As filed with the U.S. Securities and Exchange Commission on December 23, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SFIDA X, INC.

(Exact name of Registrant as specified in its charter)

| Japan | | 7371 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

SFIDA X, Inc.

Sumitomo Fudosan Shinjuku Central Park Tower, 11F

6-18-1 Nishi-Shinjuku, Shinjuku-ku

Tokyo 160-0023, Japan

Tel: +81 3-6258-1744

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Tel: 302-738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Giovanni Caruso John A. Stapleton Loeb & Loeb LLP 345 Park Ave New York, NY 10154 Tel: (212) 407-4000 | | Takuro Awazu City-Yuwa Partners Marunouchi Mitsui Building, 7th Floor 2-2-2 Marunouchi, Chiyoda-ku Tokyo 100-0005, Japan Tel: +81(0)3-6212-5500 | | Richard A. Friedman, Esq. Andrew J. Bond, Esq. Nazia J. Khan, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112 Tel: (212) 653-8700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED DECEMBER 23, 2024 |

American Depositary Shares Representing

Common Shares

SFIDA X, INC.

This is the initial public offering of our common shares, no par value, represented by American Depositary Shares (“ADSs”). Each ADS represents common shares. We are offering ADSs in the United States and ADSs are being offered in a concurrent offering in Japan in accordance with local laws. We currently expect the initial public offering price to be between $ and $ per ADS.

Prior to this offering, there has been no public market for our common shares or ADSs. We intend to apply to list the ADSs on the Nasdaq Capital Market (“Nasdaq”) under the symbol “SFDX.” Such listing, however, is not guaranteed. If the application is not approved for listing on Nasdaq, we will not proceed with this offering.

We are a “controlled company” as defined under the corporate governance rules of Nasdaq because Mr. Etsuro Sumita, our founder, President and Representative director, will retain approximately % of the voting power of our outstanding common shares if all the ADSs being offered hereby are sold (or % of our outstanding voting power if the underwriters’ option to purchase additional ADSs is exercised in full). As a result of his voting power, Mr. Sumita will be able to control any action requiring the general approval of our stockholders, including the election of our Board of Directors, the adoption of amendments to our Articles of Incorporation and the approval of any merger or sale of substantially all of our assets. As a “controlled company,” as defined under the Nasdaq Stock Market Rules, we are permitted to elect to rely on certain exemptions from Nasdaq’s corporate governance rules. Accordingly, you may not have the same protections afforded to holders of companies that are subject to all of the corporate governance requirements of the Nasdaq Capital Market Please read “Prospectus Summary—Implications of Being a Controlled Company,” beginning on page 4 of this prospectus for more information.

We are organized under the laws of Japan. We are a “foreign private issuer” as defined in Rule 405 under the Securities Act of 1933, as amended and an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, under applicable U.S. federal securities laws, and are eligible for reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in the ADSs involves a high degree of risk. Before buying any of the ADSs, you should carefully read the discussion of material risks of investing in the ADSs in “Risk Factors” beginning on page 8 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per ADS | | | Total | |

| Initial public offering price | | $ | | | | $ | | |

| Underwriting discount and commissions (1) | | $ | | | | $ | | |

| Proceeds to us, before expenses | | $ | | | | $ | | |

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 99 for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional ADSs solely to cover over-allotments, if any.

The underwriters expect to deliver the ADSs to purchasers on or about , 2024.

ThinkEquity

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us. Neither we nor the underwriters have authorized anyone to provide you with information that is different, and neither we nor the underwriters take any responsibility for, and provide any assurance as to the reliability of, any information, other than the information in this prospectus and any free writing prospectus prepared by us. We are offering to sell the ADSs, and seeking offers to buy the ADSs, only in jurisdictions where such offers and sales are permitted. This prospectus is not an offer to sell, or a solicitation of an offer to buy, the ADSs in any jurisdictions where, or under any circumstances under which, the offer, sale, or solicitation is not permitted. The information in this prospectus and in any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of the ADSs. Our business, results of operations, financial condition, or prospects may have changed since those dates.

Before you invest in the ADSs, you should read the registration statement (including the exhibits thereto and the documents incorporated by reference therein) of which this prospectus forms a part.

For investors in Japan: Any ADSs offered and sold in Japan will be registered with the Financial Services Agency of Japan pursuant to Article 4, Paragraph 1 of the Financial Instruments and Exchange Act.

For investors outside of the United States and Japan: Neither we nor the underwriters have done anything that would permit this offering, or the possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States and Japan. You are required to inform yourselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus.

ABOUT THIS PROSPECTUS

As used in this prospectus, unless the context otherwise requires or otherwise states, references to “SFIDA X,” “our company,” the “Company,” “we,” “us,” “our,” and similar references refer to SFIDA X, Inc., a stock corporation with limited liability organized under the laws of Japan. We refer to our common shares as “common shares,” unless the context otherwise requires. We sometimes refer to our common shares as “equity interests” when described on an aggregate basis.

Our functional currency and reporting currency is the Japanese yen (“JPY,” “yen” or “¥”). The terms “dollar,” “USD,” “US$” or “$” refer to U.S. dollars, the legal currency of the United States. Convenience translations included in this prospectus of Japanese yen into U.S. dollars have been made at the exchange rate of ¥151.72 = US$1.00, which was the foreign exchange rate on April 1, 2024 as reported by the U.S. Federal Reserve in is weekly release on April 8, 2024 (www.federalreserve.gov/releases/h10/20240408/).

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Our fiscal year ends on September 30 of each year as does our reporting year. Our most recent fiscal year ended on September 30, 2023. See Note 2 to our audited financial statements as of and for the year ended September 30, 2023, included elsewhere in this prospectus, for a discussion of the basis of presentation, functional currency, and translation of financial statements.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Market and Industry Data

This prospectus contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this prospectus due to a variety of factors, including those described in the section entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the forecasts and estimates.

Trademarks, Service Marks and Tradenames

This prospectus may contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, or trade names in this prospectus is not intended to imply a relationship with, or endorsement or sponsorship by, these other parties. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “believe”, “expect”, “could”, “intend”, “plan”, “anticipate”, “estimate”, “continue”, “predict”, “project”, “potential”, “target,” “goal,” or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies, and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Our Business” may cause our actual results, performance, or achievements to differ materially from any future results, performance, or achievements expressed or implied by the forward-looking statements in this prospectus. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this prospectus include:

| ● | our expectations regarding our revenue, expenses, and other operating results; |

| ● | our efforts to successfully develop and commercialize our new services and products; |

| ● | the implementation of our strategic plans for our business, services and products; |

| ● | the size of the market opportunity for our services and products and our ability to maximize those opportunities; |

| ● | the costs and success of our marketing efforts, and our ability to promote our brands; |

| ● | our competitive position and the development of and projections relating to our competitors or our industry; |

| ● | our ability to obtain adequate financing in the future on terms acceptable to us; |

| ● | our ability to identify and successfully enter into strategic collaborations in the future, and our assumptions regarding any potential revenue that we may generate thereunder; |

| ● | our ability to exploit the intellectual property rights in a manner beneficial to us; |

| ● | our ability to obtain, maintain, protect, and enforce intellectual property protection for our technologies and related products and services, and the scope of such protection; |

| ● | our ability to operate our business without infringing, misappropriating, or otherwise violating the intellectual property or proprietary rights of third parties; |

| ● | general economic conditions and events and the impact they may have on us and our customers; |

| ● | our ability to respond to national disasters, such as earthquakes and tsunamis, and to global pandemics, such as COVID-19; |

| ● | the regulatory environment in which we operate; |

| ● | our plans with respect to use of proceeds from this offering; |

| ● | our ability to attract and retain qualified key management and technical personnel; and |

| ● | our expectations regarding the time during which we will be an emerging growth company and a foreign private issuer. |

The forward-looking statements contained in this prospectus are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this prospectus, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events, or otherwise, after the date of this prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information presented in greater detail elsewhere in this prospectus. This summary does not include all the information you should consider before investing in the ADSs. You should read this summary together with the more detailed information appearing elsewhere in this prospectus, including our financial statements and related notes and the sections entitled “Risk Factors” on page 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on page 32 of this prospectus. Some of the statements in this summary and elsewhere in this prospectus constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Overview

Based on our management philosophy of “causing transformation through challenge,” we provide web development, system integration, and IT consulting solutions to a comprehensive range of clients - from Japanese small and medium-sized enterprises (“SMEs”) to large domestic businesses in varied industries. Consistent with our aim to “provide services that connect people to people and people to companies,” we offer targeted solutions through web development, IT technical support, and IT strategy planning customized to the sizes of enterprises spanning various industries in Japan.

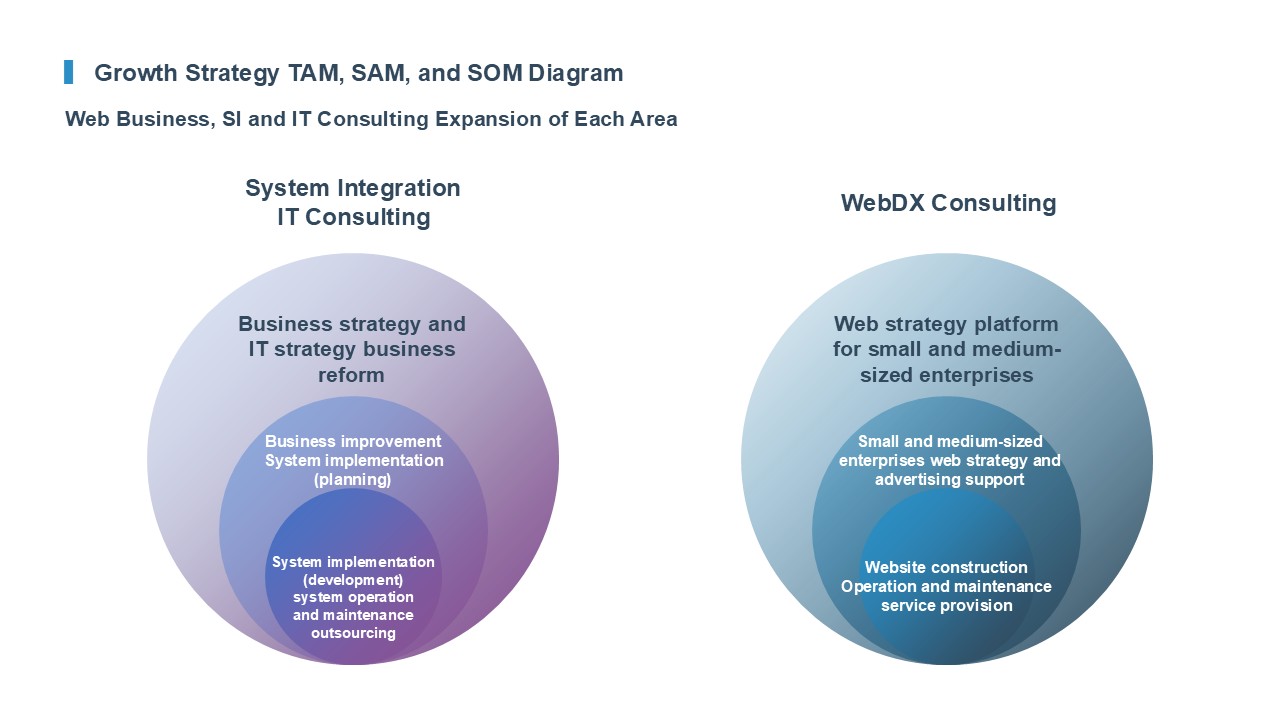

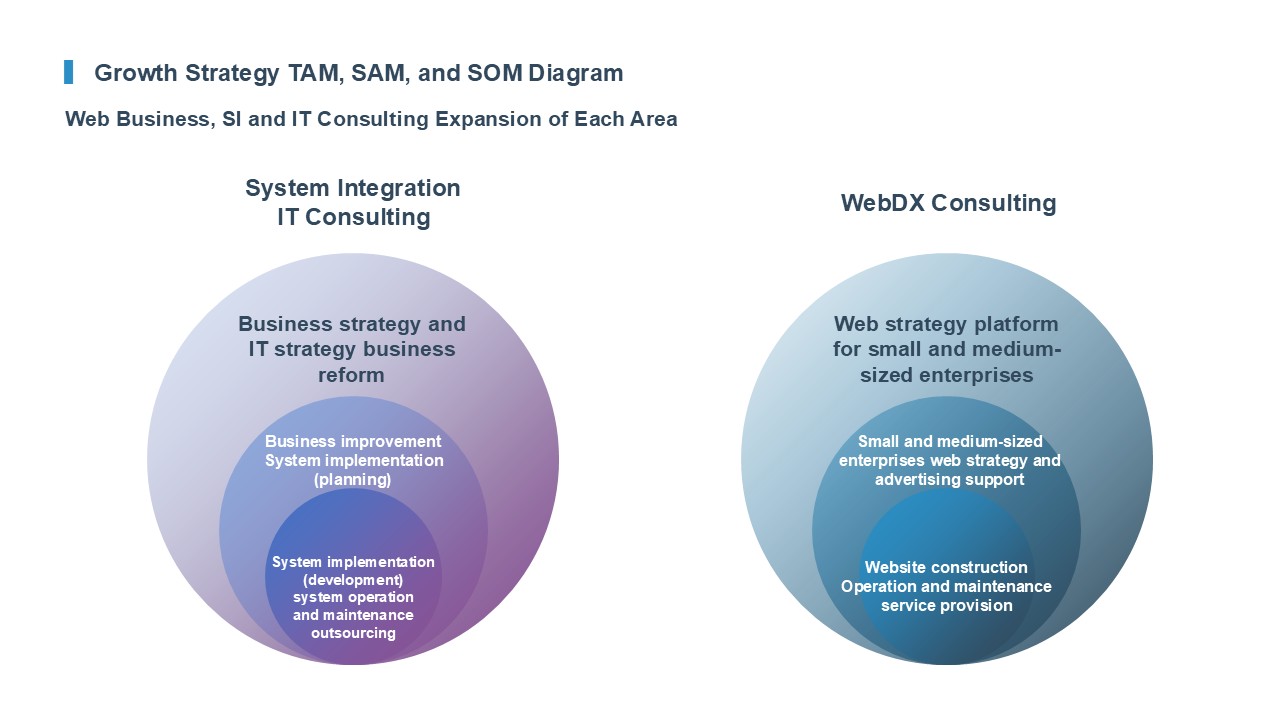

Through SFIDA X, we provide our “WebDX Consulting Business” (“DX” stands for “digital transformation”) that offers optimal solutions utilizing the Internet, Internet technology, and artificial intelligence (“AI”) to solve various problems faced by small and medium-sized enterprises and to support their business operations.

In addition, we have two wholly-owned subsidiaries: Style Free, Inc. (“Style Free”) and Berkeley Consulting, Inc. (“Berkeley Consulting”).

Style Free operates our “System Integration Business” that provides IT technical support services for system development projects and contracted system development, mainly for large companies.

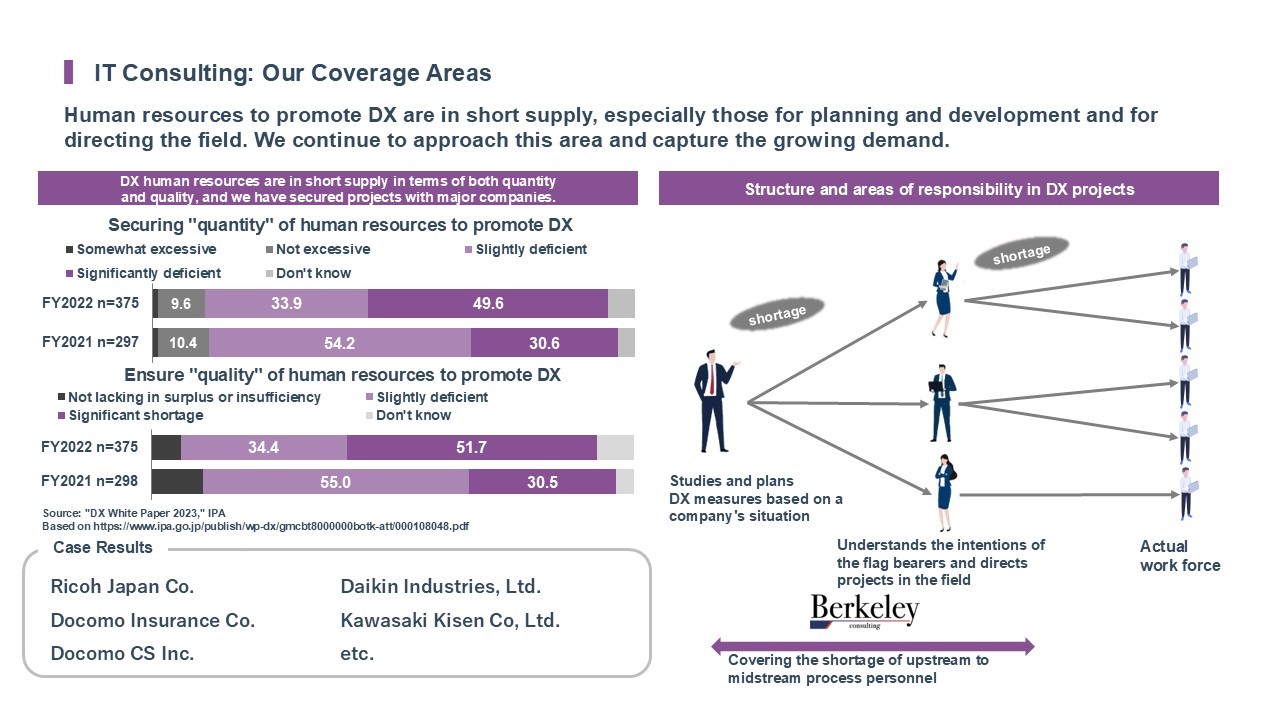

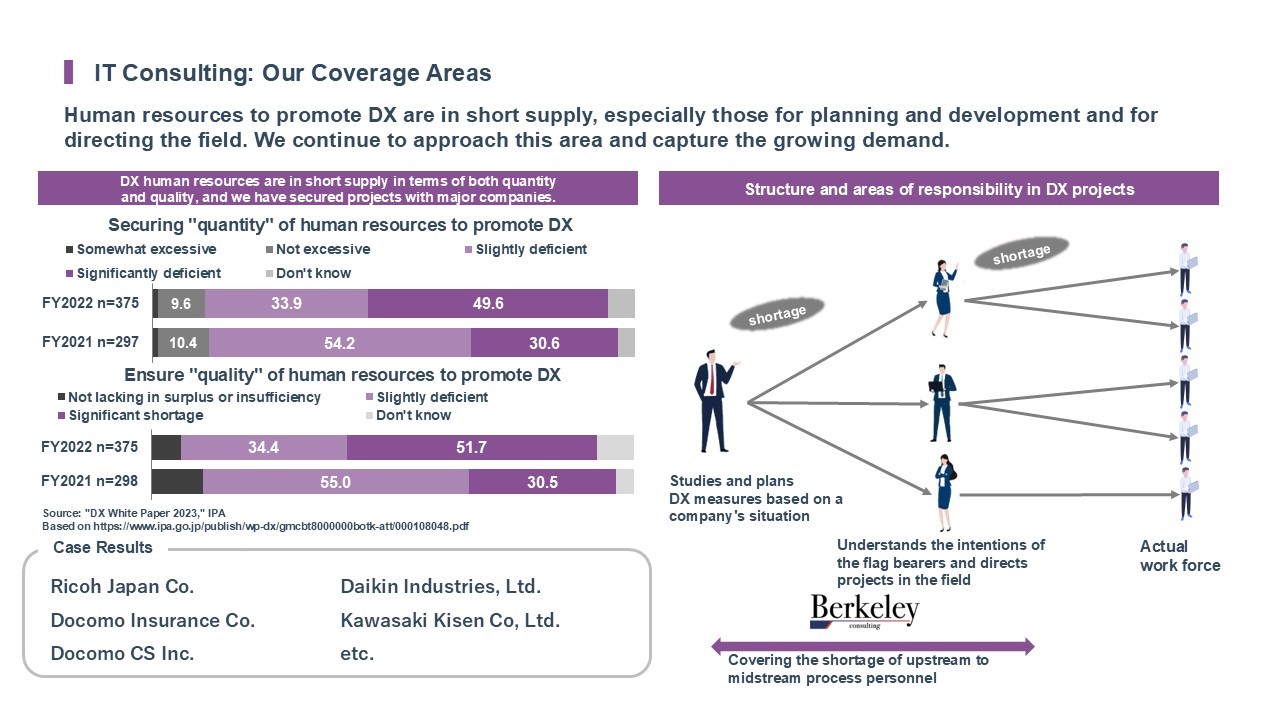

Berkeley Consulting provides our “IT Consulting Business” which helps our large enterprise clients transform their businesses through IT strategy planning, conceptual support, project management, and utilization Robotic Process Automation (“RPA”) for large enterprises.

Below is an overview of our services.

Business Environment

We select the most appropriate services from a variety of offerings and provide them to our clients, ranging from small and medium-sized companies to major corporations, that are not effectively utilizing the Internet and losing opportunities.

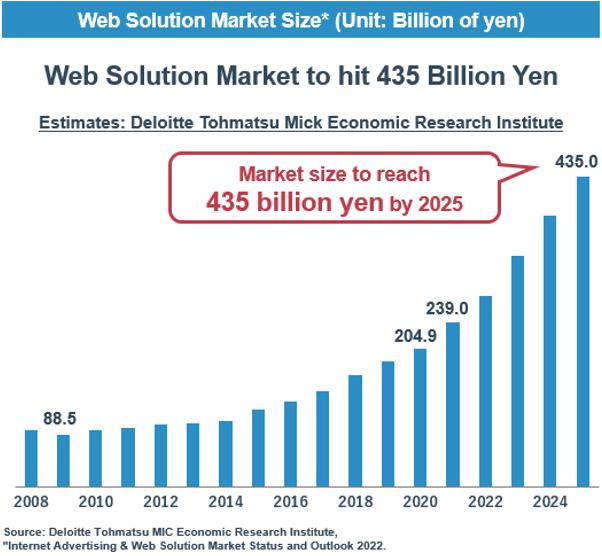

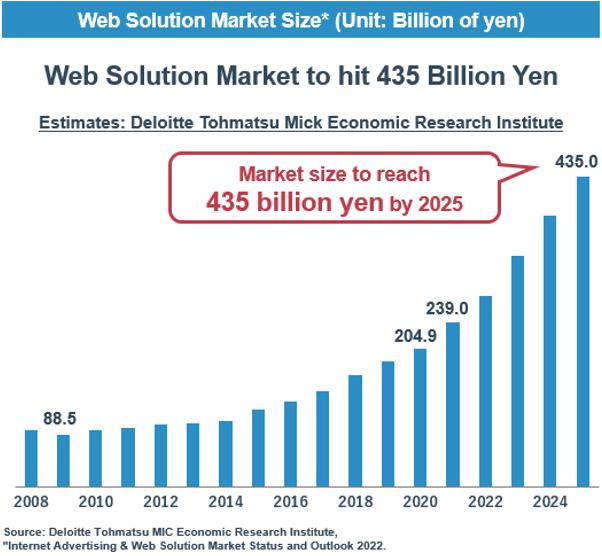

Several studies conducted by key institutions present the potential of the system integration market in Japan. According to a survey conducted by Deloitte Tohmatsu MIC Economic Research Institute in 2023, the Web integration market, to which our WebDX Consulting Business belongs, is expected to grow to 435 billion yen by 2025. In addition, we have seen that many Japanese small and medium-sized enterprises are not investing in IT due to a lack of human resources, despite having an urgent need to improve their productivity.

According to a survey conducted by Yano Research Institute in 2023, the IT investment market is expected to grow to 15.3 trillion yen in 2024. In terms of the number of IT personnel, surveys conducted by Mizuho Information & Research Institute and the Information-technology Promotion Agency, Japan (IPA) in 2019 discovered that there is a shortage of IT personnel in businesses in terms of both quantity and quality, while surveys by Mizuho Information Research Institute and the IPA in 2019 identified that there will be a shortage of approximately 500,000 IT personnel by 2030, which provides favorable market conditions for us as an engineering organization providing technical support services.

According to a survey conducted by Nikkei, Inc. in 2024, the business consulting market, to which our IT Consulting Business belongs, is expected to reach 4.5 billion dollars by 2025, and is expected to continue to expand into the future. The expansion of the IT market is particularly strong, and the needs associated with digitalization are expected to increase.

| | A. | Responding to Market Changes |

We believe that technological innovations and new service models will continue to be introduced in the IT market, prompting further market changes, while at the same time, customer needs will continue to diversify and change. In order to respond to these changes, we believe that we must be at the front lines of market trends and provide products and services that are optimal solutions for our clients and that can generate synergies with our existing businesses. We intend to continue to provide products and services that are ahead of market needs, and form business alliances that have a high level of expertise.

| | B. | Continued Strengthening of Earnings Base |

We develop our business targeting various customer segments, ranging from small and medium-sized companies and venture businesses to large corporations. In order to achieve continuous and stable growth, we believe it is necessary not only to acquire new customers, but also to increase the unit price of existing customers and extend the duration of contracts.

In addition to strengthening our support system for our clients, we seek to anticipate client demand and raise the unit price per client by responding to client needs and continuously developing and introducing our own products and services that capture trends.

| | C. | Hiring and Developing Staff |

In order to continuously expand our business, we aim to hire additional staff in line with our growth. We seek to build an organizational foundation that can withstand changes even as we develop our business from multiple perspectives by training highly specialized managers in a wide range of fields, including sales, production, and administration. Our policy is to enhance the hiring of new graduates and continue mid-career hiring of people with market experience, while at the same time actively providing internal and external training programs to improve the skills of each employee and develop management personnel.

| | D. | Strengthening of Our Internal Management System |

As our business continues to expand, we recognize that we will be required to further strengthen our internal management system to ensure efficient management. In response to this, we have been working to strengthen our internal management system by assigning personnel with expertise in various fields, and will continue to enhance this system into the future.

| | E. | Strengthening Compliance |

The establishment, maintenance, and reinforcement of a thorough compliance and information security system is important. We recognize that compliance with the Labor Standards Act, the Worker Dispatching Act, and other related laws and regulations, as well as all other laws and rules related to our business operations, is fundamental to our social responsibility.

We have established internal rules and regulations based on relevant laws and regulations and a Compliance Committee chaired by our Representative Director to monitor compliance in order to ensure thorough compliance. We will continue to ensure appropriate operations to ensure the effectiveness of our compliance system.

| | F. | Improvement of Information Security |

The protection of customer information and internal information are important issues, and we have established a basic information security policy to ensure the confidentiality, integrity, and availability of such information, and obtained Information Security Management System (ISMS) certification. We believe that information security will become even more important as our business expands, and we will continue to improve information security by strengthening our internal systems and education and training programs.

G. Promotion of Synergy Across the Businesses

We intend to invest the cash from our WebDX Consulting business into recruiting and training our workforce and expanding the performance of our System Integration and IT Consulting businesses, thereby achieving medium- to long-term earnings growth for the group as a whole as well as to continue to drive synergies between the businesses. We believe that there have been significant synergies generated among our three businesses, such as the building of tools and apps by Style Free that complement our other businesses.

H. Shifting Growth Focus

While our WebDX Consulting Business customer base is primarily composed of small businesses with ten or fewer employees, our System Integration Business’s and our IT Consulting Business’s primary customer base are mid-sized companies and large corporations, respectively. We believe that shifting the focus of growth from our WebDX Consulting Business to our System Integration Business and IT Consulting Business will allow us to shift our customer base into large customers, thereby resulting in a clear trend of stable growth in our business performance.

Summary Risk Factors

There are a number of risks that you should carefully consider before making an investment decision regarding this offering. These risks are discussed more fully in the section entitled “Risk factors” beginning on page 8 of this prospectus. You should read and carefully consider these risks and all of the other information in this prospectus, including the financial statements and the related notes thereto included in this prospectus, before deciding whether to invest in the ADSs. If any of these risks actually occur, our business, financial condition, operating results and cash flows could be materially adversely affected. In such case, the trading price of the ADSs would likely decline, and you may lose all or part of your investment. These risk factors include, but are not limited to:

| ● | Our growth depends on our ability to attract and retain a large number of customers, and the loss of our customers, or failure to attract new customers, could materially and adversely affect our business. |

| ● | We may be unable to collect sales proceeds from our customers due to changes in the management policies or screening standards of credit companies. |

| ● | We operate in a very competitive business environment, and if we are unable to compete successfully against our existing or potential competitors, our business, financial condition, and results of operations may be adversely affected. |

| ● | We need to keep pace with changing technologies in order to provide effective services and solutions to our customers, and we will need to stay ahead of the technology changes and risks in order to be successful. |

| ● | We rely significantly on the Japanese market. Any changes in the economic and regulatory conditions of Japan or changes in the business strategies of Japanese customers may have an adverse effect on our business. |

| ● | Our business depends on securing, retaining and developing personnel with information technology and engineering experience. |

| ● | Our business is subject to various governmental regulations and actions, and the occurrence of a violation of laws and regulations could have an impact on our business and financial performance. |

| ● | We may become party to intellectual property rights claims in the future that are expensive and time consuming to defend, and, if resolved adversely, could have a significant impact on our business. |

| ● | We use AI in our products and services which may result in operational challenges, legal liability, reputational concerns and competitive risks. |

| ● | Interruption or failure of our information technology and communications systems due to natural disasters, human error or malicious acts could impair our ability to effectively provide our services and products, which could damage our brand and reputation and adversely affect our operating results. |

| ● | If our third-party service providers experience significant technological or other disruptions, our business may be harmed. |

| ● | If the confidential or personal information that we handle is used inappropriately, leaked, lost or stolen, it may adversely affect the value of our brand, our reputation and our results of operations. |

| ● | Our management team lacks experience in managing a U.S. public company and complying with laws applicable to such company, the failure of which may adversely affect our business, financial condition and results of operations. |

| ● | We are an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common shares and the ADSs may be less attractive to investors. |

| ● | As a “foreign private issuer” we are permitted, and intend, to follow certain home country corporate governance and other practices instead of otherwise applicable SEC and Nasdaq requirements, which may result in less protection than is accorded to investors under rules applicable to domestic U.S. issuers. |

| ● | As a controlled company, we are not subject to all of the corporate governance rules of Nasdaq. |

| | | |

| | ● | Pursuant to the Companies Act, for so long as Mr. Sumita, our co-founder, Chief Executive Officer and Representative Director, retains 90% or more of the total number of voting rights of all shareholders of the Company, he will have the right to demand that all other shareholders sell their shares to him. |

| ● | We may amend the deposit agreement without consent from holders of ADSs and, if such holders disagree with our amendments, their choices will be limited to selling the ADSs or withdrawing the underlying common shares. |

| ● | We are incorporated in Japan, and it may be more difficult to enforce judgments against us that are obtained in courts outside of Japan. |

| ● | An increase of our international presence could expose us to fluctuations in foreign currency exchange rates, or a change in monetary policy may harm our financial results. |

| ● | We are actively expanding in Japan, and we may be adversely affected if Japanese and global economic conditions and financial markets deteriorate. |

| ● | Rights of shareholders under Japanese law may be different from rights of shareholders in other jurisdictions. |

| ● | Holders of ADSs have fewer rights than shareholders under Japanese law, and their voting rights are limited by the terms of the deposit agreement. |

| ● | Dividend payments will be affected by fluctuations in the exchange rate between the U.S. dollar and the Japanese yen. |

| ● | Direct acquisition of our common shares, in lieu of ADSs, is subject to a prior filing requirement under recent amendments to the Japanese Foreign Exchange and Foreign Trade Act and related regulations. |

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to reporting companies that make filings with the U.S. Securities and Exchange Commission (the “SEC”). For so long as we remain an emerging growth company, we will not be required to, among other things:

| ● | present more than two years of audited financial statements and two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure in our registration statement of which this prospectus forms a part; |

| ● | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| ● | disclose certain executive compensation-related items; and |

| ● | seek shareholder non-binding advisory votes on certain executive compensation matters and golden parachute arrangements, to the extent applicable to our Company as a foreign private issuer (as defined in Rule 405 under the Securities Act). |

The JOBS Act also permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (ii) the last day of the fiscal year during which we have total annual gross revenue of at least $1.235 billion, (iii) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which means the market value of our common shares that are held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, and (iv) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

In addition, upon the consummation of this offering, we will report in accordance with the rules and regulations applicable to a “foreign private issuer.” As a foreign private issuer, we will take advantage of certain provisions under the rules that allow us to follow the laws of Japan for certain corporate governance matters. Even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations with respect to a security registered under the Exchange Act; |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events; and |

| ● | Regulation Fair Disclosure (“Regulation FD”), which regulates selective disclosures of material information by issuers. |

As a foreign private issuer, we will have four months after the end of each fiscal year (September 30) to file our annual report on Form 20-F with the SEC. In addition, our executive officers, directors, and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act.

Foreign private issuers, like emerging growth companies, are exempt from certain more stringent executive compensation disclosure rules. As such, even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from the more stringent compensation disclosures required of public companies that are not a foreign private issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

| (i) | the majority of our executive officers or directors are U.S. citizens or residents; |

| (ii) | more than 50% of our assets are located in the United States; or |

| (iii) | our business is administered principally in the United States. |

In this prospectus, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign private issuer. Accordingly, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

Implications of Being a Controlled Company

The “controlled company” exception to the rules of Nasdaq provides that a company of which more than 50% of the voting power is held by an individual, group or another company, a “controlled company,” need not comply with certain requirements of the corporate governance rules of Nasdaq. As of the date of this prospectus, Mr. Sumita, our founder, President and Representative Director of the Company, beneficially owned an aggregate of 2,020,000 common shares, which represents approximately 96.12% of the voting power of our outstanding common shares. Following this offering, Mr. Sumita will control approximately % of the voting power of our outstanding common shares if all the ADSs are sold (or % of our outstanding voting power if the underwriters exercise the over-allotment option in full). Accordingly, if we obtain listing on Nasdaq, we will be a “controlled company” within the meaning of the corporate governance rules of Nasdaq. Controlled companies are exempt from the corporate governance rules of Nasdaq requiring that listed companies have (i) a majority of the board of directors consist of “independent” directors under the listing standards of Nasdaq, (ii) a nominating/corporate governance committee composed entirely of independent directors and a written nominating/corporate governance committee charter meeting the requirements of Nasdaq, and (iii) a compensation committee composed entirely of independent directors and a written compensation committee charter meeting the requirements of Nasdaq. See also “Management - Foreign Private Issuer Status and Controlled Company Exemption.”

Corporate Information

We were incorporated in Japan on March 17, 2009. Our agent for service of process in the United States is . Our principal executive offices are located at Sumitomo Fudosan Shinjuku Central Park Tower, 11F, 6-18-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo 160-0023, Japan, and our main telephone number is +81 3-6258-1744. Our website is www.sfidax.jp. The information contained in, or that can be accessed through, our website is not incorporated by reference into, and is not a part of, this prospectus. You should not consider any information on our website to be a part of this prospectus or use any such information in your decision on whether to purchase the ADSs. We have included our website address in this prospectus solely for informational purposes.

Trademarks

We own or have rights to various trademarks and trade names that we use in connection with the operation of our business. As of November 12, 2024, we had 6 registered trademarks in Japan.

THE OFFERING

| ADSs Offered by Us | | ADSs (or ADSs if the underwriters exercise in full the over-allotment option to purchase additional ADSs). |

| Offering Price | | We currently expect the initial public offering price to be between $ and $ per ADS. |

| ADSs to be Outstanding Immediately After this Offering | | ADSs (or ADSs if the underwriters exercise in full the over-allotment option to purchase additional ADSs). |

| Common Shares to be Outstanding Immediately After this Offering(1) | |

common shares (or common shares if the underwriters exercise in full the over-allotment option to purchase additional ADSs). |

| Common Shares | | Our share capital consists of common shares. Each common share shall be entitled to one vote on all matters subject to shareholders’ vote. |

| Over-Allotment Option | | We have granted to the underwriters a 45-day option to purchase from us up to additional ADSs (equal to 15% of the amount of ADSs sold in the offering) at the initial public offering price less the underwriting discounts and commissions. |

| The ADSs | | Each ADS represents common shares. The ADSs are evidenced by American depositary receipts (“ADRs”) issued by Citibank, N.A., as the depositary. |

| | | The depositary will be the holder of the common shares underlying the ADSs, and you will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and owners and beneficial owners of ADSs from time to time. |

| | | You may surrender your ADSs to the depositary to withdraw the common shares underlying your ADSs. The depositary will charge you a fee for such an exchange. |

| | | We may amend or terminate the deposit agreement for any reason without your consent. If an amendment becomes effective, you will be bound by the deposit agreement, as amended, if you continue to hold your ADSs. |

| | | To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, a form of which is an exhibit to the registration statement to which this prospectus forms a part. |

| Use of Proceeds | | We estimate that the net proceeds to us from this offering will be approximately $ (or $ if the underwriters exercise in full their option to purchase additional ADSs), assuming an initial public offering price of $ per ADS (which is the midpoint of the price range set forth on the cover page of this prospectus), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| | | We currently intend to use the net proceeds from this offering for the recruitment of additional engineers and consultants, including investment in advertising to reach more potential candidates and other recruitment-related expenses needed to attract and hire qualified candidates; to support our labor costs for our engineers and consultants, including salaries, training, and other expenses necessary to attract and retain top talent; and to fund our working capital and other general corporate purposes. See “Use of Proceeds.” |

| Lock-ups | | We, our directors, officers, and pre-offering shareholders have agreed with the underwriters not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of, or otherwise dispose of, any of our securities for a period of up to nine months from the date of this offering in the case of the Company’s directors and officers and six months from the date of the offering in the case the Company and of any other holder of outstanding securities, subject to certain exceptions. See “Underwriting” for more information. |

| Proposed Trading Market and Symbol | | We intend to apply to list the ADSs on the Nasdaq Capital Market (“Nasdaq”) under the symbol “SFDX.” The closing of this offering is contingent upon the successful listing of the ADSs on Nasdaq. |

| Risk Factors | | Investing in the ADSs is highly speculative and involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 8, and all other information contained in this prospectus, before deciding to invest in the ADSs. |

| (1) | The number of common shares that will be outstanding immediately following this offering is based on 2,101,600 common shares outstanding as of November 12, 2024 and excludes: |

| ● | up to an aggregate of 199,200 common shares issuable upon the exercise of stock options at a weighted-average exercise price of ¥196.42 ($ ) per share. |

Unless otherwise indicated, all information contained in this prospectus assumes:

| ● | no exercise of the option granted to the underwriters to purchase up to additional ADSs in connection with this offering; and |

| | | |

| | ● | no exercise of the Representative’s Warrants. |

SUMMARY FINANCIAL INFORMATION AND OPERATING DATA

The following tables set forth our summary financial information as of and for the years ended September 30, 2023 and 2022 and the six months ended March 31, 2024 and 2023. You should read the following summary financial information in conjunction with, and it is qualified in its entirety by reference to, our audited financial statements and the related notes thereto, our unaudited condensed financial statements and the related notes thereto, and the sections entitled “Capitalization”, “Selected Financial Information and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, each of which are included elsewhere in this prospectus.

Our summary statement of operations information for the years ended September 30, 2023 and 2022, and our related summary balance sheet information as of September 30, 2023, and 2022, have been derived from our audited financial statements as of and for the years ended September 30, 2023, and 2022, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

Our summary statement of operations information for the six months ended March 31, 2024 and 2023, and our related summary balance sheet information as of March 31, 2024, have been derived from our unaudited condensed financial statements as of and for the six months ended March 31, 2024, prepared in accordance with U.S. GAAP, which are included elsewhere in this prospectus.

Our historical results for the periods presented below are not necessarily indicative of the results to be expected for any future periods.

Consolidated Statement of Operations Information

| | Year ended September 30, | | Six months ended March 31, |

| (in thousands, except per share amounts) | | 2023($)(1) | | 2023(¥) | | 2022(¥) | | 2024($)(1) | | 2024(¥) | | 2023(¥) |

| Revenue | | $ | | | | ¥ | 4,280,274 | | | ¥ | 3,721,787 | | | $ | | | | ¥ | 2,301,595 | | | ¥ | 2,069,269 | |

| Cost of revenues | | | | | | | 2,285,996 | | | | 1,925,171 | | | | | | | | 1,300,083 | | | | 1,081,330 | |

| Gross profit | | | | | | | 1,994,278 | | | | 1,796,616 | | | | | | | | 1,001,512 | | | | 987,939 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | | | | | 1,513,989 | | | | 1,514,434 | | | | | | | | 846,199 | | | | 674,931 | |

| Research and development expenses | | | | | | | - | | | | 10,211 | | | | | | | | - | | | | - | |

| Provision for doubtful accounts | | | | | | | 17,581 | | | | 10,466 | | | | | | | | 15,531 | | | | 5,035 | |

| Gain on sale of long-lived assets | | | | | | | - | | | | (2,327 | ) | | | | | | | - | | | | - | |

| Total operating expenses | | | | | | | 1,531,570 | | | | 1,532,784 | | | | | | | | 861,730 | | | | 861,730 | |

| Income from operations | | | | | | | 462,708 | | | | 263,832 | | | | | | | | 139,782 | | | | 307,973 | |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest expense, net | | | | | | | (964 | ) | | | (1,542 | ) | | | | | | | (260 | ) | | | (552 | ) |

| Other income, net | | | | | | | 34,589 | | | | 35,286 | | | | | | | | 79,263 | | | | 17,359 | |

| Total other income (expense) | | | | | | | 33,625 | | | | 33,744 | | | | | | | | 79,003 | | | | 16,807 | |

| Income before income taxes | | | | | | | 496,333 | | | | 297,576 | | | | | | | | 218,785 | | | | 324,780 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | | | | ¥ | 351,104 | | | ¥ | 205,547 | | | $ | | | | ¥ | 151,044 | | | | 219,529 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted-average shares used in computing per share amounts* | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | | | | | | 2,040,400 | | | | 2,020,000 | | | | | | | | 2,101,600 | | | | 2,020,000 | |

| Diluted | | | | | | | 2,314,984 | | | | 2,331,725 | | | | | | | | 2,268,092 | | | | 2,331,725 | |

* Retrospectively restated to reflect the 2-for-1 forward split completed on July 10, 2023.

| (1) | For convenience, the Japanese yen amounts are expressed in U.S. dollars at the exchange rate of ¥151.72 = US$1.00, which was the foreign exchange rate on April 1, 2024 as reported by the U.S. Federal Reserve in is weekly release on April 8, 2024 (https://www.federalreserve.gov/releases/h10/20240408/). |

Consolidated Balance Sheet Information

| (in thousands) | | As of March 31, |

| | | 2024($)(1) | | 2024(¥) |

| Total assets | | $ | | | | ¥ | 3,179,509 | |

| Total liabilities | | $ | | | | ¥ | 1,549,608 | |

| Shareholders’ Equity: | | | | | | | | |

| Common shares (8,000,000 common shares authorized; 2,101,600 , 2,101,600 and 2,020,000 common shares issued and outstanding as of September 30, 2023, September 30, 2022 and March 31, 2024, respectively)* | | | | | | | 25,457 | |

| Additional paid-in capital | | | | | | | 234,783 | |

| Retained earnings | | | | | | | 1,369,661 | |

| | | | | | | | | |

| Total shareholders’ equity | | | | | | | 1,629,901 | |

| | | | | | | | | |

| Total Liabilities and Shareholders’ Equity | | $ | | | | ¥ | 3,179,509 | |

* Retrospectively restated to reflect the 2-for-1 forward split completed on July 10, 2023.

| (1) | For convenience, the Japanese yen amounts are expressed in U.S. dollars at the exchange rate of ¥151.72 = US$1.00, which was the foreign exchange rate on April 1, 2024 as reported by the U.S. Federal Reserve in is weekly release on April 8, 2024 (https://www.federalreserve.gov/releases/h10/20240408/). |

RISK FACTORS

An investment in the ADSs is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all the other information contained in this prospectus, including the audited and unaudited financial statements and the related notes included in this prospectus, before deciding whether to invest in the ADSs. These risk factors are not presented in the order of importance or probability of occurrence. If any of the following risks occurs, our business, financial condition and results of operations could be materially and adversely affected. In that event, the market price of the ADSs could decline, and you could lose part or all your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

Our growth depends on our ability to attract and retain a large number of customers, and the loss of our customers, or failure to attract new customers, could materially and adversely affect our business.

Our business includes website production and optimization services, system integration services, IT consulting services, among others, while our website production and optimization services that we offer through our WebDX Consulting Business constitute our major source of ordinary income. Therefore, the number of SMEs that comprise our customer base for our WebDX Consulting Business is critical to our success. As of September 30, 2023, we had commenced approximately 13,400 projects in our WebDX Consulting Business, and have experienced strong growth in the number of projects. The number of total projects in our WebDX Consulting Business grew by 29.3% from 10,866 September 30, 2021 to 14,054 March 31, 2024. However, we cannot guarantee that we will be able to achieve similar growth in the future. For example, our customers have many different ways to market their services and create and develop websites, including by using website builder platforms and other similar website production companies to us. Any decrease in the attractiveness of our services relative to these other options available to SMEs could lead to decreased use of our services, which could result in a decrease in revenue to us. If we fail to attract new customers, or the quality or types of services we provide are not satisfactory to our customers, they may decrease their use of, or cease using, our services.

Key factors in attracting and retaining customers include our ability to grow our brand awareness, attract and retain high-quality engineers and increase the quantity and quality of products and services we offer. Thus, achieving growth in our customer base may require us to increasingly engage in sophisticated and costly sales and marketing efforts that may not result in additional customers. We may also need to modify our revenue models to attract and retain such customers.

We currently rely, and expect to continue to rely, on vendors and third party service providers and if these vendors or third party service provides experience significant technological or other disruptions, our business may be harmed.

In our WebDX Consulting Business, we select third-party service providers to outsource part of our web production and video production work we provide for websites. In addition, in a part of our System Integration Business, we utilize third-party service providers and freelance engineers to develop our business. We strive to secure a sufficient number of service providers with the required capabilities and to maintain and build good relationships with them. However, if we are unable to secure sufficient third-party service providers to meet our outsourcing needs for any reason, such as a rise in outsourcing costs due to the policy of the outside service providers or market conditions, our business performance may be affected.

Additionally, we carefully select third-party service providers, taking into consideration their business performance, reputation in the industry, and previous business relationship with us. After selection, we supervise their work performance, inspect and accept their deliverables, and evaluate their quality level strictly. However, there can be no assurances that the deliverables provided by the outside service providers have no hidden defects, and if our clients suffer damage due to such defects, our business performance may be affected by claims for damages or other liabilities against us or loss of our reputation. In this case, our business performance may be affected.

In addition, our operations could be interrupted or disrupted if our vendors or third-party service providers experience operational or other systems difficulties, terminate their service, fail to comply with regulations, raise their prices, or dispute key intellectual property rights sold or licensed to or developed for our Company or our clients. If any of these events happen, and we are unable to replace vendors and service providers, on a timely basis or at all, our operations could be interrupted. If an interruption were to continue for a significant period, our business, financial condition and results of operations could be adversely affected. Even if we can replace vendors and third-party providers, it may be at a higher cost, which could also adversely affect our business, financial condition and results of operations.

We may be unable to collect sales proceeds from our customers due to changes in the management policies or screening standards of credit companies.

In our WebDX Consulting Business, our customers and third-party business credit companies enter into credit arrangements to pay for our services. In such arrangements, our customers repay the business credit companies in installments while we collect a lump sum payment from the business credit companies. While we are able to avoid the risk of uncollected sales proceeds when our customers enter into these credit arrangements, changes in the management policies or screening standards of business credit companies could reduce the availability of such arrangements for our customers affect our business and operating results.

We operate in a very competitive business environment and if we are unable to compete successfully against our existing or potential competitors, our business, financial condition and results of operations may be adversely impacted.

Our WebDX Consulting Business does not have high barriers to entry and generally has many competitors. However, we believe that we have a competitive advantage because few other companies in the industry have all the functions and systems for web production, system development, and sales in-house, as we do. Nevertheless, given the rapid pace of Internet-related technological progress, our business performance may be affected in the event that our strengths diminish, the scale of our core business shrinks, or price competition intensifies, due to new entrants to the market, the emergence of new technologies and services, and other factors in the future.

Similarly, our System Integration Business and IT Consulting Business do not require large capital investments or use of proprietary technologies. As a result, the barriers to entry are low, and we face significant competition. However, in order to promote proposals and projects for our customers facing various IT operational issues such as engineer shortages and requiring IT and other system improvements, it is necessary to have appropriate knowledge of the business and to properly assign highly specialized engineers and consultants. Therefore, if competition intensifies due to the entry of additional companies with capital power or more advanced business development, our business, financial condition and results of operations may be harmed.

Well-established IT services companies have entered or may decide to target the market for services similar to ours, and some of these companies have launched products and services that directly compete with our platforms. These or other established companies that have extensive and loyal customer bases may decide to directly target our customers, thereby intensifying competition in the IT services market.

Our current competitors may also consolidate or be acquired by an existing or prospective competitor, which could result in the emergence of a competitor with a larger market share, leading to a potential loss of our market share. There can be no assurances that we will maintain our strong position among IT service providers, particularly if our key competitors consolidate or if large IT companies successfully leverage their large customer bases to penetrate our markets.

Many of our current and potential competitors enjoy substantial competitive advantages, such as greater name recognition, longer operating histories, greater financial, technical and other resources. These companies may use these advantages to offer services similar to our platform at a lower price, develop different products and services to compete with us, spend more on advertising and brand marketing, invest more in research and development, have greater success hiring proficient engineers or respond more quickly and effectively than we do to new or changing opportunities, technologies, standards, regulatory conditions or user preferences or requirements. As a result, our customers may decide to shift from utilizing our services to utilizing our competitors’ products, services and solutions.

We need to keep pace with changing technologies in order to provide effective services and solutions to our customers, and we will need to stay ahead of the technology changes and risks in order to be successful.

The IT services industry, of which we are a part, is an industry where the speed of technological innovation and change is high, and new technologies and services are being created every day. For this reason, we strive to constantly acquire the latest technologies, and to hire, train, and develop the skills of our engineers and consultants so that we can respond quickly to the changes in the industry. However, if we are unable to respond appropriately to dramatic changes caused by technological innovations that are more rapid than we can anticipate, our business and earnings may be affected.

We need to keep pace with changing technologies in order to provide effective services and solutions. In addition, we will need to stay ahead of technological innovations and risks in order to be successful. We must anticipate, and quickly react to, rapid changes occurring in information technology and to the development of new and improved services that result from these changes. We must maintain our ability to remain technologically competitive and may require substantial expenditures and lead-time and the integration of newly acquired technologies will also take time. We may not be able to successfully achieve these requirements without significant time and effort, and if we fail to do so, our sales and profitability may be impacted.

Additionally, if we fail to anticipate or identify significant internet-related and other technology trends and developments early enough, or if we do not devote appropriate resources to adapting to such trends and developments, our business could be harmed. Uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, including text messaging capabilities, or changes in client usage patterns thereof, could increase our research and development effort or service delivery expenses or lead to our increased reliance on certain vendors. Any failure of our services to operate effectively with future network platforms and technologies could reduce the demand for our services, result in client dissatisfaction and harm the business.

To attract new clients and keep our existing ones engaged, we must introduce new products and services and upgrade our existing offerings to meet their evolving preferences. If we fail to improve our existing services and introduce new ones in a timely or cost-effective manner, our financial performance and prospects may be adversely affected.

We obtain a significant portion of our revenue from our WebDX Consulting Business and System Integration Business and we expect this will continue for the foreseeable future. Our efforts to expand our current services may not succeed and may reduce our revenue growth rate. To attract new clients and keep our existing ones engaged, we must introduce new products and services and upgrade our existing offerings to meet their evolving preferences. We have begun to offer additional services related to AI-based image creation and article creation functions in our WebDX Consulting Business. We have also expanded our System Integration Business, with a focus on front-end development, where there is severe shortage of human resources. Both of these additions require additional investment. It is uncertain whether our efforts and related investments will ever result in significant revenue. It is difficult to predict the preferences of a particular client or a specific group of customers. Changes and upgrades to our existing products and services may not be well received by our clients, and newly introduced products or services may not achieve success as expected. We cannot ensure that any of our new products or services will achieve market acceptance or generate sufficient revenues to adequately compensate the costs and expenses incurred in relation to our development and promotion efforts. Enhancements and new products and services that we develop may not be introduced in a timely or cost-effective manner, may contain errors or defects, may have interoperability difficulties with our platform or other products and services or may not achieve the broad market acceptance necessary to generate significant revenue. If we fail to improve the existing products and introduce new ones in a timely or cost-effective manner, our ability to attract and retain clients may be impaired, and our financial performance and prospects may be adversely affected. In addition, we may be required to continuously enhance our artificial intelligence solutions so that quality undertaking can be provided to our clients. Further, the introduction of significant platform changes and upgrades may not succeed, and early-stage interest and adoption of such new services may not result in long term success or significant revenue for it.

If we are unable to develop enhancements to, and new features for, our existing or new services that keep pace with rapid technological developments, our business could be harmed. The success of enhancements, new features and services depends on several factors, including the timely completion, introduction and market acceptance of the feature, service or enhancement by clients, as well as our ability to seamlessly integrate all of our product and service and develop adequate selling capabilities in new markets. Failure in this regard may significantly impair our revenue growth as well as negatively impact our operating results if the additional costs are not offset by additional revenues. In addition, because our services are designed to operate over various network technologies and on a variety of mobile devices, and our operating systems and computer hardware and software platforms use a standard browser, we will need to continuously modify and enhance our services to keep pace with changes in internet-related hardware, software, communication, browser, application development platform, and database technologies, as well as continue to maintain and support our services on legacy systems. We may not be successful in either developing these modifications and enhancements or in bringing them to market timely.

We rely significantly on the Japanese market. Any changes in the economic and regulatory conditions of Japan or changes in the business strategies of Japanese customers may have an adverse effect on our business.

Small and medium-sized enterprises, which are the customer base in our WebDX Consulting Business, tend to be more susceptible to economic recession, further increases in consumption taxes, and declining consumer spending due to industry accidents and scandals. In addition, our System Integration Business and IT Consulting Business tend to be more susceptible to trends in IT investment by Japanese domestic companies. Although we are developing our business so as not to be affected by the business conditions of a particular industry, if the business conditions of our clients deteriorate and IT investment demand declines due to political or economic changes in Japan or major markets overseas, our business and financial results may be affected.

For each of the years ended September 30, 2023 and 2022, we derived 100.0 % and 99.7 % of our revenue, respectively, from Japan. Our financial performance depends significantly on general economic conditions in Japan and Japan’s impact on consumer confidence and discretionary consumer spending. Further, economic factors in Japan such as a reduction in the availability of credit, increased unemployment levels, rising interest rates, financial market volatility, recession, reduced consumer confidence, and other factors affecting consumer spending behavior such as acts of terrorism or major epidemics could reduce demand for our services and other products.

If there is any change in the management or control of our Japanese customers, then such customers may in turn change their business strategy, which may cause their demand for IT services to decrease. This in turn may have a material and adverse effect on our business performance, financial condition, results of operations and prospects.

A potential serious downturn in the overall Japanese economy or in the Japanese IT services industry may cause the financial conditions and purchasing powers of our customers in Japan to deteriorate. Our customers are not under long-term contractual obligations to place orders with us for services, so the number of services orders may fluctuate depending on the profitability of customers’ businesses and the spending power of the consumers. An economic downturn in Japan or continued uncertainties regarding future prospects that affect consumer spending habits in Japan may have an adverse effect on the placing of service orders by our customers. We can offer no assurance that we will be able to respond quickly to any economic, market or regulatory changes in the Japanese market, and any failure to do so may result in an adverse effect on our business performance, financial condition and results of operations.

Our customized solutions may not meet our clients’ expectations.

A significant portion of our revenues derives from engagements where we are requested to provide customized solutions for our clients. After receiving an order from a client, we finalize the specifications of the deliverables and begin development. For example, we may be requested to provide system development support for customers seeking new WebDX solutions. Sometimes, such activities require a substantial investment in time and resources, which carries risks such as exceeding estimated costs, failing to meet client expectations as to quality, and experiencing delays in delivery. These risks could lead to unprofitable projects or additional expenses for us to address the issues, as well as erode client trust in us and otherwise negatively impact our reputation.

We are highly dependent on our senior management team and key personnel and our business could be harmed if we are unable to attract and retain personnel necessary for our success.

We rely heavily on our senior management and key personnel. Our success depends on our ability to retain senior management, qualified personnel and other highly skilled personnel, for the foreseeable future and integrate current and additional talent in all departments. The loss of senior management who have acquired specialized knowledge, skills and familiarity with respect to our business could adversely affect our business. If we are not successful in attracting and retaining qualified personnel, our business, financial condition and results of operations could be adversely affected. We do not currently hold a key person insurance policy.

In particular, Etsuro Sumita, President and Representative Director of the Company, is the founder of the Company and has played an important role in the formulation and decision-making of management policies and business strategies and their execution since the Company’s establishment. We are working to develop a management structure that is not overly dependent on him by hiring and training personnel, sharing information among directors and executive officers, strengthening the management organization, and dividing duties among them. Nevertheless, if for some reason Mr. Sumita becomes unable to continue his work for the Company, our business and earnings could be affected.

We have limited human resources and may not be able to appropriately manage our growth.

Our Company has limited human resources, which poses potential risks to our operations. For example, we are more susceptible than larger corporations to business disruptions due to personnel turnover, as we generally have fewer personnel responsible for each function, and limited redundancy. The problems that may arise as a result of insufficient personnel may become more pronounced as we seek to expand and diversify our business and geographic scope if we are unable to hire additional qualified employees, integrate them into our operations, and together with them establish operational, financial, and administrative controls, reporting systems, and procedures that match our desired growth.

As we expand our business, we consider it important to secure and train a wide range of human resources. To this end, we are working to strengthen our recruitment activities and training programs. However, if we are unable to secure and develop the human resources required for our operations, or if we lose our executives and a greater number of personnel than we anticipate, our business performance may be affected. Rapid expansion of human resources, however, also exposes us to risks relating to quality, cost management and other operational issues due to having generally less experienced personnel or personnel that are less well integrated into our business. Failure to take steps to hire and retain personnel, as well as enhance our internal infrastructures and compliance to match our business and operations, could materially and adversely affect our business, financial condition, and results of operations.

Our business depends on securing, retaining and developing personnel with information technology and engineering experience.

Given our business focus on information technology services, our success hinges on our hiring and retaining IT and engineering talent. The scarcity of, and competition for, professionals with experience or capabilities in these fields, including personnel that have an understanding of the information technology profession, however, poses a risk to securing the necessary expertise and industry knowledge for our services. Failure to hire and retain such talent could adversely impact our ability to offer desirable services to our clients, including our ability to maintain and grow our network of engineers, expand our business, maintain service quality, and otherwise meet our strategic objectives.

Risks Related to Government Regulation and Policies

Our business is subject to various governmental regulations and actions.

We are subject to various laws and government regulations. Our System Integration Business operates under the Worker Dispatching Act (Act No. 88 of 5 July 1985, as amended) and is subject to legal regulations under the Worker Dispatching Act and related laws and ordinances. We are committed to thorough compliance, and our Compliance Committee and internal audits are used to monitor compliance with related laws and ordinances. However, the occurrence of any disqualification as a dispatch business owner as stipulated in the Worker Dispatching Act (for example, if a member of our board of directors or an executive officer in our System Integration Business is sentenced to imprisonment or fined for violation of related laws, none of which we anticipate to be applicable to us) or any other violation of laws and regulations could affect our business and financial performance.

In addition, when we select small businesses as third-party service providers to provide services, we are subject to legal restrictions under the Act Against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors No. 120 of June 1, 1956 (Act No. 120 of June 1, 1956, as amended). We have established a system to prevent delays in payments, and strive to comply with laws and regulations. However, the occurrence of a violation of laws and regulations could have an impact on our business and financial performance.

If these laws and related regulations are revised or reinterpreted in the future due to changes in social conditions or other factors, and if such revisions or reinterpretations have an adverse effect on our business operations, our business results may be adversely affected.