Issuer Free Writing Prospectus dated February 24, 2025

Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended

Related to Preliminary Prospectus dated February 10, 2025

Registration Statement No. 333-283448

Issuer Free Writing Prospectus dated February XX , 2025 Filed Pursuant to Rule 433 of the Securities Act of 1933, as amended Related to Preliminary Prospectus dated February 10, 2025 Registration Statement No. 333 - 283448 TOP WIN INTERNATIONAL LIMITED 0 JW1

Disclaimer 2 This presentation has been prepared by Top Win International Limited (the “Company”) solely for informational purposes . The information presented or contained in this presentation is subject to change without notice . None of the Company or any of its affiliates, advisers or representatives or the underwriters make any undertaking to update any such information subsequent to the date hereof . This presentation should not be construed as legal, tax, investment or other advice . The Company has initially filed a Registration Statement on Form F - 1 with the SEC relating to the proposed initial public offering of its securities in the United States on November 25 , 2024 (Registration No . 333 - 283448 , the “Registration Statement”) . However, the Registration Statement has not yet become effective . The registration statement has not yet become effective . Before you invest, it is advisable to read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more comprehensive information about us and the offering . You can access these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov . This presentation contains forward - looking statements that reflect the Company’s intent, beliefs, or current expectations about the future . These statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially . In some cases, these forward - looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “potential,” “intend,” “plan,” “believe,” “likely to,” or other similar expressions . These statements are based on assumptions about the Company’s operations and other factors beyond its control . As such, actual results may differ materially . Undue reliance should not be placed on these statements, and the Company undertakes no obligation to revise them based on new information or future developments . This presentation does not constitute an offer to sell or an invitation to purchase or subscribe for any securities of the Company for sale in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation in such jurisdiction . No part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever . This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company and is qualified in its entirety by reference to the detailed information in the prospectus relating to the proposed offering . The Company currently reports financial results under U . S . GAAP . The preparation of our consolidated financial statements requires us to make estimates, assumptions and judgments that affect the reported amounts of assets, liabilities, costs and expenses . We base our estimates and assumptions on historical experience and other factors that we believe to be reasonable under the circumstances . We evaluate our estimates and assumptions on an ongoing basis . Our actual results may differ from these estimates . Please refer to the prospectus where necessary for a description of our significant accounting policies . By viewing, accessing or attending this presentation, you agree not to remove these materials, or any materials provided in connection herewith, from the conference room where such documents are provided . You agree further not to photograph, copy or otherwise reproduce this presentation in any form or pass on this presentation to any other person for any purpose, during the presentation or while in the conference room . You must return this presentation and all other materials provided in connection herewith to the Company upon completion of the presentation . This presentation highlights basic information about the Company and the offering to which this presentation relates . As this is a summary, it may not include all the details you should take into account before investing in our securities . The Company has filed the Registration Statement (including a preliminary prospectus) with the SEC for the proposed offering to which this communication relates . The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the proposed offering . You may get these documents for free by visiting EDGAR on the SEC website at http : //www . sec . gov/ . Alternatively, electronic copies of the prospectus relating to the Offering may be obtained, when available, if you contact, Dominari Securities LLC . , info@dominarisecurities . com or Revere Securities LLC . , contact@reveresecurities . com or the Company by email at info@topw . com . hk . *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. CZ0 CZ1 CZ2 3 4

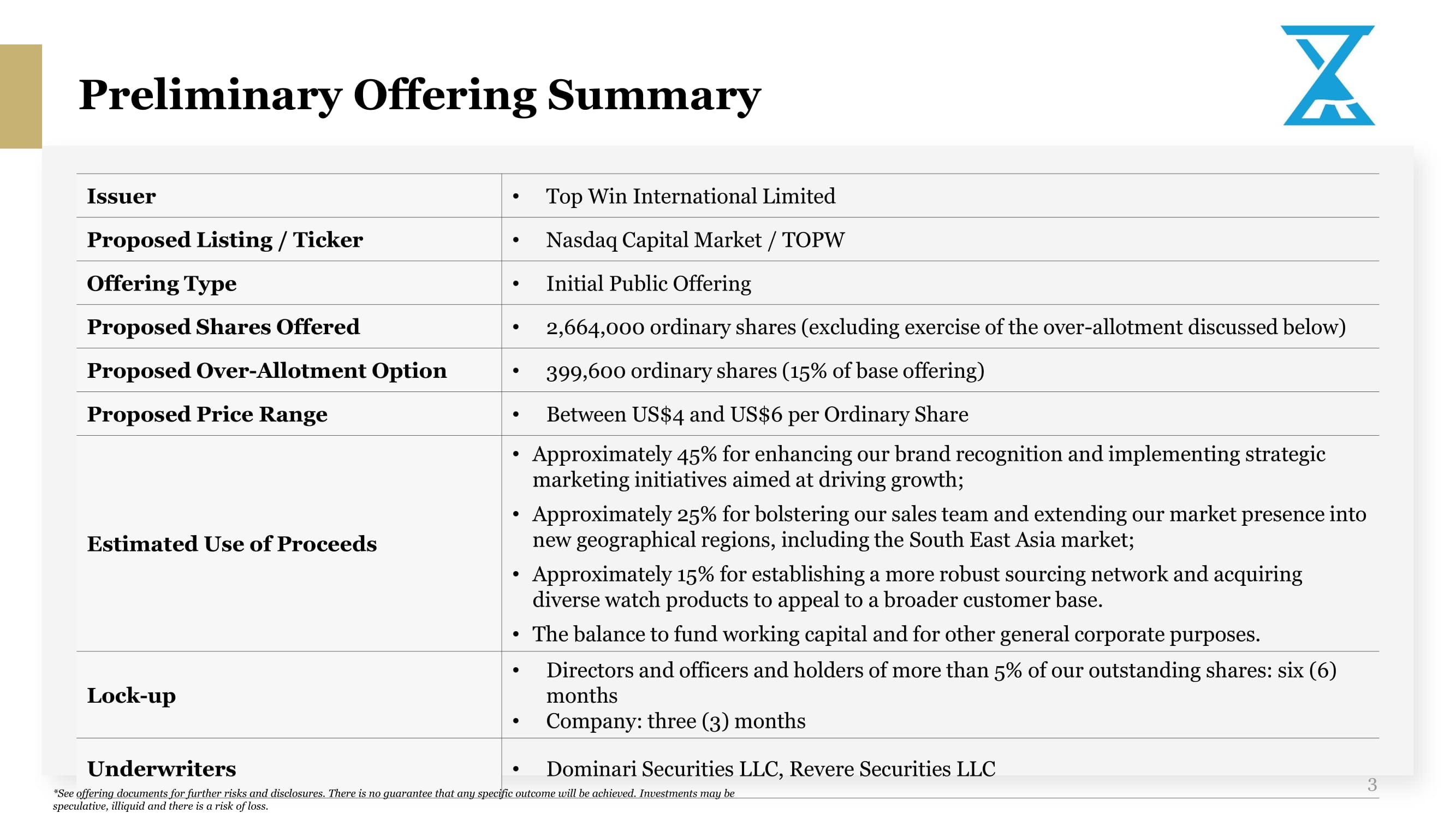

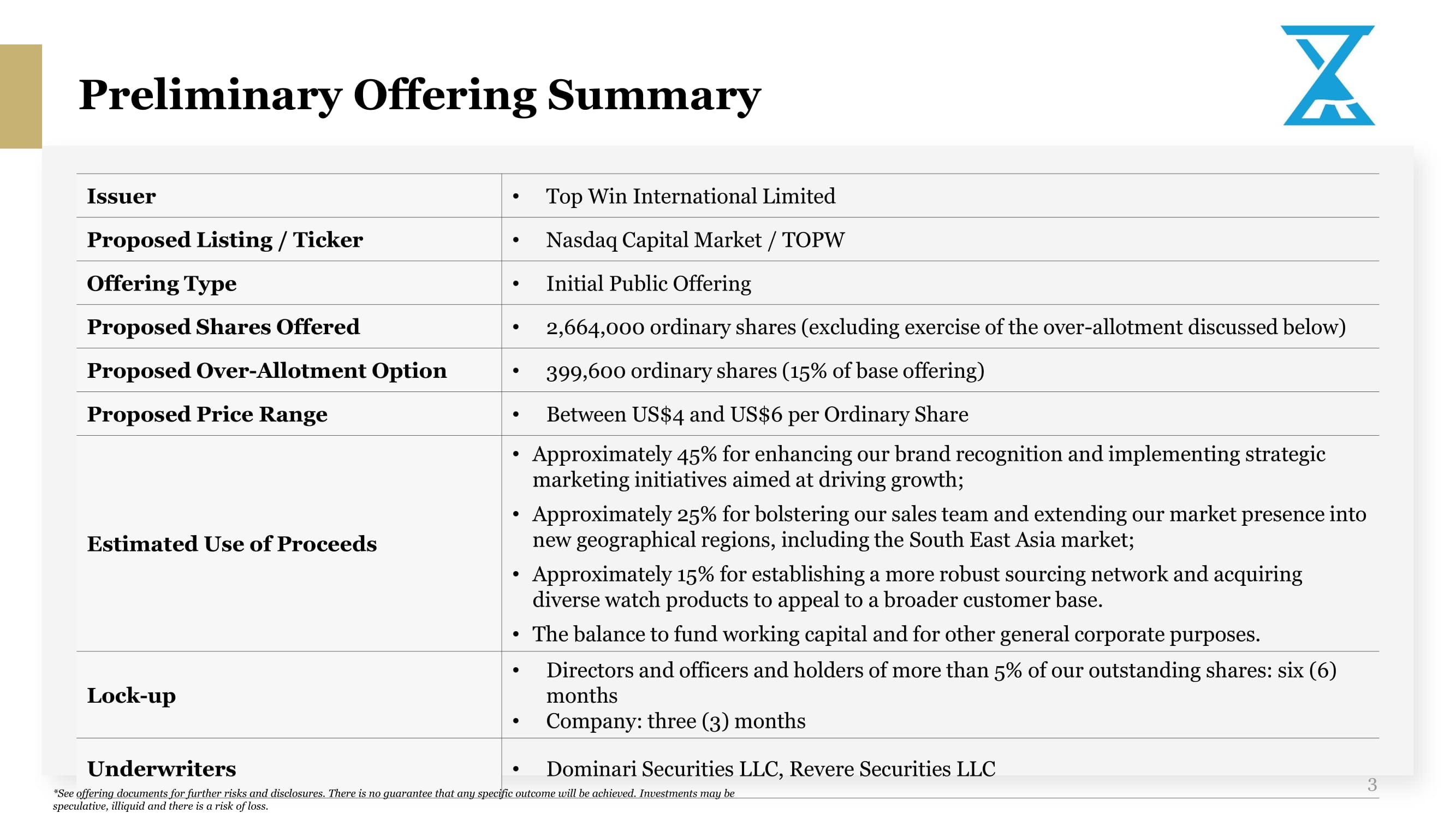

Preliminary Offering Summary 3 • Top Win International Limited Issuer • Nasdaq Capital Market / TOPW Proposed Listing / Ticker • Initial Public Offering Offering Type • 2,664,000 o rdinary shares (excluding exercise of the over - allotment discussed below) Proposed Shares Offered • 399,600 ordinary shares (15% of base offering) Proposed Over - Allotment Option • Between US$4 and US$6 per Ordinary Share Proposed Price Range • Approximately 45% for enhancing our brand recognition and implementing strategic marketing initiatives aimed at driving growth; • Approximately 25% for bolstering our sales team and extending our market presence into new geographical regions, including the South East Asia market; • Approximately 15% for establishing a more robust sourcing network and acquiring diverse watch products to appeal to a broader customer base. • The balance to fund working capital and for other general corporate purposes. Estimated Use of Proceeds • D irectors and officers and holders of more than 5% of our outstanding shares: six (6) months • Company: three (3) months Lock - up • Dominari Securities LLC, Revere Securities LLC Underwriters *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. DX0 CZ1 CZ2 CZ3

Table of Contents 4 Company Overview 01 Industry Overview 02 Investment Highlights 03 Growth Strategies 04 Selected Financials 05 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Renowed Brand Portfolio Targeting Middle to High - Income Earners We Are A Hong Kong - Based Luxury Watch Wholesaler • Engaged in trading, distribution, and retail of international brands. • Acquire luxury watches from authorized dealers and distributors in Europe, Japan, Singapore, etc. • Supply to independent dealers, distributors, and retail buyers in the watch industry. • Over 30 renowned brands like Blancpain, Cartier, Rolex, and Omega; primarily trade watches priced $1,900 - $7,500. • Targeting at middle to high - income earners. Company Overview - Top Win at a glance 5 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss.

6 Suppliers • 22 years of strong supplier relationships ensure stable global procurement. • Established supplier network secure trust, better pricing, and niche product access. Company Overview - Our business Six months ended June 30, 2024 Six months ended June 30, 2023 69.7% Omega 87.4% Omega 9.5% Pa tek Philippe 4.4% Cartier 6.4% Cartier 2.2% Rolex 6.0% Longines 1.7% Longines 4.4% Rolex 1.1% Blancpain Breakdown of approximate percentage in relation to the Company’s total revenue in respect of watches sold Customers • Primarily B2B (distributors, dealers, retailers) for broader reach. • Hong Kong showroom serves both retail and B2B customers. Quality Control • Rigorous processes ensure consistent high product quality. Sales & Marketing • Leverage supplier updates and market analysis for inventory. • Sales team actively aligns with partner and customer needs. *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

7 E - commerce, digital marketing, and customer engagement drive competitiveness. Local chains dominate authorized retailers, boutique stores, and parallel importers. Company Overview - Market position 7 Hong Kong parallel importers offer diverse watch brands, leveraging international markets. Top Win prioritizes wholesale efficiency and broad non - exclusive distribution. Targeting high - volume customers and distributing international watch brands. *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. League table ranking in terms of distributing number of brands (As of Dec 2023)

Luxury Watches Distribution in Hong Kong Key channels: • Authorized Retailers (official outlets with warranties and after - sales services). • Boutique Stores (Brand - specific shops offering personalized experiences). • Department Stores (Access to multiple luxury brands). • Online Platforms (E - commerce sites for convenient shopping). Wholesaler sales of luxury watches in Hong Kong increased from HK$13.6 billion in 2018 to HK$14.7 billion in 2023, representing a CAGR increase of about 1.6% during the relevant period ( Source: Migo Corporation Limited (“Migo”) ). 8 Industry Overview - Distribution channel, wholesaler and luxury sales *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Parallel importers: • Offer wider choice but less service. • Non - exclusive with limited warranties. • Take caution to verify authenticity. Retail Sales of watches and related products decreased from HK$85.3 billion in 2018 to HK$60.1 billion in 2023, but surged 54.7% from HK$38.9 billion in 2022 ( Source: Census and Statistics Department, Hong Kong and Migo ). CZ0

Increasing Lifestyle Awareness • Rising disposable income and changing preferences drive demand. • E - commerce platforms expand market reach and consumer awareness. • Key providers leverage international markets for diverse offerings. • Focus on innovative solutions like e - commerce and customer engagement. Regulatory Environment • Lower prices attract price - sensitive consumers. • Broader selection of brands/models not available through authorized retailers. • Stringent intellectual property and trademark laws require compliance. • Partnerships with authorized distributors aid in navigating legalities. Entry Barriers • High capital and quality service expectations. • Legal challenges related to trademark infringement and authenticity. Competitive Landscape Price & Selection Competitiveness Opportunities & Challenges • Competitive pricing and unique models offer opportunities. • Risks of counterfeit products, after - sales service limitations, and regulatory hurdles present challenges. Industry Overview - Key features of parallel importers market in Hong Kong 9 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

10 Established Reputation in Trading Industry • Over 22 years of experience in luxury watch trading in Hong Kong. • In - depth market knowledge and responsive inventory management. • Strong strategic partnerships with suppliers for competitive pricing. • Rigorous quality control ensuring no defective or counterfeit products. Investment Highlights Access to Favorable Pricing & Exclusive Models • Specializes in parallel importing for better pricing. • Extensive network ensures a steady supply of rare models. • Meets diverse customer demands with rare and exclusive offerings to enhance customer satisfaction and loyalty. Strategic Geographic Location in Hong Kong • Hong Kong’s status as a global financial hub benefits logistics. • Efficient infrastructure supports swift and secure deliveries. • High - income consumer base aligns with premium product demand. *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss.

11 Investment Highlights Strong & Stable Supplier and Customer Relationships • Decades - long relationships with key suppliers. • Global supplier network for diverse and timely inventory. • Extensive customer network enhances market penetration. • Stable business relationships with independent dealers and distributors. Experienced Management & Sales Team • Leadership with over 21 years in the luxury watch industry. • Senior management with deep industry insights and networks. • Sales and procurement teams with local and international expertise. • Rigorous quality checks guarantee product authenticity and excellence. • Strategic market trend analysis for cost - effective inventory management. *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Mr. Kwan NGAI CEO and Director Ms. Fung Yee Mary WONG CFO and Director • CFO since 2009. • Professional Member of the Hong Kong institute of Human Resource management. • Chartered Professional Accountants (Canada) in 2015, FCPA (Hong Kong) from Hong Kong Institute of Certified Public Accountants in 2014, FCCA (UK) from Association of Chartered Certified Public Accountants in 2012. • Joined Top Win Hong Kong as marketing executive in 2002. • 21 years working experience in buying and selling of luxury watches in Hong Kong watch industry. • Graduation diploma from Fukien Secondary School in 2002. Investment Highlights - Experienced and visionary management team Ms. Man Wa Claudia HO COO • Joined Top Win Hong Kong since 2016. • Previously worked as the assistant to senior management at Tai Yang International (Holdings) Limited. • Bachelor’s degree of Chemistry from the University of Auckland in 2010. 12 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Mr. Xiao Jun WANG Independent Non - Executive Director Nominee Mr. Ziyu ZHANG Independent Non - Executive Director Nominee • Previously worked as senior associate of the audit department, Deloitte Touche Tomatsu Hong Kong office. • Former senior manager, finance department in China Resources (Holdings) Co. • Former Assistant Vice President of the Listing and Regulatory Affairs Division of Hong Kong Exchanges and Clearing Limited. • Bachelor’s degree in business administration, Lingnan University; master’s degree in finance and postgraduate diploma in commercial law, The University of Hong Kong. • Specializes in capital markets and M&A. • Previously worked as solicitor at Richards Butler; investment banker at Peregrine Capital Ltd. and ING Barings. • Former partner of JunHe Law Offices. • LLB from the People’s University of China, 1983; LLM from the Graduate School of the Chinese Academy of Social Sciences, 1986. • Passed PCLL examination in 1992, becoming the first PRC lawyer to qualify to practice law in Hong Kong. Investment Highlights - Highly competent board of independent directors Mr. Shuo CHEN Independent Non - Executive Director Nominee • Law Office of Heng A Chen PLLC as counsel. • Previously associate at Ortoli Rosenstadt LLP; legal fellow at MTA Construction and Development Company. • Bachelor’s degree in Biology and Society, Cornell University; J.D. degree, Boston University School of Law. 13 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. CZ0

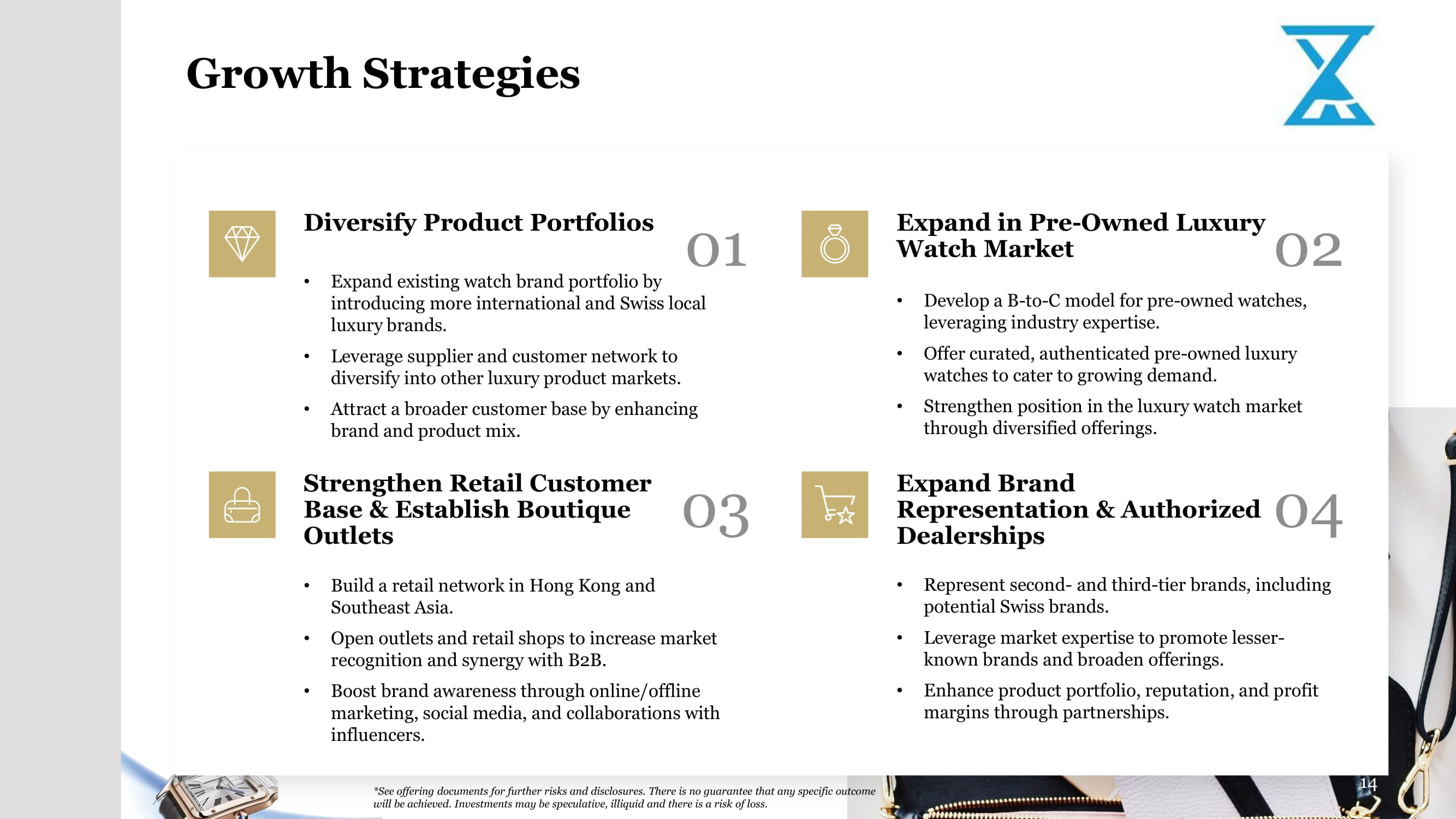

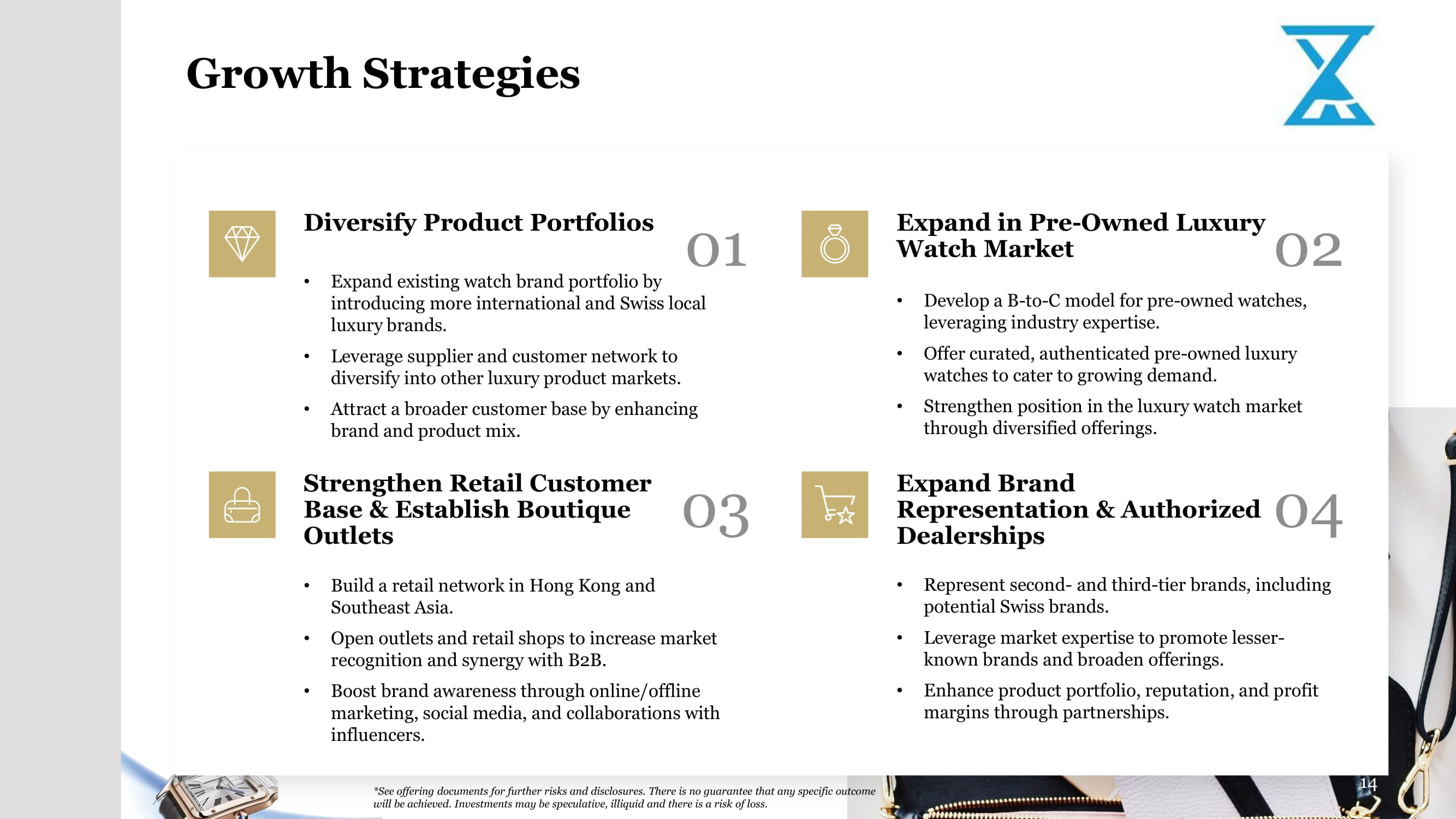

Growth Strategies Diversify Product Portfolios • Expand existing watch brand portfolio by introducing more international and Swiss local luxury brands. • Leverage supplier and customer network to diversify into other luxury product markets. • Attract a broader customer base by enhancing brand and product mix. 01 Strengthen Retail Customer Base & Establish Boutique Outlets • Build a retail network in Hong Kong and Southeast Asia. • Open outlets and retail shops to increase market recognition and synergy with B2B. • Boost brand awareness through online/offline marketing, social media, and collaborations with influencers. 03 Expand in Pre - Owned Luxury Watch Market • Develop a B - to - C model for pre - owned watches, leveraging industry expertise. • Offer curated, authenticated pre - owned luxury watches to cater to growing demand. • Strengthen position in the luxury watch market through diversified offerings. 02 Expand Brand Representation & Authorized Dealerships • Represent second - and third - tier brands, including potential Swiss brands. • Leverage market expertise to promote lesser - known brands and broaden offerings. • Enhance product portfolio, reputation, and profit margins through partnerships. 04 14 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss.

Selected Financials 15 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. • Revenue represents proceeds from trading luxury watches. • The Company buys watches from vendors located in Europe, Japan, Singapore, and other locations. • Pie charts on the right sets forth a breakdown of our purchases from vendors by country for the six months ended June 30, 2024 and 2023 Trading of luxury watches 79.2% 13.3% 6.8% 0.7% from Italy Hong Kong Singapore Switzerland Italy France Japan Six months ended June 30, 2024 Breakdown of Purchases in US$ from Vendors by Country * Fiscal years ended December 31, 2023 and 2024. 24.6% 71.7% 2.1% from Switzerland 0.8% from Italy 0.6% from France 0.2% from Japan Six months ended June 30, 2023 CZ0 JW1

Selected Financials 16 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. * Fiscal years ended December 31, 2023 and 2024. 11.5 7.9 Six months ended June 30 Revenue (In Million USD) 2023 2024 - 31.2% • This decline in revenue was primarily driven by a significant 41% reduction in sales volume, partially offset by an 18% increase in the average unit price of our products. • The drop in sales volume corresponded with the overall trend in consumer spending on luxury watches in Hong Kong, which has been significantly impacted by broader economic challenges in China. 14.2 18.8 Fiscal years ended December 31 Revenue (In Million USD) 2022 2023 32.3% • Surge in sales volume for the year ended December 31, 2023 can be attributed primarily to the 5,195 additional units sold in the category of watches priced below US$128. • We introduced several new watch models in 2023, with some of them being affordable sports watches.

Selected Financials 17 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. * Fiscal years ended December 31, 2023 and 2024. 0.9 0.5 Six months ended June 30 Gross Profit (In Million USD) 2023 2024 - 40.6% 7.9% 6.8% Six months ended June 30 Gross Margin 2023 2024 - 1.1 percentage points 0.3 - 0.2 Six months ended June 30 Net Income (Loss) In Million USD 2023 2024

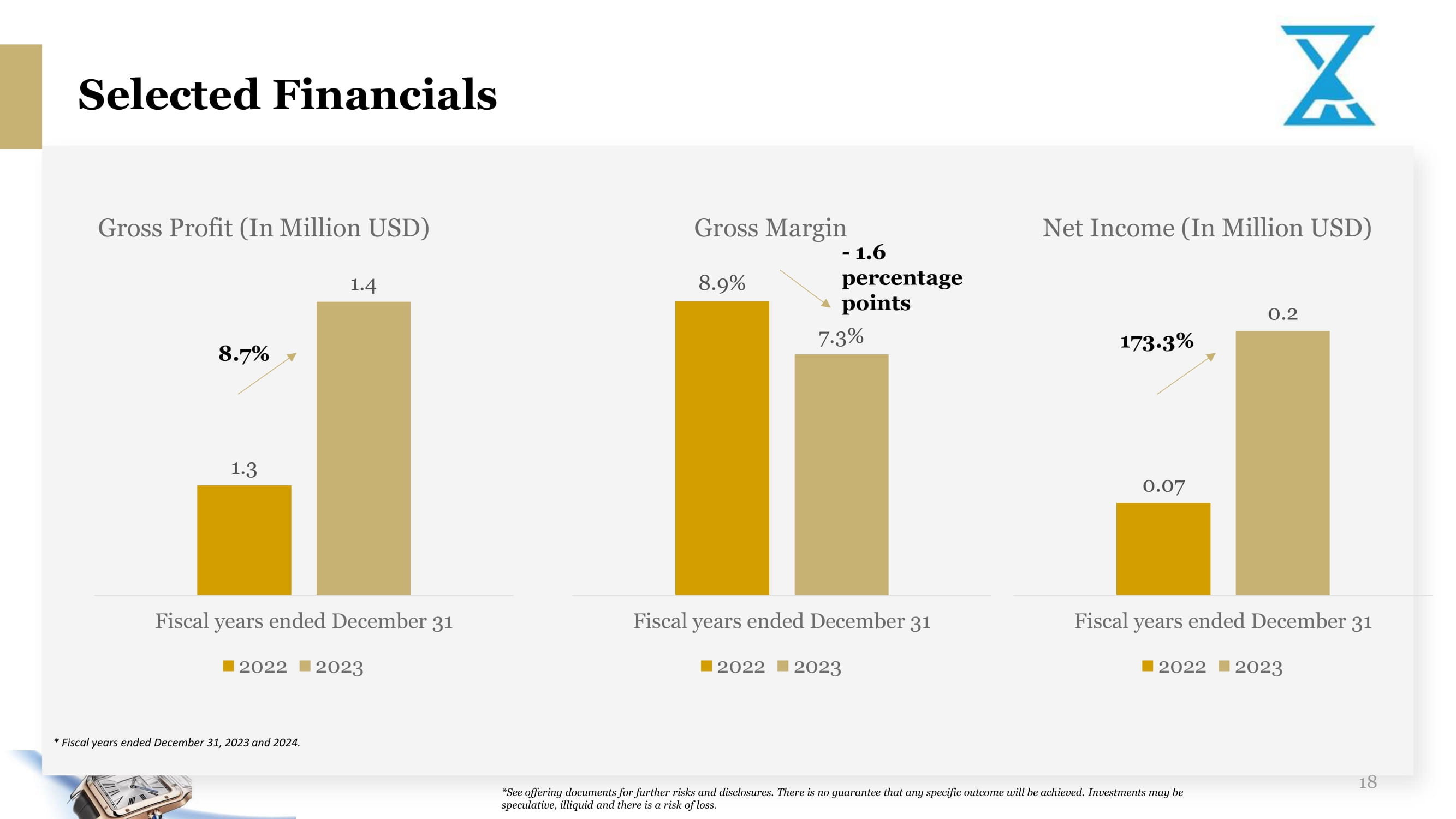

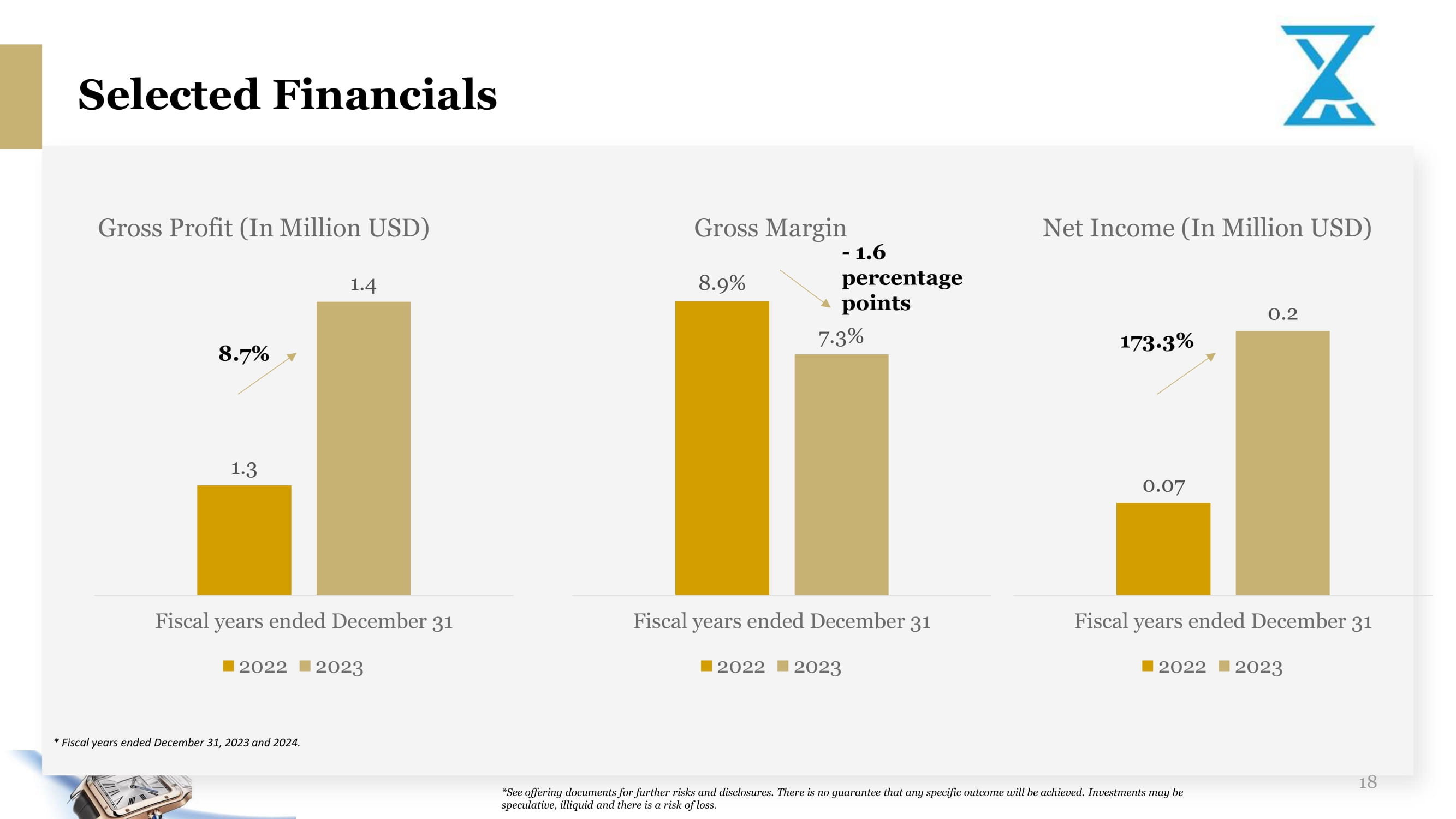

Selected Financials 18 *See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Inv estments may be speculative, illiquid and there is a risk of loss. * Fiscal years ended December 31, 2023 and 2024. 1.3 1.4 Fiscal years ended December 31 Gross Profit (In Million USD) 2022 2023 8.7% 8.9% 7.3% Fiscal years ended December 31 Gross Margin 2022 2023 - 1.6 percentage points 0.07 0.2 Fiscal years ended December 31 Net Income (In Million USD) 2022 2023 173.3%

19 THANK YOU Issuer Contact: 33/F Sunshine Plaza, 353 Lockhart Road, Wan Chai, Hong Kong +852 2815 7988 Underwriter Contact: info@dominarisecurities.com +1 (212) 393 - 4500 +1 (800) 299 - 7618 www.dominarisecurities.com Underwriter Contact: contact@reveresecurities.com +1 (212) 688 - 2350 www.reveresecurities.com Investor Relations Contact: services@wealthfsllc.com +86 138 117 68599 +1 (628) 283 9214 DX0