Exhibit 1

Urges Quanterix Shareholders to Vote AGAINST the Proposed Merger with Akoya Biosciences KENT LAKE PR LLC THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. DO NOT SEND US YOUR PROXY CARD. KENT LAKE IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS COMMUNICATION CONTEMPLATE SUCH AN EVENT.

The materials contained herein (the “Materials”) represent the opinions of Kent Lake PR LLC and its affiliates (collectively, “Kent Lake”) and are based on publicly available information with respect to the Quanterix Corporation, a Delaware corporation (the “Company”). Kent Lake recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with Kent Lake’s conclusions. Kent Lake reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes. Kent Lake disclaims any obligation to update the information or opinions contained herein. Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) or other regulatory authorities and from other third party reports. There is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein. The estimates, projections and potential impact of the opportunities identified by Kent Lake herein are based on assumptions that Kent Lake believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material. The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security. Certain members of Kent Lake currently beneficially own, and/or have an economic interest in, securities of the Company. It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause one or more members of Kent Lake from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities. To the extent that Kent Lake discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and Kent Lake expressly disclaims any obligation to update such information. The Materials contain forward - looking statements. All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could,” and similar expressions are generally intended to identify forward - looking statements. The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Kent Lake. Although Kent Lake believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward - looking statements included herein will prove to be accurate. In light of the significant uncertainties inherent in the projected results and forward - looking statements included herein, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected results and forward - looking statements will be achieved. Kent Lake will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events. Unless otherwise indicated herein, Kent Lake has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC by the Company or from any third - party source. All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use. [ 2 ] Disclaimer

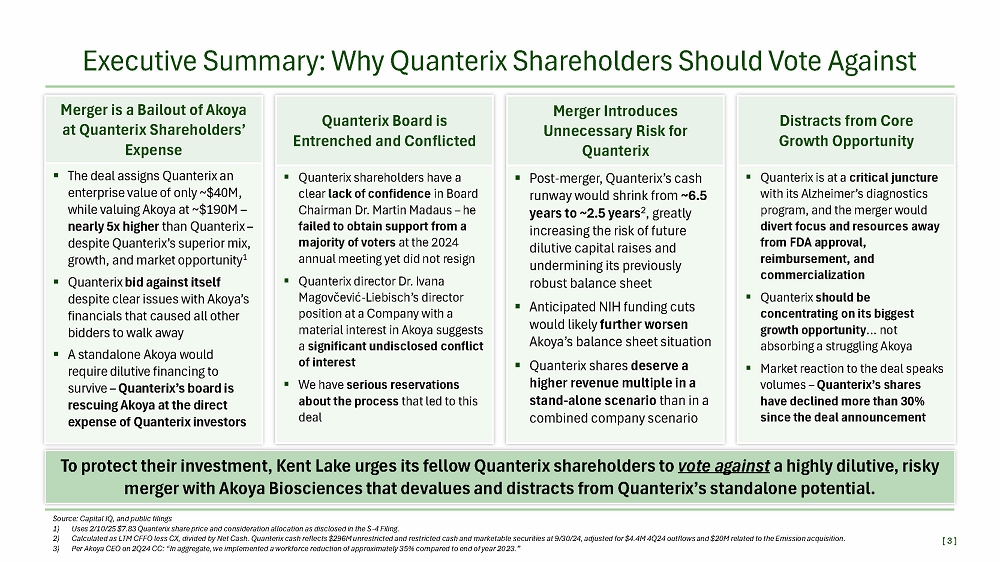

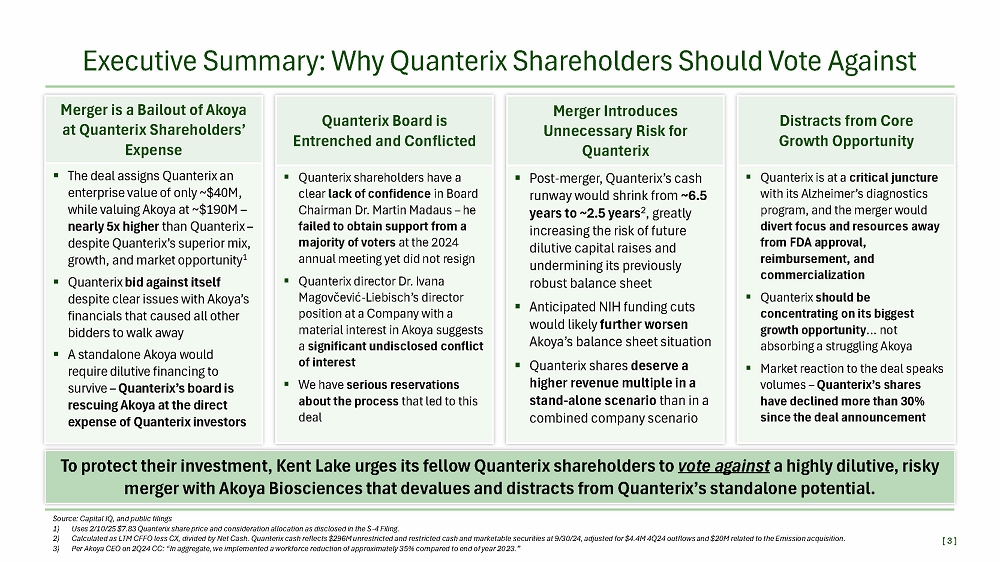

[ 3 ] Executive Summary: Why Quanterix Shareholders Should Vote Against Merger is a Bailout of Akoya at Quanterix Shareholders’ Expense ▪ The deal assigns Quanterix an enterprise value of only ~$40M, while valuing Akoya at ~$190M – nearly 5x higher than Quanterix – despite Quanterix’s superior mix, growth, and market opportunity 1 ▪ Quanterix bid against itself despite clear issues with Akoya’s financials that caused all other bidders to walk away ▪ A standalone Akoya would require dilutive financing to survive – Quanterix’s board is rescuing Akoya at the direct expense of Quanterix investors Source: Capital IQ, and public filings 1) Uses 2/10/25 $7.83 Quanterix share price and consideration allocation as disclosed in the S - 4 Filing. 2) Calculated as LTM CFFO less CX, divided by Net Cash. Quanterix cash reflects $296M unrestricted and restricted cash and marketable securities at 9/30/24, adjusted for $4.4M 4Q24 outflows and $20M related to the Emission acquisition. 3) Per Akoya CEO on 2Q24 CC: “In aggregate, we implemented a workforce reduction of approximately 35% compared to end of year 2023.” Distracts from Core Growth Opportunity ▪ Quanterix is at a critical juncture with its Alzheimer’s diagnostics program, and the merger would divert focus and resources away from FDA approval, reimbursement, and commercialization ▪ Quanterix should be concentrating on its biggest growth opportunity … not absorbing a struggling Akoya ▪ Market reaction to the deal speaks volumes – Quanterix’s shares have declined more than 30% since the deal announcement Merger Introduces Unnecessary Risk for Quanterix ▪ Post - merger, Quanterix’s cash runway would shrink from ~6.5 years to ~2.5 years 2 , greatly increasing the risk of future dilutive capital raises and undermining its previously robust balance sheet ▪ Anticipated NIH funding cuts would likely further worsen Akoya’s balance sheet situation ▪ Quanterix shares deserve a higher revenue multiple in a stand - alone scenario than in a combined company scenario Quanterix Board is Entrenched and Conflicted ▪ Quanterix shareholders have a clear lack of confidence in Board Chairman Dr. Martin Madaus – he failed to obtain support from a majority of voters at the 2024 annual meeting yet did not resign ▪ Quanterix director Dr. Ivana Magovčević - Liebisch’s director position at a Company with a material interest in Akoya suggests a significant undisclosed conflict of interest ▪ We have serious reservations about the process that led to this deal To protect their investment, Kent Lake urges its fellow Quanterix shareholders to vote against a highly dilutive, risky merger with Akoya Biosciences that devalues and distracts from Quanterix’s standalone potential.

Valuation and Market Reaction

QTRX’s Value Declined Significantly Since the Announcement Since announcing the merger, QTRX’s share price has declined nearly 40% . Why do management and the Board insist on a transaction that the owners of the company are so clearly against? Jan 10: QTRX and AKYA announce merger Feb 13: Kent Lake files 13D opposing the merger $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 $13.00 Quanterix Corporation (NasdaqGM:QTRX) Share Price Share Price Before Announcement Immediate Share Price Reaction: - 27% Total Change Since Announcement: - 38% Source: Capital IQ, and public filings Share price calculated as QTRX daily close price dated March 7, 2025 [ 5 ]

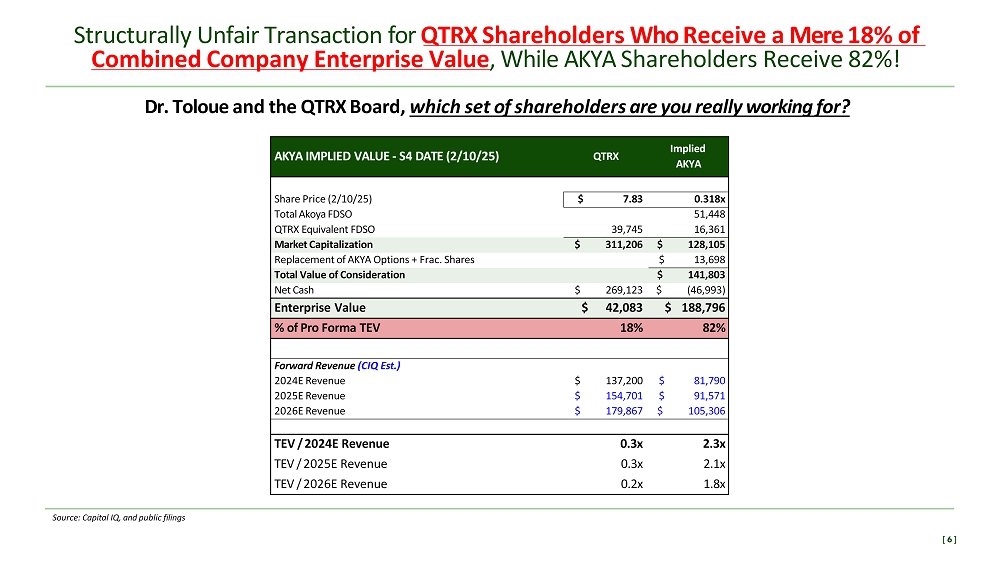

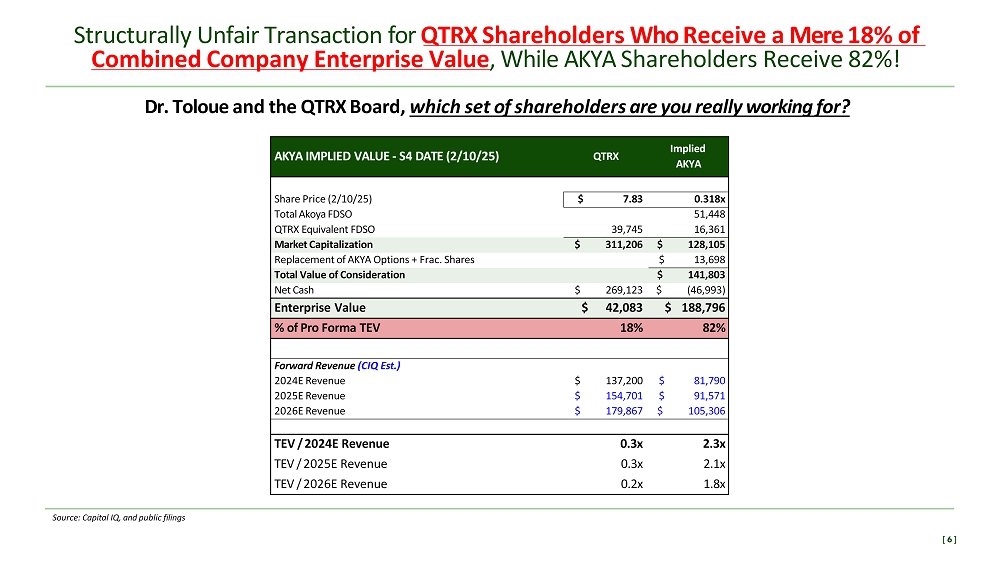

Structurally Unfair Transaction for QTRX Shareholders Who Receive a Mere 18% of Combined Company Enterprise Value , While AKYA Shareholders Receive 82%! Dr. Toloue and the QTRX Board, which set of shareholders are you really working for? Implied QTRX AKYA IMPLIED VALUE - S4 DATE (2/10/25) AKYA 0.318x $ 7.83 Share Price (2/10/25) 51,448 Total Akoya FDSO 16,361 39,745 QTRX Equivalent FDSO $ 128,105 $ 311,206 Market Capitalization $ 13,698 Replacement of AKYA Options + Frac. Shares $ 141,803 Total Value of Consideration $ (46,993) $ 269,123 Net Cash $ 188,796 $ 42,083 Enterprise Value 82% 18% % of Pro Forma TEV Forward Revenue (CIQ Est.) $ 81,790 $ 137,200 2024E Revenue $ 91,571 $ 154,701 2025E Revenue $ 105,306 $ 179,867 2026E Revenue 2.3x 0.3x TEV / 2024E Revenue 2.1x 0.3x TEV / 2025E Revenue 1.8x 0.2x TEV / 2026E Revenue Source: Capital IQ, and public filings [ 6 ]

$6.3 $5.5 $5.0 $4.7 $4.9 $6.0 $7.7 $12.1 $2.6 $2.3 $2.3 $2.8 $4.1 $6.4 $9.8 $9.7 $14.1 $18.9 $20.0 $18.0 $16.0 $14.0 $12.0 $10.0 $8.0 $6.0 $4.0 $2.0 $0.0 2025E 2026E 2027E 2028E 2029E 2030E 2031E 2032E 2033E QTRX Projected Net Cash/Share Before and After Merger 1 Quanterix’s Balance Sheet Is STRONGER WITHOUT Akoya QTRX Standalone QTRX - AKYA Source: Capital IQ, and public filings 1) Preliminary 2024 cash balance per 1/13/25 press release. Projected cash represents 2024 cash and securities plus QTRX management’s unlevered FCF projections from the S - 4. FY25 ending cash/share assumes ~1/3 of FY25 cash usage occurs in 2H, with the starting point the guided $175M net cash post transaction close. Per share assumes ~1% annual FDSO growth [ 7 ] 2) Capital IQ sell - side consensus dated 2/26/25. QTRX FY24E revenue reflects preliminary results from the 1/13/25 press release. AKYA QTRX Variance % Mgmt. Actual / Projections Consensus 2 (S - 4) Variance % Mgmt. Actual / Projections Consensus 2 (S - 4) Fiscal Year $74.9 $105.5 FY22A $96.6 $122.4 FY23A $81.8 $137.2 FY24E - 5% $87.0 $91.6 0% $155.0 $154.7 FY25E - 6% $99.0 $105.3 9% $196.0 $179.9 FY26E 15% $128.0 $110.9 27% $273.0 $215.2 FY27E 59% $192.0 $120.5 79% $450.0 $250.9 FY28E 68% $273.0 $162.7 140% $689.0 $287.5 FY29E 103% $370.0 $182.2 212% $1,022.0 $327.8 FY30E Quanterix would have >2x the cash/share at year end 2025 in the QTRX stand - alone scenario than if the merger goes through per mgmt. S - 4 projections ▪ Quanterix currently has ~$270M in cash (at 12/31/24, net of $20M related to the Emission acquisition) ▪ 2024 cash burn was ~$40M, implying a QTRX standalone cash runway of ~6.5 years ▪ With $175M expected cash outstanding following the merger, a combined TTM QTRX - AKYA cash burn of $91M means that, even after $20M in optimistic synergies, the ~$70M burn rate shrinks cash runway to just 2.5 years Note that management’s projections for the inflection years 2028 through 2030 are significantly above current sell - side estimates for both companies. While we are extremely bullish on QTRX’s potential, we caution reliance on overly optimistic projections to justify this merger

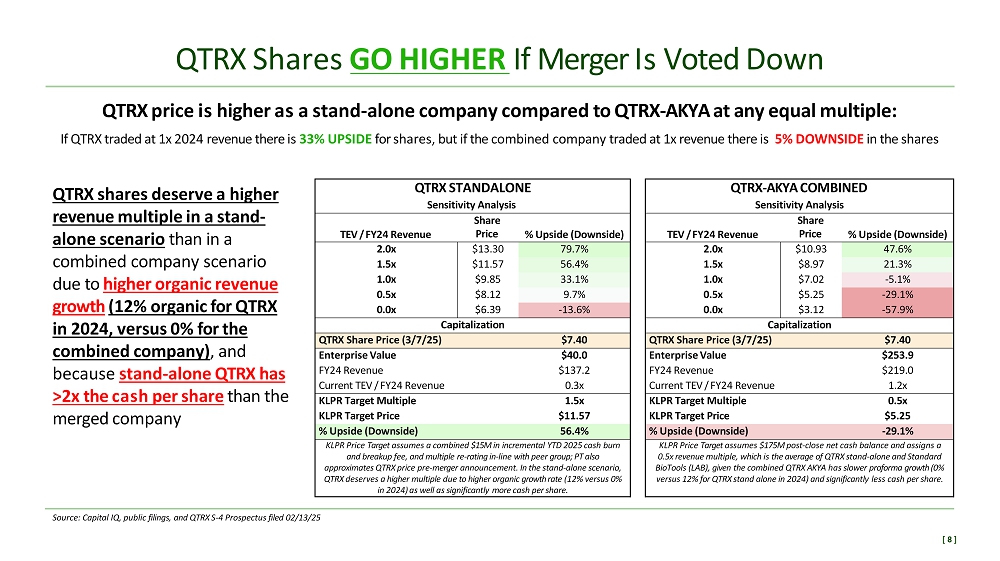

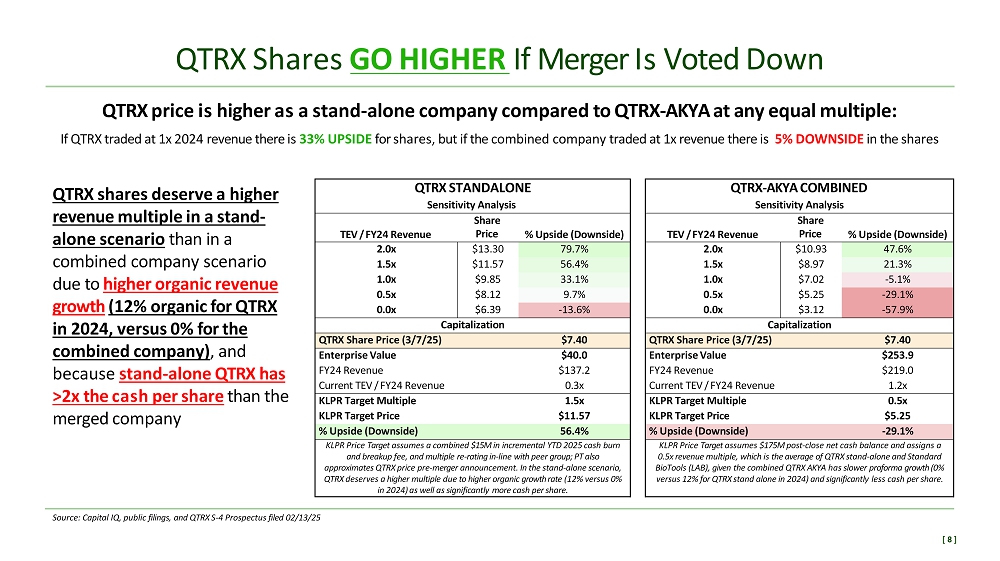

QTRX Shares GO HIGHER If Merger Is Voted Down QTRX - AKYA COMBINED QTRX STANDALONE Sensitivity Analysis Sensitivity Analysis % Upside (Downside) Share Price TEV / FY24 Revenue % Upside (Downside) Share Price TEV / FY24 Revenue 47.6% $10.93 2.0x 79.7% $13.30 2.0x 21.3% $8.97 1.5x 56.4% $11.57 1.5x - 5.1% $7.02 1.0x 33.1% $9.85 1.0x - 29.1% $5.25 0.5x 9.7% $8.12 0.5x - 57.9% $3.12 0.0x - 13.6% $6.39 0.0x Capitalization Capitalization $7.40 QTRX Share Price (3/7/25) $7.40 QTRX Share Price (3/7/25) $253.9 Enterprise Value $40.0 Enterprise Value $219.0 FY24 Revenue $137.2 FY24 Revenue 1.2x Current TEV / FY24 Revenue 0.3x Current TEV / FY24 Revenue 0.5x KLPR Target Multiple 1.5x KLPR Target Multiple $5.25 KLPR Target Price $11.57 KLPR Target Price - 29.1% % Upside (Downside) 56.4% % Upside (Downside) KLPR Price Target assumes $175M post - close net cash balance and assigns a 0.5x revenue multiple, which is the average of QTRX stand - alone and Standard BioTools (LAB), given the combined QTRX AKYA has slower proforma growth (0% versus 12% for QTRX stand alone in 2024) and significantly less cash per share. KLPR Price Target assumes a combined $15M in incremental YTD 2025 cash burn and breakup fee, and multiple re - rating in - line with peer group; PT also approximates QTRX price pre - merger announcement. In the stand - alone scenario, QTRX deserves a higher multiple due to higher organic growth rate (12% versus 0% in 2024) as well as significantly more cash per share. Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 8 ] QTRX price is higher as a stand - alone company compared to QTRX - AKYA at any equal multiple: If QTRX traded at 1x 2024 revenue there is 33% UPSIDE for shares, but if the combined company traded at 1x revenue there is 5% DOWNSIDE in the shares QTRX shares deserve a higher revenue multiple in a stand - alone scenario than in a combined company scenario due to higher organic revenue growth (12% organic for QTRX in 2024, versus 0% for the combined company) , and because stand - alone QTRX has >2x the cash per share than the merged company

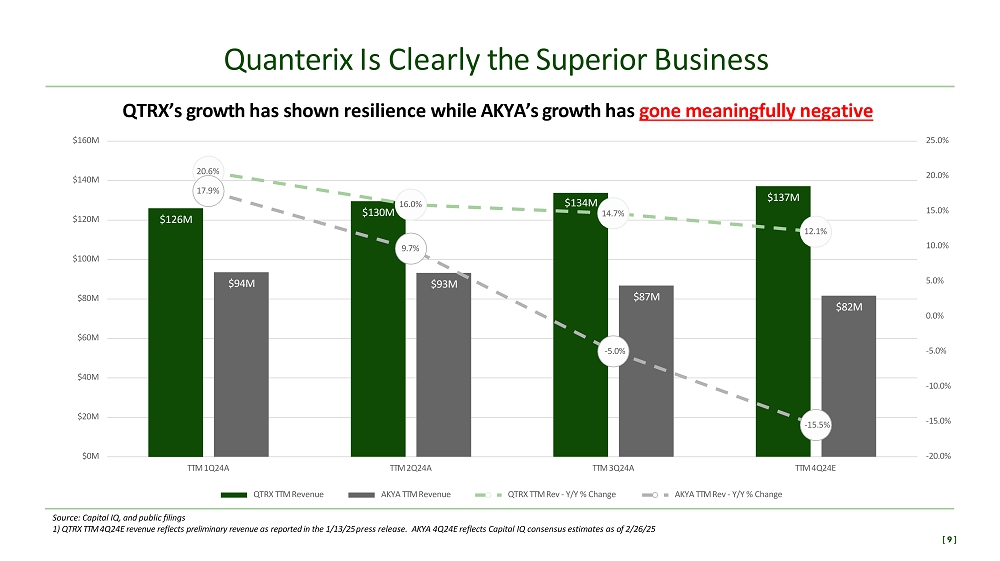

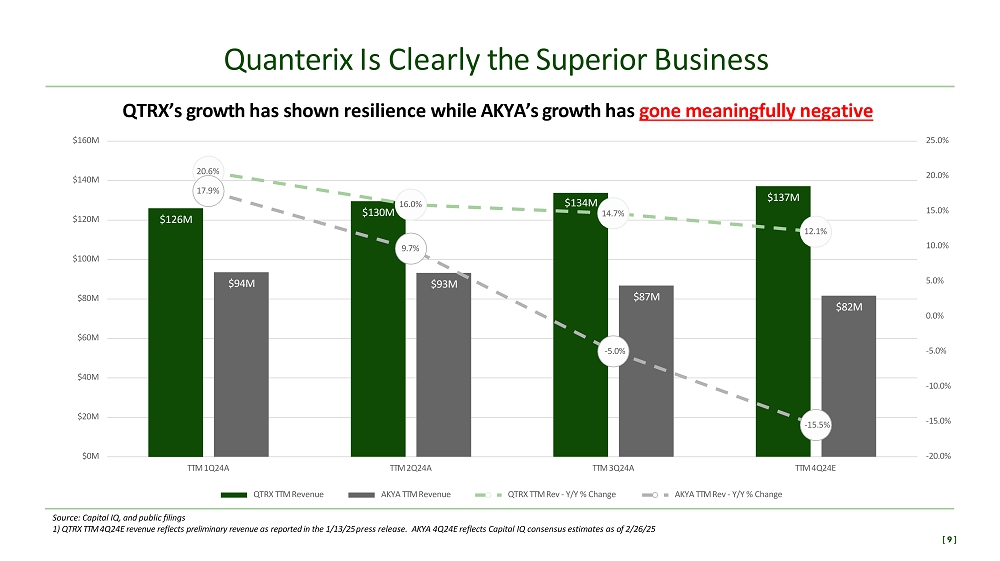

QTRX’s growth has shown resilience while AKYA’s growth has gone meaningfully negative Quanterix Is Clearly the Superior Business $126M $130M $137M $94M $93M $87M $82M 20.6% 16.0% $134M 14.7% 12.1% 17.9% 9.7% - 5.0% - 15.5% - 20.0% - 15.0% - 10.0% - 5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $0M $20M $40M $60M $80M $100M $120M $140M $160M TTM 1Q24A TTM 2Q24A TTM 3Q24A TTM 4Q24E QTRX TTM Revenue AKYA TTM Revenue QTRX TTM Rev - Y/Y % Change Source: Capital IQ, and public filings 1) QTRX TTM 4Q24E revenue reflects preliminary revenue as reported in the 1/13/25 press release. AKYA 4Q24E reflects Capital IQ consensus estimates as of 2/26/25 AKYA TTM Rev - Y/Y % Change [ 9 ]

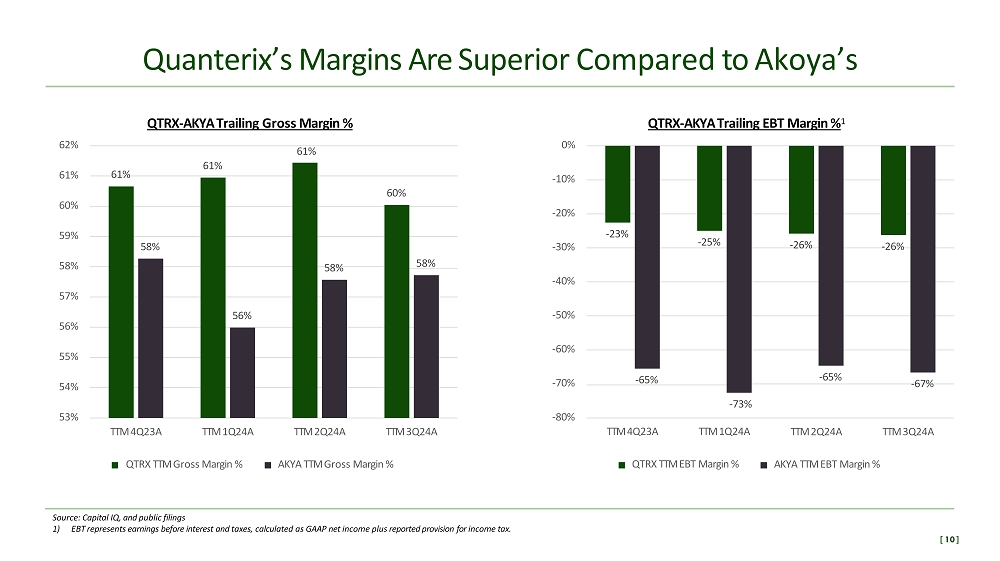

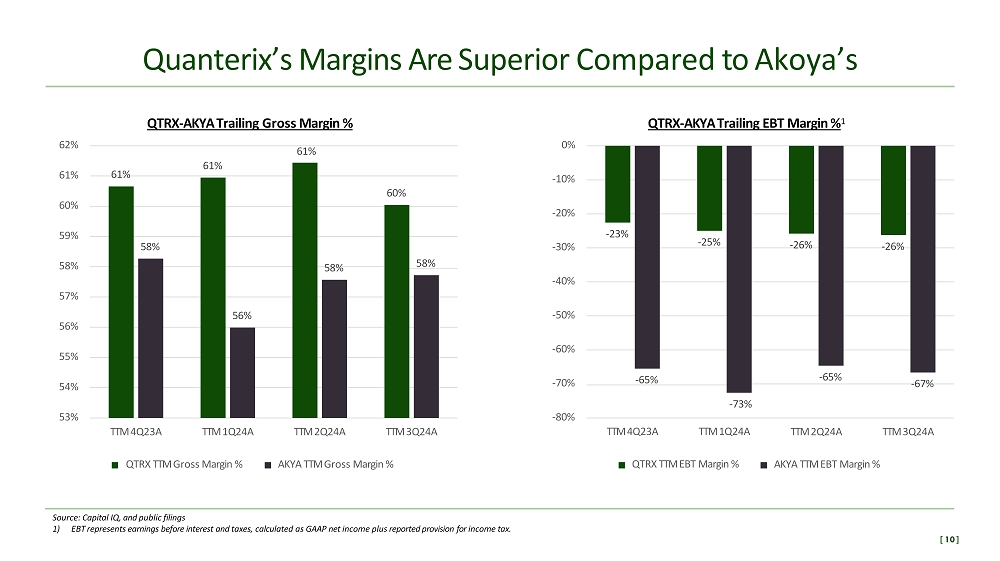

- 23% - 25% - 26% - 26% - 65% - 65% - 67% - 80% - 70% - 60% - 50% - 40% - 30% - 20% - 10% 0% TTM 2Q24A TTM 3Q24A - 73% TTM 4Q23A TTM 1Q24A QTRX TTM EBT Margin % AKYA TTM EBT Margin % QTRX - AKYA Trailing EBT Margin % 1 61% 61% 60% 58% 56% 58% 58% QTRX - AKYA Trailing Gross Margin % 61% 53% 54% 55% 56% 57% 58% 59% 60% 61% 62% TTM 2Q24A TTM 3Q24A AKYA TTM Gross Margin % TTM 4Q23A TTM 1Q24A QTRX TTM Gross Margin % Quanterix’s Margins Are Superior Compared to Akoya’s Source: Capital IQ, and public filings 1) EBT represents earnings before interest and taxes, calculated as GAAP net income plus reported provision for income tax. [ 10 ]

Negotiation and Process

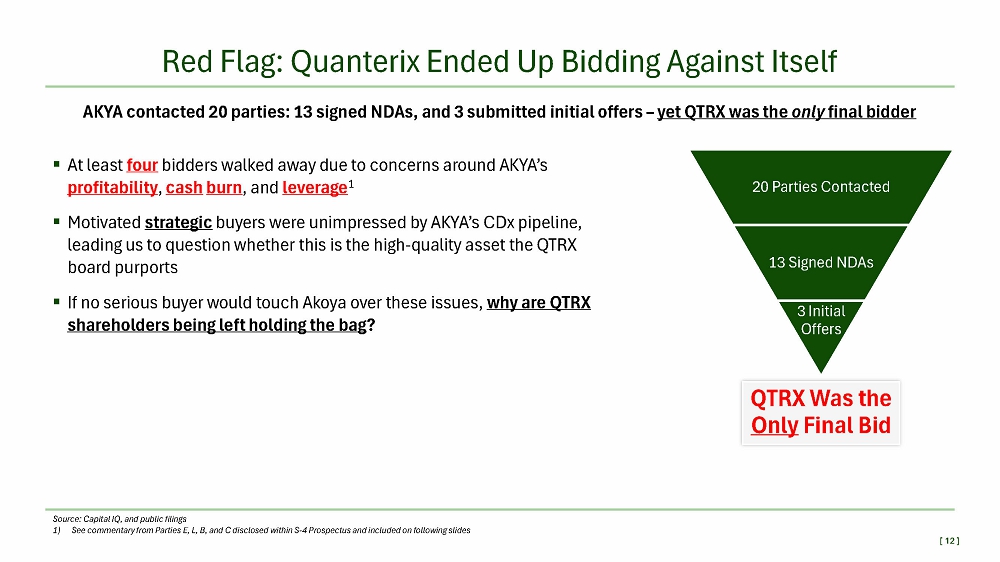

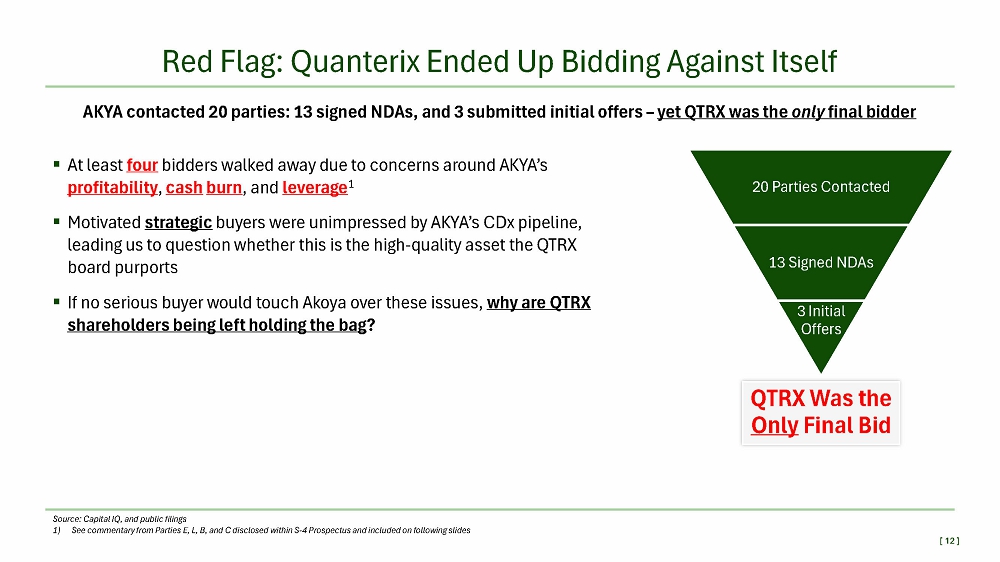

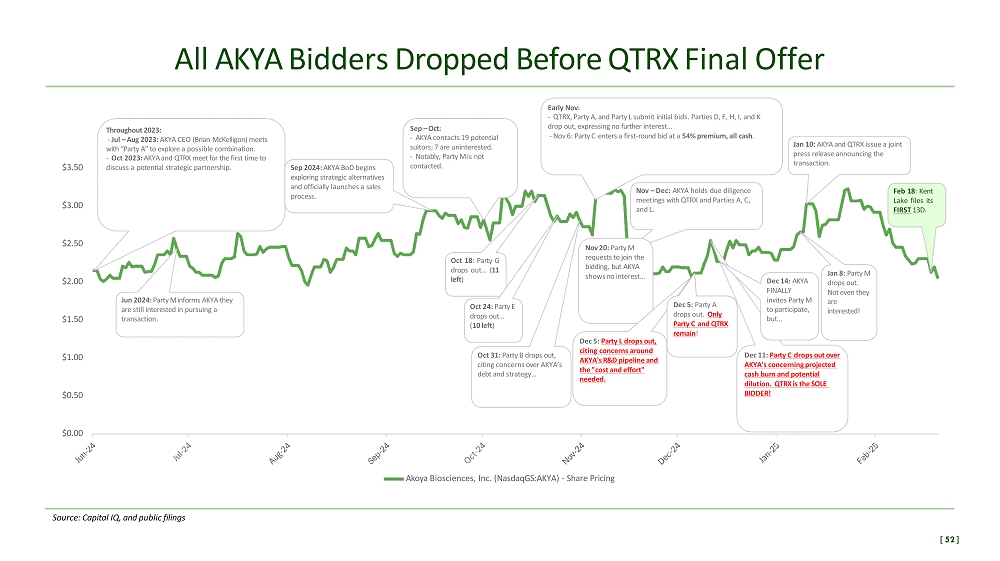

Source: Capital IQ, and public filings 1) See commentary from Parties E, L, B, and C disclosed within S - 4 Prospectus and included on following slides Red Flag: Quanterix Ended Up Bidding Against Itself 20 Parties Contacted 13 Signed NDAs 3 Initial Offers AKYA contacted 20 parties: 13 signed NDAs, and 3 submitted initial offers – yet QTRX was the only final bidder ▪ At least four bidders walked away due to concerns around AKYA’s profitability , cash burn , and leverage 1 ▪ Motivated strategic buyers were unimpressed by AKYA’s CDx pipeline, leading us to question whether this is the high - quality asset the QTRX board purports ▪ If no serious buyer would touch Akoya over these issues, why are QTRX shareholders being left holding the bag ? QTRX Was the [ 12 ] Only Final Bid

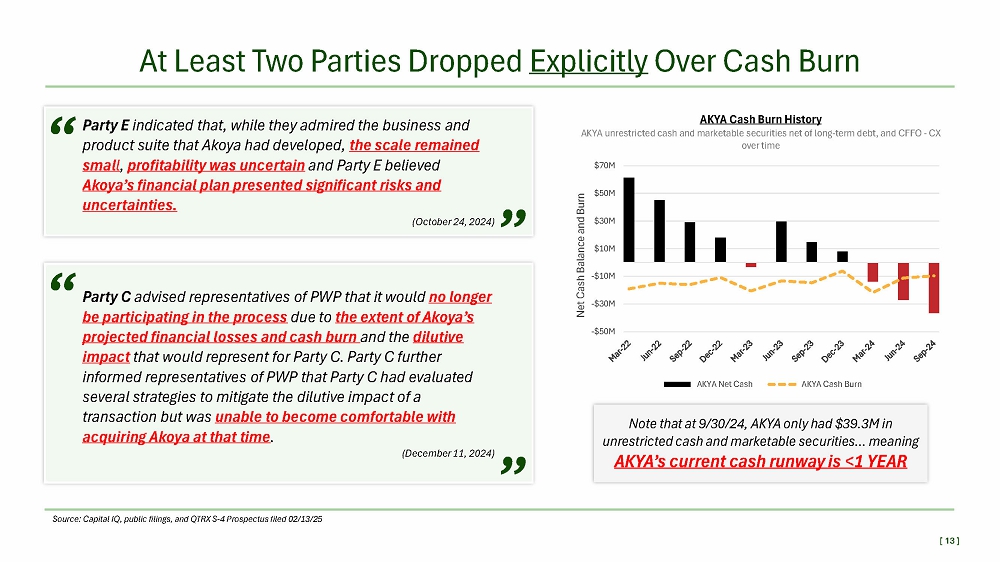

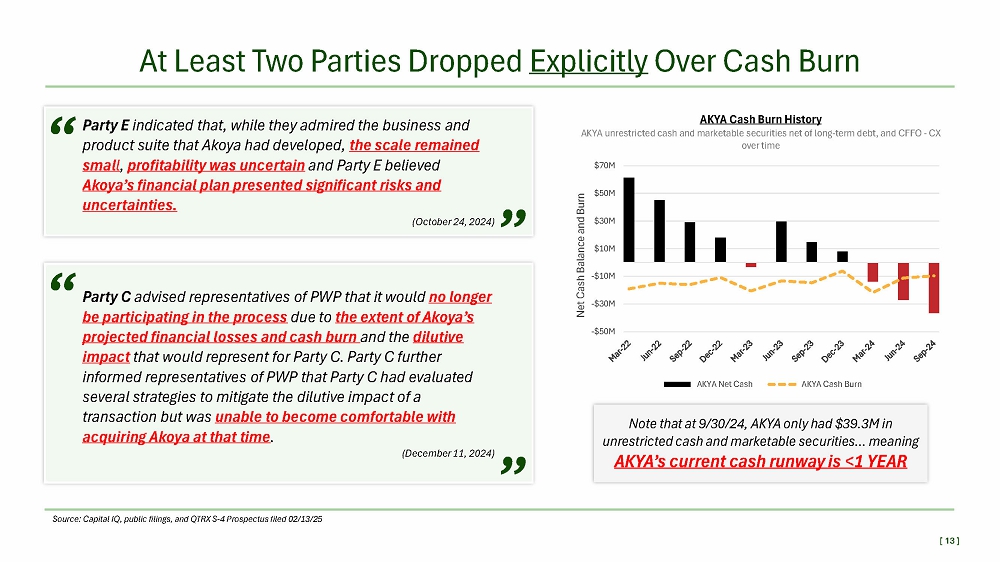

- $50M - $30M - $10M $10M $30M $50M $70M Net Cash Balance and Burn AKYA Net Cash AKYA Cash Burn AKYA Cash Burn History AKYA unrestricted cash and marketable securities net of long - term debt, and CFFO - CX over time At Least Two Parties Dropped Explicitly Over Cash Burn “ Party E indicated that, while they admired the business and product suite that Akoya had developed, the scale remained smal l , profitability was uncertain and Party E believed Akoya’s financial plan presented significant risks and uncertainties. (October 24, 2024 ) ” “ Party C advised representatives of PWP that it would no longer be participating in the process due to the extent of Akoya’s projected financial losses and cash burn and the dilutive impact that would represent for Party C. Party C further informed representatives of PWP that Party C had evaluated several strategies to mitigate the dilutive impact of a transaction but was unable to become comfortable with acquiring Akoya at that time . (December 11, 2024 ) ” Note that at 9/30/24, AKYA only had $39.3M in unrestricted cash and marketable securities… meaning AKYA’s current cash runway is <1 YEAR Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 13 ]

▪ Two bidders – “Party B” and “Party L” – exited after diligence revealed serious concerns about Akoya’s CDx path and uncertain R&D pipeline ▪ Yet QTRX management want to invest even more in these projects? ▪ If major strategic buyers were unwilling to bet on Akoya’s uncertain R&D spend, why should Quanterix shareholders shoulder the burden? Two Parties Dropped Due to Akoya’s CDX and R&D Pipeline “ Party L indicated that, after detailed diligence , Party L’s conviction around the depth of Akoya’s research and development pipeline as well as the time, cost and effort associated with Akoya’s Companion Diagnostics strategy and cultural compatibility between the companies had weakened. . (December 5, 2024 ) ” “ Party B informed representatives of PWP that it would no longer be participating in the process due to (i) their view that Akoya’s Companion Diagnostics strategy would take longer to develop and require more investment , (ii) their perspective on the timing for an overall recovery in the Spatial Biology Instrumentation market in which Akoya operates and (iii) the amount of balance sheet cash that would need to be allocated to repayment of Akoya debt under a potential transaction . (October 31, 2024 ) ” Masoud Toloue President, CEO & Director “ Akoya has a great companion diagnostics business, and we intend to make sure that, that is moving forward, if not accelerating with investment . (January 10, 2025 ) ” Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 14 ]

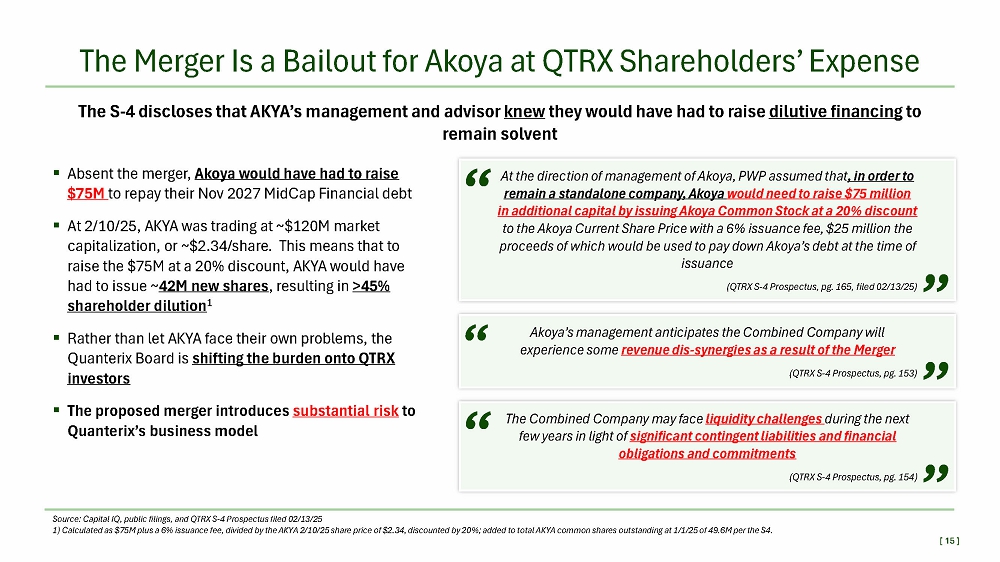

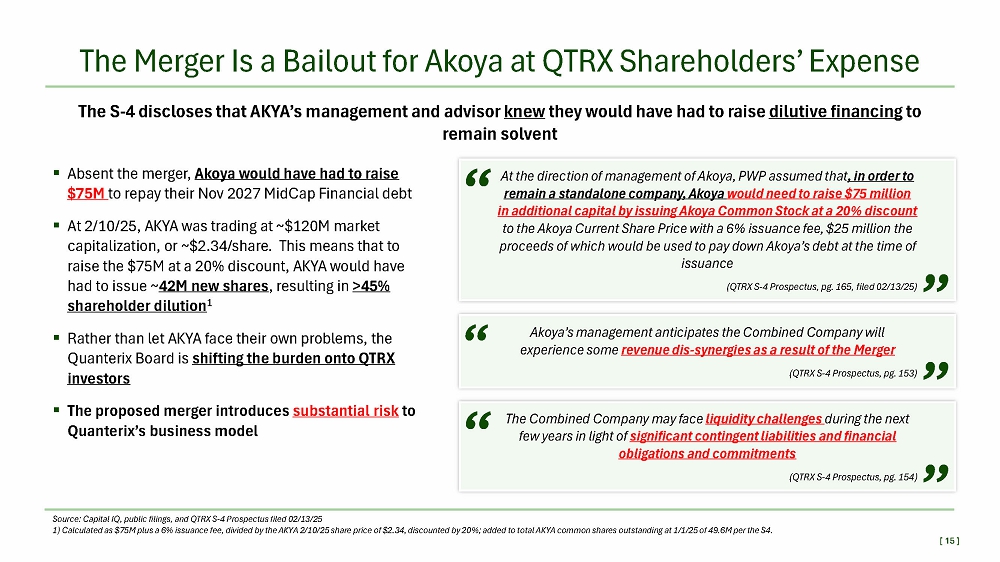

The Merger Is a Bailout for Akoya at QTRX Shareholders’ Expense The S - 4 discloses that AKYA’s management and advisor knew they would have had to raise dilutive financing to remain solvent ▪ Absent the merger, Akoya would have had to raise $75M to repay their Nov 2027 MidCap Financial debt ▪ At 2/10/25, AKYA was trading at ~$120M market capitalization, or ~$2.34/share. This means that to raise the $75M at a 20% discount, AKYA would have had to issue ~ 42M new shares , resulting in >45% shareholder dilution 1 “ At the direction of management of Akoya, PWP assumed that , in order to remain a standalone company, Akoya would need to raise $75 million in additional capital by issuing Akoya Common Stock at a 20% discount to the Akoya Current Share Price with a 6% issuance fee, $25 million the proceeds of which would be used to pay down Akoya’s debt at the time of issuance (QTRX S - 4 Prospectus, pg. 165, filed 02/13/25) ” ” ” Akoya’s management anticipates the Combined Company will experience some revenue dis - synergies as a result of the Merger (QTRX S - 4 Prospectus, pg. 153) The Combined Company may face liquidity challenges during the next few years in light of significant contingent liabilities and financial obligations and commitments (QTRX S - 4 Prospectus, pg. 154) ▪ Rather than let AKYA face their own problems, the “ Quanterix Board is shifting the burden onto QTRX investors ▪ The proposed merger introduces substantial risk to “ Quanterix’s business model Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 1) Calculated as $75M plus a 6% issuance fee, divided by the AKYA 2/10/25 share price of $2.34, discounted by 20%; added to total AKYA common shares outstanding at 1/1/25 of 49.6M per the S4. [ 15 ]

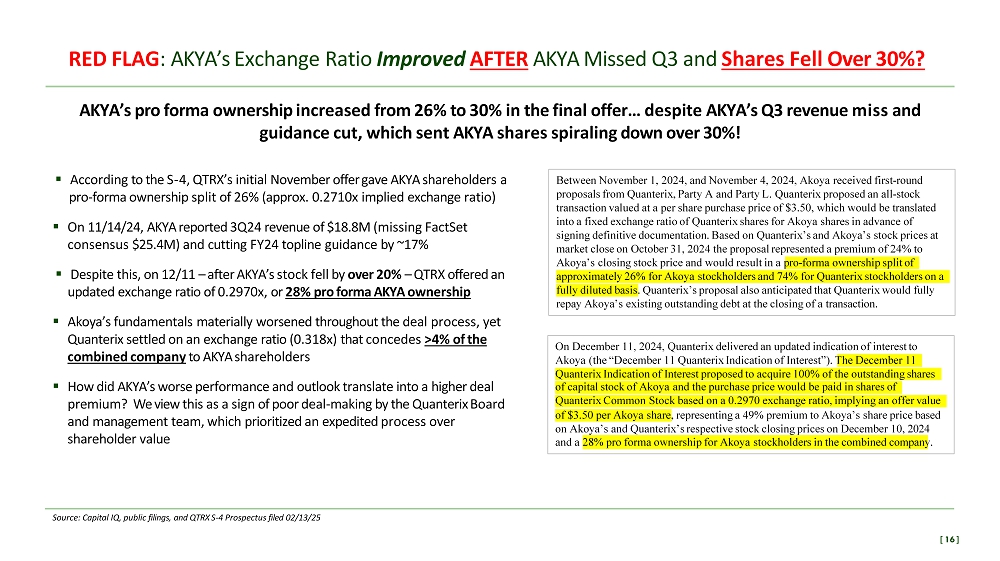

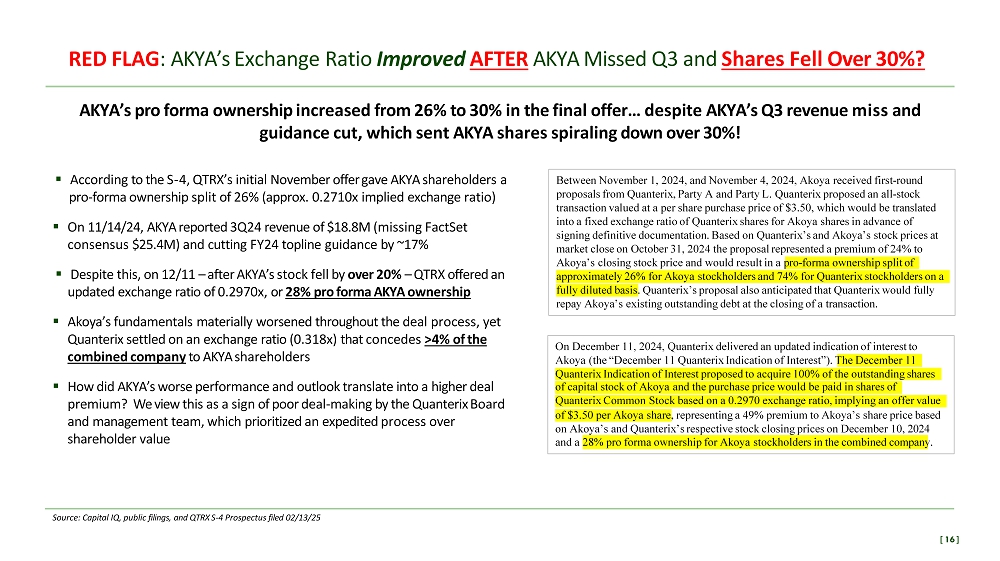

AKYA’s pro forma ownership increased from 26% to 30% in the final offer… despite AKYA’s Q3 revenue miss and guidance cut, which sent AKYA shares spiraling down over 30%! ▪ According to the S - 4, QTRX’s initial November offer gave AKYA shareholders a pro - forma ownership split of 26% (approx. 0.2710x implied exchange ratio) ▪ On 11/14/24, AKYA reported 3Q24 revenue of $18.8M (missing FactSet consensus $25.4M) and cutting FY24 topline guidance by ~17% ▪ Despite this, on 12/11 – after AKYA’s stock fell by over 20% – QTRX offered an updated exchange ratio of 0.2970x, or 28% pro forma AKYA ownership ▪ Akoya’s fundamentals materially worsened throughout the deal process, yet Quanterix settled on an exchange ratio (0.318x) that concedes >4% of the combined company to AKYA shareholders ▪ How did AKYA’s worse performance and outlook translate into a higher deal premium? We view this as a sign of poor deal - making by the Quanterix Board and management team, which prioritized an expedited process over shareholder value Between November 1, 2024, and November 4, 2024, Akoya received first - round proposals from Quanterix, Party A and Party L. Quanterix proposed an all - stock transaction valued at a per share purchase price of $3.50, which would be translated into a fixed exchange ratio of Quanterix shares for Akoya shares in advance of signing definitive documentation. Based on Quanterix’s and Akoya’s stock prices at market close on October 31, 2024 the proposal represented a premium of 24% to Akoya’s closing stock price and would result in a pro - forma ownership split of approximately 26% for Akoya stockholders and 74% for Quanterix stockholders on a fully diluted basis. Quanterix’s proposal also anticipated that Quanterix would fully repay Akoya’s existing outstanding debt at the closing of a transaction. RED FLAG : AKYA’s Exchange Ratio Improved AFTER AKYA Missed Q3 and Shares Fell Over 30%? On December 11, 2024, Quanterix delivered an updated indication of interest to Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 16 ] Akoya (the “December 11 Quanterix Indication of Interest”). The December 11 Quanterix Indication of Interest proposed to acquire 100% of the outstanding shares of capital stock of Akoya and the purchase price would be paid in shares of Quanterix Common Stock based on a 0.2970 exchange ratio, implying an offer value of $3.50 per Akoya share, representing a 49% premium to Akoya’s share price based on Akoya’s and Quanterix’s respective stock closing prices on December 10, 2024 and a 28% pro forma ownership for Akoya stockholders in the combined company.

Red Flag: Rescue Loan From QTRX to AKYA The proposal to offer $30M bridge financing before the shareholder vote is highly unusual ▪ Per the S - 4, Quanterix must provide Akoya with up to $30 million in “bridge financing” even before our shareholders approve the merger ▪ This forces Quanterix to shoulder Akoya’s immediate liquidity crisis , tying up $30M of our cash in a high - risk convertible note – without any clear shareholder mandate ▪ If this deal is not consummated, and the convert is issued, QTRX shareholders will be left holding Akoya’s subordinated distressed debt ▪ Providing backdoor financing before we even vote on the merger is an unacceptable and egregious breach of fiduciary duty ▪ How did Akoya’s desperate need for this bridge loan factor into Quanterix Board’s valuation of Akoya? ▪ If Akoya’s really needs this rescue loan, then that calls into question all forecasts utilized by QTRX management to justify this merger Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 17 ]

Quanterix Restatement Tainted Merger Negotiations Source: Capital IQ, public filings • QTRX traded at $15 prior to 11/12/24 announcement that accounting errors necessitated restating financials • QTRX shares traded from $15 to $11 within a week of this disclosure likely due to investor concern over the restatement • Much of the negotiation for AKYA occurred while QTRX shares were depressed during the restatement process which likely negatively impacted the exchange ratio for QTRX holders Material weakness led to the restatement Material weakness over ICFR has been pervasive since 2022 [ 18 ] – FY2022 10K (March 2023) – FY2023 10K (February 2024) – 3Q24 10Q (December 2024)

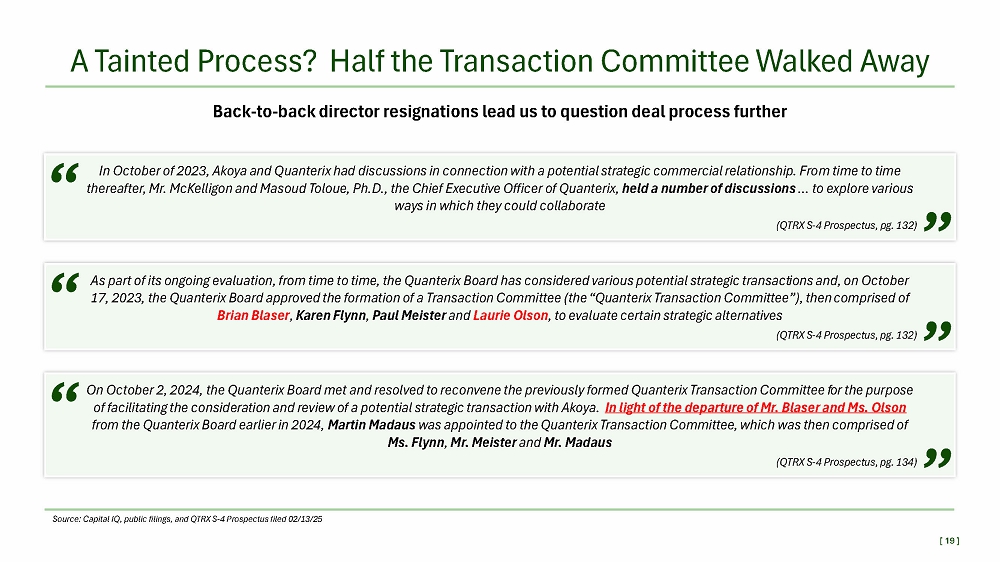

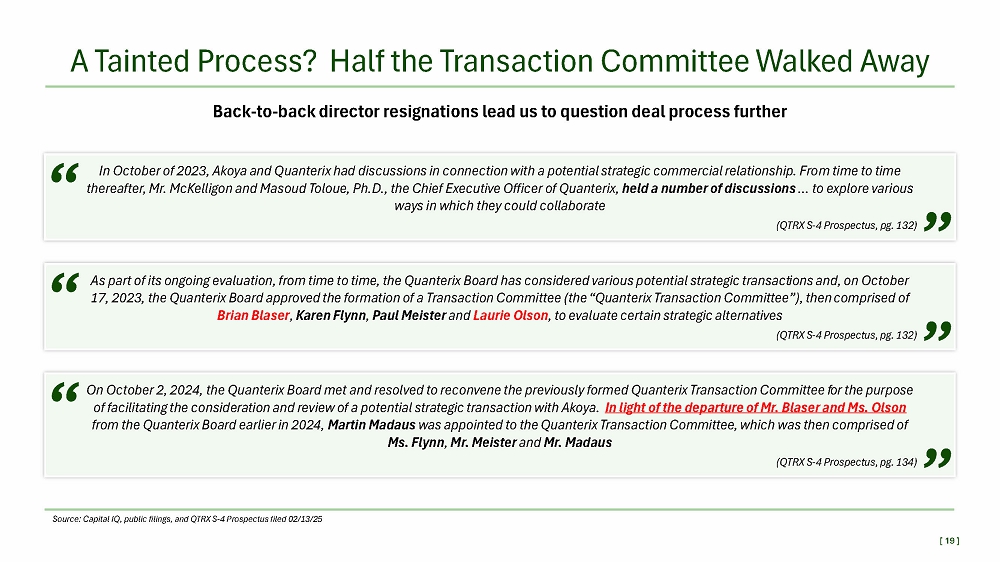

A Tainted Process? Half the Transaction Committee Walked Away Back - to - back director resignations lead us to question deal process further “ In October of 2023, Akoya and Quanterix had discussions in connection with a potential strategic commercial relationship. From time to time thereafter, Mr. McKelligon and Masoud Toloue, Ph.D., the Chief Executive Officer of Quanterix, held a number of discussions … to explore various ways in which they could collaborate (QTRX S - 4 Prospectus, pg. 132 ) ” “ As part of its ongoing evaluation, from time to time, the Quanterix Board has considered various potential strategic transactions and, on October 17, 2023, the Quanterix Board approved the formation of a Transaction Committee (the “Quanterix Transaction Committee”), thencomprised of Brian Blaser , Karen Flynn , Paul Meister and Laurie Olson , to evaluate certain strategic alternatives (QTRX S - 4 Prospectus, pg. 132) ” ” On October 2, 2024, the Quanterix Board met and resolved to reconvene the previously formed Quanterix Transaction Committee for the purpose of facilitating the consideration and review of a potential strategic transaction with Akoya. In light of the departure of Mr. Blaser and Ms. Olson from the Quanterix Board earlier in 2024, Martin Madaus was appointed to the Quanterix Transaction Committee, which was then comprised of Ms. Flynn , Mr. Meister and Mr. Madaus (QTRX S - 4 Prospectus, pg. 134) “ Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 19 ]

Conflicts of Interest & Governance

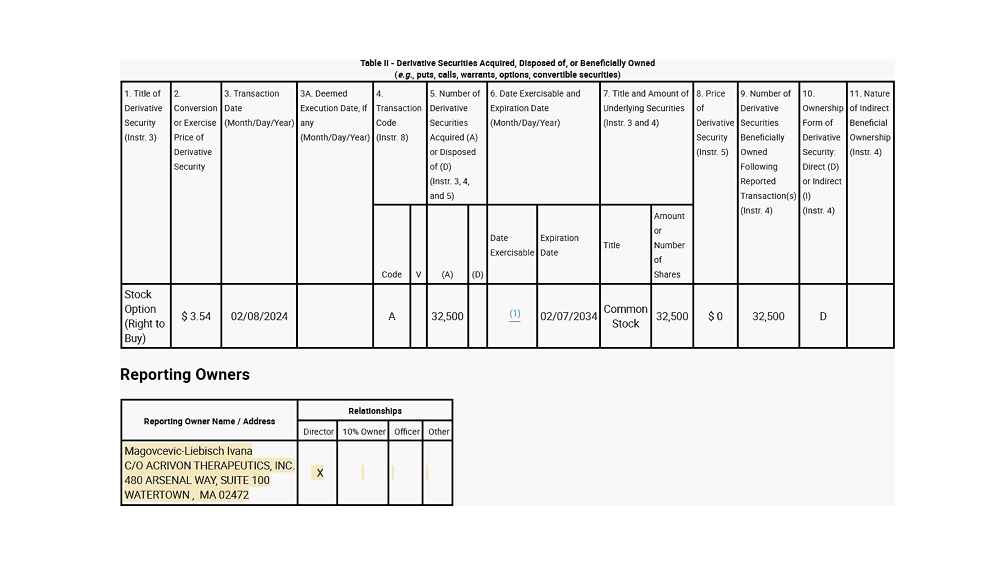

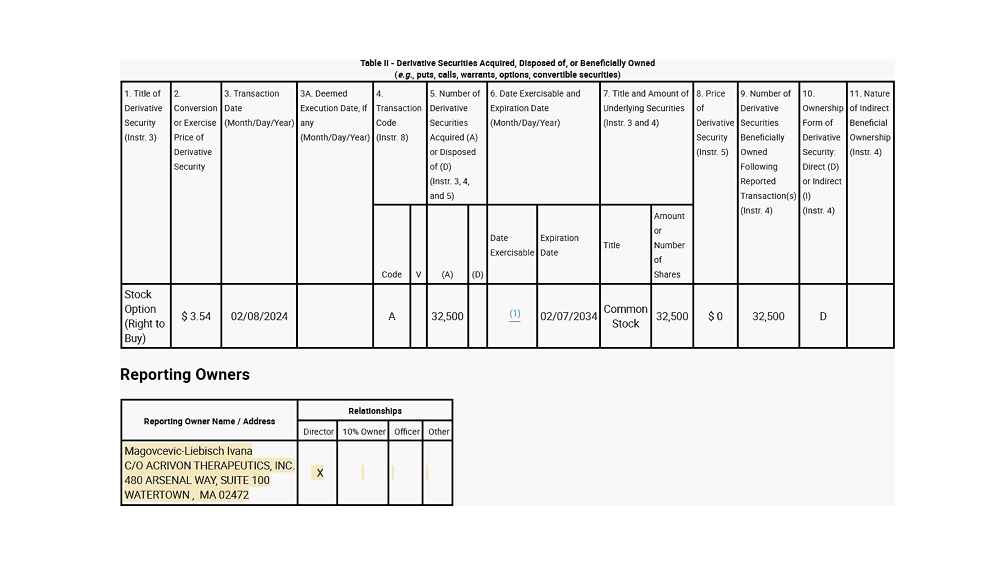

Significant Undisclosed Conflict of Interest Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 1) $3M divided by the sum of AKYA 9/30/24 TTM cash flow from operations ( - $46.7M) and CapEx ( - $2.0M) Dr. Ivana Magovčević - Liebisch appointed to Quanterix Board on October 2, 2024 – the same day merger discussions resumed ▪ DUAL - FIDUCIARY CONFLICTS : Dr. Magovčević - Liebisch serves simultaneously as a director at both Quanterix and Acrivon Therapeutics (ACRV) ▪ ACRV has an INDIRECT VESTED INTEREST In the QTRX - AKYA deal: ACRV’s flagship OncoSignature diagnostic test critically relies on Akoya’s technology platform ▪ Dr. Magovčević - Liebisch personally owns stock options for ~32,500 ACRV shares (plus potentially another 20,275 granted in 2025); total potential position value >$1 million based on median broker ACRV price targets ▪ Appointment timeline raises serious independence concerns given ACRV director role and LACK OF RECUSAL DISCLOSURES , as QTRX incorporated assumptions around the AKYA - ACRV partnership in financial projections (S - 4, pg. 170) ▪ October 2, 2024: Dr. Magovčević - Liebisch appointed to the QTRX Board; immediately attends transaction committee discussions regarding AKYA merger ▪ October 18, 2024: ACRV and AKYA amend commercial partnership, adding up to $3M in new pre - commercial milestones paid to AKYA ( ~6% AKYA TTM cash burn ) 1 ▪ October 25, 2024: QTRX submits initial non - binding offer to acquire AKYA Given: 1) Transaction Committee reconvened same day as Board appointment; 2) Shared directorship with ACRV; and 3) AKYA and ACRV have a VESTED - INTEREST in each other through their CDX Agreement; ACRV has an INDIRECT VESTED - INTEREST in the QTRX - AKYA deal; NON - RECUSAL introduces DUAL - FIDUCIARY CONFLICTS [ 21 ]

[ 22 ] Why Did Dr. Madaus Remain Board Chair Despite <50% Votes Cast? Source: QTRX 8K dated 06/07/2024 and S - 4 Prospectus filed 02/13/25 1) Proxy Voting – Frequently Asked Questions | Broadridge 2) Glass Lewis 2025 US Benchmark Policy Guideline Failure to obtain majority voting should have prompted immediate resignation ▪ Election votes from the June 3, 2024, annual meeting show a significant number of QTRX shareholders withheld votes from Karen Flynn and Martin Madaus – in fact, Dr. Madaus received only 49.9% of total votes cast ▪ As a refresher, ShareholderEducation.com (Broadridge) 1 defines a “withheld” vote as: ▪ Similar to abstain, but is used in instances in which nominees run unopposed and therefore only need a single vote to earn a “plurality.” In these cases, “against” votes are meaningless, so you only have the option to vote “for” or “withhold.” ▪ In 2019, nearly 90% of S&P 500 Index companies implemented resignation policies for directors who fail to receive majority voting support 2 ▪ Quanterix’s own voting results clearly signal no confidence in Dr. Madaus, and undermines trust in the current Board ▪ The Board should have immediately demanded Dr. Madaus’ resignation – instead, he continues to serve as a member of the Quanterix Transaction Committee On October 2, 2024, the Quanterix Board met and resolved to reconvene the previously formed Quanterix Transaction Committee for the purpose of facilitating the consideration and review of a potential strategic transaction with Akoya. In light of the departure of Mr. Blaser and Ms. Olson from the Quanterix Board earlier in 2024, Martin Madaus was appointed to the Quanterix Transaction Committee, which was then comprised of Ms. Flynn, Mr. Meister and Mr. Madaus . QTRX Shareholders Overwhelmingly Disapprove BoD Appointments Broker Non - Votes Withheld For 5,106,768 10,449,328 16,037,402 Karen A. Flynn 5,106,768 13,278,256 13,208,474 Martin D. Madaus, Ph.D.

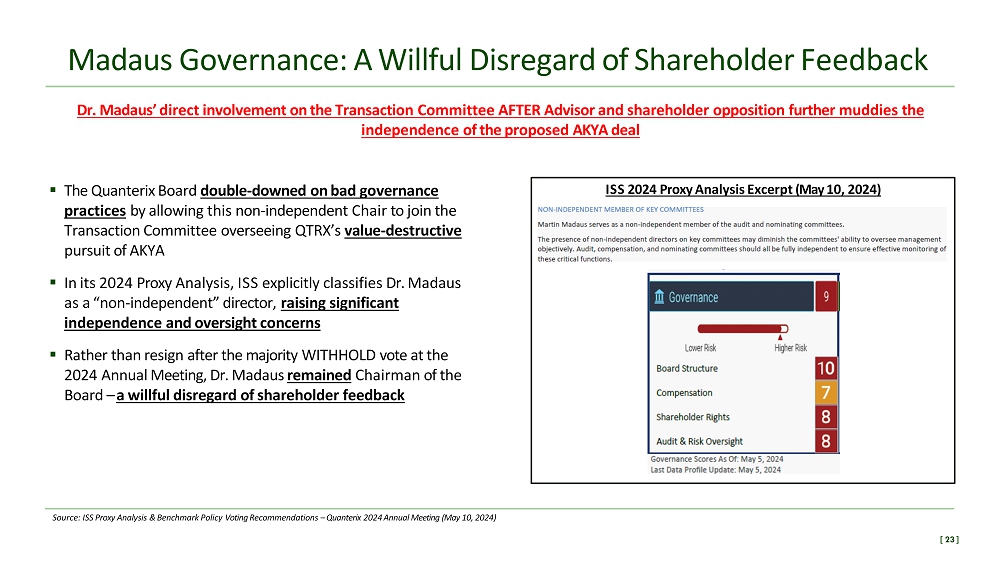

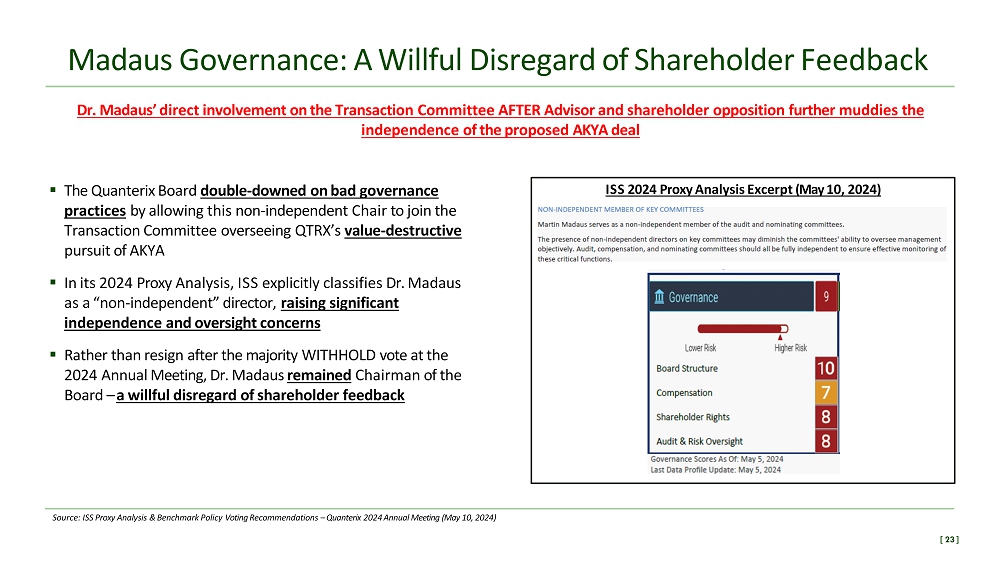

Madaus Governance: A Willful Disregard of Shareholder Feedback Dr. Madaus’ direct involvement on the Transaction Committee AFTER Advisor and shareholder opposition further muddies the independence of the proposed AKYA deal ▪ The Quanterix Board double - downed on bad governance practices by allowing this non - independent Chair to join the Transaction Committee overseeing QTRX’s value - destructive pursuit of AKYA ▪ In its 2024 Proxy Analysis, ISS explicitly classifies Dr. Madaus as a “non - independent” director, raising significant independence and oversight concerns ▪ Rather than resign after the majority WITHHOLD vote at the 2024 Annual Meeting, Dr. Madaus remained Chairman of the Board – a willful disregard of shareholder feedback ISS 2024 Proxy Analysis Excerpt (May 10, 2024) Source: ISS Proxy Analysis & Benchmark Policy Voting Recommendations – Quanterix 2024 Annual Meeting (May 10, 2024) [ 23 ]

Strategic Rationale

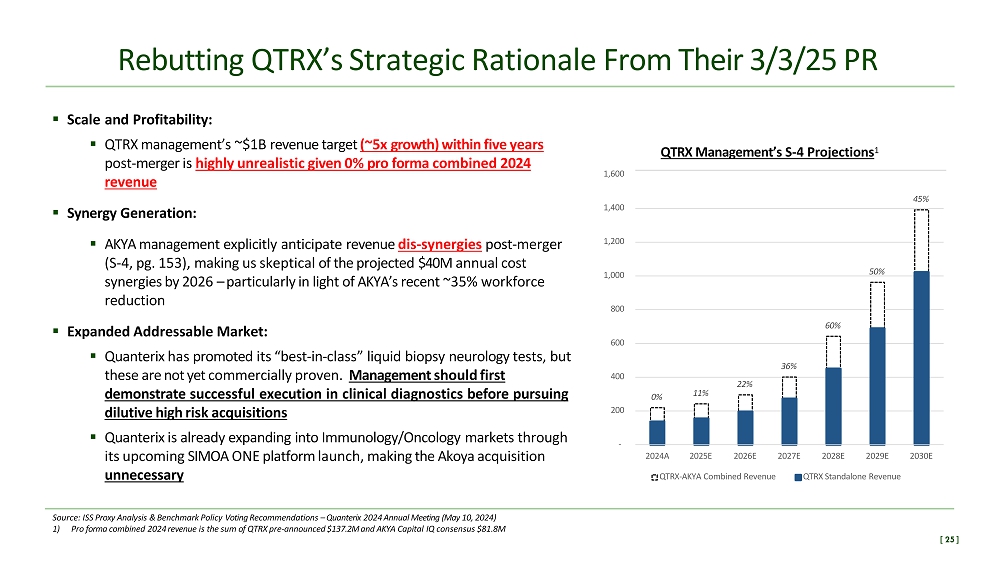

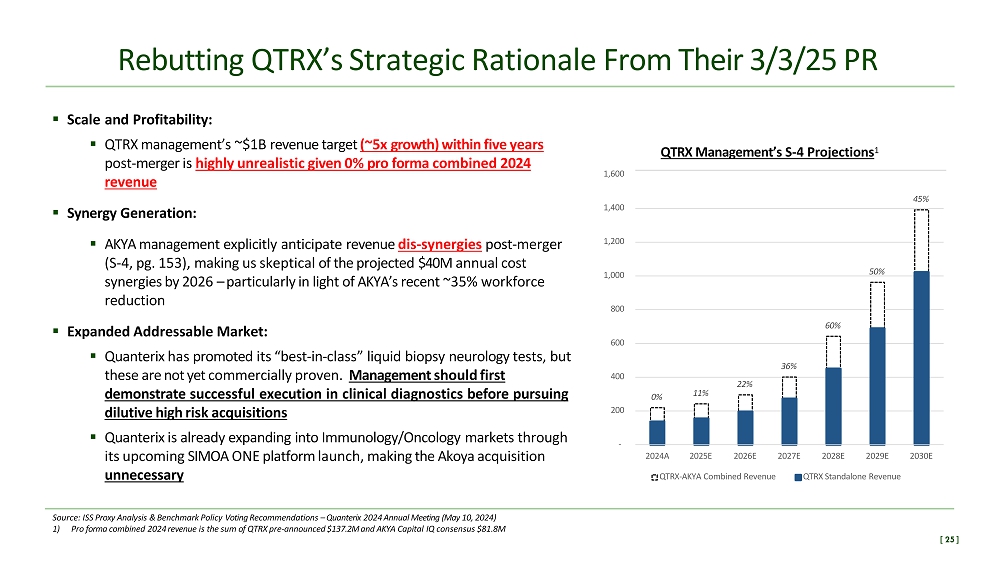

Rebutting QTRX’s Strategic Rationale From Their 3/3/25 PR Source: ISS Proxy Analysis & Benchmark Policy Voting Recommendations – Quanterix 2024 Annual Meeting (May 10, 2024) 1) Pro forma combined 2024 revenue is the sum of QTRX pre - announced $137.2M and AKYA Capital IQ consensus $81.8M ▪ Scale and Profitability: ▪ QTRX management’s ~$1B revenue target (~5x growth) within five years post - merger is highly unrealistic given 0% pro forma combined 2024 revenue ▪ Synergy Generation: ▪ AKYA management explicitly anticipate revenue dis - synergies post - merger (S - 4, pg. 153), making us skeptical of the projected $40M annual cost synergies by 2026 – particularly in light of AKYA’s recent ~35% workforce reduction ▪ Expanded Addressable Market: ▪ Quanterix has promoted its “best - in - class” liquid biopsy neurology tests, but these are not yet commercially proven. Management should first demonstrate successful execution in clinical diagnostics before pursuing dilutive high risk acquisitions ▪ Quanterix is already expanding into Immunology/Oncology markets through its upcoming SIMOA ONE platform launch, making the Akoya acquisition unnecessary QTRX Management’s S - 4 Projections 1 0% 11% 22% 36% 60% 50% 45% - 200 400 600 800 1,000 1,200 1,400 1,600 2027E 2030E 2024A 2025E 2026E QTRX - AKYA Combined Revenue 2028E 2029E QTRX Standalone Revenue [ 25 ]

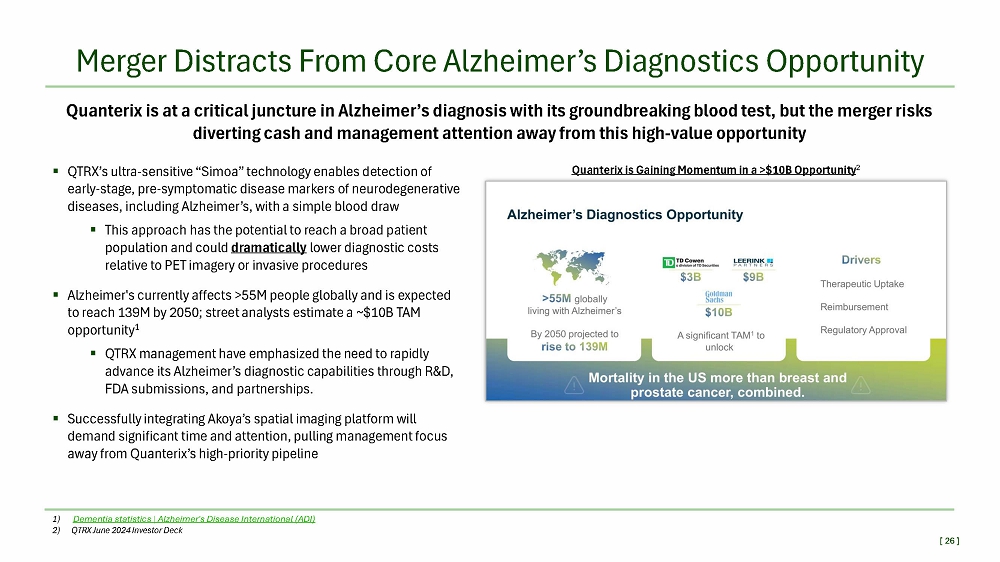

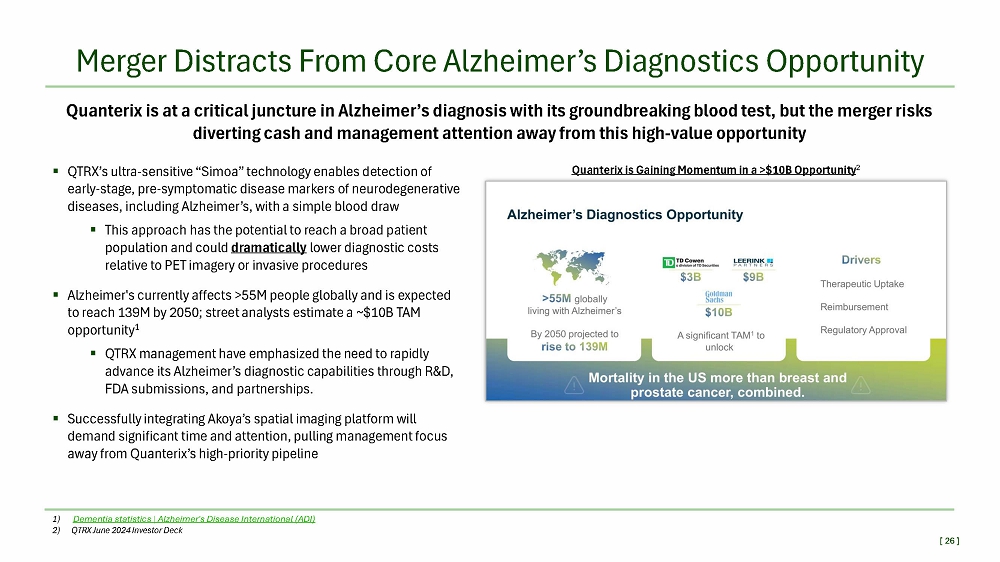

Merger Distracts From Core Alzheimer’s Diagnostics Opportunity Quanterix is at a critical juncture in Alzheimer’s diagnosis with its groundbreaking blood test, but the merger risks diverting cash and management attention away from this high - value opportunity ▪ QTRX’s ultra - sensitive “Simoa” technology enables detection of early - stage, pre - symptomatic disease markers of neurodegenerative diseases, including Alzheimer’s, with a simple blood draw ▪ This approach has the potential to reach a broad patient population and could dramatically lower diagnostic costs relative to PET imagery or invasive procedures ▪ Alzheimer's currently affects >55M people globally and is expected to reach 139M by 2050; street analysts estimate a ~$10B TAM opportunity 1 ▪ QTRX management have emphasized the need to rapidly advance its Alzheimer’s diagnostic capabilities through R&D, FDA submissions, and partnerships. ▪ Successfully integrating Akoya’s spatial imaging platform will demand significant time and attention, pulling management focus away from Quanterix’s high - priority pipeline Quanterix is Gaining Momentum in a >$10B Opportunity 2 1) Dementia statistics | Alzheimer's Disease International (ADI) 2) QTRX June 2024 Investor Deck [ 26 ]

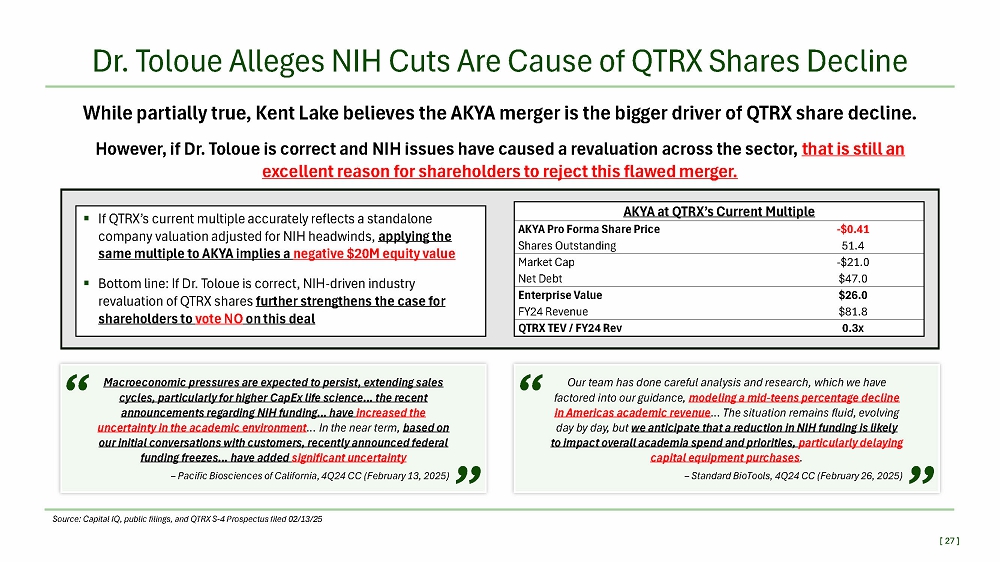

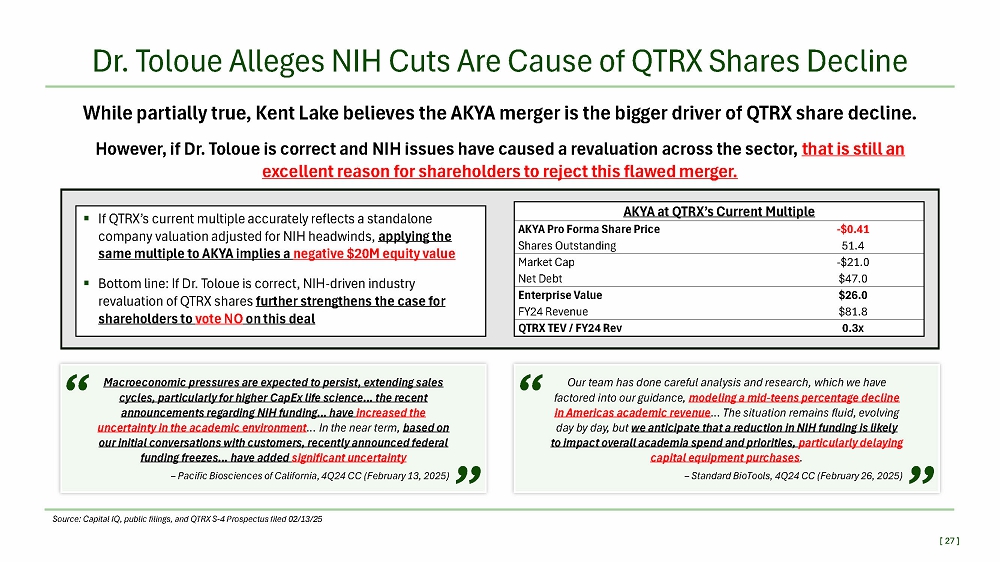

Dr. Toloue Alleges NIH Cuts Are Cause of QTRX Shares Decline Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 While partially true, Kent Lake believes the AKYA merger is the bigger driver of QTRX share decline. However, if Dr. Toloue is correct and NIH issues have caused a revaluation across the sector, that is still an excellent reason for shareholders to reject this flawed merger. ▪ If QTRX’s current multiple accurately reflects a standalone company valuation adjusted for NIH headwinds, applying the same multiple to AKYA implies a negative $20M equity value ▪ Bottom line: If Dr. Toloue is correct, NIH - driven industry revaluation of QTRX shares further strengthens the case for shareholders to vote NO on this deal AKYA at QTRX’s Current Multiple - $0.41 AKYA Pro Forma Share Price 51.4 Shares Outstanding - $21.0 Market Cap $47.0 Net Debt $26.0 Enterprise Value $81.8 FY24 Revenue 0.3x QTRX TEV / FY24 Rev “ Macroeconomic pressures are expected to persist, extending sales cycles, particularly for higher CapEx life science… the recent announcements regarding NIH funding… have increased the uncertainty in the academic environment … In the near term, based on our initial conversations with customers, recently announced federal funding freezes… have added significant uncertainty – Pacific Biosciences of California, 4Q24 CC (February 13, 2025) ” “ Our team has done careful analysis and research, which we have factored into our guidance, modeling a mid - teens percentage decline in Americas academic revenue … The situation remains fluid, evolving day by day, but we anticipate that a reduction in NIH funding is likely to impact overall academia spend and priorities, particularly delaying capital equipment purchases . [ 27 ] – Standard BioTools, 4Q24 CC (February 26, 2025) ”

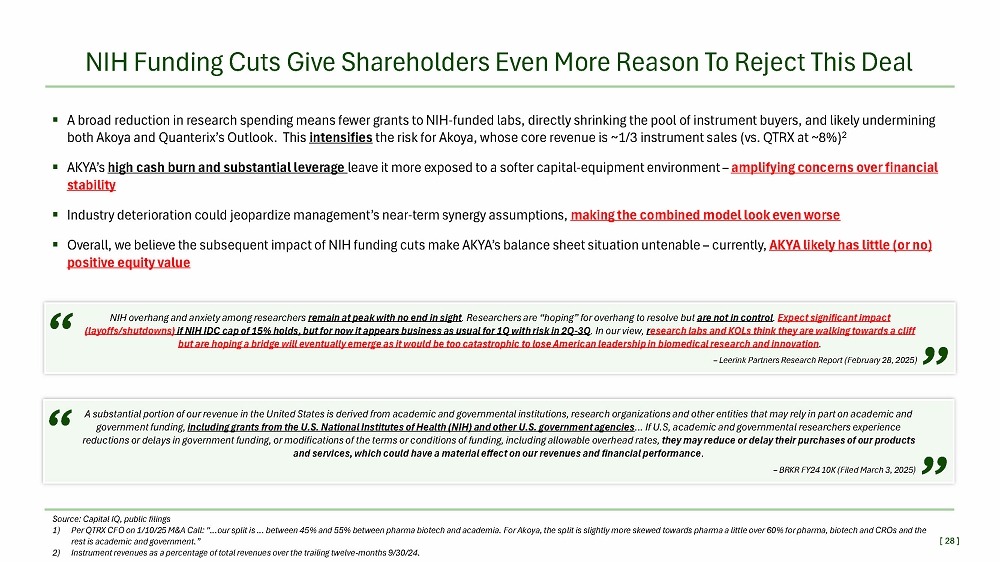

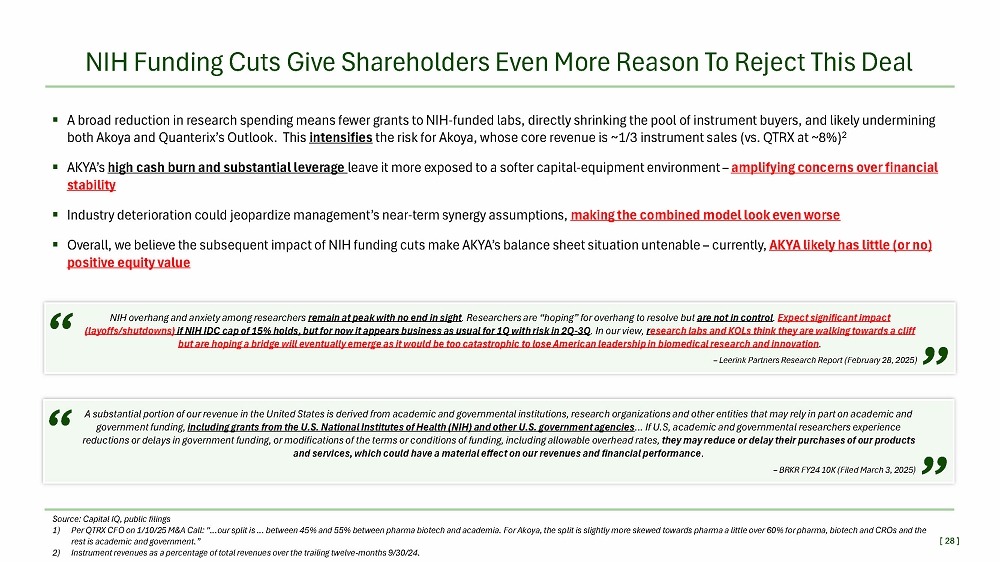

[ 28 ] ▪ A broad reduction in research spending means fewer grants to NIH - funded labs, directly shrinking the pool of instrument buyers, and likely undermining both Akoya and Quanterix’s Outlook. This intensifies the risk for Akoya, whose core revenue is ~1/3 instrument sales (vs. QTRX at ~8%) 2 ▪ AKYA’s high cash burn and substantial leverage leave it more exposed to a softer capital - equipment environment – amplifying concerns over financial stability ▪ Industry deterioration could jeopardize management’s near - term synergy assumptions, making the combined model look even worse ▪ Overall, we believe the subsequent impact of NIH funding cuts make AKYA’s balance sheet situation untenable – currently, AKYA likely has little (or no) positive equity value NIH Funding Cuts Give Shareholders Even More Reason To Reject This Deal Source: Capital IQ, public filings 1) Per QTRX CFO on 1/10/25 M&A Call: “…our split is … between 45% and 55% between pharma biotech and academia. For Akoya, the split is slightly more skewed towards pharma a little over 60% for pharma, biotech and CROs and the rest is academic and government.” 2) Instrument revenues as a percentage of total revenues over the trailing twelve - months 9/30/24. “ NIH overhang and anxiety among researchers remain at peak with no end in sight . Researchers are “hoping” for overhang to resolve but are not in control . Expect significant impact (layoffs/shutdowns) if NIH IDC cap of 15% holds, but for now it appears business as usual for 1Q with risk in 2Q - 3Q . In our view, r esearch labs and KOLs think they are walking towards a cliff but are hoping a bridge will eventually emerge as it would be too catastrophic to lose American leadership in biomedical research and innovation . – Leerink Partners Research Report (February 28, 2025) ” “ A substantial portion of our revenue in the United States is derived from academic and governmental institutions, research organizations and other entities that may rely in part on academic and government funding, including grants from the U.S. National Institutes of Health (NIH) and other U.S. government agencies ... If U.S, academic and governmental researchers experience reductions or delays in government funding, or modifications of the terms or conditions of funding, including allowable overhead rates, they may reduce or delay their purchases of our products and services, which could have a material effect on our revenues and financial performance . – BRKR FY24 10K (Filed March 3, 2025 ) ”

24.8% - 14.3% - 1.5% - 25.4% - 30.0% - 20.0% - 10.0% 0.0% 10.0% 20.0% 30.0% Total Revenue - Y/Y % Change Revenue Surprise % AKYA – Revenue Changes and Surprise % AKYA’s Competitive Position Is Weaker Than Management Claims Commentary by Akoya management reveal that market share is already slipping – So again we ask, why do the QTRX Board want to invest more dollars in an already struggling asset? “ Source: Capital IQ, public filings [ 29 ] And as you look at the areas where we've seen the most challenges in terms of the highest volatility, it's really been primarily in North America and really within the academic environment... I wouldn't say it's necessarily competition. I think the macro is the overwhelming driver . That said, we do see additional competition out there from our colleagues at Lunaphore … So in areas like core labs, CROs, people that are providing shared services, you are competing for dollars versus competing head - to - head on should I buy a spatial proteomic platform from Akoya or somebody else … For us, one telltale sign is as we look at the contribution of core labs to our revenue, that's been an area of meaningful weakness this year … In terms of a head - to - head competitive dynamic, I would say where we are potentially losing in the discovery side with the PhenoCycler - Fusion is where we don't have content ... That is an area where the competition is probably the most fierce . – Brian McKelligon, AKYA President, CEO & Director (November 14, 2024) ”

TECH Lunaphore COMET New Competitor Lunaphore (TECH) Is Taking Market Share From Akoya AKYA’s three consecutive misses and guidance cuts in 2024 coincided with Bio - Techne launching Lunaphore’s competing COMET system for the first time Competitor Quotes “ We have a fantastic platform in COMET through the Lunaphore application, obviously, newer in the market, which is now 3 quarters or so . We see good traction. Initially, we couldn't keep up with demand. We fixed that. It's a very competitive instrument and promising for us. – TECH @ Stephens Conference (November 2024) ” “ Source: Capital IQ, public filings [ 30 ] We anticipate improvement in the Diagnostics and Spatial Biology operating margin as Lunaphore continues to scale … A year ago, we launched the COMET , and we have been very happy with the uptake and the capabilities of an instrument ... we expect the pull - through of consumables on the COMET to be one of the higher pull - through instruments in our portfolio. – TECH Q2’25 CC(January 2025) ”

[ 31 ] Merger Deepens Quanterix’s Exposure to China During Trade War Source: Capital IQ, public filings 1) Per AKYA CEO on 1Q24 CC, China comprises between 60 - 70% of APAC revenue (~16% mix over the TTM 3Q24) 2) Per QTRX CEO on 2Q24 CC 3) Illumina Faces New Headaches After Trump’s Trade War, Cuts to Science Funding - WSJ AKYA’s China sales – hurt by slow demand and tightened regulations – now become QTRX’s burden ▪ AKYA derives ~10 - 11% of total revenue 1 from China, while QTRX has relatively small 2 end - market exposure ▪ AKYA’s relies upon its global distributor channel for Chinese sell - through, and any further international trade disputes (tariffs, export controls, etc.) could further its supply chain ▪ Illumina – the 800lb gorilla – is facing its own issues. On March 4, 2025, China imposed new bans on the import of genetic sequencers in response to tariffs by the Trump administration ▪ We caution that ILMN’s issues could act as a harbinger for broader industry disruptions The imposition of tariffs and trade restrictions as a result of international trade disputes or changes in trade policies may adversely affect our sales and profitability… Most notably, on February 1, 2025, President Donald Trump signed executive orders imposing a 25% tariff on certain imports from Mexico and Canada… and a 10% tariff on certain imports from China… These tariffs, and the related geopolitical uncertainty between the United States and China, may cause decreased demand for our products, which could have a material adverse effect on our business and results of operations . – CTKB FY24 10K (Filed February 27, 2025)

Conclusion

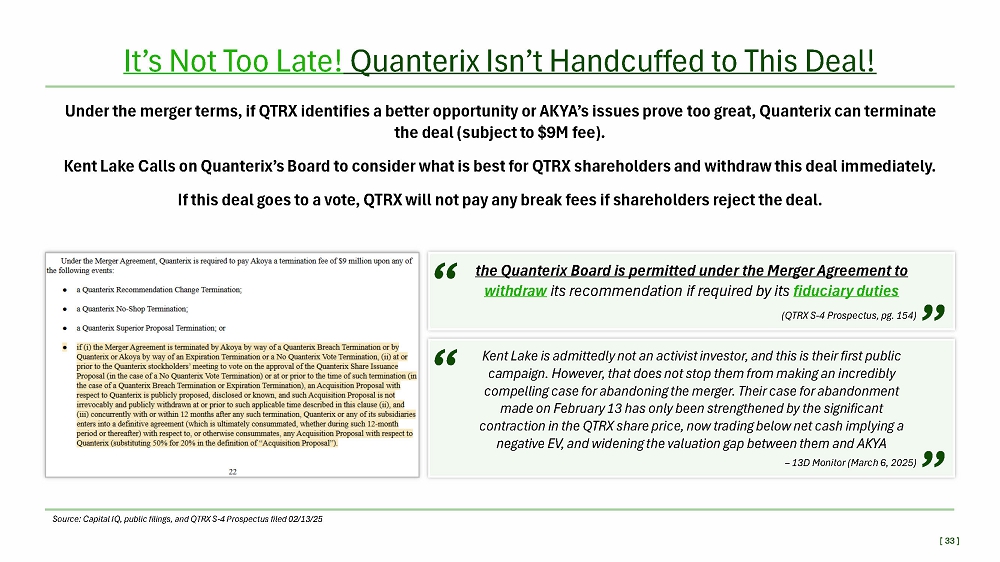

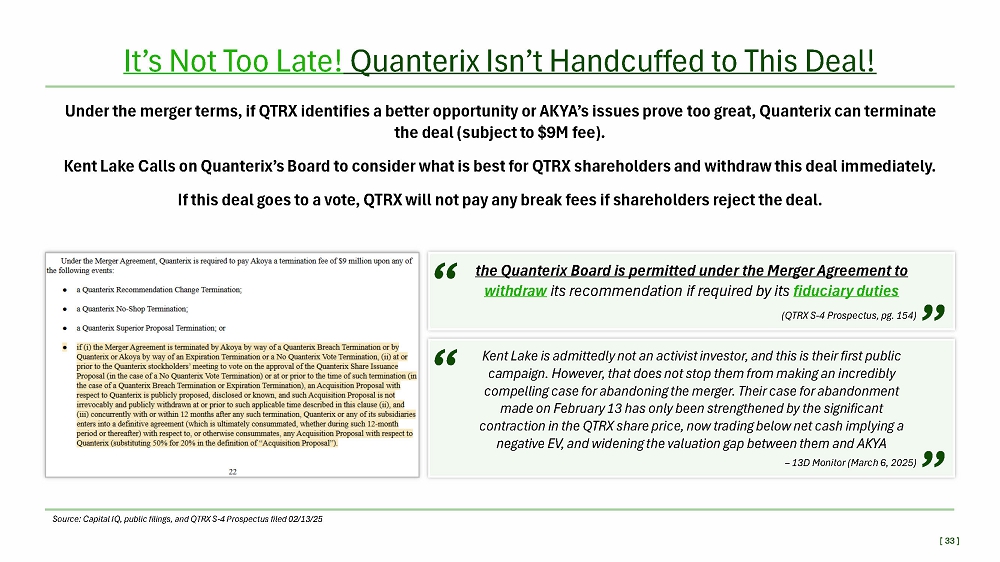

It’s Not Too Late! Quanterix Isn’t Handcuffed to This Deal! Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 Under the merger terms, if QTRX identifies a better opportunity or AKYA’s issues prove too great, Quanterix can terminate the deal (subject to $9M fee). Kent Lake Calls on Quanterix’s Board to consider what is best for QTRX shareholders and withdraw this deal immediately. If this deal goes to a vote, QTRX will not pay any break fees if shareholders reject the deal. ” the Quanterix Board is permitted under the Merger Agreement to withdraw its recommendation if required by its fiduciary duties (QTRX S - 4 Prospectus, pg. 154) “ Kent Lake is admittedly not an activist investor, and this is their first public campaign. However, that does not stop them from making an incredibly compelling case for abandoning the merger. Their case for abandonment made on February 13 has only been strengthened by the significant contraction in the QTRX share price, now trading below net cash implying a negative EV, and widening the valuation gap between them and AKYA – 13D Monitor (March 6, 2025) “ ” [ 33 ]

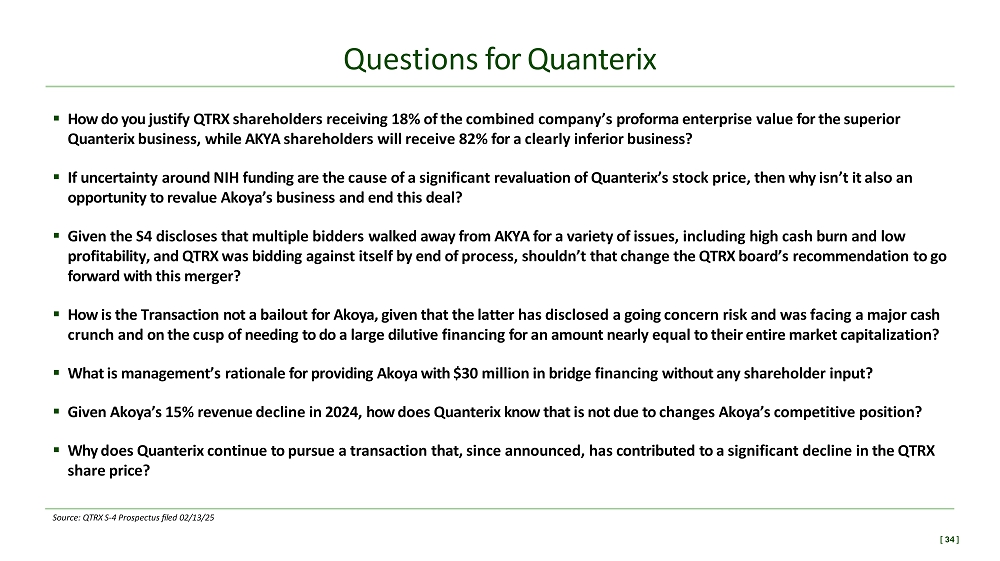

Questions for Quanterix Source: QTRX S - 4 Prospectus filed 02/13/25 [ 34 ] ▪ How do you justify QTRX shareholders receiving 18% of the combined company’s proforma enterprise value for the superior Quanterix business, while AKYA shareholders will receive 82% for a clearly inferior business? ▪ If uncertainty around NIH funding are the cause of a significant revaluation of Quanterix’s stock price, then why isn’t it also an opportunity to revalue Akoya’s business and end this deal? ▪ Given the S4 discloses that multiple bidders walked away from AKYA for a variety of issues, including high cash burn and low profitability, and QTRX was bidding against itself by end of process, shouldn’t that change the QTRX board’s recommendation to go forward with this merger? ▪ How is the Transaction not a bailout for Akoya, given that the latter has disclosed a going concern risk and was facing a major cash crunch and on the cusp of needing to do a large dilutive financing for an amount nearly equal to their entire market capitalization? ▪ What is management’s rationale for providing Akoya with $30 million in bridge financing without any shareholder input? ▪ Given Akoya’s 15% revenue decline in 2024, how does Quanterix know that is not due to changes Akoya’s competitive position? ▪ Why does Quanterix continue to pursue a transaction that, since announced, has contributed to a significant decline in the QTRX share price?

About Kent Lake PR LLC & Kent Lake Partners LP Kent Lake Partners LP is an investment fund founded by Ben Natter in 2019 with a focus on U.S. small/mid cap public equities. ▪ Kent Lake has been investing in and following Quanterix since 2022, and currently is a top three QTRX shareholder owning over 7% of QTRX’s common stock ▪ Historically, Kent Lake has avoided shareholder activism; this marks the Fund’s first public stand against a decision by one of its portfolio companies ▪ Healthcare is the majority of Kent Lake Partners LP’s investment exposure ▪ Ben Natter has over a decade of experience as a successful healthcare investor ▪ Acting in our investors’ best interests, we could not let the proposed deal move forward without raising our concerns 1) Based on Kent Lake Partners ownership refer to latest form 13D/A on file with the SEC [ 35 ]

[ 36 ] Contact Information Investor Contacts Ben Natter, 415 - 237 - 0007 info@kentlakecap.com Saratoga Proxy Consulting LLC John Ferguson / Ann Marie Mellone (212) 257 - 1311 / (888) 368 - 0379 info@saratogaproxy.com Media Contact Longacre Square Partners KentLake@longacresquarepartners.com

Appendix

Akoya’s Nov’ 2024 Off - Cycle RSU Grants Introduce Accounting Risk 1) See AKYA Form 4 filings dated November 21, 2024 2) SEC.gov | Staff Accounting Bulletin No. 120 ▪ RSUs Awarded Mid - Sales Process: AKYA management issued sizable RSU awards 1 on November 19, 2024, during active merger discussions ▪ AKYA’s November 14 announcement of "evaluating strategic alternatives" understates material positive MNPI available at the time, and these equity awards could be considered SPRING - LOADED GRANTS : ▪ AKYA had already received multiple bids within $3.50 to $5.00 per - share range ▪ AKYA management had already held post - earnings investor discussions when RSUs were granted ▪ Bidding process had already entered the 2 nd round ▪ AKYA states the fair value of RSUs are calculated using the grant date stock price ▪ This is INAPPROPRIATE for spring - loaded RSUs under SAB 120 and would result in a MISSTATEMENT ▪ Given their own restatements, QTRX MUST NOT IGNORE additional accounting risk that could MISLEAD investors and further affect financial reporting Current Price of the Underlying Share (Including Considerations for Spring - Loaded Grants) 2 Determining whether an adjustment to the observable market price is necessary, and if so, the magnitude of any adjustment, requires significant judgment . The staff acknowledges that companies generally possess non - public information when entering into share - based payment transactions. The staff believes that an observable market price on the grant date is generally a reasonable and supportable estimate of the current price of the underlying share in a share - based payment transaction, for example, when estimating the grant - date fair value of a routine annual grant to employees that is not designed to be spring - loaded. However, companies should carefully consider whether an adjustment to the observable market price is required, for example, when share - based payments arrangements are entered into in contemplation of or shortly before a planned release of material non - public information , and such information is expected to result in a material increase in share price . The staff believes that non - routine spring - loaded grants merit particular scrutiny by those charged with compensation and financial reporting governance. Additionally, when a company has a planned release of material non - public information within a short period of time after the measurement date of a share - based payment, the staff believes a material increase in the market price of the company’s shares upon release of such information indicates marketplace participants would have considered an adjustment to the observable market price on the measurement date to determine the current price of the underlying share . [ 38 ]

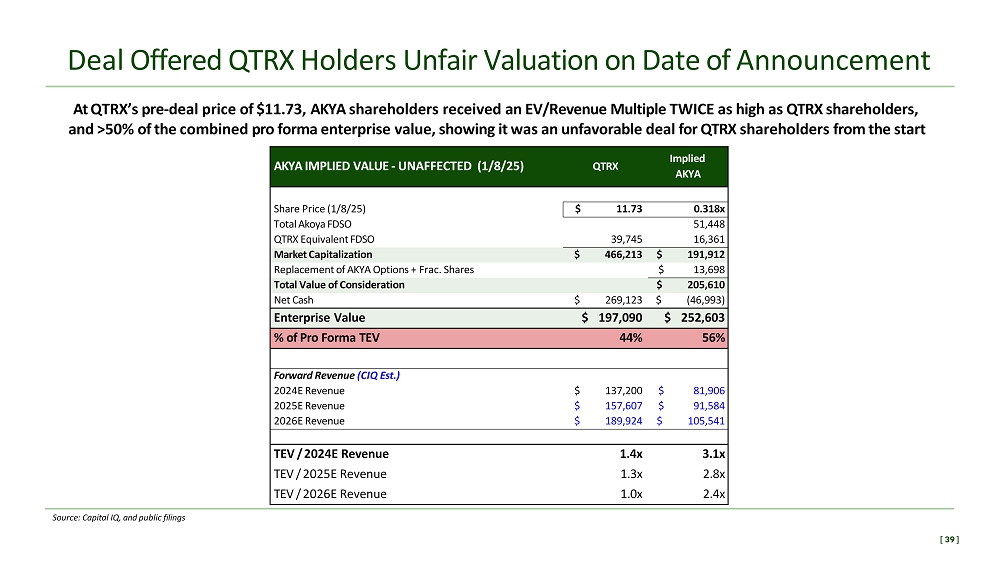

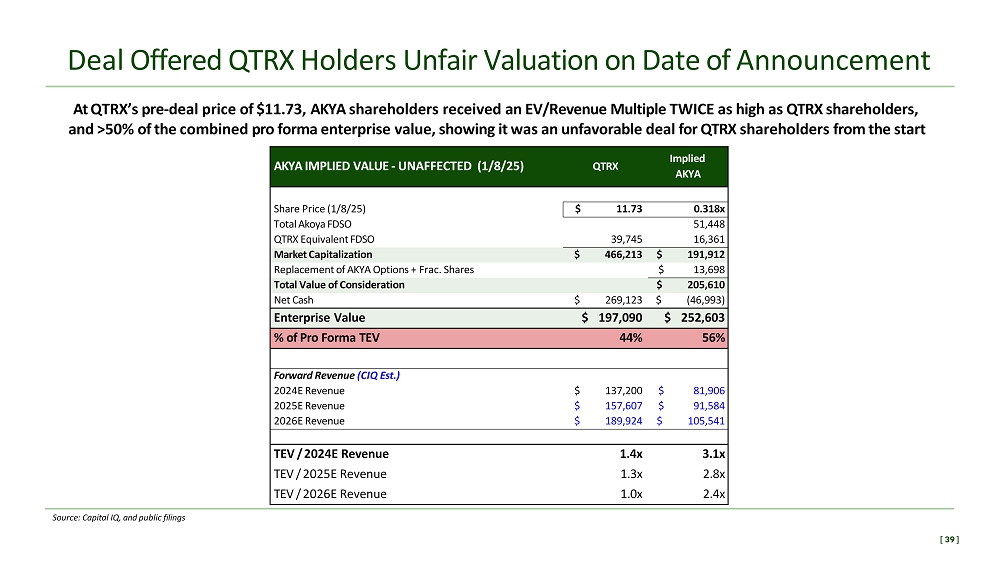

Deal Offered QTRX Holders Unfair Valuation on Date of Announcement At QTRX’s pre - deal price of $11.73, AKYA shareholders received an EV/Revenue Multiple TWICE as high as QTRX shareholders, and >50% of the combined pro forma enterprise value, showing it was an unfavorable deal for QTRX shareholders from the start Implied QTRX AKYA IMPLIED VALUE - UNAFFECTED (1/8/25) AKYA 0.318x $ 11.73 Share Price (1/8/25) 51,448 Total Akoya FDSO 16,361 39,745 QTRX Equivalent FDSO $ 191,912 $ 466,213 Market Capitalization $ 13,698 Replacement of AKYA Options + Frac. Shares $ 205,610 Total Value of Consideration $ (46,993) $ 269,123 Net Cash $ 252,603 $ 197,090 Enterprise Value 56% 44% % of Pro Forma TEV Forward Revenue (CIQ Est.) $ 81,906 $ 137,200 2024E Revenue $ 91,584 $ 157,607 2025E Revenue $ 105,541 $ 189,924 2026E Revenue 3.1x 1.4x TEV / 2024E Revenue 2.8x 1.3x TEV / 2025E Revenue 2.4x 1.0x TEV / 2026E Revenue Source: Capital IQ, and public filings [ 39 ]

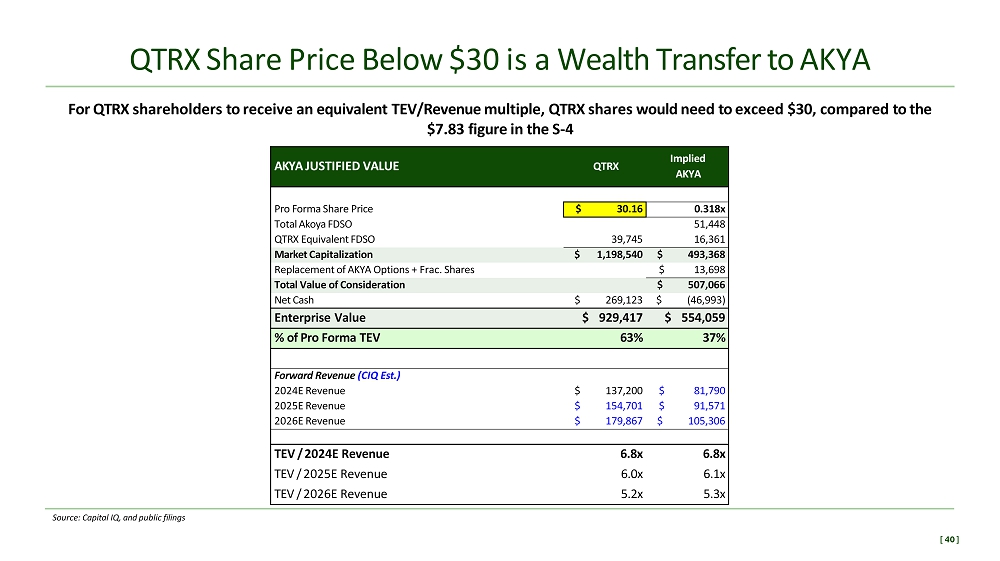

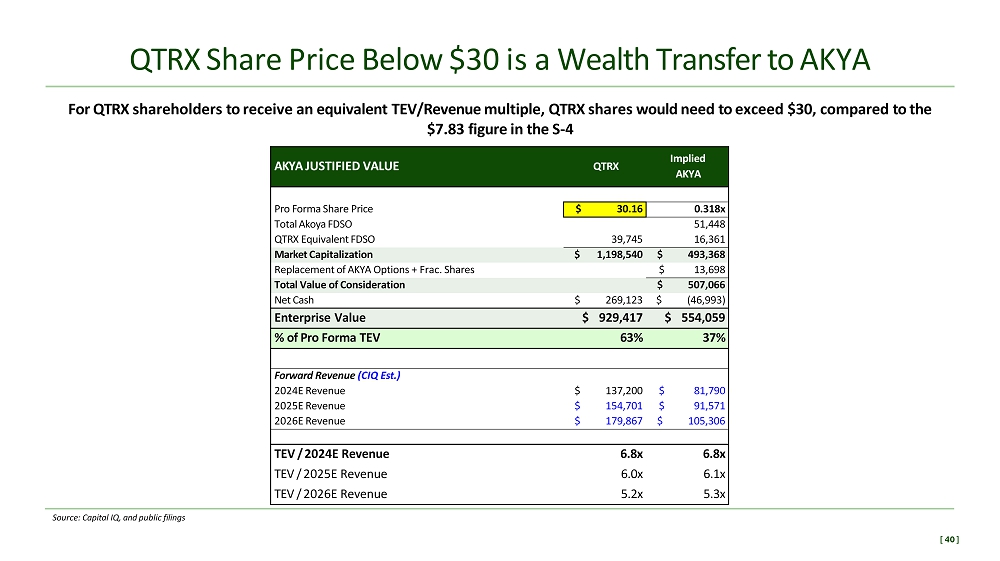

QTRX Share Price Below $30 is a Wealth Transfer to AKYA For QTRX shareholders to receive an equivalent TEV/Revenue multiple, QTRX shares would need to exceed $30, compared to the $7.83 figure in the S - 4 Implied QTRX AKYA JUSTIFIED VALUE AKYA 0.318x $ 30.16 Pro Forma Share Price 51,448 Total Akoya FDSO 16,361 39,745 QTRX Equivalent FDSO $ 493,368 $ 1,198,540 Market Capitalization $ 13,698 Replacement of AKYA Options + Frac. Shares $ 507,066 Total Value of Consideration $ (46,993) $ 269,123 Net Cash $ 554,059 $ 929,417 Enterprise Value 37% 63% % of Pro Forma TEV Forward Revenue (CIQ Est.) $ 81,790 $ 137,200 2024E Revenue $ 91,571 $ 154,701 2025E Revenue $ 105,306 $ 179,867 2026E Revenue 6.8x 6.8x TEV / 2024E Revenue 6.1x 6.0x TEV / 2025E Revenue 5.3x 5.2x TEV / 2026E Revenue Source: Capital IQ, and public filings [ 40 ]

New Director Has Significant Undisclosed Conflict of Interest Why was Dr. Magovčević - Liebisch, who sits on the Board of Acrivon Therapeutics (ACRV) – which has a material interest in Akoya’s surviva l – appointed to the Quanterix Board on the same day transaction discussions resumed ? “ Also on October 18, 2024, the Quanterix Transaction Committee held a meeting to, among other things, discuss the process letter and a potential strategic transaction with Akoya. That meeting was also attended by Ivana Magovčević - Liebisch (a member of the Quanterix Board) ... On October 25, 2024, the Quanterix Transaction Committee held a meeting to, among other things, further discuss … a potential strategic transaction with Akoya ... That meeting was also attended by William Donnelly and Ivana Magovčević - Liebisch ... At that meeting, and after discussion, the Quanterix Transaction Committee resolved to recommend to the Quanterix Board that Quanterix submit a non - binding offer to acquire 100% of the Akoya Common Stock in an all - stock transaction. (QTRX S - 4 Prospectus, pg. 135 - 136) ” ▪ On October 2, 2024, QTRX appointed Vigil Neuroscience President, CEO, and Director, to serve as a Class III director. Per the 8 - K filing, “ there is no arrangement or understanding between Dr. Magovčević - Liebisch and any other person pursuant to which she was selected as a director of the Company ” ▪ Dr. Magovčević - Liebisch concurrently serves on the Board of Acrivon Therapeutics (ACRV) – a company whose flagship OncoSignature test is critically reliant on Akoya’s platform ▪ From the ACRV March 28, 2024, 10 - K: “ We rely on our external companion diagnostic partner, Akoya , to perform ACR - 368 OncoSignature testing in our clinical trial. If Akoya encounters delays or technical challenges, enrollment in our clinical trials may be substantially delayed ” ▪ The Quanterix Board met to discuss a potential transaction with Akoya on the same day Dr. Magovčević - Liebisch was appointed (10/2/24)… QTRX submitted an offer three weeks later ▪ Dr. Magovčević - Liebisch personally owns ACRV stock options to purchase 32,500 shares (with another 20,275 likely granted following the 2025 AGM). While ACRV’s stock is only ~$5.5 (as of February 25, 2025), the median sell - side price target is ~$20 – meaning these options could be worth well over $1 million ▪ Given the sudden appointment of Dr. Magovčević - Liebisch, was the Quanterix Board’s decision effectively sealed before the process even began, making any further diligence irrelevant ? Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 41 ]

Source: public filings

Peers Are Issuing New NIH Risk Disclosures Source: Capital IQ, public filings organizations and institutes that rely on NIH funding … Our operating results may fluctuate substantially due to any such reductions and delays. Any decrease in our customers’ budgets or expenditures, or in the size, scope or frequency of their capital or operating expenditures, could materially and adversely affect our business, results of operations, financial condition and prospects. In addition, various state, federal and foreign agencies that provide grants and other funding may be subject to stringent budgetary constraints that could result in spending reductions, reduced grant making, reduced allocations or budget cutbacks, including as a result of negative or worsening conditions in the general economy, which could jeopardize the ability of these customers, or the customers to whom they provide funding, to purchase our solutions . For example, congressional appropriations to the National Institutes of Health (the “NIH”) may experience occasional year - over - year decreases in appropriations. There is no guarantee that NIH appropriations will not decrease or halt in the future. A decrease in the amount or halt of, or delay in the approval of, appropriations to NIH or other similar United States or foreign organizations, such as the Medical Research Council in the United Kingdom, could result in fewer grants benefiting life sciences research . These reductions or delays could also result in a decrease in the aggregate amount of grants awarded for life sciences research or the redirection of existing funding to other projects or priorities, any of which in turn could cause our customers and potential customers to reduce or delay purchases of our solutions . – CTKB FY24 10K (Filed February 27, 2025) Recently, budget cuts and layoffs at various federal agencies and programs, including at the National Institute of Health (NIH), have created uncertainty and budget cuts at various research – SEER FY24 10K (Filed March 3, 2025) A decrease in the amount of, or delay in the approval of, appropriations to National Institutes of Health (“NIH”) or other similar U.S. or international organizations, such as the Medical Research Council in the United Kingdom, could result in fewer grants benefiting life sciences research. For example, on February 7, 2025, the NIH imposed a standard indirect rate of 15% across all NIH grants for indirect costs, defined as “facilities” and “administration,” in lieu of a separately negotiated rate for indirect costs in every grant . Indirect costs represent more than 25% of total grant dollars in 2023 awarded by the NIH . This limitation may impact research institution’s ability to govern or even accept NIH grants, thereby affecting total spending on products such as ours. Further, as of February 2025, much of the current period NIH funding allotments have either been slowed or froze n. These reductions or delays could also result in a decrease in the aggregate amount of grants awarded for life sciences research or the redirection of existing funding to other projects or priorities , any of which in turn could cause our potential customers to reduce or delay purchases of our products. – QSI FY24 10K (Filed March 3, 2025) A substantial portion of our revenue in the United States is derived from academic and governmental institutions, research organizations and other entities that may rely in part on academic and government funding, including grants from the U.S. National Institutes of Health (NIH) and other U.S. government agencies. Government funding may fluctuate and is subject to annual appropriations and [ 44 ] budgetary constraints, and there is no assurance that such funding will continue at current levels. If U.S, academic and governmental researchers experience reductions or delays in government funding , or modifications of the terms or conditions of funding, including allowable overhead rates, they may reduce or delay their purchases of our products and services , which could have a material effect on our revenues and financial performance. – BRKR FY24 10K (Filed March 3, 2025)

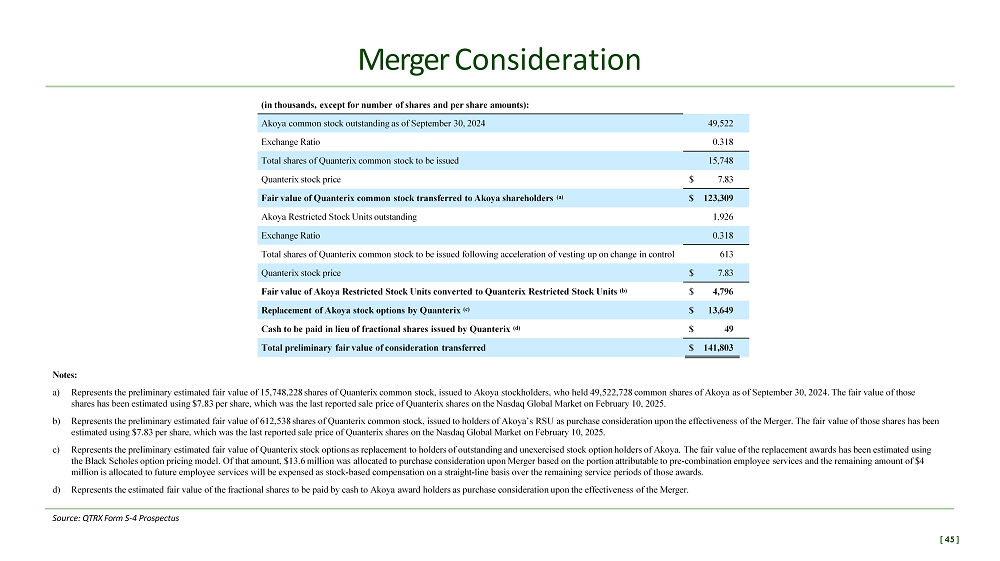

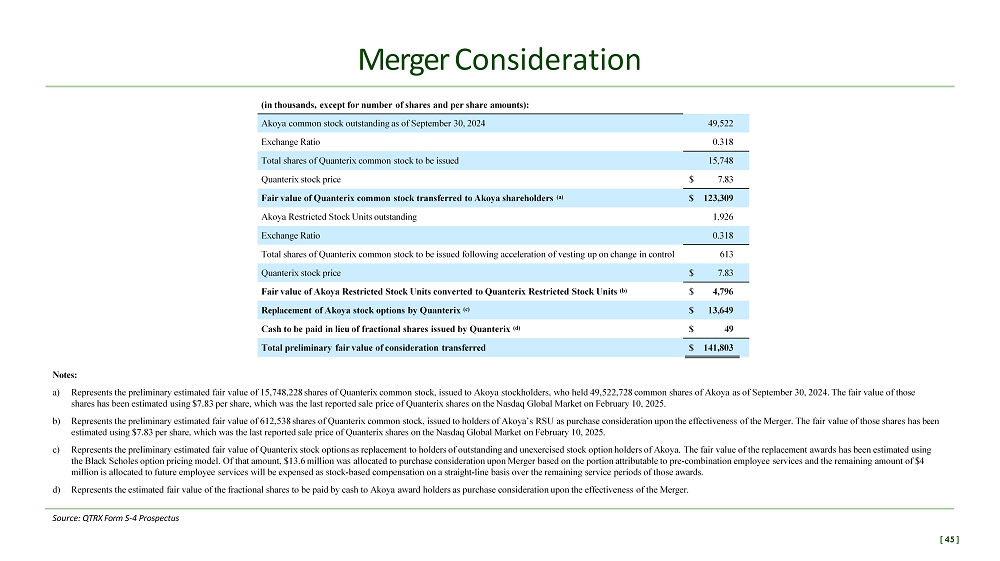

Merger Consideration Notes: a) Represents the preliminary estimated fair value of 15,748,228 shares of Quanterix common stock, issued to Akoya stockholders, who held 49,522,728 common shares of Akoya as of September 30, 2024. The fair value of those shares has been estimated using $7.83 per share, which was the last reported sale price of Quanterix shares on the Nasdaq Global Market on February 10, 2025. b) Represents the preliminary estimated fair value of 612,538 shares of Quanterix common stock, issued to holders of Akoya’s RSU as purchase consideration upon the effectiveness of the Merger. The fair value of those shares has been estimated using $7.83 per share, which was the last reported sale price of Quanterix shares on the Nasdaq Global Market on February 10, 2025. c) Represents the preliminary estimated fair value of Quanterix stock options as replacement to holders of outstanding and unexercised stock option holders of Akoya. The fair value of the replacement awards has been estimated using the Black Scholes option pricing model. Of that amount, $13.6 million was allocated to purchase consideration upon Merger based on the portion attributable to pre - combination employee services and the remaining amount of $4 million is allocated to future employee services will be expensed as stock - based compensation on a straight - line basis over the remaining service periods of those awards. d) Represents the estimated fair value of the fractional shares to be paid by cash to Akoya award holders as purchase consideration upon the effectiveness of the Merger. Source: QTRX Form S - 4 Prospectus (in thousands, except for number of shares and per share amounts): 49,522 Akoya common stock outstanding as of September 30, 2024 0.318 Exchange Ratio 15,748 Total shares of Quanterix common stock to be issued 7.83 $ Quanterix stock price 123,309 $ Fair value of Quanterix common stock transferred to Akoya shareholders (a) 1,926 Akoya Restricted Stock Units outstanding 0.318 Exchange Ratio 613 Total shares of Quanterix common stock to be issued following acceleration of vesting up on change in control 7.83 $ Quanterix stock price 4,796 $ Fair value of Akoya Restricted Stock Units converted to Quanterix Restricted Stock Units (b) 13,649 $ Replacement of Akoya stock options by Quanterix (c) 49 $ Cash to be paid in lieu of fractional shares issued by Quanterix (d) 141,803 $ Total preliminary fair value of consideration transferred [ 45 ]

Piper Sandler owns >3.5M AKYA shares through the firm’s merchant banking arm Source: Capital IQ, public filings, and QTRX S - 4 Prospectus filed 02/13/25 [ 46 ] Piper Sandler Thinks the Deal Makes Sense – But They Own >7% of AKYA Percentage of Shares Beneficially Owned(1) Number of Shares Beneficially Owned Name and Address of Beneficial Owner 5% and Greater Stockholders 35.8% 17,675,247 Entities affiliated with Telegraph Hill Partners(2) 7.2% 3,537,161 Entities affiliated with PSC Capital Partners LLC(3) 6.2% 3,077,195 Entities affiliated with aMoon Growth Fund II, L.P.(4) Named Executive Officers and Directors 2.1% 1,083,219 Brian McKelligon(5) * 106,666 Johnny Ek(6) * 355,932 Frederic Pla(7) * 76,544 Myla Lai - Goldman, M.D.(8) * 82,757 Scott Mendel(9) * 282,001 Thomas Raffin, M.D.(10) * 47,409 Thomas P. Schnettler(11) * 417,001 Robert Shepler(12) 2.1% 1,031,922 Matthew Winkler, Ph.D.(13) 7.3% 3,726,556 All executive officers and directors as a group (11 persons)(14)

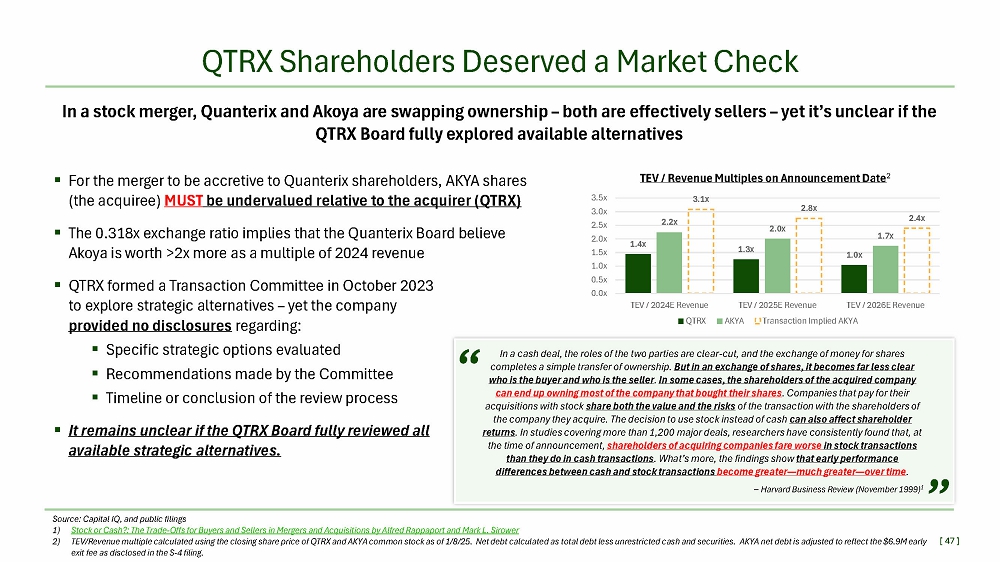

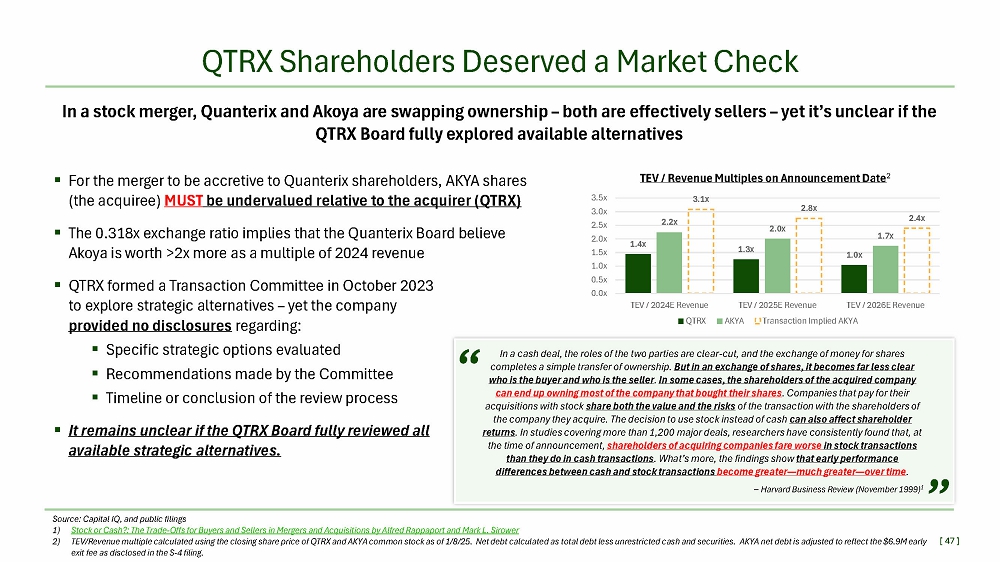

[ 47 ] 1.4x 1.3x 1.0x 2.2x 2.0x 1.7x 2.8x 2.4x 3.5x 3.0x 2.5x 2.0x 1.5x 1.0x 0.5x 0.0x TEV / 2024E Revenue QTRX TEV / 2025E Revenue TEV / 2026E Revenue AKYA Transaction Implied AKYA TEV / Revenue Multiples on Announcement Date 2 3.1x QTRX Shareholders Deserved a Market Check In a stock merger, Quanterix and Akoya are swapping ownership – both are effectively sellers – yet it’s unclear if the QTRX Board fully explored available alternatives ▪ Specific strategic options evaluated ▪ Recommendations made by the Committee ▪ Timeline or conclusion of the review process ▪ It remains unclear if the QTRX Board fully reviewed all available strategic alternatives. ▪ For the merger to be accretive to Quanterix shareholders, AKYA shares (the acquiree) MUST be undervalued relative to the acquirer (QTRX) ▪ The 0.318x exchange ratio implies that the Quanterix Board believe Akoya is worth >2x more as a multiple of 2024 revenue ▪ QTRX formed a Transaction Committee in October 2023 to explore strategic alternatives – yet the company provided no disclosures regarding: Source: Capital IQ, and public filings 1) Stock or Cash?: The Trade - Offs for Buyers and Sellers in Mergers and Acquisitions by Alfred Rappaport and Mark L. Sirower 2) TEV/Revenue multiple calculated using the closing share price of QTRX and AKYA common stock as of 1/8/25. Net debt calculated as total debt less unrestricted cash and securities. AKYA net debt is adjusted to reflect the $6.9M early exit fee as disclosed in the S - 4 filing. “ In a cash deal, the roles of the two parties are clear - cut, and the exchange of money for shares completes a simple transfer of ownership. But in an exchange of shares, it becomes far less clear who is the buyer and who is the seller . In some cases, the shareholders of the acquired company can end up owning most of the company that bought their shares . Companies that pay for their acquisitions with stock share both the value and the risks of the transaction with the shareholders of the company they acquire. The decision to use stock instead of cash can also affect shareholder returns . In studies covering more than 1,200 major deals, researchers have consistently found that, at the time of announcement, shareholders of acquiring companies fare worse in stock transactions than they do in cash transactions . What’s more, the findings show that early performance differences between cash and stock transactions become greater — much greater — over time . – Harvard Business Review (November 1999) 1 ”

[ 48 ] $35.73 $14.69 $13.18 $15.00 $7.42 $46.20 $16.58 $49.06 $28.00 $29.70 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 Goldman DCF PWP Fairness Comps PWP DCF Broker Consensus (1/8/25) 52W High / Low (2/27/25) Pre - Announcement Share Price (1/8/25) Current Share Price (2/25/25) Median QTRX Value - Per - Share Fairness Opinion Valuation Range $7.89 $11.73 $25.99 S4 Disclosures Demonstrate QTRX Is Undervalued as a Standalone Company Both transaction advisors acknowledge that QTRX is materially undervalued – A strong reason for Quanterix NOT to issue equity to buy struggling Akoya. ▪ Both PWP and Goldman value QTRX equity far above its current trading price ▪ The median share price across the PWP/GS fairness opinions, sell - side consensus, and QTRX’s 52 - week trading range is ~$26/share ▪ At the 0.318x exchange ratio, QTRX is effectively valuing AKYA at nearly $10/share – more than 5x FY26 consensus revenue and >400% above the current share price 2 ▪ QTRX’s share price has declined by over 30% since the announcement, clearly signaling shareholders oppose the transaction ▪ QTRX nearly trades for a 10% premium to its own cash. In contrast, AKYA – flagged for going concern risk 1 – is being valued with an enterprise value at >5x that of QTRX Source: Capital IQ, and public filings PWP Fairness Comps include QTRX, AKYA, MASS, CTKB, ONT, PACB, QSI, SEER, and LAB 1) AKYA 3Q24 10Q 2) Calculated as justified AKYA enterprise value less $47.0M assumed net debt, divided by total AKYA shares outstanding at 9/30/24; relative to closing AKYA share price dated 2/25/25.

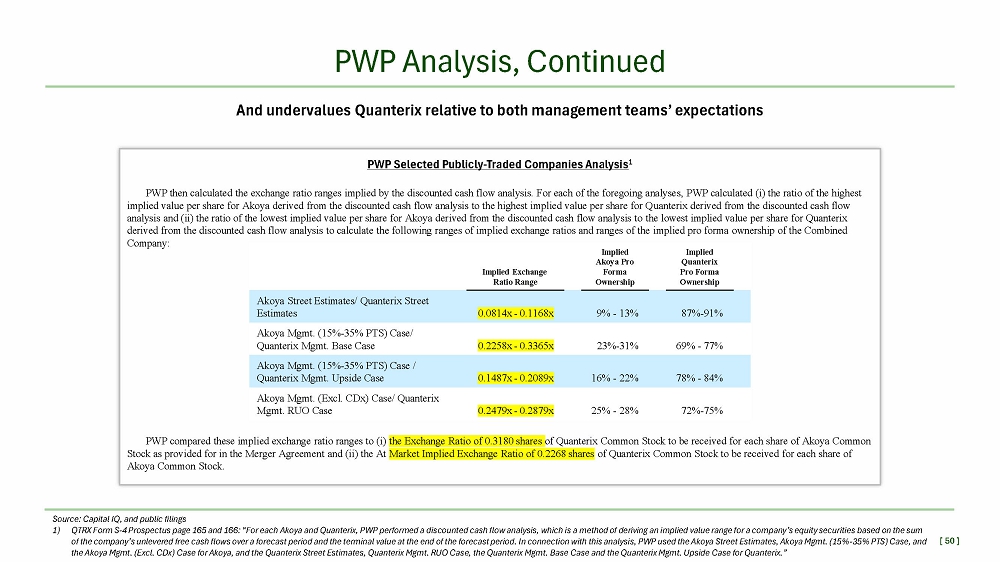

[ 49 ] PWP compared (i) these implied ranges for Akoya to the Akoya Current Share Price of $2.66 and the Implied Offer Price of $3.73 and (ii) these implied ranges for Quanterix to the Quanterix Current Share Price of $11.73. PWP then calculated the exchange ratio ranges implied by the selected publicly - traded companies analysis. For each of the foregoing analyses, PWP calculated (i) the ratio of the highest implied value per share for Akoya derived from the selected publicly - traded companies analysis to the highest implied value per share for Quanterix derived from the selected publicly - traded companies analysis and (ii) the ratio of the lowest implied value per share for Akoya derived from the selected publicly - traded companies analysis to the lowest implied value per share for Quanterix derived from the selected publicly - traded companies analysis to calculate the following ranges of implied exchange ratios and ranges of implied pro forma ownership of the Combined Company: PWP compared these implied exchange ratio ranges to (i) the Exchange Ratio of 0.3180 shares of Quanterix Common Stock to be received for each share of Akoya Common Stock as provided for in the Merger Agreement and (ii) the At Market Implied Exchange Ratio of 0.2268 shares of Quanterix Common Stock to be received for each share of Akoya Common Stock. PWP Selected Publicly - Traded Companies Analysis 1 The ranges of implied values per share derived from these calculations are summarized in the following table: Akoya’s Own Banker (PWP) Suggests the Ratio Is Too High PWP’s analysis of publicly - traded peers suggests the agreed upon Exchange Ratio is nearly 2x above fair market value Source: Capital IQ, and public filings 1) QTRX Form S - 4 Prospectus page 163 Quanterix Share Price Range ya Share e Range Ako Pric 14.75 - $16.45 $ 2.39 - $2.86 $ EV / 2024E Revenue 14.62 - $16.51 $ 2.88 - $3.53 $ EV / 2025E Revenue Implied Quanterix Pro Forma Ownership Implied Akoya Pro Forma Ownership Implied Exchange Ratio Range 81% - 82% 18% - 19% 0.1618x - 0.1738x EV / 2024E Revenue 78% - 79% 21 % - 22% 0.1968x - 0.2140x EV / 2025E Revenue PWP Implied Exchange Ratio Range Average Low High 0.1678x 0.1738x 0.1618x EV / 2024E Revenue 0.2054x 0.2140x 0.1968x EV / 2025E Revenue 0.1866x Average Implied Exchange Ratio 0.3180x Actual Exchange Ratio 1.7x Over (Under)

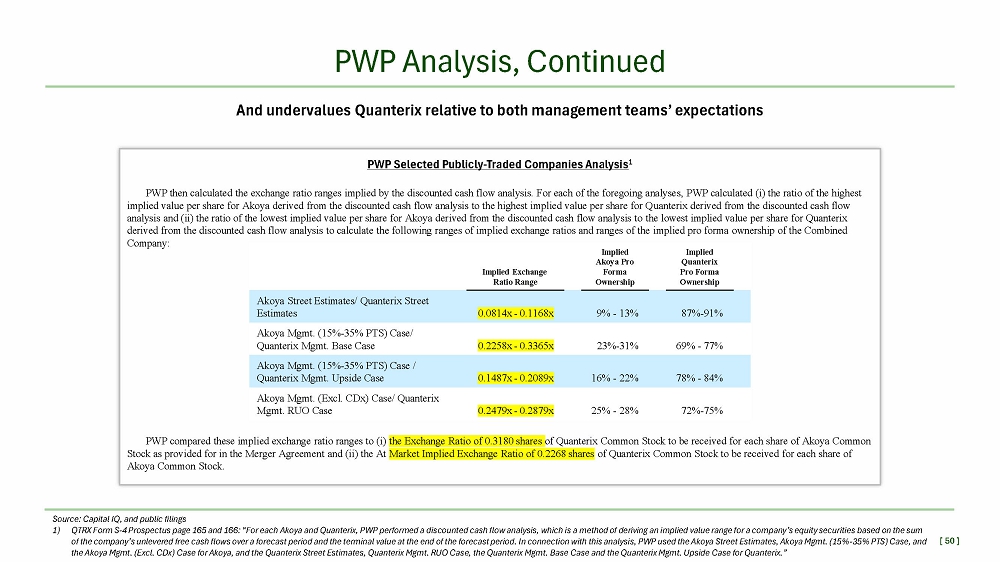

[ 50 ] the Exchange Ratio of 0.3180 shares of Quanterix Common Stock to be received for each share of Akoya Common Market Implied Exchange Ratio of 0.2268 shares of Quanterix Common Stock to be received for each share of PWP compared these implied exchange ratio ranges to (i) Stock as provided for in the Merger Agreement and (ii) the At Akoya Common Stock . PWP Selected Publicly - Traded Companies Analysis 1 PWP then calculated the exchange ratio ranges implied by the discounted cash flow analysis. For each of the foregoing analyses, PWP calculated (i) the ratio of the highest implied value per share for Akoya derived from the discounted cash flow analysis to the highest implied value per share for Quanterix derived from the discounted cash flow analysis and (ii) the ratio of the lowest implied value per share for Akoya derived from the discounted cash flow analysis to the lowest implied value per share for Quanterix derived from the discounted cash flow analysis to calculate the following ranges of implied exchange ratios and ranges of the implied pro forma ownership of the Combined Company: PWP Analysis, Continued And undervalues Quanterix relative to both management teams’ expectations Source: Capital IQ, and public filings 1) QTRX Form S - 4 Prospectus page 165 and 166: “For each Akoya and Quanterix, PWP performed a discounted cash flow analysis, which is a method of deriving an implied value range for a company’s equity securities based on the sum of the company’s unlevered free cash flows over a forecast period and the terminal value at the end of the forecast period. In connection with this analysis, PWP used the Akoya Street Estimates, Akoya Mgmt. (15% - 35% PTS) Case, and the Akoya Mgmt. (Excl. CDx) Case for Akoya, and the Quanterix Street Estimates, Quanterix Mgmt. RUO Case, the Quanterix Mgmt. Base Case and the Quanterix Mgmt. Upside Case for Quanterix.” Implied Quanterix Pro Forma Ownership Implied Akoya Pro Forma Ownership Implied Exchange Ratio Range 87% - 91% 9% - 13% 0.0814x - 0.1168x Akoya Street Estimates/ Quanterix Street Estimates 69% - 77% 23% - 31% 0.2258x - 0.3365x Akoya Mgmt. (15% - 35% PTS) Case/ Quanterix Mgmt. Base Case 78% - 84% 16% - 22% 0.1487x - 0.2089x Akoya Mgmt. (15% - 35% PTS) Case / Quanterix Mgmt. Upside Case 72% - 75% 25% - 28% 0.2479x - 0.2879x Akoya Mgmt. (Excl. CDx) Case/ Quanterix Mgmt. RUO Case

AKYA Consistently Misses Wallstreet Estimates Source: Capital IQ, public filings, and analyst research reports AKYA has reported a consistent string of misses, resulting in numerous analyst downgrades ▪ BTIG downgrades from Buy to Hold in August 2024 ▪ Morgan Stanley downgrades from Buy to Hold in August 2024 ▪ Craig Hallum initiates with a Buy in June 2024 ▪ Craig Hallum downgrades to Hold in November 2024 Broker Value Prior ($M) Broker Value Current ($M) Broker Raise (Lower) % Date Broker 83.2 82.3 - 1.1% 1/28/2025 Entitlement Needed 83.2 83.2 0.0% 1/10/2025 Entitlement Needed 97.0 83.2 - 14.2% 11/25/2024 Entitlement Needed 96.3 80.7 - 16.2% 11/18/2024 Piper Sandler Companies 99.0 80.5 - 18.7% 11/15/2024 Craig - Hallum Capital Group LLC 83.0 82.5 - 0.6% 11/15/2024 Entitlement Needed 97.0 97.0 0.0% 11/15/2024 Entitlement Needed 98.0 80.8 - 17.6% 11/14/2024 Entitlement Needed 95.4 82.1 - 13.9% 11/14/2024 Guggenheim Securities, LLC 98.9 83.0 - 16.1% 11/14/2024 Entitlement Needed 101.1 83.0 - 17.9% 11/14/2024 BTIG 97.0 97.0 0.0% 11/14/2024 Entitlement Needed 104.4 99.0 - 5.2% 11/14/2024 Craig - Hallum Capital Group LLC 104.0 101.1 - 2.8% 11/14/2024 BTIG 97.0 97.0 0.0% 9/16/2024 Entitlement Needed 99.1 97.0 - 2.1% 8/14/2024 Entitlement Needed 102.0 96.3 - 5.6% 8/12/2024 Piper Sandler Companies 99.0 98.9 - 0.1% 8/6/2024 Entitlement Needed 104.4 99.0 - 5.2% 8/6/2024 Craig - Hallum Capital Group LLC 104.1 99.1 - 4.8% 8/6/2024 Entitlement Needed 104.0 101.1 - 2.8% 8/6/2024 BTIG 99.7 95.4 - 4.3% 8/5/2024 Guggenheim Securities, LLC 105.0 96.5 - 8.1% 8/5/2024 Capital One Securities, Inc. 104.1 98.0 - 5.9% 8/5/2024 Entitlement Needed 106.1 99.0 - 6.7% 8/5/2024 Entitlement Needed 116.0 104.1 - 10.3% 8/5/2024 Entitlement Needed - 104.4 0.0% 8/5/2024 Craig - Hallum Capital Group LLC 115.0 105.0 - 8.7% 8/5/2024 Capital One Securities, Inc. 106.0 106.1 0.1% 8/5/2024 Entitlement Needed 104.1 99.1 - 4.8% 7/22/2024 Entitlement Needed - 104.4 0.0% 6/21/2024 Craig - Hallum Capital Group LLC 115.00 102.00 - 11.3% 5/14/2024 Piper Sandler Companies Analyst Quotes We believe the deal was motivated by two key issues: (1) we think AKYA needed to raise money again (we think it just simply didn't raise enough money when it did its last two raises); and (2) AKYA had been struggling like many other life sciences tools companies. AKYA has now gone three - for - three on quarterly revenue misses and guide - downs this year – BTIG (August 2024) “ ” [ 51 ]

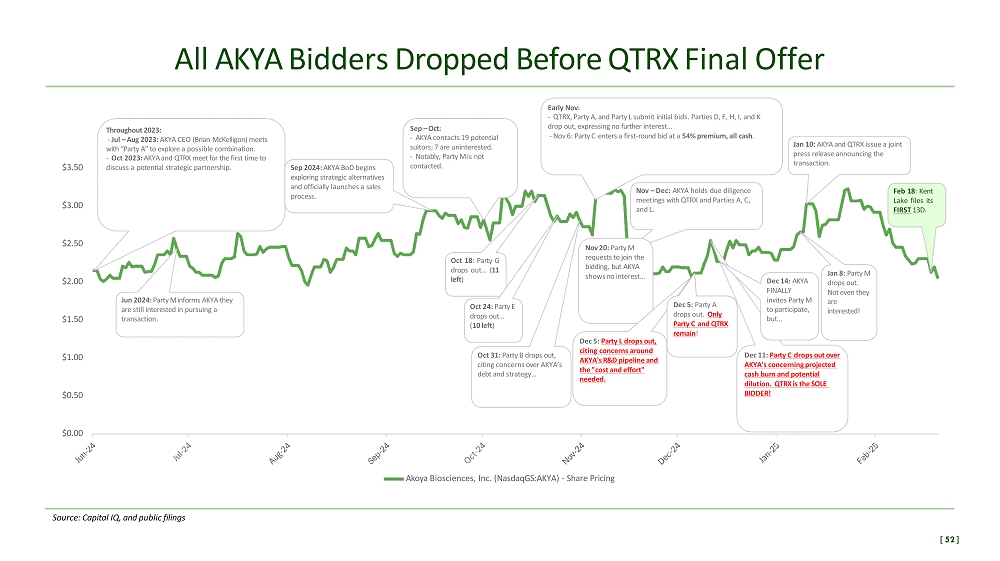

Source: Capital IQ, and public filings All AKYA Bidders Dropped Before QTRX Final Offer Throughout 2023: - Jul – Aug 2023: AKYA CEO (Brian McKelligon) meets with “Party A” to explore a possible combination. - Oct 2023: AKYA and QTRX meet for the first time to discuss a potential strategic partnership. Jun 2024: Party M informs AKYA they are still interested in pursuing a transaction. Sep 2024: AKYA BoD begins exploring strategic alternatives and officially launches a sales process. Sep – Oct: - AKYA contacts 19 potential suitors; 7 are uninterested. - Notably, Party M is not contacted. Oct 18 : Party G drops out … ( 11 left ) Oct 24: Party E drops out… ( 10 left ) Oct 31: Party B drops out, citing concerns over AKYA’s debt and strategy… Early Nov: - QTRX, Party A, and Party L submit initial bids. Parties D, F, H, I, and K drop out, expressing no further interest... - Nov 6: Party C enters a first - round bid at a 54% premium, all cash . Nov – Dec : AKYA holds due diligence meetings with QTRX and Parties A, C, and L . Nov 20: Party M requests to join the bidding, but AKYA shows no interest… Dec 5: Party L drops out, citing concerns around AKYA's R&D pipeline and the "cost and effort" needed. Dec 5: Party A drops out. Only Party C and QTRX remain ! Dec 11: Party C drops out over AKYA's concerning projected cash burn and potential dilution. QTRX is the SOLE BIDDER! Dec 14: AKYA FINALLY invites Party M to participate, but… Jan 8: Party M drops out. Not even they are interested! Jan 10: AKYA and QTRX issue a joint press release announcing the transaction. Feb 18 : Kent Lake files its FIRST 13 D . $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 Akoya Biosciences, Inc. (NasdaqGS:AKYA) - Share Pricing [ 52 ]

QTRX Relative Underperformance - 72.7% - 67.4% - 32.0% - 8.1% - 80.0% - 60.0% - 40.0% - 20.0% 0.0% 20.0% 40.0% Quanterix Corporation (NasdaqGM:QTRX) - Share Price QTRX Peer Group - Equal Weighted Akoya Biosciences, Inc. (NasdaqGS:AKYA) - Share Price S&P 500 - Life Sciences Tools & Services - Index Value “Peer Group” classified as equal weighted index of dividend - adjusted share price for MASS, ABSI, AKYA, TECH, CTKB, EVT, MXCT, NAUT, NEO, ONT, PACB, PSNL, QSI, SEER, SOPH, LAB, and TWST. Share price data as of March 7, 2025. Source: Capital IQ, and public filings [ 53 ]

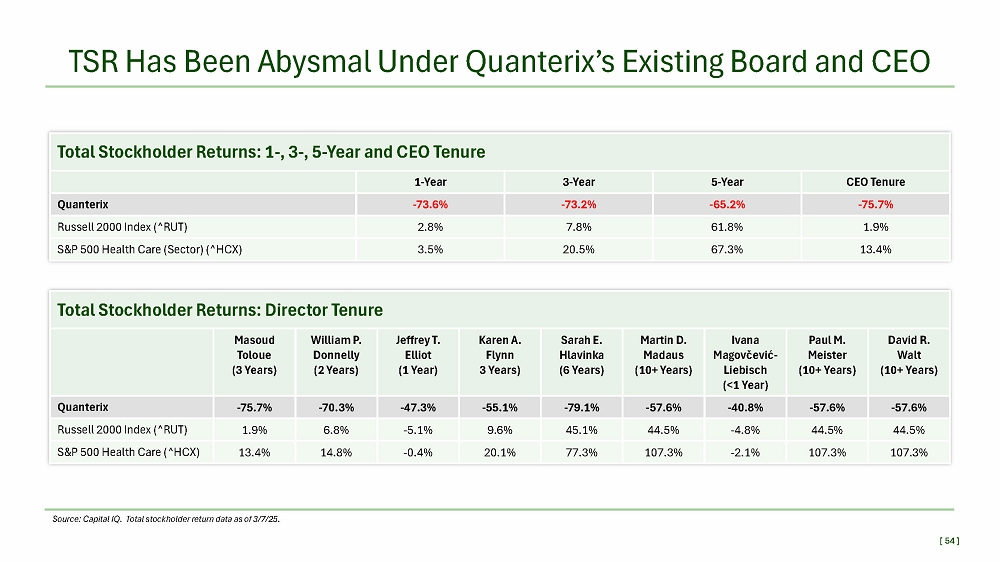

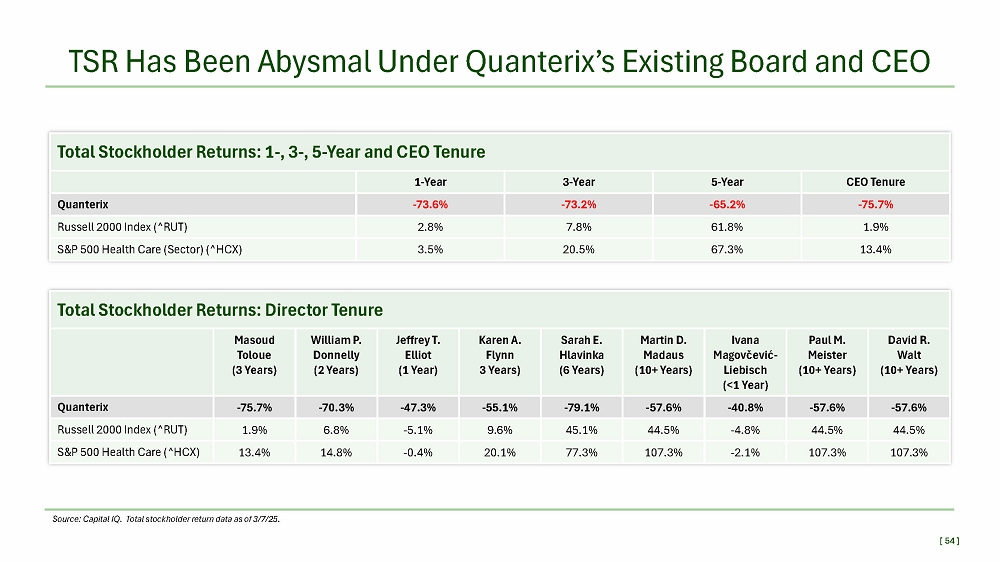

TSR Has Been Abysmal Under Quanterix’s Existing Board and CEO Total Stockholder Returns: 1 - , 3 - , 5 - Year and CEO Tenure CEO Tenure 5 - Year 3 - Year 1 - Year - 75.7% - 65.2% - 73.2% - 73.6% Quanterix 1.9% 61.8% 7.8% 2.8% Russell 2000 Index (^RUT) 13.4% 67.3% 20.5% 3.5% S&P 500 Health Care (Sector) (^HCX) Total Stockholder Returns: Director Tenure David R. Walt (10+ Years) Paul M. Meister (10+ Years) Ivana Magovčević - Liebisch (<1 Year) Martin D. Madaus (10+ Years) Sarah E . Hlavinka ( 6 Years) Karen A. Flynn 3 Years) Jeffrey T. Elliot (1 Year) William P . Donnelly ( 2 Years) Masoud Toloue ( 3 Years) - 57.6% - 57.6% - 40.8% - 57.6% - 79.1% - 55.1% - 47.3% - 70.3% - 75.7% Quanterix 44.5% 44.5% - 4.8% 44.5% 45.1% 9.6% - 5.1% 6.8% 1.9% Russell 2000 Index (^RUT) 107.3% 107.3% - 2.1% 107.3% 77.3% 20.1% - 0.4% 14.8% 13.4% S&P 500 Health Care (^HCX) Source: Capital IQ. Total stockholder return data as of 3/7/25. [ 54 ]