Exhibit 99.1

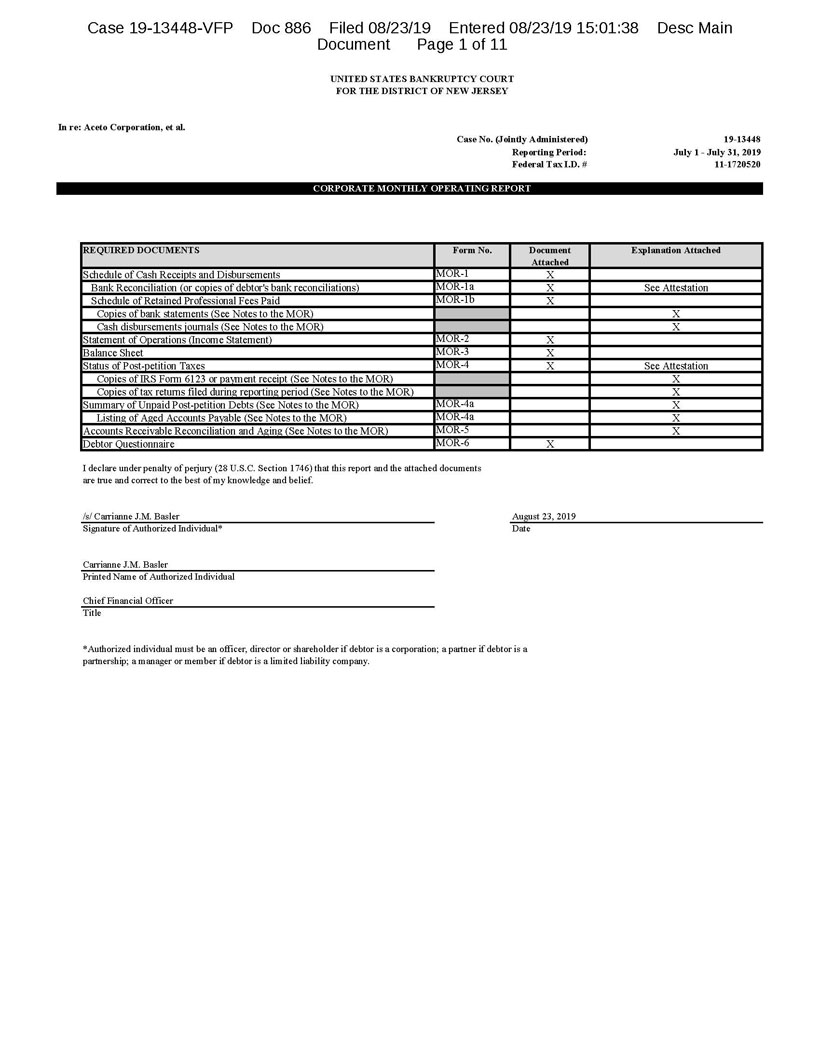

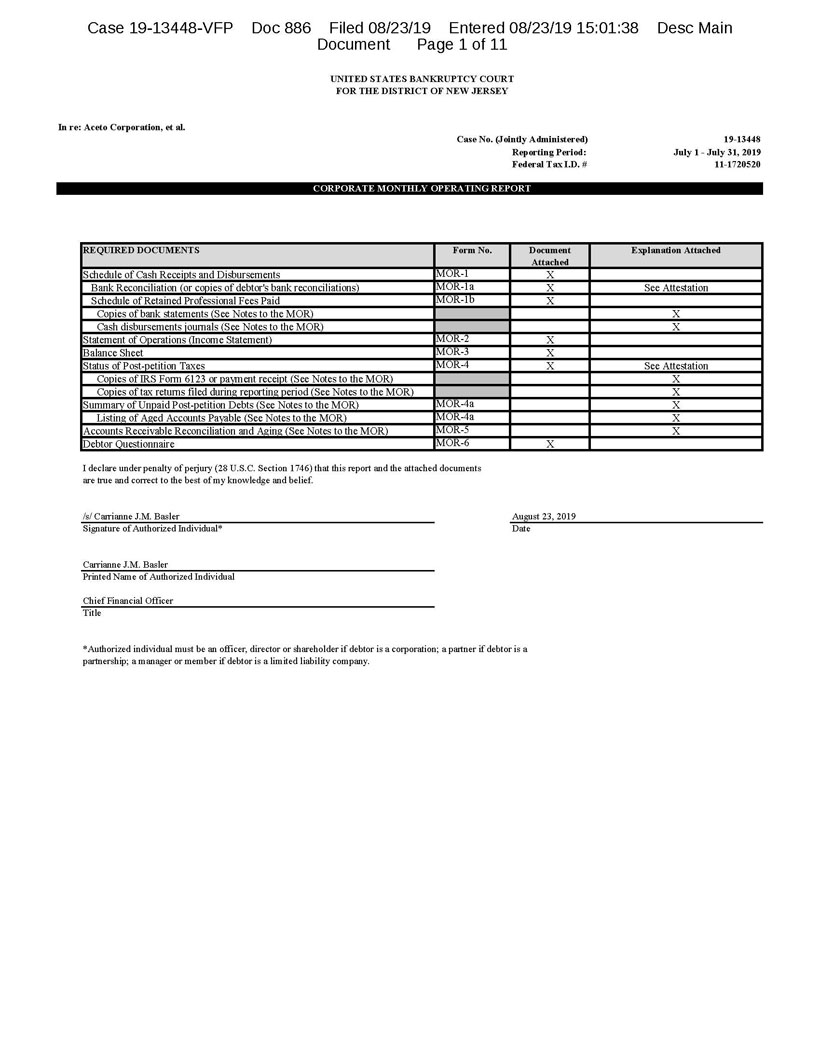

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 1 of 11 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF NEW JERSEY In re: Aceto Corporation, et al. Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 CORPORATE MONTHLY OPERATING REPORT REQUIRED DOCUMENTS Form No. Document Explanation Attached Attached Schedule of Cash Receipts and Disbursements MOR-1 X Bank Reconciliation (or copies of debtor's bank reconciliations) MOR-1a X See Attestation Schedule of Retained Professional Fees Paid MOR-1b X Copies of bank statements (See Notes to the MOR) X Cash disbursements journals (See Notes to the MOR) X Statement of Operations (Income Statement) MOR-2 X Balance Sheet MOR-3 X Status of Post-petition Taxes MOR-4 X See Attestation Copies of IRS Form 6123 or payment receipt (See Notes to the MOR) X Copies of tax returns filed during reporting period (See Notes to the MOR) X Summary of Unpaid Post-petition Debts (See Notes to the MOR) MOR-4a X Listing of Aged Accounts Payable (See Notes to the MOR) MOR-4a X Accounts Receivable Reconciliation and Aging (See Notes to the MOR) MOR-5 X Debtor Questionnaire MOR-6 X I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. /s/ Carrianne J.M. Basler August 23, 2019 Signature of Authorized Individual* Date Carrianne J.M. Basler Printed Name of Authorized Individual Chief Financial Officer Title *Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 2 of 11 In re: Aceto Corporation, et al. MOR Notes Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Notes to the Monthly Operating Report GENERAL: The report includes activity from the following Debtors and related Case Numbers: Debtor Case Number Debtor Case Number Aceto Corporation 19-13448 Kavris Health, LLC (fka Acetris Health, LLC) 19-13452 Tri Harbor Chemical Holdings LLC (fka Aceto Agricultural Chemical Corporation) 19-13449 Arsynco, Inc. 19-13454 Kavod Pharmaceuticals LLC (fka Rising Pharmaceuticals, Inc.) 19-13447 Tri Harbor Realty LLC (fka Aceto Realty LLC) 19-13450 KAVACK Pharmaceuticals LLC (fka PACK Pharmaceuticals, LLC) 19-13453 Acci Realty Corp. 19-13455 Kavod Health LLC (fka Rising Health, LLC) 19-13451 Notes to the MOR: This Monthly Operating Report ("MOR") has been prepared solely for the purpose of complying with the monthly reporting requirements applicable in these chapter 11 cases and is in a format acceptable to the U.S. Trustee. The financial information contained herein is unaudited, limited in scope, and, as discussed below, is not prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The unaudited financial statements have been derived from the books and records of Aceto Corporation and its affiliated debtors (collectively, the “Debtors”). The information furnished in this report includes primarily normal recurring adjustments, but not all of the adjustments that would typically be made for the quarterly and annual financial statements to be in accordance with U.S. GAAP. Furthermore, the monthly financial information contained herein has not been subjected to the same level of accounting review and testing that the Debtors apply in the preparation of their quarterly and annual financial information in accordance with U.S. GAAP. Accordingly, upon the application of such procedures, the Debtors believe that the financial information may be subject to change, and these changes could be material. The financial statements presented in MOR-2 and MOR-3 do not include elimination entries for intercompany balances related to non-debtor affiliates. Investment in subsidiary balances are recorded at cost which may not be in accordance with U.S. GAAP. The amounts currently classified as liabilities subject to compromise may be subject to future change as the Debtors complete their analysis of prepetition liabilities. Amounts listed in the statement of operations and balance sheet in the attached MOR-2 and MOR-3 are based on preliminary information provided by the purchasers (the “Buyers”) of the assets of the Debtors’ Pharma Business and Chemical Plus (“ChemPlus”) Business as described in the relevant Asset Purchase Agreements and related documents filed previously with this Court, though the buyers of the assets of the ChemPlus Business have not yet confirmed the closing balance sheet information. The Debtors have not had the opportunity to complete their review of such amounts and therefore they may be subject to material change. Further, the Buyers may also assert that the Debtors may be liable for additional liabilities that are presently unknown. Accordingly, the Debtors reserve the right to amend this MOR. Pursuant to the Court’s order establishing deadlines to file proofs of claim [Docket No. 509], the General Bar Date (as defined therein) for non-governmental units was June 19, 2019, and the Governmental Bar Date (as defined therein) was August 19, 2019. The Governmental Bar Date was extended to September 3, 2019 solely for the Antitrust Division of the U.S. Department of Justice and the U.S. Department of Health and Human Services. As of this filing, there have been approximately 265 claims filed in the aggregate amount of approximately $1.6 billion. The Debtors are in the process of reviewing and reconciling the claims filed to date and expect this process will continue for several months. There are many claims asserting amounts that are not reflected in the Debtors’ books and records that were relied upon for the completion of this MOR. To the extent those claims are allowed or otherwise deemed valid during the claims reconciliation process, the Debtors’ books and records will be adjusted accordingly. The results of operations contained herein are not necessarily indicative of results which may be expected from any other period or for the full year and may not necessarily reflect the consolidated results of operations, financial position, and cash flows of the Debtors in the future. The Debtors caution readers not to place undue reliance upon the MOR. Such information may be incomplete and the MOR may be subject to revision. The financial statements contained herein do not include any accruals or estimates for an estate wind-down budget. Accordingly, they should not be relied upon as an indicator of recoveries. Reference should be made to the Second Modified Joint Plan of Liquidation (the “Plan”) [Docket No. 757] and Second Modified Disclosure Statement (the “Disclosure Statement”) [Docket No. 758] for information regarding estimated creditor recoveries. Notes to MOR-1a: The Debtors maintain 24 total bank accounts (collectively, the “Bank Accounts”) at several financial institutions (the “Banks”). The Bank Accounts vary in purpose and function across the Debtors, and each Debtor's Bank Accounts serve its respective business accordingly. Notes to MOR-2: The Income Statement reflects revenue and expenses for the reporting month of July 2019 that directly correspond to the listed debtor legal entity. Amounts reported may not reflect gain/loss for tax purposes.

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 3 of 11 In re: Aceto Corporation, et al. MOR Notes Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Notes to the Monthly Operating Report Notes to MOR-3: The Balance Sheet reflects assets, liabilities, and stockholders equity that directly correspond to the debtor legal entity. As a result of the commencement of these chapter 11 cases, the payment of prepetition indebtedness is subject to compromise or other treatment under a chapter 11 plan. The Court authorized the Debtors to pay certain prepetition claims, including, but not limited to, certain trade and tax claims. To the extent such claims have been categorized as “Liabilities Not Subject to Compromise,” the Debtors reserve their right to dispute their obligation to make such payments. The Debtors have been paying, and intend to continue to pay, undisputed post-petition claims arising in the ordinary course of business. The liability information contained herein, except as otherwise noted, is listed as of the close of business as of the end of the month. Accordingly, the Debtors reserve all rights to amend, supplement, or otherwise modify this MOR as necessary and appropriate, but shall be under no obligation to do so. The Debtors have paid certain prepetition liabilities pursuant to orders entered by the Court that authorize such payments. The Debtors believe that all undisputed post-petition accounts payable have been and are being paid according to agreed-upon terms specific to each vendor and/or service provider and as authorized by the Court. In addition, the liabilities reported in this MOR do not reflect any analysis conducted by the Debtors regarding potential claims under section 503(b)(9) of the Bankruptcy Code. Accordingly, the Debtors reserve any and all of their rights to dispute or challenge the validity of any claims asserted under section 503(b)(9) of the Bankruptcy Code or the characterization of the structure of any transaction, document, or instrument related to any creditor’s claim. Intercompany accounts have not been reclassified to LSTC, nor have any Income Taxes Payable. In addition, income taxes payable and receivable are shown at gross amounts in these financial statements and have not been netted. The amount reported in LSTC for the Unsecured Convertible Notes includes principal and accrued interest through the Petition Date. The deferred payment obligation that arose in connection with the purchase of Citron Pharma and Lucid Pharma in 2016 has been adjusted to $30 million pursuant to the the Asset Purchase Agreement regarding the sale of the assets of the Pharma Business and mutual release executed in connection therewith, which was approved by the Court by order entered on April 10, 2019 [Docket No. 373]. This amount is included in LSTC for Kavod Pharmaceuticals LLC. The investment of $1.9 million reported on Tri Harbor Chemical Holdings LLC (f/k/a Aceto Agriculture Chemical Corporation) represents its interest in Canegrass LLC, a joint venture (“JV”). The JV is in the process of being dissolved as authorized by the Court pursuant to the Stipulation and Consent Order (A) In Furtherance of Order Approving the Sale of the Debtors Chemical Plus Business and (B) Regarding Resolution of Debtors Interests in Non-Debtor Canegrass LLC and Related Agreements [Docket No. 791] (the “Canegrass Stipulation”). In connection with such dissolution and as authorized pursuant to the Canegrass Stipulation, Tri Harbor Chemical Holdings LLC (f/k/a Aceto Agriculture Chemical Corporation) expects to receive approximately $1.9 million in cash. $1.9 million of the cash and cash equivalents reported at Arsynco were provided by Aceto Corporation to backstop certain remediation obligations of Arsynco and are restricted. The treatment of such funds may depend, in part, upon the outcome of the sale of the Arsynco Carlstadt Property, as well as resolution of claim # 261 filed by the United States of America EPA DOI NOAA. While no assurance can be provided at the present time, the restricted funds are expected to be released to Debtor Aceto Corporation, as payor of the funds, post- closing. Notes to MOR-4: The Debtors received authority pursuant to various “first day” orders to pay certain prepetition liabilities, including prepetition tax liabilities. The Debtors are current on all undisputed post-petition payables. Notes to MOR 4a and MOR 5: The Debtors disclose the ending accounts receivable and accounts payable balances as part of MOR-3. Due to the volume of transactions related to customer and vendor billings and payments, these items will be made available upon request.

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 4 of 11 In re: Aceto Corporation, et al. MOR-1 Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Schedule of Cash Receipts and Disbursements Whole Values Debtor Case Number Cash Receipts Cash Disbursements Aceto Corporation 19-13448 $16,379 $4,350,608 Tri Harbor Chemical Holdings LLC 19-13449 99 912 Kavod Pharmaceuticals LLC 19-13447 - 79,951 KAVACK Pharmaceuticals LLC 19-13453 - - Kavod Health LLC 19-13451 - - Kavris Health, LLC 19-13452 - - Arsynco, Inc. 19-13454 - 550,000 Tri Harbor Realty LLC 19-13450 - - Acci Realty Corp. 19-13455 - - Total Cash Receipts and Cash Disbursements $16,478 $4,981,471 Notes: - Excludes transfers between Debtors. - Cash receipts and disbursement amounts based on checks cleared, wires, and other transfer of funds. During the period, the Debtors also received and forwarded misdirected funds from customers intended for the purchasers of the Pharma and ChemPlus businesses. Those amounts are excluded from the totals represented herein.

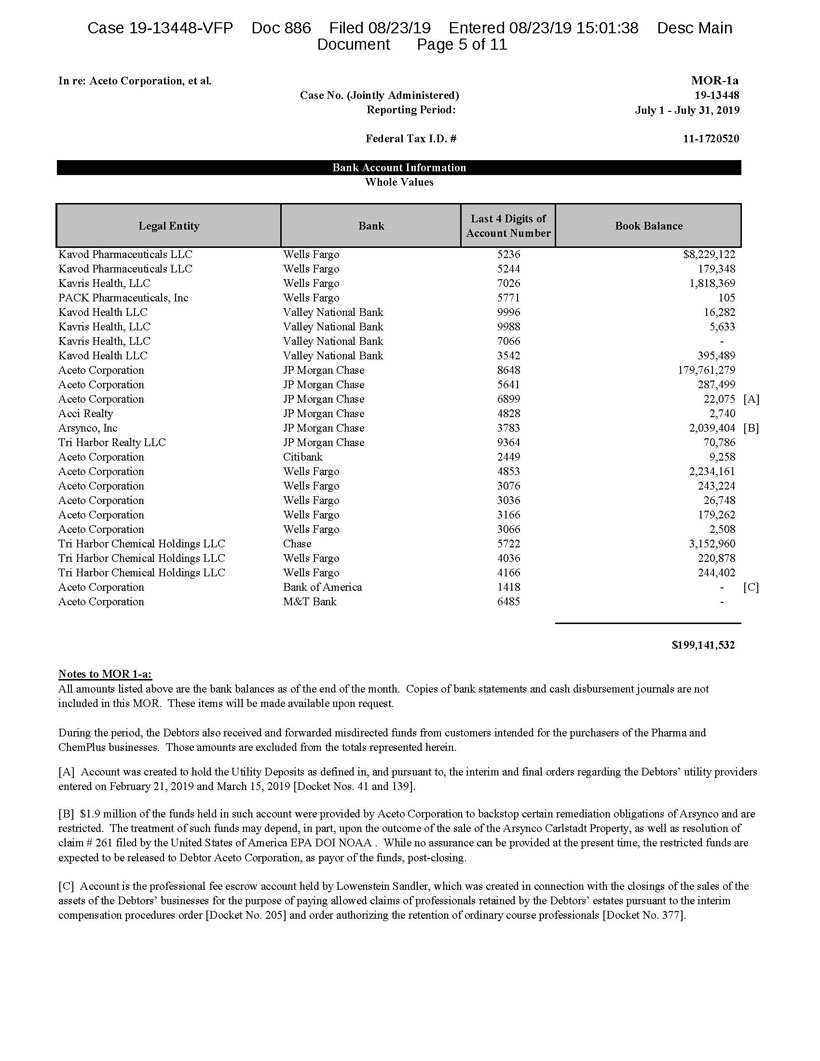

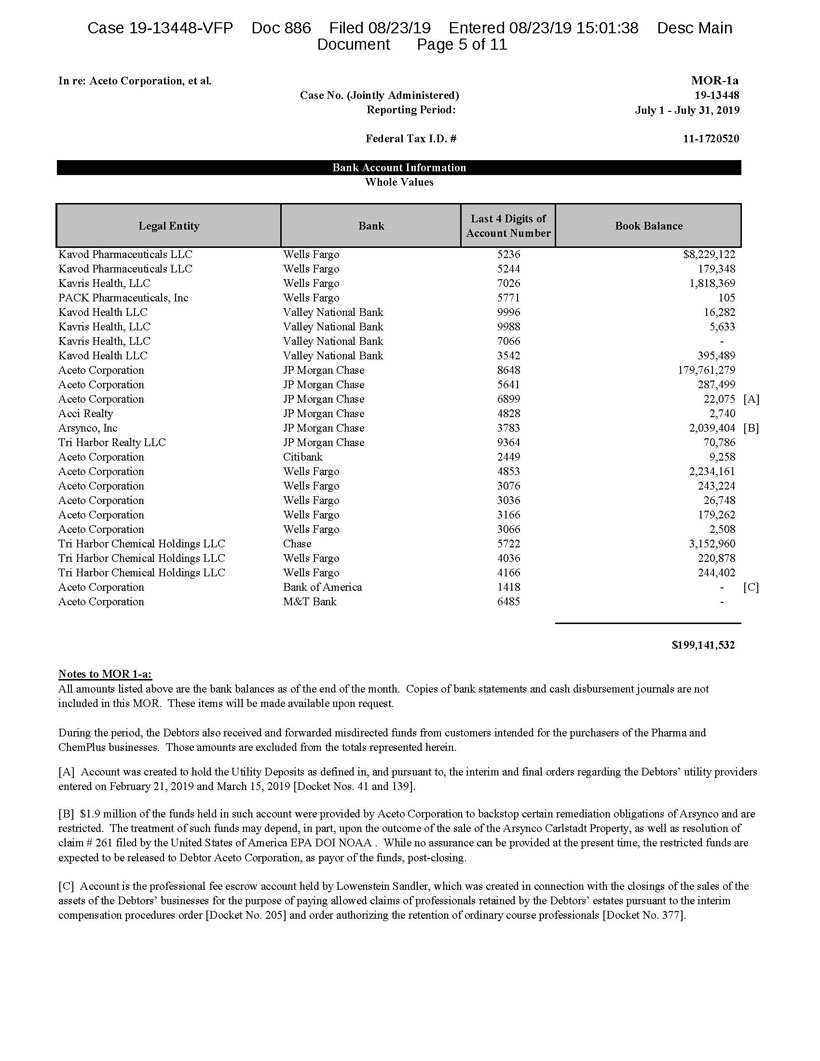

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 5 of 11 In re: Aceto Corporation, et al. MOR-1a Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Bank Account Information Whole Values Last 4 Digits of Legal Entity Bank Book Balance Account Number Kavod Pharmaceuticals LLC Wells Fargo 5236 $8,229,122 Kavod Pharmaceuticals LLC Wells Fargo 5244 179,348 Kavris Health, LLC Wells Fargo 7026 1,818,369 PACK Pharmaceuticals, Inc Wells Fargo 5771 105 Kavod Health LLC Valley National Bank 9996 16,282 Kavris Health, LLC Valley National Bank 9988 5,633 Kavris Health, LLC Valley National Bank 7066 - Kavod Health LLC Valley National Bank 3542 395,489 Aceto Corporation JP Morgan Chase 8648 179,761,279 Aceto Corporation JP Morgan Chase 5641 287,499 Aceto Corporation JP Morgan Chase 6899 22,075 [A] Acci Realty JP Morgan Chase 4828 2,740 Arsynco, Inc JP Morgan Chase 3783 2,039,404 [B] Tri Harbor Realty LLC JP Morgan Chase 9364 70,786 Aceto Corporation Citibank 2449 9,258 Aceto Corporation Wells Fargo 4853 2,234,161 Aceto Corporation Wells Fargo 3076 243,224 Aceto Corporation Wells Fargo 3036 26,748 Aceto Corporation Wells Fargo 3166 179,262 Aceto Corporation Wells Fargo 3066 2,508 Tri Harbor Chemical Holdings LLC Chase 5722 3,152,960 Tri Harbor Chemical Holdings LLC Wells Fargo 4036 220,878 Tri Harbor Chemical Holdings LLC Wells Fargo 4166 244,402 Aceto Corporation Bank of America 1418 - [C] Aceto Corporation M&T Bank 6485 - $199,141,532 Notes to MOR 1-a: All amounts listed above are the bank balances as of the end of the month. Copies of bank statements and cash disbursement journals are not included in this MOR. These items will be made available upon request. During the period, the Debtors also received and forwarded misdirected funds from customers intended for the purchasers of the Pharma and ChemPlus businesses. Those amounts are excluded from the totals represented herein. [A] Account was created to hold the Utility Deposits as defined in, and pursuant to, the interim and final orders regarding the Debtors’ utility providers entered on February 21, 2019 and March 15, 2019 [Docket Nos. 41 and 139]. [B] $1.9 million of the funds held in such account were provided by Aceto Corporation to backstop certain remediation obligations of Arsynco and are restricted. The treatment of such funds may depend, in part, upon the outcome of the sale of the Arsynco Carlstadt Property, as well as resolution of claim # 261 filed by the United States of America EPA DOI NOAA . While no assurance can be provided at the present time, the restricted funds are expected to be released to Debtor Aceto Corporation, as payor of the funds, post-closing. [C] Account is the professional fee escrow account held by Lowenstein Sandler, which was created in connection with the closings of the sales of the assets of the Debtors’ businesses for the purpose of paying allowed claims of professionals retained by the Debtors’ estates pursuant to the interim compensation procedures order [Docket No. 205] and order authorizing the retention of ordinary course professionals [Docket No. 377].

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 6 of 11 In re: Aceto Corporation, et al. MOR-1a Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Bank Reconciliation (or copies of debtor's bank reconciliations) The above-captioned debtors (the "Debtors") hereby submit this attestation regarding bank account reconciliations in lieu of providing copies of bank statements, journals, and account reconciliations. I attest that each of the Debtors' bank accounts is reconciled to bank statements. The Debtors' standard practice is to ensure that each bank account is reconciled to bank statements once per month within 31 days after the month end. /s/ Carrianne J.M. Basler August 23, 2019 Signature of Authorized Individual Date Carrianne J.M. Basler Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual

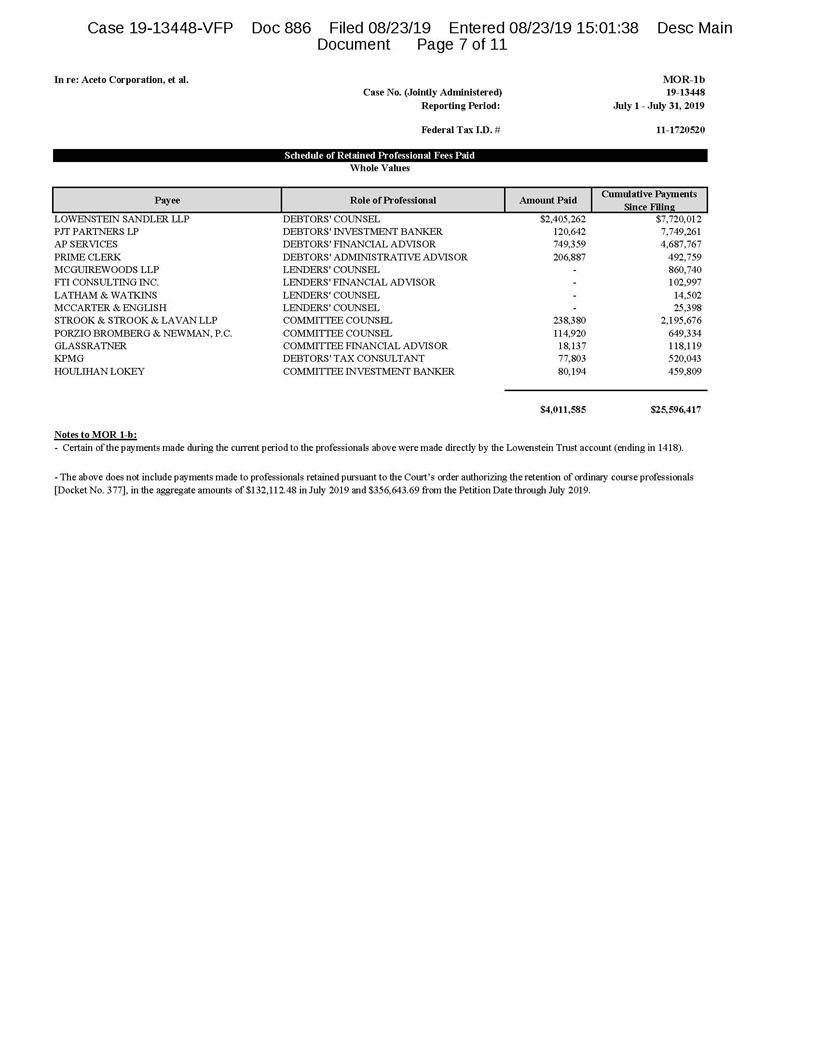

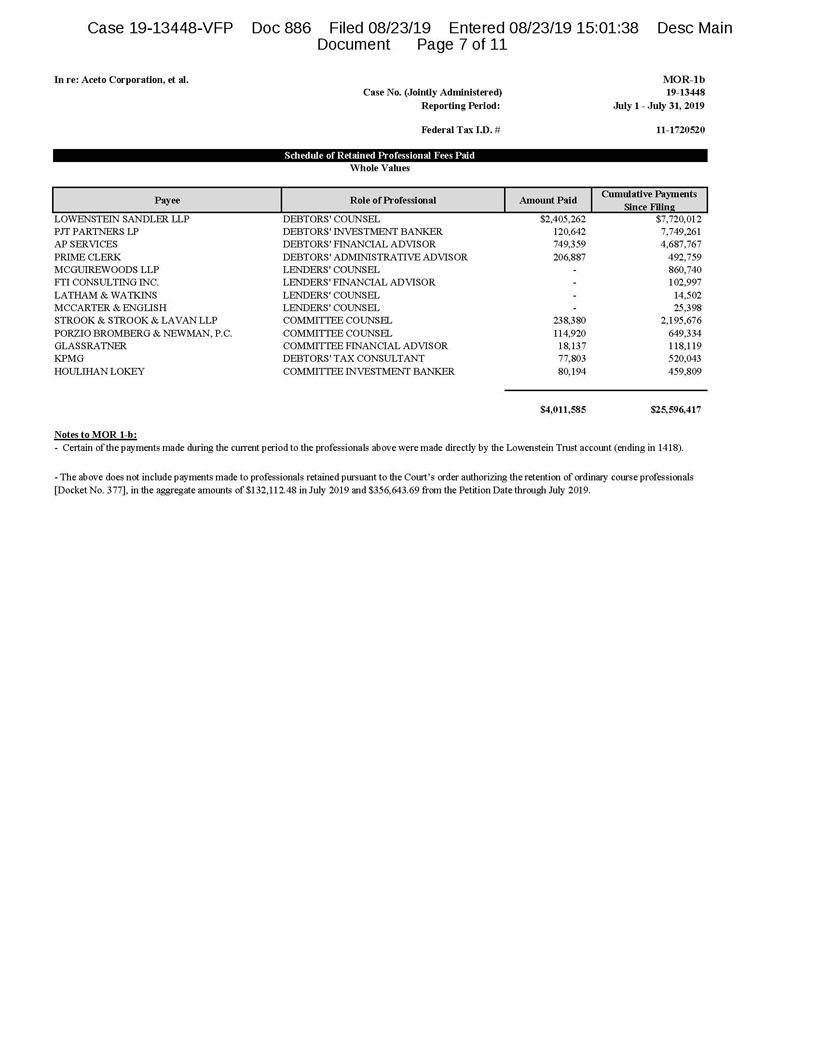

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 7 of 11 In re: Aceto Corporation, et al. MOR-1b Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Schedule of Retained Professional Fees Paid Whole Values Cumulative Payments Payee Role of Professional Amount Paid Since Filing LOWENSTEIN SANDLER LLP DEBTORS' COUNSEL $2,405,262 $7,720,012 PJT PARTNERS LP DEBTORS' INVESTMENT BANKER 120,642 7,749,261 AP SERVICES DEBTORS' FINANCIAL ADVISOR 749,359 4,687,767 PRIME CLERK DEBTORS' ADMINISTRATIVE ADVISOR 206,887 492,759 MCGUIREWOODS LLP LENDERS' COUNSEL - 860,740 FTI CONSULTING INC. LENDERS' FINANCIAL ADVISOR - 102,997 LATHAM & WATKINS LENDERS' COUNSEL - 14,502 MCCARTER & ENGLISH LENDERS' COUNSEL - 25,398 STROOK & STROOK & LAVAN LLP COMMITTEE COUNSEL 238,380 2,195,676 PORZIO BROMBERG & NEWMAN, P.C. COMMITTEE COUNSEL 114,920 649,334 GLASSRATNER COMMITTEE FINANCIAL ADVISOR 18,137 118,119 KPMG DEBTORS' TAX CONSULTANT 77,803 520,043 HOULIHAN LOKEY COMMITTEE INVESTMENT BANKER 80,194 459,809 $4,011,585 $25,596,417 Notes to MOR 1-b: - Certain of the payments made during the current period to the professionals above were made directly by the Lowenstein Trust account (ending in 1418). - The above does not include payments made to professionals retained pursuant to the Court’s order authorizing the retention of ordinary course professionals [Docket No. 377], in the aggregate amounts of $132,112.48 in July 2019 and $356,643.69 from the Petition Date through July 2019.

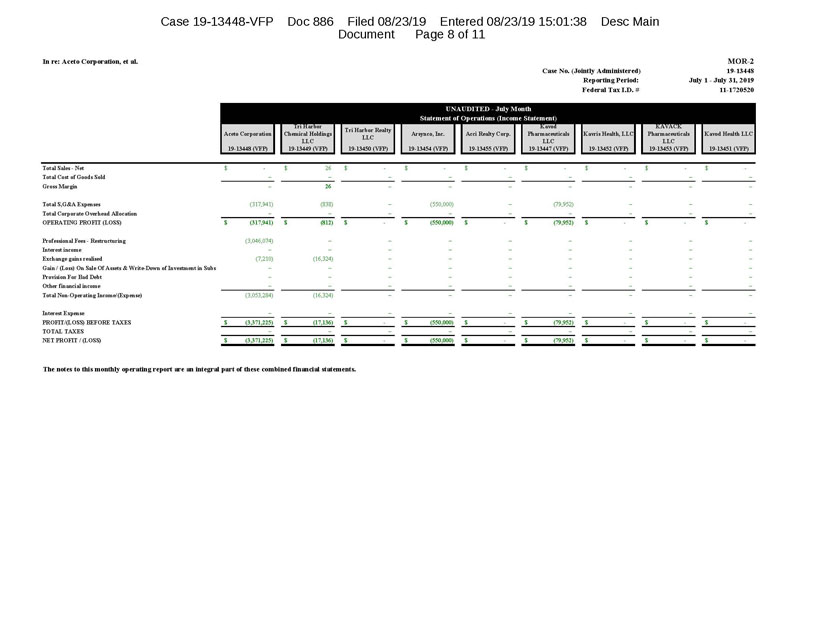

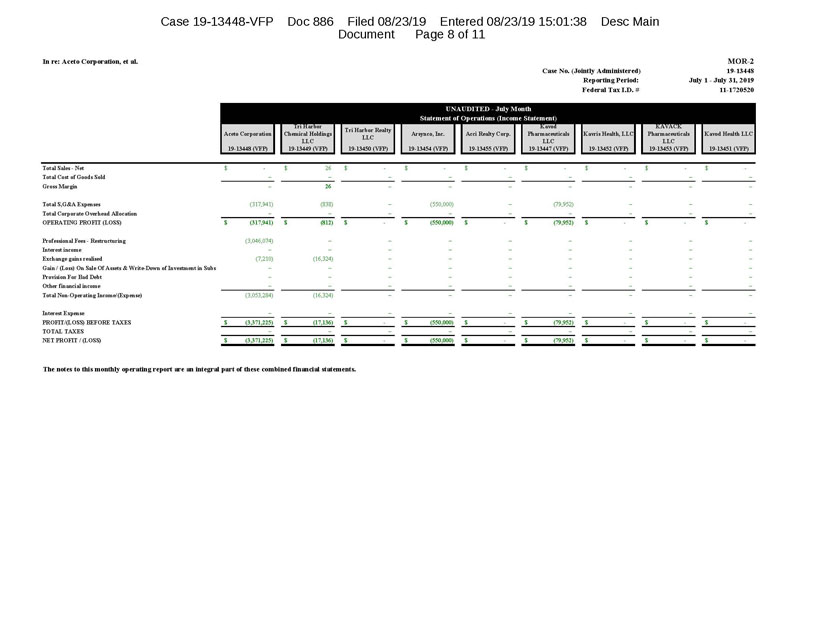

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 8 of 11 In re: Aceto Corporation, et al. MOR-2 Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 UNAUDITED - July Month Statement of Operations (Income Statement) Tri Harbor Kavod KAVACK Tri Harbor Realty Aceto Corporation Chemical Holdings Arsynco, Inc. Acci Realty Corp. Pharmaceuticals Kavris Health, LLC Pharmaceuticals Kavod Health LLC LLC LLC LLC LLC 19-13448 (VFP) 19-13449 (VFP) 19-13450 (VFP) 19-13454 (VFP) 19-13455 (VFP) 19-13447 (VFP) 19-13452 (VFP) 19-13453 (VFP) 19-13451 (VFP) Total Sales - Net $– $26 $- $- $- $- $- $- $- Total Cost of Goods Sold – – – – – – – – – Gross Margin – 26 – – – – – – – Total S,G&A Expenses (317,941) (838) – (550,000) – (79,952) – – – Total Corporate Overhead Allocation – – – – – – – – – OPERATING PROFIT (LOSS) $(317,941) $(812) $- $(550,000) $- $(79,952) $- $- $- Professional Fees - Restructuring (3,046,074) – – – – – – – – Interest income Exchange gains realised (7,210) (16,324) – – – – – – – Gain / (Loss) On Sale Of Assets & Write-Down of Investment in Subs – – – – – – – – – Provision For Bad Debt – – – – – – – – – Other financial income – – – – – – – – – Total Non-Operating Income/(Expense) (3,053,284) (16,324) – – – – – – – Interest Expense – – – – – – – – – PROFIT/(LOSS) BEFORE TAXES $(3,371,225) $(17,136) $– $(550,000) $- $(79,952) $- $- $- TOTAL TAXES – – – – – – – – – NET PROFIT / (LOSS) $(3,371,225) $(17,136) $– $(550,000) $- $(79,952) $- $- $- The notes to this monthly operating report are an integral part of these combined financial statements.

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 9 of 11 In re: Aceto Corporation, et al. MOR-3 Case No. (Jointly Administered) 19-13448 Reporting Period: Month Ending July 31, 2019 Federal Tax I.D. # 11-1720520 UNAUDITED - July 31 Balance Sheet Tri Harbor Kavod KAVACK Tri Harbor Realty Aceto Corporation Chemical Holdings Arsynco, Inc. Acci Realty Corp. Pharmaceuticals Kavris Health, LLC Pharmaceuticals Kavod Health LLC LLC LLC LLC LLC 19-13448 (VFP) 19-13449 (VFP) 19-13450 (VFP) 19-13454 (VFP) 19-13455 (VFP) 19-13447 (VFP) 19-13452 (VFP) 19-13453 (VFP) 19-13451 (VFP) Cash & Cash Equivalents $182,743,940 $3,618,240 $70,786 $2,039,404 $2,740 $8,820,346 $1,824,002 $- $- Account receivables Net – – – – – – – – – Other receivables 22,075 – 1,081 1,416,427 – – – – – Due From/(To) Affiliates (83,399,118) 29,165,101 (1,711,494) (17,134,067) (302,315) 71,132,145 2,127,450 – – Total inventories – – – – – – – – – Income Tax Receivable 1,494,550 – – – – 1,397,615 – – – Prepaid expenses 1,775,851 – – – – – – – – Total Current Assets $102,637,299 $32,783,341 $(1,639,628) $(13,678,236) $(299,576) $81,350,106 $3,951,452 $- $- Investments – 1,947,127 – – – – – – – Investments in Subsidiaries & Affiliates 5,830,500 – – – – – – – – Total Investments 5,830,500 1,947,127 – – – – – – – Property, plant & equipment - net – – – – – – – – – Total Intangible Assets - Net – – – – – (2) – – – Deferred Tax Assets - Net of Allowances (9,044) – – – – – – – – Other Assets - LT – – – – – 5,999 – – – Property held For Sale - LT – – – 6,112,710 – – – – – Total Long Term Assets $5,821,456 $1,947,127 $- $6,112,710 $- $5,997 $- $- $- Total Assets $108,458,755 $34,730,468 $(1,639,628) $(7,565,526) $(299,576) $81,356,103 $3,951,452 $- $- Account payables 104,355 – – 3,671 – – – – – Accrued Compensation (0) – – – – (0) – – – Accrued Income Tax 2,608,199 – – – – (2,213,291) – – – Accrued Environmental Remediation – – – 3,147,616 – – – – – Accrued expenses - Other 5,085,249 10,984 – – – – – – – Total Current Liabilities $7,797,803 $10,984 $- $3,151,287 $- $(2,213,291) $- $- $- Accrued Income Tax LT 5,322,572 – – – – – – – – Other long-term liabilities – – – – – – – – – Total Long Term Liabilities $5,322,572 $- $- $- $- $- $- $- $- Total Liabilities Not Subject to Compromise $13,120,375 $10,984 $- $3,151,287 $- $(2,213,291) $- $- $- Total Liabilities Subject to Compromise $144,848,869 $- $- $18,460 $- $36,238,045 $- $- $- Shareholders' Equity $(49,510,489) $34,719,484 $(1,639,628) $(10,735,273) $(299,576) $47,331,349 $3,951,452 $- $- Total Liabilities & Shareholders Equity $108,458,755 $34,730,468 $(1,639,628) $(7,565,526) $(299,576) $81,356,103 $3,951,452 $- $- The notes to this monthly operating report are an integral part of these combined financial statements.

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 10 of 11 In re: Aceto Corporation, et al. MOR-4 Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Status of Post-petition Taxes The above-captioned debtors (the "Debtors") hereby submit this attestation regarding Status of Post-petition Taxes in lieu of providing copies of post-petition tax payments and tax returns filed during reporting period. I attest that each of the Debtors' taxing authorities have been paid on time when post-petition amounts become due. Also, tax returns are being filed in an orderly and timely fashion in accordance with tax return reporting deadlines. /s/ Carrianne J.M. Basler August 23, 2019 Signature of Authorized Individual Date Carrianne J.M. Basler Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual

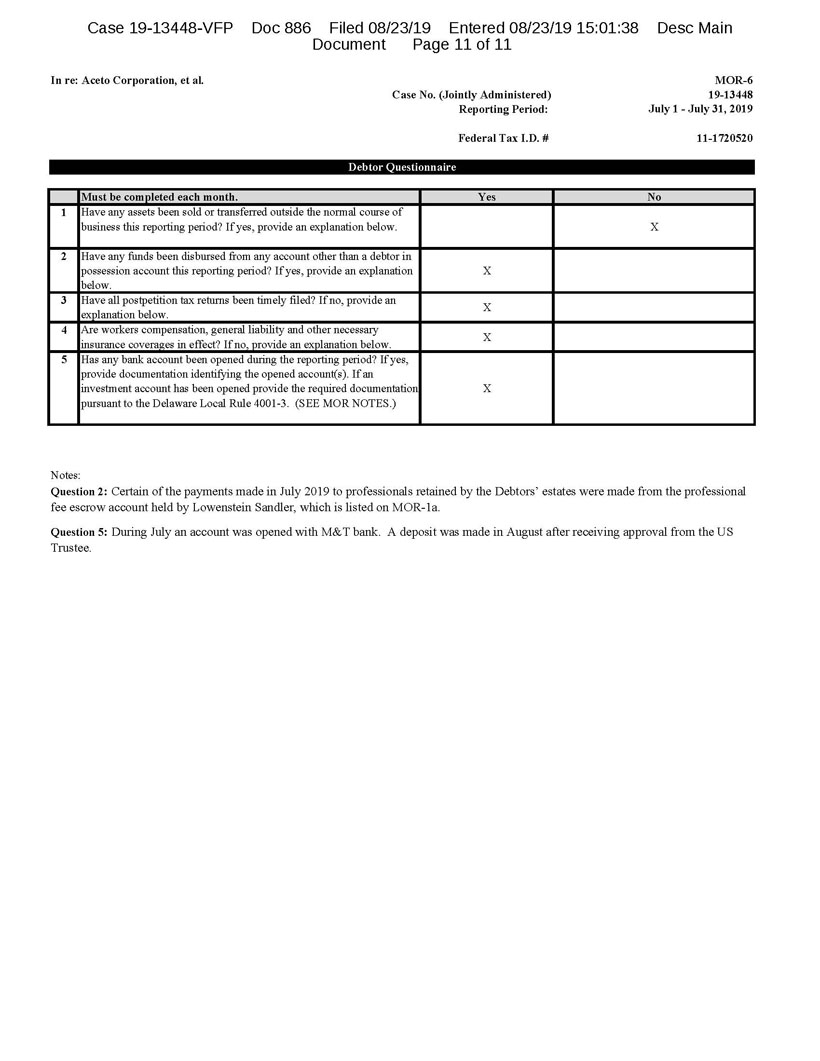

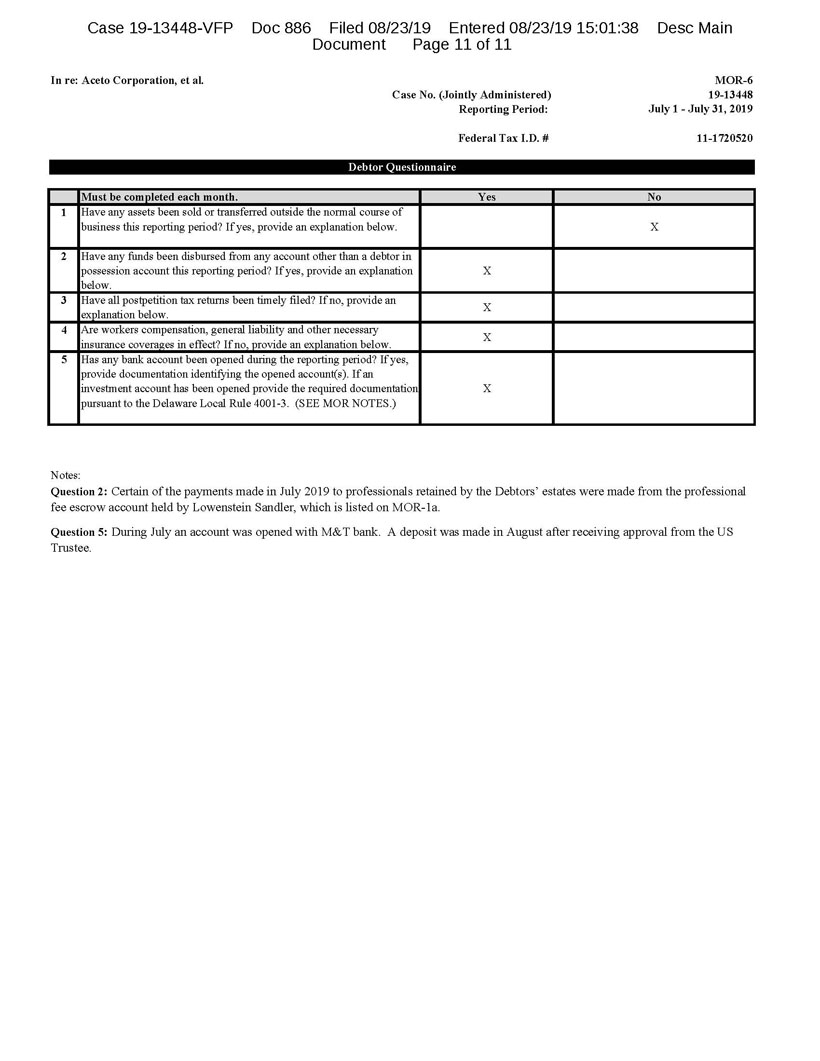

Case 19-13448-VFP Doc 886 Filed 08/23/19 Entered 08/23/19 15:01:38 Desc Main Document Page 11 of 11 In re: Aceto Corporation, et al. MOR-6 Case No. (Jointly Administered) 19-13448 Reporting Period: July 1 - July 31, 2019 Federal Tax I.D. # 11-1720520 Debtor Questionnaire Must be completed each month. Yes No 1 Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. X 2 Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation X below. 3 Have all postpetition tax returns been timely filed? If no, provide an X explanation below. 4 Are workers compensation, general liability and other necessary X insurance coverages in effect? If no, provide an explanation below. 5 Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation X pursuant to the Delaware Local Rule 4001-3. (SEE MOR NOTES.) Notes: Question 2: Certain of the payments made in July 2019 to professionals retained by the Debtors’ estates were made from the professional fee escrow account held by Lowenstein Sandler, which is listed on MOR-1a. Question 5: During July an account was opened with M&T bank. A deposit was made in August after receiving approval from the US Trustee.