As filed with the Securities and Exchange Commission on October 25, 2024

Registration No. 333-281752

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| ☑ Pre-Effective Amendment No. 2 | ☐ Post-Effective Amendment No. ___ |

TORTOISE CAPITAL SERIES TRUST

(Exact Name of Registrant as Specified in Charter)

6363 College Boulevard, Suite 100A

Overland Park, Kansas 66211

(Address of Principal Executive Offices) (Zip Code)

(913) 981-1020

(Registrant’s Area Code and Telephone Number)

Tom Florence

6363 College Boulevard, Suite 100A

Overland Park, Kansas 66211

(Name and Address of Agent for Service)

With copies to:

Deborah Bielicke Eades

Vedder Price P.C.

222 N. LaSalle Street

Chicago, Illinois 60601

TITLE OF SECURITIES BEING REGISTERED:

Shares of beneficial interest ($0.001 par value per share) of

Tortoise Power and Energy Infrastructure Fund, a Series of the Registrant.

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

important: your vote is required

TORTOISE PIPELINE & ENERGY FUND, INC.

TORTOISE ENERGY INDEPENDENCE FUND, INC.

AND

TORTOISE POWER AND ENERGY INFRASTRUCTURE FUND, INC.

[•], 2024

Dear Fellow Stockholder:

I am writing to inform you of, and to ask for your vote on, a very important matter that will significantly affect your investment in Tortoise Pipeline & Energy Fund, Inc. (“TTP”), Tortoise Energy Independence Fund, Inc. (“NDP”) and/or Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ” and, together with TTP and NDP, the “Target Funds” or each, individually, a “Target Fund”), as applicable, each a closed-end fund organized as a Maryland corporation. A joint special meeting of stockholders of each Target Fund (the “Meeting”) will be held at the offices of Tortoise Capital Advisors, L.L.C., 6363 College Boulevard, Suite 100A, Overland Park, Kansas 66211, on November 25, 2024, at 10:00 a.m. central time. At the Meeting, stockholders of each Target Fund will be asked to vote on a proposal to:

authorize the merger of the Target Fund with and into a wholly-owned subsidiary of Tortoise Power and Energy Infrastructure Fund (the “Acquiring Fund”), a series of Tortoise Capital Series Trust and a newly formed exchange traded fund (each, a “Merger” and, collectively, the “Mergers”).

The Board of Directors of each Target Fund has determined the Merger applicable to such Target Fund is advisable and recommends that stockholders of such Target Fund vote “FOR” the Merger. Enclosed in this booklet is (i) a Notice of Joint Special Meeting of Stockholders; and (ii) a Joint Proxy Statement and Prospectus providing detailed information on the Acquiring Fund, including a comparison of each Target Fund to the Acquiring Fund, and each Merger, including the reasons for proposing the Mergers.

The enclosed materials explain the proposal to be voted on at the Meeting in more detail, and I encourage you to review them carefully. No matter how large or small your holdings, your vote is extremely important. You may vote in person at the Meeting, or you may authorize a proxy to vote your shares using one of the methods below or by following the instructions on your proxy card:

| · | By touch-tone telephone, simply dial the toll-free number located on the enclosed proxy card. Please be sure to have your proxy card available at the time of the call; |

| · | By internet, please log on to the voting website detailed on the enclosed proxy card. Again, please have your proxy card handy at the time you access the website; or |

| · | By returning the enclosed proxy card in the postage-paid envelope. |

If you have any questions about the Meeting agenda or voting, please call our proxy agent, EQ Fund Solutions, LLC at (800) 829-6551. Please note, at a reasonable time after the mailing has been completed and our records indicate that you have not voted at that time, you may be contacted by our proxy agent to confirm receipt of the proxy material and review your voting options.

On behalf of the Target Funds and your fellow stockholders, I thank you for your prompt vote on these important matters.

Sincerely yours,

Matthew G.P. Sallee

Chief Executive Officer

Tortoise Pipeline & Energy Fund, Inc.,

Tortoise Energy Independence Fund, Inc.,

and Tortoise Power and Energy

Infrastructure Fund, Inc.

IMPORTANT INFORMATION FOR STOCKHOLDERS OF

TORTOISE PIPELINE & ENERGY FUND, INC.

TORTOISE ENERGY INDEPENDENCE FUND, INC.

AND

TORTOISE POWER AND ENERGY INFRASTRUCTURE FUND, INC.

[•], 2024

Although we recommend that you read the enclosed Joint Proxy Statement and Prospectus (“Joint Proxy Statement/Prospectus”) in its entirety, for your convenience, we have provided a brief overview of the proposal to be voted on at the joint special meeting of stockholders of Tortoise Pipeline & Energy Fund, Inc. (“TTP”), Tortoise Energy Independence Fund, Inc. (“NDP”), and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ” and, together with TTP and NDP, the “Target Funds” or each, individually, a “Target Fund”).

Questions Regarding the Mergers

| Q. | Why am I receiving the enclosed Joint Proxy Statement/Prospectus? |

| A. | You are receiving the Joint Proxy Statement/Prospectus as a stockholder of a Target Fund at the close of business on the record date. At the joint special meeting of stockholders of the Target Funds (the “Meeting”), stockholders of each Target Fund will be asked to vote on the following proposal with respect to such Target Fund: |

| · | To authorize the merger of the Target Fund with and into a wholly-owned subsidiary (the “Merger Sub”) of Tortoise Power and Energy Infrastructure Fund, a series of Tortoise Capital Series Trust and a newly formed exchange traded fund (the “Acquiring Fund” and, together with the Target Funds, the “Funds” and each, a “Fund”) (each, a “Merger” and, collectively, the “Mergers”). |

A Merger Sub is being used to accomplish each Merger for tax and corporate purposes. As soon as practicable following the completion or termination of all of the Mergers, the Merger Sub will liquidate and distribute all of its assets to the Acquiring Fund and the Acquiring Fund will assume all the liabilities of the Merger Sub. On August 5, 2024, the Board of Directors of each Target Fund (each, a “Target Fund Board”) unanimously determined that the Merger, with respect to its Target Fund, is advisable and in the best interests of such Target Fund. Each Target Fund Board recommends that you vote FOR the Merger.

| Q. | Why does each Target Fund Board recommend the Merger of its Target Fund? |

| A. | The Target Fund Boards have periodically evaluated various strategic alternatives for the Funds to enhance shareholder value including mergers, tender offers, and other product restructurings. The Target Fund Boards specifically considered the Mergers over the course of several meetings held in July and August 2024. At those meetings, Tortoise Capital Advisors, L.L.C. (the “Adviser”), the investment adviser for each of the Target Funds and the investment adviser for the Acquiring Fund, discussed with each Target Fund Board its reasons for proposing the Mergers. Representatives of the Adviser stated that the Adviser had conducted an evaluation of strategic alternatives for each of the Target Funds in light of certain factors, including, among others, recent increased discount levels of the Target Funds and recent increased focus by activist investors on the Target Funds (including recent increased positions by activist investors). Following a review with the Adviser of strategic alternatives for each Target Fund, each Target Fund Board believes the Merger of its Target Fund may benefit stockholders through (among other reasons) the following: |

| · | An anticipated significant reduction or elimination of the discount to net asset value (“NAV”) at which the Target Fund’s shares have traded, as shares of exchange traded funds (“ETF”) typically trade at or near their NAV due in part to the share creation and redemption features of ETFs; |

| · | The favorable tax attributes and the daily portfolio holdings transparency that the open-end ETF structure would provide; |

| · | The potential for a high level of current income resulting from lower expenses while reducing the volatility associated with the use of leverage from preferred stock and borrowings; and |

| · | Lower overall total expense ratios. |

Each Target Fund Board considered that the Acquiring Fund will have the same investment adviser and be managed by the same portfolio management team as the Target Fund. Each Target Fund Board also considered the compatibility of the investment objective and investment policies and strategies of the Target Funds and the Acquiring Fund, noting that the Acquiring Fund’s investment policies would be similar to those of TPZ except that the Acquiring Fund will focus on equity securities to a greater degree than TPZ and cannot engage in leverage through borrowings and preferred stock (“structural leverage”). See “The Mergers—Information About the Mergers—Background and Board Considerations Relating to the Proposed Mergers—Compatibility of Portfolio Management Team, Investment Objectives and Policies” in the Joint Proxy Statement/Prospectus at page 25.

Based on the foregoing and as further described in the Joint Proxy Statement/Prospectus, on August 5, 2024 each Target Fund Board determined that such Merger is advisable and in the best interests of its Target Fund. Accordingly, each Target Fund Board recommends that stockholders approve the Merger. See “The Mergers—Information About the Mergers—Background and Board Considerations Relating to the Proposed Mergers” in the Joint Proxy Statement/Prospectus at page 23 for additional information about each Target Fund Board’s considerations relating to the Mergers.

| Q. | How will the Mergers affect the common stock of the Target Funds? |

| A. | If a Merger is approved, upon the closing of the Merger, each common stockholder of the Target Fund in such Merger will become a shareholder of the Acquiring Fund and thereafter cease to be a common stockholder of the Target Fund. Each common stockholder of such Target Fund will receive a number of common shares of the Acquiring Fund (which number may not be equal to the number of shares of Target Fund common stock held by such stockholder) representing an aggregate NAV equal to the aggregate NAV of the Target Fund shares of common stock held by such stockholder immediately prior to the Merger (with cash being distributed in lieu of fractional shares). |

| Q. | Will stockholders of the Target Funds have to pay any fees or expenses in connection with the Mergers? |

| A. | Yes. Each Target Fund, and therefore indirectly its common stockholders, will bear the costs of its Merger, including its share of the costs associated with the Meeting, whether or not the Merger is consummated. Such one-time expenses, which include legal and audit fees, filing fees, and printing and mailing costs, are expected to be approximately $193,751 in aggregate (approximately $0.10 per share) for TTP, $161,281 in aggregate ($0.10 per share) for NDP, and $254,968 in aggregate ($0.04 per share) for TPZ after allocating expenses (such as printing and mailing costs) to the Target Fund accruing the expense or, in the case of shared expenses (such as legal fees), after allocating expenses among the Target Funds based on relative net assets. In addition, each Target Fund will bear additional indirect expenses, primarily relating to repositioning its portfolio in advance of its Merger (as further discussed below). Following the Merger(s), Target Fund common stockholders are expected to benefit from reduced ongoing fees and expenses (as also discussed below). |

| Q. | How will the Mergers impact ongoing operating fees and expenses? |

| A. | Common stockholders of the Target Funds are expected to experience a reduction in overall operating expenses. The Acquiring Fund will pay a unitary fee at an annual rate of 0.85% (excluding certain non-ordinary course operating expenses that are not expected during the Acquiring Fund’s first fiscal year). In comparison, the total annual expense ratios of the Target Funds (as of each Target Fund’s most recent fiscal period ended May 31, 2024) were, and the net reduction in total expense ratio expected after the Merger are, as follows: |

| · | TTP: 2.37% on Managed Assets (which translated into 2.89% on net assets), representing, based on expenses as of May 31, 2024, a reduction in the total expense ratio of 1.52% on Managed Assets (and 2.04% on net assets); and |

| · | NDP: 2.20% on Managed Assets (which translated into 2.52% on net assets), representing, based on expenses as of May 31, 2024, a reduction in the total expense ratio of 1.35% on Managed Assets (and 1.67% on net assets); and |

| · | TPZ: 2.58% on Managed Assets (which translated into 3.20% on net assets), representing, based on expenses as of May 31, 2024, a reduction in the total expense ratio of 1.73% on Managed Assets (and 2.35% on net assets). |

“Managed Assets” is defined as total assets (including any assets attributable to leverage) minus accrued liabilities (other than debt entered into for purposes of leverage and the aggregate liquidation preference of outstanding preferred stock). See “The Mergers—Synopsis—Fees and Expenses” in the Joint Proxy Statement/Prospectus at page 10 for more information.

| Q. | What are some key differences between a closed-end fund and an ETF? |

| A. | Closed-end funds, like the Target Funds, generally do not redeem their outstanding shares or engage in the continuous sale of new shares. Shares of closed-end funds, like the Target Funds, are traded on a securities exchange at market prices and trade at market prices that are independent of, and frequently at a discount to, their NAV per share. Shares of ETFs, like the Acquiring Fund, also trade on a securities exchange. However, unlike a closed-end fund, ETFs also issue and redeem shares on a continuous basis, at NAV, in large blocks consisting of a specified number of shares, referred to as “Creation Units.” Creation Units are generally issued and redeemed in-kind and, as a practical matter, only broker-dealers or large institutional investors with authorized participant agreements can purchase or redeem these Creation Units. As a result of the process through which Creation Units are purchased and redeemed, ETF shares tend to trade at market prices that are at or near their NAV per share. |

In addition, closed-end funds generally have greater flexibility than ETFs to make certain types of investments and to employ certain strategies, including using structural leverage in seeking to enhance returns. Although this flexibility can be beneficial to the performance of closed-end funds, including the potential to generate additional return, the use of these additional investments and strategies can make investments in closed-end funds subject to additional risks, including, as in the case of the Target Funds, leverage risk associated with their greater use of borrowings and preferred stock.

| Q. | Are the Funds managed by the same investment adviser? |

| A. | Yes, the Adviser serves as the investment adviser to each of the Funds. Brian A. Kessens, James R. Mick, Matthew G.P. Sallee and Robert J. Thummel, Jr. serve as portfolio managers for each of the Funds. |

| Q. | How do the Funds’ objectives, strategies and risks compare? |

| A. | The Funds have comparable investment objectives and policies but focus on different parts of the energy sector. After the Mergers, the Acquiring Fund will have identical investment objectives and comparable policies as TPZ, except that the Acquiring Fund will focus on equity securities to a greater degree than TPZ, which places a greater emphasis on fixed income securities, and the Acquiring Fund, as an ETF, cannot engage in structural leverage. Each of TTP and NDP has a primary investment objective to seek a high level of total return with an emphasis on current distributions. TPZ has, and the Acquiring Fund will have, a primary investment objective to provide a high level of current income, with a secondary objective of capital appreciation. See “The Mergers—Synopsis—Comparison of the Funds—Investment Objectives and Principal Investment Strategies” in the Joint Proxy Statement/Prospectus at page 7 for more information on the Funds’ investment objectives. |

Each Fund primarily invests or, in the case of the Acquiring Fund, will invest in energy companies, but they focus on different sectors. TTP is midstream focused and invests primarily in equity securities of pipeline companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy infrastructure companies. NDP is upstream focused and invests primarily in equity securities of upstream North American energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs. TPZ focuses, and the Acquiring Fund will focus, on companies in the energy value chain by investing primarily in securities of power and energy infrastructure companies. See “The Mergers—Synopsis—Comparison of the Funds—Investment Objectives and Principal Investment Strategies” in the Joint Proxy Statement/Prospectus at page 7 for a comparison in chart form of the asset type and investment structure of the portfolios of the Target Funds.

Unlike TTP and NDP, TPZ invests, and the Acquiring Fund will invest, in fixed income securities in addition to dividend-paying equity that provide stable and defensive characteristics throughout economic cycles (as such companies provide consistent dividends and stable earnings regardless of the state of the overall stock market), provided that the Acquiring Fund will place less of an emphasis on fixed income securities compared to TPZ (i.e., TPZ invests a minimum of 51% of total assets in fixed income securities, whereas the Acquiring Fund will invest a maximum of 50% of total assets in fixed income securities). In addition, TPZ has, and the Acquiring Fund will have, more flexibility to invest in below investment grade securities compared to TTP and NDP. See “The Mergers—Synopsis—Comparison of the Funds—Principal Investment Strategies and Policies” in the Joint Proxy Statement/Prospectus at page 34 for a detailed comparison of the principal investment policies and strategies of each Fund.

In light of the foregoing, all of the Funds are subject to similar, but not identical, risks. See “The Mergers—Risk Factors” in the Joint Proxy Statement/Prospectus at page 14, which includes a comparison of the principal risks associated with an investment in each Fund.

| Q. | Will the portfolios of the Target Funds be repositioned prior to the Mergers? |

| A. | Yes. Prior to the Mergers, the Target Funds expect to sell approximately the percentage of their respective portfolio holdings shown below based on their portfolios as of July 18, 2024, in each case to eliminate structural leverage and due to the differences in investment policies and strategies described above. Such portfolio repositioning is expected to result in estimated brokerage commissions or other transaction costs in the aggregate and per share dollar amounts shown below. |

| · | TTP: 48%, at an approximate cost of $13,230 (or approximately $0.01 per share); and |

| · | NDP: 45%, at an approximate cost of $4,553 (or approximately $0.00 per share); and |

| · | TPZ: 39%, at an approximate cost of $12,962 (or approximately $0.00 per share). |

These expenses will be borne by the respective Target Fund and its common stockholders. In addition, the Target Funds may realize gains from such portfolio repositioning. As of July 18, 2024, TTP, NDP and TPZ are estimated to realize gains of approximately $14,800,000 (or $7.36 per share), $15,100,000 (or $9.06 per share), and $14,100,000 (or $2.39 per share), respectively, from portfolio repositioning in advance of the respective Mergers. It is anticipated that any capital gains will be entirely offset by capital loss carryforwards in the case of TTP, NDP and TPZ. Actual market prices, costs and capital gains or losses experienced by a Target Fund will depend on market conditions at the time of the portfolio repositioning as well as additional factors discussed below under “What will be the federal income tax consequences to Target Fund stockholders as a direct result of the Mergers?”. Accordingly, actual capital gains could vary significantly from the estimates provided above. Moreover, the Funds and their stockholders are subject to the additional tax implications discussed below under “What will be the federal income tax consequences to Target Fund stockholders as a direct result of the Mergers?”. Stockholders of each Target Fund should understand that it is not possible at this time to determine the ultimate federal income tax impact associated with the respective Mergers.

| Q. | How does the distribution policy of the Acquiring Fund compare with the distribution policies of the Target Funds? |

| A. | The Acquiring Fund’s primary investment objective is to seek to provide a high level of current income to shareholders, with a secondary objective of capital appreciation. Net investment income, if any, is expected to be declared and paid monthly by the Acquiring Fund. TTP and NDP distribute a fixed amount per common share each quarter to its common stockholders, while TPZ distributes a fixed amount per common share each month to its common stockholders. Each Fund will distribute its net realized capital gains, if any, to shareholders at least annually. |

| Q. | What will be the federal income tax consequences to Target Fund stockholders as a direct result of the Mergers? |

| A. | Each Merger is expected to qualify as a reorganization for federal income tax purposes and, as such, stockholders of the Target Funds receiving shares of the Acquiring Fund pursuant to a Merger are not expected to recognize any gain or loss for federal income tax purposes due solely to the conversion of such shares, except to the extent that a Target Fund stockholder receives cash in lieu of a fractional share of the Acquiring Fund. If a stockholder chooses to sell Target Fund shares prior to the Merger of such Target Fund, such sale may generate taxable gain or loss. |

In addition, the Target Funds also expect to distribute all of their previously undistributed realized net investment income and net capital gains (after taking into account available capital loss carryforwards), if any, prior to the closing of the applicable Merger. All or a portion of such distribution may be taxable to Target Fund stockholders and will generally be taxed as ordinary income or capital gains for federal income tax purposes. These distributions will be reinvested in additional shares of the Target Fund unless the stockholder has made an election to receive distributions in cash. Such distributions will be taxable for federal income tax purposes whether they are paid in cash or reinvested in additional shares.

Each Target Fund also may recognize gains or losses, including ordinary income recapture, because of portfolio sales effected prior to its Merger, including sales anticipated in connection with the portfolio repositioning described above.

You should consult your own tax adviser concerning the tax consequences of the Mergers.

| Q. | Will the Acquiring Fund shares received by Target Fund stockholders in the Mergers be listed on a securities exchange following the Mergers? |

| A. | Yes. However, the Acquiring Fund shares will be listed and traded on the NYSE Arca, Inc. Exchange, as opposed to the New York Stock Exchange on which the shares of common stock of each Target Fund are currently listed and traded. |

| Q. | When will the proposed Mergers be completed? |

| A. | If approved by Target Fund stockholders and the conditions to closing are satisfied (or otherwise waived), each Merger is expected to occur in the fourth quarter of 2024. However, it is possible that the Mergers could be consummated on different dates or that only one, some or none of the Mergers are consummated, provided that, if the Merger of TPZ is approved, the Merger of TPZ with and into the Merger Sub must be consummated prior to the consummation of any other Merger. |

| Q. | What will happen if the required stockholder approval is not obtained? |

| A. | If a Merger is not consummated, the Board of the applicable Target Fund may take such actions as it deems in the best interests of the Fund, including conducting additional solicitations with respect to the Merger or continuing to operate the Target Fund as a standalone fund. While the closing of one Merger is not contingent on the closing of any other Merger, the Merger of TPZ with and into the Merger Sub must be consummated prior to the consummation of any other Merger. If the Merger of TPZ is not consummated, the Boards of TTP and NDP will determine what is in the best interests of the Funds including consummating the Mergers or continuing to operate the Funds as standalone funds. |

General Questions

| Q. | How does the Board of Directors of my Fund suggest that I vote? |

| A. | After careful consideration, the Board of Directors of each Target Fund recommends that you vote “FOR” the Merger proposal for your Fund. |

| Q. | How do I vote my shares? |

| A. | Voting is quick and easy. If you hold your shares directly as a stockholder of record, you may authorize your proxy to vote your shares via the internet, by telephone (for internet and telephone voting, please follow the instructions on the enclosed proxy card), or by simply completing and signing the enclosed proxy card and mailing it in the postage-paid envelope included in this package. You may also vote by attending and voting at the Meeting. However, even if you plan to attend the Meeting, we urge you to authorize your proxy to vote your shares in advance of the Meeting. That will ensure your vote is counted should your plans change. |

If you hold your shares in “street name” through a broker, bank or other nominee, you should contact your nominee with your instructions for voting in advance of the Meeting, including any request that your nominee provide you with a legal proxy. If you hold your shares in “street name,” you are strongly encouraged to authorize a proxy to vote your shares in advance of the Meeting, as you will not be able to vote during the Meeting itself unless you request and provide to each applicable company a legal proxy from your nominee.

If you hold your shares directly and intend to vote during the Meeting, please let us know by calling 1-866-362-9331. Regardless of whether you plan to vote during the Meeting, you may be required to provide valid identification, such as your driver’s license or passport, and satisfactory proof of ownership of shares in each applicable Target Fund, such as your voting instruction form (or a copy thereof) or a letter from your broker, bank or other nominee, or other nominee statement indicating ownership as of the close of business on August 27, 2024.

| Q. | How does holding my shares through a broker, instead of holding them directly in my own name, impact the way my shares may be voted at the Meeting under NYSE rules? |

| A. | If your shares are owned directly in your name with the Target Fund’s transfer agent, you are considered a registered holder of those shares. If you are the beneficial owner of shares held by a broker or other custodian, you hold those shares in “street name” and are not a registered stockholder. Brokers or other custodians holding shares in “street name” for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares at the Meeting. The Target Funds understand that, under the rules of the NYSE, if you do not give specific voting instructions to your broker, your broker will not have discretion to vote your shares on the Merger proposal, which is considered a “non-routine” matter. |

| Q. | How will my shares be voted if I return the accompanying proxy card? |

| A. | The shares represented by the accompanying form of proxy will be voted in accordance with the specifications made on the proxy if it is properly executed and received by the Target Fund prior to or at the Meeting. Where a choice has been specified on the accompanying proxy card with respect to the proposal, the shares represented by such proxy card will be voted in accordance with the choice specified. If you return the accompanying proxy card that has been validly executed without indicating how your shares should be voted on the proposal and you do not revoke your proxy, your proxy will be voted FOR the proposal and FOR, ABSTAIN, OR AGAINST any other matters acted upon at the Meeting in the discretion of the persons named as proxies and as permitted by federal proxy rules and by NYSE rules. |

| Q. | Whom do I contact for further information? |

| A. | You may contact Client Relations toll-free at (866) 362-9331 for further information. |

| Q. | Will anyone contact me? |

| A. | You may receive a call from EQ Fund Solutions, LLC, the proxy solicitor hired by your Fund, to verify that you received your proxy materials, to answer any questions you may have about the proposal and to encourage you to authorize your proxy. We recognize the inconvenience of the proxy solicitation process and would not impose it on you if we did not believe that the matters being proposed were important. Once your vote has been registered with the proxy solicitor, your name will be removed from the solicitor’s follow-up contact list. |

Your vote is very important. We encourage you as a stockholder to participate in your Fund’s governance by authorizing a proxy to vote your shares as soon as possible. If enough stockholders fail to cast their votes, your Target Fund may not be able to hold its Meeting or the vote on its Merger and will be required to incur additional solicitation costs in order to obtain sufficient stockholder participation.

TORTOISE PIPELINE & ENERGY FUND, INC.

TORTOISE ENERGY INDEPENDENCE FUND, INC.

AND

TORTOISE POWER AND ENERGY INFRASTRUCTURE FUND, INC.

6363 College Boulevard, Suite 100A

Overland Park, Kansas 66211

NOTICE OF JOINT SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON November 25, 2024

[•], 2024

Notice is hereby given that meetings of the stockholders of Tortoise Pipeline & Energy Fund, Inc. (“TTP”), Tortoise Energy Independence Fund, Inc. (“NDP”) and/or Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ” and, together with TTP and NDP, the “Target Funds” or each, individually, a “Target Fund”), each a Maryland corporation, will be held jointly (the “Joint Special Meeting of Stockholders” or the “Meeting”), at the offices of Tortoise Capital Advisors, L.L.C., 6363 College Boulevard, Suite 100A, Overland Park, Kansas 66211, on November 25, 2024, at 10:00 a.m. central time, for the following purposes, each as more fully described in the Joint Proxy Statement/Prospectus:

For stockholders of each Target Fund:

| (i) | to authorize the merger of the Target Fund with and into a wholly-owned subsidiary of Tortoise Power and Energy Infrastructure Fund, a series of Tortoise Capital Series Trust and a newly formed exchange traded fund. |

Stockholders of record as of the close of business on August 27, 2024 are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof.

Common stockholders and, with respect to TTP, common and preferred stockholders voting as a single class, are entitled to vote on the above matter. Each stockholder is entitled to one vote for each share of common stock and/or preferred stock owned by such stockholder.

The Board of Directors of each Target Fund recommends stockholders vote “FOR” the Merger of their Fund.

Whether or not you expect to attend the Meeting, please authorize a proxy to vote your shares of stock by following the detailed instructions provided on your proxy or voting instruction card.

IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION, THE BOARDS OF DIRECTORS ASK THAT YOU VOTE PROMPTLY, NO MATTER HOW MANY SHARES OF STOCK YOU OWN.

| | For the Boards of Directors,

Diane M. Bono

Secretary

Tortoise Pipeline & Energy Fund, Inc. Tortoise Energy Independence Fund, Inc. Tortoise Power and Energy Infrastructure Fund, Inc.

[•], 2024 |

The information contained in this Joint Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Joint Proxy Statement/Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED October 25, 2024

For the Mergers of

TORTOISE PIPELINE & ENERGY FUND, INC.

TORTOISE ENERGY INDEPENDENCE FUND, INC.

AND

TORTOISE POWER AND ENERGY INFRASTRUCTURE FUND, INC.

6363 College Boulevard, Suite 100A

Overland Park, Kansas 66211

866-362-9331

with and into a wholly-owned subsidiary of

Tortoise Power and Energy Infrastructure Fund,

a series of Tortoise Capital Series Trust

6363 College Boulevard, Suite 100A

Overland Park, Kansas 66211

866-362-9331

JOINT PROXY STATEMENT AND PROSPECTUS

[•], 2024

This Joint Proxy Statement and Prospectus (“Joint Proxy Statement/Prospectus”) is being furnished to stockholders of Tortoise Pipeline & Energy Fund, Inc. (“TTP”), Tortoise Energy Independence Fund, Inc. (“NDP”) and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”), each a Maryland corporation that is registered as a closed-end management investment company (collectively, the “Target Funds” or each, individually, a “Target Fund”), and relates to the special meetings of stockholders of the Target Funds called by the Board of Directors of each Target Fund (each, a “Target Fund Board”), to be held jointly at the offices of the Target Funds, 6363 College Boulevard, Suite 100A, Overland Park, Kansas 66211, on November 25, 2024, at 10:00 a.m. central time, and at any and all adjournments and postponements thereof (the “Meeting”). This Joint Proxy Statement/Prospectus is provided in connection with the solicitation by each Target Fund Board of proxies to be voted at the Meeting. The purpose of the Meeting is to allow the stockholders of each Target Fund to consider and vote on the Proposal (as defined below) applicable to its Target Fund. The Target Funds and Tortoise Power and Energy Infrastructure Fund (the “Acquiring Fund”), a newly formed exchange traded fund (“ETF”) organized as a separate series of Tortoise Capital Series Trust, a newly formed Maryland statutory trust that is registered as an open-end management investment company (the “Acquiring Trust”), are referred to herein collectively as the “Funds” and, each, a “Fund.”

At the Meeting, stockholders of each Target Fund will be asked to consider and vote upon the following proposal with respect to their Target Fund (the “Proposal”):

For stockholders of each Target Fund:

| (i) | to authorize the merger of the Target Fund with and into a wholly-owned subsidiary of Tortoise Power and Energy Infrastructure Fund (the “Acquiring Fund”), a series of Tortoise Capital Series Trust, and a Maryland limited liability company (the “Merger Sub”) (each, a “Merger” and collectively, the “Mergers”). |

Common stockholders and, with respect to TTP, common and preferred stockholders voting as a single class, are entitled to vote on the above matter. Each stockholder is entitled to one vote for each share of common stock and/or preferred stock owned by such stockholder.

If approved and completed, each proposed Merger would result in common stockholders of the applicable Target Fund receiving a number of Acquiring Fund common shares representing an aggregate net asset value (“NAV”) equal to the aggregate NAV of the Target Fund shares of common stock held immediately prior to the closing of its Merger, with cash being distributed in lieu of any fractional shares of the Acquiring Fund. If stockholders of a Target Fund do not approve the applicable Merger, the Target Fund Board of such Target Fund may take such actions as it deems in the best interests of the Fund, including conducting additional solicitations with respect to the Merger proposal or continuing to operate the Fund as a closed-end management investment company. While the closing of one Merger is not contingent on the closing of any other Merger, the Merger of TPZ with and into the Merger Sub must be consummated prior to the consummation of any other Merger. If the Merger of TPZ is not consummated, the Boards of TTP and NDP will determine what is in the best interests of the Funds including consummating the Mergers or continuing to operate the Funds as standalone funds.

On August 5, 2024, each Target Fund Board unanimously determined that the Merger of its Target Fund is advisable and in the best interests of the Fund, and each Target Fund Board recommends that you vote FOR the Merger.

This Joint Proxy Statement/Prospectus explains concisely what you should know before voting on a Proposal or investing in the Acquiring Fund. Please read it carefully and keep it for future reference.

The enclosed proxy cards and this Joint Proxy Statement/Prospectus are first being sent to stockholders of the Target Funds on or about [●], 2024. Target Fund stockholders of record as of the close of business on August 27, 2024 are entitled to notice of and to vote at the Meeting and any adjournments or postponements.

The securities offered by this Joint Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Joint Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

The Acquiring Fund will list and trade its shares on the NYSE Arca, Inc. Exchange (“NYSE Arca” or the “Exchange”). Shares of the Acquiring Fund are not redeemable individually and therefore liquidity for individual shareholders of the Acquiring Fund will be realized only through a sale on any national securities exchange on which the shares are traded at market prices that may differ to some degree from the NAV of the Acquiring Fund shares.

The below documents have been filed with the SEC and contain additional information about the Funds and are incorporated by reference into (and legally considered to be a part of) this Joint Proxy Statement/Prospectus:

| (i) | the Statement of Additional Information (“SAI”) to this Joint Proxy Statement/Prospectus, dated [•], 2024; |

No other parts of the Target Funds’ Annual and Semi-Annual Reports to stockholders are incorporated by reference herein.

The foregoing documents can be obtained on a web site maintained by the Funds’ investment adviser, Tortoise Capital Advisors, L.L.C. (the “Adviser”) at www.tortoiseadvisors.com or each Fund will furnish, without charge, a copy of any such document to any stockholder upon request. Any such request should be directed to the Adviser by calling 866-362-9331 or by writing to the respective Fund at its principal executive offices at 6363 College Boulevard, Suite 100A, Overland Park, Kansas 66211. The telephone number of the principal executive offices of the Funds is 913-981-1020.

Because the Acquiring Fund has not yet commenced operations as of the date of this Joint Proxy Statement/Prospectus, no annual or semi-annual report is available for the Acquiring Fund.

The Target Funds are, and when the Acquiring Fund’s registration statement has gone effective, the Acquiring Fund will be, subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith are required to file reports and other information with the SEC. These reports, proxy statements, registration statements and other information can be inspected and copied, after paying a duplicating fee, by electronic request at publicinfo@sec.gov. In addition, copies of these documents may be viewed online or downloaded without charge from the SEC’s website at www.sec.gov. Reports, proxy materials and other information concerning TTP, NDP and TPZ may be inspected at the offices of the NYSE, 11 Wall St., New York, NY 10005.

This Joint Proxy Statement/Prospectus serves as a prospectus for the Acquiring Fund in connection with the issuance of Acquiring Fund shares in the Mergers. In this connection, no person has been authorized to give any information or make any representation not contained in this Joint Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Joint Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

TABLE OF CONTENTS

THE MERGERS

You are being asked to vote at the Meeting to approve the Merger of your Target Fund. Specifically, you are being asked to consider and approve the Merger of your Target Fund with and into the Merger Sub, with shares of common stock of each Target Fund being converted into newly issued shares of the Acquiring Fund. Each Target Fund Board recommends a vote “FOR” the Merger of its Target Fund.

A. Synopsis

The following is a summary of certain information contained elsewhere in this Joint Proxy Statement/Prospectus with respect to the proposed Mergers and stockholders should reference the more complete information contained in this Joint Proxy Statement/Prospectus and in the accompanying SAI and the appendices thereto, including the Plan. Stockholders should read the entire Joint Proxy Statement/Prospectus carefully.

The Proposed Mergers

If stockholders of a Target Fund approve the Merger of the Fund and it is completed, stockholders of such Target Fund will receive a number of shares of the Acquiring Fund representing an aggregate NAV equal to the aggregate NAV of the Target Fund shares of common stock held by such stockholder immediately prior to the closing of the Merger (with cash being distributed in lieu of fractional Acquiring Fund shares), and, as such, each such Target Fund stockholder will become a shareholder of the Acquiring Fund and cease to be a stockholder of the Target Fund. The Merger Sub is being formed for tax and corporate purposes solely to accomplish each Merger and will be liquidated as soon as practicable following the Mergers. Shares of common stock of the Target Fund would be exchanged for shares of the Acquiring Fund on a tax-free basis for federal income tax purposes (although Target Fund stockholders who receive cash for their fractional shares may incur certain tax liabilities). Notwithstanding the foregoing, the Mergers involve additional tax implications that could significantly impact the Funds and their stockholders. See “Information About the Mergers—Federal Income Tax Consequences of the Merger” at page 29 for a further discussion of such tax implications. The Acquiring Fund will issue to Target Fund stockholders book-entry interests for the shares of the Acquiring Fund registered in a “street name” brokerage account held for the benefit of such stockholders. Like shares of common stock of the Target Funds, shares of the Acquiring Fund are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

After the Mergers, the Acquiring Fund will have the same investment objective and comparable investment policies and strategies as TPZ, except that the Acquiring Fund will focus on equity securities to a greater degree than TPZ and cannot engage in leverage through borrowings and preferred stock (“structural leverage”). Each Fund seeks, and the Acquiring Fund will seek, to qualify as a regulated investment company for U.S. federal income tax purposes (a “RIC”) and, as such, is not subject to federal income taxes at the Fund level for so long as a Fund continues to qualify as a RIC and distributes all of its net investment income and net capital gain.

The Target Funds, and therefore indirectly their common stockholders, will bear the costs of the Mergers, including the costs associated with the Meeting, whether or not any of the Mergers are consummated. Such one-time expenses, which include legal and audit fees, filing fees, and printing and mailing costs, are expected to be approximately $193,751 in aggregate (approximately $0.10 per share) for TTP, $161,281 in aggregate ($0.10 per share) for NDP, and $254,968 in aggregate ($0.04 per share) for TPZ after allocating expenses (such as printing and mailing costs) to the Target Fund incurring the expense or, in the case of shared expenses (such as legal fees), after allocating expenses among the Target Funds based on relative net assets. In order to de-lever and, in the case of TTP and NDP, align their portfolios with the investment strategies of the Acquiring Fund, each Target Fund expects to sell approximately the percentage of their portfolio holdings shown below based on their portfolios as of July 18, 2024, The portfolio repositioning is expected to result in estimated brokerage commissions or other transaction costs in the aggregate and per share dollar amounts shown below.

| · | TTP: 48%, at an approximate cost of $13,230 (or approximately $0.01 per share); and |

| · | NDP: 45%, at an approximate cost of $4,553 (or approximately $0.00 per share);and |

| · | TPZ: 39%, at an approximate cost of $12,962 (or approximately $0.00 per share). |

These expenses will be borne by the respective Target Fund and its common stockholders. In addition, the Target Funds may realize capital gains from such portfolio repositioning. Based on the information shown above, TTP, NDP and TPZ are estimated to realize capital gains of approximately $14,800,000 (or $7.36 per share), $15,100,000 (or $9.06 per share), and $14,100,000 (or $2.39 per share), respectively, from portfolio repositioning in advance of the respective Mergers. It is anticipated that any capital gains will be entirely offset by capital loss carryforwards. As of November 30, 2023, TTP, NDP and TPZ had short-term capital loss carryforwards of $16,580,238, $69,928,235 and $202,707, respectively, and TTP, NDP and TPZ had long-term capital loss carryforwards of $79,159,111, $100,049,062 and $9,695,844, respectively. Actual market prices, costs and capital gains or losses experienced by a Target Fund will depend on market conditions at the time of the portfolio repositioning as well as additional factors discussed above under “What will be the federal income tax consequences to Target Fund stockholders as a direct result of the Mergers?”. Accordingly, actual capital gains could vary significantly from the estimates provided above. Moreover, the Funds and their stockholders are subject to the additional tax implications discussed below under “Federal Income Tax Consequences of the Mergers.” Stockholders of each Target Fund should understand that it is not possible at this time to determine the ultimate federal income tax impact associated with the Mergers.

If stockholders of the Target Funds approve the Mergers and the conditions to closing are satisfied (or otherwise waived), it is expected that each Merger will occur in the fourth quarter of 2024, or such other date as agreed to by the parties. Following the Merger of a Target Fund, such Target Fund will cease to exist as a separate entity. If the stockholders of a Target Fund do not approve the Merger of such Target Fund, the Target Fund Board may take such actions as it deems in the best interests of the Target Fund, including conducting additional solicitations with respect to the Merger or continuing to operate the Target Fund as a standalone fund. While the closing of one Merger is not contingent on the closing of any other Merger, if the Merger of TPZ is approved, the Merger of TPZ with and into the Merger Sub must be consummated prior to the consummation of any other Merger.

If the Mergers are approved and consummated, the Acquiring Fund will adopt the financial statements and performance history of TPZ, with TPZ being the accounting survivor of the Mergers.

For each Target Fund, the presence in person or by proxy of the holders of shares entitled to cast a majority (i.e., greater than 50%) of the votes entitled to be cast constitutes a quorum at any meeting of stockholders. When a quorum is present at any meeting, the affirmative vote of a majority of the votes entitled to be cast is required to approve the Merger.

Board Considerations of the Proposed Mergers

Over the past several years, the Target Fund Boards and Tortoise Capital Advisors, L.L.C. (“TCA” or the “Adviser”), the investment adviser for each of the Target Funds and the investment adviser for the Acquiring Fund, have discussed and, in some cases, entered into unsuccessful negotiations with third parties regarding, a variety of strategic alternatives for the Target Funds in order to enhance stockholder value, including potential mergers and conversions of the closed-end Target Funds into open-end investment companies. During a series of meetings held in July and August 2024, the Adviser proposed, and the Target Fund Boards considered, the Mergers. At those meetings, the Adviser discussed with the Target Fund Boards its reasons for proposing the Mergers which would reorganize the Target Funds into an actively managed exchange traded fund (“ETF”). The Adviser stated that it had conducted a review of its investment product offerings and fund structures and evaluated strategic alternatives for each of the Target Funds in light of certain factors, including, among others, discount levels of the trading price of the Target Funds’ shares compared to NAV, variations in performance of the Target Funds, the risks of leverage, and continued focus by activist investors on the Target Funds. Following a review with the Adviser of strategic alternatives for each Target Fund, each Target Fund Board believes the Merger of its Target Fund may benefit the Target Fund and its stockholders through (among other reasons) the following:

| ● | An anticipated significant reduction or elimination of the discount to NAV at which the Target Fund’s shares have traded, as shares of ETFs typically trade at or near their NAV due in part to the share creation and redemption features of ETFs; |

| ● | Use of TPZ’s investment strategy, focused on equity and fixed income securities of power and energy infrastructure companies; |

| ● | The potential for similar or increased distributions resulting from lower expenses and the receipt of covered call option premiums while reducing the volatility associated with the use of structural leverage in the form of preferred stock and indebtedness; |

| ● | Increased scale of a larger overall fund; and |

| ● | Lower overall fees and expenses, as a percentage of net assets, of the ETF resulting after the Merger, including on both a gross and net basis considering the Acquiring Fund is subject to a fixed unitary fee rate. |

Each Target Fund Board considered that the Merger of its Target Fund will allow stockholders of its Target Fund to continue their investment in a comparable investment strategy but through an active ETF structure having the same investment adviser and being managed by the same portfolio management team as the Target Funds. Each Target Fund Board considered the Adviser’s recommendation that the Acquiring Fund adopt the investment objectives and policies of TPZ—an objective to seek a high level of current income, with a secondary objective of capital appreciation through an investment strategy to invest in fixed income and equity securities issued by power and energy infrastructure companies. The Target Fund Boards considered that the Acquiring Fund would seek to generate additional income from option premiums rather than primarily through the use of structural leverage from preferred stock and indebtedness like the Target Funds. The potential tax consequences and expenses of portfolio positioning transactions and distributions needed to accomplish the Mergers, deleverage the Target Funds, and align to the TPZ investment strategy, and the estimated transaction costs for the Mergers, was also considered by each Target Fund Board. In addition, each Target Fund Board noted that the Acquiring Fund would have a lower management fee and expense ratio. The Target Fund Boards considered that the Mergers may have the additional benefits of avoiding the extraordinary costs associated with potential future proxy contests and litigation associated with activist investors.

Based on the foregoing and as further described in the Proxy Statement/Prospectus, on August 5, 2024 each Target Fund Board, including the Directors who are not “interested persons” (as defined in the 1940 Act) of a Target Fund, unanimously approved the Merger of its Target Fund and determined that such Merger would be in the overall best interests of the Target Fund and not dilutive to the interests of the stockholders thereof. Accordingly, each Target Fund Board recommends that stockholders of its Target Fund approve the applicable Merger proposal. See “The Mergers—Information About the Mergers—Background and Board Considerations Relating to the Proposed Mergers” at page 23 for additional information about each Target Fund Board’s considerations relating to the Mergers.

Material Federal Income Tax Consequences of the Mergers

Each Merger is expected to qualify as a reorganization for federal income tax purposes and, as such, stockholders of the Target Funds receiving shares of the Acquiring Fund pursuant to the Merger are not expected to recognize any gain or loss for federal income tax purposes due solely to the conversion of such shares, except to the extent that a Target Fund stockholder receives cash in lieu of a fractional share of the Acquiring Fund. As a condition to the Merger, each Fund will receive a tax opinion stating that the Merger will qualify as a reorganization for federal income tax purposes. See “Information About the Mergers—Federal Income Tax Consequences” at page 29. If a stockholder chooses to sell Target Fund shares prior to the Merger of such Target Fund, such sale may generate taxable gain or loss.

Notwithstanding the foregoing, the Mergers involve additional tax implications that could significantly impact the Funds and their stockholders. Each Target Fund expects to distribute all its previously undistributed realized net investment income and net capital gains (after taking into account available capital loss carryforwards), if any, prior to the closing of its Merger. All or a portion of such distribution may be taxable to Target Fund stockholders and will generally be taxed as ordinary income or capital gains for federal income tax purposes. Such distributions will be taxable for federal income tax purposes whether they are paid in cash or reinvested in additional shares.

Each Target Fund also may recognize gains or losses, including ordinary income recapture, because of portfolio sales effected prior to its Merger, including sales anticipated in connection with the portfolio repositioning described above, which may increase the amount of distributions the Target Fund will make prior to the closing of its Merger.

Comparison of the Funds

General. Each Target Fund is a non-diversified, closed-end management investment company organized as a Maryland corporation on the following dates: July 19, 2011, in the case of TTP, April 11, 2012, in the case of NDP, and July 5, 2007 in the case of TPZ. The Acquiring Fund is a newly created, non-diversified, actively managed ETF that is a series of the Acquiring Trust, newly organized as a Maryland statutory trust on August 12, 2024. The following sets forth generally some of the primary differences between a closed-end fund (such as the Target Funds) and an ETF (such as the Acquiring Fund).

| Exchange Traded Funds |

| Exchange Listing and Trading Considerations | Exchange Listing and Trading Considerations |

| Shares of closed-end funds typically are traded on a securities exchange (e.g., the NYSE). Thus, persons wishing to buy or sell closed-end fund shares generally must do so through a broker-dealer and pay or receive the market price per share (plus or minus any applicable commissions). The market price may be more (a premium) or less (a discount) than the NAV per share of the closed-end fund. | Like most closed-end funds, ETF shares trade on a securities exchange, and persons wishing to buy or sell shares generally may do so through a broker-dealer and pay and receive the market price per share (plus or minus any applicable commissions). Shares of the Acquiring Fund are expected to be traded on the Exchange to provide liquidity for purchasers of Acquiring Fund shares in amounts less than the size of a Creation Unit (as defined below). The market price of Acquiring Fund shares on the Exchange may be equal to, more than or less than the NAV per share but shares of ETFs typically trade in a range closer to NAV per share than do shares of closed-end funds. |

| Offering and Redemption of Shares | Offering and Redemption of Shares |

| Closed-end funds generally do not redeem their outstanding shares or engage in the continuous sale of new shares. | Unlike a closed-end fund, ETFs issue and redeem shares on a continuous basis, at NAV, in large blocks consisting of a specified number of shares, referred to as “Creation Units.” Creation Units of the Acquiring Fund will generally be issued and redeemed in-kind for securities in which the Acquiring Fund invests. Except when aggregated in Creation Units, Acquiring Fund shares are not redeemable securities of the Acquiring Fund. These ETF features are designed to protect shareholders from adverse effects that could arise from frequent cash creation and redemption transactions such as those that occur in a conventional mutual fund. In conventional mutual funds, redemptions can have an adverse tax impact on taxable shareholders because of a mutual fund’s frequent need to sell portfolio securities to obtain cash to meet fund redemptions. These sales may generate taxable gains for the shareholders of the mutual fund, whereas the in-kind Creation Unit redemption mechanism of the Acquiring Fund generally will not lead to a tax event for the Acquiring Fund or its shareholders. As a practical matter, only broker-dealers or large institutional investors with authorized participant agreements, called “Authorized Participants,” can purchase or redeem these Creation Units. |

| Exchange Traded Funds |

| Use of Leverage | Use of Leverage |

Closed-end funds may utilize leverage by issuing preferred shares and issuing and borrowing, subject to certain asset coverage requirements. In doing so, closed-end funds are subject to leverage risk which can magnify the effect of any losses. If the income and gains from the securities and investments purchased with leverage proceeds do not cover the cost of leverage, the return of the closed-end fund will be less than if leverage had not been used. The use of leverage also involves the following risks and special considerations: (i) the likelihood of greater volatility with respect to the NAV and market price of common shares than a comparable portfolio that does not utilize structural leverage; (ii) the risk that fluctuations in interest rates on borrowings will reduce the return to stockholders or result in fluctuations in dividends paid to stockholders; (iii) in declining markets, the use of leverage is likely to cause a greater decline in the NAV of shares of the closed-end fund than if the fund had not been leveraged, which may result in a greater decline in the market price of the closed-end fund shares; and (iv) the investment advisory fee payable to the investment adviser may be higher than if the fund did not use leverage. | ETFs may not utilize structural leverage (i.e., preferred shares or notes) and are limited in their ability to borrow. |

| Portfolio Liquidity | Portfolio Liquidity |

Closed-end funds are not subject to any regulatory limit on illiquid securities. | ETFs may not invest more than 15% of their net assets in illiquid securities. |

| Tax Considerations | Tax Considerations |

| To qualify as a RIC for U.S. federal income tax purposes, a closed-end fund must, among other things, distribute at least 90% of its net investment income (including interest, dividends, and capital gains) to shareholders each year and at least 90% of income must be “good income.” | ETFs are subject to the same requirements as a closed-end fund to qualify as a RIC for U.S. federal income tax purposes, but ETFs that use in-kind redemption baskets generally avoid recognizing capital gains on those securities and can thereby avoid making capital gains distributions to shareholders that would otherwise result from such capital gains. |

Investment Objectives and Principal Investment Strategies. The Target Funds and the Acquiring Fund have similar investment objectives, as shown below:

Investment Objectives

TTP | NDP | TPZ | Acquiring Fund | Comparison |

| TTP seeks a high level of total return with an emphasis on current distributions paid to stockholders. | NDP seeks a high level of total return with an emphasis on current distributions paid to stockholders. | TPZ seeks to provide a high level of current income to stockholders, with a secondary objective of capital appreciation. | The Acquiring Fund seeks to provide a high level of current income to shareholders, with a secondary objective of capital appreciation. | The investment objective of TPZ and the Acquiring Fund are identical. TTP and NDP each have a primary objective of total return while the Acquiring Fund has a primary objective of income and secondary objective of capital appreciation. |

Each Fund primarily invests or, in the case of the Acquiring Fund, will invest in energy companies but they focus on different sectors. TTP is midstream focused and invests primarily in equity securities of pipeline companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy infrastructure companies. NDP is upstream focused and invests primarily in equity securities of upstream North American energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs. TPZ focuses, and the Acquiring Fund will focus, on companies in the energy value chain by investing primarily in securities of power and energy infrastructure companies. Unlike TTP and NDP, TPZ invests, and the Acquiring Fund will invest, in fixed income securities in addition to dividend-paying equity securities that provide stable and defensive characteristics throughout economic cycles (as such companies provide consistent dividends and stable earnings regardless of the state of the overall stock market) provided that the Acquiring Fund will place less of an emphasis on fixed income securities compared to TPZ (i.e., TPZ will invest a minimum of 51% of total assets in fixed income securities, whereas the Acquiring Fund will invest a maximum of 50% of total assets in fixed income securities).

The Target Funds and the Acquiring Fund have comparable investment policies and strategies and identical fundamental investment restrictions except that each Fund concentrates its assets in a different segment of the energy sector. TTP concentrates in the group of industries constituting the energy infrastructure sector. NDP concentrates its assets in the energy industry and TTZ concentrates, and the Acquiring Fund will concentrate, its assets in the power and energy infrastructure industries. For a full comparison of the investment objectives and investment strategies and policies of the Target Funds and the Acquiring Fund, see “Additional Information About the Investment Policies and Management of the Funds” below at page 31 and for the Acquiring Fund’s fundamental investment restrictions set forth in their entirety, see the SAI at page 11.

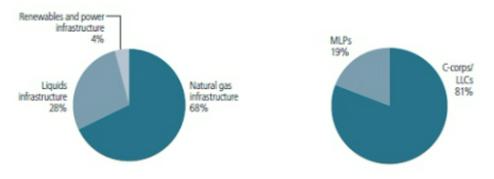

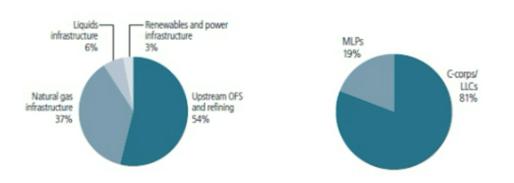

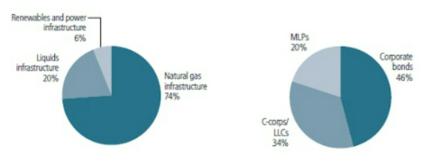

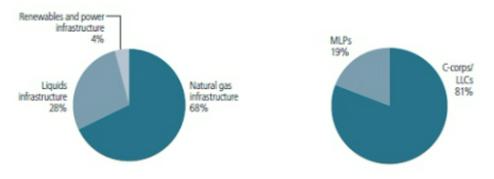

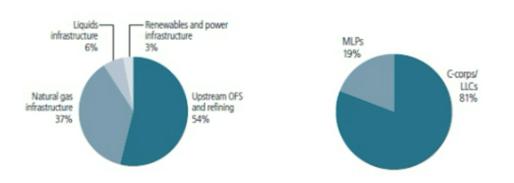

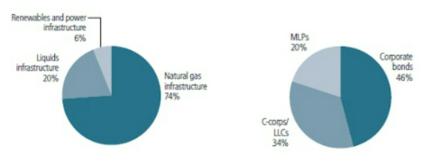

A comparison of the asset type and investment structure of the portfolios of the Target Funds, as of May 31, 2024, is set forth below.

TTP

NDP

TPZ

Risks of the Funds. Because the Target Funds and the Acquiring Fund have comparable principal investment strategies, they are subject to some of the same risks, including cybersecurity risk, pandemic and epidemic risk, capital markets risk, MLP risk, restricted securities risk, equity securities risk, non-U.S. securities risk, liquidity risk, concentration risk and market discount risk. However, there are differences between the Funds as well that result in certain differences in their principal risks. Certain material differences include the following:

| · | TPZ and, after the Mergers, the Acquiring Fund may invest in fixed income securities including both investment grade and non-investment grade securities, which subject them to risks associated with such fixed income investments. |

| · | The Acquiring Fund will not be subject to the risks associated with the Target Funds’ use of structural leverage, which use can magnify the effect of any losses particularly during a declining market. |

| · | The Target Funds are also subject to different risks from the Acquiring Fund due to the differences in their structure, including the differences between closed-end funds and ETFs. |

| · | Unlike TTP and NDP, TPZ is, and the Acquiring Fund will be, subject to Power Infrastructure Company Risk and Energy Infrastructure Company Risk. See “Additional Information About the Investment Policies and Management of the Funds—Principal Investment Strategies and Policies” at page 33. |

Description of the Shares. The shares of each Target Fund and the Acquiring Fund have similar voting rights, although there are differences. Each Target Fund and the Acquiring Fund have the same rights with respect to the payment of dividends and the distribution of assets upon dissolution, liquidation or winding up of the affairs of the respective Fund and have no rights to cumulative voting. See “Additional Information About the Investment Policies and Management of the Funds” below at page 31.

Share Information.

| Fund | | Authorized

Shares | | | Shares

Outstanding | | | Par Value

Per Share | | | Preemptive,

Appraisal or

Exchange Rights | | Rights to

Cumulative

Voting | | Exchange on

which Shares

are Listed |

| TTP | | 100,000,000 | | | | 2,010,566 | | | $ | 0.001 | | | None | | None | | NYSE |

| NDP | | 100,000,000 | | | | 1,666,014 | | | $ | 0.001 | | | None | | None | | NYSE |

| TPZ | | 100,000,000 | | | | 5,890,167 | | | $ | 0.001 | | | None | | None | | NYSE |

Acquiring

Fund | | Unlimited | | | | — | | | $ | 0.001 | | | None | | None | | NYSE Arca |

In addition, each Target Fund has authorized 10,000,000 preferred shares. TTP currently has outstanding 244,000 shares of Series B Mandatory Redeemable Preferred Stock (“MRP Stock”), with a liquidation value of $25.00 per share plus any accumulated but unpaid distributions, whether or not declared. Holders of MRP Stock are entitled to receive cash interest payments each quarter at a fixed rate until maturity. The MRP Stock has a mandatory redemption date of December 13, 2024, and will not be outstanding upon the completion of the TTP Merger. NDP and TPZ do not have any outstanding preferred stock.

Distributions and Dividend Reinvestment Plan. Each Target Fund has adopted a managed distribution policy. Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending NAV per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return on trailing NAV. Under the managed distribution policy, distribution amounts will normally be reset in February and August, with no changes in distribution amounts in May and November. A Target Fund may designate a portion of its distributions as capital gains and may also distribute additional capital gains in the last quarter of the year to meet annual excise tax distribution requirements. Distribution amounts are subject to change from time to time at the discretion of a Target Fund Board.

In connection with the managed distribution policy, TTP and TPZ are relying on exemptive relief permitting them to make long-term capital gain distributions throughout the year. TTP distributes a fixed amount per share of common stock, currently $0.59, each quarter to its common stockholders. TPZ distributes a fixed amount per common stock, currently $0.105, each month to its common stockholders.

Net investment income, if any, is expected to be declared and paid monthly by the Acquiring Fund. The Acquiring Fund will distribute its net realized capital gains, if any, to shareholders at least annually. Distributions in cash from the Acquiring Fund may be reinvested automatically in additional whole shares only if the broker through whom you purchased shares makes such option available, and such shares will generally be reinvested by the broker based upon the market price of those shares and may be subject to brokerage commissions charged by the broker. Distributions are taxable for federal income tax purposes whether they are paid in cash or reinvested in additional shares. The exemptive order allowing for TTP’s and TPZ’s managed distribution policy is not available to the Acquiring Fund.

Fees and Expenses

The following tables set forth the fees and expenses of investing in shares of the Target Funds and the Acquiring Fund. Expenses for TTP, NDP and TPZ are based on operating expenses for the six-month period ended May 31, 2024 (annualized). As the Acquiring Fund has not yet commenced operations as of the date of this Joint Proxy Statement/Prospectus, the fees and expenses shown for the Acquiring Fund are pro forma estimates based on its unitary fee structure. Investors may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

| | | TTP

Based on

Net Assets | | | NDP

Based on

Net Assets | | | TPZ

Based on

Net Assets | | | Acquiring

Fund

pro forma(1) | |

Shareholder Fees

(fees paid directly from your investment) | | | | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | | None | (2) | | | None | (2) | | | None | (2) | | | None | (3) |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | | | | | | | | | | | |

| Management Fees(4) | | | 1.34 | % | | | 1.26 | % | | | 1.18 | % | | | 0.85 | % |

| Dividends and Expenses on Preferred Stock and Interest and Related Expenses from Borrowings and Other Leverage Expenses | | | 1.24 | % | | | 0.97 | % | | | 1.50 | % | | | - | |

| Other Expenses | | | 0.64 | % | | | 0.69 | % | | | 0.52 | % | | | - | |

| Total Fund Expenses | | | 3.22 | % | | | 2.92 | % | | | 3.20 | % | | | 0.85 | % |

| Less Expenses Reimbursed by Adviser | | | (0.33 | )% | | | (0.40 | )% | | | - | | | | - | |

| Total Annual Fund Expenses (net of expense reimbursement) | | | 2.89 | % | | | 2.52 | % | | | 3.20 | % | | | 0.85 | % |

| (1) | The Mergers are not contingent on each other. Because the Acquiring Fund is subject to a fixed unitary fee rate, total expenses of the Acquiring Fund will remain the same regardless of the number of Funds that complete a Merger. |

| (2) | As closed-end funds, shares of common stock of TTP, NDP and TPZ trade on a national securities exchange, and are not subject to a sales load or a redemption fee. When buying or selling shares of common stock of TTP, NDP or TPZ, investors will incur customary brokerage commissions and charges. |

| (3) | As an ETF, shares of the Acquiring Fund will be listed and traded on the NYSE Arca and are not subject to a sales load or a redemption fee on individual shares. When buying or selling Acquiring Fund shares on the exchange, investors will incur customary brokerage commissions and charges. Purchasers of Creation Units of the Acquiring Fund and shareholders redeeming Creation Units of the Acquiring Fund must pay a standard creation or redemption transaction fee. |

| (4) | Based on average daily net assets for the six-month period ended May 31, 2024.

|

| | | TTP

Based on

Managed Assets | | | NDP

Based on

Managed Assets | | | TPZ

Based on

Managed Assets | | | Acquiring

Fund

pro forma(1) | |

Shareholder Fees

(fees paid directly from your investment) | | | | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | | None | (2) | | | None | (2) | | | None | (2) | | | None | (3) |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | | | | | | | | | | | |

| Management Fees(4) | | | 1.10 | % | | | 1.10 | % | | | 0.95 | % | | | 0.85 | % |

| Dividends and Expenses on Preferred Stock and Interest and Related Expenses from Borrowings and Other Leverage Expenses | | | 1.02 | % | | | 0.85 | % | | | 1.21 | % | | | - | |

| Other Expenses | | | 0.52 | % | | | 0.60 | % | | | 0.42 | % | | | - | |

| Total Fund Expenses | | | 2.64 | % | | | 2.55 | % | | | 2.58 | % | | | 0.85 | % |

| Less Expenses Reimbursed by Adviser | | | (0.27 | )% | | | (0.35 | )% | | | - | | | | - | |

| Total Annual Fund Expenses (net of expense reimbursement) | | | 2.37 | % | | | 2.20 | % | | | 2.58 | % | | | 0.85 | % |

| (1) | The Mergers are not contingent on each other. Because the Acquiring Fund is subject to a fixed unitary fee rate, total expenses of the Acquiring Fund will remain the same regardless of the number of Funds that complete a Merger. |

| (2) | As closed-end funds, shares of common stock of TTP, NDP and TPZ trade on a national securities exchange, and are not subject to a sales load or a redemption fee. When buying or selling shares of common stock of TTP, NDP or TPZ, investors will incur customary brokerage commissions and charges. |

| (3) | As an ETF, shares of the Acquiring Fund trade on the NYSE Arca and does not charge a sales load or a redemption fee on individual shares. When buying or selling Acquiring Fund shares on the exchange, investors will incur customary brokerage commissions and charges. Purchasers of Creation Units of the Acquiring Fund and shareholders redeeming Creation Units of the Acquiring Fund must pay a standard creation or redemption transaction fee. |

| (4) | The management fee of each Target Fund is based on its Managed Assets, which means the average daily gross asset value of the Fund (which includes assets attributable to leverage), minus accrued liabilities (other than the principal amount of borrowings). The management fee of the Acquiring Fund is based on the Acquiring Fund’s average daily net assets. |

Example

The following example is intended to help you compare the costs of investing in the shares of the Acquiring Fund on a pro forma basis following the Mergers with the costs of investing in a Target Fund. An investor would pay the following expenses on a $10,000 investment that is held for the time periods provided in the table, assuming that all dividends and other distributions are reinvested and that operating expenses remain the same. The example also assumes a 5% annual return. The example should not be considered a representation of future expenses or returns. Actual expenses may be greater or lesser than those shown whether you hold or sell your shares.

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| TTP (based on net assets) | | $ | 292 | | | $ | 895 | | | $ | 1,523 | | | $ | 3,213 | |

| TTP (based on Managed Assets) | | $ | 240 | | | $ | 739 | | | $ | 1,265 | | | $ | 2,706 | |

| NDP (based on net assets) | | $ | 255 | | | $ | 784 | | | $ | 1,340 | | | $ | 2,855 | |

| NDP (based on Managed Assets) | | $ | 223 | | | $ | 688 | | | $ | 1,179 | | | $ | 2,533 | |

| TPZ (based on net assets) | | $ | 323 | | | $ | 987 | | | $ | 1,675 | | | $ | 3,504 | |

| TPZ (based on Managed Assets) | | $ | 261 | | | $ | 802 | | | $ | 1,370 | | | $ | 2,914 | |

| Acquiring Fund (based on net assets) | | $ | 87 | | | $ | 271 | | | $ | 471 | | | $ | 1,048 | |

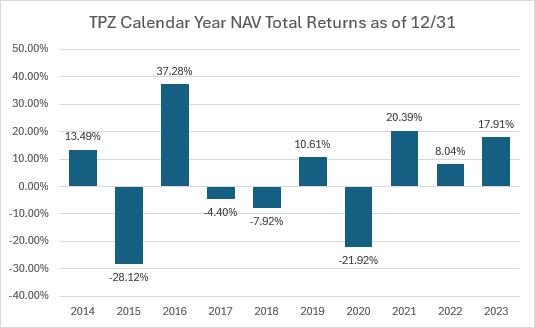

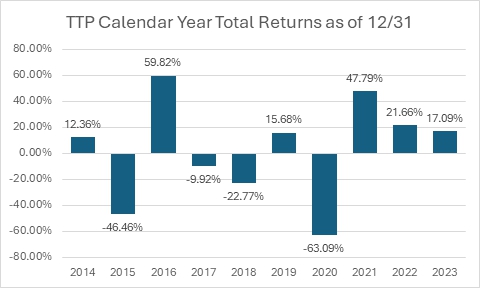

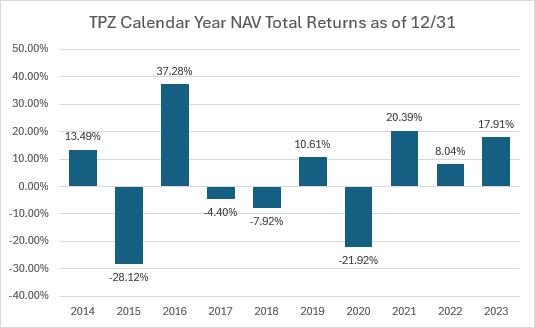

Performance