As filed with the Securities and Exchange Commission on August 21, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| British Virgin Islands | | 7310 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

RM 2405, Sanhang Technoloy Building,

Northwestern Polytechnical University, 45 High-Tech South Road,

Nanshan District, Shenzhen, China

TeL: +(86) 13760195413

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Copies of all communications, including communications sent to agent for service, should be sent to

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion) Dated August 21, 2024

YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION

Ordinary Shares

We are offering ordinary shares, par value $0.0001 per share (“Ordinary Shares”). This is the initial public offering of ordinary shares of YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION (the “Company”). The offering price of our ordinary shares in this offering is expected to be $ and $ per share. Prior to this offering, there has been no public market for our ordinary shares.

We have applied to list our ordinary shares on the Nasdaq Capital Market under the symbol “YYDT”. There is no assurance that such application will be approved, and if our application is not approved, this offering may not be completed.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” for additional information.

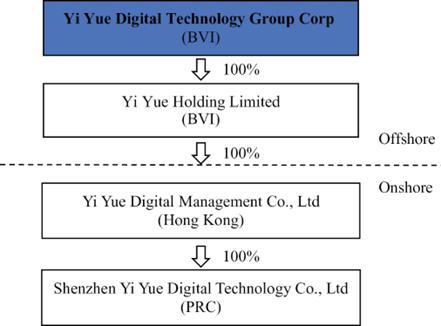

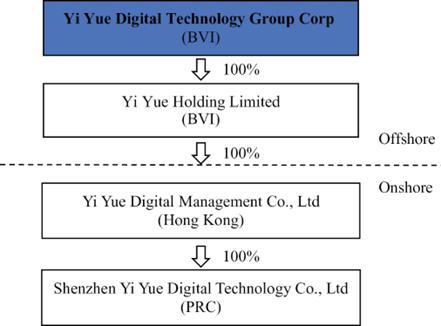

We are a holding company incorporated in the BVI as a holding company. The Ordinary Shares offered in this prospectus are shares of the BVI holding company. For a description of our corporate structure, see “Corporate History and Structure.” See also “Risk Factors — Risks Relating to Our Corporate Structure.”

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately $[●], exclusive of the above commissions. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor any of the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Here are legal and operational risks associated with being based in and having the majority of our operations in China. The conduct of our business in the PRC shall comply with the laws and regulations of the PRC (“PRC Laws”) and shall be governed by the relevant PRC authorities which were authorized by the PRC Laws to supervise our daily operations. The PRC government’s exercise of oversight over the conduct of our business may influence our operations at any time. If we are deemed not to comply with the PRC Laws, we may be subject to fines and other administrative penalties from the relevant PRC authorities. The application of and our violation of such laws and regulations (if any) and the punishment imposed by the relevant PRC authorities for such violation could result in a material change in our operations and/or the value of the securities we are registering for sale; could cause significant negative effect on our ability to continue our operations; could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors; and may cause the value of our securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in certain areas in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity (“VIE”) structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement.

We do not believe that we are directly subject to these regulatory actions or statements, as we do not have a VIE structure, and our business does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. Since these statements and regulatory actions are new, it is uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on a U.S. exchange. Any change in foreign investment regulations, and other policies in China or any punishment imposed by the PRC government for our violation of such regulations or policies could result in a material change in our operations and/or the value of the securities we are registering for sale and could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors or cause the value of our Class A Ordinary Shares to significantly decline or be worthless.

The Anti-Monopoly Law of the PRC (the “Anti-Monopoly Law”), which was promulgated by the Standing Committee of the National People’s Congress on August 30, 2007 and became effective on August 1, 2008 and whose amendments made on June 24, 2022 and became effective on August 1, 2022, provides additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex. Companies undertaking acquisitions relating to businesses in China must declare to the State Council’s anti-monopoly law enforcement authority, in advance of any transaction reaching the threshold of declaration prescribed in the Anti-Monopoly Law. We do not believe that we or the PRC subsidiaries are directly subject to these regulatory actions or statements, as neither we nor the PRC subsidiaries have implemented any monopolistic behaviour.

On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On November 14, 2021, Cyberspace Administration of China (“CAC”) published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber Data Security Measure (Draft)”, and on December 28, 2021, Cybersecurity Review Measures published by CAC, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s Bank of China, State Administration for Market Regulation, State Administration of Radio and Television, China Securities Regulatory Commission, State Secrecy Administration and State Cryptography

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our ordinary shares involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our ordinary shares in “Risk Factors”.

| | | PER SHARE | | | TOTAL | |

| Initial public offering price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| Proceeds, before expenses, to us | | $ | | | | $ | | |

| (1) | Does not include accountable and non-accountable expense allowance payable to underwriters. Please see the section of this prospectus entitled “Underwriting” for additional information regarding underwriter compensation. |

TABLE OF CONTENTS

For investors outside the United States: neither we nor the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares and the distribution of this prospectus outside the United States.

Neither we nor the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus, or in any free writing prospectus we have prepared, and neither we nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. Neither we nor the underwriters are making an offer to sell, or seeking offers to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of shares. Our business, financial condition, results of operations and prospects may have changed since the date on the cover page of this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission (the “SEC”). As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website described below under the heading “Where You Can Find More Information”.

The information contained in this prospectus is accurate as of the date on the front of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Common Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

In this prospectus, unless the context otherwise requires:

| ● | references to “Common Shares” or “our shares” refer to common shares of YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION; |

| ● | references to the “Company,” “we,” “us,” “our” and “YYDT” refer to YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION; |

| ● | references to “dollars,” “U.S. dollars,” “USD,” “$,” and “US$” are to United States Dollars; |

| ● | “U.S. GAAP” refers to generally accepted accounting principles in the United States; |

| ● | references to the “SEC” are to the United States Securities and Exchange Commission. |

Market data and certain industry data and forecasts used in, or incorporated by reference in, this prospectus were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies and industry publications and surveys. We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. Our historical results do not necessarily indicate our expected results for any future periods.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

We have obtained the statistical data, market data and other industry data and forecasts used in this prospectus and in our SEC filings incorporated herein by reference from publicly available information. We have not sought the consent of the sources to refer to the publicly available reports in this prospectus.

Impact of COVID-19

By the end of 2022, the control measures for epidemic prevention gradually liberalized. We expect the continuous optimization of epidemic prevention policy to stimulate the content marketing industry and have a positive impact on our business. However, any resurgence of the COVID-19 pandemic could negatively affect the content marketing business. The extent of any future impact of the COVID-19 pandemic on our business is still highly uncertain and cannot be predicted as of the date of this prospectus. Any potential impact to our operating results will depend on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19 pandemic and the actions taken by competent authorities to contain the spread of the COVID-19 pandemic, almost all of which are beyond our control.

See “Risk Factors — Risks Related to Our Business and Industry — Pandemics and epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks could disrupt our operations, which could materially and adversely affect our business, financial condition, and results of operations.” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Impact of COVID-19 On Our Operations.”

INTERNATIONAL FINANCIAL REPORTING STANDARDS

Our financial statements are prepared in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board. Our fiscal year ends on June 30 of each year as does our reporting year.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

MARKET AND INDUSTRY DATA

This prospectus contains references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us. Some data is also based on our good faith estimates, which are derived from our review of internal surveys or data, as well as the independent sources referenced above. Assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus also contains additional trademarks, trade names and service marks belonging to other companies. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Brands and Trademarks

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “might”, “will”, “should”, “believe”, “expect”, “could”, “would”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this prospectus, including among other things:

| ● | our future financial performance, including our expectations regarding our revenue, cost of revenue, operating expenses, including capital expenditures related to asset-intensive offerings, our ability to determine reserves and our ability to achieve and maintain future profitability; |

| ● | our ability to develop and market new products; |

| ● | the continued market acceptance of our products; |

| ● | exposure to product liability claims and actions; |

| ● | risks associated with product recalls; |

| ● | the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| ● | our ability to manage operations-related risk; |

| ● | our expectations and management of future growth; |

| ● | our expectations concerning relationships with third parties; |

| ● | the impact of COVID-19 on the Company; |

| ● | our ability to maintain, protect and enhance our intellectual property; |

| ● | our ability to successfully acquire and integrate companies and assets; |

| ● | the increased expenses associated with being a public company; |

| ● | exposure to product liability and defect claims; |

| ● | protection of our intellectual property rights; |

| ● | damage to our reputation due to negative publicity; |

| ● | changes in the laws that affect our operations; |

| ● | inflation and fluctuations in foreign currency exchange rates; |

| ● | our ability to obtain all necessary government support; |

| ● | certifications, approvals, and/or licenses to conduct our business; |

| ● | continued development of a public trading market for our securities; |

| ● | the cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; |

| ● | risks associated with expansion into new jurisdictions; |

| ● | managing our growth effectively; |

| ● | fluctuations in operating results; |

| ● | our ability to maintain and enhance our market position; |

| ● | our ability to obtain and maintain adequate insurance coverage; |

| ● | our ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth; |

| ● | dependence on our senior management and key employees; |

| ● | our ability to maintain the listing of our securities on Nasdaq; |

| ● | our ability to continue to develop new technologies and/or upgrade our existing technologies; and |

| ● | other factors set forth under “Risk Factors.” |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

These and other factors are more fully discussed in the “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by the forward-looking statements contained in this prospectus.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by applicable law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus that we consider important. This summary does not contain all of the information you should consider before investing in our Common Shares. You should read this summary together with the entire prospectus, including the risks related to our business, our industry, investing in our Common Shares and our location in British that we describe under “Risk Factors” and our consolidated financial statements and the related notes before making an investment in our securities.

Overview of Our Company

Shenzhen Yi Yue Digital Technology Co., Ltd is a Software as a Service (SaaS) digital technology provider focusing on the specific field of beauty industry. The Company is founded in September 2021, headquartered in the city of Shenzhen, and it has 8 branches in mainland China with the number of employees is more than 200. We are located in RM 2405, Sanhang Technoloy Building, Northwestern Polytechnical University, 45 High-Tech South Road, Nanshan District, Shenzhen, China. The Company is committed to supporting beauty industry and health institutions to build scientific and efficient management through SaaS plus supply chain service. The Company helps SaaS users maintain sustainable profitable operation, by relying on AI and big data technology. The service provided by the Company can help connect suppliers and customers work together, forming a closed loop of Online to Offline (O2O) e-commerce transactions and services. The Company is building up a new ecology of beauty industry and committing to become a SaaS leader of Chinese beauty industry.

Corporate Vision

Let the craftsman become a respected freelancer.

Corporate Value

The value of the Company includes Integrity, Customer-oriented, Flexibility, and Teamwork.

Corporate Slogan

Meet the most authentic version of yourself.

Corporate Mission

The Company is committed to become China’s first-class SaaS service provider in beauty industry.

Our Corporate Information

Yi Yue Digital Technology Group Corporation was incorporated in BVI on April 2, 2024 for the purpose of holding the China’s business of Shenzhen Yi Yue Digital Technology Co., Ltd. Our principal executive offices are located at RM 2405, Sanhang Technoloy Building, Northwestern Polytechnical University, 45 High-Tech South Road, Nanshan District, Shenzhen, Guangdong Province, China

The management team has the following core members to ensure that the company operates in compliance with the law and regulations, while also ensuring the development of the business.

Renzhuo FENG appointed as CEO and the Chairman of the Board.

Qing WANG appointed as CFO and Director.

Xing LI appointed as COO.

Jiangguang DUAN appointed as Independent Director.

Yong LI appointed as Independent Director.

THE OFFERING

| Issuer | | YI YUE DIGITAL TECHNOLOGY GROUP CORPORATION |

| | | |

| Securities Being Offered | | Ordinary Shares, par value US$ 5 per share |

| | | |

| Offering Price | | We expect that the initial public offering price will be US$ per Ordinary Share. |

| | | |

| Ordinary Shares Outstanding Immediately Before This Offering | | Ordinary Shares |

| | | |

| Ordinary Shares Outstanding Immediately After This Offering | | Ordinary Shares (or Ordinary Shares if the underwriters exercise their option to purchase additional Ordinary Shares in full). |

| | | |

| Over-allotment option: | | |

| | | |

| Voting Rights: | | Each Ordinary Share is entitled to one vote. |

| | | |

| Use of Proceeds: | | ● [ ]% for the development or purchase of intelligent specialized software designed to enhance operational service efficiency and enable business optimization. ● [ ]% for the complement the Company’s existing sales channels and market expansion. ● [ ]% for product management and product branding |

| | | |

| Proposed Nasdaq Trading Symbol and Listing: | | We plan to apply to list our Ordinary Shares on the Nasdaq Capital Market under the symbol “YYDT” This offering is contingent upon us listing our Ordinary Shares on Nasdaq Capital Market or another national exchange. No assurance can be given that such listing will be approved or that a liquid trading market will develop for our Ordinary Shares. |

| | | |

| Lock-up: | | Our directors, executive officers, and shareholder who own 5% or more of the outstanding Ordinary Shares intended agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Ordinary Shares or securities convertible into Ordinary Shares for a period of 6 months commencing on the date of this prospectus. The Company is also prohibited from conducting offerings during this period and from re-pricing or changing the terms of existing options and warrants. See “Underwriting” for additional information. |

| | | |

| Risk factors: | | See “Risk Factors” for a discussion of risks you should carefully consider before investing in our Ordinary Shares. |

| | | |

| Transfer Agent: | | V-Stock |

RISK FACTORS

Risks Related to Our Business and Industry

Our operating history may not be indicative of our future growth or financial results and we may not be able to sustain our historical growth rates.

Our operating history may not be indicative of our future growth or financial results. There is no assurance that we will be able to grow our revenues in future periods. Our growth rates may decline for any number of possible reasons, and some of them are beyond our control, including decreasing customer demand, increasing competition, declining growth of the marketing industry in general, emergence of alternative business models, or changes in government policies or general economic conditions. We will continue to expand our sales network and product offerings to bring greater convenience to our customers and to increase our customer base and number of transactions. However, the execution of our expansion plan is subject to uncertainty and the total number of items sold and number of transacting customers may not grow at the rate we expect for the reasons stated above. If our growth rates decline, investors’ perceptions of our business and prospects may be adversely affected and the market price of our common stock could decline.

We operate in the competitive content marketing industry, which may make it difficult for investors to evaluate our future prospects, and we cannot assure you that our current or future strategies will be successfully implemented or will generate sustainable profit.

We primarily operate in China’s content marketing services industry providing content marketing for customers. The marketing services industry is rapidly evolving, business models continue to evolve, and the industry may not develop as we anticipate. The regulatory framework in China governing the marketing services industry is also developing. As our business develops and in response to the evolving customer needs and market competition, we need to continuously introduce new products and services, improve our existing products and services, or adjust and optimize our business model. In response to new regulatory requirements or industry standards, or in connection with the introduction of new products, we may need to impose more rigorous risk management systems and policies, which may negatively affect the growth of our business. Any significant change to our business model may not achieve expected results and may materially and adversely affect our financial condition and results of operations. It is therefore difficult to accurately predict our future prospects.

You should consider our business and prospects in light of the risks and challenges that we encounter or may encounter as an entrant in the newly emerging and rapidly evolving market in which we operate and our limited operating history. These risks and challenges include our ability to, among other things:

| ● | build a well-recognized and respected brand; |

| ● | establish and expand our customer base; |

| ● | maintain and enhance our relationships with our business partners; |

| ● | attract, retain, and motivate talented employees; |

| ● | anticipate and adapt to changing market conditions and competitive landscape; |

| ● | manage our future growth; |

| ● | ensure that the performance of our products and services meets client expectations; |

| ● | maintain or improve our operational efficiency; |

| ● | navigate a complex and evolving regulatory environment; and |

| ● | defend ourselves in any legal or regulatory actions against us. |

If we fail to address any or all of these risks and challenges, if we fail to educate business partners and customers about the value of our platform and services, if the market for our products and services does not develop as we expect, if we fail to address the needs of our target customers, or if we are not able to effectively tackle other risks and challenges that we may encounter, our business and results of operations may be adversely affected.

If we fail to achieve the content marketing objectives in relation to offline events, we could lose customers.

We mainly offer services to our customers in the area of integrated marketing solutions in Greater China in relation to offline events. In general, the scope of work required in order to achieve the marketing objectives of our customers will be set out in the contract with the customer or in a customer brief before the commencement of a project and may be revised throughout the project, and our integrated marketing solutions services may be fine-tuned with reference to the feedback from the customers.

When we are in charge of a project in order to assist our customers to achieve their content marketing objectives, we may be subject to risks of various unexpected hazards and adverse situations. Some of these risks include, but are not limited to, participant dropout, venue cancellation, technical issues and unexpected weather conditions.

Most of our customers assess our performance mainly based on our effectiveness in achieving their marketing objectives as set out in the scope of work and/or key performance indicators in the contract with the client. If our marketing solutions services fail to achieve the customers’ desired marketing objectives, or if we fail in the projects or events that we organize and/or manage, or if there are any quality issues or accidents which occur during the provision of our services, our customers’ reputation will be adversely affected, which in turn could have a material adverse effect on our relationships with our customers, reputation and revenue, and we may lose customers and the opportunity to be engaged in future projects.

If we fail to provide satisfactory services to address the rapidly evolving market in a timely manner, and if we are not able to implement successful enhancements and new features for our services, we may not be able to attract or retain customers.

Our success depends on our ability to attract or retain customers through the provision of satisfactory services, and to generate recurring business from existing customers. To attract and retain customers, we need to further enrich our service offerings by providing satisfactory services in a cost-effective and timely manner. Furthermore, we need to anticipate and quickly respond to changing customer preferences and development in the market trends. Our ability to provide services is dependent on our industry expertise and innovative ideas and technologies. However, we cannot assure you that the services that we design and develop on our own or together with our business partners will cater to the needs of potential or existing customers, sustain for a period of time that we expect them to, or be welcomed or accepted by the market at all. If we fail to cater to the needs and preferences of our customers or provide satisfactory service in an efficient manner, or our customers cannot find their desired services at attractive prices and terms, they may turn to other channels for their needs, and we may suffer from reduced customer base. If we are unable to grow our customer base or increase customer satisfaction, our business, financial condition, and results of operations may be materially and adversely affected.

Failure to maintain and enlarge our customer base or strengthen customer engagement may adversely affect our business and results of operations.

Our revenue growth depends on our ability to maintain and enlarge our customer base and strengthen customer engagement so that more of our customers will use our products and services more often and contribute to our revenue growth. Our customers may not continue to use our solutions once their existing contract expires or they may not purchase additional solutions from us. This risk is especially apparent in circumstances where it is inexpensive for them to switch service providers. Our ability to maintain and enlarge our customer base and strengthen our customer engagement will depend on many factors, some of which are out of our control, including:

| ● | our ability to continually innovate our solutions in response to evolving customer demands and expectations and intense market competition; |

| ● | our ability to customize solutions for our customers; |

| ● | customer satisfaction with our solutions, including any new solutions that we may develop, and the competitiveness of our pricing and payment terms; and |

| ● | the effectiveness of our solutions in helping our customers improve efficiency, enhance service quality, and reduce costs. |

Economic recessions could have a significant, adverse impact on our business.

Our revenues are generated from marketing service fees and we anticipate that revenues from such marketing services will continue to represent the substantial portion of our total revenues in the near future. Our earnings can also be affected by changes in the general economy.

The marketing industry historically has experienced cyclical fluctuations in financial results due to economic recession, downturns in business cycles of our customers, interest rate fluctuations, and other economic factors beyond our control. Deterioration in the economic environment subjects our business to various risks, which may have a material and adverse impact on our operating results and cause us to not reach our long-term growth goals. For example, a downturn in the economy could directly affect the discretionary spending power of our customers and in turn, depress the number of orders.

Changes in U.S. and international trade policies, particularly with regard to China, may adversely impact our business and operating results.

The U.S. government has recently made statements and taken certain actions that may lead to potential changes to U.S. and international trade policies, including recently-imposed tariffs affecting certain products manufactured in China. It is unknown whether and to what extent new tariffs (or other new laws or regulations) will be adopted, or the effect that any such actions would have on us or our industry and customers, any unfavorable government policies on international trade, such as capital controls or tariffs, may affect the demand for our services, impact the competitive position of our services or prevent us from being able to expand and provide our services in certain countries. If any new tariffs, legislation and/or regulations are implemented, or if existing trade agreements are renegotiated or, in particular, if the U.S. government takes retaliatory trade actions, such changes could have an adverse effect on our business, financial condition, results of operations. During the financial year period ended June 30, 2023, we have not been adversely affected by any international trade policies, including recently-imposed tariffs affecting certain products manufactured in China.

Our business, operating results and financial condition could be materially and adversely affected if we fail to obtain and maintain the necessary licenses and related qualifications required by the complex regulatory environment applicable to our business in China.

Our business is subject to governmental supervision and regulation by relevant governmental authorities in China, including but not limited to the State Council, the Ministry of Commerce, the Cyberspace Administration of China and other governmental authorities. These government authorities promulgate and enforce regulations covering various aspects of beauty and e-commerce operations, including licenses and qualification documents for entry into these industries, the scope of permissible business activities, and various business activities. Violations could result in significant penalties for our company, which could affect our licenses and qualification documents and could prevent some of our operations from being conducted properly.

We have obtained beauty business licenses and qualifications to carry out operational activities on SaaS and can operate the general business activities that we currently carry out in China. However, we cannot assure you that we will be able to successfully renew these licenses on an ongoing basis or that these licenses will be sufficient to conduct all of our current or future business.

There is significant uncertainty in the interpretation and implementation of current and future Chinese laws and regulations that may apply to our business operations. For example, in August 2018, the National People’s Congress enacted the E-Commerce Law, which became effective in January 2019. We must cooperate with e-commerce platforms and fully comply with the E-Commerce Law in order to continue to operate on these e-commerce platforms. We cannot assure you that our current business activities will not violate any future laws and regulations or any currently valid laws and regulations as a result of changes in the interpretation of these laws and regulations by the relevant authorities.

The conduct of our multi-platform operations relies on multiple licenses and operating qualifications that we have obtained. If we fail to adapt to any new regulatory requirements, or if any competent governmental authority determines that we are operating our business without any required licenses or approvals, or otherwise fail to comply with applicable regulatory requirements, we may be subject to administrative actions and penalties, including fines, forfeiture of our revenues, revocation of our licenses or permits or, in severe cases, cessation of certain operations. Any such actions could have a material adverse effect on our business, financial condition and operating results.

Risk of our online operations relating to SaaS.

| ● | Dependency risk: Relating to online SaaS may lead to a concentration of operational risk. Changes in SaaS policies or algorithms may affect the stability and profitability of the business. |

| ● | Competition risk: competition on platforms is intense and the entry of other merchants or the dominance of competitors may adversely affect the business. |

| ● | Compliance risk: operating on SaaS requires compliance with relevant laws and regulations and platform rules, and any violation may result in penalties, including restriction of business or account closure. |

| ● | Brand reputation risk: user reviews and ratings, etc. on the SaaS have a significant impact on the brand image and reputation, and may have an impact on the business in the event of negative reviews. |

| ● | Data security risk: operating on SaaS may need to involve user data, and data leakage or misappropriation may have a negative impact on business and user trust. |

| ● | Technology risk: reliance on SaaS may require adapting to their technological changes, such as adjustments to API interfaces and the release of new functions, etc. Insufficient technological adaptability may have an impact on our business. |

| ● | Transaction risk: transactions on SaaS may involve payment risk, refund risk, etc., and need to be handled carefully to avoid losses. |

We may not be able to adequately protect our intellectual property rights, which may adversely affect our business and operations.

Our trademarks, copyrights, domain names, proprietary services and similar intellectual property rights are critical to our success, and we rely on a combination of intellectual property laws and contractual arrangements, including confidentiality and non-compete agreements with our employees and others, to protect our trademarks as well as our proprietary rights. If an unrelated third party were to actually use our trademarks or brands in the future in connection with products or services similar to ours, the general public consumer may become confused and associate any quality issues with the products and services provided to us by such unrelated third party, which would adversely affect our brand image.

It is often difficult to register, maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be consistently applied due to a lack of clear guidance on statutory interpretation. Our counterparties may breach confidentiality, invention assignment and non-competition agreements, and we may not be able to provide adequate remedies for any such breaches.

We may be accused of infringing the intellectual property rights of others and content restrictions under relevant laws.

External third parties may complain that the content we publish or our products and services infringe their intellectual property rights. For example, we may have liability for copyright or trademark infringement, among other things, in connection with the provision of our operational services, as well as other claims based on the content we publish. As our business continues to grow, the likelihood of intellectual property claims against us increases. Such claims, whether founded or unfounded, could cause us to expend significant financial and administrative resources, generate injunctions against us or pay damages.

Our acquisition activities and other strategic transactions may involve management, integration, operational and financial risks, which may prevent us from realizing the full anticipated benefits of our acquisitions.

We will seek to acquire beauty brands as part of our future growth strategy, and we believe that these acquisitions will strengthen our competitive position in key segments of the beauty market and geographic areas, or accelerate our ability to grow into adjacent product categories, channels and emerging markets, or otherwise cater to our strategy.

However, investments and acquisitions may divert management’s attention from current operations and result in liabilities and expenses in excess of expectations, unidentified issues not identified in due diligence, the use of significant amounts of cash, all of which could dilute the issuance of equity securities, significant amortization expense related to goodwill or intangible assets and exposure to potentially unknown liabilities of the acquired business. We may be required to record a significant charge to operating results if our goodwill or intangible assets become impaired.

Risks to our financial statements brought by exchange rate fluctuations

The Company’s business generates revenues and profits in RMB, which are subsequently converted to U.S. dollars at the average RMB/U.S. dollar exchange rate for the period when the statements are presented; therefore, exchange rate fluctuations will have an impact on the Company’s statements.

II. Risks Relating to Doing Business in China

Our business and financial condition could be materially and adversely affected by a downturn in the Chinese or global economy as well as China’s economic and political policies.

All our business is currently located in mainland China. Accordingly, our business, prospects, financial condition and operating results may be affected to an important extent by the political, economic and social conditions in China as well as the continued economic growth of Hong Kong and China as a whole. The economy of China differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rates, foreign exchange controls and allocation of resources. Although the Chinese economy has experienced significant growth over the past few decades, growth has been uneven both geographically and across sectors of the economy. The Chinese government has taken various measures to encourage economic growth and guide resource allocation. Some of these measures may benefit the Chinese economy as a whole, but at the same time they may have a negative impact on us.

All of our operations are located in China and our business is subject to the complex and rapidly evolving laws and regulations in China

The regulations with which we comply may change rapidly and it is difficult for us or our shareholders to stay on top of them at all times. As a result, the application, interpretation and enforcement of newly arising and existing laws and regulations in mainland China are often uncertain. Furthermore, these laws and regulations may be inconsistently interpreted and applied by different agencies or authorities and may be inconsistent with our current policies and practices. The cost of compliance with new laws, regulations and other governmental directives in mainland China may also be significant, and such compliance or any related inquiries or investigations or any other governmental action may:

| ● | affect the implementation of our strategy |

| ● | increase our operating costs as a result of negative publicity |

| ● | require significant time and labor costs in China’s domestic policy dynamics |

III. Risks Related to Our Securities

Inactive stock trading of the Company

We have had no public offering experience with our common stock, including Class A common stock, prior to this offering. There is a risk that our Class A common stock may not be actively traded in the trading market following the completion of this offering or, if developed, may not be able to maintain a consistently active trading volume. The lack of an active trading market could harm the stock value for investors and your ability to sell your stocks if you wish to do so. An inactive trading market may also impair our ability to raise capital through the sale of our Class A common stock, the formation of strategic partnerships or the acquisition of other complementary products, technologies or businesses in consideration for shares of Class A common stock. In addition, if we fail to meet exchange listing standards, we may be delisted, which would negatively affect the price of our securities.

Risks that our stock price may fluctuate

Each of the following factors could have a material adverse effect on the market price of our common stock, and investors should consider their investments carefully:

| ● | Fluctuations in our operating results; |

| ● | Negative market publicity; |

| ● | Changes in the recommendations of securities or industry analysts regarding our Company, the industries in which we operate, the securities markets generally and financial market conditions; |

| ● | Regulatory developments affecting our industry; |

| ● | Research and report announcements related to our products or those of our competitors; |

| ● | Changes in the economic performance or market valuations of our competitors; |

| ● | Actual or anticipated fluctuations in our quarterly results; |

| ● | Announcements of new products, acquisitions, strategic relationships, joint ventures or capital commitments by us or our competitors; |

| ● | Additions or departures of our key executives and employees. |

(3) Trademark. A trademark is a symbol used to divide the source of a product or service, which can be text, patterns, graphics, colors, etc. Companies can use unique trademarks for the minerals they process so that consumers can identify and identify the company’s products. The registration of a trademark may provide legal protection against the unauthorized use of the same or similar trademark by others.

(4) Copyright. Mining or processing machinery may involve the creation of software programs, algorithms, interface design and other aspects. These creations can be protected by copyright law. After the development of the software, the company can register the source code and related documents to ensure the exclusive rights and interests in these creations.

(5) Industrial design patents. The design of machinery for mining or processing can also be protected by industrial design patents to ensure that other companies do not copy the appearance of the product. Industrial design patents mainly focus on the appearance and shape of the product, and ensure that the company has a competitive advantage in the market through patent protection.

Implications of Our Being an “Emerging Growth Company”

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended (the “Securities Act”) occurred, if we have more than $1.235 billion in annual revenue, have more than $700 million in market value of our Class A Ordinary Share held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Foreign Private Issuer Status (applicability of whole section to be verified)

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | We are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| ● | For interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| ● | We are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | We are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| ● | We are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and |

| ● | We are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Implications of Being a Controlled Company (applicability of whole section to be verified)

Controlled companies are exempt from the majority of independent director requirements. Controlled companies are subject to an exemption from Nasdaq standards requiring that the board of a listed company consist of a majority of independent directors within one year of the listing date.

Public Companies that qualify as a “Controlled Company” with securities listed on the Nasdaq Stock Market (Nasdaq), must comply with the exchange’s continued listing standards to maintain their listings. Nasdaq has adopted qualitative listing standards. Companies that do not comply with these corporate governance requirements may lose their listing status. Under the Nasdaq rules, a “controlled company” is a company with more than 50% of its voting power held by a single person, entity or group. Under Nasdaq rules, a controlled company is exempt from certain corporate governance requirements including:

| ● | The requirement that a majority of the board of directors consist of independent directors; |

| ● | The requirement that a listed company have a nominating and governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| ● | The requirement that a listed company have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| ● | The requirement for an annual performance evaluation of the nominating and governance committee and compensation committee. |

Controlled companies must still comply with the exchange’s other corporate governance standards. These include having an audit committee and the special meetings of independent or non-management directors.

INDUSTRY AND MARKET DATA

This prospectus contains estimates, projections and other information concerning our industry, our business, and the markets for our product candidates. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by third parties, industry, medical and general publications, government data and similar sources. While we believe our internal company research as to such matters is reliable, it has not been verified by any independent source.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties. All statements other than statements of current or historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

In some cases, you can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “potential,” “intend,” “plan,” “believe,” “likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements about:

| ● | changes in political, social and economic conditions, the regulatory environment, laws and regulations and interpretation thereof in the jurisdictions where we conduct business or expect to conduct business; |

| ● | the risk that we may be unable to realize our anticipated growth strategies and expected internal growth; |

| ● | changes in the availability and cost of professional staff which we require to operate our business; |

| ● | changes in customers’ preferences and needs; |

| ● | changes in competitive conditions and our ability to compete under such conditions; |

| ● | changes in our future capital needs and the availability of financing and capital to fund such needs; |

| ● | changes in currency exchange rates or interest rates; |

| ● | projections of revenue, profits, earnings, capital structure and other financial items; |

| ● | changes in our plan to enter into certain new business sectors; and |

| ● | other factors beyond our control. |

You should read this prospectus and the documents that we refer to in this prospectus with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this prospectus include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should read this prospectus and the documents that we refer to in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Industry Data and Forecasts

This prospectus contains certain data and information including industry data and information from Frost & Sullivan. Statistical data in these publications also include projections based on a number of assumptions. The content marketing industry in mainland China may not grow at the rate projected by market data, or at all. Failure of our industries to grow at the projected rate may have a material and adverse effect on our subsidiaries’ business and the market price of our Class A Ordinary Shares. In addition, the rapidly changing nature of the content management industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our industry. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

USE OF PROCEEDS

We estimate that we will receive net proceeds from this offering of approximately $ million after deducting estimated underwriting discounts and commissions and the estimated offering expenses payable by us and based upon an assumed initial offering price of $ per ordinary share (excluding any exercise of the underwriters’ over-allotment option).

A $ increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) the net proceeds to us from this offering by approximately $ million, after deducting the estimated underwriting discounts and commissions and estimated aggregate offering expenses payable by us and assuming no change to the number of ordinary share offered by us as set forth on the cover page of this prospectus, provided, however, that in no case would we decrease the initial public offering price to less than $4.00 per share.

| Description of Use | | Estimated

Amount of

Net Proceeds

(US$) | | | Percentage | |

| The development or purchase of intelligent specialized software designed to enhance operational service efficiency and enable business optimization. | | | | | | | | % |

| The increase the Company’s existing sales channels and market expansion. | | | | | | | | % |

| The upgrade of product management and product branding | | | | | | | | % |

| Total project input funds | | | | | | | 100 | % |

The foregoing represents our current intentions based upon our present plans and business conditions to use and allocate the net proceeds of this offering. Our management, however, will have some flexibility and discretion to apply the net proceeds of this offering. If an unforeseen event occurs or business conditions change, we may use the proceeds of this offering differently than as described in this prospectus. To the extent that the net proceeds we receive from this offering are not imminently used for the above purposes, we intend to invest in short-term, interest-bearing bank deposits or debt instruments.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common stock, and we do not currently intend to pay any cash dividends on our common stock in the foreseeable future.

We currently intend to retain all available funds and any future earnings to support operations and to finance the growth and development of our business.

Any future determination to pay dividends will be made at the discretion of our board of directors, subject to applicable laws, and will depend upon, among other factors, our results of operations, financial condition, contractual restrictions, and capital requirements.

From time to time, we may also enter into other loan or credit agreements or similar borrowing arrangements that may further restrict our ability to declare or pay dividends on our common stock. Our board of directors will have sole discretion in making any future determination to pay dividends, subject to applicable laws, taking into account, among other factors, our results of operations, financial condition, contractual restrictions, and capital requirements.

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2024 as follows:

| ● | on an adjusted basis to reflect the sale of ordinary shares in this offering, at an assumed initial public offering price of $ per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

The adjustments reflected below are subject to change and are based upon available information and certain assumptions that we believe are reasonable. Total shareholders’ equity and total capitalization following the completion of this offering are subject to adjustment based on the actual initial public offering price and other terms of this offering determined at pricing. You should read this capitalization table in conjunction with “Use of Proceeds,” “Summary Consolidated Financial and Operating Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes appearing elsewhere in this prospectus.

| | | As of June 30, 2024 | |

| | | Actual | | | As

Adjusted | |

| Shareholder’s Equity: | | | | | | | | |

| Ordinary shares, US$ par value per share | | | | | | | | |

| Statutory reserves | | | | | | | | |

| Additional paid-in capital | | | | | | | | |

| Retained earnings | | | | | | | | |

| Accumulated other comprehensive loss | | | | | | | | |

| Total shareholders’ equity | | | | | | | | |

| Total capitalization | | | | | | | | |

| (1) | Gives effect to the sale of Ordinary Shares in this offering at an assumed initial public offering price of $ per share and reflects the application of the proceeds after deducting the underwriting discounts, non-accountable expense allowance and our estimated offering expenses. |

| (2) | Pro forma adjusted additional paid in capital reflects the net proceeds we expect to receive, after deducting underwriting discounts and non-accountable expense allowance, and other expenses. We expect to receive net proceeds of approximately $ ($ offering, less underwriting discounts of $ , non-accountable expense allowance of $ , accountable expenses of $ and offering expenses of $ ). |

Each $1.00 increase (decrease) in the assumed initial public offering price of $ per Ordinary Share would increase (decrease) the pro forma as adjusted amount of total capitalization by $ million, assuming that the number of Ordinary Shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts, non-accountable expense allowance and estimated offering expenses payable by us. An increase (decrease) of one million in the number of Ordinary Shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of total capitalization by $ million, assuming no change in the assumed initial public offering price per Ordinary Share as set forth on the cover page of this prospectus.

DILUTION

If you invest in our Ordinary Shares, your interest will be diluted to the extent of the difference between the initial public offering price per Ordinary Share and the pro forma net tangible book value per Ordinary Share after the offering. Dilution results from the fact that the offering price per Ordinary Share is substantially in excess of the book value per Ordinary Share attributable to the existing shareholders for our presently outstanding Ordinary Shares. Our net tangible book value attributable to shareholders on June 30, 2024 was $ or approximately $ per Ordinary Share. Net tangible book value per Ordinary Share as of June 30, 2024 represents the amount of total assets less intangible assets and total liabilities, divided by the number of Ordinary Shares outstanding.

Our post offering pro forma net tangible book value, which gives effect to receipt of the net proceeds from the offering and issuance of additional shares in the offering, but does not take into consideration any other changes in our net tangible book value after June 30, 2024, will be $ or approximately $ per Ordinary Share. This would result in dilution to investors in this offering of approximately $ per Ordinary Share or approximately % from the assumed offering price of $ per Ordinary Share. Net tangible book value per Ordinary Share would increase to the benefit of present shareholders by $ per share attributable to the purchase of the Ordinary Shares by investors in this offering.

The following table sets forth the estimated net tangible book value per Ordinary Share after the offering and the dilution to persons purchasing Ordinary Shares based on the foregoing firm commitment offering assumptions. The number of our Ordinary Shares had been adjusted retrospectively to reflect the increasing of share capital. See “Description of Share Capital” for more details.

| | | Post-

Offering | |

| Assumed public offering price per share | | | | |

| Net tangible book value per share as of June 30, 2024 | | | | |

| Increase in pro forma net tangible book value per share attributable to price paid by new investors | | | | |

| Pro forma net tangible book value per share after this offering | | | | |

| Dilution in pro forma net tangible book value per share to new investors in this offering | | | | |

The following table sets forth, on an as adjusted basis as of December 30, 2023, the difference between the number of common stock purchased from us, the total cash consideration paid, and the average price per share paid by our existing shareholders and by new public investors before deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, using an assumed public offering price of $4.00 per share:

| | | Shares Purchased | | | Total Cash

Consideration | |

| | | Number | | | Percent | | | Amount | | | Percent | |

| Existing shareholders | | | | | | | | | | | | | | | | |

| New investors from public offering | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | | |

The dilution information in this section is presented for illustrative purposes only. Our as adjusted net tangible book value following the consummation of this Offering is subject to adjustment based on the actual initial public offering price of our Ordinary Shares and other terms of this offering determined at pricing.

Changes in Shareholders’ Equity

As of [ ], [ ], 202 [ ], our shareholders’ equity is as follows:

| ● | Based on historical actuals; |

| ● | Based on adjusted conditions: assuming an initial public offering price of $[ ] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, net of underwriting discounts payable by us, an allowance for non-reimbursable expenses, and estimated offering expenses, on a basis that reflects sales of the [ ] common stock in this offering. |

| Based on the date of [ ], [ ], 202[ ]. |

| | | Actual

US$ | | | As

Adjusted

US$ | |

| Shareholders’ Equity | | | | | | | | |

| Common Stock | | | | | | | | |

| Additional Paid-In Capital | | | | | | | | |

| Statutory Reserves | | | | | | | | |

| Retained Earnings | | | | | | | | |

| Accumulated Other Comprehensive Income | | | | | | | | |

| Total Shareholders’ Equity | | | | | | | | |

| Total Capitalization | | | | | | | | |

ELECTED COMBINED FINANCIAL AND OPERATING DATA