Acquisition of Premier Financial Corp. July 2024 Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, predictions, protections, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements are typically, but not exclusively, identified by the use of forward-looking terminology such as “believes,” “expects,” “anticipate,” “intend,” “potential,” “could,” “may,” “will, “should,” “seeks,” “likely,” “intends” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. The statements in this presentation that are not historical facts, in particular the statements with respect to the expected timing of and benefits of the proposed merger between WesBanco, Inc. (“WSBC” or “WesBanco”) and Premier Financial Corp. ("PFC“ or “Premier”), the parties’ plans, obligations, expectations, and intentions, and the statements with respect to accretion, earn back of tangible book value, tangible book value dilution and internal rate of return, constitute forward-looking statements as defined by federal securities laws. Such statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those contained or implied by such statements for a variety of factors including: the businesses of WesBanco and Premier may not be integrated successfully or such integration may take longer to accomplish than expected; the expected cost savings and any revenue synergies from the proposed merger may not be fully realized within the expected timeframes; disruption from the proposed merger may make it more difficult to maintain relationships with clients, associates, or suppliers; the required governmental approvals of the proposed merger may not be obtained on the expected terms and schedule; Premier’s stockholders and/or WesBanco’s shareholders may not approve the proposed merger and the merger agreement and issuance of shares of WesBanco common stock in the proposed merger, respectively; changes in economic conditions; movements in interest rates; competitive pressures on product pricing and services; success and timing of other business strategies; the nature, extent, and timing of governmental actions and reforms; extended disruption of vital infrastructure; and other factors described in WesBanco’s 2023 Annual Report on Form 10-K, Premier’s 2023 Annual Report on Form 10-K, and documents subsequently filed by WesBanco and Premier with the Securities and Exchange Commission. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Use of Non-GAAP Financial Measures. This presentation contains certain pro forma and projected information, including projected pro forma information that reflects WesBanco's current expectations and assumptions. This pro forma information does not purport to present the results that WesBanco will ultimately realize. In addition to financial measures presented in material compliance with Generally Accepted Accounted Principles of the United States of America (“GAAP”), this presentation contains certain non-GAAP financial measures, including tangible common equity (“TCE”), tangible book value per share (“TBVPS”), and the return on average TCE (“ROATCE”). The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP. WesBanco’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations and WesBanco’s balance sheet, and enhance comparability of results of operations with prior periods. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP. Limitations associated with non-GAAP financial measures include the risks that persons might disagree as to the appropriateness of items included in these measures and that different companies might calculate these measures differently. Forward-Looking Statements

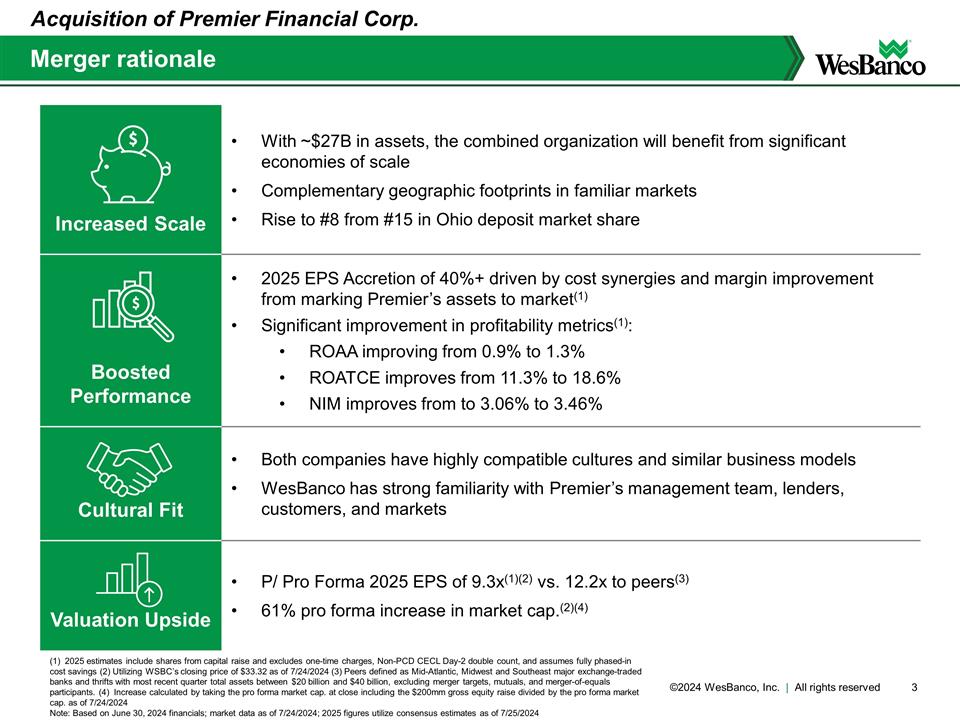

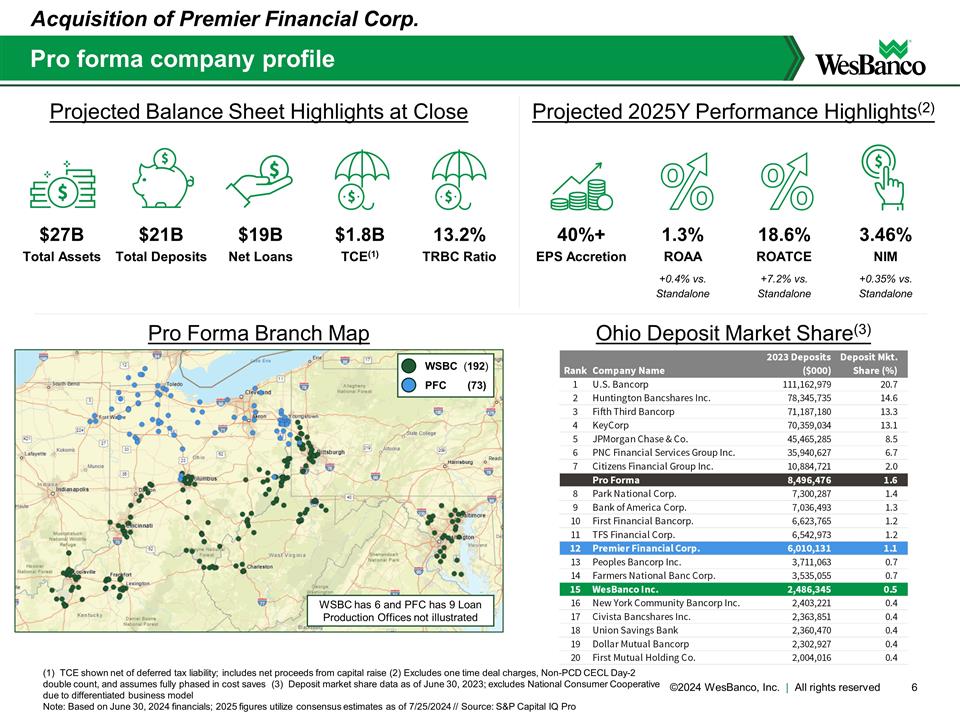

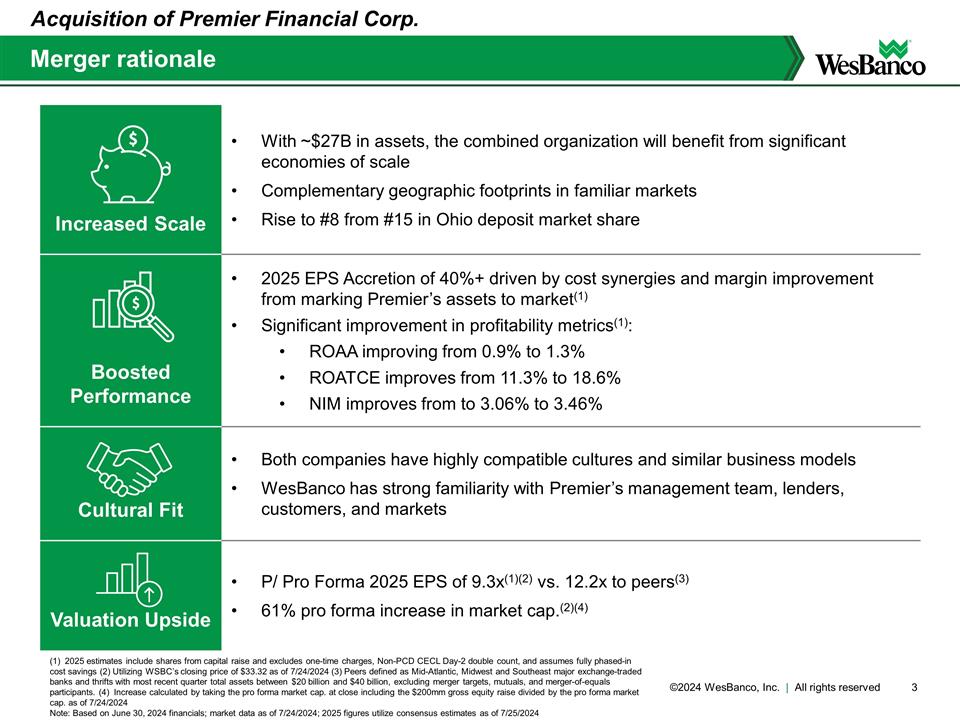

Increased Scale With ~$27B in assets, the combined organization will benefit from significant economies of scale Complementary geographic footprints in familiar markets Rise to #8 from #15 in Ohio deposit market share Boosted Performance 2025 EPS Accretion of 40%+ driven by cost synergies and margin improvement from marking Premier’s assets to market(1) Significant improvement in profitability metrics(1): ROAA improving from 0.9% to 1.3% ROATCE improves from 11.3% to 18.6% NIM improves from to 3.06% to 3.46% Cultural Fit Both companies have highly compatible cultures and similar business models WesBanco has strong familiarity with Premier’s management team, lenders, customers, and markets Valuation Upside P/ Pro Forma 2025 EPS of 9.3x(1)(2) vs. 12.2x to peers(3) 61% pro forma increase in market cap.(2)(4) Merger rationale Acquisition of Premier Financial Corp. (1) 2025 estimates include shares from capital raise and excludes one-time charges, Non-PCD CECL Day-2 double count, and assumes fully phased-in cost savings (2) Utilizing WSBC’s closing price of $33.32 as of 7/24/2024 (3) Peers defined as Mid-Atlantic, Midwest and Southeast major exchange-traded banks and thrifts with most recent quarter total assets between $20 billion and $40 billion, excluding merger targets, mutuals, and merger-of-equals participants. (4) Increase calculated by taking the pro forma market cap. at close including the $200mm gross equity raise divided by the pro forma market cap. as of 7/24/2024 Note: Based on June 30, 2024 financials; market data as of 7/24/2024; 2025 figures utilize consensus estimates as of 7/25/2024

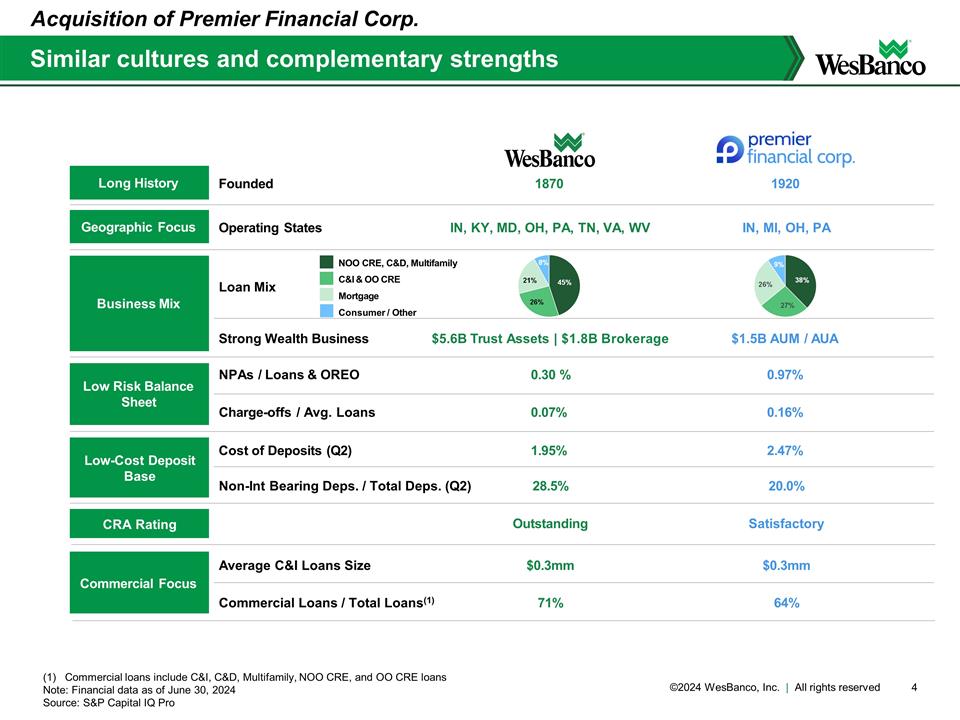

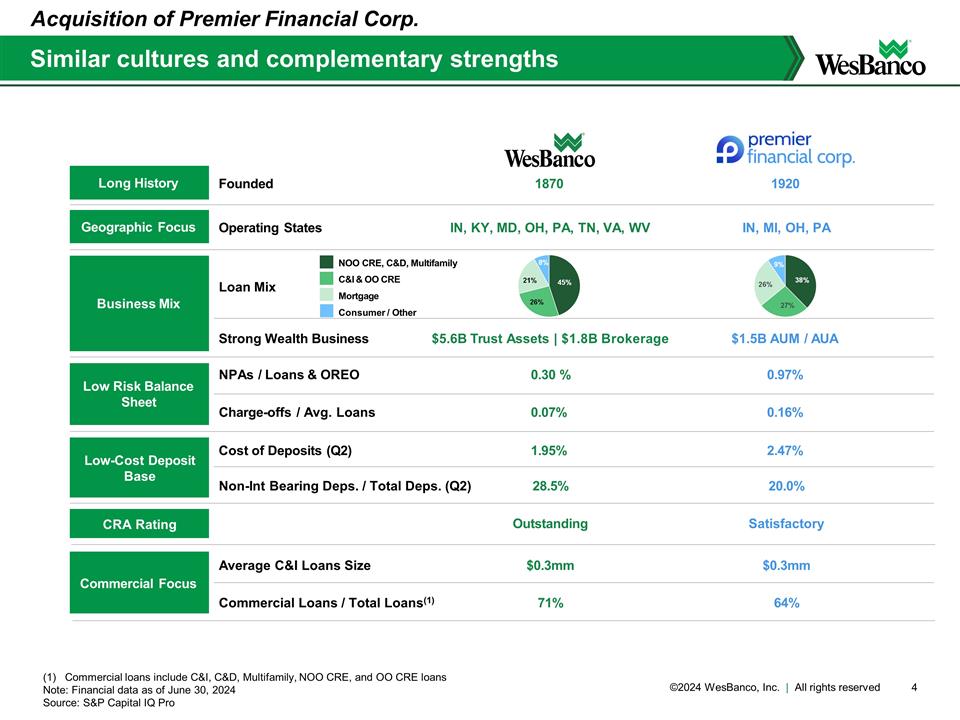

Similar cultures and complementary strengths Acquisition of Premier Financial Corp. (1) Commercial loans include C&I, C&D, Multifamily, NOO CRE, and OO CRE loans Note: Financial data as of June 30, 2024 Source: S&P Capital IQ Pro Long History Founded 1870 1920 Business Mix Loan Mix Strong Wealth Business $5.6B Trust Assets | $1.8B Brokerage $1.5B AUM / AUA Low Risk Balance Sheet NPAs / Loans & OREO Low-Cost Deposit Base Cost of Deposits (Q2) Non-Int Bearing Deps. / Total Deps. (Q2) Geographic Focus IN, KY, MD, OH, PA, TN, VA, WV IN, MI, OH, PA Operating States 1.95% 28.5% 2.47% 20.0% 0.30 % 0.97% Charge-offs / Avg. Loans 0.07% 0.16% CRA Rating Outstanding Satisfactory 64% Commercial Loans / Total Loans(1) 71% Commercial Focus NOO CRE, C&D, Multifamily C&I & OO CRE Mortgage Consumer / Other $0.3mm Average C&I Loans Size $0.3mm

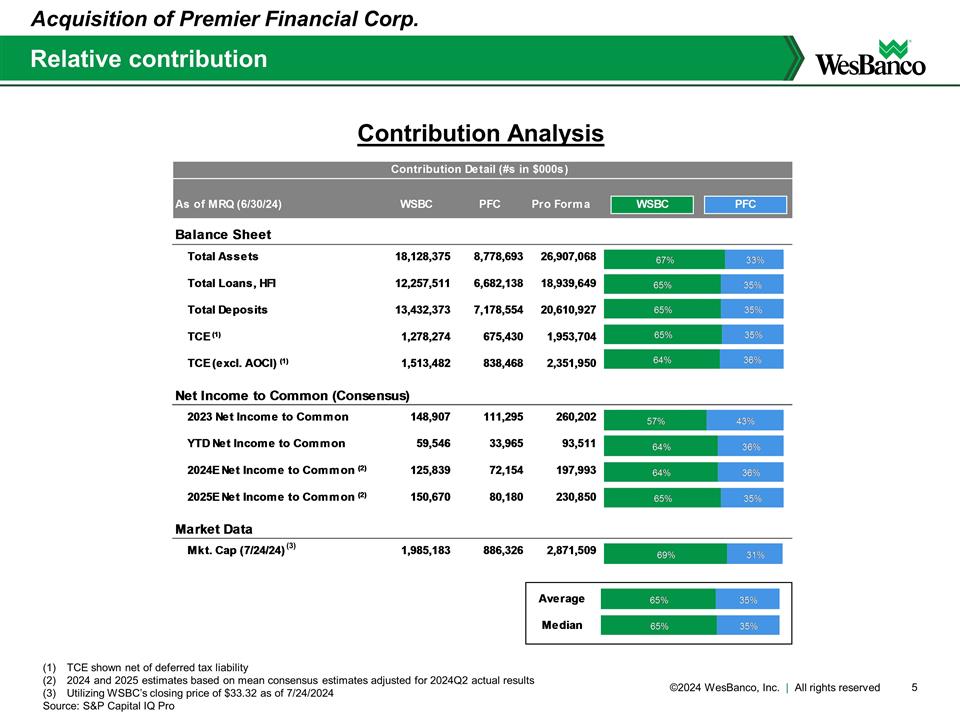

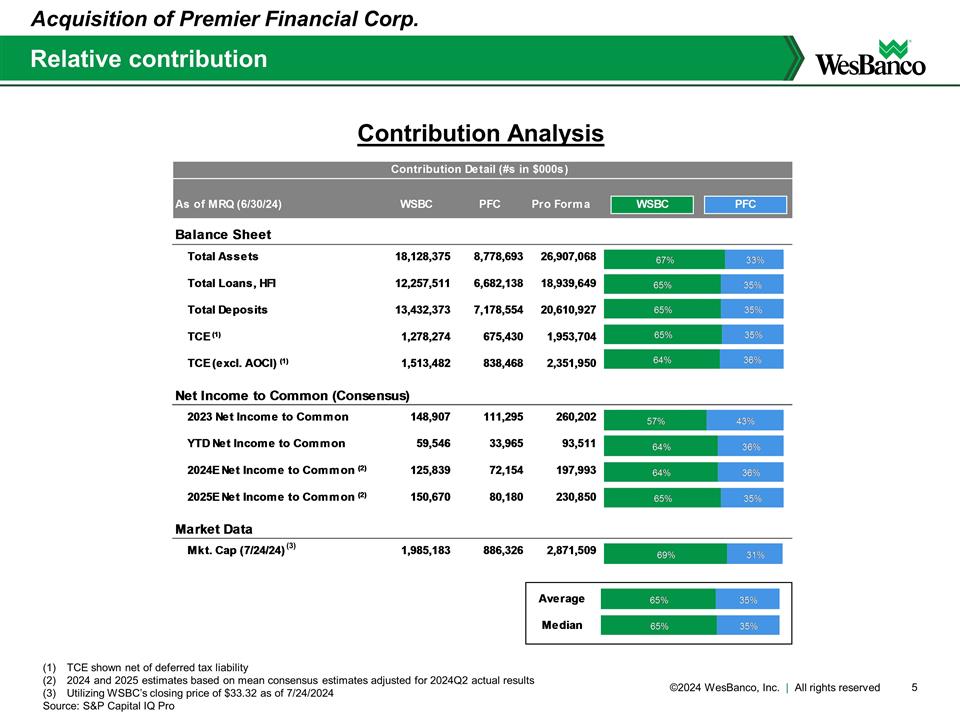

Relative contribution Acquisition of Premier Financial Corp. TCE shown net of deferred tax liability 2024 and 2025 estimates based on mean consensus estimates adjusted for 2024Q2 actual results Utilizing WSBC’s closing price of $33.32 as of 7/24/2024 Source: S&P Capital IQ Pro Contribution Analysis (3)

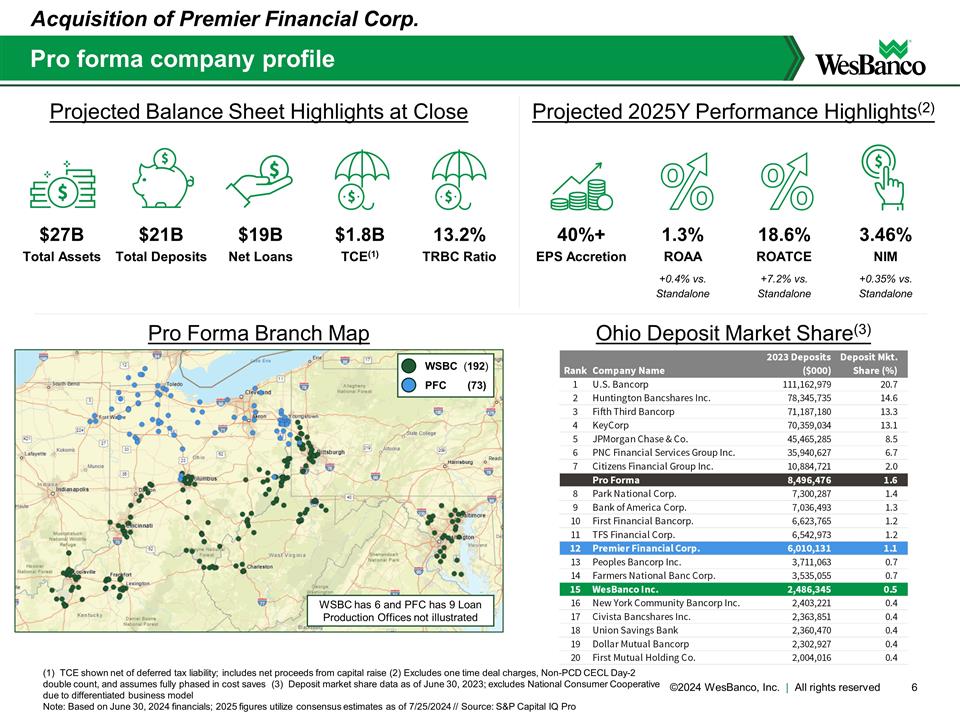

Pro forma company profile (1) TCE shown net of deferred tax liability; includes net proceeds from capital raise (2) Excludes one time deal charges, Non-PCD CECL Day-2 double count, and assumes fully phased in cost saves (3) Deposit market share data as of June 30, 2023; excludes National Consumer Cooperative due to differentiated business model Note: Based on June 30, 2024 financials; 2025 figures utilize consensus estimates as of 7/25/2024 // Source: S&P Capital IQ Pro Acquisition of Premier Financial Corp. #039547 #205933 Pro Forma Branch Map +0.4% vs. Standalone +7.2% vs. Standalone +0.35% vs. Standalone Projected Balance Sheet Highlights at Close Projected 2025Y Performance Highlights(2) $27B Total Assets $21B Total Deposits $19B Net Loans 13.2% TRBC Ratio 40%+ EPS Accretion 1.3% ROAA 18.6% ROATCE 3.46% NIM $1.8B TCE(1) Ohio Deposit Market Share(3) WSBC (192) PFC (73) WSBC has 6 and PFC has 9 Loan Production Offices not illustrated

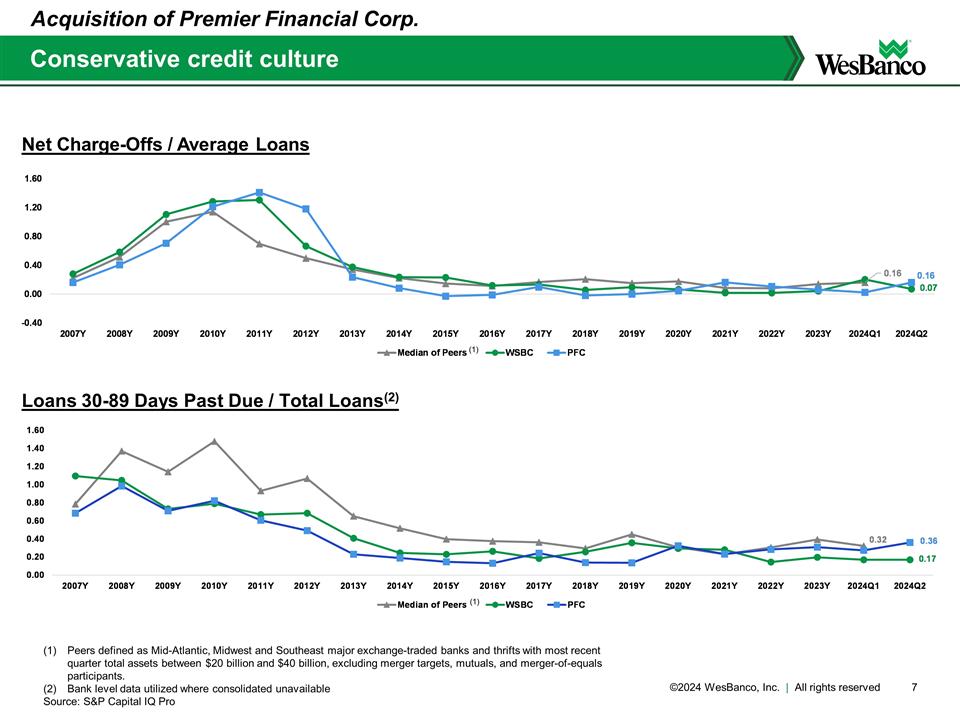

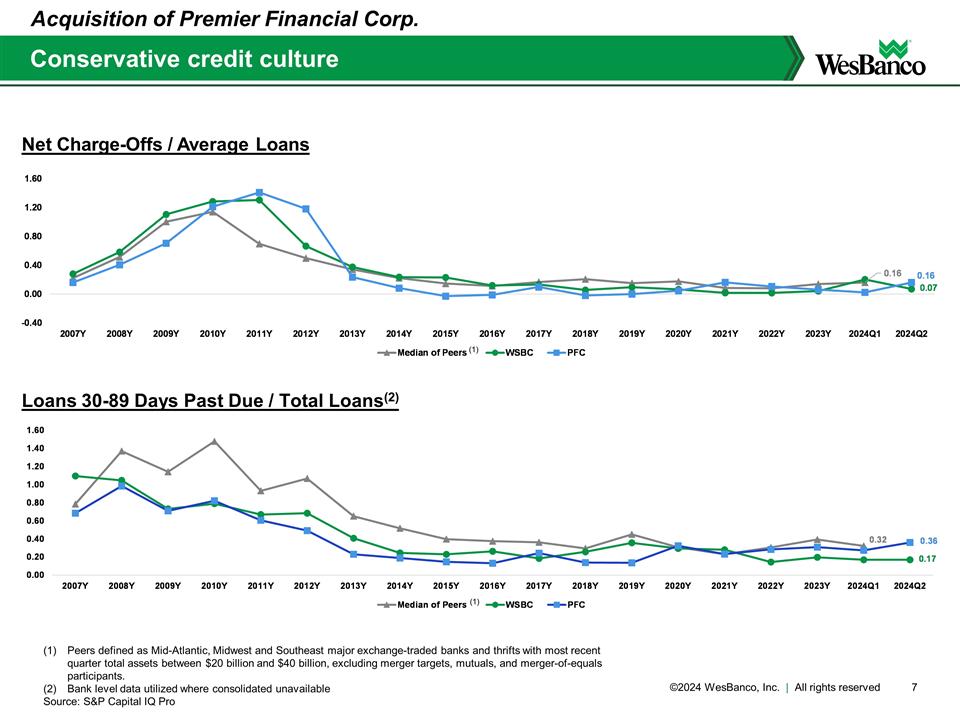

Conservative credit culture Acquisition of Premier Financial Corp. Peers defined as Mid-Atlantic, Midwest and Southeast major exchange-traded banks and thrifts with most recent quarter total assets between $20 billion and $40 billion, excluding merger targets, mutuals, and merger-of-equals participants. Bank level data utilized where consolidated unavailable Source: S&P Capital IQ Pro Net Charge-Offs / Average Loans Loans 30-89 Days Past Due / Total Loans(2) (1) (1)

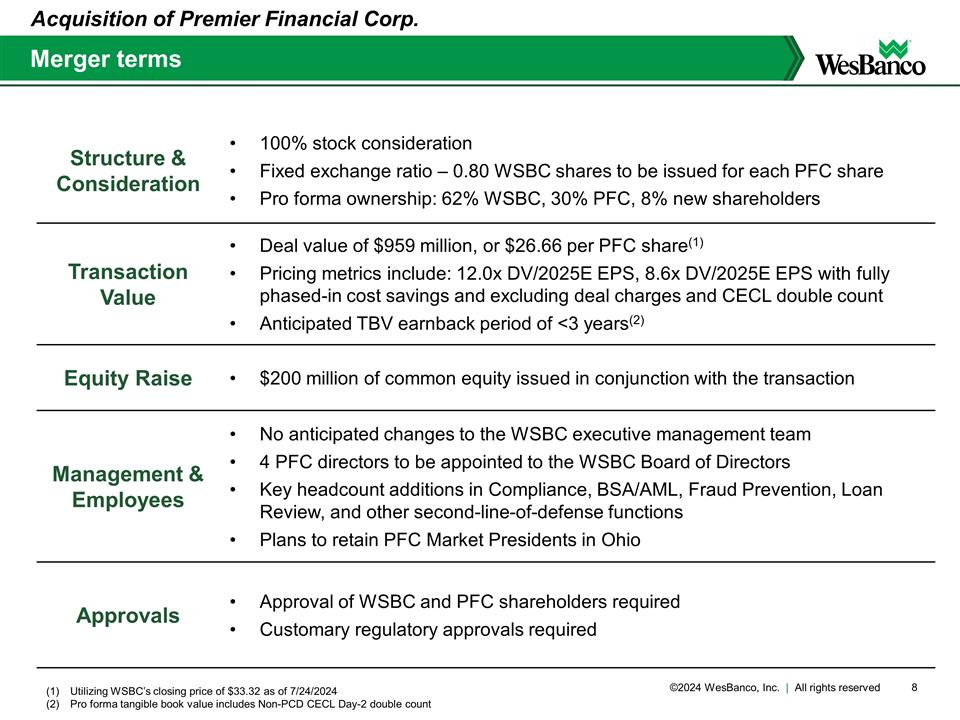

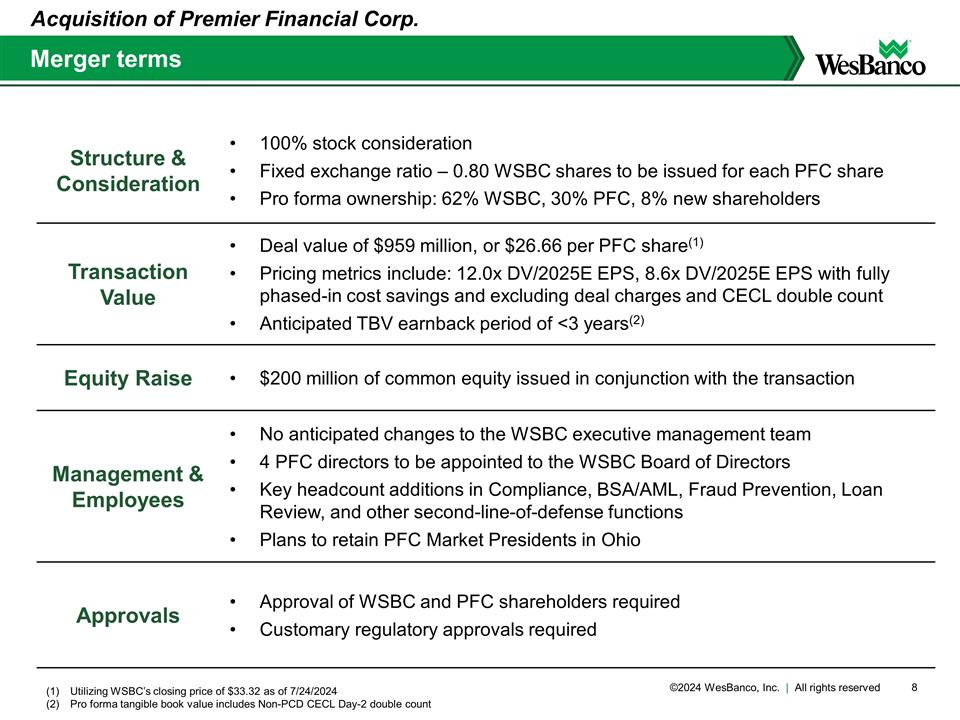

Structure & Consideration 100% stock consideration Fixed exchange ratio – 0.80 WSBC shares to be issued for each PFC share Pro forma ownership: 62% WSBC, 30% PFC, 8% new shareholders Transaction Value Deal value of $959 million, or $26.66 per PFC share(1) Pricing metrics include: 12.0x DV/2025E EPS, 8.6x DV/2025E EPS with fully phased-in cost savings and excluding deal charges and CECL double count Anticipated TBV earnback period of <3 years(2) Equity Raise $200 million of common equity issued in conjunction with the transaction Management & Employees No anticipated changes to the WSBC executive management team 4 PFC directors to be appointed to the WSBC Board of Directors Key headcount additions in Compliance, BSA/AML, Fraud Prevention, Loan Review, and other second-line-of-defense functions Plans to retain PFC Market Presidents in Ohio Approvals Approval of WSBC and PFC shareholders required Customary regulatory approvals required Merger terms Acquisition of Premier Financial Corp. Utilizing WSBC’s closing price of $33.32 as of 7/24/2024 Pro forma tangible book value includes Non-PCD CECL Day-2 double count

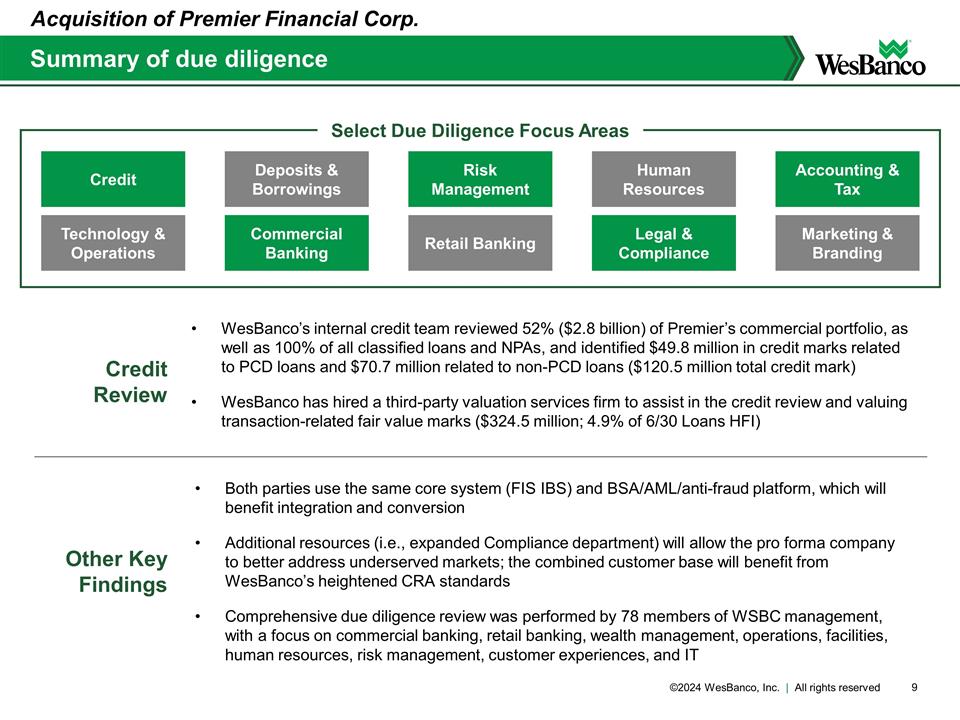

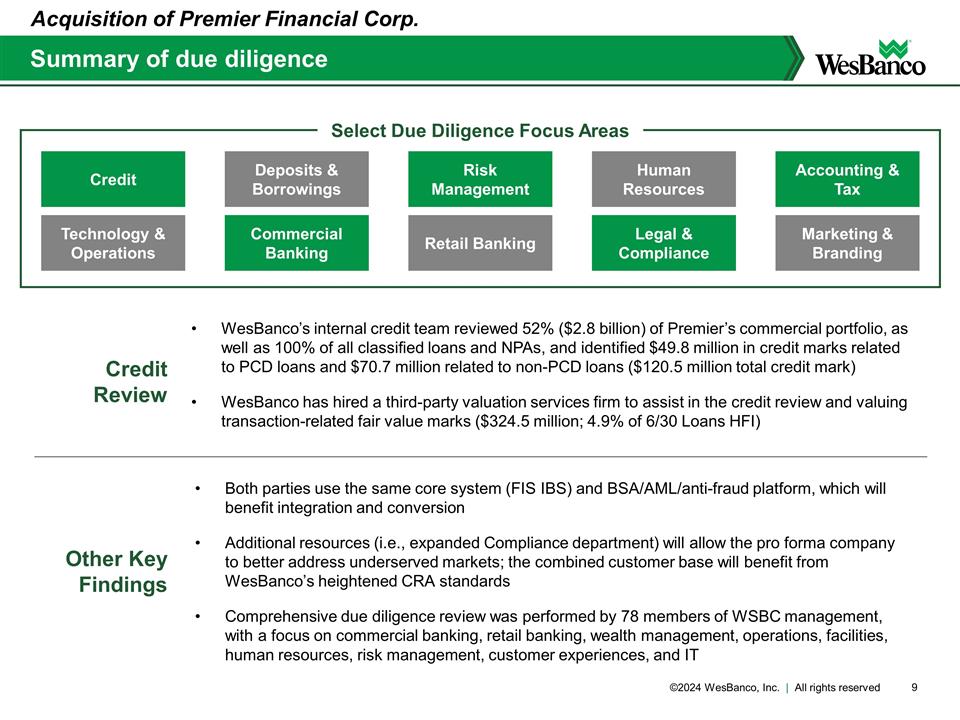

Summary of due diligence Acquisition of Premier Financial Corp. Credit Deposits & Borrowings Risk Management Human Resources Accounting & Tax Technology & Operations Commercial Banking Retail Banking Legal & Compliance Marketing & Branding Select Due Diligence Focus Areas Other Key Findings Both parties use the same core system (FIS IBS) and BSA/AML/anti-fraud platform, which will benefit integration and conversion Additional resources (i.e., expanded Compliance department) will allow the pro forma company to better address underserved markets; the combined customer base will benefit from WesBanco’s heightened CRA standards Comprehensive due diligence review was performed by 78 members of WSBC management, with a focus on commercial banking, retail banking, wealth management, operations, facilities, human resources, risk management, customer experiences, and IT Credit Review WesBanco’s internal credit team reviewed 52% ($2.8 billion) of Premier’s commercial portfolio, as well as 100% of all classified loans and NPAs, and identified $49.8 million in credit marks related to PCD loans and $70.7 million related to non-PCD loans ($120.5 million total credit mark) WesBanco has hired a third-party valuation services firm to assist in the credit review and valuing transaction-related fair value marks ($324.5 million; 4.9% of 6/30 Loans HFI)

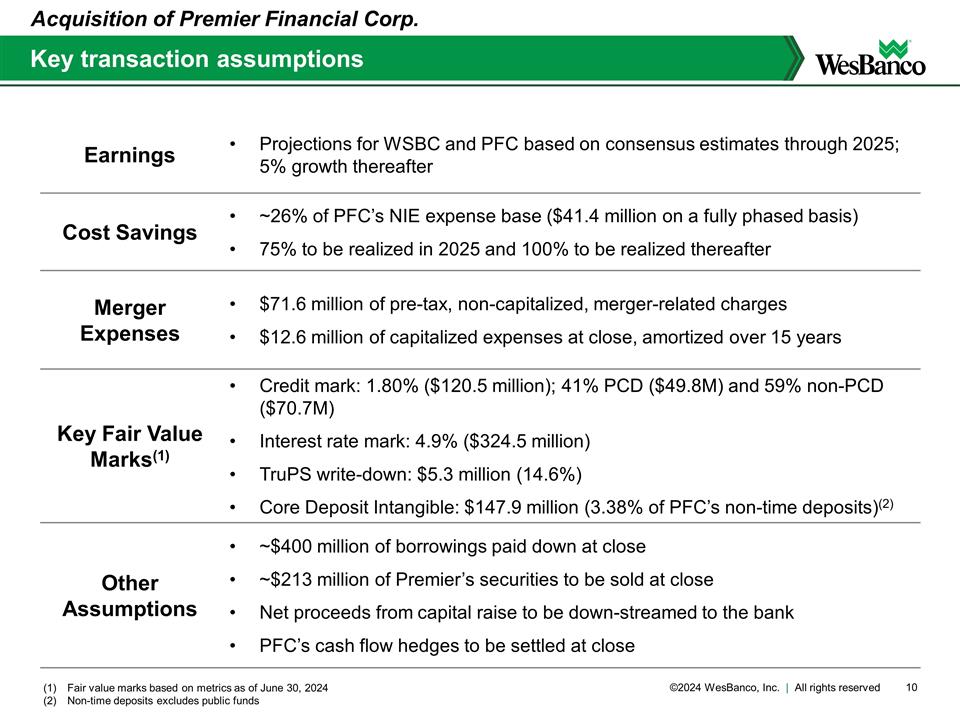

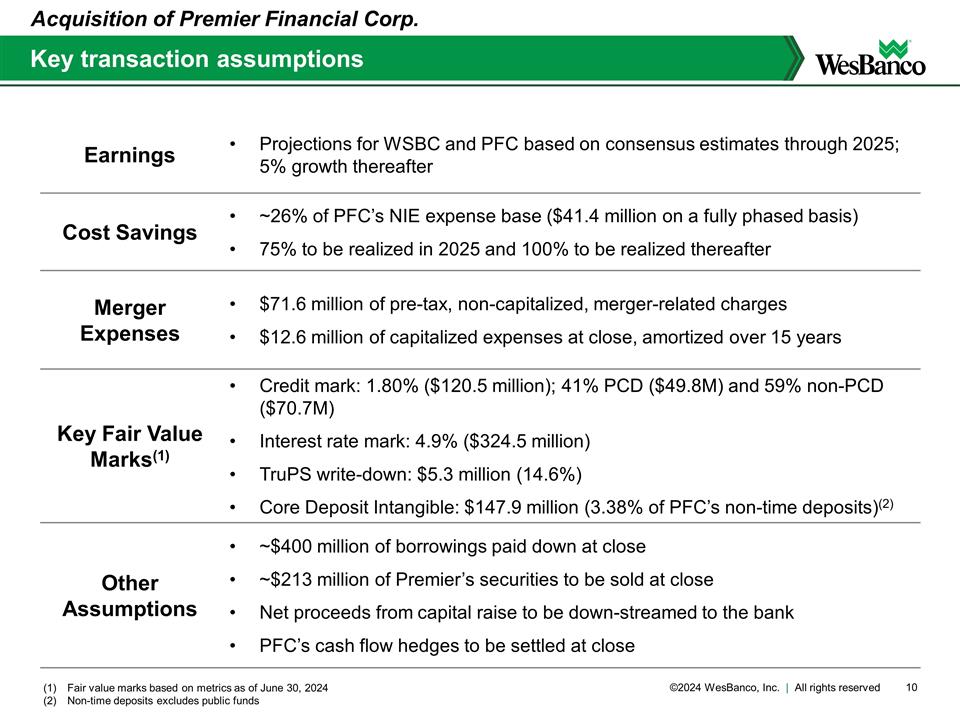

Earnings Projections for WSBC and PFC based on consensus estimates through 2025; 5% growth thereafter Cost Savings ~26% of PFC’s NIE expense base ($41.4 million on a fully phased basis) 75% to be realized in 2025 and 100% to be realized thereafter Merger Expenses $71.6 million of pre-tax, non-capitalized, merger-related charges $12.6 million of capitalized expenses at close, amortized over 15 years Key Fair Value Marks(1) Credit mark: 1.80% ($120.5 million); 41% PCD ($49.8M) and 59% non-PCD ($70.7M) Interest rate mark: 4.9% ($324.5 million) TruPS write-down: $5.3 million (14.6%) Core Deposit Intangible: $147.9 million (3.38% of PFC’s non-time deposits)(2) Other Assumptions ~$400 million of borrowings paid down at close ~$213 million of Premier’s securities to be sold at close Net proceeds from capital raise to be down-streamed to the bank PFC’s cash flow hedges to be settled at close Key transaction assumptions Acquisition of Premier Financial Corp. Fair value marks based on metrics as of June 30, 2024 Non-time deposits excludes public funds

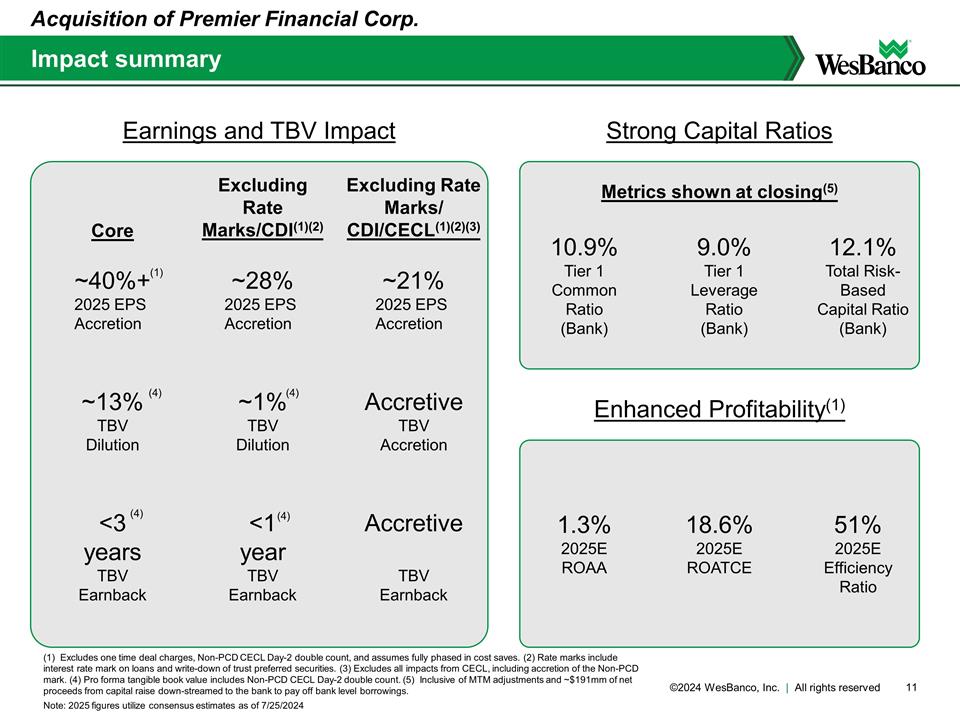

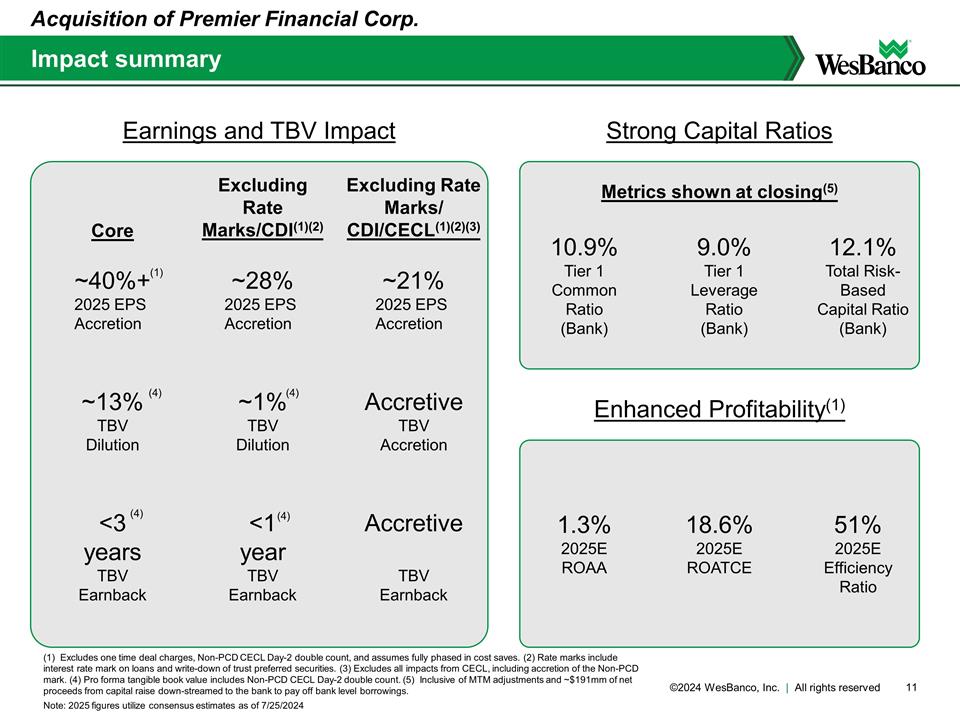

Impact summary Acquisition of Premier Financial Corp. (1) Excludes one time deal charges, Non-PCD CECL Day-2 double count, and assumes fully phased in cost saves. (2) Rate marks include interest rate mark on loans and write-down of trust preferred securities. (3) Excludes all impacts from CECL, including accretion of the Non-PCD mark. (4) Pro forma tangible book value includes Non-PCD CECL Day-2 double count. (5) Inclusive of MTM adjustments and ~$191mm of net proceeds from capital raise down-streamed to the bank to pay off bank level borrowings. Note: 2025 figures utilize consensus estimates as of 7/25/2024 Earnings and TBV Impact Strong Capital Ratios Enhanced Profitability(1) Core Excluding Rate Marks/CDI(1)(2) Excluding Rate Marks/ CDI/CECL(1)(2)(3) ~40%+ 2025 EPS Accretion ~28% 2025 EPS Accretion ~21% 2025 EPS Accretion ~13% TBV Dilution Accretive TBV Accretion ~1% TBV Dilution <3 years TBV Earnback <1 year TBV Earnback Accretive TBV Earnback 10.9% Tier 1 Common Ratio (Bank) 12.1% Total Risk-Based Capital Ratio (Bank) 9.0% Tier 1 Leverage Ratio (Bank) 1.3% 2025E ROAA 18.6% 2025E ROATCE 51% 2025E Efficiency Ratio Metrics shown at closing(5) (1) (4) (4) (4) (4)

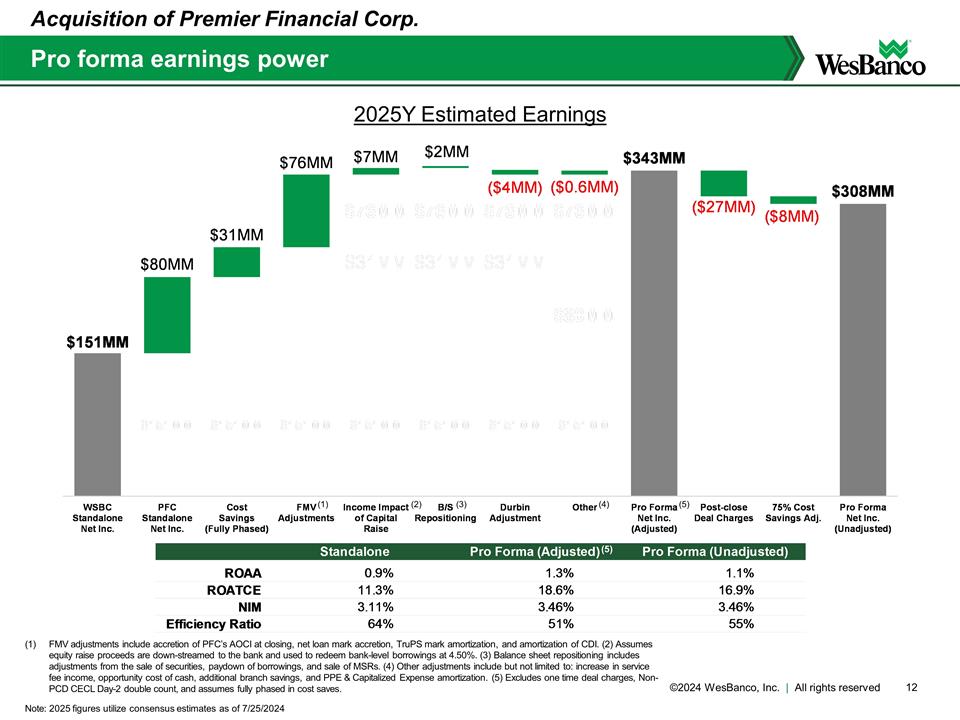

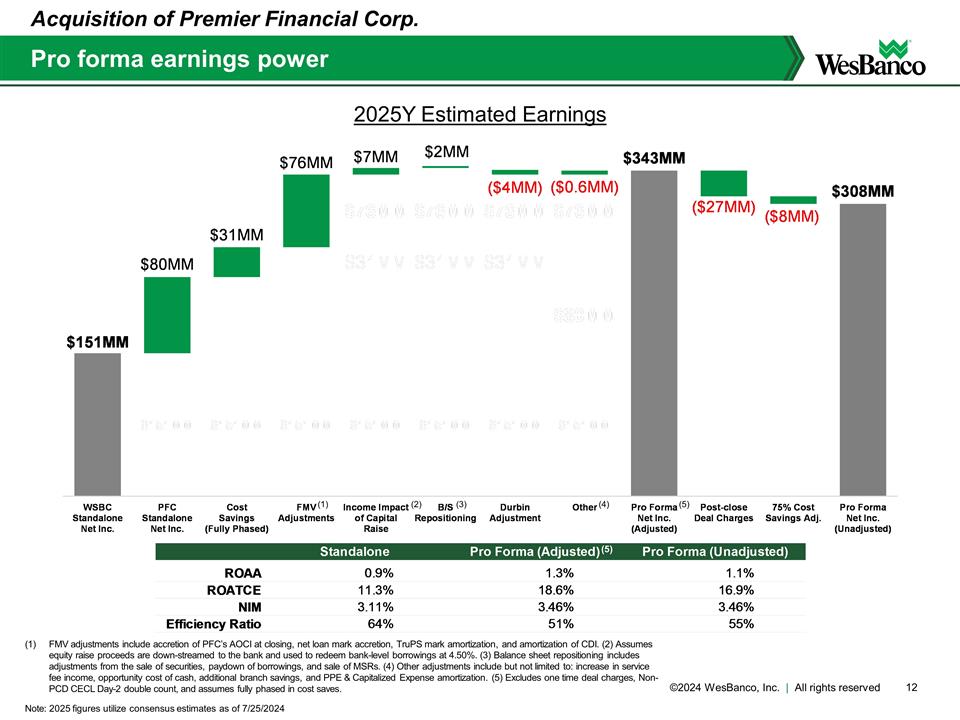

Pro forma earnings power Acquisition of Premier Financial Corp. FMV adjustments include accretion of PFC’s AOCI at closing, net loan mark accretion, TruPS mark amortization, and amortization of CDI. (2) Assumes equity raise proceeds are down-streamed to the bank and used to redeem bank-level borrowings at 4.50%. (3) Balance sheet repositioning includes adjustments from the sale of securities, paydown of borrowings, and sale of MSRs. (4) Other adjustments include but not limited to: increase in service fee income, opportunity cost of cash, additional branch savings, and PPE & Capitalized Expense amortization. (5) Excludes one time deal charges, Non-PCD CECL Day-2 double count, and assumes fully phased in cost saves. Note: 2025 figures utilize consensus estimates as of 7/25/2024 2025Y Estimated Earnings (5) (4) (1) (3) (5) (2)

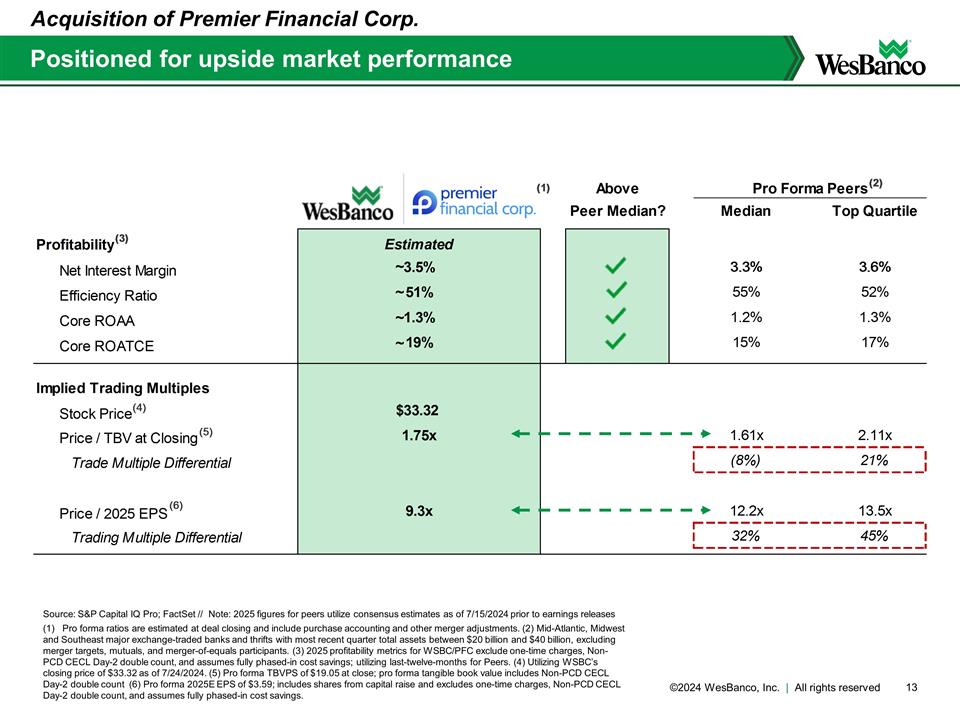

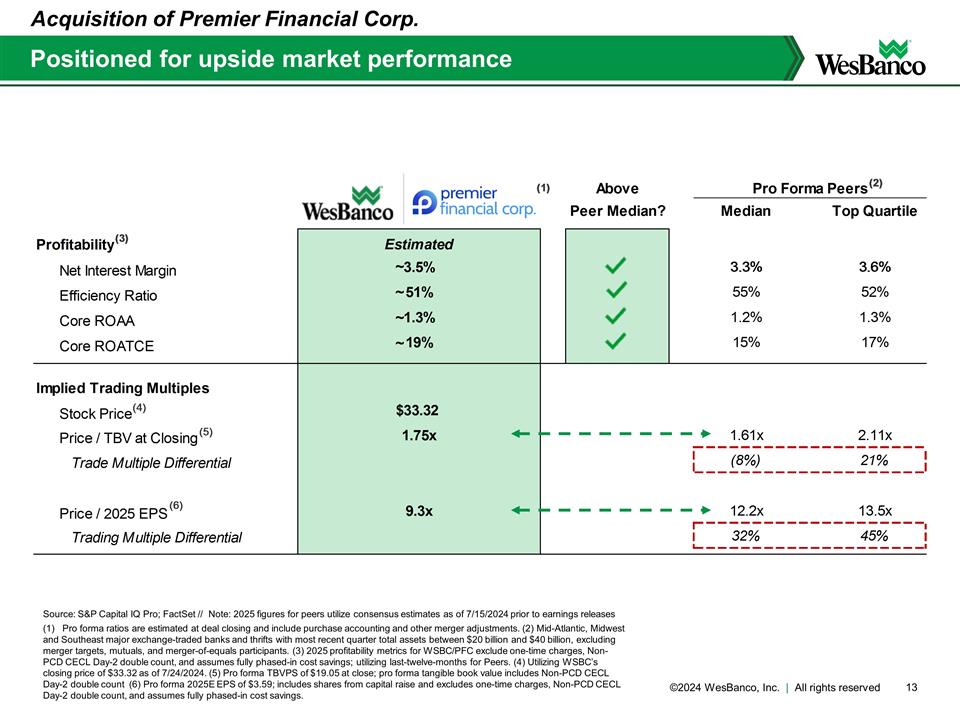

Positioned for upside market performance Acquisition of Premier Financial Corp. Source: S&P Capital IQ Pro; FactSet // Note: 2025 figures for peers utilize consensus estimates as of 7/15/2024 prior to earnings releases (1) Pro forma ratios are estimated at deal closing and include purchase accounting and other merger adjustments. (2) Mid-Atlantic, Midwest and Southeast major exchange-traded banks and thrifts with most recent quarter total assets between $20 billion and $40 billion, excluding merger targets, mutuals, and merger-of-equals participants. (3) 2025 profitability metrics for WSBC/PFC exclude one-time charges, Non-PCD CECL Day-2 double count, and assumes fully phased-in cost savings; utilizing last-twelve-months for Peers. (4) Utilizing WSBC’s closing price of $33.32 as of 7/24/2024. (5) Pro forma TBVPS of $19.05 at close; pro forma tangible book value includes Non-PCD CECL Day-2 double count (6) Pro forma 2025E EPS of $3.59; includes shares from capital raise and excludes one-time charges, Non-PCD CECL Day-2 double count, and assumes fully phased-in cost savings.

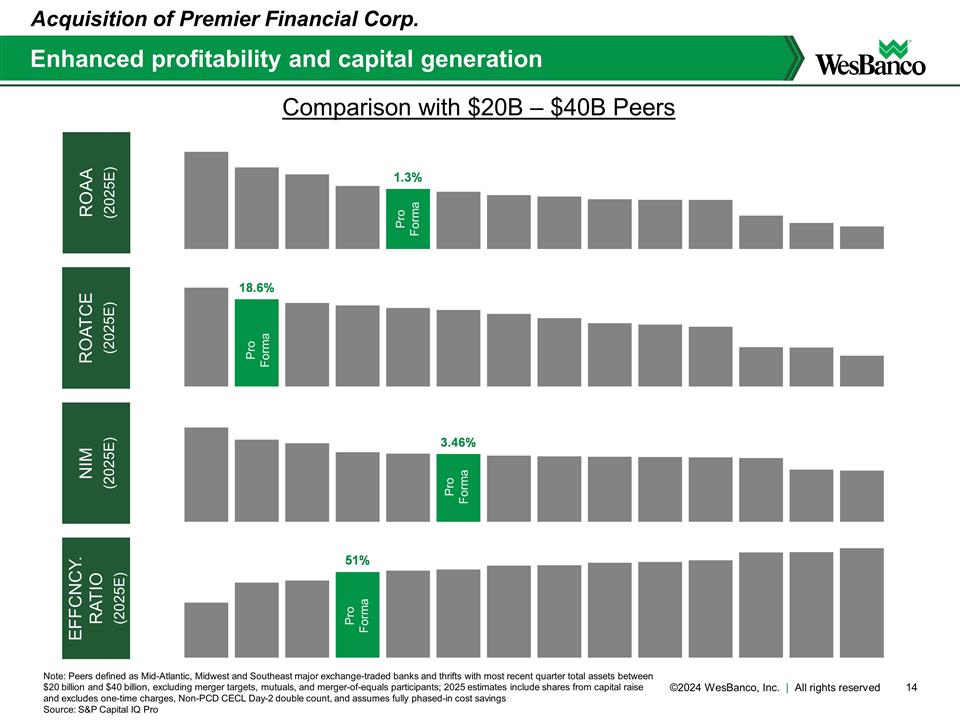

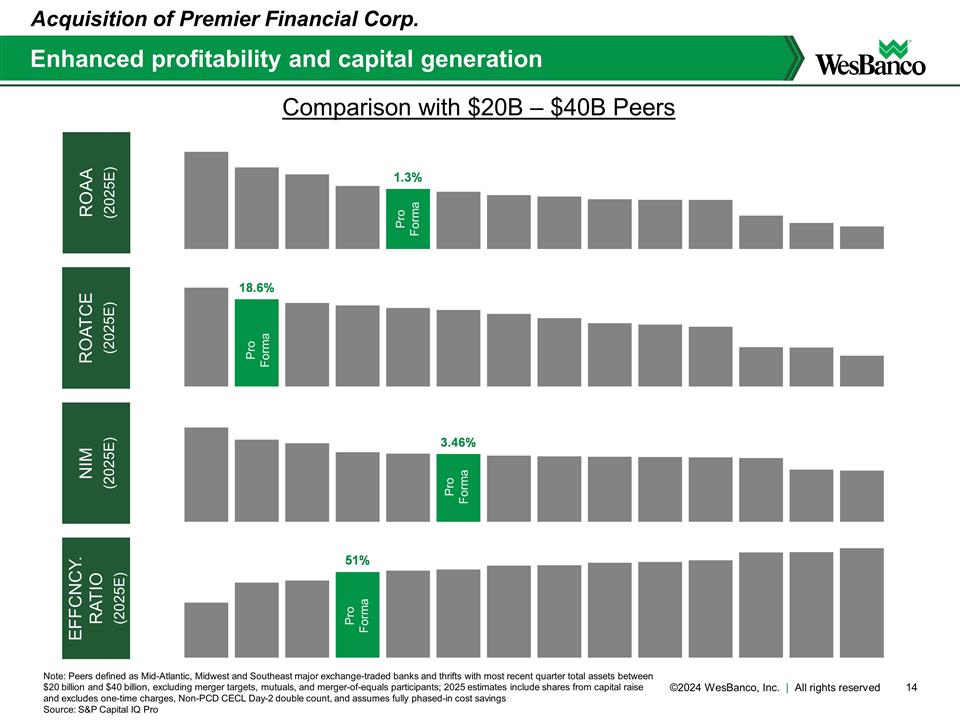

Enhanced profitability and capital generation Acquisition of Premier Financial Corp. Note: Peers defined as Mid-Atlantic, Midwest and Southeast major exchange-traded banks and thrifts with most recent quarter total assets between $20 billion and $40 billion, excluding merger targets, mutuals, and merger-of-equals participants; 2025 estimates include shares from capital raise and excludes one-time charges, Non-PCD CECL Day-2 double count, and assumes fully phased-in cost savings Source: S&P Capital IQ Pro ROATCE (2025E) EFFCNCY. Ratio (2025E) ROAA (2025E) NIM (2025E) Pro Forma Pro Forma Pro Forma Pro Forma Comparison with $20B – $40B Peers

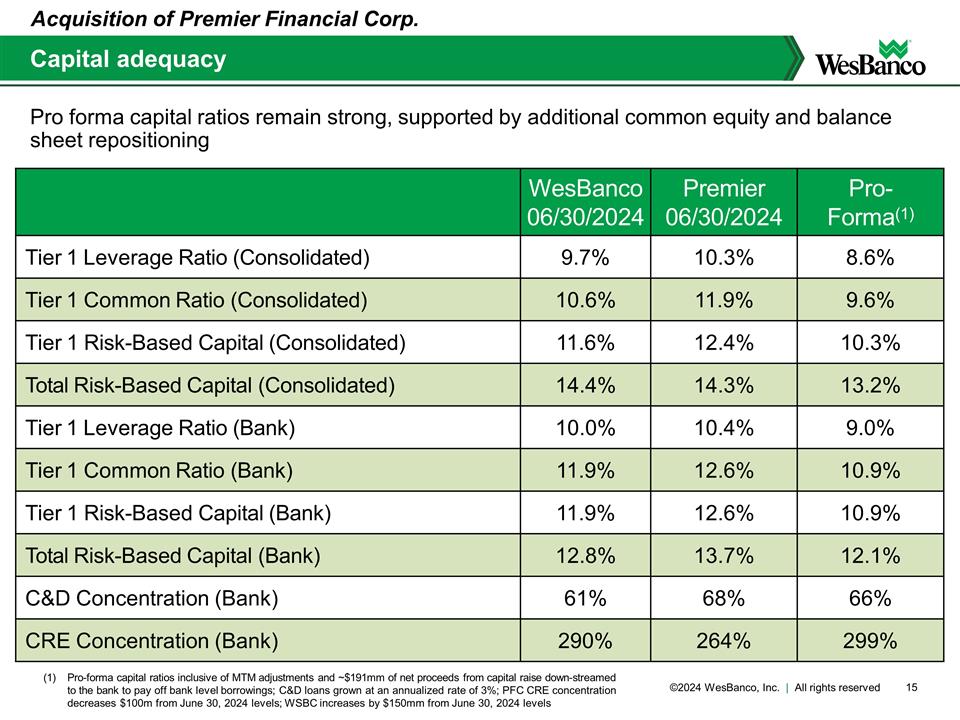

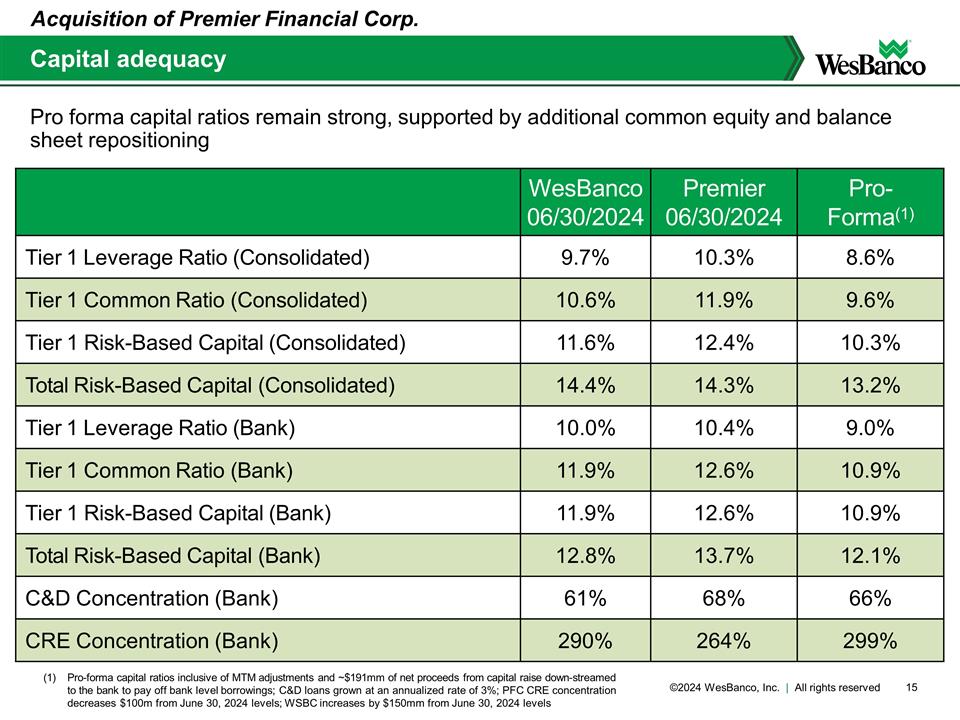

WesBanco 06/30/2024 Premier 06/30/2024 Pro- Forma(1) Tier 1 Leverage Ratio (Consolidated) 9.7% 10.3% 8.6% Tier 1 Common Ratio (Consolidated) 10.6% 11.9% 9.6% Tier 1 Risk-Based Capital (Consolidated) 11.6% 12.4% 10.3% Total Risk-Based Capital (Consolidated) 14.4% 14.3% 13.2% Tier 1 Leverage Ratio (Bank) 10.0% 10.4% 9.0% Tier 1 Common Ratio (Bank) 11.9% 12.6% 10.9% Tier 1 Risk-Based Capital (Bank) 11.9% 12.6% 10.9% Total Risk-Based Capital (Bank) 12.8% 13.7% 12.1% C&D Concentration (Bank) 61% 68% 66% CRE Concentration (Bank) 290% 264% 299% Pro forma capital ratios remain strong, supported by additional common equity and balance sheet repositioning Acquisition of Premier Financial Corp. Capital adequacy Pro-forma capital ratios inclusive of MTM adjustments and ~$191mm of net proceeds from capital raise down-streamed to the bank to pay off bank level borrowings; C&D loans grown at an annualized rate of 3%; PFC CRE concentration decreases $100m from June 30, 2024 levels; WSBC increases by $150mm from June 30, 2024 levels

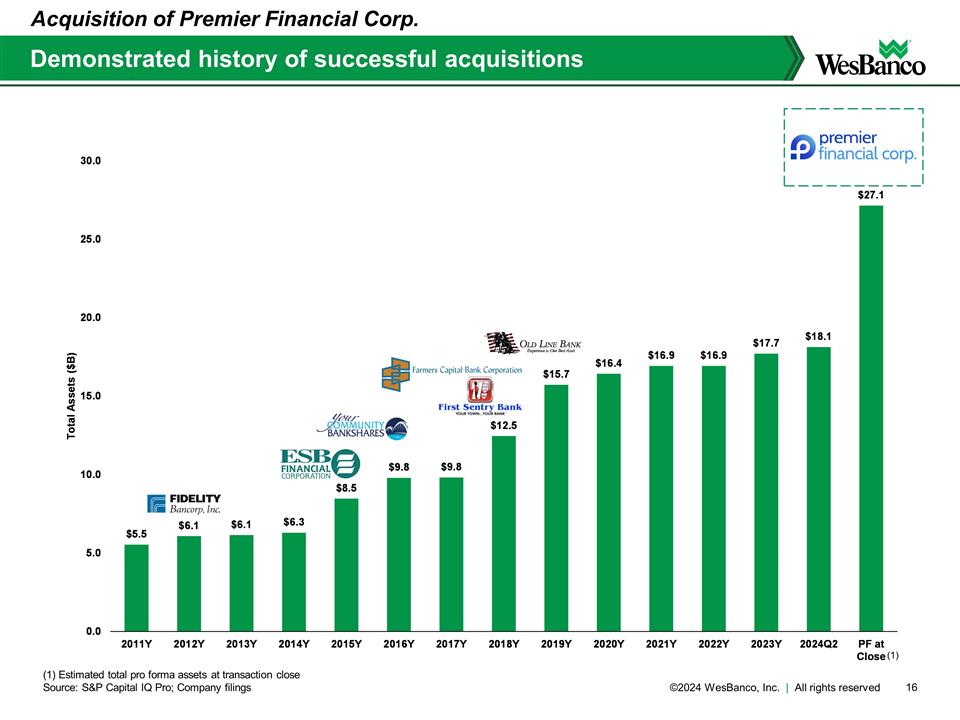

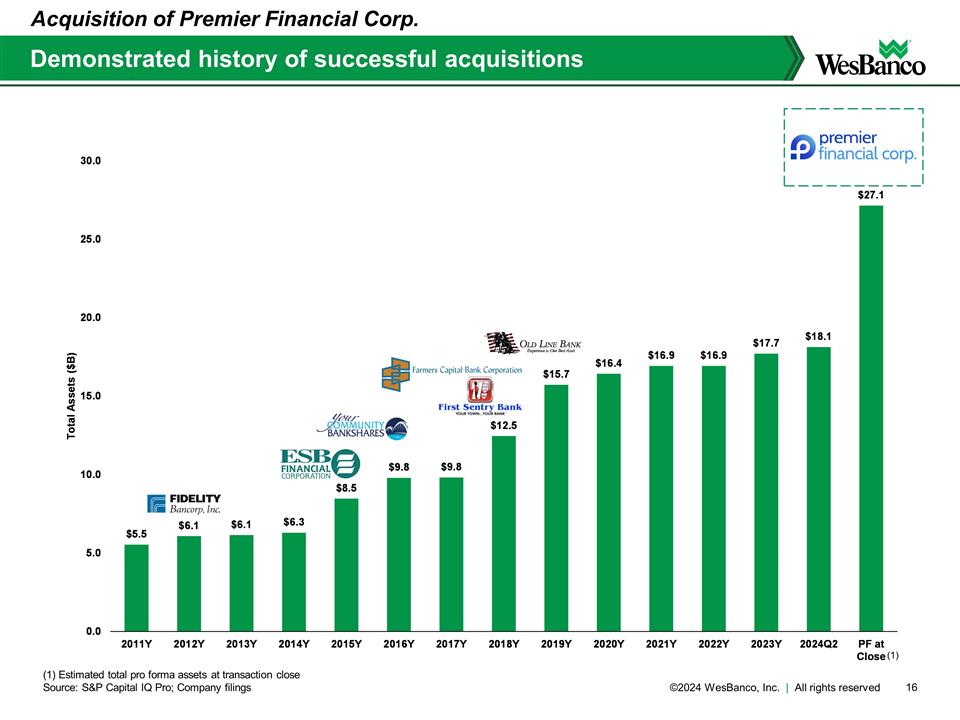

Demonstrated history of successful acquisitions Acquisition of Premier Financial Corp. (1) Estimated total pro forma assets at transaction close Source: S&P Capital IQ Pro; Company filings (1)

Premier Overview

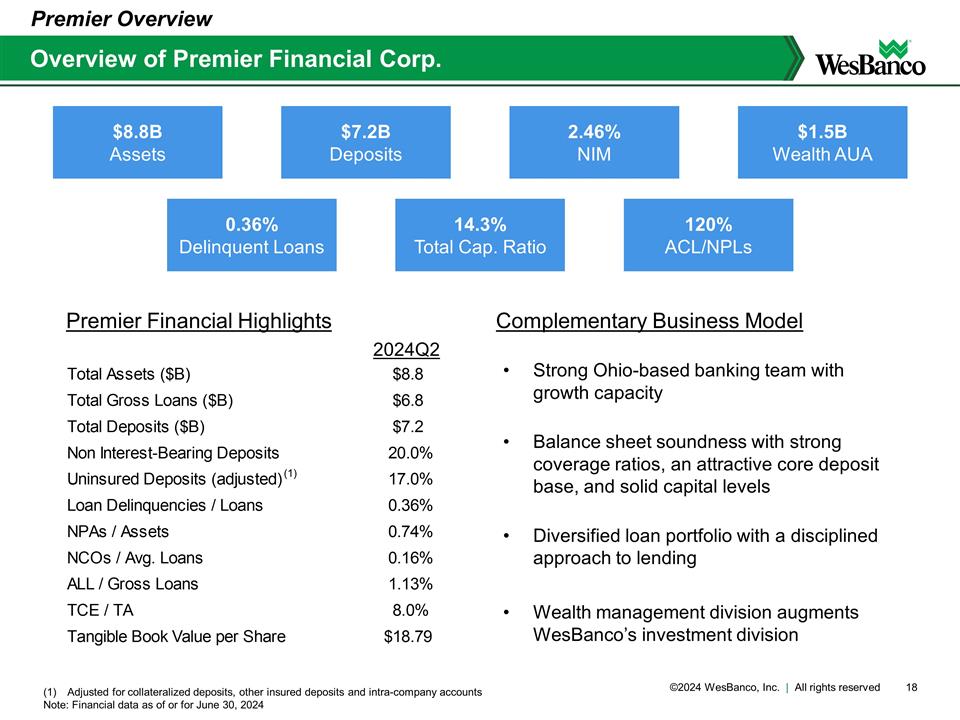

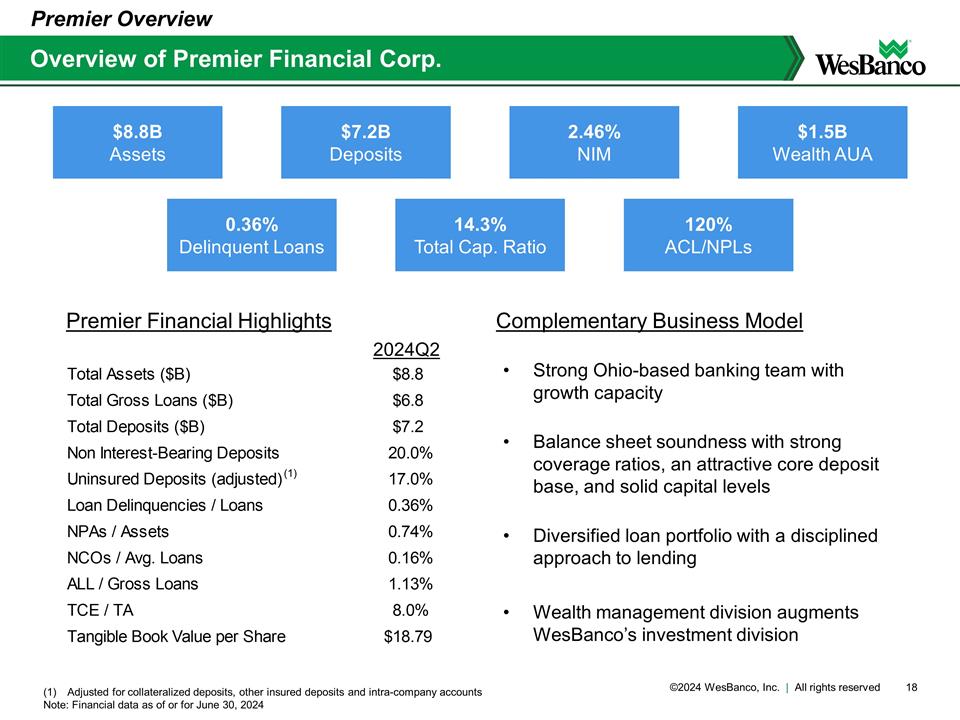

Overview of Premier Financial Corp. Premier Overview Complementary Business Model 120% ACL/NPLs 0.36% Delinquent Loans 14.3% Total Cap. Ratio $8.8B Assets $7.2B Deposits 2.46% NIM $1.5B Wealth AUA Strong Ohio-based banking team with growth capacity Balance sheet soundness with strong coverage ratios, an attractive core deposit base, and solid capital levels Diversified loan portfolio with a disciplined approach to lending Wealth management division augments WesBanco’s investment division Adjusted for collateralized deposits, other insured deposits and intra-company accounts Note: Financial data as of or for June 30, 2024 (1) Premier Financial Highlights 2024Q2

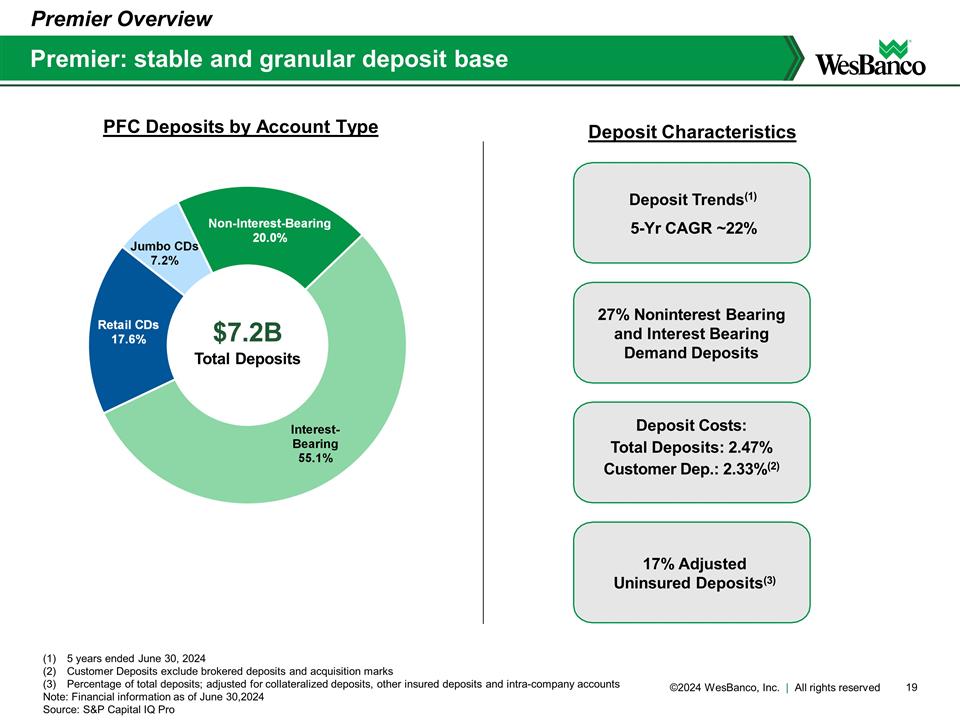

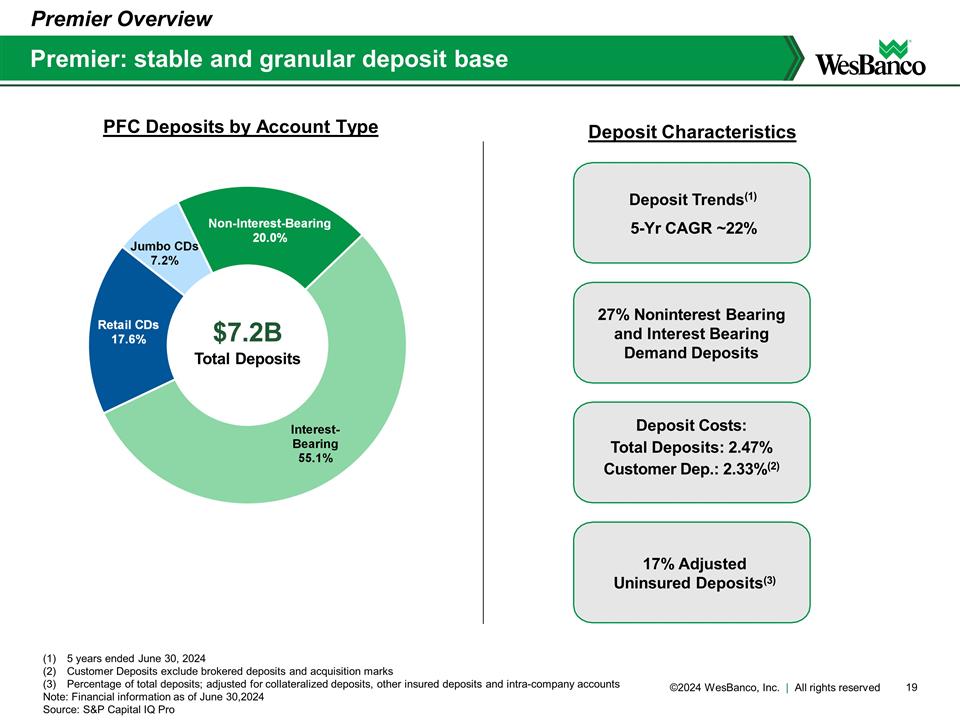

Premier: stable and granular deposit base Premier Overview 5 years ended June 30, 2024 Customer Deposits exclude brokered deposits and acquisition marks Percentage of total deposits; adjusted for collateralized deposits, other insured deposits and intra-company accounts Note: Financial information as of June 30,2024 Source: S&P Capital IQ Pro Deposit Characteristics 27% Noninterest Bearing and Interest Bearing Demand Deposits Deposit Costs: Total Deposits: 2.47% Customer Dep.: 2.33%(2) 17% Adjusted Uninsured Deposits(3) Deposit Trends(1) 5-Yr CAGR ~22% $7.2B Total Deposits PFC Deposits by Account Type

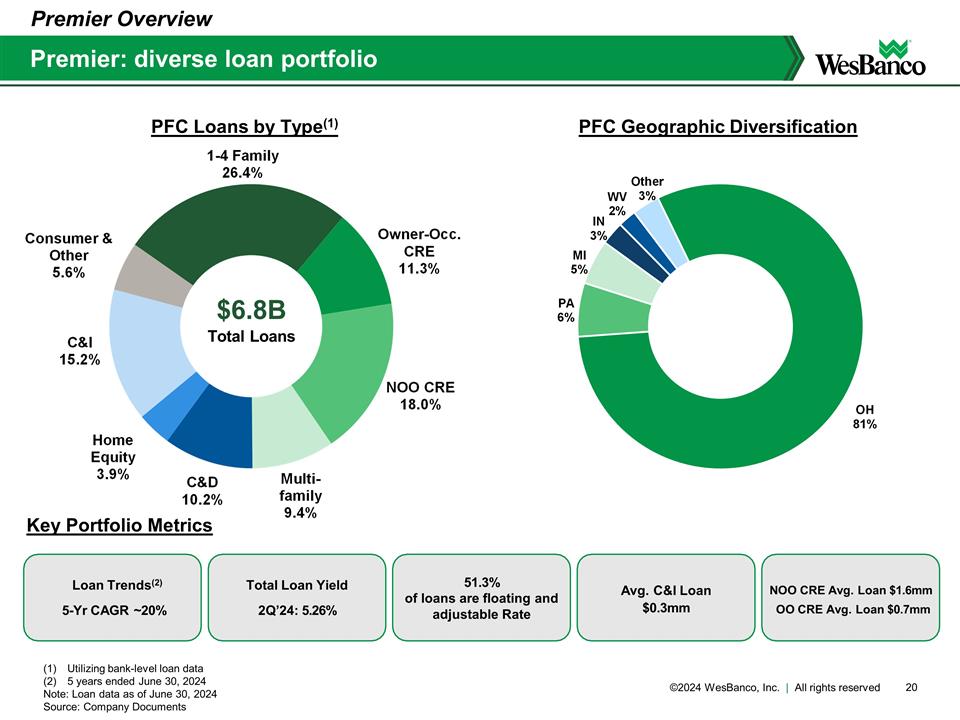

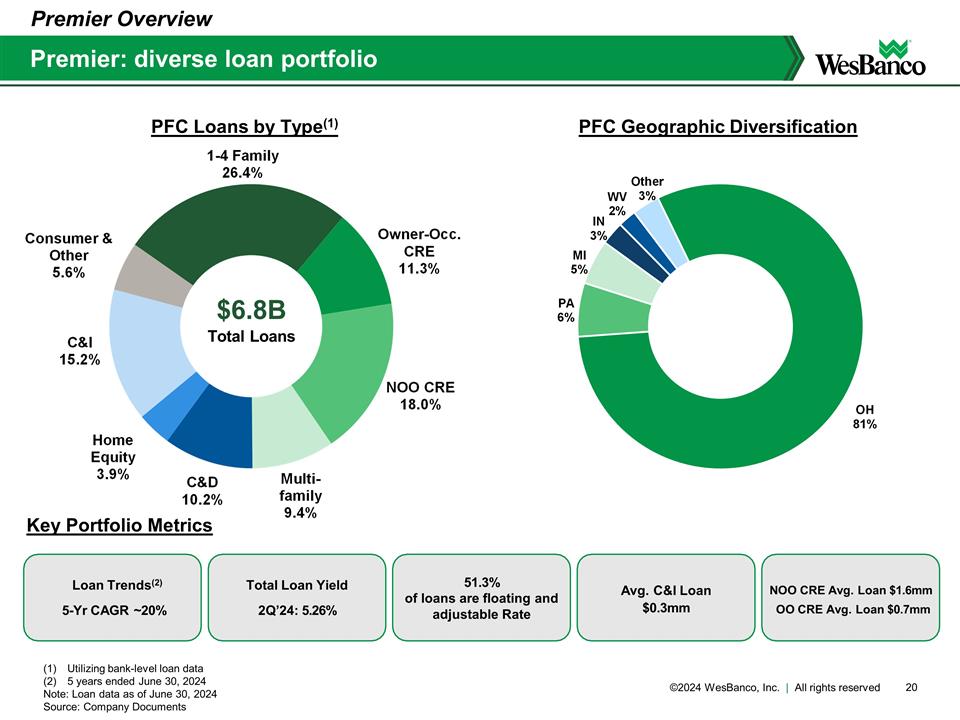

Premier: diverse loan portfolio Premier Overview Utilizing bank-level loan data 5 years ended June 30, 2024 Note: Loan data as of June 30, 2024 Source: Company Documents Key Portfolio Metrics 51.3% of loans are floating and adjustable Rate Total Loan Yield 2Q’24: 5.26% Avg. C&I Loan $0.3mm NOO CRE Avg. Loan $1.6mm OO CRE Avg. Loan $0.7mm Loan Trends(2) 5-Yr CAGR ~20% $6.8B Total Loans PFC Loans by Type(1) PFC Geographic Diversification

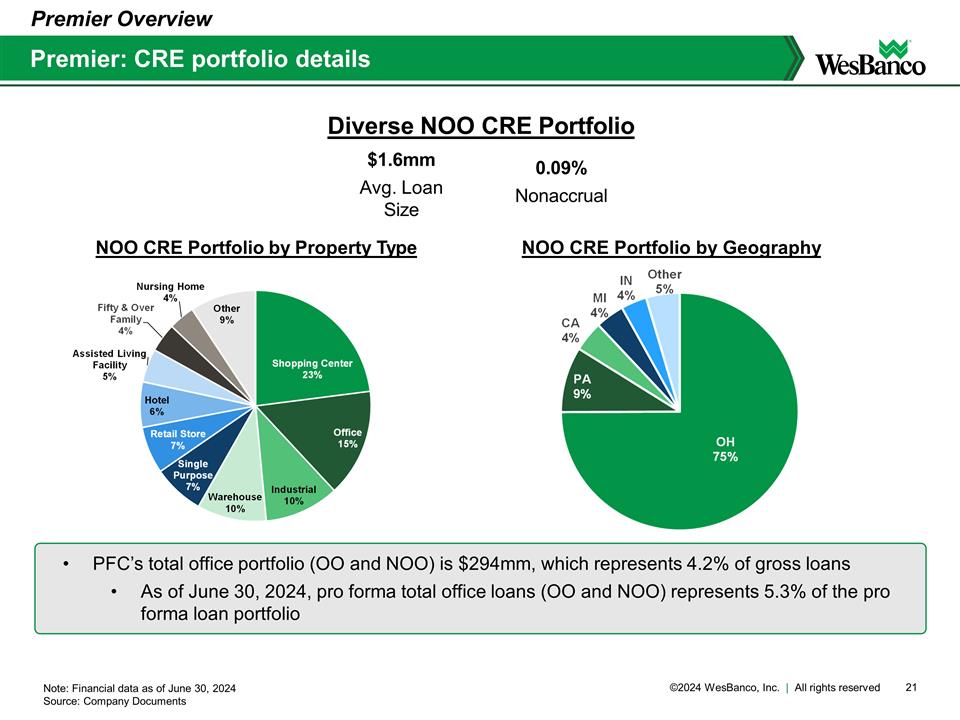

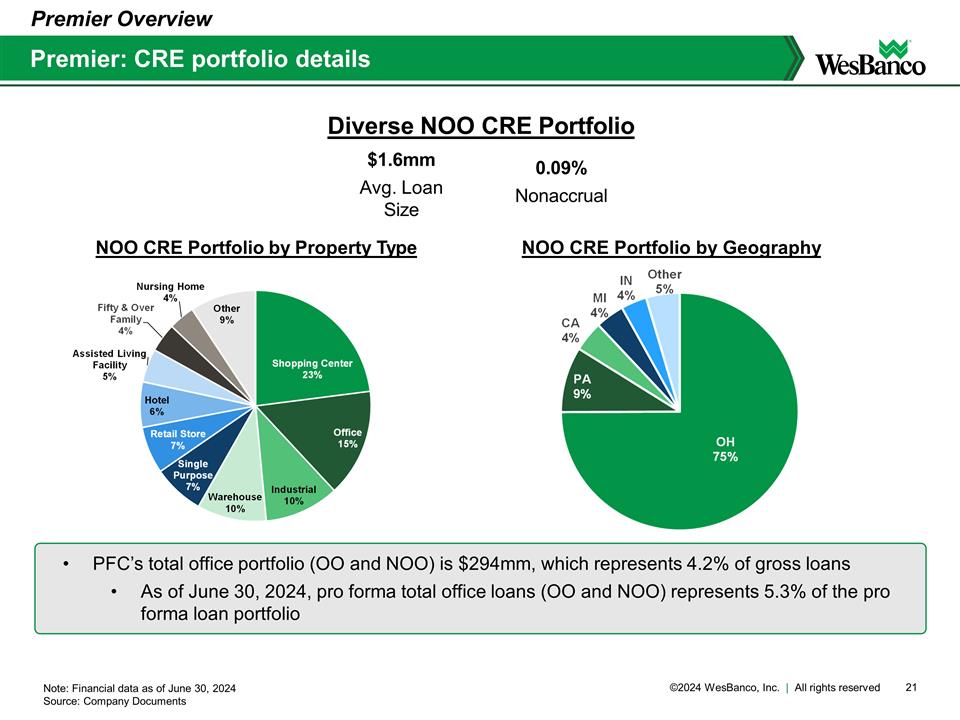

Premier: CRE portfolio details Premier Overview Note: Financial data as of June 30, 2024 Source: Company Documents Diverse NOO CRE Portfolio $1.6mm Avg. Loan Size 0.09% Nonaccrual NOO CRE Portfolio by Geography NOO CRE Portfolio by Property Type PFC’s total office portfolio (OO and NOO) is $294mm, which represents 4.2% of gross loans As of June 30, 2024, pro forma total office loans (OO and NOO) represents 5.3% of the pro forma loan portfolio

WesBanco Overview

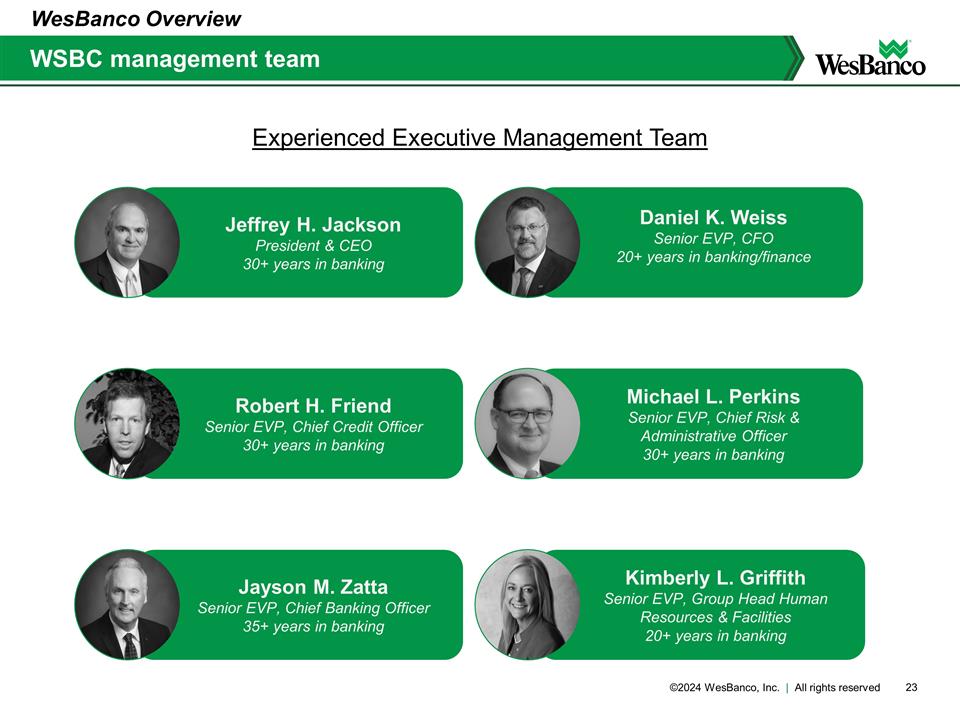

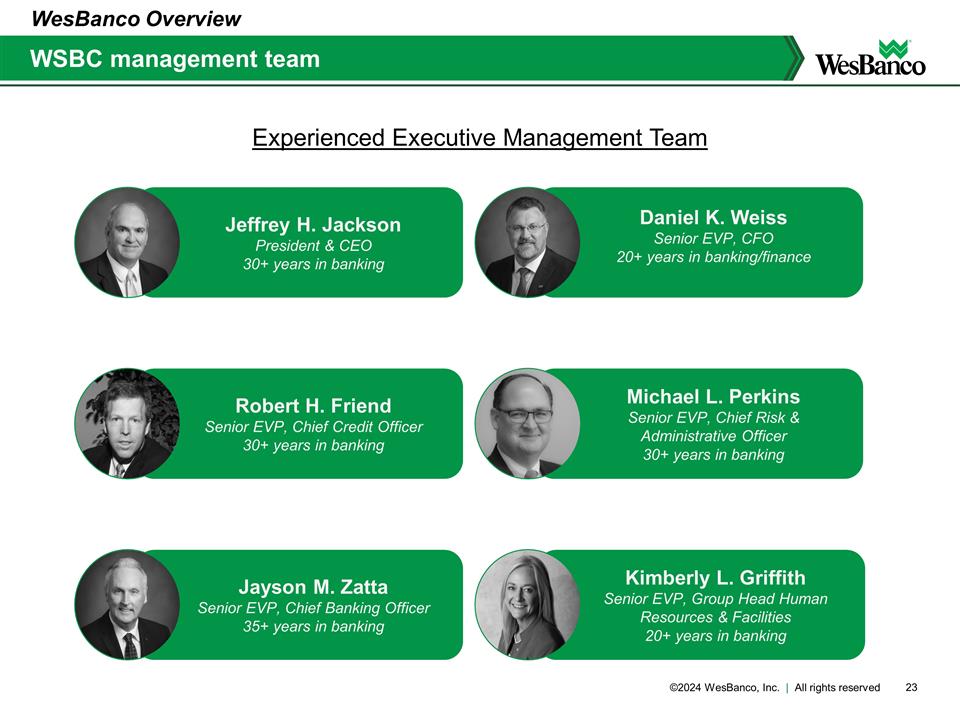

Michael L. Perkins Senior EVP, Chief Risk & Administrative Officer 30+ years in banking Experienced Executive Management Team WSBC management team WesBanco Overview Jeffrey H. Jackson President & CEO 30+ years in banking Daniel K. Weiss Senior EVP, CFO 20+ years in banking/finance Robert H. Friend Senior EVP, Chief Credit Officer 30+ years in banking Jayson M. Zatta Senior EVP, Chief Banking Officer 35+ years in banking Kimberly L. Griffith Senior EVP, Group Head Human Resources & Facilities 20+ years in banking

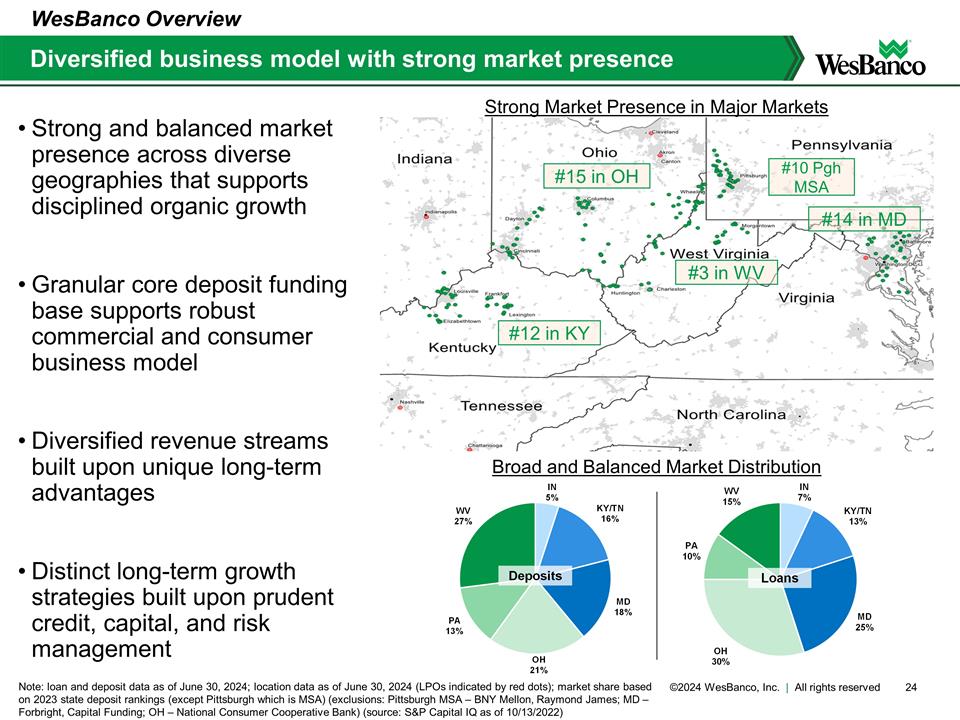

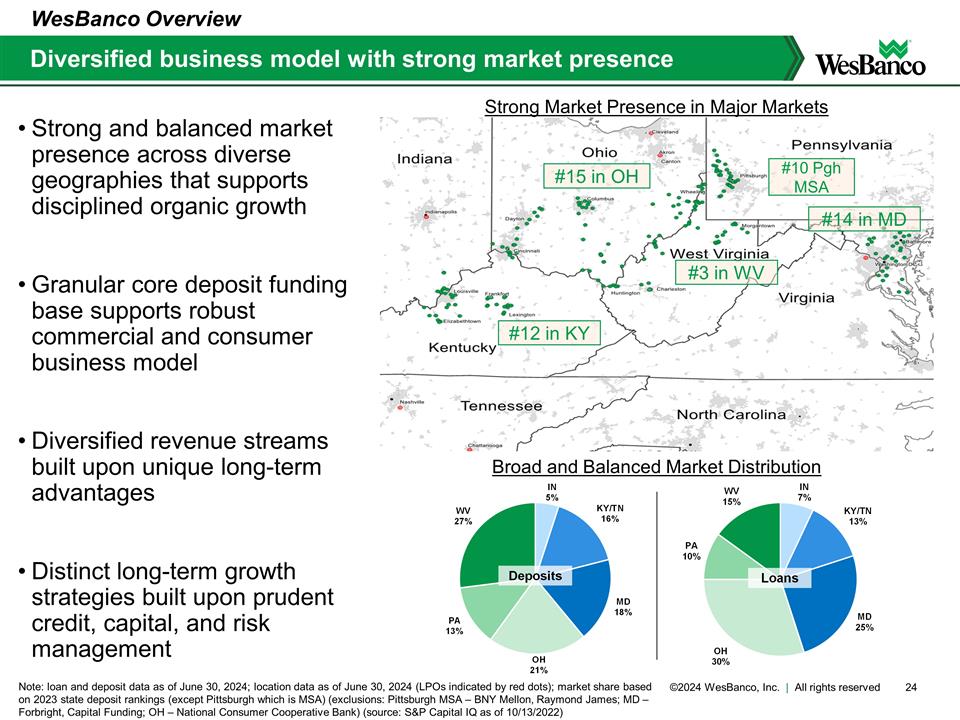

Strong and balanced market presence across diverse geographies that supports disciplined organic growth Granular core deposit funding base supports robust commercial and consumer business model Diversified revenue streams built upon unique long-term advantages Distinct long-term growth strategies built upon prudent credit, capital, and risk management Diversified business model with strong market presence Note: loan and deposit data as of June 30, 2024; location data as of June 30, 2024 (LPOs indicated by red dots); market share based on 2023 state deposit rankings (except Pittsburgh which is MSA) (exclusions: Pittsburgh MSA – BNY Mellon, Raymond James; MD – Forbright, Capital Funding; OH – National Consumer Cooperative Bank) (source: S&P Capital IQ as of 10/13/2022) WesBanco Overview #14 in MD #15 in OH #12 in KY #3 in WV #10 Pgh MSA Strong Market Presence in Major Markets Broad and Balanced Market Distribution

Balanced loan and deposit distribution across contiguous eight state footprint, with complementary loan production office strategy Full suite of commercial and consumer banking capabilities, complemented by a wealth management business with a 100+ year track-record of success managing assets of $5.6B under trust and $1.8B under securities brokerage Robust legacy deposit base provides core funding and pricing advantages Streamlining through digitization and technology investments Unique advantages, sustainable growth, shareholder focus Note: assets under trust are market value of Trust & Investment Services assets under management and securities brokerage assets are account value (including annuities), both as of June 30, 2024 Balanced and Diversified with Unique Long-Term Advantages Disciplined Growth from Distinct Long-Term Growth Strategies Legacy of Credit Quality, Risk Management, and Shareholder Focus Organic growth-oriented business model supported by strategic acquisition and loan and production office strategies that support positive operating leverage Relationship-focused model that meets customer needs efficiently and effectively Leveraging digital capabilities to drive customer relationship value Focus on positive operating leverage built upon a culture of expense management Uncompromising approach to risk management, regulatory compliance, credit underwriting, and capital management Eight consecutive “outstanding” CRA ratings from the FDIC since 2003 Senior unsecured debt ratings of BBB+ to WesBanco, Inc. and A- to WesBanco Bank, Inc., from Kroll Bond Rating Agency Critical, long-term focus on shareholder return through earnings growth and effective capital management WesBanco Overview

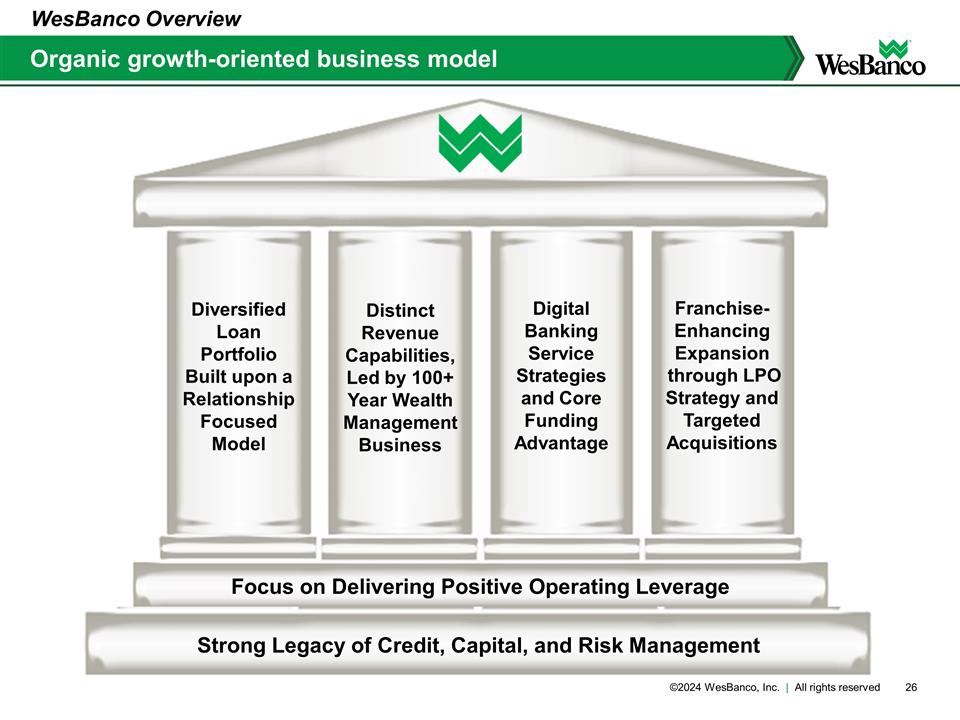

Organic growth-oriented business model WesBanco Overview Focus on Delivering Positive Operating Leverage Strong Legacy of Credit, Capital, and Risk Management Diversified Loan Portfolio Built upon a Relationship Focused Model Distinct Revenue Capabilities, Led by 100+ Year Wealth Management Business Digital Banking Service Strategies and Core Funding Advantage Franchise-Enhancing Expansion through LPO Strategy and Targeted Acquisitions

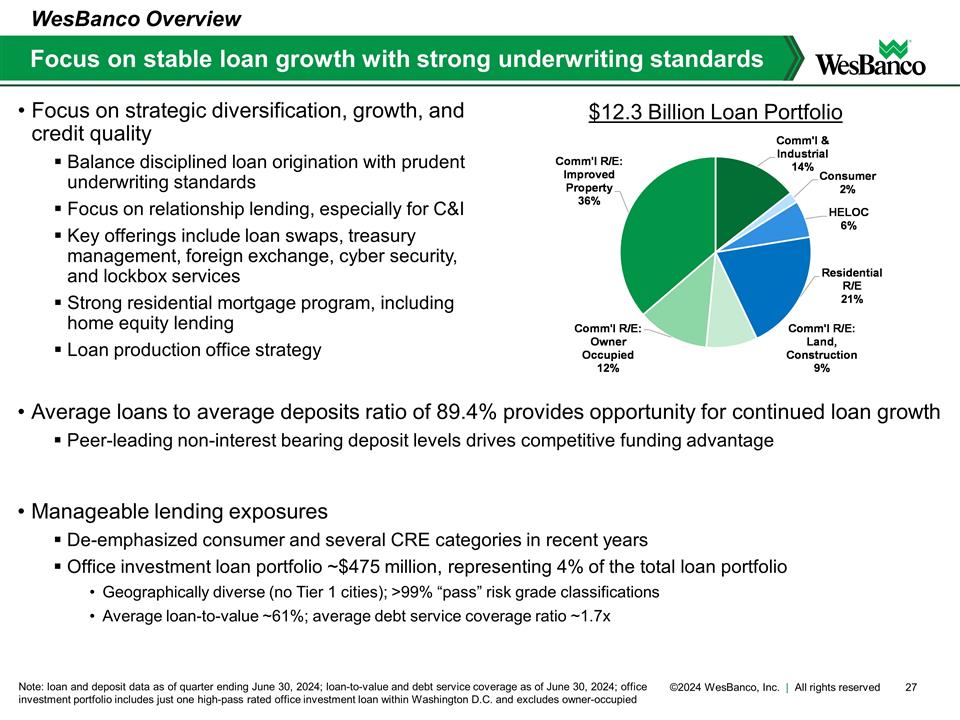

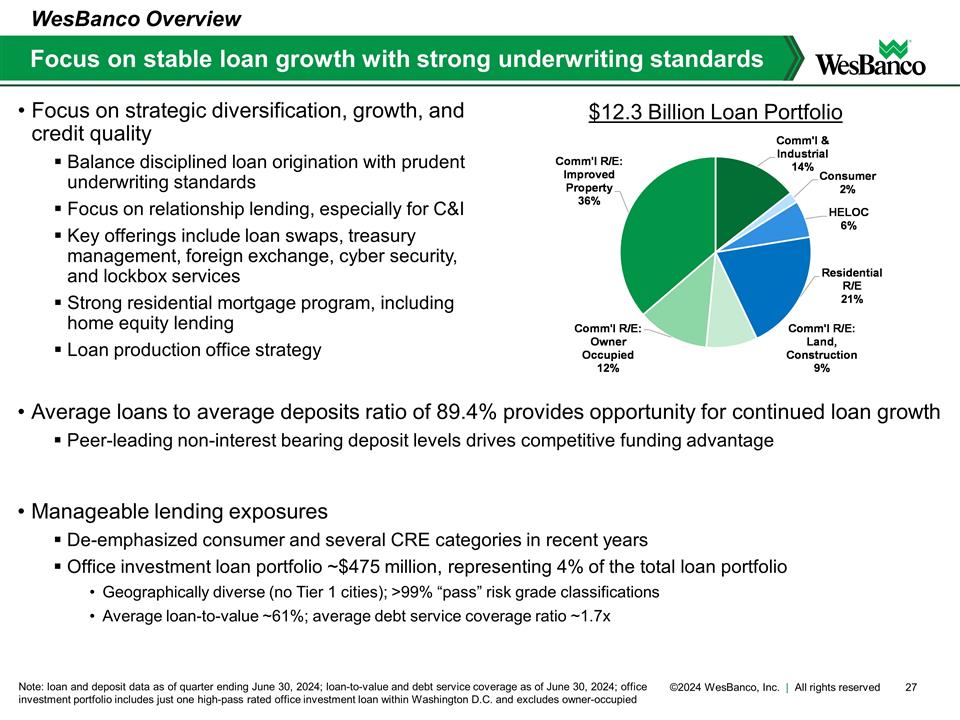

Focus on strategic diversification, growth, and credit quality Balance disciplined loan origination with prudent underwriting standards Focus on relationship lending, especially for C&I Key offerings include loan swaps, treasury management, foreign exchange, cyber security, and lockbox services Strong residential mortgage program, including home equity lending Loan production office strategy Focus on stable loan growth with strong underwriting standards Note: loan and deposit data as of quarter ending June 30, 2024; loan-to-value and debt service coverage as of June 30, 2024; office investment portfolio includes just one high-pass rated office investment loan within Washington D.C. and excludes owner-occupied WesBanco Overview $12.3 Billion Loan Portfolio Average loans to average deposits ratio of 89.4% provides opportunity for continued loan growth Peer-leading non-interest bearing deposit levels drives competitive funding advantage Manageable lending exposures De-emphasized consumer and several CRE categories in recent years Office investment loan portfolio ~$475 million, representing 4% of the total loan portfolio Geographically diverse (no Tier 1 cities); >99% “pass” risk grade classifications Average loan-to-value ~61%; average debt service coverage ratio ~1.7x

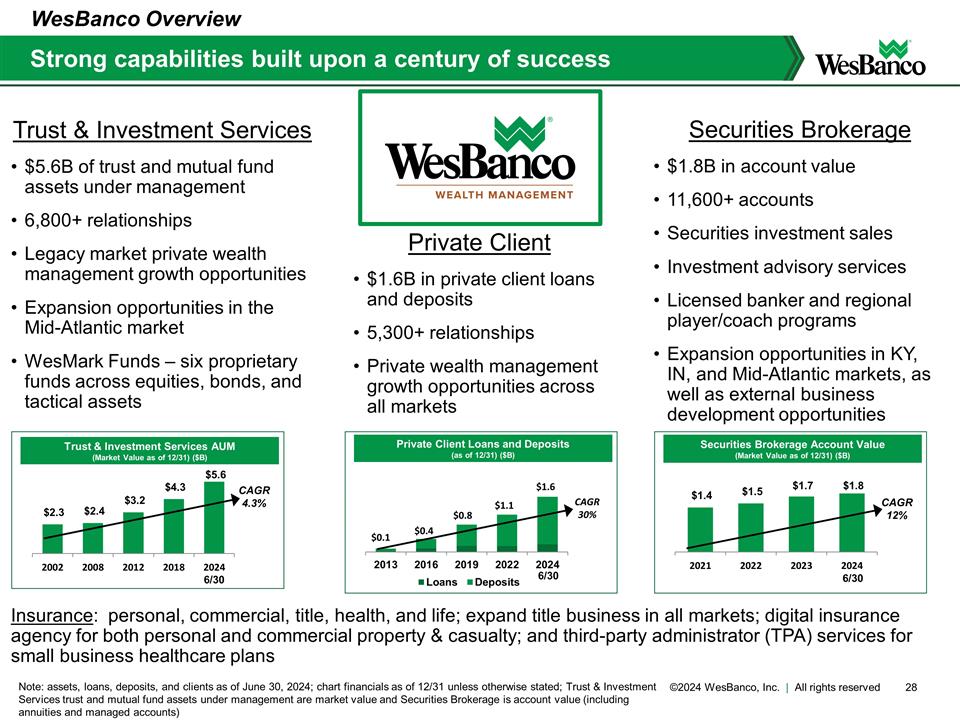

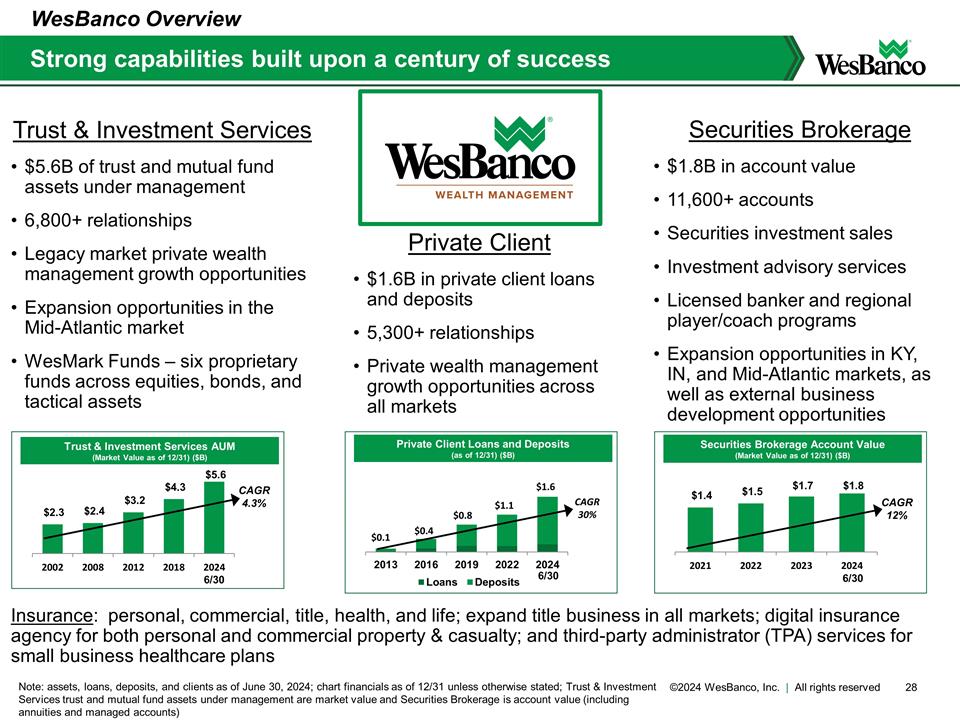

Securities Brokerage $1.8B in account value 11,600+ accounts Securities investment sales Investment advisory services Licensed banker and regional player/coach programs Expansion opportunities in KY, IN, and Mid-Atlantic markets, as well as external business development opportunities Trust & Investment Services $5.6B of trust and mutual fund assets under management 6,800+ relationships Legacy market private wealth management growth opportunities Expansion opportunities in the Mid-Atlantic market WesMark Funds – six proprietary funds across equities, bonds, and tactical assets Strong capabilities built upon a century of success Note: assets, loans, deposits, and clients as of June 30, 2024; chart financials as of 12/31 unless otherwise stated; Trust & Investment Services trust and mutual fund assets under management are market value and Securities Brokerage is account value (including annuities and managed accounts) WesBanco Overview Private Client Loans and Deposits (as of 12/31) ($B) CAGR 30% Trust & Investment Services AUM (Market Value as of 12/31) ($B) CAGR 4.3% 6/30 6/30 Private Client $1.6B in private client loans and deposits 5,300+ relationships Private wealth management growth opportunities across all markets $1.6 Securities Brokerage Account Value (Market Value as of 12/31) ($B) CAGR 12% 6/30 Insurance: personal, commercial, title, health, and life; expand title business in all markets; digital insurance agency for both personal and commercial property & casualty; and third-party administrator (TPA) services for small business healthcare plans

New capabilities with long-term growth opportunities WesBanco Overview Focus on building comprehensive business customer relationships by providing individualized services to improve cash flow management, increase earning power, and strengthen fraud protection for clients Key Treasury Management services Online and mobile access Deposit services Payables Sweep products Fraud and risk mitigation New Treasury Management products Multi-card (purchasing, T&E, fleet, virtual cards) Deposit escrow sub-accounting capabilities Integrated payables Integrated receivables During 2023, transformed the Treasury Management business line into a sales-oriented organization that strategically partners with commercial and business bankers to strengthen customer relationships Represents an untapped market for our business clients, as current focus is on building a strong pipeline to drive future fee-based revenues Industry experts estimate that 40% of all B2B payments in the U.S. are still made with a check .... costing companies $25 billion of processing costs annually

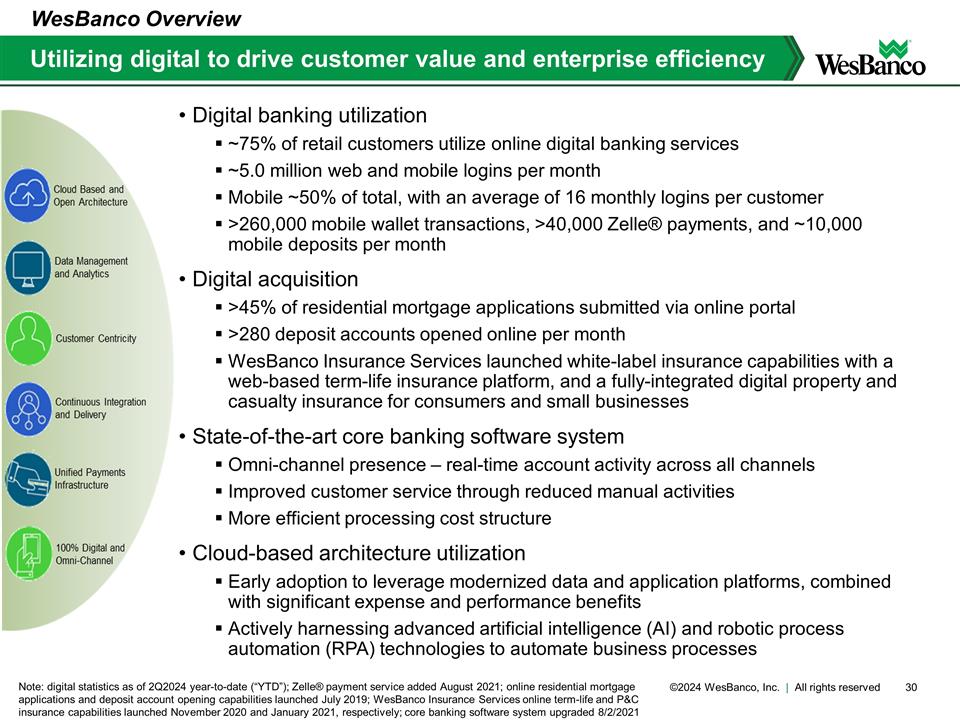

Digital banking utilization ~75% of retail customers utilize online digital banking services ~5.0 million web and mobile logins per month Mobile ~50% of total, with an average of 16 monthly logins per customer >260,000 mobile wallet transactions, >40,000 Zelle® payments, and ~10,000 mobile deposits per month Digital acquisition >45% of residential mortgage applications submitted via online portal >280 deposit accounts opened online per month WesBanco Insurance Services launched white-label insurance capabilities with a web-based term-life insurance platform, and a fully-integrated digital property and casualty insurance for consumers and small businesses State-of-the-art core banking software system Omni-channel presence – real-time account activity across all channels Improved customer service through reduced manual activities More efficient processing cost structure Cloud-based architecture utilization Early adoption to leverage modernized data and application platforms, combined with significant expense and performance benefits Actively harnessing advanced artificial intelligence (AI) and robotic process automation (RPA) technologies to automate business processes Utilizing digital to drive customer value and enterprise efficiency Note: digital statistics as of 2Q2024 year-to-date (“YTD”); Zelle® payment service added August 2021; online residential mortgage applications and deposit account opening capabilities launched July 2019; WesBanco Insurance Services online term-life and P&C insurance capabilities launched November 2020 and January 2021, respectively; core banking software system upgraded 8/2/2021 WesBanco Overview

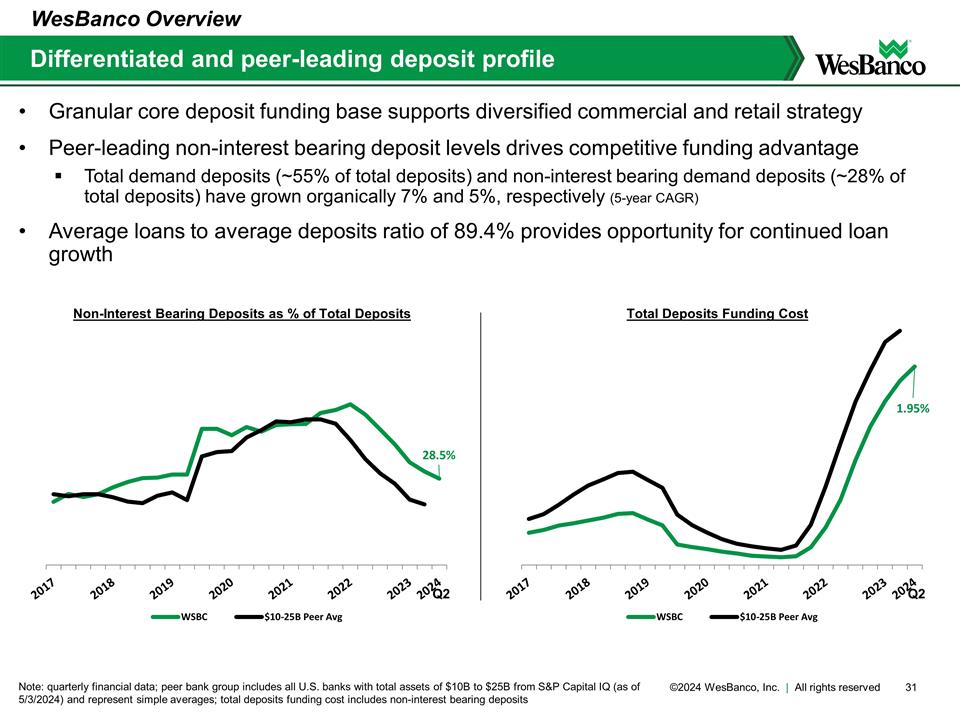

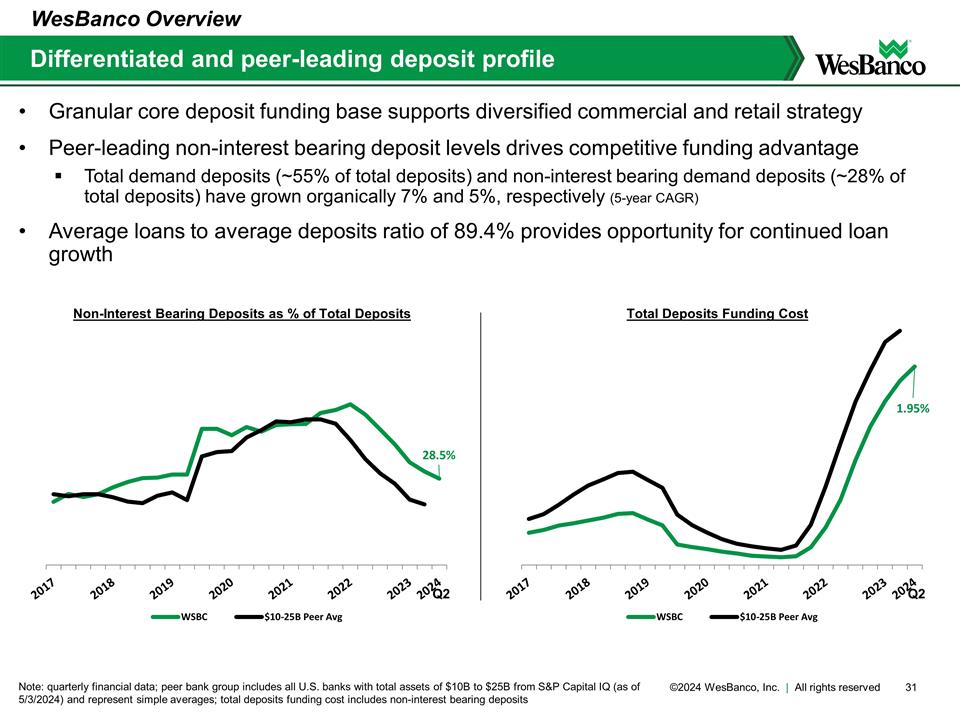

Differentiated and peer-leading deposit profile Note: quarterly financial data; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 5/3/2024) and represent simple averages; total deposits funding cost includes non-interest bearing deposits WesBanco Overview Granular core deposit funding base supports diversified commercial and retail strategy Peer-leading non-interest bearing deposit levels drives competitive funding advantage Total demand deposits (~55% of total deposits) and non-interest bearing demand deposits (~28% of total deposits) have grown organically 7% and 5%, respectively (5-year CAGR) Average loans to average deposits ratio of 89.4% provides opportunity for continued loan growth

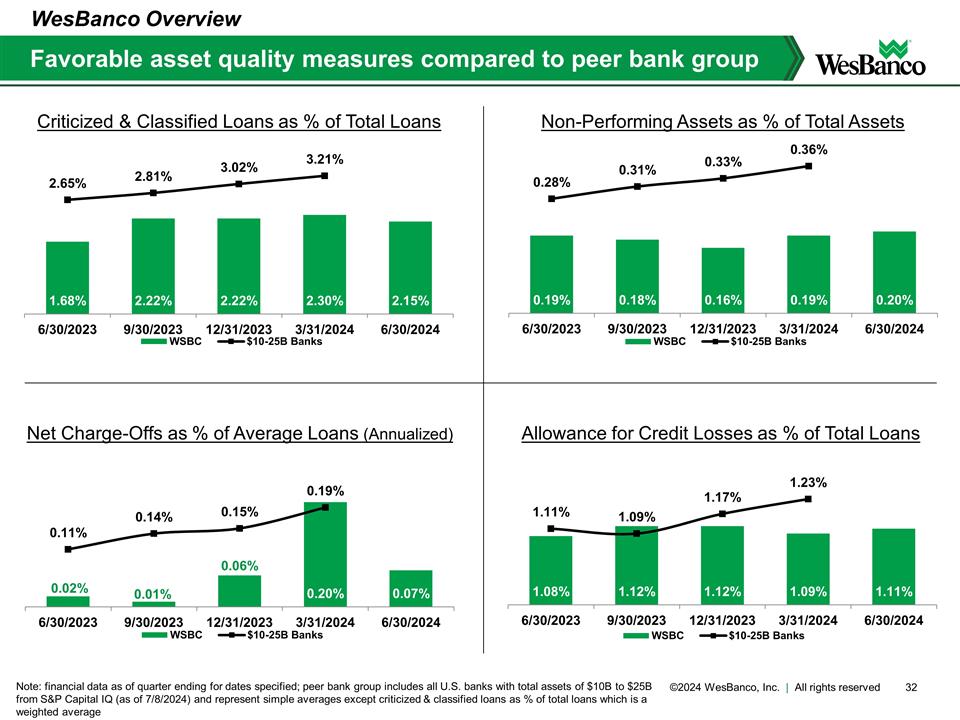

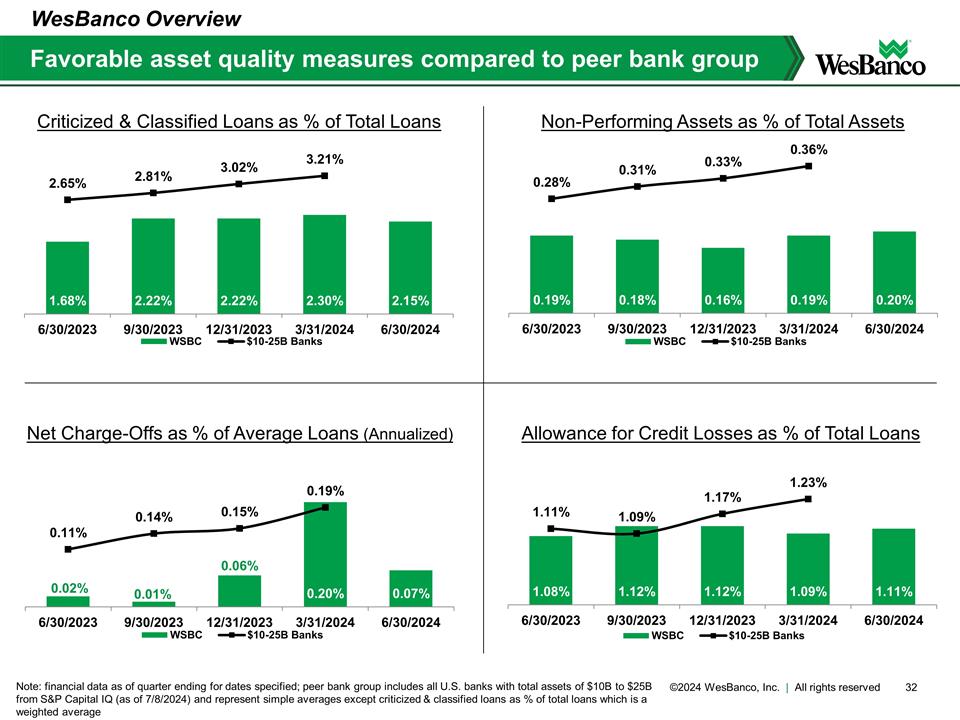

Favorable asset quality measures compared to peer bank group Note: financial data as of quarter ending for dates specified; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 7/8/2024) and represent simple averages except criticized & classified loans as % of total loans which is a weighted average Non-Performing Assets as % of Total Assets Net Charge-Offs as % of Average Loans (Annualized) Allowance for Credit Losses as % of Total Loans Criticized & Classified Loans as % of Total Loans WesBanco Overview

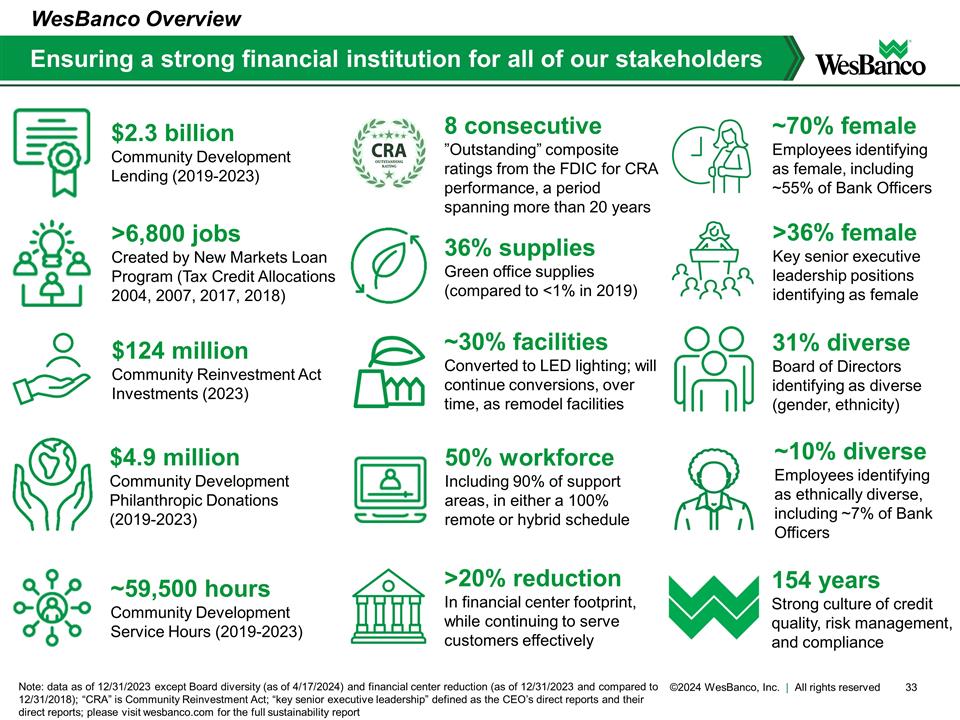

Ensuring a strong financial institution for all of our stakeholders Note: data as of 12/31/2023 except Board diversity (as of 4/17/2024) and financial center reduction (as of 12/31/2023 and compared to 12/31/2018); “CRA” is Community Reinvestment Act; “key senior executive leadership” defined as the CEO’s direct reports and their direct reports; please visit wesbanco.com for the full sustainability report WesBanco Overview >6,800 jobs Created by New Markets Loan Program (Tax Credit Allocations 2004, 2007, 2017, 2018) $2.3 billion Community Development Lending (2019-2023) $124 million Community Reinvestment Act Investments (2023) $4.9 million Community Development Philanthropic Donations (2019-2023) ~59,500 hours Community Development Service Hours (2019-2023) 8 consecutive ”Outstanding” composite ratings from the FDIC for CRA performance, a period spanning more than 20 years ~70% female Employees identifying as female, including ~55% of Bank Officers >36% female Key senior executive leadership positions identifying as female 31% diverse Board of Directors identifying as diverse (gender, ethnicity) ~10% diverse Employees identifying as ethnically diverse, including ~7% of Bank Officers 36% supplies Green office supplies (compared to <1% in 2019) ~30% facilities Converted to LED lighting; will continue conversions, over time, as remodel facilities 50% workforce Including 90% of support areas, in either a 100% remote or hybrid schedule >20% reduction In financial center footprint, while continuing to serve customers effectively 154 years Strong culture of credit quality, risk management, and compliance

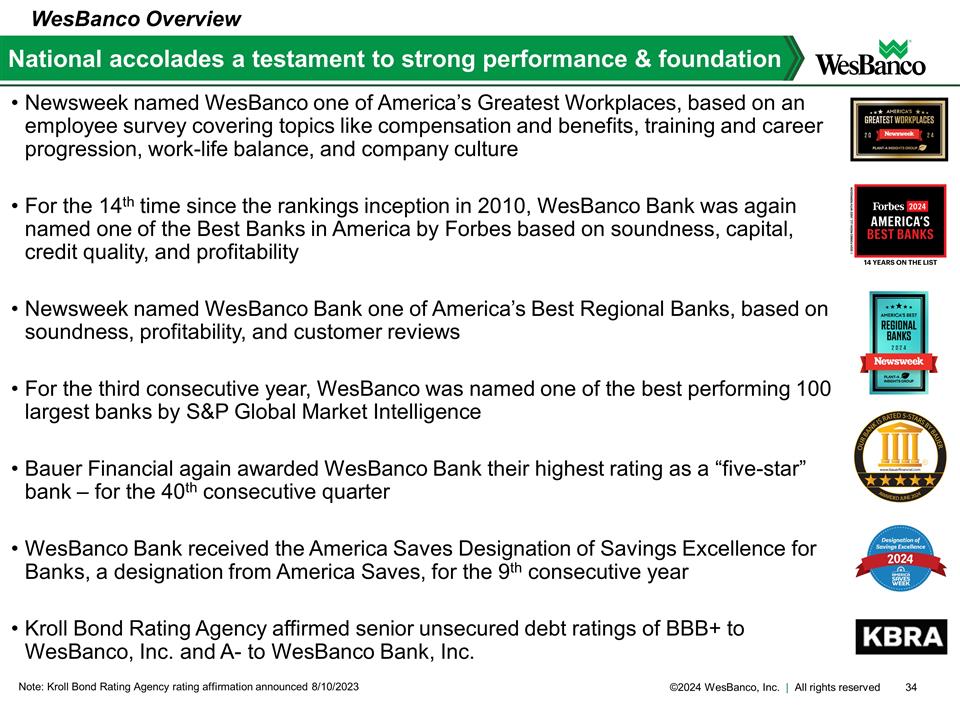

Newsweek named WesBanco one of America’s Greatest Workplaces, based on an employee survey covering topics like compensation and benefits, training and career progression, work-life balance, and company culture For the 14th time since the rankings inception in 2010, WesBanco Bank was again named one of the Best Banks in America by Forbes based on soundness, capital, credit quality, and profitability Newsweek named WesBanco Bank one of America’s Best Regional Banks, based on soundness, profitability, and customer reviews For the third consecutive year, WesBanco was named one of the best performing 100 largest banks by S&P Global Market Intelligence Bauer Financial again awarded WesBanco Bank their highest rating as a “five-star” bank – for the 40th consecutive quarter WesBanco Bank received the America Saves Designation of Savings Excellence for Banks, a designation from America Saves, for the 9th consecutive year Kroll Bond Rating Agency affirmed senior unsecured debt ratings of BBB+ to WesBanco, Inc. and A- to WesBanco Bank, Inc. National accolades a testament to strong performance & foundation Note: Kroll Bond Rating Agency rating affirmation announced 8/10/2023 WesBanco Overview

Appendix

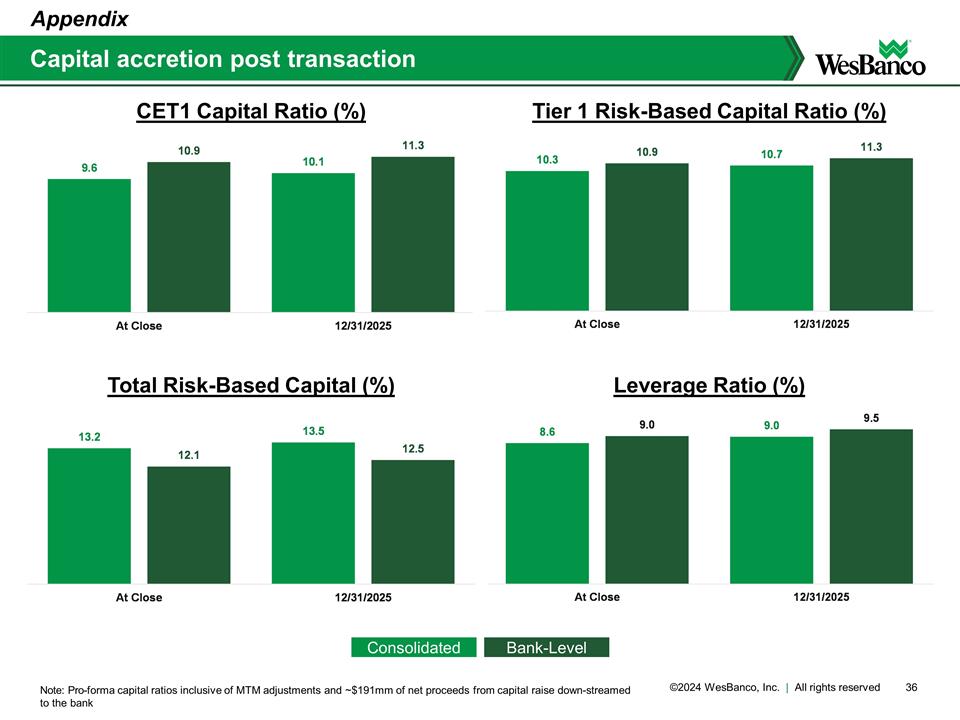

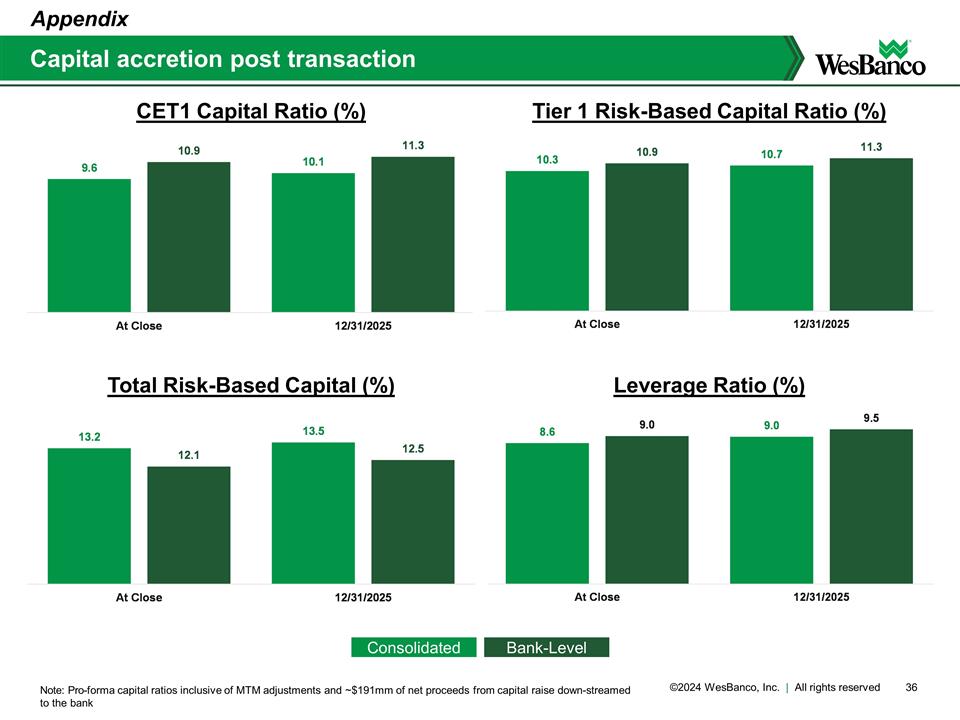

Capital accretion post transaction Appendix CET1 Capital Ratio (%) Leverage Ratio (%) Total Risk-Based Capital (%) Tier 1 Risk-Based Capital Ratio (%) Note: Pro-forma capital ratios inclusive of MTM adjustments and ~$191mm of net proceeds from capital raise down-streamed to the bank Consolidated Bank-Level

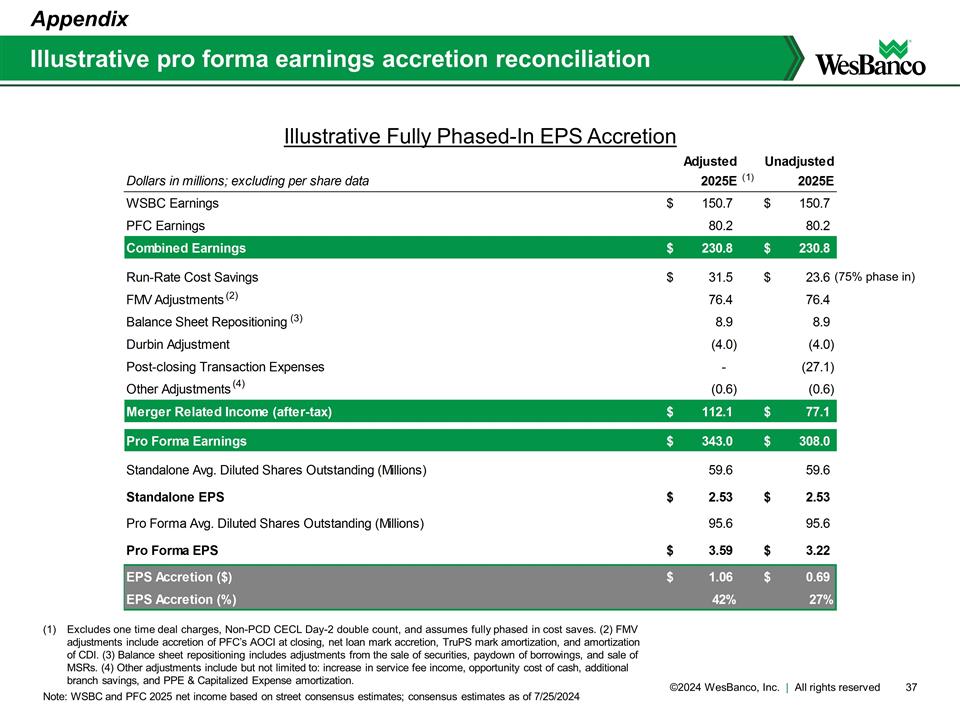

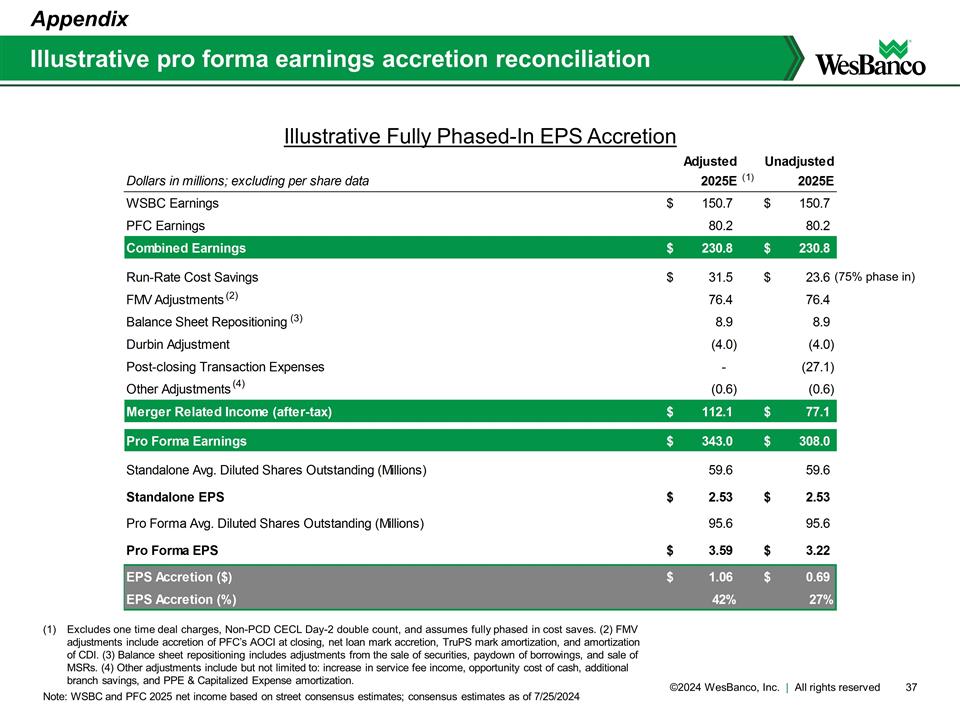

Illustrative pro forma earnings accretion reconciliation Illustrative Fully Phased-In EPS Accretion Appendix Excludes one time deal charges, Non-PCD CECL Day-2 double count, and assumes fully phased in cost saves. (2) FMV adjustments include accretion of PFC’s AOCI at closing, net loan mark accretion, TruPS mark amortization, and amortization of CDI. (3) Balance sheet repositioning includes adjustments from the sale of securities, paydown of borrowings, and sale of MSRs. (4) Other adjustments include but not limited to: increase in service fee income, opportunity cost of cash, additional branch savings, and PPE & Capitalized Expense amortization. Note: WSBC and PFC 2025 net income based on street consensus estimates; consensus estimates as of 7/25/2024 (2) (3) (4) (75% phase in)

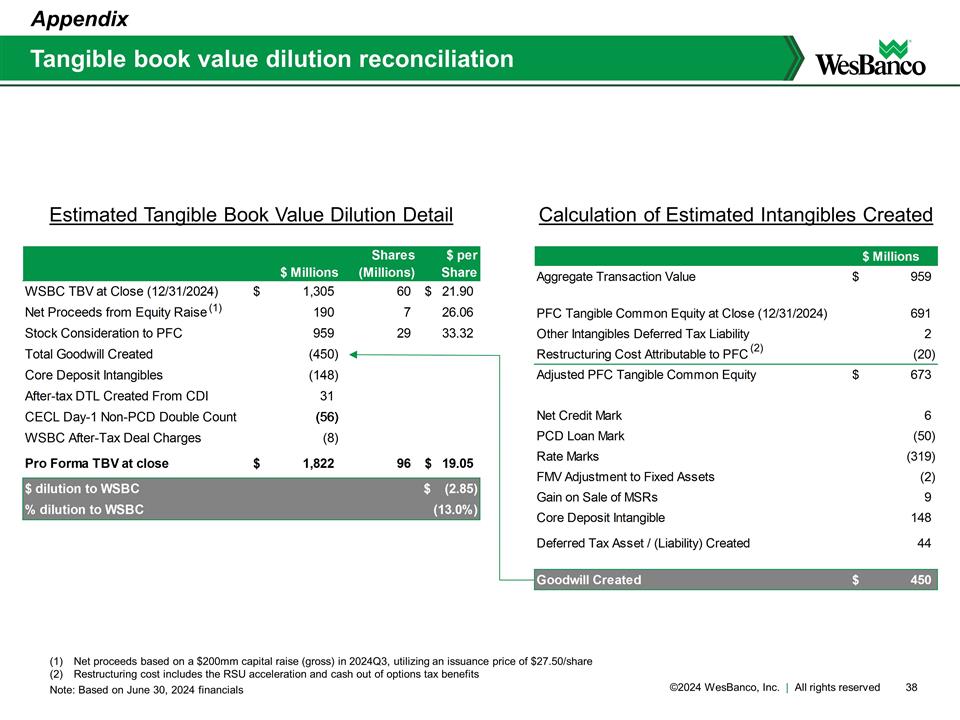

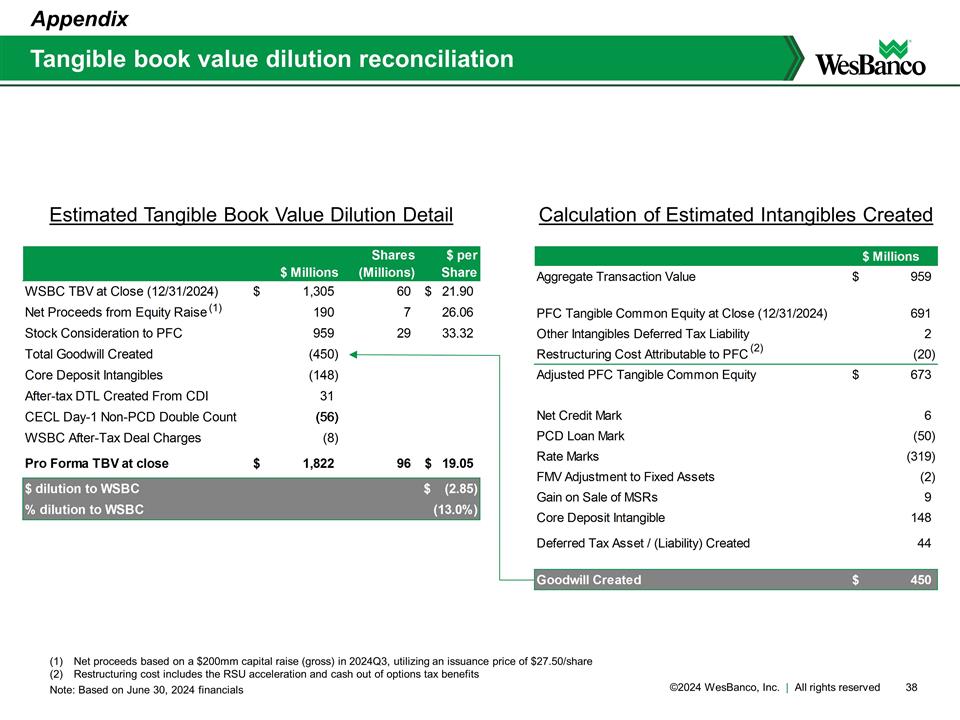

Tangible book value dilution reconciliation Appendix Estimated Tangible Book Value Dilution Detail Calculation of Estimated Intangibles Created Net proceeds based on a $200mm capital raise (gross) in 2024Q3, utilizing an issuance price of $27.50/share Restructuring cost includes the RSU acceleration and cash out of options tax benefits Note: Based on June 30, 2024 financials (1) (2)

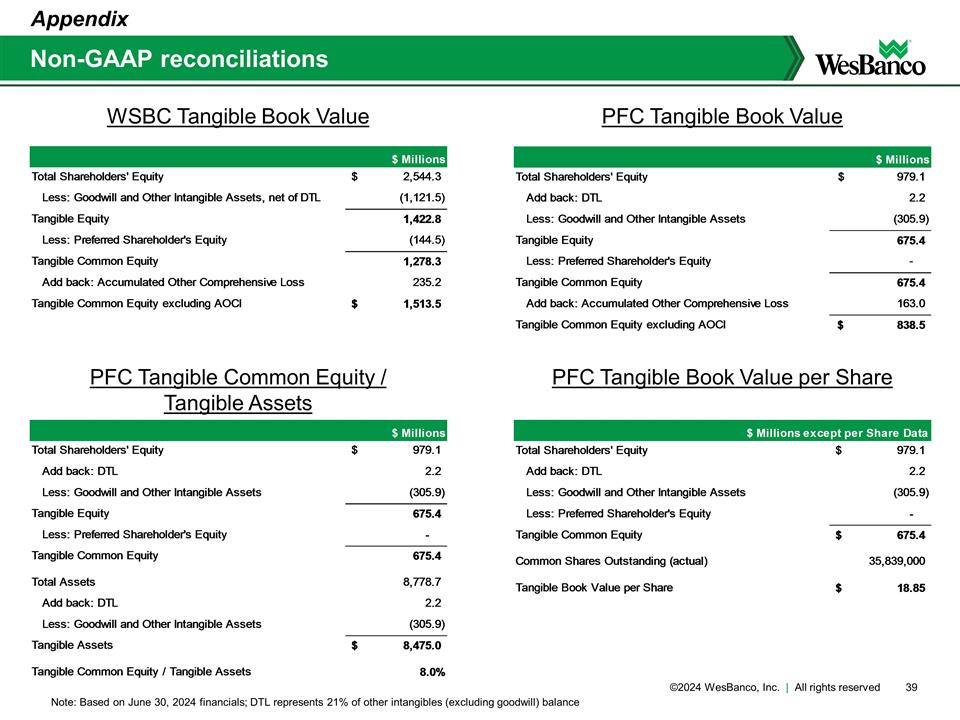

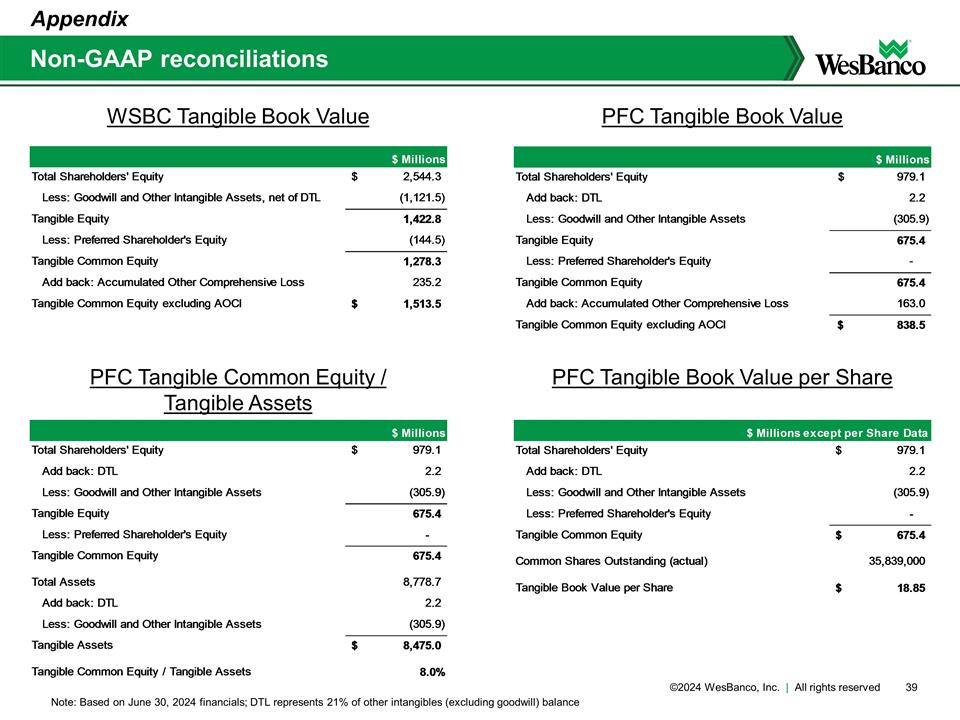

Non-GAAP reconciliations Appendix WSBC Tangible Book Value PFC Tangible Book Value PFC Tangible Common Equity / Tangible Assets PFC Tangible Book Value per Share Note: Based on June 30, 2024 financials; DTL represents 21% of other intangibles (excluding goodwill) balance