Public Accounts

Volume 1

Main Financial Statements

SASKATCHEWAN

2009-10 Public Accounts

Volume 1 - Main Financial Statements

Contents

3Letters of Transmittal

4Introduction to the Public Accounts

Financial Statement Discussion and Analysis

9 Introduction - Discussion and Analysis

10 General Revenue Fund Financial Statements - Discussion and Analysis

24 Growth and Financial Security Fund - Discussion and Analysis

25 Summary Financial Statements - Discussion and Analysis

42 Risks and Uncertainties

General Revenue Fund Financial Statements

45 Statement of Responsibility

47 Auditor’s Report

49 Financial Statements

53 Notes to the Financial Statements

61 Schedules to the Financial Statements

Summary Financial Statements

77 Statement of Responsibility

79 Auditor's Report

81 Summary Financial Statements

85 Notes to the Summary Financial Statements

96 Schedules to the Summary Financial Statements

Supplementary Information

119 Growth and Financial Security Fund

120 General Revenue Fund - Public Issue Debentures

124 General Revenue Fund - Debentures Issued to the Minister of Finance of Canada

125 Glossary of Terms

Regina, Saskatchewan

June 2010

To His Honour

The Honourable Gordon Barnhart

Lieutenant Governor of the Province of Saskatchewan

Your Honour:

I have the honour to submit the main financial statements of the Government of the Province of Saskatchewan for the fiscal year ended March 31, 2010.

Respectfully submitted,

/s/ Rod Gantefoer

Rod Gantefoer

Minister of Finance

Regina, Saskatchewan

June 2010

The Honourable Rod Gantefoer

Minister of Finance

We have the honour of presenting the main financial statements of the Government of the Province of Saskatchewan for the fiscal year ended March 31, 2010.

Respectfully submitted,

/s/ Doug Matthies /s/ Terry Paton

Doug Matthies Terry Paton

Deputy Minister of Finance Provincial Comptroller

Government of Saskatchewan – 2009-10 Public Accounts 3

Introduction to the Public Accounts

Introduction

The 2009-10 Public Accounts of the Government of Saskatchewan are prepared in accordance with the Financial Administration Act, 1993 and consist of two volumes.

Volume 1

Financial Statement Discussion and Analysis provides users of the Government’s main financial statements with an overview of the Government’s performance by presenting comparative financial highlights and variance analysis.

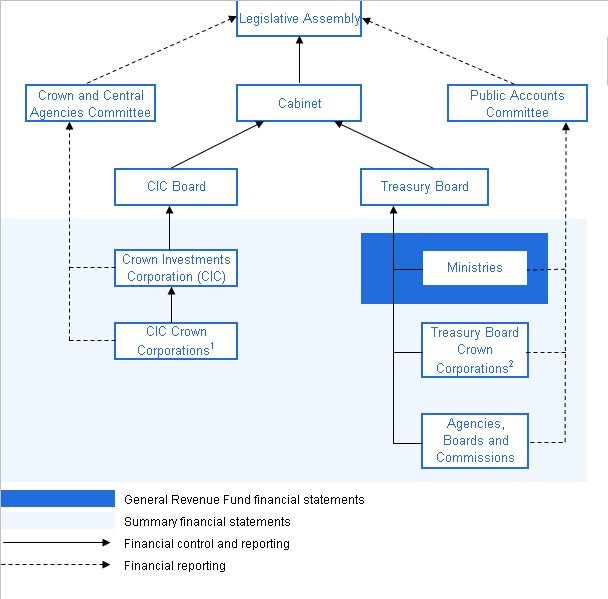

General Revenue Fund Financial Statements account for the financial transactions of the General Revenue Fund (GRF). The GRF is comprised of all Ministries of the Government. This is the fund into which all revenues are paid, unless otherwise provided for by legislation, and from which all expenses are appropriated by the Legislative Assembly.

Summary Financial Statements consolidate the financial transactions of the GRF, Crown corporations, agencies, boards and commissions. These consolidated statements provide an accounting of the full nature and extent of the financial affairs and resources controlled by the Government.

Supplementary Information contains unaudited information on:

| • | the Growth and Financial Security Fund; |

| • | GRF public issue debentures; |

| • | GRF debentures issued to the Minister of Finance of Canada; and |

| • | a glossary of terms used throughout. |

Volume 2

Volume 2 contains details on the revenue and expense of the GRF. It also provides details on capital asset acquisitions of the GRF; a listing of suppliers who received $50,000 or more for goods and services and capital assets supplied to the GRF and Revolving Funds during the fiscal year; financial information on the assets, liabilities and residual balances of pension plans and trust funds administered by the Government; a listing of remissions of taxes and fees; and information on road-use fuel tax accountability.

The Public Accounts are available on the Internet at: http://www.finance.gov.sk.ca/public-accounts/

A Compendium is also available on the Internet at: http://www.finance.gov.sk.ca/public-accounts/ that contains the financial statements of various government agencies, boards, commissions, pension plans, special purpose funds and institutions, as well as Crown corporations which are accountable to Treasury Board.

4 Government of Saskatchewan – 2009-10 Public Accounts

Introduction to the Public Accounts

Financial Reporting Structure

| 1 | Examples of CIC Crown corporations are: SaskEnergy Incorporated, Saskatchewan Power Corporation, Saskatchewan Telecommunications Holding Corporation, Saskatchewan Government Insurance and Saskatchewan Transportation Company. |

| 2 | Examples of Treasury Board Crown corporations are: Agricultural Credit Corporation of Saskatchewan, Liquor and Gaming Authority, and Saskatchewan Housing Corporation. |

Government of Saskatchewan – 2009-10 Public Accounts 5

Financial Statement Discussion and Analysis

Financial Statement Discussion and Analysis

Financial Statement Discussion and Analysis

The purpose of the Financial Statement Discussion and Analysis is to provide users of the Government’s main financial statements with an overview of the Government’s financial performance, as well as the Government’s accountability for the resources entrusted to it. This information should be read in conjunction with the General Revenue Fund and Summary financial statements. The Government is responsible for the integrity and objectivity of this discussion and analysis.

General Revenue Fund (GRF) Financial Statements

| * | How has the Government performed as compared to the Budget Estimates? |

The GRF is the fund where all public monies are deposited to and disbursed from, as authorized by the Legislative Assembly. Exceptions to this principle must be authorized by law. Each year the Government presents a Budget for the GRF to the Legislative Assembly along with a detailed financial plan for the GRF called the Estimates. The GRF financial statements report on the performance of the Government against the Estimates. As a result, budget-to-actual analysis on the Government’s revenue and expenses can be found in the GRF section of the Financial Statement Discussion and Analysis.

Summary Financial Statements (SFS)

| * | How has the Government performed as a whole? |

The SFS provide an accounting of the full nature and extent of the financial affairs and resources controlled by the Government. The SFS include the financial results of the GRF, Crown corporations, agencies, boards and commissions.

Government of Saskatchewan – 2009-10 Public Accounts 9

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Financial Highlights

| | | | | | | | | | |

| (millions of dollars) | | 2010 | | | 2009 | |

| | | Budget 1 | | | Actual 2 | | | Actual 2 | |

| | | | | | | | | | |

| Revenue | | | 10,661 | | | | 10,267 | | | | 12,325 | |

| Expense | | | 10,245 | | | | 10,099 | | | | 10,355 | |

| Pre-transfer surplus | | | 416 | | | | 168 | | | | 1,970 | |

| Transfer to the Growth and Financial Security Fund | | | (208 | ) | | | (84 | ) | | | (985 | ) |

| Transfer from the Growth and Financial Security Fund | | | 217 | | | | 341 | | | | 1,404 | |

| Net transfer from the Growth and Financial Security Fund | | | 9 | | | | 257 | | | | 419 | |

| Surplus | | | 425 | | | | 425 | | | | 2,389 | |

| | | | | | | | | | | | | |

| Financial assets | | | - | | | | 3,693 | | | | 3,199 | |

Less: Government general debt | | | - | | | | (4,140 | ) | | | (4,145 | ) |

| Other liabilities | | | - | | | | (3,191 | ) | | | (2,902 | ) |

| Net debt | | | - | | | | (3,638 | ) | | | (3,848 | ) |

Plus: Non-financial assets | | | - | | | | 3,092 | | | | 2,877 | |

| Accumulated Deficit | | | - | | | | (546 | ) | | | (971 | ) |

| | | | | | | | | | | | | |

| Growth and Financial Security Fund Balance | | | 1,206 | | | | 958 | | | | 1,215 | |

| 1 | The Budget Estimates do not include a statement of financial position. |

| 2 | The Provincial Auditor’s report indicates that, in his opinion, there are certain adjustments required to the General Revenue Fund financial statements. |

Surplus

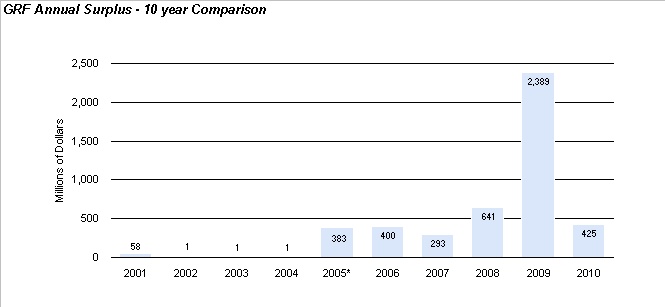

The 2009-10 General Revenue Fund (GRF) financial statements report a pre-transfer surplus of $168 million. After a $257 million net transfer from the Growth and Financial Security Fund (GFSF), the financial statements reported a $425 million GRF surplus. This surplus is unchanged from the budget estimate and is $1,964 million lower than the GRF surplus reported in 2008-09.

The $168 million pre-transfer surplus was a $248 million decrease from the budgeted pre-transfer surplus as the result of a $394 million decrease in revenue partially offset by a $146 million reduction in expense. As a result of this decrease in the pre-transfer surplus, the net transfer from the GFSF to the GRF increased by $248 million, from a budget estimate of $9 million to an actual transfer of $257 million, in order to maintain the budgeted $425 million GRF surplus.

Growth and Financial Security Fund

The Government’s Growth and Financial Security Fund, established to safeguard Saskatchewan’s future, has a balance of $958 million at March 31, 2010. This is after an $84 million transfer from the GRF, representing half of the GRF pre-transfer surplus for the year, and a $341 million transfer back to the GRF to assist in financing government-owned capital.

Debt

Government general debt at March 31, 2010 is $4.14 billion, maintaining the level of debt achieved last year which had the largest decrease in debt in Saskatchewan’s history.

10 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Surplus

The GRF annual results for the past ten years were as follows:

| * | Since 2004-05, tangible capital assets have been capitalized and expensed over their useful lives rather than being fully expensed in the year of acquisition. |

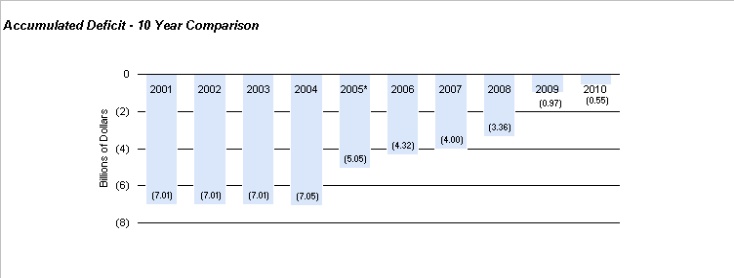

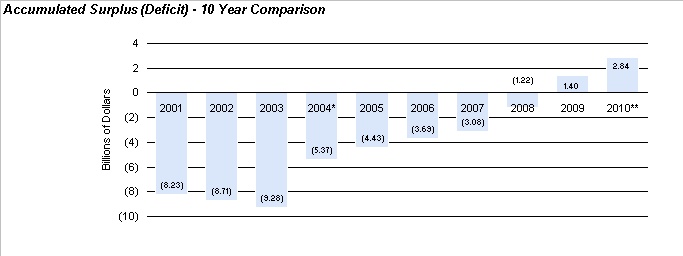

Accumulated Deficit

The accumulated deficit is the sum of all the annual results reported to date by the Government. An accumulated deficit indicates that a government has financed past annual operating deficits by borrowing. In 2009-10, the GRF accumulated deficit improved from $971 million to $546 million.

The GRF accumulated deficit for the past ten years was as follows:

| * | Since 2004-05, tangible capital assets have been capitalized and expensed over their useful lives rather than being fully expensed in the year of acquisition. |

Government of Saskatchewan – 2009-10 Public Accounts 11

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Revenue

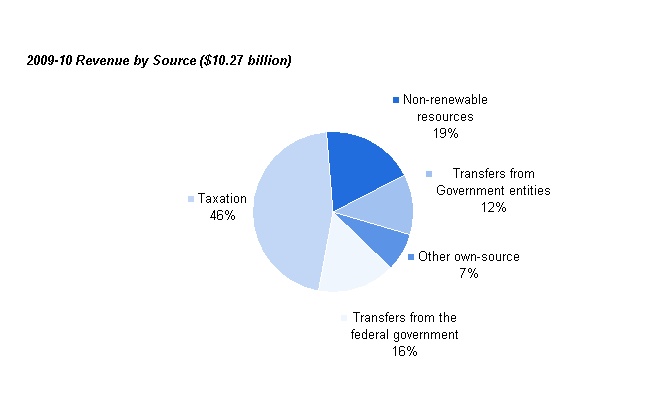

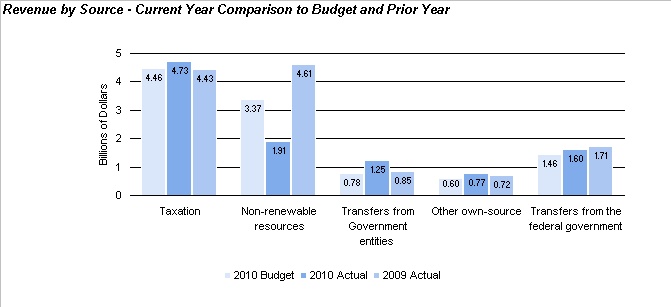

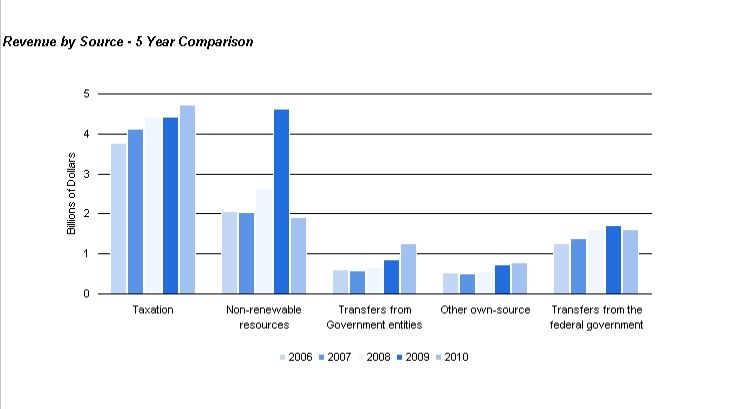

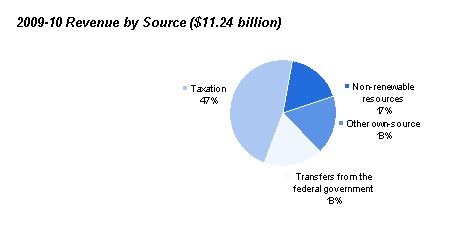

The GRF sources of revenue for 2009-10 were as follows:

12 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Revenue (continued)

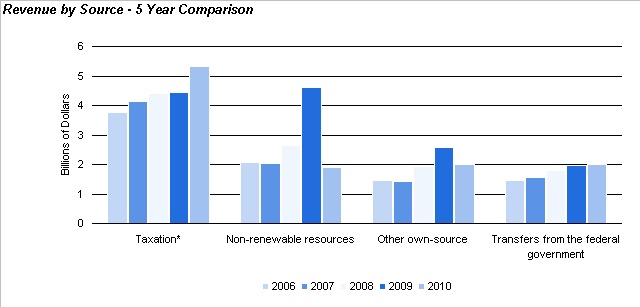

In the last five fiscal years, the GRF revenue was derived from the following sources:

Total revenue for 2009-10 was $10.27 billion. This was $394 million, or 3.7 per cent, lower than budgeted primarily due to lower non-renewable resources revenue, partially offset by increases across all other own-source revenue categories and federal transfers. Compared to 2008-09, total revenue decreased $2.06 billion, or 16.7 per cent. The decrease from the previous year is primarily due to lower revenue from non-renewable resources and transfers from the federal government, partially offset by increases in taxation revenue, other own-source revenue and transfers from Government entities.

Taxation Revenue

Taxation revenue was $4.73 billion in 2009-10, $273 million higher than budgeted. The increase was primarily due to higher revenue from corporation income tax and individual income tax, partially offset by lower Provincial Sales Tax revenue. Compared to 2008-09, taxation revenue increased by $301 million.

Corporation income tax (CIT) revenue was $257 million higher than budgeted. The increase is primarily due to stronger-than-anticipated assessments for 2008 that resulted in a larger-than-budgeted prior-year adjustment payment, as well as an amendment to the Canada-Saskatchewan Tax Collection Agreement that resulted in the acceleration of 2010 instalment payments from the federal government. CIT revenue was $289 million higher than 2008-09 primarily due to an increase in the prior-year adjustment payments between the two years and the acceleration of 2010 instalment payments.

Individual income tax (PIT) revenue was $88 million higher than budgeted primarily due to stronger final assessment data for the 2008 taxation year that resulted in a larger-than-budgeted prior-year adjustment payment and an upward revision to the 2009 taxable income base. PIT revenue was $47 million higher than 2008-09, reflecting growth in the taxable income base.

Provincial Sales Tax (PST) revenue was $72 million lower than budgeted primarily due to lower-than-budgeted economic activity. Compared to 2008-09, PST revenue decreased by $25 million.

Government of Saskatchewan – 2009-10 Public Accounts 13

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Revenue (continued)

Non-renewable Resources Revenue

Non-renewable resources revenue was $1.91 billion in 2009-10, a decrease of $1.46 billion from budget primarily due to lower potash revenue, partially offset by higher oil royalties and Crown land sales. Compared to 2008-09, revenue was $2.70 billion lower as the result of declines in potash, Crown land sales and oil revenue.

Potash revenue was negative $184 million as refunds of revenue received in the final quarter of 2008-09 exceeded 2009-10 revenue collections. This was due to a significant decline in sales volumes and prices in 2009.

On a fiscal-year basis, potash sales volumes declined from the budget assumption of 10.3 million K2O tonnes to 4.7 million K2O tonnes. The average mine netback (price) decreased from the budget assumption of 556 U.S. dollars per KCl tonne to 421 U.S. dollars per KCl tonne ($1,071 to $751 per K2O tonne).

Compared to 2008-09, potash revenue decreased $1.55 billion primarily due to lower sales volumes.

Oil revenue was $1.29 billion in 2009-10, an increase of $722 million from budget primarily due to higher West Texas Intermediate (WTI) oil prices, partially offset by a higher-than-budgeted exchange rate. Compared to 2008-09, oil revenue was $321 million lower due to lower oil prices.

WTI oil prices averaged 70.71 U.S. dollars per barrel in 2009-10, 21.96 U.S. dollars per barrel higher than the budget assumption of 48.75 U.S. dollars. In 2008-09, WTI oil prices averaged 85.94 U.S. dollars.

The Canadian dollar averaged 91.9 U.S. cents in 2009-10, 6.8 U.S. cents higher than the budget assumption of 85.1 U.S. cents. In 2008-09, the dollar averaged 89.5 U.S. cents.

Crown land sales revenue was $151 million, $24 million higher than budgeted, but $777 million lower than 2008-09. The amount of Crown land sold decreased 49 per cent in 2009-10 and the average price paid per hectare decreased from $1,289 in 2008-09 to $409 in 2009-10.

Transfers from Government Entities

Transfers from Government entities were $1.25 billion in 2009-10, an increase of $472 million from budget primarily due to a higher-than-budgeted special dividend from the Crown Investments Corporation of Saskatchewan (CIC). Compared to 2008-09, transfers increased $398 million largely as the result of increases in both the regular and special CIC dividends.

Other Own-Source Revenue

Other own-source revenue was $770 million, an increase of $172 million from budget. The change from budget was primarily due to higher interest, premium, discount and exchange revenue, increased other revenue due to larger-than-budgeted refunds of prior-year expense, and lower sales, services and service fees revenue. Compared to 2008-09, other own-source revenue increased $49 million.

In addition, commercial operations accounted for $88 million of the increase from budget. Ministries with commercial operations are allowed to re-spend the revenues earned through these operations. Accordingly, the budget expense is shown net of revenues in the Estimates. In the Public Accounts revenues and expenses are reported on a gross basis to provide accountability for these operations. This results in variances between the budget and actual revenue being shown in the Public Accounts.

Transfers from the Federal Government

Federal transfers were $1.60 billion in 2009-10, $146 million higher than budgeted primarily due to increased federal funding from several infrastructure and stimulus funding streams, partially offset by a decrease in the Canada Health Transfer. Compared to the prior year, total transfers from the federal government declined by $105 million.

14 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Expense

Expenses are reported by ministry in the GRF Statement of Operations. Because the Government’s expense budget for the GRF is organized by ministry, this best provides a comparison of actual to budget. Schedules to the GRF financial statements also disclose expense by theme and by object, which provide information on the purpose for which the expenses have been incurred. These best allow for comparison from year to year as programs maintain the same theme and object when the Government undergoes reorganization of ministries.

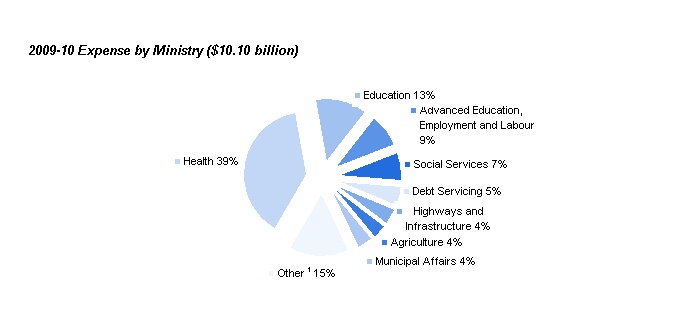

Expense by Ministry

The GRF expense by ministry for 2009-10 was as follows:

| 1 | Key components of “other” include Corrections, Public Safety and Policing (3%), Finance (3%) and Environment (2%). |

Comparison to Budget

Total expense was $146 million lower than budget. Key decreases occurred in the following ministries:

| • | Health – a $141 million decrease, primarily due to allowing regional health authorities to use long-term care capital funds to replace operating grants from the Ministry of Health and the deferral of capital funding related to the Children’s Hospital. These savings were partially offset by utilization program increases, continued development of the Electronic Health Record and H1N1 preparedness; |

| • | Agriculture – a $110 million decrease, primarily due to a decrease in Crown Land Sale Incentive Program, AgriStability, AgriInvest and Crop Insurance Program costs; |

| • | Education – a $45 million decrease, primarily due to reduced requirements for the Teachers’ Superannuation Plan; |

| • | Environment – a $28 million decrease, primarily due to savings resulting from a lower-than-average fire season; and |

| • | Finance Debt Servicing – a $23 million decrease, primarily due to lower in-year borrowing requirements and lower interest rates. |

The above decreases are partially offset by the following key increases:

| • | Municipal Affairs – a $70 million increase, primarily due to increased spending under the Building Canada Fund and Municipal Infrastructure Grants programs; and |

| • | Advanced Education, Employment and Labour – a $26 million increase, primarily related to federal government stimulus funding provided through the Knowledge Infrastructure Program and labour market programs. |

In addition, commercial operations accounted for an $87 million expense increase. Ministries with commercial operations are allowed to re-spend the revenues earned through these operations. Accordingly, the budget expense is shown net of revenues in the Estimates. In the Public Accounts, revenues and expenses are reported on a gross basis to provide accountability for these operations. This results in variances between the budget and actual expense being shown in the Public Accounts.

Government of Saskatchewan – 2009-10 Public Accounts 15

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Expense (continued)

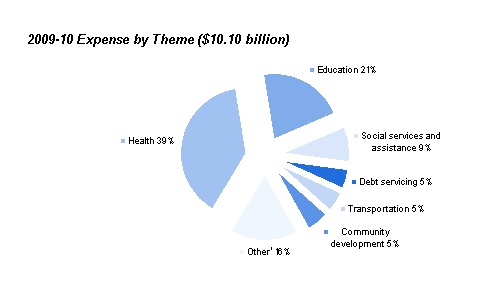

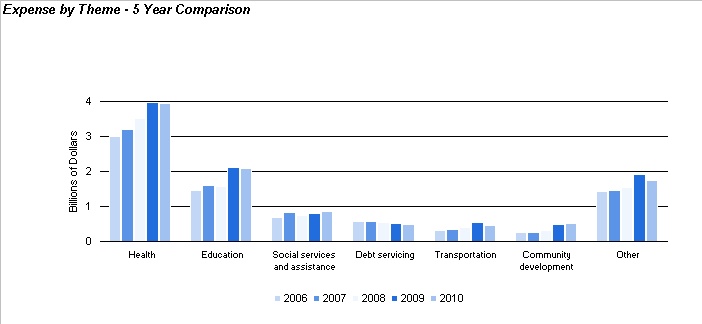

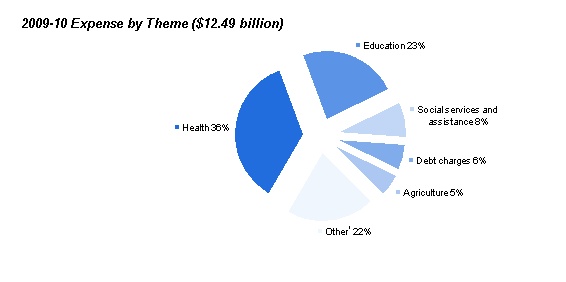

Expense by Theme

The GRF expense by theme for 2009-10 was as follows:

| 1 | Key components of “other” include protection of persons and property (4%), agriculture (4%), economic development (2%) and environment and natural resources (2%). |

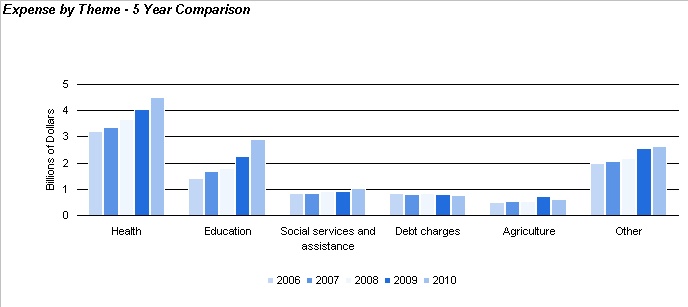

In the last five fiscal years, the GRF expense by theme was as follows:

16 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Expense (continued)

Comparison to Previous Year

Total expense was $256 million lower than in 2008-09. Key decreases pertain to the following themes:

| • | Environment and natural resources – a $245 million decrease, primarily due to the removal of one-time federal funding provided to the CIC in 2008-09 for the Carbon Capture project; |

| • | Transportation – a $77 million decrease, primarily related to funding the provincial portion of the south Saskatoon bridge in 2008-09; |

| • | Agriculture – a $51 million decrease, mainly related to a one-time 2008-09 cattle and hog support program that was no longer in place in 2009-10; |

| • | Health – a $42 million decrease, primarily due to lower facilities and equipment capital funding requirements; and |

| • | Debt servicing – a $40 million decrease, primarily due to lower debt levels and lower long-term borrowing costs. |

| | These key decreases were partially offset by increases in the following themes: |

| • | Social services and assistance – a $71 million increase, primarily due to higher utilization in child and family services, disability services and various income support programs; |

| • | Protection of persons and property – a $33 million increase related to additional funding for adult corrections and community services as a result of higher incarceration rates, increased funding for the expansion at the Saskatoon Provincial Correctional Centre and salary and operating increases for the Royal Canadian Mounted Police; and |

| • | Other – a $62 million increase, primarily related to the conversion of the Research and Development Tax Credit to a refundable tax credit, executive government’s settlement of the non-permanent pension liability lawsuit, and increases for employee benefits and information technology. |

Government of Saskatchewan – 2009-10 Public Accounts 17Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Expense (continued)

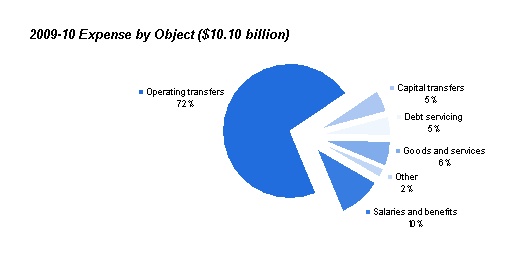

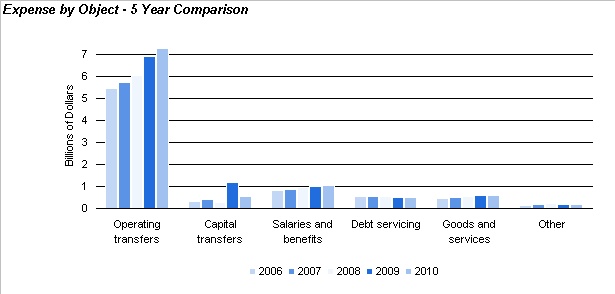

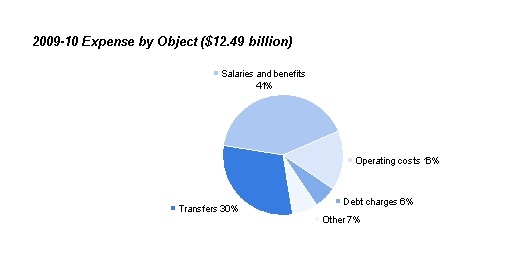

Expense by Object

The GRF expense by object for 2009-10 was as follows:

In the last five fiscal years, the GRF expense by object was as follows:

18 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Public Debt and Debt Servicing Costs

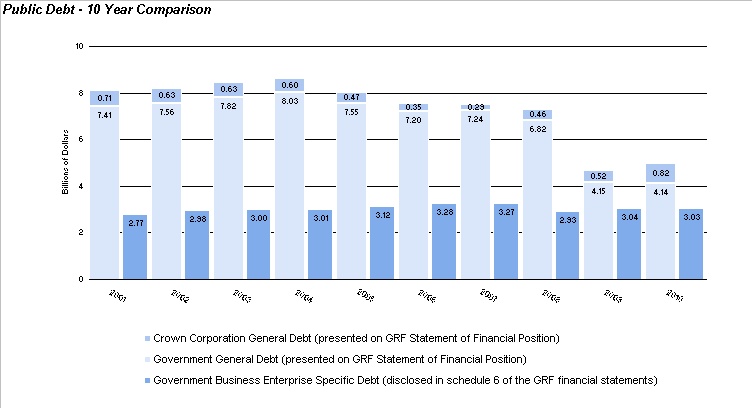

Public Debt

| | Public debt consists of gross debt net of sinking funds and includes: |

| • | government general debt, which is debt issued by the GRF to fund government spending; |

| • | Crown corporation general debt, which is debt issued by the GRF and subsequently loaned to a Crown corporation; and |

| • | government business enterprise specific debt, which is debt of self-sufficient Crown corporations issued by the GRF specifically on their behalf. The Government expects to realize the receivables from the government business enterprises and settle the external debt simultaneously. |

The Government has undertaken initiatives to significantly reduce the government general debt outstanding and the costs to service this debt. The Government’s debt reduction strategy includes the following components:

| • | paying down existing debt; |

| • | transferring debt borrowed for general government purposes to Crown corporations to meet their borrowing requirements; and |

| • | increasing sinking fund contributions. |

This strategy has resulted in a $2.68 billion reduction in government general debt since April 1, 2008. At March 31, 2010, government general debt was $4.14 billion.

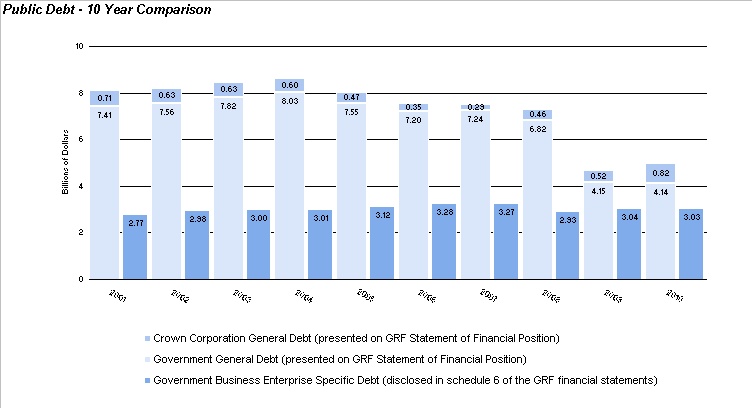

The GRF public debt for the past ten years was as follows:

Since 2000-01, the government general debt reported on the GRF Statement of Financial Position has declined by $3.27 billion from $7.41 billion to $4.14 billion.

Crown corporation general debt and government business enterprise specific debt have remained relatively constant since 2000-01 and at March 31, 2010 include $2,516 million for Saskatchewan Power Corporation, $817 million for SaskEnergy Incorporated and $285 million for Saskatchewan Telecommunications Holding Corporation.

Government of Saskatchewan – 2009-10 Public Accounts 19Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Public Debt and Debt Servicing Costs (continued)

Debt Servicing Costs

The GRF incurs interest and other costs to service general debt. The amount of these costs is determined by the amount of general debt and the interest rate attached to that debt. The average effective interest rate on gross debt during 2009-10 was 6.6 per cent.

The Government’s debt reduction strategy has resulted in a decrease in debt servicing costs and an increase in interest revenue. While paying down existing debt reduces the cost of debt servicing, contributing to sinking funds increases interest earnings.

Net interest cost is calculated as debt servicing costs less interest earnings. It is a measure of the positive impact on the Province’s operations from reducing general debt.

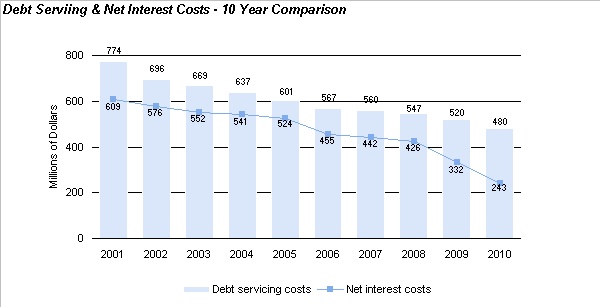

The GRF has reported the following debt servicing costs and net interest costs over the past ten years:

Since 2000-01, both the amount of general debt and the level of interest rates have declined. As a result, the debt servicing costs reported by the GRF have decreased from $774 million in 2000-01 to $480 million in 2009-10. At the same time, interest revenue has increased, resulting in a reduction in net interest costs from $609 million in 2000-01 to $243 million in 2009-10.

20 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Public Debt and Debt Servicing Costs (continued)

Credit Rating

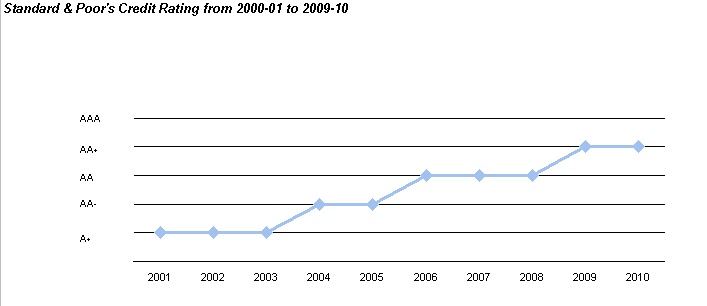

The improvement in the Government’s finances since 2000-01 has led to a series of upgrades in its credit ratings. One of the world’s leading credit rating agencies is Standard & Poor’s. Its credit rating for the Province of Saskatchewan since 2000-01 is shown below.

Saskatchewan holds the second-highest possible credit rating from two of the three credit rating agencies and holds the third-highest rating from the third agency. The credit ratings for all jurisdictions are as follows:

| Credit Ratings - March 2010 | | | |

| | | | | |

| | Jurisdiction | Moody's Investors Service Inc. | Standard and Poor's | Dominion Bond Rating Service |

| | British Columbia | Aaa | AAA | AA(high) |

| | Alberta | Aaa | AAA | AAA |

| | Saskatchewan | Aa1 | AA+ | AA |

| | Manitoba | Aa1 | AA | A(high) |

| | Ontario | Aa1 | AA- | AA (low) |

| | Quebec | Aa2 | A+ | A(high) |

| | New Brunswick | Aa2 | AA- | A(high) |

| | Nova Scotia | Aa2 | A+ | A* |

| | Prince Edward Island | Aa2 | A* | A(low) |

| | Newfoundland | Aa2 | A* | A |

| | | | | |

The rating agencies assign letter ratings to borrowers. The major A bracket categories, in descending order of credit quality, are: AAA/Aaa; AA/Aa; A. The ‘1’, ‘2’, ‘3’, ‘high’, ‘low’, ‘-’, and ‘+’ modifiers show relative standing within the major categories. For example, AAA exceeds AA, Aa1 exceeds Aa2 and AA exceeds AA-.* positive outlook or trend.

Government of Saskatchewan – 2009-10 Public Accounts 21Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Investment in Infrastructure

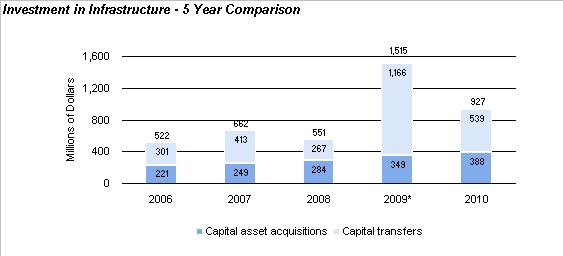

The Government invests in infrastructure in two ways:

| • | by providing grants to third parties for capital purposes. This includes grants for universities and hospitals; and |

| • | by investing in government-owned capital, such as highways. |

During 2009-10, $927 million was invested in infrastructure. The Government’s investment in infrastructure over the past five years is presented below.

* Capital transfers for 2009 include $154 million which was subsequently permitted to be used by recipients for operations.

22 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

General Revenue Fund Financial Statements

Net Debt

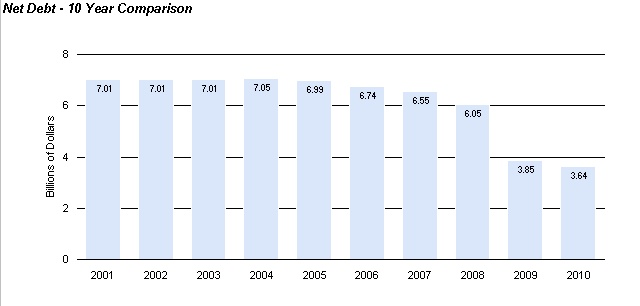

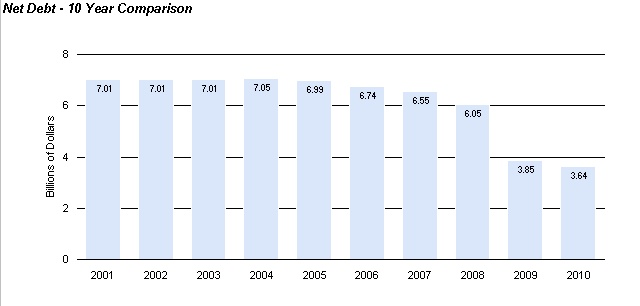

Net debt is one measure of the amount of debt that has been left to future generations. It is the difference between the GRF liabilities and financial assets.

During 2009-10, net debt decreased by $210 million. This decrease can be attributed to the GRF surplus of $425 million, partially offset by amounts invested in tangible capital assets and other non-financial assets.

Since 2000-01, the net debt of the GRF has declined from $7.01 billion to $3.64 billion, as follows:

A decreasing net debt is an indicator of increased flexibility over future spending.

Government of Saskatchewan – 2009-10 Public Accounts 23Financial Statement Discussion and Analysis

Growth and Financial Security Fund

The Growth and Financial Security Fund (GFSF) was established during 2008-09 under The Growth and Financial Security Act. The Growth and Financial Security Act requires:

| • | the Government to balance the GRF budget each fiscal year; |

| • | the annual preparation of four-year financial plans and public debt management plans; and |

| • | that 50 per cent of the annual surplus in the GRF be transferred to the GFSF. |

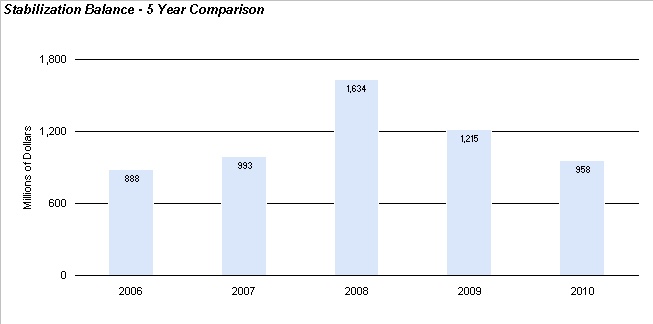

The stabilization balance for the past five years was as follows:

The balance in the GFSF at March 31, 2010 was $958 million. This represents a $257 million decrease from the previous year, which is the net result of:

| • | a transfer to the fund of $84 million, representing 50 per cent of the GRF pre-transfer surplus; and |

| • | a transfer from the fund of $341 million to assist in financing government-owned capital. |

| Growth and Financial Security Fund - Current Year Activity | | | |

| (millions of dollars) | | 2010 | |

| | | | |

| Opening balance | | | 1,215 | |

Transfers from the GRF (50 per cent of GRF pre-transfer surplus) | | | 84 | |

| Transfers to the GRF | | | (341 | ) |

| Closing balance | | | 958 | |

| | | | | |

24 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Financial Highlights

| | | | | | | |

| (millions of dollars) | | 2010 | | | 2009 | |

| | | | | | | |

| | | | | | | |

| Revenue | | | 11,243 | | | | 13,589 | |

| Expense | | | 12,486 | | | | 11,306 | |

| (Deficit) surplus from government service organizations | | | (1,243 | ) | | | 2,283 | |

| Income from government business enterprises | | | 834 | | | | 685 | |

| (Deficit) Surplus | | | (409 | ) | | | 2,968 | |

| | | | | | | | | |

| Financial assets | | | 10,355 | | | | 9,553 | |

Less: Liabilities | | | (13,914 | ) | | | (13,077 | ) |

| Net debt | | | (3,559 | ) | | | (3,524 | ) |

Plus: Non-financial assets | | | 6,395 | | | | 4,921 | |

| Accumulated Surplus | | | 2,836 | | | | 1,397 | |

| | | | | | | | | |

Reporting Entity

The Summary financial statements (SFS) include the financial activities of organizations controlled by the Government. These organizations are segregated into two classifications, government service organizations (GSOs) and government business enterprises (GBEs). GBEs are self-sufficient government organizations that have the financial and operating authority to sell goods and services to individuals and organizations outside the government reporting entity as their principal activity. All other organizations, including the General Revenue Fund, are GSOs. A complete listing of the organizations included in the government reporting entity is provided in schedule 20 of the SFS.

During 2009-10, amendments to The Education Act, 1995 resulted in a change in the relationship between the Government and the Boards of Education of Saskatchewan School Divisions (Boards of Education), such that the Boards of Education now meet the criteria for inclusion in the government reporting entity. As a result, 29 Boards of Education have been included in the SFS effective April 1, 2009. Comparative figures have not been restated.

The inclusion resulted in a $1.58 billion increase to the April 1, 2009 accumulated surplus, the net effect of increases of $708 million and $1,173 million respectively for financial and non-financial assets held by the Boards of Education, and $304 million in Board of Education liabilities. The impact on current-year operations of including the Boards of Education is a $160.0 million reduction in the deficit.

Deficit

Comparison to Previous Year

The deficit of $409 million in 2009-10 was $3.38 billion lower than the $2.97 billion surplus reported in 2008-09.

This decrease was primarily due to a $3.53 billion decline in the net operating results of GSOs. Revenues from GSOs decreased in 2009-10 by $2.35 billion, primarily due to decreases in non-renewable resources revenue ($2,702 million) and the prior-year gain on the sale of Saskferco Products Inc. ($680 million), partially offset by an increase in taxation revenue ($895 million). At the same time, expenses for GSOs increased in 2009-10 by $1.18 billion, primarily in education ($646 million) and health ($491 million).

There was a $149 million increase in income from GBEs. This increase was mainly the result of an improvement in the net profits of utility sales.

Government of Saskatchewan – 2009-10 Public Accounts 25

Financial Statement Discussion and Analysis

Summary Financial Statements

Financial Highlights (continued)

Comparison to Budget

The Government prepares a Summary Financial Budget, which is based on the entities that are included in the SFS. In this budget, the categorization of organizations is aligned with the Cabinet Committee (CIC Board or Treasury Board) that examines an organization’s budget. There is also a category for Not-for-Profit Insurance organizations, which are intended to be actuarially sound over the long term. As the categorization is different than that used for reporting purposes in the SFS, actual results are most easily compared to budget based on the annual surplus/deficit.

| | | | | | | |

| 2009-10 Deficit - Comparison to Budget | | | | | | |

| (millions of dollars) | | 2010 | |

| | | Estimated 1 | | | Actual 1 | |

| | | | | | | |

| Treasury Board Organizations | | | | | | |

| General Revenue Fund | | | 425 | | | | 425 | |

| Growth and Financial Security Fund | | | (9 | ) | | | (257 | ) |

| Other Treasury Board Organizations | | | 392 | | | | 434 | |

Less: Dividends included in General Revenue Fund surplus | | | (441 | ) | | | (437 | ) |

| Adjustment for pension liability accrual | | | (389 | ) | | | (423 | ) |

| | | | (22 | ) | | | (258 | ) |

| CIC Board Organizations | | | 243 | | | | 330 | |

Less: Dividends included in General Revenue Fund surplus | | | (295 | ) | | | (755 | ) |

| | | | (74 | ) | | | (683 | ) |

| Not-for-Profit Insurance Organizations | | | 49 | | | | 274 | |

| Deficit | | | (25 | ) | | | (409 | ) |

| | | | | | | | | |

1 Presented on the basis of the Summary Financial Budget.

The 2009-10 SFS report a deficit of $409 million, $384 million higher than the $25 million budget deficit.

This higher-than-budget deficit was largely due to budget to actual variances in the General Revenue Fund (GRF). For example, non-renewable resource revenue was lower than expected as a result of an unprecedented decline in potash sales. See the GRF financial statement discussion and analysis for further information.

Net Debt

Net debt is the difference between the liabilities and financial assets reported on the Summary Statement of Financial Position. Net debt is an indicator of the amount of future revenues that will be required to pay for past transactions and events. In 2009-10, the SFS net debt increased by $35 million to $3.56 billion.

Accumulated Surplus

The accumulated surplus is the sum of all the annual results reported to date by the Government. The accumulated surplus of $2.84 billion represents a $1.44 billion improvement over the $1.40 billion accumulated surplus reported in 2008-09. This improvement is mainly due to a $1.58 billion increase to the accumulated surplus on April 1, 2009, the impact of the first-time inclusion of the Boards of Education. An accumulated surplus indicates that a government has net resources that can be used to provide future services.

26 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Surplus/Deficit

The SFS have reported the following results over the past ten years:

| * | Since 2003-04, tangible capital assets have been capitalized and expensed over their useful lives rather than being fully expensed in their year of acquisition. |

Accumulated Surplus

The SFS accumulated surplus (deficit) for the past ten years was as follows:

| * | Since 2003-04, tangible capital assets have been capitalized and expensed over their useful lives rather than being fully expensed in their year of acquisition. |

| ** | Includes a $1.58 billion increase for the first-time inclusion of the Boards of Education. |

Government of Saskatchewan – 2009-10 Public Accounts 27Financial Statement Discussion and Analysis

Summary Financial Statements

Revenue

The SFS sources of revenue for 2009-10 were as follows:

In the last five fiscal years, the SFS revenue was derived from the following sources:

* The increase in 2010 taxation revenue is primarily due to the impact of recording education property tax resulting from the first-time inclusion of Boards of Education.

28 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Expense

Expense by Theme

The SFS expense by theme for 2009-10 was as follows:

| 1 | Key components of “other” include community development (4%), transportation (4%) and protection of persons and property (4%). |

In the last five fiscal years, the SFS expense by theme was as follows:

Government of Saskatchewan – 2009-10 Public Accounts 29Financial Statement Discussion and Analysis

Summary Financial Statements

Expense (continued)

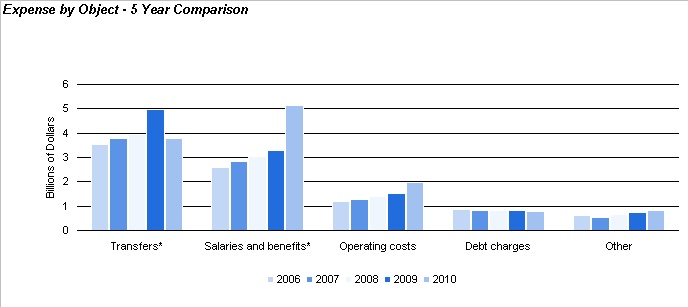

Expense by Object

In addition to reporting expense by theme, the SFS also present expense by object, or major type of expense. The SFS expense by object for 2009-10 was as follows:

In the last five fiscal years, the SFS expense by object was as follows:

* The increase in 2010 salaries and benefits expense and corresponding decrease in transfers expense are primarily due to the impact of the first-time inclusion of Boards of Education.

30 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Income from Government Business Enterprises

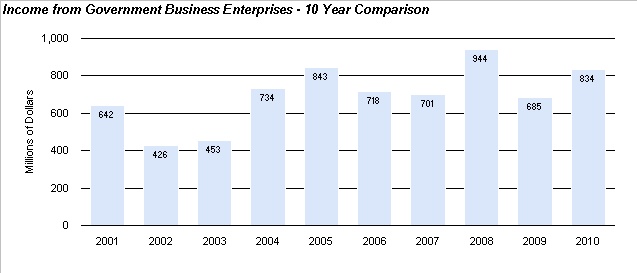

Government business enterprises are independently managed, profit-oriented organizations that are controlled by the Government. The SFS reported the following income from government business enterprises over the past ten years:

Government of Saskatchewan – 2009-10 Public Accounts 31Financial Statement Discussion and Analysis

Summary Financial Statements

Public Debt and Debt Charges

Public Debt

Public debt consists of gross debt net of sinking funds and includes:

| • | general debt, which is: |

| • | debt issued by the GRF and other government service organizations; and |

| • | debt issued by government service organizations and subsequently loaned to government business enterprises; and |

| • | government business enterprise specific debt, which is debt issued by government service organizations specifically on behalf of government business enterprises where the Government expects to realize the receivables from the government business enterprises and settle the external debt simultaneously. |

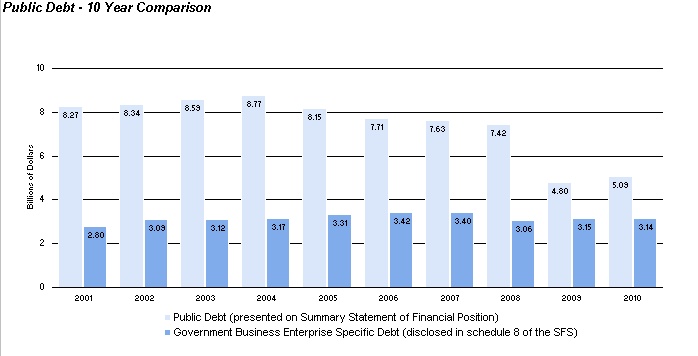

Public debt on the Summary Statement of Financial Position is presented net of government business enterprise specific debt. The SFS public debt for the past ten years was as follows:

At March 31, 2010, the SFS report public debt of $5.09 billion. Since 2000-01, public debt has declined $3.18 billion, from $8.27 billion to $5.09 billion.

At March 31, 2010, government business enterprise specific debt was $3.14 billion. This debt is primarily held by Saskatchewan Power Corporation, SaskEnergy Incorporated and Saskatchewan Telecommunications Holding Corporation. Government business enterprise specific debt is included in the Investment in (or net assets of) Government Business Enterprises reported on the Summary Statement of Financial Position and disclosed in schedule 3 of the SFS. Since 2000-01, government business enterprise specific debt has remained relatively stable, increasing slightly from $2.80 billion to $3.14 billion.

32 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Public Debt and Debt Charges (continued)

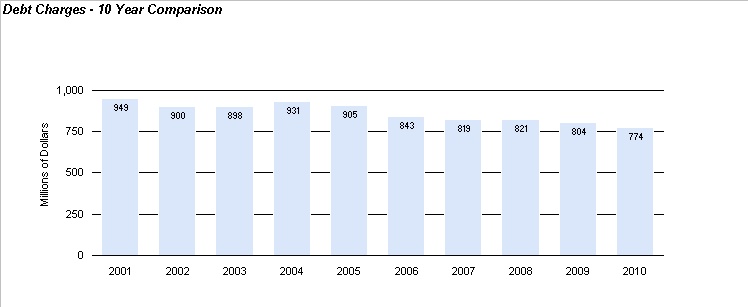

Debt Charges

The Government incurs interest and other costs to service its public debt. The amount of these costs is determined by the amount of public debt and the interest rate attached to that debt. The average effective interest rate on gross debt during 2009-10 was 6.7 per cent.

Government of Saskatchewan – 2009-10 Public Accounts 33Financial Statement Discussion and Analysis

Summary Financial Statements

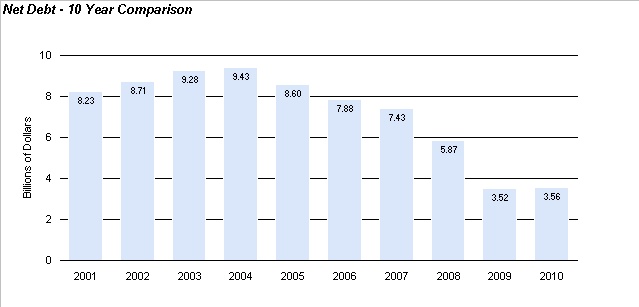

Net Debt

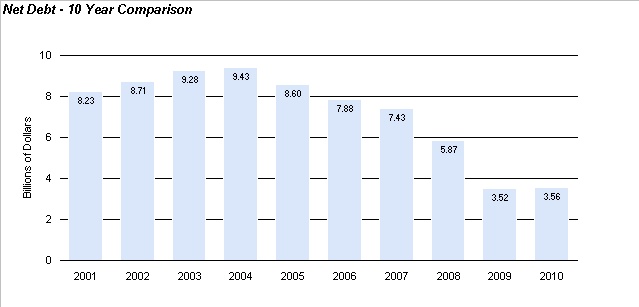

Net debt is one measure of the amount of debt that has been left to future generations. It is the difference between the SFS liabilities and its financial assets.

During 2009-10, net debt increased by $35 million. This increase can be attributed to the SFS deficit of $409 million plus amounts invested in tangible capital assets and other non-financial assets, almost entirely offset by the $404 million reduction of net debt on April 1, 2009 for the first-time inclusion of the Boards of Education.

Since 2000-01, the net debt of the SFS has declined from $8.23 billion to $3.56 billion, as follows:

Lower levels of net debt indicate increased flexibility over future spending.

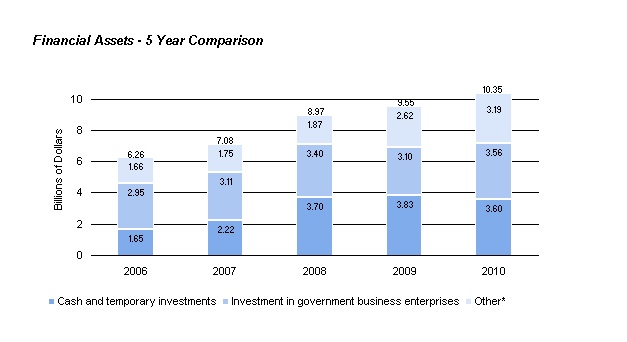

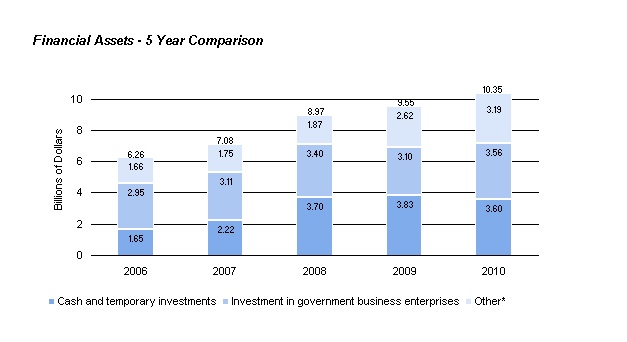

Financial Assets

Financial assets represent the amount of resources that are available to the Government that can be converted to cash to meet obligations or fund operations. In the past five years, the SFS financial assets were as follows:

* In 2009-10, primarily accounts receivable ($1.37 billion).

34 Government of Saskatchewan – 2009-10 Public AccountsFinancial Statement Discussion and Analysis

Summary Financial Statements

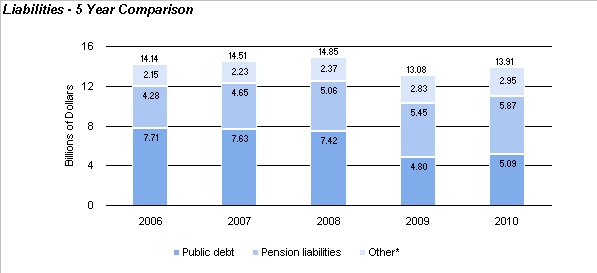

Liabilities

Liabilities represent the obligations that the Government has to others arising from past transactions or events. In the past five years, the SFS liabilities were as follows:

* In 2009-10, primarily accounts payable ($2.25 billion).From 2005-06 to 2009-10, liabilities decreased by $228 million. This is the net result of a $2.62 billion decrease in public debt, partially offset by a $1.59 billion increase in pension liabilities. Information relating to public debt can be found in more detail in the public debt and debt charges section found on page 32.

The total pension liability has increased from $4.28 billion in 2005-06 to $5.87 billion in 2009-10. The increase is due to pension costs, including interest on the pension liabilities, exceeding payments to the pension plans and retirees. The liabilities are projected to increase until the majority of plan members are retired around 2013. In subsequent years, the liabilities will decline as pensions are paid to retired members.

Government of Saskatchewan – 2009-10 Public Accounts 35Financial Statement Discussion and Analysis

Summary Financial Statements

Non-financial Assets

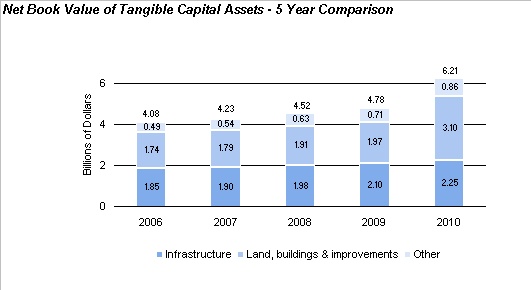

The 2009-10 SFS report total non-financial assets of $6.40 billion, which primarily consists of tangible capital assets.

Tangible Capital Assets

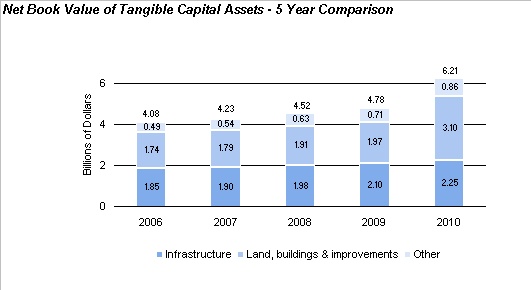

The Statement of Financial Position reports the net book value of tangible capital assets held by government service organizations and does not include the capital assets held by government business enterprises. The capital assets held by government business enterprises are included in the Investment in (or net assets of) Government Business Enterprises reported on the Statement of Financial Position and disclosed in schedule 3 of the SFS. The net book value of capital assets of government service organizations in the past five years is as follows:

The net book value represents the original cost of capital assets net of accumulated amortization and any write-down in value. The net book value of capital assets held by the Government has steadily increased over the last five years indicating an increase in the future service potential of the Government’s capital assets.

In 2009-10, amendments were made to The Education Act, 1995 such that the Boards of Education are included in the SFS for the first time. As a result, tangible capital assets with a net book value of $1.16 billion were included in these financial statements, effective April 1, 2009.

36 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Assessment of Financial Condition

Financial condition describes a government’s financial health or its ability to meet its existing financial obligations, both with respect to its service commitments to the public and its financial commitments to creditors, employees and others. The following assessment of the Government’s financial condition considers three elements: sustainability, flexibility and vulnerability.

Sustainability

Sustainability is the degree to which a government can maintain its existing service commitments and meet its existing financial obligations without increasing its debt or tax burden relative to the economy within which it operates.

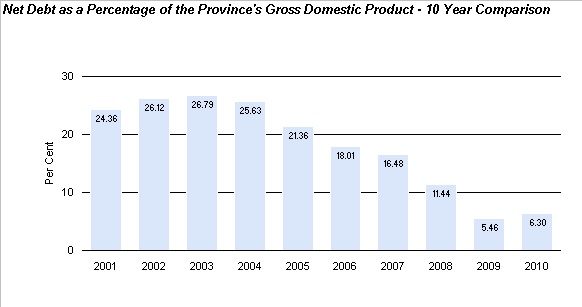

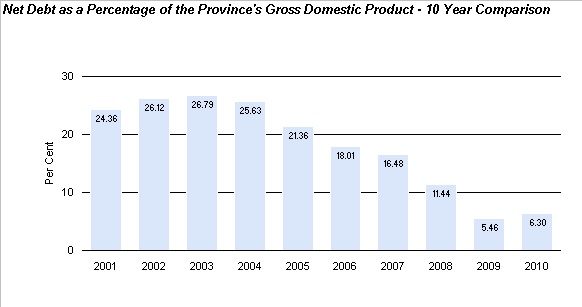

Net Debt to the Province’s Gross Domestic Product

Gross domestic product (GDP) is a measure of the value of the goods and services produced during a year, indicating the size of the provincial economy. Net debt is the difference between a government’s liabilities and financial assets and represents the future revenue that is required to pay for past transactions and events. Net debt as a percentage of the Province’s GDP provides a measure of the level of financial demands placed on the economy by the Government’s spending and taxation policies. A higher ratio means the net debt of the Government is more onerous on the economy, which may not be sustainable. Therefore, a lower net debt to GDP ratio is desired and indicates higher sustainability.

The overall downward trend illustrated by this ratio is a result of growth in the provincial economy together with a declining net debt over the ten-year period.

Government of Saskatchewan – 2009-10 Public Accounts 37Financial Statement Discussion and Analysis

Summary Financial Statements

Assessment of Financial Condition (continued)

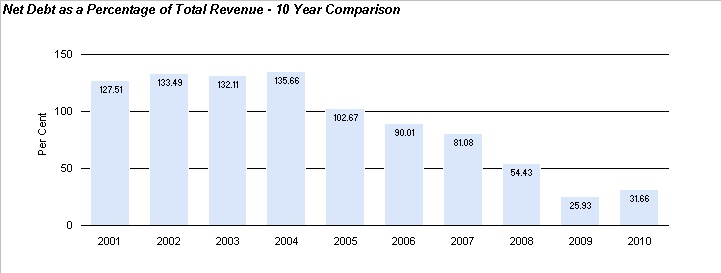

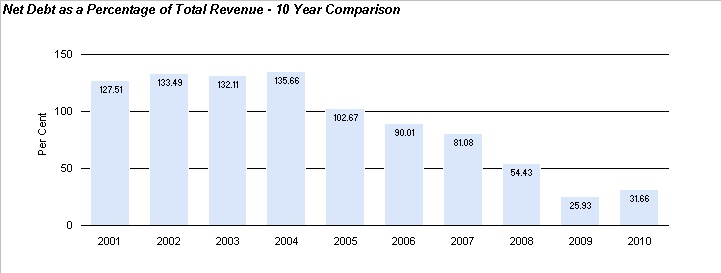

Net Debt to Total Revenue

Another measure of a government’s sustainability is net debt as a percentage of total revenue. Net debt provides a measure of the future revenue that is required to pay for past transactions and events. A lower net debt to revenue ratio indicates higher sustainability, as less time is required to eliminate net debt.

When expressed as a percentage of total revenue, the Government’s net debt has declined from 127.5 per cent to 31.7 per cent of total revenue since 2000-01. The reduction in this ratio indicates that the Government’s annual revenue has been sufficient not only to pay for current transactions and events, but also to pay off a portion of past deficits.

38 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Assessment of Financial Condition (continued)

Flexibility

Flexibility is the degree to which a government can change its debt or tax burden and still meet its existing service commitments and financial obligations.

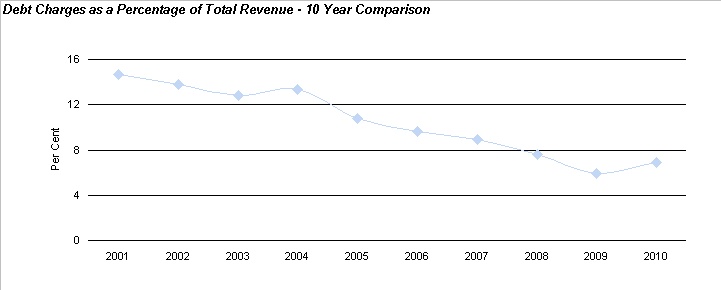

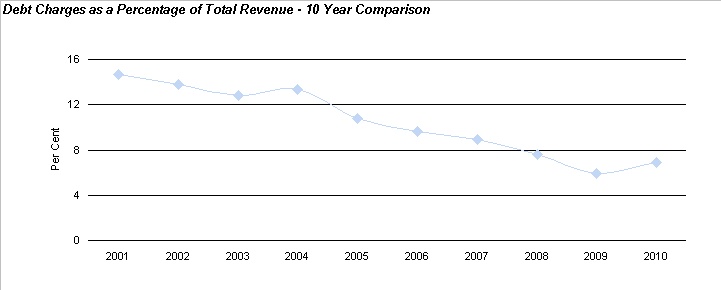

Debt Charges to Total Revenue

A debt charges to revenue ratio, often referred to as the interest bite, indicates the proportion of provincial revenue that is required to pay interest charges on public debt and therefore, is not available to pay for program spending. A lower ratio means that there is more money available to provide government services.

Over the last ten years, the interest bite has decreased due to both increased revenue and decreased interest costs. In 2009-10, the Government spent approximately 6.9 cents of each dollar of revenue on debt charges on public debt, compared to 14.7 cents in 2000-01. This reduction leaves more resources available to the Government to provide services without increasing its revenue.

Government of Saskatchewan – 2009-10 Public Accounts 39Financial Statement Discussion and Analysis

Summary Financial Statements

Assessment of Financial Condition (continued)

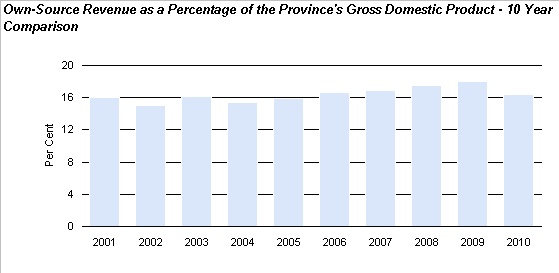

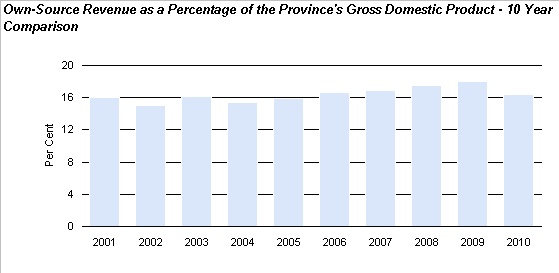

Own-source Revenue to the Province’s Gross Domestic Product

This ratio measures the extent to which the Government is taking income out of the provincial economy, either through taxation or user fees. An increase in this ratio indicates that the Government’s own-source revenues are growing faster than the economy, reducing the Government’s flexibility to increase revenues without slowing the growth of the provincial economy.

Own-source revenue as a percentage of GDP has remained relatively stable over the last ten years meaning that the Government has not significantly changed its demands on the provincial economy over this time. This indicates that the Government’s flexibility is largely unchanged over the last ten years.

40 Government of Saskatchewan – 2009-10 Public Accounts

Financial Statement Discussion and Analysis

Summary Financial Statements

Assessment of Financial Condition (continued)

Vulnerability

Vulnerability is the degree to which a government is dependent on sources of funding outside of its control or is exposed to risks that could impair its ability to meet its existing service commitments and financial obligations.

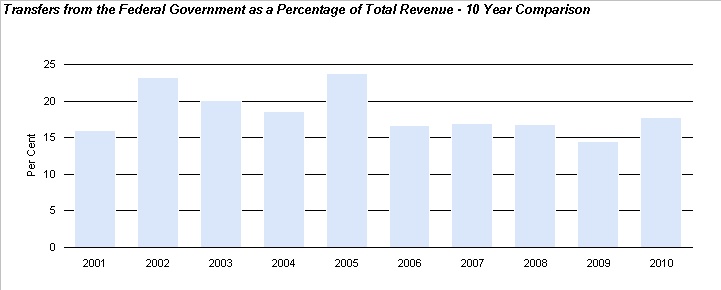

Transfers from the Federal Government to Total Revenue

The Government has no control over the amount of federal transfers that it receives each year. Transfers from the federal government as a percentage of total revenue is therefore an indicator of the degree of vulnerability the Government has as a result of reliance on the federal government for revenues. Generally, a decreasing ratio indicates that a government is less reliant on federal transfers to fund its programs, making it less vulnerable.

For the past ten years, the percentage of total revenue attributable to transfers from the federal government was as follows:

In 2009-10, 17.8 per cent of the Government’s revenue came from transfers from the federal government with the remainder coming from Saskatchewan sources. The Government’s ability to fund essential programs and services from own-source revenues has remained fairly stable over the past several years.

Government of Saskatchewan – 2009-10 Public Accounts 41Financial Statement Discussion and Analysis

Risks and Uncertainties

The Government is subject to risks and uncertainties that arise from variables which the Government can not directly control. These risks and uncertainties include:

| • | changes in economic factors such as economic growth, commodity and non-renewable resource prices, inflation, interest rates, population growth, personal income and retail sales; |

| • | financial risks including interest rate risk, foreign exchange rate risk, credit risk and liquidity risk; |

| • | changes in transfers from the federal government; |

| • | utilization of Government services, such as crop insurance, health care and social services; |

| • | other unforeseen developments including natural and other disasters, changes in environmental liabilities and legal obligations; and |

| • | changes in accounting standards. |

The Government has implemented strategies that limit its exposure to such risks and uncertainties. The key component of this fiscal management plan is The Growth and Financial Security Act (the Act), legislation that provides a fiscal framework to ensure balanced budgets and the appropriate use of surplus revenues.

The Act imposes discipline into the budgetary process and reduces risk to external events by requiring annual program reviews and the tabling of balanced budgets and debt management plans, yet the fiscal framework has the flexibility to respond to sudden and rapid changes in factors beyond Government’s influence or control. Specifically, the Act:

| • | requires a four-year financial plan with balanced budgets to be prepared annually; |

| • | requires a four-year debt management plan to be prepared annually; |

| • | requires actual revenue in each fiscal year to be greater than actual expense; |

| • | requires deficits to be fully offset in the following fiscal year; |

| • | establishes the Growth and Financial Security Fund to assist in providing for financial security from year to year and to provide a source of funds available for use for promoting or enhancing the economic development of Saskatchewan; |

| • | requires 50 per cent of any GRF pre-transfer surplus to be transferred to the Growth and Financial Security Fund; |

| • | requires the remaining 50 per cent of any GRF pre-transfer surplus to be applied to the Debt Retirement Fund; and |

| • | contains provisions for extraordinary events, such as natural or other disasters, that lead to unanticipated spending or reduced revenues. |

In addition, recognizing that Saskatchewan is heavily reliant on non-renewable resources and external events, the Government takes a prudent approach in developing its budget assumptions for macroeconomic variables and non-renewable resource prices. Government makes use of a number of forecasts from national forecasting agencies and banks, private industry and private sector analysts when developing the underlying assumptions to fiscal forecasts both at budget and throughout the fiscal year.

The fiscal impact of changes in the underlying economic assumptions, including non-renewable resource prices, are estimated on a regular basis in order to quantify the risk associated with each forecast assumption. By understanding the size of the risk inherent in the fiscal projections, Government is better able to make sound financial decisions.

Finally, the Government requires regular fiscal updates during the fiscal year. These updates are based on the continual monitoring of monthly financial results and current economic conditions, as well as the early identification of potential spending pressures. The Government publishes quarterly reports that contain revised fiscal and economic forecasts so that Saskatchewan residents are well-informed as to the Government’s current fiscal position and the risks and uncertainties associated with the Government’s fiscal plan.

Risk management specific to public debt is discussed in note 3 of the GRF financial statements and note 3 of the SFS.

42 Government of Saskatchewan – 2009-10 Public Accounts

General Revenue Fund Financial Statements

Responsibility for the General Revenue Fund Financial Statements

The Government is responsible for the General Revenue Fund Financial Statements. The Government maintains a system of accounting and administrative controls to ensure that accurate and reliable financial statements are prepared and to obtain reasonable assurance that transactions are authorized, assets are safeguarded, and financial records are maintained.

The Provincial Comptroller prepares these statements in accordance with the Government's stated accounting policies, using the Government's best estimates and judgement when appropriate.

The Provincial Auditor expresses an independent opinion on these statements. His report, which appears on the following page, provides the scope of his audit and states his opinion.

Treasury Board approves the General Revenue Fund Financial Statements. The statements are tabled in the Legislative Assembly as part of the Public Accounts and referred to the Standing Committee on Public Accounts for review.

On behalf of the Government of the Province of Saskatchewan.

/s/ Rod Gantefoer

Rod Gantefoer

Minister of Finance

/s/ Doug Matthies

Doug Matthies

Deputy Minister of Finance

/s/ Terry Paton

Terry Paton

Provincial Comptroller

Regina, Saskatchewan

June 2010

Government of Saskatchewan – 2009-10 Public Accounts 45

Auditor’s Report

To the Members of the Legislative Assembly of Saskatchewan

These financial statements report transactions and events of the General Revenue Fund only. Significant financial activities of the Government occur outside this Fund. Readers should not use the General Revenue Fund’s financial statements to understand and assess the Government’s management of public financial affairs and resources as a whole; rather they should use the Summary Financial Statements of the Government of Saskatchewan (Summary Financial Statements).

Volume 1 of the Public Accounts includes the Summary Financial Statements. These statements report the full nature and extent of the financial affairs and resources for which the Government is responsible.

I have audited the statement of financial position of the General Revenue Fund as at March 31, 2010 and the statements of operations, accumulated deficit, change in net debt, and cash flow for the year then ended. These financial statements are the responsibility of Treasury Board. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

| 1. | The Government through the General Revenue Fund is responsible for the liabilities of several pension plans and a disability benefit plan. Notes 1 and 4 state that the pension liabilities and a disability benefit liability are not recorded in these financial statements. Canadian generally accepted accounting principles for the public sector require that the pension and disability benefit liabilities be recorded in the financial statements. Had the pension and disability benefit liabilities been recorded, liabilities and accumulated deficit would increase by $5,783 million (2009 - $5,442 million) as at March 31, 2010 and, for the year, expenses would increase by $341 million (2009 - $355 million), and surplus would decrease by the same amounts. |

| 2. | The Government records transactions between the General Revenue Fund and the Growth and Financial Security Fund (GFSF) as revenue or expense of the General Revenue Fund. The substance of the transactions between the General Revenue Fund and the GFSF is that the amounts the General Revenue Fund owes the GFSF must be repaid by the GFSF to the General Revenue Fund. Canadian generally accepted accounting principles for the public sector do not allow the General Revenue Fund to record changes in the amount due to the GFSF as revenue or expense of the General Revenue Fund. |

The financial statements show an expense (as Transfer to the GFSF) of $84 million (2009 - $985 million) and a revenue (as Transfer from the GFSF) of $341 million (2009 - $1,404 million) for a net transfer of $257 million. It is not appropriate to record an expense because the GFSF must return all amounts to the

Government of Saskatchewan – 2009-10 Public Accounts 47

General Revenue Fund. Also, it is not appropriate to record a revenue for it is only the amount the GFSF has returned to the General Revenue Fund in the year. Instead of recording an expense or a revenue, the financial statements should record an asset equal to the amount it owed or paid to the GFSF. Had the Government properly recorded these transactions, Total Financial Assets would increase by $958 million (2009 - $1,215 million) and accumulated deficit would decrease by the same amount as at March 31, 2010 and, for the year, the net Transfer from the GFSF and Surplus would each decrease by $257 million

(2009 - $419 million).

In my opinion, except for the effects of not recording pension and disability benefit liabilities and recording the amounts that the General Revenue Fund has paid to the GFSF as expense and revenue of the General Revenue Fund as described in the preceding paragraphs, these financial statements present fairly, in all material respects, the financial position of the General Revenue Fund as at March 31, 2010 and the results of its operations, the changes in its net debt, and its cash flows for the year then ended in accordance with Canadian generally accepted accounting principles.

/s/ Brian Atkinson, FCA

Brian Atkinson, FCA

Acting Provincial Auditor

Regina, Saskatchewan

June 4, 2010

48 Government of Saskatchewan – 2009-10 Public Accounts

| Statement of Financial Position | | | | | | |

| As at March 31, 2010 | | | | | | |

(thousands of dollars) | | | | | | |

| | | | | | | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| Financial Assets | | | | | | |

Cash and temporary investments (note 2) | | | 858,427 | | | | 575,895 | |

Accounts receivable (schedule 1) | | | 855,117 | | | | 915,389 | |

| Deferred charges | | | 9,775 | | | | 14,166 | |

Loans to Crown corporations (schedule 2) | | | 818,751 | | | | 520,229 | |

Other loans (schedule 3) | | | 100,168 | | | | 122,454 | |

| Equity investment in Crown Investments Corporation of Saskatchewan | | | 1,051,152 | | | | 1,051,152 | |

| Total Financial Assets | | | 3,693,390 | | | | 3,199,285 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

Accounts payable and accrued liabilities (schedule 4) | | | 1,896,708 | | | | 1,721,516 | |

Deposits held (schedule 5) | | | 396,122 | | | | 594,355 | |

| Unearned revenue | | | 75,642 | | | | 76,454 | |

| Public debt | | | | | | | | |

Government general debt (note 3)(schedule 6) | | | 4,140,482 | | | | 4,145,286 | |

Crown corporation general debt (note 3)(schedule 6) | | | 818,751 | | | | 520,229 | |

| Unamortized foreign exchange gain (loss) | | | 3,939 | | | | (10,503 | ) |

| Total Liabilities | | | 7,331,644 | | | | 7,047,337 | |

| Net Debt | | | (3,638,254 | ) | | | (3,848,052 | ) |

| | | | | | | | | |

| Non-financial Assets | | | | | | | | |

| Prepaid expenses | | | 7,004 | | | | 6,902 | |

| Inventories held for consumption | | | 109,411 | | | | 97,345 | |

Tangible capital assets (schedule 9) | | | 2,975,411 | | | | 2,772,877 | |

| Total Non-financial Assets | | | 3,091,826 | | | | 2,877,124 | |

| Accumulated Deficit | | | (546,428 | ) | | | (970,928 | ) |

| | | | | | | | | |

Employee future benefits (note 4) | | | | | | | | |

Contingencies (note 5) | | | | | | | | |

Contractual obligations (note 6) | | | | | | | | |

Guaranteed debt (note 5)(schedule 8) | | | | | | | | |

| | | | | | |

| The accompanying notes and schedules are an integral part of these financial statements. | | | | | |

Government of Saskatchewan – 2009-10 Public Accounts 49

| Statement of Operations | | | | | | | | | |

| For the Year Ended March 31, 2010 | | | | | | | | | |

(thousands of dollars) | | | | | | | | | |

| | | | | | | | | | |

| | | 2010 | | | 2009 | |

| | | Budget | | | Actual | | | Actual | |

| | | | | | | | | | |

| Revenue | | | | | | | | | |

| Taxation | | | 4,458,900 | | | | 4,732,273 | | | | 4,430,995 | |

| Non-renewable resources | | | 3,368,900 | | | | 1,910,624 | | | | 4,612,408 | |

| Transfers from Government entities | | | 776,900 | | | | 1,249,096 | | | | 851,216 | |

| Other own-source revenue | | | 598,400 | | | | 770,432 | | | | 721,489 | |

| Transfers from the federal government | | | 1,457,700 | | | | 1,604,033 | | | | 1,708,964 | |

Total Revenue (schedule 10) | | | 10,660,800 | | | | 10,266,458 | | | | 12,325,072 | |

| Expense | | | | | | | | | | | | |

| Ministries and Agencies | | | | | | | | | | | | |

| Advanced Education, Employment and Labour | | | 840,020 | | | | 866,110 | | | | 893,291 | |

| Agriculture | | | 483,444 | | | | 373,246 | | | | 424,396 | |

| Corrections, Public Safety and Policing | | | 324,014 | | | | 340,314 | | | | 315,083 | |

| Crown Investments Corporation of Saskatchewan | | | - | | | | - | | | | 240,000 | |

| Education | | | 1,379,235 | | | | 1,334,346 | | | | 1,307,461 | |

| Energy and Resources | | | 42,888 | | | | 40,546 | | | | 37,946 | |

| Enterprise and Innovation | | | 22,133 | | | | 22,497 | | | | 54,618 | |

| Enterprise Saskatchewan | | | 47,305 | | | | 45,406 | | | | 6,087 | |

| Environment | | | 200,380 | | | | 172,304 | | | | 177,129 | |

| Executive Council | | | 9,057 | | | | 8,478 | | | | 8,293 | |

| Finance | | | 329,392 | | | | 326,558 | | | | 290,832 | |

Finance Debt Servicing (schedule 11) | | | 502,500 | | | | 479,962 | | | | 520,181 | |

| First Nations and Métis Relations | | | 87,585 | | | | 86,842 | | | | 86,526 | |

| Government Services | | | 14,884 | | | | 15,215 | | | | 12,738 | |

Government Services - commercial operations (schedule 12) | | | - | | | | 82,030 | | | | 81,180 | |

| Health | | | 4,075,223 | | | | 3,934,231 | | | | 3,976,241 | |

| Highways and Infrastructure | | | 436,990 | | | | 418,279 | | | | 482,400 | |

Highways and Infrastructure - commercial operations (schedule 12) | | | - | | | | 3,281 | | | | 2,892 | |

| Information Technology Office | | | 7,091 | | | | 11,834 | | | | 5,384 | |

Information Technology Office - commercial operations (schedule 12) | | | - | | | | 1,574 | | | | 1,630 | |

| Intergovernmental Affairs | | | 4,014 | | | | 3,295 | | | | 3,519 | |

| Justice and Attorney General | | | 142,275 | | | | 145,293 | | | | 135,648 | |

| Municipal Affairs | | | 339,697 | | | | 409,956 | | | | 397,388 | |

| Office of the Provincial Secretary | | | 5,024 | | | | 4,879 | | | | 4,401 | |

| Public Service Commission | | | 38,085 | | | | 50,229 | | | | 35,182 | |

| Saskatchewan Research Council | | | 15,016 | | | | 15,016 | | | | 12,082 | |

| Social Services | | | 722,760 | | | | 740,087 | | | | 676,604 | |

| Tourism, Parks, Culture and Sport | | | 139,180 | | | | 129,703 | | | | 130,726 | |

| Legislative Assembly and its Officers | | | | | | | | | | | | |

| Chief Electoral Officer | | | 1,179 | | | | 1,679 | | | | 1,166 | |

| Children's Advocate | | | 1,621 | | | | 1,628 | | | | 1,529 | |

| Conflict of Interest Commissioner | | | 151 | | | | 143 | | | | 145 | |

| Information and Privacy Commissioner | | | 927 | | | | 874 | | | | 812 | |

| Legislative Assembly | | | 23,662 | | | | 23,295 | | | | 22,429 | |

| Ombudsman | | | 2,195 | | | | 2,152 | | | | 2,085 | |

| Provincial Auditor | | | 7,459 | | | | 7,471 | | | | 7,115 | |

Total Expense (schedules 13 and 14) | | | 10,245,386 | | | | 10,098,753 | | | | 10,355,139 | |

| Pre-transfer Surplus | | | 415,414 | | | | 167,705 | | | | 1,969,933 | |

| Transfer to the Growth and Financial Security Fund | | | (207,707 | ) | | | (83,853 | ) | | | (984,967 | ) |

| Transfer from the Growth and Financial Security Fund | | | 216,793 | | | | 340,648 | | | | 1,403,897 | |

| Surplus | | | 424,500 | | | | 424,500 | | | | 2,388,863 | |

| | | | | | |

| The accompanying notes and schedules are an integral part of these financial statements. | | | | | |

50 Government of Saskatchewan – 2009-10 Public Accounts

| Statement of Accumulated Deficit | | | | | | | | | |

| For the Year Ended March 31, 2010 | | | | | | | | | |

(thousands of dollars) | | | | | | | | | |

| | | | | | | | | | |

| | | 2010 | | | 2009 | |

| | | Budget | | | Actual | | | Actual | |

| | | | | | | | | | |

| Accumulated deficit, beginning of year | | | (970,928 | ) | | | (970,928 | ) | | | (3,359,791 | ) |

| Surplus | | | 424,500 | | | | 424,500 | | | | 2,388,863 | |

| Accumulated Deficit, End of Year | | | (546,428 | ) | | | (546,428 | ) | | | (970,928 | ) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Statement of Change in Net Debt | | | | | | | | | | | | |

| For the Year Ended March 31, 2010 | | | | | | | | | | | | |

(thousands of dollars) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | 2010 | | | 2009 | |

| | | Budget | | | Actual | | | Actual | |

| | | | | | | | | | | | | |

| Surplus | | | 424,500 | | | | 424,500 | | | | 2,388,863 | |

| | | | | | | | | | | | | |

| Tangible Capital Assets | | | | | | | | | | | | |

Acquisitions (schedule 9) | | | (473,563 | ) | | | (388,541 | ) | | | (349,349 | ) |

Amortization (schedule 9) | | | 159,618 | | | | 160,175 | | | | 151,521 | |

| Net (gain) loss on disposal | | | - | | | | (13,284 | ) | | | 5,153 | |

| Proceeds on disposal | | | 8,000 | | | | 40,332 | | | | 7,082 | |

Write downs (schedule 9) | | | - | | | | 180 | | | | 11,026 | |

| Net Acquisition of Tangible Capital Assets | | | (305,945 | ) | | | (201,138 | ) | | | (174,567 | ) |

| | | | | | | | | | | | | |

| Other Non-financial Assets | | | | | | | | | | | | |

| Net acquisition of prepaid expenses | | | - | | | | (102 | ) | | | (217 | ) |

| Net acquisition of inventories held for consumption | | | - | | | | (12,066 | ) | | | (12,076 | ) |

| Net Acquisition of Other Non-financial Assets | | | - | | | | (12,168 | ) | | | (12,293 | ) |

| | | | | | | | | | | | | |

| Decrease in net debt | | | 118,555 | | | | 211,194 | | | | 2,202,003 | |

| Net debt, beginning of year | | | (3,848,052 | ) | | | (3,848,052 | ) | | | (6,048,714 | ) |

| Transfers from government organizations | | | - | | | | (1,396 | ) | | | (1,341 | ) |

| Net Debt, End of Year | | | (3,729,497 | ) | | | (3,638,254 | ) | | | (3,848,052 | ) |

| | | | | | |

| The accompanying notes and schedules are an integral part of these financial statements. | | | | | |

Government of Saskatchewan – 2009-10 Public Accounts 51

| Statement of Cash Flow | | | | | | |

| For the Year Ended March 31, 2010 | | | | | | |

(thousands of dollars) | | | | | | |

| | | | | | | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| Operating Activities | | | | | | |

| Surplus | | | 424,500 | | | | 2,388,863 | |

Non-cash items included in surplus (schedule 15) | | | (10,122 | ) | | | 94,061 | |

Net change in non-cash operating activities (schedule 16) | | | 226,875 | | | | (114,537 | ) |

| Cash Provided by Operating Activities | | | 641,253 | | | | 2,368,387 | |

| | | | | | | | | |

| Capital Activities | | | | | | | | |

Acquisition of tangible capital assets (schedule 9) | | | (388,541 | ) | | | (349,349 | ) |

| Proceeds on disposal of tangible capital assets | | | 40,332 | | | | 7,082 | |

| Cash Used for Capital Activities | | | (348,209 | ) | | | (342,267 | ) |

| | | | | | | | | |

| Investing Activities | | | | | | | | |

| Loan advances | | | (352,586 | ) | | | (376,804 | ) |

| Loan repayments | | | 114,977 | | | | 332,835 | |

| Sinking funds | | | | | | | | |

| Contributions for general debt | | | (64,558 | ) | | | (1,913,015 | ) |

| Contributions received for Crown corporation general debt | | | 4,644 | | | | 20,261 | |

| Redemptions for general debt | | | 892,655 | | | | 81,635 | |

| Redemptions disbursed for Crown corporation general debt | | | (48,993 | ) | | | (32,793 | ) |

| Equity investment in Crown Investments Corporation of Saskatchewan | | | - | | | | 130,000 | |

Cash Provided by (Used for) Investing Activities (schedule 17) | | | 546,139 | | | | (1,757,881 | ) |

| | | | | | | | | |

| Financing Activities | | | | | | | | |

| Proceeds from general debt | | | 508,629 | | | | 32,005 | |

| Repayment of general debt | | | (867,047 | ) | | | (754,791 | ) |

| (Decrease) increase in deposits held | | | (198,233 | ) | | | 208,967 | |

| Cash Used for Financing Activities | | | (556,651 | ) | | | (513,819 | ) |

| | | | | | | | | |

| Increase (Decrease) in Cash and Temporary Investments | | | 282,532 | | | | (245,580 | ) |

| Cash and temporary investments, beginning of year | | | 575,895 | | | | 821,475 | |

| Cash and Temporary Investments, End of Year | | | 858,427 | | | | 575,895 | |

| | | | | | | | | |

| | | | | | | | | |

| Supplemental information: | | | | | | | | |

| | | | | | | | | |

| Cash interest paid during the year | | | 495,587 | | | | 520,836 | |

| Cash interest received during the year | | | 159,001 | | | | 122,434 | |

| The accompanying notes and schedules are an integral part of these financial statements. | | | | | |

52 Government of Saskatchewan – 2009-10 Public Accounts

Notes to the Financial Statements

As at March 31, 2010

1. Significant Accounting Policies

Basis of accounting

These financial statements are prepared in accordance with generally accepted accounting principles for the public sector, as recommended by the Public Sector Accounting Board of the Canadian Institute of Chartered Accountants, with the following exceptions:

| • | transfers to and from the Growth and Financial Security Fund are included in the determination of surplus for the year; and |

| • | pension liabilities and a disability benefit liability are not recorded in the financial statements. The General Revenue Fund accounts for defined benefit pension plans and a disability benefit plan on a cash basis. |

Reporting entity

The General Revenue Fund is the general fund which receives all revenues unless otherwise specified by law. Spending from the General Revenue Fund is appropriated by the Legislative Assembly.

Other government entities such as special purpose funds, government business enterprises, and other Crown corporations and agencies report separately in other financial statements. Only financial transactions to or from these other entities are included in the General Revenue Fund. The net expenses/recoveries for revolving funds’ operations are charged to expense.

Government business enterprises are self-sufficient government organizations that have the financial and operating authority to sell goods and services to individuals and organizations outside the government reporting entity as their principal activity.

The Government’s Summary financial statements, which include the financial activities of the General Revenue Fund and other government entities, are provided separately.

Specific accounting policies

Financial assets

Financial assets are assets that could be used to discharge existing liabilities or finance future operations and are not for consumption in the normal course of operations.

Temporary investments are recorded at the lower of cost or market.

Deferred charges include issue costs and net discounts or premiums incurred on the issue of general debt and related derivative instruments. They are recorded at cost and amortized on a straight-line basis over the remaining life of the debt issue.

Loans to Crown corporations and Other loans generally have fixed repayment terms and are interest bearing. Promissory notes issued by Crown corporations are recorded at par; all other loans are recorded at cost. Loans to Crown corporations are presented net of amounts Crown corporations have contributed to sinking funds and net of government business enterprise specific debt.

Equity investment in Crown Investments Corporation of Saskatchewan is an advance to the corporation to form its equity capitalization and is recorded at cost.

Where there has been a loss in value that is other than a temporary decline, loans and equity investments are written down to recognize the loss.

Liabilities