24 April 2023 First Quarter 2023�Earnings Call Presentation

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s Form 10-K for the year ended December 31, 2022 and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.WesBanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including, without limitation, the effects of changing regional and national economic conditions changes in interest rates, spreads on earning assets and interest-bearing liabilities, and associated interest rate sensitivity; sources of liquidity available to WesBanco and its related subsidiary operations; potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities; actions of the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, the SEC, the Financial Institution Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investors Protection Corporation, and other regulatory bodies; potential legislative and federal and state regulatory actions and reform, including, without limitation, the impact of the implementation of the Dodd-Frank Act; adverse decisions of federal and state courts; fraud, scams and schemes of third parties; cyber-security breaches; competitive conditions in the financial services industry; rapidly changing technology affecting financial services; marketability of debt instruments and corresponding impact on fair value adjustments; and/or other external developments materially impacting WesBanco’s operational and financial performance. WesBanco does not assume any duty to update forward-looking statements. In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco's management uses, and this presentation contains or references, certain non-GAAP financial measures, such as pre-tax pre-provision income, tangible common equity/tangible assets; net income excluding after-tax restructuring and merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco believes that these non-GAAP financial measures enhance investors' understanding of WesBanco's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, as well as other filings that the company has made with the SEC.

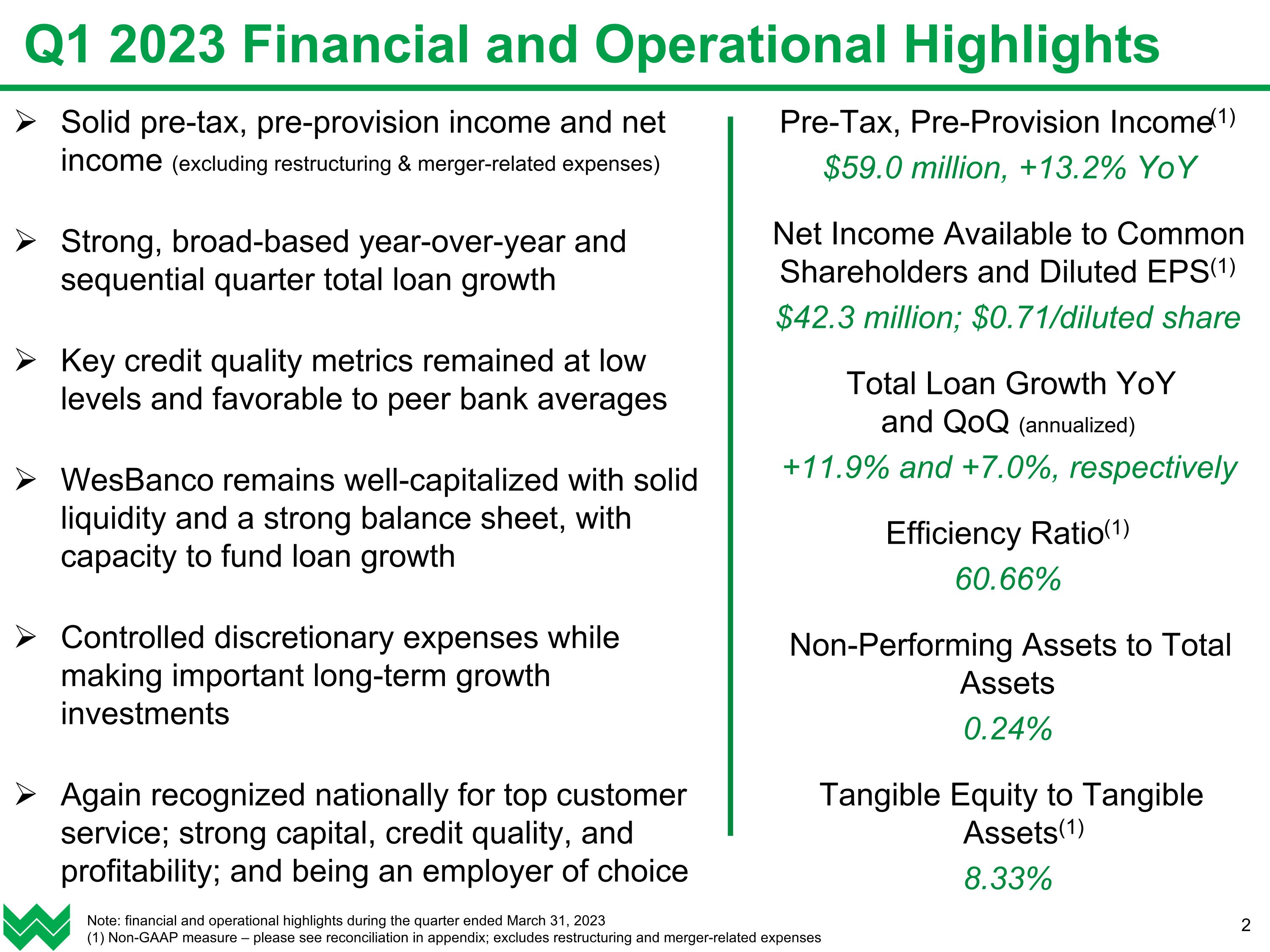

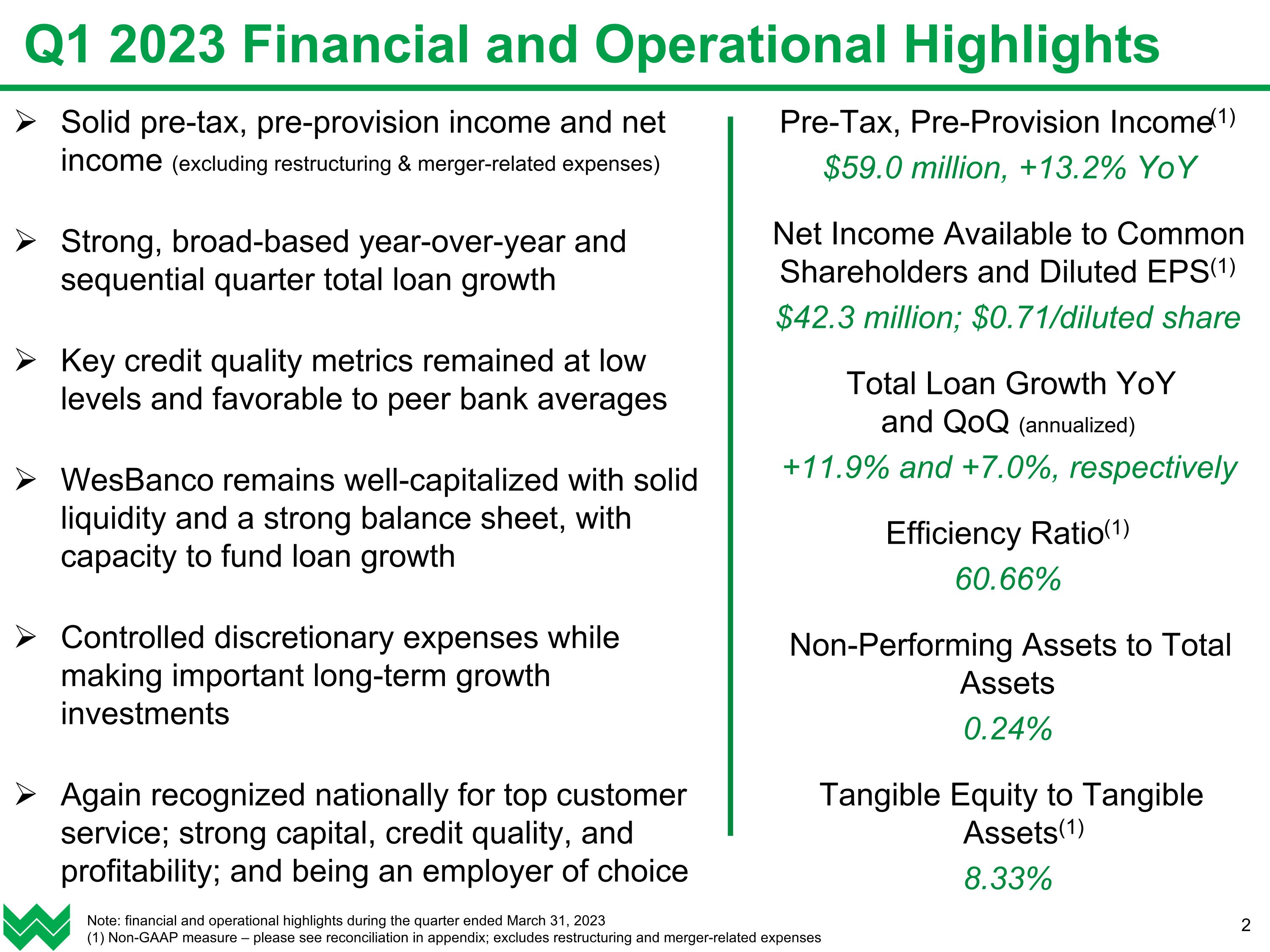

Q1 2023 Financial and Operational Highlights Note: financial and operational highlights during the quarter ended March 31, 2023 (1) Non-GAAP measure – please see reconciliation in appendix; excludes restructuring and merger-related expenses Solid pre-tax, pre-provision income and net income (excluding restructuring & merger-related expenses) Strong, broad-based year-over-year and sequential quarter total loan growth Key credit quality metrics remained at low levels and favorable to peer bank averages WesBanco remains well-capitalized with solid liquidity and a strong balance sheet, with capacity to fund loan growth Controlled discretionary expenses while making important long-term growth investments Again recognized nationally for top customer service; strong capital, credit quality, and profitability; and being an employer of choice Pre-Tax, Pre-Provision Income(1) $59.0 million, +13.2% YoY Net Income Available to Common Shareholders and Diluted EPS(1) $42.3 million; $0.71/diluted share Total Loan Growth YoY and QoQ (annualized) +11.9% and +7.0%, respectively Efficiency Ratio(1) 60.66% Non-Performing Assets to Total Assets 0.24% Tangible Equity to Tangible Assets(1) 8.33%

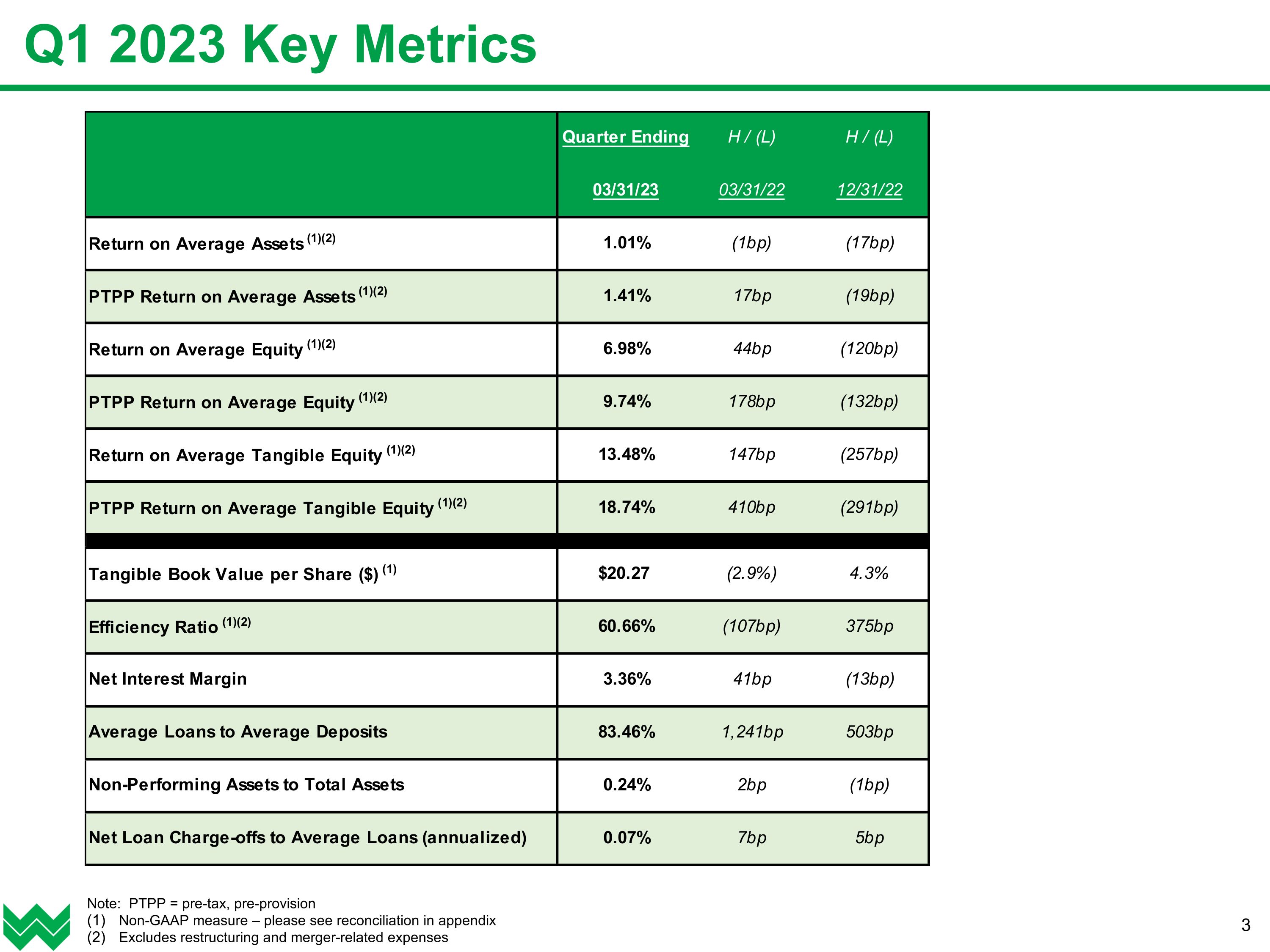

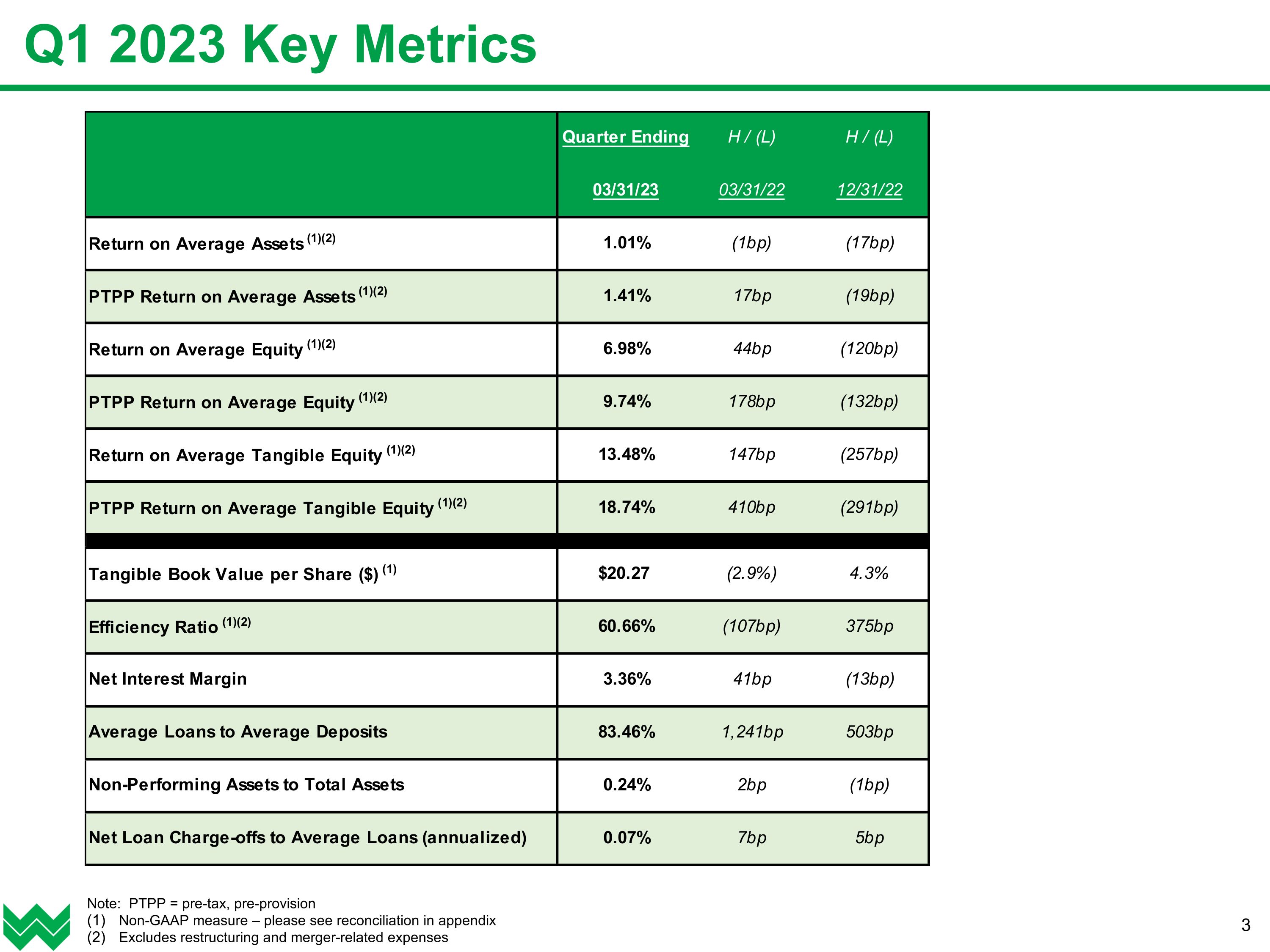

Q1 2023 Key Metrics Note: PTPP = pre-tax, pre-provision Non-GAAP measure – please see reconciliation in appendix Excludes restructuring and merger-related expenses

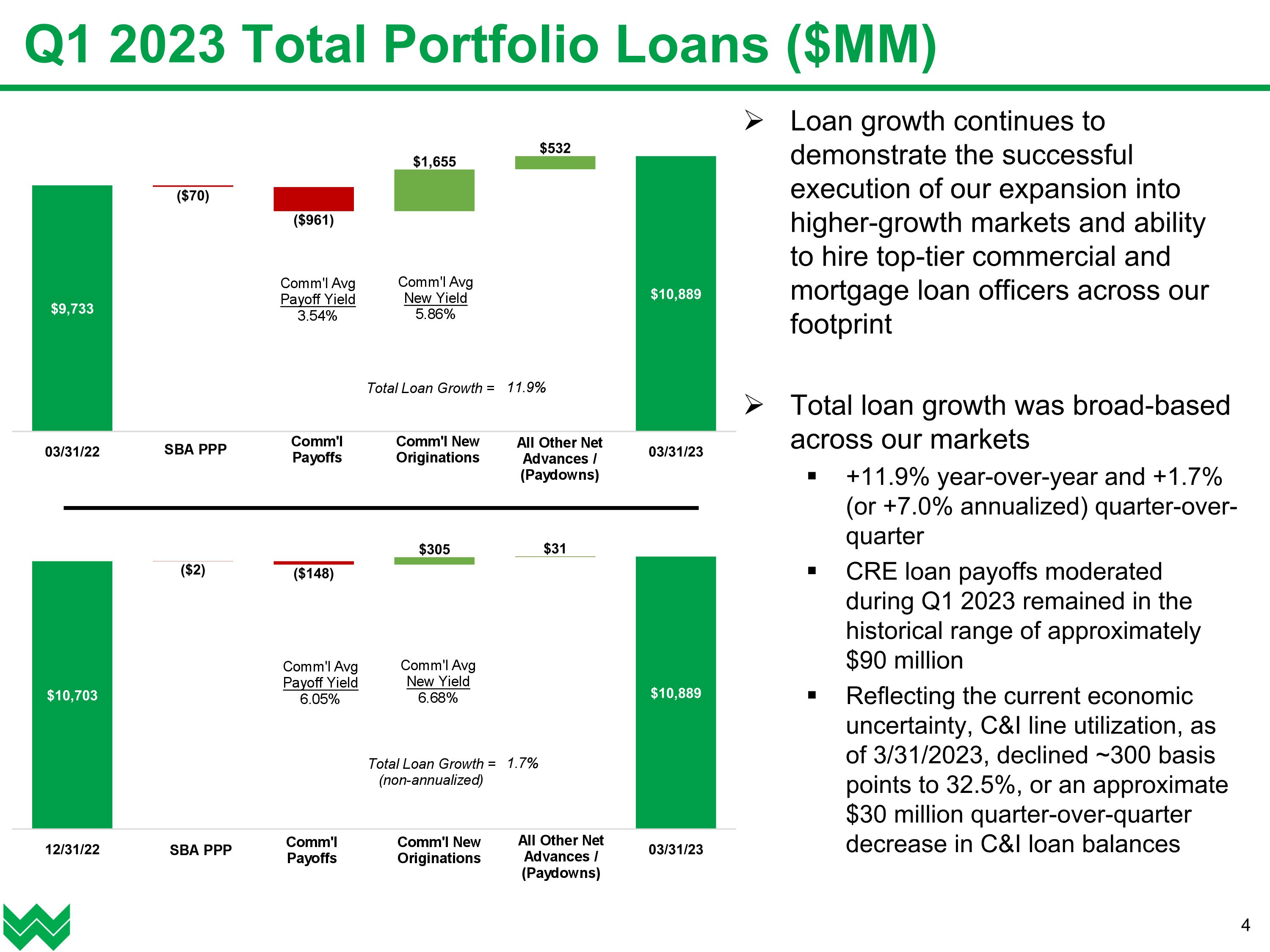

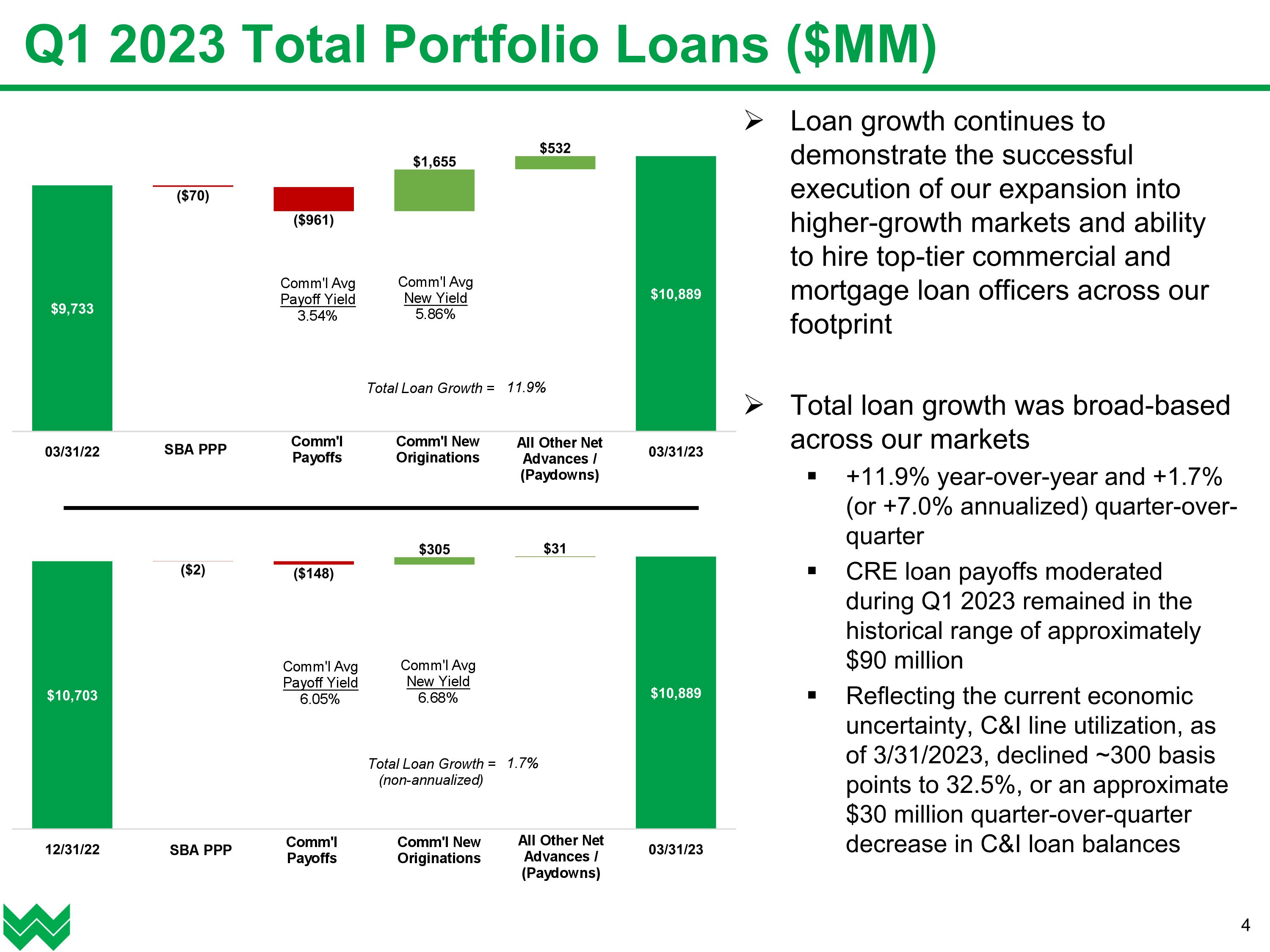

Q1 2023 Total Portfolio Loans ($MM) Loan growth continues to demonstrate the successful execution of our expansion into higher-growth markets and ability to hire top-tier commercial and mortgage loan officers across our footprint Total loan growth was broad-based across our markets +11.9% year-over-year and +1.7% (or +7.0% annualized) quarter-over-quarter CRE loan payoffs moderated during Q1 2023 remained in the historical range of approximately $90 million Reflecting the current economic uncertainty, C&I line utilization, as of 3/31/2023, declined ~300 basis points to 32.5%, or an approximate $30 million quarter-over-quarter decrease in C&I loan balances

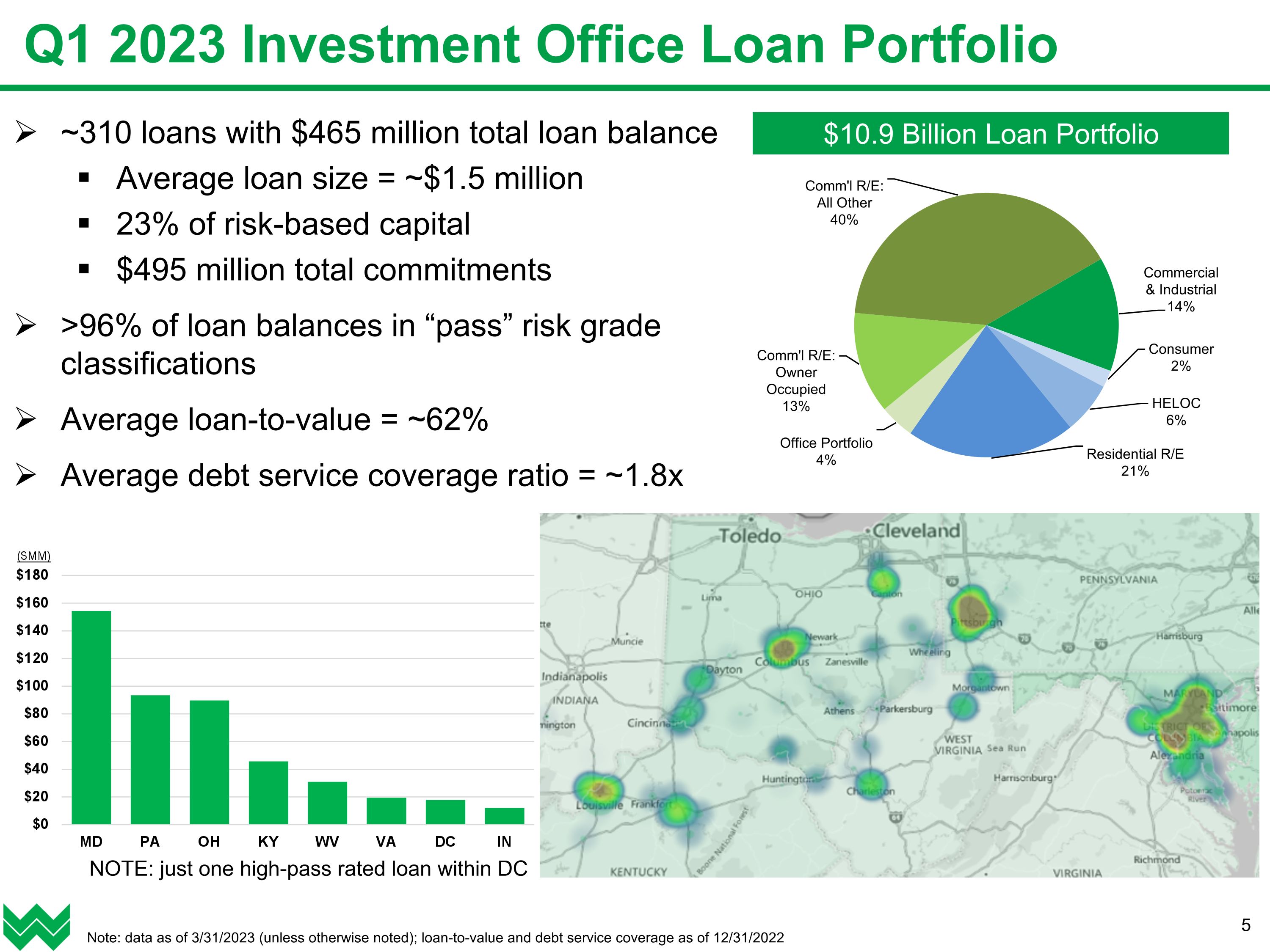

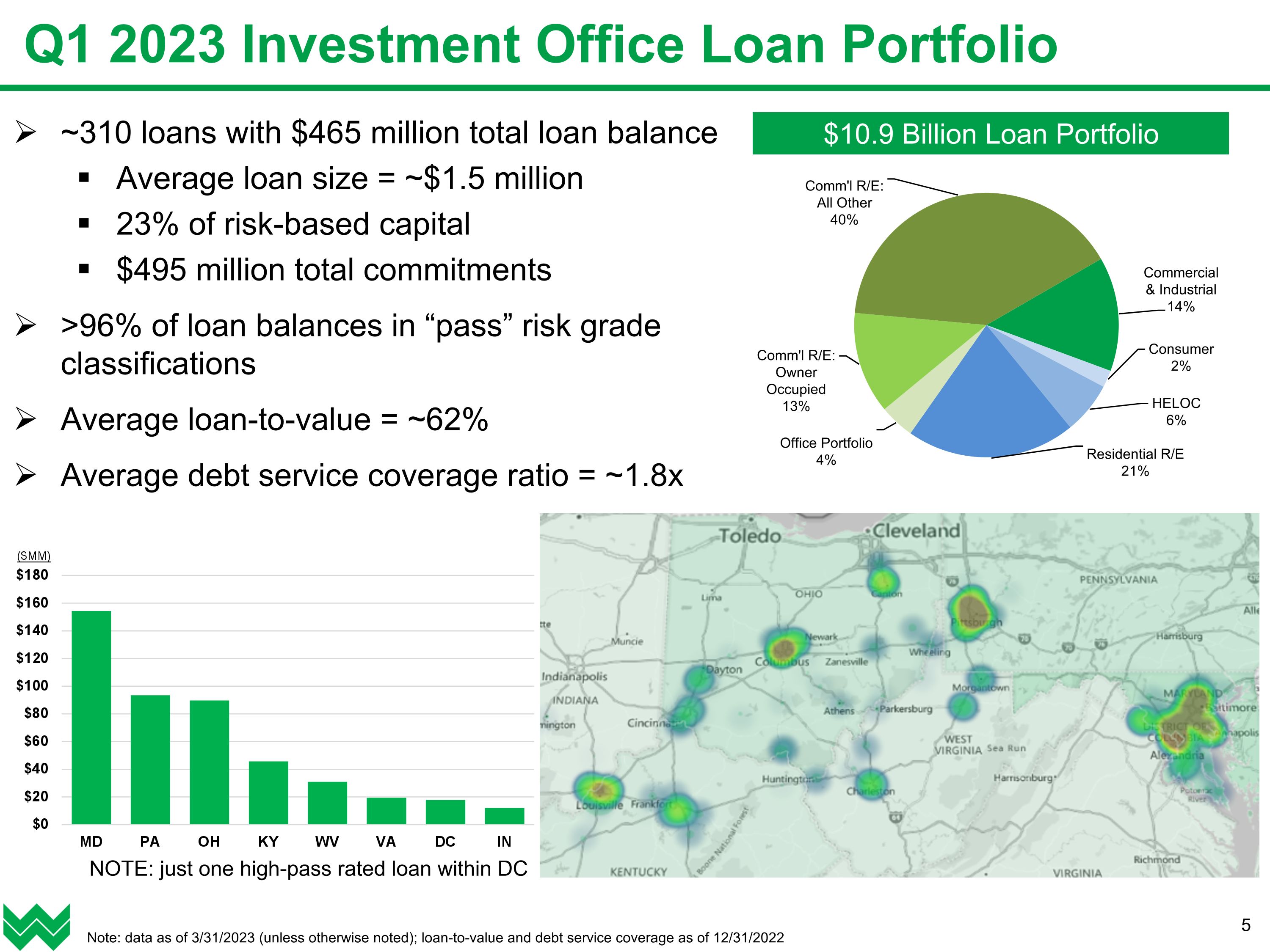

~310 loans with $465 million total loan balance Average loan size = ~$1.5 million 23% of risk-based capital $495 million total commitments >96% of loan balances in “pass” risk grade classifications Average loan-to-value = ~62% Average debt service coverage ratio = ~1.8x Q1 2023 Investment Office Loan Portfolio Note: data as of 3/31/2023 (unless otherwise noted); loan-to-value and debt service coverage as of 12/31/2022 $10.9 Billion Loan Portfolio NOTE: just one high-pass rated loan within DC

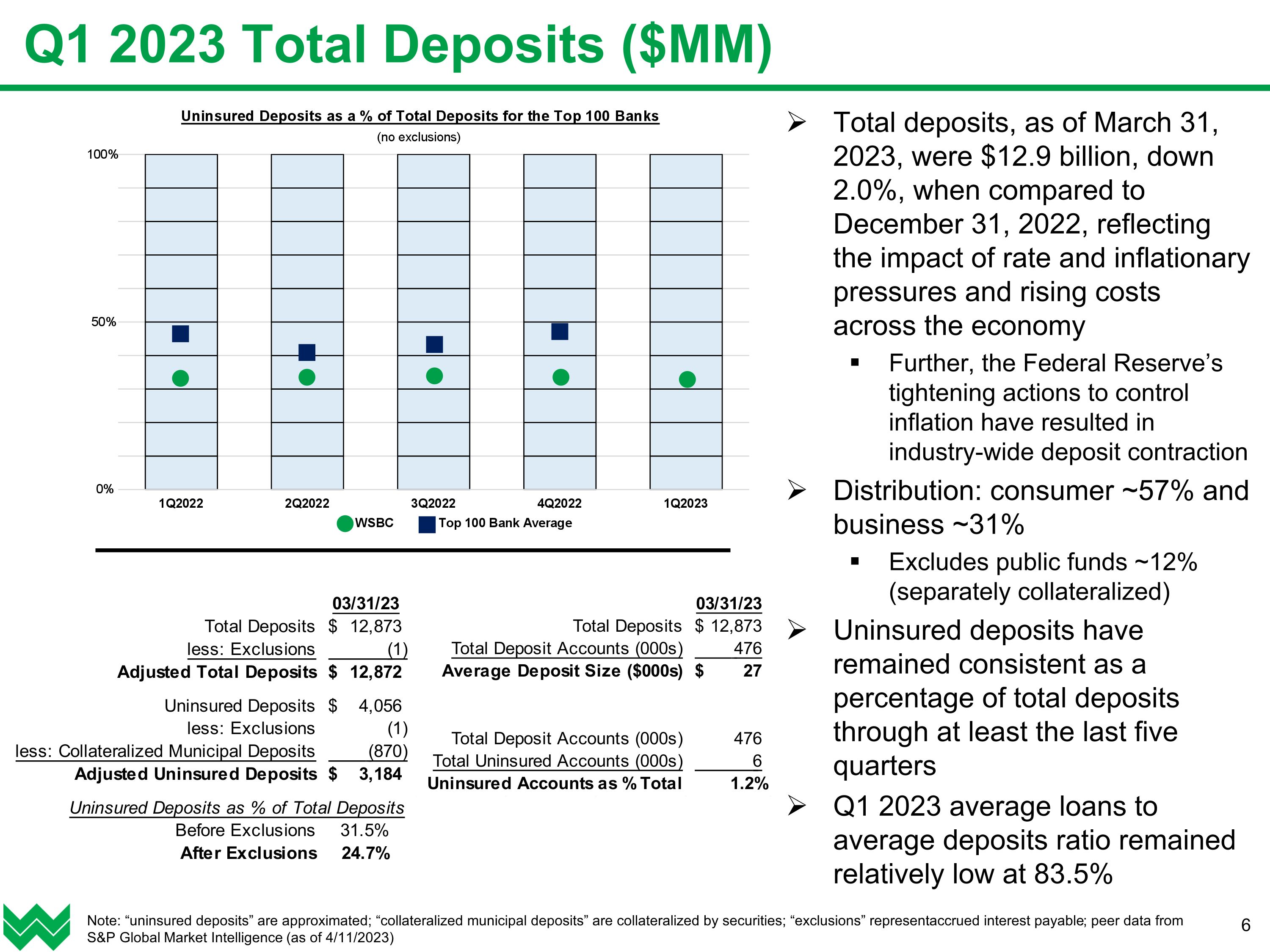

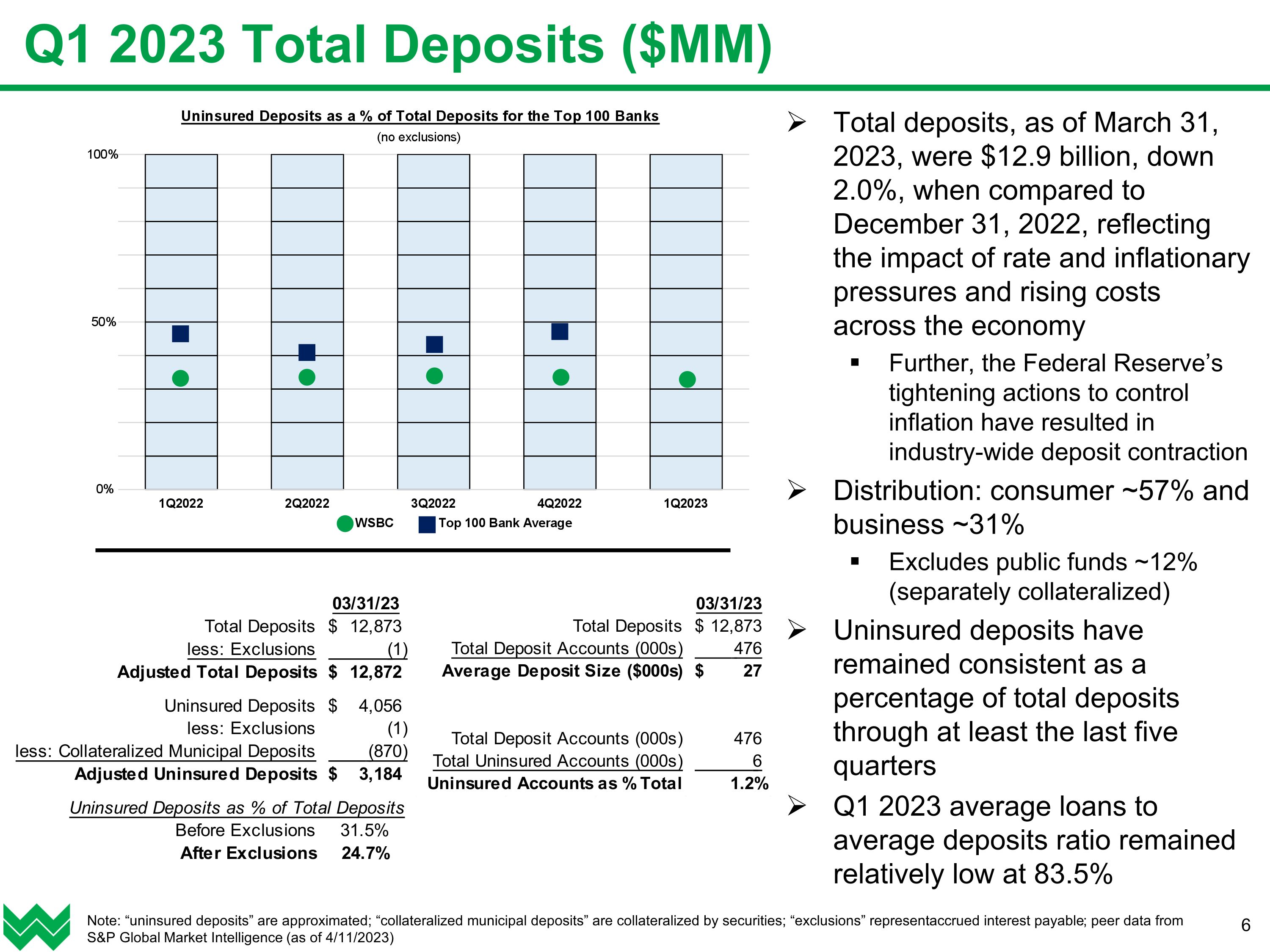

Q1 2023 Total Deposits ($MM) Total deposits, as of March 31, 2023, were $12.9 billion, down 2.0%, when compared to December 31, 2022, reflecting the impact of rate and inflationary pressures and rising costs across the economy Further, the Federal Reserve’s tightening actions to control inflation have resulted in industry-wide deposit contraction Distribution: consumer ~57% and business ~31% Excludes public funds ~12% (separately collateralized) Uninsured deposits have remained consistent as a percentage of total deposits through at least the last five quarters Q1 2023 average loans to average deposits ratio remained relatively low at 83.5% Note: “uninsured deposits” are approximated; “collateralized municipal deposits” are collateralized by securities; “exclusions” represent accrued interest payable; peer data from S&P Global Market Intelligence (as of 4/11/2023)

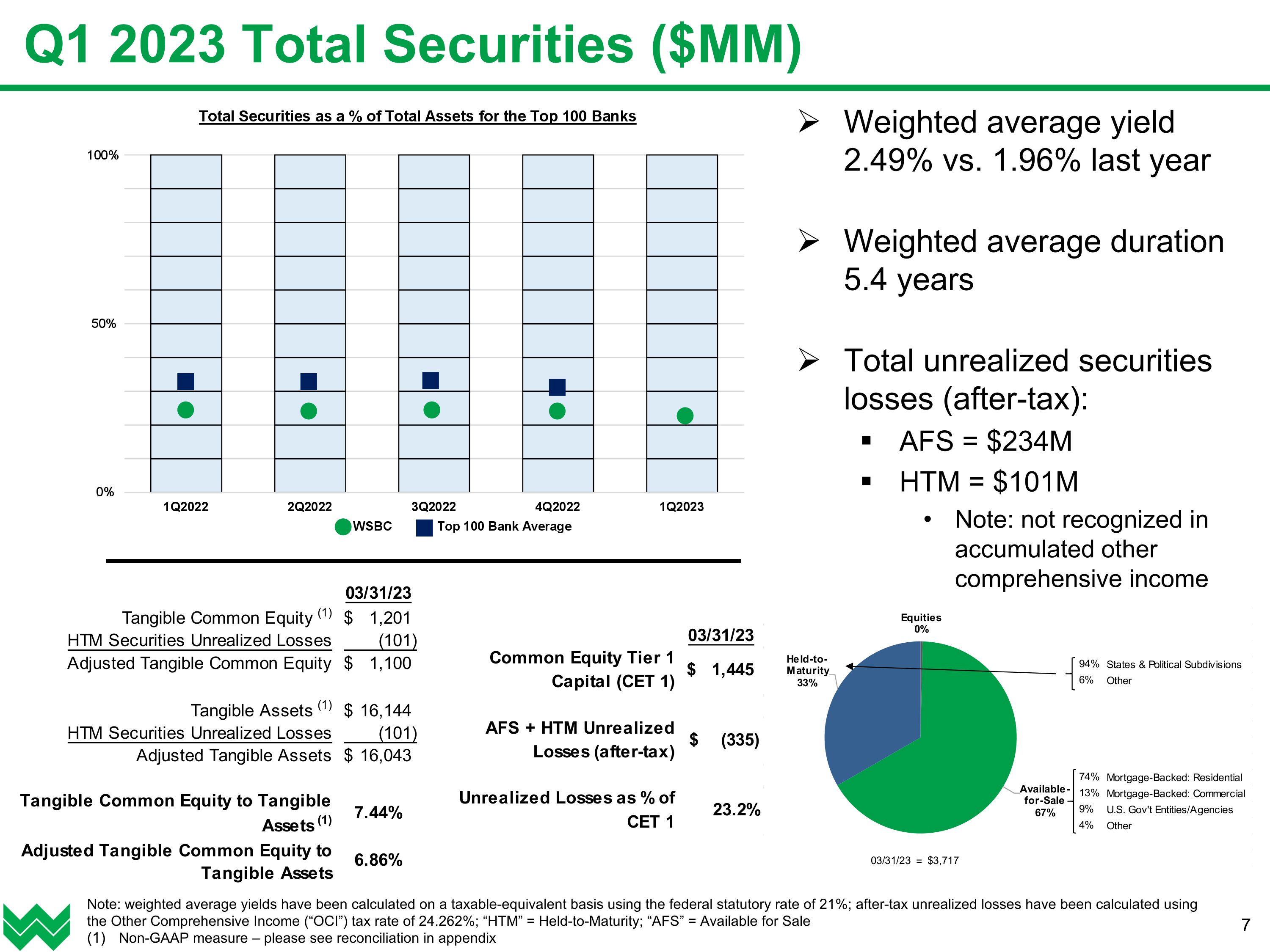

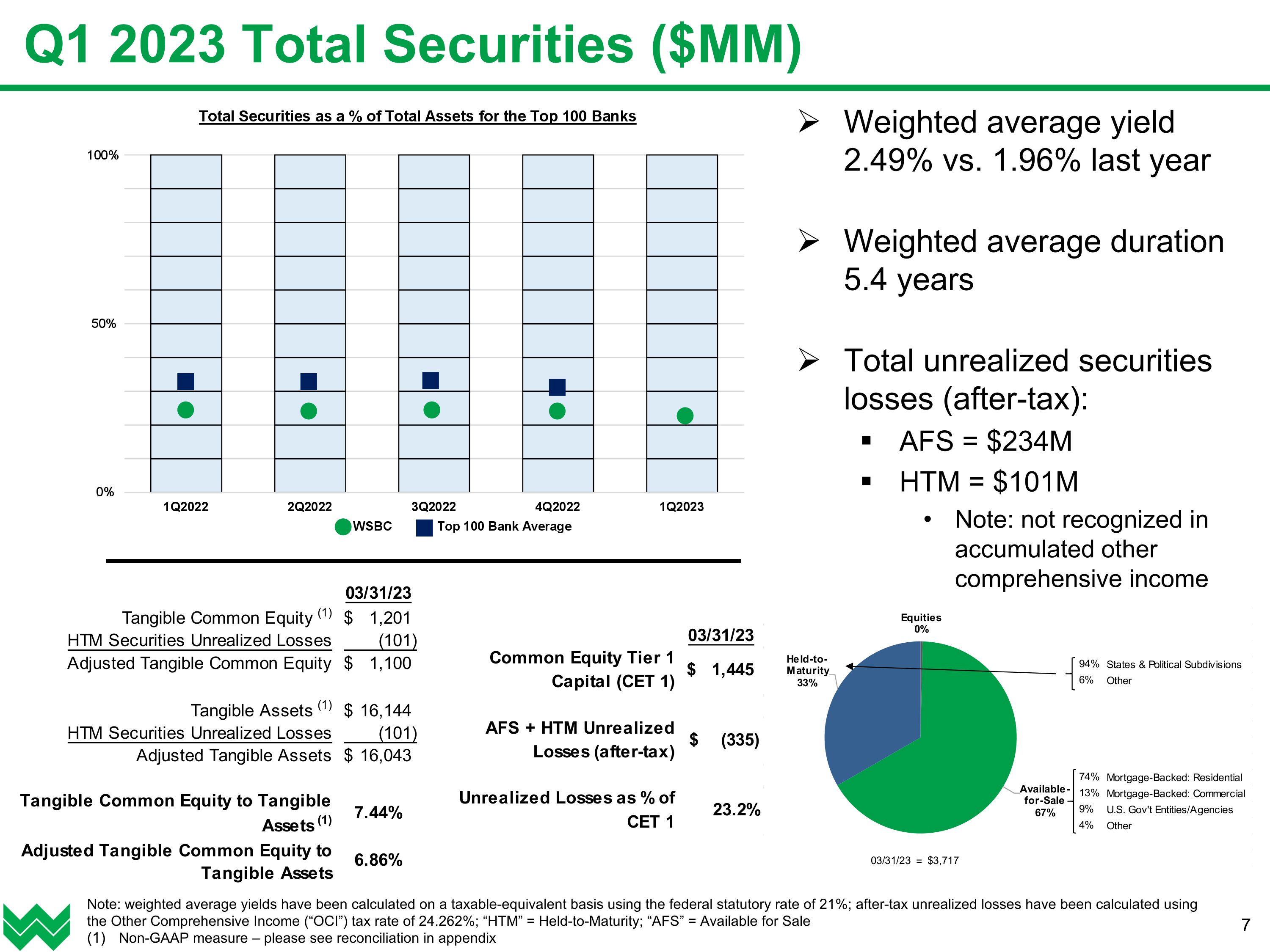

Q1 2023 Total Securities ($MM) Weighted average yield 2.49% vs. 1.96% last year Weighted average duration 5.4 years Total unrealized securities losses (after-tax): AFS = $234M HTM = $101M Note: not recognized in accumulated other comprehensive income Note: weighted average yields have been calculated on a taxable-equivalent basis using the federal statutory rate of 21%; after-tax unrealized losses have been calculated using the Other Comprehensive Income (“OCI”) tax rate of 24.262%; “HTM” = Held-to-Maturity; “AFS” = Available for Sale Non-GAAP measure – please see reconciliation in appendix

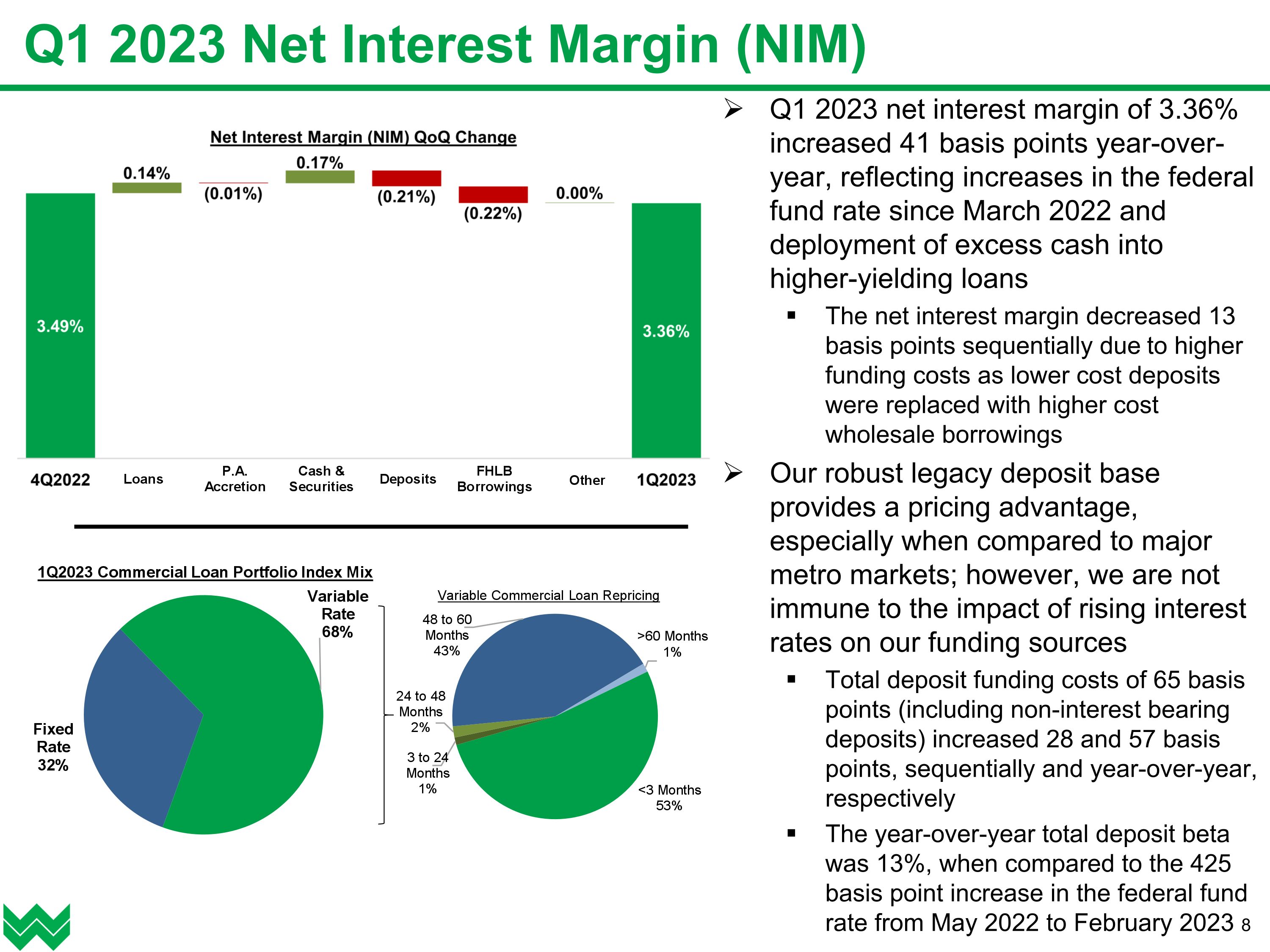

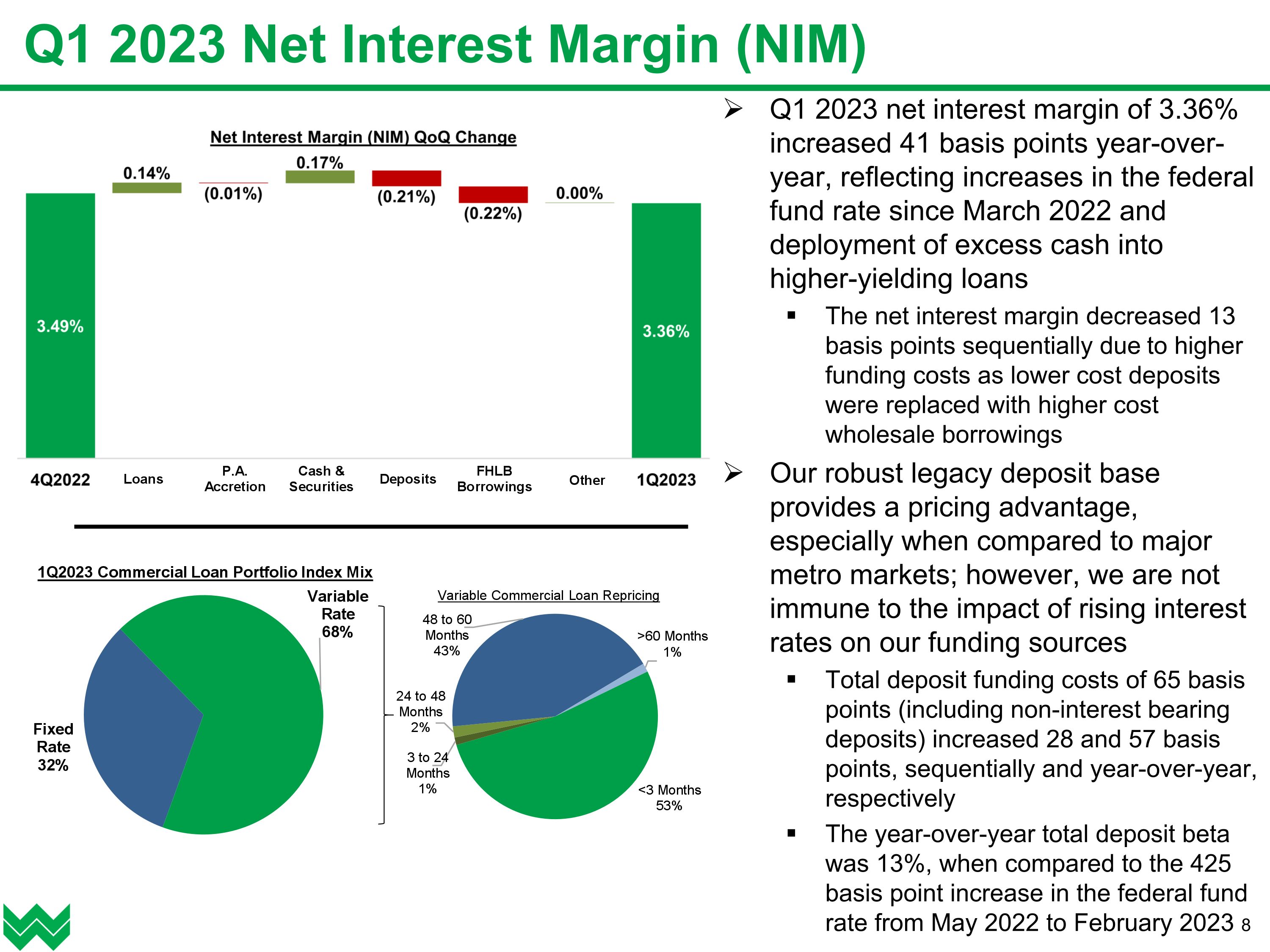

Q1 2023 Net Interest Margin (NIM) Q1 2023 net interest margin of 3.36% increased 41 basis points year-over-year, reflecting increases in the federal fund rate since March 2022 and deployment of excess cash into higher-yielding loans The net interest margin decreased 13 basis points sequentially due to higher funding costs as lower cost deposits were replaced with higher cost wholesale borrowings Our robust legacy deposit base provides a pricing advantage, especially when compared to major metro markets; however, we are not immune to the impact of rising interest rates on our funding sources Total deposit funding costs of 65 basis points (including non-interest bearing deposits) increased 28 and 57 basis points, sequentially and year-over-year, respectively The year-over-year total deposit beta was 13%, when compared to the 425 basis point increase in the federal fund rate from May 2022 to February 2023

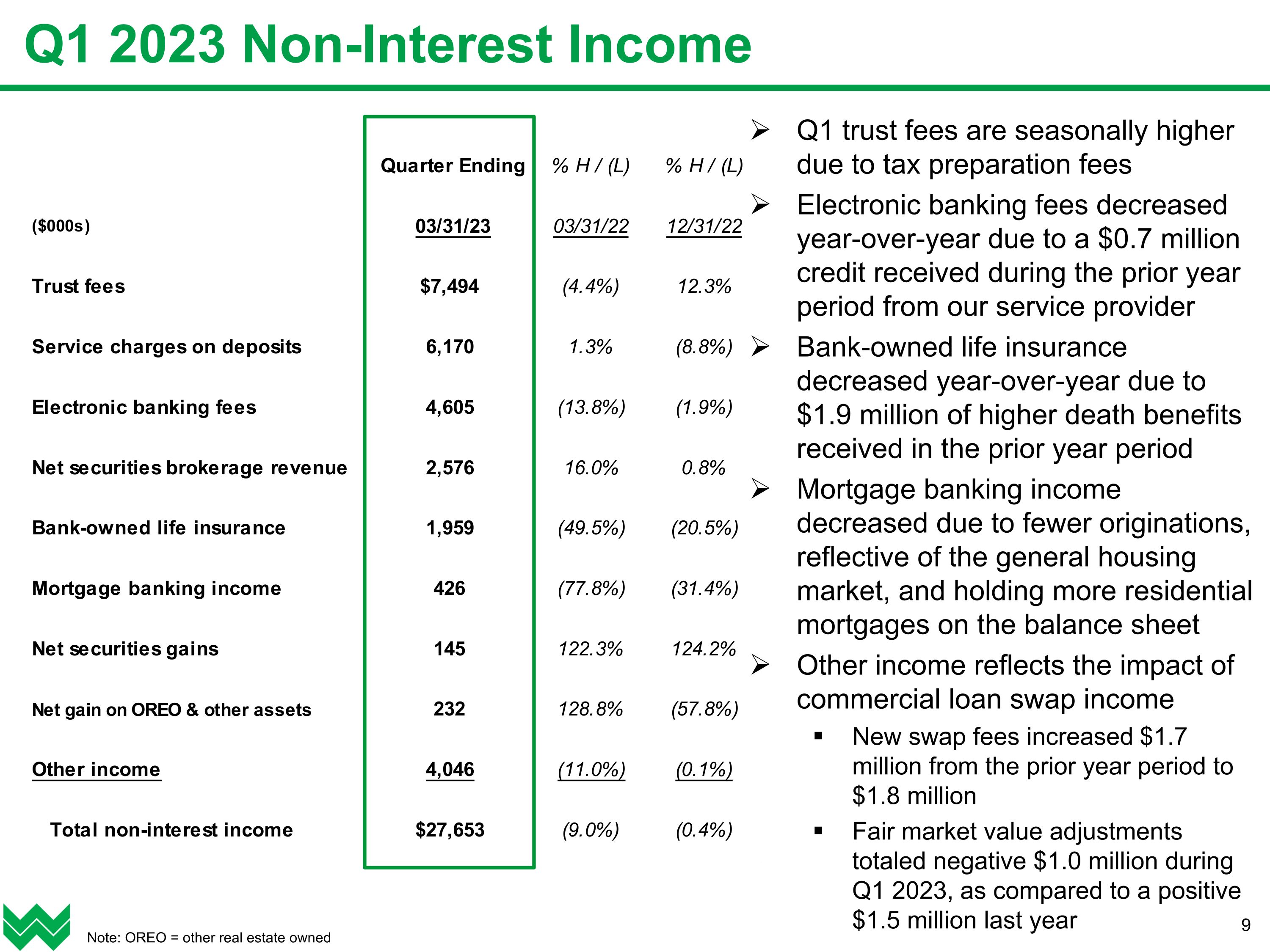

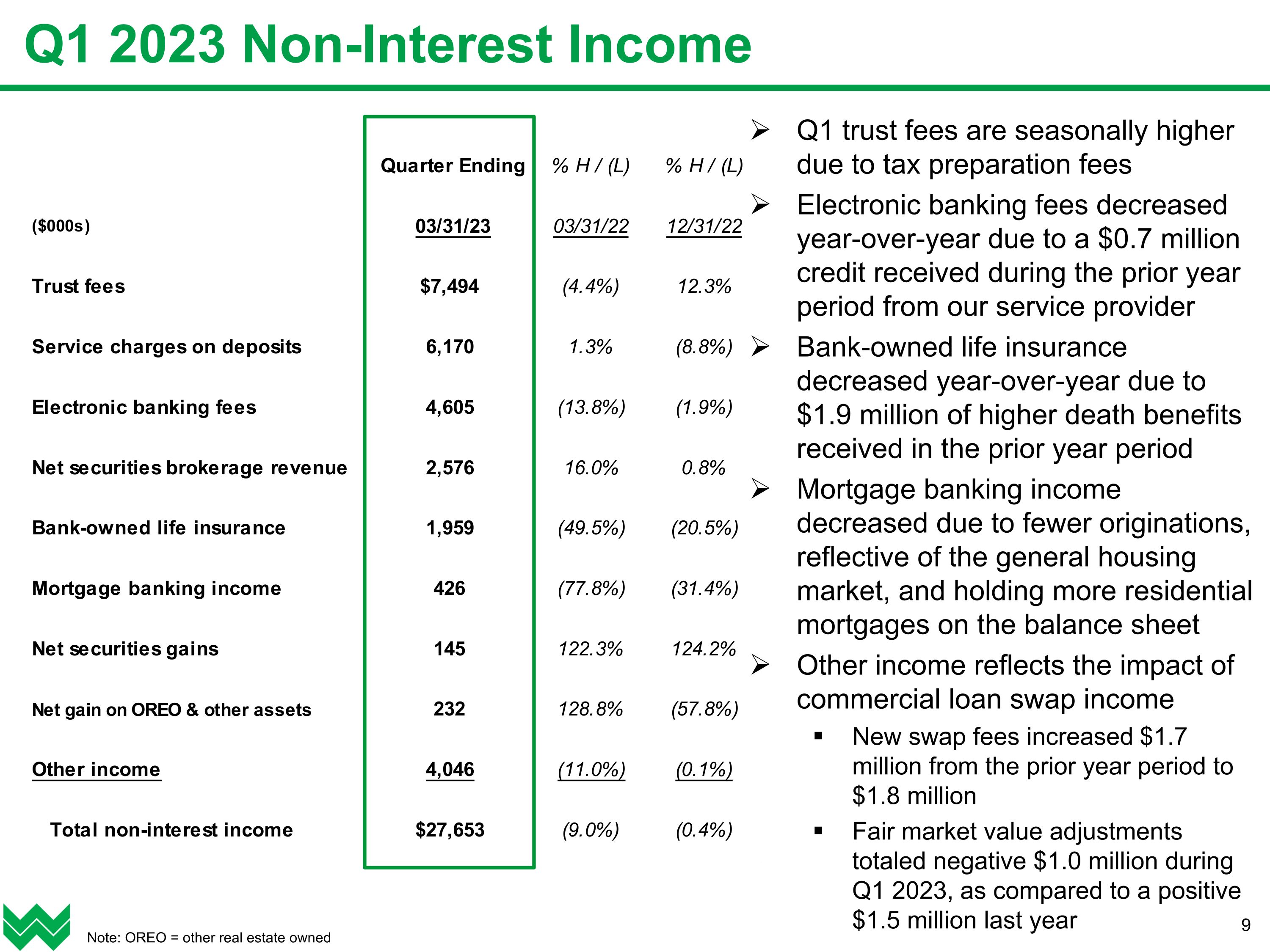

Q1 2023 Non-Interest Income Q1 trust fees are seasonally higher due to tax preparation fees Electronic banking fees decreased year-over-year due to a $0.7 million credit received during the prior year period from our service provider Bank-owned life insurance decreased year-over-year due to $1.9 million of higher death benefits received in the prior year period Mortgage banking income decreased due to fewer originations, reflective of the general housing market, and holding more residential mortgages on the balance sheet Other income reflects the impact of commercial loan swap income New swap fees increased $1.7 million from the prior year period to $1.8 million Fair market value adjustments totaled negative $1.0 million during Q1 2023, as compared to a positive $1.5 million last year Note: OREO = other real estate owned

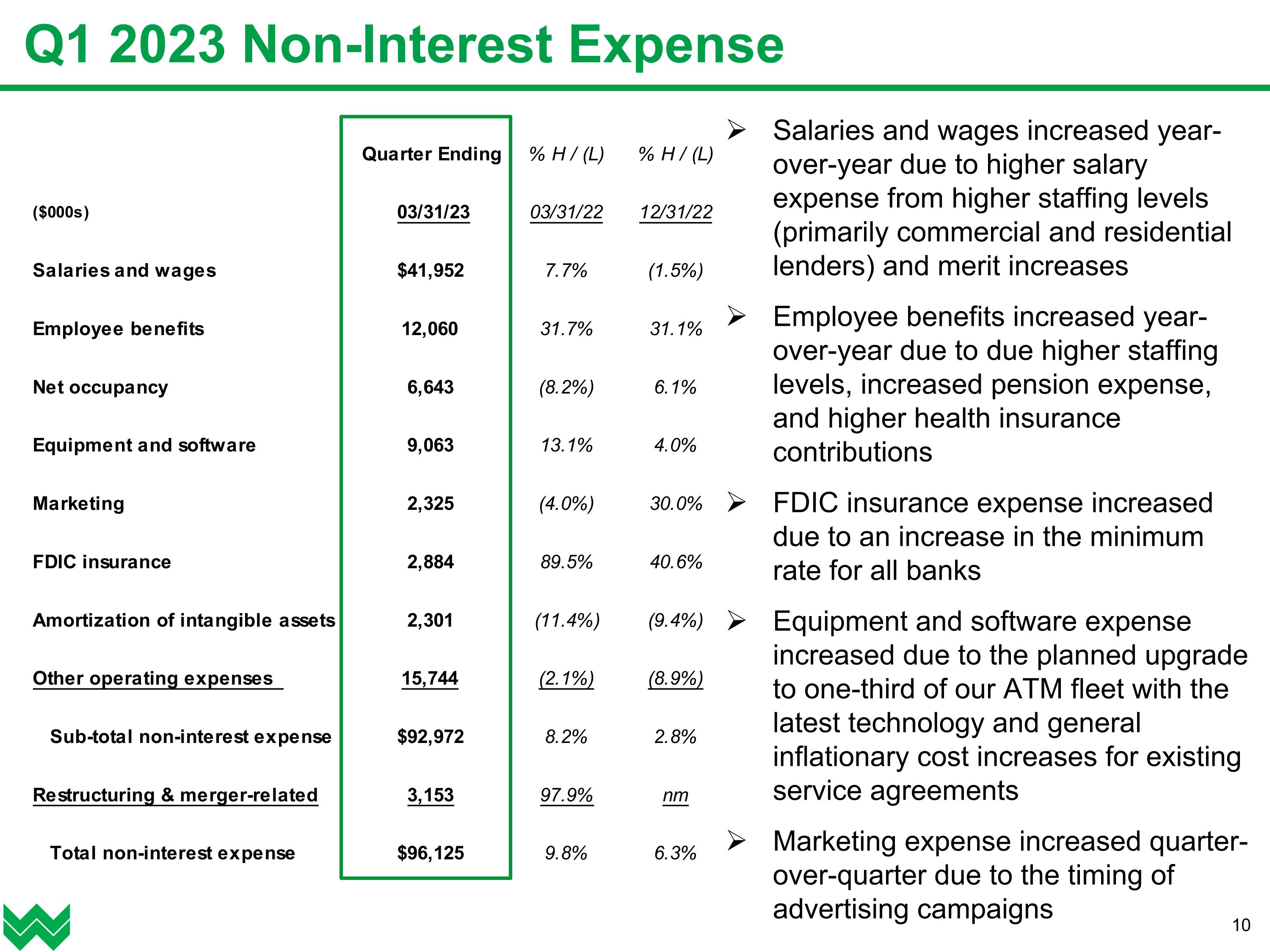

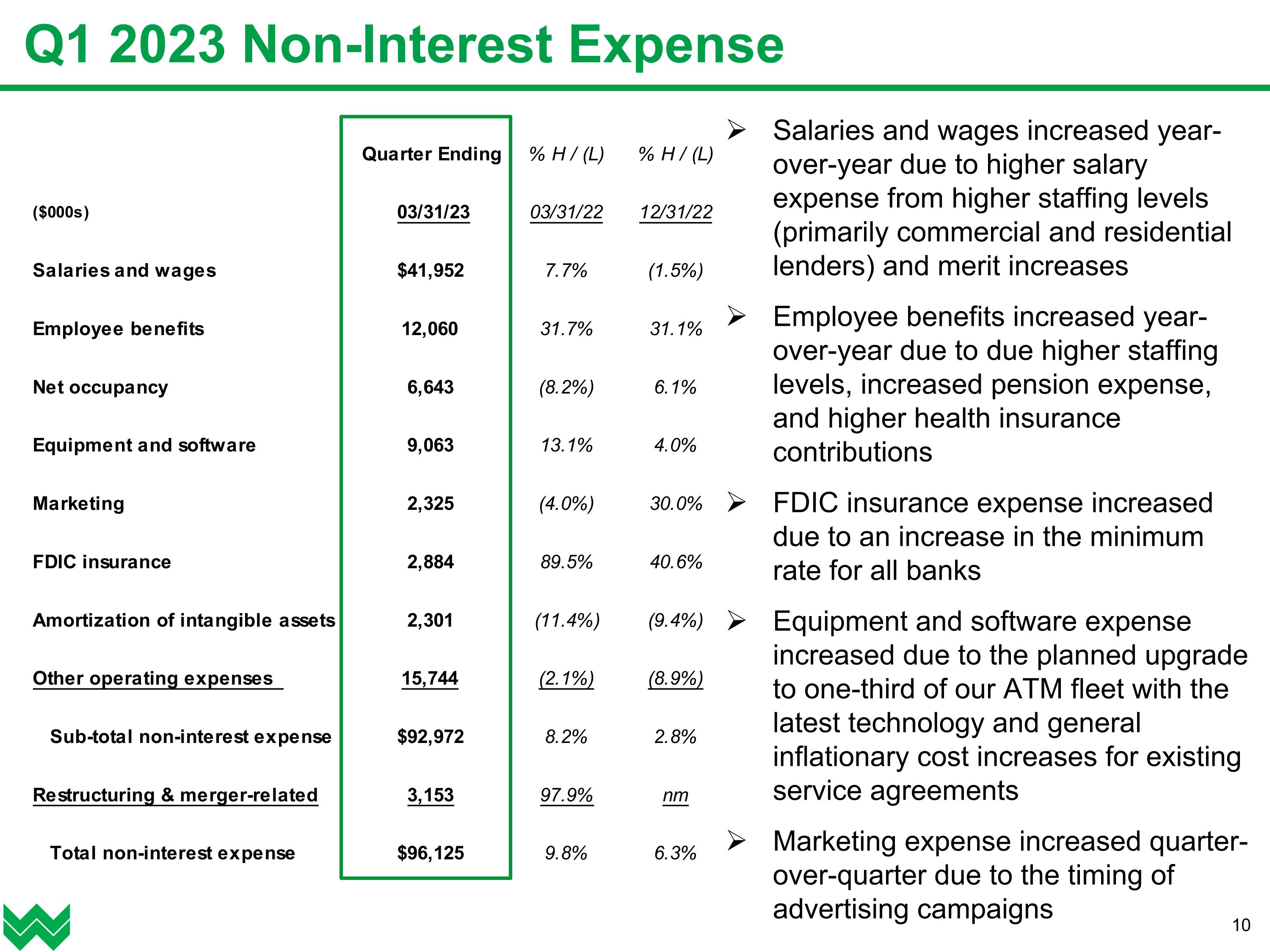

Q1 2023 Non-Interest Expense Salaries and wages increased year-over-year due to higher salary expense from higher staffing levels (primarily commercial and residential lenders) and merit increases Employee benefits increased year-over-year due to due higher staffing levels, increased pension expense, and higher health insurance contributions FDIC insurance expense increased due to an increase in the minimum rate for all banks Equipment and software expense increased due to the planned upgrade to one-third of our ATM fleet with the latest technology and general inflationary cost increases for existing service agreements Marketing expense increased quarter-over-quarter due to the timing of advertising campaigns

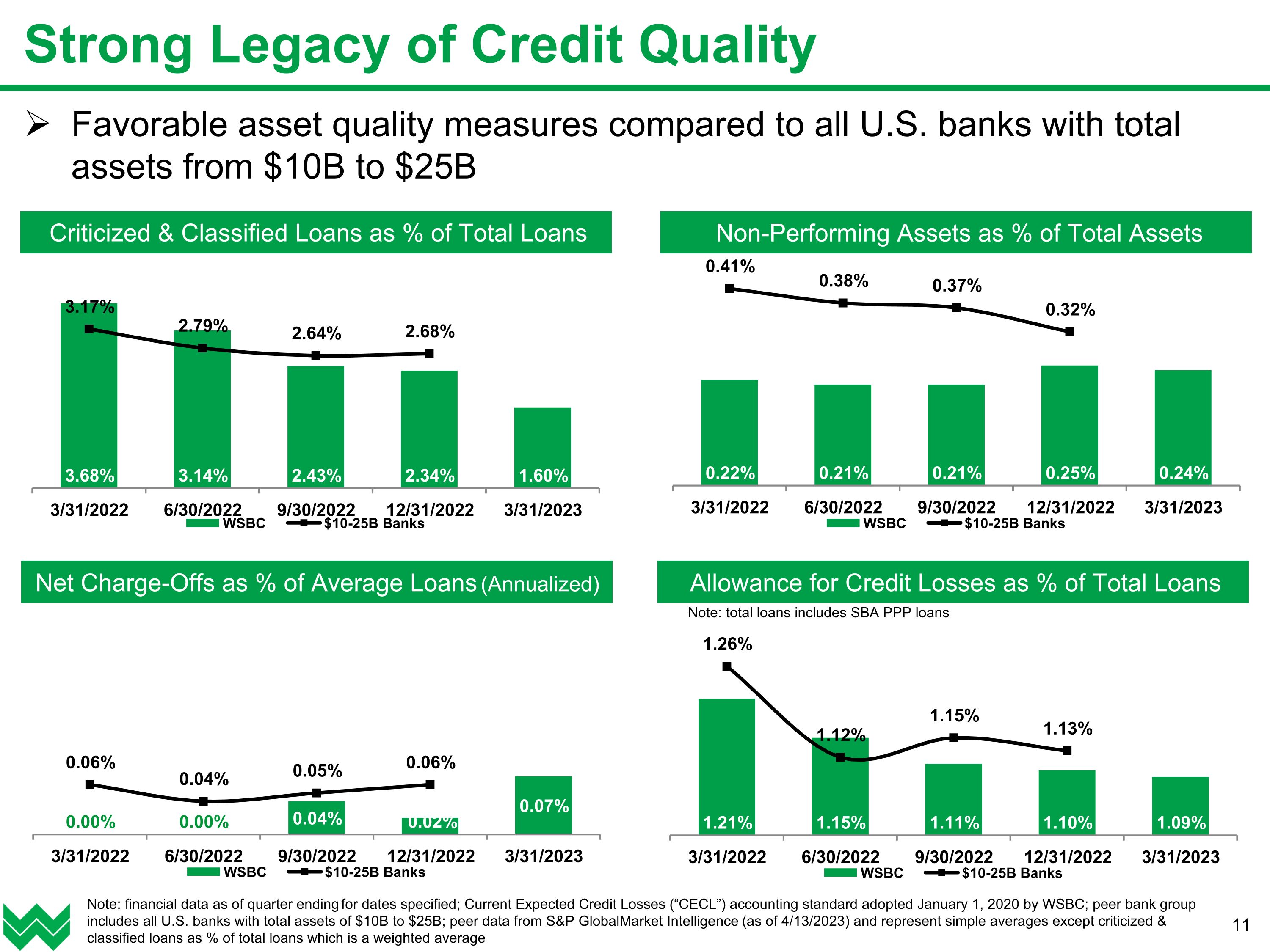

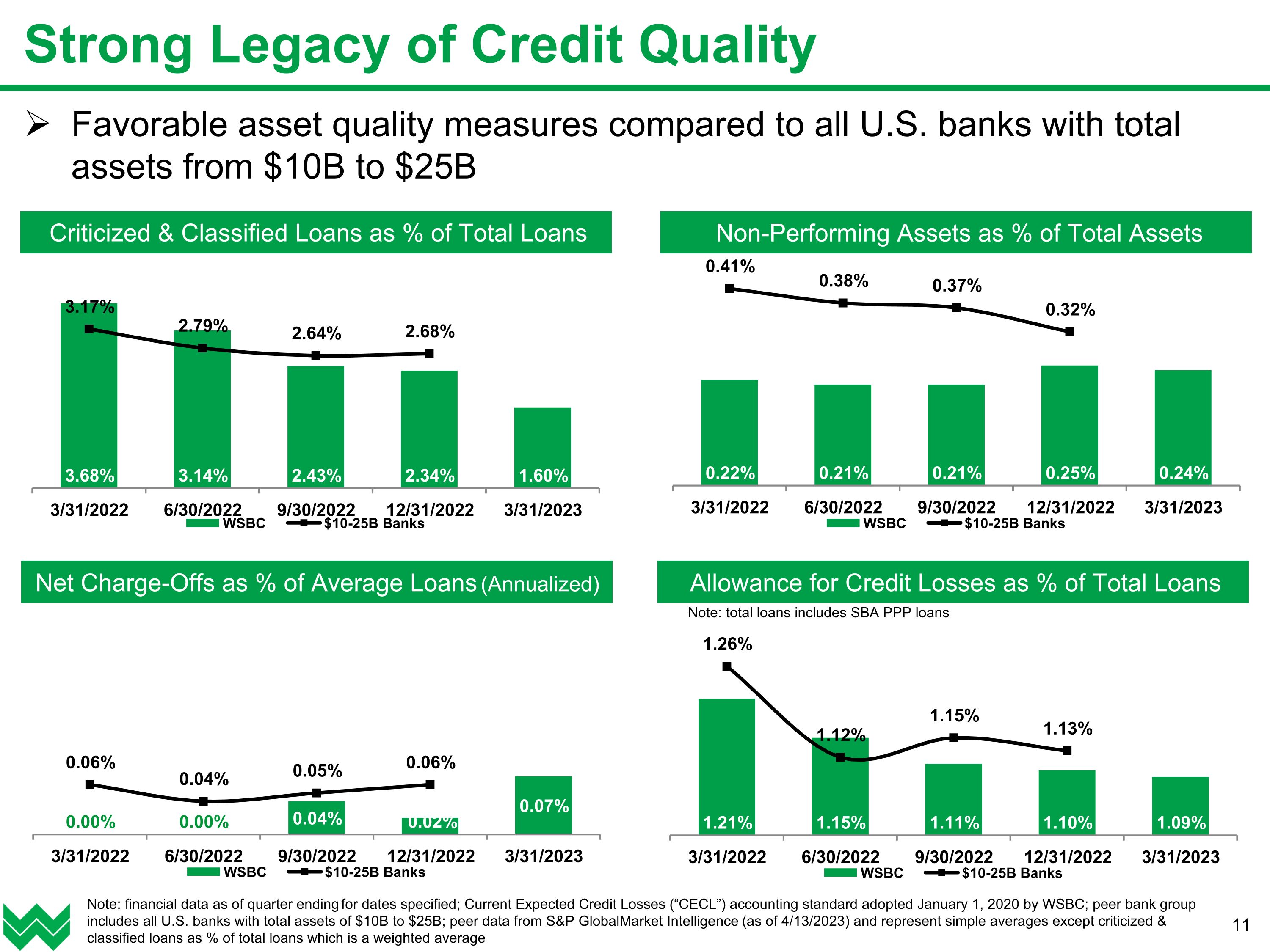

Non-Performing Assets as % of Total Assets Net Charge-Offs as % of Average Loans (Annualized) Allowance for Credit Losses as % of Total Loans Criticized & Classified Loans as % of Total Loans Favorable asset quality measures compared to all U.S. banks with total assets from $10B to $25B Strong Legacy of Credit Quality Note: financial data as of quarter ending for dates specified; Current Expected Credit Losses (“CECL”) accounting standard adopted January 1, 2020 by WSBC; peer bank group includes all U.S. banks with total assets of $10B to $25B; peer data from S&P Global Market Intelligence (as of 4/13/2023) and represent simple averages except criticized & classified loans as % of total loans which is a weighted average Note: total loans includes SBA PPP loans

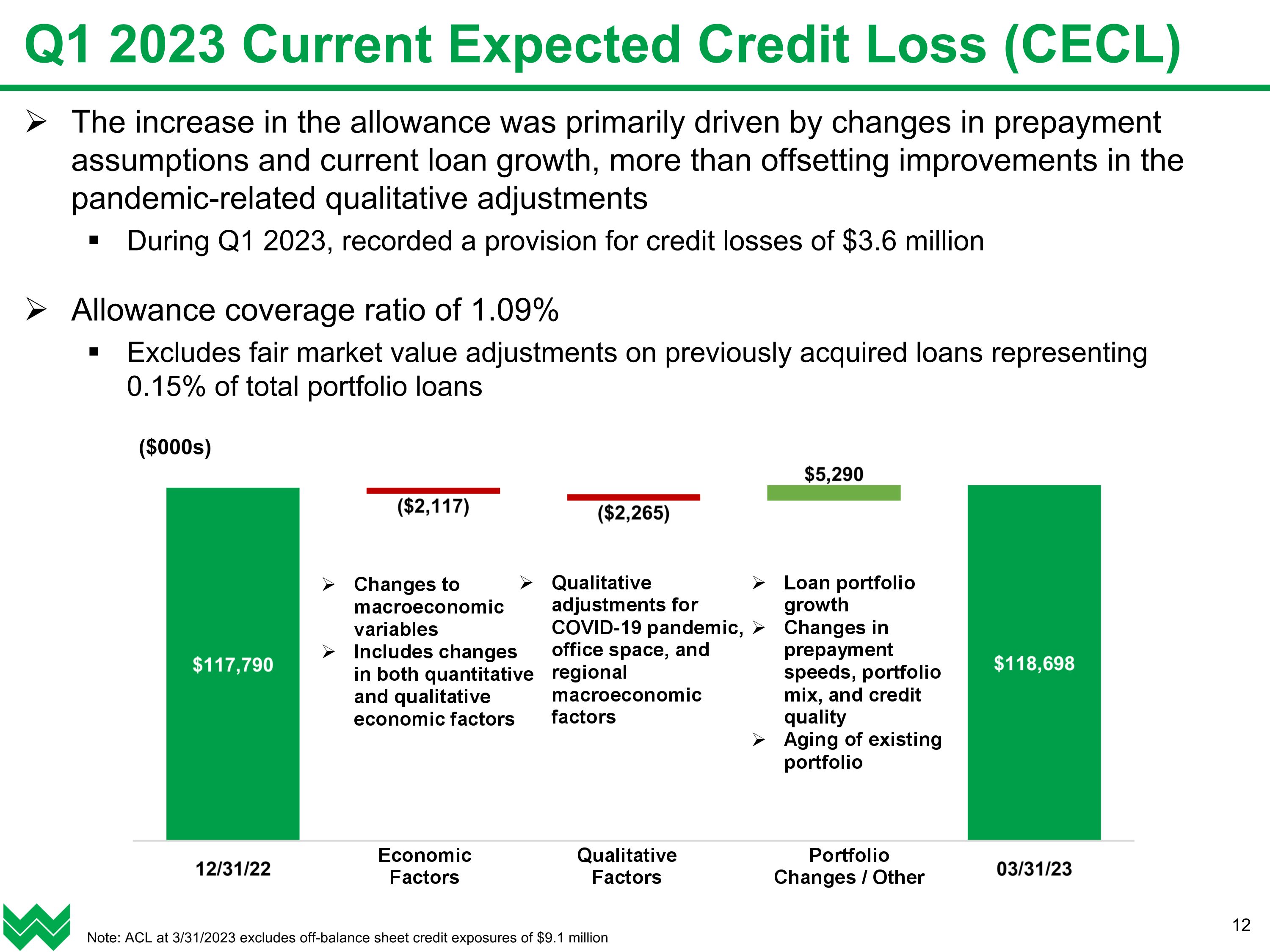

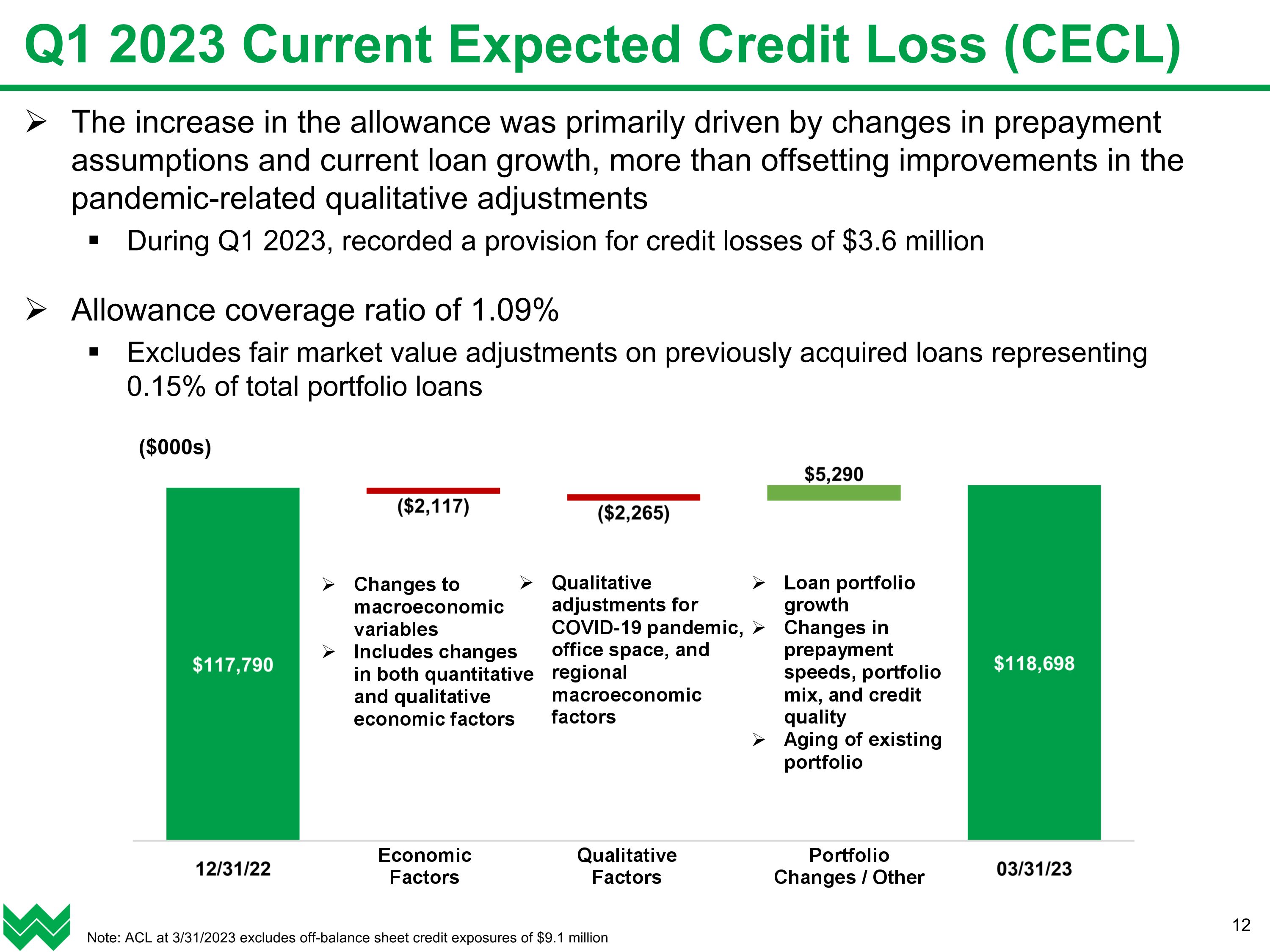

The increase in the allowance was primarily driven by changes in prepayment assumptions and current loan growth, more than offsetting improvements in the pandemic-related qualitative adjustments During Q1 2023, recorded a provision for credit losses of $3.6 million Allowance coverage ratio of 1.09% Excludes fair market value adjustments on previously acquired loans representing 0.15% of total portfolio loans Q1 2023 Current Expected Credit Loss (CECL) Note: ACL at 3/31/2023 excludes off-balance sheet credit exposures of $9.1 million ($000s)

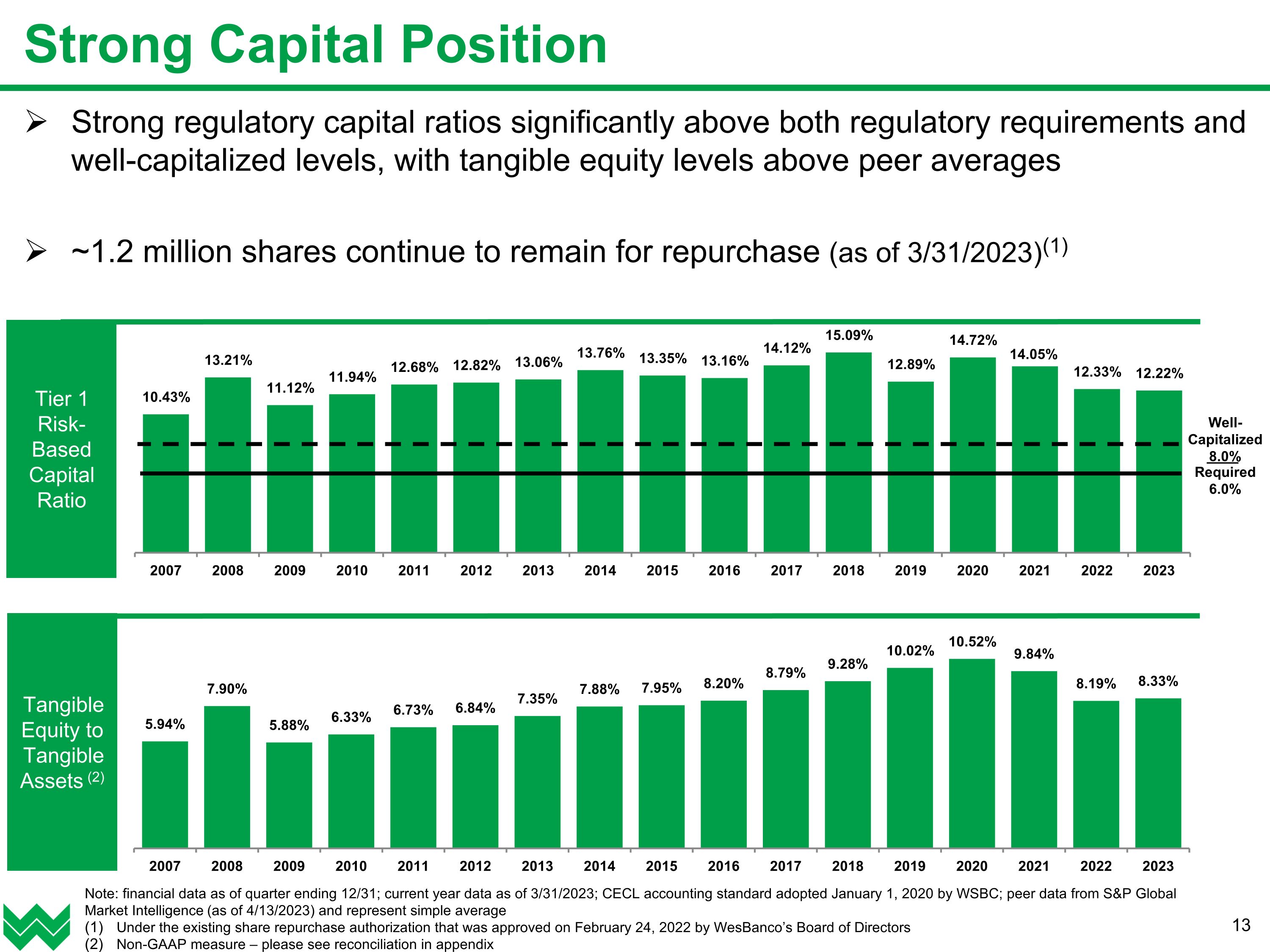

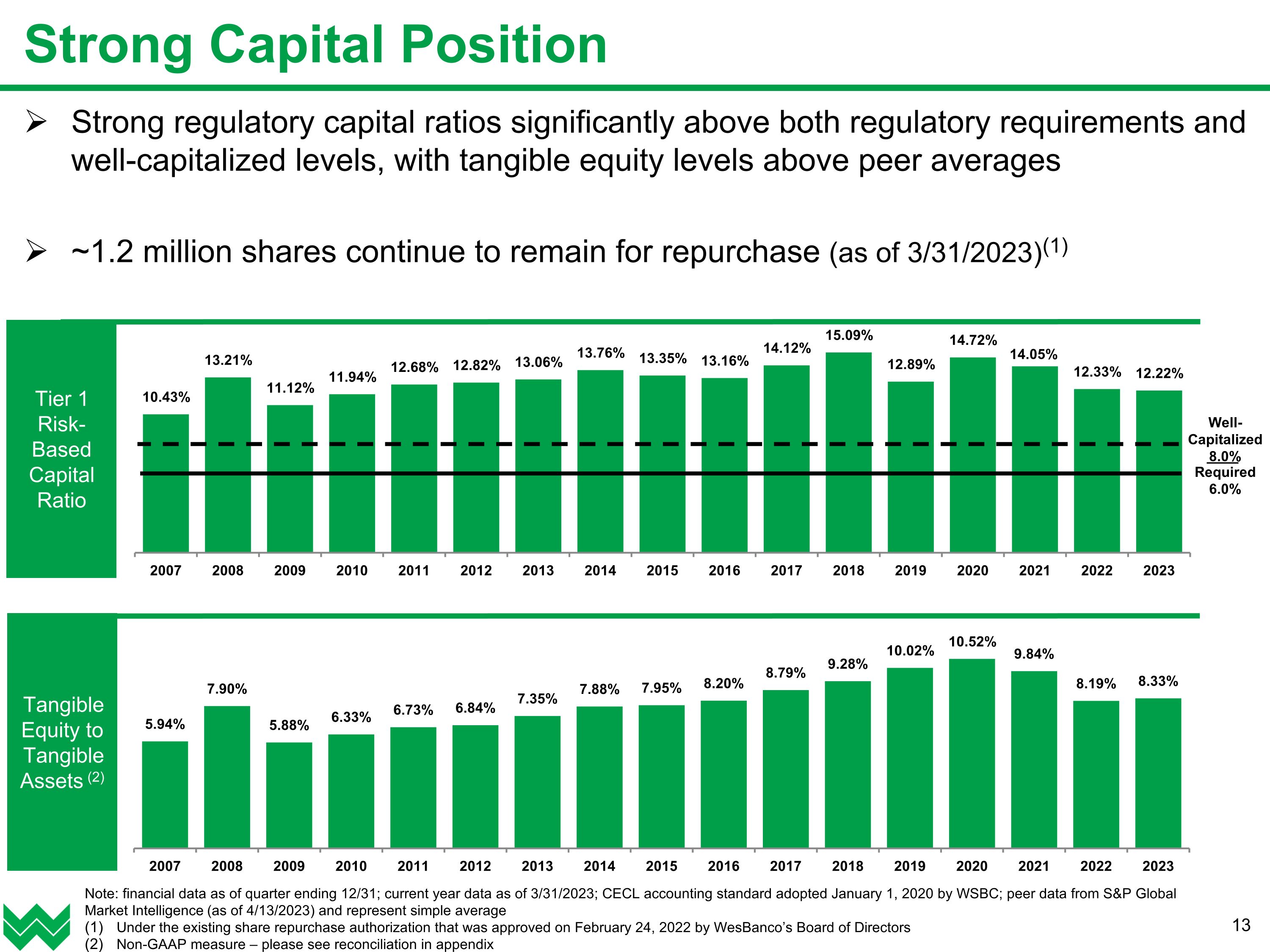

Strong regulatory capital ratios significantly above both regulatory requirements and well-capitalized levels, with tangible equity levels above peer averages ~1.2 million shares continue to remain for repurchase (as of 3/31/2023)(1) Tangible Equity to Tangible Assets (2) Tier 1 Risk-Based Capital Ratio Strong Capital Position Note: financial data as of quarter ending 12/31; current year data as of 3/31/2023; CECL accounting standard adopted January 1, 2020 by WSBC; peer data from S&P Global Market Intelligence (as of 4/13/2023) and represent simple average Under the existing share repurchase authorization that was approved on February 24, 2022 by WesBanco’s Board of Directors Non-GAAP measure – please see reconciliation in appendix Well-Capitalized 8.0% Required 6.0%

Appendix

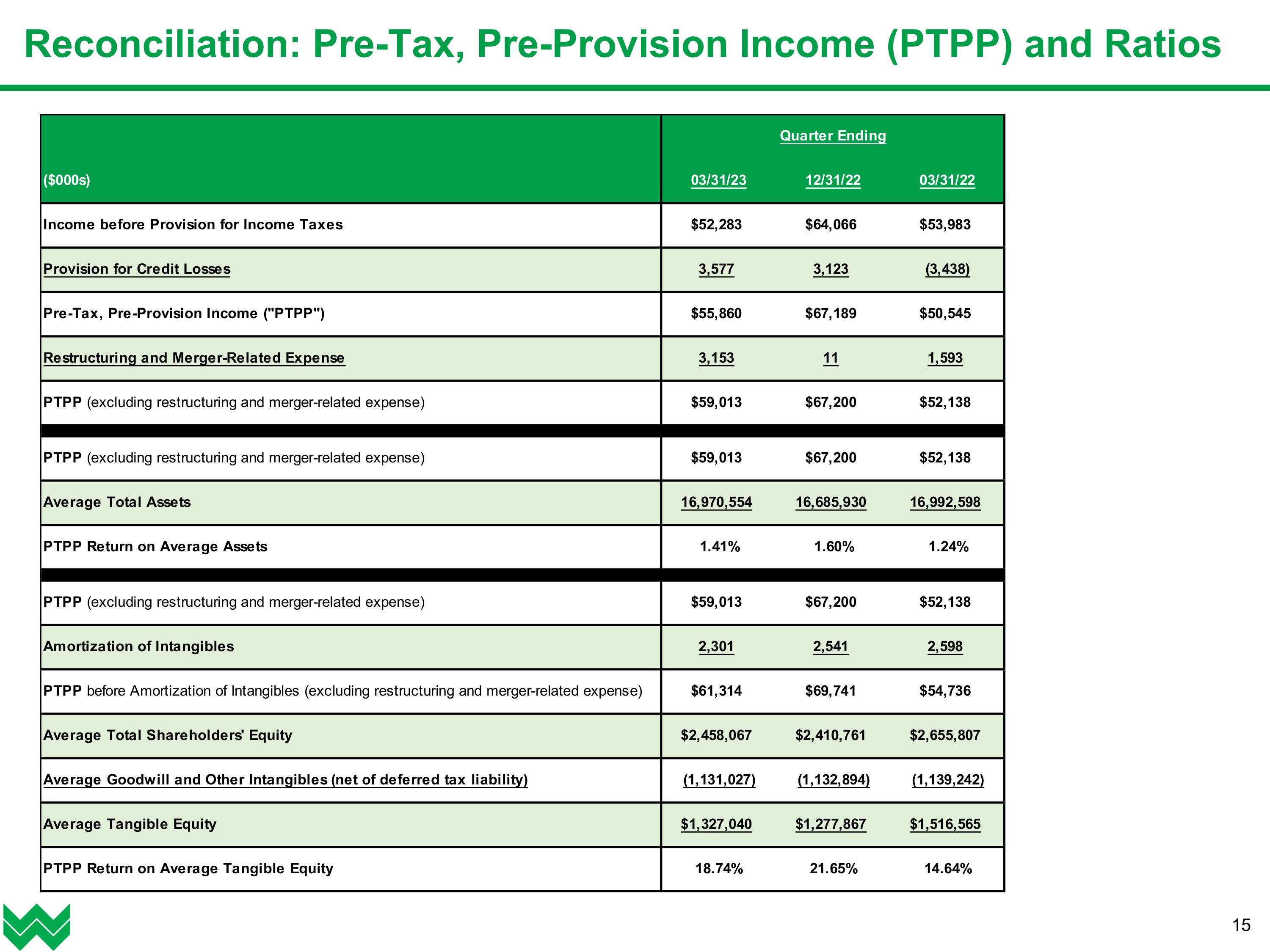

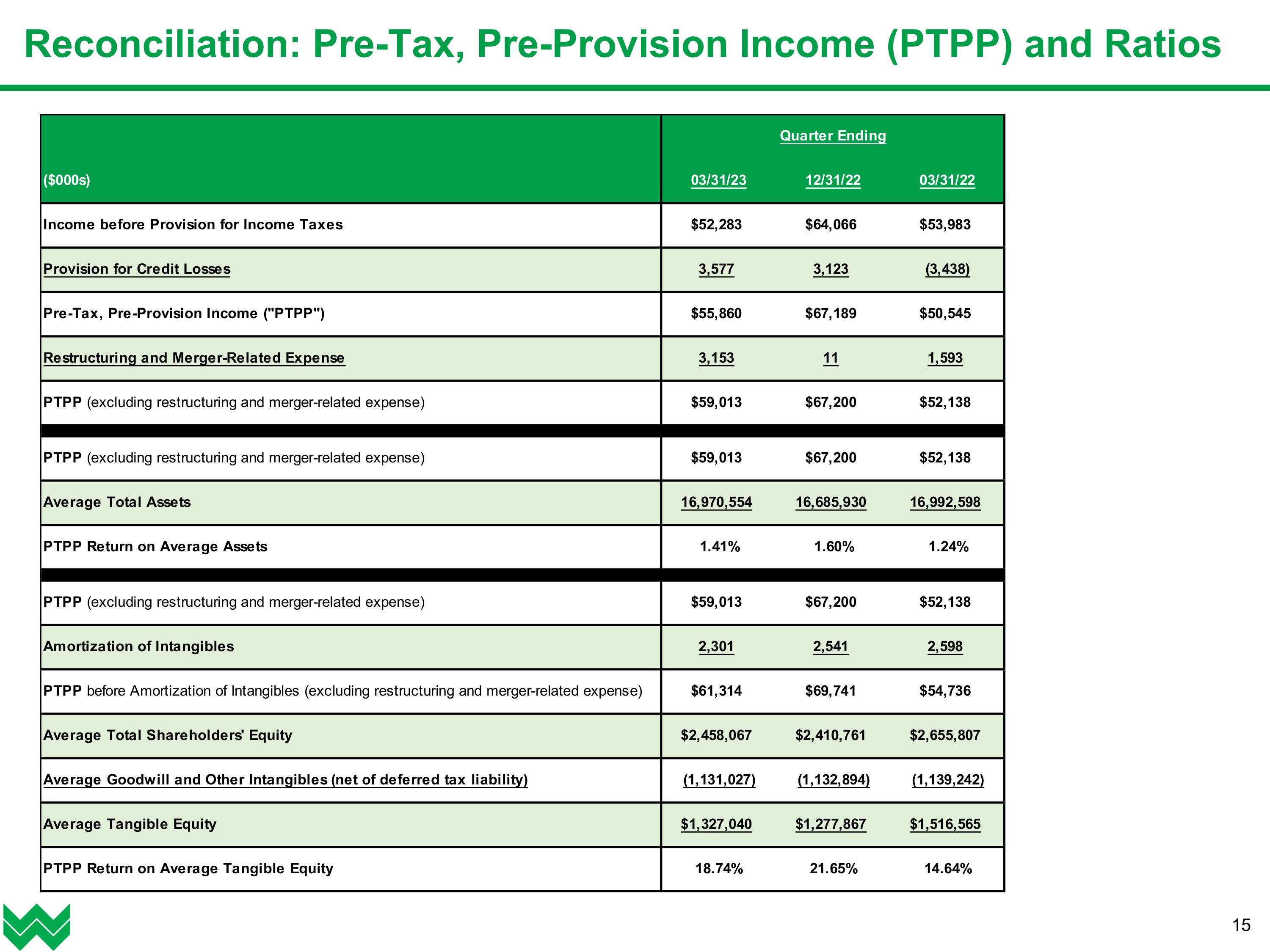

Reconciliation: Pre-Tax, Pre-Provision Income (PTPP) and Ratios

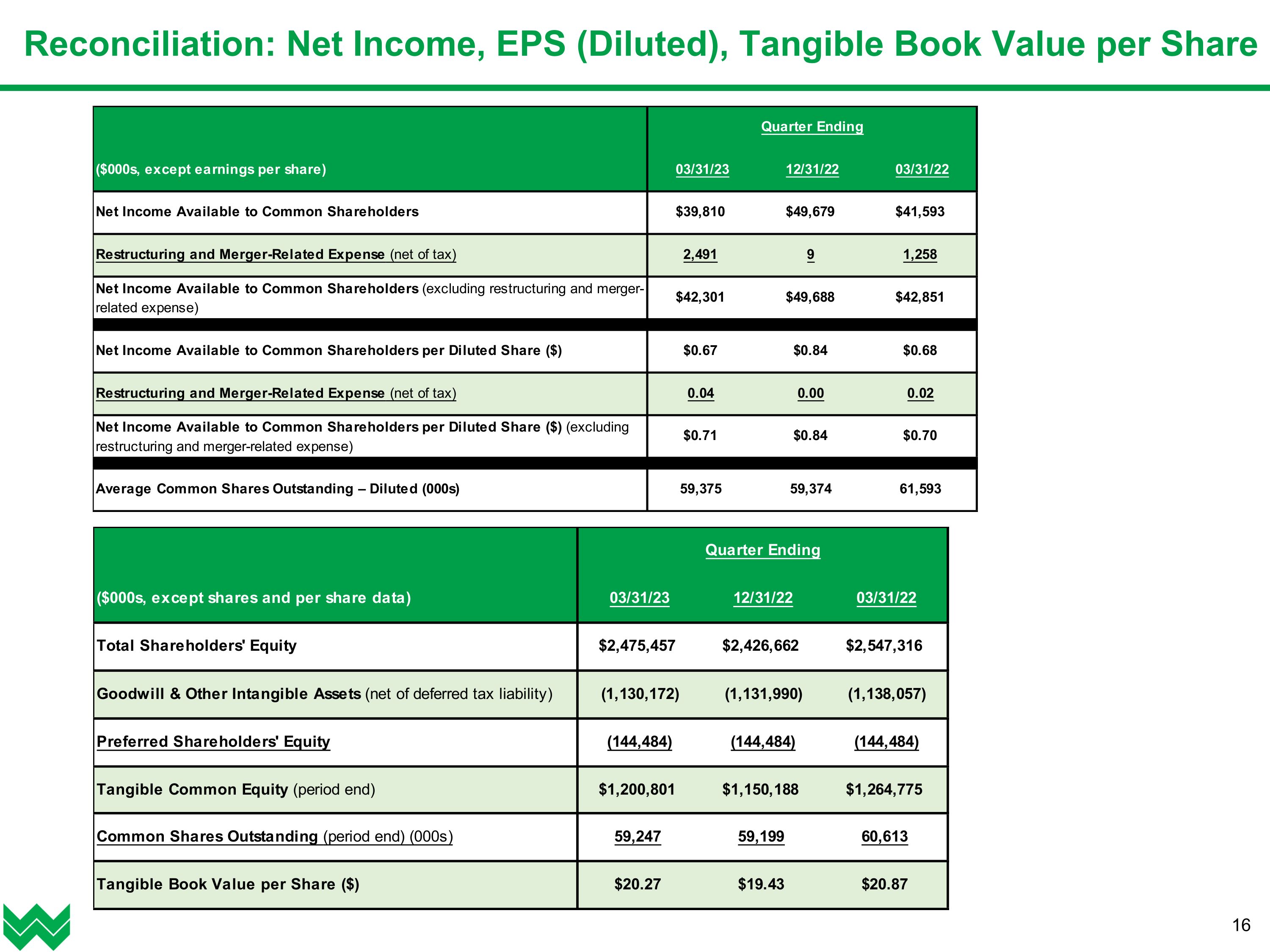

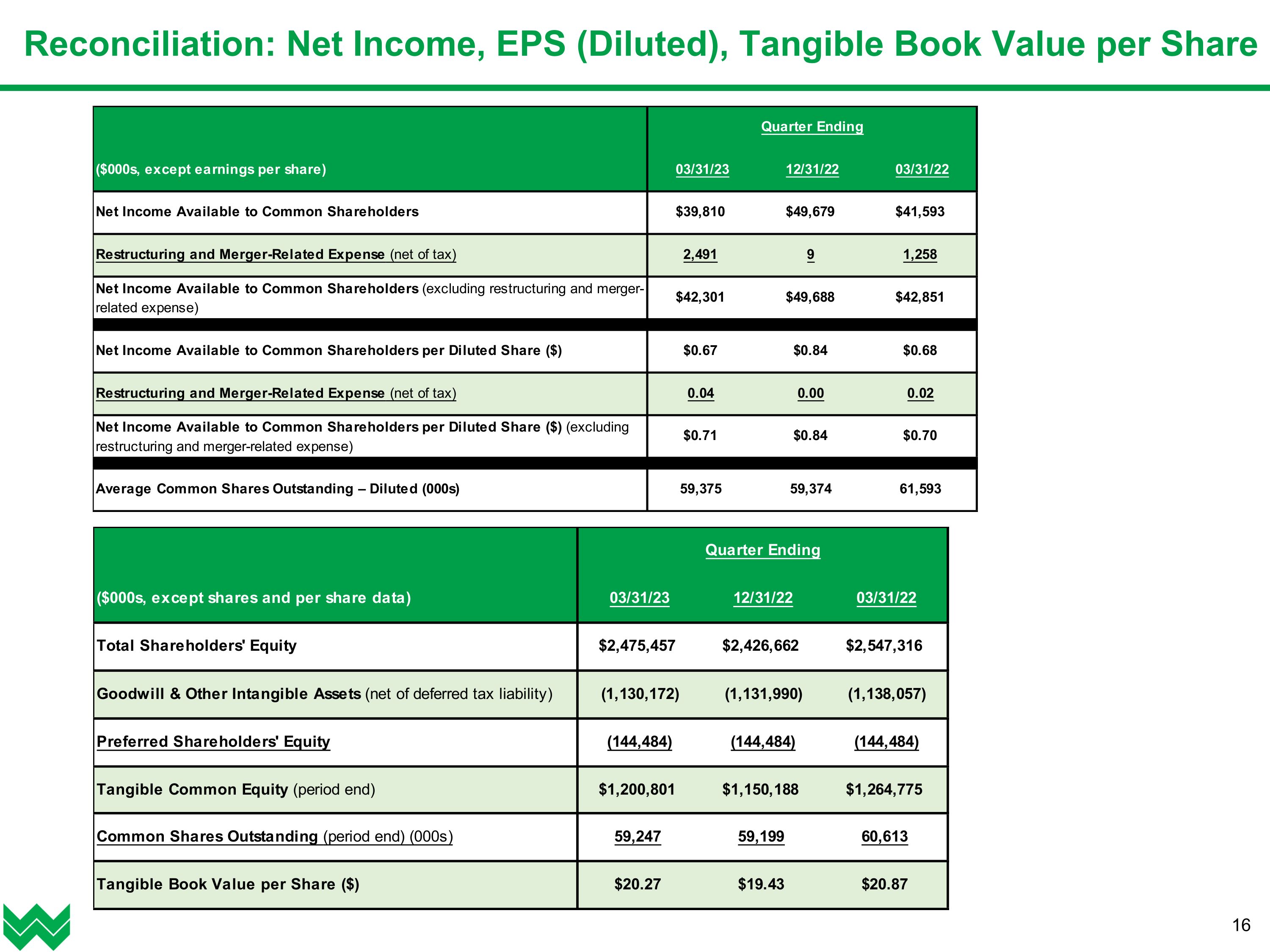

Reconciliation: Net Income, EPS (Diluted), Tangible Book Value per Share

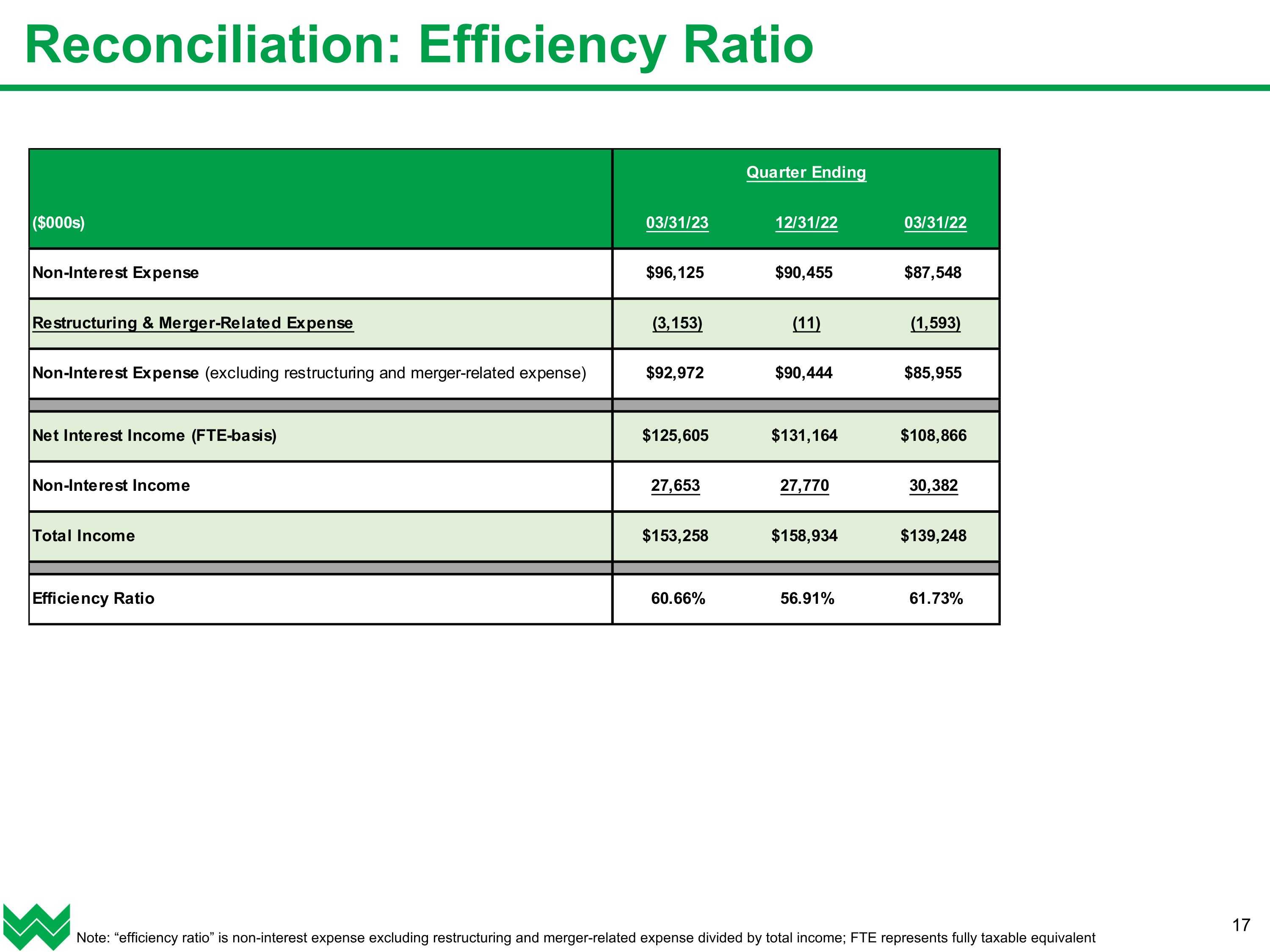

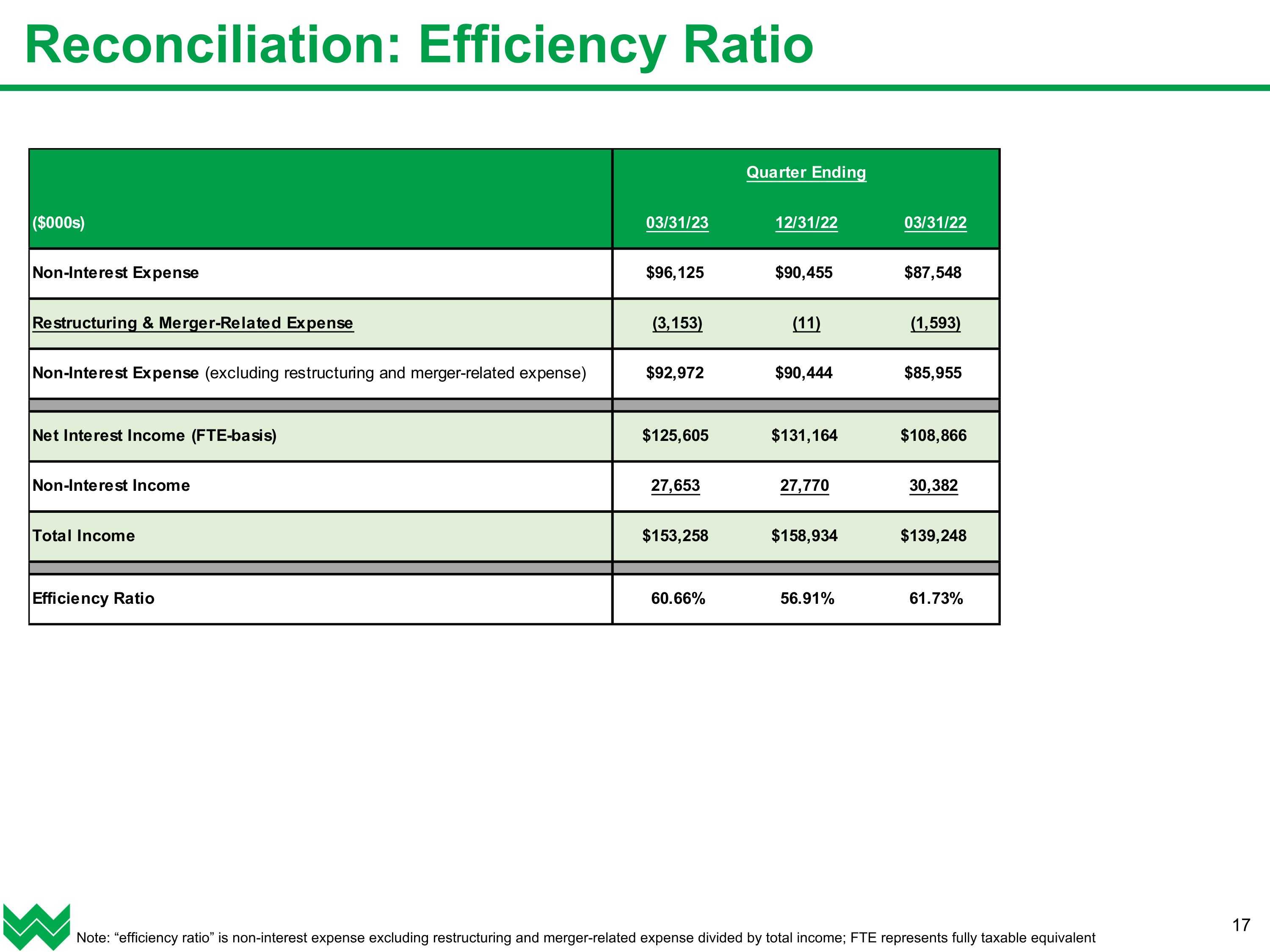

Reconciliation: Efficiency Ratio Note: “efficiency ratio” is non-interest expense excluding restructuring and merger-related expense divided by total income; FTE represents fully taxable equivalent

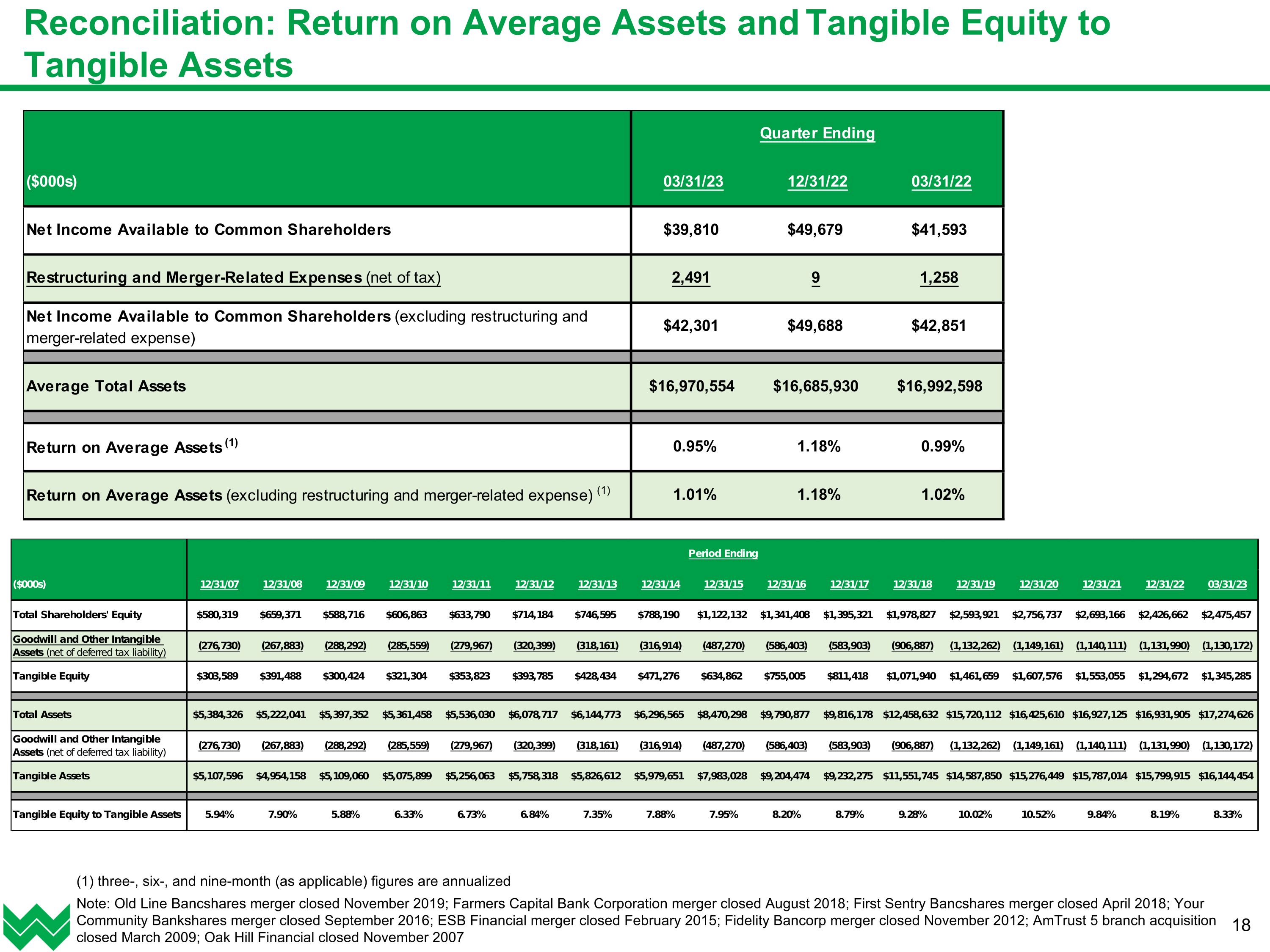

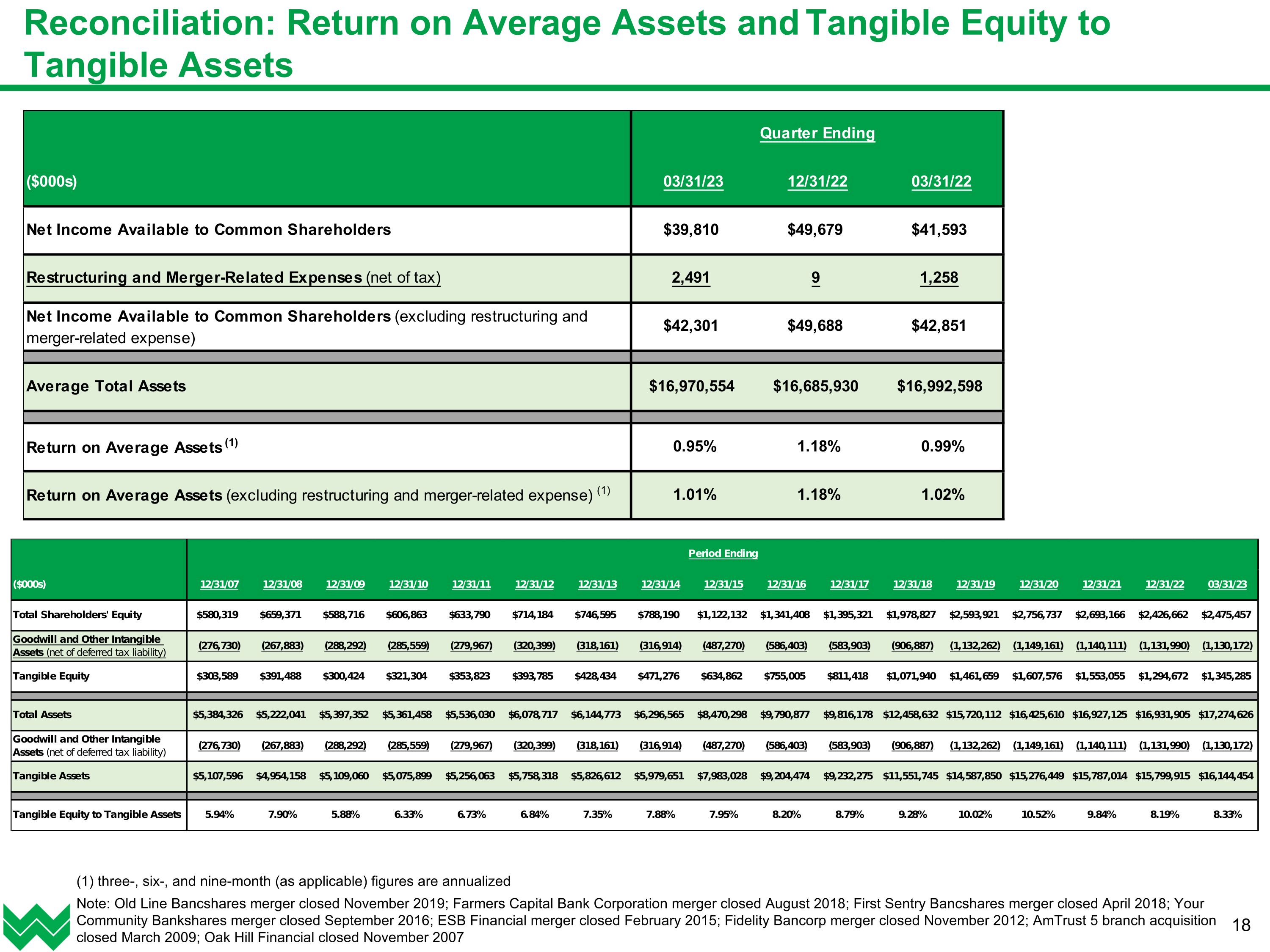

Reconciliation: Return on Average Assets and Tangible Equity to Tangible Assets (1) three-, six-, and nine-month (as applicable) figures are annualized Note: Old Line Bancshares merger closed November 2019; Farmers Capital Bank Corporation merger closed August 2018; First Sentry Bancshares merger closed April 2018; Your Community Bankshares merger closed September 2016; ESB Financial merger closed February 2015; Fidelity Bancorp merger closed November 2012; AmTrust 5 branch acquisition closed March 2009; Oak Hill Financial closed November 2007

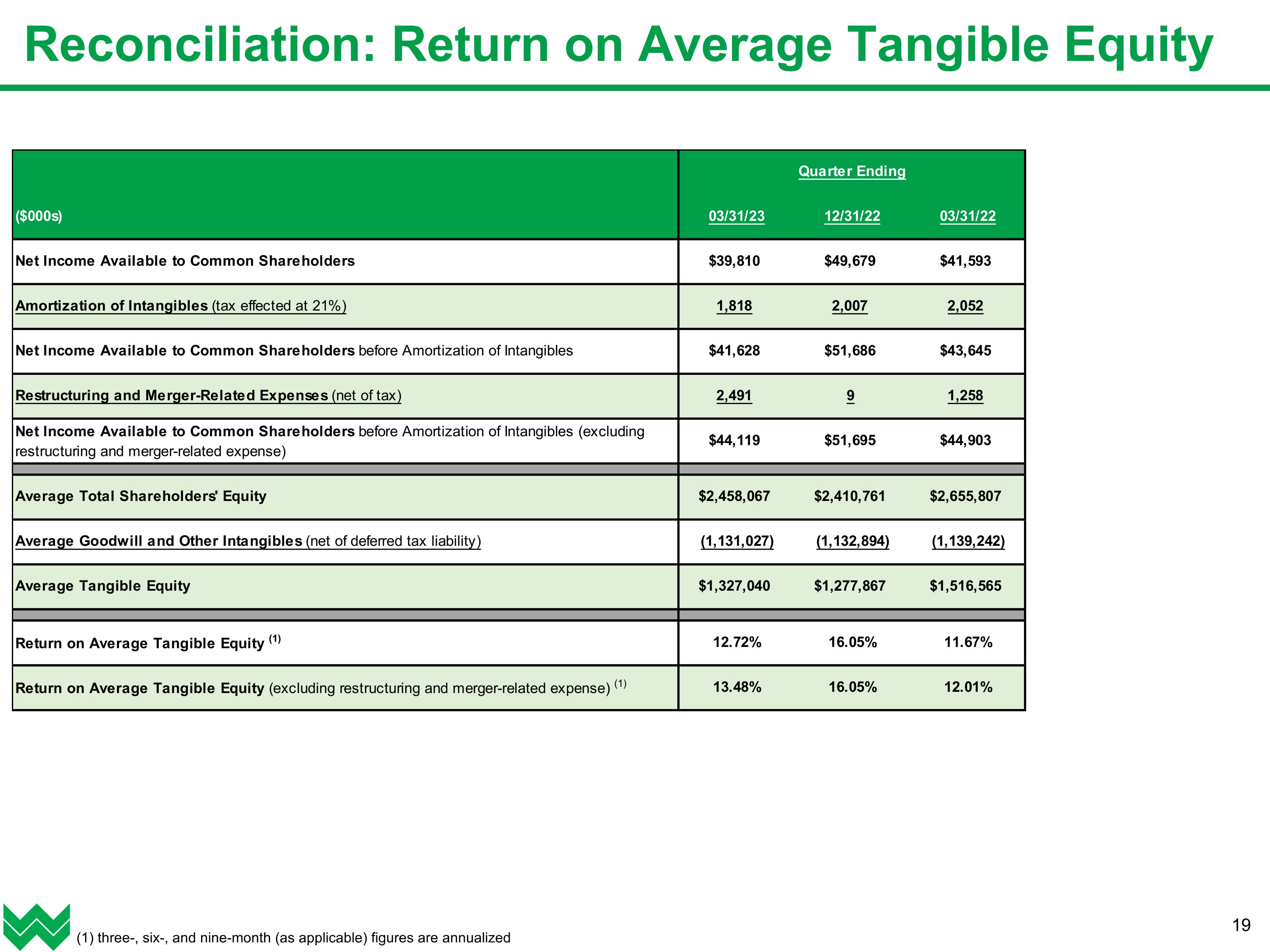

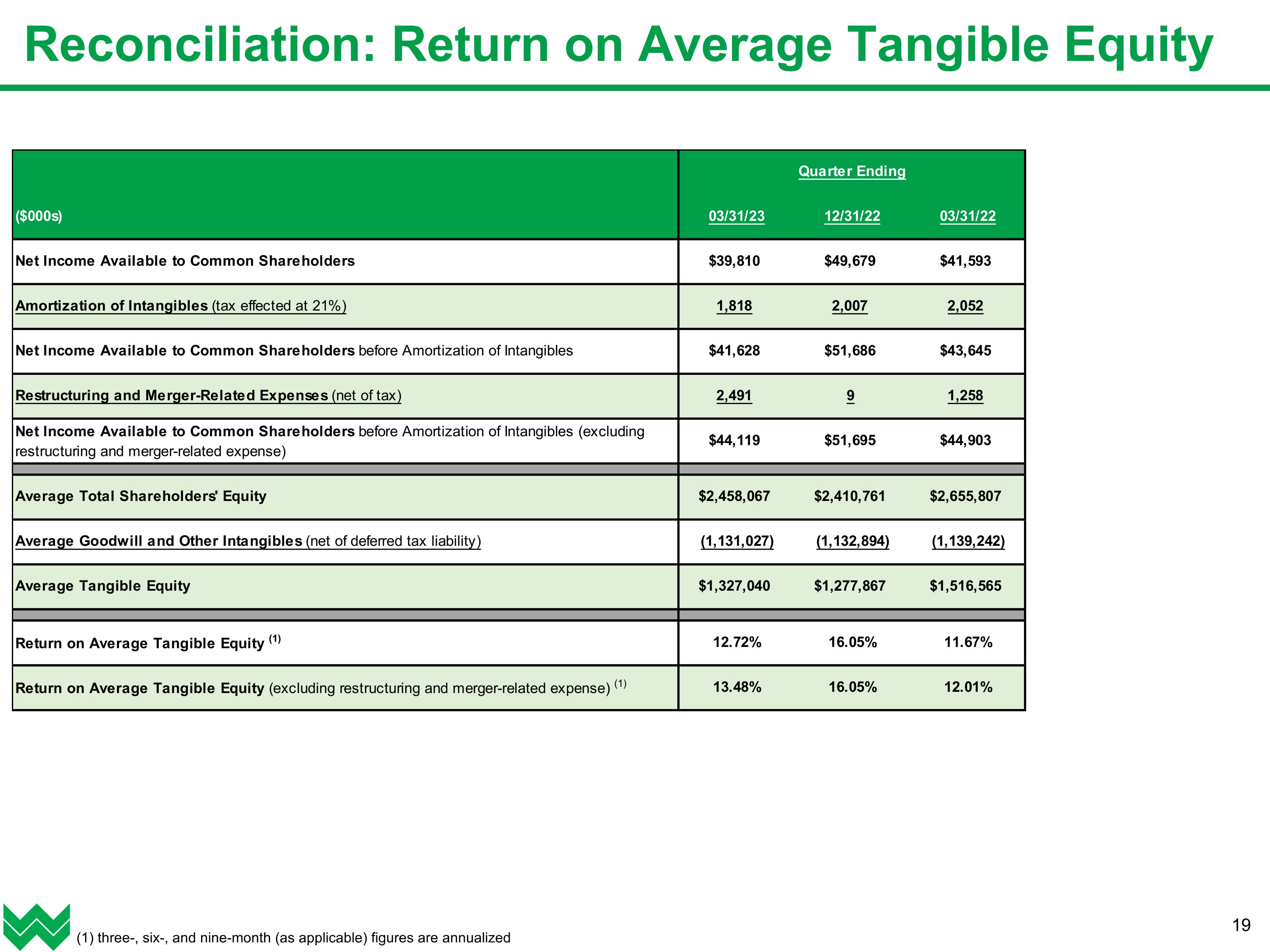

Reconciliation: Return on Average Tangible Equity (1) three-, six-, and nine-month (as applicable) figures are annualized