PROSPECTUS

CQS Asset Backed Securities Fund

John Hancock CQS Asset Backed Securities Fund, is a Massachusetts business trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a continuously offered, non-diversified, closed-end management investment company.

The fund’s investment objective is to seek to generate a return comprised of both current income and capital appreciation.

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in ABS-Related Investments (as defined below). The term “ABS-Related Investments” includes commercial mortgage-backed securities (“CMBS”); asset-backed securities (“ABS”); collateralized loan obligations (“CLOs”); agency and non-agency residential mortgage-backed securities (“RMBS”); significant risk transfer securitization transactions (“SRTs”); and collateralized mortgage obligations (“CMOs”). As part of its principal investment strategy, the fund will primarily make use of credit default swaps, options and foreign exchange contracts for purposes of hedging against various types of exposure, including, but not limited to, interest rate risk exposure, asset-backed market exposure and foreign currency exposure. To the extent the fund’s investments in derivatives and other synthetic instruments provide investment exposure to ABS-Related Investments, such derivatives and synthetic instruments will be counted toward satisfaction of this 80% policy. The fund will be concentrated in the real estate industry indirectly due to its investments in the following: CMBS, RMBS and CMOs. Certain ABS-Related Investments may be issued by non-US issuers and/or may reflect underlying exposures to non-US issuers and/or borrowers. See “INVESTMENT PROGRAM – Principal Investment Strategies.”

The fund seeks to achieve its investment objective by generating attractive risk-adjusted returns over the medium to long term by investing, on a global basis, in asset-backed securities (“ABS”), markets and other appropriate markets to generate returns in excess of any hedging and/or financing costs. The fund also seeks to identify mis-valuations and relative value opportunities in such markets. There can be no assurance that the fund will achieve its investment objective or that it will not incur a loss.

The fund is operated as an “interval fund” and, in order to provide a degree of liquidity to the shareholders of the fund (“Shareholders”), the fund has adopted a fundamental policy pursuant to Rule 23c-3 under the 1940 Act, to make quarterly offers to repurchase between 5% and 25% of its outstanding Class I Shares, Class A Shares and Class U Shares of beneficial interest (the “Shares”) at the current net asset value (“NAV”) per share. Notices of each quarterly repurchase offer are sent to Shareholders of the fund of record at least 21 days before the “Repurchase Request Deadline” (

, the latest date on which Shareholders can tender their Shares in response to a repurchase offer). This notice may be included with a shareholder report or other fund document. For the avoidance of doubt, Shareholders may withdraw or modify their tenders at any time prior to the Repurchase Request Deadline pursuant to Rule 23c-3(b)(6) under the 1940 Act. In addition, the fund cannot require that a minimum number of Shares be tendered pursuant to Rule 23c-3(b)(1) under the 1940 Act. The fund expects its initial repurchase offer to be issued no later than the second calendar quarter after the date that the fund’s Registration Statement becomes effective.

If you invest in the fund through a financial intermediary, the notice will be provided to you by your financial intermediary. This notice will also be posted on the fund’s website at

https://www.jhinvestments.com/investments/interval-and-tender-offer-funds/alternative-funds/cqs-asset-backed-securities-fund-i-absbx

. The fund determines the NAV applicable to repurchases no later than fourteen

i

(14) days after the Repurchase Request Deadline (or the next business day, if the 14th day is not a business day). The fund expects to distribute payment to Shareholders no later than seven (7) calendar days after such date. For a more complete description of the periodic repurchase offers that the fund anticipates engaging in, see “PERIODIC REPURCHASE OFFERS” below. There can be no assurance that the fund will achieve its investment objective.

John Hancock Investment Management LLC serves as the fund’s investment adviser (the “Advisor”). Under the supervision of the Advisor and with oversight by the Board of Trustees of the fund (the “Board”), CQS (US), LLC (the “Subadvisor” or “CQS”) has day-to-day portfolio management responsibilities for the fund.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | |

| | |

| |

| |

| | | |

| | At current

NAV | | At current NAV plus

sales load | | At current

NAV | |

| At current NAV

plus

sales load |

|

Maximum Sales Load 2 as a Percentage of Purchase Amount | | None | | 2.50% | | None | | | | |

Total Proceeds to the Fund 3 | | Current

NAV | | Current NAV | | Current

NAV | | | At current NAV | |

| 1 | The Shares are continuously offered at current NAV, which will fluctuate. |

| 2 | Class A Share investments may be subject to a maximum sales charge of 2.50%. Such sales load will not form part of an investor’s investment in the fund. The sales load may be waived in certain circumstances at the Advisor’s discretion. See “Distribution Arrangements.” Also, Shareholders may qualify for a reduced sales load on Class A Shares. See “Purchase Terms” regarding how sales charges on Class A Shares are calculated. |

| 3 | Total Proceeds to the fund assume that all registered Shares will be sold in a continuous offering and the maximum sales load is incurred as applicable. The proceeds may differ from that shown if other than the maximum sales load is paid on average, the then-current net asset value at which Shares are sold varies from that shown and/or additional Shares are registered. |

John Hancock Investment Management Distributors LLC (the “Distributor”) acts as the distributor of the Shares, on a best efforts basis, subject to various conditions. Shares may be purchased through brokers, dealers or banks that have entered into selling agreements with the Distributor, or through intermediaries that have an agreement with the Distributor related to the purchase of Shares. Neither the Distributor nor any other adviser, broker or dealer is obligated to buy from the fund any of the Shares. The Distributor serves as the principal underwriter for the fund. The Distributor is an affiliate of the Advisor.

In consideration for distribution and investor services in connection with Class A Shares and Class U Shares of the fund, the fund will pay the Distributor or a designee a monthly fee equal to 0.25% per annum of the aggregate value of the fund’s Class A Shares outstanding and equal to 0.75% per annum of the aggregate value of the fund’s Class U Shares outstanding, determined as of the close of regular trading on the New York Stock Exchange (“NYSE”) (typically 4:00 p.m., Eastern time, on each business day that the NYSE is open) (or more frequently as needed) (prior to any repurchases of Shares and prior to the Management Fee (as defined below) being calculated). The Advisor or its affiliates may pay from their own resources compensation to broker-dealers and other intermediaries in connection with placement of Shares or servicing of investors. These arrangements may result in receipt by such broker-dealers and other intermediaries and their personnel (who themselves may receive all or a substantial part of the relevant payments) of compensation in excess of that which otherwise would have been paid in connection with their placement of shares of a different investment fund. A prospective investor with questions regarding this arrangement may obtain additional detail by contacting his, her or its intermediary directly. Prospective investors also should be aware that this payment could create incentives on the part of an intermediary to view the fund more favorably relative to investment funds not making payments of this nature or making smaller such payments.

ii

Shares are an illiquid investment. An investment in the fund should be considered a speculative investment that entails substantial risks, including but not limited to:

| | | | The fund’s Shares are not listed on any securities exchange and it is not anticipated that a secondary market for the fund’s Shares will develop. Thus, an investment in the fund may not be suitable for investors who may need the money they invest in a specified timeframe; |

| | | | The amount of distributions that the fund may pay, if any, is uncertain; |

| | | | The fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the fund’s performance, such as from offering proceeds, borrowings, and amounts from the fund’s affiliates that are subject to repayment by investors; |

| | | | All or a portion of an annual distribution may consist solely of a return of capital (i.e., from your original investment) and not a return of net investment income; |

| | | | Because you will be unable to sell your Shares or have them repurchased immediately, you will find it difficult to reduce your exposure on a timely basis during a market downturn or otherwise; |

| | | | Risks related to non-diversification, asset-based securities, fixed-income securities, foreign securities, securitized credit, consumer based loans, corporate asset-based credit, and commercial real estate and residential real estate investments, are described in the “Risk Factors” section beginning on page [ ] of this Prospectus; |

| | | | More specifically, (i) the methods by which the fund may use leverage is described in greater detail under “Borrowing and Leverage” in the “Investment Program” section beginning on page [ ] of this Prospectus: and (ii) the risks related to the use of leverage are described under “Leverage Risk” in the “Risk Factors” section beginning on page [ ] of this Prospectus; |

| | | | An investor may pay a sales load up to 2.50% for Class A Shares as described in this Prospectus. If an investor pays the maximum 2.50% sales load for Class A Shares, the investor must experience a total return on his or her net investment of more than 2.50% in order to recover these expenses; |

| | | | Even though the fund will make quarterly repurchase offers for its outstanding Shares, investors should consider Shares of the fund to be an illiquid investment; |

| | | | Investors should carefully consider the fund’s risks and investment objective, as an investment in the fund may not be appropriate for all investors and is not designed to be a complete investment program; |

| | | | Because of the risks associated with non-diversification, the use of leverage and the fund’s investments in ABS-Related Investments (as defined below) and other financial instruments, an investment in the fund should be considered speculative and involving a high degree of risk, including the risk of a substantial loss of investment; |

| | | | Before making an investment/allocation decision, investors and financial intermediaries should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objective and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age and risk tolerance; and |

| | | | Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of their investment. It is possible that investing in the fund may result in a loss of some or all of the amount invested. |

This Prospectus sets forth concisely the information about the fund that a prospective investor should know before investing. You should read this Prospectus, which contains important information, before deciding whether to invest in the fund. You should retain the Prospectus for future reference. A Statement of Additional Information (SAI) dated January 13, 2025, containing additional information about the fund, has been filed with the SEC and is

iii

incorporated by reference in its entirety into this Prospectus. A copy of the SAI may be obtained without charge by calling 800-225-6020 (toll-free) or from the SEC’s website at sec.gov. Copies of the fund’s annual report and semi-annual report, when available, and other information about the fund may be obtained upon request by writing to the fund, by calling 800-225-6020, or by visiting the fund’s website at

https://www.jhinvestments.com/investments/interval-and-tender-offer-funds/alternative-funds/cqs-asset-backed-securities-fund-i-absbx

. You also may obtain a copy of any information regarding the fund filed with the SEC from the SEC’s website (sec.gov). The fund will also provide to each person, including any beneficial owner, to whom the Prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into the Prospectus but not delivered with the Prospectus. Such information will be provided upon written or oral request at no cost to the requester by writing to the fund, by calling 800-225-6020, or by visiting the fund’s website at

https://www.jhinvestments.com/investments/interval-and-tender-offer-funds/alternative-funds/cqs-asset-backed-securities-fund-i-absbx

. You also may obtain a copy of any information regarding the fund filed with the SEC from the SEC’s website (sec.gov).

Copies of the fund’s shareholder reports are not sent by mail. Instead, the reports are made available on at

https://www.jhinvestments.com/investments/interval-and-tender-offer-funds/alternative-funds/cqs-asset-backed-securities-fund-i-absbx

and you will be notified and provided with a link each time a report is posted to the website. You may request to receive paper reports from the fund or from your financial intermediary, free of charge, at any time. You may also request to receive documents through eDelivery. Your election to receive reports in paper will apply to all funds held with the Advisor or your financial intermediary.

The fund’s Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

You should rely only on the information contained or incorporated by reference in this Prospectus. The fund has not, and the Distributor has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither the fund nor the Distributor is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information provided by this Prospectus is accurate as of any date other than the date on the front of this Prospectus. The fund’s business, financial condition and results of operations may have changed since the date of this Prospectus.

iv

The following is only a summary of this Prospectus and does not contain all of the information that you should consider before investing in the fund. You should review the more detailed information contained in this prospectus (“Prospectus”) and in the Statement of Additional Information (“SAI”), especially the information set forth under the heading “Investment Objective and Principal Investment Strategies” and “Risk Factors.”

| | |

| | John Hancock CQS Asset Backed Securities Fund, a Massachusetts business trust (the “fund”). |

| |

| | The fund continuously offers and sells shares of beneficial interests (the “Shares”) designated as Class I Shares (“Class I Shares”), Class A Shares (“Class A Shares”), and Class U Shares (“Class U Shares”), through John Hancock Investment Management Distributors LLC (the “Distributor”). Investors who purchase Shares in the offering, and other persons who acquire Shares and are admitted to the fund by its Board of Trustees (each, individually a “Trustee” and collectively, the “Board”), will become shareholders of the fund (the “Shareholders”). The fund currently intends to accept purchases of Shares on a daily basis. All Shares are sold at the most recently calculated net asset value per Share for the class of Shares purchased as of the date on which the purchase is accepted. The minimum initial investment in the fund by any account is $250,000 for Class I Shares and $1,000 for Class A Shares and Class U Shares. The minimum investment amounts may be reduced or waived by the fund at the fund’s sole discretion. “Purchase Terms.” The fund is a closed-end “interval fund” and, in order to provide a degree of liquidity to Shareholders, the fund has adopted a fundamental policy pursuant to Rule 23c-3 under the 1940 Act, to make regular offers to repurchase between 5% and 25% of its outstanding Shares at NAV per share. In each repurchase offer, the fund will offer to repurchase its Shares at their net asset value (“NAV”) on the relevant valuation date reduced by any applicable repurchase fee. Although the policy permits repurchase of between 5% and 25% of the fund’s outstanding Shares at NAV per Share, for each quarterly repurchase offer, the fund currently expects to offer to repurchase 10% of the fund’s outstanding Shares at NAV subject to approval of the Board. The schedule requires the fund to make repurchase offers every three months. “Repurchases and Transfers of Shares.” The fund reserves the right to reject a purchase order for any reason. Shareholders will not have the right to redeem their Shares. However, as described below, in order to provide liquidity to Shareholders, the fund will conduct periodic repurchase offers for a portion of its outstanding Shares. |

| |

Investment Objective and Principal Investment Strategies | | The fund’s investment objective is to seek to generate a return comprised of both current income and capital appreciation. Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in ABS-Related Investments (as defined below). The term “ABS-Related Investments” includes commercial mortgage-backed securities (“CMBS”); asset-backed securities (“ABS”); collateralized loan obligations (“CLOs”); agency and non-agency residential mortgage-backed securities (“RMBS”); significant risk transfer securitization transactions (“SRTs”); and collateralized mortgage obligations (“CMOs”). As part of its principal investment strategy, the fund will primarily make use of credit default swaps, options and foreign exchange contracts for purposes of hedging against various types of exposure, including, but not limited to, interest rate risk exposure, asset-backed market exposure and foreign currency exposure. To the extent the fund’s investments in derivatives and other synthetic instruments provide investment exposure to ABS-Related Investments, such derivatives and synthetic instruments will be counted toward satisfaction of this 80% policy. The fund will be concentrated in the real estate industry indirectly due to its investments in the following: CMBS, RMBS and CMOs. Certain ABS-Related Investments may be issued by non-US issuers and/or may reflect underlying exposures to non-US issuers and/or borrowers. See “INVESTMENT PROGRAM – Principal Investment Strategies.” |

1

| | |

| | The fund seeks to achieve its investment objective by generating attractive risk-adjusted returns over the medium to long term by investing, on a global basis, in asset-backed securities (“ABS”), markets and other appropriate markets to generate returns in excess of any hedging and/or financing costs. The fund also seeks to identify mis-valuations and relative value opportunities in such markets. There can be no assurance that the fund will achieve its investment objective or that it will not incur a loss. The Board may change the investment objective of the fund without shareholder approval. |

| |

| | Under the 1940 Act, the fund is subject to certain regulatory restrictions in negotiating investments with entities, such as the Subadvisor and its affiliates, unless it obtains an exemptive order from the SEC. The fund relies on an exemptive order from the SEC permitting co-investment with other funds managed in a manner consistent with the fund’s investment objective, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors. Under the order, the fund is permitted to co-invest with affiliates if a “required majority” (as defined in Section 57(o) of the 1940 Act) of the fund’s Independent Trustees (as defined below) make certain conclusions in connection with a co-investment transaction, including, for example, that (1) the terms of the transactions, including the consideration to be paid, are reasonable and fair to the fund and its Shareholders and do not involve overreaching of the fund or its Shareholders by any person concerned and (2) the transaction is consistent with the interests of Shareholders and is consistent with the fund’s investment objective and strategies. |

| |

The Investment Advisor and Subadvisor | | The fund’s investment advisor is John Hancock Investment Management LLC (the “Advisor” or “JHIM”) and its subadvisor is CQS (US), LLC (the “Subadvisor” or “CQS”). The Advisor is a registered investment adviser with the SEC under the Investment Advisers Act of 1940 (“Advisers Act”) and is an indirect principally owned subsidiary of Manulife Financial Corporation. The Advisor is responsible for overseeing the management of the fund, including its day-to-day business operations and monitoring the Subadvisor. As of September 30, 2024, the Advisor had total assets under management of approximately $169.5 billion. The Subadvisor is a registered investment adviser with the SEC under the Advisers Act and is a Delaware limited liability company. The Subadvisor is also an indirect principally owned subsidiary of Manulife Financial Corporation. The Subadvisor handles the fund’s portfolio management activity, subject to oversight by the Advisor. As of September 30, 2024, the Subadvisor had total assets under management of approximately $15.5 billion. |

| |

| | John Hancock Investment Management Distributors LLC acts as the distributor of Shares on a best efforts basis, subject to various conditions, pursuant to the terms of a distribution agreement entered into with the fund. The Distributor maintains its principal office at 200 Berkeley Street, Boston, Massachusetts, 02116. |

| |

| | State Street Bank and Trust Company, located at One Congress Street, Suite 1, Boston, Massachusetts 02114, currently acts as custodian with respect to the fund’s assets. |

| |

| | SS&C GIDS, Inc. currently acts as transfer agent and dividend paying agent with respect to the fund’s assets and is located at 80 Lamberton Road, Windsor, Connecticut 06095. |

| |

| | The Board has an oversight role with respect to the fund and will include a majority of members who will not be “interested persons” of the fund or of the Advisor as defined in Section 2(a)(19) of the 1940 Act (“Independent Trustees”). The Board consists of four members, three of whom are Independent Trustees. |

| |

| | The fees and expenses of the fund are set forth below under “Fees and Expenses.” In consideration of the advisory services provided by the Advisor to the fund, the Advisor is entitled to a Management Fee (as defined below). The fund’s fees and expenses also include the following other fees: transfer agent fee, custody fee, and distribution and service fee. Class I Shares, Class A Shares and Class U Shares are subject to different fees and expenses. |

2

| | |

| | The fund may enter into one or more credit agreements or other similar agreements negotiated on market terms (each, a “Borrowing Transaction”) with one or more banks or other financial institutions which may or may not be affiliated with the Advisor (each, a “Financial Institution”). The fund may borrow under a credit facility for a number of reasons, including without limitation, in connection with its investment activities, to make quarterly income distributions, to satisfy repurchase requests from Shareholders, and to otherwise provide the fund with temporary liquidity. To facilitate such Borrowing Transactions, the fund may pledge its assets to the Financial Institution. |

| |

Organizational and Offering Expenses | | The initial operating expenses for a new fund, including start-up costs, which may be significant, may be higher than the expenses of an established fund. The fund is expected to incur organization expenses of approximately $550,000. The fund will also bear certain ongoing offering costs associated with the fund’s continuous offering of Shares. |

| |

Expense Limitation Agreement | | The Advisor contractually agrees to reduce its Management Fee for the fund or, if necessary, make payment to the fund, in an amount equal to the amount by which the “Other Fund Level Expenses” of the fund, incurred in the ordinary course of the fund’s business, exceed 0.50% percent of the fund’s average daily Managed Assets. Managed Assets is defined as the total assets of the fund (including any assets attributable to any preferred shares that may be issued or to indebtedness), minus the fund’s liabilities incurred in the normal course of operations other than liabilities relating to indebtedness. “Other Fund Level Expenses” means all the expenses of the fund excluding: (1) advisory and incentive fees; (2) interest expense and other borrowing related costs, fees and expenses; (3) Rule 12b-1 fees; (4) any cashiering or other investment servicing fees; (5) litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the business of the fund; (6) taxes; (7) short dividends; (8) acquired fund fees and expenses, which are based on indirect net expenses associated with the fund’s investments in underlying investment companies; (9) class specific expenses; (10) portfolio brokerage commissions; (11) expenses related to, or incurred by, special purpose vehicles or other subsidiaries of the fund held directly or indirectly by the fund; (12) expenses, including legal expenses, related to investments of the fund; and (13) expenses, including legal expenses, related to co-investment transactions involving the fund. This agreement expires February 28, 2026, unless renewed by mutual agreement of the Advisor and the fund based upon a determination that this is appropriate under the circumstances at that time. The Advisor also contractually agrees to waive a portion of its Management Fee and/or reimburse expenses for the fund and certain other John Hancock funds according to an asset level breakpoint schedule that is based on the aggregate net assets of all the funds participating in the waiver or reimbursement. This waiver is allocated proportionally among the participating funds. This agreement expires on July 31, 2026, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time. |

| |

| | |

| |

| | The fund will offer three separate classes of Shares designated as Class A Shares, Class U Shares, and Class I Shares. Shares may only be purchased through brokers, dealers or banks that have entered into selling agreements with the Distributor, or through intermediaries that have an agreement with the Distributor related to the purchase of Shares. The fund intends to accept purchases of Shares on a daily basis. The Board may discontinue accepting purchases on a daily basis at any time. |

3

| | |

Closed-End Fund Structure: Limited Liquidity and Transfer Restrictions | | The fund has been organized as a closed-end management investment company. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that closed-end fund shareholders do not have the right to redeem their shares on a daily basis. In order to meet daily redemption requests, mutual funds are subject to more stringent regulatory limitations than closed-end funds. In particular, a mutual fund generally may not invest more than 15% of its assets in illiquid securities and closed-end funds are not subject to such a limitation. The fund does not list the Shares on any securities exchange, and it is not expected that any secondary market will develop for the Shares. Shareholders will not be able to tender for repurchase of their Shares on a daily basis because the fund is a closed-end fund. Shares may not currently be exchanged for shares of any other fund. In order to provide liquidity to Shareholders, the fund is structured as an “interval fund” and conducts periodic repurchase offers for a portion of its outstanding Shares, as described herein. An investment in the fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Shares. Shares should be viewed as a long-term investment. |

| |

Periodic Repurchase Offers | | The fund is a closed-end “interval fund” and, in order to provide a degree of liquidity to Shareholders, the fund has adopted a fundamental policy pursuant to Rule 23c-3 under the 1940 Act, to make quarterly offers to repurchase between 5% and 25% of its outstanding Shares at NAV per share. Although the policy permits repurchase of between 5% and 25% of the fund’s outstanding Shares at NAV per Share, for each quarterly repurchase offer, the fund currently expects to offer to repurchase 10% of the fund’s outstanding Shares at NAV subject to approval of the Board. The schedule requires the fund to make repurchase offers every three months. The fund expects its initial repurchase offer to be issued no later than the second calendar quarter after the date that the fund’s Registration Statement becomes effective. Notices of each quarterly repurchase offer are sent to Shareholders of record at least 21 days before the “Repurchase Request Deadline” ( , the latest date on which Shareholders can tender their Shares in response to a repurchase offer). This notice may be included with a Shareholder report or other fund document. For the avoidance of doubt, Shareholders may withdraw or modify their tenders at any time prior to the Repurchase Request Deadline pursuant to Rule 23c-3(b)(6) under the 1940 Act. In addition, the fund cannot require that a minimum number of Shares be tendered pursuant to Rule 23c-3(b)(1) under the 1940 Act. If you invest in the fund through a financial intermediary, the notice will be provided to you by your financial intermediary. This notice will also be posted on the fund’s website at https://www.jhinvestments.com/investments/interval-and-tender-offer-funds/alternative-funds/cqs-asset-backed-securities-fund-i-absbx . The fund determines the net asset value applicable to repurchases no later than fourteen (14) days after the Repurchase Request Deadline (or the next business day, if the 14th day is not a business day) (the “Repurchase Pricing Date”). The fund expects to distribute payment to Shareholders no later than seven (7) calendar days after such date (the “Repurchase Payment Deadline”). The fund’s Shares are not listed on any securities exchange, and the fund anticipates that no secondary market will develop for its Shares. Accordingly, you may not be able to sell Shares when and/or in the amount that you desire. Thus, Shares are appropriate only as a long-term investment. In addition, the fund’s repurchase offers may subject the fund and Shareholders to special risks. The Repurchase Request Deadline will be strictly observed. Subject to its investment limitations, the fund may borrow to finance the repurchase of Shares or to make a tender offer. Interest on any borrowings to finance Share repurchase transactions or the accumulation of cash by the fund in anticipation of Share repurchases or tenders will reduce the fund’s net income and gains. Any Share repurchase, tender offer or borrowing that might be approved by the Board would have to comply with the 1940 Act and the rules and regulations thereunder and other applicable law. |

4

| | |

| | The fund intends to make regular quarterly cash distributions to Shareholders. The fund will distribute annually any net short-term capital gain and any net capital gain (which is the excess of net long-term capital gain over net short-term capital loss). Distributions to Shareholders cannot be assured, and the amount of each quarterly distribution may vary. See “Distributions” and “Federal Income Tax Matters.” |

| |

Dividend Reinvestment Plan | | Each Shareholder will automatically be a participant under the fund’s Dividend Reinvestment Plan (“DRP”) and have all income dividends and/or capital gains distributions automatically reinvested in Shares. Election not to participate in the DRP and to receive all income dividends and/or capital gains distributions, if any, in cash may be made by notice to the fund or, if applicable, to a Shareholder’s broker or other intermediary (who should be directed to inform the fund). |

| |

Provision of Tax Information to Shareholders; Shareholder Reports | | The fund will furnish to Shareholders as soon as practicable after the end of each taxable year information on Form 1099 as is required by law to assist Shareholders in preparing their tax returns. The fund will prepare and transmit to Shareholders an unaudited semi-annual and an audited annual report. Shareholders may also receive additional periodic reports regarding the fund’s operations. |

| |

| | The fund expects to qualify, as a “regulated investment company” (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). For each taxable year that the fund so qualifies, the fund is not subject to federal income tax on that part of its taxable income that it distributes to Shareholders. Taxable income consists generally of net investment income and any capital gains. The fund will distribute substantially all of its net investment income and gains to Shareholders. These distributions generally will be taxable as ordinary income or capital gains to the Shareholders. Shareholders not subject to tax on their income will not be required to pay tax on amounts distributed to them. The fund will inform Shareholders of the amount and character of the distributions to Shareholders. See “Investing in the Fund—Dividend Reinvestment Plan.” |

| |

| | The fund’s principal risk factors are listed below by general risks and strategy risks. The fund ordered the descriptions of the eight most significant risks to the fund, based on the currently expected impact to the fund’s net asset value, yield and total return, so that they appear first. The fund’s other main risks follow in alphabetical order, not in order of importance. Before investing, be sure to read the additional descriptions of these risks beginning on page [ ] of this Prospectus, and under “Investments, Techniques, Risks and Limitations” in the fund’s SAI. |

| |

| | . ABS include interests in pools of debt securities, commercial or consumer loans, or other receivables. The value of these securities depends on many factors, including changes in interest rates, the availability of information concerning the pool and its structure, the credit quality of the underlying assets, the market’s perception of the servicer of the pool, and any credit enhancement provided. In addition, ABS have prepayment risk. Prepayment of debt or loans will result in an unforeseen loss of interest income to the fund as the fund may be required to reinvest assets at a lower interest rate. |

| |

| | Fixed-income Securities Risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by the fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security’s credit quality may adversely affect fund performance. Less information may be publicly available regarding foreign issuers, including foreign government issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and political and economic developments may adversely impact the value of foreign securities. The risks of investing in foreign securities are magnified in emerging markets. If applicable, depositary receipts are subject to most of the risks associated with investing in foreign securities directly because the value of a depositary receipt is dependent upon the market price of the underlying foreign equity security. If applicable, any depositary receipts are also subject to liquidity risk. Foreign countries, especially emerging market countries, also may have problems associated with settlement of sales. Such problems could cause the fund to suffer a loss if a security to be sold declines in value while settlement of the sale is delayed. In addition, there may be difficulties and delays in enforcing a judgment in a foreign court resulting in potential losses to the fund. |

5

| | | | |

| | | | The fund is a non-diversified fund, which means that it may invest in a smaller number of issuers than a diversified fund and may invest more of its assets in the securities of a single issuer. |

| | | | Investments related to securitized credit (including SRTs), have the following principal risks: • Credit and Counterparty Risk (as defined below); • changes in factors that affect overall performance of investments in financial markets, which may cause the fund to experience losses; • Interest Rate Risk (as defined below); • Structural and legal risks; and • Regulatory risk related to consumer finance activities, including supervision and licensing by numerous governmental entities. |

| | |

| | Risks Related to Consumer Based Loans | | Investments in Consumer Based Loans (as defined below) have the following principal risks: • Consumer Finance Industry Regulatory Environment The fund may be subject to a wide variety of laws and regulations in the jurisdictions where it operates in respect of its consumer finance activities, including supervision and licensing by numerous governmental entities. These laws and regulations may create significant constraints on the fund’s consumer finance investments and result in significant costs related to compliance. • Noncompliance with Consumer Financial Protection Laws If certain consumer loan contracts do not comply with U.S. federal and state consumer financial protection laws, the servicer may be prevented from or delayed in collecting the loan contract. |

| | |

| | Risks Associated with Corporate Asset-Based Credit | | The fund may invest in asset-based corporate credit. A fundamental risk associated with the fund’s investments in corporate asset-based credit is that the companies in whose debt the fund invests will be unable to make regular payments (e.g., principal and interest payments) when due, or at all, or otherwise fail to perform. A number of factors may impact the failure of such companies to make payments on their loans, such as, among other factors, (i) an adverse development in their business, (ii) an economic downturn, (iii) poor performance by their management teams, (iv) legal, tax or regulatory changes, (v) a change in the competitive environment, or (vi) a force majeure event. The companies may be operating at a loss or have significant variations in operating results, or may otherwise be experiencing financial distress even when the Subadvisor expects them to remain stable. Additionally, the companies may require substantial additional capital to support their operations or to maintain their competitive position and as a result of that may become highly leveraged. |

6

| | | | |

| | Risks Related to Commercial Real Estate and Residential Real Estate Investments | | |

| | |

| | Investments in Real Estate Investments and Real Estate Debt Generally | | Investments in real estate have the following principal risks: • Economic and market fluctuations; • Changes in environmental, zoning and other laws; • Casualty or condemnation losses; • Regulatory limitations on rents; • Decreases in property values; • Changes in the appeal of properties to tenants; • Tenant defaults; • Changes in supply and demand; • Energy supply shortages; • Various uninsured or uninsurable risks; • Natural disasters; • Changes in government regulations (such as rent control); • Changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable; • Increased mortgage defaults; • Increases in borrowing rates; and • Negative developments in the economy that depress travel activity, demand and real estate values generally. |

| | |

| | Risks Related to Residential Real Estate | | Investments related to Residential Real Estate have the following principal risks: • Mortgages made to borrowers with lower credit scores. may be more sensitive to economic factors; • A decline or an extended flattening of home prices and appraisal values may result in increases in delinquencies and losses; • The increase in monthly payments on adjustable-rate mortgage loans may result in higher delinquency rates; • Certain residential mortgage loans may be structured with negative amortization features; |

7

| | | | |

| | | | • Economic and market fluctuations; • Changes in environmental, zoning and other laws; • Casualty or condemnation losses; • Regulatory limitations on rents; • Decreases in property values; • Changes in supply and demand; • Natural disasters; • Changes in government regulations (such as rent control); • Changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable; and • Increases in borrowing rates. |

| | |

| | Changes in state and U.S. federal laws applicable to the fund, including changes to state and U.S. federal tax laws, or applicable to the Advisor, the Subadvisor and securities or other instruments in which the fund may invest, may negatively affect the fund’s returns to Shareholders. |

| |

| | Credit and Counterparty Risk. |

| |

| | There can be no assurance that quarterly distributions paid by the fund to Shareholders will be maintained at current levels or increase over time. The fund’s cash available for distribution may vary widely over the short- and long-term. |

| |

| | Economic and Market Events Risk. |

| |

| | Hedging, Derivatives, and Other Strategic Transactions Risk. |

8

| | |

| | In addition, swaps may be subject to interest-rate and settlement risk, and the risk of default of the underlying reference obligation. Derivatives associated with foreign currency transactions are subject to currency risk. An event of default or insolvency of the counterparty to a reverse repurchase agreement could result in delays or restrictions with respect to the fund’s ability to dispose of the underlying securities. In addition, a reverse repurchase agreement may be considered a form of leverage and may, therefore, increase fluctuations in the fund’s NAV. |

| |

| | The fund is a closed-end investment company designed primarily for long-term investors and is not intended to be a trading vehicle. The fund does not currently intend to list Shares for trading on any national securities exchange. There is no secondary trading market for Shares, and it is not expected that a secondary market will develop. Shares therefore are not readily marketable. |

| |

| | Inflation risk is the risk that the purchasing power of assets or income from investments will be worth less in the future as inflation decreases the value of money. As inflation increases, the real value of the Shares and distributions thereon can decline. |

| |

| | Leverage creates risks for Shareholders, including the likelihood of greater volatility of NAV and market price of, and distributions from, the Shares and the risk that fluctuations in the costs of borrowings may affect the return to Shareholders. |

| |

| | The fund is subject to management risk because it relies on the Subadvisor’s ability to pursue the fund’s investment objective, subject to the oversight of the Advisor and the Board. |

| |

| | Operational and Cybersecurity Risk. |

| |

| | Potential Consequences of Periodic Repurchase Offers. |

| |

| | To qualify for the special tax treatment available to regulated investment companies, the fund must: (i) derive at least 90% of its annual gross income from certain kinds of investment income; (ii) meet certain asset diversification requirements at the end of each quarter; and (iii) distribute in each taxable year at least the sum of 90% of its net investment income (including net interest income and net short-term capital gain and 90% of its net exempt interest income). If the fund fails to meet any of these requirements, subject to the opportunity to cure such failures under applicable provisions of the Code, the fund will be subject to U.S. federal income tax at regular corporate rates on its taxable income, including its net capital gain, even if such income is distributed to Shareholders of the fund. |

| |

| | Tax Risk - Distributions to Shareholders and Payment of Tax Liability. |

9

| | |

| |

| | The Board has designated the Advisor as the valuation designee to perform fair value functions for the fund in accordance with the Advisor’s valuation policies and procedures. In accordance with these policies and procedures, the Advisor values the fund’s investments at fair value as determined in good faith when market quotations are not readily available or are deemed to be unreliable. Fair value pricing may require subjective determinations about the value of a security or other asset. As a result, there can be no assurance that fair value pricing will reflect actual market value, and it is possible that the fair value determined for a security or other asset will be materially different from quoted or published prices, from the prices used by others for the same security or other asset and/or from the value that actually could be or is realized upon the sale of that security or other asset. The Advisor, as valuation designee, is subject to Board oversight and reports to the Board information regarding the fair valuation process and related material matters. |

Given the risks described above, an investment in Shares may not be appropriate for all investors. You should carefully consider your ability to assume these risks before making an investment in the fund

10

The purpose of the table below is to help you understand all fees and expenses that you, as a Shareholder, would bear directly or indir

ec

tly. The table below shows the fund’s expenses as a percentage of approximately $103,000,000 in net assets.

| | | | | | | | | | | | |

Shareholder Transaction Expenses | | Class A | | | Class I | | | Class U | |

Sales Load on Purchases (as a percentage of offering price) (1) | | | 2.50 | | | | None | | | | None | |

(as a percentage of net assets attributable to Shares) | | | | | | | | | | | | |

| Management Fee | | | 1.80 | | | | 1.80 | | | | 1.80 | |

| Distribution and Service Fee | | | 0.25 | | | | 0.00 | | | | 0.75 | |

| Interest Expense on Borrowed Funds | | | 0.96 | | | | 0.96 | | | | 0.96 | |

| | | 1.04 | | | | 1.04 | | | | 1.04 | |

Total Annual Fund Operating Expenses | | | 4.05 | | | | 3.80 | | | | 4.55 | |

Fee Waiver and/or Expense Reimbursements (3) | | | -0.45 | | | | -0.45 | | | | -0.45 | |

Total Annual Fund Operating Expenses after Fee Waiver and/or Expense Reimbursements | | | 3.60 | | | | 3.35 | | | | 4.10 | |

| (1) | Class A Share investments may be subject to a maximum sales charge of 2.50%. Such sales load will not form part of an investor’s investment in the fund. Any sales load will reduce the amount of an investor’s initial or subsequent investment in the fund, and the impact on a particular investor’s investment returns would not be reflected in the returns of the fund. The sales load may be waived in certain circumstances as described in this Prospectus or as otherwise approved by the Advisor. |

| (2) | “Other Expenses” are based on estimated amounts for the current fiscal year. Other Expenses include the Fund’s operating expenses, including professional fees, transfer agency fees, administration fees, custody fees, offering costs and other operating expenses. |

| (3) | The Advisor contractually agrees to reduce its Management Fee for the fund or, if necessary, make payment to the fund, in an amount equal to the amount by which the “Other Fund Level Expenses” of the fund, incurred in the ordinary course of the fund’s business, exceed 0.50% percent of the fund’s average daily Managed Assets. Managed Assets is defined as the total assets of the fund (including any assets attributable to any preferred shares that may be issued or to indebtedness), minus the fund’s liabilities incurred in the normal course of operations other than liabilities relating to indebtedness. “Other Fund Level Expenses” means all the expenses of the fund excluding: (1) advisory and incentive fees; (2) interest expense and other borrowing related costs, fees and expenses; (3) Rule 12b-1 fees; (4) any cashiering or other investment servicing fees; (5) litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the business of the fund; (6) taxes; (7) short dividends; (8) acquired fund fees and expenses, which are based on indirect net expenses associated with the fund’s investments in underlying investment companies; (9) class specific expenses; (10) portfolio brokerage commissions; (11) expenses related to, or incurred by, special purpose vehicles or other subsidiaries of the fund held directly or indirectly by the fund; (12) expenses, including legal expenses, related to investments of the fund; and (13) expenses, including legal expenses, related to co-investment transactions involving the fund. This agreement expires February 28, 2026, unless renewed by mutual agreement of the Advisor and the fund based upon a determination that this is appropriate under the circumstances at that time. The Advisor also contractually agrees to waive a portion of its Management Fee and/or reimburse expenses for the fund and certain other John Hancock funds according to an asset level breakpoint schedule that is based on the aggregate net assets of all the funds participating in the waiver or reimbursement. This waiver is allocated proportionally among the participating funds. This agreement expires on July 31, 2026, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time. |

For a more complete description of the various fees and expenses of the fund, see “Management of the Fund.”

11

The following example illustrates the expenses that you would pay on a $1,000 investment in Shares, for the time periods indicated and then redeem or hold all of your Shares at the end of those periods. This example assumes a 5% average annual return and that fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:*:

| | | | | | | | | | | | |

Cumulative Expenses Paid for the Period of: | | | | | | | | | |

| | | | | | | | | | | | |

| | | 60 | | | | 34 | | | | 41 | |

| | | 141 | | | | 112 | | | | 133 | |

| | | 224 | | | | 192 | | | | 226 | |

| | | 436 | | | | 401 | | | | 463 | |

The example should not be considered a representation of future expenses. Actual expenses may be higher or lower.

| * | The example assumes that the total annual fund operating expenses (excluding any sales loads on reinvested dividends, fee waivers and/or expense reimbursements) set forth in the Annual Expenses table above are as shown and remain the same for each year, and that all dividends and distributions are reinvested at net asset value. The expenses used to calculate the fund’s examples do not include fee waivers or expense reimbursements. Actual expenses may be greater or less than those assumed. Moreover, the fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the example. |

The fund bears all costs of its organization and operation, including but not limited to expenses of preparing, printing and mailing all shareholders’ reports, notices, prospectuses, proxy statements and reports to regulatory agencies; expenses relating to the issuance, registration and qualification of shares; government fees; interest charges; expenses of furnishing to Shareholders their account statements; taxes; expenses of redeeming shares; brokerage and other expenses connected with the execution of portfolio securities transactions; expenses pursuant to the fund’s plan of distribution; fees and expenses of custodians including those for keeping books and accounts maintaining a committed line of credit and calculating the NAV of shares; fees and expenses of transfer agents and dividend disbursing agents; legal, accounting, financial, management, tax and auditing fees and expenses of the fund (including an allocable portion of the cost of the Advisor’s employees rendering such services to the fund); the compensation and expenses of officers and Trustees (other than persons serving as President or Trustee who are otherwise affiliated with the funds the Advisor or any of their affiliates); expenses of Trustees’ and shareholders’ meetings; trade association memberships; insurance premiums; and any extraordinary expenses.

The initial operating expenses for a new fund, including start-up costs, which may be significant, may be higher than the expenses of an established fund. The fund is expected to incur organization expenses of approximately $550,000. The fund will also bear certain ongoing offering costs associated with the fund’s continuous offering of Shares.

The Advisor shall be entitled to receive from the fund as compensation for its services a Management Fee.

The fund will pay to the Advisor, as full compensation for all services under the Advisory Agreement with respect to the fund, a Management Fee accrued daily and paid monthly at the annual rate of 1.50% of the fund’s Managed Assets (the “Management Fee”). Managed Assets is defined as the total assets of the fund (including any assets attributable to any preferred shares that may be issued or to indebtedness), minus the fund’s liabilities incurred in the normal course of operations other than liabilities relating to indebtedness. Derivatives will be valued at market value for purposes of determining Managed Assets in the calculation of Management Fee. The Management Fee shown in the table above is higher than the contractual rate because the Management Fee in the table is required to be calculated as a percentage of net assets, rather than Managed Assets. Because the Management Fee is based on the fund’s average monthly value of the Managed Assets, the fund’s use of leverage, if any, will increase the Management Fee paid to the Advisor.

12

This section normally details the financial performance of the fund. The fund and its Shares have not previously been offered. Therefore, the fund does not have any financial history. Additional information about the fund’s investments will be available in the fund’s annual and semi-annual reports when they are prepared.

The fund is expected to commence operations on January 15, 2025 and is a continuously offered non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The fund was organized on July 12, 2024, as a Massachusetts business trust pursuant to an Agreement and Declaration of Trust (the “Declaration of Trust”).

The fund’s principal office is located at the Advisor’s offices at 200 Berkeley Street, Boston, Massachusetts, 02116. The Advisor’s telephone number is 617-663-2430. Investment advisory services are provided to the fund by the Advisor, John Hancock Investment Management LLC, a limited liability company organized under Massachusetts law, pursuant to an investment advisory agreement approved by the fund’s Board of Trustees (the “Advisory Agreement”). Under the supervision of the Advisor and oversight by the Board of Trustees of the fund (the “Board”), CQS (US), LLC (the “Subadvisor” or “CQS”) handles the fund’s portfolio management activities. The fund’s business and affairs are overseen by the Board.

The net proceeds to the fund will be invested in accordance with the fund’s investment objective and policies (as stated below) as soon as practicable. The fund currently anticipates being able to do so, under normal circumstances within three months after receipt. Pending investment of the net proceeds in accordance with the fund’s investment objective and policies, the fund will invest in high-quality, short-term debt securities, cash and/or cash equivalents. Investors should expect, therefore, that before the fund has fully invested the proceeds of the offering in accordance with its investment objective and policies, the fund would earn interest income at a modest rate. If the fund’s investments are delayed, the first planned distribution could consist principally of a return of capital.

13

Investment Objective and Principal Investment Strategies

The fund’s investment objective is to seek to generate a return comprised of both current income and capital appreciation.

Principal Investment Strategies

:

The fund is a non-diversified fund, which means that it may invest in a smaller number of issuers than a diversified fund and may invest more of its assets in the securities of a single issuer.

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in ABS-Related Investments (as defined below). The term “ABS-Related Investments” includes commercial mortgage-backed securities (“CMBS”); asset-backed securities (“ABS”); collateralized loan obligations (“CLOs”); agency and non-agency residential mortgage-backed securities (“RMBS”); significant risk transfer securitization transactions (“SRTs”); and collateralized mortgage obligations (“CMOs”). As part of its principal investment strategy, the fund will primarily make use of credit default swaps, options and foreign exchange contracts for purposes of hedging against various types of exposure, including, but not limited to, interest rate risk exposure, asset-backed market exposure and foreign currency exposure. To the extent the fund’s investments in derivatives and other synthetic instruments provide investment exposure to ABS-Related Investments, such derivatives and synthetic instruments will be counted toward satisfaction of this 80% policy. The fund will be concentrated in the real estate industry indirectly due to its investments in the following: CMBS, RMBS and CMOs. Certain ABS-Related Investments may be issued by non-US issuers and/or may reflect underlying exposures to non-US issuers and/or borrowers.

In addition to investing in ABS-Related Investments, the fund may invest up to 20% of its net assets (plus any borrowings for investment purposes) in certain other securities and other financial instruments. In this regard, the fund expects to focus any such other investments mainly on secured loans. Such secured loans include “Consumer Based Loans” (e.g., automobile loans and leases, credit cards, personal installment loans and other types of consumer loans); “Corporate Asset-Based Credit” (i.e., asset-based corporate debt secured by real estate, equipment, receivables, inventory and intellectual property rights, among other assets) and other asset-backed loans. Except for secured loans and subject to any derivatives included in the fund’s 80% policy as described above, the fund does not currently anticipate investing a significant portion of its assets directly in other securities and other financial instruments but reserves the flexibility to invest opportunistically in the following instruments with no particular focus on any one type of instrument: commercial paper; preferred stock; common stock; sovereign bonds; repurchase agreements; interest rate and credit default swaps and swaptions; equity and equity index swaps, futures and options; single-tranche credit default swaps; total return swaps; interest rate futures and options; bond futures and options; foreign exchange contracts, futures and options; and other options and derivatives.

The Subadvisor uses its investment, research and trading experience to seek to identify securities and other financial instruments, at all levels of the capital structure of an issuer, which are believed to have attractive risk-adjusted return characteristics through the opportunity for income and/or capital appreciation.

There is no limit on the range of maturities and credit quality of securities in which the fund may invest. Such securities will include below-investment grade securities. Below-investment-grade debt securities are also referred to as junk bonds.

14

Background on ABS-Related Investments

The types of ABS and ABS-Related Investments in which the fund will invest include the following:

| | • | | ABS : ABS are bonds or notes where the repayment obligations undertaken by the issuer are collateralized by an individual financial asset or, more typically, one or more financial assets held by the relevant issuer and the associated cash flows such issuer will receive from those assets. The financial assets supporting ABS are commonly referred to as “receivables”. The financial assets held by the issuer of the ABS to which the fund may, directly or indirectly, have exposure are likely to consist of receivables including, but not limited to, the following: |

| | • | | RMBS/CMBS : pools encompassing residential mortgage loans including home equity loans and home equity lines of credit (residential mortgage-backed securities (“RMBS”)) and pools encompassing commercial mortgage loans (commercial mortgage-backed securities (“CMBS”)); |

| | • | | ABS Collateralized Debt Obligations : pools encompassing auto loans, credit card receivables, student loans, corporate debt, small business loans, trade receivables, equipment leases, aircraft leases and royalties and securities encompassing tranches of other ABS transactions (ABS collateralized debt obligations); |

| | • | | Significant Risk Transfer Securitization Transactions : pools of fixed- or floating-rate general obligations issued by banks or other financial institutions (“SRTs”); and/or |

| | • | | CLOs : pools encompassing corporate loans (i.e., diversified pools of sub-investment grade loans to large and mid-sized corporates) (“CLOs”)). |

The fund seeks to achieve its investment objective by generating attractive risk-adjusted returns over the medium to long term by investing, on a global basis, in ABS markets and other appropriate markets to generate returns in excess of any hedging and/or financing costs. The fund also seeks to identify mis-valuations and relative value opportunities in such markets. There can be no assurance that the fund will achieve its investment objective or that it will not incur a loss. The Board of Trustees of the fund (the “Board”) may change the investment objective of the fund without shareholder approval.

The following categories of receivables support specific market segments within the ABS markets:

| | • | | corporate bonds (to create collateralized bond obligations); |

| | • | | leveraged loans and loans to small and medium sized enterprises (to create CLOs); |

| | • | | credit derivatives (to create synthetic collateralized debt obligations); and |

| | • | | pass-through certificates (to create collateralized mortgage obligations (“CMOs”)). |

ABS differ from many other debt securities in that their creditworthiness is primarily a function of the underlying asset(s) together with the features embedded in the transaction structure.

The assets that support the majority of ABS are created by financial institutions that originate receivables, such as leases, loans and mortgage loans. Originators typically seek to maximize their origination capacity, transfer risk and manage their balance sheets by converting existing receivables and loans into ABS for sale in the capital markets. This process is commonly referred to as “securitization”.

A common form of securitization requires that an originator sell a pool of receivables to an SPV or a newly formed entity which in turn issues ABS collateralized by the pool of receivables. The issuer funds itself by issuing the interest-bearing ABS in the capital markets, usually with the assistance of an investment bank. The ABS typically benefit from a number of credit enhancement techniques in order to increase the credit quality of certain levels of the capital structure. Those enhancements may provide some protection for investors in the issuer’s ABS against losses or periodic cash flow disruptions from the underlying receivables. Credit enhancement may be a function of the transaction structure or it may be provided by third parties to the issuer. Examples of such enhancement include:

| | i. | internal credit enhancement: structural subordination; tranche turbo amortization features; over-collateralization; cash collateral accounts; reserve funds; excess spread; and |

15

| | ii. | external credit enhancement: third-party guarantees; surety bonds (credit insurance); letters of credit. |

However, it should be understood that such enhancement may be insufficient to protect investors in the ABS against a significant underperformance of the underlying pool of receivables.

The fund may also take long exposures to ABS indices (such as CMBX) through credit default swaps.

The fund may trade both rated and unrated debt as well as listed and unlisted instruments and debt-equity hybrid instruments.

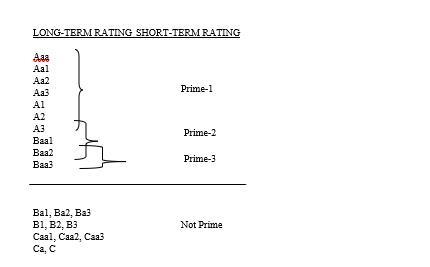

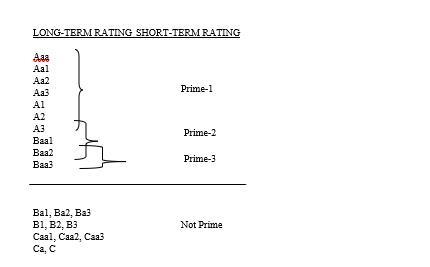

Except for RMBS, CMBS, CMOs, SRTs, CLOs and other forms ABS referred to in this section, which may range from most senior (AAA-rated) to most subordinate (BB-rated, B-rated and equity, also known as “junk”), most loans and investments made directly by the fund are not rated. If a loan or investment is rated, it will usually be rated by S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings, Kroll Bond Rating Agency or DBRS Morningstar, and may be rated below investment-grade.

The fund may execute transactions denominated in any currency and has flexibility to trade in any market or instrument using various techniques to achieve its stated investment objective. The fund invests in securities or loans which may have been rated for credit worthiness and other criteria by an independent rating agency (and such rating may be that the security is not “investment grade”) or which may not have been subject to such a rating, as well as listed and unlisted securities. Investments may be made in both public and private placements of securities or loans.

The fund may invest a significant portion of its assets in securities whose right to receive payment is subordinated in relation to other securities issued by the same issuer and/or residual cash flows of asset pools and asset-backed securitizations which may only be received after investors in other securities linked to the relevant underlying revenue producing assets have been paid first. Investments at this lower level of the capital structure of an issuer are generally the first to suffer the impact of reductions in the value of the underlying asset pool under the terms of the transaction and, as such, exhibit a higher default probability, lower recovery rate and higher risk of capital loss compared with other instruments which rank in priority in the capital structure.

As part of its principal investment strategy, the fund may use a wide range of derivative instruments for investment and/or hedging purposes. In particular, the fund may execute trades synthetically using derivatives including, but not limited to, credit default swaps referencing individual, and/or indices of, ABS and/or issuers of ABS-Related Investments. In addition, as part of its principal investment strategy, the fund may write credit default swaps. The fund may also retain amounts in cash or cash equivalents pending reinvestment if this is considered appropriate in seeking to achieve the investment objective.

The Subadvisor focuses on exploiting inefficiencies in the pricing of credit and related risks in the markets for ABS and other instruments that arise from a number of factors. These aspects may include, for example, failure by market participants to correctly price the credit risks, interest rate risks, prepayment risks, third-party agent/principal risks and/or liquidity risks relating to a pool of receivables.

The construction of the fund’s portfolio may involve the fund holding positions through special purpose vehicles (“SPVs”).

The Subadvisor seeks, without limitation, to construct the following sub-strategies within the fund:

| | i. | identifying securities or derivatives with an attractive risk-adjusted return and relative value opportunities within the markets for ABS; |

| | ii. | identifying and exploiting mis-valuations within the capital structure of asset-backed securitizations; |

16

| | iii. | structuring relative value positions between ABS and any combination of the following: derivatives referencing individual ABS and/or indices of asset-backed securities; derivatives referencing originators, servicers and/or issuers of ABS; securities issued by financial institutions and/or other institutions directly or indirectly related to the sectors associated with the underlying collateral types for ABS, including banks and business development companies (“Related Institutions”); derivatives referencing Related Institutions; and/or underlying collateral types for ABS; |

| | iv. | structuring cash flow arbitrages between the income yield of individual ABS and the financing costs of leveraging the securities; |

| | v. | structuring relative value and/or directional positions in securities issued by, and/or derivatives referencing, Related Institutions. Such instruments may or may not be used as part of hedges to various strategies including, but not limited to, the strategies in (i) to (iv); |

| | vi. | identifying and structuring transactions with parties involved in either the sourcing of pools of receivables or the sponsoring of securitizations that reference pools of receivables including ABS; and/or |

| | vii. | investing directly at any level of the capital structure in an existing or start-up issuer which is an originator of receivables suitable for subsequent securitization. |

The Subadvisor will seek to construct hedging strategies to protect against potential changes in the market value of the fund’s portfolio resulting from, amongst other things, fluctuations in the securities markets, changes in interest rates and to enhance or preserve returns.

The Subadvisor may choose to hedge interest rate risk exposures within the fund using financial instruments and derivatives including, but not limited to, government bonds, agency bonds, interest rate futures and options, bond futures and options, interest rate swaps, caps and floors on interest rates and interest rate swaptions.

The Subadvisor may choose to hedge asset-backed market exposures within the fund using financial instruments and derivatives including, but not limited to, asset-backed derivatives (including credit derivatives referencing individual ABS and/or indices of asset-backed indices), credit derivatives, corporate bonds, equities and equity derivatives.

The Subadvisor typically quantifies and hedges foreign currency exposure of the fund to currencies other than the US dollar through the use of spot and forward foreign exchange contracts and/or other methods of reducing exposure to currency fluctuations.

The Subadvisor does not seek to hedge against all risks and may elect not to establish hedges to mitigate the impact of events that are not anticipated to be plausible or probable or where the cost of such hedges is detrimental to the success of the expected hedge and or the risk return profile of the investment.

Similar Investment Strategies

It should be noted that the investment objective and strategy of the fund is substantially similar to that of other portfolios managed by the Subadvisor that also involve sourcing, constructing, trading and hedging a portfolio of ABS and other associated instruments. Whilst that is the case, the allocations of capital between the sub-strategies noted in the relevant offering memoranda or prospectus and the appetite for market risk and liquidity risk may differ from time to time between the fund and these other portfolios. Such differences may arise due to, among other things, the fund’s regulatory requirements, including compliance with 1940 Act and Internal Revenue Code of 1986, as amended (“IRC”) requirements, differences between the number of the holdings in, and composition of, the fund’s portfolio as compared to these other portfolios, and the asset size and cash flow differences between the fund and the other portfolios. Furthermore, the fund may invest in sub-strategies that the other portfolio do not invest in and vice-versa.

17

The Subadvisor will take into account internal policies to assess, quantify and manage the risk of single positions, risk concentrations and portfolio risk. The risks resulting from investment and hedging activity may include market risk, liquidity risk, counterparty credit risk and operational risk. The Subadvisor will use internal and/or third-party risk-analytic technologies to seek to measure, analyze and manage these risks.

Sustainable Finance Disclosures

The Subadvisor considers environmental, social, and/or governance (“ESG”) factors, alongside other relevant factors, as part of its investment process. ESG factors may include, but are not limited to, matters regarding board diversity, climate change policies, and supply chain and human rights policies. The ESG characteristics utilized in the fund’s investment process may change over time and one or more characteristics may not be relevant with respect to all issuers that are eligible fund investments.

The fund may use leverage to seek to achieve its investment objective or for liquidity (i.e., to finance the repurchase of Shares and/or bridge the financing of investments). As stated above, the fund may create or organize or otherwise utilize SPVs, which are wholly-owned subsidiaries of the fund, to facilitate the fund’s investment strategy. Certain fund investments may be held by these SPVs. The fund’s use of leverage may increase or decrease from time to time in its discretion and the fund may, in the future, determine not to use leverage. The use of leverage creates an opportunity for increased investment returns, but also creates risks for Shareholders. The use of leverage, if employed, is subject to numerous risks. When leverage is employed, the fund’s net asset value and any distributions to holders of the fund’s Shares will be more volatile than if leverage was not used. Changes in the value of the fund’s portfolio, including securities bought with the proceeds of leverage, will be borne entirely by the holders of Shares. If there is a net decrease or increase in the value of the fund’s investment portfolio, leverage will decrease or increase, as the case may be, the net asset value per Share to a greater extent than if the fund did not utilize leverage. The fund’s leveraging strategy may not be successful. The fund is not permitted to incur indebtedness (aggregated with any SPVs), including through the issuance of senior securities, unless immediately thereafter the total asset value of the fund’s portfolio (less all liabilities and indebtedness not represented by senior securities) is at least 300% of the aggregate amount of outstanding senior securities representing indebtedness (i.e., the aggregate amount of outstanding senior securities representing indebtedness may not exceed 33 1/3% of the fund’s total assets immediately after any borrowing or other issuance of senior securities representing indebtedness). When the fund borrows money, the fund intends to retire outstanding indebtedness to the extent necessary to maintain asset coverage of any outstanding indebtedness of at least 300%. Under the 1940 Act, the fund is also not permitted to issue a class of preferred shares unless immediately thereafter the fund’s asset coverage is at least 200% of the aggregate liquidation value of outstanding preferred shares (i.e., the aggregate liquidation value of outstanding preferred shares may not exceed 50% of the fund’s assets less all liabilities and indebtedness not represented by senior securities). In addition to the asset coverage requirements under the 1940 Act, certain types of borrowings may result in the fund being subject to covenants in credit agreements relating to asset coverage and portfolio composition requirements. In addition, the direct borrowings which the fund may incur will likely be secured by a lien on its assets. The cost associated with any issuance and use of leverage will be borne by the Shareholders and result in a reduction of the NAV of the fund’s Shares. Such costs may include legal fees, audit fees, structuring fees, commitment fees and usage fees associated with direct borrowings.