- WSBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

WesBanco (WSBC) 8-KRegulation FD Disclosure

Filed: 16 Apr 08, 12:00am

Annual Meeting of Annual Meeting of Stockholders Stockholders April 16, 2008 April 16, 2008 Exhibit 99.1 Exhibit 99.1 |

2 2 Forward-Looking Statements Forward-looking statements in this presentation relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this presentation should be read in conjunction with WesBanco’s 2007 Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC"), which is available at the SEC’s website www.sec.gov or at WesBanco’s website, www.wesbanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco's 2007 Annual Report on Form 10-K with the SEC under the section "Risk Factors". Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements. Please refer to WesBanco’s 2007 Annual Report on Form 10-K for further information on these risk factors. WesBanco does not assume any duty to update forward-looking statements. |

3 3 Corporate Profile Founded in 1870 in Wheeling, WV Founded in 1870 in Wheeling, WV $5.4 billion in assets $5.4 billion in assets Over 30 acquisitions in past 25 years Over 30 acquisitions in past 25 years Three state presence; two bank charters Three state presence; two bank charters 112 full-service banking offices, 2 loan 112 full-service banking offices, 2 loan production office & 147 ATMs production office & 147 ATMs Securities brokerage, insurance, proprietary Securities brokerage, insurance, proprietary mutual fund family mutual fund family |

4 4 WesBanco Stock Profile NASDAQ Global Stock Market: WSBC NASDAQ Global Stock Market: WSBC Market capitalization: $644 million* Market capitalization: $644 million* 2007 average daily shares traded: 86,493 2007 average daily shares traded: 86,493 26.5 million shares; 93% float 26.5 million shares; 93% float 37% institutional ownership 37% institutional ownership * Closing price of $24.31 on 4/9/08. |

5 5 Wealth Management Profile Market value of trust assets $3.1 billion at 12/31/07. Market value of trust assets $3.1 billion at 12/31/07. Currently manage over 5,000 trust relationships. Currently manage over 5,000 trust relationships. 76% of trust assets are under management at 12/31/07. 76% of trust assets are under management at 12/31/07. Trust assets increased 3.6% in 2007. Trust assets increased 3.6% in 2007. Trust revenue for 2007 totaled $16.2 million, an Trust revenue for 2007 totaled $16.2 million, an increase of 7.8% compared to 2006. increase of 7.8% compared to 2006. Revenue generated from WesMark Revenue generated from WesMark Funds for 2007 Funds for 2007 totaled $4.2 million on Fund assets of $652.7 million. totaled $4.2 million on Fund assets of $652.7 million. |

6 6 2007 Financial Results YTD YTD (dollars in thousands) 12/31/2007 12/31/2006 % CHG Net income 44,669 $ 39,035 $ 14.4% EPS - diluted 2.09 $ 1.79 $ 16.8% Return on assets 1.09% 0.94% 15.9% Return on tangible equity 16.21% 14.40% 12.6% Net interest margin 3.44% 3.49% (1.4%) |

7 7 Asset Quality 0.28% 0.29% 0.46% 0.31% 0.23% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% 2003 2004 2005 2006 2007 Net charge-offs Mortgage- backed Municipals Agencies Commercial & Industrial Commercial Real Estate Residential Real Estate Home Equity Consumer Held for Sale Loans Securities Market Valuation Gains @ 12/31/07 Municipals Agencies Mortgage-backed $6,717 $ 879 $ 204 41% 49% 10% 44% 26% 10% 5% 13% 2% Equities $ 1,246 |

8 8 2008 Strategy / Business Plan Challenging economic conditions ahead. Challenging economic conditions ahead. Monitor for credit deterioration. Monitor for credit deterioration. Successful integration of Oak Hill Banks. Successful integration of Oak Hill Banks. Focus on balance sheet remix strategy; higher- Focus on balance sheet remix strategy; higher- yielding loan products and non interest-bearing yielding loan products and non interest-bearing DDA customers. DDA customers. Concentrate on efficiency ratio by improving non- Concentrate on efficiency ratio by improving non- interest income and reducing expenses. interest income and reducing expenses. |

9 9 Key Investor Messages “Against the tide” “Against the tide” earnings increase in 2007. earnings increase in 2007. Recent stock price rally still leaves opportunity for Recent stock price rally still leaves opportunity for appreciation as earnings visibility improves post-Oak Hill. appreciation as earnings visibility improves post-Oak Hill. 23 consecutive years of dividend increases; payout ratio 23 consecutive years of dividend increases; payout ratio targeted at 55% of earnings; current yield above market targeted at 55% of earnings; current yield above market at 4.6%. at 4.6%. Potential for improved net interest margin in current Potential for improved net interest margin in current rate environment. rate environment. Business plan - Business plan - not “stretching” not “stretching” for growth / earnings in for growth / earnings in current market environment. current market environment. |

10 10 Creates a Powerful Community Bank Franchise Projected Population Growth* (%) (1.16) 2.72 2.17 (4.00) (2.00) 0.00 2.00 4.00 WSBC OAKF Ohio Median 2006 Household Income $39,879 $42,159 $49,467 $0 $15,000 $30,000 $45,000 $60,000 WSBC OAKF Ohio Projected HH Income Change* (%) 15.35 14.71 14.36 12.00 13.50 15.00 16.50 18.00 WSBC OAKF Ohio Source: SNL Financial and Microsoft MapPoint * Projected change from 2006-2011 |

11 11 Transaction Rationale Top 15 deposit market share in Ohio Top 15 deposit market share in Ohio Connects geographic gap in branch network Connects geographic gap in branch network Market Share Enhanced Growth Financially Attractive Common Cultures Doubles presence in growth markets Doubles presence in growth markets Increased scale enhances lending capabilities Increased scale enhances lending capabilities Identifiable, achievable cost savings Identifiable, achievable cost savings Accretive to GAAP and Cash EPS in 2009 Accretive to GAAP and Cash EPS in 2009 Common community banking philosophy Common community banking philosophy Shared expertise in commercial lending Shared expertise in commercial lending |

12 12 Dividends Per Share Dividends Per Share $0.94 $1.12 2002 2003 2004 2005 2006 2007 2008 1) 23 consecutive years of dividend increases. 2) Current dividend yield of approximately 4.6% (at 4/9/08). 3) 19% increase in dividends since 2002. |

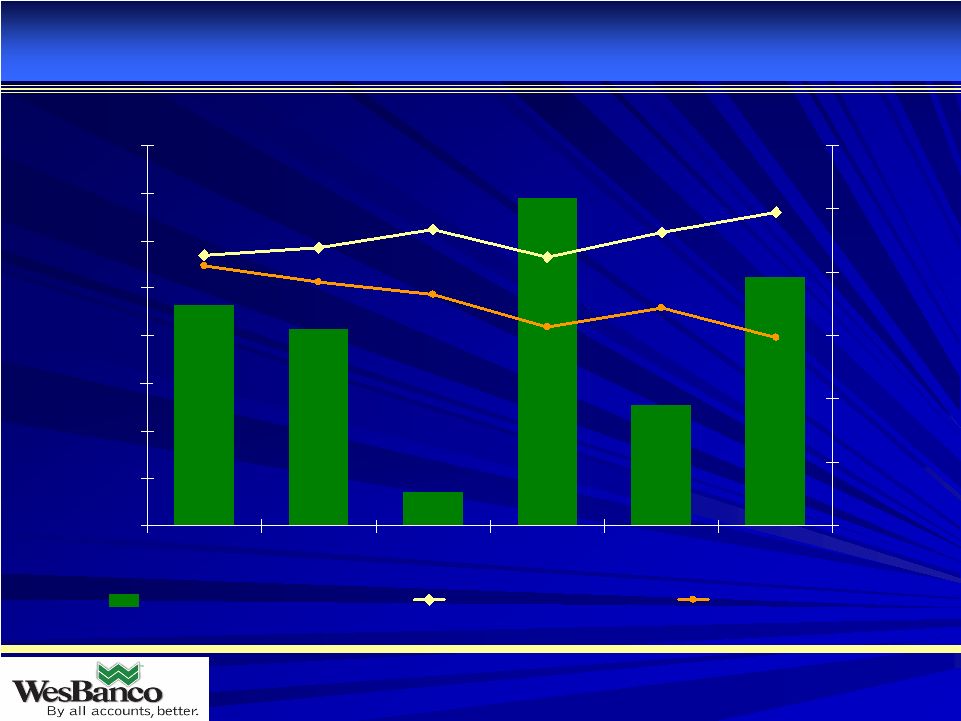

13 13 Return to Shareholders Return to Shareholders 8.53% 9.34% 8.46% 9.27% 7.29% 6.26% 5.94% 8.76% 9.90% 8.21% 6.87% 7.69% - 200 400 600 800 1,000 1,200 1,400 1,600 2002 2003 2004 2005 2006 2007 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% Shares repurchased Tier I leverage Tangible equity Note: $263 million in dividends and stock repurchases returned to shareholders from 2002 through 2007. Shares |

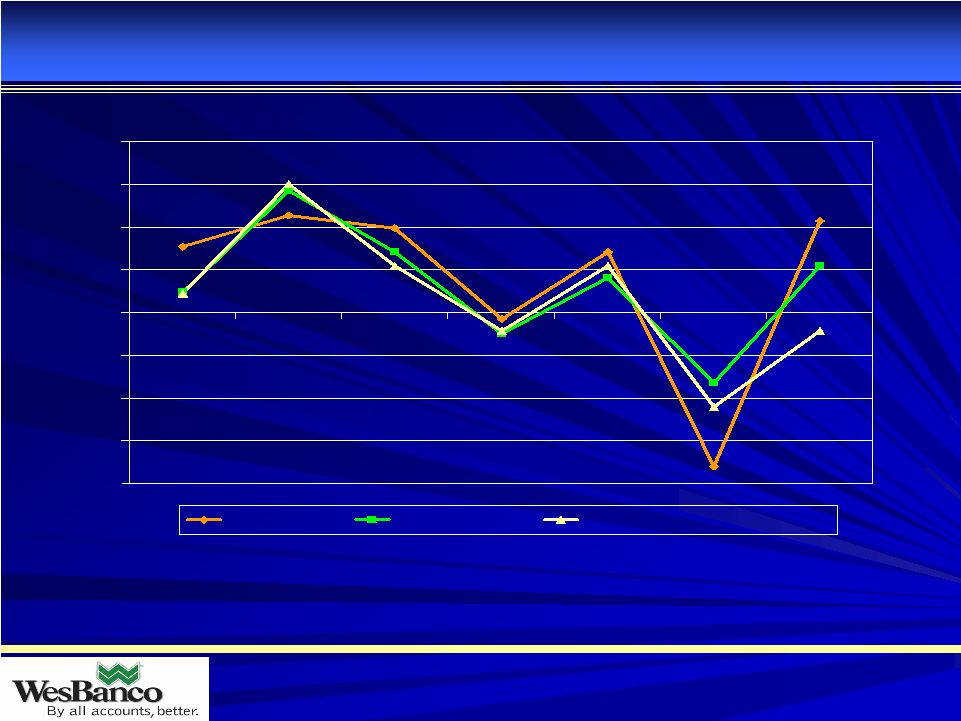

14 14 WesBanco / Peer Median – Stock Performance From 2002 through March 31, 2008 WesBanco has outperformed both the NASDAQ Bank Index and its peers with a 48% total return, compared to 19% and 33%, respectively. Source: FactSet Research Systems * YTD through 3/31/08 Peers include select banks from western PA, Ohio, Indiana and West Virginia with Assets between $1 billion and $15 billion. -40% -30% -20% -10% 0% 10% 20% 30% 40% 2002 2003 2004 2005 2006 2007 2008 YTD* WesBanco Peer Median NASDAQ Bank Index |

15 15 Stock Performance – Long-term Cumulative Return -50% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% 500% '77 '78 '79 '80 '81 '82 '83 '84 '85 '86 '87 '88 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 WesBanco S & P 500 Q1 |

Annual Meeting of Annual Meeting of Stockholders Stockholders April 16, 2008 April 16, 2008 |