2022-23 FIRST QUARTER HIGHLIGHTS

Overview

Saskatchewan is forecasting a significant surplus in 2022-23 largely due to a surge in non-renewable resource revenue. A strong bottom line is due primarily to resources that belong to all Saskatchewan people. This improved fiscal outlook allows the Government to launch a four-point affordability plan to help people address rising costs due to inflation and to reduce the province’s debt.

At first quarter, a surplus of $1.04 billion is forecast, an improvement of $1.51 billion from budget, mainly due to higher forecasts for potash and oil revenue. Forecasts for higher-than-budgeted Individual and Corporate Income Tax revenue and Provincial Sales Tax (PST) revenue also reflect stronger economic growth.

To help people facing challenges due to inflation, a one-time Saskatchewan Affordability Tax Credit payment of $500 will be issued to all adult residents 18 years of age and older, as of December 31, 2022, who have filed a 2021 tax return. In addition, gym and fitness memberships and some recreational activities will now be excluded from the admissions, entertainment and recreation PST expansion, which comes into effect October 1, 2022.

Small businesses will be helped by a one-year extension of the temporary small business tax rate reduction. Maintaining the small business rate at zero per cent retroactive to July 1, 2022, and delaying the restoration of the rate to two per cent for another year will provide further support to small businesses as they continue to recover from the pandemic while facing new challenges such as inflationary pressures, interest rate hikes, supply chain issues and labour shortages.

Higher revenue and a surplus means Saskatchewan will be able to retire up to $1 billion in operating debt, resulting in lower debt servicing costs this year and in future years.

Revenue

Revenue is forecast to be up from budget by $2.02 billion, 11.7 per cent, largely due to a $1.86 billion increase in non-renewable resource revenue reflecting higher potash and oil prices. Taxation revenue is forecast to be up $536.5 million from budget, with higher Individual and Corporate Income Tax revenue and PST revenue reflecting stronger-than-anticipated economic recovery. Other own-source revenue and federal transfers are also forecast to be higher than at budget.

These increases in revenue are partially offset by a projected $533.6 million decrease from budget for net income from Government Business Enterprises (GBEs), primarily due to lower investment income and higher natural gas prices.

Expense

At first quarter, expense is forecast to be $508.2 million higher than budgeted. The increase is largely due to a $450 million increase for the one-time affordability payment to Saskatchewan residents.

Also contributing to a higher expense forecast are higher-than-budgeted wildfire costs, support for refugees from Ukraine, higher-than-anticipated Saskatchewan Prescription Drug Plan expenditures, increases related to transit and housing supports, increases to boards of education related to higher maintenance, fuel, and insurance costs, as well as other pressures.

Higher expenses are partially offset by lower pension costs and lower actuarial losses on pensions, vacancy management savings, and lower-than-budgeted financing charges from reduced operating borrowing.

Debt

Public debt is forecast to be $1.72 billion lower than budget. Lower debt is primarily due to a $1.89 billion decrease in General Revenue fund (GRF) operating debt due to the return to a surplus, which eliminates the need for operating borrowing and provides the opportunity to retire up to $1 billion in existing operating debt. There is also a $131.0 million decrease in Saskatchewan Capital Plan debt as some new capital spending can be funded with cash, rather than new debt.

These reductions are offset by a $300.8 million increase in GBE debt, primarily due to increased debt forecasts for SaskPower, SaskTel and the Municipal Financing Corporation.

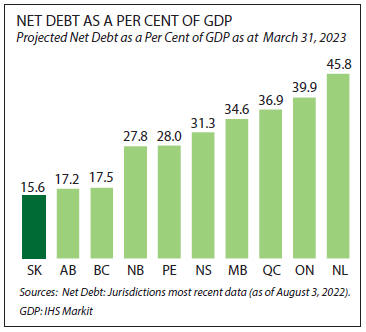

Saskatchewan will continue to have one of the lowest net-debt-to-GDP ratios in the country. Net debt is now forecast to be $15.24 billion at the end of 2022-23, an improvement of $2.30 billion from budget. Net debt as a percentage of GDP is now forecast to be 15.6 per cent compared to 18.8 per cent projected in the 2022-23 Budget.

2022-23 First Quarter Financial Report 1