- WSBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

WesBanco (WSBC) 425Business combination disclosure

Filed: 23 Jul 19, 4:50pm

Acquisition of Old Line Bancshares, Inc. 23 July 2019 Exhibit 99.2

The statements in this presentation that are not historical facts, in particular the statements with respect to the expected timing of and benefits of the proposed merger between WesBanco and Old Line, the parties’ plans, obligations, expectations, and intentions, and the statements with respect to accretion, earn back of tangible book value, tangible book value dilution and internal rate of return, constitute forward-looking statements as defined by federal securities laws. Such statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: the businesses of WesBanco and Old Line may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the proposed merger may not be fully realized within the expected timeframes; disruption from the proposed merger may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental approvals of the proposed merger may not be obtained on the expected terms and schedule; Old Line’s stockholders and/or WesBanco’s shareholders may not approve the proposed merger and the merger agreement and issuance of shares of WesBanco common stock in the proposed merger, respectively; changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms; and extended disruption of vital infrastructure; and other factors described in WesBanco’s 2018 Annual Report on Form 10-K, Old Line’s 2018 Annual Report on Form 10-K, and documents subsequently filed by WesBanco and Old Line with the Securities and Exchange Commission. All forward-looking statements included herein are based on information available at the time of the presentation. Neither WesBanco nor Old Line assumes any obligation to update any forward-looking statement. Forward-Looking Statements

In connection with the proposed merger, WesBanco will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a proxy statement of Old Line and WesBanco and a prospectus of WesBanco, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS OF WESBANCO, STOCKHOLDERS OF OLD LINE AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Proxy Statement/Prospectus will be mailed to shareholders of WesBanco and stockholders of Old Line prior to the respective shareholder and stockholder meetings, which have not yet been scheduled. In addition, when the Registration Statement on Form S-4, which will include the Proxy Statements/Prospectus, and other related documents are filed by WesBanco with the SEC, they may be obtained for free at the SEC’s website at http://www.sec.gov, and from either WesBanco’s or Old Line’s website at http://www.wesbanco.com or http://www.oldlinebank.com, respectively. Additional Information About the Merger and Where to Find It

WesBanco and Old Line and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of WesBanco and the stockholders of Old Line in connection with the proposed Merger. Information about the directors and executive officers of WesBanco is set forth in the proxy statement for WesBanco’s 2019 annual meeting of shareholders, as filed with the SEC on March 13, 2019 and as supplemented on April 5, 2019. Information about the directors and executive officers of Old Line is set forth in the proxy statement for Old Line’s 2019 annual meeting of stockholders, as filed with the SEC on April 26, 2019. Information about any other persons who may, under the rules of the SEC, be considered participants in the solicitation of WesBanco shareholders or Old Line stockholders in connection with the proposed Merger will be included in the Proxy Statement/Prospectus. You can obtain free copies of these documents from the SEC, WesBanco or Old Line using the website information above. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. WESBANCO SHAREHOLDERS AND OLD LINE STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS WITH RESPECT TO THE PROPOSED MERGER. Participants in the Solicitation

In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco and Old Line management use, and this presentation contains or references, certain non-GAAP financial measures, such as tangible common equity/tangible assets; net income excluding after-tax merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco and Old Line believe these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco and Old Line believe that these non-GAAP financial measures enhance investors' understanding of WesBanco's and Old Line's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, and for Old Line and its subsidiaries, as well as other filings that the companies have made with the SEC. Non-GAAP Financial Measures

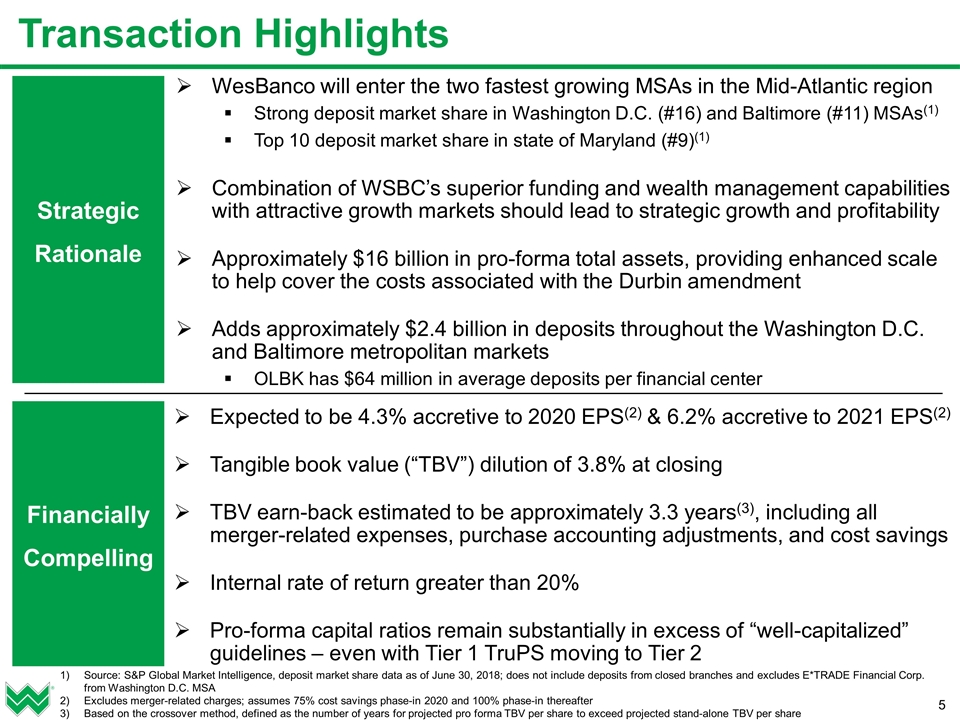

Transaction Highlights WesBanco will enter the two fastest growing MSAs in the Mid-Atlantic region Strong deposit market share in Washington D.C. (#16) and Baltimore (#11) MSAs(1) Top 10 deposit market share in state of Maryland (#9)(1) Combination of WSBC’s superior funding and wealth management capabilities with attractive growth markets should lead to strategic growth and profitability Approximately $16 billion in pro-forma total assets, providing enhanced scale to help cover the costs associated with the Durbin amendment Adds approximately $2.4 billion in deposits throughout the Washington D.C. and Baltimore metropolitan markets OLBK has $64 million in average deposits per financial center Strategic Rationale Financially Compelling Expected to be 4.3% accretive to 2020 EPS(2) & 6.2% accretive to 2021 EPS(2) Tangible book value (“TBV”) dilution of 3.8% at closing TBV earn-back estimated to be approximately 3.3 years(3), including all merger-related expenses, purchase accounting adjustments, and cost savings Internal rate of return greater than 20% Pro-forma capital ratios remain substantially in excess of “well-capitalized” guidelines – even with Tier 1 TruPS moving to Tier 2 Source: S&P Global Market Intelligence, deposit market share data as of June 30, 2018; does not include deposits from closed branches and excludes E*TRADE Financial Corp. from Washington D.C. MSA Excludes merger-related charges; assumes 75% cost savings phase-in 2020 and 100% phase-in thereafter Based on the crossover method, defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share

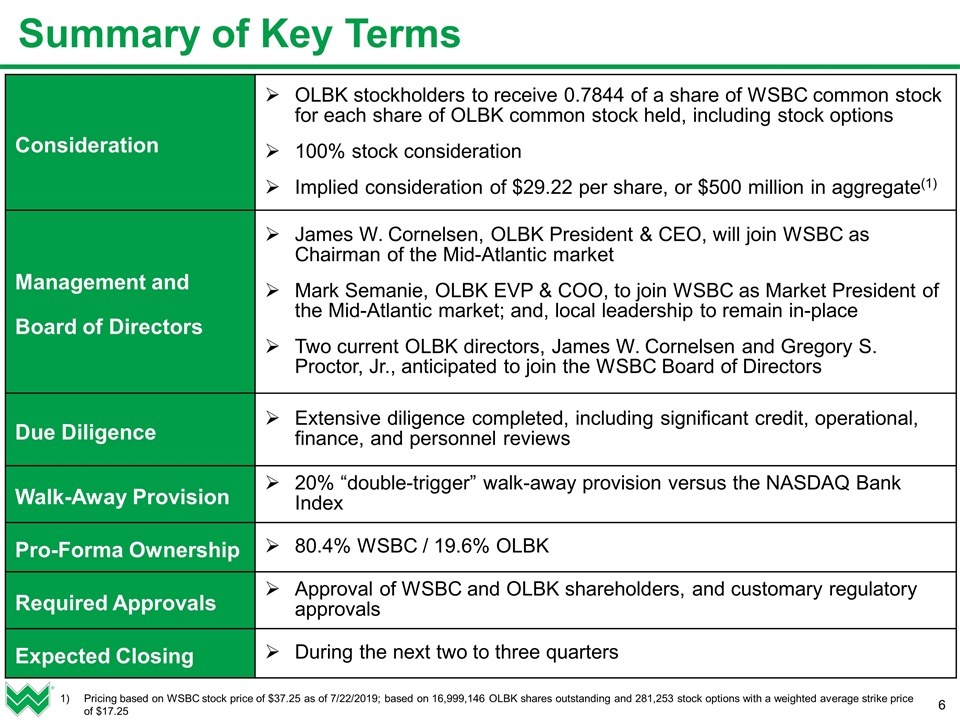

Summary of Key Terms Consideration OLBK stockholders to receive 0.7844 of a share of WSBC common stock for each share of OLBK common stock held, including stock options 100% stock consideration Implied consideration of $29.22 per share, or $500 million in aggregate(1) Management and Board of Directors James W. Cornelsen, OLBK President & CEO, will join WSBC as Chairman of the Mid-Atlantic market Mark Semanie, OLBK EVP & COO, to join WSBC as Market President of the Mid-Atlantic market; and, local leadership to remain in-place Two current OLBK directors, James W. Cornelsen and Gregory S. Proctor, Jr., anticipated to join the WSBC Board of Directors Due Diligence Extensive diligence completed, including significant credit, operational, finance, and personnel reviews Walk-Away Provision 20% “double-trigger” walk-away provision versus the NASDAQ Bank Index Pro-Forma Ownership 80.4% WSBC / 19.6% OLBK Required Approvals Approval of WSBC and OLBK shareholders, and customary regulatory approvals Expected Closing During the next two to three quarters Pricing based on WSBC stock price of $37.25 as of 7/22/2019; based on 16,999,146 OLBK shares outstanding and 281,253 stock options with a weighted average strike price of $17.25

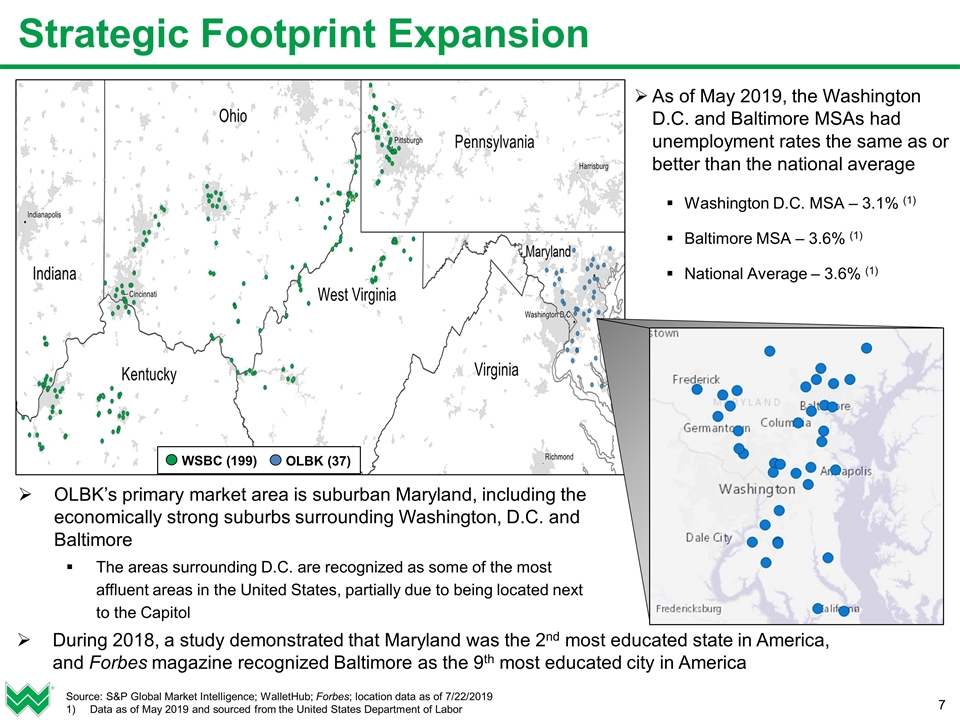

Strategic Footprint Expansion Source: S&P Global Market Intelligence; WalletHub; Forbes; location data as of 7/22/2019 Data as of May 2019 and sourced from the United States Department of Labor WSBC (199) OLBK (37) As of May 2019, the Washington D.C. and Baltimore MSAs had unemployment rates the same as or better than the national average Washington D.C. MSA – 3.1% (1) Baltimore MSA – 3.6% (1) National Average – 3.6% (1) OLBK’s primary market area is suburban Maryland, including the economically strong suburbs surrounding Washington, D.C. and Baltimore The areas surrounding D.C. are recognized as some of the most affluent areas in the United States, partially due to being located next to the Capitol During 2018, a study demonstrated that Maryland was the 2nd most educated state in America, and Forbes magazine recognized Baltimore as the 9th most educated city in America

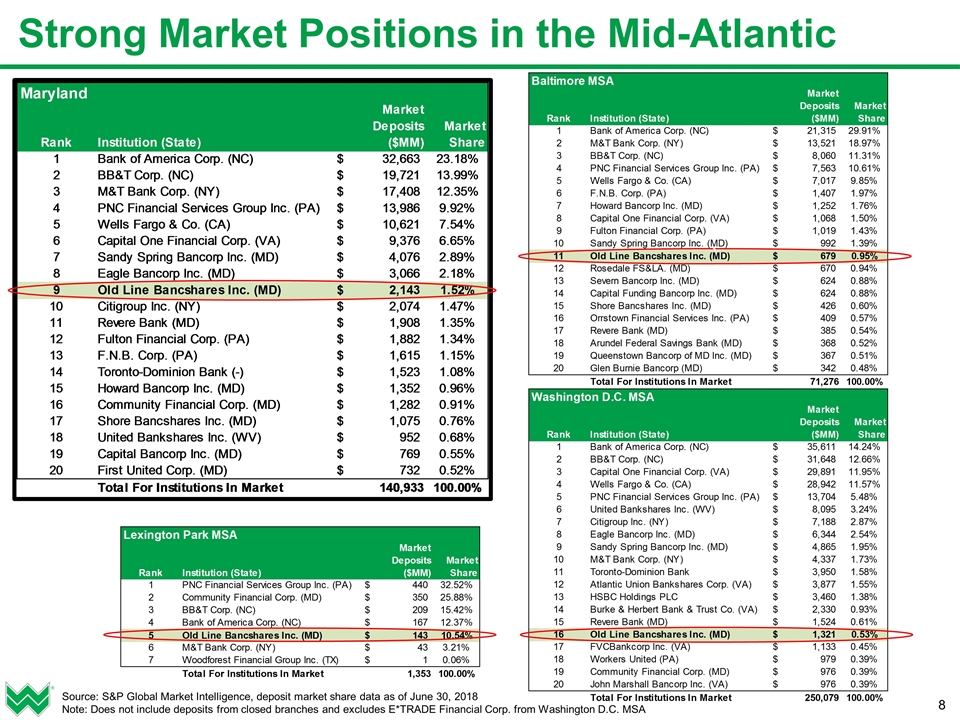

Strong Market Positions in the Mid-Atlantic Source: S&P Global Market Intelligence, deposit market share data as of June 30, 2018 Note: Does not include deposits from closed branches and excludes E*TRADE Financial Corp. from Washington D.C. MSA `

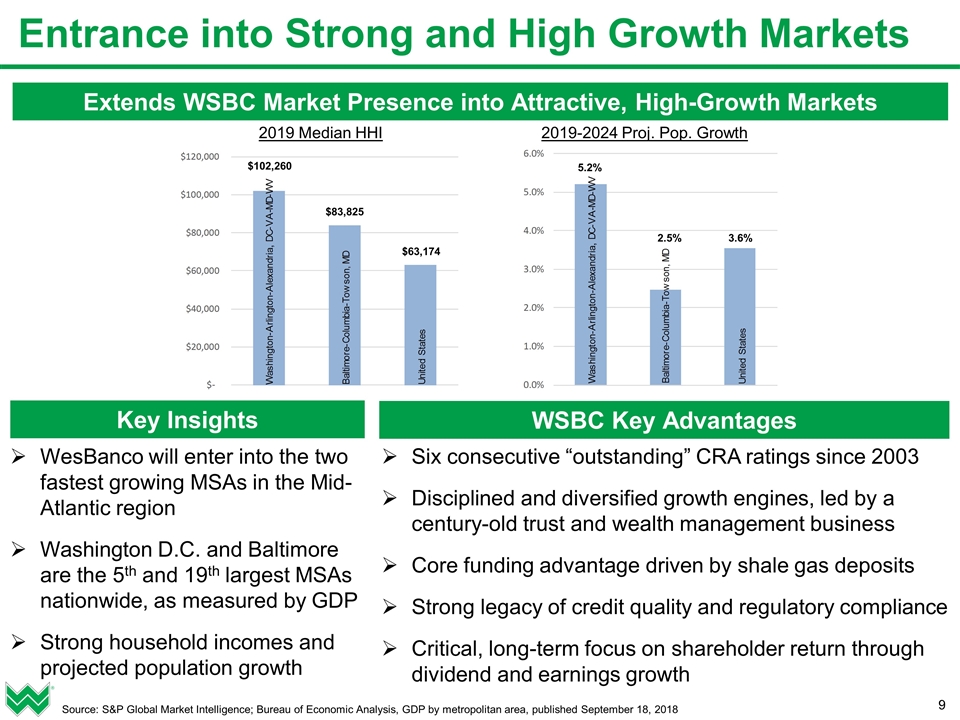

Entrance into Strong and High Growth Markets Extends WSBC Market Presence into Attractive, High-Growth Markets Source: S&P Global Market Intelligence; Bureau of Economic Analysis, GDP by metropolitan area, published September 18, 2018 WesBanco will enter into the two fastest growing MSAs in the Mid-Atlantic region Washington D.C. and Baltimore are the 5th and 19th largest MSAs nationwide, as measured by GDP Strong household incomes and projected population growth 2019 Median HHI 2019-2024 Proj. Pop. Growth Key Insights WSBC Key Advantages $102,260 $83,825 $63,174 5.2% 2.5% 3.6% Six consecutive “outstanding” CRA ratings since 2003 Disciplined and diversified growth engines, led by a century-old trust and wealth management business Core funding advantage driven by shale gas deposits Strong legacy of credit quality and regulatory compliance Critical, long-term focus on shareholder return through dividend and earnings growth

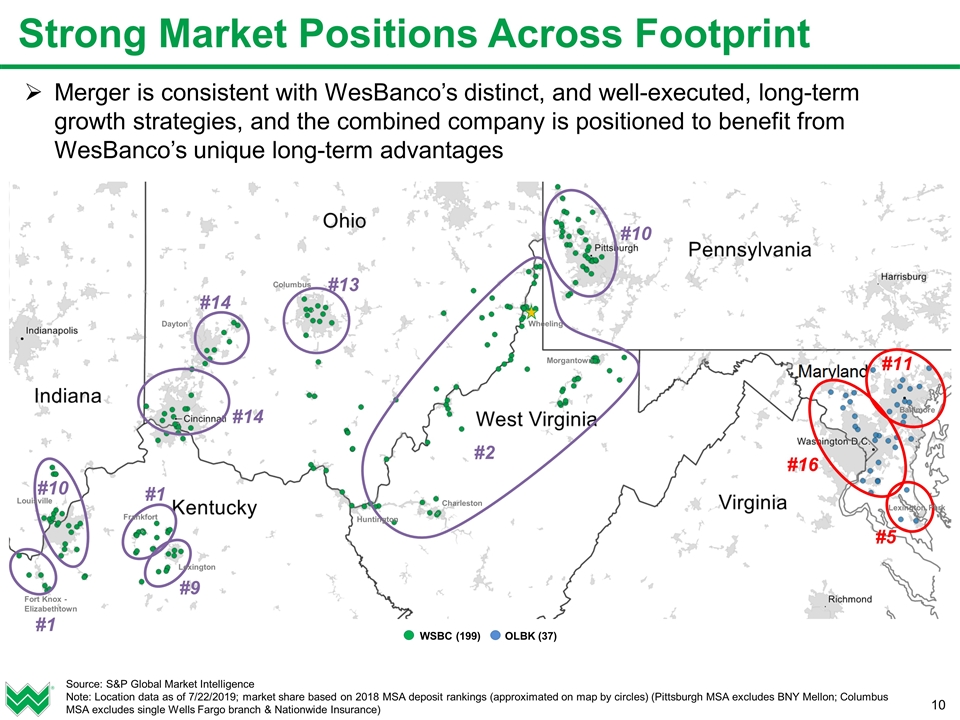

Strong Market Positions Across Footprint Source: S&P Global Market Intelligence Note: Location data as of 7/22/2019; market share based on 2018 MSA deposit rankings (approximated on map by circles) (Pittsburgh MSA excludes BNY Mellon; Columbus MSA excludes single Wells Fargo branch & Nationwide Insurance) #9 Wheeling #1 WSBC (199) OLBK (37) #14 #13 #14 #1 #10 #10 #2 #11 #16 #5 Fort Knox - Elizabethtown Merger is consistent with WesBanco’s distinct, and well-executed, long-term growth strategies, and the combined company is positioned to benefit from WesBanco’s unique long-term advantages Louisville Lexington Frankfort Dayton Columbus Morgantown Charleston Huntington Baltimore Lexington Park

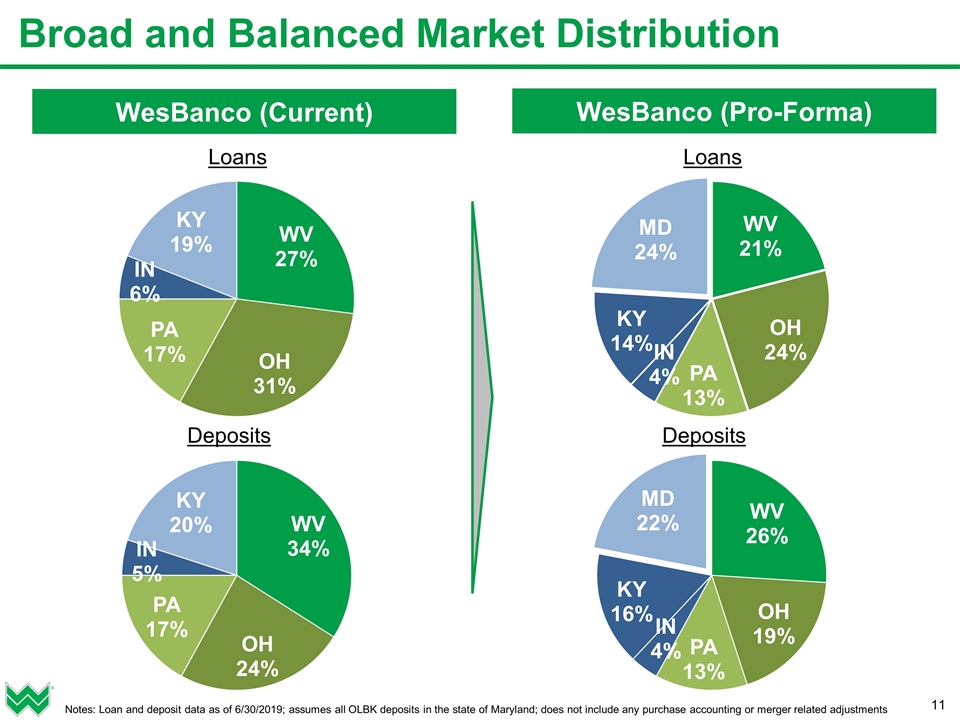

Broad and Balanced Market Distribution Notes: Loan and deposit data as of 6/30/2019; assumes all OLBK deposits in the state of Maryland; does not include any purchase accounting or merger related adjustments WesBanco (Current) WesBanco (Pro-Forma)

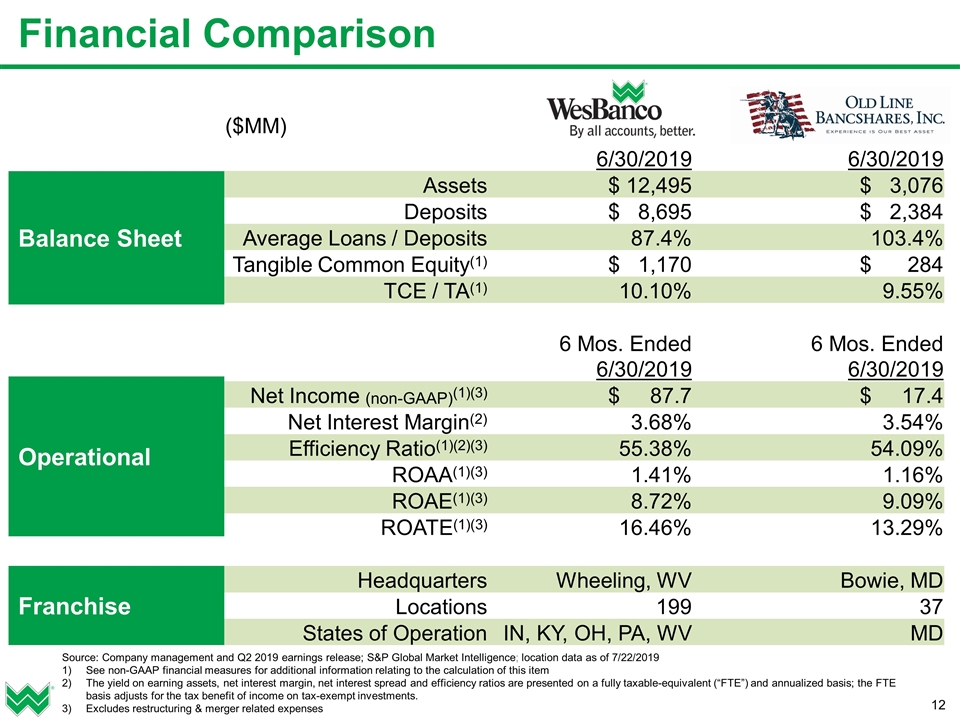

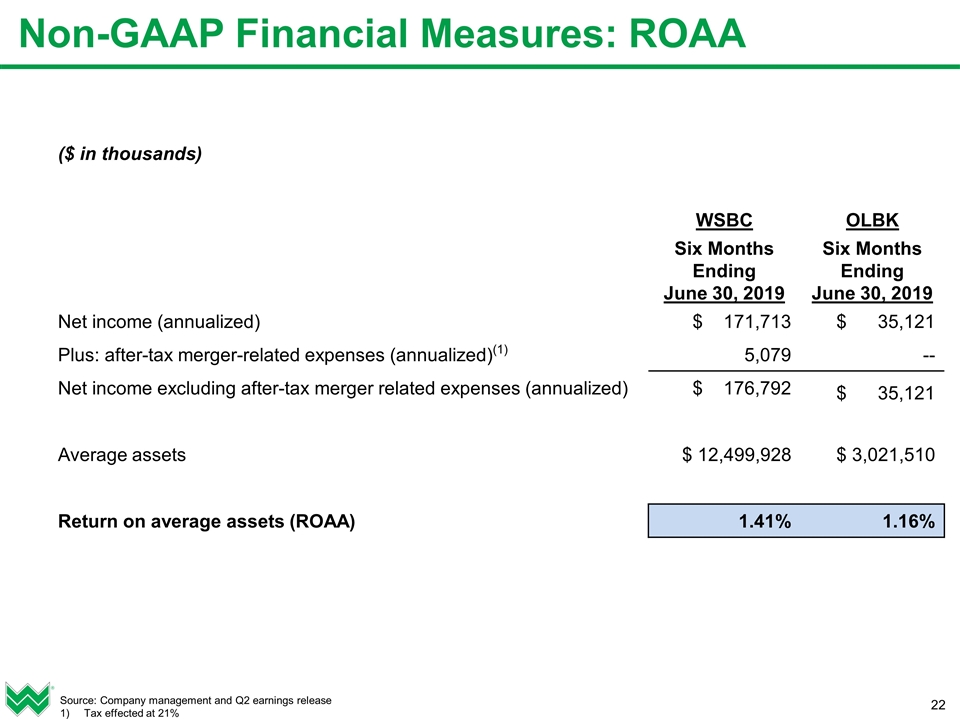

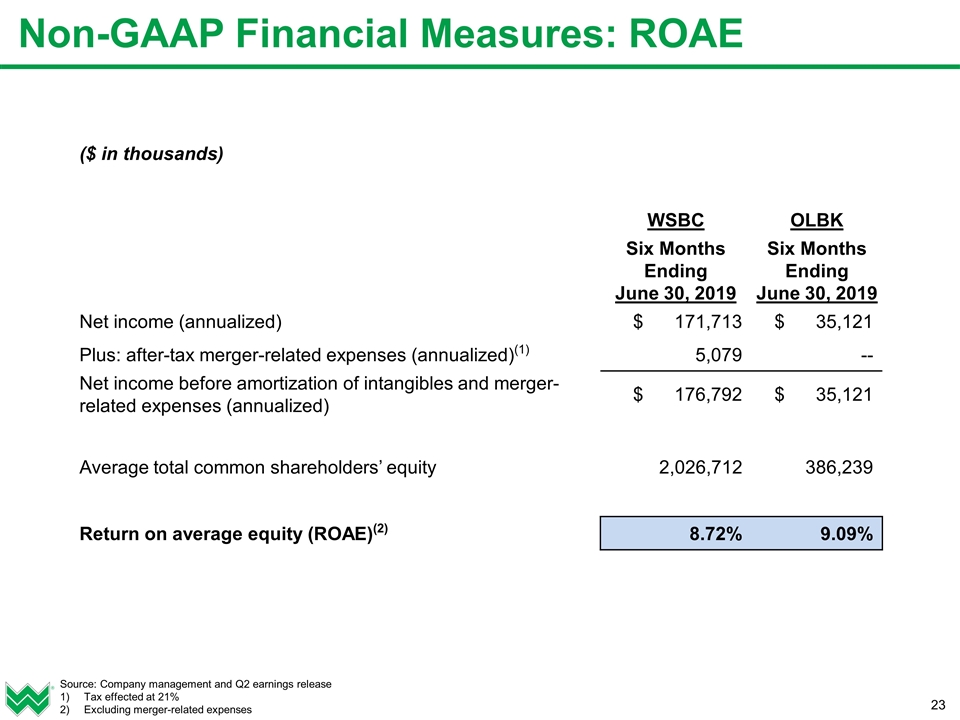

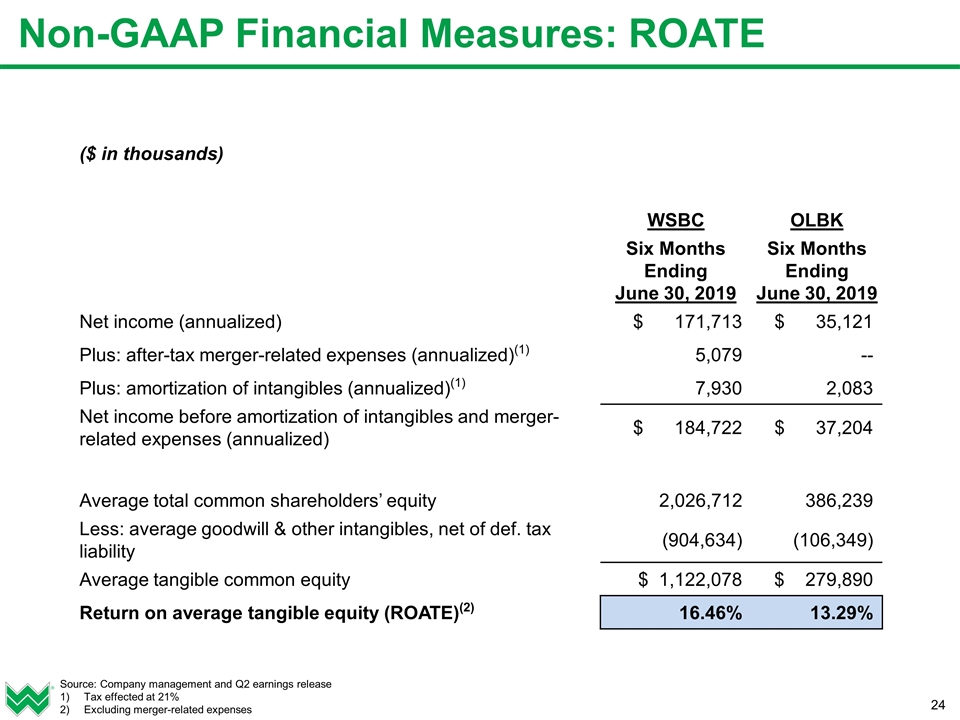

($MM) 6/30/2019 6/30/2019 Assets $ 12,495 $ 3,076 Deposits $ 8,695 $ 2,384 Average Loans / Deposits 87.4% 103.4% Tangible Common Equity(1) $ 1,170 $ 284 TCE / TA(1) 10.10% 9.55% 6 Mos. Ended 6/30/2019 6 Mos. Ended 6/30/2019 Net Income (non-GAAP)(1)(3) $ 87.7 $ 17.4 Net Interest Margin(2) 3.68% 3.54% Efficiency Ratio(1)(2)(3) 55.38% 54.09% ROAA(1)(3) 1.41% 1.16% ROAE(1)(3) 8.72% 9.09% ROATE(1)(3) 16.46% 13.29% Headquarters Wheeling, WV Bowie, MD Locations 199 37 States of Operation IN, KY, OH, PA, WV MD Financial Comparison Balance Sheet Operational Franchise Source: Company management and Q2 2019 earnings release; S&P Global Market Intelligence; location data as of 7/22/2019 See non-GAAP financial measures for additional information relating to the calculation of this item The yield on earning assets, net interest margin, net interest spread and efficiency ratios are presented on a fully taxable-equivalent (“FTE”) and annualized basis; the FTE basis adjusts for the tax benefit of income on tax-exempt investments. Excludes restructuring & merger related expenses

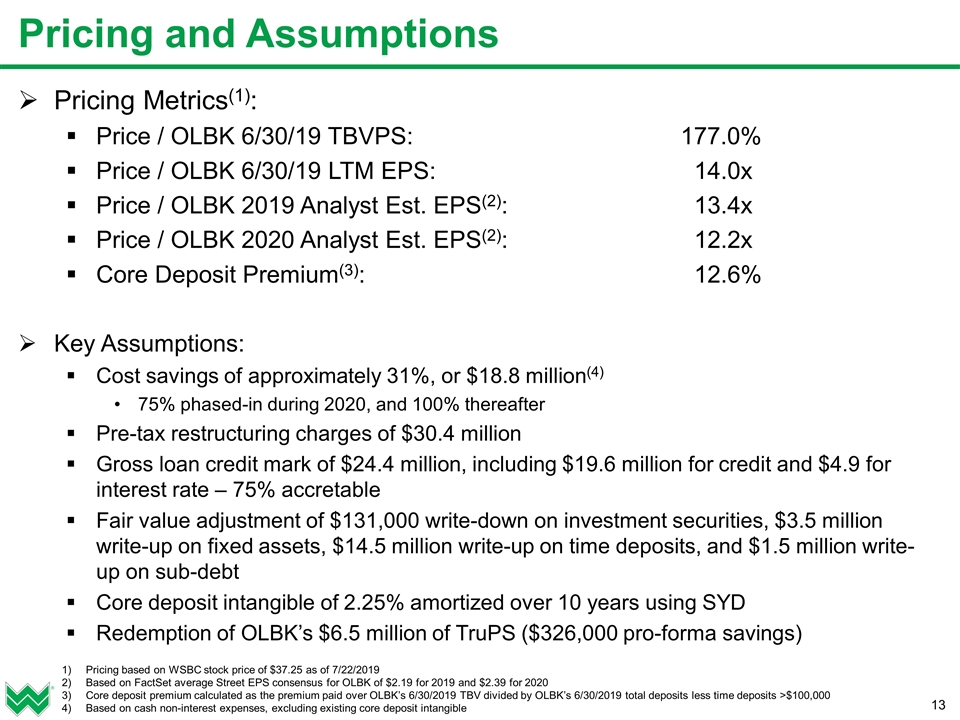

Pricing and Assumptions Pricing Metrics(1): Price / OLBK 6/30/19 TBVPS: 177.0% Price / OLBK 6/30/19 LTM EPS: 14.0x Price / OLBK 2019 Analyst Est. EPS(2): 13.4x Price / OLBK 2020 Analyst Est. EPS(2): 12.2x Core Deposit Premium(3): 12.6% Key Assumptions: Cost savings of approximately 31%, or $18.8 million(4) 75% phased-in during 2020, and 100% thereafter Pre-tax restructuring charges of $30.4 million Gross loan credit mark of $24.4 million, including $19.6 million for credit and $4.9 for interest rate – 75% accretable Fair value adjustment of $131,000 write-down on investment securities, $3.5 million write-up on fixed assets, $14.5 million write-up on time deposits, and $1.5 million write-up on sub-debt Core deposit intangible of 2.25% amortized over 10 years using SYD Redemption of OLBK’s $6.5 million of TruPS ($326,000 pro-forma savings) Pricing based on WSBC stock price of $37.25 as of 7/22/2019 Based on FactSet average Street EPS consensus for OLBK of $2.19 for 2019 and $2.39 for 2020 Core deposit premium calculated as the premium paid over OLBK’s 6/30/2019 TBV divided by OLBK’s 6/30/2019 total deposits less time deposits >$100,000 Based on cash non-interest expenses, excluding existing core deposit intangible

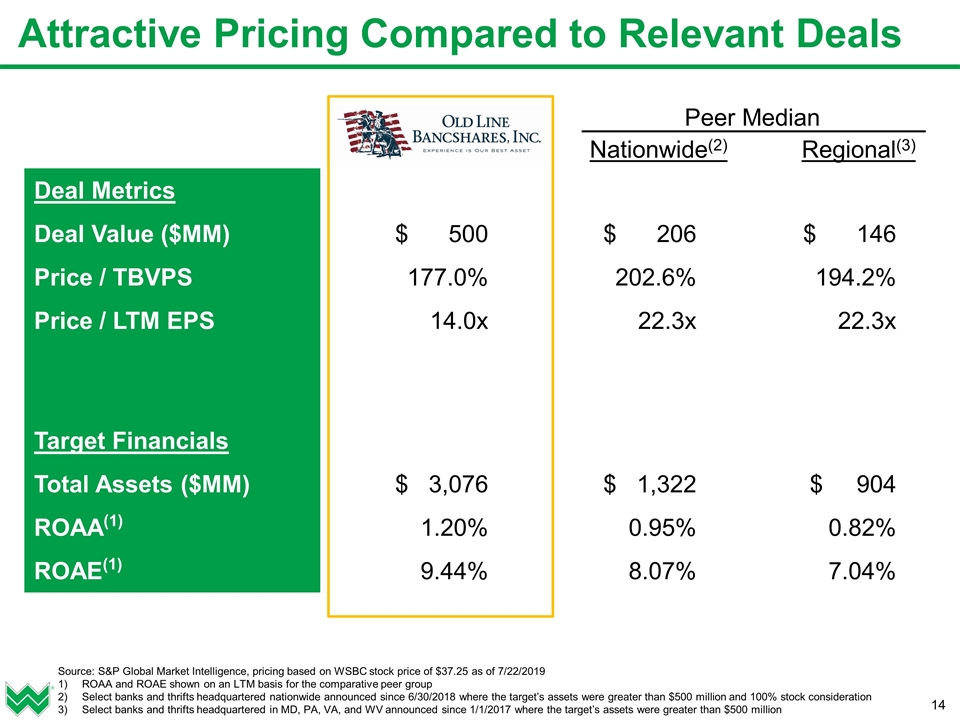

Attractive Pricing Compared to Relevant Deals Deal Metrics Deal Value ($MM) $ 500 $ 206 $ 146 Price / TBVPS 177.0% 202.6% 194.2% Price / LTM EPS 14.0x 22.3x 22.3x Target Financials Total Assets ($MM) $ 3,076 $ 1,322 $ 904 ROAA(1) 1.20% 0.95% 0.82% ROAE(1) 9.44% 8.07% 7.04% Peer Median Source: S&P Global Market Intelligence, pricing based on WSBC stock price of $37.25 as of 7/22/2019 ROAA and ROAE shown on an LTM basis for the comparative peer group Select banks and thrifts headquartered nationwide announced since 6/30/2018 where the target’s assets were greater than $500 million and 100% stock consideration Select banks and thrifts headquartered in MD, PA, VA, and WV announced since 1/1/2017 where the target’s assets were greater than $500 million Regional(3) Nationwide(2)

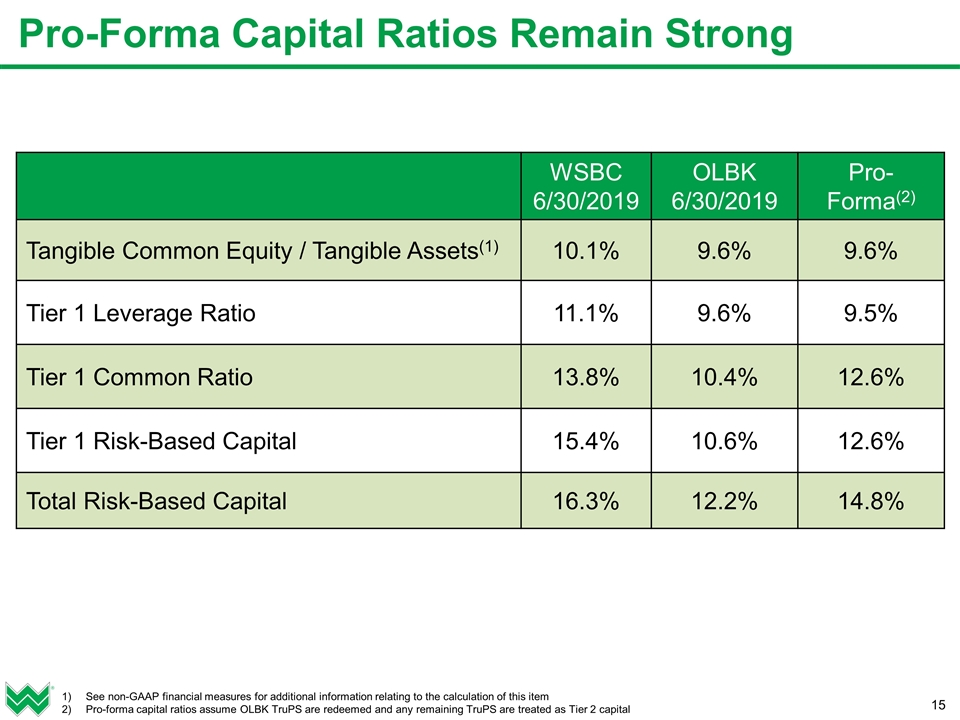

Pro-Forma Capital Ratios Remain Strong WSBC 6/30/2019 OLBK 6/30/2019 Pro- Forma(2) Tangible Common Equity / Tangible Assets(1) 10.1% 9.6% 9.6% Tier 1 Leverage Ratio 11.1% 9.6% 9.5% Tier 1 Common Ratio 13.8% 10.4% 12.6% Tier 1 Risk-Based Capital 15.4% 10.6% 12.6% Total Risk-Based Capital 16.3% 12.2% 14.8% See non-GAAP financial measures for additional information relating to the calculation of this item Pro-forma capital ratios assume OLBK TruPS are redeemed and any remaining TruPS are treated as Tier 2 capital

Summary WesBanco enters two major Mid-Atlantic markets with strong positions, supported by unique long-term advantages and distinct long-term strategies Old Line Bank is one of the region’s leading community banks combined with excellent credit quality and strong management and lending teams; and, provides the opportunity for WesBanco to leverage its superior funding into attractive, high-growth markets Capacity in the market for a strong and disciplined emerging regional financial institution with a community bank service culture, as demonstrated by WesBanco recently being named the #7 Best Bank in America by Forbes magazine Disciplined acquisition with compelling financial metrics – pro-forma company remains well-capitalized with strong growth opportunities for fee-based businesses Pro-forma balance sheet approximately $16 billion in total assets provides enhanced scale to help cover the costs associated with the Durbin amendment Long history of successful integrations, led by a seasoned management team, and being a thoughtful and strategic acquirer WesBanco – well-positioned for continued, high-quality growth

Appendix

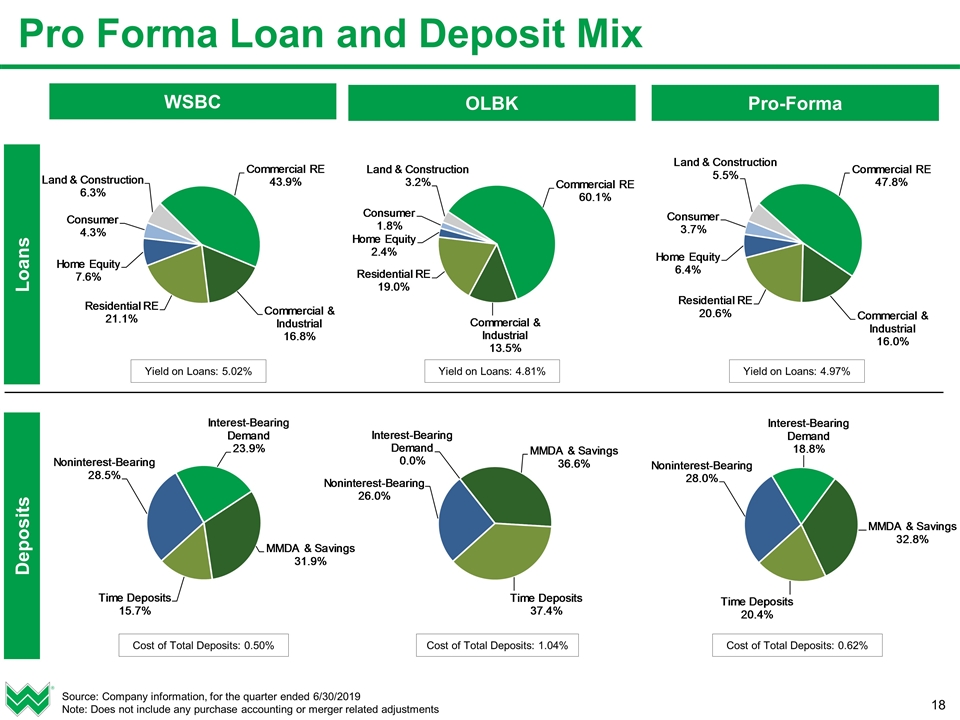

Pro Forma Loan and Deposit Mix WSBC Pro-Forma OLBK Loans Deposits Cost of Total Deposits: 0.50% Cost of Total Deposits: 1.04% Cost of Total Deposits: 0.62% Yield on Loans: 5.02% Yield on Loans: 4.81% Yield on Loans: 4.97% Source: Company information, for the quarter ended 6/30/2019 Note: Does not include any purchase accounting or merger related adjustments

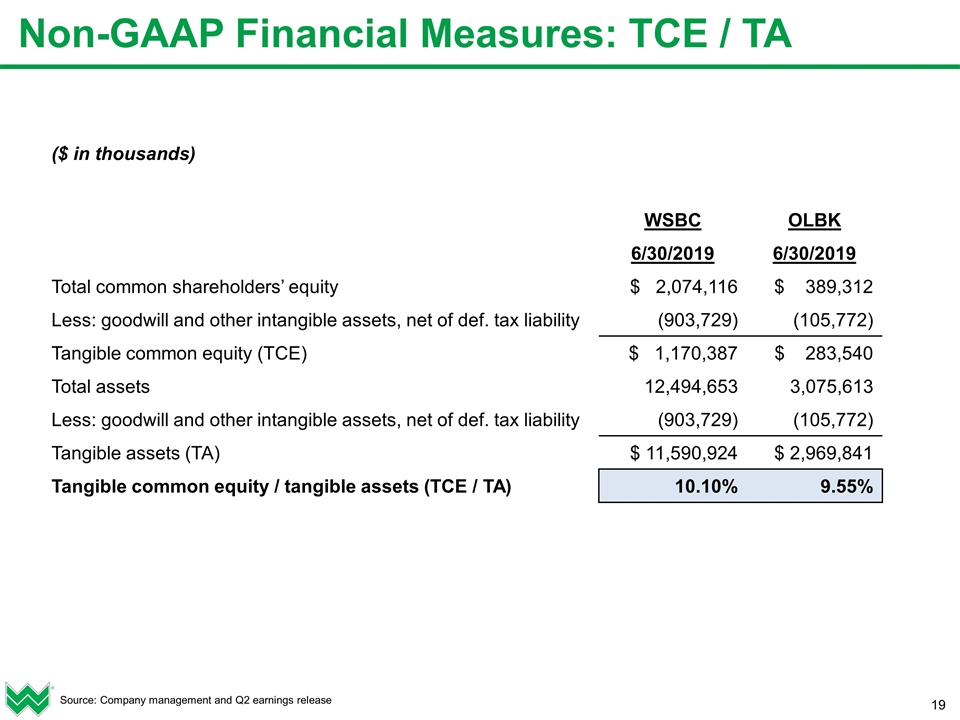

Non-GAAP Financial Measures: TCE / TA Source: Company management and Q2 earnings release ($ in thousands) WSBC OLBK 6/30/2019 6/30/2019 Total common shareholders’ equity $ 2,074,116 $ 389,312 Less: goodwill and other intangible assets, net of def. tax liability (903,729) (105,772) Tangible common equity (TCE) $ 1,170,387 $ 283,540 Total assets 12,494,653 3,075,613 Less: goodwill and other intangible assets, net of def. tax liability (903,729) (105,772) Tangible assets (TA) $ 11,590,924 $ 2,969,841 Tangible common equity / tangible assets (TCE / TA) 10.10% 9.55%

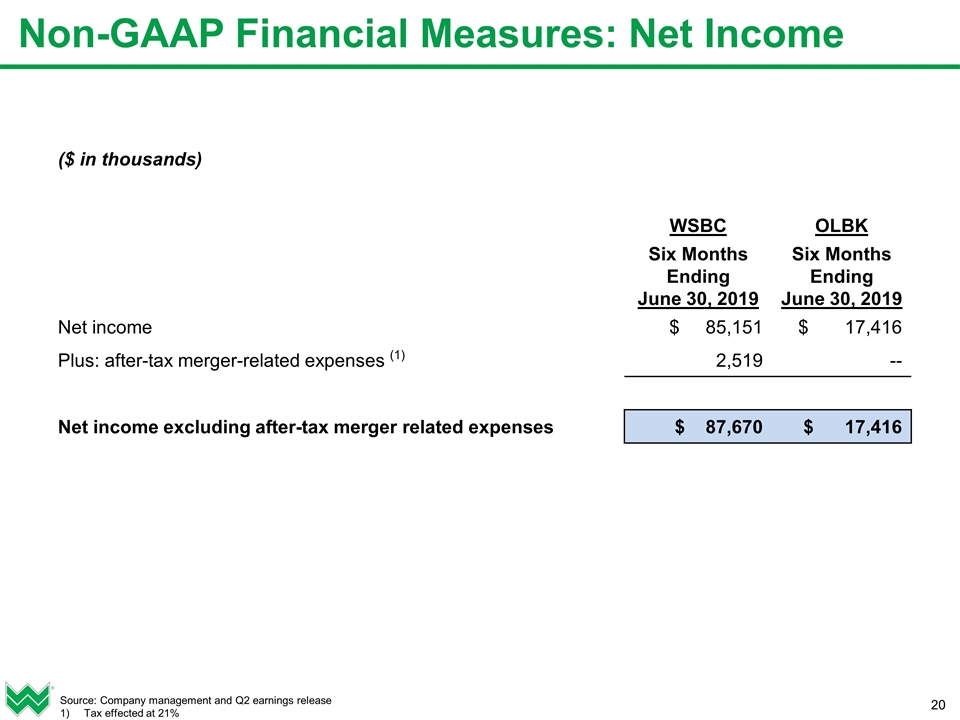

Non-GAAP Financial Measures: Net Income Source: Company management and Q2 earnings release Tax effected at 21% ($ in thousands) WSBC OLBK Six Months Ending June 30, 2019 Six Months Ending June 30, 2019 Net income $ 85,151 $ 17,416 Plus: after-tax merger-related expenses (1) 2,519 -- Net income excluding after-tax merger related expenses $ 87,670 $ 17,416

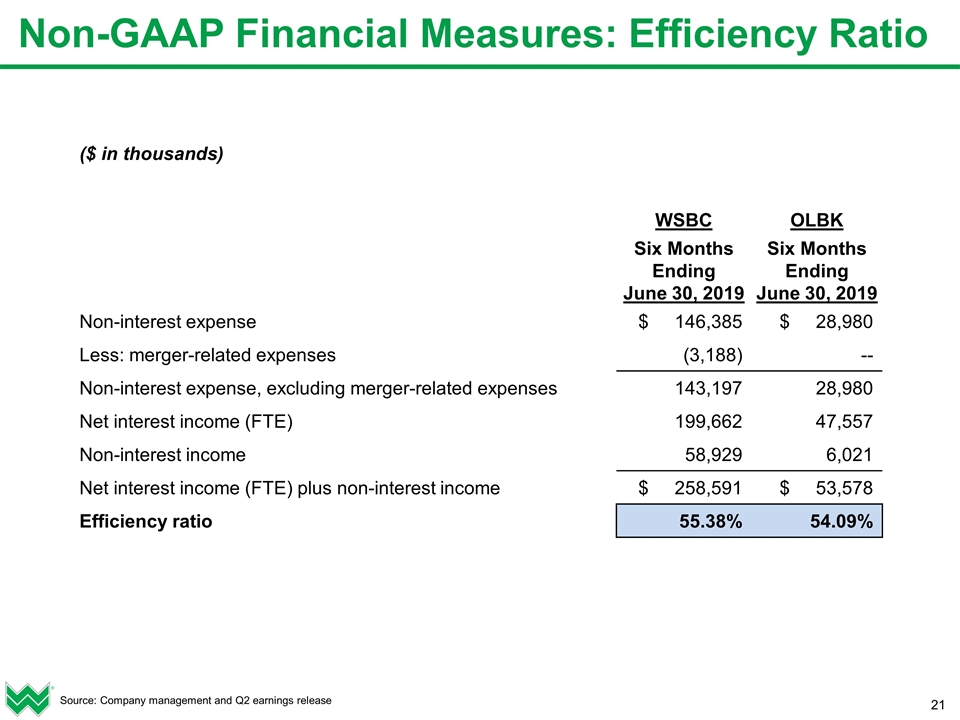

Non-GAAP Financial Measures: Efficiency Ratio Source: Company management and Q2 earnings release ($ in thousands) WSBC OLBK Six Months Ending June 30, 2019 Six Months Ending June 30, 2019 Non-interest expense $ 146,385 $ 28,980 Less: merger-related expenses (3,188) -- Non-interest expense, excluding merger-related expenses 143,197 28,980 Net interest income (FTE) 199,662 47,557 Non-interest income 58,929 6,021 Net interest income (FTE) plus non-interest income $ 258,591 $ 53,578 Efficiency ratio 55.38% 54.09%

Non-GAAP Financial Measures: ROAA Source: Company management and Q2 earnings release Tax effected at 21% ($ in thousands) WSBC OLBK Six Months Ending June 30, 2019 Six Months Ending June 30, 2019 Net income (annualized) $ 171,713 $ 35,121 Plus: after-tax merger-related expenses (annualized)(1) 5,079 -- Net income excluding after-tax merger related expenses (annualized) $ 176,792 $ 35,121 Average assets $ 12,499,928 $ 3,021,510 Return on average assets (ROAA) 1.41% 1.16%

Non-GAAP Financial Measures: ROAE Source: Company management and Q2 earnings release Tax effected at 21% Excluding merger-related expenses ($ in thousands) WSBC OLBK Six Months Ending June 30, 2019 Six Months Ending June 30, 2019 Net income (annualized) $ 171,713 $ 35,121 Plus: after-tax merger-related expenses (annualized)(1) 5,079 -- Net income before amortization of intangibles and merger-related expenses (annualized) $ 176,792 $ 35,121 Average total common shareholders’ equity 2,026,712 386,239 Return on average equity (ROAE)(2) 8.72% 9.09%

Non-GAAP Financial Measures: ROATE Source: Company management and Q2 earnings release Tax effected at 21% Excluding merger-related expenses ($ in thousands) WSBC OLBK Six Months Ending June 30, 2019 Six Months Ending June 30, 2019 Net income (annualized) $ 171,713 $ 35,121 Plus: after-tax merger-related expenses (annualized)(1) 5,079 -- Plus: amortization of intangibles (annualized)(1) 7,930 2,083 Net income before amortization of intangibles and merger-related expenses (annualized) $ 184,722 $ 37,204 Average total common shareholders’ equity 2,026,712 386,239 Less: average goodwill & other intangibles, net of def. tax liability (904,634) (106,349) Average tangible common equity $ 1,122,078 $ 279,890 Return on average tangible equity (ROATE)(2) 16.46% 13.29%