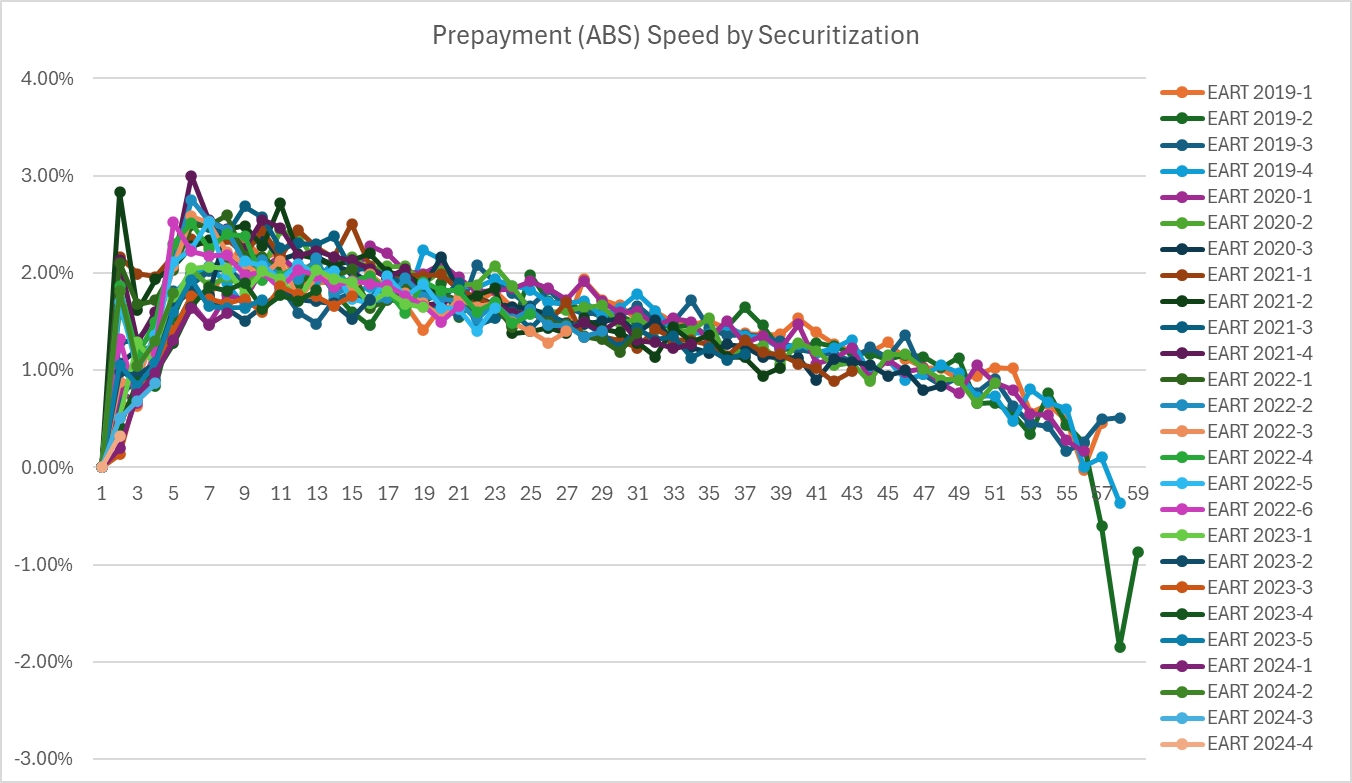

The assumptions used to construct the tables are hypothetical and have been provided only to give a general sense of how the principal cash flows might behave under various prepayment scenarios. The actual characteristics and performance of the automobile loan contracts will differ from the assumptions used to construct the tables. For example, it is very unlikely that the automobile loan contracts will prepay at a constant level of ABS each monthly period until maturity or that each of the automobile loan contracts will prepay at the same level of ABS. Moreover, the automobile loan contracts have diverse terms and that fact alone could produce slower or faster principal distributions than indicated in the tables at the various constant percentages of ABS, even if the original and remaining terms to maturity of the automobile loan contracts are as assumed. Any difference between the assumptions used to construct the tables and the actual characteristics and performance of the automobile loan contracts, including actual prepayment experience or losses, will affect the percentages of initial principal amounts outstanding on any given date and the weighted average lives of each class of notes.

The percentages in the tables have been rounded to the nearest whole number. As used in the tables which follow, the weighted average life of a class of notes is determined by:

* Greater than 0.00% but less than 0.50%.

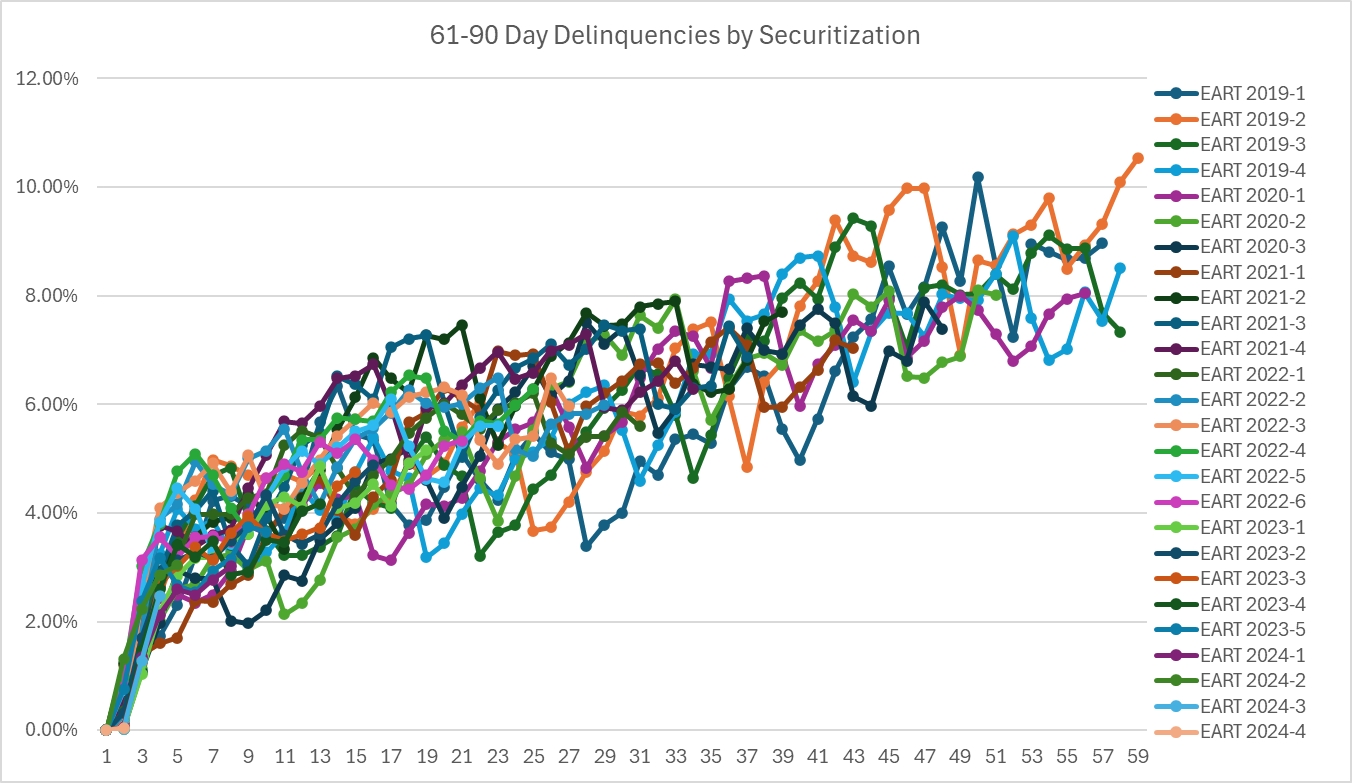

The following tables provide information relating to Exeter’s delinquency and loan loss experience for each period indicated with respect to all automobile loan contracts Exeter has originated indirectly and has serviced. This information includes the experience with respect to all automobile loan contracts in Exeter’s portfolio of automobile loan contracts serviced during each listed period, including automobile loan contracts that do not meet the criteria for inclusion in, or were otherwise excluded from, this securitization.

Exeter’s net charge-offs as an annualized percentage of average automobile loan contracts outstanding may vary from period to period based upon the average age or seasoning of the portfolio and economic factors. Delinquency percentages, as reflected in the following delinquency experience table, are subject to periodic fluctuation based on average age or seasoning of the portfolio, seasonality within the calendar year and economic factors. Due to the target customer base, a relatively high percentage of accounts become delinquent at some point in the life of the automobile loan contract. Furthermore, a relatively high rate of account movement occurs between current and delinquent status in the portfolio.

Exeter’s policy is to charge-off an account (i) on the last day of a calendar month, if as of that date, more than 10% of any scheduled automobile loan contract payment related to such account remains unpaid for 120 days or more from the date for such payment (so long as the related financed vehicle has not been repossessed and the related obligor has not been identified on Exeter’s records as being the subject of a current bankruptcy proceeding), (ii) if the related financed vehicle has been repossessed and it has either liquidated such financed vehicle or held such financed vehicle in its inventory for more than 60 days (or up to 90 days subject to the modification of its Customary Servicing Practices) at month-end, or (iii) if such account is otherwise required to be charged-off or is deemed uncollectible in accordance with its Customary Servicing Practices. A charge-off generally represents the difference between the estimated net sales proceeds and the amount of the delinquent automobile loan contract.

During periods of economic slowdown or recession, delinquencies, defaults, repossessions and losses generally increase. These periods also may be accompanied by increased unemployment rates, decreased consumer demand for automobiles and declining values of automobiles securing outstanding automobile loan contracts, which weakens collateral coverage and increases the amount of a loss in the event of default. Significant increases in the inventory of used automobiles during periods of economic recession may also depress the prices at which repossessed automobiles may be sold or delay the timing of these sales. Additionally, higher gasoline prices, unstable real estate values, declining stock market values, increasing unemployment levels, general availability of consumer credit or other factors that impact consumer confidence or disposable income could increase loss frequency and decrease consumer demand for automobiles as well as weaken collateral values on certain types of automobiles. Because Exeter focuses predominately on sub-prime borrowers, the actual rates of delinquencies, defaults, repossessions and losses on these automobile loan contracts are higher than those experienced in the general automobile finance industry and could be dramatically affected by a general economic downturn.

We cannot assure you that the levels of delinquency and loss experience reflected in the following tables are indicative of the performance of the automobile loan contracts owned by the issuing entity. Because a pandemic such as the COVID-19 outbreak has not occurred in recent years, the sponsor’s historical delinquency and loan loss experience described in this prospectus is unlikely to accurately predict the performance of the automobile loan contracts in this transaction. See “Risk Factors—Adverse events arising from the coronavirus outbreak could result in delays in payment or losses on your notes.”

For purposes of the “Delinquency Experience” and “Loan Loss Experience” tables below: (i) accounts that pay in accordance with their bankruptcy payment plan are deemed to be current and not delinquent, (ii) accounts remain in delinquency until Exeter is notified of the bankruptcy case as published by the courts, (iii) figures below include losses associated with principal balance cramdown for bankrupt accounts, and (iv) automobile loan contracts sold to a third party at the time of origination are excluded from these tables.

Delinquency Experience

|

At June 30, |

At December 31, |

| | | | | | | | | | | | | |

Portfolio at end of period(1) | $9,956,211,937 | | $9,194,463,826 | $9,239,705,834 | | $8,782,982,669 | | $7,840,421,493 | | $6,302,961,564 | | $5,604,439,824 |

Period of Delinquency(2) | | | | | | | | | | | | |

31 - 60 days(3) | $952,797,541 | | $925,612,438 | $1,030,347,761 | | $989,667,591 | | $726,307,906 | | $575,755,667 | | $593,574,456 |

| 61 - 90 days | $443,230,160 | | $437,510,306 | $475,314,853 | | $490,113,188 | | $335,698,206 | | $266,224,825 | | $288,878,659 |

| 91 days or more | $213,269,683 | | $187,539,521 | $243,916,705 | | $248,945,495 | | $131,913,181 | | $112,871,567 | | $135,730,280 |

Total Delinquencies(4) | $1,609,297,384 | | $1,550,662,264 | $1,749,579,319 | | $1,728,726,273 | | $1,193,919,293 | | $954,852,059 | | $1,018,183,395 |

| Repossessed Assets | $83,111,588 | | $72,144,537 | $99,642,767 | | $81,190,578 | | $58,705,754 | | $41,273,550 | | $49,582,440 |

Total Delinquencies and Repossessed Assets(4) | $1,692,408,972 | | $1,622,806,801 | $1,849,222,086 | | $1,809,916,851 | | $1,252,625,047 | | $996,125,609 | | $1,067,765,836 |

| Total Delinquencies as a Percentage of the Portfolio | 16.16% | | 16.87% | 18.94% | | 19.68% | | 15.23% | | 15.15% | | 18.17% |

| Repossessed Assets as a Percentage of the Portfolio | 0.83% | | 0.78% | 1.08% | | 0.92% | | 0.75% | | 0.65% | | 0.88% |

| Total Delinquencies and Repossessed Assets as a Percentage of the Portfolio | 17.00% | | 17.65% | 20.01% | | 20.61% | | 15.98% | | 15.80% | | 19.05% |

_________________________

| (1) | All amounts and percentages are based on the Principal Balances of the automobile loan contracts. |

| (2) | Exeter considers an automobile loan contract delinquent when more than 10% of a contractual payment remains unpaid by the due date. The period of delinquency is based on the number of days that more than 10% of the contractual payment that was due on an automobile loan contract on a prior due date remained unpaid after that due date. |

| (3) | Amounts shown do not include automobile loan contracts which are less than 31 days delinquent. |

| (4) | Totals may not sum because of rounding. |

Loan Loss Experience

| |

Six Months Ended June 30, | | |

Fiscal Year Ended December 31, |

| | | | | | | | | | | | | | | |

Period End Principal Outstanding(1) | $9,956,211,937 | | $9,194,463,826 | | | $9,239,705,834 | | $8,782,982,669 | | $7,840,421,493 | | $6,302,961,564 | | $5,604,439,824 |

Average Month End Amount Outstanding During the Period(1) | $9,593,716,005 | | $8,965,730,849 | | | $9,103,500,325 | | $8,624,435,825 | | $7,237,939,274 | | $6,023,721,480 | | $5,060,856,113 |

Net Charge Offs(2) | $476,696,392 | | $407,127,684 | | | $936,216,274 | | $714,067,549 | | $336,196,298 | | $413,174,942 | | $435,830,345 |

Net Charge Offs as a Percentage of Period End Principal Outstanding(3) | 9.58% | | 8.86% | | | 10.13% | | 8.13% | | 4.29% | | 6.56% | | 7.78% |

| Net Charge Offs as a Percentage of Average Month End Amount Outstanding | 9.94% | | 9.08% | | | 10.28% | | 8.28% | | 4.64% | | 6.86% | | 8.61% |

_________________________

| (1) | All amounts and percentages are based on the Principal Balances of the automobile loan contracts. |

| (2) | Net charge offs equal gross charge offs minus recoveries. Gross charge-offs do not include unearned finance charges and other fees. Recoveries include repossession proceeds received from the sale of repossessed financed vehicles net of repossession expenses, refunds of unearned premiums from credit life and credit accident and health insurance and extended service contract costs obtained and financed in connection with the vehicle financing and recoveries from obligors on deficiency balances and matured loan balances. |

General

The issuing entity will issue the notes under an indenture, a form of which has been filed as an exhibit to the registration statement. In addition, a copy of the indenture will be filed with the SEC no later than the last date upon which this prospectus is required to be filed. The notes will represent debt secured by the automobile loan contracts owned by the holding trust. The following summary describes material terms of the notes and the indenture, but is not a complete description of the entire indenture.

The issuing entity will offer the publicly offered notes in minimum denominations of $1,000 and integral multiples of $1,000 in book-entry form only. Persons acquiring beneficial interests in the book-entry notes will hold their interests (i) in the United States, through The Depository Trust Company, or (ii) in Europe, through Clearstream or, with respect to the publicly offered notes and only if the sponsor satisfies any applicable conditions precedent to the holding of such notes on its system, through Euroclear. See “—Book-Entry Registration” below and “Risk Factors— Book-entry registration for the notes may reduce their liquidity” and Annex B in this prospectus. The depositor and its affiliates may buy or sell notes in the secondary market from time to time, in accordance with the terms of the indenture and applicable securities law. If the depositor or an affiliate of the depositor were to acquire notes in the secondary market, such notes may be exchanged for definitive notes. If the depositor or an affiliate of the depositor were to sell any notes acquired by it in the secondary market, such notes may become subject to additional transfer restrictions.

None of the notes will be guaranteed or insured by any governmental agency or instrumentality, the sponsor, the depositor, the servicer, the indenture trustee, or any of their respective affiliates.

Distribution Dates

Payments on the notes will be made on the fifteenth day of each month or, if the fifteenth day is not a business day, on the next following business day, by the indenture trustee, or a paying agent appointed by the indenture trustee, to the persons who are registered as noteholders at the close of business on the record date. The first distribution date will be October 15, 2024.

Only holders of record as of the close of business on the record date, which is the business day immediately preceding a distribution date, will receive payments on that distribution date. Distributions will be made in immediately available funds, by wire transfer or otherwise, to the account of a noteholder, in an amount equal to the percentage interest represented by the note held by the noteholder multiplied by the total amount to be distributed on that distribution date on account of that note. Distributions required to be made to noteholders shall be made by wire

transfer, in immediately available funds, to the account of such noteholder at a bank or other entity having appropriate facilities therefore, in accordance with written instructions provided by such noteholder to the indenture trustee pursuant to the terms of the sale and servicing agreement. The final payment distribution upon retirement of any note will be made only upon presentation and surrender of such note at the office or agency of the indenture trustee specified in the notice to noteholders of the final distribution.

Collections on the automobile loan contracts during a collection period, which is the calendar month immediately preceding the calendar month in which the related distribution date occurs or, for the first distribution date, the period after the cutoff date to the close of business on September 30, 2024 (the collection period), will be required to be remitted by the servicer to the Collection Account prior to the related distribution date and will be used to distribute payments to noteholders on that distribution date. Prior to each distribution date, the servicer will determine the amounts of principal and interest which will be due to noteholders on that distribution date.

A business day is a day other than a Saturday, Sunday or any other day on which commercial banks located in Texas, Delaware or New York or the location in which the corporate trust office of either the indenture trustee under the indenture or the owner trustee under the trust agreement are authorized or obligated to be closed.

The final scheduled distribution dates are as follows:

| • | for the Class A-1 Notes, October 15, 2025; |

| • | for the Class A-2 Notes, April 15, 2027; |

| • | for the Class A-3 Notes, March 15, 2028; |

| • | for the Class B Notes, April 16, 2029; |

| • | for the Class C Notes, January 15, 2030; |

| • | for the Class D Notes, February 18, 2031; and |

| • | for the Class E Notes, May 17, 2032. |

Payments of Interest

Interest on each class of notes will accrue during each interest period at the applicable interest rate (i) with respect to the Class A-1 Notes, from and including the distribution date occurring in the preceding calendar month—or, in the case of the first distribution date, from and including the closing date—to but excluding the distribution date occurring in the current calendar month and (ii) with respect to the notes (other than the Class A-1 Notes), from and including the fifteenth day of the preceding calendar month—or, in the case of the first distribution date, from and including the closing date—to but excluding the fifteenth day of the current calendar month. The interest accruing during an interest period will accrue on each class’s outstanding note principal amount as of the end of the prior distribution date, or, in the case of the first distribution date, as of the closing date.

Interest on the notes will be calculated (i) with respect to the Class A-1 Notes, on the basis of the actual number of days elapsed in such Interest Period, but assuming a 360-day year and (ii) with respect to the notes (other than the Class A-1 Notes), on the basis of a 360-day year consisting of twelve 30-day months.

Interest payments on the notes will be paid sequentially in alphabetical order (i.e., first to the Class A Notes, pro rata, based upon the aggregate amount of interest due to each class of the Class A Notes, second to the Class B notes, third to Class C Notes, fourth to the Class D Notes and fifth to the Class E Notes). For any distribution date, interest due but not paid on that distribution date will be due on the next distribution date. To the extent permitted by law, interest at the applicable interest rate on that unpaid amount will be due on the next distribution date.

For any distribution date, the indenture trustee will pay interest on the notes from the note distribution account after paying (i) accrued and unpaid fees to the servicer, (ii) accrued and unpaid fees expenses and indemnities due to the indenture trustee, custodian, asset representations reviewer, owner trustee, backup servicer, lockbox bank, intercreditor agent and any successor servicer under the transaction documents (subject to the aggregate limit or maximum aggregate annual limit, as applicable, described under “Description of the Transaction Documents—

Distributions—Distribution Date Payments” in this prospectus), and (iii) certain payments of principal on more senior classes of notes. See “Description of the Transaction Documents—Distributions—Distribution Date Payments” in this prospectus.

Payments of Principal

On each distribution date, payments of principal will be distributed to the most senior Outstanding class of notes to maintain parity between the note principal amount and the Pool Balance. The principal payments made to cure this undercollateralization, if any then exists, will be made prior to the payment of interest and principal on the more subordinated classes of notes on that distribution date. See “Description of the Transaction Documents—Distributions—Distribution Date Payments” in this prospectus.

On each distribution date, once the reserve account is fully funded, Available Funds (as defined in the Glossary) that remain following payment of all amounts pursuant to clauses 1 through 18 under “Description of the Transaction Documents—Distributions—Distribution Date Payments” below will be available to be paid as the Principal Payment Amount and will be paid to the most senior Outstanding class or classes of notes as payments of principal. These amounts will be paid under clause 19 under “Description of the Transaction Documents—Distributions—Distribution Date Payments” in this prospectus.

The classes of notes are “sequential pay” classes. On each distribution date, all amounts allocated to the payment of principal as described in clauses 4, 5, 7, 8, 10, 11, 13, 14, 16, 17 and 19 under “Description of the Transaction Documents—Distributions—Distribution Date Payments” in this prospectus (other than any distribution date when the priorities set forth under “Description of the Transaction Documents—Distributions—Distribution Date Payments after an Event of Default” in this prospectus are applicable) will be aggregated and will be paid out in the following order:

| • | first, the Class A-1 Notes will amortize until they are paid in full; |

| • | once the Class A-1 Notes are paid in full, the Class A-2 Notes will begin to amortize, until they are paid in full; |

| • | once the Class A-2 Notes are paid in full, the Class A-3 Notes will begin to amortize, until they are paid in full; |

| • | once the Class A-3 Notes are paid in full, the Class B Notes will begin to amortize, until they are paid in full; |

| • | once the Class B Notes are paid in full, the Class C Notes will begin to amortize, until they are paid in full; |

| • | once the Class C Notes are paid in full, the Class D Notes will begin to amortize, until they are paid in full; and |

| • | once the Class D Notes are paid in full, the Class E Notes will begin to amortize, until they are paid in full. |

In addition, any outstanding principal amount of any class of notes that has not been previously paid will be payable on the final scheduled distribution date for that class. The actual date on which the aggregate outstanding principal amount of any class of notes is paid may be earlier than the final scheduled distribution date for that class, depending on a variety of factors.

Amounts collected (i) following the occurrence of an event of default (other than an event of default related to a breach of a covenant or a representation and warranty) or (ii) upon liquidation of the trust assets that are allocated to principal will be aggregated and will be paid out in the following order: first, to the Class A-1 Notes, until the principal amount of the Class A-1 Notes is paid in full, second, to the Class A-2 Notes and the Class A-3 Notes, pro rata, based upon their respective unpaid principal amounts, until the principal amount of each such class of Class A Notes is paid in full, third, to the Class B Notes until the principal amount of the Class B Notes is paid in full, fourth, to the Class C Notes until the principal amount of the Class C Notes is paid in full, fifth, to the Class D Notes until the

principal amount of the Class D Notes is paid in full and sixth, to the Class E Notes until the principal amount of the Class E Notes is paid in full. For additional information, see “Description of the Transaction Documents—Distributions—Distribution Date Payments after an Event of Default” in this prospectus.

Optional Redemption

On any distribution date on which the Pool Balance, as of the last day of the related collection period, has declined to 5% or less of the Pool Balance as of the cutoff date, the servicer or the depositor may exercise its “clean-up call” option to purchase the automobile loan contract pool, in which case any notes that are still Outstanding may be redeemed in whole, but not in part. This redemption will cause the early retirement of the redeemed notes. The redemption price paid in respect of the notes by the servicer or the depositor, as the case may be, will equal the greater of (i) the amount necessary to pay the full amount of principal and interest then due and payable on the notes after giving effect to the application of Available Funds and the distributions required to be made to the noteholders and the other transaction parties on such date and (ii) the aggregate Principal Balance of the automobile loan contracts as of the last day of the related collection period.

Collections on the automobile loan contracts received after the last day of the collection period preceding the redemption date will be distributed to the servicer or the depositor, as applicable, or may be applied by the servicer or the depositor, at their option, to the payment of the redemption price.

Any Available Funds or amounts on deposit in the reserve account remaining after giving effect to the distributions required to be made to the noteholders and the other transaction parties on the redemption date for the notes will be distributed to the certificateholders.

Notice of any such redemption will be given by the servicer or the issuing entity to the engaged rating agencies and to the indenture trustee. Such notice shall be provided to the indenture trustee no later than 10 days prior to the planned redemption date.

Substitution

The servicer may permit the substitution of the vehicle financed by an automobile loan contract if the vehicle (i) is insured under a qualifying insurance policy at the time of a casualty loss that is treated as a total loss under such insurance policy, (ii) is deemed to be a “lemon” pursuant to applicable state law and repurchased by the related dealer or (iii) is the subject of an order by a court of competent jurisdiction directing the servicer to substitute another vehicle under the related automobile loan contract and certain other conditions are satisfied, so long as the original aggregate Principal Balance of all Substitution Receivables does not exceed the Substitution Limit. If this Substitution Limit is exceeded for any reason, the servicer is obligated to repurchase a sufficient number of such automobile loan contracts to cause the aggregate original Principal Balances of such Substitution Receivables to be less than the Substitution Limit.

Events of Default

The occurrence and continuance of any of the following events will constitute an event of default under the indenture:

| 1. | default in the payment of interest when it becomes due and payable on (i) any class of Class A Notes, (ii) if no Class A Notes are Outstanding, the Class B Notes, (iii) if no Class A Notes or Class B Notes are Outstanding, the Class C Notes, (iv) if no Class A Notes, Class B Notes or Class C Notes are Outstanding, the Class D Notes and (v) if no Class A Notes, Class B Notes, Class C Notes or Class D Notes are Outstanding, the Class E Notes, which default, in each case, remains uncured for five days; provided, however, that if such payment default shall have been caused by a Force Majeure Event, the five day cure period shall be extended for an additional 60 calendar days; |

| 2. | default in the payment of the principal of any note on its final scheduled distribution date; provided, however, that if such payment default shall have been caused by a Force Majeure Event, such default shall not constitute an “event of default” for an additional 60 calendar days; |

| 3. | default in the observance or performance of any covenant or agreement of the issuing entity made in the indenture (other than a default in the payment of principal of or interest on any note when due) which |

default materially and adversely affects the rights of the noteholders, and which default shall continue unremedied for a period of 45 days (or for such longer period, not in excess of 90 days, as may be reasonably necessary to remedy such default; provided that such default is capable of remedy within 90 days or less and the servicer on behalf of the owner trustee delivers an officer’s certificate to the indenture trustee to the effect that such default is capable of remedy within 90 days or less and that the issuing entity has commenced, or will promptly commence and diligently pursue, all reasonable efforts to remedy such default) after the giving of written notice to the issuing entity and the indenture trustee, by the holders of at least 25% of the voting rights of the notes Outstanding or to the issuing entity by the indenture trustee, specifying such default and requiring it to be remedied and stating that such notice is a “Notice of Default” under the indenture; provided, however, that if such default shall have been caused by a Force Majeure Event, the 45 day cure period shall be extended for an additional 60 calendar days;

| 4. | any representation or warranty of the issuing entity made in the indenture, any transaction document or in any certificate or any other writing delivered pursuant to the indenture or in connection with the indenture proving to have been incorrect at the time it was made, which failure materially and adversely affects the rights of the noteholders and which default shall continue unremedied for a period of 45 days (or for such longer period, not in excess of 90 days, as may be reasonably necessary to remedy such default; provided that such default is capable of remedy within 90 days or less and the servicer on behalf of the owner trustee delivers an officer’s certificate to the indenture trustee to the effect that such default is capable of remedy within 90 days or less and that the issuing entity has commenced, or will promptly commence and diligently pursue, all reasonable efforts to remedy such default) after the giving of written notice to the issuing entity and the indenture trustee, by the holders of at least 25% of the voting rights of the notes Outstanding or to the issuing entity by the indenture trustee, specifying such default and requiring it to be remedied and stating that such notice is a “Notice of Default” under the indenture; provided, however, that if such default shall have been caused by a Force Majeure Event, the 45 day cure period shall be extended for an additional 60 calendar days; |

| 5. | the filing of a decree or order for relief by a court having jurisdiction in the premises in respect of the issuing entity or any substantial part of the Trust Estate in an involuntary case under any applicable federal or state bankruptcy, insolvency or other similar law now or hereafter in effect, or appointing a receiver, liquidator, assignee, custodian, trustee, sequestrator or similar official of the issuing entity or for any substantial part of the Trust Estate, or ordering the winding-up or liquidation of the issuing entity’s affairs, and such decree or order shall remain unstayed and in effect for 60 consecutive days; and |

| 6. | the commencement by the issuing entity of a voluntary case under any applicable federal or state bankruptcy, insolvency or other similar law now or hereafter in effect, or the consent by the issuing entity to the entry of an order for relief in an involuntary case under any such law, or the consent by the issuing entity to the appointment or taking possession by a receiver, liquidator, assignee, custodian, trustee, sequestrator or similar official of the issuing entity or for any substantial part of the Trust Estate, or the making by the issuing entity of any general assignment for the benefit of creditors, or the failure by the issuing entity generally to pay its debts as such debts become due, or the taking of action by the issuing entity in furtherance of any of the foregoing. |

If an event of default has occurred and is continuing, the indenture trustee shall, if so requested in writing by the Majority Noteholders (as defined in the Glossary), declare that the notes become due and payable at par, together with accrued interest. Prior to the declaration of the acceleration of the notes, the Majority Noteholders may waive any event of default or unmatured event of default and its consequences, except a default (i) in the payment of principal of or interest on any of the notes or (ii) in respect of a covenant or provision which cannot be modified or amended without the consent of the holder of each note.

Upon the occurrence of an event of default, the indenture trustee shall, if so requested in writing by the Majority Noteholders (subject to limitations set forth in the indenture), accelerate the notes, exercise remedies or liquidate the holding trust property or trust property in whole or in part, on any date or dates following the event of default. The indenture trustee shall not cause the liquidation of the holding trust property or trust property unless (i) the event of default is a default in the payment of interest on the most senior class of notes then Outstanding, (ii) the event of default is a default in the payment of the principal of any note on its final scheduled distribution date or (iii) any of (a) noteholders representing 100% of the Outstanding amount of the notes consent thereto, or (b) the proceeds

of such sale or liquidation distributable to the noteholders will be sufficient to discharge in full all amounts then due and unpaid on such notes for principal and interest or (c) the indenture trustee determines that the holding trust property and trust property, in the aggregate, will not continue to provide sufficient funds for the payment of principal of and interest on the notes as they would have become due if the notes had not been accelerated and the indenture trustee provides notice to the issuing entity (who shall deliver such notice to the engaged rating agencies) and obtains the consent of noteholders representing at least 66‑2/3% of the Outstanding amount of the notes.

Book-Entry Registration

Upon issuance, the notes will be available in book-entry form or definitive form, as described in this prospectus. Investors in the book-entry notes may hold their notes (i) in the United States, through The Depository Trust Company or DTC, or (ii) in Europe, through Clearstream or, with respect to the publicly offered notes and only if the sponsor satisfies any applicable conditions precedent to the holding of such notes on its system, through, Euroclear. Each of Clearstream and Euroclear in turn hold securities through DTC, if they are participants of those systems, or indirectly through organizations that are participants in those systems. See “Risk Factors—Book-entry registration for the notes may reduce their liquidity” in this prospectus. Such notes will be issued as fully-registered notes registered in the name of Cede & Co. (DTC’s partnership nominee) or such other name as may be requested by an authorized representative of DTC. One global note will be issued to represent each $500,000,000 of aggregate principal amount of notes of the same issue, and will be deposited with DTC. Additional global notes will be issued to represent any remaining principal amount of the issue.

The notes will be tradable as home market instruments in both the European and U.S. domestic markets. Initial settlement and all secondary trades will settle in same-day funds. Secondary market trading between investors through Clearstream and Euroclear will be conducted in the ordinary way in accordance with the normal rules and operating procedures of Clearstream and Euroclear and in accordance with conventional eurobond practice, which is seven calendar day settlement. Secondary market trading between investors through DTC will be conducted according to DTC’s rules and procedures applicable to U.S. corporate debt obligations. Secondary cross-market trading between Clearstream or Euroclear and DTC participants holding notes will be effected on a delivery-against-payment basis through the respective Depositaries of Clearstream and Euroclear and as DTC participants.

Non-U.S. holders of global securities will be subject to U.S. withholding taxes unless the holders meet a number of requirements and deliver appropriate U.S. tax documents to the notes clearing organizations or their participants.

DTC, the world’s largest securities depository, is a limited-purpose trust company organized under the New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered pursuant to the provisions of Section 17A of the Exchange Act. DTC holds and provides asset servicing for over 3.5 million issues of U.S. and non-U.S. equity issues, corporate and municipal debt issues, and money market instruments (from over 100 countries) that DTC’s participants, or Direct Participants, deposit with DTC. DTC also facilitates the post-trade settlement among Direct Participants of sales and other securities transactions in deposited notes, through electronic computerized book-entry transfers and pledges between Direct Participants’ accounts. This eliminates the need for physical movement of definitive notes. Direct Participants include both U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations, and certain other organizations. DTC is a wholly-owned subsidiary of The Depository Trust & Clearing Corporation, or DTCC. DTCC is the holding company for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearing agencies. DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system is also available to others such as both U.S. and non-U.S. securities brokers and dealers, banks, trust companies, and clearing corporations that clear through or maintain a custodial relationship with a Direct Participant, either directly or indirectly, or Indirect Participants. DTC has a Standard & Poor’s rating of AA+. The DTC Rules applicable to its participants are on file with the Securities and Exchange Commission. More information about DTC can be found at www.dtcc.com.

Purchases of notes under the DTC system must be made by or through Direct Participants, which will receive a credit for the notes on DTC’s records. The ownership interest of each actual purchaser of each note, or a “beneficial owner,” is in turn to be recorded on the Direct and Indirect Participants’ records. Beneficial owners will not receive written confirmation from DTC of their purchase. Beneficial owners are, however, expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the Direct and

Indirect Participant through which the beneficial owner entered into the transaction. Transfers of ownership interests in the notes are to be accomplished by entries made on the books of Direct and Indirect Participants acting on behalf of beneficial owners. Beneficial owners will not receive definitive notes representing their ownership interests in notes, except in the event that use of the book-entry system for the notes is discontinued.

To facilitate subsequent transfers, all notes deposited by Direct Participants with DTC are registered in the name of DTC’s partnership nominee, Cede & Co., or such other name as may be requested by an authorized representative of DTC. The deposit of notes with DTC and their registration in the name of Cede & Co., or such other DTC nominee, do not effect any change in beneficial ownership. DTC has no knowledge of the actual beneficial owners of the notes; DTC’s records reflect only the identity of the Direct Participants to whose accounts such notes are credited, which may or may not be the beneficial owners. The Direct and Indirect Participants will remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time. Beneficial owners of notes may wish to take certain steps to augment the transmission to them of notices of significant events with respect to the notes, such as redemptions, tenders, defaults, and proposed amendments to the transaction documents. For example, beneficial owners of notes may wish to ascertain that the nominee holding the notes for their benefit has agreed to obtain and transmit notices to beneficial owners. In the alternative, beneficial owners may wish to provide their names and addresses to the registrar and request that copies of notices be provided directly to them.

Redemption notices shall be sent to DTC. If less than all of the notes within a class are being redeemed, DTC’s practice is to determine by lot the amount of the interest of each Direct Participant in such class to be redeemed.

Neither DTC nor Cede & Co. (nor any other DTC nominee), will consent or vote with respect to notes unless authorized by a Direct Participant in accordance with DTC’s procedures. Under its usual procedures, DTC mails an omnibus proxy to the related issuing entity as soon as possible after the record date. The omnibus proxy assigns Cede & Co.’s consenting or voting rights to those Direct Participants to whose accounts notes are credited on the record date (identified in a listing attached to the omnibus proxy).

Redemption proceeds, distributions and dividend payments on the notes will be made to Cede & Co., or such other nominee as may be requested by an authorized representative of DTC. DTC’s practice is to credit Direct Participants’ account upon DTC’s receipt of funds and corresponding detail information from the issuing entity or its agent, on payable date in accordance with their respective holdings shown on DTC’s records. Payments by participants to beneficial owners will be governed by standing instructions and customary practices, as is the case with notes held for the accounts of customers in bearer form or registered in “street name,” and will be the responsibility of such participant and not of DTC nor its nominee, or the issuing entity, subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of redemption proceeds, distributions and dividend payments to Cede & Co. (or such other nominee as may be requested by an authorized representative of DTC) is the responsibility of the issuing entity or agent, disbursement of such payments to Direct Participants will be the responsibility of DTC, and disbursements of such payments to the beneficial owners will be the responsibility of Direct and Indirect Participants.

A beneficial owner shall give notice to elect to have its notes purchased or sold, through its participant and shall effect delivery of such notes by causing the Direct Participant to transfer the participant’s interest in the notes, on DTC’s records. The requirement for physical delivery of the notes in connection with a sale will be deemed satisfied when the ownership rights in the notes are transferred by Direct Participants on DTC’s records and followed by a book-entry credit of sold notes to the purchaser’s account.

DTC may discontinue providing its services as depository with respect to the notes at any time by giving reasonable notice to the issuing entity. Under such circumstances, in the event that a successor depository is not obtained, definitive notes are required to be printed and delivered.

The issuing entity may decide to discontinue use of the system of book-entry-only transfers through DTC (or a successor securities depository). In that event, definitive notes will be printed and delivered to DTC.

The information in this section concerning DTC and DTC’s book-entry system has been obtained from sources that we believe to be reliable, but we take no responsibility for the accuracy thereof.

Clearstream Banking, société anonyme, Luxembourg, formerly Cedelbank, or Clearstream, Luxembourg, is incorporated under the laws of Luxembourg. Clearstream, Luxembourg holds securities for its customers and facilitates the clearance and settlement of securities transactions between Clearstream, Luxembourg customers through electronic book-entry changes in accounts of Clearstream, Luxembourg customers, thereby eliminating the need for physical movement of definitive securities. Transactions may be settled by Clearstream, Luxembourg in a number of currencies, including U.S. Dollars. Clearstream, Luxembourg provides to its customers, among other things, services for safekeeping, administration, clearance and settlement of internationally traded securities and securities lending and borrowing. Clearstream, Luxembourg also deals with 45 domestic securities markets around the globe through established depository and custodial relationships. Clearstream, Luxembourg is registered as a bank in Luxembourg, and as such is subject to regulation by the Commission de Surveillance du Secteur Financier, ‘CSSF’, which supervises Luxembourg banks. Clearstream, Luxembourg’s customers are worldwide financial institutions, including underwriters, securities brokers and dealers, banks, trust companies and clearing corporations. Clearstream, Luxembourg’s U.S. customers are limited to securities brokers and dealers and banks. Currently, Clearstream, Luxembourg has over 2,500 customers located across 110 countries, including all major European countries, Canada and the United States. Indirect access to Clearstream, Luxembourg is available to other institutions that clear through or maintain a custodial relationship with a Clearstream, Luxembourg participant. Clearstream, Luxembourg has established an electronic bridge with Euroclear Bank in Brussels to facilitate settlement of trades between Clearstream, Luxembourg and Euroclear Bank, or Euroclear.

Euroclear was created in 1968 to hold securities for its participants and to clear and settle transactions between Euroclear participants through simultaneous electronic book-entry delivery against payment, thereby eliminating the need for movement of physical securities and any risk from lack of simultaneous transfers of securities and cash. Transactions may be settled in over 30 currencies, including United States dollars. Euroclear provides various other services, including securities lending and borrowing and interfaces with domestic markets in several countries generally similar to the arrangements for cross-market transfers with DTC described above. Euroclear is operated by Euroclear Bank S.A./NV under contract with Euroclear Clearance Systems S.C., a Belgian cooperative corporation. Euroclear Bank S.A./NV conducts all operations. All Euroclear securities clearance accounts and Euroclear cash accounts are accounts with Euroclear Bank S.A./NV, not Euroclear Clearance Systems S.C. Euroclear Clearance Systems S.C. establishes policy for Euroclear on behalf of Euroclear participants. Euroclear participants include banks (including central banks), securities brokers and dealers and other professional financial intermediaries. Indirect access to Euroclear is also available to other firms that clear through or maintain a custodial relationship with a Euroclear participant, either directly or indirectly.

Euroclear Bank S.A./NV has advised that it is licensed by the Belgian Banking and Finance Commission to carry out banking activities on a global basis. As a Belgian bank, it is regulated and examined by the Belgian Banking Commission. Securities clearance accounts and cash accounts with Euroclear Bank S.A./NV are governed by the Terms and Conditions Governing Use of Euroclear and the related Operating Procedures of the Euroclear System and applicable Belgian law. These terms and conditions, operating procedures and laws govern transfers of securities and cash within Euroclear, withdrawals of securities and cash from Euroclear, and receipts of payments with respect to securities in Euroclear. All securities in Euroclear are held on a fungible basis without attribution of specific certificates to specific securities clearance accounts. Euroclear Bank S.A./NV acts under the Terms and Conditions only on behalf of Euroclear participants, and has no record of or relationship with persons holding through Euroclear participants.

Definitive Notes

The notes will be issued in fully registered, certificated form, commonly called “definitive notes,” to the noteholders or their nominees, rather than to DTC or its nominee, only if:

| • | DTC or Exeter advises the indenture trustee in writing that DTC is no longer willing, qualified or able to discharge properly its responsibilities as nominee and depositary with respect to the book-entry notes and Exeter is unable to locate a qualified successor; or |

| • | after the occurrence of an event of default, the noteholders evidencing at least a majority of the principal amount of the most senior class of notes then Outstanding advise the indenture trustee through DTC participants in a manner consistent with the related transaction documents and with the necessary percentage of the aggregate outstanding principal amount of the notes that the continuation of a book-entry system with respect to the notes through DTC is no longer in the best interests of the noteholders. |

Upon the occurrence of any event described in the immediately preceding paragraph, DTC will notify all affected noteholders through participants of the availability of definitive notes. Upon surrender by DTC of its notes and receipt of instructions for re-registration, the indenture trustee will reissue the notes as definitive notes.

Distributions of principal of, and interest on, the notes will then be made by the indenture trustee in accordance with the procedures set forth in the transaction documents directly to holders of definitive notes in whose names the definitive notes were registered at the close of business on the applicable record date. Distributions required to be made to noteholders will be made by wire transfer, in immediately available funds, to the account of such noteholder at a bank or other entity having appropriate facilities therefore, in accordance with written instructions provided by such noteholder to the indenture trustee pursuant to the terms of the sale and servicing agreement. The final payment on any note, however, will be made only upon presentation and surrender of the note at the office or agency specified in the notice of final distribution.

Definitive notes will be transferable and exchangeable at the offices of the indenture trustee or of a certificate registrar named in a notice delivered to holders of the definitive notes. No service charge will be imposed for any registration of transfer or exchange, but the indenture trustee may require payment of a sum sufficient to cover any tax or other governmental charge imposed in connection therewith.

Statements to Noteholders

On or prior to each distribution date, the indenture trustee will make available a statement to the noteholders detailing information required under the transaction documents. These statements will be based on the information in the related servicer’s certificate. Each statement that the indenture trustee makes available to the noteholders will include the following information regarding the notes on the related distribution date to the extent such information has been received from the servicer:

| (a) | the amount of the distribution(s) allocable to interest; |

| (b) | the amount of the distribution(s) allocable to principal; |

| (c) | each class of notes’ aggregate outstanding principal amount and pool factor, before and after considering all payments reported under (b) above on that date; |

| (d) | the related Noteholders’ Interest Carryover Amount (as defined in the Glossary), if any, and the change in that amount from the preceding statement; |

| (e) | the servicing fee paid for the related collection period; |

| (f) | the amounts paid to the owner trustee, the indenture trustee, the asset representations reviewer, the backup servicer, the lockbox bank, the intercreditor agent and the custodian for the related collection period; |

| (g) | the balance of the reserve account, before and after considering all distributions and deposits to be made on the related distribution date; |

| (h) | the number of automobile loan contracts and the Pool Balance as of the close of business on the last day of the preceding collection period; |

| (i) | the amount of the aggregate realized losses on the automobile loan contract pool, if any, for the related period; |

| (j) | delinquency and loss information with respect to the automobile loan contracts for the related collection period; |

| (k) | any material change in practices with respect to charge-offs, collection and management of delinquent automobile loan contracts during the related collection period; |

| (l) | any material modifications, extensions or waivers to automobile loan contracts terms, fees, penalties or payments during the related collection period; |

| (m) | whether a delinquency trigger has occurred as of the end of the related collection period; |

| (n) | the aggregate Purchase Amounts for automobile loan contracts, if any, that were repurchased by the servicer, the sponsor or the depositor during the related collection period; and |

| (o) | the amount of the distribution(s) payable out of amounts withdrawn from the reserve account. |

The noteholders will not receive a separate notification when changes are made to the automobile loan contract pool, such as when automobile loan contracts are removed from the automobile loan contract pool pursuant to the provisions of the transaction documents providing the repurchase of automobile loan contracts upon breaches of eligibility representations and warranties. However, filings detailing the automobile loan contract pool composition will be filed periodically on Form 10-D under the SEC file number 333-268757-10 as required by Regulation AB. In addition, updated asset level data will be filed with the SEC on Form ABS-EE at the time of filing each Form 10-D.

Unless and until definitive notes are issued, the indenture trustee will send these reports to Cede & Co., as registered holder of the notes and the nominee of DTC on the issuing entity’s behalf. See “Description of the Notes” in this prospectus.

The indenture trustee will make available each month to each noteholder the above information (and certain other documents, reports and information regarding the automobile loan contracts provided by the servicer from time to time) via the indenture trustee’s internet website with the use of a password provided by the indenture trustee. The indenture trustee’s internet website will be located at http://sf.citidirect.com or at such other address as the indenture trustee shall notify the noteholders from time to time. For assistance with regard to this service, you can call the indenture trustee’s customer service desk at (888) 855-9695.

After the end of each calendar year, within the required time period, the indenture trustee will furnish to each person who at any time during the calendar year was a noteholder a statement as to the aggregate amounts of interest and principal paid to the noteholder and any other information as the depositor deems necessary to enable the noteholder to prepare its tax returns.

Description of the Transaction Documents

The following summary describes material terms of the purchase agreement, the sale and servicing agreement, the indenture and the trust agreement, but is not a complete description of each transaction document. The issuing entity has filed forms of these transaction documents as exhibits to the registration statement. On or prior to the filing of the final prospectus, the issuing entity will also file final versions of these transaction documents on a Form 8-K under the issuing entity’s SEC file number. The term transaction documents as used with respect to the issuing entity or the holding trust means, except as otherwise specified, any and all agreements relating to the establishment of the issuing entity, the transfer and servicing of the automobile loan contracts and the issuance of the notes, including without limitation the purchase agreement, the sale and servicing agreement, the indenture and the trust agreement.

The notes will be issued in connection with the entry into the transaction documents by the issuing entity, the holding trust, the depositor and the sponsor, which transaction documents will establish the issuing entity and holding trust, transfer the automobile loan contracts among the parties and issue the notes.

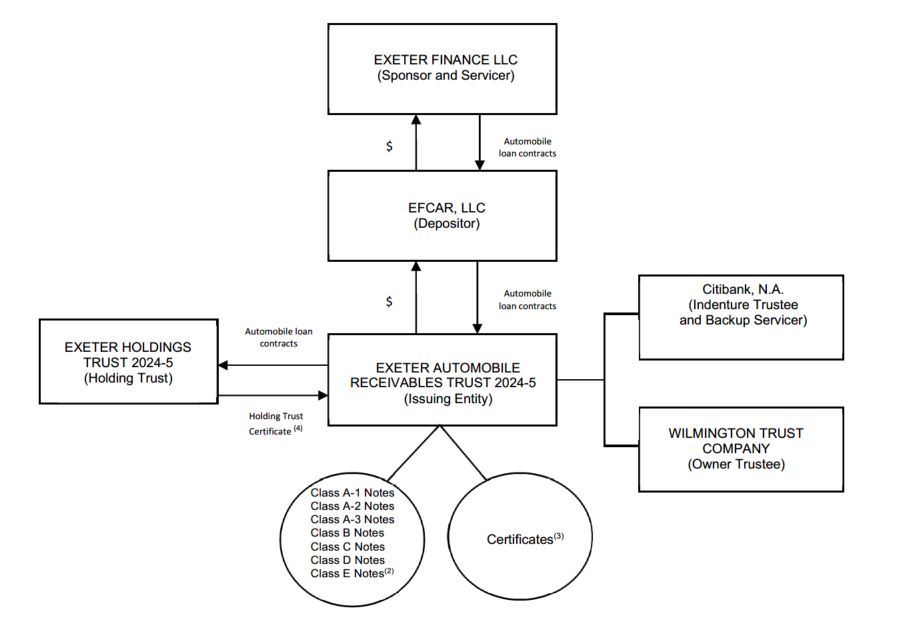

Sale and Assignment of the Automobile Loan Contracts

On or prior to the closing date, Exeter will enter into a purchase agreement with the depositor pursuant to which Exeter will sell and assign to the depositor, without recourse, its entire interest in and to the automobile loan contracts. Under the purchase agreement, Exeter will also sell and assign to the depositor, without recourse, its security interest in the financed vehicles securing the related automobile loan contracts and its rights to receive all payments on, or proceeds from, the related automobile loan contracts to the extent paid or payable after the cutoff date. The

automobile loan contracts transferred by Exeter to the depositor will be identified in an automobile loan contract schedule appearing as an exhibit to the purchase agreement.

On or prior to the closing date, the depositor will enter into a sale and servicing agreement with the issuing entity pursuant to which the depositor will sell and assign to the issuing entity, without recourse, its entire interest in and to the automobile loan contracts. Under the sale and servicing agreement, the depositor will also sell and assign to the issuing entity, without recourse, its security interest in the financed vehicles securing the related automobile loan contracts and its rights to receive all payments on, or proceeds from, the related automobile loan contracts to the extent paid or payable after the cutoff date. Each automobile loan contract transferred by the depositor to the issuing entity will be identified in an automobile loan contract schedule appearing as an exhibit to the sale and servicing agreement. Under the contribution agreement, the issuing entity will transfer to the holding trust 100% of the interest in and to the automobile loan contracts. The holding trust will issue the holding trust certificate to the issuing entity under the contribution agreement.

Under the purchase agreement, Exeter will agree that, upon the breach of any eligibility representation and warranty made by Exeter to the depositor which is breached and which triggers the depositor’s repurchase obligation with respect to any automobile loan contract, the holding trust will be entitled to require Exeter to repurchase the affected automobile loan contracts directly from the holding trust. The holding trust’s rights under the purchase agreement will constitute part of the holding trust’s property and may be enforced directly by the holding trust. In addition, the holding trust will pledge these rights to the indenture trustee as collateral for the notes and the indenture trustee may directly enforce those rights.

The servicer will establish and will agree to maintain a deposit account, the lockbox account, with a bank, the lockbox bank. The servicer will agree to use its best efforts to notify or direct obligors to make all payments on the automobile loan contracts directly to the lockbox bank, and to notify or direct the lockbox bank to deposit all payments on the automobile loan contracts in the lockbox account no later than the business day after receipt. The lockbox account is a commingled account, into which payments on other automobile loan contracts serviced by the servicer on behalf of itself and other parties will also be deposited from time to time. The lockbox account will be the subject of an intercreditor agreement, the lockbox intercreditor agreement, pursuant to which a third party, the intercreditor agent, will agree to act as agent on behalf of (a) the issuing entity and the indenture trustee, with respect to proceeds of the automobile loan contracts that are deposited to the lockbox account from time to time, and (b) other persons, with respect to other amounts deposited to the lockbox account from time to time. Under the lockbox intercreditor agreement, the intercreditor agent does not have the ability to exercise control rights which would have the effect of restricting the servicer’s access to the lockbox account, except upon receipt of direction from a party for whom it is acting as agent to the effect that certain conditions have occurred which would permit such party to restrict such servicer access. Under the sale and servicing agreement, each of the issuer and the indenture trustee will agree that it will not deliver, or cause to be delivered, a direction or notice which would have the effect of permitting or requiring the intercreditor agent to exercise control rights over the lockbox account, unless a servicer termination event shall have occurred and a successor servicer shall have been appointed and such successor servicer shall have assumed all of the rights and obligations of a successor servicer in accordance with the terms of the sale and servicing agreement. Under the sale and servicing agreement, the indenture trustee will agree to deliver such a notice or direction at the written direction of the majority noteholders. The issuing entity will indemnify the intercreditor agent and its respective officers, directors, employees and agents against any and all loss, liability or expense (including reasonable fees and expenses of outside counsel, including those incurred in connection with (i) any enforcement of the indemnification obligation and (ii) a successful defense, in whole or in part, of any claim that intercreditor agent breached its standard of care), in each case, incurred by it in connection with the performance of its duties under the lockbox intercreditor agreement.

The indenture trustee will establish a collection account in its own name, on the noteholders’ behalf. The servicer will agree to cause all proceeds of the automobile loan contracts that are deposited to the lockbox account to be transferred, within two business days of deposit in the lockbox account, to the collection account. The collection account will be maintained with the indenture trustee so long as the indenture trustee’s deposits have a rating acceptable to the engaged rating agencies. If the deposits of the indenture trustee or its corporate parent no longer have an acceptable rating, the servicer will, with the indenture trustee’s assistance if necessary, establish a new collection account within 5 business days (or such longer period as to which each engaged rating agency may consent) at a bank whose deposits have the required rating under the sale and servicing agreement and will transfer any cash and/or investments to such new collection account.

The indenture trustee will establish and maintain a note distribution account in its own name, on the noteholders’ behalf. Amounts that are released from the collection account or the reserve account for distribution to noteholders will be deposited to the note distribution account and all distributions to the noteholders will be made from the note distribution account.

The indenture trustee will establish and maintain a reserve account in its own name, on the noteholders’ behalf. Amounts may be released from the reserve account in the manner set forth in “—Credit Enhancement—Reserve Account.”

Funds on deposit in the collection account, the note distribution account and the reserve account (collectively, the trust accounts) will be invested by the indenture trustee (or any custodian with respect to funds on deposit in such account) in eligible investments that mature not later than the business day prior to the following distribution date selected in writing by the servicer (pursuant to standing instructions or otherwise). Eligible investments are limited to investments acceptable to the engaged rating agencies as being consistent with the rating of the notes, and may include securities issued by the sponsor, the servicer or their respective affiliates or other issuing entities created by the sponsor or its affiliates. The servicer will deposit investment earnings on funds in the trust accounts, net of losses and investment expenses, in the collection account on each distribution date. Absent written direction from the servicer, the indenture trustee shall hold such funds uninvested.

All accounts, other than the lockbox account, will be maintained as eligible deposit accounts. An “eligible deposit account” is a segregated trust account with the corporate trust department of a depository institution organized under the laws of the United States of America or any one of the states or the District of Columbia (or any domestic branch of a foreign bank), having corporate trust powers and acting as trustee for funds deposited in such account, so long as (i) the long-term unsecured debt of such depository institution has a credit rating acceptable to each rating agency engaged to rate the notes and (ii) such depository institutions’ deposits are insured by the FDIC.

The sponsor will be the initial servicer under the transaction documents. The servicer may delegate its servicing responsibilities to one or more affiliates or sub-servicers, but delegation will not relieve it of its liabilities under the transaction documents. The transaction documents will describe certain circumstances under which a servicer may resign or be removed, as described in this prospectus.

The servicer will make representations and warranties regarding its authority to enter into, and its ability to perform, its obligations under the transaction documents. An uncured material breach of a representation or warranty that materially and adversely affects the interests of the issuing entity, the holding trust or the noteholders will constitute a servicer termination event.

The transaction documents will provide that the servicer will make reasonable efforts to:

| (a) | collect all payments due on the automobile loan contracts which are part of the holding trust property; and |

| (b) | make collections on the automobile loan contracts using the same collection procedures that it follows with respect to automobile loan contracts that it services for itself and others. |

Consistent with its Customary Servicing Practices, the servicer may, in its discretion, arrange with an obligor on an automobile loan contract to extend the payment schedule. Some of the arrangements — including, without limitation, any extension of the payment schedule beyond the final scheduled distribution date for the latest maturing class of notes — may result in the servicer repurchasing the automobile loan contract. The servicer may sell the vehicle securing a defaulted automobile loan contract, if any, at a public or private sale, or take any other action permitted by applicable law.

Payments on Automobile Loan Contracts

The servicer will deposit into the lockbox account all payments on the related automobile loan contracts, from whatever source, and all proceeds of the automobile loan contracts collected, within two business days of receipt

and identification, which amounts will be transferred to the collection account. The servicer may not commingle amounts deposited in the collection account with funds from other sources.

Servicing Compensation

Under the sale and servicing agreement, the servicer will receive a servicing fee on each distribution date. For so long as Exeter or the backup servicer is the servicer, the base servicing fee on each distribution date will equal 3.00% times the aggregate Principal Balance of the automobile loan contracts as of the opening of business on the first day of the collection period times one-twelfth (or, in the case of the first distribution date, a fraction, the numerator of which is 21 and the denominator of which is 360). For so long as any successor servicer other than the backup servicer is the servicer, the servicing fee may be greater than the servicing fee that Exeter and the backup servicer are entitled to receive as the servicer, if a fee adjustment is agreed to by the Majority Noteholders, the depositor and the successor servicer. However, in the event Exeter is terminated as servicer, and absent any such agreement with respect to a fee adjustment, the backup servicer will be obligated to become the successor servicer for the same servicing fee as Exeter would have been entitled to receive as servicer. In addition to the base servicing fee, the servicer will also retain any late fees, prepayment charges and other administrative fees or similar charges allowed by applicable law with respect to the automobile loan contracts as supplemental servicing fees, and would be entitled to reimbursement from the issuing entity for various expenses. The servicer will allocate obligor payments to scheduled payments due from obligors, late fees and other charges, and principal and interest in accordance with the servicer’s normal practices and procedures.

The servicing fee and any supplemental servicing fee will compensate the servicer for performing the functions of a third-party servicer of automobile loan contracts as an agent for their beneficial owner. These servicer functions will include:

| • | collecting and posting all payments; |

| • | responding to obligor inquiries on the related automobile loan contracts; |

| • | investigating delinquencies; |

| • | sending billing statements to obligors; |

| • | reporting tax information to obligors; |

| • | paying collection and disposition costs with respect to defaulted accounts; |

| • | monitoring the collateral; |

| • | administering the automobile loan contracts; |

| • | complying with the terms of the lockbox account agreement and the lockbox intercreditor agreement; |

| • | accounting for collections and furnishing statements to the indenture trustee with respect to distributions; |

| • | paying outside auditor fees; and |

| • | paying data processing costs. |

The servicer will also be reimbursed for repossession and recovery fees and costs associated with maintaining bank accounts that are necessary to service the automobile loan contracts.

The servicer may delegate its duties under any transaction document with respect to the servicing of and collections on certain automobile loan contracts to an affiliate of the servicer without first obtaining the consent of any person. The servicer may utilize third party agents in connection with its usual collection activities, such as

repossessions and pursuing deficiency balances. The fees and expenses of any third party agent will be as agreed between the servicer and its third party agent and none of the indenture trustee, the backup servicer, the issuing entity, the holding trust or the noteholders will have any responsibility for those fees and expenses. No delegation by the servicer of any of its duties under any transaction document shall relieve the servicer of its responsibility with respect to such duties.

Distributions

Distributions of principal and interest on each note will be made by the indenture trustee to the noteholders. The timing, calculation, allocation, order, source, priorities of and requirements for distributions on each note will be as described below under “—Distribution Date Payments”, “—Distribution Date Payments after an Event of Default” and “—Distribution Date Payments after an Event of Default Related to a Breach of a Covenant or a Representation and Warranty.”

On each distribution date, the servicer will transfer collections on the automobile loan contracts from the collection account to the note distribution account for distribution to noteholders. As described below in “—Credit Enhancement”, credit enhancement may be available to cover certain shortfalls in the amount available for distribution. Distributions in respect of principal of a class of notes will be subordinate to distributions in respect of interest on the class.

Servicer’s Certificates

On each determination date, the servicer will deliver the servicer’s certificate to the indenture trustee, the owner trustee and the backup servicer. The servicer will also make the servicer’s certificate available to each engaged rating agency no later than the fifteenth day of each month (or, if not a business day, the next succeeding business day). The servicer’s certificate will specify, among other things:

| • | information necessary to enable the indenture trustee to make the required distributions on the related distribution date; |

| • | the amount of aggregate collections on the automobile loan contracts during the related collection period; |

| • | the aggregate Purchase Amounts (as defined in the Glossary) of automobile loan contracts purchased by the depositor and Exeter during the related collection period; and |

| • | the aggregate amount of Net Liquidation Proceeds (as defined in the Glossary) during the related collection period. |

The determination date with respect to collections received during a collection period is the second business day prior to the related distribution date in the next calendar month.

Distribution Date Payments

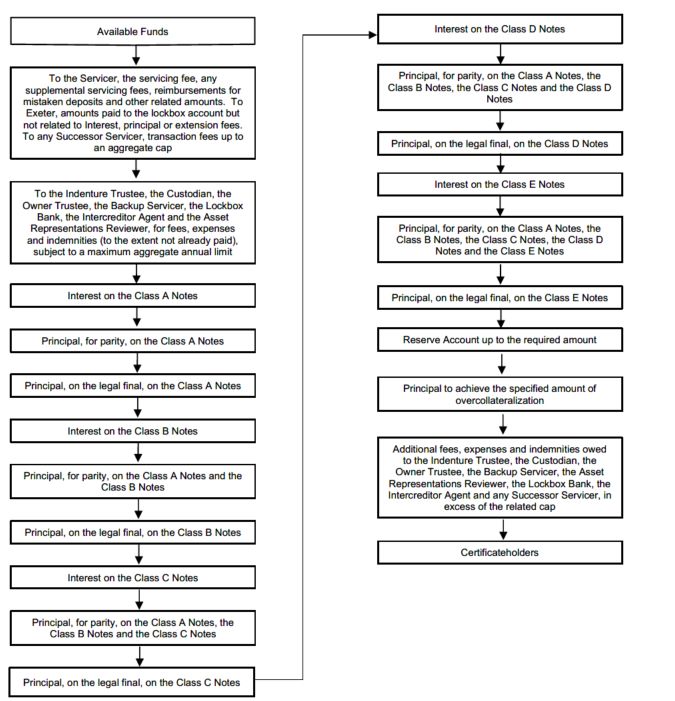

On or prior to each distribution date, the servicer will instruct the indenture trustee to make the following distributions on such distribution date from Available Funds and the amounts withdrawn from the reserve account in the following order of priority:

| 1. | to the servicer, the servicing fee for the related collection period, any supplemental servicing fees for the related collection period and, to the extent the servicer has not reimbursed itself or to the extent not retained by the servicer, other amounts relating to mistaken deposits, postings or checks returned for insufficient funds; to Exeter, to the extent available, any amounts paid by the borrowers during the related collection period that were deposited in the lockbox account but that do not relate to principal payments, interest payments or extension fees due on the automobile loan contracts; and to any successor servicer, transition fees not to exceed $200,000 (including boarding fees) in the aggregate; |

| 2. | to each of the indenture trustee, the custodian, the owner trustee, the backup servicer (including the backup servicer in its capacity as successor servicer if so appointed), the lockbox bank, the intercreditor agent and the asset representations reviewer, any accrued and unpaid fees, expenses |

and indemnities then due to each of them (in each case, to the extent Exeter has not previously paid those fees, expenses and indemnities and, in the case of any such amounts payable to the lockbox bank or the intercreditor agent, as applicable, to the extent such amounts are allocable to the issuing entity, and provided that such fees, expenses and indemnities payable shall not exceed (i) $100,000 in the aggregate in any calendar year to the owner trustee, (ii) $25,000 in the aggregate in any calendar year to the custodian, (iii) $100,000 in the aggregate in any calendar year to the indenture trustee and the backup servicer (including the backup servicer in its capacity as successor servicer if so appointed), (iv) $50,000 in the aggregate in any calendar year to the asset representations reviewer, (v) $50,000 in the aggregate in any calendar year to the lockbox bank and (vi) $25,000 in the aggregate in any calendar year to the intercreditor agent);

| 3. | to the note distribution account, that portion of the Noteholders’ Interest Distributable Amount (as defined in the Glossary) payable on the Class A Notes, to be paid pro rata, based upon the aggregate amount of interest due to each class of the Class A Notes; |

| 4. | to the note distribution account, to make a payment of principal to the extent necessary to reduce the aggregate principal amount of the Class A Notes to the Pool Balance, which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 5. | to the note distribution account, to make a payment of the remaining note principal amount of each class of Class A Notes on its respective final scheduled distribution date; |

| 6. | to the note distribution account, that portion of the Noteholders’ Interest Distributable Amount payable on the Class B Notes; |

| 7. | to the note distribution account, to make a payment of principal to the extent necessary, after giving effect to any payments made under clauses 4 and 5 above, to reduce the combined principal amount of the Class A Notes and Class B Notes to the Pool Balance, which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 8. | to the note distribution account, to make a payment of the remaining note principal amount of the Class B Notes on its final scheduled distribution date; |

| 9. | to the note distribution account, that portion of the Noteholders’ Interest Distributable Amount payable on the Class C Notes; |

| 10. | to the note distribution account, to make a payment of principal to the extent necessary, after giving effect to any payments made under clauses 4, 5, 7 and 8 above, to reduce the combined principal amount of the Class A Notes, Class B Notes and Class C Notes to the Pool Balance, which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 11. | to the note distribution account, to make a payment of the remaining note principal amount of the Class C Notes on its final scheduled distribution date; |

| 12. | to the note distribution account, that portion of the Noteholders’ Interest Distributable Amount payable on the Class D Notes; |

| 13. | to the note distribution account, to make a payment of principal to the extent necessary, after giving effect to any payments made under clauses 4, 5, 7, 8, 10 and 11 above, to reduce the combined principal amount of the Class A Notes, Class B Notes, Class C Notes and Class D Notes to the Pool Balance, which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 14. | to the note distribution account, to make a payment of the remaining note principal amount of the Class D Notes on its final scheduled distribution date; |

| 15. | to the note distribution account, that portion of the Noteholders’ Interest Distributable Amount payable on the Class E Notes; |

| 16. | to the note distribution account, to make a payment of principal to the extent necessary, after giving effect to any payments made under clauses 4, 5, 7, 8, 10, 11, 13 and 14 above, to reduce the combined principal amount of the Class A Notes, Class B Notes, Class C Notes, Class D Notes and Class E Notes to the Pool Balance, which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 17. | to the note distribution account, to make a payment of the remaining note principal amount of the Class E Notes on its final scheduled distribution date; |

| 18. | to the reserve account, an amount necessary to cause the amount deposited therein to equal the specified reserve account amount; |

| 19. | to the note distribution account, to make a payment of the Principal Payment Amount which amount will be paid out as described above under “Description of the Notes—Payments of Principal;” |

| 20. | to pay each of the indenture trustee, the custodian, the owner trustee, the asset representations reviewer, the lockbox bank, the intercreditor agent, the backup servicer (including the backup servicer in its capacity as successor servicer if so appointed) and any successor servicer, any fees, expenses and indemnities then due to such party that are in excess of the aggregate limit or maximum aggregate annual limit specified in clause 1 or clause 2 above, as applicable; and |

| 21. | to pay all remaining amounts to the certificate distribution account for further distribution to the certificateholders. |