Exhibit 99.1

Governance Update December 2018

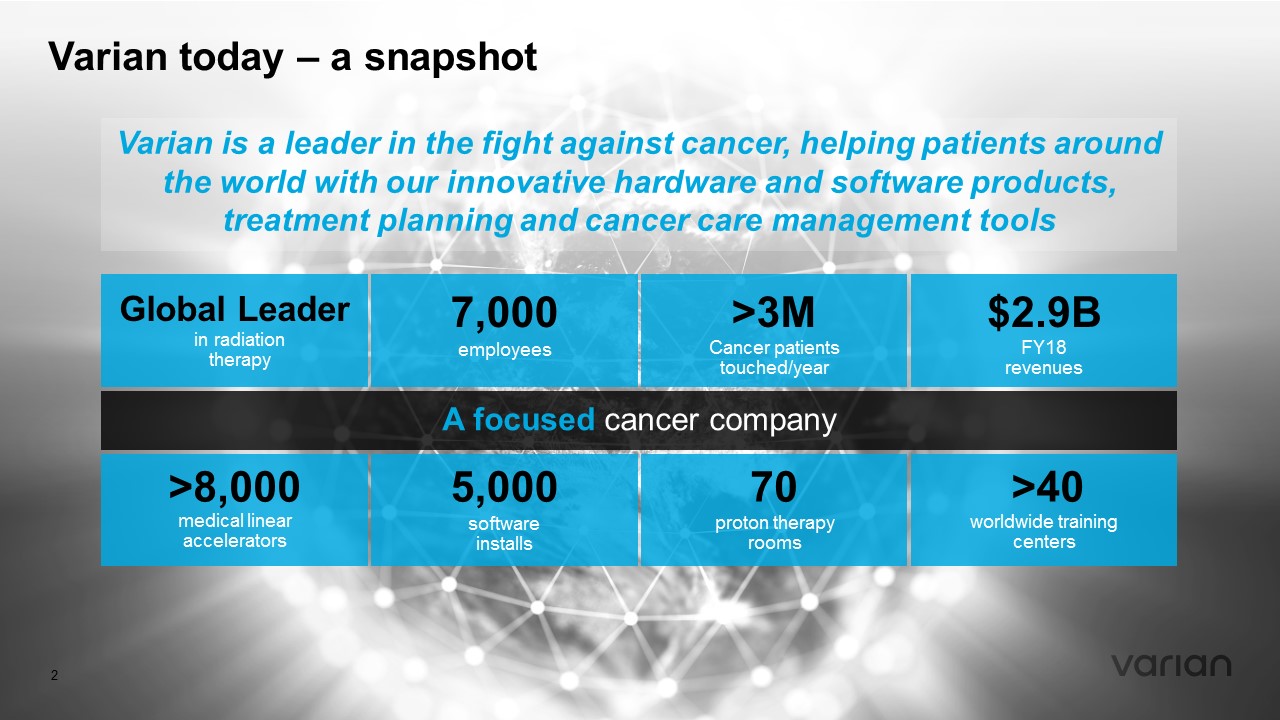

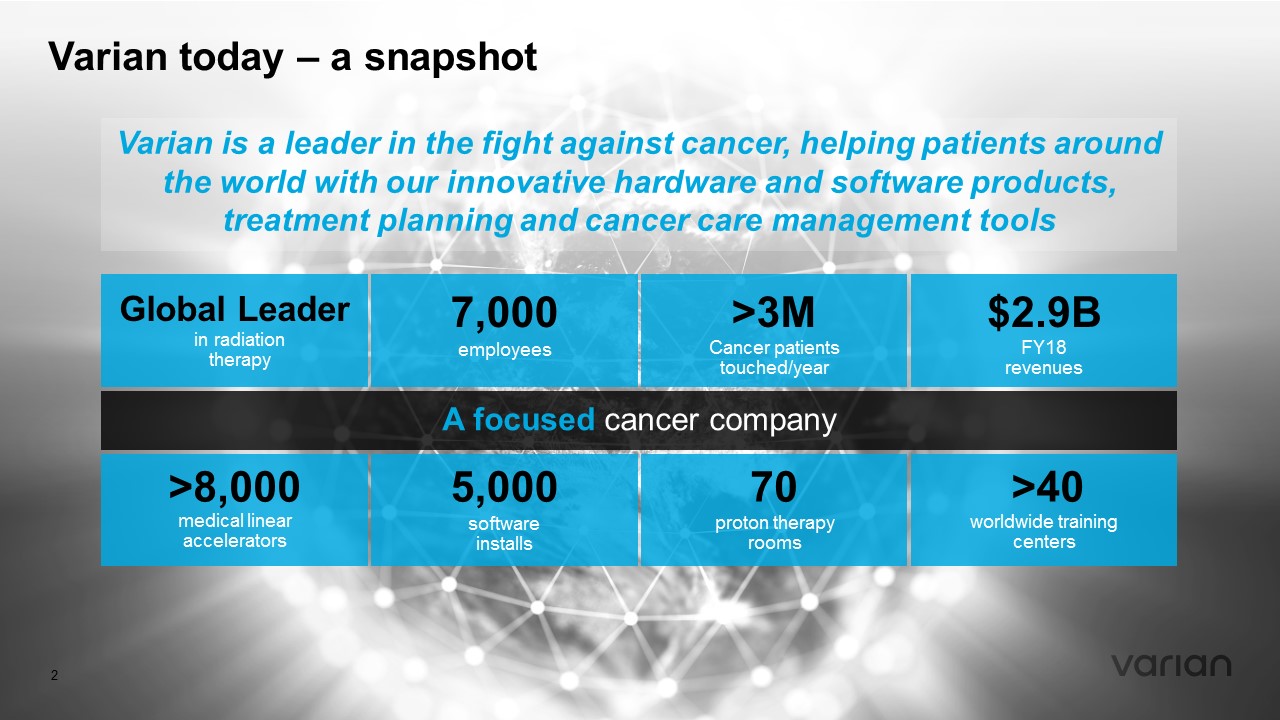

Varian today – a snapshot A focused cancer company Global Leader in radiation therapy FY18 revenues $2.9B >8,000 medical linear accelerators >40 worldwide training centers software installs 5,000 proton therapy rooms 70 employees 7,000 Cancer patients touched/year >3M 2 Varian is a leader in the fight against cancer, helping patients around the world with our innovative hardware and software products, treatment planning and cancer care management tools

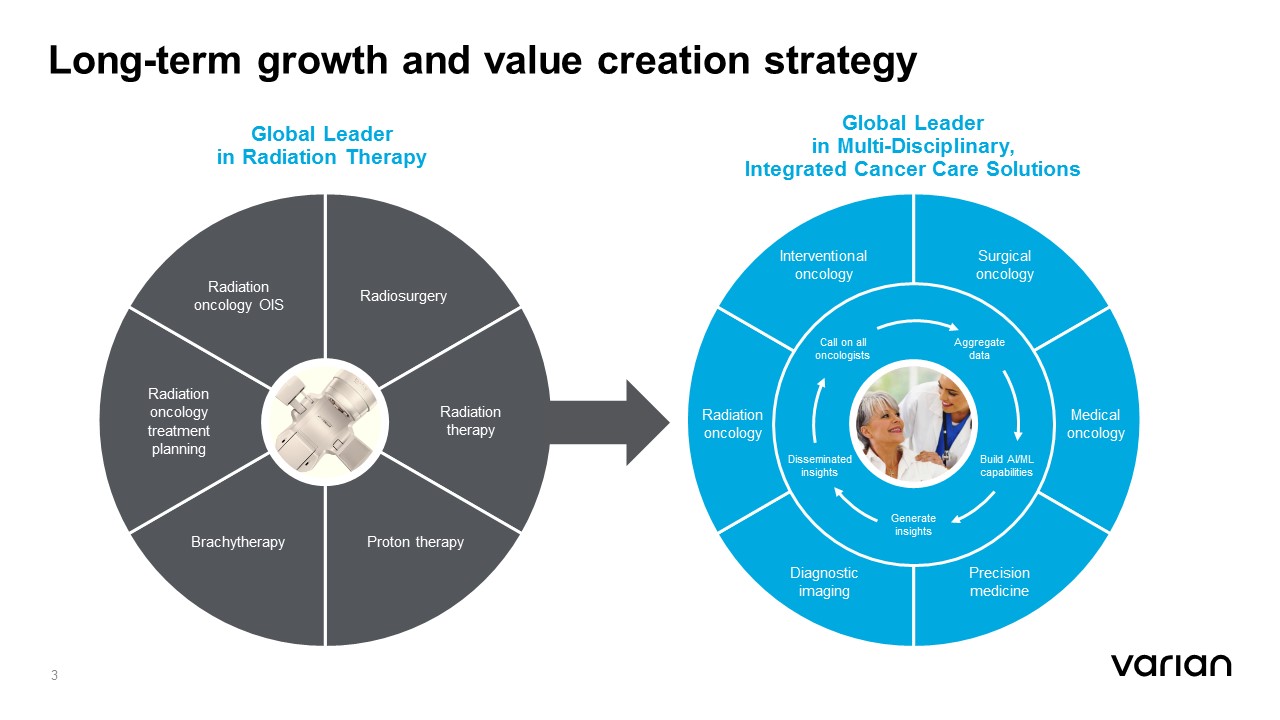

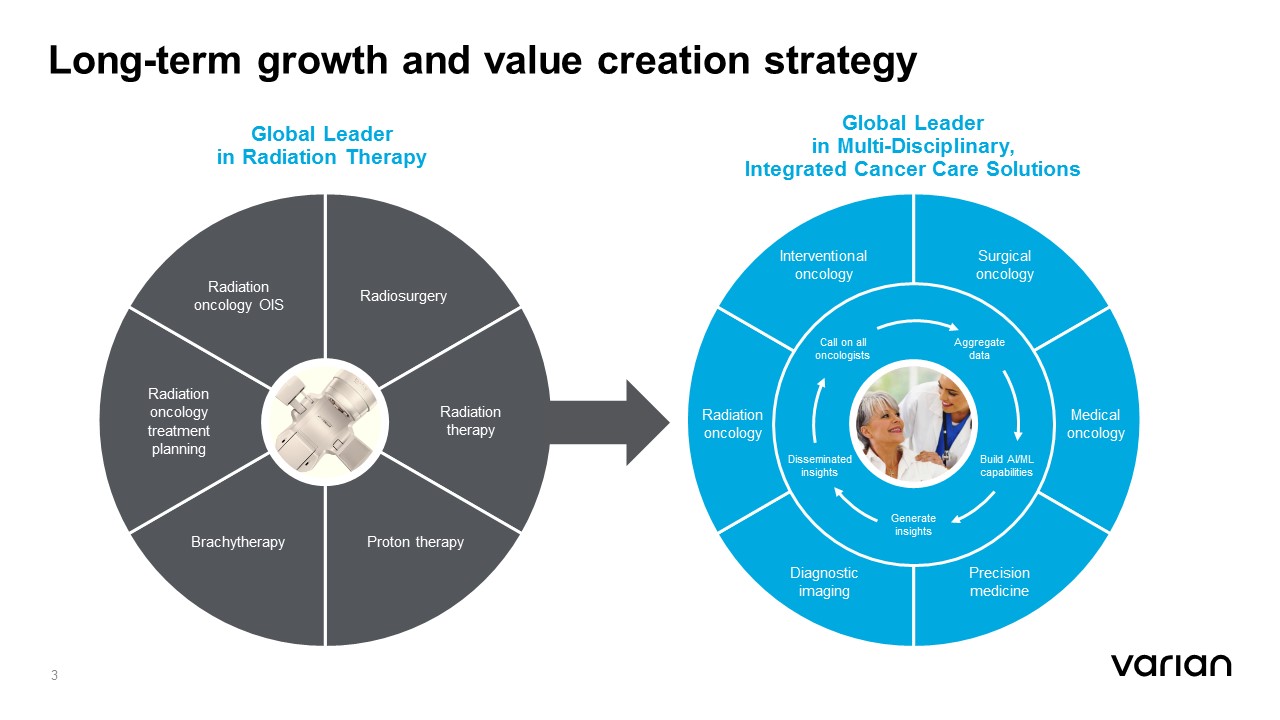

Long - term growth and value creation strategy Global Leader in Radiation Therapy Radiation oncology OIS Radiosurgery Brachytherapy Radiation oncology treatment planning Proton therapy Radiation therapy Global Leader in Multi - Disciplinary, Integrated Cancer Care Solutions Interventional oncology Surgical oncology Diagnostic imaging Radiation oncology Precision medicine Medical oncology Generate insights Call on all oncologists Aggregate data Disseminated insights Build AI/ML capabilities 3

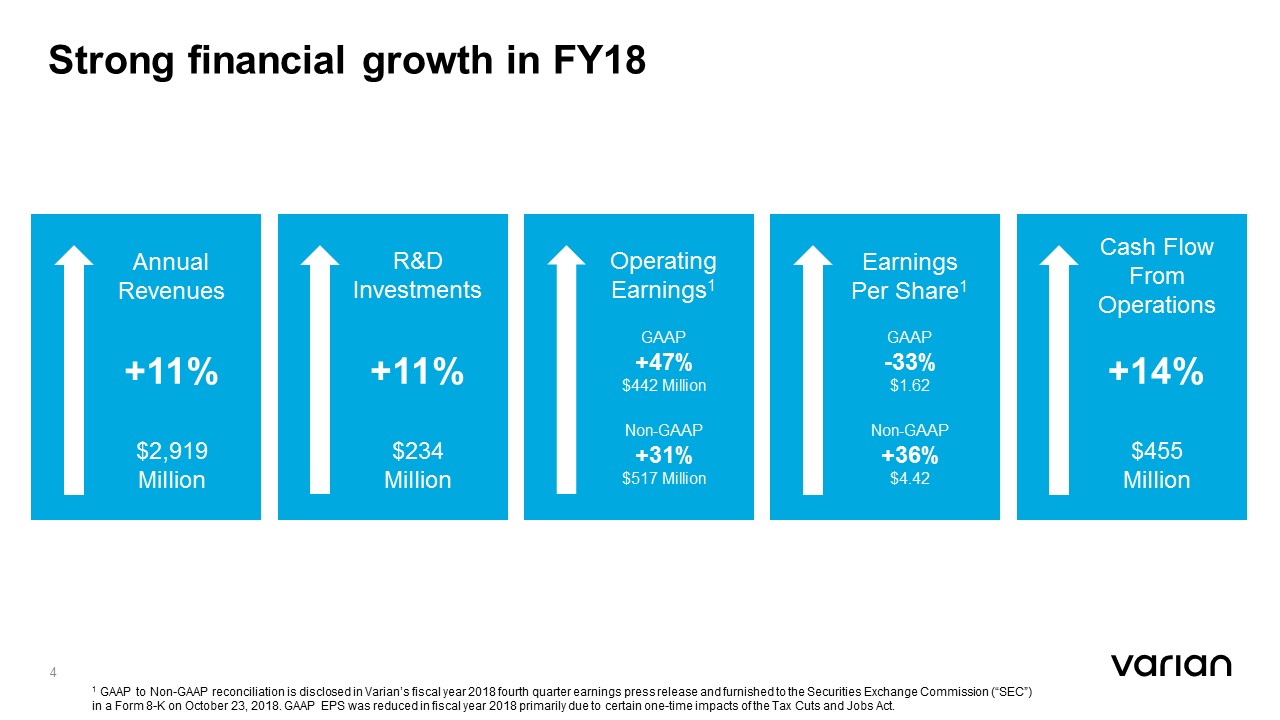

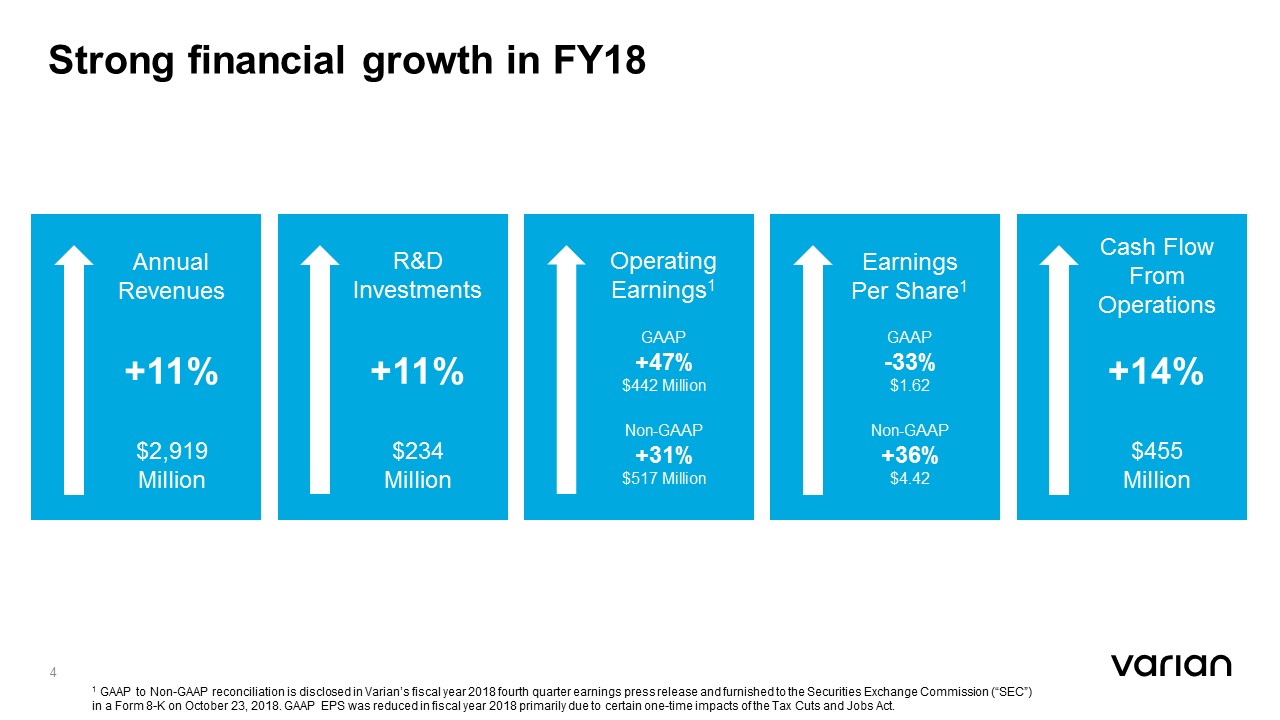

Strong financial growth in FY18 Annual Revenues +11% $2,919 Million 1 GAAP to Non - GAAP reconciliation is disclosed in Varian’s fiscal year 2018 fourth quarter earnings press release and furnished to the Securities Exchange Commission (“SEC”) in a Form 8 - K on October 23, 2018 . GAAP EPS was reduced in fiscal year 2018 primarily due to certain one - time impacts of the Tax Cuts and Jobs Act. Cash Flow From Operations +14% $455 Million Operating Earnings 1 GAAP +47% $442 Million Non - GAAP +31% $517 Million Earnings Per Share 1 GAAP - 33% $1.62 Non - GAAP +36% $4.42 4 R&D Investments +11% $234 Million

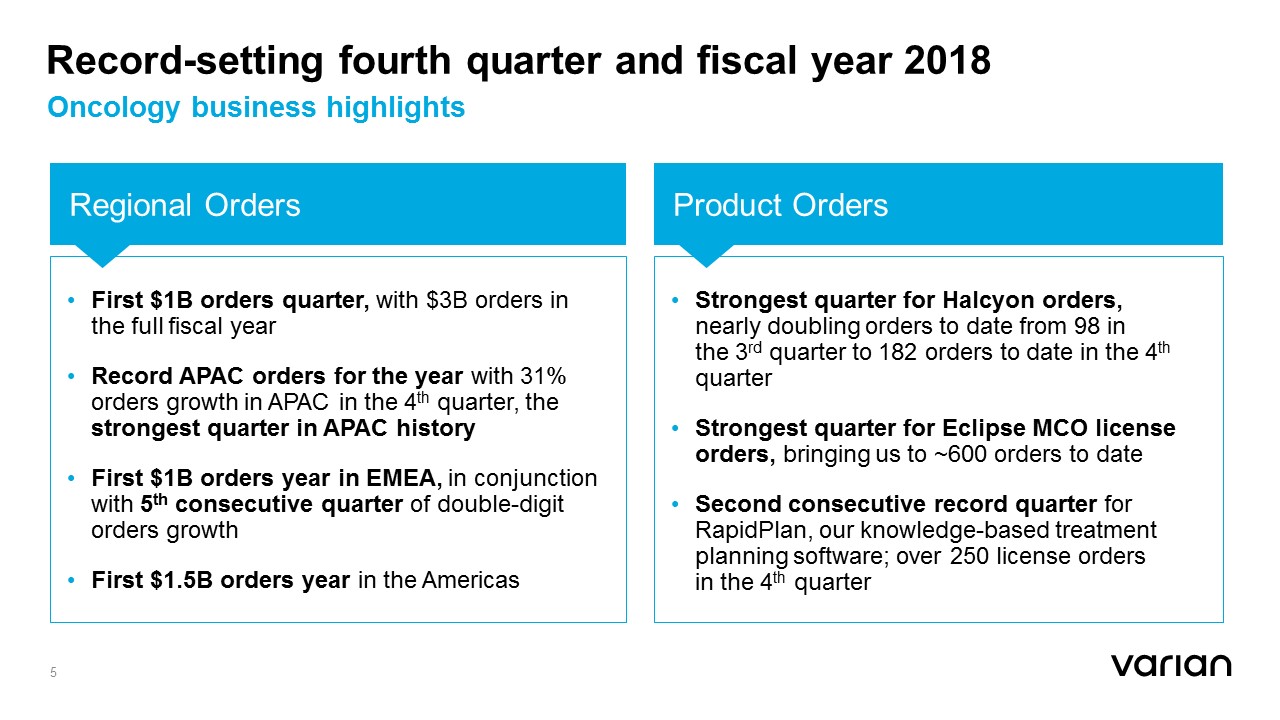

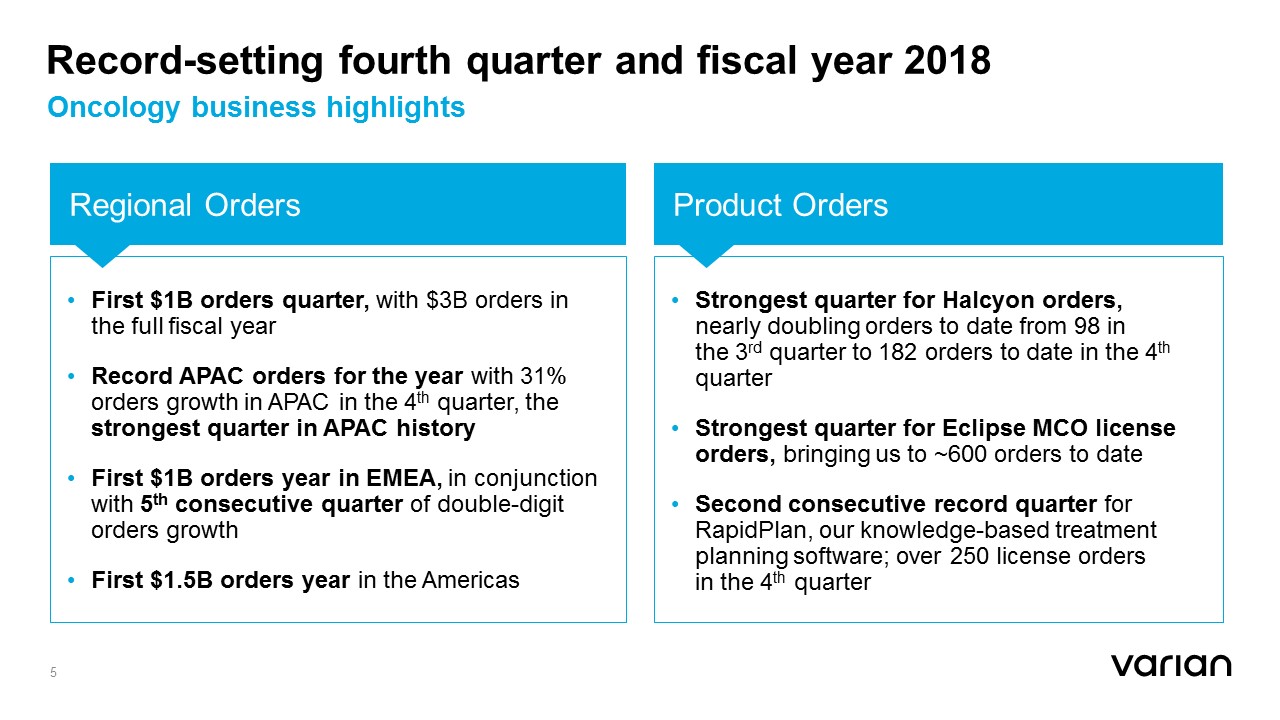

• First $1B orders quarter, with $3B orders in the full fiscal year • Record APAC orders for the year with 31% orders growth in APAC in the 4 th quarter, the strongest quarter in APAC history • First $1B orders year in EMEA, in conjunction with 5 th consecutive quarter of double - digit orders growth • First $1.5B orders year in the Americas Record - setting fourth quarter and fiscal year 2018 Regional Orders Oncology business highlights • Strongest quarter for Halcyon orders, nearly doubling orders to date from 98 in the 3 rd quarter to 182 orders to date in the 4 th quarter • Strongest quarter for Eclipse MCO license orders, bringing us to ~600 orders to date • Second consecutive record quarter for RapidPlan , our knowledge - based treatment planning software; over 250 license orders in the 4 th quarter Product Orders 5

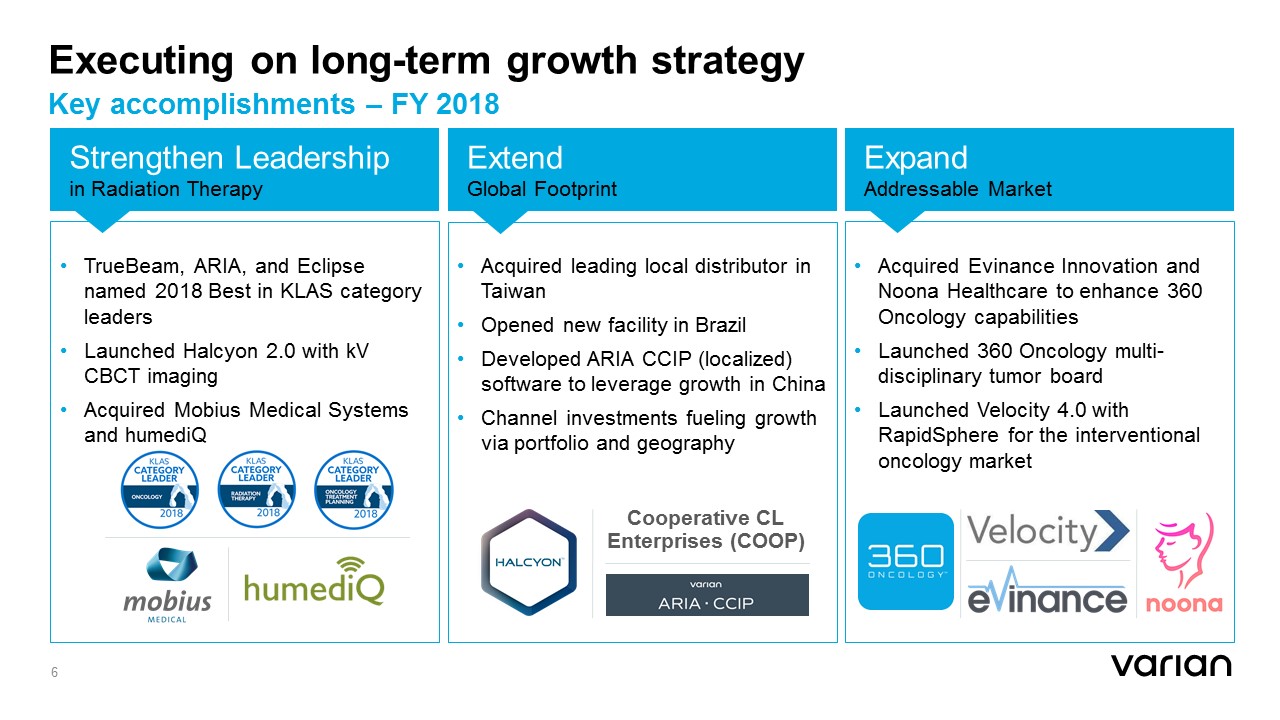

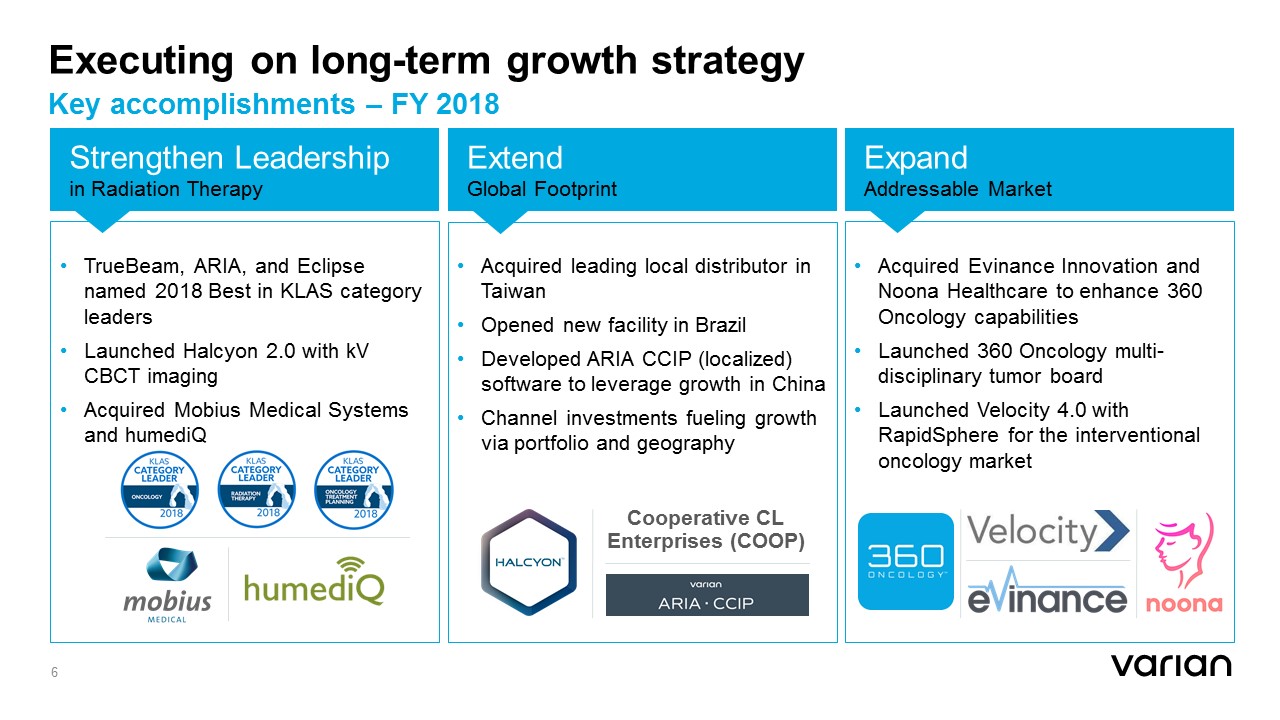

Executing on long - term growth strategy • TrueBeam, ARIA, and Eclipse named 2018 Best in KLAS category leaders • Launched Halcyon 2.0 with kV CBCT imaging • Acquired Mobius Medical Systems and humediQ Key accomplishments – FY 2018 Strengthen Leadership in Radiation Therapy • Acquired leading local distributor in Taiwan • Opened new facility in Brazil • Developed ARIA CCIP (localized) software to leverage growth in China • Channel investments fueling growth via portfolio and geography Extend Global Footprint • Acquired Evinance Innovation and Noona Healthcare to enhance 360 Oncology capabilities • Launched 360 Oncology multi - disciplinary tumor board • Launched Velocity 4.0 with RapidSphere for the interventional oncology market Expand Addressable Market Cooperative CL Enterprises (COOP) 6

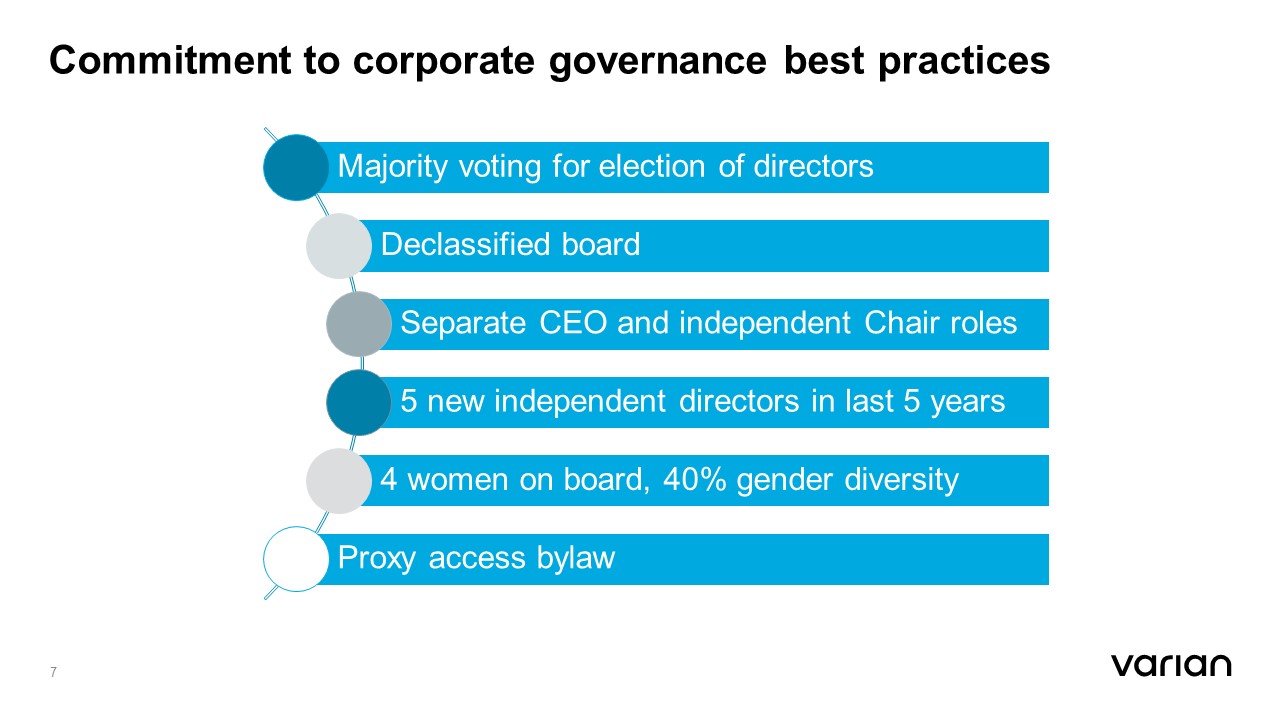

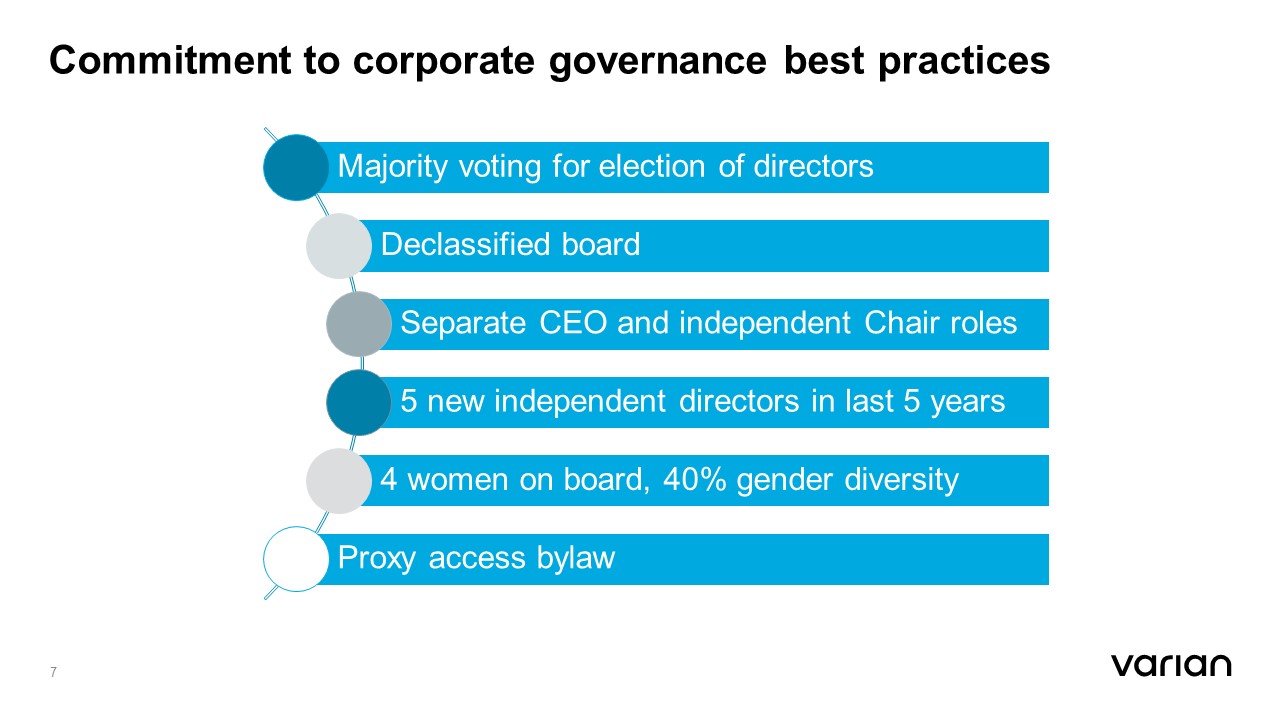

Commitment to corporate governance best practices 7 Majority voting for election of directors Declassified board Separate CEO and independent Chair roles 5 new independent directors in last 5 years 4 women on board, 40% gender diversity Proxy access bylaw

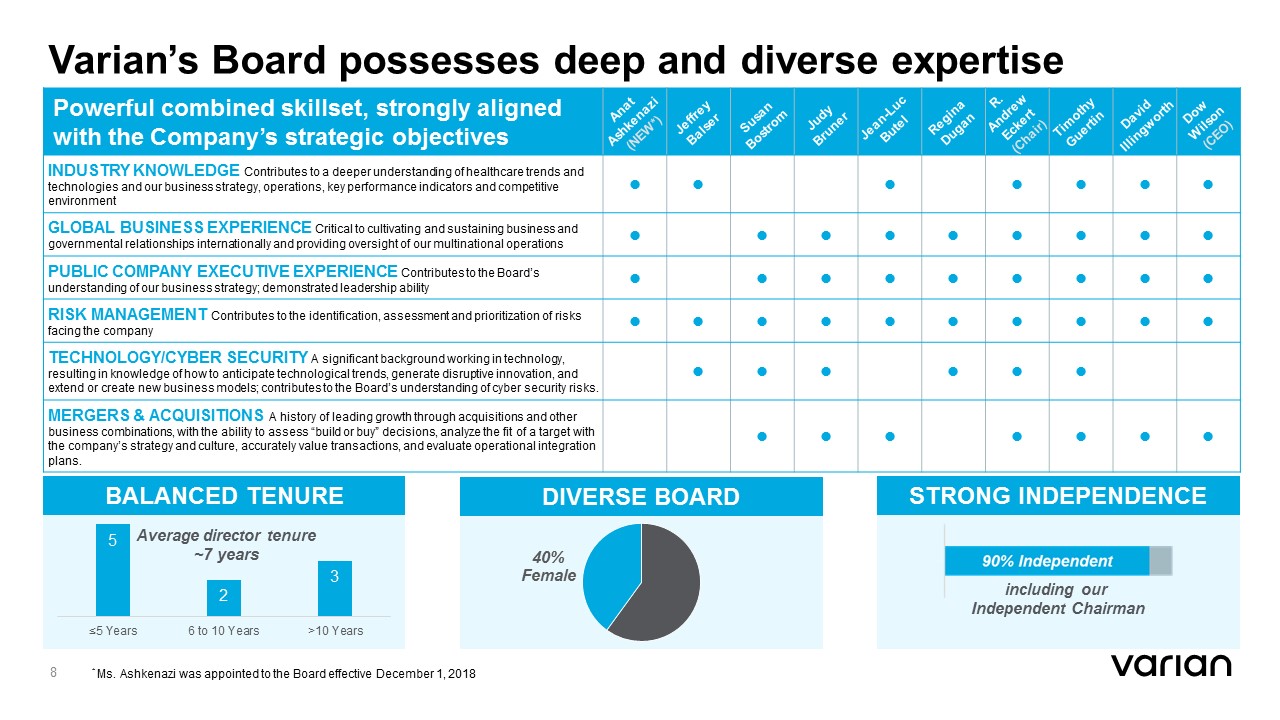

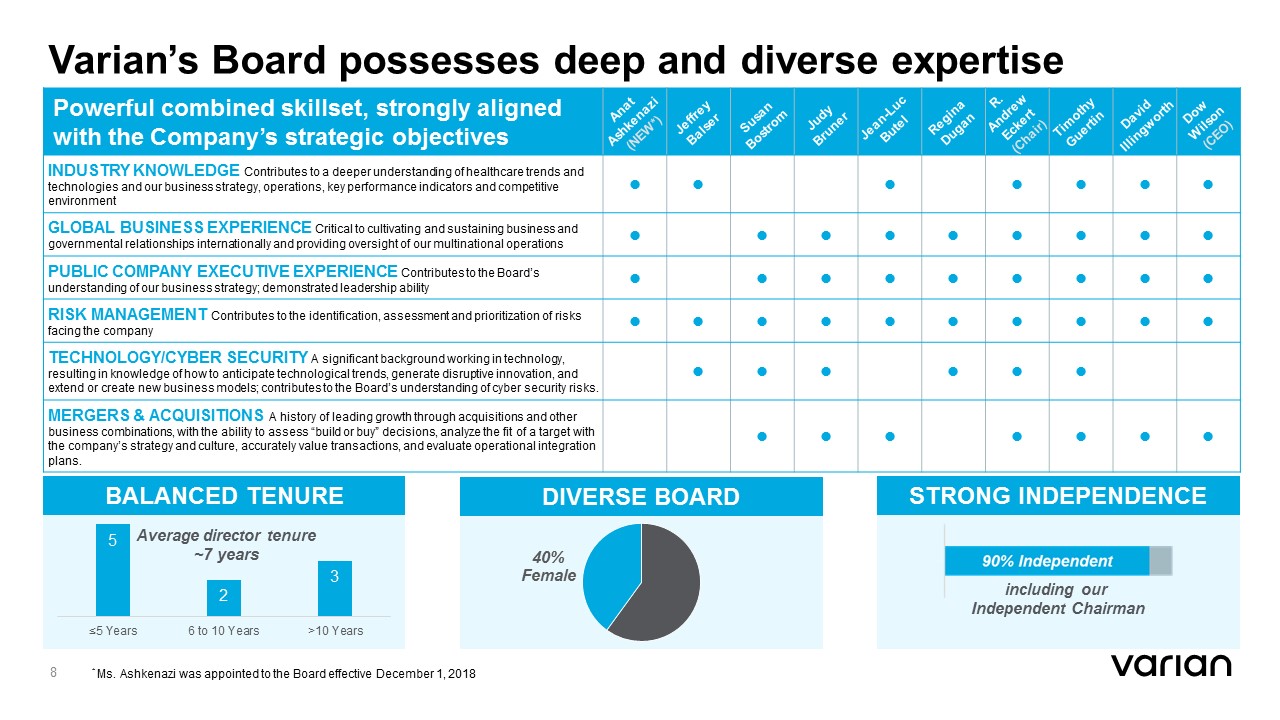

Varian’s Board possesses deep and diverse expertise 8 Powerful combined skillset, strongly aligned with the Company’s strategic objectives INDUSTRY KNOWLEDGE Contributes to a deeper understanding of healthcare trends and technologies and our business strategy, operations, key performance indicators and competitive environment GLOBAL BUSINESS EXPERIENCE Critical to cultivating and sustaining business and governmental relationships internationally and providing oversight of our multinational operations PUBLIC COMPANY EXECUTIVE EXPERIENCE Contributes to the Board’s understanding of our business strategy; demonstrated leadership ability RISK MANAGEMENT Contributes to the identification, assessment and prioritization of risks facing the company TECHNOLOGY/CYBER SECURITY A significant background working in technology, resulting in knowledge of how to anticipate technological trends, generate disruptive innovation, and extend or create new business models; contributes to the Board’s understanding of cyber security risks. MERGERS & ACQUISITIONS A history of leading growth through acquisitions and other business combinations, with the ability to assess “build or buy” decisions, analyze the fit of a target with the company’s strategy and culture, accurately value transactions, and evaluate operational integration plans. BALANCED TENURE 5 2 3 ≤5 Years 6 to 10 Years >10 Years Average director tenure ~7 years 40% Female DIVERSE BOARD including our Independent Chairman STRONG INDEPENDENCE * Ms. Ashkenazi was appointed to the Board effective December 1, 2018

13% 11% 46% 30% 2018 CEO compensation program overview 9 1 Other NEOs receive long - term equity granted in PSUs (60%), RSUs (20%) and Stock Options (20%) 2 Economic profit is referred to internally as Varian Value Added (VVA); see slide 11 for details regarding how we calculate VV A Base Salary Attract and retain talented and skilled senior executives and recognize sustained performance, capabilities, job scope, and experience Annual Cash Incentive Motivate and rewards achievement of annual strategic and financial results that drive stockholder value and provide the foundation for future growth and profitability ► Performance Period: One Year ► Metrics: Economic Profit 2 (80%), Strategic Goals (20%) LTI: Performance Stock Options 1 Reward achievement of long - term financial goals and TSR relative to peers and provide leveraged gains aligned with stockholders ► Performance Period: Three Years ► Metrics: Revenue Growth, EBIT Margin, TSR Modifier LTI: Performance Share Units 1 Reward achievement of long - term financial goals and TSR relative to peers and align with shareholder interests through use of equity ► Performance Period: Three Years ► Metrics: Revenue Growth, EBIT Margin, TSR Modifier 89% Performance - Based Compensation 76% Long - Term Equity Compensation 100% Long - Term Incentive Performance - Based 1

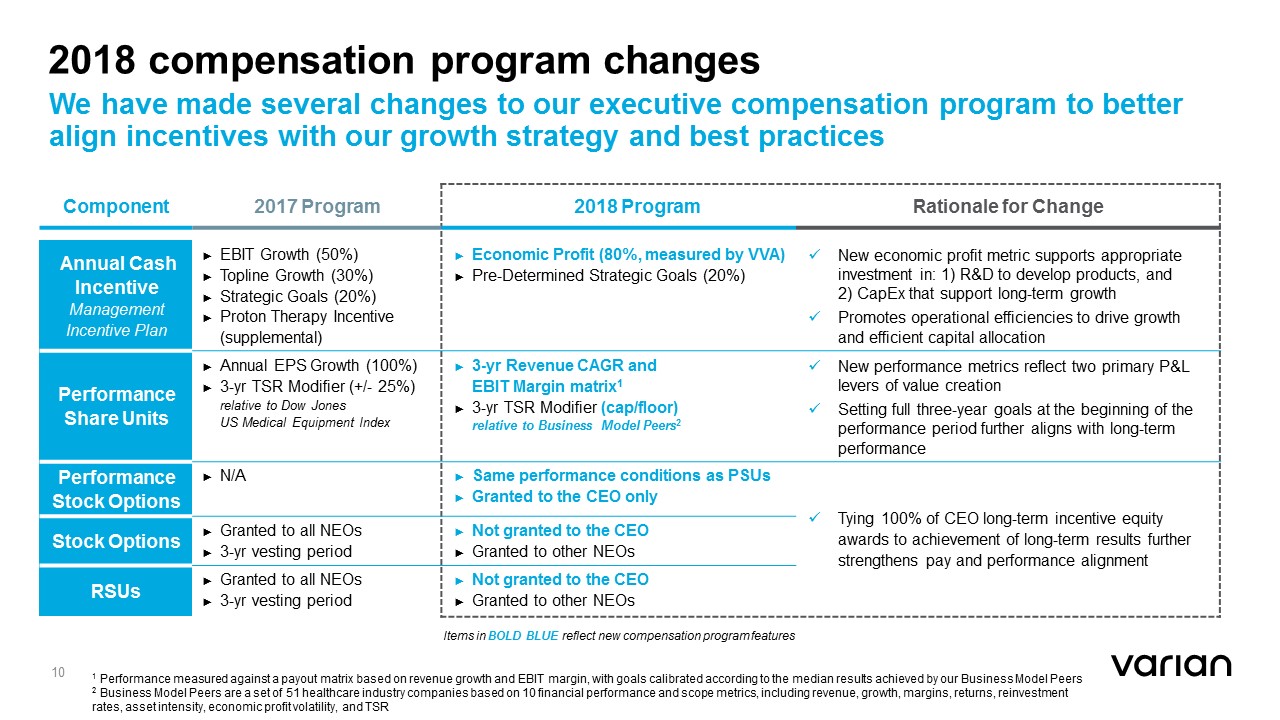

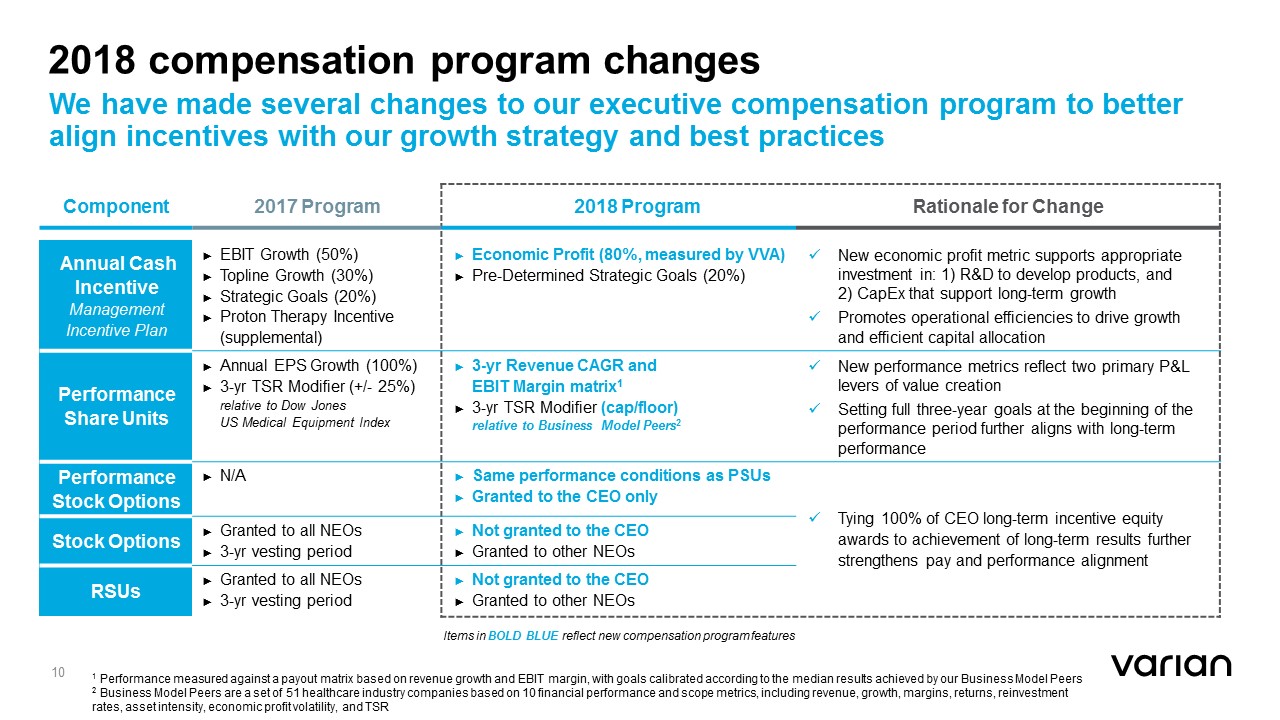

2018 compensation program changes We have made several changes to our executive compensation program to better align incentives with our growth strategy and best practices 10 Component 2017 Program 2018 Program Rationale for Change Annual Cash Incentive Management Incentive Plan ► EBIT Growth (50%) ► Topline Growth (30%) ► Strategic Goals (20%) ► Proton Therapy Incentive (supplemental) ► Economic Profit (80%, measured by VVA) ► Pre - Determined Strategic Goals (20%) x New economic profit metric supports appropriate investment in: 1) R&D to develop products, and 2) CapEx that support long - term growth x Promotes operational efficiencies to drive growth and efficient capital allocation Performance Share Units ► Annual EPS Growth (100%) ► 3 - yr TSR Modifier (+/ - 25%) relative to Dow Jones US Medical Equipment Index ► 3 - yr Revenue CAGR and EBIT Margin matrix 1 ► 3 - yr TSR Modifier (cap/floor) relative to Business Model Peers 2 x New performance metrics reflect two primary P&L levers of value creation x Setting full three - year goals at the beginning of the performance period further aligns with long - term performance Performance Stock Options ► N/A ► Same performance conditions as PSUs ► Granted to the CEO only x Tying 100% of CEO long - term incentive equity awards to achievement of long - term results further strengthens pay and performance alignment Stock Options ► Granted to all NEOs ► 3 - yr vesting period ► Not granted to the CEO ► Granted to other NEOs RSUs ► Granted to all NEOs ► 3 - yr vesting period ► Not granted to the CEO ► Granted to other NEOs Items in BOLD BLUE reflect new compensation program features 1 Performance measured against a payout matrix based on revenue growth and EBIT margin, with goals calibrated according to the me dian results achieved by our Business Model Peers 2 Business Model Peers are a set of 51 healthcare industry companies based on 10 financial performance and scope metrics, inclu di ng revenue, growth, margins, returns, reinvestment rates, asset intensity, economic profit volatility, and TSR

Varian Value Added (VVA) VVA is a measure of economic profit that drives long - term value creation 11 Varian Value Added ► VVA accommodates volatility by rewarding continuous improvement Growth in VVA reflects appropriate R&D investment that serves as the foundation for our future growth and long - term value creation Gross Cash Earnings = Operating Income + R&D Expense + Depreciation & Amortization Expense - Taxes ► VVA encourages long - term focus in an R&D - driven business VVA treats R&D as an investment rather than expense, with cumulative R&D spend treated as an asset on which management must make a return on investment in excess of the cost of capital Capital Charge = Gross Operating Assets x Required Rate of Return ► VVA balances investments in growth with accountability for returns Gross cash earnings must offset the capital charge on new investments in order to maintain or increase VVA

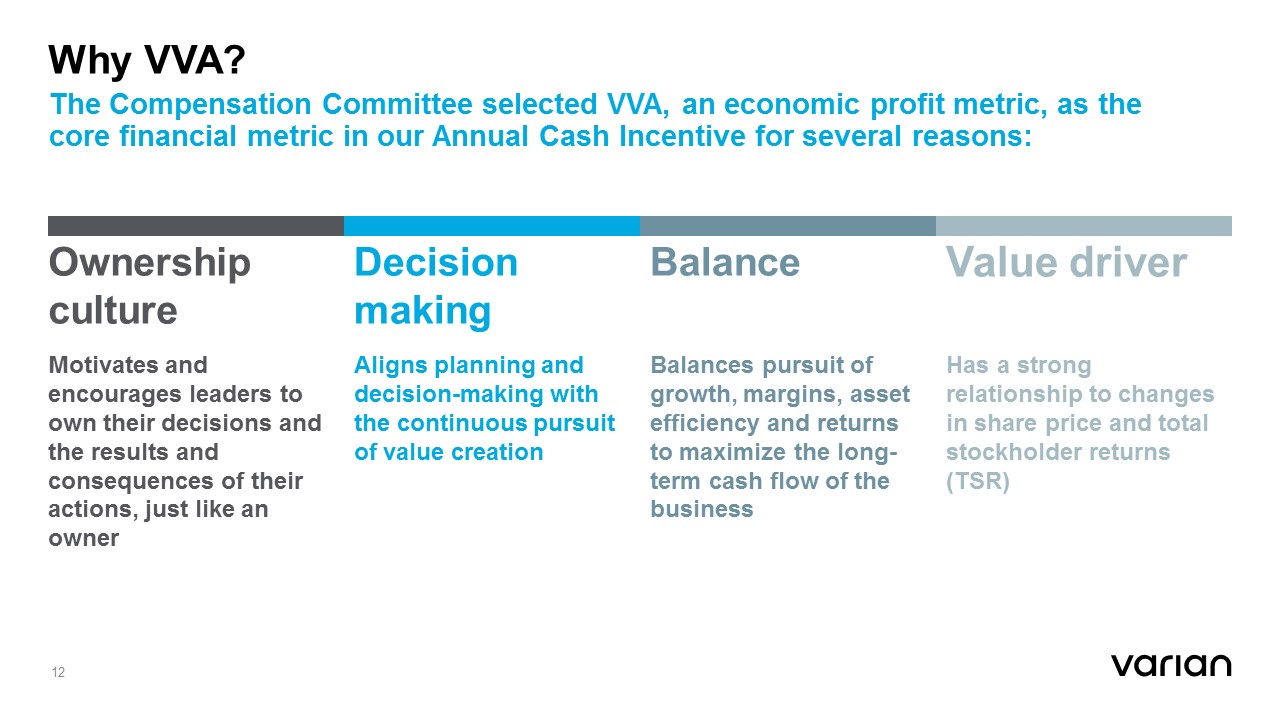

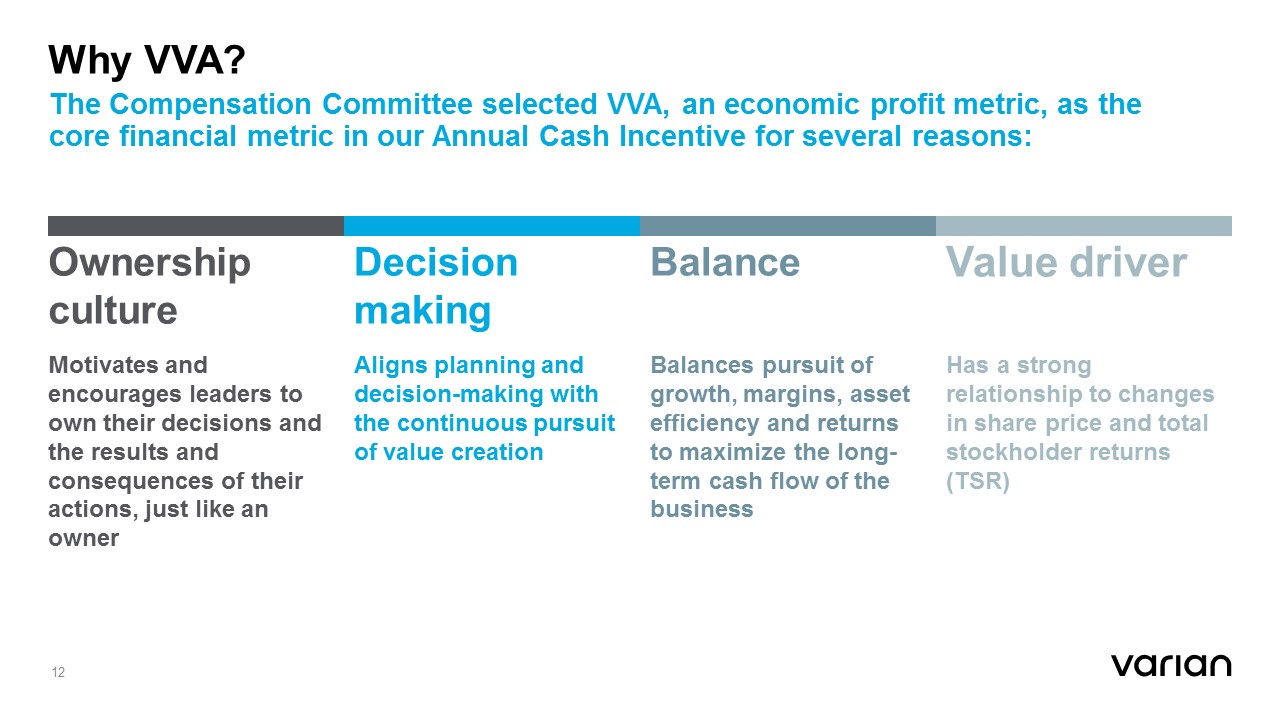

Why VVA? The Compensation Committee selected VVA, an economic profit metric, as the core financial metric in our Annual Cash Incentive for several reasons: 12 Ownership culture Decision making Balance Value driver Motivates and encourages leaders to own their decisions and the results and consequences of their actions, just like an owner Aligns planning and decision - making with the continuous pursuit of value creation Balances pursuit of growth, margins, asset efficiency and returns to maximize the long - term cash flow of the business Has a strong relationship to changes in share price and total stockholder returns (TSR)

Appropriately Values New Assets to Encourage Growth Values R&D as an Investment for Long - Term Growth Encourages Ownership Mentality and Accountability ► Treats R&D as an investment rather than an expense ► Removes distortions that encourage underinvestment in R&D to meet short - term objectives at the expense of long - term value creation ► Encourages innovation and discourages short - term cost cutting at the expense of long - term results ► Encourages investment in profitable opportunities: − Treats old and new assets alike by removing accounting distortions that make new investments look prohibitively expensive − Amortizes the capital charge over the entire life of an asset ► Focuses management on underlying, longer - term trends vs. short - term fluctuations ► Requires continuous improvement, as outperformance in one year sets a high hurdle for the next period 13 How VVA works for Varian VVA incentivizes important investments in R&D that provide the foundation for our future growth and generate returns that maximize value for stockholders

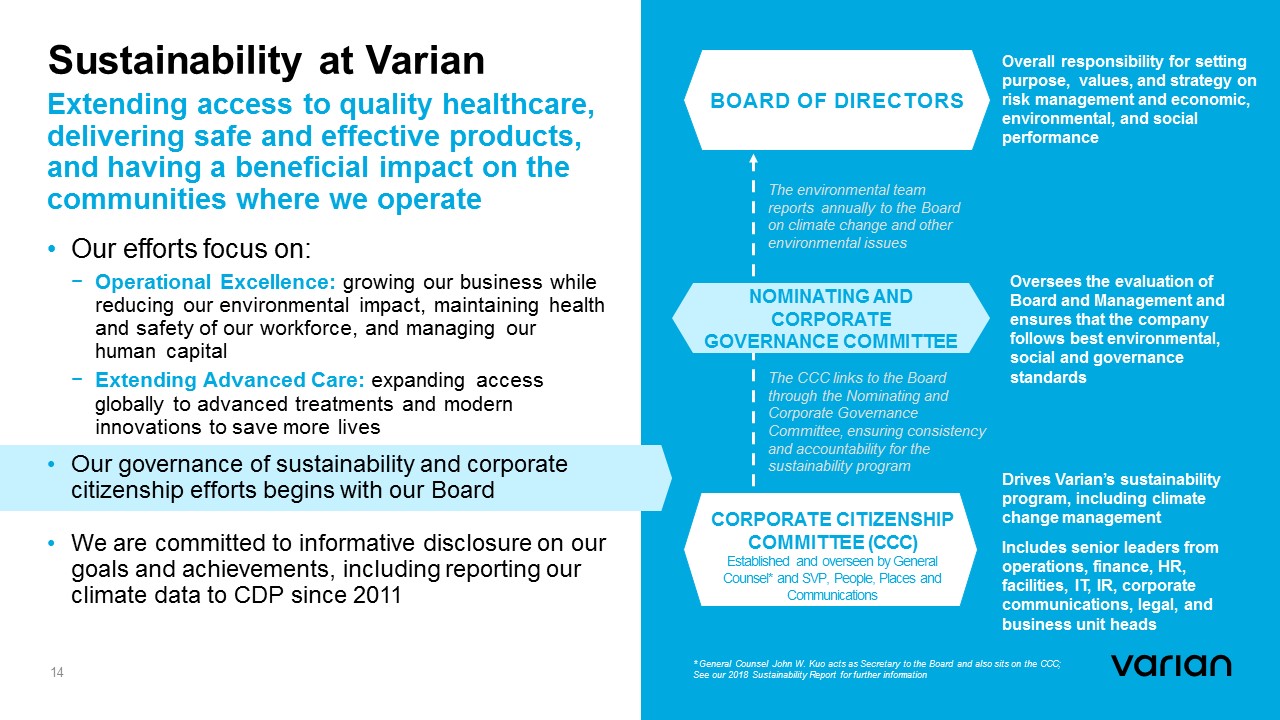

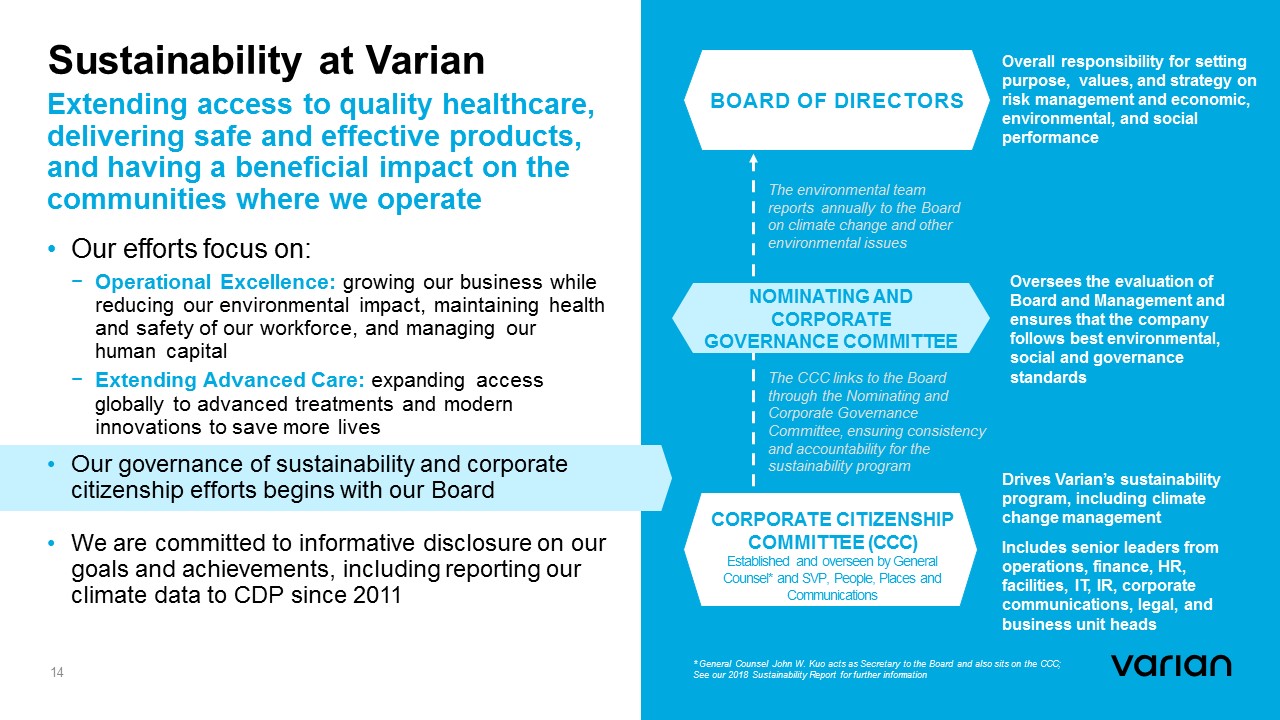

Sustainability at Varian 14 Extending access to quality healthcare, delivering safe and effective products, and having a beneficial impact on the communities where we operate • Our efforts focus on: − Operational Excellence: growing our business while reducing our environmental impact, maintaining health and safety of our workforce, and managing our human capital − Extending Advanced Care: expanding access globally to advanced treatments and modern innovations to save more lives • Our governance of sustainability and corporate citizenship efforts begins with our Board • We are committed to informative disclosure on our goals and achievements, including reporting our climate data to CDP since 2011 CORPORATE CITIZENSHIP COMMITTEE ( CCC) Established and overseen by General Counsel* and SVP, People, Places and Communications Overall responsibility for setting purpose, values, and strategy on risk management and economic, environmental, and social performance Drives Varian’s sustainability program, including climate change management Includes senior leaders from operations, finance, HR, facilities, IT, IR, corporate communications, legal, and business unit heads BOARD OF DIRECTORS Oversees the evaluation of Board and Management and ensures that the company follows best environmental, social and governance standards NOMINATING AND CORPORATE GOVERNANCE COMMITTEE The environmental team reports annually to the Board on climate change and other environmental issues The CCC links to the Board through the Nominating and Corporate Governance Committee , ensuring consistency and accountability for the sustainability program * General Counsel John W. Kuo acts as Secretary to the Board and also sits on the CCC; See our 2018 Sustainability Report for further information

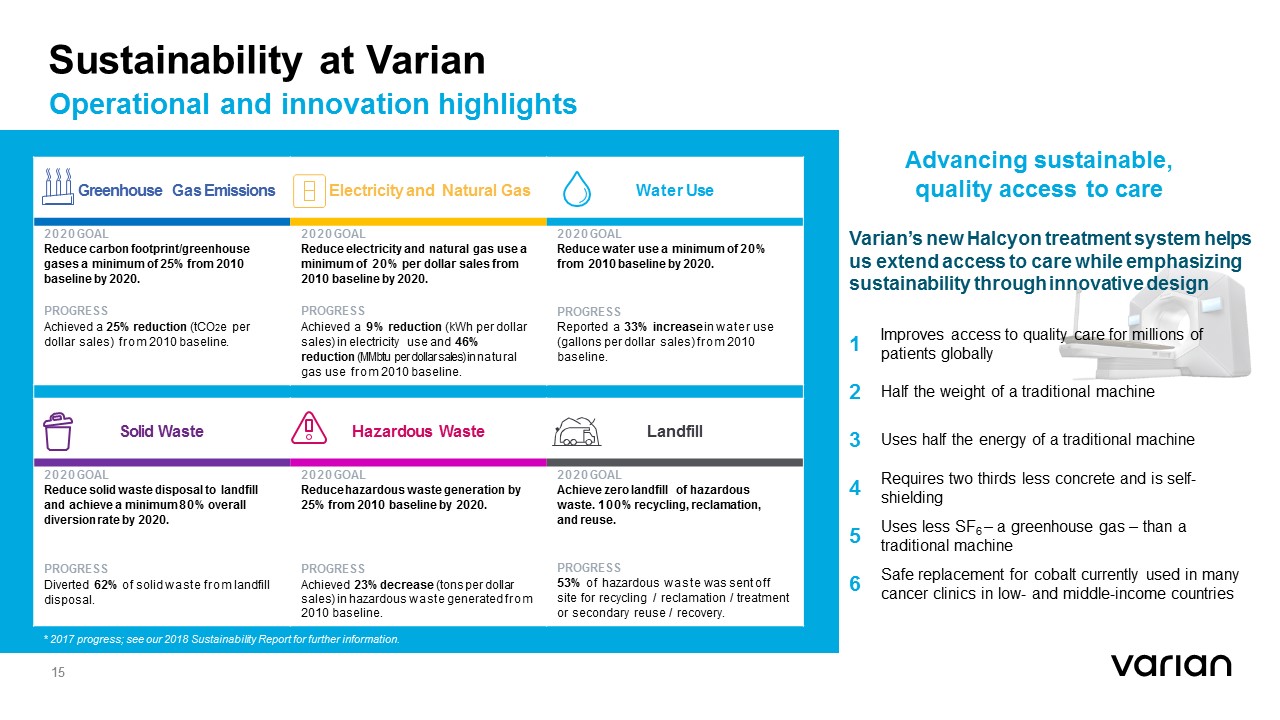

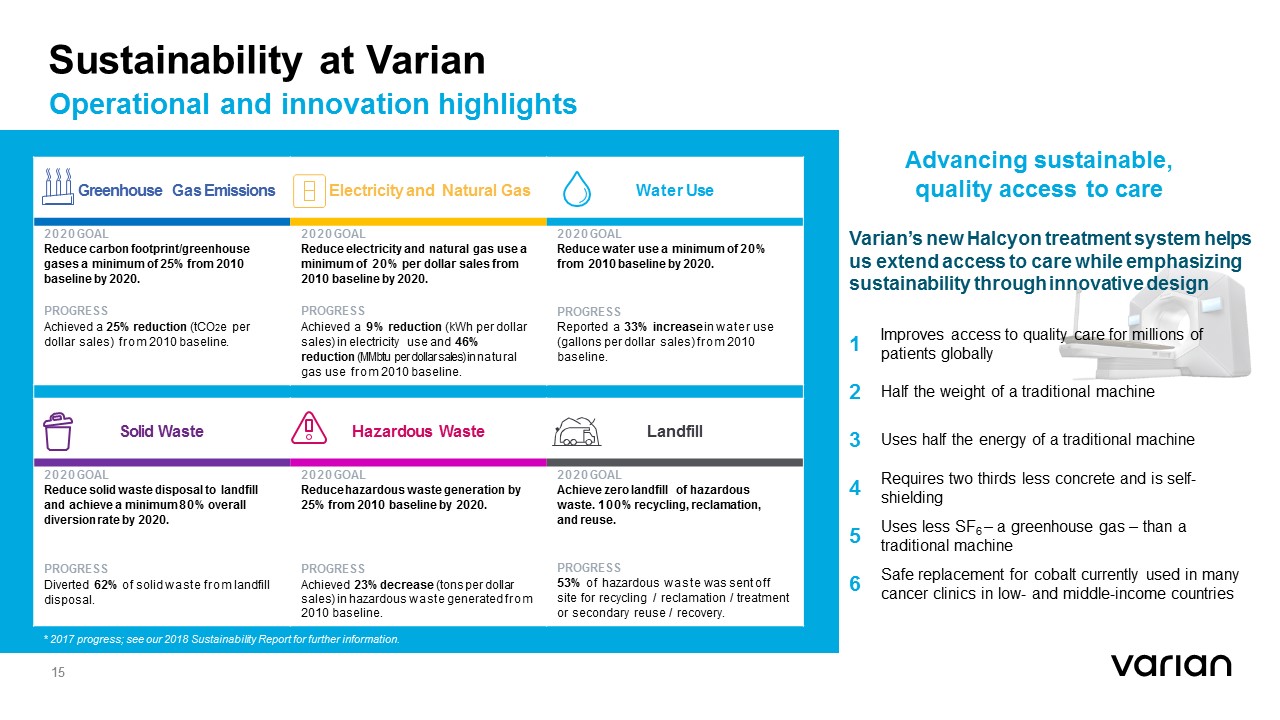

Sustainability at Varian Operational and innovation highlights 15 1 Improves access to quality care for millions of patients globally 2 Half the weight of a traditional machine 3 Uses half the energy of a traditional machine 4 Requires two thirds less concrete and is self - shielding 5 Uses less SF 6 – a greenhouse gas – than a traditional machine 6 Safe replacement for cobalt currently used in many cancer clinics in low - and middle - income countries Varian’s new Halcyon treatment system helps us extend access to care while emphasizing sustainability through innovative design Advancing sustainable, quality access to care 15 Water Use Greenhouse Gas Emissions Electricity and Natural Gas Water Use 2020 GOAL Reduce carbon footprint/ greenhouse gases a minimum of 25% from 2010 baseline by 2020. PROGRESS Achieved a 25% reduction (tCO 2 e per dollar sales) from 2010 baseline. 2020 GOAL Reduce electricity and natural gas use a minimum of 20% per dollar sales from 2010 baseline by 2020. PROGRESS Achieved a 9% reduction (kWh per dollar sales) in electricity use and 46% reduction ( MMbtu per dollar sales) in natural gas use from 2010 baseline. 2020 GOAL Reduce water use a minimum of 20% from 2010 baseline by 2020. PROGRESS Reported a 33% increase in water use (gallons per dollar sales) from 2010 baseline. Solid Waste H a z a r do u s Waste Landfill 2020 GOAL Reduce solid waste disposal to landfill and achieve a minimum 80% overall diversion rate by 2020. PROGRESS Diverted 62% of solid waste from landfill disposal. 2020 GOAL Reduce hazardous waste generation by 25% from 2010 baseline by 2020. PROGRESS Achieved 23% decrease (tons per dollar sales) in hazardous waste generated from 2010 baseline. 2020 GOAL Achieve zero landfill of hazardous waste. 100% recycling, reclamation, and reuse. PROGRESS 53% of hazardous waste was sent off site for recycling / reclamation / treatment or secondary reuse / recovery . * 2017 progress; see our 2018 Sustainability Report for further information.