UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-02671

Deutsche Municipal Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 5/31 |

| Date of reporting period: | 11/30/2014 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

November 30, 2014

Semiannual Report

to Shareholders

Deutsche Strategic High Yield Tax-Free Fund

(formerly DWS Strategic High Yield Tax-Free Fund)

Contents

3 Letter to Shareholders 4 Performance Summary 7 Portfolio Management Team 8 Portfolio Summary 9 Investment Portfolio 35 Statement of Assets and Liabilities 37 Statement of Operations 38 Statement of Cash Flows 39 Statement of Changes in Net Assets 40 Financial Highlights 48 Notes to Financial Statements 59 Information About Your Fund's Expenses 61 Advisory Agreement Board Considerations and Fee Evaluation 66 Account Management Resources 68 Privacy Statement |

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. The fund invests in inverse floaters, which are derivatives that involve leverage and could magnify the fund's gains or losses. Although the fund seeks income that is exempt from federal income taxes, a portion of the fund’s distributions may be subject to federal, state and local taxes, including the alternative minimum tax. See the prospectus for details.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DeAWM Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Dear Shareholder:

I am very pleased to tell you that the DWS funds have been renamed Deutsche funds, aligning more closely with the Deutsche Asset & Wealth Management brand. We are proud to adopt the Deutsche name — a brand that fully represents the global access, discipline and intelligence that support all of our products and services.

Deutsche Asset & Wealth Management combines the asset management and wealth management divisions of Deutsche Bank to deliver a comprehensive suite of active, passive and alternative investment capabilities. Your investment in the Deutsche funds means you have access to the thought leadership and resources of one of the world’s largest and most influential financial institutions.

In conjunction with your fund’s name change, please note that the Deutsche funds’ Web address has changed as well. The former dws-investments.com is now deutschefunds.com.

In addition, key service providers have been renamed as follows:

| Former Name | New name, effective August 11, 2014 |

| DWS Investments Distributors, Inc. | DeAWM Distributors, Inc. |

| DWS Trust Company | DeAWM Trust Company |

| DWS Investments Service Company | DeAWM Service Company |

These changes have no effect on the day-to-day management of your investment, and there is no action required on your part. You will continue to experience the benefits that come from our decades of experience, in-depth research and worldwide network of investment professionals.

Thanks for your continued support. We appreciate your trust and the opportunity to put our capabilities to work for you.

Best regards,

Brian Binder

President, Deutsche Funds

| Class A | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Average Annual Total Returns as of 11/30/14 | ||||

| Unadjusted for Sales Charge | 2.33% | 10.26% | 5.99% | 4.85% |

| Adjusted for the Maximum Sales Charge (max 2.75% load) | –0.48% | 7.23% | 5.40% | 4.56% |

Barclays Municipal Bond Index† | 2.45% | 8.23% | 5.12% | 4.81% |

Average Annual Total Returns as of 9/30/14 (most recent calendar quarter end) | ||||

| Unadjusted for Sales Charge | 10.01% | 5.09% | 4.84% | |

| Adjusted for the Maximum Sales Charge (max 2.75% load) | 6.99% | 4.51% | 4.55% | |

Barclays Municipal Bond Index† | 7.93% | 4.67% | 4.72% | |

| Class B | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Average Annual Total Returns as of 11/30/14 | ||||

| Unadjusted for Sales Charge | 1.95% | 9.43% | 5.19% | 4.05% |

Adjusted for the Maximum Sales Charge (max 4.00% CDSC) | –2.05% | 6.43% | 5.03% | 4.05% |

Barclays Municipal Bond Index† | 2.45% | 8.23% | 5.12% | 4.81% |

Average Annual Total Returns as of 9/30/14 (most recent calendar quarter end) | ||||

| Unadjusted for Sales Charge | 9.18% | 4.31% | 4.04% | |

Adjusted for the Maximum Sales Charge (max 4.00% CDSC) | 6.18% | 4.14% | 4.04% | |

Barclays Municipal Bond Index† | 7.93% | 4.67% | 4.72% | |

| Class C | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Average Annual Total Returns as of 11/30/14 | ||||

| Unadjusted for Sales Charge | 1.87% | 9.45% | 5.18% | 4.06% |

Adjusted for the Maximum Sales Charge (max 1.00% CDSC) | 0.87% | 9.45% | 5.18% | 4.06% |

Barclays Municipal Bond Index† | 2.45% | 8.23% | 5.12% | 4.81% |

Average Annual Total Returns as of 9/30/14 (most recent calendar quarter end) | ||||

| Unadjusted for Sales Charge | 9.11% | 4.30% | 4.05% | |

Adjusted for the Maximum Sales Charge (max 1.00% CDSC) | 9.11% | 4.30% | 4.05% | |

Barclays Municipal Bond Index† | 7.93% | 4.67% | 4.72% | |

| Class S | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Average Annual Total Returns as of 11/30/14 | ||||

| No Sales Charges | 2.46% | 10.54% | 6.25% | 5.09% |

Barclays Municipal Bond Index† | 2.45% | 8.23% | 5.12% | 4.81% |

Average Annual Total Returns as of 9/30/14 (most recent calendar quarter end) | ||||

| No Sales Charges | 10.29% | 5.35% | 5.08% | |

Barclays Municipal Bond Index† | 7.93% | 4.67% | 4.72% | |

| Institutional Class | 6-Month‡ | 1-Year | 5-Year | 10-Year |

Average Annual Total Returns as of 11/30/14 | ||||

| No Sales Charges | 2.47% | 10.54% | 6.25% | 5.12% |

Barclays Municipal Bond Index† | 2.45% | 8.23% | 5.12% | 4.81% |

Average Annual Total Returns as of 9/30/14 (most recent calendar quarter end) | ||||

| No Sales Charges | 10.29% | 5.37% | 5.11% | |

Barclays Municipal Bond Index† | 7.93% | 4.67% | 4.72% | |

Performance in the Average Annual Total Returns table(s) above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit deutschefunds.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated October 1, 2014 are 1.00%, 1.77%, 1.75%, 0.87% and 0.76% for Class A, Class B, Class C, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

A portion of the Fund's distributions may be subject to federal, state and local taxes and the alternative minimum tax.

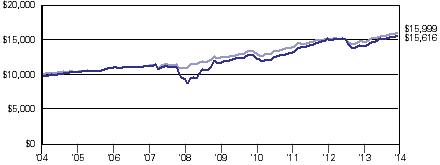

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge) |

|

|

| Yearly periods ended November 30 |

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 2.75%. This results in a net initial investment of $9,725.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

† The Barclays Municipal Bond Index is an unmanaged, market-value-weighted measure of municipal bonds issued across the United States. Index issues have a credit rating of at least Baa and a maturity of at least two years.

‡ Total returns shown for periods less than one year are not annualized.

| Class A | Class B | Class C | Class S | Institutional Class | ||||||||||||||||

| Net Asset Value | ||||||||||||||||||||

| 11/30/14 | $ | 12.50 | $ | 12.50 | $ | 12.50 | $ | 12.51 | $ | 12.51 | ||||||||||

| 5/31/14 | $ | 12.49 | $ | 12.49 | $ | 12.50 | $ | 12.50 | $ | 12.50 | ||||||||||

Distribution Information as of 11/30/14 | ||||||||||||||||||||

| Income Dividends, Six Months | $ | .28 | $ | .23 | $ | .23 | $ | .29 | $ | .29 | ||||||||||

| November Income Dividend | $ | .0451 | $ | .0373 | $ | .0375 | $ | .0477 | $ | .0477 | ||||||||||

SEC 30-day Yield‡‡ | 2.64 | % | 1.97 | % | 1.97 | % | 2.97 | % | 2.97 | % | ||||||||||

Tax Equivalent Yield‡‡ | 4.66 | % | 3.48 | % | 3.48 | % | 5.25 | % | 5.25 | % | ||||||||||

Current Annualized Distribution Rate‡‡ | 4.33 | % | 3.58 | % | 3.60 | % | 4.58 | % | 4.58 | % | ||||||||||

‡‡ The SEC yield is net investment income per share earned over the month ended November 30, 2014 shown as an annualized percentage of the maximum offering price per share on the last day of the period. The SEC yield is computed in accordance with a standardized method prescribed by the Securities and Exchange Commission. The SEC yield would have been 2.60%, 1.92%, 1.91%, 2.85% and 2.94% for Classes A, B, C, S and Institutional shares, respectively, had certain expenses not been reduced. Tax equivalent yield is based on the Fund's yield and a marginal federal income rate of 43.4%. Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value on November 30, 2014. Distribution rate simply measures the level of dividends and is not a complete measure of performance. The current annualized distribution rate would have been 4.29%, 3.53%, 3.54%, 4.46% and 4.55% for Classes A, B, C, S and Institutional shares, respectively, had certain expenses not been reduced. Yields and distribution rates are historical, not guaranteed and will fluctuate.

Philip G. Condon, Managing Director

Co-Lead Portfolio Manager of the fund. Began managing the fund in 1987.

— Joined Deutsche Asset & Wealth Management in 1983.

— Vice Chairman of Deutsche Asset & Wealth Management, Americas; formerly, Head of Municipal Bonds.

— BA and MBA, University of Massachusetts at Amherst.

Rebecca L. Flinn, Director

Co-Lead Portfolio Manager of the fund. Began managing the fund in 1998.

— Joined Deutsche Asset & Wealth Management in 1986.

— BA, University of Redlands, California.

A. Gene Caponi, CFA, Managing Director

Co-Lead Portfolio Manager of the fund. Began managing the fund in 2009.

— Joined Deutsche Asset & Wealth Management in 1998.

— BS, State University of New York, Oswego; MBA, State University of New York at Albany.

Effective October 1, 2014, Ashton P. Goodfield and Carol L. Flynn were added as Co-Lead Portfolio Managers of the fund, joining the current portfolio management team.

Ashton P. Goodfield, CFA, Managing Director

Co-Lead Portfolio Manager of the fund. Began managing the fund in 2014.

— Joined Deutsche Asset & Wealth Management in 1986.

— Co-Head of Municipal Bonds.

— BA, Duke University.

Carol L. Flynn, CFA, Managing Director

Co-Lead Portfolio Manager of the fund. Began managing the fund in 2014.

— Joined Deutsche Asset & Wealth Management in 1994.

— Co-Head of Municipal Bonds.

— BS, Duke University; MBA, University of Connecticut.

| Principal Amount ($) | Value ($) | |||||||

| Municipal Bonds and Notes 93.2% | ||||||||

| Alabama 0.1% | ||||||||

| Montgomery, AL, Medical Clinic Board, Health Care Facility Revenue, Jackson Hospital & Clinic, 5.25%, 3/1/2036 | 2,000,000 | 2,040,620 | ||||||

| Arizona 1.3% | ||||||||

| Arizona, Salt River Pima-Maricopa Indian Community, 0.06%**, 10/1/2025, LOC: Bank of America NA | 3,135,000 | 3,135,000 | ||||||

| Arizona, Salt Verde Financial Corp., Gas Revenue, 5.25%, 12/1/2025, GTY: Citibank NA | 4,000,000 | 4,735,360 | ||||||

| Maricopa County, AZ, Pollution Control Corp. Revenue, El Paso Electric Co. Project, Series B, 7.25%, 4/1/2040 | 3,930,000 | 4,626,946 | ||||||

| Pima County, AZ, Industrial Development Revenue, Tucson Electric Power, 5.75%, 9/1/2029 | 2,250,000 | 2,259,090 | ||||||

| Tempe, AZ, Industrial Development Authority Revenue, Tempe Life Care Village, Inc.: | ||||||||

| Series A, 6.25%, 12/1/2042 | 1,535,000 | 1,649,143 | ||||||

| Series A, 6.25%, 12/1/2046 | 1,400,000 | 1,501,332 | ||||||

| Yavapai County, AZ, Industrial Development Authority, Solid Waste Disposal Revenue, Waste Management, Inc. Project, Series A-1, AMT, 4.9%, 3/1/2028 | 5,000,000 | 5,209,400 | ||||||

| 23,116,271 | ||||||||

| California 10.4% | ||||||||

| California, Bay Area Toll Authority, Toll Bridge Revenue, San Francisco Bay Area: | ||||||||

| Series F-1, Prerefunded, 5.125%, 4/1/2039 | 10,000,000 | 11,762,400 | ||||||

| Series F-1, Prerefunded, 5.5%, 4/1/2043 | 10,000,000 | 11,586,300 | ||||||

| California, M-S-R Energy Authority, Series B, 7.0%, 11/1/2034, GTY: Citigroup, Inc. | 8,750,000 | 12,271,087 | ||||||

| California, Morongo Band of Mission Indians, Enterprise Casino Revenue, Series B, 144A, 6.5%, 3/1/2028 | 5,000,000 | 5,552,250 | ||||||

| California, State General Obligation: | ||||||||

| Series B, 144A, 0.04%**, 5/1/2040, LOC: Bank of Tokyo-Mitsubishi UFJ | 2,500,000 | 2,500,000 | ||||||

| 5.0%, 8/1/2034 | 5,185,000 | 5,767,431 | ||||||

| 5.0%, 2/1/2043 | 12,820,000 | 14,374,681 | ||||||

| 5.5%, 3/1/2040 | 5,130,000 | 5,901,449 | ||||||

| California, State General Obligation, Various Purposes: | ||||||||

| 5.0%, 11/1/2032 | 10,000,000 | 10,957,200 | ||||||

| 5.0%, 11/1/2037 | 9,145,000 | 9,949,120 | ||||||

| 5.75%, 4/1/2031 | 23,360,000 | 27,533,497 | ||||||

| California, State Public Works Board, Lease Revenue, Series B, 5.0%, 10/1/2039 | 5,500,000 | 6,233,040 | ||||||

| California, State Public Works Board, Lease Revenue, Capital Projects: | ||||||||

| Series A-1, 6.0%, 3/1/2035 | 10,175,000 | 12,098,584 | ||||||

| Series I-1, 6.375%, 11/1/2034 | 5,000,000 | 6,151,550 | ||||||

| California, Statewide Communities Development Authority Revenue, Terraces At San Joaquin Gardens Project: | ||||||||

| Series A, 5.625%, 10/1/2032 | 500,000 | 532,625 | ||||||

| Series A, 6.0%, 10/1/2042 | 1,000,000 | 1,072,850 | ||||||

| Series A, 6.0%, 10/1/2047 | 1,000,000 | 1,070,540 | ||||||

| Long Beach, CA, Bond Finance Authority, Natural Gas Purchase Revenue, Series A, 5.25%, 11/15/2023, GTY: Merrill Lynch & Co., Inc. | 620,000 | 728,395 | ||||||

| Riverside County, CA, Transportation Commission Toll Revenue, Series A, 5.75%, 6/1/2048 | 2,850,000 | 3,243,898 | ||||||

| San Buenaventura, CA, Community Memorial Health Systems, 7.5%, 12/1/2041 | 3,250,000 | 3,906,207 | ||||||

| San Diego, CA, Community College District, Election of 2006, 5.0%, 8/1/2036 | 2,050,000 | 2,361,580 | ||||||

| San Francisco City & County, CA, Airports Commission, International Airport Revenue, Series A, AMT, 5.0%, 5/1/2044 | 11,000,000 | 12,170,400 | ||||||

| San Francisco, CA, City & County Public Utilities Commission, Water Revenue, Series A, 5.125%, 11/1/2039 | 10,400,000 | 11,924,744 | ||||||

| San Francisco, CA, City & County Redevelopment Financing Authority, Tax Allocation, Mission Bay South Redevelopment, Series D, 7.0%, 8/1/2041 | 1,400,000 | 1,708,588 | ||||||

| San Joaquin Hills, CA, Transportation Corridor Agency, Toll Road Revenue, Series A, 5.0%, 1/15/2050 | 3,555,000 | 3,736,554 | ||||||

| Vernon, CA, Electric Systems Revenue, Series A, 5.5%, 8/1/2041 | 2,240,000 | 2,493,680 | ||||||

| 187,588,650 | ||||||||

| Colorado 2.2% | ||||||||

| Colorado, E-470 Public Highway Authority Revenue: | ||||||||

| Series C, 5.375%, 9/1/2026 | 2,000,000 | 2,227,000 | ||||||

| Series A-1, 5.5%, 9/1/2024, INS: NATL | 3,500,000 | 3,620,225 | ||||||

| Colorado, Health Facilities Authority Revenue, Christian Living Communities Project, Series A, 5.75%, 1/1/2037 | 1,000,000 | 1,021,140 | ||||||

| Colorado, Health Facilities Authority Revenue, Covenant Retirement Communities, Inc., 5.0%, 12/1/2035 | 11,750,000 | 11,977,010 | ||||||

| Colorado, Health Facilities Authority Revenue, Valley View Hospital Association, 5.75%, 5/15/2036 | 2,000,000 | 2,192,420 | ||||||

| Colorado, Public Energy Authority, Natural Gas Purchased Revenue, 6.25%, 11/15/2028, GTY: Merrill Lynch & Co., Inc. | 6,365,000 | 8,179,025 | ||||||

| Colorado, Regional Transportation District, Private Activity Revenue, Denver Transit Partners, 6.0%, 1/15/2041 | 2,000,000 | 2,242,560 | ||||||

| Colorado, State Health Facilities Authority Revenue, Christian Living Community, 6.375%, 1/1/2041 | 1,615,000 | 1,749,642 | ||||||

| Colorado, State Health Facilities Authority Revenue, Covenant Retirement Communities, Series A, 5.0%, 12/1/2033 | 4,835,000 | 5,129,500 | ||||||

| Montrose, CO, Memorial Hospital Revenue, 6.375%, 12/1/2023 | 2,355,000 | 2,389,312 | ||||||

| 40,727,834 | ||||||||

| Connecticut 1.7% | ||||||||

| Connecticut, Harbor Point Infrastructure Improvement District, Special Obligation Revenue, Harbor Point Project, Series A, 7.875%, 4/1/2039 | 20,000,000 | 23,718,000 | ||||||

| Connecticut, Mashantucket Western Pequot Tribe Bond, 144A, 6.05%, 7/1/2031 (PIK) | 15,239,244 | 2,133,494 | ||||||

| Connecticut, Mohegan Tribe Indians Gaming Authority, Priority Distribution, 144A, 5.25%, 1/1/2033 | 3,000,000 | 2,999,850 | ||||||

| Hamden, CT, Facility Revenue, Whitney Center Project, Series A, 7.625%, 1/1/2030 | 1,200,000 | 1,245,540 | ||||||

| 30,096,884 | ||||||||

| District of Columbia 0.4% | ||||||||

| Metropolitan Washington, DC, Airport Authority Dulles Toll Road Revenue, Dulles Metrorail & Capital Important Project, Series A, 5.0%, 10/1/2053 | 7,000,000 | 7,400,960 | ||||||

| Florida 6.6% | ||||||||

| Bayside, FL, Sales & Special Tax Revenue, Community Development District, Series A, 6.3%, 5/1/2018 | 210,000 | 210,078 | ||||||

| Collier County, FL, Industrial Development Authority, Continuing Care Community Revenue, Arlington of Naples Project, Series A, 8.125%, 5/15/2044 | 4,000,000 | 4,474,960 | ||||||

| Florida, Capital Region Community Development District, Capital Improvement Revenue, Series A, 7.0%, 5/1/2039 | 5,985,000 | 6,085,668 | ||||||

| Florida, Harbourage at Braden River Community Development District, Capital Improvement Revenue, Series A, 6.125%, 5/1/2034 | 1,295,000 | 1,299,481 | ||||||

| Florida, Middle Village Community Development District, Special Assessment, Series A, 6.0%, 5/1/2035 | 7,905,000 | 6,722,965 | ||||||

| Florida, Tolomato Community Development District, Special Assessment, 5.4%, 5/1/2037 | 15,405,000 | 15,464,771 | ||||||

| Florida, Village Community Development District No. 9, Special Assessment Revenue: | ||||||||

| 5.5%, 5/1/2042 | 1,470,000 | 1,644,195 | ||||||

| 7.0%, 5/1/2041 | 1,765,000 | 2,171,338 | ||||||

| Greater Orlando, FL, Aviation Authority Airport Facilities Revenue, Jetblue Airways Corp. Project, AMT, 5.0%, 11/15/2026 | 1,500,000 | 1,521,165 | ||||||

| Highlands County, FL, Health Facilities Authority Revenue, Adventist Health System: | ||||||||

| Series G, 5.125%, 11/15/2020 | 970,000 | 1,055,205 | ||||||

| Series G, Prerefunded, 5.125%, 11/15/2020 | 30,000 | 32,777 | ||||||

| Series G, Prerefunded, 5.125%, 11/15/2021 | 70,000 | 76,479 | ||||||

| Series G, Prerefunded, 5.125%, 11/15/2022 | 75,000 | 81,941 | ||||||

| Series G, Prerefunded, 5.125%, 11/15/2023 | 180,000 | 196,659 | ||||||

| Lee County, FL, Airport Revenue, Series A, AMT, 5.375%, 10/1/2032 | 1,750,000 | 1,939,210 | ||||||

| Martin County, FL, Health Facilities Authority, Martin Memorial Medical Center, 5.5%, 11/15/2042 | 3,040,000 | 3,336,035 | ||||||

| Miami Beach, FL, Health Facilities Authority, Mount Sinai Medical Center: | ||||||||

| 5.0%, 11/15/2029 | 1,000,000 | 1,097,630 | ||||||

| 5.0%, 11/15/2044 | 2,500,000 | 2,705,875 | ||||||

| Miami-Dade County, FL, Aviation Revenue, Miami International Airport: | ||||||||

| Series A, AMT, 5.25%, 10/1/2033, INS: AGC | 10,000,000 | 11,099,800 | ||||||

| Series A-1, 5.5%, 10/1/2041 | 5,000,000 | 5,737,850 | ||||||

| Miami-Dade County, FL, Double Barreled Aviation, 5.0%, 7/1/2041 | 5,000,000 | 5,515,750 | ||||||

| Miami-Dade County, FL, Expressway Authority, Toll Systems Revenue, Series A, 5.0%, 7/1/2044 | 2,500,000 | 2,776,325 | ||||||

| Miami-Dade County, FL, Water & Sewer Systems Revenue, 5.0%, 10/1/2034 | 3,650,000 | 4,128,624 | ||||||

| Orange County, FL, Health Facilities Authority Revenue, Orlando Regional Healthcare, Series C, 5.25%, 10/1/2035 | 5,000,000 | 5,440,200 | ||||||

| Palm Beach County, FL, Health Facilities Authority Revenue, Waterford Project, 5.375%, 11/15/2022 | 2,600,000 | 2,840,682 | ||||||

| Palm Beach County, FL, Health Facilities Authority, Retirement Community Revenue, Acts Retirement-Life Communities, Inc., 5.5%, 11/15/2033 | 9,000,000 | 9,966,240 | ||||||

| Port St. Lucie, FL, Special Assessment Revenue, Southwest Annexation District 1, Series B, 5.0%, 7/1/2027, INS: NATL | 2,500,000 | 2,695,775 | ||||||

| Seminole Tribe, FL, Special Obligation Revenue: | ||||||||

| Series A, 144A, 5.5%, 10/1/2024 | 8,000,000 | 8,697,760 | ||||||

| Series A, 144A, 5.75%, 10/1/2022 | 9,500,000 | 10,308,830 | ||||||

| 119,324,268 | ||||||||

| Georgia 3.7% | ||||||||

| Americus-Sumter County, GA, Hospital Authority, Magnolia Manor Obligated Group, Series A, 6.375%, 5/15/2043 | 4,000,000 | 4,359,840 | ||||||

| Atlanta, GA, Tax Allocation, Beltline Project: | ||||||||

| Series B, 7.375%, 1/1/2031 | 4,915,000 | 5,800,339 | ||||||

| Atlanta, GA, Tax Allocation, Princeton Lakes Project, 144A, 5.5%, 1/1/2031 | 1,045,000 | 1,056,965 | ||||||

| Atlanta, GA, Water & Wastewater Revenue: | ||||||||

| Series B, 5.375%, 11/1/2039, INS: AGMC | 10,000,000 | 11,436,300 | ||||||

| Series A, 6.25%, 11/1/2034 | 10,000,000 | 11,903,400 | ||||||

| De Kalb County, GA, Hospital Authority Revenue, Anticipation Certificates, Dekalb Medical Center, Inc. Project, 6.125%, 9/1/2040 | 7,500,000 | 8,224,425 | ||||||

| De Kalb County, GA, Water & Sewer Revenue, Series A, 5.25%, 10/1/2032 | 820,000 | 953,463 | ||||||

| Gainesville & Hall County, GA, Hospital Authority, Northeast Georgia Health System, Inc. Project: | ||||||||

| Series A, 5.25%, 8/15/2049 (a) | 500,000 | 559,705 | ||||||

| Series A, 5.5%, 8/15/2054 (a) | 1,820,000 | 2,083,936 | ||||||

| Georgia, Glynn-Brunswick Memorial Hospital Authority Revenue, Anticipation Certificates-Southeast Health, Series A, 5.625%, 8/1/2034 | 5,500,000 | 6,104,835 | ||||||

| Georgia, Main Street Natural Gas, Inc., Gas Project Revenue: | ||||||||

| Series A, 5.0%, 3/15/2019, GTY: JPMorgan Chase & Co. (b) | 10,000,000 | 11,216,900 | ||||||

| Series A, 5.5%, 9/15/2024, GTY: Merrill Lynch & Co., Inc. | 2,440,000 | 2,929,123 | ||||||

| 66,629,231 | ||||||||

| Guam 0.9% | ||||||||

| Government of Guam, General Obligation, Series A, 7.0%, 11/15/2039 | 10,155,000 | 11,740,500 | ||||||

| Guam, International Airport Authority, Series C, AMT, 6.375%, 10/1/2043 | 1,610,000 | 1,853,448 | ||||||

| Guam, Power Authority Revenue, Series A, 5.5%, 10/1/2030 | 3,000,000 | 3,410,640 | ||||||

| 17,004,588 | ||||||||

| Hawaii 1.9% | ||||||||

| Hawaii, State Airports Systems Revenue, Series A, 5.0%, 7/1/2034 | 15,000,000 | 16,368,000 | ||||||

| Hawaii, State Department of Budget & Finance, Special Purpose Revenue, 15 Craigside Project, Series A, 9.0%, 11/15/2044 | 2,000,000 | 2,506,540 | ||||||

| Hawaii, State Department of Budget & Finance, Special Purpose Revenue, Hawaiian Electric Co., Inc.: | ||||||||

| Series B, AMT, 4.6%, 5/1/2026, INS: FGIC | 11,790,000 | 12,149,949 | ||||||

| 6.5%, 7/1/2039, GTY: Hawaiian Electric Co., Inc. | 2,500,000 | 2,908,175 | ||||||

| 33,932,664 | ||||||||

| Illinois 6.7% | ||||||||

| Chicago, IL, General Obligation: | ||||||||

| Series A, 5.0%, 1/1/2033 | 7,000,000 | 7,135,660 | ||||||

| Series A, 5.25%, 1/1/2029, INS: AGMC | 175,000 | 175,480 | ||||||

| Series A, 5.25%, 1/1/2032 | 3,000,000 | 3,140,010 | ||||||

| Series A, 5.25%, 1/1/2035 | 4,050,000 | 4,202,442 | ||||||

| Chicago, IL, O'Hare International Airport Revenue, Third Lien: | ||||||||

| Series A, 5.75%, 1/1/2039 | 9,955,000 | 11,465,572 | ||||||

| Series B, 6.0%, 1/1/2041 | 12,095,000 | 14,112,083 | ||||||

| Cook County, IL, Forest Preservation District, Series C, 5.0%, 12/15/2037 | 1,845,000 | 2,027,784 | ||||||

| Illinois, Finance Authority Revenue, Elmhurst Memorial Healthcare, Series A, 5.625%, 1/1/2037 | 5,500,000 | 5,951,000 | ||||||

| Illinois, Finance Authority Revenue, Friendship Village of Schaumburg: | ||||||||

| Series A, 5.625%, 2/15/2037 | 5,000,000 | 5,000,700 | ||||||

| 7.25%, 2/15/2045 | 4,000,000 | 4,300,000 | ||||||

| Illinois, Finance Authority Revenue, Park Place of Elmhurst, Series A, 8.125%, 5/15/2040 | 6,000,000 | 4,109,940 | ||||||

| Illinois, Finance Authority Revenue, Rush University Medical Center, Series B, 5.75%, 11/1/2028, INS: NATL | 1,250,000 | 1,398,725 | ||||||

| Illinois, Finance Authority Revenue, Swedish Covenant Hospital, Series A, 6.0%, 8/15/2038 | 7,830,000 | 8,826,602 | ||||||

| Illinois, Finance Authority Revenue, The Admiral at Lake Project: | ||||||||

| Series A, 7.75%, 5/15/2030 | 1,675,000 | 1,793,724 | ||||||

| Series A, 8.0%, 5/15/2040 | 1,000,000 | 1,068,030 | ||||||

| Series A, 8.0%, 5/15/2046 | 3,500,000 | 3,721,585 | ||||||

| Illinois, Finance Authority Revenue, Three Crowns Park Plaza: | ||||||||

| Series A, 5.875%, 2/15/2026 | 1,225,000 | 1,245,384 | ||||||

| Series A, 5.875%, 2/15/2038 | 500,000 | 505,150 | ||||||

| Illinois, Metropolitan Pier & Exposition Authority, Dedicated State Tax Revenue, McCormick Place, Series B, 5.0%, 6/15/2050, INS: AGMC | 8,000,000 | 8,438,880 | ||||||

| Illinois, Railsplitter Tobacco Settlement Authority, 6.0%, 6/1/2028 | 6,405,000 | 7,502,433 | ||||||

| Illinois, State Finance Authority Revenue, Northwestern University, Series C, 0.04%**, 12/1/2034 | 9,500,000 | 9,500,000 | ||||||

| Illinois, State Finance Authority Revenue, OSF Healthcare Systems, Series A, 5.0%, 5/15/2041 | 5,265,000 | 5,654,452 | ||||||

| Illinois, State Finance Authority Revenue, Trinity Health Corp., Series L, 5.0%, 12/1/2030 | 1,500,000 | 1,676,790 | ||||||

| Illinois, State General Obligation: | ||||||||

| 5.0%, 2/1/2039 | 2,400,000 | 2,515,920 | ||||||

| 5.0%, 5/1/2039 | 5,000,000 | 5,246,950 | ||||||

| 5.5%, 7/1/2038 | 1,280,000 | 1,415,936 | ||||||

| 122,131,232 | ||||||||

| Indiana 1.4% | ||||||||

| Indiana, Health & Educational Facility Financing Authority, Hospital Revenue, Community Foundation Northwest, 5.5%, 3/1/2037 | 1,750,000 | 1,845,340 | ||||||

| Indiana, State Finance Authority Revenue, Greencroft Obligation Group, Series A, 7.0%, 11/15/2043 | 2,290,000 | 2,660,705 | ||||||

| Indiana, State Finance Authority Revenue, I-69 Development Partners LLC, AMT, 5.25%, 9/1/2034 | 2,275,000 | 2,522,156 | ||||||

| Indiana, State Finance Authority, Hospital Revenue, Indiana University Health, Series D, 0.03%**, 3/1/2033, LOC: Northern Trust Co. | 4,145,000 | 4,145,000 | ||||||

| North Manchester, IN, Economic Development Revenue, Peabody Retirement Community Project: | ||||||||

| Series B, 1.0%, 12/1/2045* | 1,341,246 | 14 | ||||||

| Series A, 5.13%**, 12/1/2045 | 1,557,576 | 782,744 | ||||||

| Valparaiso, IN, Exempt Facilities Revenue, Pratt Paper LLC Project, AMT, 7.0%, 1/1/2044, GTY: Pratt Industries (U.S.A.) | 6,220,000 | 7,124,450 | ||||||

| Vigo County, IN, Hospital Authority Revenue, Union Hospital, Inc.: | ||||||||

| 144A, 5.5%, 9/1/2027 | 1,000,000 | 1,054,250 | ||||||

| 8.0%, 9/1/2041 | 4,000,000 | 4,864,880 | ||||||

| 24,999,539 | ||||||||

| Iowa 0.9% | ||||||||

| Altoona, IA, Urban Renewal Tax Increment Revenue, Annual Appropriation: | ||||||||

| 6.0%, 6/1/2034 | 1,000,000 | 1,083,060 | ||||||

| 6.0%, 6/1/2039 | 2,000,000 | 2,161,320 | ||||||

| Iowa, Finance Authority Retirement Community Revenue, Edgewater LLC Project, 6.5%, 11/15/2027 | 5,000,000 | 5,366,250 | ||||||

| Iowa, State Finance Authority, Midwestern Disaster Area Revenue, Fertilizer Co. Project, 5.25%, 12/1/2025 | 6,665,000 | 7,052,103 | ||||||

| 15,662,733 | ||||||||

| Kansas 0.4% | ||||||||

| Lenexa, KS, Health Care Facility Revenue, 5.5%, 5/15/2039 | 6,340,000 | 6,446,258 | ||||||

| Lenexa, KS, Health Care Facility Revenue, Lakeview Village, Inc. Project, 7.25%, 5/15/2039 | 1,200,000 | 1,357,704 | ||||||

| 7,803,962 | ||||||||

| Kentucky 1.7% | ||||||||

| Kentucky, Economic Development Finance Authority, Hospital Facilities Revenue, Owensboro Medical Health Systems, Series A, 6.5%, 3/1/2045 | 15,000,000 | 17,407,800 | ||||||

| Kentucky, Economic Development Finance Authority, Louisville Arena Project Revenue, Series A-1, 6.0%, 12/1/2033, INS: AGC | 3,635,000 | 3,935,687 | ||||||

| Kentucky, Public Transportation Infrastructure Authority Toll Revenue, 1st Tier-Downtown Crossing, Series A, 6.0%, 7/1/2053 | 7,195,000 | 8,279,287 | ||||||

| Louisville & Jefferson County, KY, Metropolitan Government Health Systems Revenue, Norton Healthcare, Inc., 5.0%, 10/1/2030 | 1,000,000 | 1,033,720 | ||||||

| 30,656,494 | ||||||||

| Louisiana 2.5% | ||||||||

| DeSoto Parish, LA, Environmental Improvement Revenue, International Paper Co. Project, Series A, AMT, 5.75%, 9/1/2031 | 5,000,000 | 5,374,900 | ||||||

| Louisiana, Local Government Environmental Facilities & Community Development, Westlake Chemical Corp., Series A, 6.5%, 8/1/2029 | 6,055,000 | 7,226,219 | ||||||

| Louisiana, Local Government Environmental Facilities, Community Development Authority Revenue, 6.75%, 11/1/2032 | 6,000,000 | 6,809,340 | ||||||

| Louisiana, Public Facilities Authority Revenue, Ochsner Clinic Foundation Project, 6.75%, 5/15/2041 | 2,500,000 | 2,971,125 | ||||||

| Louisiana, Public Facilities Authority, Hospital Revenue, Lafayette General Medical Center, 5.5%, 11/1/2040 | 5,000,000 | 5,466,800 | ||||||

| Louisiana, St. John Baptist Parish Revenue, Marathon Oil Corp., Series A, 5.125%, 6/1/2037 | 15,000,000 | 15,848,100 | ||||||

| Louisiana, Tobacco Settlement Financing Corp. Revenue, Series A, 5.25%, 5/15/2035 | 1,820,000 | 2,004,875 | ||||||

| 45,701,359 | ||||||||

| Maine 0.6% | ||||||||

| Maine, Health & Higher Educational Facilities Authority Revenue, Maine General Medical Center, 6.75%, 7/1/2036 | 9,000,000 | 10,165,410 | ||||||

| Maryland 1.9% | ||||||||

| Anne Arundel County, MD, Special Obligation, National Business Park North Project, 6.1%, 7/1/2040 | 2,200,000 | 2,354,660 | ||||||

| Maryland, State Economic Development Corp. Revenue, Senior Lien Project, Chesapeake Bay: | ||||||||

| Series A, 5.0%, 12/1/2031 (c) | 7,000,000 | 3,197,600 | ||||||

| Series B, 5.25%, 12/1/2031 (c) | 3,400,000 | 1,553,120 | ||||||

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Adventist Healthcare, Series A, 6.125%, 1/1/2036 | 3,250,000 | 3,737,533 | ||||||

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Doctors Community Hospital, Inc., 5.75%, 7/1/2038 | 6,250,000 | 6,624,250 | ||||||

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Mercy Medical Center: | ||||||||

| Series A, 5.0%, 7/1/2037 | 5,005,000 | 5,185,530 | ||||||

| 6.25%, 7/1/2031 | 2,500,000 | 2,869,775 | ||||||

| Maryland, State Health & Higher Educational Facilities Authority Revenue, Washington County Hospital: | ||||||||

| 5.75%, 1/1/2033 | 2,660,000 | 2,801,911 | ||||||

| 6.0%, 1/1/2028 | 6,100,000 | 6,502,417 | ||||||

| Westminster, MD, Project Revenue, Lutheran Village Millers Grant, Inc., Series A, 6.25%, 7/1/2044 | 440,000 | 467,685 | ||||||

| 35,294,481 | ||||||||

| Massachusetts 2.9% | ||||||||

| Boston, MA, Industrial Development Financing Authority Revenue, Crosstown Center Project: | ||||||||

| AMT, 6.5%, 9/1/2035 | 8,805,000 | 6,788,039 | ||||||

| AMT, 8.0%, 9/1/2035* | 960,000 | 192,048 | ||||||

| Massachusetts, Industrial Development Revenue, Development Finance Agency, Series A, 7.1%, 7/1/2032 | 3,270,000 | 3,283,145 | ||||||

| Massachusetts, Project Revenue, Health & Educational Facilities Authority, Jordan Hospital, Series E, 6.75%, 10/1/2033 | 7,450,000 | 7,459,461 | ||||||

| Massachusetts, State Development Finance Agency Revenue, Linden Ponds, Inc. Facility: | ||||||||

| Series A-2, 5.5%, 11/15/2046 | 86,572 | 65,978 | ||||||

| Series A-1, 6.25%, 11/15/2039 | 1,621,881 | 1,261,288 | ||||||

| Series B, 11/15/2056* | 430,598 | 431 | ||||||

| Massachusetts, State Development Finance Agency Revenue, Tufts Medical Center, Inc., Series I, 7.25%, 1/1/2032 | 2,250,000 | 2,756,228 | ||||||

| Massachusetts, State Health & Educational Facilities Authority Revenue, Caregroup Healthcare System: | ||||||||

| Series E-1, 5.0%, 7/1/2028 | 1,500,000 | 1,594,020 | ||||||

| Series E-1, 5.125%, 7/1/2038 | 1,500,000 | 1,583,100 | ||||||

| Massachusetts, State Health & Educational Facilities Authority Revenue, Milford Regional Medical Center: | ||||||||

| Series E, 5.0%, 7/15/2022 | 2,250,000 | 2,347,830 | ||||||

| Series E, 5.0%, 7/15/2032 | 3,250,000 | 3,317,210 | ||||||

| Series E, 5.0%, 7/15/2037 | 2,750,000 | 2,783,605 | ||||||

| Massachusetts, State Health & Educational Facilities Authority Revenue, South Shore Hospital: | ||||||||

| Series F, 5.625%, 7/1/2019 | 135,000 | 135,559 | ||||||

| Series F, 5.75%, 7/1/2029 | 1,480,000 | 1,486,068 | ||||||

| Massachusetts, State Health & Educational Facilities Authority Revenue, Suffolk University, Series A, 5.75%, 7/1/2039 | 7,145,000 | 7,896,154 | ||||||

| Massachusetts, State Port Authority Special Facilities Revenue, Delta Air Lines, Inc. Project: | ||||||||

| Series A, AMT, 5.5%, 1/1/2016, INS: AMBAC | 5,000,000 | 5,006,550 | ||||||

| Series A, AMT, 5.5%, 1/1/2018, INS: AMBAC | 4,000,000 | 4,005,240 | ||||||

| 51,961,954 | ||||||||

| Michigan 2.4% | ||||||||

| Dearborn, MI, Economic Development Corp. Revenue, Limited Obligation, Henry Ford Village: | ||||||||

| 7.0%, 11/15/2038 | 4,500,000 | 4,543,065 | ||||||

| 7.125%, 11/15/2043 | 1,500,000 | 1,517,925 | ||||||

| Detroit, MI, Water & Sewerage Department, Sewerage Disposal System Revenue, Series A, 5.25%, 7/1/2039 | 2,100,000 | 2,255,400 | ||||||

| Detroit, MI, Water Supply Systems Revenue, Series A, 5.75%, 7/1/2037 | 7,590,000 | 8,336,552 | ||||||

| Kalamazoo, MI, Economic Development Corp. Revenue, Limited Obligation, Heritage Community: | ||||||||

| 5.375%, 5/15/2027 | 1,000,000 | 1,007,530 | ||||||

| 5.5%, 5/15/2036 | 1,000,000 | 1,008,210 | ||||||

| Kentwood, MI, Economic Development Corp., Limited Obligation, Holland Home, 5.625%, 11/15/2041 | 3,750,000 | 3,941,475 | ||||||

| Michigan, State Finance Authority Revenue, Detroit Water & Sewer, Series C-3, 5.0%, 7/1/2033, INS: AGMC | 1,820,000 | 2,005,658 | ||||||

| Michigan, State Finance Authority Revenue, Trinity Health Corp., 5.0%, 12/1/2031 | 10,910,000 | 12,174,033 | ||||||

| Michigan, State Hospital Finance Authority Revenue, Henry Ford Health Hospital, 5.75%, 11/15/2039 | 6,315,000 | 7,008,829 | ||||||

| 43,798,677 | ||||||||

| Mississippi 1.1% | ||||||||

| Lowndes County, MS, Solid Waste Disposal & Pollution Control Revenue, Weyerhaeuser Co. Project, Series A, 6.8%, 4/1/2022 | 5,500,000 | 6,942,210 | ||||||

| Warren County, MS, Gulf Opportunity Zone, International Paper Co.: | ||||||||

| Series A, 5.375%, 12/1/2035 | 1,000,000 | 1,120,850 | ||||||

| Series A, 5.5%, 9/1/2031 | 4,250,000 | 4,479,415 | ||||||

| Series A, 5.8%, 5/1/2034, GTY: International Paper Co. | 4,000,000 | 4,518,320 | ||||||

| Series A, 6.5%, 9/1/2032 | 2,620,000 | 3,020,546 | ||||||

| 20,081,341 | ||||||||

| Missouri 0.8% | ||||||||

| Cass County, MO, Hospital Revenue, 5.5%, 5/1/2027 | 2,000,000 | 2,043,200 | ||||||

| Kansas City, MO, Industrial Development Authority, Health Facilities Revenue, First Mortgage, Bishop Spencer, Series A, 6.5%, 1/1/2035 | 1,000,000 | 1,001,530 | ||||||

| Kirkwood, MO, Industrial Development Authority, Retirement Community Revenue, Aberdeen Heights: | ||||||||

| Series A, 8.25%, 5/15/2039 | 1,000,000 | 1,154,200 | ||||||

| Series A, 8.25%, 5/15/2045 | 2,850,000 | 3,282,145 | ||||||

| Missouri, State Health & Educational Facilities Authority, Lutheran Senior Services, 6.0%, 2/1/2041 | 2,250,000 | 2,496,510 | ||||||

| St. Louis, MO, Lambert-St. Louis International Airport Revenue, Series A-1, 6.625%, 7/1/2034 | 4,085,000 | 4,804,818 | ||||||

| 14,782,403 | ||||||||

| Nebraska 0.2% | ||||||||

| Douglas County, NE, Hospital Authority No. 002 Revenue, Health Facilities, Immanuel Obligation Group, 5.625%, 1/1/2040 | 1,500,000 | 1,665,150 | ||||||

| Lancaster County, NE, Hospital Authority No.1, Health Facilities Revenue, Immanuel Obligation Group, 5.625%, 1/1/2040 | 2,500,000 | 2,775,250 | ||||||

| 4,440,400 | ||||||||

| Nevada 0.4% | ||||||||

| Reno, NV, Hospital Revenue, Renown Regional Medical Center Project, Series A, 5.0%, 6/1/2027 | 5,000,000 | 5,190,800 | ||||||

| Sparks, NV, Local Improvement Districts, Limited Obligation District No. 3, 6.75%, 9/1/2027 | 1,395,000 | 1,488,214 | ||||||

| 6,679,014 | ||||||||

| New Hampshire 1.3% | ||||||||

| New Hampshire, Health & Education Facilities Authority Revenue, Havenwood-Heritage Heights: | ||||||||

| Series A, 5.35%, 1/1/2026 | 1,035,000 | 1,042,359 | ||||||

| Series A, 5.4%, 1/1/2030 | 550,000 | 552,398 | ||||||

| New Hampshire, Health & Education Facilities Authority Revenue, Wentworth-Douglas Hospital, Series A, 7.0%, 1/1/2038 | 5,325,000 | 6,205,861 | ||||||

| New Hampshire, Senior Care Revenue, Health & Educational Facilities Authority, New Hampshire Catholic Charities, 5.8%, 8/1/2022 | 2,325,000 | 2,333,231 | ||||||

| New Hampshire, State Business Finance Authority Revenue, Elliot Hospital Obligation Group, Series A, 6.125%, 10/1/2039 | 5,000,000 | 5,638,950 | ||||||

| New Hampshire, State Business Finance Authority, Solid Waste Disposal Revenue, Waste Management, Inc. Project, AMT, 5.2%, 5/1/2027 | 4,000,000 | 4,206,720 | ||||||

| New Hampshire, State Health & Education Facilities Authority Revenue, Rivermead Retirement Community: | ||||||||

| Series A, 6.625%, 7/1/2031 | 700,000 | 783,678 | ||||||

| Series A, 6.875%, 7/1/2041 | 2,825,000 | 3,159,084 | ||||||

| 23,922,281 | ||||||||

| New Jersey 3.4% | ||||||||

| New Jersey, Health Care Facilities Financing Authority Revenue, St. Joseph's Health Care System, 6.625%, 7/1/2038 | 5,785,000 | 6,473,936 | ||||||

| New Jersey, Industrial Development Revenue, Economic Development Authority, Harrogate, Inc., Series A, 5.875%, 12/1/2026 | 1,425,000 | 1,426,012 | ||||||

| New Jersey, State Economic Development Authority Revenue, 5.0%, 6/15/2028 | 450,000 | 494,892 | ||||||

| New Jersey, State Economic Development Authority Revenue, The Goethals Bridge Replacement Project, AMT, 5.375%, 1/1/2043 | 2,275,000 | 2,484,186 | ||||||

| New Jersey, State Economic Development Authority, Continental Airlines, Inc. Project, AMT, 4.875%, 9/15/2019 | 10,110,000 | 10,633,193 | ||||||

| New Jersey, State Economic Development Authority, Special Facilities Revenue, Continental Airlines, Inc. Project, Series B, AMT, 5.625%, 11/15/2030 | 2,500,000 | 2,719,675 | ||||||

| New Jersey, State Health Care Facilities Financing Authority Revenue, Saint Barnabas Health, Series A, 5.625%, 7/1/2032 | 3,500,000 | 4,018,630 | ||||||

| New Jersey, State Transportation Trust Fund Authority, Transportation Systems, Series A, 5.5%, 6/15/2041 | 7,000,000 | 7,858,410 | ||||||

| New Jersey, Tobacco Settlement Financing Corp.: | ||||||||

| Series 1A, 4.75%, 6/1/2034 | 16,240,000 | 12,353,930 | ||||||

| Series 1-A, 5.0%, 6/1/2029 | 15,965,000 | 13,764,065 | ||||||

| 62,226,929 | ||||||||

| New Mexico 0.5% | ||||||||

| Farmington, NM, Pollution Control Revenue, Public Service Co. of New Mexico, Series C, 5.9%, 6/1/2040 | 7,500,000 | 8,374,800 | ||||||

| New York 3.9% | ||||||||

| Albany, NY, Industrial Development Agency, Civic Facility Revenue, St. Peter's Hospital Project: | ||||||||

| Series A, 5.25%, 11/15/2027 | 3,000,000 | 3,290,550 | ||||||

| Series A, 5.75%, 11/15/2022 | 1,500,000 | 1,689,945 | ||||||

| Hudson, NY, Yards Infrastructure Corp. Revenue: | ||||||||

| Series A, 5.25%, 2/15/2047 | 5,000,000 | 5,558,950 | ||||||

| Series A, 5.75%, 2/15/2047 | 7,000,000 | 8,058,960 | ||||||

| Nassau, NY, Health Care Corp. Revenue, 0.04%**, 8/1/2029, LOC: TD Bank NA | 1,800,000 | 1,800,000 | ||||||

| New York, State Dormitory Authority Revenues, NYU Hospital Center, Series B, Prerefunded, 5.25%, 7/1/2024 | 715,000 | 763,756 | ||||||

| New York, State Dormitory Authority Revenues, Orange Regional Medical Center, 6.125%, 12/1/2029 | 2,000,000 | 2,145,620 | ||||||

| New York, State Liberty Development Corp. Revenue, World Trade Center Project, "3-3", 7.25%, 11/15/2044 | 1,820,000 | 2,064,772 | ||||||

| New York & New Jersey, Port Authority, Special Obligation Revenue, JFK International Air Terminal LLC, 6.0%, 12/1/2042 | 5,795,000 | 6,723,591 | ||||||

| New York City, NY, Industrial Development Agency, Special Facility Revenue, American Airlines, JFK International Airport: | ||||||||

| AMT, 7.625%, 8/1/2025, GTY: American Airlines Group | 5,000,000 | 5,440,650 | ||||||

| AMT, 7.75%, 8/1/2031, GTY: American Airlines Group | 6,470,000 | 7,081,803 | ||||||

| AMT, 8.0%, 8/1/2028, GTY: American Airlines Group | 6,100,000 | 6,682,916 | ||||||

| New York City, NY, Industrial Development Agency, Special Facility Revenue, British Airways PLC Project, AMT, 7.625%, 12/1/2032 | 1,500,000 | 1,508,235 | ||||||

| New York City, NY, Municipal Finance Authority, Water & Sewer Systems Revenue, Series AA-2, 0.04%**, 6/15/2050, SPA: JPMorgan Chase Bank NA | 4,750,000 | 4,750,000 | ||||||

| New York City, NY, Municipal Water Finance Authority, Water & Sewer Systems Revenue, Series EE, 5.0%, 6/15/2047 | 11,000,000 | 12,256,970 | ||||||

| Orange County, NY, Senior Care Revenue, Industrial Development Agency, The Glen Arden Project, 5.7%, 1/1/2028 | 1,250,000 | 667,212 | ||||||

| 70,483,930 | ||||||||

| North Carolina 0.2% | ||||||||

| Charlotte, NC, Airport Revenue, Series A, 5.0%, 7/1/2039 | 1,450,000 | 1,602,714 | ||||||

| North Carolina, Medical Care Commission, Retirement Facilities Revenue, First Mortgage, Southminster Project, Series A, 5.625%, 10/1/2027 | 2,500,000 | 2,583,500 | ||||||

| 4,186,214 | ||||||||

| North Dakota 0.2% | ||||||||

| Burleigh County, ND, Health Care Revenue, St. Alexius Medical Center Project, Series A, 5.0%, 7/1/2035 | 1,200,000 | 1,294,116 | ||||||

| Grand Forks, ND, Health Care System Revenue, Altru Health System, 5.0%, 12/1/2032 | 2,000,000 | 2,156,660 | ||||||

| 3,450,776 | ||||||||

| Ohio 0.7% | ||||||||

| Cleveland, OH, Airport Systems Revenue, Series A, 5.0%, 1/1/2030 | 1,000,000 | 1,085,280 | ||||||

| Hamilton County, OH, Health Care Facilities Revenue, Christ Hospital Project, 5.5%, 6/1/2042 | 3,100,000 | 3,422,276 | ||||||

| Hamilton County, OH, Health Care Revenue, Life Enriching Communities Project: | ||||||||

| 6.125%, 1/1/2031 | 2,030,000 | 2,272,605 | ||||||

| 6.625%, 1/1/2046 | 2,500,000 | 2,829,200 | ||||||

| Ohio, State Higher Educational Facility Commission Revenue, Summa Health Systems Project, Series 2010, 5.75%, 11/15/2040 | 3,000,000 | 3,323,580 | ||||||

| 12,932,941 | ||||||||

| Oklahoma 0.4% | ||||||||

| Tulsa County, OK, Industrial Authority, Senior Living Community Revenue, Montereau, Inc. Project, Series A, 7.25%, 11/1/2045 | 6,500,000 | 7,180,615 | ||||||

| Pennsylvania 3.1% | ||||||||

| Cumberland County, PA, Municipal Authority Revenue, Asbury Obligation Group, 6.125%, 1/1/2045 | 4,350,000 | 4,632,663 | ||||||

| Lancaster County, PA, Hospital Authority Revenue, Brethren Village Project, Series A, 6.375%, 7/1/2030 | 1,000,000 | 1,051,710 | ||||||

| Montgomery County, PA, Industrial Development Authority Revenue, Whitemarsh Continuing Care, 6.25%, 2/1/2035 | 2,400,000 | 2,408,832 | ||||||

| Northampton County, PA, Hospital Authority Revenue, St. Luke's Hospital Project: | ||||||||

| Series A, 5.375%, 8/15/2028 | 3,500,000 | 3,839,640 | ||||||

| Series A, 5.5%, 8/15/2035 | 6,500,000 | 7,111,065 | ||||||

| Pennsylvania, Economic Development Finance Authority, U.S. Airways Group, Series B, 8.0%, 5/1/2029, GTY: U.S. Airways, Inc. | 985,000 | 1,169,589 | ||||||

| Pennsylvania, Economic Development Financing Authority, Sewer Sludge Disposal Revenue, Philadelphia Biosolids Facility, 6.25%, 1/1/2032 | 1,500,000 | 1,656,930 | ||||||

| Pennsylvania, State Turnpike Commission Revenue: | ||||||||

| Series C, 5.0%, 12/1/2043 | 7,000,000 | 7,756,770 | ||||||

| Series A, 6.5%, 12/1/2036 | 6,385,000 | 7,686,965 | ||||||

| Philadelphia, PA, Airport Revenue, Series A, 5.0%, 6/15/2035 | 7,085,000 | 7,786,982 | ||||||

| Philadelphia, PA, Gas Works Revenue, 5.25%, 8/1/2040 | 3,000,000 | 3,422,640 | ||||||

| Philadelphia, PA, Hospitals & Higher Education Facilities Authority Revenue, Temple University Health Systems, Series A, 5.0%, 7/1/2034 | 6,750,000 | 6,803,460 | ||||||

| 55,327,246 | ||||||||

| Puerto Rico 2.5% | ||||||||

| Commonwealth of Puerto Rico, General Obligation, Series A, 8.0%, 7/1/2035 | 3,280,000 | 2,817,848 | ||||||

| Commonwealth of Puerto Rico, Public Improvement, Series B, 6.5%, 7/1/2037 | 10,000,000 | 7,520,600 | ||||||

| Puerto Rico, Public Buildings Authority Revenue, Government Facilities, Series M, 6.25%, 7/1/2022 | 5,000,000 | 3,999,200 | ||||||

| Puerto Rico, Sales Tax Financing Corp., Sales Tax Revenue: | ||||||||

| Series C, 5.25%, 8/1/2041 | 3,065,000 | 2,235,335 | ||||||

| Series A, 5.5%, 8/1/2042 | 10,175,000 | 7,579,968 | ||||||

| Series A, 5.75%, 8/1/2037 | 2,130,000 | 1,649,174 | ||||||

| Series A, 6.0%, 8/1/2042 | 4,570,000 | 3,567,205 | ||||||

| Series A, 6.375%, 8/1/2039 | 10,000,000 | 8,155,600 | ||||||

| Puerto Rico, Sales Tax Financing Corp., Sales Tax Revenue, Convertible Capital Appreciation, Series A, Step-up Coupon, 0% to 8/1/2016, 6.75% to 8/1/2032 | 10,000,000 | 7,754,000 | ||||||

| 45,278,930 | ||||||||

| South Carolina 1.6% | ||||||||

| Greenwood County, SC, Hospital Revenue, Self Regional Healthcare, Series B, 5.0%, 10/1/2031 | 1,000,000 | 1,116,210 | ||||||

| Hardeeville, SC, Assessment Revenue, Anderson Tract Municipal Improvement District: | ||||||||

| Series B, 7.5%, 11/1/2015 | 552,000 | 551,371 | ||||||

| Series A, 7.75%, 11/1/2039 | 4,595,000 | 4,362,447 | ||||||

| South Carolina, Jobs Economic Development Authority, Hospital Facilities Revenue, Palmetto Health Alliance, 5.75%, 8/1/2039 | 3,595,000 | 3,934,368 | ||||||

| South Carolina, State Public Service Authority Revenue, Series C, 5.0%, 12/1/2046 | 7,500,000 | 8,353,050 | ||||||

| South Carolina, State Public Service Authority Revenue, Santee Cooper, Series A, 5.75%, 12/1/2043 | 8,890,000 | 10,488,066 | ||||||

| 28,805,512 | ||||||||

| South Dakota 0.5% | ||||||||

| South Dakota, State Health & Educational Facilities Authority Revenue, Avera Health: | ||||||||

| Series B, 5.25%, 7/1/2038 | 3,000,000 | 3,249,930 | ||||||

| Series B, 5.5%, 7/1/2035 | 5,000,000 | 5,493,100 | ||||||

| South Dakota, State Health & Educational Facilities Authority Revenue, Sanford Health, 5.0%, 11/1/2027 | 1,000,000 | 1,054,700 | ||||||

| 9,797,730 | ||||||||

| Tennessee 2.7% | ||||||||

| Clarksville, TN, Natural Gas Acquisition Corp., Gas Revenue: | ||||||||

| 5.0%, 12/15/2017, GTY: Merrill Lynch & Co., Inc. | 2,500,000 | 2,750,300 | ||||||

| 5.0%, 12/15/2018, GTY: Merrill Lynch & Co., Inc. | 2,160,000 | 2,413,368 | ||||||

| Jackson, TN, Hospital Revenue, Jackson-Madison Project, 5.625%, 4/1/2038 | 3,000,000 | 3,277,980 | ||||||

| Johnson City, TN, Health & Educational Facilities, Board Hospital Revenue, First Mortgage, Mountain States Health Alliance, Series A, 5.5%, 7/1/2036 | 18,795,000 | 19,643,406 | ||||||

| Johnson City, TN, Health & Educational Facilities, Board Hospital Revenue, Mountain States Health Alliance, 6.5%, 7/1/2038 | 3,570,000 | 4,158,729 | ||||||

| Tennessee, Energy Acquisition Corp., Gas Revenue: | ||||||||

| Series C, 5.0%, 2/1/2027, GTY: The Goldman Sachs Group, Inc. | 6,435,000 | 7,398,705 | ||||||

| Series A, 5.25%, 9/1/2018, GTY: The Goldman Sachs Group, Inc. | 8,000,000 | 9,085,840 | ||||||

| 48,728,328 | ||||||||

| Texas 13.3% | ||||||||

| Bexar County, TX, Health Facilities Development Corp. Revenue, Army Retirement Residence Project, 6.2%, 7/1/2045 | 6,000,000 | 6,884,940 | ||||||

| Brazos River, TX, Harbor Navigation District, Brazoria County Environmental Health, Dow Chemical Co. Project: | ||||||||

| Series B-2, 4.95%, 5/15/2033 | 4,000,000 | 4,276,040 | ||||||

| Series A-3, AMT, 5.125%, 5/15/2033 | 9,000,000 | 9,593,640 | ||||||

| Brazos River, TX, Pollution Control Authority Revenue, Series D-1, 144A, AMT, 8.25%, 5/1/2033* | 7,000,000 | 576,800 | ||||||

| Cass County, TX, Industrial Development Corp., Environmental Improvement Revenue, International Paper Co. Projects, Series A, 9.25%, 3/1/2024 | 2,000,000 | 2,520,720 | ||||||

| Central Texas, Regional Mobility Authority Revenue, Capital Appreciation: | ||||||||

| Zero Coupon, 1/1/2030 | 5,000,000 | 2,569,600 | ||||||

| Zero Coupon, 1/1/2032 | 3,500,000 | 1,627,675 | ||||||

| Central Texas, Regional Mobility Authority Revenue, Senior Lien: | ||||||||

| Series A, 5.0%, 1/1/2043 | 1,000,000 | 1,084,330 | ||||||

| 6.0%, 1/1/2041 | 5,455,000 | 6,336,692 | ||||||

| Gulf Coast, TX, Waste Disposal Authority, Exxon Mobil Project, AMT, 0.05%**, 12/1/2025 | 8,300,000 | 8,300,000 | ||||||

| Harris County, TX, Cultural Education Facilities Finance Corp. Revenue, 1st Mortgage-Brazos Presbyterian Homes, Inc. Project: | ||||||||

| Series B, 7.0%, 1/1/2043 | 3,000,000 | 3,499,380 | ||||||

| Series B, 7.0%, 1/1/2048 | 4,000,000 | 4,616,000 | ||||||

| Houston, TX, Airport System Revenue, United Airlines, Inc., Terminal E Project, AMT, 4.75%, 7/1/2024 | 3,385,000 | 3,661,148 | ||||||

| Houston, TX, Airport Systems Revenue, Special Facilities Continental Airlines, Inc. Terminal Projects, AMT, 6.625%, 7/15/2038 | 2,000,000 | 2,257,060 | ||||||

| La Vernia, TX, Higher Education Finance Corp. Revenue, Lifeschools of Dallas: | ||||||||

| Series A, Prerefunded, 7.25%, 8/15/2031 | 1,275,000 | 1,617,593 | ||||||

| Series A, Prerefunded, 7.5%, 8/15/2041 | 1,785,000 | 2,284,943 | ||||||

| Lewisville, TX, Combination Contract Revenue, 6.75%, 10/1/2032 | 14,020,000 | 14,644,311 | ||||||

| Matagorda County, TX, Navigation District No. 1, Pollution Control Revenue, AEP Texas Central Co. Project, Series A, 4.4%, 5/1/2030, INS: AMBAC | 11,000,000 | 11,830,060 | ||||||

| Matagorda County, TX, Navigation District No. 1, Pollution Control Revenue, Central Power & Light Co. Project, Series A, 6.3%, 11/1/2029 | 3,000,000 | 3,442,500 | ||||||

| North Texas, Tollway Authority Revenue: | ||||||||

| First Tier, Series A, 5.625%, 1/1/2033 | 1,000,000 | 1,107,020 | ||||||

| Second Tier, Series F, 5.75%, 1/1/2038 | 17,500,000 | 19,360,425 | ||||||

| First Tier, 6.0%, 1/1/2043 | 5,000,000 | 5,812,650 | ||||||

| First Tier, Series A, 6.25%, 1/1/2039 | 9,525,000 | 11,048,619 | ||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, MRC Crossings Project, Series A, 8.0%, 11/15/2049 | 1,715,000 | 1,980,568 | ||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project: | ||||||||

| Series A, 5.45%, 11/15/2038* | 2,411,000 | 964,352 | ||||||

| Series A, 6.05%, 11/15/2046* | 2,565,000 | 1,025,949 | ||||||

| Series D, 6.05%, 11/15/2046* | 445,000 | 177,991 | ||||||

| Series B, 6.15%, 11/15/2049* | 4,852,000 | 1,940,703 | ||||||

| Series C, 6.25%, 5/9/2053* | 226,000 | 90,395 | ||||||

| San Antonio, TX, Convention Center Hotel Finance Corp., Contract Revenue, Empowerment Zone, Series A, AMT, 5.0%, 7/15/2039, INS: AMBAC | 8,000,000 | 8,067,600 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp., Retirement Facility, Mirador Project: | ||||||||

| Series A, 8.125%, 11/15/2039 | 1,000,000 | 971,400 | ||||||

| Series A, 8.25%, 11/15/2044 | 3,430,000 | 3,355,432 | ||||||

| Texas, Dallas/Fort Worth International Airport Revenue: | ||||||||

| Series D, 5.0%, 11/1/2035 | 2,715,000 | 3,015,170 | ||||||

| Series A, 5.25%, 11/1/2038 | 15,000,000 | 16,800,150 | ||||||

| Texas, Love Field Airport Modernization Corp., Special Facilities Revenue, Southwest Airlines Co. Project, 5.25%, 11/1/2040 | 7,445,000 | 7,994,292 | ||||||

| Texas, Municipal Gas Acquisition & Supply Corp. I, Gas Supply Revenue: | ||||||||

| Series D, 5.625%, 12/15/2017, GTY: Merrill Lynch & Co., Inc. | 6,945,000 | 7,552,965 | ||||||

| Series D, 6.25%, 12/15/2026, GTY: Merrill Lynch & Co., Inc. | 16,875,000 | 20,767,725 | ||||||

| Texas, SA Energy Acquisition Public Facility Corp., Gas Supply Revenue, 5.5%, 8/1/2020, GTY: The Goldman Sachs Group, Inc. | 10,000,000 | 11,560,500 | ||||||

| Texas, State Municipal Gas Acquisition & Supply Corp., III Gas Supply Revenue, 5.0%, 12/15/2030 | 1,670,000 | 1,834,512 | ||||||

| Texas, State Private Activity Bond, Surface Transportation Corp. Revenue, Senior Lien, North Tarrant Express Mobility Partners Segments LLC, AMT, 6.75%, 6/30/2043 | 2,220,000 | 2,692,793 | ||||||

| Texas, State Transportation Commission-Highway Improvement, 5.0%, 4/1/2044 | 12,000,000 | 13,831,200 | ||||||

| Texas, Uptown Development Authority, Tax Increment Contract Revenue, Infrastructure Improvement Facilities, 5.5%, 9/1/2029 | 1,000,000 | 1,097,940 | ||||||

| Travis County, TX, Health Facilities Development Corp. Revenue, Westminster Manor Health: | ||||||||

| 7.0%, 11/1/2030 | 1,530,000 | 1,799,035 | ||||||

| 7.125%, 11/1/2040 | 3,580,000 | 4,172,239 | ||||||

| 240,645,057 | ||||||||

| Virginia 0.7% | ||||||||

| Virginia, Marquis Community Development Authority Revenue: | ||||||||

| Series C, Zero Coupon, 9/1/2041 | 7,906,000 | 1,121,782 | ||||||

| Series B, 5.625%, 9/1/2041 | 5,332,000 | 5,076,917 | ||||||

| Virginia, Mosaic District Community Development Authority Revenue, Series A, 6.875%, 3/1/2036 | 2,000,000 | 2,313,760 | ||||||

| Virginia, Peninsula Ports Authority, Residential Care Facility Revenue, Virginia Baptist Homes, Series C, 5.4%, 12/1/2033 | 2,600,000 | 2,543,788 | ||||||

| Virginia, State Small Business Financing Authority Revenue, Elizabeth River Crossings LLC Project, AMT, 6.0%, 1/1/2037 | 2,000,000 | 2,275,720 | ||||||

| 13,331,967 | ||||||||

| Washington 3.4% | ||||||||

| Klickitat County, WA, Public Hospital District No. 2 Revenue, Skyline Hospital, 6.5%, 12/1/2038 | 3,205,000 | 3,258,171 | ||||||

| Washington, Energy Northwest Electric Revenue, Columbia Station: | ||||||||

| Series A, 5.0%, 7/1/2024 | 6,765,000 | 7,253,907 | ||||||

| Series A, Prerefunded, 5.0%, 7/1/2024 | 3,235,000 | 3,472,190 | ||||||

| Washington, Port of Seattle, Industrial Development Corp., Special Facilities — Delta Airlines, AMT, 5.0%, 4/1/2030 | 2,000,000 | 2,047,680 | ||||||

| Washington, State General Obligation, Series 2007A, Prerefunded, 5.0%, 7/1/2023, INS: AGMC | 10,000,000 | 10,738,200 | ||||||

| Washington, State Health Care Facilities Authority Revenue, Series C, 5.375%, 8/15/2028, INS: Radian | 2,970,000 | 3,168,396 | ||||||

| Washington, State Health Care Facilities Authority Revenue, Virginia Mason Medical Center: | ||||||||

| Series B, 5.75%, 8/15/2037, INS: ACA | 6,675,000 | 7,248,783 | ||||||

| Series A, 6.125%, 8/15/2037 | 16,000,000 | 17,589,440 | ||||||

| Washington, State Housing Finance Commission, Rockwood Retirement Communities Project, Series A, 7.375%, 1/1/2044 | 6,000,000 | 6,613,200 | ||||||

| 61,389,967 | ||||||||

| West Virginia 0.8% | ||||||||

| West Virginia, State Hospital Finance Authority Revenue, Charleston Medical Center, Series A, 5.625%, 9/1/2032 | 3,080,000 | 3,375,742 | ||||||

| West Virginia, State Hospital Finance Authority Revenue, Thomas Health Systems: | ||||||||

| 6.5%, 10/1/2028 | 7,000,000 | 7,379,820 | ||||||

| 6.5%, 10/1/2038 | 3,000,000 | 3,140,340 | ||||||

| 13,895,902 | ||||||||

| Wisconsin 0.8% | ||||||||

| Wisconsin, Public Finance Authority, Apartment Facilities Revenue, Senior Obligation Group, AMT, 5.0%, 7/1/2042 | 3,500,000 | 3,602,270 | ||||||

| Wisconsin, State Health & Educational Facilities Authority Revenue, Aurora Health Care, Inc., Series A, 5.625%, 4/15/2039 | 8,160,000 | 9,058,253 | ||||||

| Wisconsin, State Health & Educational Facilities Authority Revenue, St. John's Communities, Inc., Series A, 7.625%, 9/15/2039 | 1,000,000 | 1,191,840 | ||||||

| 13,852,363 | ||||||||

| Other Territories 0.1% | ||||||||

| Non-Profit Preferred Funding Trust I, Series A1, 144A, 4.22%, 9/15/2037 | 1,557,650 | 1,559,052 | ||||||

Total Municipal Bonds and Notes (Cost $1,542,064,850) | 1,687,391,509 | |||||||

| Underlying Municipal Bonds of Inverse Floaters (d) 13.8% | ||||||||

| California 0.3% | ||||||||

| San Diego County, CA, Water Authority Revenue, Certificates of Participation, Series 2008-A, 5.0%, 5/1/2027, INS: AGMC (e) | 2,126,587 | 2,383,076 | ||||||

| San Diego County, CA, Water Authority Revenue, Certificates of Participation, Series 2008-A, 5.0%, 5/1/2028, INS: AGMC (e) | 1,935,078 | 2,168,469 | ||||||

| Trust: San Diego County, CA, Water Utility Improvements, Certificates of Participation, Series 2008-1104, 144A, 9.354%, 11/1/2015, Leverage Factor at purchase date: 2 to 1 | ||||||||

| 4,551,545 | ||||||||

| Hawaii 0.6% | ||||||||

| Hawaii, State General Obligation, Series DK, 5.0%, 5/1/2027 (e) | 10,000,000 | 11,208,500 | ||||||

| Trust: Hawaii, State General Obligation, Series 2867, 144A, 18.17%, 5/1/2016, Leverage Factor at purchase date: 4 to 1 | ||||||||

| Louisiana 0.6% | ||||||||

| Louisiana, State Gas & Fuels Tax Revenue, Series B, 5.0%, 5/1/2033 (e) | 3,026,513 | 3,434,847 | ||||||

| Louisiana, State Gas & Fuels Tax Revenue, Series B, 5.0%, 5/1/2034 (e) | 3,304,152 | 3,749,944 | ||||||

| Louisiana, State Gas & Fuels Tax Revenue, Series B, 5.0%, 5/1/2035 (e) | 3,666,834 | 4,161,558 | ||||||

| Trust: Louisiana, State Gas & Fuels Tax Revenue, Series 3806, 144A, 9.418%, 5/1/2018, Leverage Factor at purchase date: 2 to 1 | ||||||||

| 11,346,349 | ||||||||

| Nevada 2.5% | ||||||||

| Clark County, NV, School District, Series C, 5.0%, 6/15/2021 (e) | 7,851,481 | 8,779,580 | ||||||

| Clark County, NV, School District, Series C, 5.0%, 6/15/2022 (e) | 8,203,602 | 9,173,324 | ||||||

| Clark County, NV, School District, Series C, 5.0%, 6/15/2023 (e) | 5,298,193 | 5,924,476 | ||||||

| Trust: Clark County, NV, School Improvements, Series 2008-1153, 144A, 9.181%, 6/15/2015, Leverage Factor at purchase date: 2 to 1 | ||||||||

| Las Vegas Valley, NV, General Obligation, Water District, Series A, 5.0%, 2/1/2035 (e) | 9,150,000 | 9,979,714 | ||||||

| Las Vegas Valley, NV, General Obligation, Water District, Series A, 5.0%, 2/1/2036 (e) | 9,605,000 | 10,475,974 | ||||||

| Trust: Las Vegas Valley, NV, General Obligation, Water District, 144A, 9.398%, 2/1/2016, Leverage Factor at purchase date: 2 to 1 | ||||||||

| 44,333,068 | ||||||||

| New York 2.2% | ||||||||

| New York, State Dormitory Authority Revenues, Personal Income Tax Revenue, Series A, 5.0%, 3/15/2023 (e) | 5,095,207 | 5,556,958 | ||||||

| Trust: New York, State Dormitory Authority Revenues, Secondary Issues, Series 1955-2, 144A, 18.243%, 3/15/2015, Leverage Factor at purchase date: 4 to 1 | ||||||||

| New York, State Dormitory Authority, Personal Income Tax Revenue, Series F, 5.0%, 2/15/2035 (e) | 10,000,000 | 11,314,700 | ||||||

| Trust: New York, State Dormitory Authority Revenues, Series 4688, 144A, 9.49%, 3/15/2024, Leverage Factor at purchase date: 2 to 1 | ||||||||

| New York, State Environmental Facilities Corp., Clean Drinking Water, Series A, 5.0%, 6/15/2025 (e) | 4,000,000 | 4,519,101 | ||||||

| New York, State Environmental Facilities Corp., Clean Drinking Water, Series A, 5.0%, 6/15/2026 (e) | 3,000,000 | 3,389,326 | ||||||

| New York, State Environmental Facilities Corp., Clean Drinking Water, Series A, 5.0%, 6/15/2027 (e) | 3,000,000 | 3,389,326 | ||||||

| Trust: New York, State Environmental Facilities Corp., Clean Drinking Water, Series 2870, 144A, 16.574%, 12/15/2015, Leverage Factor at purchase date: 3.6 to 1 | ||||||||

| New York City, NY, Transitional Finance Authority Revenue, Series C-1, 5.0%, 11/1/2027 (e) | 10,000,000 | 11,026,200 | ||||||

| Trust: New York City, NY, Transitional Finance Authority Revenue, Series 2072, 144A, 11.465%, 11/1/2027, Leverage Factor at purchase date: 2.5 to 1 | ||||||||

| 39,195,611 | ||||||||

| Ohio 0.7% | ||||||||

| Ohio, State Higher Educational Facilities Commission Revenue, Cleveland Clinic Health, Series A, 5.125%, 1/1/2028 (e) | 4,522,767 | 4,998,020 | ||||||

| Ohio, State Higher Educational Facilities Commission Revenue, Cleveland Clinic Health, Series A, 5.25%, 1/1/2033 (e) | 7,712,913 | 8,523,387 | ||||||

| Trust: Ohio, State Higher Educational Revenue, Series 3139, 144A, 14.639%, 1/1/2016, Leverage Factor at purchase date: 3 to 1 | ||||||||

| 13,521,407 | ||||||||

| Pennsylvania 2.3% | ||||||||

| Pennsylvania, State General Obligation, Series A, 5.0%, 8/1/2023 (e) | 21,790,000 | 24,092,952 | ||||||

| Trust: Pennsylvania, State General Obligation, Series R-11505-1, 144A, 45.299%, 8/1/2015, Leverage Factor at purchase date: 10 to 1 | ||||||||

| Pennsylvania, State Revenue Bond, Series A, 5.0%, 8/1/2024 (e) | 15,475,000 | 17,109,726 | ||||||

| Trust: Pennsylvania, State Revenue Bond, Series 2720, 144A, 12.996%, 8/1/2015, Leverage Factor at purchase date: 3 to 1 | ||||||||

| 41,202,678 | ||||||||

| Tennessee 0.9% | ||||||||

| Nashville & Davidson County, TN, Metropolitan Government, 5.0%, 1/1/2024 (e) | 14,996,415 | 16,977,428 | ||||||

| Trust: Nashville & Davidson County, TN, Metropolitan Government, Series 2631-1, 144A, 18.256%, 1/1/2016, Leverage Factor at purchase date: 4 to 1 | ||||||||

| Texas 3.1% | ||||||||

| Conroe, TX, Independent School District, School Building, 5.0%, 2/15/2024 (e) | 3,710,000 | 3,919,691 | ||||||

| Conroe, TX, Independent School District, School Building, 5.0%, 2/15/2025 (e) | 4,315,000 | 4,558,886 | ||||||

| Trust: Conroe, TX, Independent School District, Series 2487, 144A, 18.137%, 8/15/2015, Leverage Factor at purchase date: 4 to 1 | ||||||||

| Harris County, TX, Flood Control District, Series A, 5.0%, 10/1/2034 (e) | 5,500,000 | 6,234,030 | ||||||

| Trust: Harris County, TX, Flood Control District, Series 4692, 144A, 9.59%, 10/11/2018, Leverage Factor at purchase date: 2 to 1 | ||||||||

| San Antonio, TX, Electric & Gas Revenue, 5.0%, 2/1/2024 (e) | 15,000,000 | 16,771,200 | ||||||

| Trust: San Antonio, TX, Electric & Gas Revenue, Series 2957, 144A, 13.78%, 2/1/2016, Leverage Factor at purchase date: 3 to 1 | ||||||||

| Texas, North East Independent School District, School Building, Series A, 5.0%, 8/1/2024 (e) | 10,000,000 | 11,062,000 | ||||||

| Trust: Texas, North East Independent School District, Series 2355, 144A, 22.68%, 8/1/2015, Leverage Factor at purchase date: 5 to 1 | ||||||||

| Texas, State Transportation Commission Revenue, 5.0%, 4/1/2026 (e) | 12,500,000 | 13,714,875 | ||||||

| Trust: Texas, State Transportation Commission Revenue, Series 2563, 144A, 22.56%, 4/1/2015, Leverage Factor at purchase date: 5 to 1 | ||||||||

| 56,260,682 | ||||||||

| Washington 0.6% | ||||||||

| Washington, State General Obligation, Series A, 5.0%, 7/1/2025 (e) | 10,000,000 | 11,139,400 | ||||||

| Trust: Washington, State General Obligation, Series 2154, 144A, 22.68%, 7/1/2015, Leverage Factor at purchase date: 5 to 1 | ||||||||

Total Underlying Municipal Bonds of Inverse Floaters (Cost $228,231,233) | 249,736,668 | |||||||

| % of Net Assets | Value ($) | |||||||

Total Investment Portfolio (Cost $1,770,296,083)† | 107.0 | 1,937,128,177 | ||||||

| Floating Rate Notes (d) | (8.3 | ) | (150,354,570 | ) | ||||

| Other Assets and Liabilities, Net | 1.3 | 23,810,673 | ||||||

| Net Assets | 100.0 | 1,810,584,280 | ||||||

The following table represents bonds that are in default:

| Security | Coupon | Maturity Date | Principal Amount ($) | Cost ($) | Value ($) | ||||||||||||

| Boston, MA, Industrial Development Financing Authority Revenue, Crosstown Center Project, AMT* | 8.0 | % | 9/1/2035 | 960,000 | 960,000 | 192,048 | |||||||||||

| Brazos River, TX, Pollution Control Authority Revenue, Series D-1, 144A, AMT* | 8.25 | % | 5/1/2033 | 7,000,000 | 7,000,000 | 576,800 | |||||||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project, Series A* | 5.45 | % | 11/15/2038 | 2,411,000 | 1,953,138 | 964,352 | |||||||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project, Series A* | 6.05 | % | 11/15/2046 | 2,565,000 | 2,507,519 | 1,025,949 | |||||||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project, Series D* | 6.05 | % | 11/15/2046 | 445,000 | 436,731 | 177,991 | |||||||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project, Series B* | 6.15 | % | 11/15/2049 | 4,852,000 | 4,852,000 | 1,940,703 | |||||||||||

| Red River, TX, Health Facilities Development Corp., Retirement Facilities Revenue, Sears Methodist Retirement System Obligated Group Project, Series C* | 6.25 | % | 5/9/2053 | 226,000 | 226,000 | 90,395 | |||||||||||

| 17,935,388 | 4,968,238 | ||||||||||||||||

* Non-income producing security.

** Variable rate demand notes are securities whose interest rates are reset periodically at market levels. These securities are often payable on demand and are shown at their current rates as of November 30, 2014.

† The cost for federal income tax purposes was $1,613,429,723. At November 30, 2014, net unrealized appreciation for all securities based on tax cost was $173,343,884. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $208,816,740 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $35,472,856.

(a) When-issued security.

(b) At November 30, 2014, this security has been pledged, in whole or in part, as collateral for tender option bond trust.

(c) Partial payment of interest received for 6/1/14 interest payment (37% received); 12/1/14 interest payment received in full.

(d) Securities represent the underlying municipal obligations of inverse floating rate obligations held by the Fund. The Floating Rate Notes represent leverage to the Fund and is the amount owed to the floating rate note holders.

(e) Security forms part of the below inverse floater. The Fund accounts for these inverse floaters as a form of secured borrowing, by reflecting the value of the underlying bond in the investments of the Fund and the amount owed to the floating rate note holder as a liability.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ACA: ACA Financial Guaranty Corp.

AGC: Assured Guaranty Corp.

AGMC: Assured Guaranty Municipal Corp.

AMBAC: Ambac Financial Group, Inc.

AMT: Subject to alternative minimum tax.

FGIC: Financial Guaranty Insurance Co.

GTY: Guaranty Agreement

INS: Insured

LOC: Letter of Credit

NATL: National Public Finance Guarantee Corp.

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

Prerefunded: Bonds which are prerefunded are collateralized usually by U.S. Treasury securities, which are held in escrow and used to pay principal and interest on tax-exempt issues and to retire the bonds in full at the earliest refunding date.

Radian: Radian Asset Assurance, Inc.

SPA: Standby Bond Purchase Agreement

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of November 30, 2014 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Municipal Investments (f) | $ | — | $ | 1,937,128,177 | $ | — | $ | 1,937,128,177 | ||||||||

| Total | $ | — | $ | 1,937,128,177 | $ | — | $ | 1,937,128,177 | ||||||||

There have been no transfers between fair value measurement levels during the period ended November 30, 2014.

(f) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

| as of November 30, 2014 (Unaudited) | ||||

| Assets | ||||

| Investments in non-affiliated securities, at value (cost $1,770,296,083) | $ | 1,937,128,177 | ||

| Receivable for investments sold | 1,930,000 | |||

| Receivable for Fund shares sold | 1,336,665 | |||

| Interest receivable | 28,513,269 | |||

| Other assets | 73,543 | |||

| Total assets | 1,968,981,654 | |||

| Liabilities | ||||

| Cash overdraft | 964,994 | |||

| Payable for investments purchased — when-issued securities | 2,599,284 | |||

| Payable for Fund shares redeemed | 835,123 | |||

| Payable for floating rate notes issued | 150,354,570 | |||

| Distributions payable | 1,542,467 | |||

| Accrued management fee | 542,514 | |||

| Accrued Trustees' fees | 24,999 | |||

| Other accrued expenses and payables | 1,533,423 | |||

| Total liabilities | 158,397,374 | |||

| Net assets, at value | $ | 1,810,584,280 | ||

| Net Assets Consist of | ||||

| Undistributed net investment income | 2,056,486 | |||

| Net unrealized appreciation (depreciation) on investments | 166,832,094 | |||

| Accumulated net realized gain (loss) | (151,435,527 | ) | ||

| Paid-in capital | 1,793,131,227 | |||

| Net assets, at value | $ | 1,810,584,280 | ||

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities as of November 30, 2014 (Unaudited) (continued) | ||||

| Net Asset Value | ||||

Class A Net Asset Value and redemption price per share ($390,902,935 ÷ 31,284,048 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ | 12.50 | ||

| Maximum offering price per share (100 ÷ 97.25 of $12.50) | $ | 12.85 | ||

Class B Net Asset Value offering and redemption price (subject to contingent deferred sales charge) per share ($2,094,480 ÷ 167,607 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ | 12.50 | ||

Class C Net Asset Value offering and redemption price (subject to contingent deferred sales charge) per share ($148,386,569 ÷ 11,868,108 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ | 12.50 | ||

Class S Net Asset Value offering and redemption price per share ($935,738,175 ÷ 74,818,211 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ | 12.51 | ||

Institutional Class Net Asset Value offering and redemption price per share ($333,462,121 ÷ 26,656,227 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ | 12.51 | ||

The accompanying notes are an integral part of the financial statements.

| for the six months ended November 30, 2014 (Unaudited) | ||||

| Investment Income | ||||

Income: Interest | $ | 49,255,583 | ||

Expenses: Management fee | 4,319,732 | |||

| Administration fee | 900,639 | |||

| Services to shareholders | 1,246,981 | |||

| Distribution and service fees | 1,251,185 | |||

| Custodian fee | 10,919 | |||

| Professional fees | 60,451 | |||

| Reports to shareholders | 51,789 | |||

| Registration fees | 54,951 | |||

| Trustees' fees and expenses | 45,872 | |||

| Interest expense and fees on floating rate notes issued | 452,150 | |||

| Other | 53,516 | |||

| Total expenses before expense reductions | 8,448,185 | |||

| Expense reductions | (1,179,193 | ) | ||

| Total expenses after expense reductions | 7,268,992 | |||

| Net investment income | 41,986,591 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) from investments | (19,304,510 | ) | ||

| Change in net unrealized appreciation (depreciation) on investments | 19,509,159 | |||

| Net gain (loss) | 204,649 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 42,191,240 | ||

The accompanying notes are an integral part of the financial statements.

| for the six months ended November 30, 2014 (Unaudited) | ||||

Increase (Decrease) in Cash: Cash Flows from Operating Activities | ||||

| Net increase (decrease) in net assets resulting from operations | $ | 42,191,240 | ||

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) by operating activities: Purchases of long-term investments | (334,295,279 | ) | ||

| Net amortization of premium/(accretion of discount) | 1,060,233 | |||

| Proceeds from sales and maturities of long-term investments | 322,482,763 | |||

| (Increase) decrease in interest receivable | 684,594 | |||

| (Increase) decrease in other assets | 86,889 | |||

| (Increase) decrease in receivable for investments sold | (1,930,000 | ) | ||

| Increase (decrease) in payable for investments purchased — when-issued securities | (745,570 | ) | ||

| Increase (decrease) in other accrued expenses and payables | 207,979 | |||

| Change in unrealized (appreciation) depreciation on investments | (19,509,159 | ) | ||