As filed with the Securities and Exchange Commission on November 1, 2024.

Registration No. 333-281923

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

Amendment No. 2

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________

PHARMA TWO B LTD.

(Exact name of registrant as specified in its charter)

_____________________________

State of Israel | | 2834 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) |

Pharma Two B Ltd.

12 Shaul Hamelech St.,

Kiryat Ono, 5565420,

Israel

+972-54-550-0804

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_____________________________

Pharma Two B, Inc.

14 Ridge Rd.

Cresskill, New Jersey, 07626

201-597-0013

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________

Copies of all correspondence to:

Mike Rimon, Adv.

Matthew Rudolph, Adv.

Meitar | Law Offices

16 Abba Hillel Silver Rd.

Ramat Gan 5250608, Israel

Tel: +972 (3) 610-3100 | | Mayan Katz, Esq.

Marianne Sarrazin, Esq.

Goodwin Procter LLP

620 Eighth Avenue

New York, NY 10018-1405 | | Jeffrey J. Fessler, Esq.

Lindsay H. Ferguson, Esq.

Sheppard, Mullin, Richter &

Hampton LLP

30 Rockefeller Plaza, 39th Floor

New York, New York 10112 |

_____________________________

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement and all other conditions to the proposed Merger described herein have been satisfied or waived.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this proxy statement/prospectus is not complete and may be changed. Pharma Two Ltd. may not sell these securities until the registration statement filed with the Securities and Exchange Commission, of which this proxy statement/prospectus is a part, is effective. This proxy statement/prospectus is neither an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any state or jurisdiction where the offer or sale is not permitted. Any representation to the contrary is a criminal offense.

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION DATED NOVEMBER 1, 2024

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

OF

HEPION PHARMACEUTICALS, INC.

_____________________________

PROSPECTUS FOR UP TO 7,504,902 ORDINARY SHARES

OF

PHARMA TWO B LTD.

_____________________________

The board of directors of Hepion Pharmaceuticals, Inc., a Delaware corporation (“Hepion”), has approved the Agreement and Plan of Merger (the “Merger Agreement”), dated as of July 19, 2024, by and among Hepion, Pharma Two B Ltd., a company organized under the laws of the State of Israel (“Pharma Two B”) and Pearl Merger Sub Inc., a Delaware corporation and indirect wholly-owned subsidiary of Pharma Two B (“Merger Sub”). Pursuant to the Merger Agreement, Merger Sub will merge with and into Hepion, with Hepion surviving the merger (the “Merger”). As a result of the Merger, and upon consummation of the Merger and the other transactions contemplated by the Merger Agreement (the “Transactions”), Hepion will become an indirect wholly owned subsidiary of Pharma Two B, with the securityholders of Hepion becoming securityholders of Pharma Two B.

Prior to the effective time of the Merger (the “Effective Time”), (i) each ordinary A share, ordinary B share, and preferred share of Pharma Two B will be automatically converted into such number of Pharma Two B’s ordinary shares, par value 1.0 New Israeli Shekels (NIS) (each a “Pharma Two B Ordinary Share”) as determined in accordance with articles of association of Pharma Two B effective as of immediately prior to the Effective Time; (ii) each Pharma Two B ordinary share that is issued and outstanding immediately prior to the Effective Time will be split into approximately 78.34 Pharma Two B ordinary shares (the “Share Split”); and (iii) outstanding securities convertible into Pharma Two B ordinary shares shall be adjusted to give effect to the foregoing transactions and remain outstanding. The closing price for Hepion’s common stock on Nasdaq Stock Market, LLC (“Nasdaq”) was $1.05 per share on July 18, 2024, immediately prior to the execution of the Merger Agreement.

Pursuant to the Merger Agreement and immediately prior to the Share Split, at the Effective Time, any approximately 703.4 shares of common stock of Hepion, par value $0.0001 per share (“Hepion Common Stock”), outstanding immediately prior to the Effective Time will be exchanged for one Pharma Two B ordinary share.

Pursuant to the Merger Agreement and assuming the Share Split has been effected, at the Effective Time, approximately 8.98 each shares of Hepion Common Stock, outstanding immediately prior to the Effective Time will be exchanged for one Pharma Two B ordinary share.

Concurrently with the execution of the Merger Agreement, Pharma Two B and certain accredited investors (the “PIPE Investors”) entered into a series of securities purchase agreements (“Securities Purchase Agreements”), providing for the purchase by the PIPE Investors immediately after the Effective Time of an aggregate of 2,254,902 Pharma Two B ordinary shares (“PIPE Shares”) at a price per share of $5.10 together with the issuance of accompanying Series A warrants to purchase 2,254,902 Pharma Two B ordinary shares and accompanying Series B warrants to purchase 2,254,902 Pharma Two B ordinary shares, for gross proceeds of $11,500,000 (the “PIPE Investment”).

It is anticipated that, upon completion of the Merger, Hepion’s existing public stockholders will own approximately 13% to 17% of the combined company’s fully diluted share capital and Pharma Two B’s existing securityholders will own approximately 83% to 87% of the combined company’s fully diluted share capital. These percentages are calculated based on a number of assumptions and are subject to adjustment in accordance with the terms of the Merger Agreement. Immediately after the consummation of the PIPE Investment, it is anticipated that Hepion’s existing securityholders will own approximately 7.8% of the combined company, Pharma Two B’s existing securityholders will own approximately 44.5% of the combined company, and the PIPE Investors will own approximately 47.7% of the combined company, in each case on a fully-diluted basis. These percentages are calculated based on a number of assumptions and are subject to adjustment in accordance with the terms of the Merger Agreement.

Table of Contents

This proxy statement/prospectus covers the Pharma Two B ordinary shares issuable to the securityholders of Pharma Two B and Hepion as described above. Accordingly, Pharma Two B is registering the issuance of up to an aggregate of 7,504,902 Pharma Two B ordinary shares. This proxy statement/prospectus does not register the shares issuable in the PIPE Investment.

Proposals to approve the Merger Agreement and the other matters discussed in this proxy statement/prospectus will be presented at the special meeting of Hepion stockholders scheduled to be held on , 2024.

Although Pharma Two B is not currently a public reporting company, following the effectiveness of the registration statement of which this proxy statement/prospectus is a part and the closing of the Merger, Pharma Two B will become subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Pharma Two B intends to apply for listing of the Pharma Two B ordinary shares on Nasdaq under the proposed symbol “PHTB”, to be effective at the consummation of the Merger. It is a condition of the consummation of the Transactions that the Pharma Two B ordinary shares are approved for listing on Nasdaq (subject only to official notice of issuance thereof and round lot holder requirements). While trading on Nasdaq is expected to begin on the first business day following the date of completion of the Merger, there can be no assurance that Pharma Two B’s securities will be listed on Nasdaq or that a viable and active trading market will develop. If such listing condition is not met or if such confirmation is not obtained, the Merger will not be consummated unless the Nasdaq condition set forth in the Merger Agreement is waived by the applicable parties. See “Risk Factors” beginning on page 11 for more information.

Pharma Two B will be an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, and is therefore eligible to take advantage of certain reduced reporting requirements otherwise applicable to other public companies.

Pharma Two B will also be a “foreign private issuer” as defined in the Exchange Act and will be exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, Pharma Two B’s officers, directors and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions under Section 16 of the Exchange Act. Moreover, Pharma Two B will not be required to file periodic reports and financial statements with the U.S. Securities and Exchange Commission as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

The accompanying proxy statement/prospectus provides Hepion stockholders with detailed information about the Merger and other matters to be considered at the special meeting of Hepion stockholders. We encourage you to read the entire accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 11 of the accompanying proxy statement/prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the Merger, or determined if this proxy statement/prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2024, and is first being mailed to Hepion stockholders on or about , 2024.

Table of Contents

Notice of Special Meeting in lieu of Annual Meeting of Stockholders

of Hepion Pharmaceuticals, Inc.

To Be Held on , 2024

TO THE STOCKHOLDERS OF HEPION PHARMACEUTICALS, INC.:

NOTICE IS HEREBY GIVEN that a special meeting in lieu of annual meeting of stockholders of Hepion Pharmaceuticals, Inc., a Delaware corporation (“Hepion”), will be held at a.m. Eastern Time, on , 2024 (the “special meeting”).The special meeting will be a virtual meeting. You are cordially invited to attend and participate in the special meeting online by visiting https://annualgeneralmeetings.com/hepasp2024. The special meeting will be held for the following purposes:

1. Proposal No. 1 — The Merger Proposal — to consider and vote upon a proposal to approve and adopt the Agreement and Plan of Merger (“Merger Agreement”), dated July 19, 2024, by and among Hepion, Pharma Two B Ltd., a company organized under the laws of the State of Israel (“Pharma Two B”) and Pearl Merger Sub Inc., a Delaware corporation and indirect wholly-owned subsidiary of Pharma Two B (“Merger Sub”), a copy of which is attached to this proxy statement/prospectus as Annex A, and the transactions contemplated therein, including the merger of Merger Sub with and into Hepion, with Hepion surviving the merger (the “Merger”) whereby Merger Sub will merge with and into Hepion, with Hepion surviving the merger as an indirect subsidiary of Pharma Two B (the “Merger Proposal”);

2. Proposal No. 2 — The Adjournment Proposal — to consider and vote on any proposal to postpone or adjourn the special meeting, from time to time, to a later date or dates, if necessary or appropriate, including to solicit additional proxies if there are insufficient votes to adopt the Merger Agreement at the time of the special meeting (the “Adjournment Proposal”).

Hepion also will transact any other business as may properly come before the special meeting or any adjournment or postponement thereof.

The items of business listed above are more fully described elsewhere in the proxy statement/prospectus. Whether or not you intend to attend the special meeting, Hepion and Pharma Two B urge you to read the attached proxy statement/prospectus in its entirety, including the annexes and accompanying financial statements, before voting. IN PARTICULAR, HEPION AND PHARMA TWO B URGE YOU TO CAREFULLY READ THE SECTION IN THE PROXY STATEMENT/PROSPECTUS ENTITLED “RISK FACTORS.”

Only holders of record of shares of common stock of Hepion, par value $0.0001 per share (“Hepion Common Stock”) at the close of business on , 2024, (the “record date”) are entitled to notice of the special meeting and to vote and have their votes counted at the special meeting and any adjournments or postponements of the special meeting.

After careful consideration, Hepion’s board of directors has determined that each of the proposals listed is fair to and in the best interests of Hepion and its stockholders and recommends that you vote or give instruction to vote “FOR” each of the proposals set forth above. When you consider the recommendations of Hepion’s board of directors, you should keep in mind that Hepion’s directors and officers may have interests in the Merger that conflict with, or are different from, your interests as a stockholder of Merger. See the section entitled “Proposal One — The Merger Proposal — Interests of Certain Persons in the Merger.”

The closing of the Merger is conditioned on approval of the Merger Proposal.

All of Hepion’s stockholders are cordially invited to attend the special meeting, which will be held virtually over the Internet at https://annualgeneralmeetings.com/hepasp2024. To ensure your representation at the special meeting, however, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible. If you are a holder of record of Hepion Common Stock on the record date, you may also cast your vote at the special meeting. If your Hepion Common Stock is held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the special meeting, obtain a proxy from your broker or bank.

Table of Contents

A complete list of Hepion’s stockholders of record entitled to vote at the special meeting will be available for ten days before the special meeting at the principal executive offices of Hepion for inspection by its stockholders during business hours for any purpose germane to the special meeting.

Your vote is important regardless of the number of shares you own. Whether you plan to attend the special meeting virtually or not, please complete, sign, date and return the enclosed proxy card as soon as possible in the envelope provided. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly voted and counted.

If you have any questions or need assistance voting your Hepion Common Stock,

please call Hepion’s proxy solicitor, Campaign Management:

Strategic Stockholder Advisor and Proxy Solicitation Agent

15 West 38th Street, Suite #747, New York, New York 10018

North American Toll-Free Phone:

1-855-422-1042

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

This notice of special meeting is and the proxy statement/prospectus relating to the Merger will be available at https://annualgeneralmeetings.com/hepasp2024.

Thank you for your participation. We look forward to your continued support.

By Order of the Board of Directors

John Brancaccio

Interim Chief Executive Officer and Interim Chief Financial Officer

, 2024

IF YOU RETURN YOUR SIGNED PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

Table of Contents

i

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms a part of a registration statement on Form F-4 filed with the Securities and Exchange Commission (“SEC”) by Pharma Two B, constitutes a prospectus of Pharma Two B under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the Pharma Two B ordinary shares to be issued (or reserve for issuance) to Hepion securityholders in connection with the Merger. This document also constitutes a proxy statement of Hepion under Section 14(a) of the Exchange Act, and the rules thereunder, and a notice of meeting with respect to the special meeting of Hepion stockholders to consider and vote upon the proposals to adopt the Merger Agreement, to adjourn the meeting, if necessary, to permit further solicitation of proxies because there are not sufficient votes to adopt the Merger Agreement.

Unless otherwise indicated or the context otherwise requires, all references in this proxy statement/prospectus to the terms “Pharma Two B” and the “Company” refer to Pharma Two B Ltd., together with its subsidiaries. All references in this proxy statement/prospectus to “Hepion” refer to Hepion Pharmaceuticals, Inc.

ii

Table of Contents

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this proxy statement/prospectus concerning Pharma Two B’s industry and the regions in which it operates, including Pharma Two B’s general expectations and market position, market opportunity, market share and other management estimates, is based on information obtained from various independent publicly available sources and other industry publications, surveys and forecasts, which Pharma Two B believes to be reliable based upon its management’s knowledge of the industry Pharma Two B assumes liability for the accuracy and completeness of such information to the extent included in this proxy statement/prospectus. Such assumptions and estimates of Pharma Two B’s future performance and growth objectives and the future performance of its industry and the markets in which it operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements; Market, Ranking and Other Industry Data” and “Pharma Two B’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this proxy statement/prospectus.

iii

Table of Contents

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This document contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this proxy statement/prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE SPECIAL MEETING

The questions and answers below highlight only selected information set forth elsewhere in this proxy statement/prospectus and only briefly address some commonly asked questions about the special meeting and the proposals to be presented at the special meeting, including with respect to the proposed Merger. The following questions and answers do not include all the information that may be important to Hepion stockholders. Hepion stockholders are urged to carefully read this entire proxy statement/prospectus, including the annexes and the other documents referred to herein, to fully understand the proposed Merger and the voting procedures for the special meeting.

Q: Why am I receiving this proxy statement/prospectus?

A: Hepion and Pharma Two B have agreed to merge under the terms of the Merger Agreement that is described in this proxy statement/prospectus. A copy of the Merger Agreement is attached to this proxy statement/prospectus as Annex A, and Hepion encourages its stockholders to read it in its entirety. Hepion’s stockholders are being asked to consider and vote upon a proposal to approve the Merger Agreement, which, among other things, provides for Merger Sub to be merged with and into Hepion with Hepion being the surviving corporation in the Merger and becoming an indirect subsidiary of Pharma Two B, and the other Transactions contemplated by the Merger Agreement. See the section entitled “Proposal One — The Merger Proposal.”

Q: Are there any other matters being presented to stockholders at the meeting?

A: In addition to voting on the Merger Proposal, the stockholders of Hepion will be asked to consider and vote upon a proposal to adjourn the special meeting to a later date or dates, if necessary or appropriate, including to solicit additional proxies if there are insufficient votes to adopt the Merger Agreement.

Q: Who can attend the special meeting?

A: All Hepion stockholders of record at the close of business on , 2024 (the “Record Date”), or their duly appointed proxies, may attend the special meeting.

Q: What is the board of directors’ recommendation?

A: Hepion’s board of directors recommends that you vote FOR the approval of the Merger Proposal.

Q: What will happen to Hepion’s securities upon consummation of the Merger?

A: Hepion shall cause all of its issued capital stock that is not in the form of Hepion Common Stock to be converted into shares of Hepion Common Stock in accordance with Hepion’s organizational documents, and shall further cause any convertible instruments, including but not limited to warrants, to be converted into shares of Hepion Common Stock. At the Effective Time, on the terms and subject to the conditions set forth in the Merger Agreement, each share of Hepion Common Stock that is issued and outstanding immediately prior to the Effective Time shall, by virtue of the Merger, be converted into the right to receive such number of ordinary shares of Pharma Two B and shall no longer be outstanding and shall automatically be cancelled and shall cease to exist (the “Merger Consideration”).

The estimated Exchange Ratio (as defined in the Merger Agreement) calculation is 0.0014, whereby each share of Hepion Common Stock immediately prior to the Closing will be multiplied by the foregoing estimated Exchange Ratio, which is based upon Pharma Two B’s and Hepion’s capitalization immediately prior to the Effective Time, and will be adjusted based on the amount of Hepion Net Cash (as defined in the Merger Agreement), the terms and net proceeds from the PIPE Investment, and changes in the capitalization of Pharma Two B or Hepion prior to the Closing as described in the section titled “The Merger — Merger Consideration and Adjustment” of this proxy statement/prospectus. The foregoing material factors and assumptions may produce an Exchange Ratio that is slightly different than 0.0014, and may be between 0.0012 and 0.0017, which variation will affect the number of Pharma Two B Ordinary Shares issued to holders of Hepion Common Stock. If, for example, the Exchange Ratio is 0.0012, the number of Pharma Two B Ordinary Shares issuable to holders of Hepion Common Stock will be 12,167 Pharma Two B Ordinary Shares (i.e., 10,107,609 shares of Hepion Common Stock prior to the Effective Time multiplied by 0.0012), which represents 13% of the combined company’s fully diluted share capital (such that Pharma Two B’s existing securityholders will own approximately 87% of the combined company’s fully diluted share capital), or, alternatively, if the Exchange Ratio is 0.0017, the number of Pharma Two B Ordinary Shares issuable to

v

Table of Contents

holders of Hepion Common Stock will be 16,678 Pharma Two B Ordinary Shares (i.e., 10,107,609 shares of Hepion Common Stock prior to the Effective Time multiplied by 0.0017), which represents 17% of the combined company’s fully diluted share capital (such that Pharma Two B’s existing securityholders will own approximately 83% of the combined company’s fully diluted share capital). Accordingly, it is anticipated that, upon the Effective Time, Hepion’s existing public stockholders will own approximately 13% to 17% of the combined company’s fully diluted share capital and Pharma Two B’s existing securityholders will own approximately 83% to 87% of the combined company’s fully diluted share capital. These percentages are calculated based on a number of assumptions, including Pharma Two B’s and Hepion’s capitalization immediately prior to the Effective Time, and are subject to adjustments based on the amount of Hepion Net Cash (as defined in the Merger Agreement), the terms and net proceeds from the PIPE Investment, and changes in the capitalization of Pharma Two B or Hepion prior to the Closing, all in accordance with the terms of the Merger Agreement. Immediately after the consummation of the PIPE Investment, it is anticipated that Hepion’s existing securityholders will own approximately 7.8% of the combined company, Pharma Two B’s existing securityholders will own approximately 44.5% of the combined company, and the PIPE Investors will own approximately 47.7% of the combined company, in each case on a fully-diluted basis. These percentages are calculated based on a number of assumptions and are subject to adjustment in accordance with the terms of the Merger Agreement. See “Risk Factors — Risks Related to the Combined Company” for more information.

Q: Why is Hepion proposing the Merger?

A: Hepion’s board of directors conducted a review of multiple strategic alternatives to identify paths to provide value to its stockholders. Hepion’s board of directors believes consummating the Merger with Pharma Two B presents an excellent opportunity for Hepion’s stockholders to become a part of a company poised to file an New Drug Application (an “NDA”) in a therapeutic area to treat Parkinson’s disease patients. The combined company does not have any plans to continue the development of rencofilstat or any other pre-Merger assets of Hepion that will be acquired through the Merger.

Q: What is the Hepion private placement transaction and intercompany loan transaction with Pharma Two B?

A: Concurrently with the execution of the Merger Agreement, Hepion entered into privately negotiated transactions in which Hepion sold $2.9 million in principal amount of non-convertible senior notes to qualified institutional investors. These notes are unsecured, interest-free, and were issued with an aggregate $400,000 original issue discount, and mature at the earlier of: (i) December 31, 2024; (ii) the closing of Merger; or (iii) the termination of Merger pursuant to terms of Merger Agreement. Hepion also loaned $600,000 of the proceeds to Pharma Two B through a non-convertible unsecured note that bears nominal interest and matures on the same terms as the notes issued in the private placement with qualified institutional investors, but which will be forgiven and cancelled upon consummation of the Merger. The purpose of this intercompany loan was to provide Pharma Two B with sufficient working capital to continue its operations and consummate the Merger. In connection with the purchase of the notes, the investors received 1,159,245 shares of Hepion Common Stock, or approximately 19.99% of Hepion’s outstanding common stock immediately prior to the issuance.

Q: What is the “PIPE” transaction?

A: On July 19, 2024, concurrently with the execution of the Merger Agreement, Pharma Two B and the PIPE Investors entered into a Securities Purchase Agreement, providing for the purchase by the PIPE Investors immediately after consummation of the Merger, of an aggregate of 2,254,902 Pharma Two B ordinary shares (or pre-funded warrants in lieu thereof) together with the issuance of 2,254,902 Series A warrants to purchase Pharma Two B ordinary shares and 2,254,902 Series B warrants to purchase Pharma Two B ordinary shares, after giving effect to a 78.34-for-one forward stock split of Pharma Two B’s ordinary shares that it intends to effect after consummation of the Merger, for an aggregate amount of $11,500,000. The closing of the PIPE Investment is conditioned upon the closing of the Merger as well as certain other conditions. The Series A warrants will have a 5-year term, and an exercise price of $6.00 per ordinary share (after giving effect to the Share Split). The Series B warrants will have a 2.5-year term, and an exercise price of $6.00 per ordinary share (after giving effect to the Share Split). The warrants will have customary anti-dilution adjustments as well as anti-dilution price protection and share adjustment features, subject to a floor price of 20% of the initial exercise price per share, as well as a cash true up feature, in each case subject to certain limitations. Pharma Two B has agreed to register for resale the shares (including shares underlying the warrants) to be issued in the concurrent private financing. The

vi

Table of Contents

actual number of ordinary shares (or pre-funded warrants in lieu thereof) and shares underlying the accompany Series A warrants and Series B warrants to be issued in the PIPE Investment is not yet determinable and will depend on the actual number of ordinary shares issued and outstanding immediately following consummation of the Merger. However, it is anticipated that, upon completion of the Merger, Hepion’s existing securityholders will own approximately 7.8% of the combined company, Pharma Two B’s existing securityholders will own approximately 44.5% of the combined company, and the PIPE Investors will own approximately 47.7% of the combined company, in each case on a fully-diluted basis. These percentages are calculated based on a number of assumptions and are subject to adjustment in accordance with the terms of the Merger Agreement.

The combined company plans to use the proceeds from the PIPE transaction to fund additional process development work to the P2B001 manufacturing process, including characterization of critical process parameters and scale up necessary to support the NDA submission to the U.S. Food and Drug Administration (“FDA”) in the first half of 2026.

Q: Did Hepion’s board of directors obtain a third-party valuation or fairness opinion in determining whether or not to proceed with the Merger?

A: Yes. Hepion’s board of directors obtained a fairness opinion from ValueScope Inc. (for more information see “The Merger Agreement — Summary of Opinion of ValueScope, Inc. as Financial Advisor to Hepion”).

Q: Do I have appraisal rights if I object to the proposed Merger?

A: In connection with the Merger, Hepion’s stockholders will have no appraisal rights under Delaware General Corporate Law because shares of Hepion Common Stock will remain listed on Nasdaq prior to the closing of the Merger, and, as a closing condition of the Merger, Pharma Two B’s ordinary shares will be approved for listing on Nasdaq concurrently with the closing of the Merger.

Q: What happens if the Merger is not consummated?

A: If Hepion does not complete the Merger with Pharma Two B for whatever reason, Hepion’s stockholders will not receive any consideration for their shares of Hepion Common Stock. Instead, Hepion will remain an independent public company and Hepion Common Stock will continue to be listed and traded separately on Nasdaq (subject to Hepion’s compliance with Nasdaq’s continued listing standards).

Q: How do the officers and directors of Hepion intend to vote on the proposals?

A: Hepion’s officers and directors, beneficially own and are entitled to vote an aggregate of approximately % of the outstanding Hepion Common Stock. These holders have agreed to vote their shares in favor of the Merger Proposal. These holders have also indicated that they intend to vote their shares in favor of all other proposals being presented at the meeting. In addition to the shares of Hepion Common Stock held by Hepion’s officers and directors, Hepion would need shares, or approximately %, of the public shares to be voted in favor of the Merger Proposal and other proposal in order for them to be approved.

Q: What interests do the current officers and directors of Hepion have in the Merger?

A: In considering the recommendation of Hepion’s board of directors to vote in favor of the Merger, stockholders should be aware that, aside from their interests as stockholders, certain of Hepion’s directors and officers have interests in the Merger that are different from, or in addition to, those of other stockholders generally. Hepion’s directors were aware of and considered these interests, among other matters, in evaluating the Merger, in recommending to stockholders that they approve the Merger and in agreeing to vote their shares in favor of the Merger. Stockholders should take these interests into account in deciding whether to approve the Merger. These interests include, among other things, the fact that:

i. Each of Timothy Block and Michael Purcell will continue as directors of the combined company after the Effective Time, and, following the closing of the Merger, will be eligible to be compensated as a non-employee director of the combined company pursuant to the non-employee director compensation policy that will be in place following the Effective Time of the Merger; and

ii. Pursuant to the Merger Agreement, Hepion’s directors and executive officers are entitled to continued indemnification, expense advancement and insurance coverage.

vii

Table of Contents

Q: When do you expect the Merger to be completed?

A: It is currently anticipated that the Merger will be consummated promptly following the Hepion special meeting, which is set for , 2024. The closing of the Merger pursuant to the Merger Agreement (the “Closing”) is also subject to the approval of the holders of Pharma Two B ordinary shares, as well as other customary closing conditions. For a description of the conditions for the completion of the Merger, see the section entitled “The Merger Agreement — Conditions to Closing of the Transactions.”

Q: Who will be the executive officers and directors of the combined company and how are they being selected?

A: Dan Teleman, the current Chief Executive Officer of Pharma Two B, will remain in place as Chief Executive Officer of the combined company. Mr. Teleman has served as Pharma Two B’s Chief Executive Officer since May 2023 and prior to his appointment he served as its President. Mr. Teleman brings over 20 years of experience in the biotechnology industry.

Shai Lankry will serve as the combined company’s Chief Financial Officer. Mr. Lankry previously served as Chief Financial Officer of Gamida Cell Ltd. (Nasdaq: GMDA) among other public companies.

According to the Merger Agreement, Pharma Two B has the right to appoint three of the combined company’s directors, in addition to the right to appoint two industry experts as directors, and Hepion has the right to appoint the remaining two directors. Pharma Two B’s three director designees are Dan Teleman, Jeffrey Berkowitz and Ron Cohen; the industry experts designated by Pharma Two B will be Gwen Melincoff and Edward Saltzman; and Hepion’s director designees will be Timothy Block and Michael Purcell. For additional information, please see the section titled “Management Following the Merger — Compensation of Directors and Executive Officers” below.

Q: What do I need to do now?

A: Hepion urges you to carefully read and consider the information contained in this proxy statement/prospectus, including the annexes, and to consider how the Merger will affect you as a stockholder and/or a warrant holder of Hepion. Stockholders should then vote as soon as possible in accordance with the instructions provided in this proxy statement/prospectus and on the enclosed proxy card.

Q: May I attend the special meeting and vote at the special meeting?

A: Yes. You may attend the special meeting via a live interactive webcast on , 2024, at Eastern Time, by visiting the following website: https://annualgeneralmeetings.com/hepasp2024. Online check-in will begin at , Eastern Time, and you should allow ample time for the check-in procedures. You will need the 16-digit control number included on your proxy card or voting instruction form that accompanied your proxy materials to participate in the special meeting (including voting your shares). If you lose your control number, you may join the special meeting as a guest, but you will not be able to vote. Hepion believes that a virtual meeting provides expanded access, improved communication and cost savings for its stockholders.

Even if you plan to attend the special meeting, to ensure that your shares will be represented at the special meeting, please sign, date and return the enclosed proxy card (a prepaid reply envelope is provided for your convenience) or grant your proxy electronically over the internet or by telephone (using the instructions found on the proxy card). If you attend the special meeting and vote at the special meeting, your vote will revoke any proxy previously submitted.

Q: What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

A: If your shares are registered in your name with Hepion’s transfer agent, Pacific Stock Transfer Company, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by Hepion.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the special meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

viii

Table of Contents

Q: How do I vote?

A: Stockholders of Record

For your convenience, record holders of Hepion Common Stock have three methods of voting:

1. Vote by Internet. The website address for Internet voting is on your proxy card.

2. Vote by Mail. Mark, date, sign and promptly mail the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States).

3. Vote at special meeting. You may vote by virtually attending the special meeting and submitting a ballot via the special meeting webcast.

Beneficial Owners of Shares Held in Street Name

For your convenience, beneficial owners of Hepion Common Stock have three methods of voting:

1. Vote by Internet. The website address for Internet voting is on your vote instruction form.

2. Vote by Mail. Mark, date, sign and promptly mail your vote instruction form (a postage-paid envelope is provided for mailing in the United States).

3. Vote at special meeting. Obtain a valid legal proxy from the organization that holds your shares and attend and vote by virtually attending the special meeting and submitting a ballot via the special meeting webcast.

If you vote by Internet, please DO NOT mail your proxy card.

All shares entitled to vote and represented by a properly completed and executed proxy received before the special meeting and not revoked will be voted at the special meeting as instructed in a proxy delivered before the special meeting. If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed and executed proxy will be voted as Hepion’s board of directors recommends on each of the enumerated proposals, with regard to any other matters that may be properly presented at the special meeting and on all matters incident to the conduct of the special meeting. If you are a record holder and desire to vote, you may deliver your properly completed proxy card prior to the special meeting, or you may virtually attend the special meeting and submit a ballot via the special meeting webcast. If you are a street name stockholder and wish to vote at the special meeting, you will need to obtain a proxy form from the institution that holds your shares. All votes will be tabulated by the inspector of elections appointed for the special meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Q: If my shares are held in “street name,” will my broker, bank or nominee automatically vote my shares for me?

A: No. If you hold your shares in “street name,” you should contact your broker, bank or nominee to ensure that votes related to the shares you beneficially own are properly voted and counted. In this regard, you must provide the broker, bank or nominee with instructions on how to vote your shares or, if you wish to attend the virtual special meeting and vote through the web portal, obtain a legal proxy from your broker, bank or nominee.

Q: May I change my vote after I have mailed my signed proxy card?

A: Yes. You may revoke your proxy and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of Hepion, by delivering a properly completed, later-dated proxy card or by virtually attending the special meeting and submitting a ballot through the web portal during the special meeting webcast. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: 399 Thornall Street, First Floor, Edison, NJ 08837, Attention: Secretary, or by facsimile at 732-902-4100. Your most current proxy card or Internet proxy is the one that will be counted.

If you hold your shares in “street name,” you should contact your broker, bank or nominee to change your instructions on how to vote. If you hold your shares in “street name” and wish to virtually attend the special meeting and vote through the web portal, you must obtain a legal proxy from your broker, bank or nominee.

ix

Table of Contents

Q: What constitutes a quorum for the special meeting?

A: To carry on business at the special meeting, Hepion must have a quorum. A quorum is present when one-third (1/3) of the shares entitled to vote as of the Record Date, are represented in person or by proxy. Thus, shares must be represented in person or by proxy to have a quorum at the special meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person virtually at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by Hepion are not considered outstanding or considered to be present at the special meeting. If there is not a quorum at the special meeting, either the chairperson of the special meeting or Hepion stockholders entitled to vote at the special meeting may adjourn the special meeting.

Q: What stockholder vote thresholds are required for the approval of each proposal brought before the special meeting?

A: The vote required to approve the Merger Proposal assumes the presence of a quorum.

Proposal | | Votes Required | | Effects of Abstentions and Broker

Non-Votes |

The Merger Proposal | | The affirmative vote of holders of a majority of the outstanding shares of Hepion stock. | | Abstentions and broker non-votes will have the same effect as a vote AGAINST the proposal. |

The Adjournment Proposal | | The affirmative vote of a majority of the voting power of the shares cast for or against this Proposal. | | Abstentions and broker non-votes will have no effect. |

Q: How are votes counted?

A: Votes will be counted by the inspector of election appointed for the special meeting, who will separately count with respect to the Merger Proposal votes “FOR” and “AGAINST,” abstentions and broker non-votes.

Q: What is a broker non-vote?

A: If your shares are held in street name, you must instruct the organization who holds your shares how to vote your shares. If you sign your proxy card but do not provide instructions on how your broker should vote on “routine” proposals, your broker will vote your shares as recommended by the Board. If you do not provide voting instructions, your shares will not be voted on any “non-routine” proposals. This is called a “broker non-vote.” All of the Proposals are “non-routine” matters and a bank, broker or other nominee will lack the authority to vote shares at its discretion on the Proposals. As a result, broker non-votes may exist in connection with the Proposals. Under Delaware law, broker non-votes are counted as shares present and entitled to vote at the special meeting for purposes of achieving quorum. Additionally, because the affirmative vote of a majority of the outstanding shares of Hepion stock is required to approve the Merger Proposal, a broker non-vote will have the effect of a vote against such matters.

Q: What is an abstention?

A: An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote at the special meeting for purposes of achieving quorum.

Additionally, because the affirmative vote of a majority of the outstanding shares of Hepion Common Stock is required to approve the Merger Proposal, an abstention will have the effect of a vote against such matters.

Q: Does my vote matter?

A: Yes, your vote is very important. Hepion and Pharma Two B cannot complete the Merger without the approval of the Merger Proposal.

x

Table of Contents

Q: What happens if I fail to take any action with respect to the special meeting?

A: If you fail to take any action with respect to the meeting and the Merger is approved by Hepion’s stockholders and consummated, you will become a shareholder of Pharma Two B.

If you fail to take any action with respect to the special meeting and the Merger is not approved, you will continue to be a stockholder and/or warrant holder of Hepion, as applicable.

Q: What should I do with my share and/or warrant certificates?

A: If the Merger is consummated, further instructions will be provided to you regarding how the exchange of Hepion Common Stock for Pharma Two B shares will be effected, if necessary.

Q: What should I do if I receive more than one set of voting materials?

A: Stockholders may receive more than one set of voting materials, including multiple copies of this proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your shares of Hepion Common Stock.

Q: Who can help answer my questions?

A: If you have questions about the Merger or if you need additional copies of this proxy statement/prospectus or the enclosed proxy card, you should contact Hepion’s proxy solicitor, Campaign Management, at:

Strategic Stockholder Advisor and Proxy Solicitation Agent

15 West 38th Street, Suite #747, New York, New York 10018

North American Toll-Free Phone:

1-855-422-1042

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

You may also obtain additional information about Hepion from documents filed with the SEC by following the instructions in the section entitled “Where You Can Find More Information.”. If you have questions regarding the certification of your position or delivery of your stock, please contact: Hepion’s transfer agent, Pacific Stock Transfer at (702) 361-3033.

xi

Table of Contents

SUMMARY

This summary highlights selected information from this proxy statement/prospectus. It may not contain all of the information that is important to you. You should carefully read the entire proxy statement/prospectus and the other documents referred to in this proxy statement/prospectus, including the annexes, to fully understand the Merger Agreement, the Merger and the other matters being considered at the special meeting of Hepion stockholders. For additional information, see “Where You Can Find More Information” beginning on page 234. Each item in this summary refers to the page of this proxy statement/prospectus on which that subject is discussed in more detail.

The Parties to the Merger

Pharma Two B Ltd.

Pharma Two B is a late clinical-stage pharmaceutical company focused on developing innovative, value-added combination products of previously approved oral drugs to enhance current treatment options for neurological disorders.

Pharma Two B’s lead product candidate, P2B001, is a combined product designed to provide significant clinical benefits, improved tolerability through diminished side effects, and enhanced convenience and adherence for people with Parkinson’s disease (“Parkinson’s”). Parkinson’s is a progressive neurodegenerative disorder that impairs the brain’s ability to control movement and coordination, and it is one of the fastest-growing neurodegenerative disorders globally, particularly due to the world’s aging population. As of 2020, nearly one million people in the United States and more than 10 million worldwide, are estimated to be affected by Parkinson’s, according to the Parkinson’s Foundation (2020).

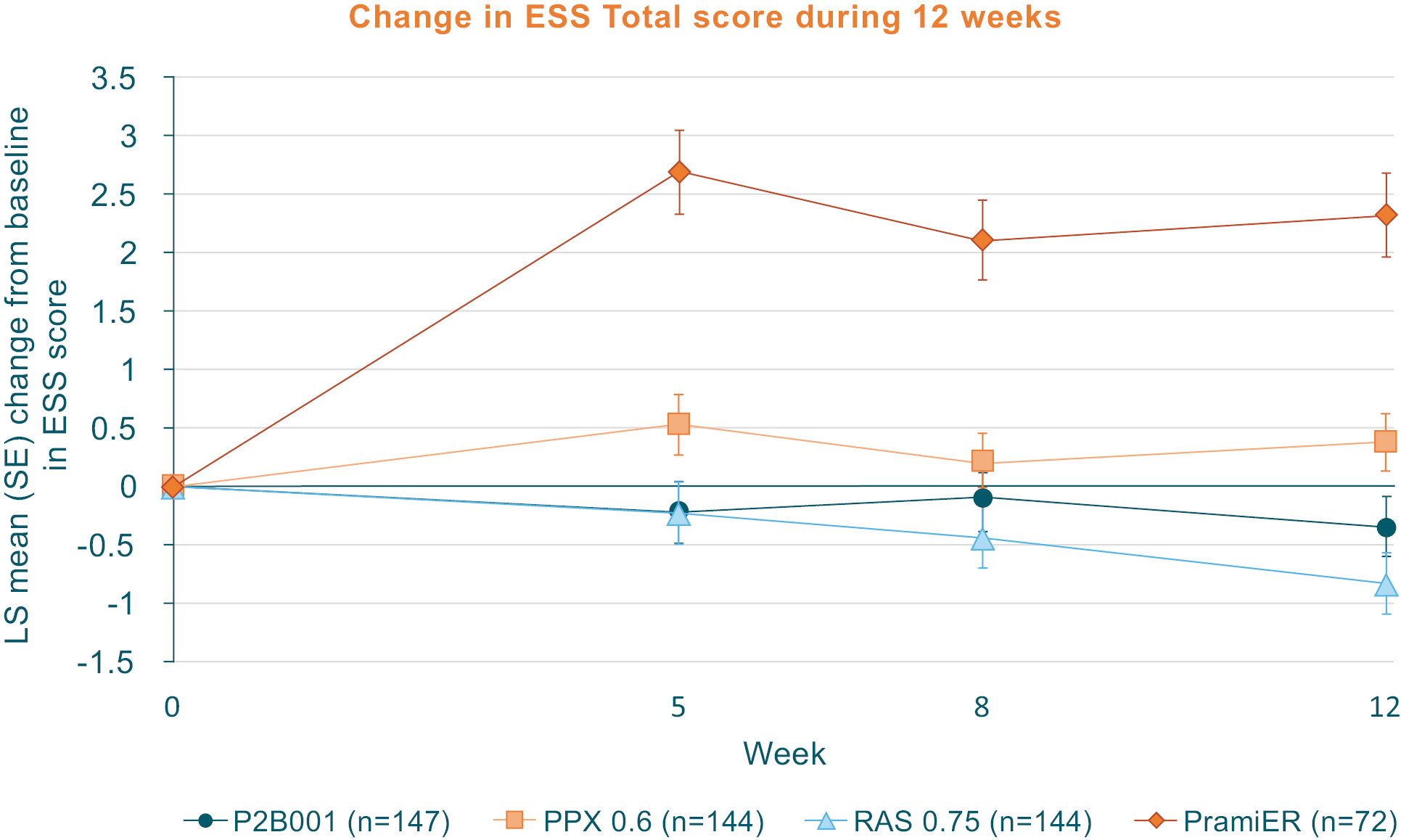

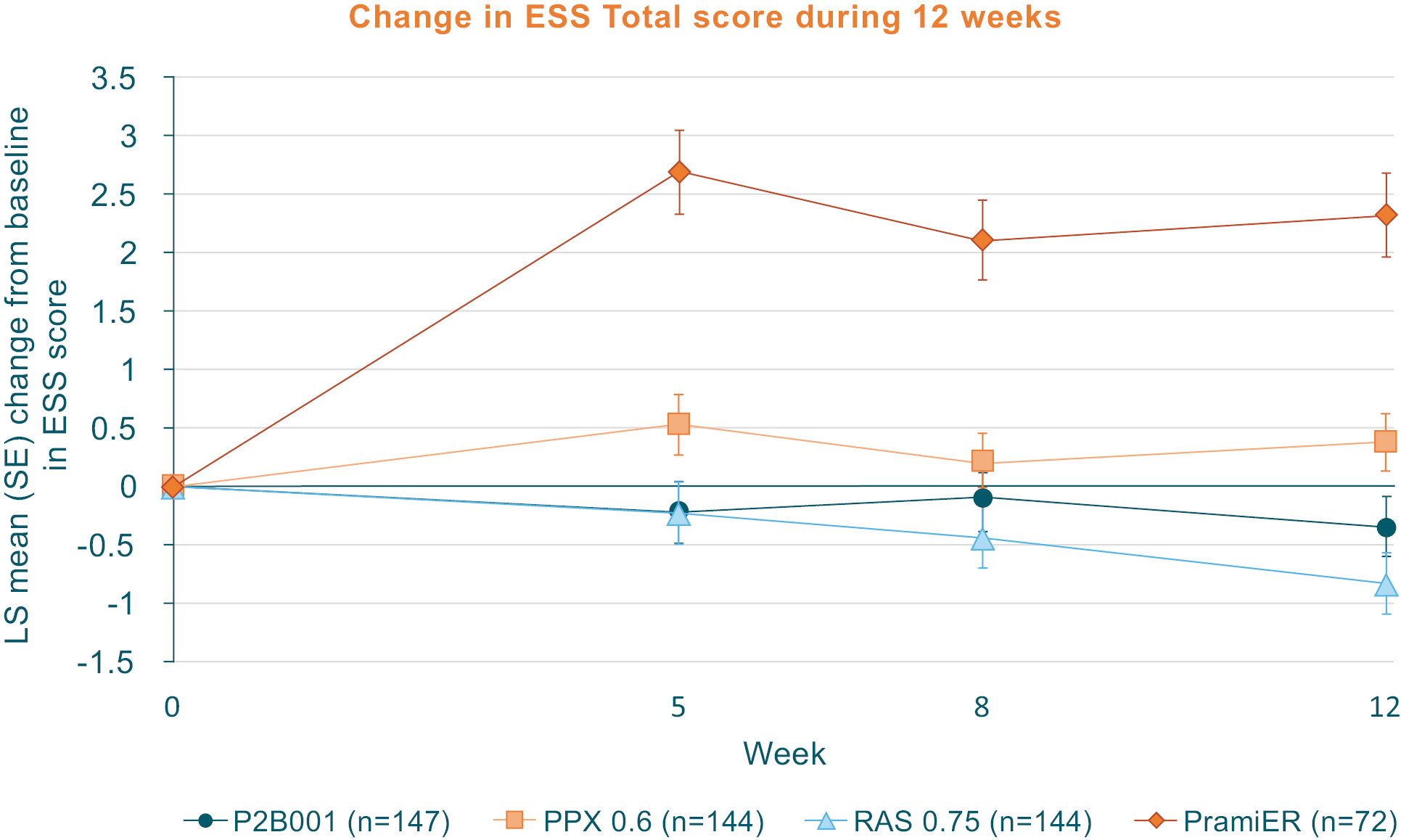

Current early Parkinson’s disease treatments, including Levodopa (“L-DOPA”), Dopamine Agonists (“DA”), and Monoamine Oxidase B Inhibitors (“MAO-B inhibitors”), often lead to debilitating side effects such as nausea, hallucinations, somnolence, and dyskinesia, which each significantly impact patient quality of life (AAAN 2022). Due to the progressive nature of Parkinson’s and the need to manage multiple symptoms, many patients require the use of several medications concurrently in order to achieve adequate symptom control (Mouchaileh 2020). However, certain research has indicated that this approach not only exacerbates side effects but also increases the treatment costs for patients, with monthly prescriptions ranging from $300 to $1,000. The need for treatment options that reduce side effects while also reducing costly multi-prescription treatments presents a significant market opportunity for innovative therapies that can provide effective symptom management with fewer side effects at lower costs.

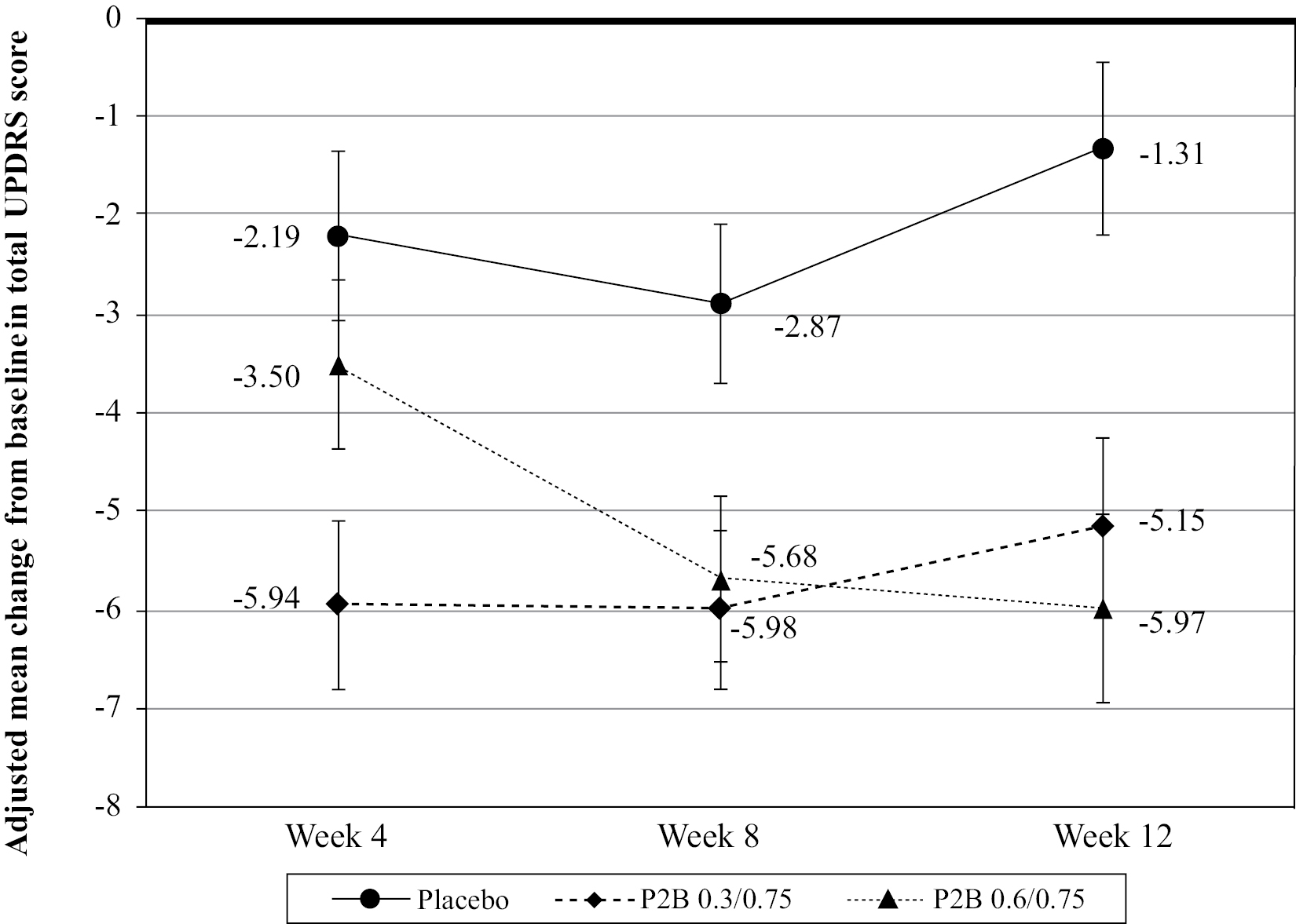

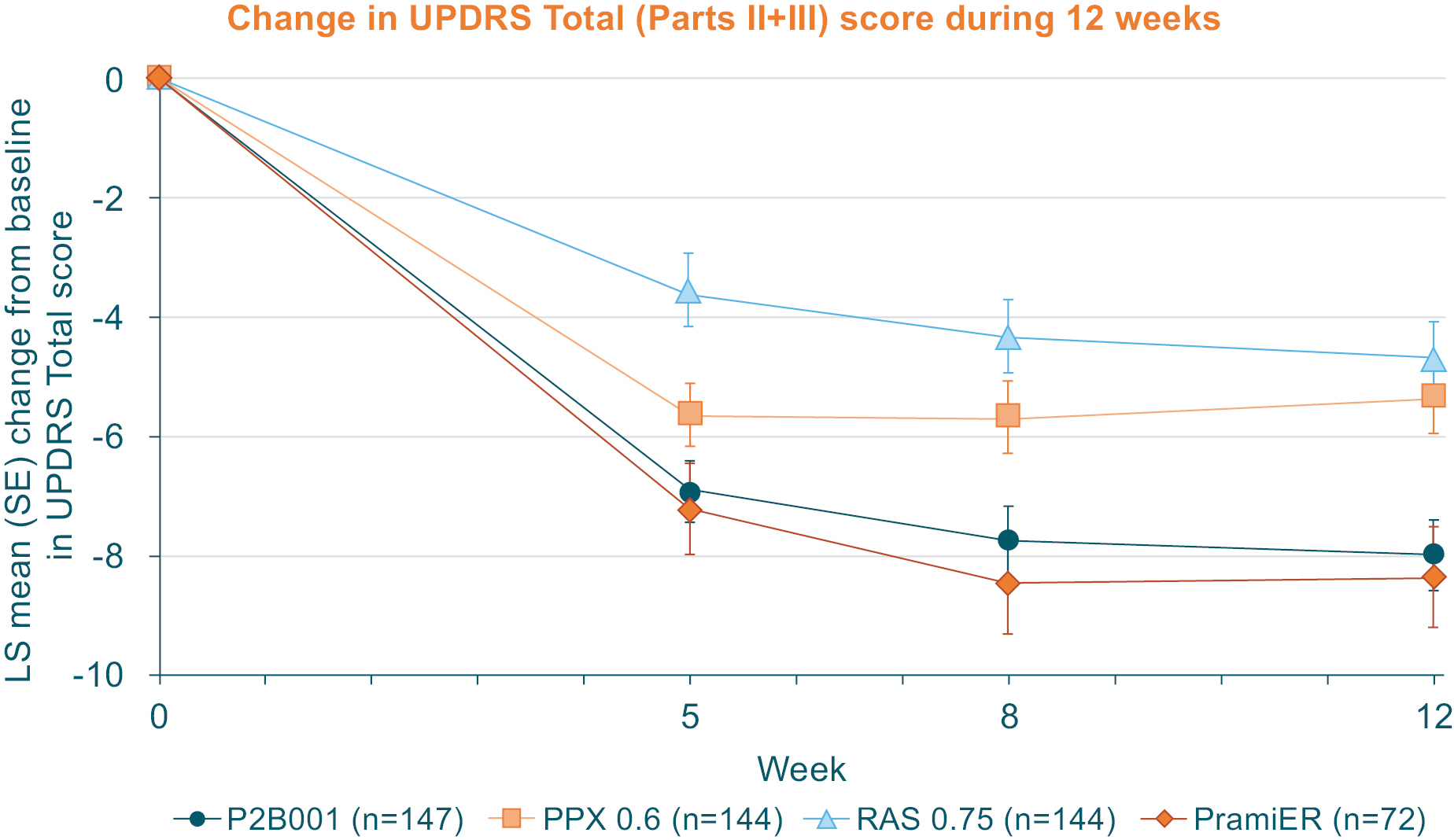

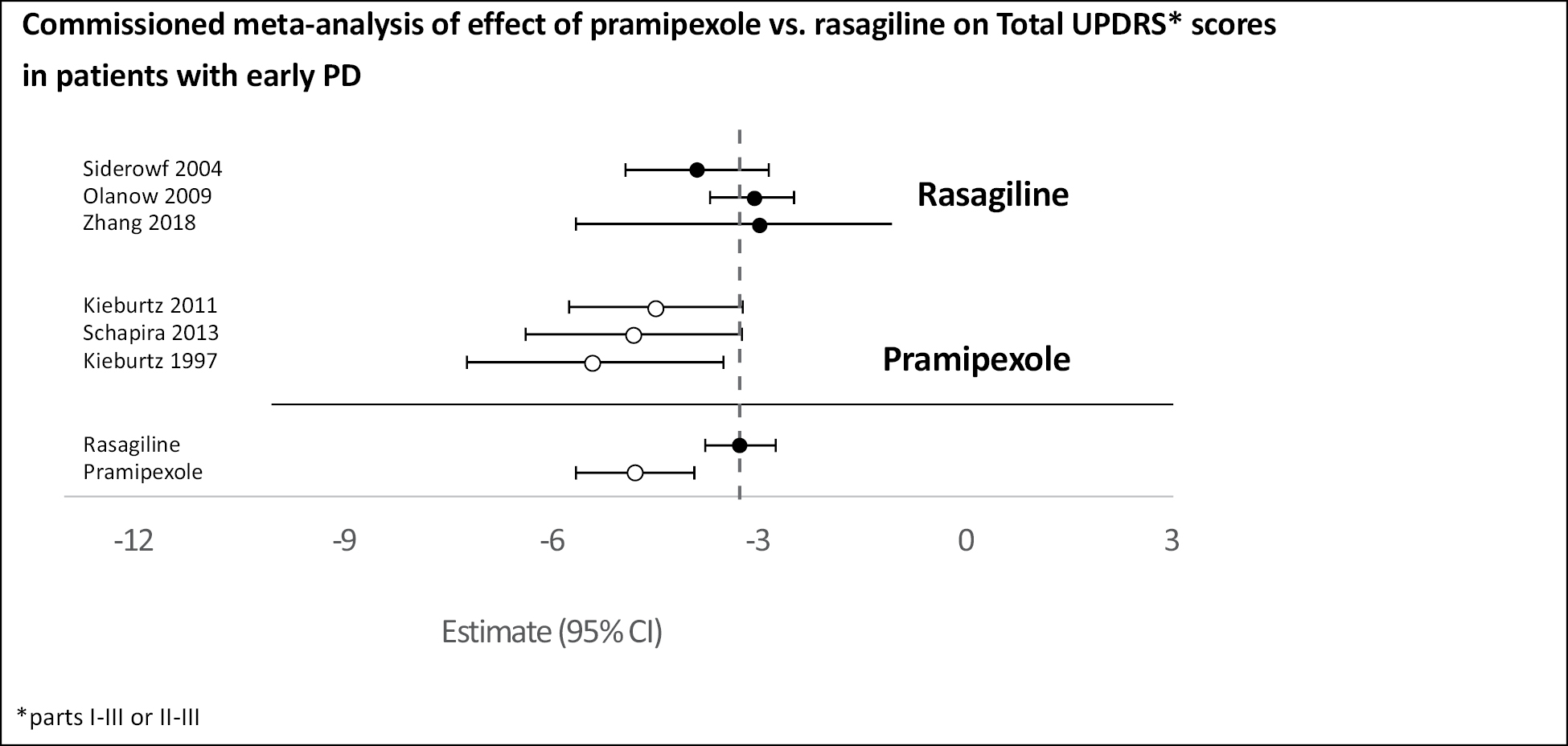

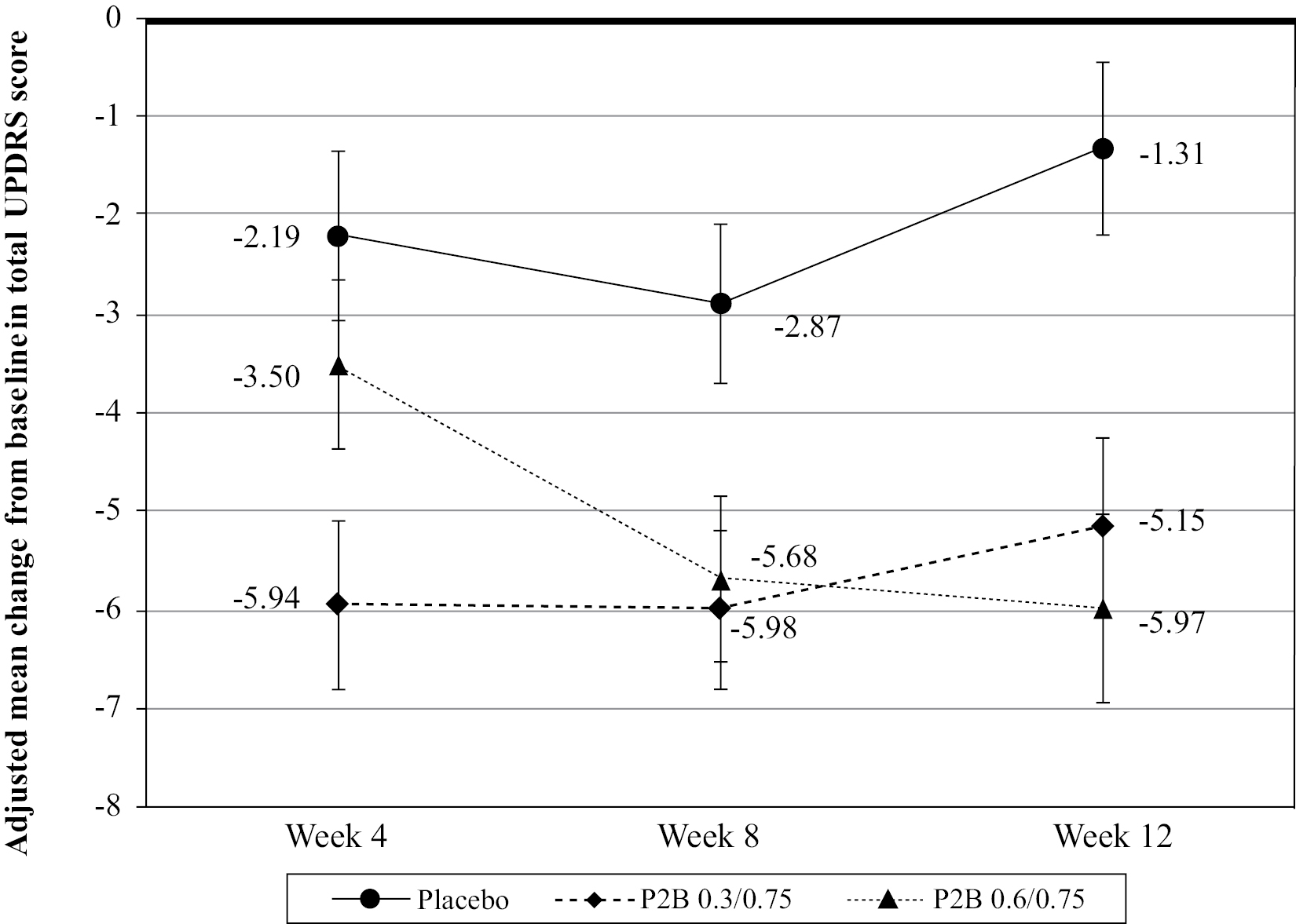

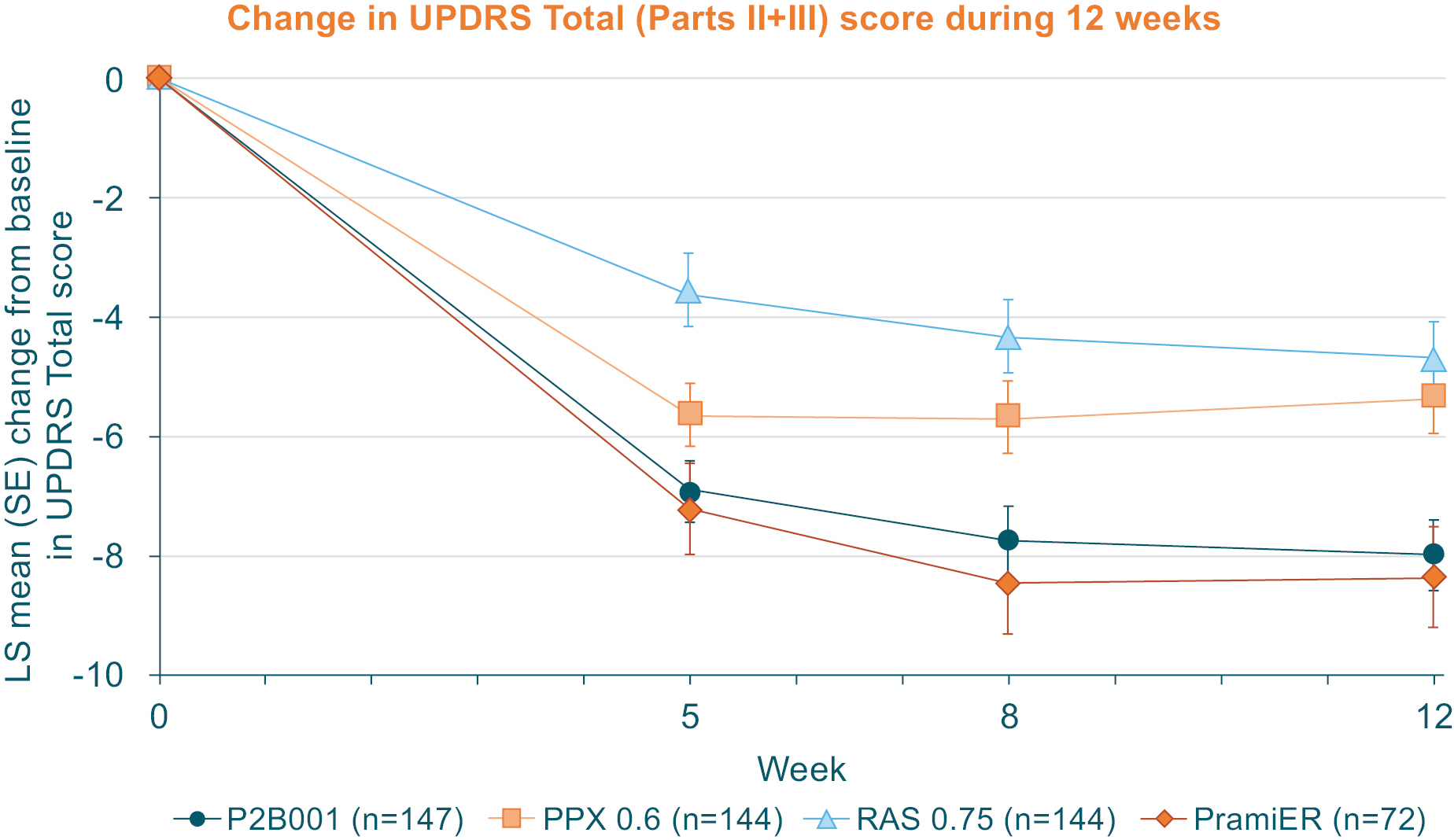

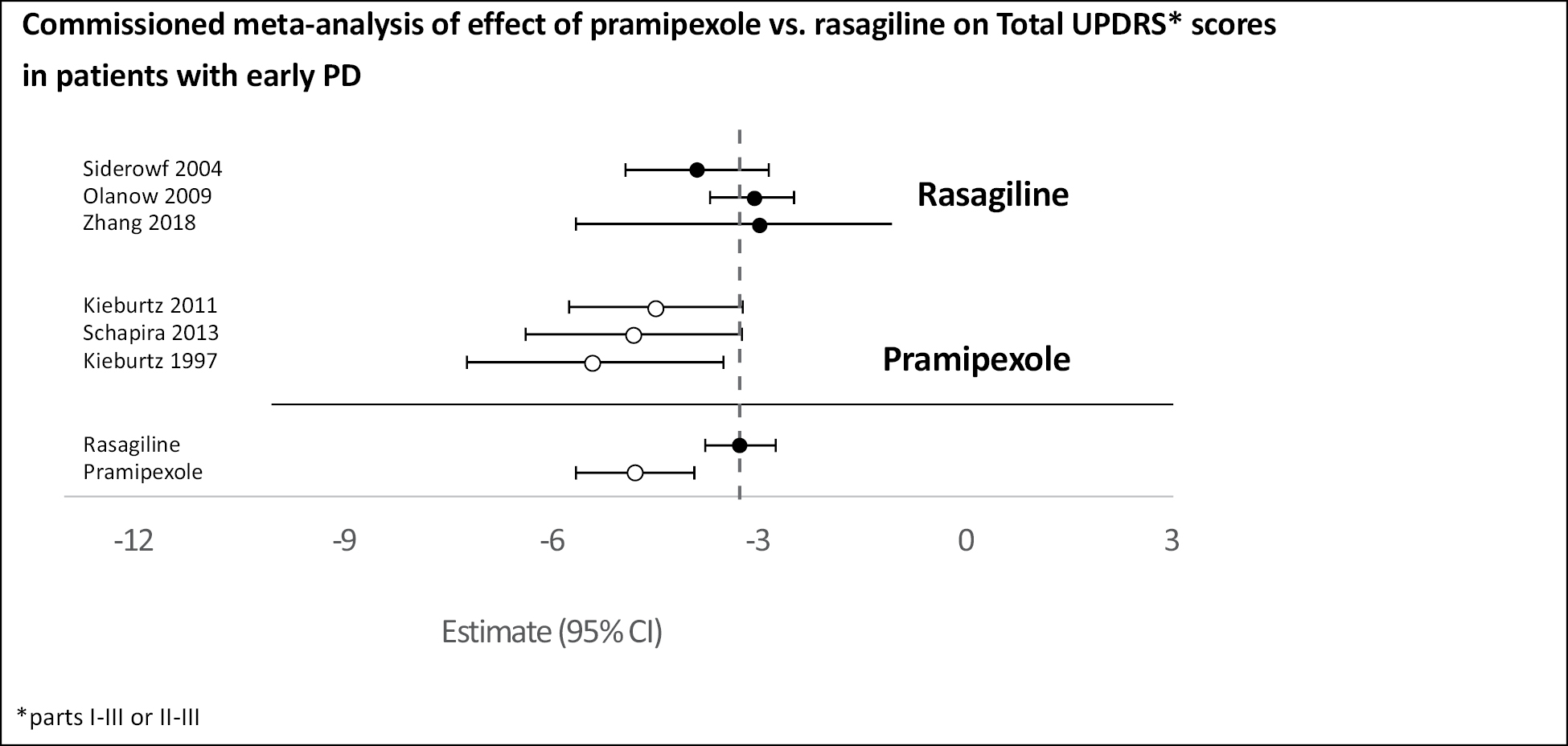

To address the foregoing challenges presented by current Parkinson’s treatments, Pharma Two B has developed P2B001, a novel, once-a-day oral therapy, that requires no titration and has a lower incidence of excessive daytime sleepiness, a commonly reported side effect among people with Parkinson’s, often caused by dopamine agonist treatment. Specifically, P2B001 is an extended-release (“ER”) capsule that combines a low-dose of DA, Pramipexole ER, with a low-dose of MAO-B inhibitor, Rasagiline ER. By administering both ER drugs in a single daily capsule, P2B001 has the potential to offer additive mechanisms of action that sustain clinical activity while minimizing side effects over an extended period.

Pharma Two B has successfully completed a Phase 3 clinical trial for P2B001 involving 544 Parkinson’s patients across 70 leading Parkinson’s centers in the United States, Europe, and Canada. This success builds on a positive Phase 2b study with 149 patients and earlier encouraging results from non-clinical studies. Data from both the Phase 2b and Phase 3 studies demonstrated that P2B001 achieved statistically significant and clinically meaningful outcomes with a low incidence of serious side effects. Following the completion of manufacturing process enhancement, Pharma Two B’s goal is to submit P2B001 for approval to the FDA during the first half of 2026. If Pharma Two B is successful and receives the necessary regulatory approvals, it believes that its commercialization in the United States presents a lucrative market opportunity consisting of DAs and MAO-B inhibitors, representing approximately $2.4 billion by 2029.

1

Table of Contents

Hepion Pharmaceuticals, Inc.

Hepion is a biopharmaceutical company headquartered in Edison, New Jersey, previously focused on the development of drug therapy for treatment of chronic liver diseases. This therapeutic approach targets fibrosis, inflammation, and shows potential for the treatment of hepatocellular carcinoma (“HCC”) associated with non-alcoholic steatohepatitis (“NASH”), viral hepatitis, and other liver diseases. Hepion’s cyclophilin inhibitor, rencofilstat (formerly CRV431), was being developed to offer benefits to address multiple complex pathologies related to the progression of liver disease.

Hepion has completed a number of Phase 1 and Phase 2 clinical trials. In May 2023, Hepion announced that its Phase 2a study (“ALTITUDE-NASH”) met its primary endpoint by demonstrating improved liver function and was well tolerated after four months of treatment with once daily oral rencofilstat administered to NASH subjects with stage 3 or greater fibrosis. All additional secondary efficacy and safety endpoints were also met. These observations provide further evidence that builds on previous findings from a shorter 28-day Phase 2a (“AMBITION”) trial. Taken together, the AMBITION and ALTITUDE-NASH trials reinforced rencofilstat’s direct antifibrotic mode of action and increase Hepion’s confidence level that it anticipated observing fibrosis reductions in its 12-month Phase 2b (“ASCEND-NASH”) clinical trial.

In December 2023, Hepion’s board of directors approved a strategic restructuring plan to preserve capital by reducing operating costs. Additionally, Hepion initiated a process to explore a range of strategic and financing alternatives focused on maximizing stockholder value within the current financial environment and NASH drug development landscape. On April 19, 2024, Hepion announced that it had begun wind-down activities in its ASCEND-NASH clinical trial. Hepion did not have access to sufficient funding to complete the study, as designed. The wind-down activities were implemented to halt further clinical activities other than those which would allow for an orderly and patient safety manner that would meet the minimum FDA requirements for safely closing a clinical trial.

Hepion is continuing efforts, to the extent that cash is available, to provide any value derived from rencofilstat to its stockholders.

The combined company does not have any plans to continue the development of rencofilstat or any other pre-Merger assets of Hepion that will be acquired through the Merger.

Pearl Merger Sub, Inc.

Merger Sub is a newly formed Delaware corporation and an indirect subsidiary of Pharma Two B. Merger Sub was formed solely for the purpose of effecting the Merger and has not carried on any activities other than those in connection with the Merger.

The Merger Agreement (page 100)

The terms and conditions of the merger of Merger Sub with and into Hepion, with Hepion surviving the merger as a wholly owned subsidiary of Pharma Two B are contained in the Merger Agreement, which is attached as Annex A to this proxy statement/prospectus. We encourage you to read the Merger Agreement carefully, as it is the legal document that governs the Merger.

Merger Consideration

On the Closing Date (as defined in the Merger Agreement), subject to obtaining Pharma Two B’s shareholder approval and Hepion’s stockholder approval, immediately prior to the Effective Time and prior to the consummation of any of the transactions contemplated by the PIPE Agreements (as defined in the Merger Agreement), the following actions shall take place or be effected: (A) Hepion shall cause all of its issued capital stock that is not in the form of Hepion Common Stock to be converted into shares of Hepion Common Stock in accordance with Hepion’s organizational documents, and shall further cause any convertible instruments, including but not limited to warrants, to be converted into shares of Hepion Common Stock; and (B) (i) each Ordinary A Share of Pharma Two B, nominal value NIS 1 (“Pharma Two B Ordinary A Share”), Ordinary B Share of Pharma Two B, nominal value NIS 1 (“Pharma Two B Ordinary B Share”), and each of the outstanding classes of Pharma Two B’s preferred shares (collectively, the “Pharma Two B Preferred Share”) that is issued and outstanding immediately prior to the Effective Time shall be automatically converted into such number of Pharma Two B’s ordinary shares per the terms of the Merger Agreement; (ii) the amended and restated articles of association of Pharma Two B shall be adopted and become effective (the “Pharma Two B Articles”); (iii) each of Pharma Two B’s ordinary shares, issued and outstanding immediately prior to the Effective Time

2

Table of Contents

(including each of Pharma Two B’s ordinary shares that are issued upon the conversion of Pharma Two B Ordinary A Shares, Pharma Two B Ordinary B Shares and Pharma Two B Preferred Shares pursuant to clause (i) above), shall be split in accordance with the Share Split; provided that no fraction of a Pharma Two B’s ordinary share will be issued by virtue of the Share Split, and each of Pharma Two B’s shareholders that would otherwise be so entitled to a fraction of Pharma Two B’s ordinary shares (after aggregating all fractional Pharma Two B’s ordinary shares that otherwise would be received by such Pharma Two B’s shareholder) shall instead be entitled to receive such number of Pharma Two B’s ordinary shares to which such Pharma Two B’s shareholder would otherwise be entitled, rounded to the nearest whole number; and (iv) any outstanding options and warrants of Pharma Two B issued and outstanding immediately prior to the Effective Time shall be adjusted immediately upon the Share Split to give effect to the foregoing transactions, provided that to the extent such adjustment would result in (x) a fraction of share being subject to any outstanding stock option or warrant, such share shall be rounded down to the nearest whole share or (y) the exercise price of an option being a fraction of a cent, the exercise price will be rounded up to the nearest whole cent.

At the Effective Time, on the terms and subject to the conditions set forth in the Merger Agreement, each share of Hepion Common Stock that is issued and outstanding immediately prior to the Effective Time shall, by virtue of the Merger, be converted into the right to receive such ordinary shares of Pharma Two B and shall no longer be outstanding and shall automatically be canceled and shall cease to exist (the “Merger Consideration”).

Additionally, each share of common stock of Merger Sub that shall be outstanding immediately prior to the Effective Time shall, by virtue of the Merger, be converted into the right to receive one share of common stock of the combined company.

Agreements Entered Into in Connection with the Merger Agreement (page 110)

Hepion Securities Purchase Agreements

Concurrently with the Merger Agreement, on July 19, 2024, Hepion entered into a Securities Purchase Agreement (the “SPA”) with certain purchasers pursuant to which Hepion sold an aggregate of $2.9 million in principal amount of Hepion’s Original Issue Discount Senior Unsecured Nonconvertible Notes (the “Notes”). The Notes are due on the earlier of: (i) December 31, 2024, (ii) the date of the closing of the Merger Agreement, (iii) the date that the Merger Agreement is terminated pursuant to the terms of the Merger Agreement, or (iv) such earlier date as the Notes are required or permitted to be repaid as provided in the Note, as may be extended at the option of the holder of the Note as described in the Note.

Pursuant to the SPA, Hepion, in addition to the other closing deliverables, delivered to each purchaser (i) a Note with a principal amount equal to such purchaser’s subscription amount multiplied by 1.16, and (ii) a number of shares of Hepion Common Stock equal to 19.99% of the total outstanding shares of Hepion Common Stock, multiplied by such purchaser’s subscription amount, divided by $2,500,000. This resulted in the purchasers collectively receiving 1,159,245 shares of Hepion Common Stock. The SPA also contained customary representations, warranties, covenants and conditions to close.

Hepion Senior Unsecured Note

Hepion also loaned $600,000 of the proceeds from the sale of the Notes to Pharma Two B through a non-convertible unsecured promissory note that bears nominal interest and matures on the same terms as the Notes, but which will be forgiven and cancelled upon consummation of the Merger. The purpose of this intercompany loan was to provide Pharma Two B with sufficient working capital to continue its operations and consummate the Merger.

Hepion Registration Rights Agreement

On July 19, 2024, in connection with the Merger and the Transactions contemplated by the Merger Agreement and the SPA, Hepion entered into a Registration Rights Agreement (the “RRA”) with Pharma Two B and the purchasers identified therein pursuant to which Pharma Two B agreed to provide certain registration rights with respect to the shares of Hepion Common Stock issued by Hepion pursuant to the SPA.

Hepion Support Agreement

In connection with the execution of the Merger Agreement, certain stockholders of Hepion entered into support agreements with Hepion and Pharma Two B relating to the Merger covering approximately 0.025% of the outstanding shares of Hepion Common Stock, as of immediately prior to the signing of the Merger Agreement (the

3

Table of Contents

“Hepion Support Agreements”). The Hepion Support Agreements provide, among other things, that the stockholders party to the Hepion Support Agreements will vote all of the shares of Hepion Common Stock held by them in favor of the Merger and the other Transactions contemplated by the Merger Agreement.

Pharma Two B and Hepion Lock-Up Agreement

Subsequently to the execution of the Merger Agreement, Pharma Two B entered into a lock-up agreement (the “Lock-Up Agreement”) with certain shareholders of Pharma Two B and Hepion (each, a “Lock-Up Shareholder” and collectively, the “Lock-Up Shareholders”) that collectively hold 85% of Pharma Two B’s issued and outstanding share capital and 3% of Hepion, (collectively, the “Lock-Up Shares”). Pursuant to the Lock-Up Agreement, such Lock-Up Shareholders agreed not to transfer any of the Lock-Up Shares, except to certain permitted transferees, beginning at the Effective Time and continuing until 180 days following the Closing Date (as defined in the Merger Agreement).

The Adjournment Proposal

Hepion’s stockholders will vote on a proposal to adjourn the special meeting on a later date or dates or indefinitely, if necessary or convenient, to permit further solicitation and vote of proxies and if, based upon the tabulated vote at the time of the special meeting, there are insufficient votes to approve the Merger Proposal.

Date, Time and Place of Special Meeting of Hepion’s Stockholders

The special meeting will be held at , Eastern time, on , 2024, via live webcast at https:// , or such other date, time and place to which such meeting may be adjourned, to consider and vote upon the proposals.

Voting Power; Record Date

Hepion stockholders will be entitled to vote or direct votes to be cast at the special meeting if they owned Hepion Common Stock at the close of business on the Record Date for the special meeting. Hepion’s stockholders will have one vote for each share of Hepion Common Stock owned at the close of business on the Record Date. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. Hepion’s warrants do not have voting rights. On the Record Date, there were shares of Hepion Common Stock outstanding.

Appraisal Rights

In connection with the Merger, Hepion’s stockholders will have no appraisal rights under the Delaware General Corporate Law because shares of Hepion Common Stock will remain listed on Nasdaq prior to the Closing, and, as a closing condition of the Merger, Pharma Two B’s ordinary shares will be approved for listing on Nasdaq concurrently with the closing of the Merger.

Hepion’s Board of Directors’ Reasons for the Merger

During the course of its evaluation of the Merger Agreement and the transactions contemplated by the Merger Agreement, Hepion’s board of directors held numerous meetings, consulted with Hepion’s senior management, Hepion’s legal counsel and financial advisors, and reviewed and assessed a significant amount of information. In reaching its decision to approve the Merger Agreement and the transactions contemplated by the Merger Agreement, the Hepion board of directors took into account other information presented to it during the process, and considered a number of factors that it viewed as supporting its decision to approve the Merger Agreement, including the following:

i. the financial condition and prospects of Hepion and the risks associated with continuing to operate Hepion on a stand-alone basis, including in light of:

a. Hepion’s decision, announced in December 2023, to initiate a process to explore a range of strategic and financing alternatives focused on maximizing stockholder value within the current financial environment and NASH drug development landscape, and Hepion’s decision, announced in April 2024, to begin wind-down activities in its ASCEND-NASH trial while continuing to explore strategic alternatives;

4

Table of Contents

b. investor interest and value perception for possible further development of its programs, the product candidates’ efficacy and safety profiles, stage of development, regulatory agencies’ feedback regarding development pathways, and probability of success in relation to the requisite time and costs; and

c. difficulties encountered in Hepion’s related business development efforts to license, sell or otherwise partner its assets that could result in meaningful new capital or shared future development costs.

ii. Hepion’s board of directors and legal advisor undertook a comprehensive and thorough process of reviewing and analyzing potential strategic alternatives and merger partner candidates and Hepion’s board of directors was of the view that no alternatives to the Merger (including remaining a standalone company, a liquidation or dissolution of Hepion to distribute any available cash, and alternative strategic transactions) were reasonably likely to create greater value to Hepion’s stockholders.

iii. Hepion’s board of directors believe, after a thorough review of strategic alternatives, such as attempting to further advance the development of its internal programs, entering into a licensing, sale or other strategic agreement related to certain assets sufficient to fund operations, combining with other potential strategic transaction candidates, and discussions with Hepion’s senior management, financial advisors and legal counsel, that the Merger is more favorable to Hepion stockholders than the potential value that might have resulted from other strategic alternatives available to Hepion.

iv. Hepion’s board of directors believe that, as a result of arm’s length negotiations with Pharma Two B, Hepion and its representatives negotiated the highest exchange ratio achievable, and that the other terms of the Merger Agreement include the most favorable terms to Hepion in the aggregate that were achievable and are consistent with other similar transactions.

v. Hepion’s board of directors believe that the $10.0 million enterprise value ascribed to Hepion would provide the existing Hepion stockholders significant value for Hepion’s public listing, and afford the Hepion stockholders a significant opportunity to participate in the potential growth of the combined company following the Merger at the negotiated exchange ratio.

vi. Hepion’s board of directors evaluated, following a review with Hepion’s management and advisors of Pharma Two B’s current development and clinical trial plans, the likelihood that the combined company would possess sufficient cash resources at the closing of the Merger to fund development of Pharma Two B’s product candidates through upcoming value inflection points, including Pharma Two B’s anticipated filing of its NDA for P2B001 for early state Parkinson’s Disease.

Interests of Hepion’s Directors and Officers in the Merger

In considering the recommendation of Hepion’s board of directors with respect approving the Merger Proposal and the other matters to be acted upon by Hepion’s stockholders at the Hepion special meeting, Hepion’s stockholders should be aware that Hepion’s directors and executive officers have interests in the Merger that are different from, or in addition to, the interests of Hepion’s stockholders generally. These interests may present them with actual or potential conflicts of interest. These interests include the following:

i. each of Timothy Block and Michael Purcell will continue as directors of the combined company after the Effective Time, and, following the closing of the Merger, will be eligible to be compensated as a non-employee director of the combined company pursuant to the non-employee director compensation policy in place following the Effective Time of the Merger; and

ii. under the Merger Agreement, Hepion’s directors and executive officers are entitled to continued indemnification, expense advancement and insurance coverage.

5

Table of Contents

Hepion’s board of directors was aware of these potential conflicts of interest and considered them, among other matters, in reaching its decision to approve the Merger Agreement and the Merger, and to recommend that Hepion’s stockholders approve the Proposals to be presented to Hepion’s stockholders for consideration at the Hepion special meeting as contemplated by this proxy statement/prospectus.

Recommendation to Hepion Stockholders

Hepion’s board of directors has determined that each of the proposals outlined above is fair to and in the best interests of Hepion and its stockholders and recommended that Hepion stockholders vote “FOR” the Merger Proposal, or “FOR” each the Adjournment Proposal if necessary.

Certain Material U.S. Federal Income Tax Considerations (page 197)

For a description of certain material U.S. federal income tax consequences of the Merger, the ownership and disposition of Pharma Two B ordinary shares, please see “Certain Material U.S. Federal Income Tax Considerations” beginning on page 197.

Certain Material Israeli Tax Considerations (page 203)

For a description of certain material Israeli tax consequences of the ownership and disposition of Pharma Two B ordinary shares, please see “Certain Material Israeli Tax Considerations” beginning on page 203.

Anticipated Accounting Treatment

The Merger and PIPE Investment will be accounted for as a recapitalization, with no goodwill or other intangible assets recorded, in accordance with GAAP. Under this method of accounting, Hepion will be treated as the “accounting acquiree” and Pharma Two B as the “accounting acquirer” for financial reporting purposes. Accordingly, the Merger will be treated as the equivalent of Pharma Two B issuing shares for the net assets of Hepion, followed by a recapitalization. The net assets of Hepion will be stated at historical cost, with no goodwill or other intangible assets recorded.

Comparison of Rights of Stockholders of Hepion and Shareholders of Pharma Two B (page 216)

If the Merger is successfully completed, holders of Hepion Common Stock will become holders of Pharma Two B ordinary shares and their rights as shareholders will be governed by the Pharma Two B Articles. There are also differences between the laws governing Hepion, a Delaware corporation, and Pharma Two B, an Israeli company. Please see “Comparison of Rights of Pharma Two B Shareholders and Hepion Stockholders” on page 216 for more information.

Emerging Growth Company

Following the Merger, the combined company will be an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As such, the combined company will be eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in their periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If some investors find the combined company’s securities less attractive as a result, there may be a less active trading market for the combined company’s securities and the prices of the combined company’s securities may be more volatile.

6

Table of Contents

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The combined company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the combined company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of the combined company’s financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

The combined company will remain an emerging growth company until the earlier of: (i) the last day of the fiscal year (a) following the fifth anniversary of the date on which Pharma Two B ordinary shares were offered in exchange for Hepion Common Stock in connection with the Merger, (b) in which the combined company has total annual gross revenue of at least $1.235 billion, or (c) in which the combined company is deemed to be a large accelerated filer, which means the market value of the combined company’s common equity that is held by non-affiliates exceeds $700 million as of the last business day of its most recently completed second fiscal quarter; and (ii) the date on which the combined company has issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Regulatory Matters

The Merger is not subject to any federal or state regulatory requirement or approval, except for filings with the State of Delaware necessary to effectuate the Merger.

Summary Risk Factors