improve the efficiency of the provincial environmental management system and reduce response times to better serve industry and the public.

Effective July 1, 2010, boiler and pressure vessel, elevator, and amusement ride licensing and inspection services will move from the Ministry of Corrections, Public Safety and Policing (CPSP) to a delegated administrative agency.

This move will allow these services to be provided in a more flexible manner, adapting to industry demand for licensing and inspection services. Costs will be recovered on a fee-for-service basis. Legislative and regulatory authority will remain with CPSP.

The Ethanol Grant Program is being restructured, reflecting a reduced need to support the maturing provincial ethanol industry. The revised program will provide an annual subsidy for the first 25 million litres of production. Small, local ethanol producers with production of 25 million litres or less will receive nine cents per litre produced, while larger producers will receive six cents per litre.

Government is decreasing its fire management budget by $30.8 million, including both operating and government-owned capital, to reflect more refined forecasts. Core funding of $71 million continues to be provided to ensure protection of people, communities, and the commercial forest and to renew the province’s aerial fire fighting fleet.

24 Budget 2010-11 | Budget Summary

There has been a change in how the Province funds capital acquisition by Treasury Board Crown organizations. Rather than provide the TB Crown an upfront capital grant, the Province will fund (and expense) the capital as it is amortized by the TB Crown. This change effectively amortizes and expenses TB Crown capital acquisitions in the same manner that it amortizes its own capital assets.

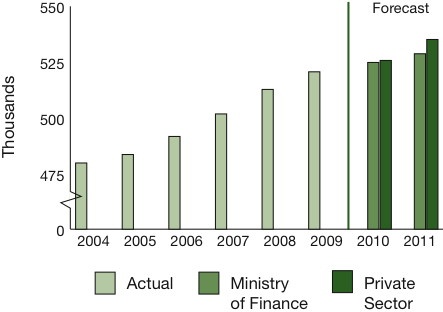

A Reduced Government Footprint

Over the past decade, the size of the public service has grown at a faster pace than the growth in Saskatchewan’s population.

Government has signalled its interest in attaining a smaller footprint, focusing on core government programs, and improving the administration of programs and services within government and across the public sector including regional health authorities, school divisions and post-secondary institutions.

Saskatchewan began this process early last fiscal year with the first signals that revenue sources may not hold. The government implemented a process to find efficiencies throughout its operations, including delays in hiring staff and holding positions vacant.

The examination of government programs and services, ensuring their efficient delivery, continued during the development of this budget.

Government is moving in the right direction but real efficiencies take more time than is allowed in one budget process. We need to do more.

All agencies that receive taxpayer funding are being asked to consider how programs and services can be made more efficient and effective and how we might get by with less. Executive government is taking the lead, but it cannot make significant gains without the support of the health and education sectors participating in this effort.

Over the next four years, ministries and agencies are being asked to find ways to reduce the size of the public service. The goal is to reduce the size of the service by 15 per cent at the end of four years. This will be achieved primarily through attrition and vacancy management.

The Growth and Financial Security Act, 2008 requires Treasury Board to monitor the size of the public service. The Ministry of Finance has developed a performance measure in its Ministry Plan in response to the requirements of the Act. The Ministry of Finance and the Public Service Commission will be monitoring the workforce adjustment strategy and the corresponding reduction in the size of the public service.

The Crown sector will also be participating in finding efficiencies in their operations. In 2010 the Crown sector will build on the productivity reviews currently underway at SaskTel and SaskPower.

As new efficiency measures are introduced, the Crown sector will reduce staff levels through attrition. The Crown sector’s ability to efficiently deliver high quality service at the lowest possible cost will drive staffing decisions.

Consistent with the SaskFirst Policy, SaskTel, SaskEnergy and SaskPower will sell non-core out-of-province assets to support required capital investment in Saskatchewan.

These efforts, in addition to the interest in pursuing LEAN practices, will help to encourage greater fiscal responsibility, improved governance and a more sustainable and accountable government.

� 60; Budget Summary | Budget 2010-11 25

Revenue Initiatives

In working to achieve a balanced budget, the Government made every effort to avoid tax increases. The Tobacco Tax is being increased as outlined earlier.

In addition, this Budget increases the Saskatchewan Liquor and Gaming Authority’s mark-ups on various alcohol products. These changes will increase provincial revenues by approximately $18 million. As an example, the mark-up on a case of 12 bottles of beer increases by 75 cents.

A small number of fee increases were announced on March 4, 2010 which are intended to recover the costs of services provided. Anticipated revenue from these fee increases is estimated at about $1 million.

Keeping Government’s Promises

The Government remains committed to the promises it made to the people of Saskatchewan. Sometimes difficult choices need to be made. However, commitments made in the election platform, through the last three Speeches from the Throne and through the Ministers’ mandate letters remained front and centre during the budget deliberations.

A fundamental promise made to the people of Saskatchewan was to maintain balanced budgets. Despite some challenges with volatile revenue sources and an unpredictable international economy, Government has delivered a balanced budget.

This Government is on track to continue delivering the promises made to the people of this province. While not all commitments will be delivered as quickly as initially hoped, this Government places high value on being held accountable for delivering on its commitments.

Balanced. Forward-Looking. Responsible.

The 2010-11 Budget sets Saskatchewan firmly on the path of fiscal responsibility and continued economic growth. Our Government has chosen to make key investments in health, education, innovation and other priority areas that meet the needs of Saskatchewan people.

The Government has also made some difficult but necessary choices to meet the challenges of today because we know what it means for our children tomorrow.

This Budget makes the right choices for the new Saskatchewan – where our best days lie ahead.

This document provides highlights of government activity for the upcoming year. For more detailed information, see the Ministry Plans for 2010-11 accessible through each of the ministries’ websites or at www.finance.gov.sk.ca/PlanningAndReporting. Crown sector plans are available through www.cic.gov.sk.ca.

For more information on changes made within the 2010-11 Budget, see the technical and background papers provided through the Ministry of Finance website.

26 Budget 2010-11 | Budget Summary

| | | |

| | | |

| | SASKATCHEWAN PROVINCIAL BUDGET | |

| | 10-11 | |

| | | |

| | TECHNICAL PAPERS | |

Saskatchewan’s Economic Outlook

2009 PERFORMANCE

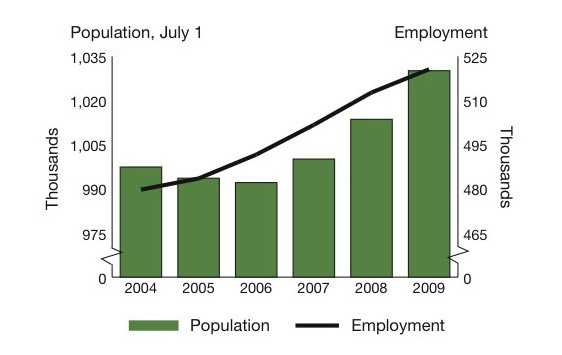

Last year was a good year for the province in terms of both population and employment gains.

POPULATION AND EMPLOYMENT

IN SASKATCHEWAN

| | Source: Statistics Canada |

Whereas most provinces lost jobs, Saskatchewan created (on average) 7,817. Further, Saskatchewan’s population continued to grow. As of October 1, 2009, there were 1,034,974 people living in Saskatchewan, more than ever before.

2009 EMPLOYMENT GROWTH

BY PROVINCE

Source: Statistics Canada

Yet Saskatchewan’s economy was affected by the global economic slowdown, as evident in most other indicators for 2009.

SASKATCHEWAN ECONOMIC INDICATORS

(Per Cent Change Unless Otherwise Noted)

| | | | 2007 | | | | 2008 | | | | 2009 | |

| Employment Growth (000s) | | | 10.2 | | | | 11.0 | | | | 7.8 | |

| Unemployment Rate (%) | | | 4.2 | | | | 4.1 | | | | 4.8 | |

| Consumer Price Index | | | 2.9 | | | | 3.2 | | | | 1.1 | |

| Average Weekly Earnings | | | 5.4 | | | | 4.8 | | | | 2.5 | |

| International Exports | | | 19.4 | | | | 55.2 | | | | (26.4 | ) |

| Wholesale Trade | | | 17.3 | | | | 41.0 | | | | (21.0 | ) |

| Retail Sales | | | 13.0 | | | | 10.6 | | | | (2.3 | ) |

| New Vehicle Sales | | | 14.1 | | | | 8.6 | | | | (9.1 | ) |

| Manufacturing Sales | | | 4.5 | | | | 18.9 | | | | (10.7 | ) |

| Building Permits | | | 44.6 | | | | 32.8 | | | | (13.5 | ) |

| Housing Starts | | | 61.7 | | | | 13.7 | | | | (43.4 | ) |

Private/Public Investment1 | | | 14.0 | | | | 25.2 | | | | (2.8 | ) |

| | 1 | Private and Public Investment Intentions Survey, February 26, 2010 |

| | Source: Statistics Canada |

28 Budget 2010-11 | Budget Summary

Overall, Saskatchewan’s economy, like all other provincial economies, contracted last year. For Saskatchewan, weak potash sales were a major contributor.

PRIVATE SECTOR FORECASTS

OF 2009 REAL GDP GROWTH 1

| 1 | Percentages are the average of private sector forecasts. Private sector here includes major Canadian banks, Global Insight, Conference Board of Canada and the Centre for Spatial Economics. |

INTERNATIONAL ECONOMIC CONDITIONS AND OUTLOOK

Saskatchewan exports roughly 70 per cent of what it produces. Therefore, what happens in the rest of the world is an important factor in the province’s economic performance.

The global economy is gradually recovering from what turned out to be one of the worst recessions in years.

The U.S. economy in particular is expected to grow by 2.2 per cent this year, much improved from the 2.4 per cent contraction in 2009.

Countries that were least affected by the financial crisis are expected to post the strongest growth in 2010. The economies of China, India and Brazil, for example, are anticipated to grow by 9.5 per cent, 7.0 per cent and 5.0 per cent, respectively.

OUTLOOK FOR GLOBAL ECONOMIC GROWTH

Source: Ministry of Finance

� 0; Budget Summary | Budget 2010-11 29

CANADIAN ECONOMIC CONDITIONS AND OUTLOOK

Canada’s growth tracks U.S. developments quite closely due to the large bilateral trade relationship and closely aligned monetary policies between the two countries.

Just like in the U.S., economic recovery in Canada appears to be taking hold. Growth in the final quarter of 2009 was 5.0 per cent on an annualized basis, much higher than forecasters had expected. For 2010, the Canadian economy is expected to grow by 2.2 per cent.

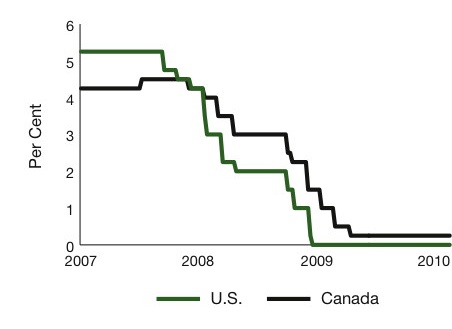

Few central banks around the world appear ready to raise interest rates just yet. In part, this reflects the view that the global economic recovery will be slow. In the near term, the U.S. Federal Reserve and the Bank of Canada are likely to keep interest rates at a relatively low level, conditional on the outlook for inflation.

CANADA AND U.S. KEY POLICY RATES

WEEKLY

Source: Bank of Canada, U.S. Federal Reserve

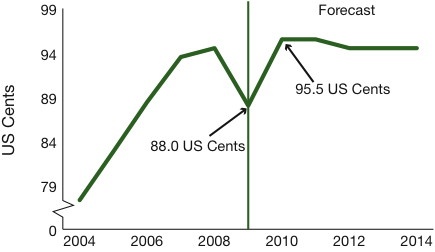

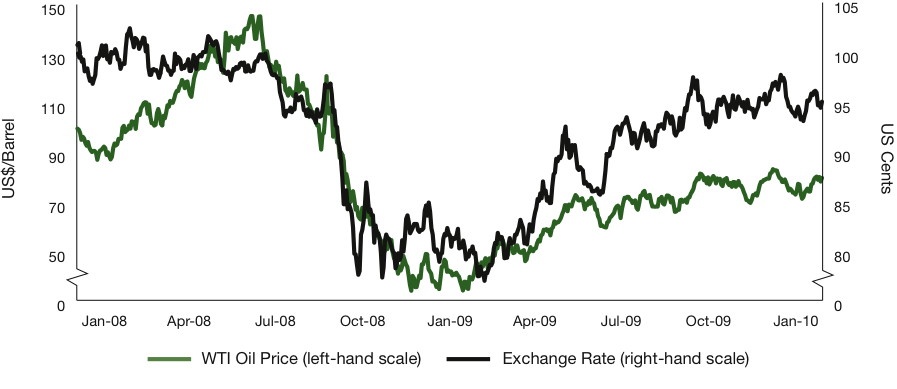

The value of the Canadian dollar tumbled alongside commodity prices early last year, but rebounded quickly in the second half of 2009 as commodity prices began to improve. The value of the Canadian dollar rose from an average of 79.4 US cents in March 2009 to 94.9 US cents in December 2009. For the year, it averaged 88.0 US cents.

CANADIAN ECONOMIC ASSUMPTIONS

| | 2009 Actual | | | 2010 | | | | 2011 | | | | 2012 | | | | 2013 | | | | 2014 | |

| Real GDP Growth (%) | (2.6 | ) | | 2.2 | | | | 3.5 | | | | 3.6 | | | | 3.2 | | | | 2.9 | |

| CPI Growth (%) | 0.3 | | | 1.6 | | | | 2.0 | | | | 2.0 | | | | 2.0 | | | | 2.0 | |

| Interest Rates (%) | | | | | | | | | | | | | | | | | | | | | |

Short-term1 | 0.33 | | | 0.27 | | | | 1.59 | | | | 3.08 | | | | 4.13 | | | | 4.69 | |

Long-term2 | 3.23 | | | 3.65 | | | | 4.07 | | | | 4.64 | | | | 4.93 | | | | 5.64 | |

| Canadian Dollar (US cents) | 88.0 | | | 95.5 | | | | 95.5 | | | | 94.5 | | | | 94.5 | | | | 94.5 | |

| | 2 | 10-year Government of Canada Bond |

30 Budget 2010-11 | Budget Summary

CANADIAN DOLLAR

Source: Bank of Canada, Ministry of Finance

Private sector forecasters disagree on how quickly and how high the value of the Canadian dollar will rise. For 2010, for example, Canadian dollar forecasts range from 94.3 US cents (IHS Global Insight) to 100.8 US cents (Scotiabank).

The Canadian dollar is assumed to average 95.5 US cents in 2010.

Alberta’s 2010 budget assumed 95.0 US cents for 2010 while the 2010 federal budget included 95.5 US cents as a private sector average.

PRIVATE SECTOR FORECASTS OF THE CANADIAN DOLLAR

(Expressed in US Cents)

| | | | 2010 | | | | | |

| IHS Global Insight | | | 94.3 | | | 93.3 | | | Mar./10 | |

| Conference Board of Canada (CBOC) | | | 95.5 | | | 96.4 | | Jan./10 | |

Centre for Spatial Economics (C4SE) | | | 94.8 | | | 93.1 | | Jan./10 | |

| TD Bank | | | 95.5 | | | 94.8 | | | Feb./10 | |

| Royal Bank of Canada | | | 99.1 | | | 97.6 | | | Mar./10 | |

| Bank of Montreal | | | 98.2 | | | 101.4 | | | Mar./10 | |

| CIBC | | | 100.7 | | | 100.8 | | | Mar./10 | |

| Scotiabank | | | 100.8 | | | 104.4 | | | Mar./10 | |

| High | | | 100.8 | | | 104.4 | | | | |

| Low | | | 94.3 | | | 93.1 | | | | |

| Private Sector Average | | | 97.3 | | | 97.7 | | | | |

| Ministry of Finance | | | 95.5 | | | 95.5 | | | | |

COMMODITY PRICES

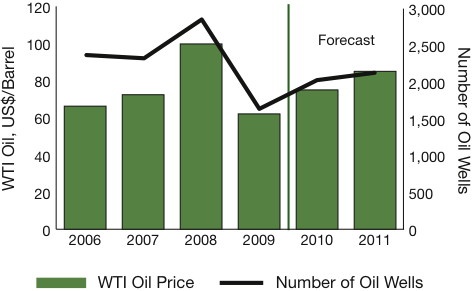

The price of West Texas Intermediate (WTI) oil is expected to average US$75.00 per barrel in 2010 and US$85.00 per barrel in 2011.

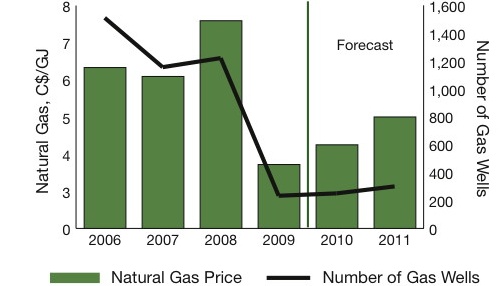

The price of natural gas is expected to average C$4.25 per gigajoule (GJ) in 2010 and C$5.00 per GJ in 2011.

NON-RENEWABLE RESOURCE PRICE ASSUMPTIONS

| | | | 2009 Actual | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

| WTI Oil (US$/barrel) | | | 62.09 | | | 75.00 | | | 85.00 | | | 87.00 | | | 90.00 | | | 92.00 | |

| Natural Gas (C$/GJ) | | | 3.72 | | | 4.25 | | | 5.00 | | | 5.50 | | | 5.75 | | | 6.00 | |

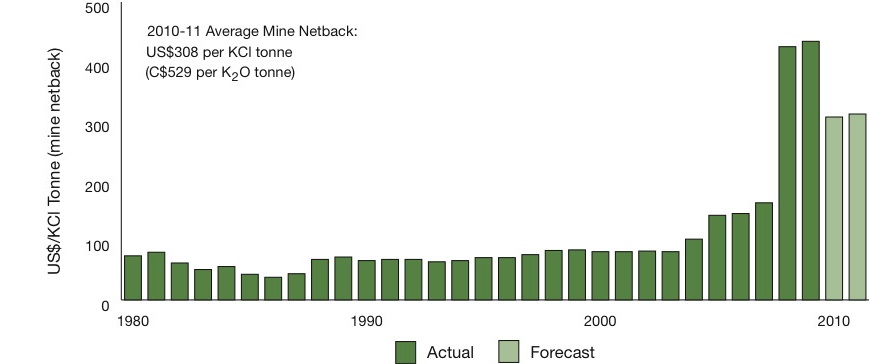

Potash1 (C$/K2O tonne) | | | 809.03 | | | 527.29 | | | 535.26 | | | 549.38 | | | 559.86 | | | 570.47 | |

Potash1 (US$/KCl tonne) | | | 434.19 | | | 307.17 | | | 311.82 | | | 316.69 | | | 322.73 | | | 328.85 | |

| 1 | The potash industry quotes prices in US dollars per KCl tonne. Provincial royalty calculations, however, are based on the Canadian dollar price per K2O tonne. |

| | Source: Ministry of Energy and Resources |

� 0; Budget Summary | Budget 2010-11 31

Oil and gas well drilling levels are expected to improve slightly this year and next due to higher prices.

OIL PRICES AND THE NUMBER OF

WELLS DRILLED IN SASKATCHEWAN

| | Source: Ministry of Energy and Resources |

NATURAL GAS PRICES AND THE NUMBER

OF WELLS DRILLED IN SASKATCHEWAN

| | Source: Ministry of Energy and Resources |

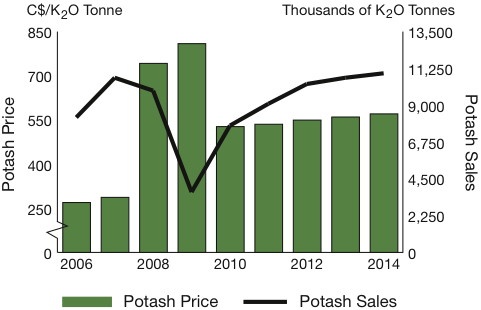

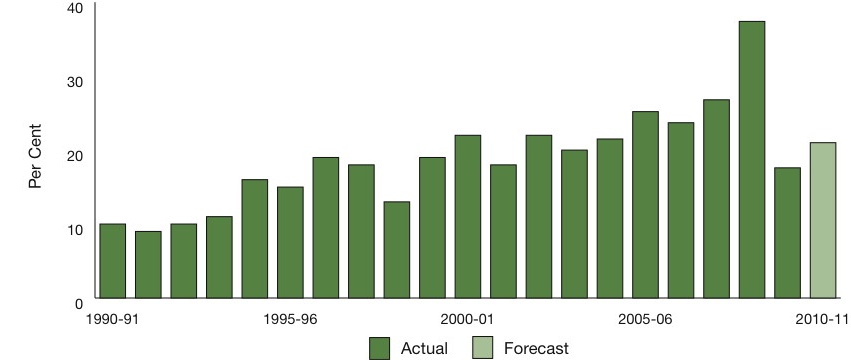

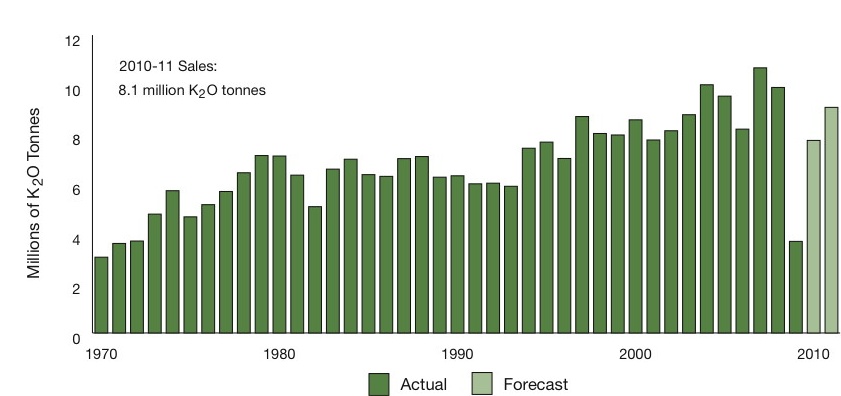

Saskatchewan potash sales fell by 63 per cent last year to roughly 3.7 million K2O tonnes, a level not seen since 1971.

POTASH PRICES AND SALES

| | Source: Ministry of Energy and Resources |

Despite this drop in demand, potash prices averaged C$809 per K2O tonne last year, roughly 10 per cent higher than in 2008.

For 2010, both domestic and offshore sales are expected to improve yet still remain well below 2008 levels.

Prices, on the other hand, are expected to ease. Recent contracts with both China and India were concluded at a price of about US$350 per KCl tonne, delivered. The current potash price assumption for 2010 is consistent with these developments.

For the most part, no significant change in major crop and livestock prices is expected for 2010.

MAJOR CROP AND LIVESTOCK PRICE ASSUMPTIONS

| | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Wheat1 (C$/tonne) | | | 162.05 | | | 163.67 | | | 174.57 | | | 186.04 | | | 191.11 | | | 180.93 | |

Canola1 (C$/tonne) | | | 403.03 | | | 412.02 | | | 417.47 | | | 418.79 | | | 415.35 | | | 396.52 | |

Barley1 (C$/tonne) | | | 157.04 | | | 151.35 | | | 154.46 | | | 163.57 | | | 162.85 | | | 155.56 | |

| Cattle (C$/cwt) | | | 82.40 | | | 83.74 | | | 84.08 | | | 85.74 | | | 85.80 | | | 85.80 | |

| Hogs (C$/ckg) | | | 125.21 | | | 134.95 | | | 131.88 | | | 132.57 | | | 133.39 | | | 131.14 | |

| | 1 | Crop price assumptions are on a crop year basis. |

| | Source: Ministry of Agriculture |

32 Budget 2010-11 | Budget Summary

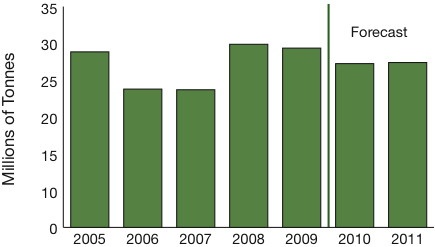

Saskatchewan farmers harvested 29.3 million tonnes in 2009, 20.9 per cent more than the 10-year average. The current forecast assumes roughly 27.0 million tonnes in 2010.

SASKATCHEWAN CROP PRODUCTION

Source: Ministry of Agriculture

SASKATCHEWAN’S ECONOMIC OUTLOOK

Saskatchewan real GDP is forecast to grow by 2.6 per cent this year and 3.3 per cent in 2011.

SASKATCHEWAN FORECAST SUMMARY

| | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

| Real GDP Growth (%) | | | (1.6 | ) | | 2.6 | | | 3.3 | | | 2.0 | | | 1.9 | | | 1.5 | |

| Nominal GDP Growth (%) | | | (12.5 | ) | | 3.8 | | | 10.0 | | | 6.2 | | | 5.4 | | | 4.5 | |

| CPI Growth (%) | | | 1.1 | 1 | | 2.1 | | | 2.8 | | | 3.1 | | | 3.2 | | | 3.4 | |

| Employment Growth (000s) | | | 7.8 | 1 | | 4.1 | | | 3.9 | | | 4.6 | | | 4.7 | | | 5.6 | |

| Unemployment Rate (%) | | | 4.8 | 1 | | 5.0 | | | 4.9 | | | 4.6 | | | 4.3 | | | 3.7 | |

| Personal Income Growth (%) | | | 1.1 | | | 1.2 | | | 5.1 | | | 4.7 | | | 5.0 | | | 5.0 | |

| Retail Sales Growth (%) | | | (2.3 | )1 | | 5.7 | | | 4.3 | | | 5.1 | | | 5.0 | | | 5.2 | |

| | Source: Statistics Canada, Ministry of Finance |

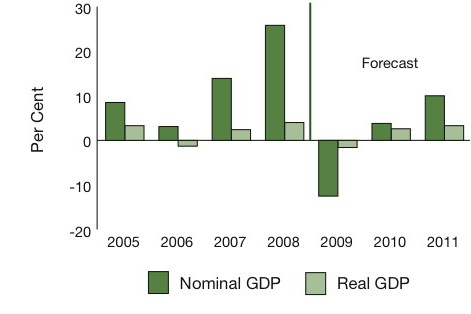

SASKATCHEWAN GDP GROWTH

| | Source: Ministry of Finance |

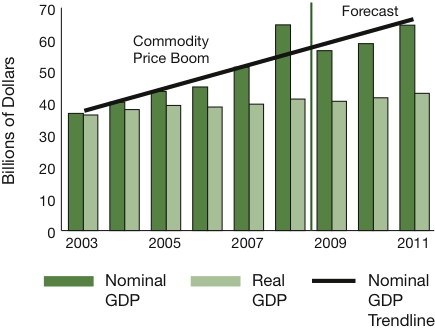

Nominal GDP is forecast to grow by 3.8 per cent this year and 10.0 per cent in 2011. The 10.0 per cent growth rate forecast for 2011 is driven by both increases in real economic activity as well as higher commodity prices.

� 0; Budget Summary | Budget 2010-11 33

SASKATCHEWAN GDP

| | Source: Ministry of Finance |

The private sector is similarly optimistic concerning Saskatchewan’s economy this year and next.

Private sector forecasts of Saskatchewan real GDP growth in 2010 range from a high of 3.6 per cent to a low of 2.3 per cent.

PRIVATE SECTOR REAL GDP GROWTH FORECASTS FOR SASKATCHEWAN

(Per Cent Change)

| | | | 2009 | | | 2010 | | | 2011 | | | Release Date | |

| IHS Global Insight | | | | (1.4 | ) | | 3.1 | | | 3.8 | | | Jan./10 | |

| CBOC | | | | (4.2 | ) | | 2.5 | | | 2.9 | | | Feb./10 | |

C4SE | | | | (0.7 | ) | | 2.4 | | | 3.2 | | | Jan./10 | |

| TD Bank | | | | (1.1 | ) | | 2.3 | | | 3.1 | | | Nov./09 | |

| Royal Bank of Canada | | | | (3.0 | ) | | 3.6 | | | 4.6 | | | Mar./10 | |

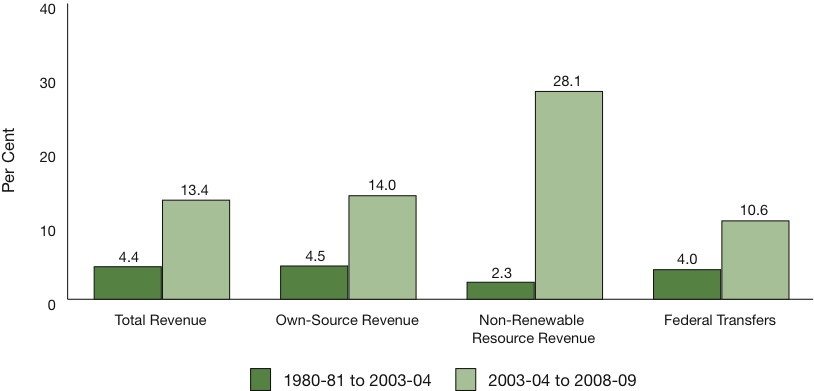

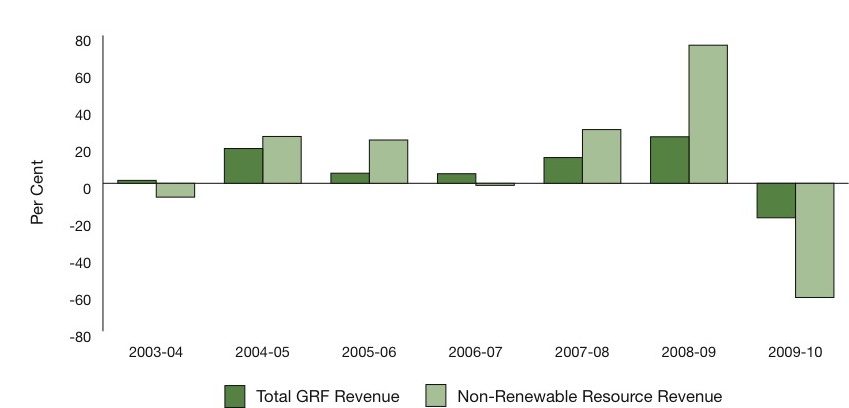

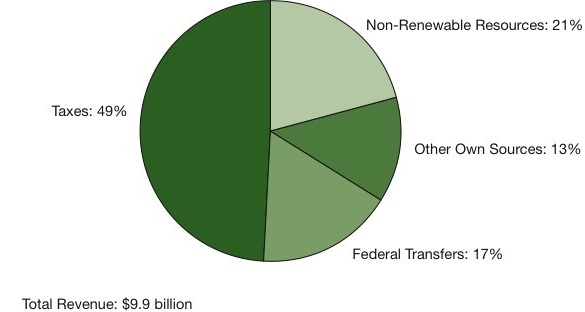

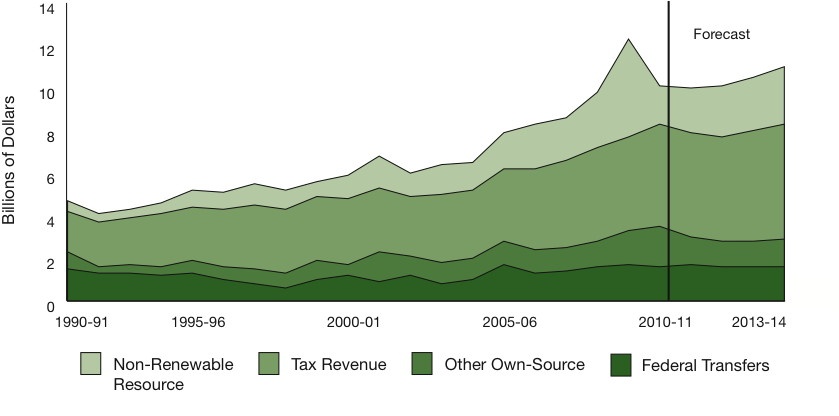

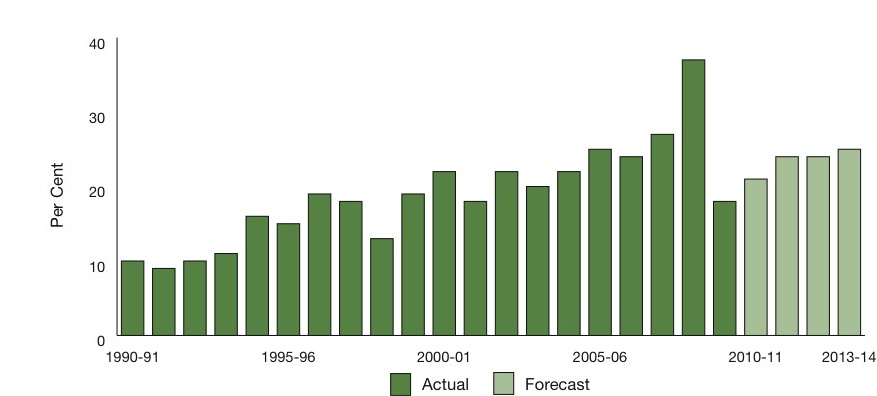

| Bank of Montreal | | | | (2.0 | ) | | 3.5 | | | 3.8 | | | Mar./10 | |