As filed with the Securities and Exchange Commission on October 28, 2024.

Registration Statement No. 333-[•]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

–––––––––––––––––––––––––––

PLUM III MERGER CORP.

(Exact name of Registrant as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

–––––––––––––––––––––––––––

British Columbia | | 6770 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (IRS Employer

Identification Number) |

2021 Fillmore St., #2089

San Francisco, California 94115

(929) 529-7125

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

–––––––––––––––––––––––––––

CT Corporation System

28 Liberty Street

New York, New York 10005

(212) 894-8940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

–––––––––––––––––––––––––––

With copies to:

Bill Nelson

Alain Dermarkar

Romain Dambre

Allen Overy Shearman

Sterling US LLP

800 Capitol Stret,

Suite 2200

Houston, Texas 77002

Tel: +1-713-358-4900 | | Richard Aftanas

John Duke

Hogan Lovells US LLP

390 Madison Avenue

New York, NY 10017

(212) 918-3000 | | Francesco Gucciardo

Aird & Berlis LLP

Brookfield Place

181 Bay Street, Suite 1800

Toronto, Canada M5J 2T9

(416) 863-1500 | | Desmond Balakrishnan

McMillan LLP

Suite 1500 – 1055 West

Georgia Street

Vancouver,

British Columbia,

V6E 4N7

Canada

(604) 689-9111 |

–––––––––––––––––––––––––––

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effectiveness of this registration statement and upon completion of the business combination described in the enclosed proxy statement/prospectus.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

Name of Additional Registrant(1) | | Jurisdiction of Incorporation or

Organization | | IRS Employer ID Number |

Tactical Resources Corp. | | British Columbia | | Not Applicable |

Table of Contents

The information contained in this document is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document is not an offer to sell these securities and it is not soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PRELIMINARY — SUBJECT TO COMPLETION, DATED OCTOBER 28, 2024

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

PLUM ACQUISITION CORP. III

PROSPECTUS FOR

60,979,776 CLASS A COMMON SHARES,

12,059,166 WARRANTS AND 12,059,166 CLASS A COMMON SHARES

ISSUABLE UPON EXERCISE OF WARRANTS OF PLUM III MERGER CORP.

PROPOSED BUSINESS COMBINATION — YOUR PARTICIPATION IS VERY IMPORTANT

Dear Shareholders of Plum Acquisition Corp. III:

You are cordially invited to attend the extraordinary general meeting (the “Plum Shareholders’ Meeting”) of shareholders of Plum Acquisition Corp. III (“Plum” and such shareholders, the “Plum Shareholders”), which will be held at 10:00 a.m., Eastern Time, on [•], 2024, virtually pursuant to the procedures described in the accompanying proxy statement/prospectus for the purposes of Cayman Islands law and Plum’s Amended and Restated Memorandum and Articles of Association (the “Plum Articles”).

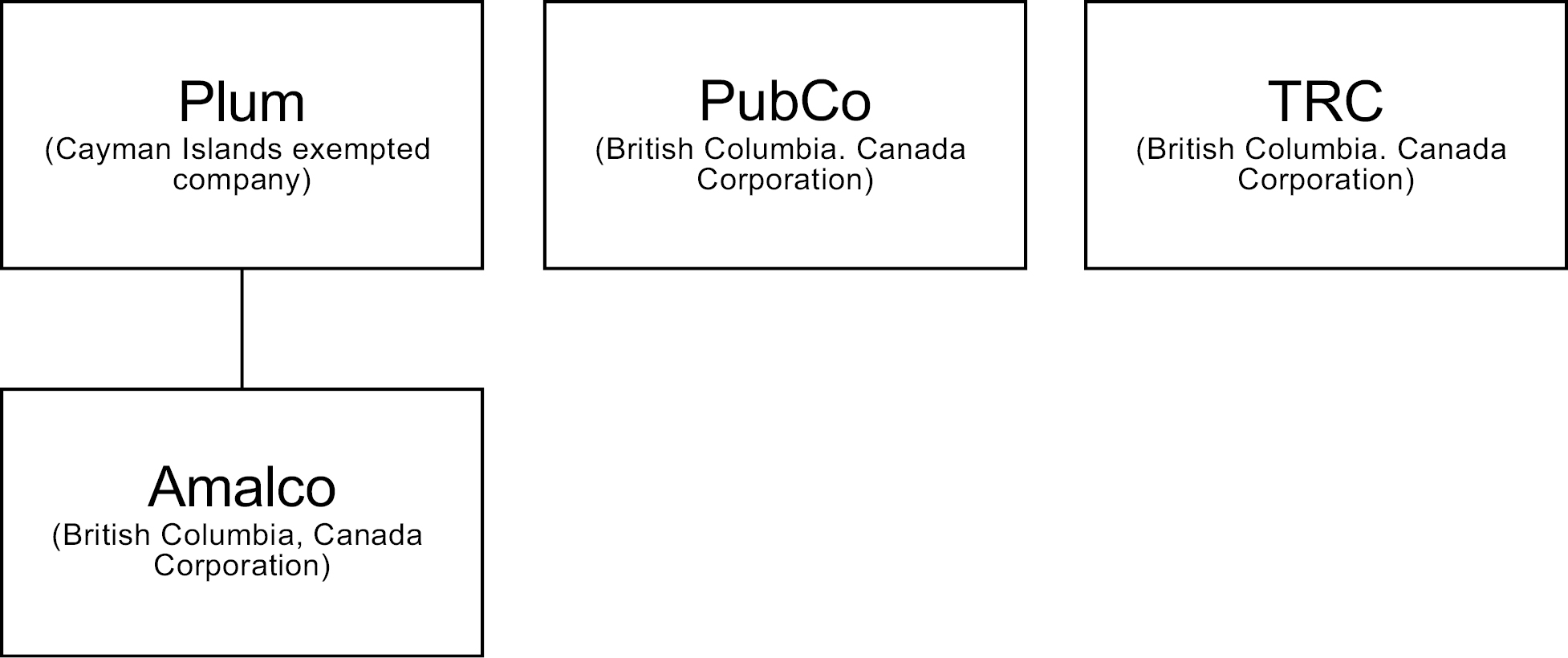

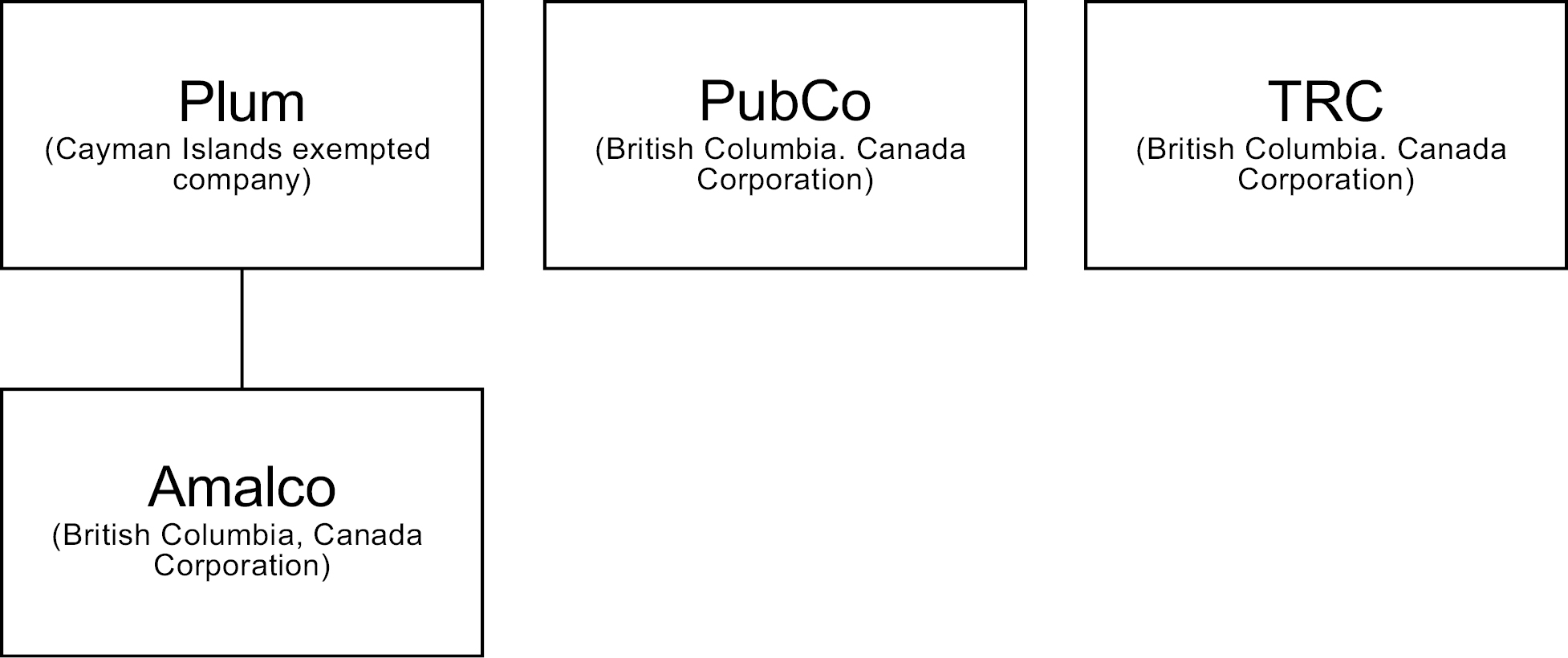

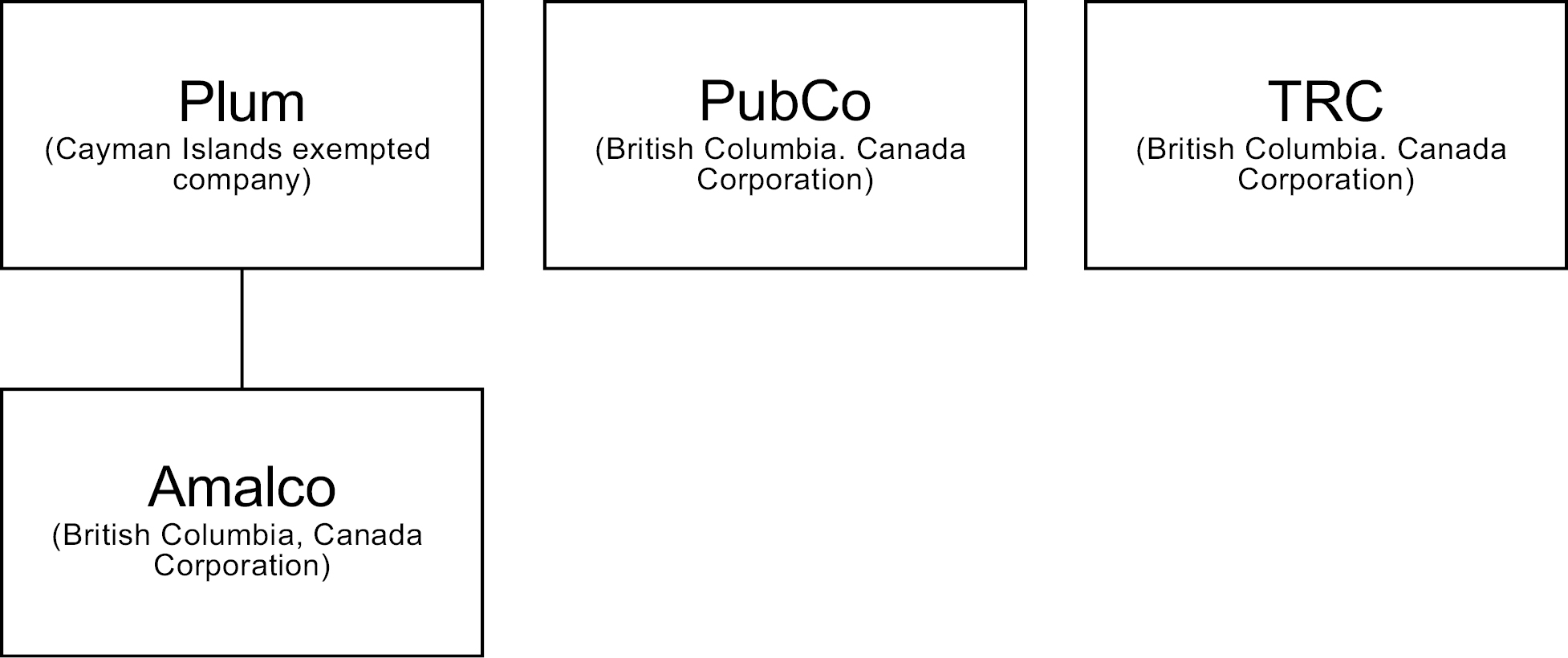

On August 22, 2024, Plum, Plum III Amalco Corp., a corporation formed under the Laws of the Province of British Columbia and a direct, wholly owned subsidiary of Plum (“Amalco”), Plum III Merger Corp., a corporation formed under the Laws of the Province of British Columbia (“PubCo”), and Tactical Resources Corp., a corporation formed under the Laws of the Province of British Columbia (“TRC”), entered into a Business Combination Agreement (as may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement,” and the transactions contemplated thereby, collectively, the “Business Combination”), pursuant to which, among other things and subject to the terms and conditions contained in the Business Combination Agreement, and the plan of arrangement attached hereto as Annex B (the “Plan of Arrangement”) (i) Plum shall transfer by way of continuation from the Cayman Islands to the Province of British Columbia in accordance with the Cayman Islands Companies Act (As Revised) (the “Companies Act”) and continue as a corporation under the Laws of the Province of British Columbia in accordance with the applicable provisions of the Business Corporations Act (British Columbia) (the “BCBCA”) (the “Domestication”), (ii) following the Domestication, Plum shall amalgamate with PubCo (the “Plum Amalgamation”) to form one corporate entity and PubCo will survive the Plum Amalgamation, and (iii) immediately following the Plum Amalgamation, TRC and Amalco shall amalgamate (the “TRC Amalgamation” and, together with the Plum Amalgamation, the “Amalgamations”) to form one corporate entity and TRC will survive the TRC Amalgamation.

Pursuant to the Plum Amalgamation, which will take place after the Domestication and on the date on which the closing of the Business Combination will occur (the “Closing” and such date the “Closing Date”):

• each Plum Unit shall be automatically divided, and the holder thereof shall be deemed to hold one Plum Class A Share, par value $0.0001 per share (a “Plum Class A Share”) and one-third of one Plum Warrant in accordance with the terms of the applicable Plum Unit;

• each Plum Class A Share and Plum Class B ordinary share, par value $0.0001 per share (a “Plum Class B Share” and together with the Plum Class A Shares, the “Plum Common Shares”), will be exchanged on a one-for-one basis, for a common share in the authorized share capital of PubCo (a “PubCo Common Share”); and

• each Plum Warrant shall automatically be converted into a warrant (each, a “PubCo Assumed Plum Warrant”) to purchase a number of PubCo Common Shares determined in accordance with the terms of such Plum Warrant.

On the Closing Date, pursuant to the TRC Amalgamation, among other things:

• each TRC Common Share (other than any Cancelled TRC Shares or Dissenting Shares) shall automatically be exchanged for the right to receive a number of PubCo Common Shares equal to the TRC Exchange Ratio (the aggregate of all such PubCo Common Shares, the “Arrangement Consideration Shares”). Any Arrangement Consideration Shares exchanged for TRC Common Shares which were subject to any vesting or forfeiture terms shall continue to be governed by such terms from and after the TRC Amalgamation Effective Time;

• each of the Dissenting Shares shall be cancelled and shall thereafter represent only the right to receive the applicable payments set forth in the Plan of Arrangement;

• each TRC Option shall be assumed by PubCo and converted into an option to purchase PubCo Common Shares (each, a “Converted TRC Option”), subject to the same terms and conditions as were previously applicable, except that (A) the number of TRC Common Shares subject to such Converted TRC Option shall

Table of Contents

be increased by multiplying the number of shares previously issuable thereunder by the TRC Exchange Ratio, rounded down to the nearest whole PubCo Common Share, and (B) the per share exercise price shall be reduced by dividing the previous exercise price thereof by the TRC Exchange Ratio (rounded up to the nearest cent);

• each TRC RSU shall be assumed by PubCo and converted into a restricted stock unit in respect of PubCo Common Shares (each, a “Converted TRC RSU”), subject to the same terms and conditions as were previously applicable thereto, except that such Converted TRC RSU shall be in respect of a number of PubCo Common Shares equal to the product of (A) the number of shares previously subject to such TRC RSU and (B) the TRC Exchange Ratio;

• each TRC Warrant shall automatically be converted into a warrant to purchase PubCo Common Shares (each, a “PubCo Assumed TRC Warrant”), and such PubCo Assumed TRC Warrant shall continue to be governed by the same terms and conditions as were previously applicable, except that (A) the number of TRC Common Shares subject to such PubCo Assumed TRC Warrant shall be increased by multiplying the number of shares previously issuable thereunder by the TRC Exchange Ratio, rounded down to the nearest whole PubCo Common Share, and (B) the per share exercise price shall be reduced by dividing the previous exercise price thereof by the TRC Exchange Ratio (rounded up to the nearest cent);

• the TRC Convertible Debenture shall survive the TRC Amalgamation in accordance with the terms thereof (subject to the conversion rights of the holder set forth therein); and

• each Amalco Share shall automatically be exchanged for one validly-issued, fully paid and nonassessable common share of TRC.

At the Plum Shareholders’ Meeting, Plum Shareholders will be asked to consider and vote upon proposals to approve, (i) by Special Resolution, the transfer of Plum by way of continuation from the Cayman Islands to the Province of British Columbia, Canada in accordance with the Plum Articles and the Companies Act and the domestication of Plum as a British Columbia corporation in accordance with the applicable provisions of the BCBCA, including the adoption of the Domestication Articles (the “Domestication Proposal” or “Proposal No. 1”); and (ii) by Ordinary Resolution, the Business Combination Agreement, a copy of which is attached to the accompanying proxy statement/prospectus as Annex A, and approve the transactions contemplated thereby, including the Business Combination (the “Business Combination Proposal” or “Proposal No. 2”).

In connection with the submission of the Business Combination to a shareholder vote, holders of Plum Common Shares, including Plum’s sponsor, Mercury Capital LLC (“Sponsor”), Alpha Partners Technology Merger Sponsor LLC (“Former Sponsor”), and certain other Plum Shareholders set forth therein (together with Sponsor and Former Sponsor, the “Sponsor Parties”) have agreed to vote any Plum Class A Shares (except for any Plum Class A Shares purchased as described below under “The Business Combination — Potential Purchases of Public Shares”) and Plum Class B Shares owned by them in favor of the Business Combination. The consummation of the Business Combination is not subject to the approval of a majority of unaffiliated Plum Public Shareholders. Since the Sponsor Parties own approximately 69.2% of the Plum Shares entitled to vote at the Plum Shareholders’ Meeting, the Sponsor Parties have sufficient votes to approve all of the Proposals without the vote of any of the Plum Public Shareholders.

In addition to the Domestication Proposal and the Business Combination Proposal, Plum Shareholders are being asked to consider and vote upon:

• proposals to approve on a non-binding advisory basis, by Ordinary Resolution the governance provisions contained in the PubCo Closing Articles that materially affect Plum Shareholders’ rights, presented separately in accordance with U.S. Securities and Exchange Commission guidance (the “Advisory Organizational Documents Proposals” or “Proposal No. 3”). The full text of the PubCo Closing Articles are attached to the accompanying proxy statement/prospectus as Annex E . Proposal No. 3 is separated into sub-proposals submitted to Plum Shareholders to approve on a non-binding advisory basis, by Ordinary Resolution, those governance provisions contained in the PubCo Closing Articles that materially affect Plum Shareholders’ rights as described in the following paragraphs (a)–(d):

(a) the proposed PubCo Closing Articles would change the authorized share capital from the existing (i) 200,000,000 Plum Class A Shares, (ii) 20,000,000 Plum Class B Shares, and (iii) 1,000,000 preference shares of a nominal par value of $0.0001 each, to an unlimited number of PubCo Common Shares (the “Authorized Capital Proposal” or “Proposal No. 3A”);

Table of Contents

(b) the proposed PubCo Closing Articles would reduce the requisite quorum for a meeting of shareholders from (x) one or more shareholders holding at least a majority of the paid up voting share capital present in person or by proxy and entitled to vote at that meeting to (y) not less than one person holding or representing not less than 5% of the shares entitled to be voted at the meeting (the “Quorum Proposal” or “Proposal No. 3B”);

(c) the proposed PubCo Closing Articles would change the name of the company from “Plum III Merger Corp.” to “Tactical Resources Corporation” (the “Name Change Proposal” or “Proposal No. 3C”); and

(d) the proposed PubCo Closing Articles would not include provisions relating to the Plum Class B Shares, the Plum IPO, Sponsor, the Initial Business Combination and other related matters (the “Other Matters Proposal” or “Proposal No. 3D” and, together with the Authorized Capital Proposal, the Quorum Proposal and the Name Change Proposal, the “Sub-Proposals”);

• Incentive Plan Proposal — To approve, by Ordinary Resolution, for the purposes of complying with the rules of the Nasdaq Stock Market, the issuance of PubCo Common Shares pursuant to the PubCo Omnibus Equity Incentive Plan (the “Incentive Plan Proposal” or “Proposal No. 4”). A copy of the Incentive Plan is attached to this proxy statement/prospectus as Annex K;

• Adjournment Proposal — if put to Plum Shareholders for a vote, a proposal to approve, by Ordinary Resolution, the adjournment of the Plum Shareholders’ Meeting (i) to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the foregoing proposals or (ii) if the board of directors of Plum determines before the Plum Shareholders’ Meeting that it is not necessary or no longer desirable to proceed with the proposals (the “Adjournment Proposal” or “Proposal No. 5” and, together with the Domestication Proposal, the Business Combination Proposal, the Incentive Plan Proposal and the Advisory Organizational Documents Proposals, the “Proposals”). If put forth at the Plum Shareholders’ Meeting, the Adjournment Proposal will be the first and only Proposal voted upon and none of the Domestication Proposal, the Business Combination Proposal, the Advisory Organizational Documents Proposals or the Incentive Plan Proposal will be submitted to the Plum Shareholders for a vote.

Each of the Proposals is more fully described in the accompanying proxy statement/prospectus, which each Plum Shareholder is encouraged to read carefully.

The approval of the Domestication Proposal requires a special resolution under Cayman Islands Companies Law (a “Special Resolution”), being the affirmative vote of at least a two-thirds (66 2/3%) majority of the votes cast by the holders of the Plum Common Shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter. The approval of each of the Business Combination Proposal, the Advisory Organizational Documents Proposals, the Incentive Plan Proposal and the Adjournment Proposal requires an ordinary resolution under the Cayman Islands Company Law (an “Ordinary Resolution”), being the affirmative vote of at least a majority of the votes cast by the holders of the Plum Common Shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter.

In connection with the Business Combination, we expect to enter into one or more subscription agreements with certain PIPE Investors to purchase PubCo Common Shares in a separate private placement transaction as described below under “The Business Combination — PIPE Investment.” The final terms of the PIPE Investment have yet to be determined and are subject to negotiation between us, TRC, PubCo and the PIPE Investors. This proxy statement/prospectus does not constitute an offer to sell nor is soliciting an offer to buy any securities in connection with the PIPE Investment.

The Plum Class A Shares and Plum Warrants, which are exercisable for Plum Class A Shares under certain circumstances, are currently listed on the NASDAQ Capital Market (the “NASDAQ”) under the symbols “PLMJ” and “PLMJW,” respectively. In addition, certain of the Plum Class A Shares and Plum Public Warrants currently trade as Plum Units, consisting of one Plum Class A Share and one-third of one Plum Public Warrant, and are listed on the NASDAQ under the symbol “PLMJU”. At the Plum Amalgamation Effective Time, the Plum Units will automatically separate into the component PubCo Common Shares and PubCo Public Warrants. PubCo has applied

Table of Contents

to have the PubCo Common Shares and PubCo Public Warrants listed on the NASDAQ. Listing is subject to the approval of the NASDAQ in accordance with its original listing requirements. There is no assurance that NASDAQ will approve PubCo’s listing application. Any such listing of the PubCo Common Shares and PubCo Warrants will be conditional upon PubCo fulfilling all of the listing requirements and conditions of NASDAQ. It is anticipated that upon the Closing, the PubCo Common Shares and PubCo Public Warrants will be listed on the NASDAQ under the ticker symbols “TREO” and “TREOW,” respectively. Following the Closing, it is anticipated that the TRC Common Shares will be delisted from the TSX Venture Exchange (the “TSX-V”), and TRC will apply to have TRC cease to be a reporting issuer in the jurisdictions in which it is currently a reporting issuer.

The table set forth below summarizes the existing interests in Plum private placement securities and the anticipated interests of Former Sponsor, Sponsor, Plum management, and the lender under a subscription agreement in PubCo as of Closing along with the value of such interests based on (i) in the case of Sponsor’s and Plum management’s interests, the closing price of the Plum Public Warrants and Plum Class A Shares as of [•], 2024, which would be lost if an Initial Business Combination is not completed by Plum by the Deadline Date, and (ii) the transaction value:

Name of Holder | | Type of

Holder | | Total

Purchase

Price/Capital

Contributions | | Number of

Plum

Private

Placement

Shares | | Number of

Plum

Private

Placement

Warrants | | Value of

Plum

Private

Placement

Shares

and

Warrants | | Number of

PubCo

Common

Shares | | Number of

PubCo

Warrants | | Value of

PubCo

Common

Shares

and

Warrants |

Mercury Capital, LLC | | Sponsor | | $ | 1 | | 0 | | 0 | | | | 4,964,828 | | 1,867,443 | | |

Alpha Partners Technology Merger Sponsor, LLC | | Former Sponsor | | $ | 6,675,000 | | 665,000 | | 221,667 | | | | 1,128,992 | | 376,331 | | |

Palmeira Investment

Limited | | Lender to Sponsor | | $ | 0 | | 0 | | 0 | | | | 637,500 | | 0 | | |

Kanishka Roy | | CEO &

Chairman | | $ | 1 | | 0 | | 0 | | | | 4,964,828 | | 1,867,443 | | |

Steven Handwerker | | CFO | | $ | 0 | | 0 | | 0 | | | | 0 | | 0 | | |

Michael Dinsdale | | Director | | $ | 0 | | 0 | | 0 | | | | 0 | | 0 | | |

Alan Black | | Director | | $ | 0 | | 0 | | 0 | | | | 0 | | 0 | | |

David Sable | | Director | | $ | 0 | | 0 | | 0 | | | | 0 | | 0 | | |

See “The Business Combination — Interests of Certain Persons in the Business Combination” for a description of all compensation to be paid to the Sponsor, it affiliates and promoters in connection with the Business Combination.

In considering the unanimous recommendation of the Plum Board to vote in favor of the Business Combination, Plum Public Shareholders should be aware that, aside from their interests as shareholders, Sponsor and certain members of Plum management have interests in the Business Combination that are different from, or in addition to, those of other Plum Public Shareholders generally. Plum’s directors were aware of and considered these interests, among other matters, in evaluating the Business Combination, and in recommending to Plum Shareholders that they approve the Business Combination. Plum Shareholders should take these interests into account in deciding whether to approve the Business Combination. In addition, aside from their interests as shareholders, members of TRC management have interests in the Business Combination that are different from, or in addition to, those of other TRC shareholders generally. TRC’s directors were aware of and considered these interests, among other matters, in evaluating the Business Combination. See “The Business Combination — Interests of Certain Persons in the Business Combination” for a description of such potential conflicts of interest.

Plum is providing the accompanying proxy statement/prospectus and accompanying proxy card to Plum Shareholders in connection with the solicitation of proxies to be voted at the Plum Shareholders’ Meeting and at any adjournments or postponements of the Plum Shareholders’ Meeting. Information about the Plum Shareholders’ Meeting, the Business Combination and other related business to be considered by Plum Shareholders at the Plum Shareholders’ Meeting is included in the accompanying proxy statement/prospectus. Whether or not you plan to attend the Plum Shareholders’ Meeting, all Plum Shareholders are urged to read carefully and in its entirety

Table of Contents

the accompanying proxy statement/prospectus, including the annexes and the accompanying financial statements of TRC and Plum. In particular, you are urged to carefully read the section entitled “Risk Factors” beginning on page 65 of the accompanying proxy statement/prospectus.

The Board of Directors of Plum (the “Plum Board”) has unanimously approved the Business Combination Agreement and the transactions contemplated therein, and unanimously recommends that Plum Shareholders vote “FOR” the adoption of the Business Combination Agreement and approval of the transactions contemplated thereby, including the Business Combination, and “FOR” all other Proposals presented to Plum Shareholders in the accompanying proxy statement/prospectus. When you consider the Plum Board’s recommendation of the Proposals, you should keep in mind that certain members of Plum management have interests in the Business Combination that may conflict with your interests as a shareholder. Please see the subsection entitled “The Business Combination — Interests of Certain Persons in the Business Combination” for additional information.

Your vote is very important, regardless of the number of Plum Common Shares you own. To ensure your representation at the Plum Shareholders’ Meeting, please complete, sign, date and return the enclosed proxy card in the postage-paid envelope provided or submit your proxy by telephone or over the internet by following the instructions on your proxy card. If you hold your Plum Common Shares in “street name,” which means your shares are held of record by a broker, bank or other nominee, you should follow the instructions provided by your broker, bank or nominee to ensure that votes related to the shares you beneficially own are properly counted. In accordance with the Business Corporations Act (British Columbia), please submit your proxy promptly, whether or not you expect to attend the Plum Shareholders’ Meeting, but in any event, no later than [•], 2024, at 11:59 p.m., Eastern Time, which is two business days prior to the Plum Shareholders’ Meeting.

On behalf of the Plum Board, I would like to thank you for your support of Plum Acquisition Corp. III and look forward to a successful completion of the Business Combination.

Sincerely,

/s/ Kanishka Roy | | |

Kanishka Roy

President and Chief Executive Officer

[•], 2024 | | |

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE ACCOMPANYING PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Investing in Plum and PubCo securities involves a high degree of risk. Before making an investment decision, please read the information under the section entitled “Risk Factors” elsewhere in the accompanying proxy statement/prospectus and under similar headings or in any amendment or supplement to the accompanying proxy statement/prospectus.

PubCo is a “foreign private issuer” under the Exchange Act and therefore is exempt from certain rules under the Exchange Act, including the proxy rules, which impose certain disclosure and procedural requirements for proxy solicitations for U.S. and other issuers. Accordingly, after the Business Combination, PubCo Shareholders may receive less or different information about PubCo than they would receive about a U.S. domestic public company. See “Risk Factors — Risks Related to Ownership of PubCo’s Securities — As a “foreign private issuer” under the rules and regulations of the SEC, PubCo will be, permitted to, and may, file less or different information with the SEC than a company incorporated in the United States or otherwise not filing as a “foreign private issuer,” and may follow certain home country corporate governance practices in lieu of certain NASDAQ requirements applicable to U.S. issuers.”

The accompanying proxy statement/prospectus is dated [•], 2024, and is expected to be first mailed or otherwise delivered to Plum Shareholders on or about [•], 2024.

Table of Contents

ADDITIONAL INFORMATION

No person is authorized to give any information or to make any representation with respect to the matters that this proxy statement/prospectus describes other than those contained in this proxy statement/prospectus, and, if given or made, the information or representation must not be relied upon as having been authorized by PubCo, Plum or TRC. This proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. Neither the delivery of this proxy statement/prospectus nor any distribution of securities made under this proxy statement/prospectus will, under any circumstances, create an implication that there has been no change in the affairs of PubCo, Plum or TRC since the date of this proxy statement/prospectus or that any information contained herein is correct as of any time subsequent to such date.

Table of Contents

PLUM ACQUISITION CORP. III

2021 Fillmore St., #2089, San Francisco, California 94115

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

PLUM ACQUISITION CORP. III

TO BE HELD [•], 2024

To the shareholders of Plum Acquisition Corp. III (“Plum”):

NOTICE IS HEREBY GIVEN that the extraordinary general meeting (the “Plum Shareholders’ Meeting”) of shareholders of Plum (the “Plum Shareholders”) will be held at 10:00 a.m., Eastern Time, on [•], 2024, virtually pursuant to the procedures described in the accompanying proxy statement/prospectus for the purposes of Cayman Islands law and Plum’s Amended and Restated Memorandum and Articles of Association (the “Plum Articles”).

At the Plum Shareholders’ Meeting, Plum Shareholders will be asked to consider and vote upon the following proposals:

• The Domestication Proposal — To approve, by Special Resolution, the transfer of Plum by way of continuation from the Cayman Islands to the Province of British Columbia, Canada in accordance with the Plum Articles and Cayman Islands Companies Act (As Revised) (the “Companies Act”) and the domestication of Plum (the “Domestication”) as a British Columbia corporation in accordance with the applicable provisions of the Business Corporations Act (British Columbia) (the “BCBCA”), including the adoption of the Domestication Articles (the “Domestication Proposal” or “Proposal No. 1”);

• Business Combination Proposal — To approve, by Ordinary Resolution, the Business Combination Agreement, dated as of August 22, 2024 (as may be amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement” and the transactions contemplated thereby, collectively, the “Business Combination”) by Plum, Plum III Amalco Corp., a corporation formed under the Laws of the Province of British Columbia and a direct, wholly owned subsidiary of Plum (“Amalco”), Plum III Merger Corp., a corporation formed under the Laws of the Province of British Columbia (“PubCo”), and Tactical Resources Corp., a corporation formed under the Laws of the Province of British Columbia (“TRC”), including the Arrangement Resolution pursuant to which, among other things and subject to the terms and conditions contained in the Business Combination Agreement and the Plan of Arrangement attached hereto as Annex B, (i) Plum shall effect the Domestication, (ii) following the Domestication, Plum shall amalgamate with PubCo (the “Plum Amalgamation”) to form one corporate entity and PubCo will survive the Plum Amalgamation, and (iii) immediately following the Plum Amalgamation, TRC and Amalco shall amalgamate (the “TRC Amalgamation” and, together with the Plum Amalgamation, the “Amalgamations”) to form one corporate entity and TRC will survive the TRC Amalgamation (the “Business Combination Proposal” or “Proposal No. 2”). A copy of the Business Combination Agreement is attached to this proxy statement/prospectus as Annex A;

• Advisory Organization Documents Proposals — To approve on a non-binding advisory basis, by Ordinary Resolution, the governance provisions contained in the PubCo Closing Articles that materially affect Plum Shareholders’ rights, presented separately in accordance with U.S. Securities and Exchange Commission guidance (the “Advisory Organizational Documents Proposals” or “Proposal No. 3”). The full text of the PubCo Closing Articles are attached to the accompanying proxy statement/prospectus as Annex E. Proposal No. 3 is separated into sub-proposals submitted to Plum Shareholders to approve on a non-binding advisory basis, by Ordinary Resolution, those governance provisions contained in the PubCo Closing Articles that materially affect Plum Shareholders’ rights as described in the following paragraphs (a)–(d):

(a) the proposed PubCo Closing Articles would change the authorized share capital from the existing (i) 200,000,000 Plum Class A Shares, (ii) 20,000,000 Plum Class B Shares, and (iii) 1,000,000 preference shares of a nominal or par value of $0.0001 each, to an unlimited number of PubCo Common Shares (the “Authorized Capital Proposal” or “Proposal No. 3A”);

Table of Contents

(b) the proposed PubCo Closing Articles would reduce the requisite quorum for a meeting of shareholders from (x) one or more shareholders holding at least a majority of the paid up voting share capital present in person or by proxy and entitled to vote at that meeting to (y) not less than one person holding or representing not less than 5% of the shares entitled to be voted at the meeting (the “Quorum Proposal” or “Proposal No. 3B”);

(c) the proposed PubCo Closing Articles would change the name of the company from “Plum III Merger Corp.” to “Tactical Resources Corporation” (the “Name Change Proposal” or “Proposal No. 3C”); and

(d) the proposed PubCo Closing Articles would not include provisions relating to the Plum Class B Shares, the Plum IPO, Sponsor, the Initial Business Combination and other related matters (the “Other Matters Proposal” or “Proposal No. 3D” and, together with the Authorized Capital Proposal, the Quorum Proposal and the Name Change Proposal, the “Sub-Proposals”);

• Incentive Plan Proposal — To approve, by Ordinary Resolution, for the purposes of complying with the rules of the Nasdaq Stock Market, the issuance of PubCo Common Shares pursuant to the PubCo Omnibus Equity Incentive Plan (the “Incentive Plan Proposal” or “Proposal No. 4”). A copy of the Incentive Plan is attached to this proxy statement/prospectus as Annex K;

• Adjournment Proposal — If put to Plum Shareholders for a vote, a proposal to approve, by Ordinary Resolution, the adjournment of the Plum Shareholders’ Meeting (i) to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the foregoing proposals or (ii) if the board of directors of Plum determines before the Plum Shareholders’ Meeting that it is not necessary or no longer desirable to proceed with the proposals (the “Adjournment Proposal” or “Proposal No. 5” and, together with the Domestication Proposal, the Business Combination Proposal, the Incentive Plan Proposal and the Advisory Organizational Documents Proposals, the “Proposals”). If put forth at the Plum Shareholders’ Meeting, the Adjournment Proposal will be the first and only Proposal voted upon and none of the Domestication Proposal, the Business Combination Proposal, the Advisory Organizational Documents Proposals or the Incentive Plan Proposal will be submitted to the Plum Shareholders for a vote.

The record date for the Plum Shareholders’ Meeting is [•], 2024. Only holders of record of Plum Class A ordinary shares, par value $0.0001 per share (the “Plum Class A Shares”), and Plum Class B ordinary shares, par value $0.0001 per share (the “Plum Class B Shares” and together with the Plum Class A Shares, the “Plum Common Shares”), at the close of business on [•], 2024 are entitled to notice of, and to vote at, the Plum Shareholders’ Meeting and any adjournments or postponements thereof.

The approval of the Domestication Proposal and the Business Combination Proposal each require a special resolution under Cayman Islands Companies Law (a “Special Resolution”), being the affirmative vote of at least a two-thirds (66 2/3%) majority of the votes cast by the holders of the Plum Common Shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter. The approval of each of the Advisory Organizational Documents Proposal, the Incentive Plan Proposal and the Adjournment Proposal requires an ordinary resolution under the Cayman Islands Company Law (an “Ordinary Resolution”), being the affirmative vote of at least a majority of the votes cast by the holders of the Plum Common Shares present in person or represented by proxy at the Extraordinary General Meeting and entitled to vote on such matter.

Plum is providing the accompanying proxy statement/prospectus and accompanying proxy card to the Plum Shareholders in connection with the solicitation of proxies to be voted at the Plum Shareholders’ Meeting and at any adjournments of the Plum Shareholders’ Meeting. Information about the Plum Shareholders’ Meeting, the Business Combination and other related business to be considered by Plum Shareholders at the Plum Shareholders’ Meeting is included in the accompanying proxy statement/prospectus.

Whether or not you plan to attend the Plum Shareholders’ Meeting, all Plum Shareholders are urged to read the accompanying proxy statement/prospectus, including the annexes and other documents referred to therein, carefully and in their entirety. In particular, you should carefully consider the matters discussed under “Risk Factors” beginning on page 65 of the accompanying proxy statement/prospectus.

Table of Contents

Whether or not you plan to attend the Plum Shareholders’ Meeting, please submit your proxy by completing, signing, dating and mailing the enclosed proxy card in the pre-addressed postage paid envelope or submit your proxy by telephone or over the internet by following the instructions on your proxy card. If your Plum Common Shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your Plum Common Shares or, if you wish to attend the Plum Shareholders’ Meeting and vote online, you must obtain a proxy from your broker or bank.

Pursuant to the Plum Articles, a holder of Plum Class A Shares issued as part of the units sold in Plum’s initial public offering (the “Plum IPO,” such shares, the “Plum Public Shares” and, holders of such Plum Public Shares the “Plum Public Shareholders”) may request that PubCo redeem all or a portion of its Plum Public Shares for cash if the Business Combination is consummated. As a holder of Plum Public Shares, you will be entitled to exercise your redemption rights if you:

• hold Plum Public Shares, or if you hold Plum Public Shares through Plum units sold in the Plum IPO (the “Plum Units”), you elect to separate your Plum Units into the underlying Plum Public Shares and Plum Public Warrants prior to exercising your redemption rights;

• submit a written request to Continental Stock Transfer & Trust Company, Plum’s transfer agent, in which you (i) request the exercise of your redemption rights with respect to all or a portion of your Plum Public Shares for cash, and (ii) identify yourself as the beneficial holder of the Plum Public Shares and provide your legal name, phone number and address; and

• deliver your Plum Public Shares to Continental Stock Transfer & Trust Company, Plum’s transfer agent, physically or electronically through The Depository Trust Company.

Holders must complete the procedures for electing to redeem their Plum Public Shares in the manner described above prior to 10:30 a.m., Eastern Time, on [•], 2024 (two business days before the Plum Shareholders’ Meeting) in order for their shares to be redeemed.

Holders of Plum Units must elect to separate the Plum Units into the underlying Plum Public Shares and Plum Public Warrants prior to exercising their redemption rights with respect to the Plum Public Shares. If Plum Public Shareholders hold their Plum Units in an account at a brokerage firm or bank, such Plum Public Shareholders must notify their broker or bank that they elect to separate the Plum Units into the underlying Plum Public Shares and Plum Public Warrants, or if a holder holds Plum Units registered in its own name, the holder must contact Continental Stock Transfer & Trust Company, Plum’s transfer agent, directly and instruct it to do so. The redemption rights include the requirement that a holder must identify itself to Plum in order to validly exercise its redemption rights. Plum Public Shareholders may elect to exercise their redemption rights with respect to their Plum Public Shares even if they vote “FOR” the Business Combination Proposal. If the Business Combination is not consummated, the Plum Public Shares will be returned to the respective holder, broker or bank. If the Business Combination is consummated, and if a Plum Public Shareholder properly exercises its redemption rights with respect to all or a portion of the Plum Public Shares that it holds and timely delivers its shares to Continental Stock Transfer & Trust Company, PubCo will redeem the related common shares in the authorized share capital of PubCo (“PubCo Common Shares”) for a per share price, payable in cash, equal to the pro rata portion of the trust account established at the consummation of the Plum IPO, including interest earned on the funds held in the trust account and not previously released to Plum to fund regulatory withdrawals or to pay its taxes, calculated as of two business days prior to the consummation of the Business Combination. For illustrative purposes, as of [•], 2024, this would have amounted to approximately $[•] per issued and outstanding Plum Public Share. If a Plum Public Shareholder exercises its redemption rights in full, then it will not own Plum Public Shares or PubCo Common Shares following the redemption. The redemption will take place following the TRC Amalgamation, and, accordingly, it is PubCo Common Shares that will be redeemed as promptly as practicable after consummation of the Business Combination. Please see the subsection entitled “Extraordinary General Meeting of Plum Shareholders — Redemption Rights” in the accompanying proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to exercise your redemption rights with respect to your Plum Public Shares.

Plum may not consummate the Business Combination unless the Domestication Proposal and the Business Combination Proposal are approved at the Plum Shareholders’ Meeting. The Advisory Organizational Documents Proposals are non-binding and are not conditioned on the approval of any other Proposal set forth in this proxy statement/prospectus. In the event the Adjournment Proposal is put forth at the Plum Shareholders’ Meeting, it

Table of Contents

will be the first and only Proposal voted upon and none of the Domestication Proposal, the Business Combination Proposal, the Advisory Organizational Documents Proposals or the Incentive Plan Proposal will be submitted to the Plum Shareholders for a vote.

Approval of the Domestication Proposal requires the affirmative vote (in person or by proxy, including by way of the online meeting option) of the holders of not less than two thirds (662⁄3%) of the outstanding Plum Class A Shares and Plum Class B Shares entitled to vote and actually cast thereon at the Plum Shareholders’ Meeting, voting as a single class. The Business Combination Proposal, the Advisory Organizational Documents Proposals, the Incentive Plan Proposal and (if put) the Adjournment Proposal require the affirmative vote (in person or by proxy, including by way of the online meeting option) of the holders of a majority of the outstanding Plum Class A Shares and Plum Class B Shares entitled to vote and actually cast thereon at the Plum Shareholders’ Meeting, voting as a single class. Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will not count as votes cast at the Plum Shareholders’ Meeting (assuming a quorum is present). Accordingly, a Plum Shareholder’s failure to vote by proxy or to vote online at the Plum Shareholders’ Meeting will not, if a valid quorum is established, have any effect on the outcome of any vote on any of the Proposals.

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF PLUM COMMON SHARES YOU OWN. To ensure your representation at the Plum Shareholders’ Meeting, please complete and return the enclosed proxy card or submit your proxy by telephone or over the internet by following the instructions on your proxy card. Please submit your proxy promptly, whether or not you expect to attend the Plum Shareholders’ Meeting. If you hold your Plum Common Shares in “street name,” you should instruct your broker, bank or other nominee how to vote in accordance with the voting instruction form you received from your broker, bank or other nominee.

The board of directors of Plum has unanimously approved the Business Combination Agreement and the transactions contemplated thereby and recommends that you vote “FOR” the Domestication Proposal, “FOR” the Business Combination Proposal, “FOR” the Advisory Organizational Documents Proposals, “FOR” the Incentive Plan Proposal, and (if put) “FOR” the Adjournment Proposal. Signed and dated proxies received by Plum without an indication of how the Plum Shareholder intends to vote on a Proposal will be voted “FOR” each Proposal being submitted to a vote of the Plum Shareholders at the Plum Shareholders’ Meeting.

Your attention is directed to the proxy statement/prospectus accompanying this notice (including the financial statements and annexes attached thereto) for a more complete description of the proposed Business Combination and related transactions and each of the Proposals. Plum encourages you to read this proxy statement/prospectus carefully. If you have any questions or need assistance voting your shares, please call Plum’s proxy solicitor, [•], at [•], or banks and brokerage firms, please call collect at [•].

[•], 2024

By Order of the Board of Directors | | |

/s/ Kanishka Roy | | |

Kanishka Roy

President and Chief Executive Officer | | |

Table of Contents

i

Table of Contents

ii

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form F-4 filed with the SEC by PubCo, as it may be amended or supplemented from time to time (File No. 333-[•]) (the “Registration Statement”), serves as:

• A notice of meeting and proxy statement of Plum under Section 14(a) of the Exchange Act, for the Plum Shareholders’ Meeting being held on [•], 2024, where Plum Shareholders will vote on, among other things, the proposed Business Combination and related transactions and each of the Proposals described herein; and

• A prospectus of PubCo under Section 5 of the Securities Act with respect to the (i) PubCo Common Shares that Plum Shareholders and TRC shareholders will receive in the Business Combination; (ii) PubCo Warrants that Plum Warrant Holders will receive in the Business Combination; and (iii) PubCo Common Shares that may be issued upon exercise of the PubCo Warrants.

This information is available without charge to you upon written or oral request. To make this request, you should contact Plum’s proxy solicitor at:

[We expect to engage a proxy solicitation agent and incur customary fees in connection therewith.]

To obtain timely delivery of requested materials, you must request the information no later than five business days prior to the date of the Plum Shareholders’ Meeting.

You may also obtain additional information about Plum from documents filed with the SEC by following the instruction in the section entitled “Where You Can Find More Information.”

MARKET AND INDUSTRY DATA

This proxy statement/prospectus contains estimates, projections, and other information concerning PubCo’s and TRC’s industry and business, as well as data regarding market research, estimates, forecasts and projections prepared by PubCo’s and TRC’s management. Information that is based on market research, estimates, forecasts, projections, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which PubCo and TRC operate, and PubCo will operate, is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Unless otherwise expressly stated, PubCo and TRC obtained industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, PubCo and TRC do not expressly refer to the sources from which this data is derived. In that regard, when PubCo and TRC refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources that PubCo and TRC paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While PubCo and TRC have compiled, extracted, and reproduced industry data from these sources, PubCo and TRC have not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this proxy statement/prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

1

Table of Contents

TRADEMARKS AND TRADE NAMES

TRC and Plum own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This proxy statement/prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this proxy statement/prospectus is not intended to create, and does not imply, a relationship with TRC, PubCo or Plum, or an endorsement or sponsorship by or of TRC, PubCo or Plum. Solely for convenience, the trademarks, service marks and trade names referred to in this proxy statement/prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that TRC, PubCo or Plum will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

PRESENTATION OF FINANCIAL INFORMATION

PubCo was incorporated on August 8, 2024 for the purpose of effectuating the Business Combination described herein. PubCo has no material assets or liabilities and does not operate any businesses. Accordingly, no financial statements of PubCo have been included in this proxy statement/prospectus. This proxy statement/prospectus contains:

• the audited consolidated financial statements of Plum as of and for the fiscal years ended December 31, 2023 and 2022, and the unaudited consolidated financial statements of Plum as of and for the six months ended June 30, 2024 and 2023; and

• the audited consolidated financial statements of TRC as of and for the fiscal years ended July 31, 2023 and 2022 and the unaudited consolidated financial statements of TRC as of and for the three and nine months ended April 30, 2024 and 2023.

Unless indicated otherwise, financial data presented in this proxy statement/prospectus has been taken from the audited and unaudited consolidated financial statements of Plum and TRC, as applicable, included in this proxy statement/prospectus. Unless otherwise indicated, financial information of Plum and TRC has been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

As presented herein, TRC presents its consolidated financial statements in U.S. dollars. Plum publishes its consolidated financial statements in U.S. dollars. In this proxy statement/prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars, all references to “$,” “US$,” “USD” and “dollars” mean U.S. dollars and all references to “C$” and “CAD” mean Canadian dollars.

EXCHANGE RATES

PubCo’s reporting currency will be the Canadian dollar. The determination of the functional and reporting currency of each group company is based on the primary currency in which the group company operates. For PubCo, the Canadian dollar is the functional currency. The functional currency of PubCo’s subsidiaries will generally be the local currency.

2

Table of Contents

CERTAIN DEFINED TERMS

Unless the context otherwise requires, references in this proxy statement/prospectus to:

“Adjournment Proposal” means a proposal to approve, by Ordinary Resolution, the adjournment of the Plum Shareholders’ Meeting (i) to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the other Proposals or (ii) if the board of directors of Plum determines before the Plum Shareholders’ Meeting that it is not necessary or no longer desirable to proceed with the proposals.

“Advisory Organizational Documents Proposals” means non-binding advisory votes with regard to the Authorized Capital Proposal, the Quorum Proposal, the Name Change Proposal and the Other Matters Proposal.

“Aggregate Exercise Price” means the aggregate dollar amount payable to TRC upon (a) the conversion of the TRC Convertible Debenture in accordance with its terms and (b) the exercise of all vested In-the-Money TRC Options and vested In-the-Money TRC Warrants that are outstanding immediately prior to the TRC Amalgamation Effective Time.

“Alternative Transaction” means, other than any of the Transactions, any Permitted Financing and the acquisition or disposition of equipment or other tangible personal property in the ordinary course, (a) any acquisition or purchase, direct or indirect, of (i) more than 25% of the consolidated assets of such Person and its Subsidiaries (based on the fair market value thereof as determined in good faith by the board of directors (or equivalent governing body) of such Person) or (ii) more than 25% of the total voting power of the Equity Securities of (A) such Person or (B) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, more than 25% of the consolidated assets of such Person and its Subsidiaries, (b) any take-over bid, issuer bid, tender offer (including a self-tender offer) or exchange offer that, if consummated, would result in any Person beneficially owning more than 25% of the total voting power of the Equity Securities of (i) such Person or (ii) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, more than 25% of the consolidated assets of such Person and its Subsidiaries, or (c) a merger, amalgamation, consolidation, share exchange, business combination, arrangement or other similar transaction involving (i) such Person or (ii) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, more than 25% or more of the consolidated assets of such Person and its Subsidiaries, in each case, that would result in any Person or Group who does not beneficially own more than 25% of the total voting power of the Equity Securities of such Person or such Subsidiaries prior to the consummation of such transaction becoming the beneficial owner of more than 25% of the total voting power of the Equity Securities of such Person or such Subsidiaries following the consummation of such transaction.

“Amalco” means Plum III Amalco Corp., a corporation formed under the Laws of the Province of British Columbia and a direct, wholly owned subsidiary of Plum.

“Amalco Articles” means the Articles of PubCo adopted on August 8, 2024, as amended, restated or amended and restated from time to time.

“Amalco Certificate” means the Certificate of Incorporation of Amalco filed with the Registrar on August 8, 2024, as amended, restated or amended and restated from time to time.

“Amalco Governing Documents” means, collectively, the Amalco Articles and the Amalco Certificate.

“Amalco Shares” means the issued and outstanding common shares of Amalco

“Amalco Sole Shareholder” means Plum.

“Amalco Sole Shareholder Approval” means approval by the affirmative vote of the Amalco Sole Shareholder by means of a special resolution in respect of the Arrangement pursuant to the terms and subject to the conditions of the Plan of Arrangement, applicable Law and the Amalco Governing Documents.

“Amalgamations” means the Plum Amalgamation and the TRC Amalgamation.

3

Table of Contents

“Ancillary Agreements” means, collectively, (a) the Plan of Arrangement, (b) the TRC Securityholder Support Agreement, (c) the Sponsor Support Agreement, (d) the Sponsor Parties Lock-up Agreement, (e) the Registration Rights Agreement, (f) the PIPE Subscription Agreements and (g) all other agreements, certificates and instruments executed and delivered by any of Plum, Amalco, PubCo, or TRC in connection with the Transactions.

“Arrangement” means an arrangement under Section 288 of the BCBCA on the terms and subject to the conditions set forth in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of the Business Combination Agreement and the Plan of Arrangement or made at the direction of the Court in the Interim Order and the Final Order with the prior written consent of Plum and TRC, such consent not to be unreasonably withheld, conditioned or delayed.

“Arrangement Consideration” means the sum of (a) $500,000,000, plus (b) the Aggregate Exercise Price, plus (c) the gross proceeds received by TRC in connection with any Permitted Financing.

“Arrangement Consideration Shares” means the aggregate of all PubCo Common Shares issued to holders of TRC Common Shares.

“Authorized Capital Proposal” means the proposal to change the authorized share capital of Plum to PubCo from the existing (i) 200,000,000 Plum Class A Shares, (ii) 20,000,000 Plum Class B Shares, and (iii) 1,000,000 preference shares of a nominal or par value of $0.0001 each, to an unlimited number of PubCo Common Shares.

“BCBCA” means the Business Corporations Act (British Columbia).

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including the Domestication and the Amalgamations.

“Business Combination Agreement” means the Business Combination Agreement entered into on August 22, 2024, by and among Plum, Amalco, PubCo and TRC, as it may be amended, supplemented or otherwise modified from time to time.

“Business Combination Proposal” means the Proposal to vote on approval of the Business Combination.

“Closing” means the closing of the Business Combination.

“Closing Date” means the date upon which Closing occurs.

“Code” means the U.S. Internal Revenue Code of 1986.

“Companies Act” means the Cayman Islands Companies Act (As Revised).

“Converted TRC Option” means each TRC Option assumed by PubCo and converted into an option to purchase PubCo Common Shares.

“Converted TRC Option In-The-Money Amount” means, with respect to a given Converted TRC Option, the amount, if any, by which the total fair market value (determined as of immediately following the TRC Amalgamation Effective Time) of the PubCo Common Shares that the holder of such Converted TRC Option is entitled to acquire upon exercise of such Converted TRC Option exceeds the amount payable by such holder to acquire such PubCo Common Shares upon exercise of such Converted TRC Option.

“Converted TRC RSU” means each TRC RSU assumed by PubCo and converted into a restricted stock unit in respect of PubCo Common Shares.

“Court” means the Supreme Court of British Columbia.

“CSA” means the Canadian Securities Administrators.

“CSE” means the Canadian Securities Exchange.

“Deadline Date” means the date to consummate an initial business combination as described in the Plum Articles in Article 49.7. “Dissent Rights” means the rights of dissent in respect of the Arrangement described in the Plan of Arrangement.

4

Table of Contents

“Domestication” means the process whereby Plum shall transfer by way of continuation from the Cayman Islands to the Province of British Columbia in accordance with the Companies Act and continue as a corporation under the Laws of the Province of British Columbia in accordance with the applicable provisions of the BCBCA.

“Domestication Articles” means the articles adopted and filed with the Registrar by Plum in connection with the Domestication.

“Equity Securities” means, with respect to any Person, (a) any capital stock, partnership or membership interest, unit of participation or other similar interest (however designated) in such Person and (b) any option, warrant, purchase right, conversion right, exchange right or other contractual obligation which would entitle any other Person to acquire any such interest in such Person or otherwise entitle any other Person to share in the equity, profits, earnings, losses or gains of such Person (including any interest, the value of which is in any way based on, linked to or derived from any interest described in clause (a), including stock appreciation, phantom stock, profit participation or other similar rights).

“Exchange Act” means the U.S. Securities Exchange Act of 1934.

“Final Order” means the final order of the Court pursuant to Section 291 of the BCBCA, approving the Arrangement, as such order may be amended by the Court with the consent of Plum and TRC, such consent to not be unreasonably withheld, conditioned or delayed, at any time prior to the TRC Amalgamation Effective Time or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended, on appeal; provided, that any such amendment is reasonably acceptable to each of Plum and TRC.

“Former Sponsor” means Alpha Partners Technology Merger Sponsor LLC, the former sponsor of Plum.

“Fully-Diluted TRC Shares” means, without duplication, the total number of issued and outstanding TRC Common Shares as of immediately prior to the TRC Amalgamation Effective Time, determined on a fully-diluted basis as the sum of (a) the number of TRC Common Shares outstanding immediately prior to the TRC Amalgamation Effective Time and (b) the number of TRC Common Shares issuable (i) in respect of all issued and outstanding TRC RSUs, (ii) upon exercise of all vested In-the-Money TRC Options, (iii) upon exercise of all vested In-the-Money TRC Warrants and (iv) upon conversion of the TRC Convertible Debenture (including the number of TRC Common Shares issuable in respect of all vested In-the-Money TRC Warrants issuable upon the conversion thereof), in each case, in accordance with the terms thereof; provided, that, for the avoidance of doubt, Fully-Diluted TRC Shares shall not include any TRC Common Shares issuable upon exercise of any unvested In-the-Money TRC Options, unvested In-the-Money TRC Warrants, Out-of-the-Money TRC Options or Out-of-the-Money TRC Warrants.

“GAAP” means generally accepted accounting principles in the U.S. as in effect from time to time.

“Governmental Authority” means any federal, state, provincial, municipal, local, international, supranational or foreign government, governmental, regulatory or administrative authority, agency (which, for the purposes of this Agreement, shall include the SEC and the CSA, as applicable), commission, department, board, bureau, agency or similar body or instrumentality thereof, or any court, tribunal or judicial or arbitral body thereof.

“Governmental Order” means any order, judgment, injunction, decree, writ, ruling, stipulation, determination, verdict or award, in each case, entered by or with any Governmental Authority.

“Group” means a “group” of Persons as defined in Section 13(d) of the Exchange Act.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“ICA” means the Investment Canada Act.

“IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board, as incorporated in the CPA Canada Handbook at the relevant time.

“Interim Order” means the interim order of the Court made pursuant to Section 291 of the BCBCA, attached as Annex N — “Interim Order” providing for, among other things, the calling and holding of the Plum Shareholders’ Meeting and the TRC Shareholders Meeting, as the same may be amended by the Court with the consent of TRC and Plum, such consent not to be unreasonably withheld, conditioned or delayed.

5

Table of Contents

“In-the-Money TRC Option” means a TRC Option with an exercise price per TRC Common Share less than $10.00.

“In-the-Money TRC Warrant” means a TRC Warrant with an exercise price per TRC Common Share less than $10.00.

“Key TRC Securityholders” means Ranjeet Sundher, Kuljit Basi, Alnesh Mohan, J. Garry Clark, Justus Parmar, Manavdeep Mukhija, SVK Metrix Inc., Matthew Chatterton, 1129925 BC Ltd., Number Eight Management Ltd. and Blue Bird Capital Corp.

“Law” means any statute, law, ordinance, rule, regulation, directive or Governmental Order, in each case, of any Governmental Authority, including general principles of common and civil law.

“MI 61-101” means Multilateral Instrument 61-101 — Protection of Minority Shareholders in Special Transactions, as amended and replaced from time to time.

“Original Registration Rights Agreement” means the Registration Rights Agreement, dated as of July 27, 2021 among Plum and the Sponsor Parties.

“Other Matters Proposal” means the proposal to cause the PubCo Closing Articles not to include provisions relating to the Plum Class B Shares, the Plum IPO, Sponsor, the Initial Business Combination and other related matters.

“Out-of-the-Money TRC Options” means TRC Options other than In-the-Money TRC Options.

“Out-of-the-Money TRC Warrants” means TRC Warrants other than In-the-Money TRC Warrants.

“PCAOB” means the U.S. Public Company Accounting Oversight Board and any division or subdivision thereof.

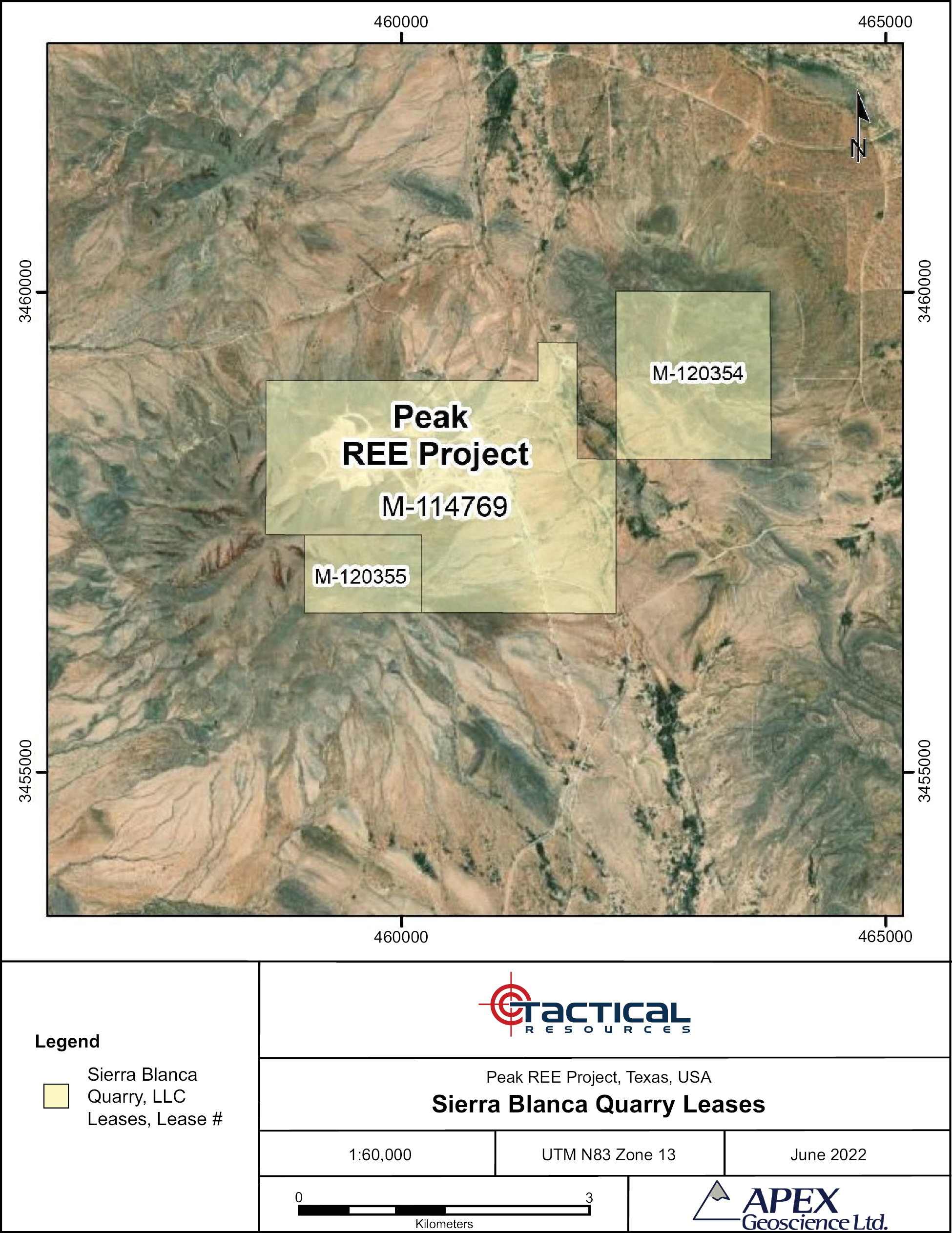

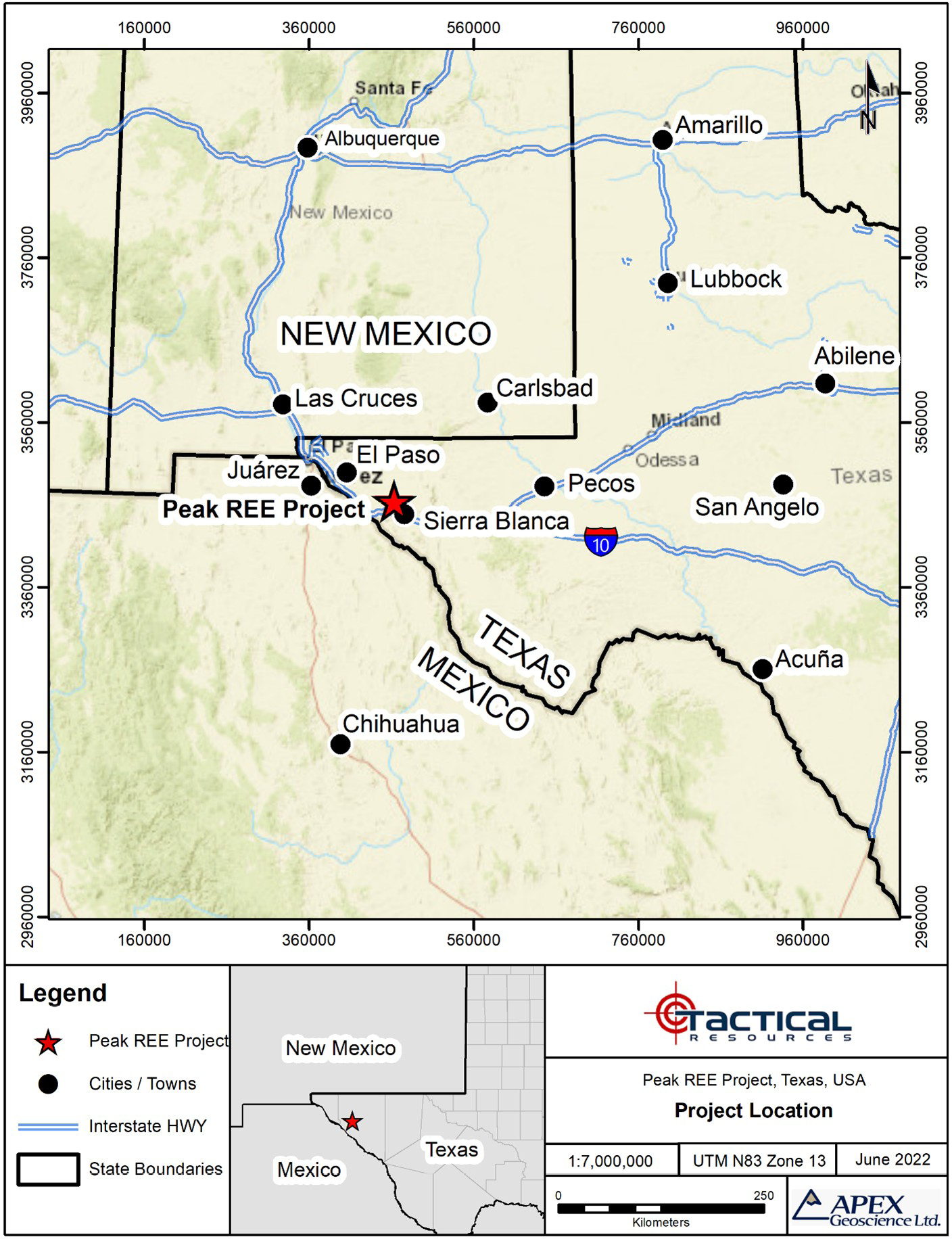

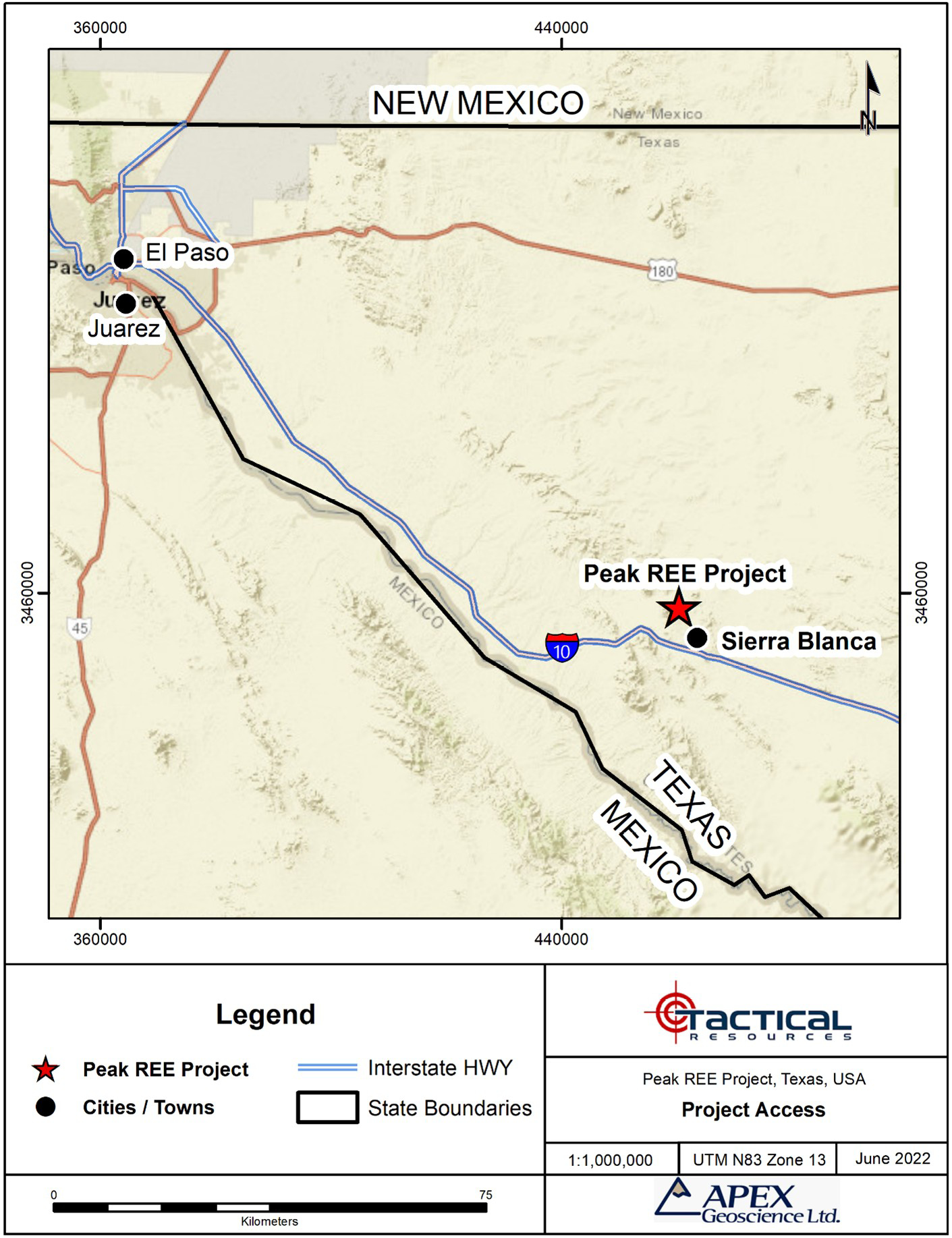

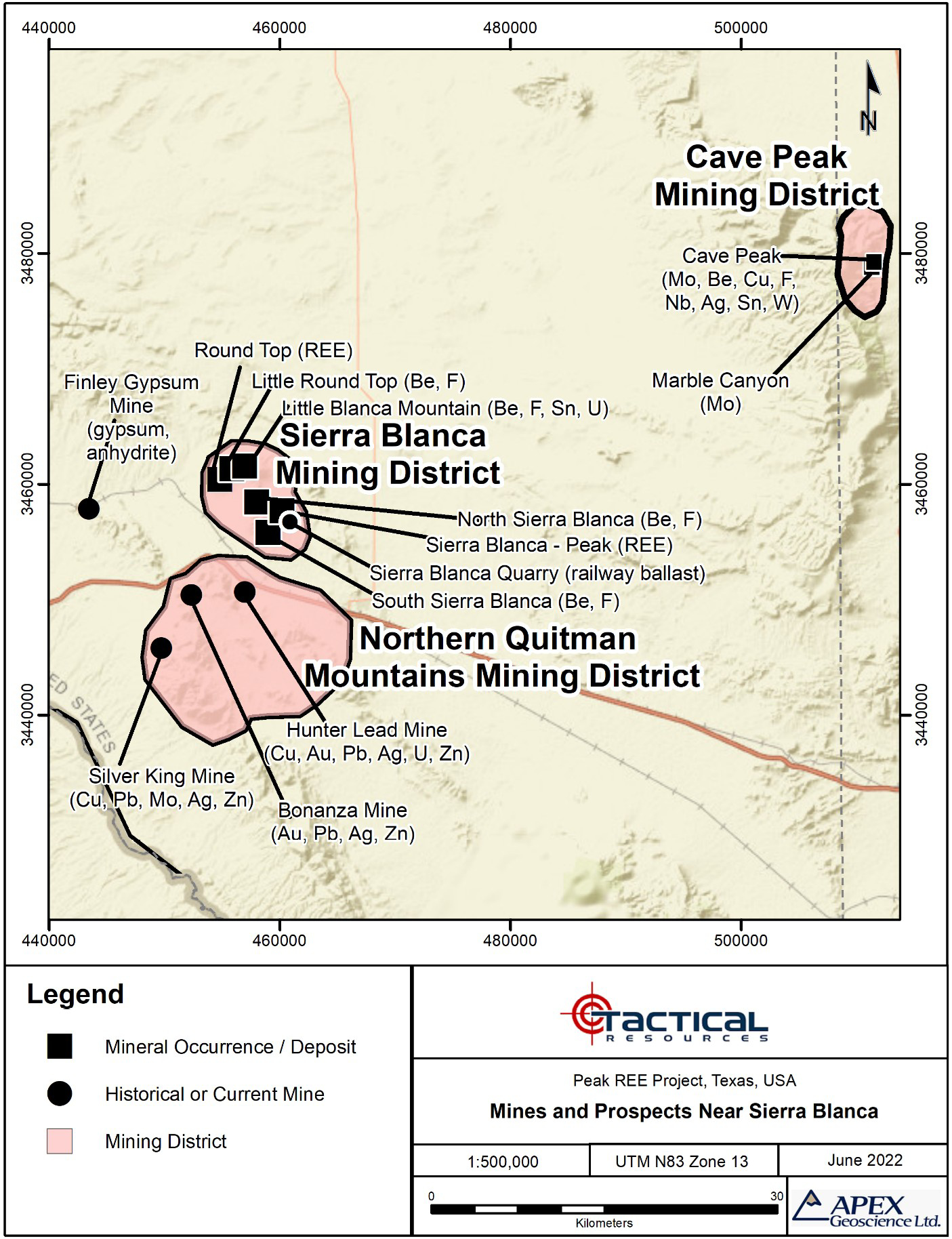

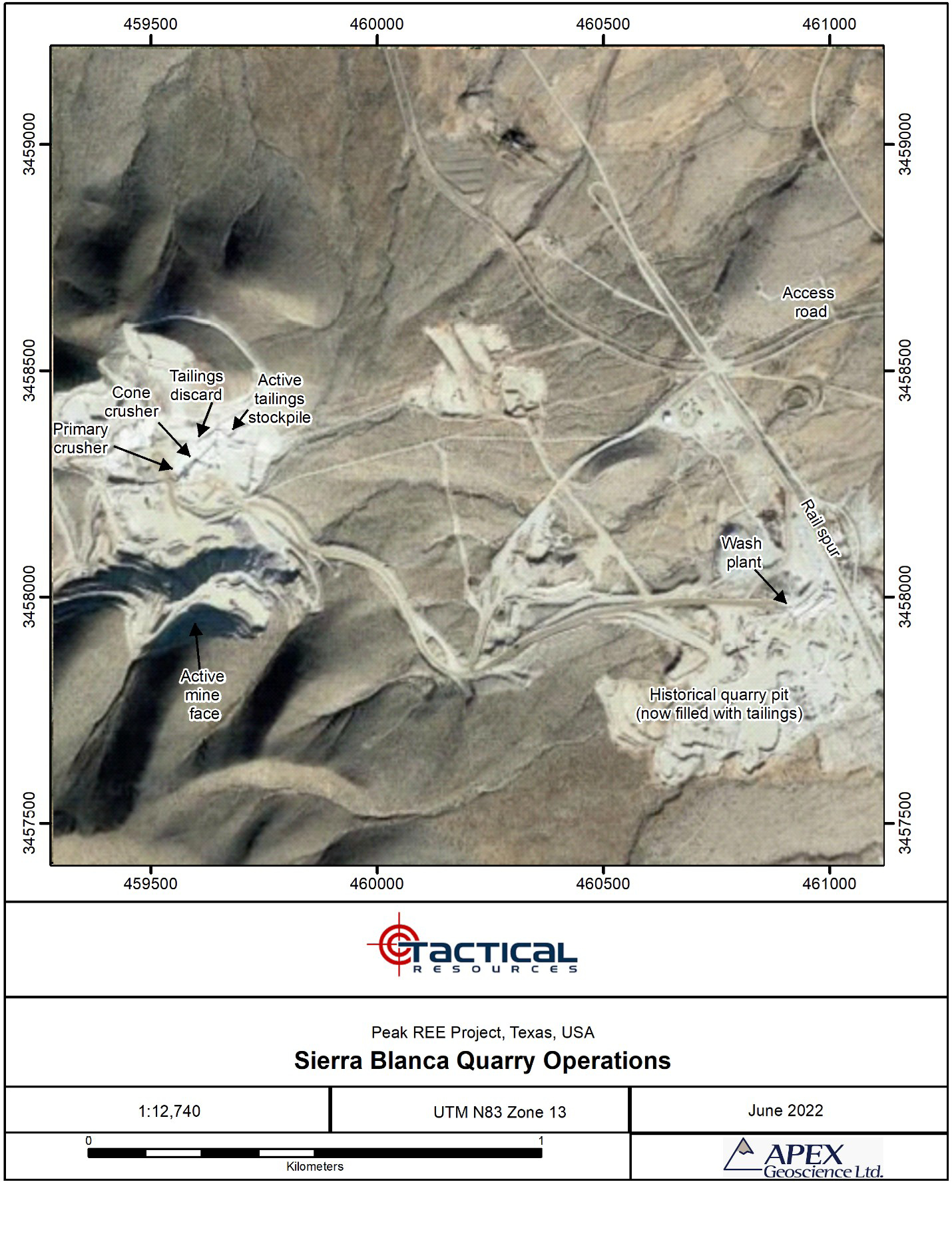

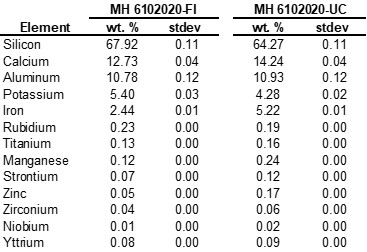

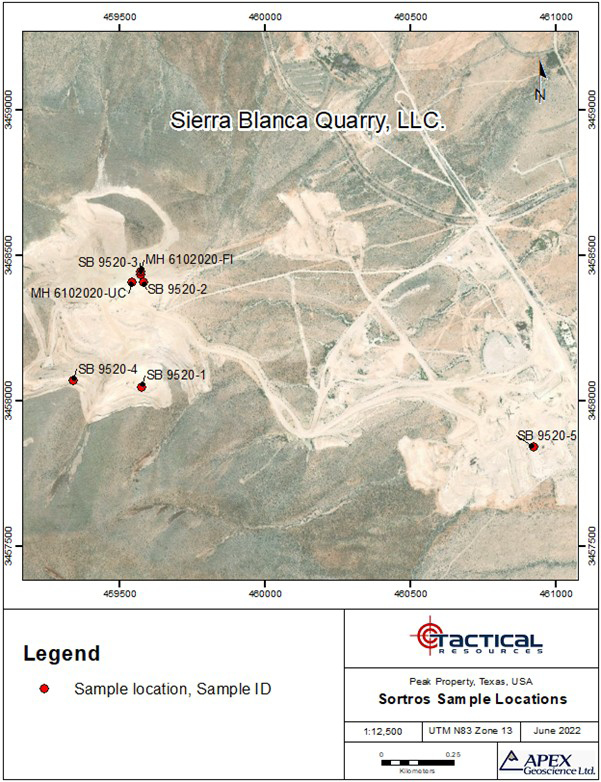

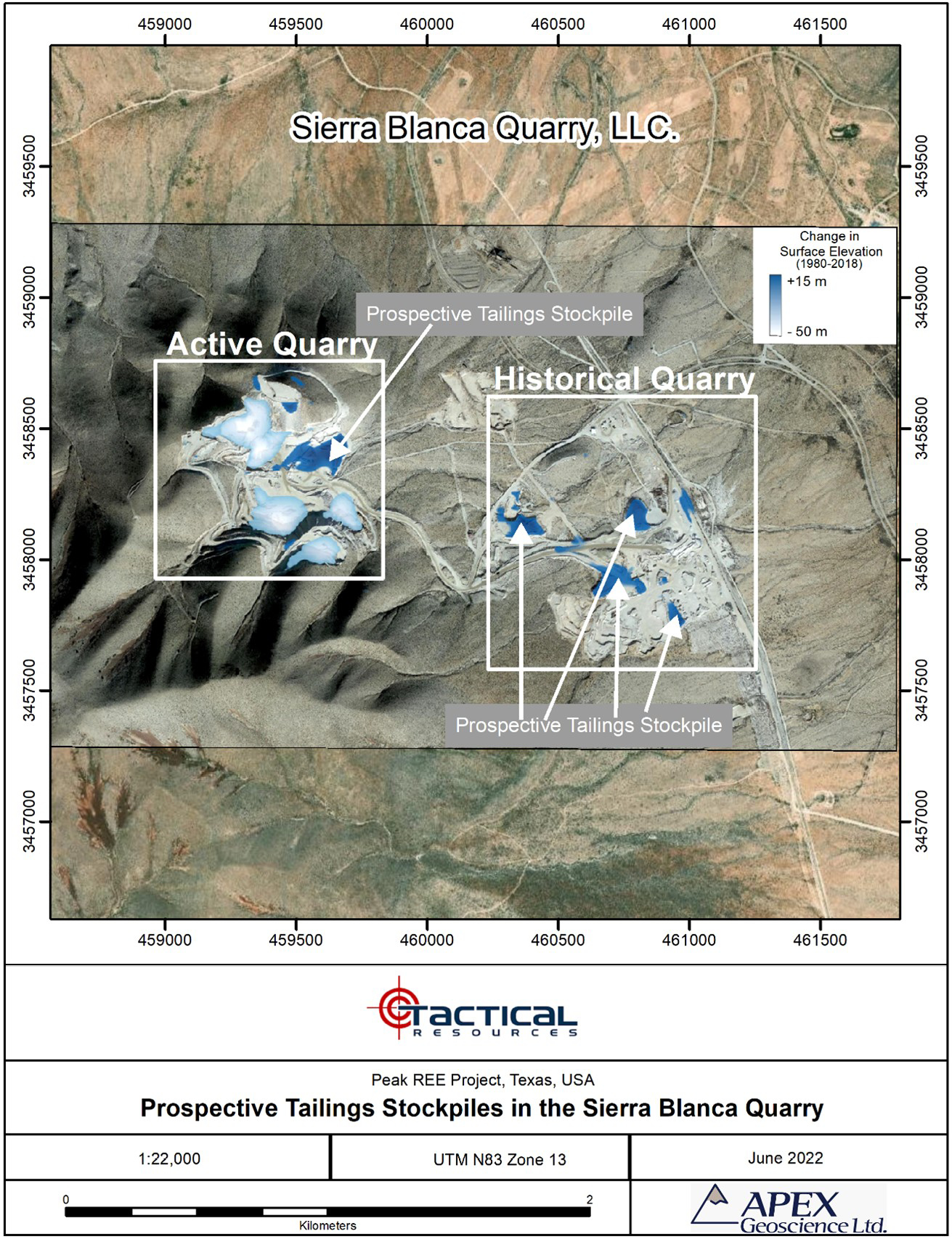

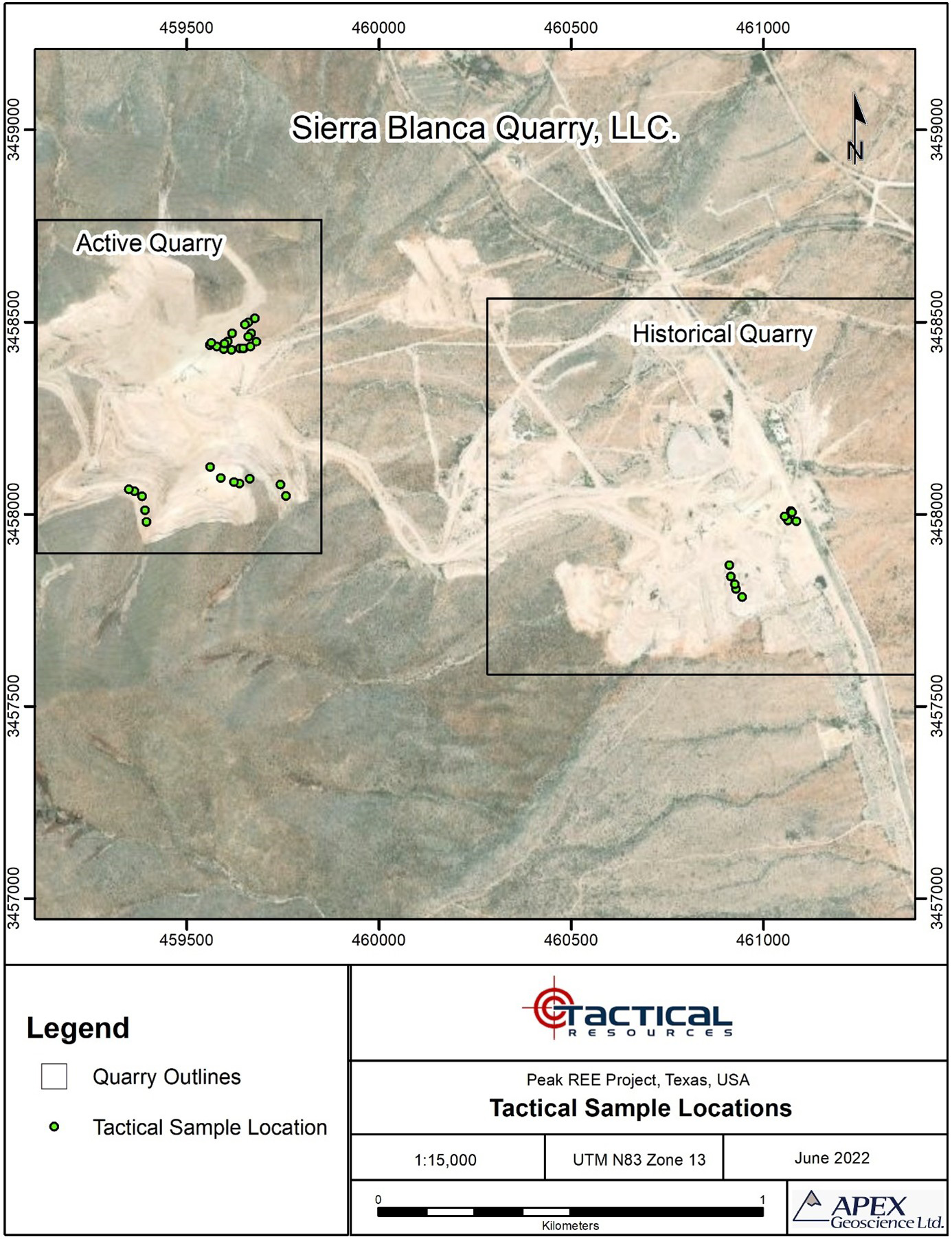

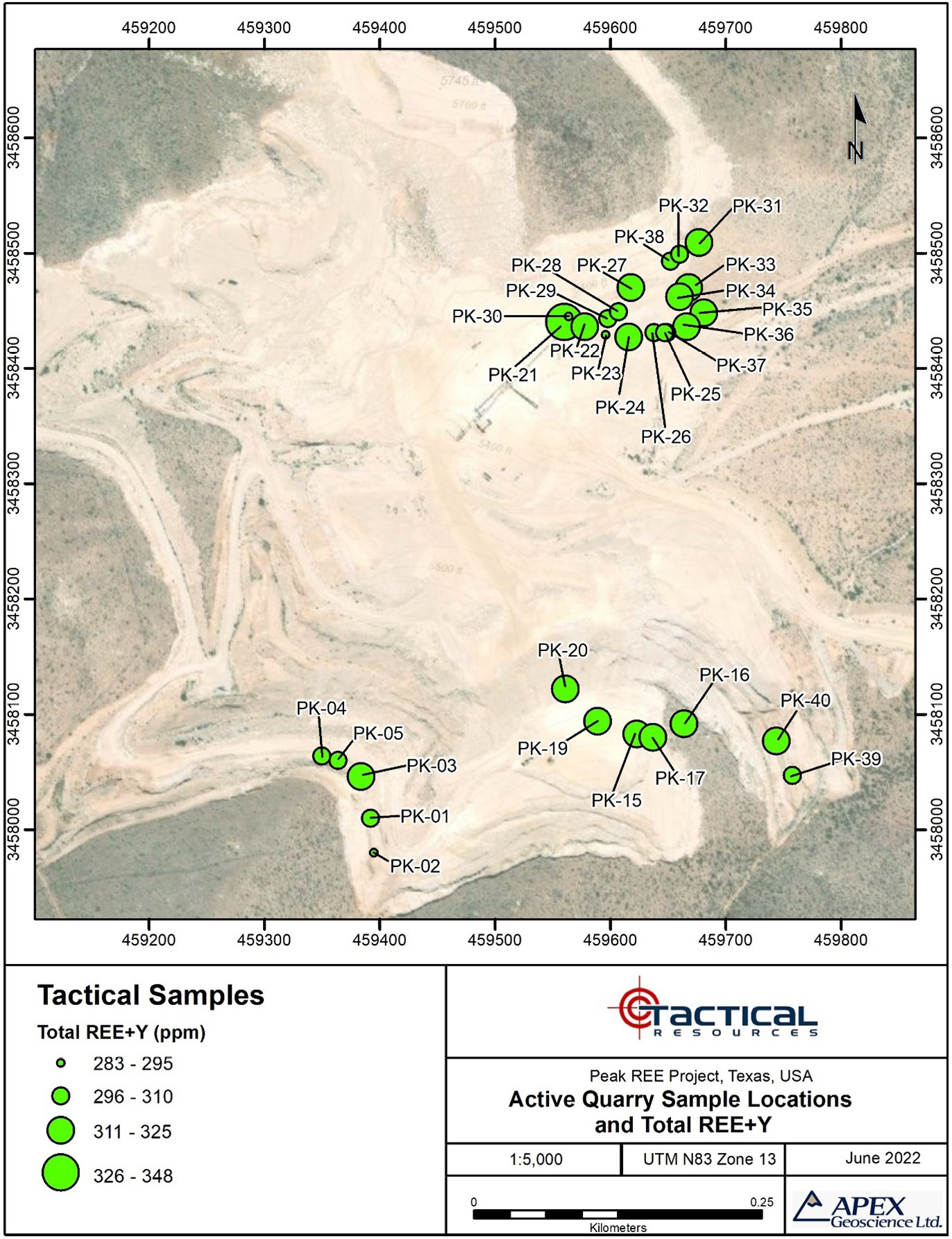

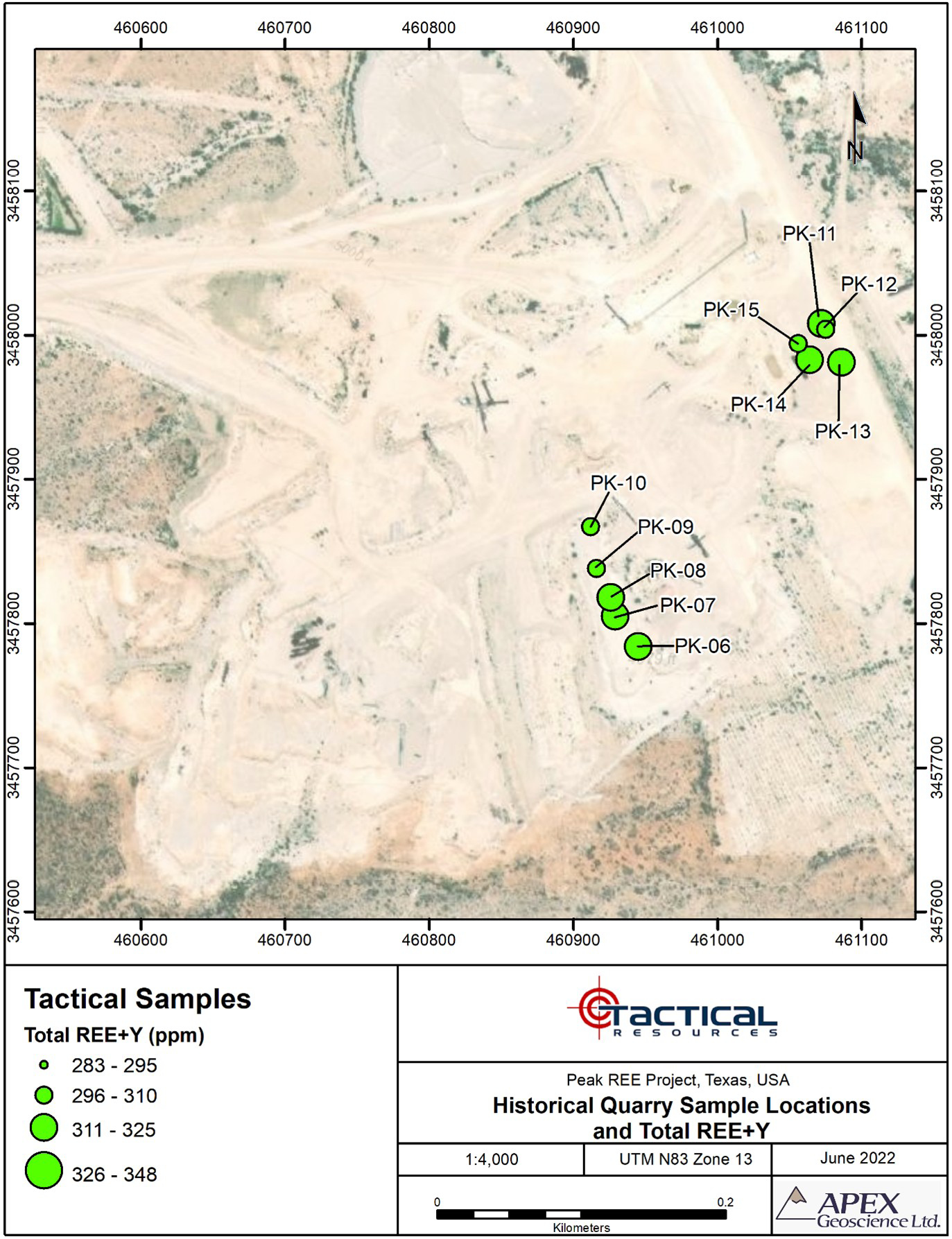

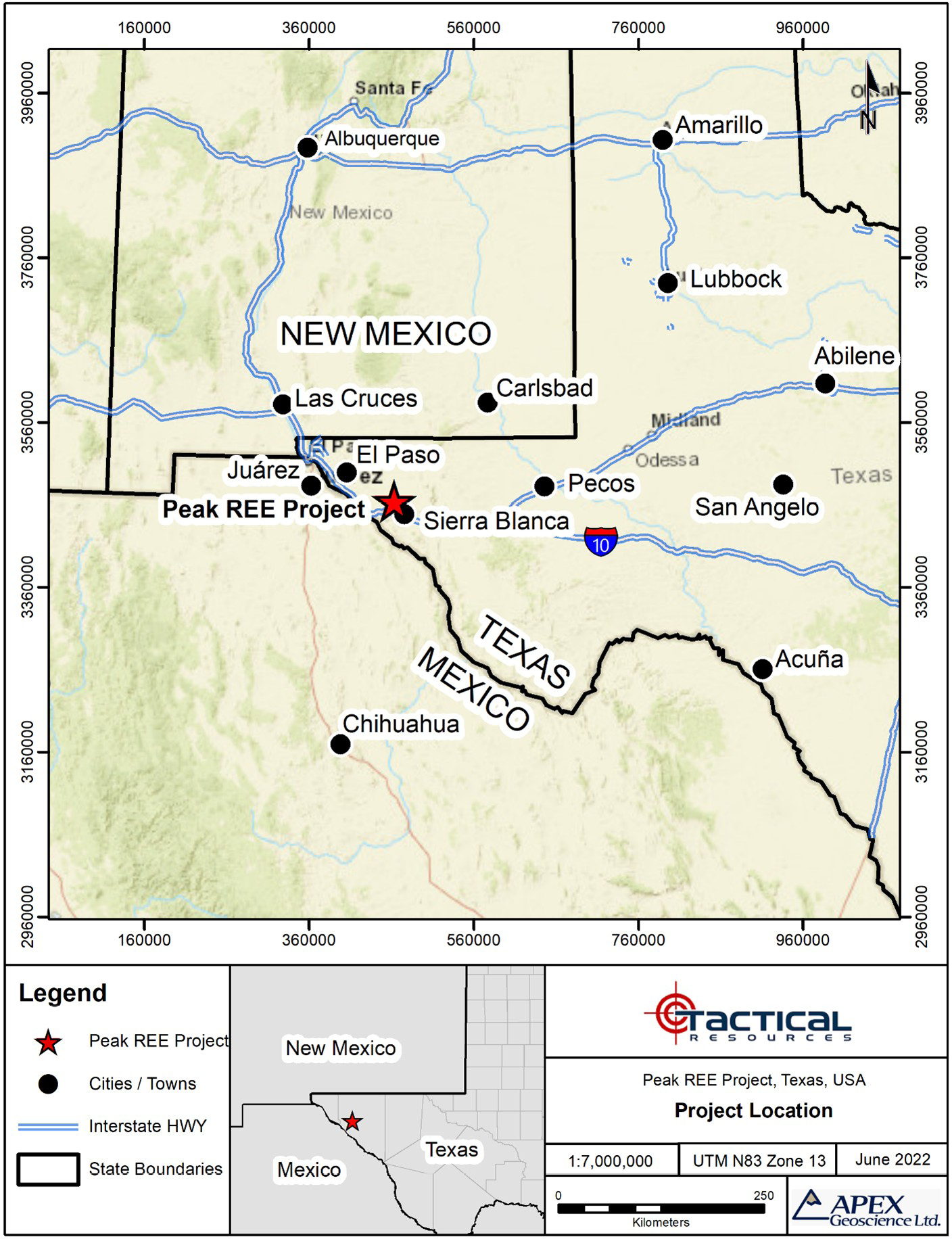

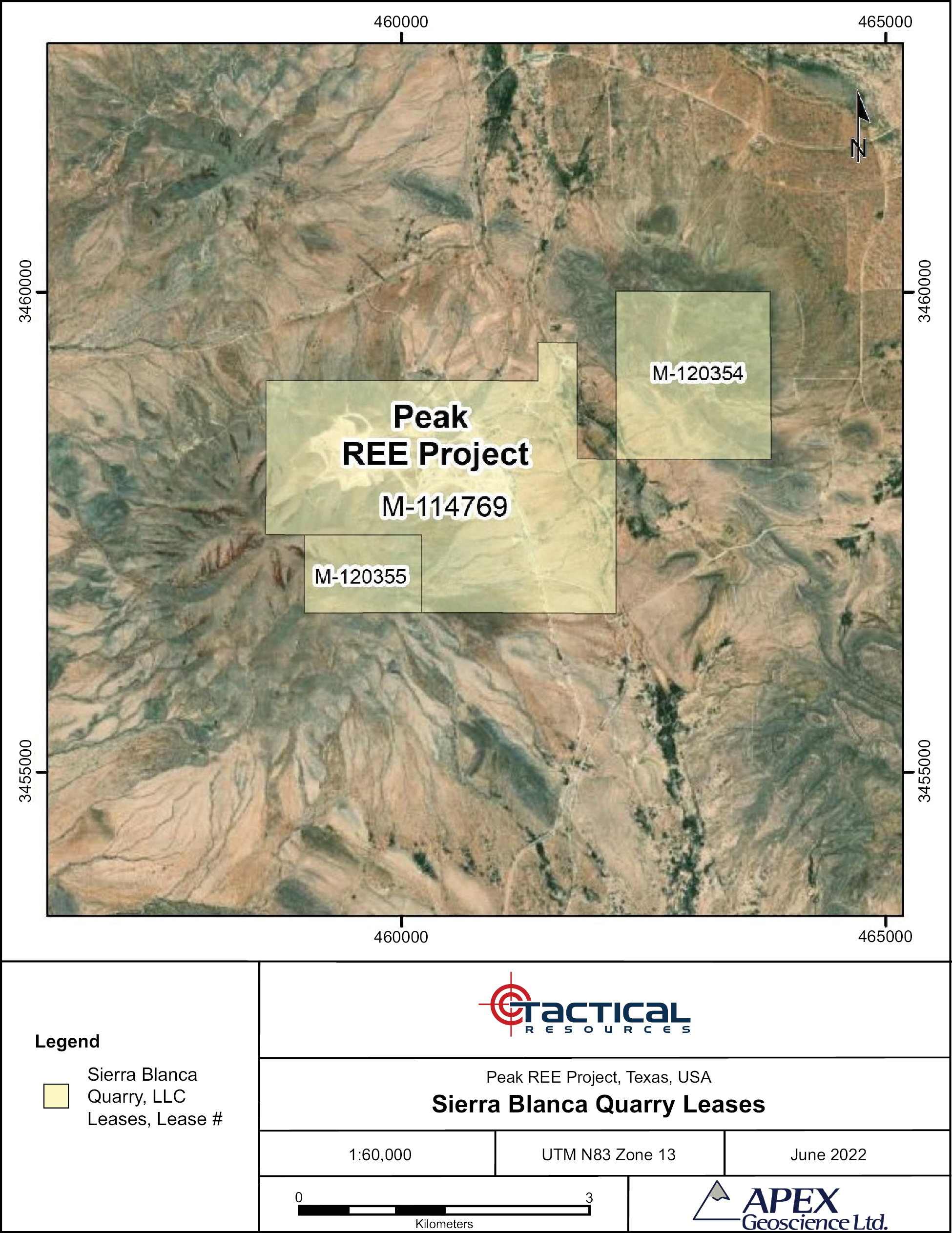

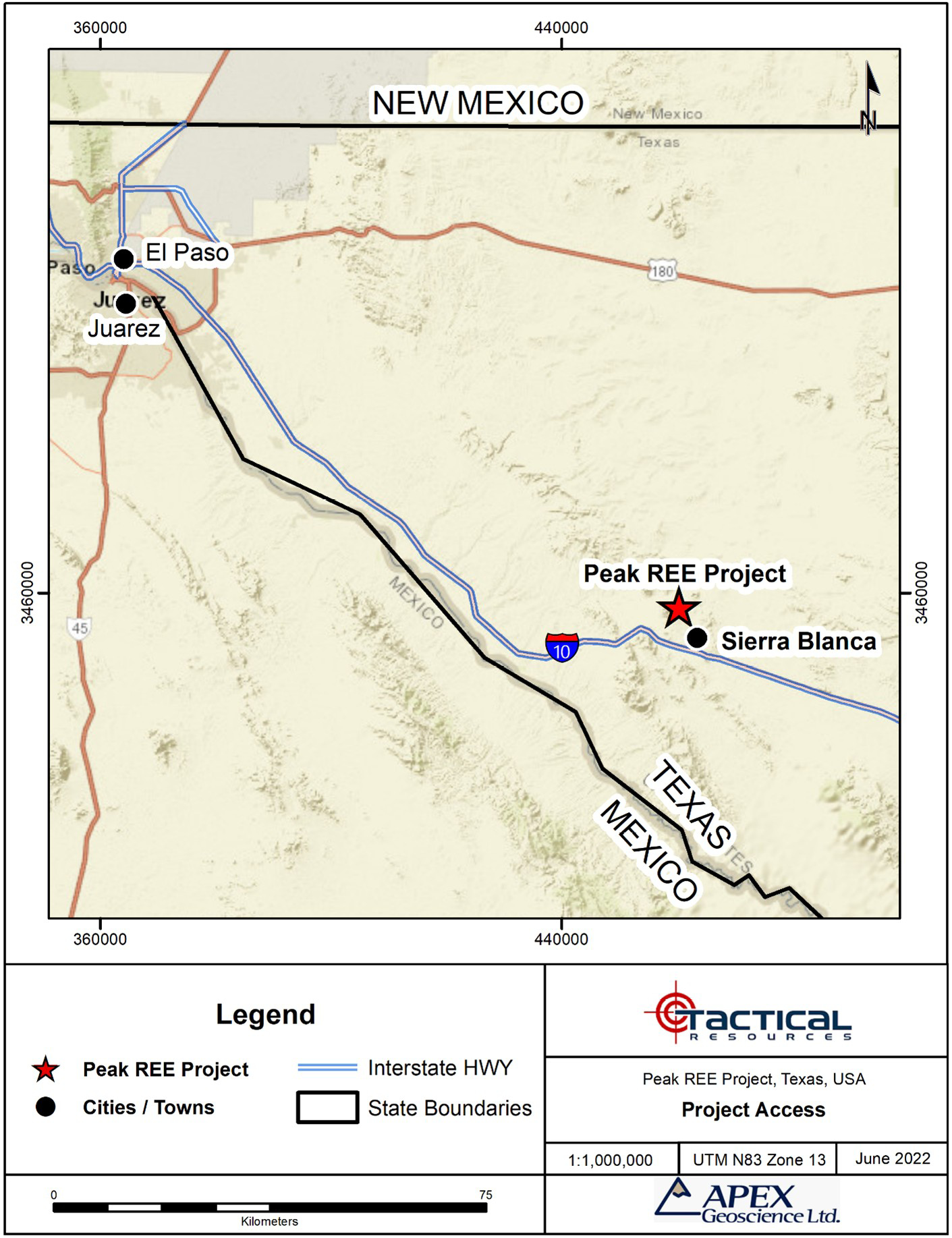

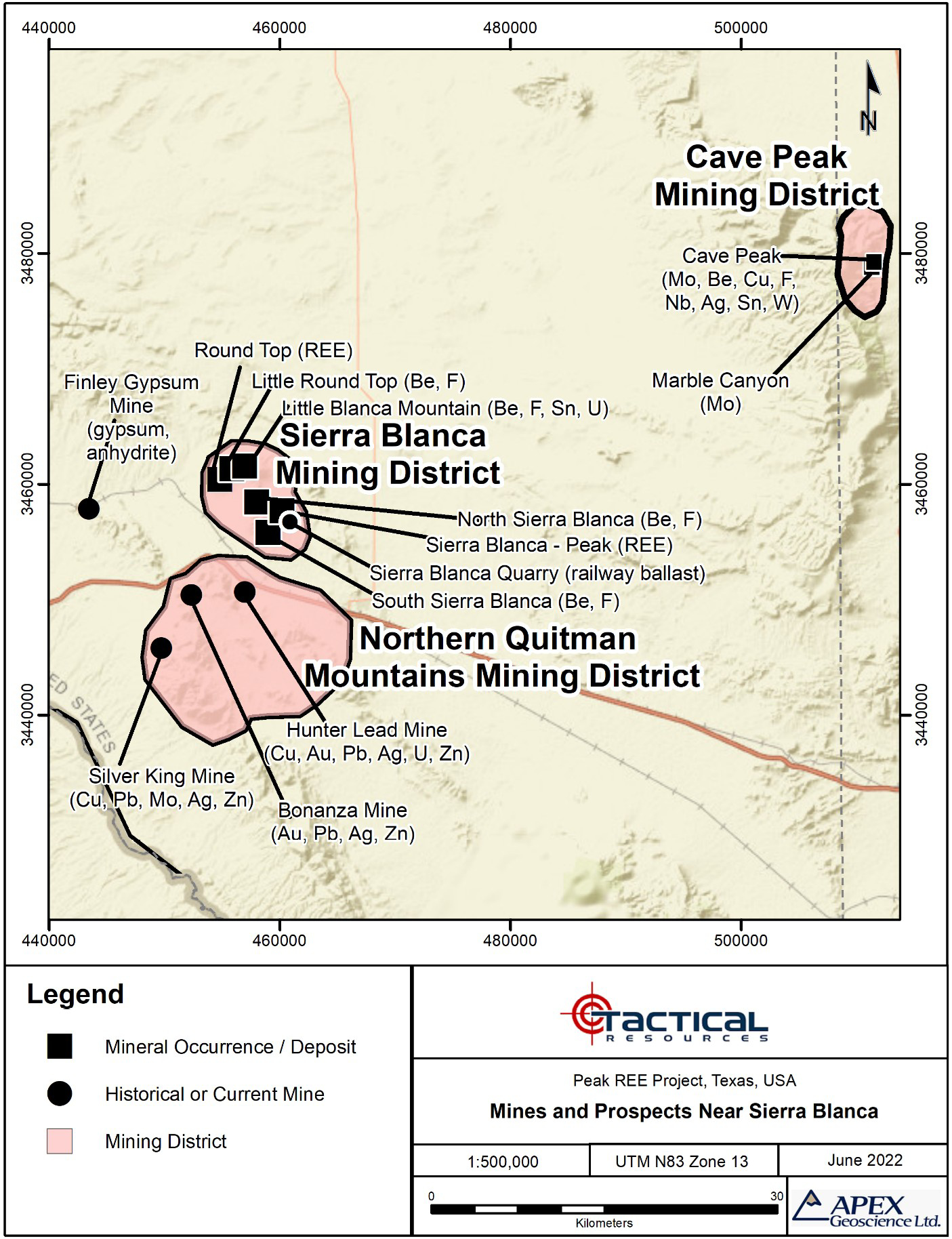

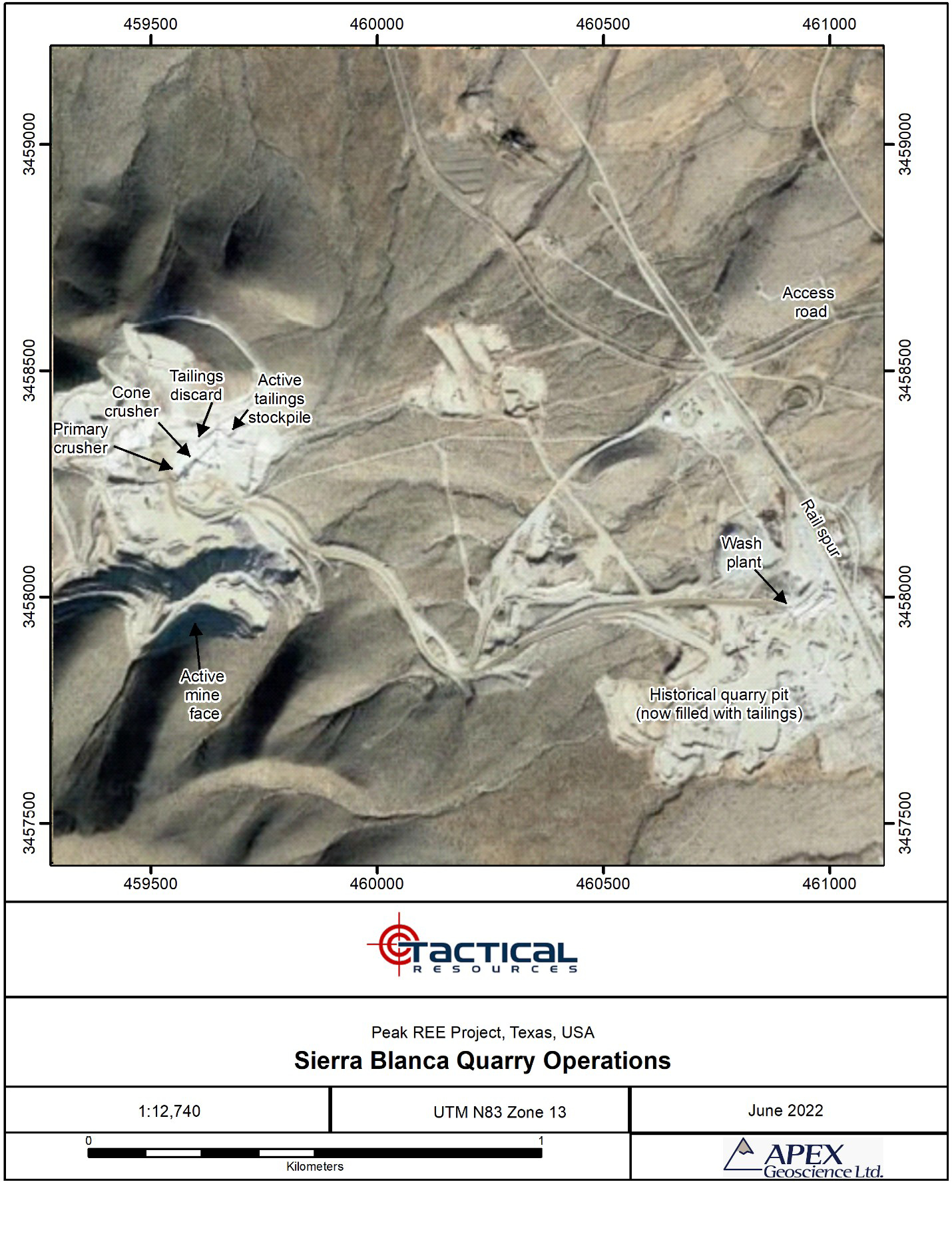

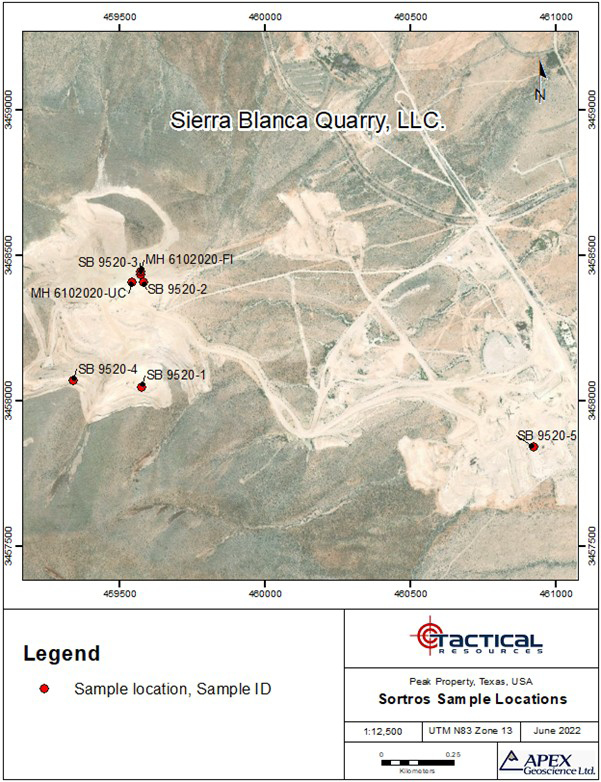

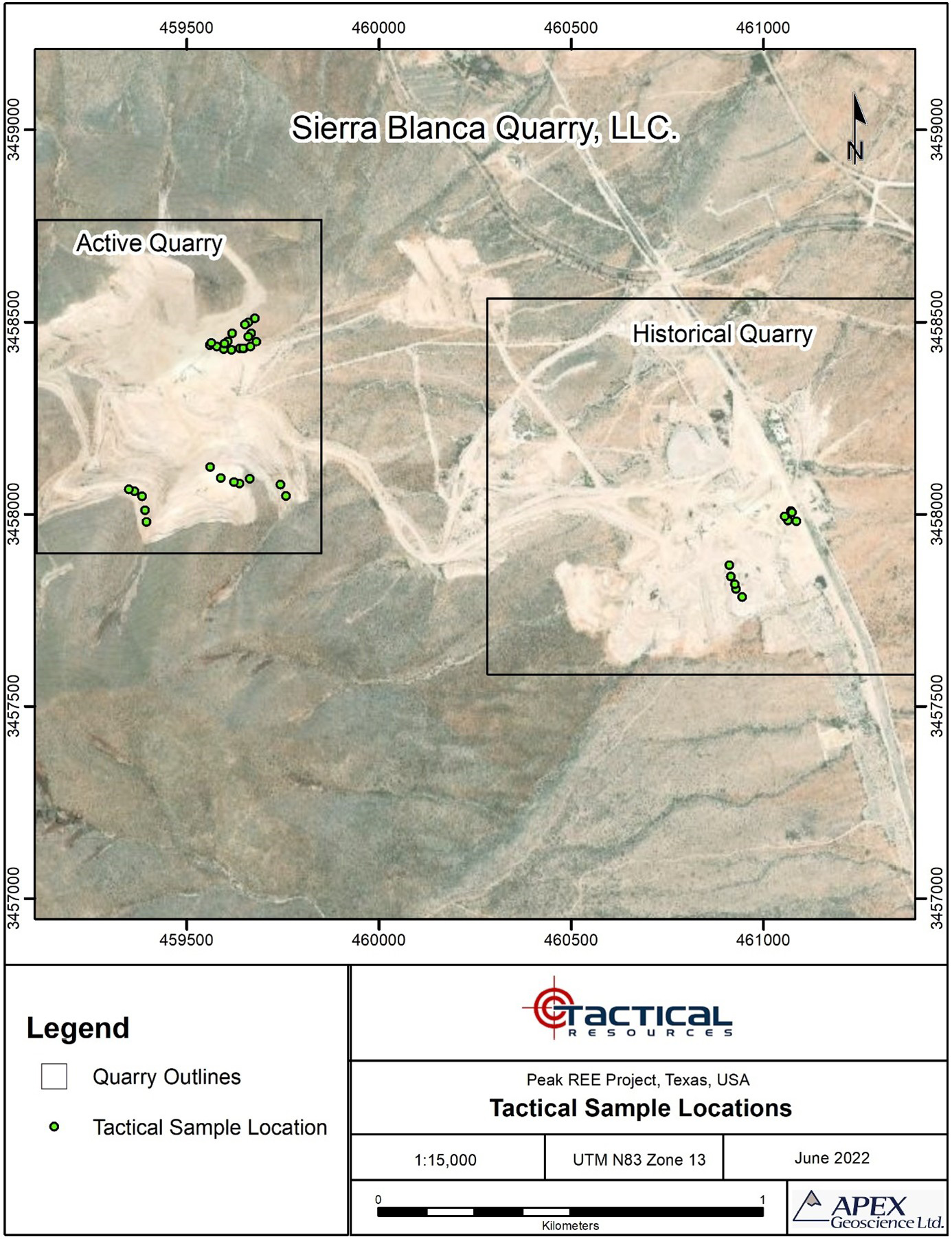

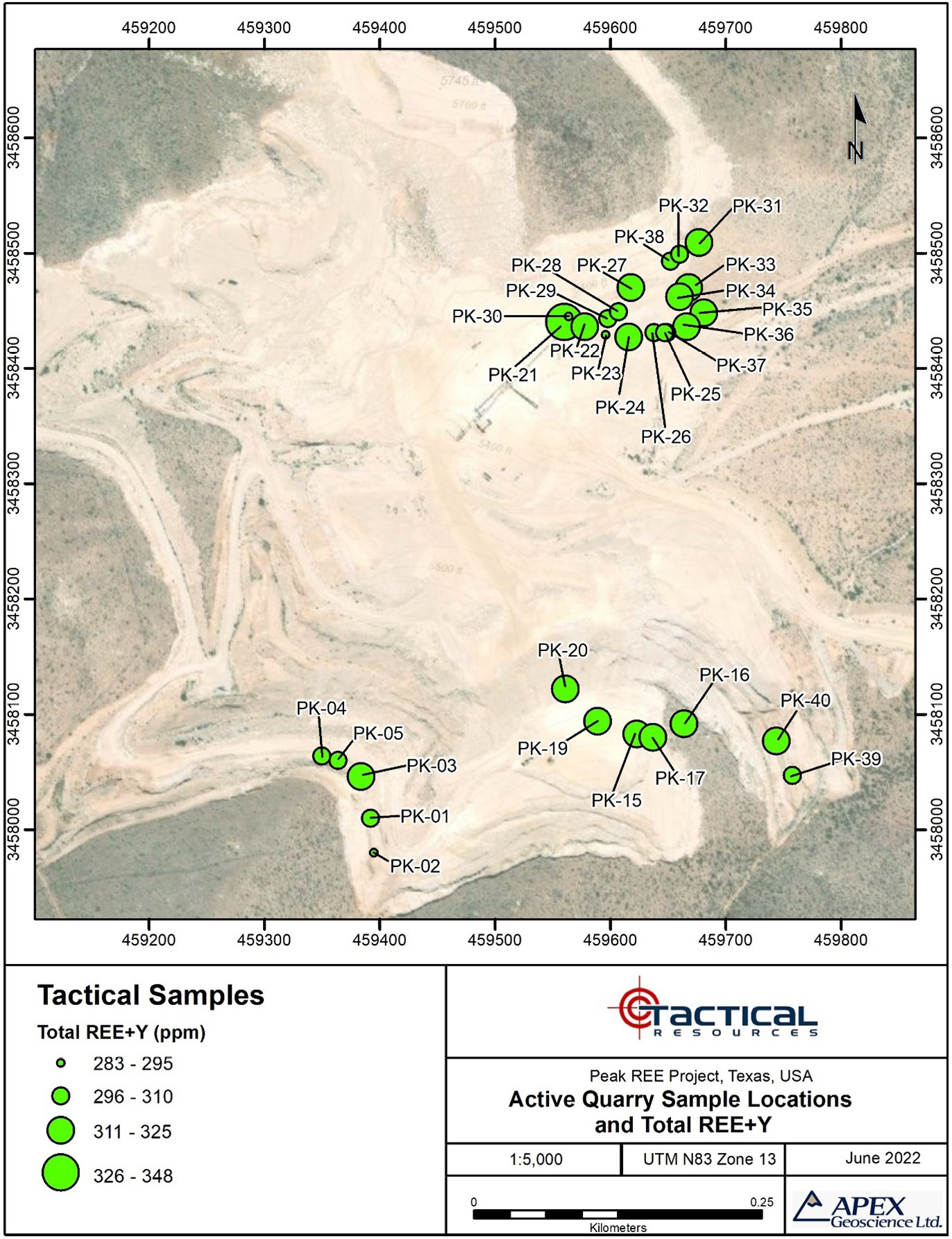

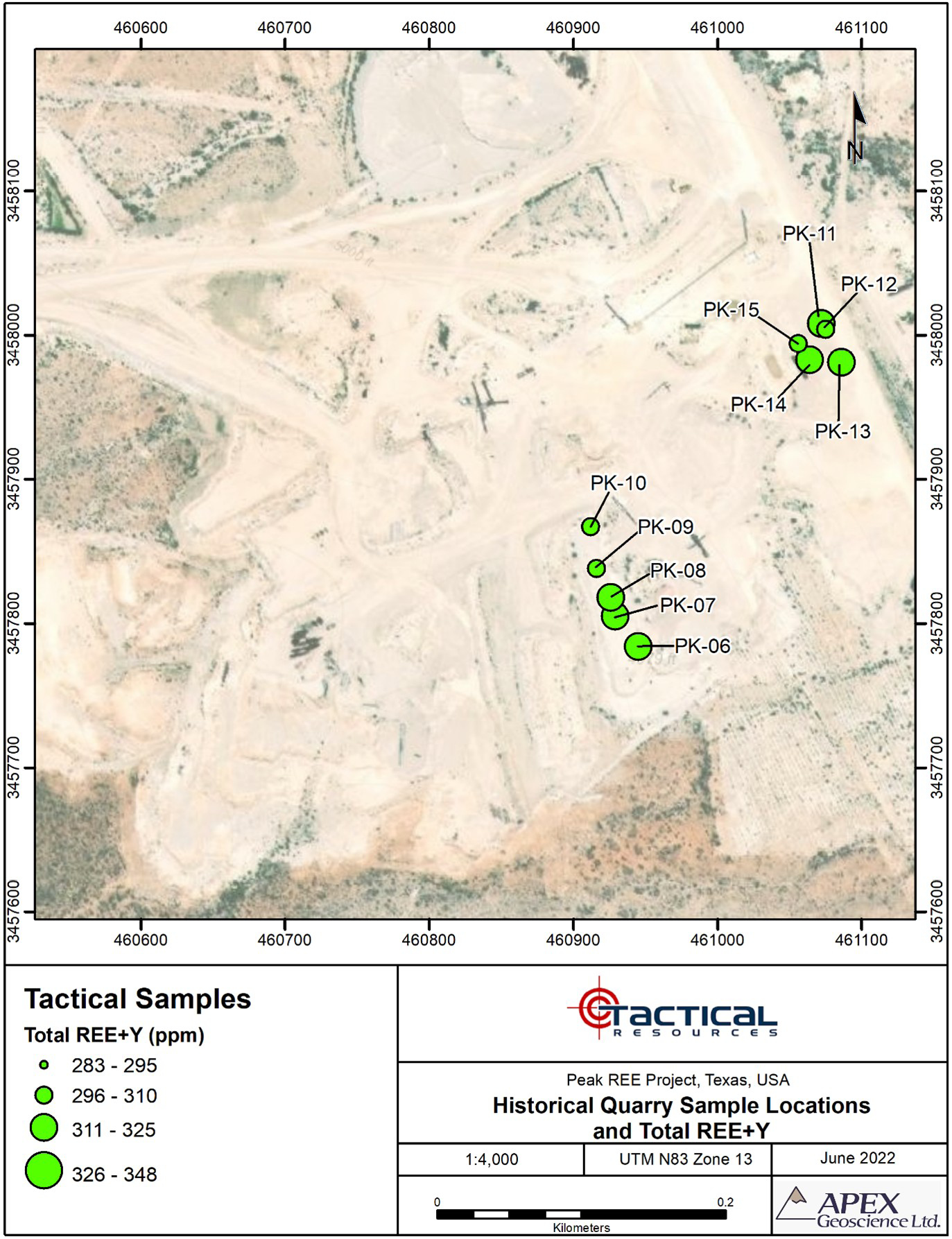

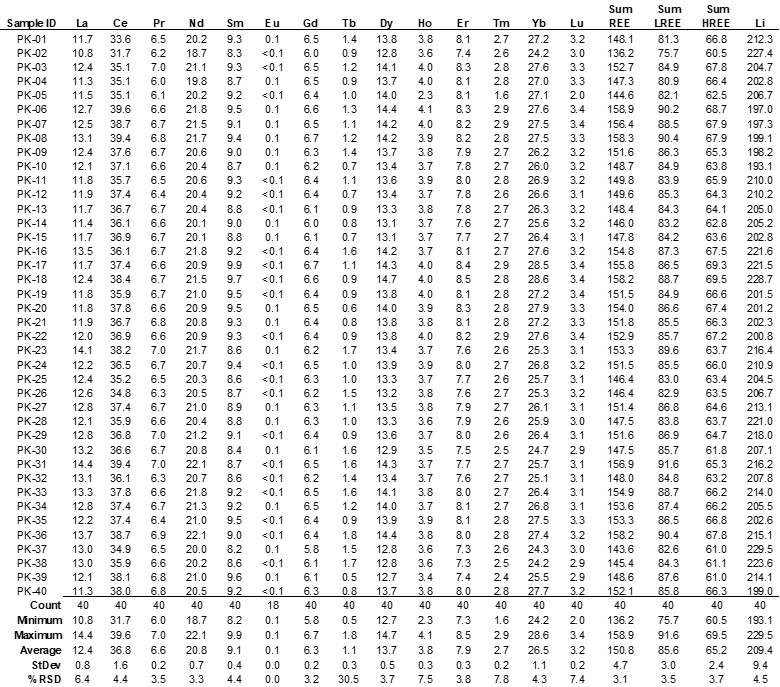

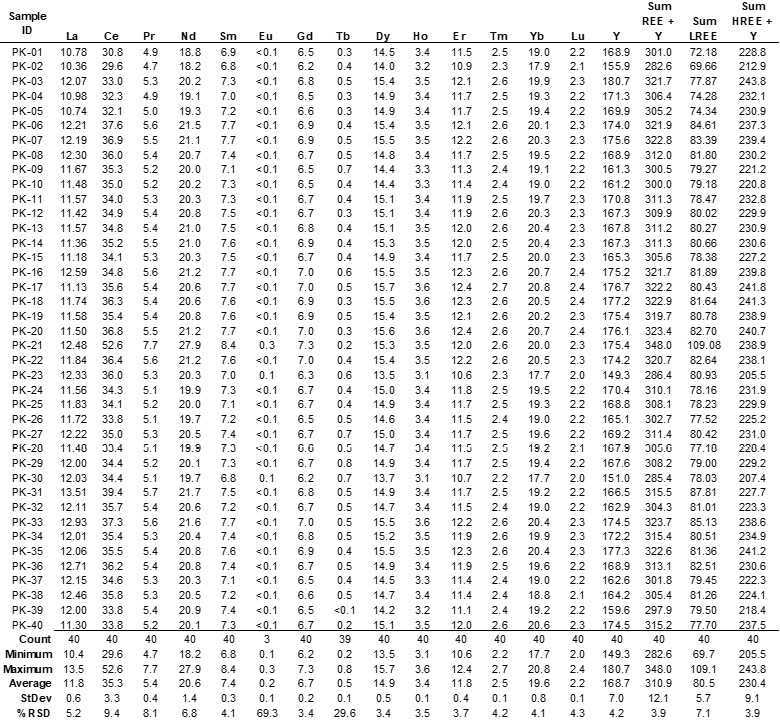

“Peak REE Project” means the project undertaken by TRC to explore and potentially develop rare earth elements from materials extracted from the Sierra Blanca Quarry operated by Sierra Blanca Quarry LLC in Hudspeth County, Texas.

“Permitted Financing” means a financing transaction prior to the TRC Amalgamation Effective Time pursuant to which Equity Securities of TRC are sold.

“Person” means any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, trust, estate, joint venture, joint stock company, union, association, Governmental Authority or other entity, enterprise, authority or business organization of any kind.

“Permitted Financing Securities” means any Equity Securities of TRC issued in any Permitted Financing.

“Plan of Arrangement” means the plan of arrangement attached to this proxy statement/prospectus as Annex B.

“PIPE Investment” means a PIPE Investor’s purchase of PubCo Common Shares concurrently with the Closing, on the terms and subject to the conditions set forth in a PIPE Subscription Agreement.

“PIPE Investment Amount” means the aggregate amount of cash payable to PubCo at the PIPE closing pursuant to the PIPE Subscription Agreements.

“PIPE Investors” means Persons that enter into PIPE Subscription Agreements to purchase PubCo Common Shares for cash.

“PIPE Subscription Agreement” means a contract executed by Plum, PubCo and a PIPE Investor in connection with the PIPE Investment.

“Plum” means Plum Acquisition Corp. III, a Cayman Islands exempt company.

6

Table of Contents

“Plum Amalgamation” means, on the terms and subject to the conditions set forth in the Business Combination Agreement and the Plan of Arrangement and in accordance with applicable Law, the amalgamation of Plum and PubCo to form one corporate entity, with the legal existence of PubCo to not cease and PubCo to survive such amalgamation.

“Plum Amalgamation Application” means an amalgamation application as contemplated by the BCBCA.

“Plum Amalgamation Effective Time” means 12:01 a.m. (Pacific Time) on the Closing Date.

“Plum Articles” means (a) for all periods prior to the Domestication, the Amended and Restated Memorandum and Articles of Association of Plum adopted on July 27, 2021, as amended, restated or amended and restated from time to time, and (b) for all periods from and after the Domestication, the Domestication Articles.

“Plum Board” means the board of directors of Plum.

“Plum Certificates” means the Certificate of Incorporation of Plum issued by the Registrar of Companies of the Cayman Islands on February 5, 2021 and the Certificate of Incorporation on Change of Name issued by the Registrar of Companies of the Cayman Islands on 1 February 2024.

“Plum Class A Shares” means (a) for all periods prior to the Domestication, Class A ordinary shares of Plum, par value $0.0001 per share, authorized under the Plum Articles, and (b) for all periods from and after the Domestication, Class A common shares of Plum, par value $0.0001 per share, authorized under the Domestication Articles.

“Plum Class B Shares” means (a) for all periods prior to the Domestication, Class B ordinary shares of Plum, par value $0.0001 per share, authorized under the Plum Articles, and (b) for all periods from and after the Domestication, Class B common shares of Plum, par value $0.0001 per share, authorized under the Domestication Articles.

“Plum Class B Unit” mean a unit of Plum comprised of one Plum Class B Share and one-third of one Plum Class B Warrant.

“Plum Class B Warrant” means a warrant to purchase one Plum Class B Share at an exercise price of $11.50 per share.

“Plum Common Shares” means, collectively, the Plum Class A Shares and the Plum Class B Shares.

“Plum Deadline” means the deadline for Plum to consummate a Business Combination as set forth in the Plum Articles.

“Plum Governing Documents” means, collectively, the Plum Articles and the Plum Certificate.

“Plum Founder Shareholders” means the holders of the Plum Founder Shares.

“Plum Founder Shares” means the Plum Class B Shares or the Plum Class A Shares issued upon conversion of the Plum Class B Shares.

“Plum IPO” means the initial public offering of Plum consummated on July 30, 2021.

“Plum Material Adverse Effect” means any event that has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on (a) the business, assets and liabilities, results of operations or financial condition of Plum, Amalco or PubCo or (b) the ability of Plum, Amalco or PubCo to consummate the Transactions prior to January 27, 2025; provided, however, that in no event shall any of the following, alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a Plum Material Adverse Effect: (i) any change or proposed change in any applicable Laws, GAAP or IFRS, or any change in interpretation thereof following the date of the Business Combination Agreement, (ii) any change in interest or exchange rates or economic, political, business or financial market conditions generally, including changes in the credit, debt, securities or capital markets or changes in prices of any security or market index or commodity or any disruption of such markets, (iii) the taking of any action required to be taken, or refraining from taking any action required not to be taken, under the Business Combination Agreement or any Ancillary Agreement, (iv) any act of God, natural disaster (including hurricanes, storms, tornados, flooding,

7

Table of Contents

earthquakes, wildfires, volcanic eruptions or similar occurrences), epidemic, pandemic, disease or other outbreak of illness or public health event, acts of nature or change in climate or any other force majeure event (including any escalation or worsening of any of the foregoing), (v) any acts of terrorism or war (whether or not declared), sabotage, civil unrest, curfews, public disorder, riots, hostilities, geopolitical or local, regional, state, national or international political conditions or social conditions (including any escalation or worsening of any of the foregoing), (vi) any matter existing as of the date of the Business Combination Agreement to the extent expressly set forth in Plum’s disclosure schedules to the Business Combination Agreement, (vii) any action taken at the written request of an authorized officer of, or with the written approval or consent of, TRC or (viii) any event attributable to the announcement of the Business Combination Agreement or the pendency of the Transactions; provided, that, in the case of clauses (i), (ii), (iv) and (v), to the extent any such event disproportionately affects Plum or Amalco relative to other participants in the industries or markets in which Plum and Amalco operate, such event shall not be excluded from the determination of whether there has been, or would reasonably be expected to be, a Plum Material Adverse Effect.

“Plum Miscellaneous Agreement” means any business combination marketing agreement, financial advisory agreement, placement agent agreement or any similar agreement in respect of the Transactions to which Plum, Sponsor or any of their respective affiliates is a party.

“Plum Ordinary Units” means, collectively, the Plum Public Units and the Plum Private Units.

“Plum Preference Shares” means (a) for all periods prior to the Domestication, preference shares of Plum, par value $0.0001 per share, authorized under the Plum Articles, and (b) for all periods from and after the Domestication, preference shares of Plum, par value $0.0001 per share, authorized under the Domestication Articles.

“Plum Private Units” means units of Plum sold in one or more private placements consummated concurrently with the Plum IPO, each unit comprised of one Plum Class A Share and one-third of one Plum Private Warrant.

“Plum Private Warrant” means a warrant to purchase one Plum Class A Share at an exercise price of $11.50 per share sold in a private placement consummated concurrently with the Plum IPO.

“Plum Public Shares” means the Plum Shares included in units of Plum sold in the Plum IPO.

“Plum Public Units” means units of Plum sold in the Plum IPO, each unit comprised of one Plum Class A Share and one-third of one Plum Public Warrant.

“Plum Public Warrant” means a warrant to purchase one Plum Class A Share at an exercise price of $11.50 per share included in a Plum Public Unit sold in the Plum IPO.

“Plum Securities” means, collectively, the Plum Units, the Plum Shares and the Plum Warrants.

“Plum Share Redemption” means the election (not validly withdrawn or cancelled prior to the Closing) of an eligible (as determined in accordance with the Plum Articles) holder of Plum Class A Shares to redeem all or a portion of the Plum Class A Shares held by such holder at a per share price, payable in cash, equal to a pro rata share of the aggregate amount on deposit in the Trust Account (including any interest earned on the funds held in the Trust Account, but net of Taxes payable and up to $100,000 to pay dissolution expenses) in accordance with the Plum Articles in connection with the consummation of the Transactions.

“Plum Shareholder” means any holder of Plum Shares.

“Plum Shareholder Proposals” means the proposals at the Plum Shareholders’ Meeting.

“Plum Shareholders’ Approval” means the approval of the Plum Shareholder Proposals, in each case, by an affirmative vote of the holders of at least a majority of Plum Shares entitled to vote, who attend and vote thereupon (as determined in accordance with the Plum Governing Documents and applicable Law) at a Plum Shareholders’ Meeting duly called by the Plum Board and held for such purpose.

“Plum Shareholders’ Meeting” means the extraordinary general meeting of shareholders of Plum at which the Proposals will be voted upon.

“Plum Shares” means, collectively, the Plum Common Shares and the Plum Preference Shares.

8

Table of Contents