Third Quarter 2024�Earnings Call Presentation 23 October 2024 Note: update footnote copyright year annually

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s Form 10-K for the year ended December 31, 2023 and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC”) including WesBanco’s Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.WesBanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including, without limitation, that the proposed merger with Premier may not close when expected, that the businesses of WesBanco and Premier may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the merger of WesBanco and Premier may not be fully realized within the expected timeframes; disruption from the proposed merger of WesBanco and Premier may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental approvals of the proposed Merger may not be obtained on the expected terms and schedule; Premier’s shareholders and/or the Company’s shareholders may not approve the proposed Merger; the shareholders of the Company may not approve the issuance of shares of the Company’s common stock in connection with the Merger; the effects of changing regional and national economic conditions, changes in interest rates, spreads on earning assets and interest-bearing liabilities, and associated interest rate sensitivity; sources of liquidity available to WesBanco and its related subsidiary operations; potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities; actions of the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, the SEC, the Financial Institution Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investors Protection Corporation, and other regulatory bodies; potential legislative and federal and state regulatory actions and reform, including, without limitation, the impact of the implementation of the Dodd-Frank Act; adverse decisions of federal and state courts; fraud, scams and schemes of third parties; cyber-security breaches; competitive conditions in the financial services industry; rapidly changing technology affecting financial services; marketability of debt instruments and corresponding impact on fair value adjustments; and/or other external developments materially impacting WesBanco’s operational and financial performance. WesBanco does not assume any duty to update forward-looking statements. In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco's management uses, and this presentation contains or references, certain non-GAAP financial measures, such as pre-tax pre-provision income, tangible common equity/tangible assets; net income excluding after-tax restructuring and merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco believes that these non-GAAP financial measures enhance investors' understanding of WesBanco's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, as well as other filings that the company has made with the SEC.

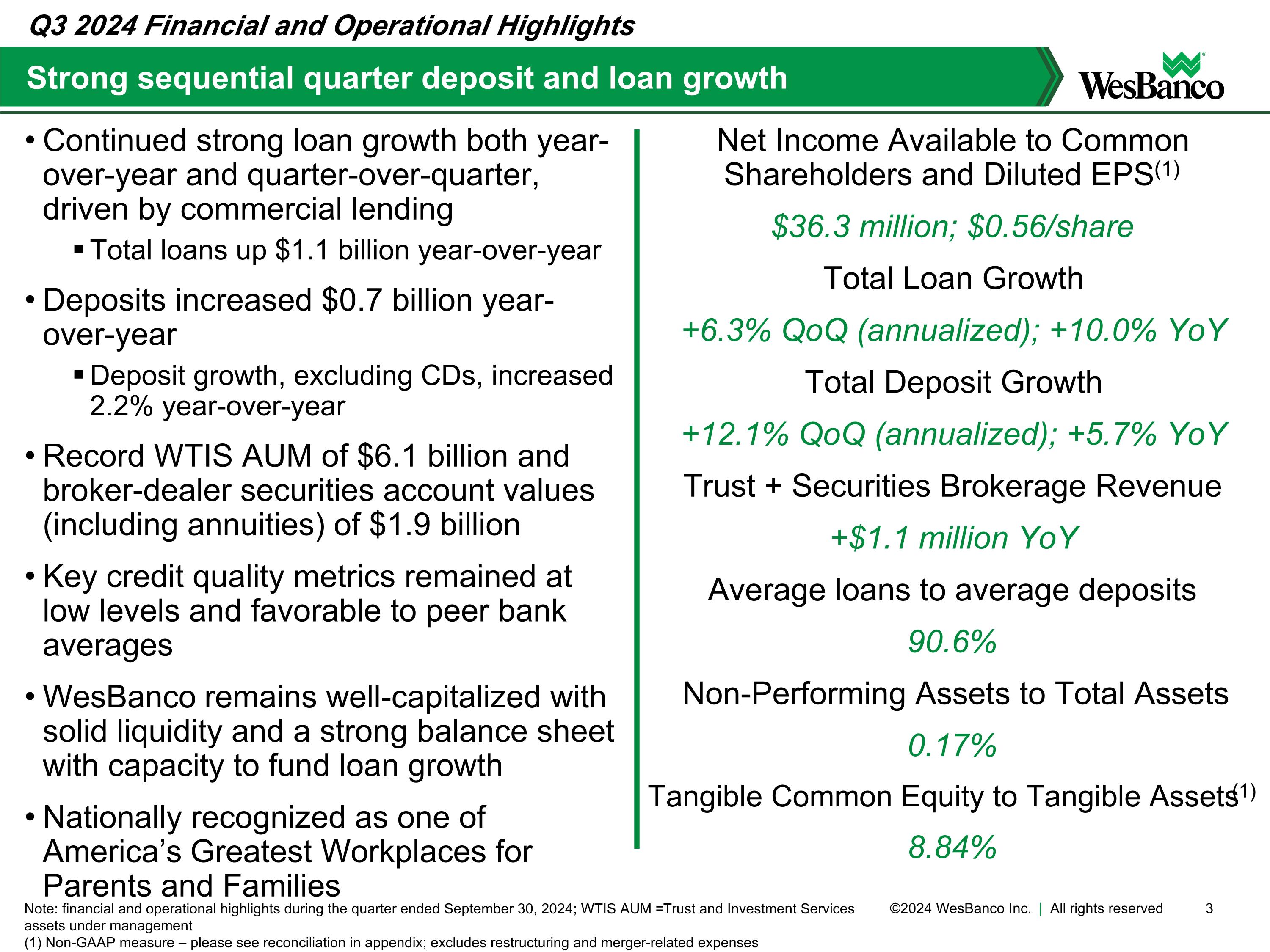

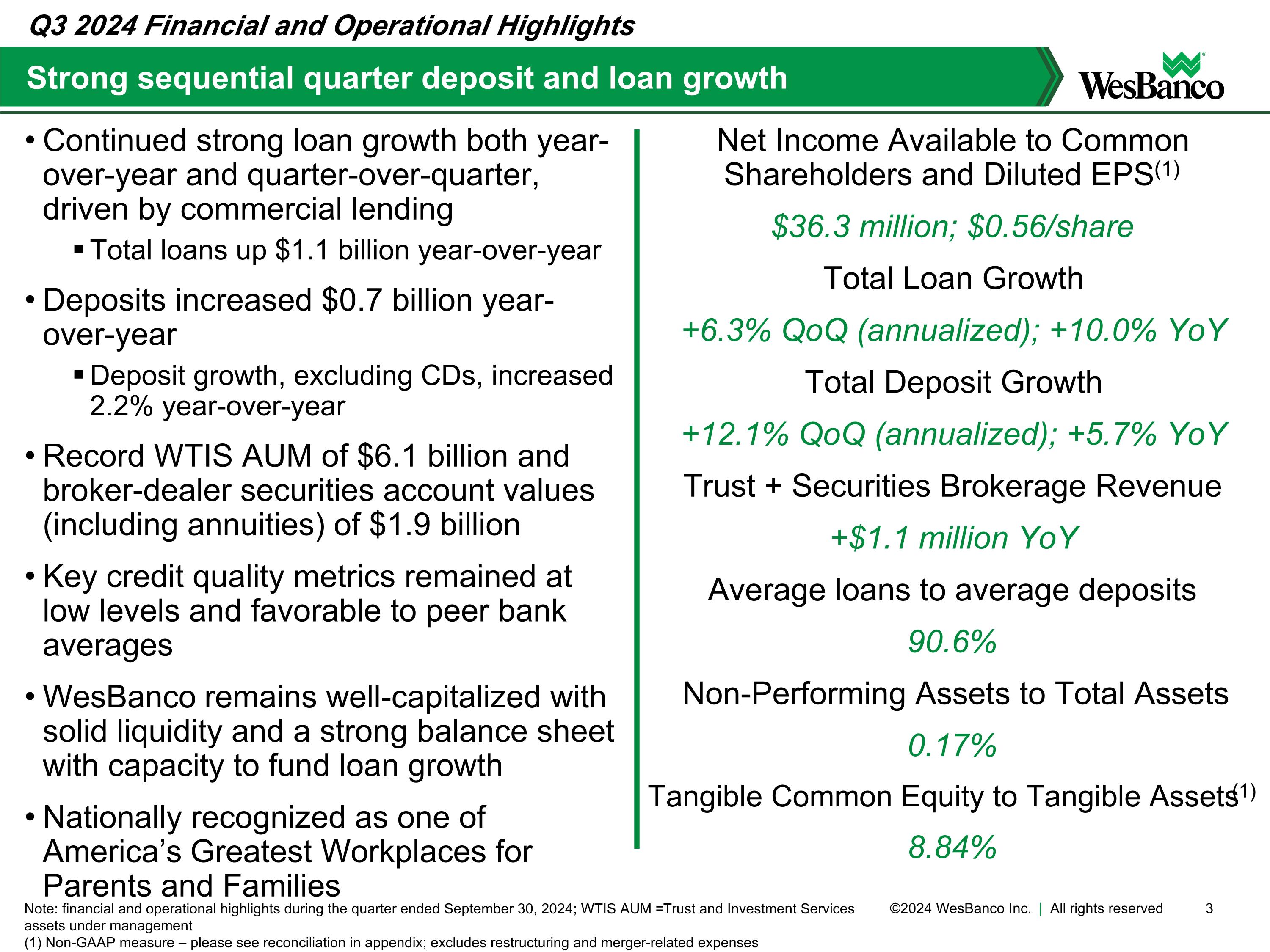

Continued strong loan growth both year-over-year and quarter-over-quarter, driven by commercial lending Total loans up $1.1 billion year-over-year Deposits increased $0.7 billion year-over-year Deposit growth, excluding CDs, increased 2.2% year-over-year Record WTIS AUM of $6.1 billion and broker-dealer securities account values (including annuities) of $1.9 billion Key credit quality metrics remained at low levels and favorable to peer bank averages WesBanco remains well-capitalized with solid liquidity and a strong balance sheet with capacity to fund loan growth Nationally recognized as one of America’s Greatest Workplaces for Parents and Families Net Income Available to Common Shareholders and Diluted EPS(1) $36.3 million; $0.56/share Total Loan Growth +6.3% QoQ (annualized); +10.0% YoY Total Deposit Growth +12.1% QoQ (annualized); +5.7% YoY Trust + Securities Brokerage Revenue +$1.1 million YoY Average loans to average deposits 90.6% Non-Performing Assets to Total Assets 0.17% Tangible Common Equity to Tangible Assets(1) 8.84% Strong sequential quarter deposit and loan growth Note: financial and operational highlights during the quarter ended September 30, 2024; WTIS AUM = Trust and Investment Services assets under management (1) Non-GAAP measure – please see reconciliation in appendix; excludes restructuring and merger-related expenses Q3 2024 Financial and Operational Highlights

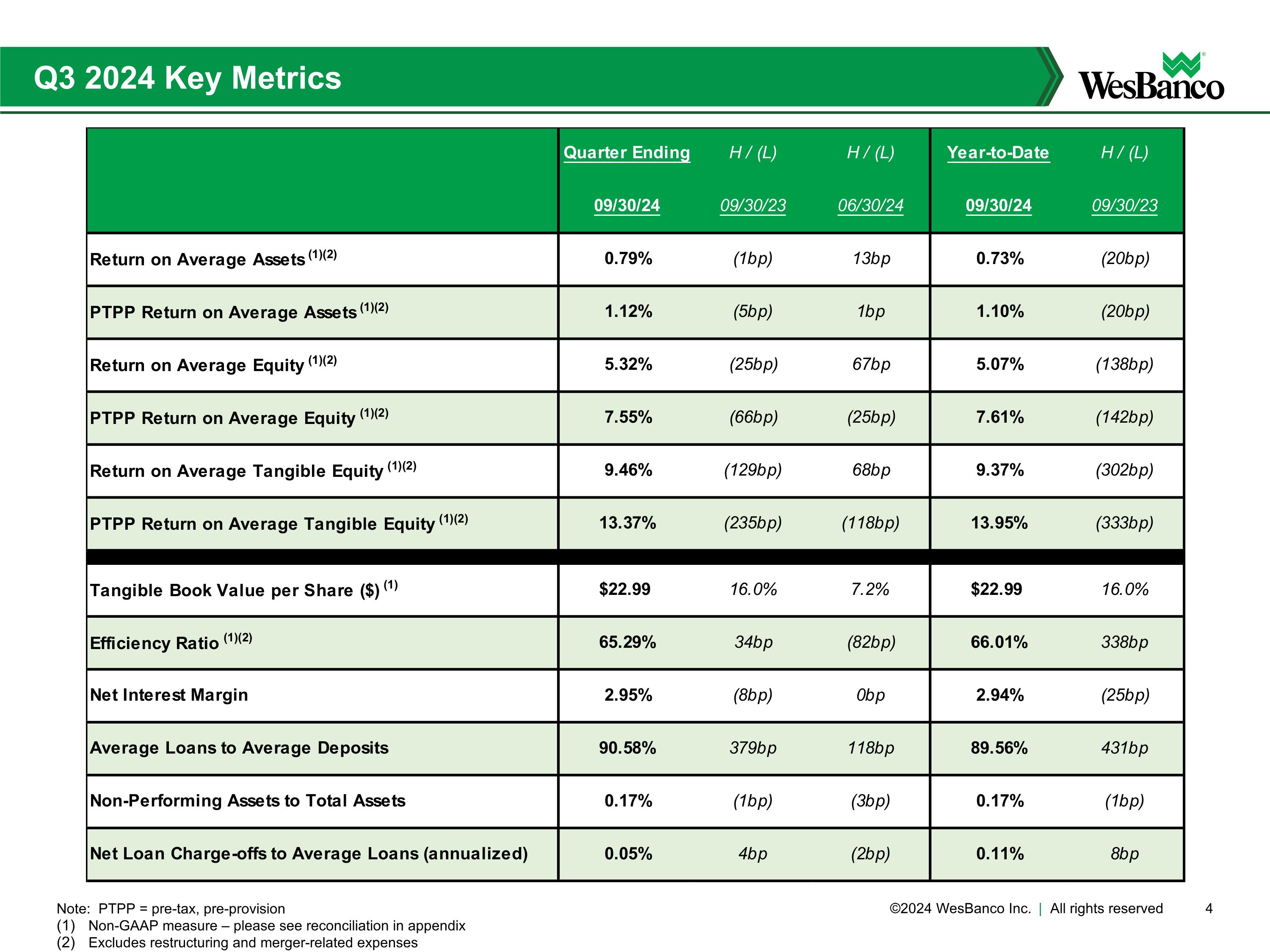

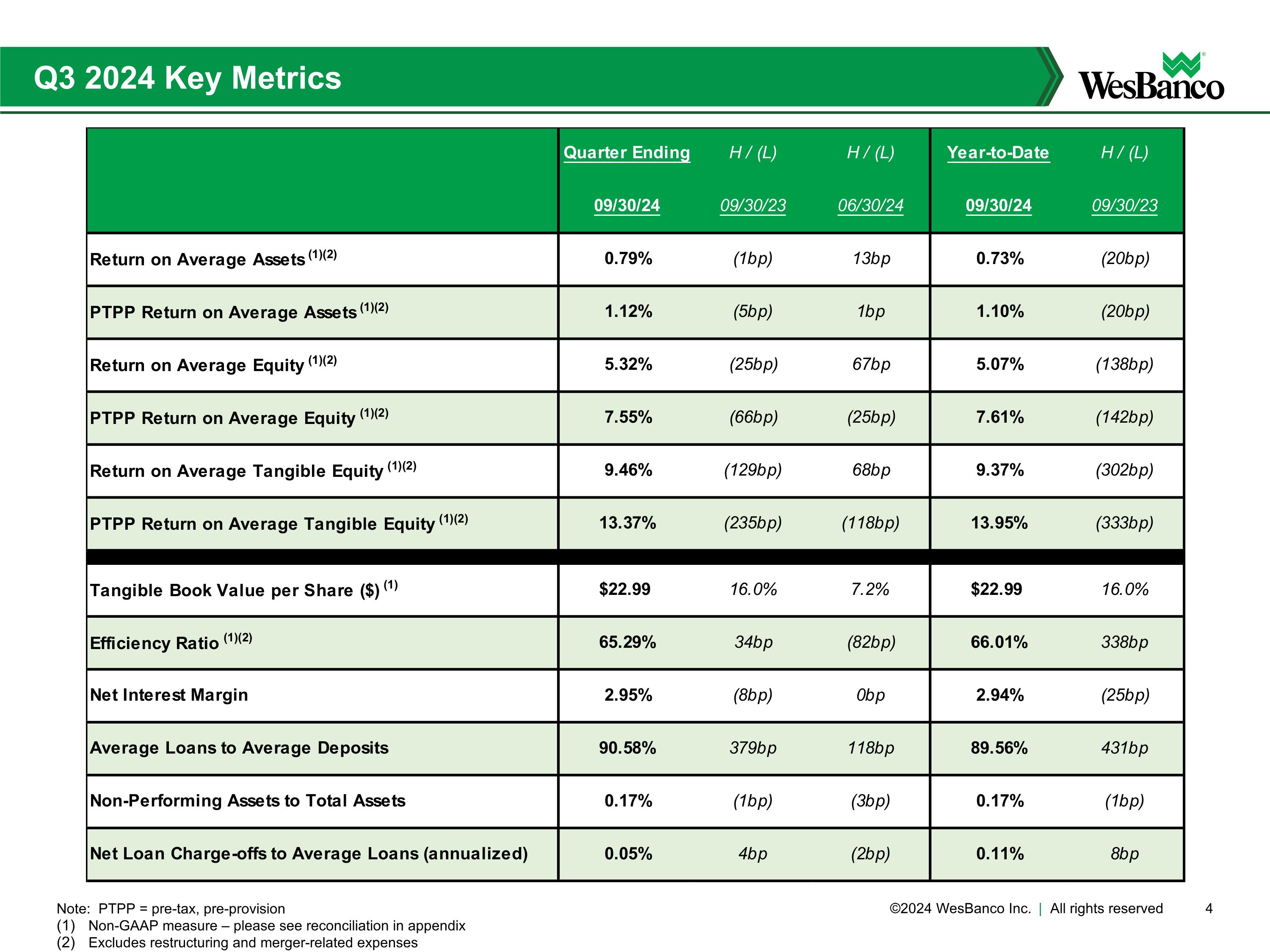

Q3 2024 Key Metrics Note: PTPP = pre-tax, pre-provision Non-GAAP measure – please see reconciliation in appendix Excludes restructuring and merger-related expenses

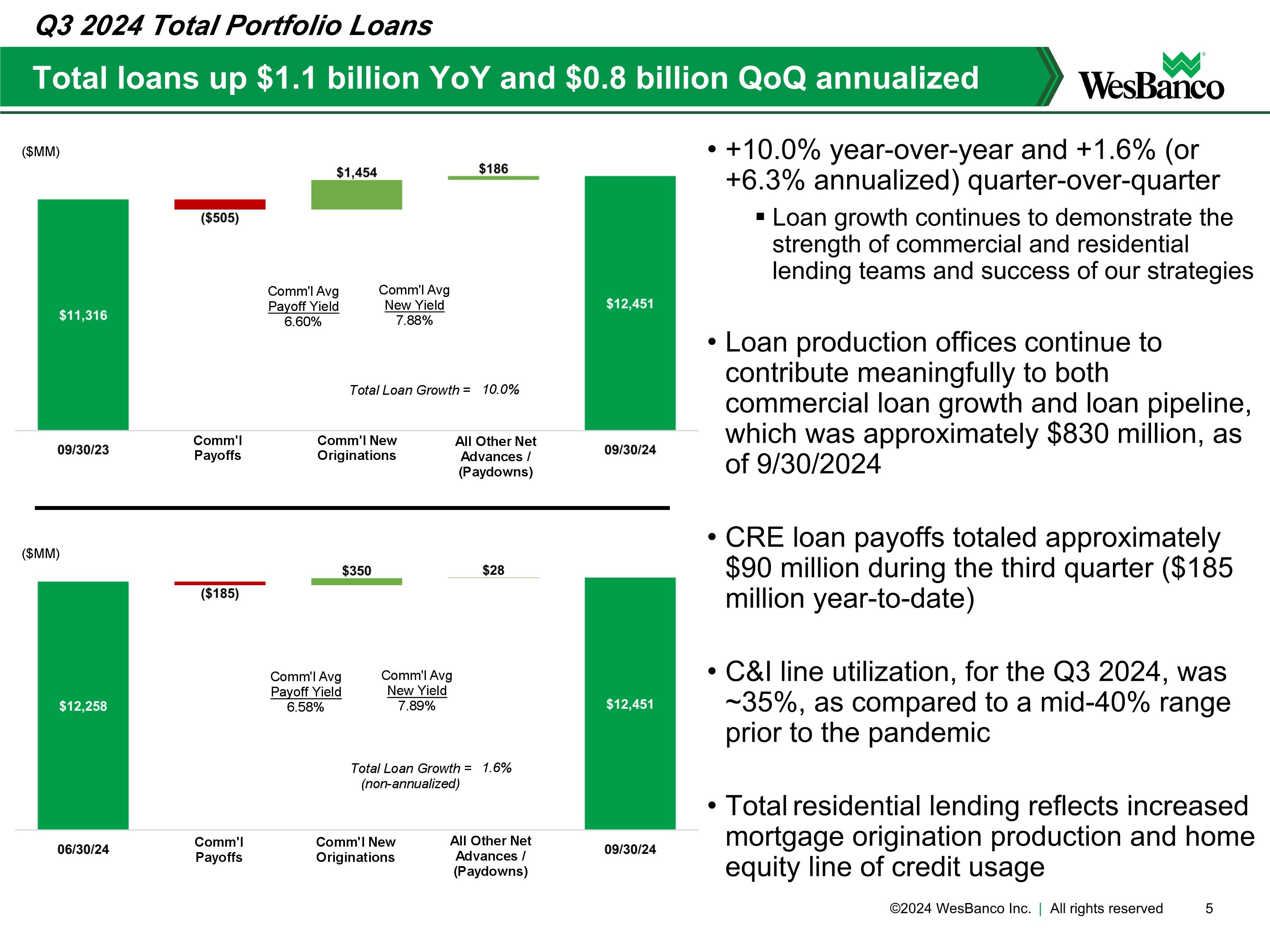

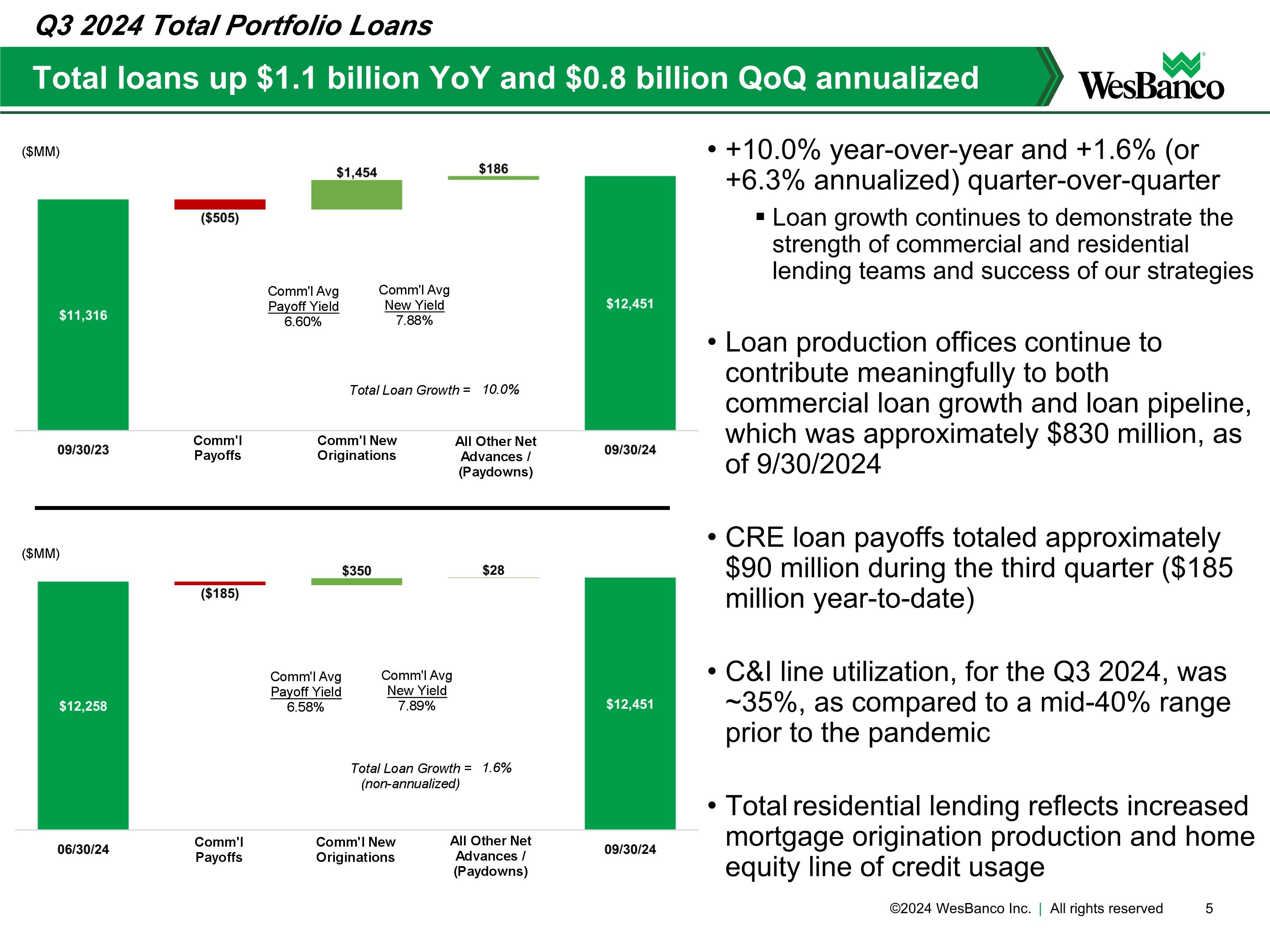

+10.0% year-over-year and +1.6% (or +6.3% annualized) quarter-over-quarter Loan growth continues to demonstrate the strength of commercial and residential lending teams and success of our strategies Loan production offices continue to contribute meaningfully to both commercial loan growth and loan pipeline, which was approximately $830 million, as of 9/30/2024 CRE loan payoffs totaled approximately $90 million during the third quarter ($185 million year-to-date) C&I line utilization, for the Q3 2024, was ~35%, as compared to a mid-40% range prior to the pandemic Total residential lending reflects increased mortgage origination production and home equity line of credit usage Total loans up $1.1 billion YoY and $0.8 billion QoQ annualized Q3 2024 Total Portfolio Loans

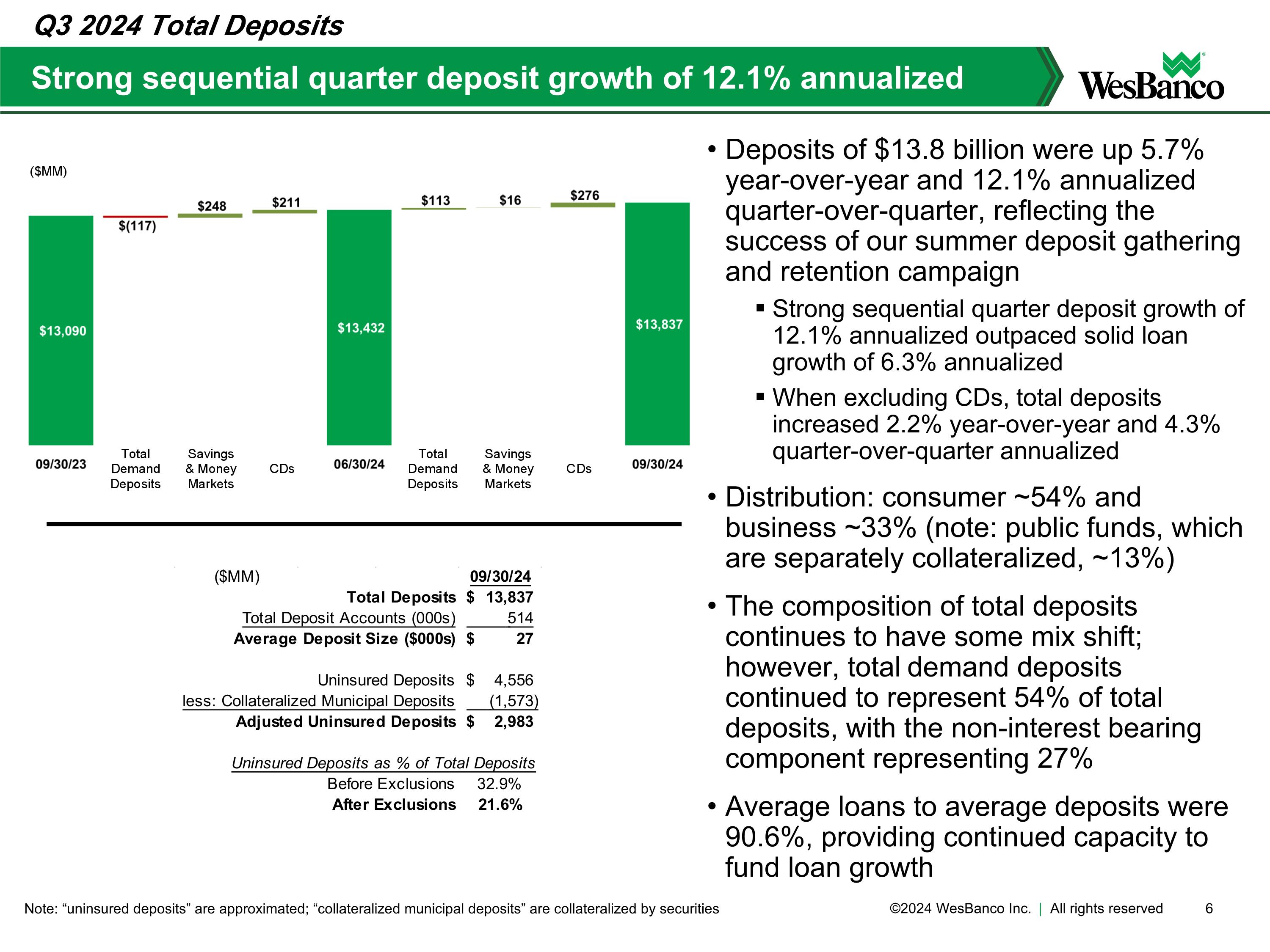

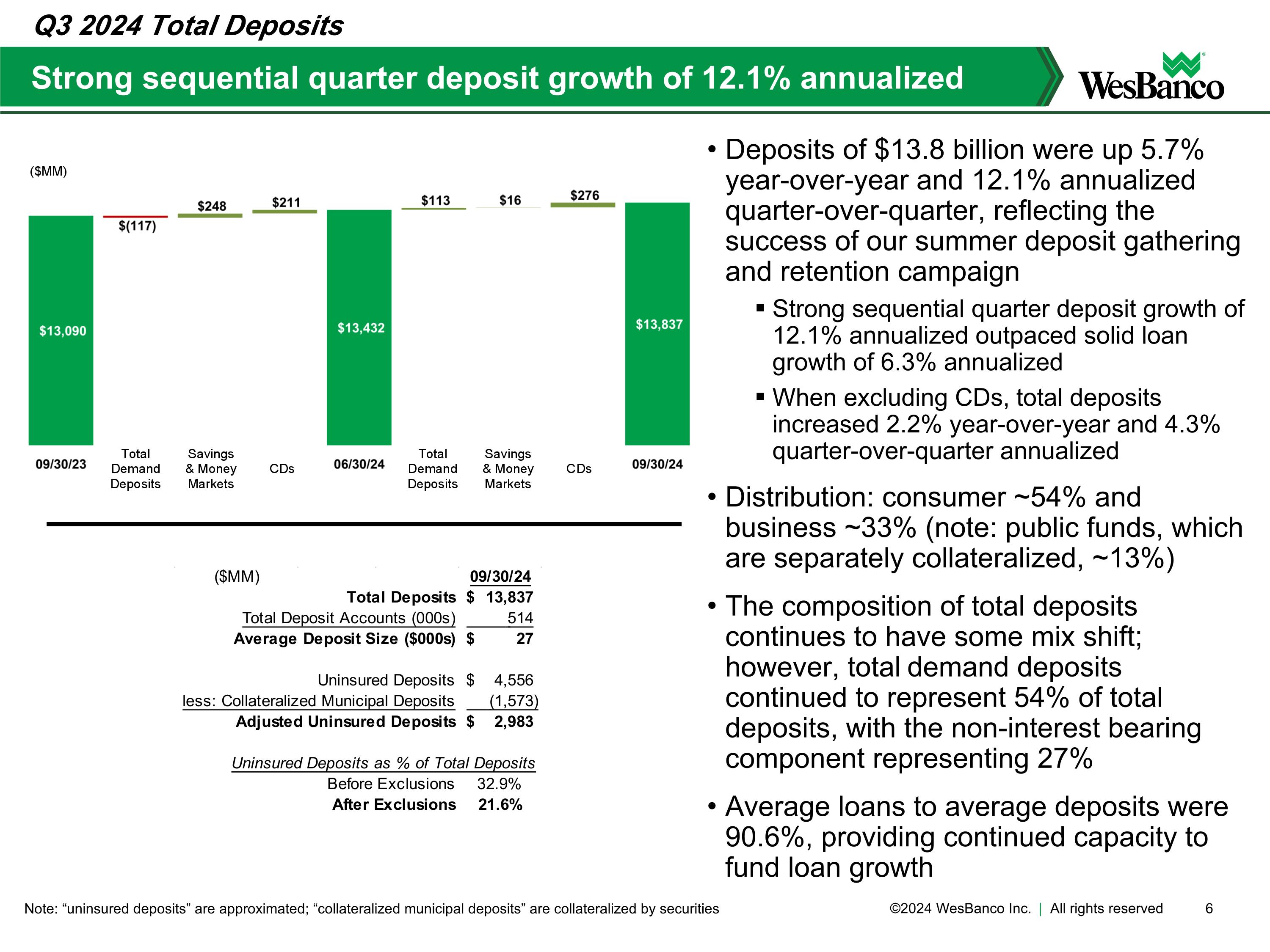

Strong sequential quarter deposit growth of 12.1% annualized Note: “uninsured deposits” are approximated; “collateralized municipal deposits” are collateralized by securities Deposits of $13.8 billion were up 5.7% year-over-year and 12.1% annualized quarter-over-quarter, reflecting the success of our summer deposit gathering and retention campaign Strong sequential quarter deposit growth of 12.1% annualized outpaced solid loan growth of 6.3% annualized When excluding CDs, total deposits increased 2.2% year-over-year and 4.3% quarter-over-quarter annualized Distribution: consumer ~54% and business ~33% (note: public funds, which are separately collateralized, ~13%) The composition of total deposits continues to have some mix shift; however, total demand deposits continued to represent 54% of total deposits, with the non-interest bearing component representing 27% Average loans to average deposits were 90.6%, providing continued capacity to fund loan growth Q3 2024 Total Deposits

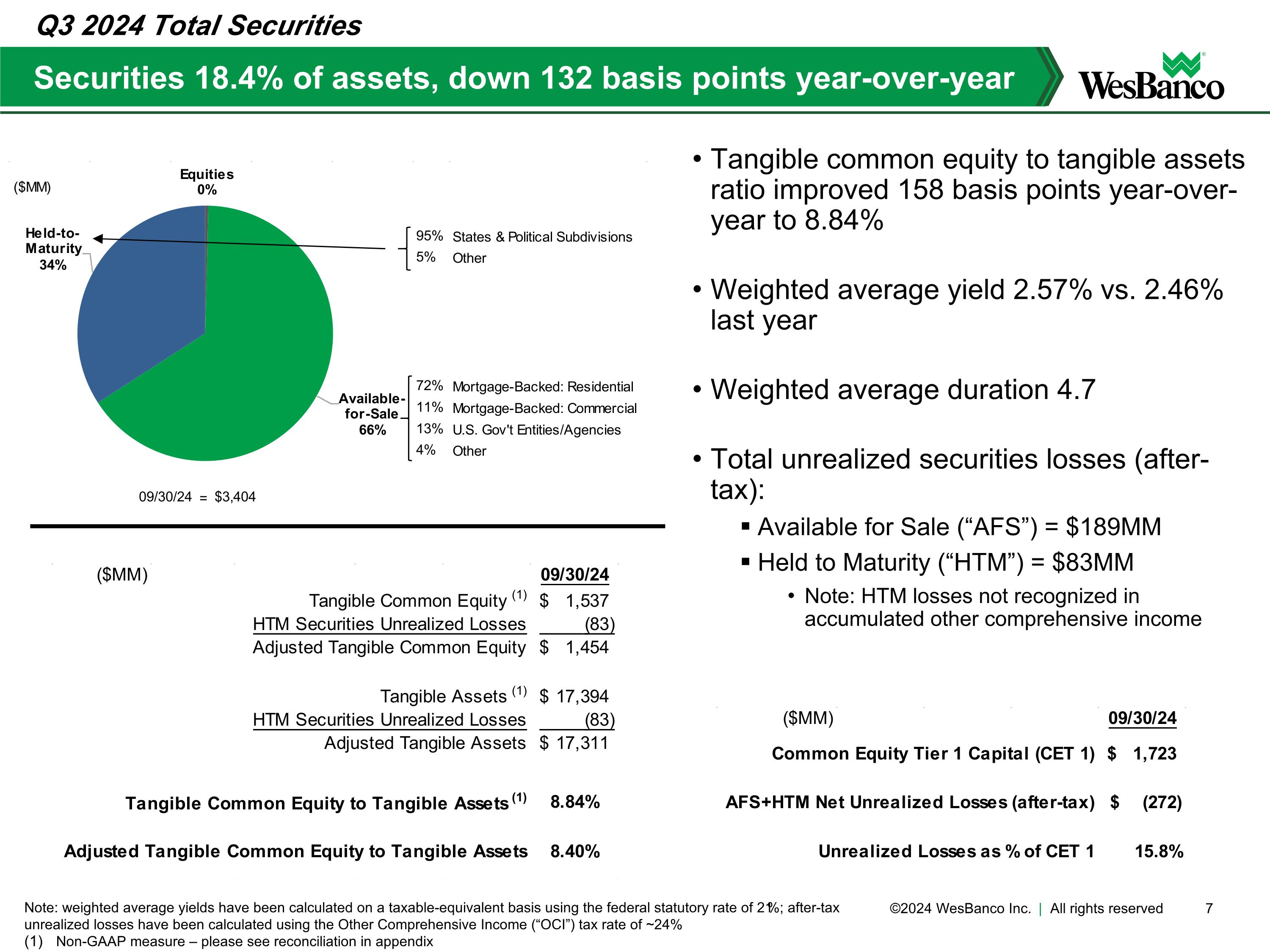

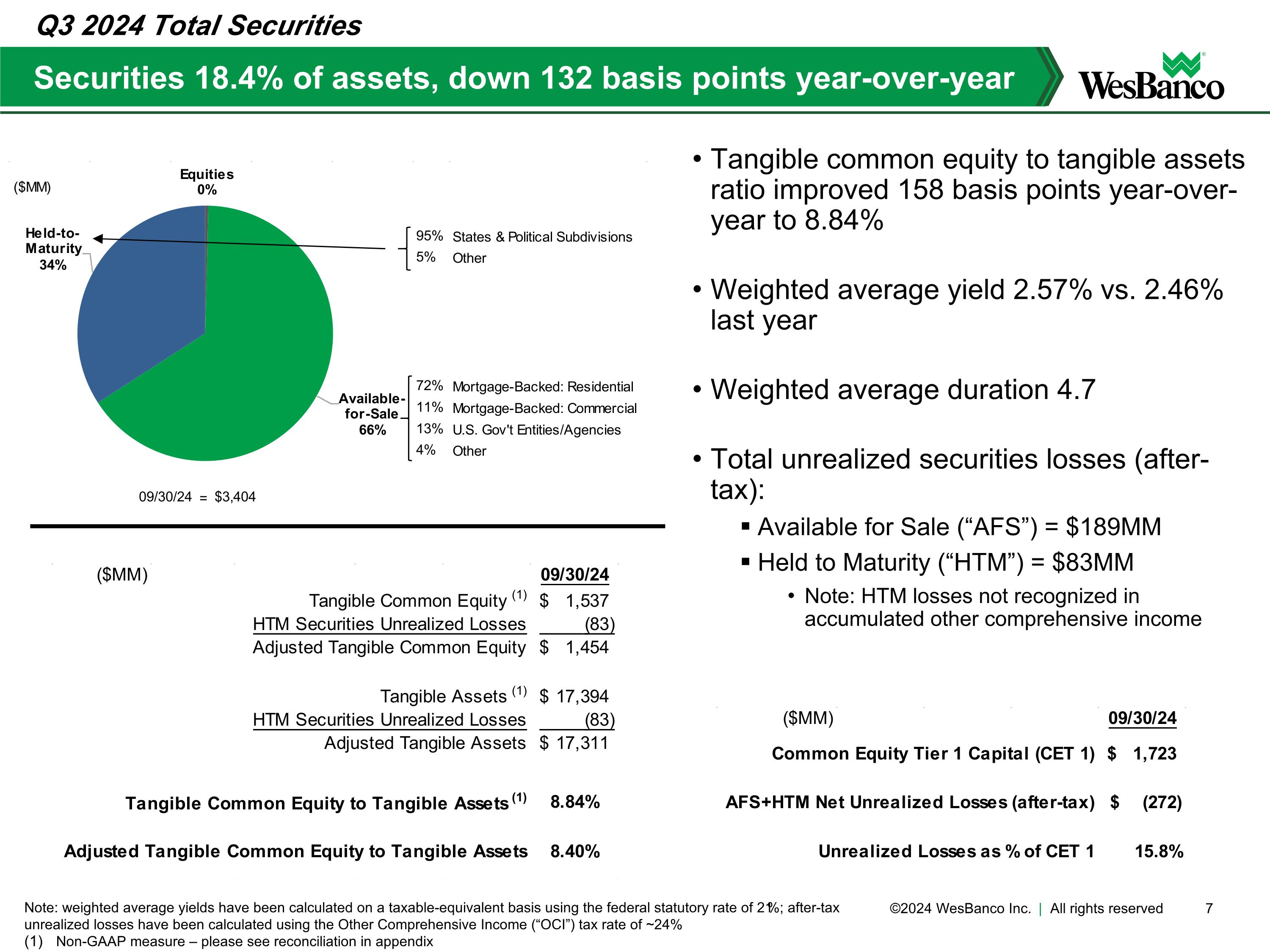

Tangible common equity to tangible assets ratio improved 158 basis points year-over-year to 8.84% Weighted average yield 2.57% vs. 2.46% last year Weighted average duration 4.7 Total unrealized securities losses (after-tax): Available for Sale (“AFS”) = $189MM Held to Maturity (“HTM”) = $83MM Note: HTM losses not recognized in accumulated other comprehensive income Securities 18.4% of assets, down 132 basis points year-over-year Note: weighted average yields have been calculated on a taxable-equivalent basis using the federal statutory rate of 21%; after-tax unrealized losses have been calculated using the Other Comprehensive Income (“OCI”) tax rate of ~24% Non-GAAP measure – please see reconciliation in appendix Q3 2024 Total Securities

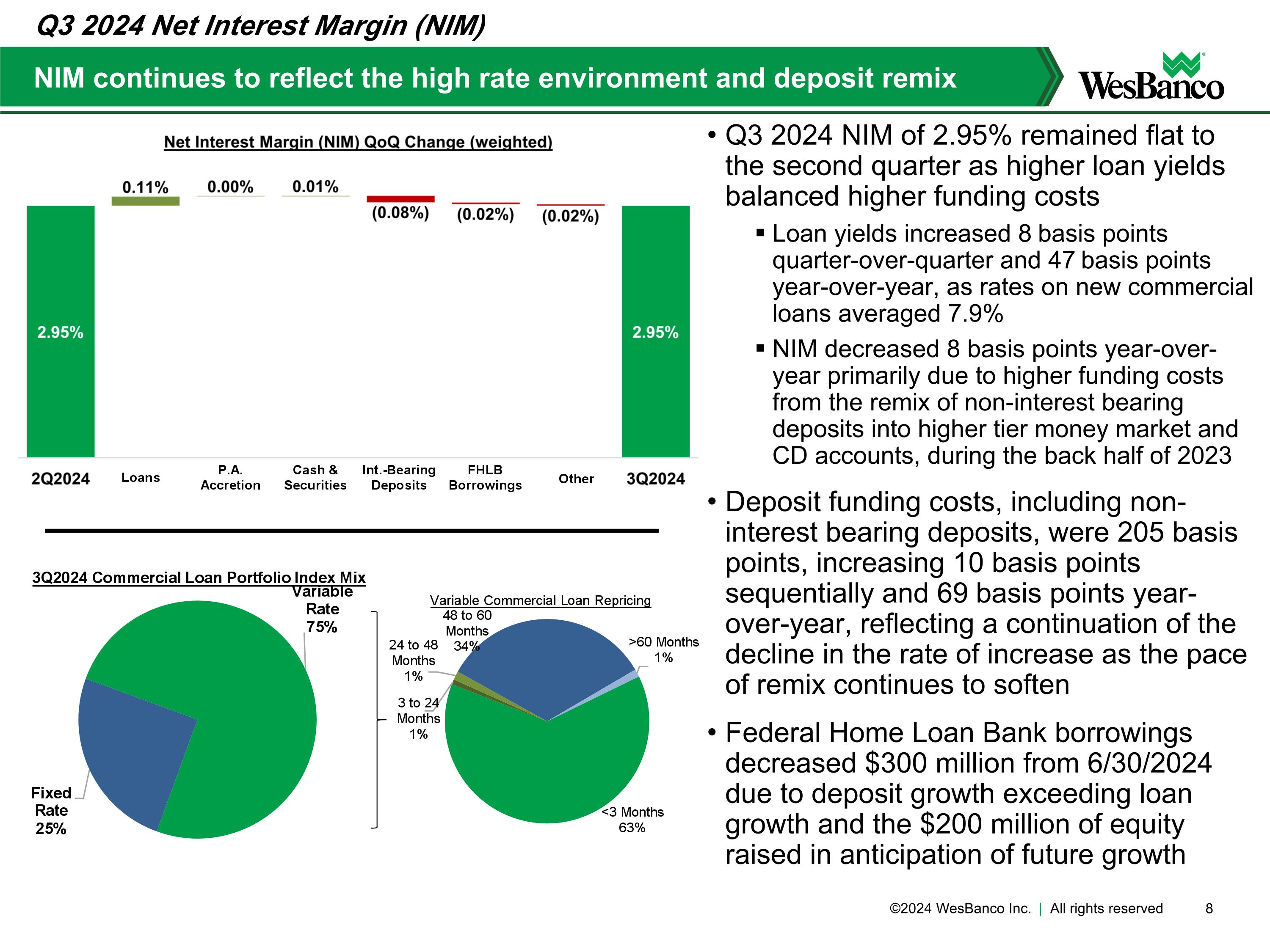

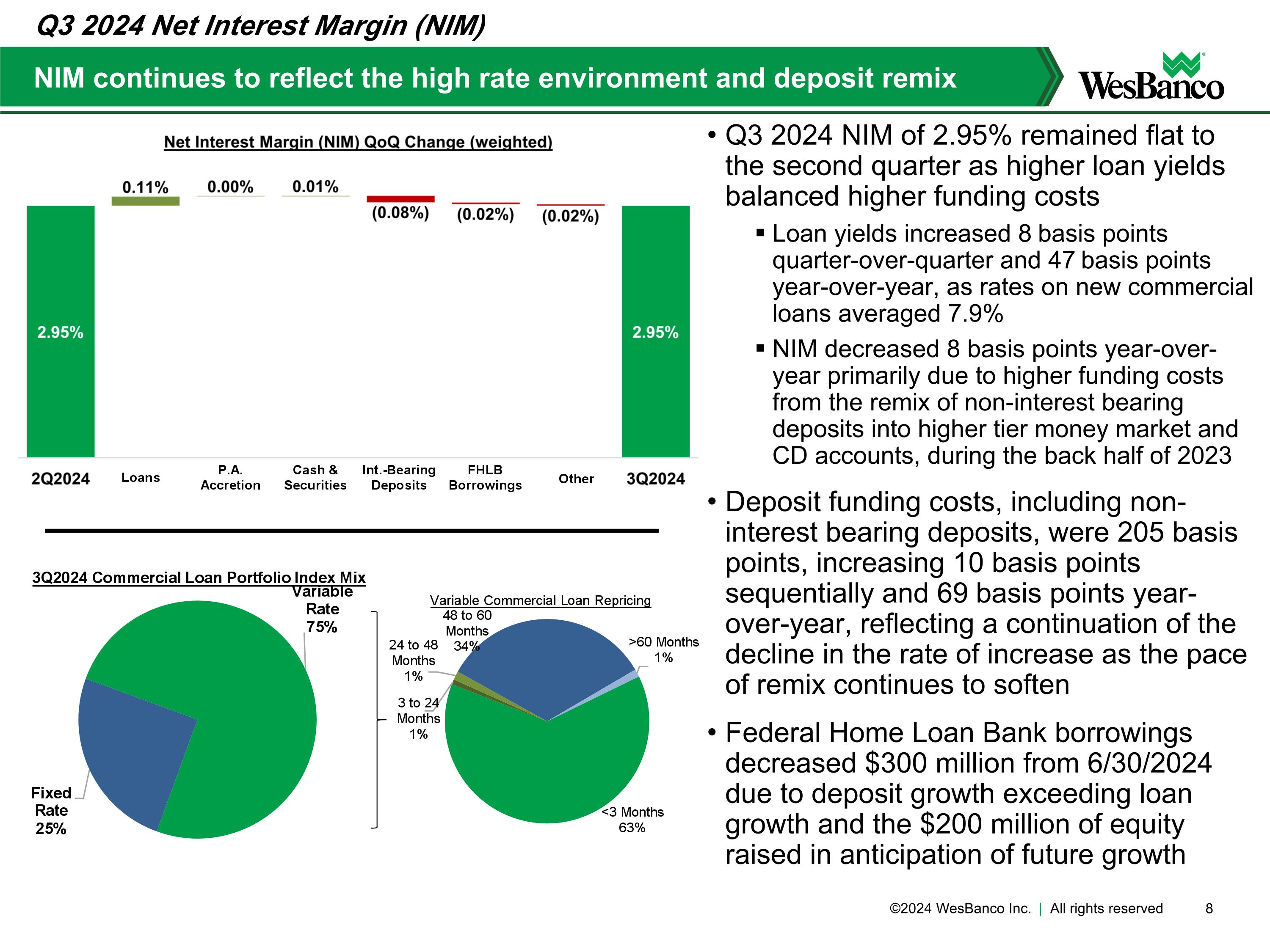

NIM continues to reflect the high rate environment and deposit remix Q3 2024 NIM of 2.95% remained flat to the second quarter as higher loan yields balanced higher funding costs Loan yields increased 8 basis points quarter-over-quarter and 47 basis points year-over-year, as rates on new commercial loans averaged 7.9% NIM decreased 8 basis points year-over-year primarily due to higher funding costs from the remix of non-interest bearing deposits into higher tier money market and CD accounts, during the back half of 2023 Deposit funding costs, including non-interest bearing deposits, were 205 basis points, increasing 10 basis points sequentially and 69 basis points year-over-year, reflecting a continuation of the decline in the rate of increase as the pace of remix continues to soften Federal Home Loan Bank borrowings decreased $300 million from 6/30/2024 due to deposit growth exceeding loan growth and the $200 million of equity raised in anticipation of future growth Q3 2024 Net Interest Margin (NIM)

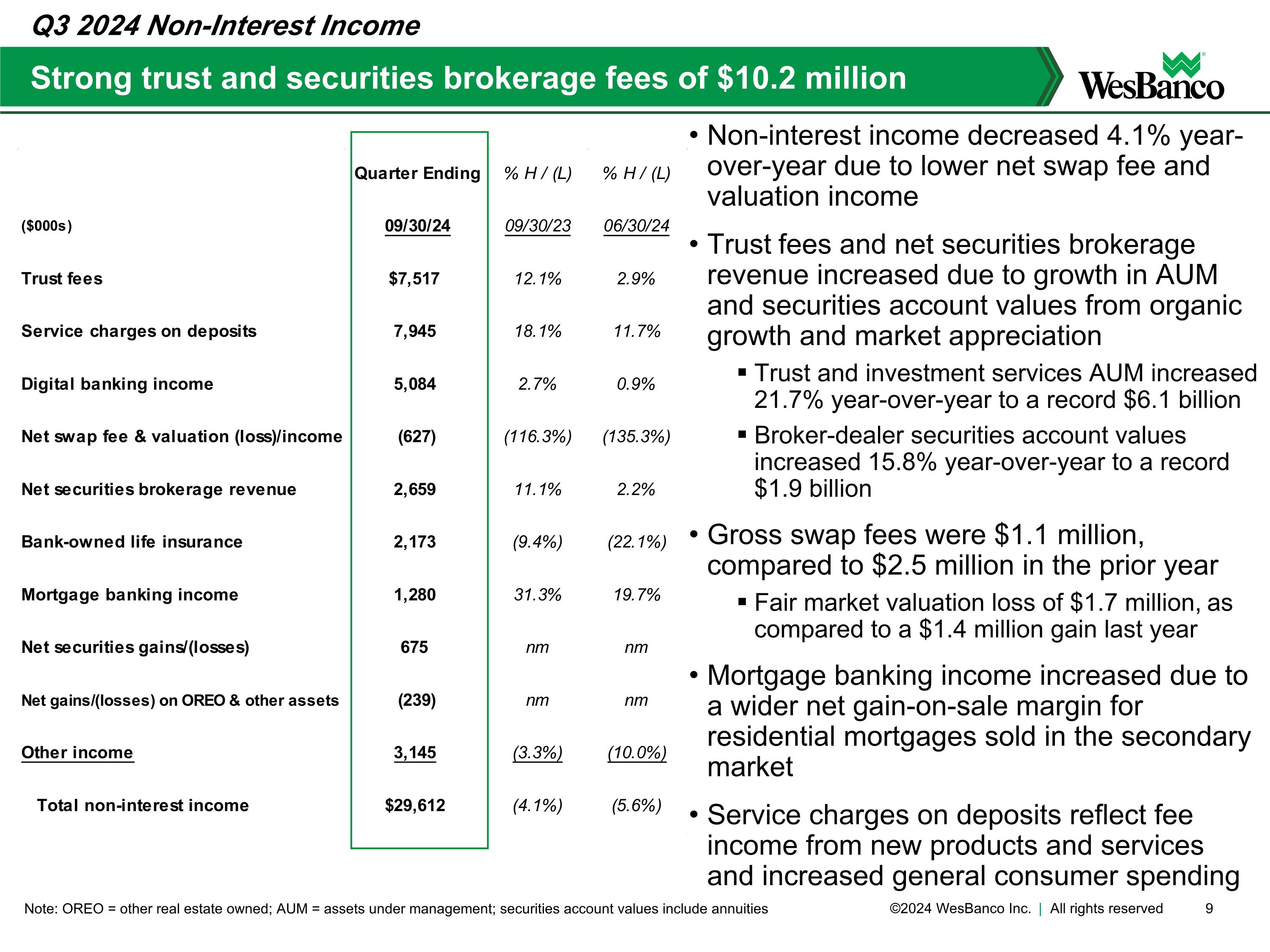

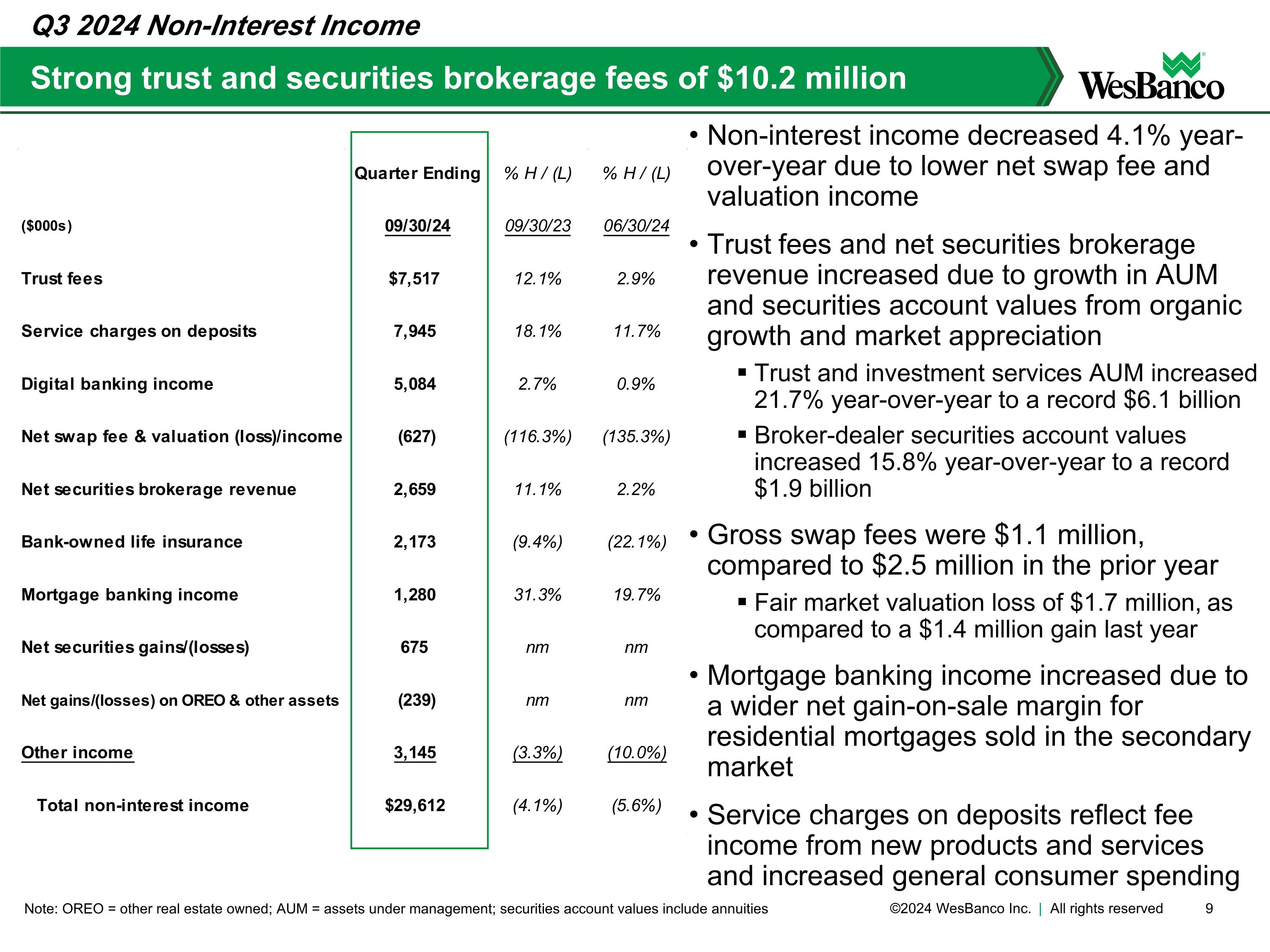

Non-interest income decreased 4.1% year-over-year due to lower net swap fee and valuation income Trust fees and net securities brokerage revenue increased due to growth in AUM and securities account values from organic growth and market appreciation Trust and investment services AUM increased 21.7% year-over-year to a record $6.1 billion Broker-dealer securities account values increased 15.8% year-over-year to a record $1.9 billion Gross swap fees were $1.1 million, compared to $2.5 million in the prior year Fair market valuation loss of $1.7 million, as compared to a $1.4 million gain last year Mortgage banking income increased due to a wider net gain-on-sale margin for residential mortgages sold in the secondary market Service charges on deposits reflect fee income from new products and services and increased general consumer spending Strong trust and securities brokerage fees of $10.2 million Note: OREO = other real estate owned; AUM = assets under management; securities account values include annuities Q3 2024 Non-Interest Income

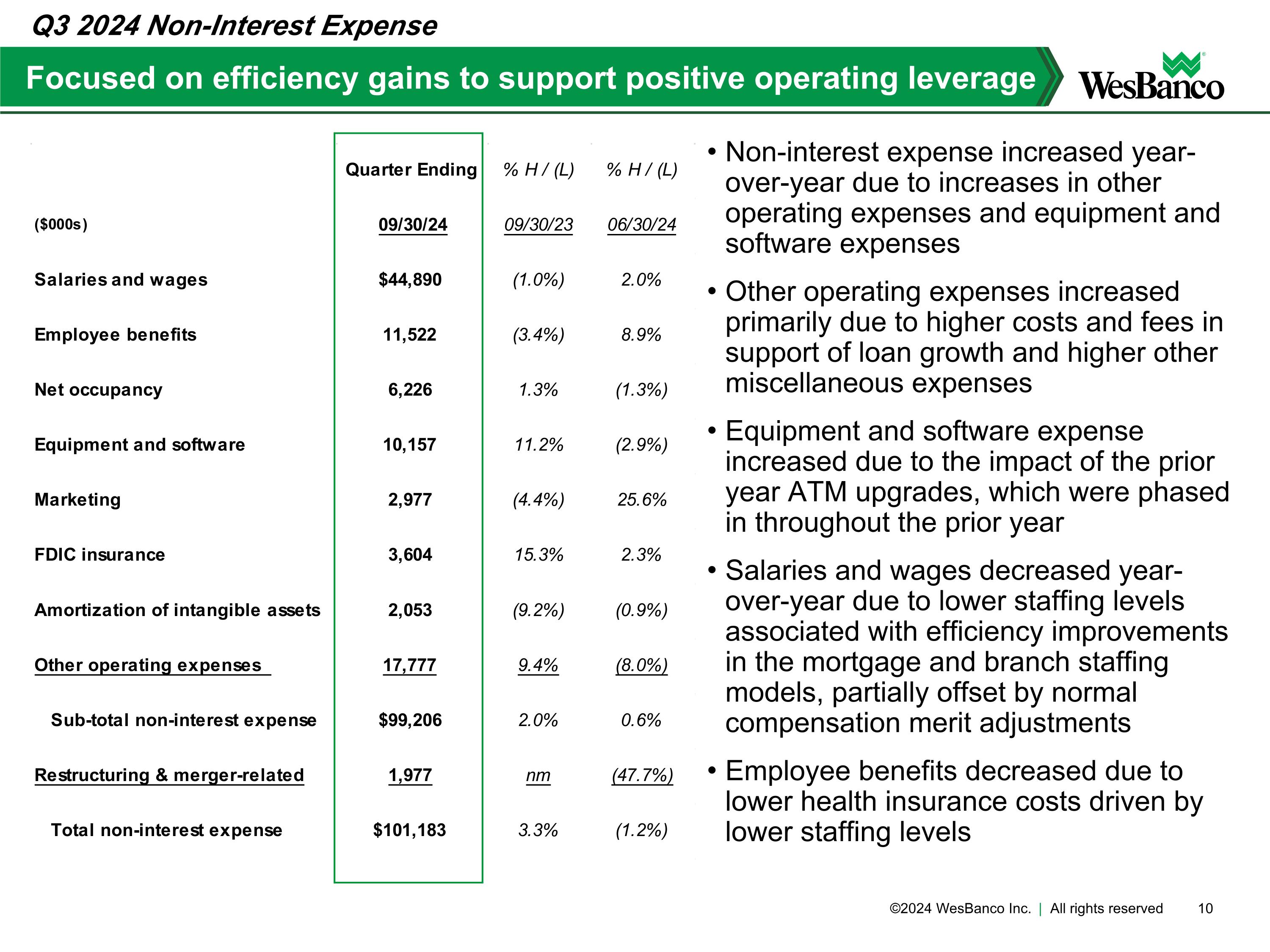

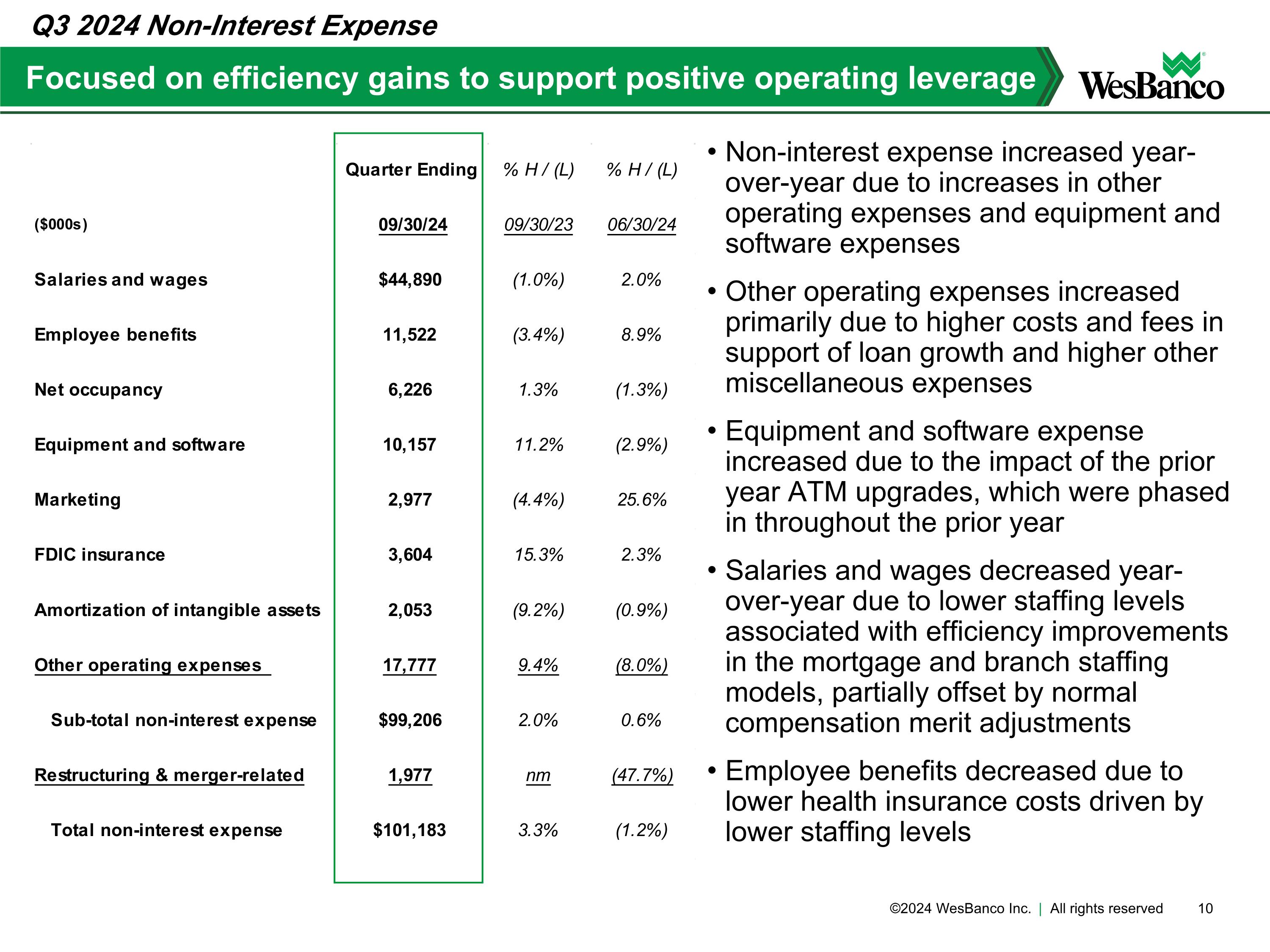

Focused on efficiency gains to support positive operating leverage Q3 2024 Non-Interest Expense Non-interest expense increased year-over-year due to increases in other operating expenses and equipment and software expenses Other operating expenses increased primarily due to higher costs and fees in support of loan growth and higher other miscellaneous expenses Equipment and software expense increased due to the impact of the prior year ATM upgrades, which were phased in throughout the prior year Salaries and wages decreased year-over-year due to lower staffing levels associated with efficiency improvements in the mortgage and branch staffing models, partially offset by normal compensation merit adjustments Employee benefits decreased due to lower health insurance costs driven by lower staffing levels

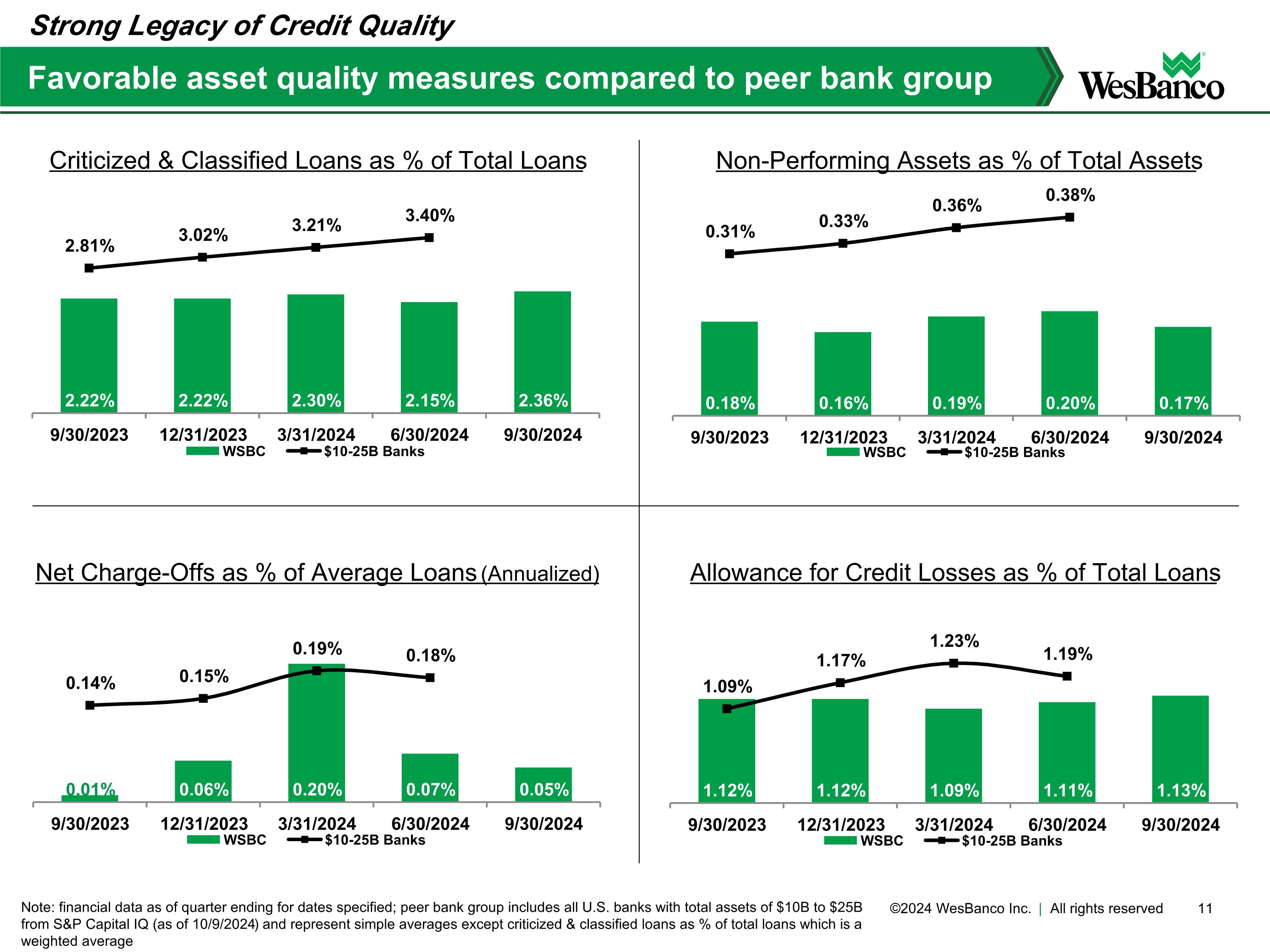

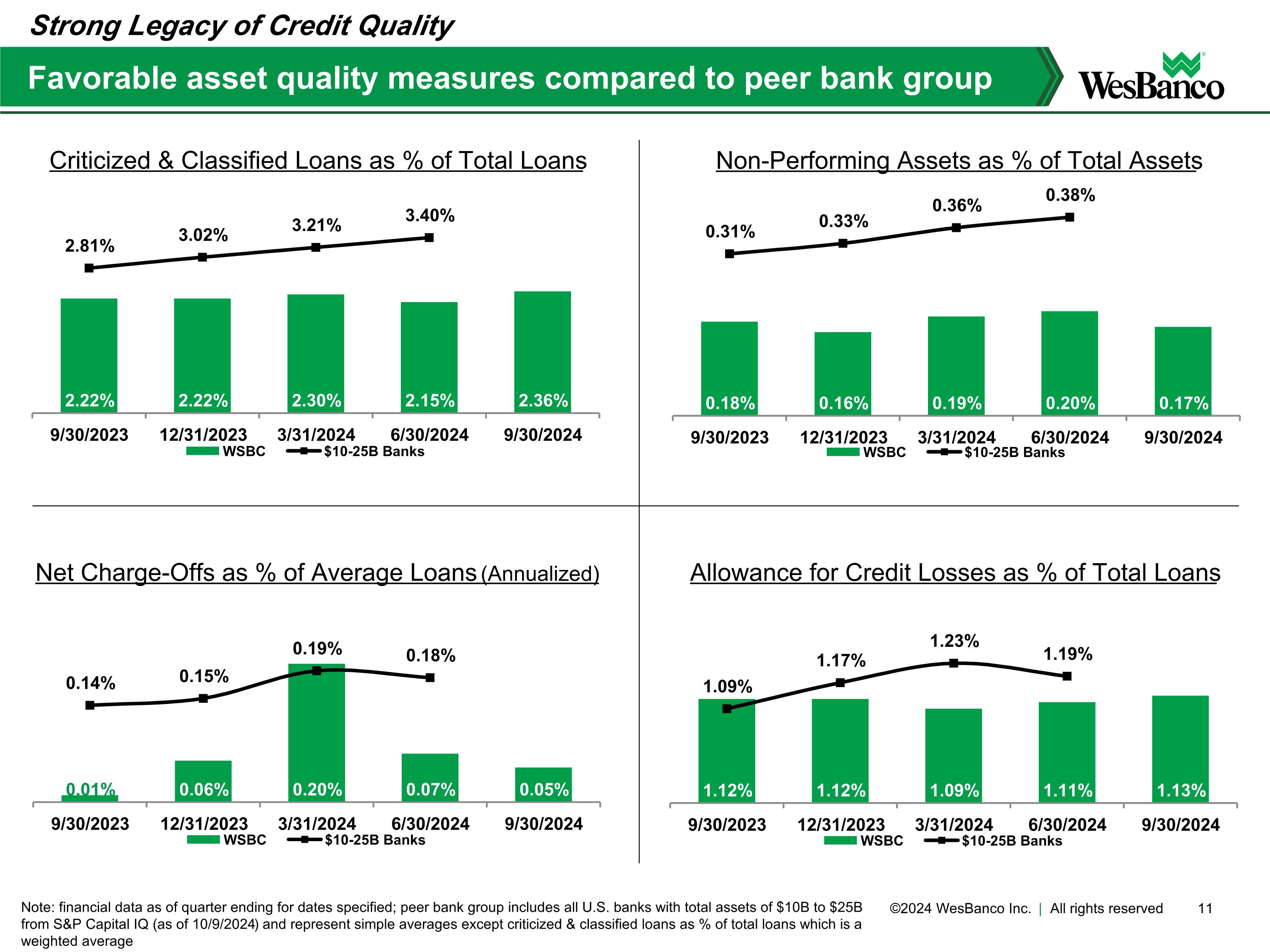

Favorable asset quality measures compared to peer bank group Note: financial data as of quarter ending for dates specified; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 10/9/2024) and represent simple averages except criticized & classified loans as % of total loans which is a weighted average Non-Performing Assets as % of Total Assets Net Charge-Offs as % of Average Loans (Annualized) Allowance for Credit Losses as % of Total Loans Criticized & Classified Loans as % of Total Loans Strong Legacy of Credit Quality

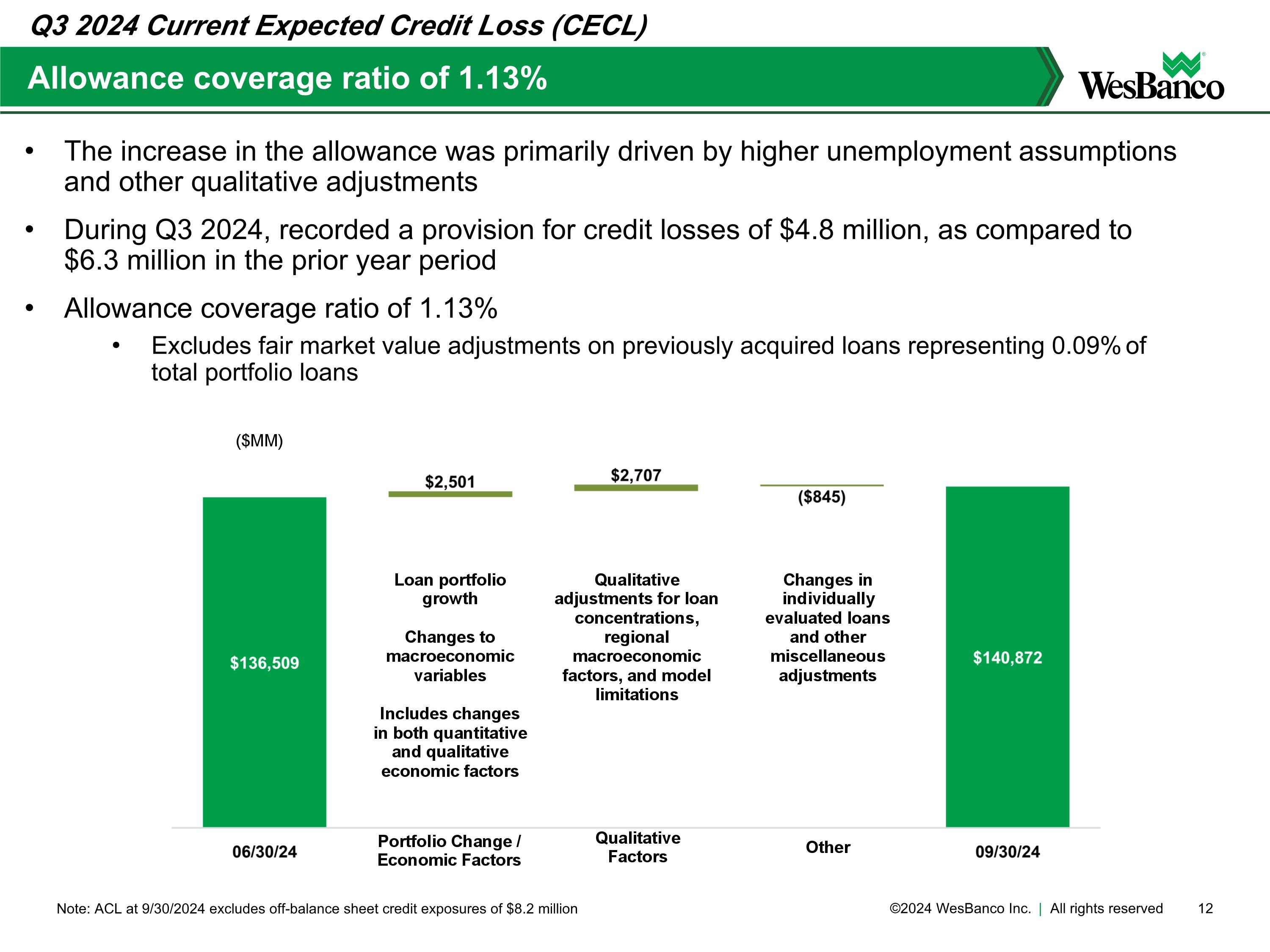

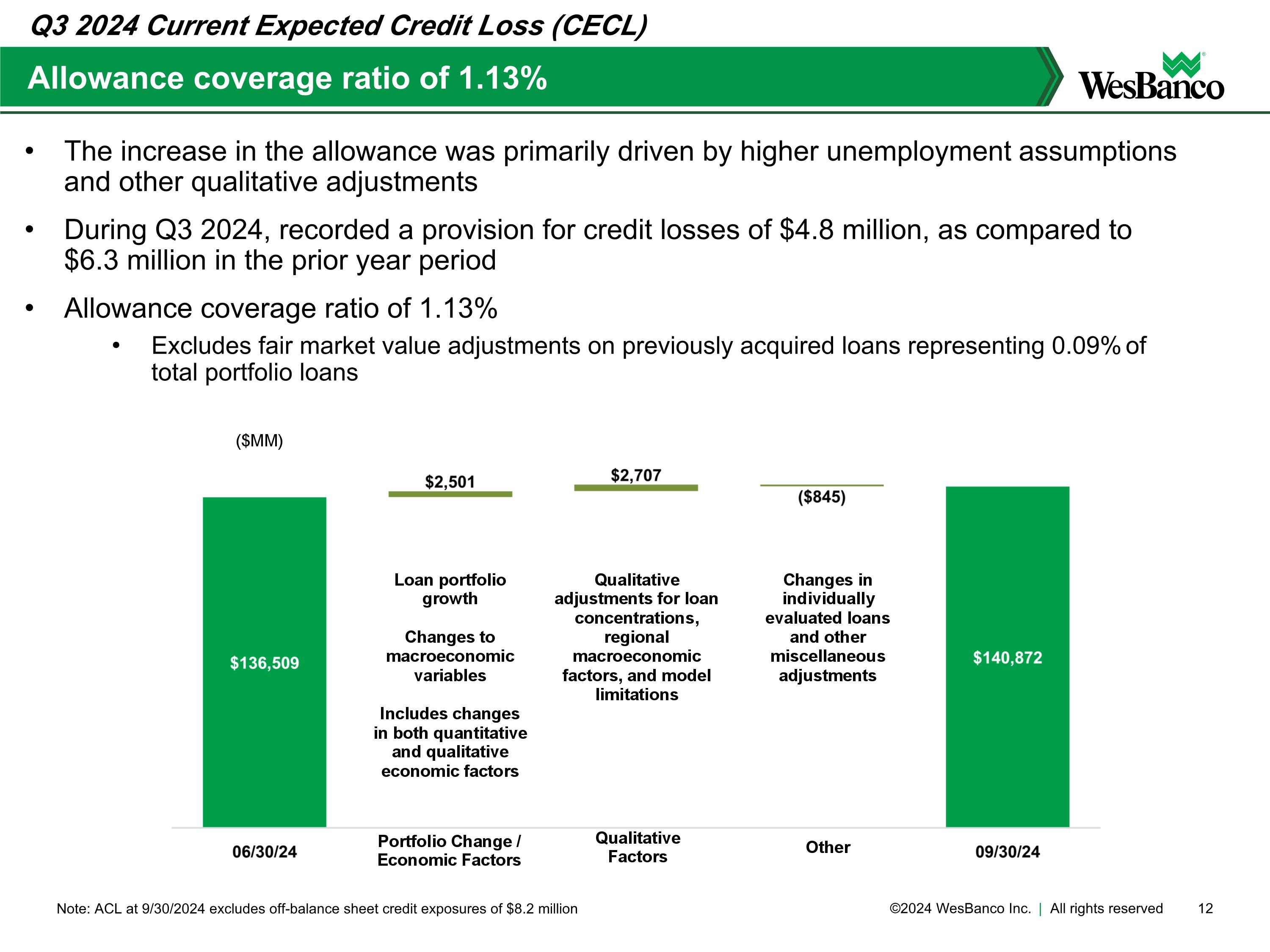

Allowance coverage ratio of 1.13% Note: ACL at 9/30/2024 excludes off-balance sheet credit exposures of $8.2 million The increase in the allowance was primarily driven by higher unemployment assumptions and other qualitative adjustments During Q3 2024, recorded a provision for credit losses of $4.8 million, as compared to $6.3 million in the prior year period Allowance coverage ratio of 1.13% Excludes fair market value adjustments on previously acquired loans representing 0.09% of total portfolio loans Q3 2024 Current Expected Credit Loss (CECL)

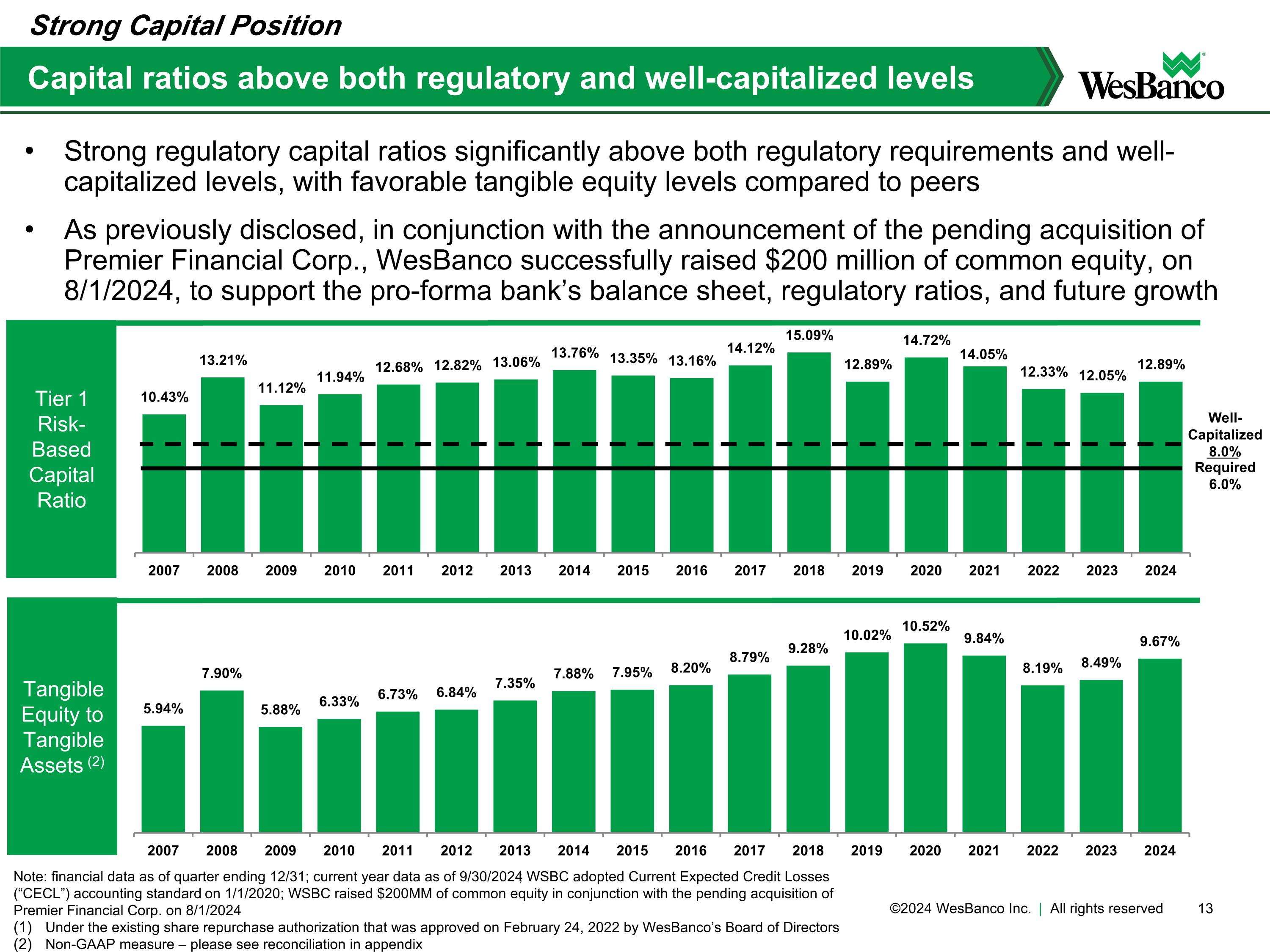

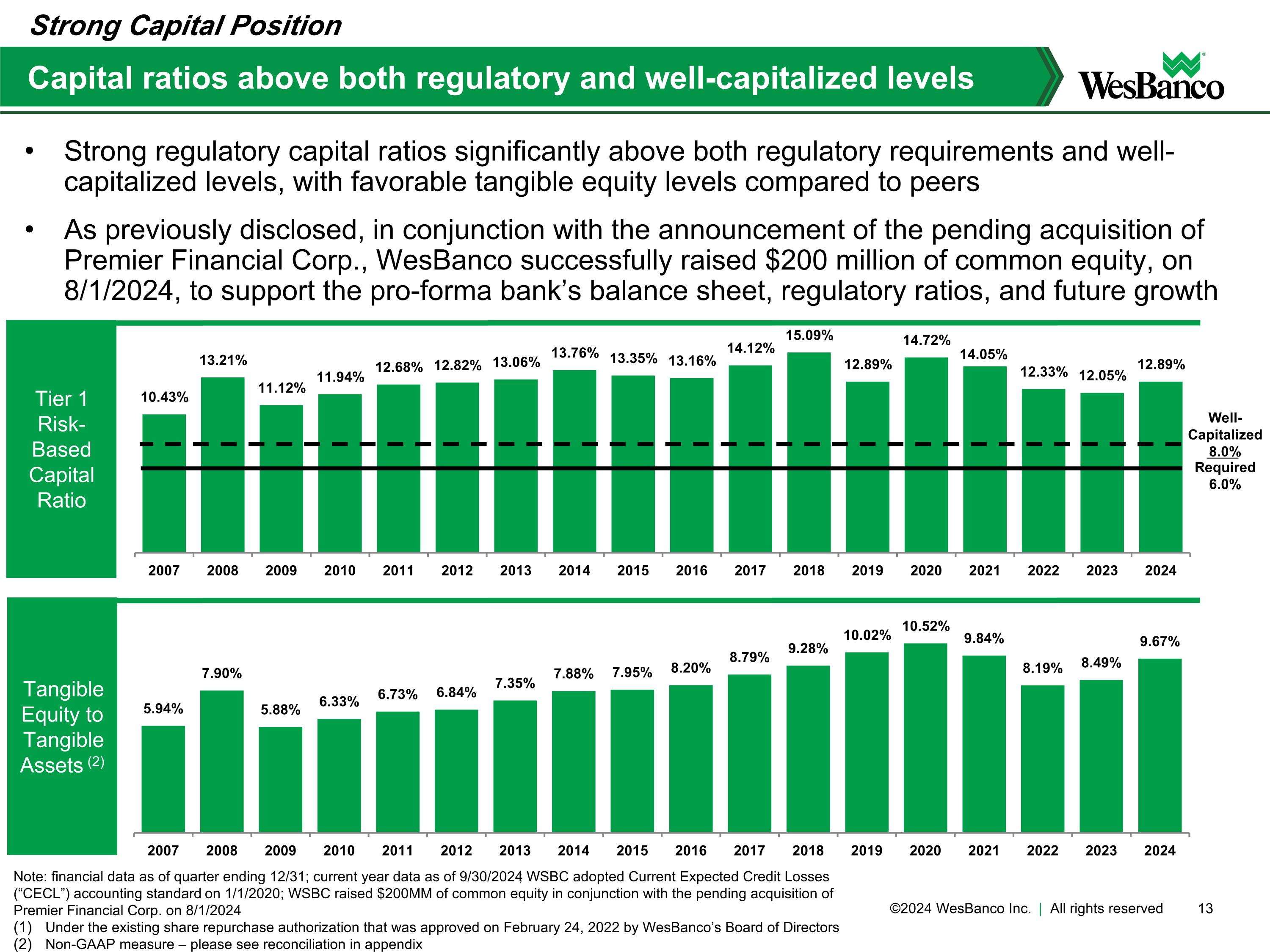

Capital ratios above both regulatory and well-capitalized levels Note: financial data as of quarter ending 12/31; current year data as of 9/30/2024; WSBC adopted Current Expected Credit Losses (“CECL”) accounting standard on 1/1/2020; WSBC raised $200MM of common equity in conjunction with the pending acquisition of Premier Financial Corp. on 8/1/2024 Under the existing share repurchase authorization that was approved on February 24, 2022 by WesBanco’s Board of Directors Non-GAAP measure – please see reconciliation in appendix Tangible Equity to Tangible Assets (2) Tier 1 Risk-Based Capital Ratio Well-Capitalized 8.0% Required 6.0% Strong regulatory capital ratios significantly above both regulatory requirements and well-capitalized levels, with favorable tangible equity levels compared to peers As previously disclosed, in conjunction with the announcement of the pending acquisition of Premier Financial Corp., WesBanco successfully raised $200 million of common equity, on 8/1/2024, to support the pro-forma bank’s balance sheet, regulatory ratios, and future growth Strong Capital Position Replace equity raise bullet with the following for 4q24 earnings ~1.0 million shares continue to remain for repurchase (as of 12/31/2024)(1) No shares repurchased on the open market during Q4 2024

Appendix

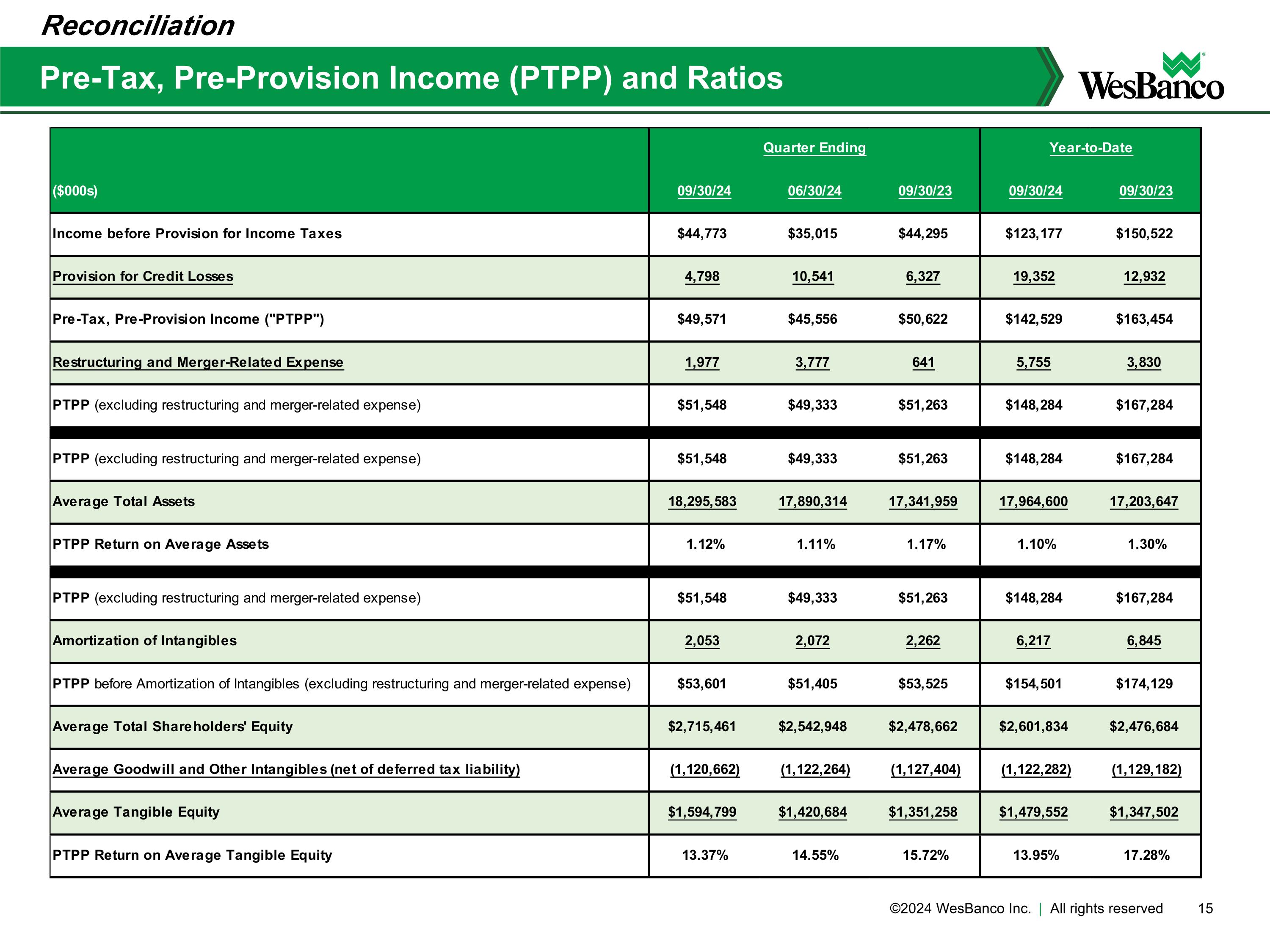

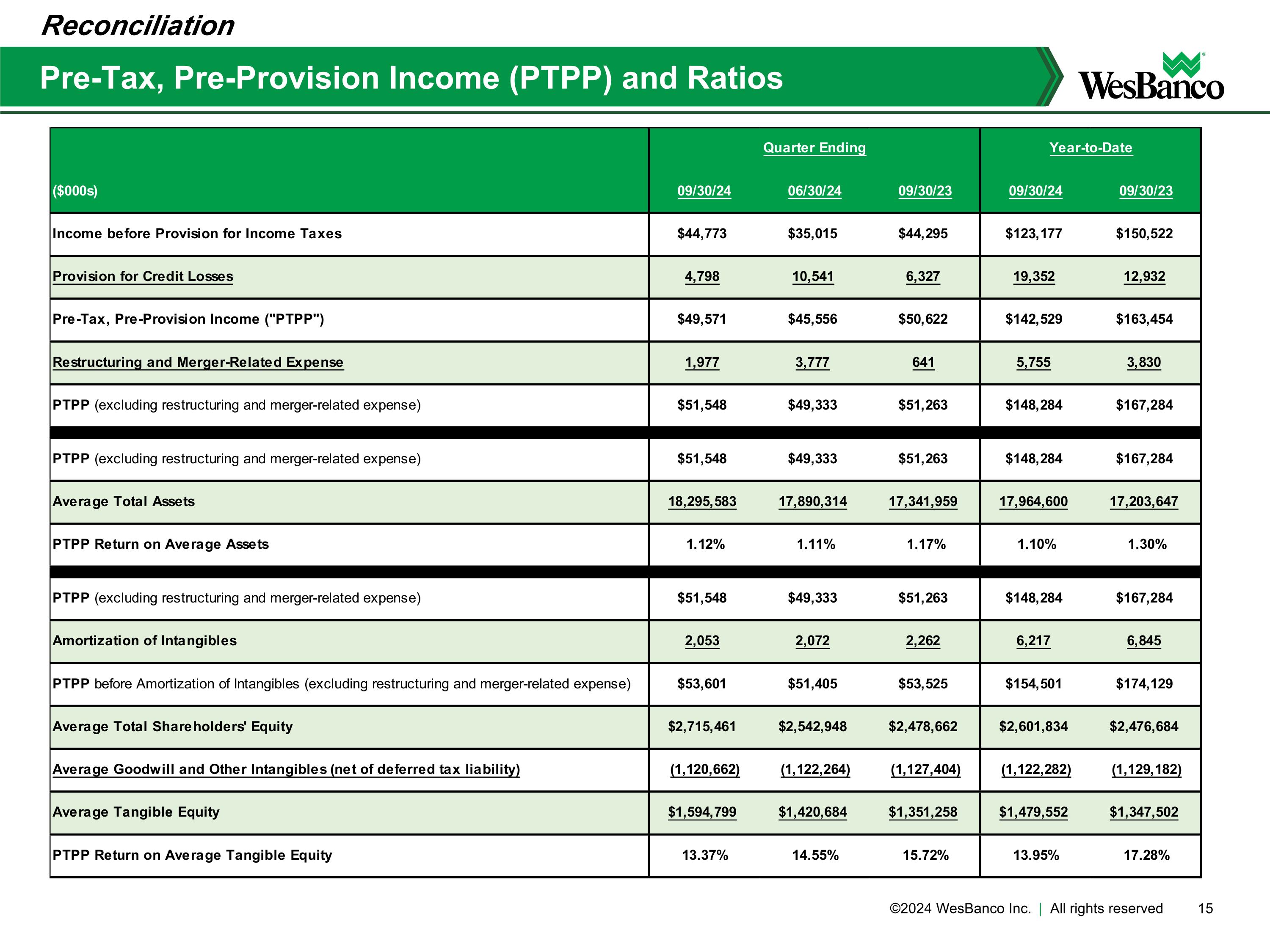

Pre-Tax, Pre-Provision Income (PTPP) and Ratios Reconciliation

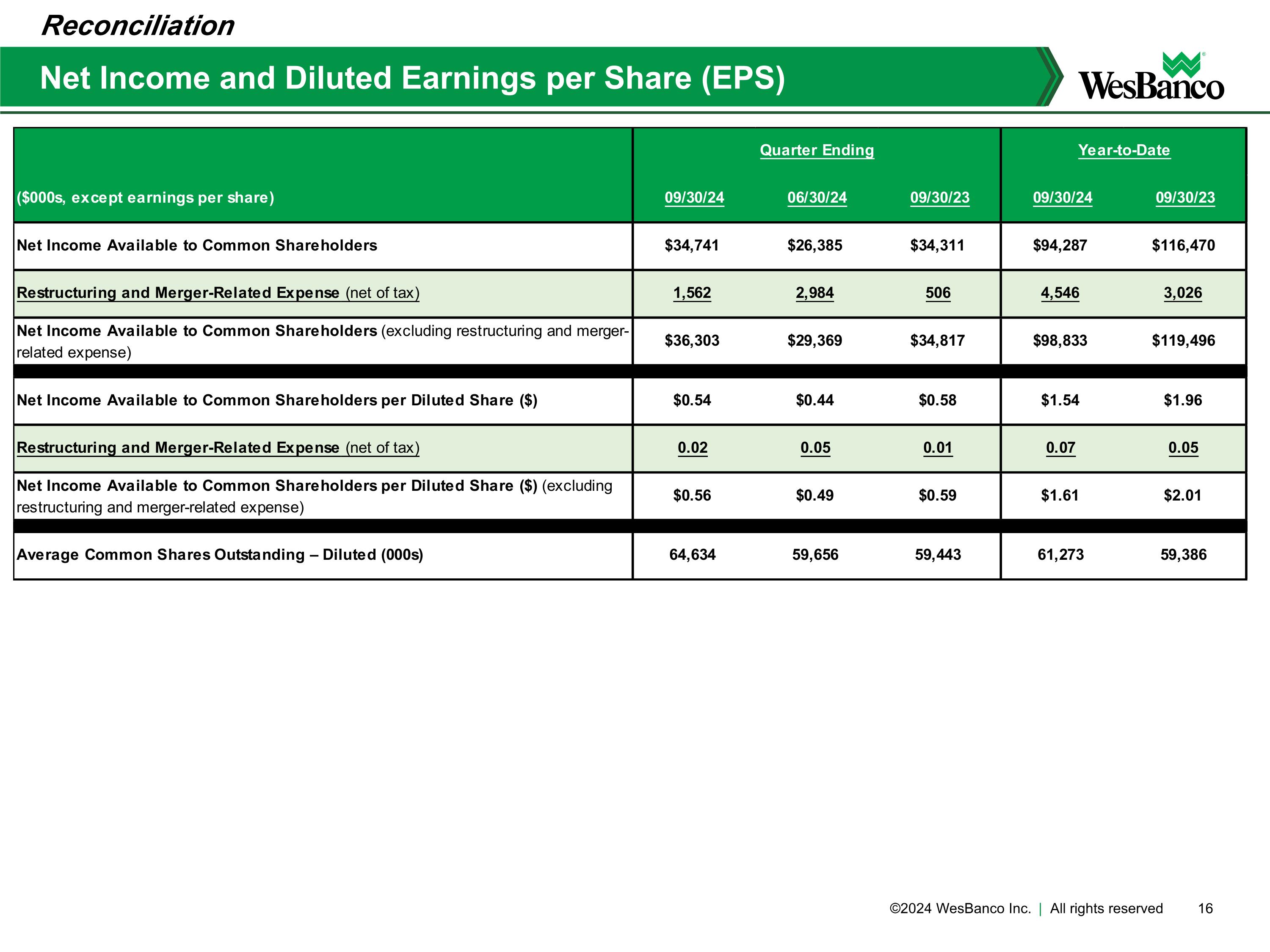

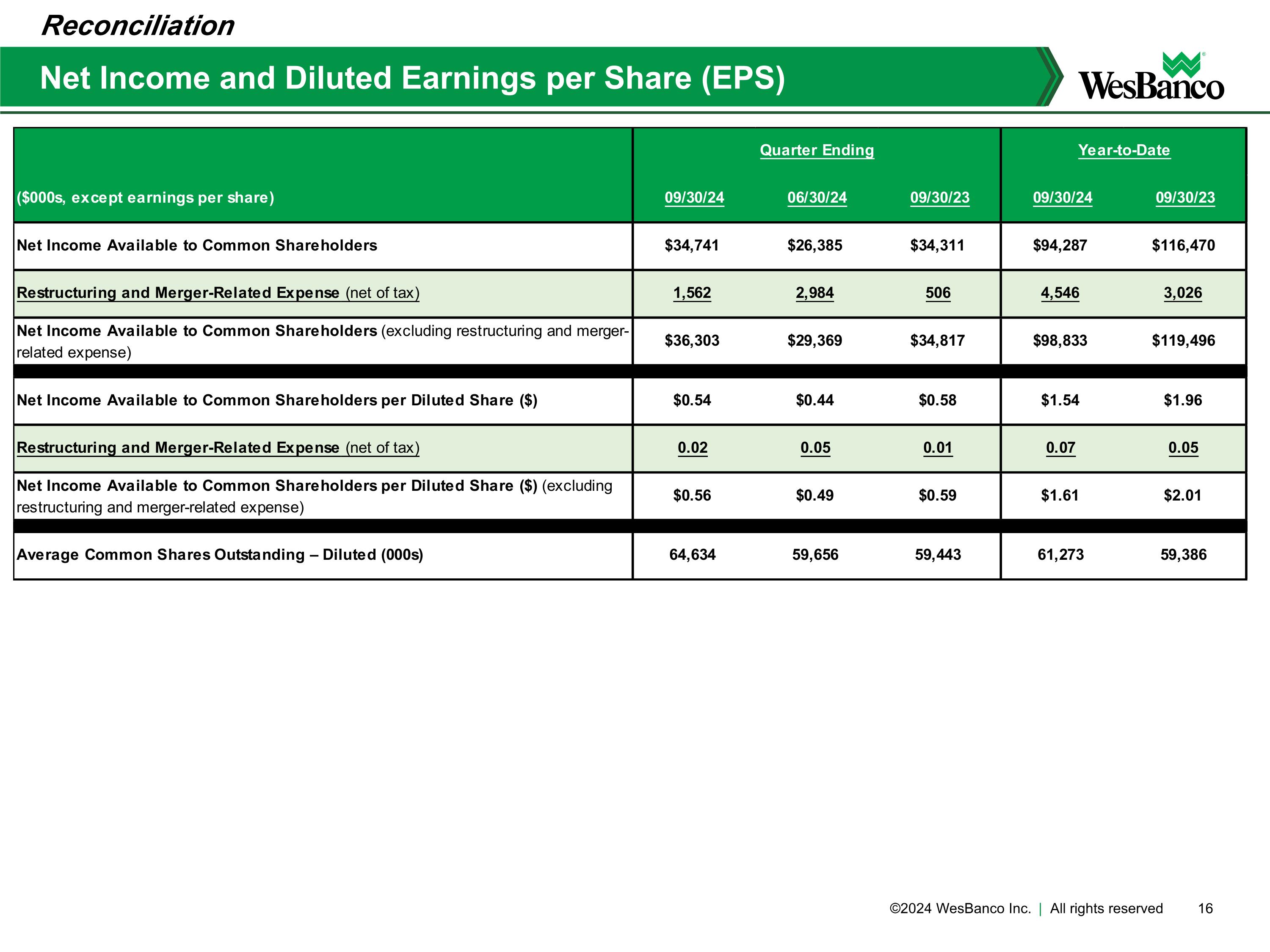

Net Income and Diluted Earnings per Share (EPS) Reconciliation

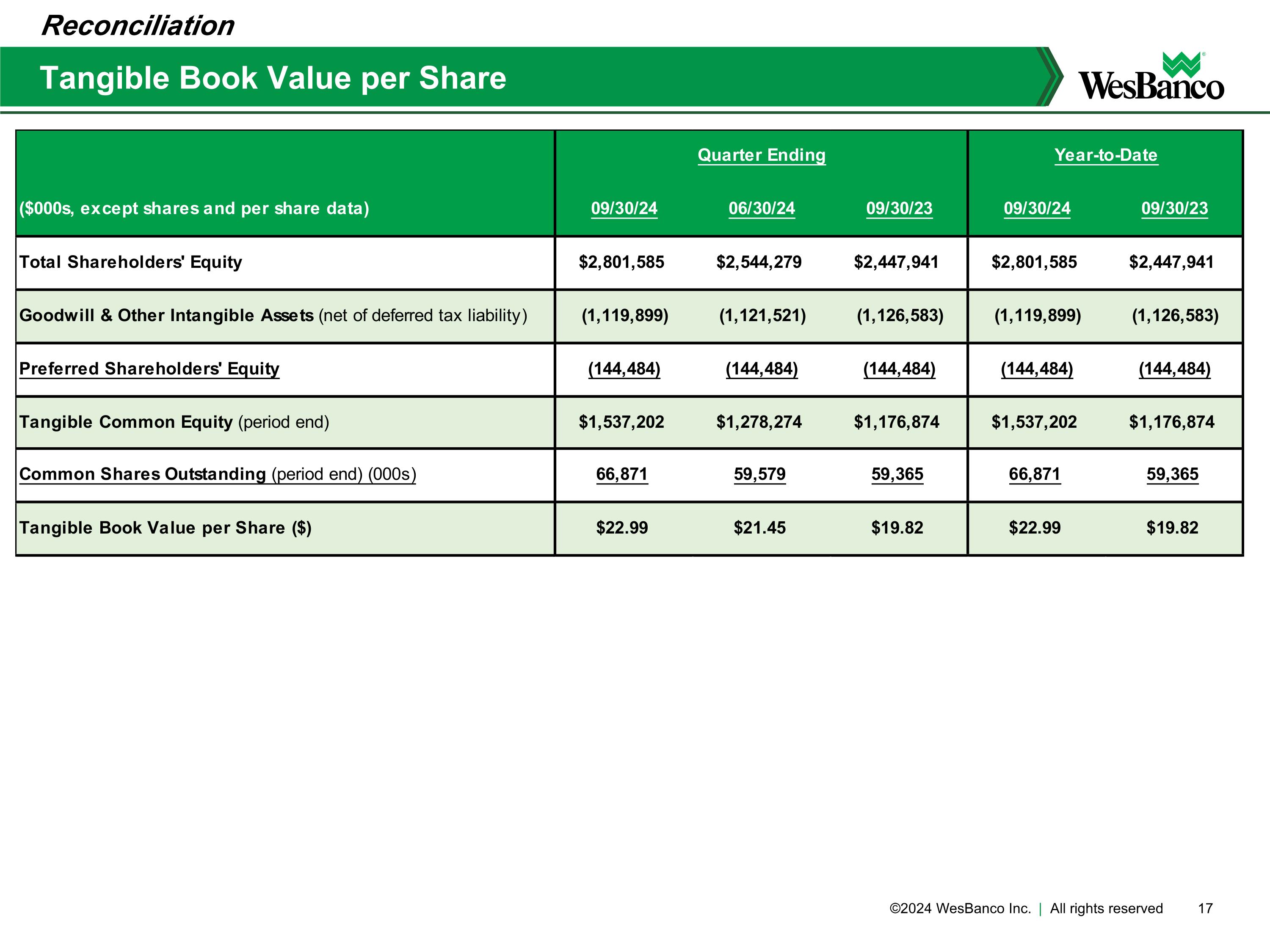

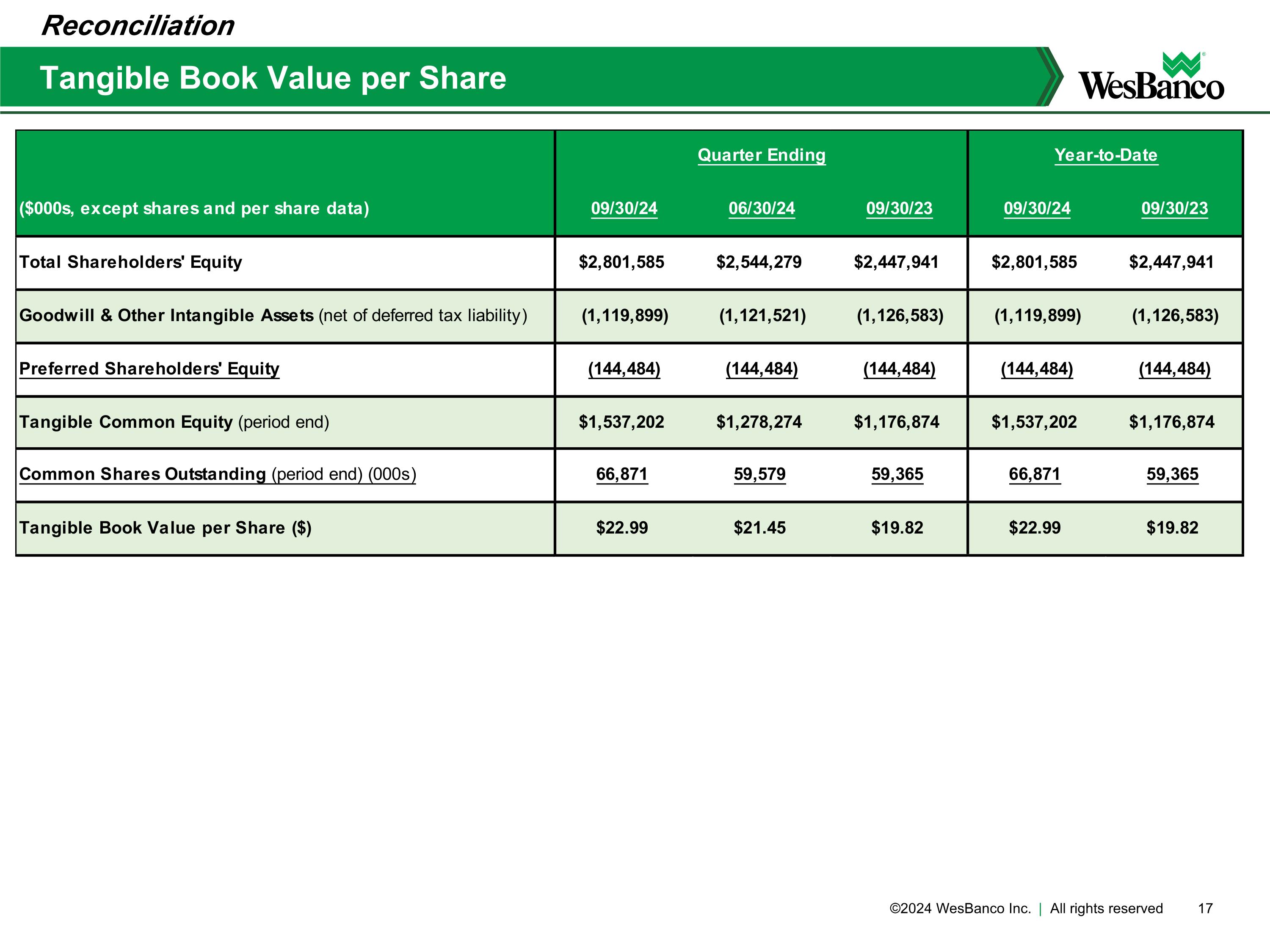

Tangible Book Value per Share Reconciliation

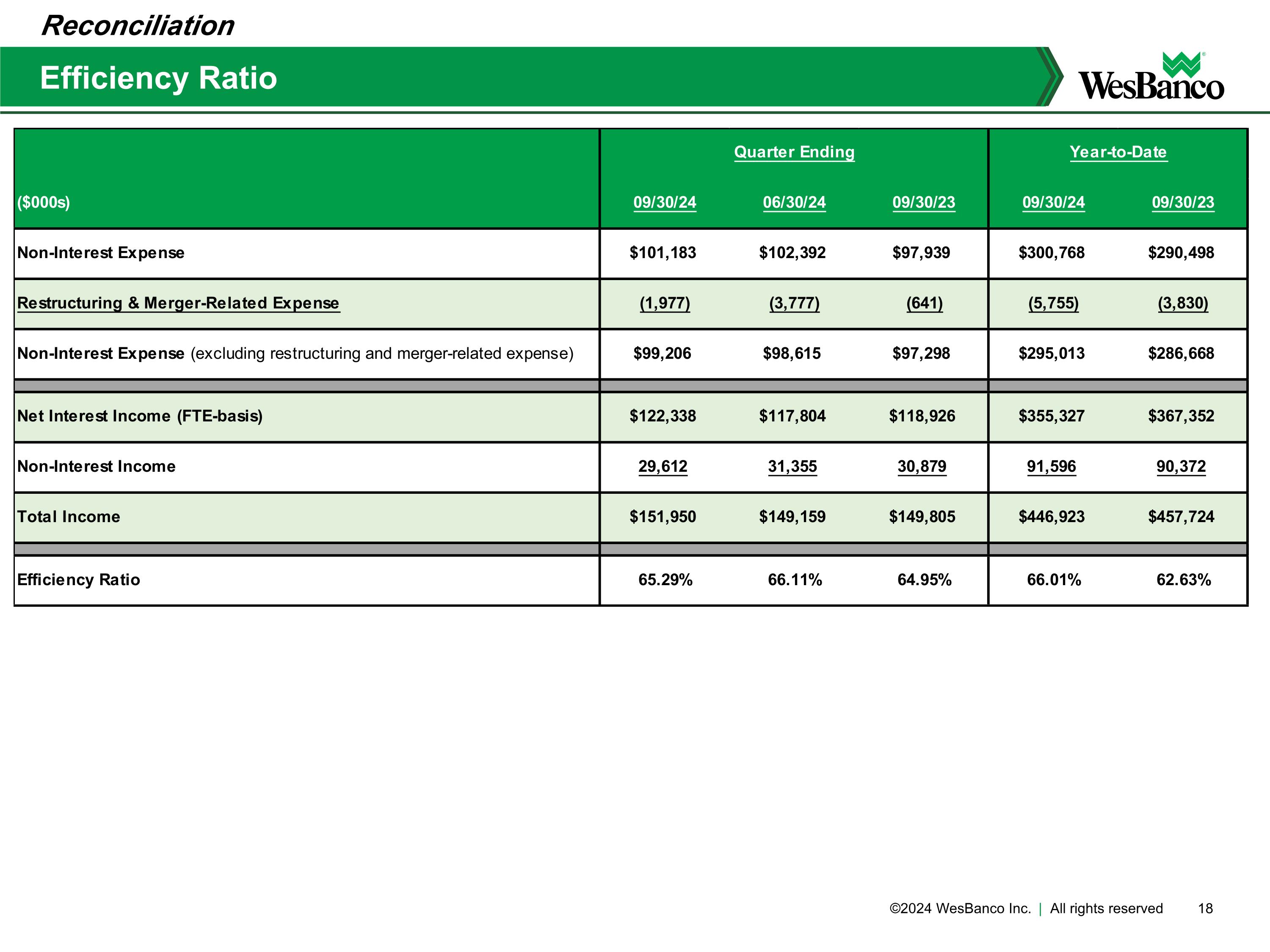

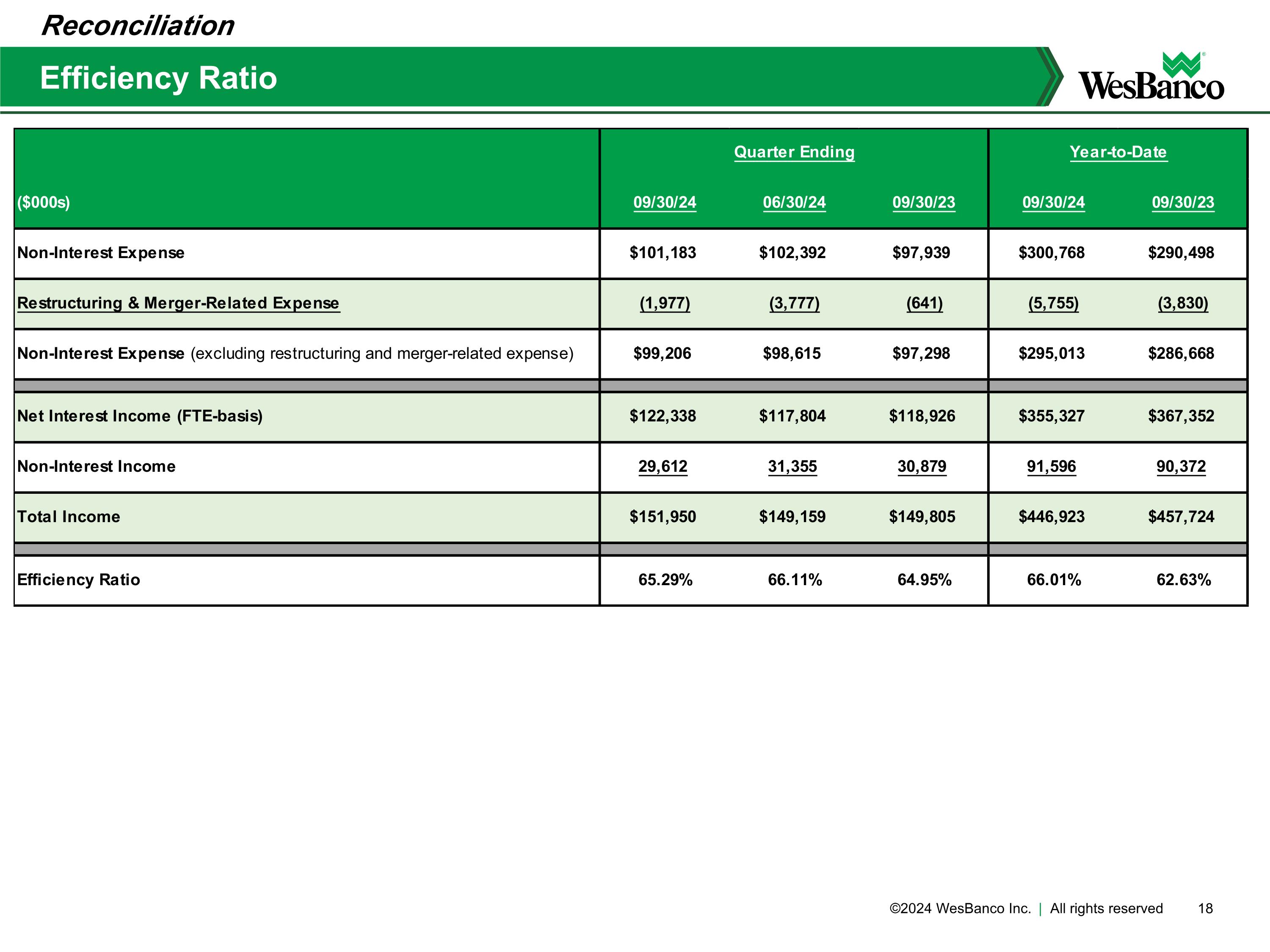

Efficiency Ratio Reconciliation

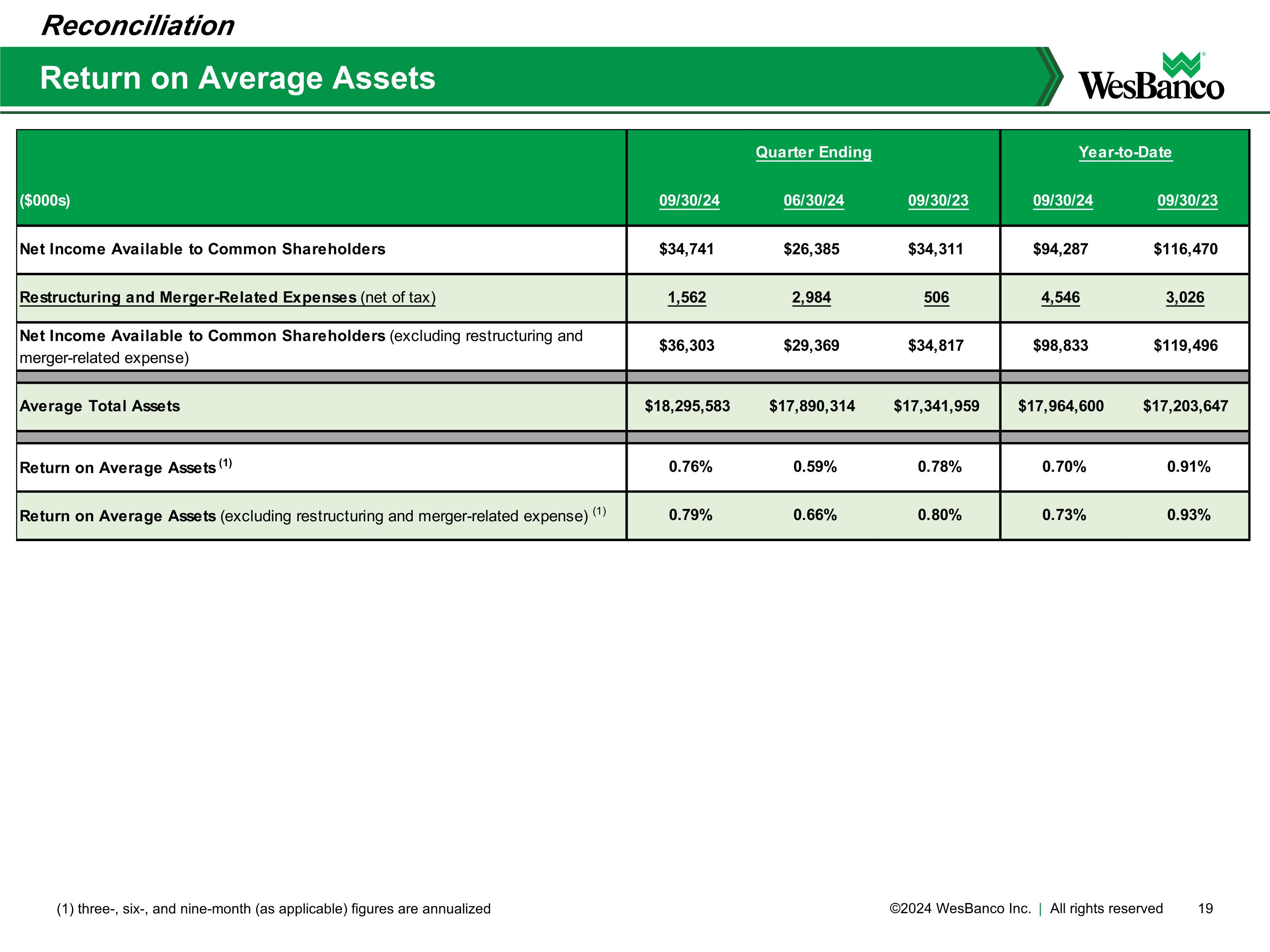

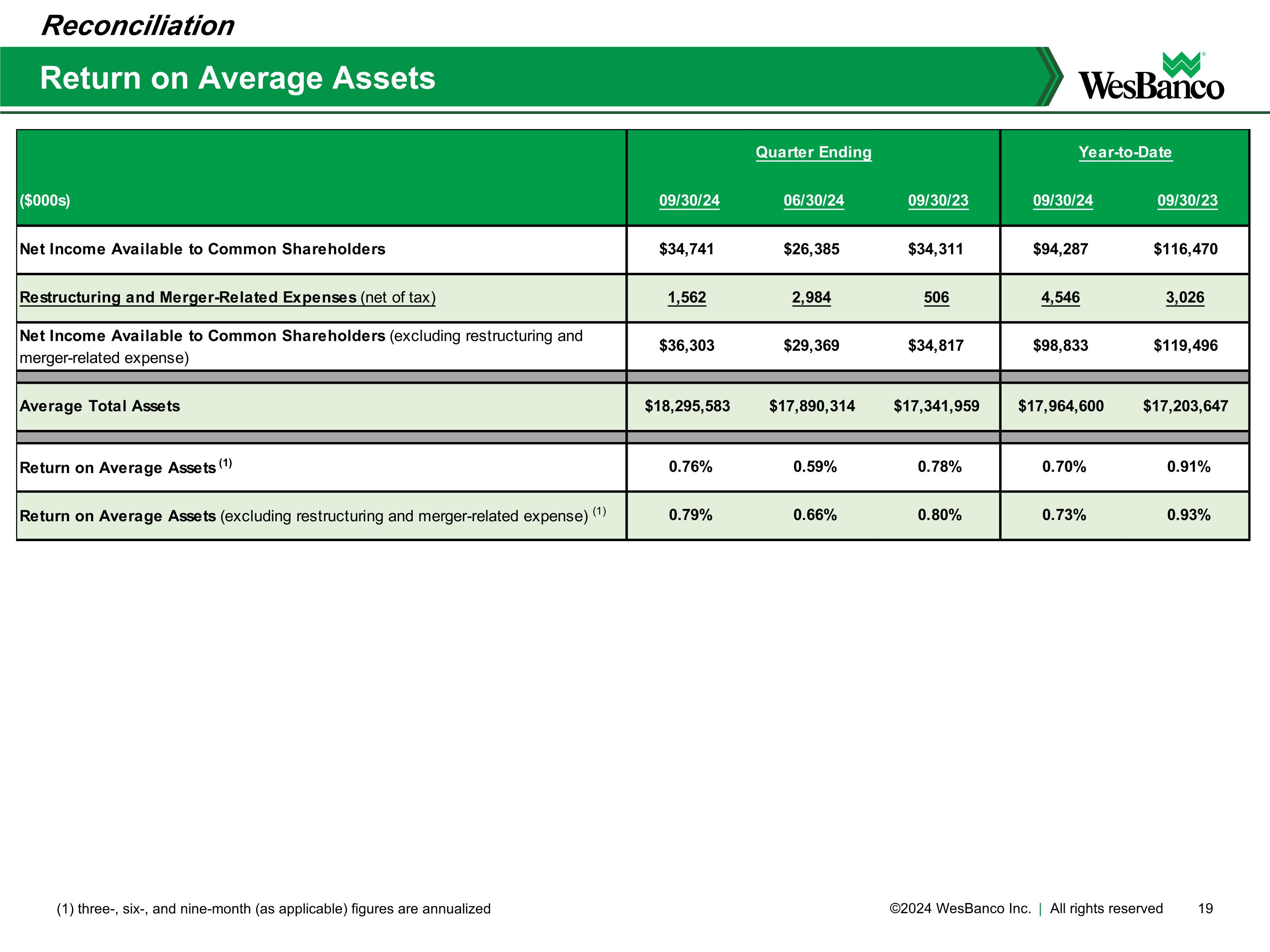

Return on Average Assets (1) three-, six-, and nine-month (as applicable) figures are annualized Reconciliation

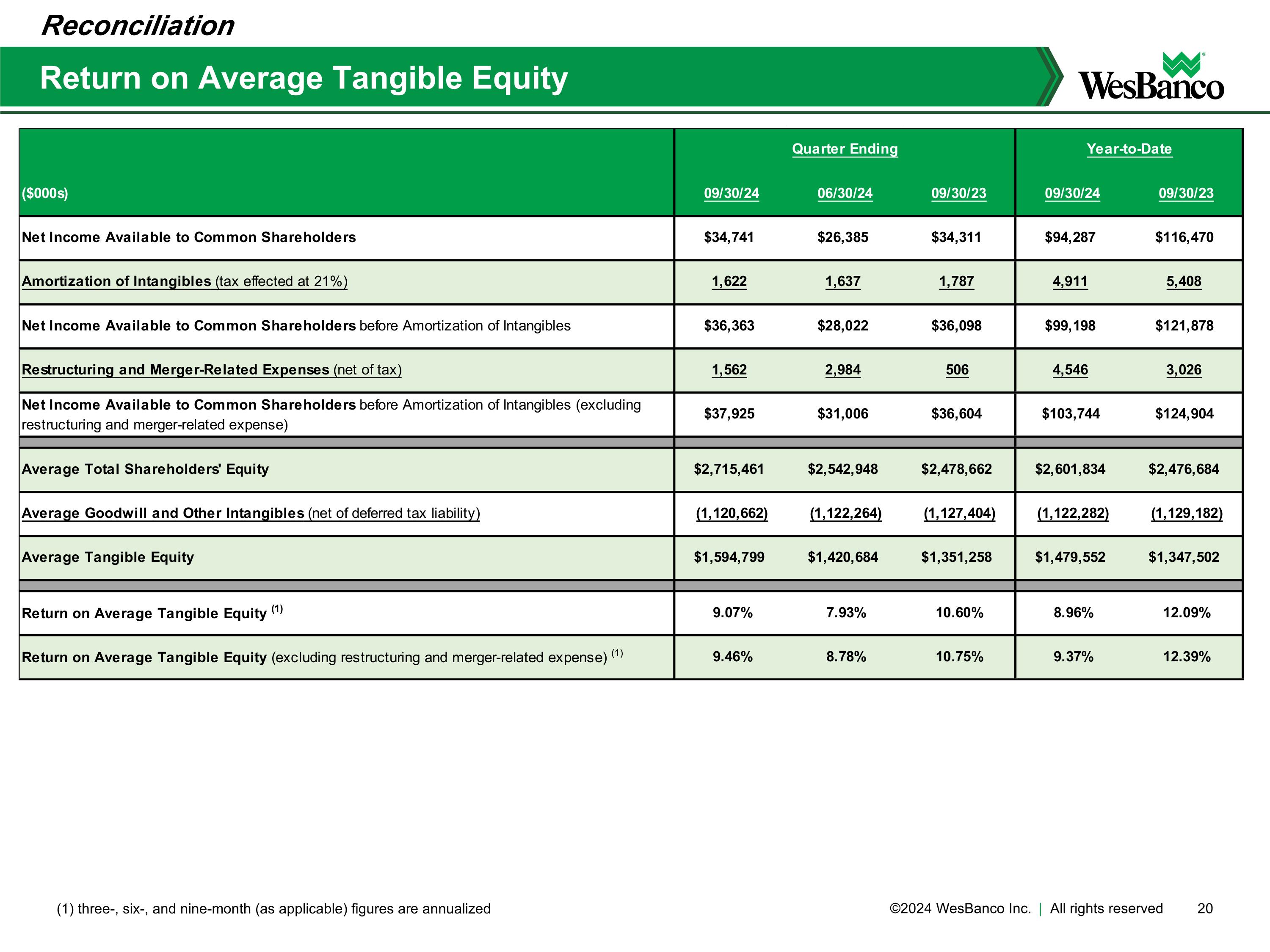

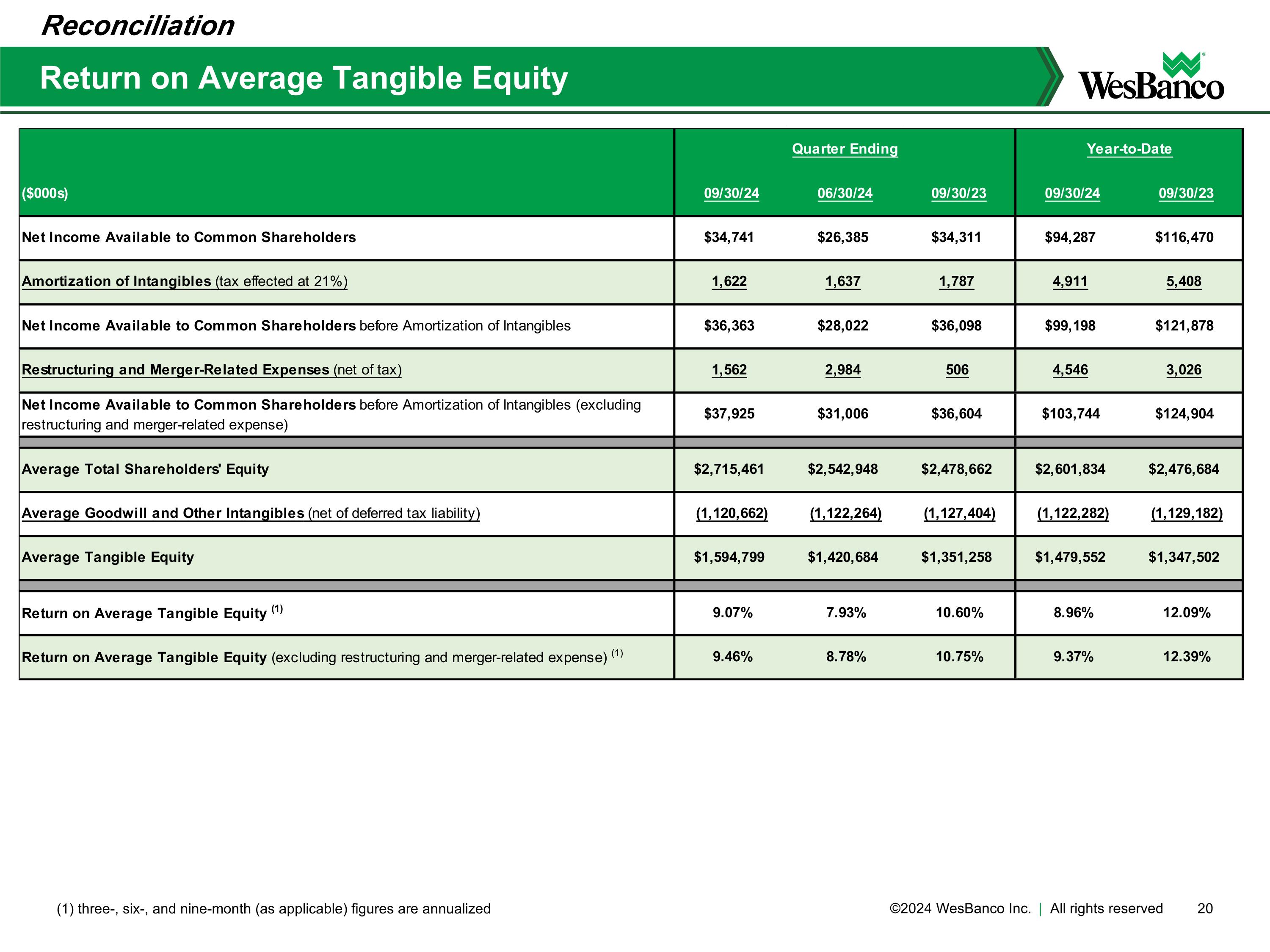

Return on Average Tangible Equity (1) three-, six-, and nine-month (as applicable) figures are annualized Reconciliation

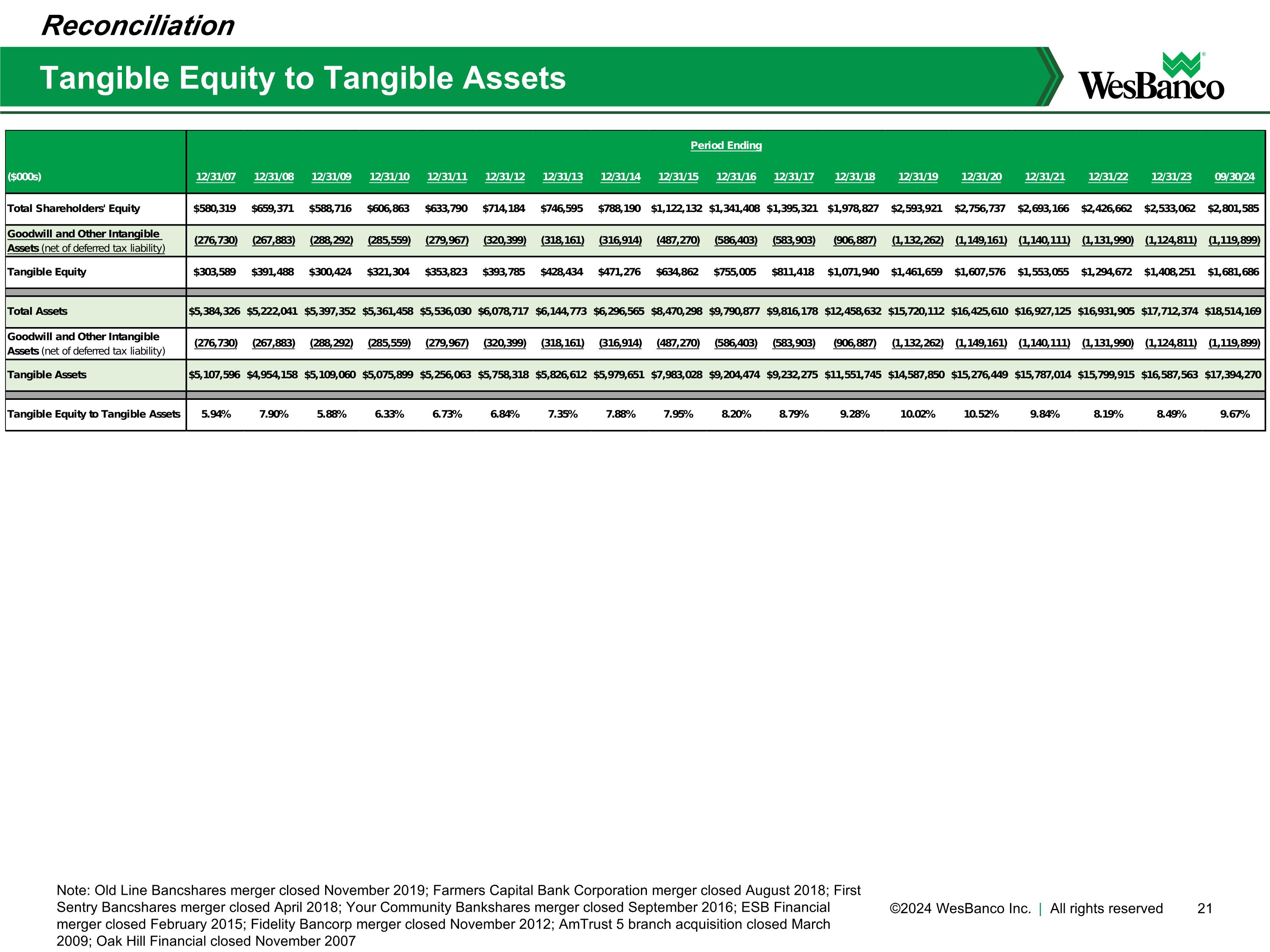

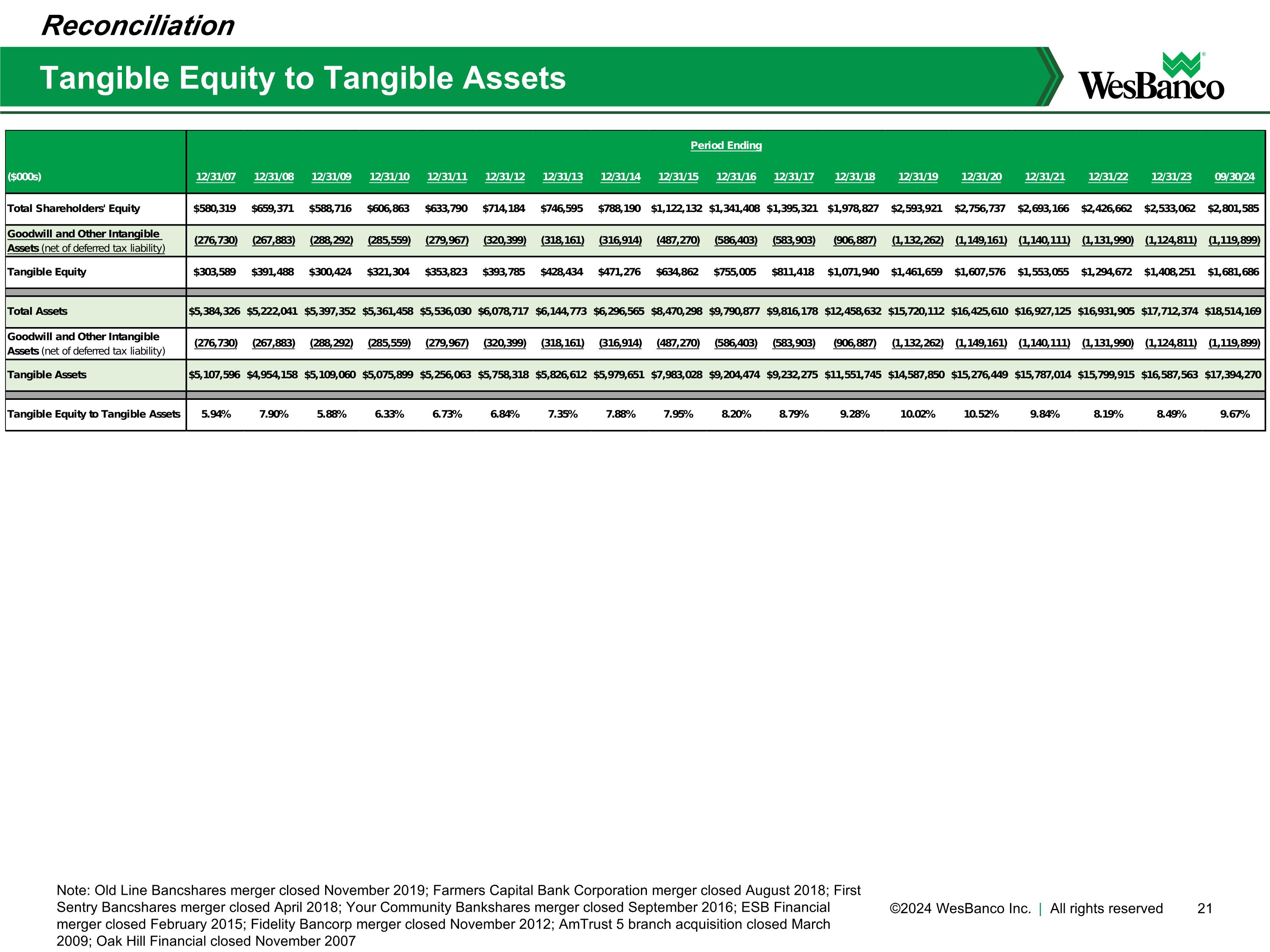

Tangible Equity to Tangible Assets Note: Old Line Bancshares merger closed November 2019; Farmers Capital Bank Corporation merger closed August 2018; First Sentry Bancshares merger closed April 2018; Your Community Bankshares merger closed September 2016; ESB Financial merger closed February 2015; Fidelity Bancorp merger closed November 2012; AmTrust 5 branch acquisition closed March 2009; Oak Hill Financial closed November 2007 Reconciliation