Overview

The Saskatchewan economy remains strong, but inconsistent weather during the growing season negatively affected the province’s crops and the mid-year financial position.

Although weather conditions were good early in the season, very dry conditions in many regions of the province during the summer significantly impacted crop yields and quality. These fluctuations led to higher crop insurance claims, increasing the Agriculture expense theme by more than 25 per cent from the 2024-25 Budget.

Partially offsetting the expense challenges in agriculture and across important human services areas, total revenue is forecast to increase by 1.4 per cent compared to budget.

Overall, the 2024-25 Mid-Year Report forecasts a deficit of $743.5 million, an increase of $470.4 million from budget.

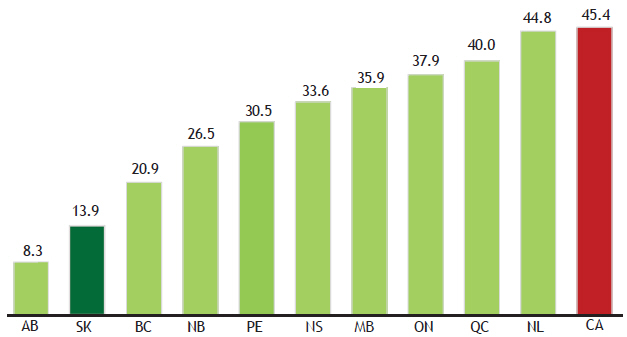

In terms of the economy, population and employment growth remain strong. Saskatchewan has one of the lowest unemployment rates and one of the highest gross domestic product (GDP) growth rates among provinces. The province also continues to enjoy the second-lowest net debt-to-GDP ratio in the country.

For a more detailed overview, see Tables 1 and 2.

Economy

Saskatchewan had the second-fastest growing economy among the provinces in 2023, as measured by growth in real GDP at 2.3 per cent (see Table 3). This economic growth includes record-setting labour market performance, solid export volumes and strong investment growth.

According to the most recent average private-sector forecasts, real GDP is expected to grow by 1.4 per cent in 2024, the fourth highest among the provinces (see Tables 4 and 5), up from 1.0 per cent projected in the 2024-25 Budget.

The upward revision reflects strength in many aspects of the economy so far in 2024. Among them are:

| • | | significant population growth of more than 30,000 |

people in the province as of July 2024 (year-over-year);

| • | | strong employment growth of 14,800 more jobs in 2024, compared to 2023 (year-to-date as of October 2024); |

| • | | third-lowest unemployment rate in Canada at 5.5 per cent (year-to-date as of October 2024); |

| • | | expanding consumer spending with retail sales up 3.0 per cent and new motor vehicle sales up 20.3 per cent (year-to-date as of August 2024); |

| • | | total exports of more than $33 billion in 2024, and on pace to have the third-highest annual total exports in provincial history (year-to-date as of September 2024); and |

| • | | strong non-residential investment growth of 25.1 per cent (year-to-date as of August 2024) – see Table 6. |

Private-sector forecasters anticipate Saskatchewan’s real GDP growth will accelerate to 1.7 per cent in 2025 amidst modest growth in the United States and Canada, and global economic uncertainty (see Table 7). Investment will continue to be one of the key growth drivers over the medium term, as major private-sector capital projects with an estimated value of $44.9 billion over the next five years or more are in various stages of development.

Revenue

Total revenue at mid-year is forecast to increase $275.1 million, or 1.4 per cent, higher than budget.

Other Own-Source revenue is forecast to increase $235.5 million compared to budget due to improvements across the majority of revenue sources in this category, including increases in investment and insurance income.

Taxation revenue is forecast to increase by $133 million, primarily due to an increase in corporate income taxes resulting from Saskatchewan’s robust 2023 tax assessments, which were buoyed by the province’s strong economy. This is partially offset by softening across some of the other taxation categories.

Transfers from the Federal Government are forecast to increase $33.1 million.

Net Income from Government Business Enterprises is forecast to decrease by $24.3 million, primarily due to a decrease in customer demand at SaskPower as a result of milder weather and lower than anticipated growth in sales at SGI. This is partially offset by revenue increases at the Saskatchewan Workers’ Compensation Board, Lotteries and Gaming Saskatchewan, and SaskEnergy.