| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-280224-01 |

| | | |

| Dated October 9, 2024 | BMO 2024-5C7 |

| Structural and Collateral Term Sheet |

BMO 2024-5C7 Mortgage Trust |

$959,562,630 (Approximate Mortgage Pool Balance) |

| |

$[] (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

Commercial Mortgage Pass-Through Certificates, Series 2024-5C7 |

Bank of Montreal German American Capital Corporation Starwood Mortgage Capital LLC Citi Real Estate Funding Inc. UBS AG Goldman Sachs Mortgage Company Societe Generale Financial Corporation Greystone Commercial Mortgage Capital LLC Sponsors and Mortgage Loan Sellers |

BMO

Capital

Markets | Citigroup | Goldman Sachs

& Co. LLC | Société Générale | UBS

Securities

LLC | Deutsche

Bank

Securities |

| Co-Lead Managers and Joint Bookrunners |

Academy Securities

Co-Manager | Bancroft Capital, LLC

Co-Manager | Drexel Hamilton

Co-Manager |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| Dated October 9, 2024 | BMO 2024-5C7 |

This material is for your information, and none of BMO Capital Markets Corp., Deutsche Bank Securities Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, SG Americas Securities, LLC, UBS Securities LLC, Academy Securities, Inc., Bancroft Capital, LLC and Drexel Hamilton, LLC (collectively, the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-255934) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-200-0266. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2024-5C7 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these Certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the Certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the Certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG and its banking affiliates.

Société Générale is the marketing name for SG Americas Securities, LLC.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Dated October 9, 2024 | BMO 2024-5C7 |

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| Collateral Characteristics |

Mortgage Loan Seller | Number of

Mortgage Loans | Number of Mortgaged

Properties | Aggregate

Cut-off Date Balance | % of

IPB | Roll-up

Aggregate Cut-

off Date

Balance | Roll-up

Aggregate % of

Cut-off Date

Balance |

| GACC | 3 | 10 | $111,662,000 | 11.6% | $159,200,462 | 16.6% |

| BMO | 3 | 3 | $49,000,000 | 5.1% | $157,923,077 | 16.5% |

| SMC | 6 | 6 | $153,140,000 | 16.0% | $153,140,000 | 16.0% |

| CREFI | 5 | 9 | $138,850,000 | 14.5% | $138,850,000 | 14.5% |

| UBS AG | 6 | 12 | $138,300,000 | 14.4% | $138,300,000 | 14.4% |

| GSMC | 2 | 2 | $40,000,000 | 4.2% | $81,538,462 | 8.5% |

| SGFC | 3 | 3 | $68,960,630 | 7.2% | $68,960,630 | 7.2% |

| GCMC | 3 | 3 | $19,650,000 | 2.0% | $61,650,000 | 6.4% |

| GCMC, BMO | 1 | 1 | $60,000,000 | 6.3% | - | - |

| BMO, GACC, GSMC | 1 | 1 | $60,000,000 | 6.3% | - | - |

| GACC, BMO | 1 | 1 | $60,000,000 | 6.3% | - | - |

| GSMC, BMO | 1 | 23 | $60,000,000 | 6.3% | - | - |

| Total: | 35 | 74 | $959,562,630 | 100.0% | $959,562,630 | 100.0% |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $959,562,630 |

| | Number of Mortgage Loans: | 35 |

| | Number of Mortgaged Properties: | 74 |

| | Average Cut-off Date Balance per Mortgage Loan: | $27,416,075 |

| | Weighted Average Current Mortgage Rate: | 6.38270% |

| | 10 Largest Mortgage Loans as % of IPB: | 57.7% |

| | Weighted Average Remaining Term to Maturity: | 60 months |

| | Weighted Average Seasoning: | 0 month |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF DSCR: | 1.70x |

| | Weighted Average UW NOI Debt Yield: | 11.3% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”): | 60.5% |

| | Weighted Average Maturity Date/ARD LTV: | 60.4% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 3.1% |

| | % of Mortgage Loans with Single Tenants(1): | 15.3% |

| | % of Mortgage Loans secured by Multiple Properties: | 18.2% |

| | |

| Amortization | |

| | Weighted Average Original Amortization Term: | 360 months |

| | Weighted Average Remaining Amortization Term: | 358 months |

| | % of Mortgage Loans with Interest-Only: | 94.2% |

| | % of Mortgage Loans with Interest-Only with Anticipated Repayment Date: | 3.1% |

| | % of Mortgage Loans with Amortizing Balloon: | 2.7% |

| | | |

| Lockboxes | |

| | % of Mortgage Loans with Springing Lockboxes: | 46.0% |

| | % of Mortgage Loans with Hard Lockboxes: | 44.6% |

| | % of Mortgage Loans with Soft (Residential); Hard (Commercial) Lockbox: | 6.3% |

| | % of Mortgage Loans with Soft Lockbox: | 3.2% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 81.7% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 53.2% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 86.4% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves(2): | 67.0% |

| (1) | Excludes mortgage loans that are secured by multiple properties leased to separate single tenants. are occupied by a single tenant. |

| (2) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, industrial, mixed use and multifamily (with commercial tenants) properties. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| Collateral Characteristics |

| | Ten Largest Mortgage Loans |

| |

| No. | Loan Name | City, State | Mortgage Loan

Seller | No.

of

Prop. | Cut-off Date

Balance | % of IPB | Square

Feet /

Rooms /

Units | Property

Type | UW

NCF DSCR | UW NOI

Debt Yield | Cut-off

Date LTV | Maturity

Date/ARD

LTV |

| 1 | Signum at 375 Dean | Brooklyn, NY | GCMC, BMO | 1 | $60,000,000 | 6.3% | 143 | Multifamily | 1.25x | 7.7% | 68.6% | 68.6% |

| 2 | Colony Square | Atlanta, GA | BMO, GACC, GSMC | 1 | $60,000,000 | 6.3% | 1,085,612 | Mixed Use | 1.51x | 11.8% | 50.4% | 50.4% |

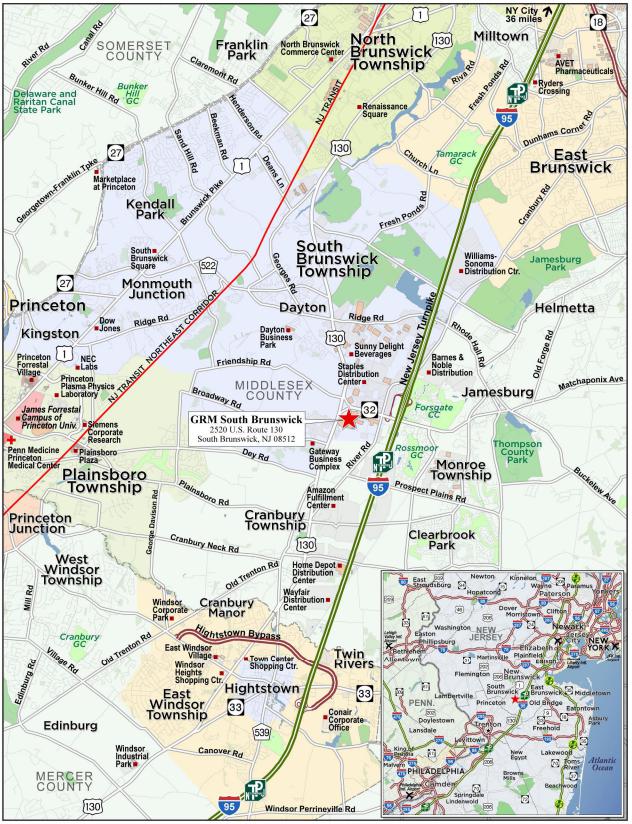

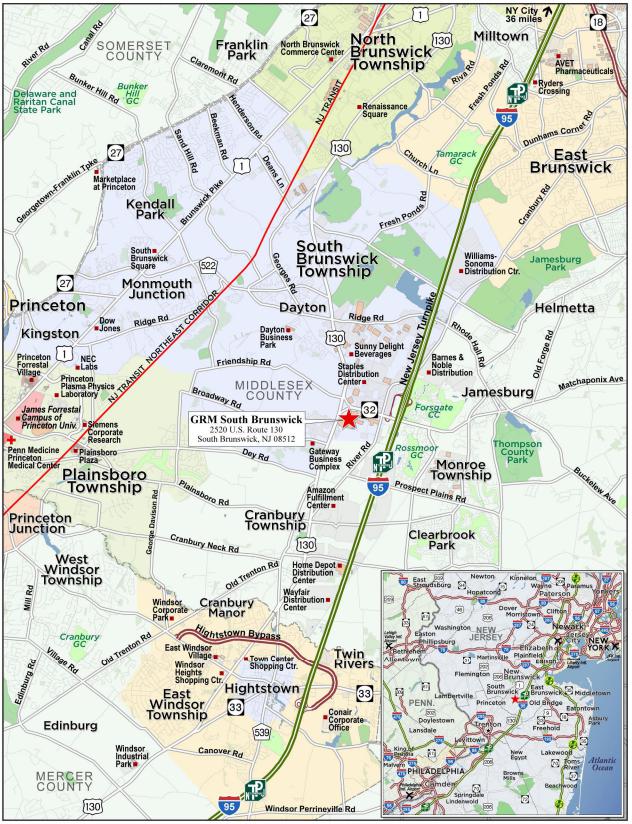

| 3 | GRM South Brunswick | South Brunswick, NJ | SMC | 1 | $60,000,000 | 6.3% | 509,775 | Industrial | 1.37x | 10.0% | 57.1% | 57.1% |

| 4 | 125 Summer | Boston, MA | GACC, BMO | 1 | $60,000,000 | 6.3% | 489,637 | Office | 2.57x | 17.9% | 61.1% | 61.1% |

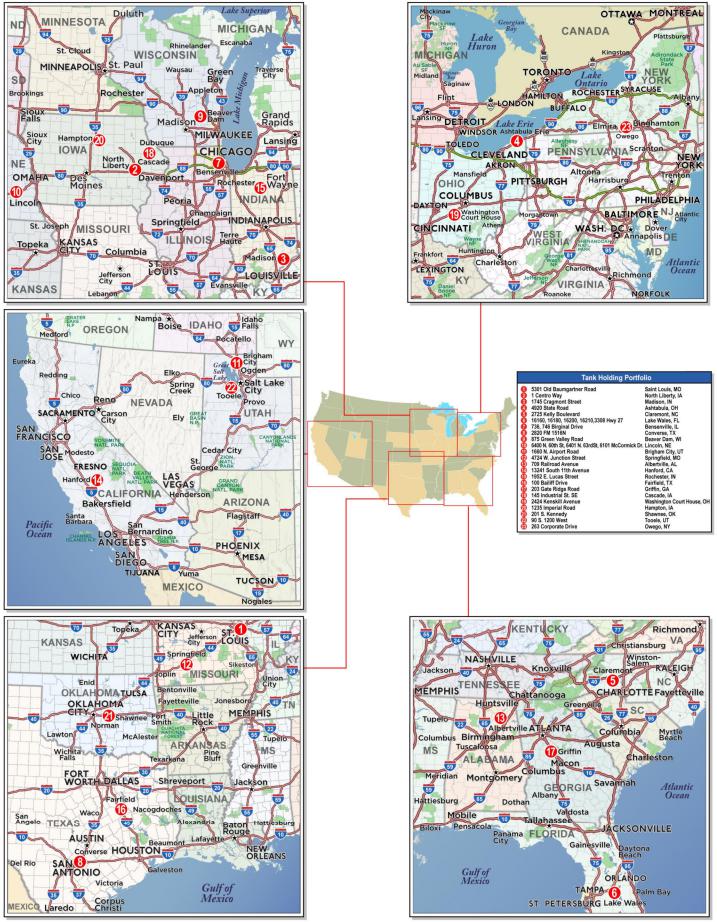

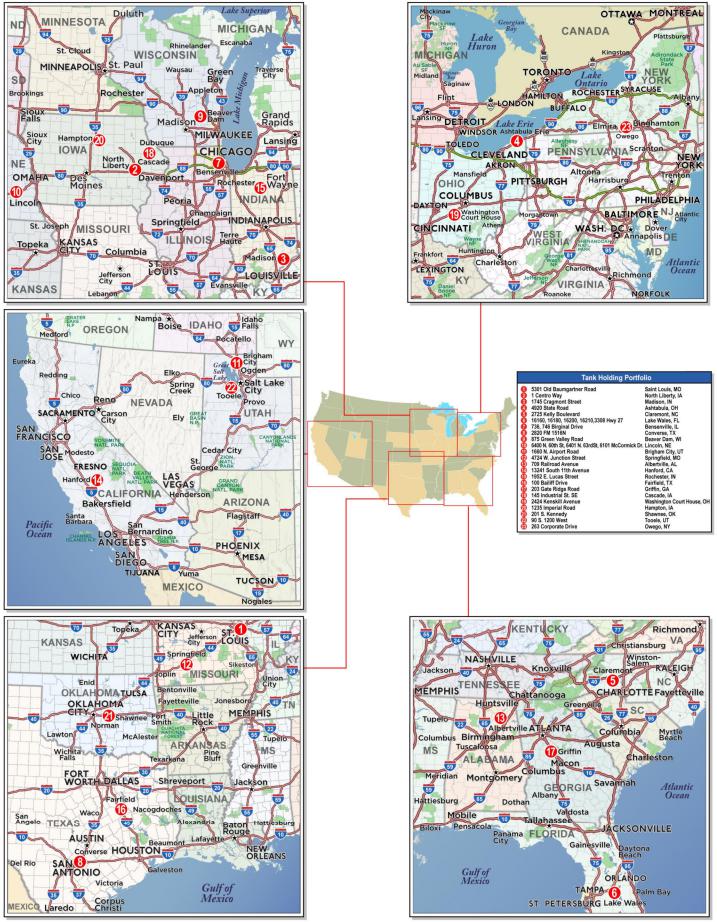

| 5 | Tank Holding Portfolio | Various, Various | GSMC, BMO | 23 | $60,000,000 | 6.3% | 1,489,315 | Industrial | 2.25x | 11.8% | 65.0% | 65.0% |

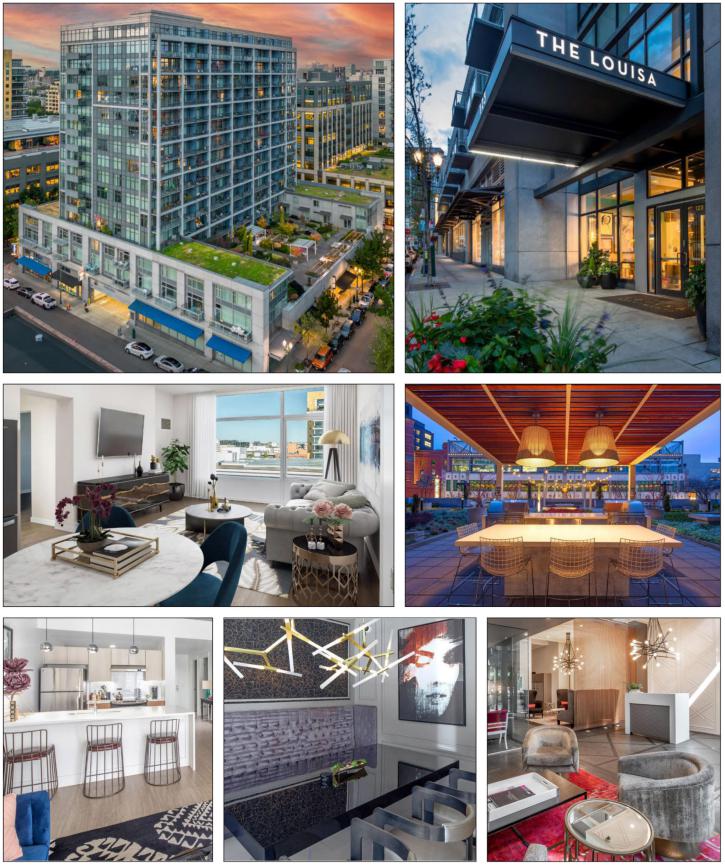

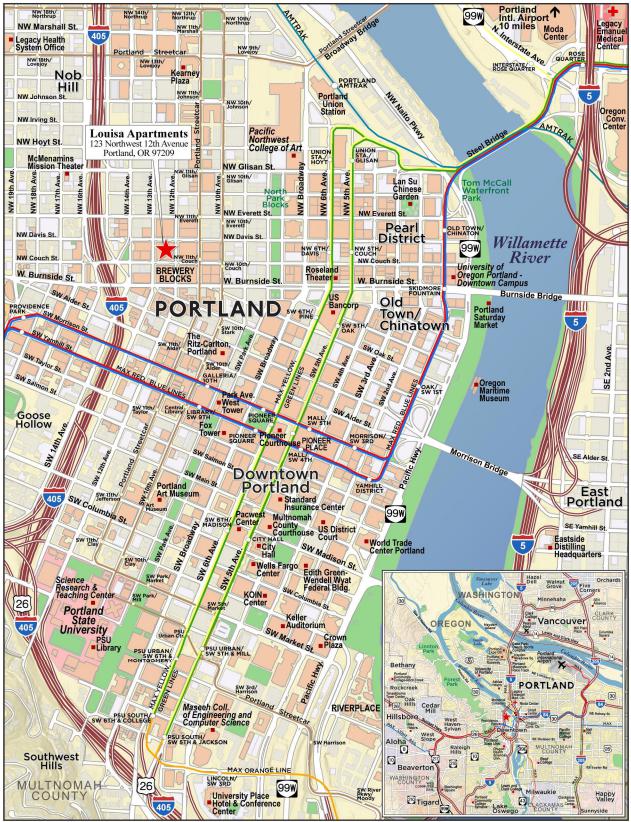

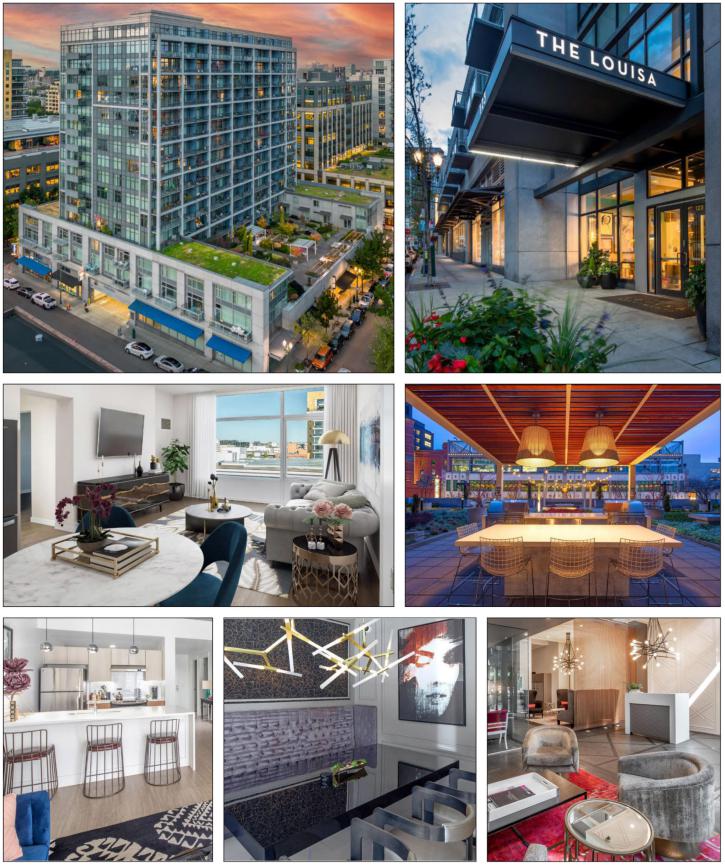

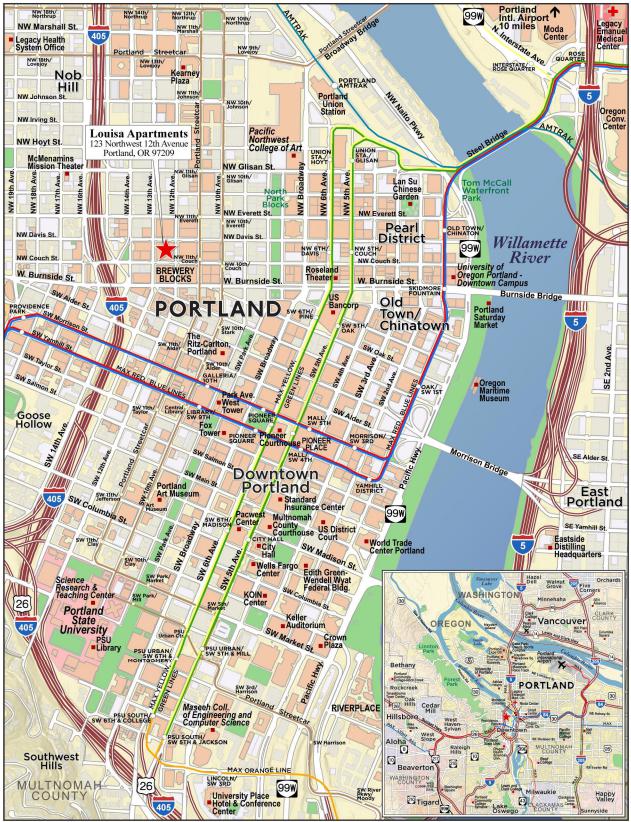

| 6 | Louisa Apartments | Portland, OR | GACC | 1 | $58,392,000 | 6.1% | 242 | Multifamily | 1.76x | 9.2% | 72.0% | 72.0% |

| 7 | Interstate Industrial Portfolio | Various, Various | UBS AG | 7 | $54,000,000 | 5.6% | 2,573,860 | Industrial | 1.37x | 9.9% | 63.9% | 63.9% |

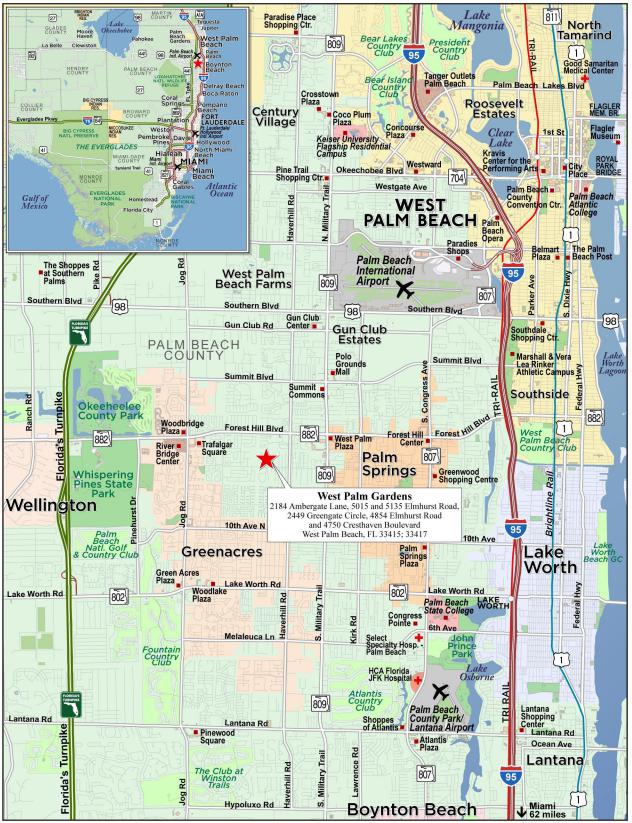

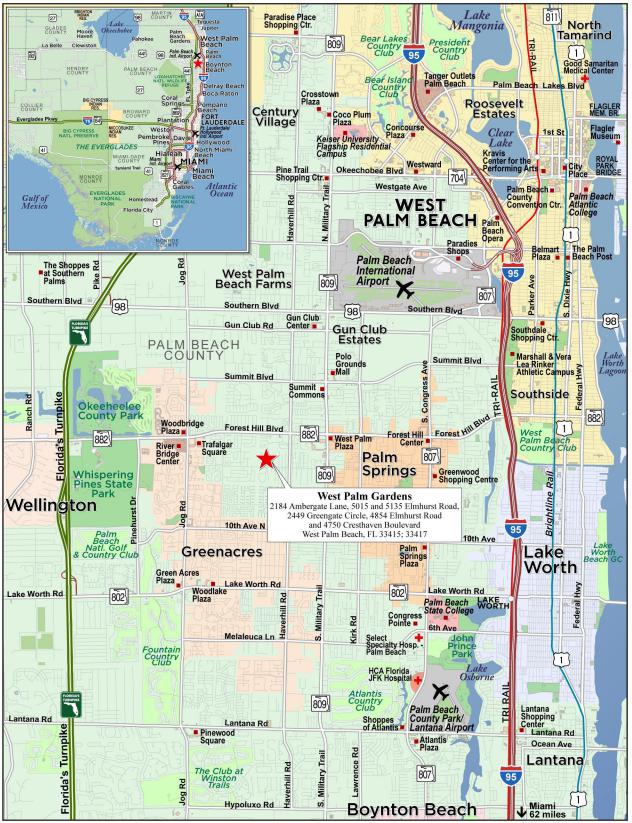

| 8 | West Palm Gardens | West Palm Beach, FL | CREFI | 1 | $50,000,000 | 5.2% | 437 | Multifamily | 1.58x | 10.6% | 59.4% | 59.4% |

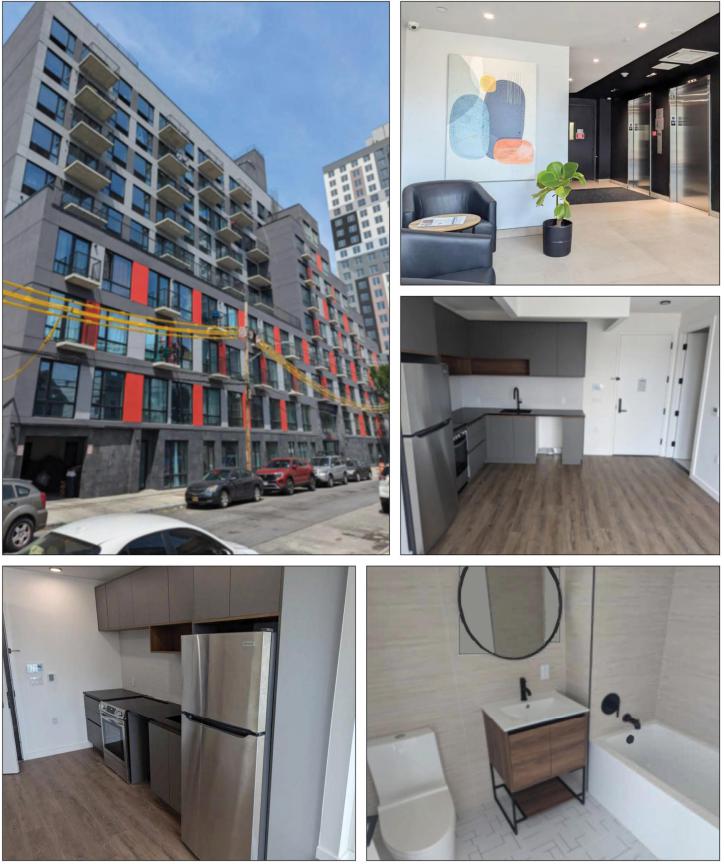

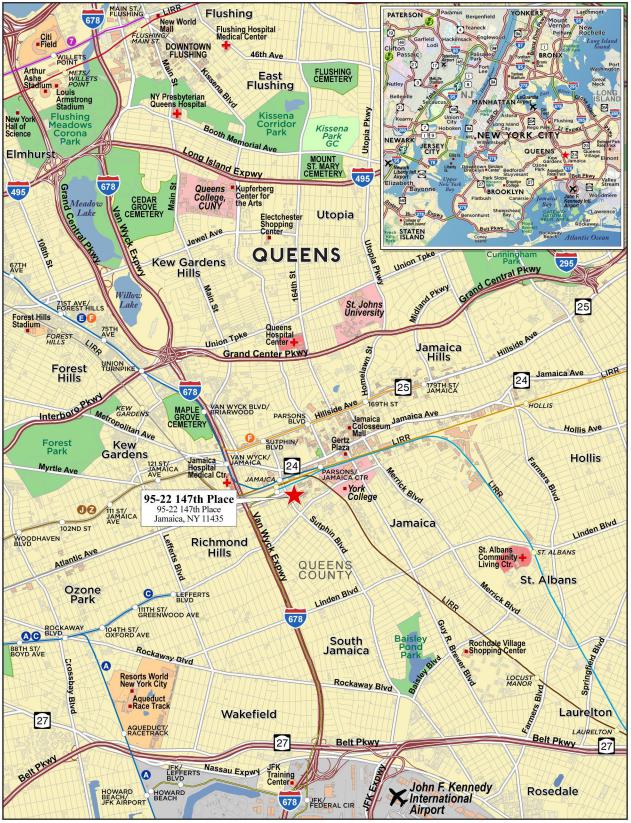

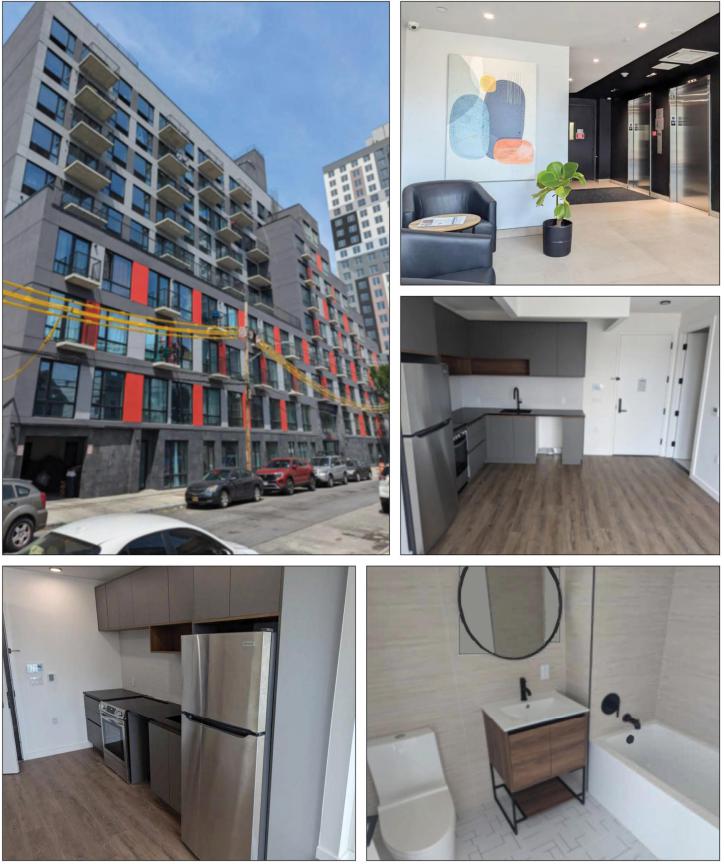

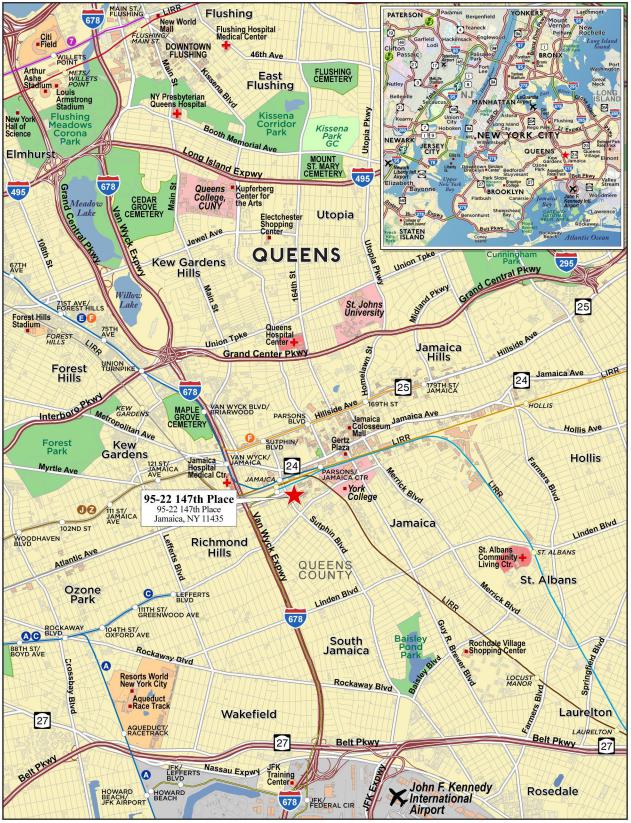

| 9 | 95-22 147th Place | Jamaica, NY | CREFI | 1 | $46,000,000 | 4.8% | 118 | Multifamily | 1.32x | 8.6% | 62.1% | 62.1% |

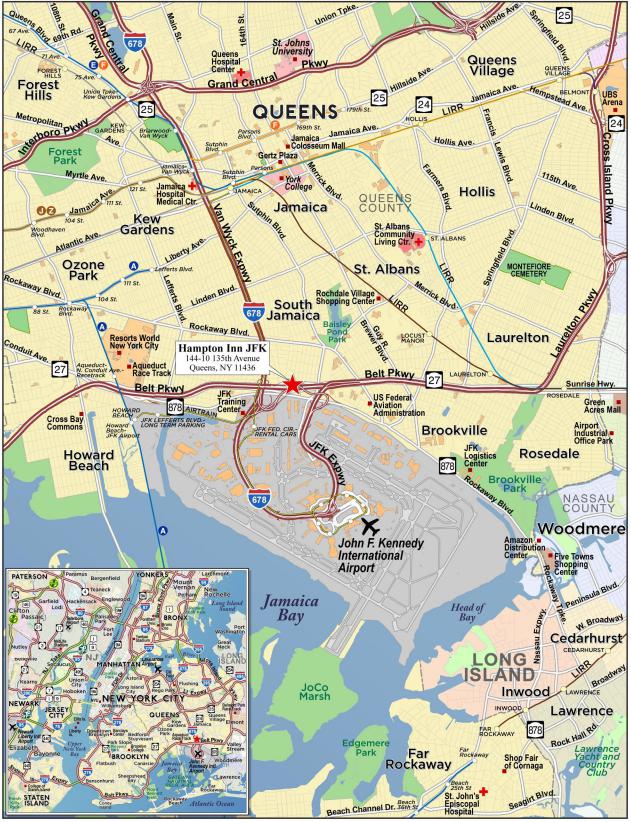

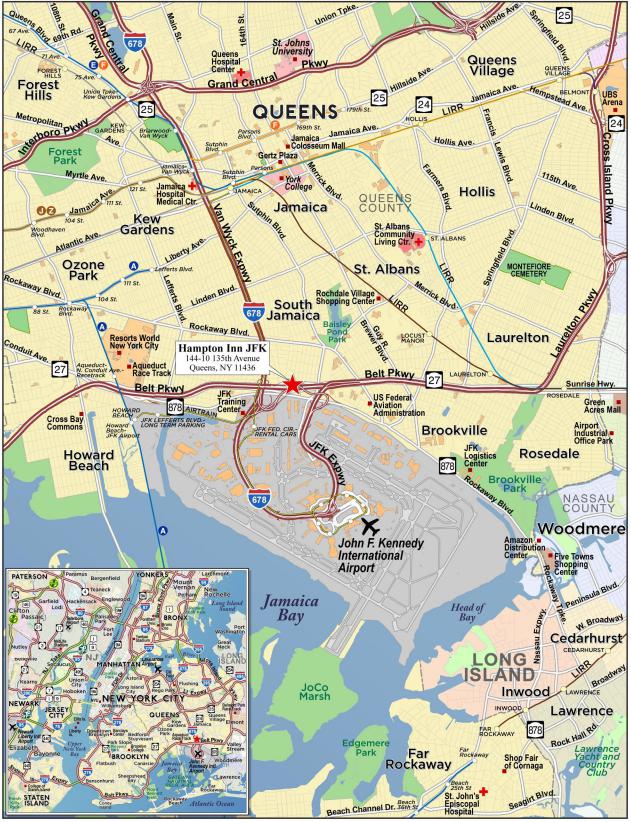

| 10 | Hampton Inn JFK | Queens, NY | UBS AG | 1 | $45,000,000 | 4.7% | 216 | Hospitality | 1.66x | 14.2% | 60.7% | 60.7% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | | 3 | $180,000,000 | 18.8% | | | 1.38x | 9.8% | 58.7% | 58.7% |

| | Top 5 Total/Weighted Average | | 27 | $300,000,000 | 31.3% | | | 1.79x | 11.8% | 60.4% | 60.4% |

| | Top 10 Total/Weighted Average | | 38 | $553,392,000 | 57.7% | | | 1.68x | 11.2% | 62.1% | 62.1% |

| | Non-Top 10 Total/Weighted Average | | 36 | $406,170,630 | 42.3% | | | 1.73x | 11.5% | 58.4% | 58.2% |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

| |

No. | Loan Name | Mortgage Loan Seller | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement | Master

Servicer | Special

Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | Signum at 375 Dean | GCMC, BMO | $60,000,000 | $24,000,000 | BMO 2024-5C7 | Midland | Greystone | Future Securitization(s) | $24,000,000 |

| 2 | Colony Square | BMO, GACC,

GSMC | $60,000,000 | $200,000,000 | BMO 2024-5C7(1) | Midland(1) | Greystone(1) | Future Securitization(s) | $200,000,000 |

| 3 | GRM South Brunswick | SMC | $60,000,000 | $12,000,000 | BMO 2024-5C7 | Midland | Greystone | Future Securitization(s) | $12,000,000 |

| 4 | 125 Summer | GACC, BMO | $60,000,000 | $42,635,000 | BMO 2024-5C7 | Midland | Greystone | Future Securitization(s) | $42,635,000 |

| 5 | Tank Holding Portfolio | GSMC | $60,000,000 | $26,389,388 | BMO 2024-5C7 | Midland | Greystone | Future Securitization(s) | $26,389,388 |

| 7 | Interstate Industrial Portfolio | UBS AG | $54,000,000 | $58,000,000 | BMO 2024-5C7(1) | Midland(1) | Greystone(1) | Future Securitization(s) | $58,000,000 |

| 14 | 277 Park Avenue | GACC | $30,000,000 | $490,000,000 | COMM 2024-277P | KeyBank | KeyBank | COMM 2024-277P BBCMS 2024-5C29 | $420,000,000 $70,000,000 |

| 15 | Baybrook Mall | SGFC | $25,960,630 | $193,706,236 | BANK5 2024-5YR9 | Wells Fargo | Midland | BANK5 2024-5YR9

Benchmark 2024-V9

BBCMS 2024-5C29

BANK5 2024-5YR10(2) | $88,000,000

$25,000,000

$61,000,000

$20,000,000 |

| 18 | One Park Square | GSMC | $20,000,000 | $27,650,000 | BMO 2024-5C7(1) | Midland(1) | Greystone(1) | Future Securitization(s) | $27,650,000 |

| 20 | Cortland West Champions | GSMC | $20,000,000 | $58,400,000 | BMO 2024-5C7(1) | Midland(1) | Greystone(1) | Future Securitization(s) | $58,400,000 |

| 26 | Westshore Crossing | UBS AG | $10,400,000 | $40,000,000 | BBCMS 2024-5C29 | KeyBank | Argentic | BBCMS 2024-5C29

BMO 2024-5C5 | $25,000,000

$15,000,000 |

| 28 | Northbridge Centre | BMO | $8,000,000 | $88,000,000 | BMO 2024-5C6 | Midland | LNR | BMO 2024-5C6

Future Securitization(s) | $53,000,000

$35,000,000 |

| 31 | Linx | SGFC | $6,000,000 | $88,000,000 | BMO 2024-5C6 | Midland | LNR | BMO 2024-5C6

Future Securitization(s) | $53,000,000

$35,000,000 |

| (1) | In the case of each of Loan Nos. 2, 7, 18 and 20, until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BMO 2024-5C7 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the Controlling Pooling/Trust & Servicing Agreement. |

| (2) | Based on a publicly available prospectus, the BANK5 2024-5YR10 transaction is expected to close after the date of this Term Sheet and prior to the closing of this securitization transaction. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| Collateral Characteristics |

| Mortgaged Properties by Type |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW

NCF DSCR | UW

NOI DY | Cut-off Date LTV | Maturity Date/ARD LTV |

| Multifamily | High Rise | 4 | $185,392,000 | 19.3% | 1.43x | 8.5% | 68.1% | 68.1% |

| | Garden | 17 | 157,020,000 | 16.4 | 1.50x | 10.2% | 61.6% | 61.6% |

| | Mid Rise | 6 | 129,950,000 | 13.5 | 1.48x | 9.2% | 63.9% | 63.9% |

| | Low Rise | 4 | 17,250,000 | 1.8 | 1.42x | 10.2% | 58.2% | 58.2% |

| | Subtotal: | 31 | $489,612,000 | 51.0% | 1.47x | 9.3% | 64.5% | 64.5% |

| Industrial | Warehouse | 8 | $114,000,000 | 11.9% | 1.37x | 10.0% | 60.3% | 60.3% |

| | Warehouse Distribution/Light manufacturing | 23 | $60,000,000 | 6.3 | 2.25x | 11.8% | 65.0% | 65.0% |

| | Car Dealership/Service Center | 1 | $14,090,000 | 1.5 | 2.97x | 12.8% | 47.9% | 47.9% |

| | Manufacturing | 1 | 12,500,000 | 1.3 | 2.29x | 16.6% | 50.8% | 50.8% |

| | Subtotal: | 33 | $200,590,000 | 20.9% | 1.80x | 11.1% | 60.3% | 60.3% |

| Office | CBD | 3 | $98,000,000 | 10.2% | 2.53x | 17.8% | 51.4% | 51.4% |

| | Suburban | 1 | 20,000,000 | 2.1 | 2.18x | 14.2% | 58.8% | 58.8% |

| | Subtotal: | 4 | $118,000,000 | 12.3% | 2.47x | 17.2% | 52.7% | 52.7% |

| Mixed Use | Office/Retail | 1 | $60,000,000 | 6.3% | 1.51x | 11.8% | 50.4% | 50.4% |

| | Lab/Office | 1 | 6,000,000 | 0.6 | 2.36x | 14.3% | 38.1% | 38.1% |

| | Subtotal: | 2 | $66,000,000 | 6.9% | 1.59x | 12.0% | 49.3% | 49.3% |

| Hospitality | Limited Service | 2 | $53,500,000 | 5.6% | 1.88x | 15.4% | 58.6% | 58.6% |

| | Extended Stay | 1 | 5,900,000 | 0.6 | 1.80x | 15.2% | 56.2% | 56.2% |

| | Subtotal: | 3 | $59,400,000 | 6.2% | 1.87x | 15.4% | 58.3% | 58.3% |

| Retail | Super Regional Mall | 1 | $25,960,630 | 2.7% | 1.72x | 13.8% | 55.9% | 53.0% |

| Total / Weighted Average: | 74 | $959,562,630 | 100.0% | 1.70x | 11.3% | 60.5% | 60.4% |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | GCMC, BMO | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $60,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $60,000,000 | | Property Type – Subtype: | Multifamily – High Rise |

| % of IPB: | 6.3% | | Net Rentable Area (Units)(3): | 143 |

| Loan Purpose: | Refinance | | Location: | Brooklyn, NY |

| Borrower: | Dean Holdings DE LLC | | Year Built / Renovated: | 2023 / NAP |

| Borrower Sponsor: | Joseph Brunner, Abraham Mandel and Toby Mandel | | Occupancy(4): | 96.5% |

| Interest Rate: | 6.000% | | Occupancy Date: | 9/30/2024 |

| Note Date: | 10/9/2024 | | 4th Most Recent NOI (As of)(5): | NAP |

| Maturity Date: | 11/6/2029 | | 3rd Most Recent NOI (As of)(5): | NAP |

| Interest-only Period: | 60 months | | 2nd Most Recent NOI (As of)(5): | NAP |

| Original Term: | 60 months | | Most Recent NOI (As of)(5): | NAP |

| Original Amortization Term: | None | | UW Economic Occupancy(6): | 97.0% |

| Amortization Type: | Interest Only | | UW Revenues: | $7,578,167 |

| Call Protection(2): | L(24),D(29),O(7) | | UW Expenses: | $1,145,992 |

| Lockbox / Cash Management: | Soft / Springing | | UW NOI: | $6,432,176 |

| Additional Debt(1): | Yes | | UW NCF: | $6,391,049 |

| Additional Debt Balance(1): | $24,000,000 | | Appraised Value / Per Unit(7): | $122,500,000 / $856,643 |

| Additional Debt Type(1): | Pari Passu | | Appraisal Date(7): | 4/1/2025 |

| | | | | |

| Escrows and Reserves(8) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / Unit: | $587,413 | |

| Taxes: | $1,061,067 | $33,151 | N/A | | Maturity Date Loan / Unit: | $587,413 | |

| Insurance: | $96,000 | $8,000 | N/A | | Cut-off Date LTV: | 68.6% | |

| Replacement Reserve: | $0 | $2,478 | N/A | | Maturity Date LTV: | 68.6% | |

| TI/LC: | $0 | $949 | N/A | | UW NCF DSCR: | 1.25x | |

| Other: | $126,525 | $0 | N/A | | UW NOI Debt Yield: | 7.7% | |

| | | | | | | |

| (1) | The Signum at 375 Dean Mortgage Loan (as defined below) is part of the Signum at 375 Dean Whole Loan (as defined below), which is comprised of six pari passu promissory notes with an aggregate original balance of $84,000,000. For additional information, see “The Loan” below. The financial information presented above is calculated based on the Signum at 375 Dean Whole Loan. |

| (2) | Defeasance of the Signum at 375 Dean Whole Loan is permitted at any time after the earlier to occur of (a) the end of the two-year period commencing on the closing date of the securitization of the last promissory note representing a portion of the Signum at 375 Dean Whole Loan to be securitized and (b) October [ ], 2027. The assumed defeasance lockout period of 24 payments is based on the anticipated closing date of the BMO 2024-5C7 securitization trust in October 2024. The actual lockout period may be longer. |

| (3) | The Signum at 375 Dean Property (as defined below) also contains 7,592 square feet of commercial space and a 54-space parking garage. |

| (4) | Occupancy represents residential occupancy only. The commercial space at the Signum at 375 Dean Property is 100.0% leased. |

| (5) | Historical NOI is not available, as the Signum at 375 Dean Property was constructed in 2023. |

| (6) | UW Economic Occupancy is 97.0% for the residential portion of the Signum at 375 Dean Property and 95.0% for the commercial portion. |

| (7) | The Appraised Value for the Signum at 375 Dean Property is based on the value upon stabilization, which assumed lease-up of the commercial portion. As of October 1, 2024, the commercial portion of the Signum at 375 Dean Property is 100% leased. |

| (8) | See “Escrows and Reserves” below for further discussion of reserve information. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

The Loan. The largest mortgage loan (the “Signum at 375 Dean Mortgage Loan”) is part of a whole loan (the “Signum at 375 Dean Whole Loan”) that is evidenced by six pari passu promissory notes in the aggregate original principal amount of $84,000,000 secured by the borrower’s fee interest in a 143-unit multifamily property located in Brooklyn, New York (the “Signum at 375 Dean Property”). The Signum at 375 Dean Mortgage Loan was originated by Greystone Commercial Mortgage Capital LLC (“GCMC”) on October [9], 2024, and Notes A-4, A-5 and A-6 were subsequently acquired by Bank of Montreal (“BMO”). The Signum at 375 Dean Whole Loan accrues interest at a rate of [6.000]% per annum on an Actual/360 basis and has an outstanding principal balance as of the Cut-off Date of $84,000,000. The Signum at 375 Dean Mortgage Loan has a five-year term and is interest-only for the full term. The Signum at 375 Dean Mortgage Loan is evidenced by the controlling Note A-1 and the non-controlling Notes A-2, A-3, and A-4, with an aggregate original principal balance of $60,000,000.

The relationship between the holders of the Signum at 375 Dean Whole Loan is governed by a co-lender agreement. The Signum at 375 Dean Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BMO 2024-5C7 transaction. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

The table below identifies the promissory notes that comprise Signum at 375 Dean Mortgage Loan:

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling

Piece |

| A-1 | $20,000,000 | $20,000,000 | BMO 2024-5C7 | Yes |

| A-2 | $15,000,000 | $15,000,000 | BMO 2024-5C7 | No |

| A-3 | $7,000,000 | $7,000,000 | BMO 2024-5C7 | No |

| A-4 | $18,000,000 | $18,000,000 | BMO 2024-5C7 | No |

| A-5(1) | $19,000,000 | $19,000,000 | BMO | No |

| A-6(1) | $5,000,000 | $5,000,000 | BMO | No |

| Whole Loan | $84,000,000 | $84,000,000 | | |

| (1) | Expected to be contributed to one or more future securitization transactions. |

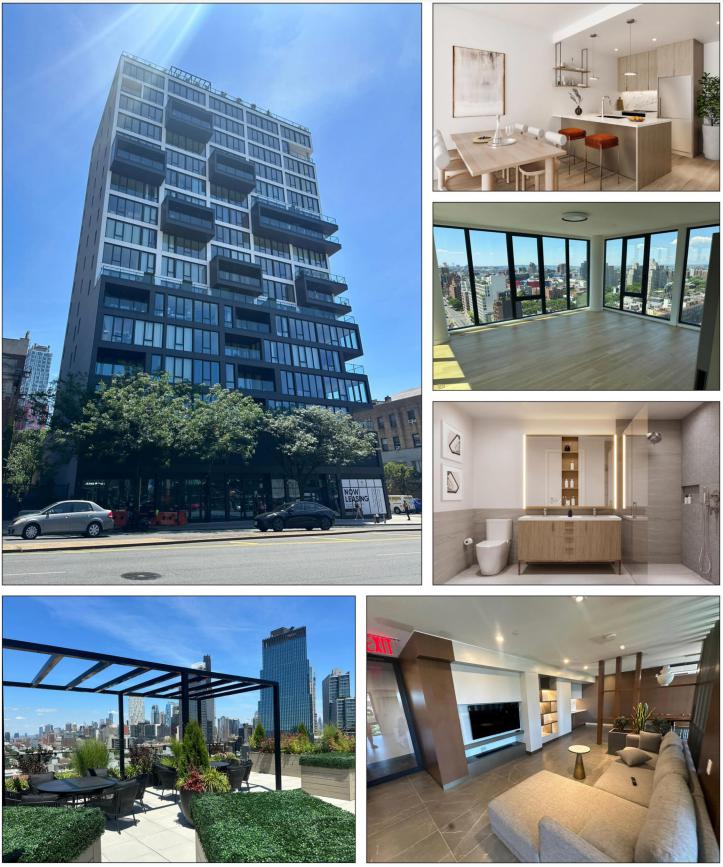

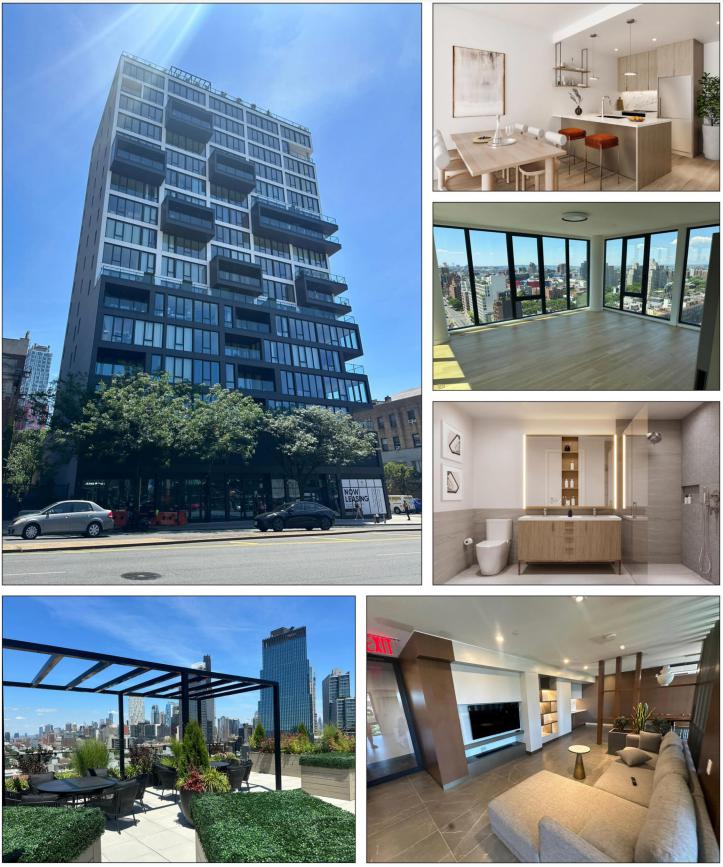

The Property. The Signum at 375 Dean Property is a 143-unit high-rise multifamily property built in 2023. As of September 30, 2024, the residential portion of the Signum at 375 Dean Property was 96.5% leased. The Signum at 375 Dean Property is located at the corner of Dean Street and 4th Avenue, in Brooklyn, New York at the nexus of the Boerum Hill, Park Slope and Prospect Heights neighborhoods. The Signum at 375 Dean Property is located one block from the Barclays Center near Atlantic Terminal, a major transportation hub with access to nine subway lines and the Long Island Rail Road.

The Signum at 375 Dean Property consists of a 17-story building featuring 143 residential units, 7,592 square feet of commercial space and a 54-space parking garage. The residential units feature studio, 1-bedroom, and 2-bedroom layouts, and of the 143 total units, 38 (26.6% of total units) are designated for affordable housing, while the remaining 105 units (73.4%) are leased as market units. Construction on the Signum at 375 Dean Property was completed in 2023, and leasing began in September 2023. The Signum at 375 Dean Property reached 96.5% occupancy on the residential units by September 2024.

Amenities at the Signum at 375 Dean Property include a virtual doorman, indoor and outdoor lounges, a fitness center, bike storage, a package room, entertainment room, coworking and party lounges, and a rooftop deck with views of Downtown Brooklyn. All units contain washers and dryers, stainless steel appliances, floor-to-ceiling windows, and built-in closet systems, with approximately 40% of units having private balconies.

The commercial space at the Signum at 375 Dean Property is 100% leased to Cactus Equity, LLC, on a lease that runs through September 30, 2029.

The Signum at 375 Dean Property is expected to benefit from a 35-year 421-a tax abatement from the NYC Department of Housing Preservation & Development, and is required to reserve at least 10% of units for households earning up to 40% of area median income, 10% of units for households earning up to 60% of area median income, and 5% of the units for households earning up to 130% of area median income under affordable housing guidelines, which 421-a tax abatement phases out in 2058/2059. The Signum at 375 Dean Property’s 421-a workbook was approved by the New York City Department of Housing Preservation & Development on August 2, 2024 and is awaiting the final Certificate of Eligibility.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

The Signum at 375 Dean Loan borrower sponsor is subject to full-recourse until such final Certificate of Eligibility is received for the 421-a tax abatements.

The following table presents certain information relating to the unit mix at the Signum at 375 Dean Property:

| Signum at 375 Dean Unit Mix |

| Unit Type | No. of Units(1) | % of Total Units(1) | Average Unit Size (SF) (1) | Average Rent Per Unit(1) | Average Rent PSF(1) | Market Rent Per Unit(2) | Market Rent PSF(2) |

| Studio - Market | 22 | 15.4 | % | 335 | $3,455 | $10.32 | $3,455 | $10.32 |

| 1 Bed / 1 Bath - Market | 69 | 48.3 | | 526 | $4,929 | $9.37 | $4,950 | $9.41 |

| 2 Bed / 1 Bath – Market | 9 | 6.3 | | 715 | $7,328 | $10.24 | $7,328 | $10.24 |

| 2 Bed / 2 Bath – Market | 5 | 3.5 | | 1,029 | $7,460 | $7.25 | $7,460 | $7.25 |

| Studio - Affordable | 7 | 4.9 | | 378 | $867 | $2.29 | $867 | $2.29 |

| 1 Bed / 1 Bath - Affordable | 26 | 18.2 | | 559 | $1,421 | $2.54 | $1,421 | $2.54 |

| 2 Bed / 2 Bath - Affordable | 5 | 3.5 | | 1,067 | $2,492 | $2.33 | $2,492 | $2.33 |

| Collateral Total/Wtd. Avg. | 143 | 100.0 | % | 544 | $3,987 | $7.33 | $4,030 | $7.41 |

| (1) | Based on the borrower rent roll dated as of September 30, 2024. |

| (2) | Market rent per the appraisal for market rate units and based on the in-place rent for affordable units. |

The Market. According to the appraisal, the Signum at 375 Dean Property is located in the Kings County multifamily submarket. As of the first quarter of 2024, the Downtown Brooklyn submarket had an inventory of 462,317 units, average monthly asking rent of $2,709, and a vacancy rate of approximately 1.8%, below the submarket’s 10-year average of 2.6%.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

The following table presents certain information relating to comparable multifamily rental properties to the Signum at 375 Dean Property:

| Comparable Rental Summary(1) |

| Property | Unit Mix | Average SF per Unit | Average Rent per SF | Average Rent per Unit |

Signum at 375 Dean(2) 375 Dean Street Brooklyn, NY | Studio - Market 1 Bed / 1 Bath - Market 2 Bed / 1 Bath - Market 2 Bed / 2 Bath - Market Studio - Affordable 1 Bed / 1 Bath - Affordable 2 Bed / 2 Bath - Affordable | 335 526 715 1,029 378 559 1,067 | $10.32 $9.37 $10.24 $7.25 $2.29 $2.54 $2.33 | $3,455 $4,950 $7,328 $7,460 $867 $1,421 $2,492 |

Saint Marks Place 58 Saint Marks Place Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 412 717 877 877 | $8.56 $6.97 $6.84 $6.84 | $3,525 $5,000 $6,000 $6,000 |

The Bergen 316 Begen Street Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 460 625 900 900 | $7.45 $7.35 $7.44 $7.44 | $3,425 $4,595 $6,700 $6,700 |

461 Dean Street Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 521 689 1,065 1,065 | $6.67 $6.96 $6.15 $6.15 | $3,475 $4,795 $6,550 $6,550 |

Plank Road 662 Pacific Street Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 511 660 1,040 1,040 | $6.86 $6.39 $6.15 $6.15 | $3,505 $4,218 $6,400 $6,400 |

834 Pacific Street Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 355 512 722 722 | $9.58 $8.50 $7.62 $7.62 | $3,400 $4,350 $5,500 $5,500 |

The Heritage Dean 470 Dean Street Brooklyn, NY | Studio 1 Bed / 1 Bath 2 Bed / 1 Bath 2 Bed / 2 Bath | 515 727 1,250 1,250 | $6.41 $5.78 $4.92 $4.92 | $3,300 $4,200 $6,150 $6,150 |

| (1) | Source: Appraisal, unless otherwise indicated. |

| (2) | Based on the borrower rent roll dated as of September 30, 2024. |

Environmental. According to the Phase I environmental site assessment dated July 11, 2024, there was no evidence of any recognized environmental conditions at the Signum at 375 Dean Property.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

The following table presents certain information relating to operating history and underwritten cash flows at the Signum at 375 Dean Property:

| Operating History and Underwritten Net Cash Flow(1) |

| | Borrower Sponsor

Proforma | Underwritten | Per Unit | %(2) | |

| Gross Potential Rent(3) | $7,441,736 | $7,437,003 | $52,007 | 100.0 | % |

| | | | | |

| Net Rental Income | $7,441,736 | $7,437,003 | $52,007 | 100.0 | % |

| (Vacancy/Credit Loss)(4) | (244,381) | (233,536) | (1,633) | (3.1 | ) |

| Other Income | 366,900 | 374,700 | 2,620 | 5.0 | |

| Effective Gross Income | $7,564,255 | $7,578,167 | $52,994 | 101.9 | % |

| Total Expenses(5) | $793,014 | $1,145,992 | $8,014 | 15.1 | % |

| Net Operating Income | $6,771,241 | $6,432,176 | $44,980 | 84.9 | % |

| Total TI/LC, Capex/RR | 0 | 41,127 | 288 | 0.5 | |

| Net Cash Flow | $6,771,241 | $6,391,049 | $44,693 | 84.3 | % |

| (1) | Historical financials are not available, as the Signum at 375 Dean Property was constructed in 2023. |

| (2) | % column represents percent of Net Rental Income for revenue fields and represents percent of Effective Gross Income for the remainder of fields |

| (3) | Based on the rent roll as of September 30, 2024 and includes both residential and commercial Gross Potential Rent. |

| (4) | Underwritten Vacancy is 3.0% for the residential component and 5.0% commercial component. |

| (5) | Underwritten Total Expenses reflect real estate taxes based on the anticipated 421-a abated amount. |

The Borrower. The borrower is Dean Holdings DE LLC, a Delaware limited liability company and special purpose entity with two independent directors. Legal counsel to the borrower provided a non-consolidation opinion in connection with the origination of Signum at 375 Dean Loan.

The Borrower Sponsor. The borrower sponsors and guarantors are Joseph Brunner, Abraham Mandel and Toby Mandel. Joseph Brunner and Abraham Mandel are the founders of Bruman Realty, a real estate company specializing in multifamily development and ownership in New York. The borrower sponsors have a combined portfolio of over 40 multifamily, mixed-use, retail and office properties, primarily located in Brooklyn and Queens, New York.

Property Management. The Signum at 375 Dean Property is managed by Bruman Realty LLC, an affiliate of the borrower.

Escrows and Reserves. At origination, the borrower was required to deposit into escrow (i) approximately $1,061,067 for real estate taxes, representing six months of unabated real estate taxes, (ii) approximately $95,639 for insurance, and (iii) $126,525 for free rent related to the commercial space.

Tax Escrows – On a monthly basis, the borrower is required to escrow 1/12th of the annual estimated tax payments, which currently equates to approximately $33,151.

Insurance Escrows – On a monthly basis, the borrower is required to escrow 1/12th of the annual estimated insurance payments, which currently equates to $8,000.

Replacement Reserves – On a monthly basis, the borrower is required to escrow approximately $2,478 for replacement reserves ($200 per unit and $0.15 per square foot of commercial space annually).

TI/LC Reserves – On a monthly basis, the borrower is required to escrow approximately $949 for tenant improvements and leasing commissions ($1.50 per square foot of commercial space annually).

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

Unfunded

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

|

| No. 1 – Signum at 375 Dean |

Lockbox / Cash Management. The Signum at 375 Dean Mortgage Loan is structured with an in-place soft lockbox and springing cash management.

Upon the occurrence and during the continuance of a Signum at 375 Dean Trigger Event (as defined below), all funds in the lockbox account are required to be swept daily to a cash management account under the control of the lender to be applied and disbursed in accordance with the Signum at 375 Dean Mortgage Loan documents, and all excess cash flow funds remaining in the cash management account after the application of such funds in accordance with the Signum at 375 Dean Mortgage Loan documents are required to be held by the lender in an excess cash flow reserve account as additional collateral for the Signum at 375 Dean Mortgage Loan. To the extent that no Signum at 375 Dean Trigger Event is continuing, all excess cash flow funds are required to be disbursed to the borrower.

A “Signum at 375 Dean Trigger Event” will commence upon the earliest of the following: (i) the occurrence of an event of default under the Signum at 375 Dean Mortgage Loan documents or (ii) commencing on our after October [ ], 2025, the date on which the debt service coverage ratio is less than 1.05x based on the net cash flow for the trailing 12 months.

A Signum at 375 Dean Trigger Event will end: (a) with regard to clause (i), upon the cure of such event of default and the lender’s acceptance of such cure in its sole and absolute discretion; (b) with regard to clause (ii), upon the debt service coverage ratio based on the trailing 12-month period being at least 1.05x for one calendar quarter.

Subordinate Debt and Mezzanine Debt. None.

Permitted Future Subordinate or Mezzanine Debt. Not permitted.

Partial Release. Not permitted.

Ground Lease. None.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 18 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 19 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 20 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 21 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | BMO, GACC, GSMC | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $60,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $60,000,000 | | Property Type – Subtype: | Mixed Use – Office / Retail |

| % of IPB: | 6.3% | | Net Rentable Area (SF): | 1,085,612 |

| Loan Purpose: | Refinance | | Location: | Atlanta, GA |

| Borrower: | LVA4 Atlanta Colony Square, L.P. | | Year Built / Renovated: | 1972, 1974, 2020, 2021 / 2000 |

| Borrower Sponsors: | North American Ventures LLC and Lionstone U.S. Value-Add Four, L.P. | | Occupancy: | 83.0% |

| Interest Rate: | 7.37500% | | Occupancy Date: | 7/1/2024 |

| Note Date: | 10/2/2024 | | 4th Most Recent NOI (As of): | $16,554,450 (12/31/2021) |

| Maturity Date: | 10/6/2029 | | 3rd Most Recent NOI (As of): | $24,041,323 (12/31/2022) |

| Interest-only Period: | 60 months | | 2nd Most Recent NOI (As of): | $29,712,592 (12/31/2023) |

| Original Term: | 60 months | | Most Recent NOI (As of): | $29,188,955 (TTM 7/31/2024) |

| Original Amortization Term: | None | | UW Economic Occupancy: | 83.3% |

| Amortization Type: | Interest Only | | UW Revenues: | $49,913,938 |

| Call Protection(2): | L(24),DorYM1(29),O(7) | | UW Expenses: | $19,331,831 |

| Lockbox / Cash Management: | Hard / Springing | | UW NOI: | $30,582,107 |

| Additional Debt(1): | Yes | | UW NCF: | $29,266,672 |

| Additional Debt Balance(1): | $200,000,000 | | Appraised Value / Per SF: | $516,000,000 / $475 |

| Additional Debt Type(1): | Pari Passu | | Appraisal Date: | 5/24/2024 |

| | | | | |

| Escrows and Reserves(3) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | | Whole Loan |

| Taxes: | $0 | $375,955 | N/A | | Cut-off Date Loan / SF: | $240 |

| Insurance: | $0 | Springing | N/A | | Maturity Date Loan / SF: | $240 |

| Replacement Reserve: | $0 | $19,152 | N/A | | Cut-off Date LTV: | 50.4% |

| Rollover Reserve: | $4,000,000 | $90,468 | N/A | | Maturity Date LTV: | 50.4% |

| Free Rent Reserve: | $965,127 | $0 | N/A | | UW NCF DSCR: | 1.51x |

| Outstanding TI/LC: | $3,965,065 | $425,000 | N/A | | UW NOI Debt Yield: | 11.8% |

| | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total | |

| Whole Loan | $260,000,000 | 87.3 | % | | Loan Payoff | $281,760,456 | 94.6 | % |

| Equity Contribution | 37,832,154 | 12.7 | | | Upfront Reserves | 8,930,192 | 3.0 | |

| | | | | Closing Costs | 7,141,506 | 2.4 | |

| | | | | | | |

| Total Sources | $297,832,154 | 100.0 | % | | Total Uses | $297,832,154 | 100.0 | % |

| (1) | The Colony Square Mortgage Loan (as defined below) is part of the Colony Square Whole Loan (as defined below), which is comprised of 16 pari passu promissory notes with an aggregate original balance of $260,000,000. The Colony Square Whole Loan was originated by Bank of Montreal (“BMO”), Goldman Sachs Bank USA (“GSBI”) and German American Capital Corporation (“GACC”). For additional information, see “The Loan” below. The information presented under “Financial Information” above is calculated based on the Colony Square Whole Loan. |

| (2) | The lockout period will be at least 24 payment dates beginning with and including the first payment date on November 6, 2024. Defeasance or voluntary prepayment with yield maintenance of the Colony Square Whole Loan in full (but not in part) is permitted at any time following the earlier to occur of (i) November 6, 2028 or (ii) the date that is two years from the closing date of the securitization that includes the last pari passu note to be securitized. The assumed lockout period of 24 payments is based on the expected BMO 2024-5C7 securitization trust closing date in October 2024. The actual lockout period may be longer. |

| (3) | For a full description of Escrows and Reserves, see “Escrows and Reserves” below. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 22 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The Loan. The second largest mortgage loan (the “Colony Square Mortgage Loan”) is part of a whole loan evidenced by 16 pari passu notes that is secured by the borrower’s fee interest in a 1,085,612 square foot mixed-use property in Atlanta, Georgia (the “Colony Square Property”).

The Colony Square Mortgage Loan, which is evidenced by the non-controlling Note A-2, Note A-5, Note A-7 and Note A-12, has an outstanding principal balance as of the Cut-off Date of $60,000,000. The Colony Square Whole Loan was co-originated by Bank of Montreal (“BMO”), Goldman Sachs Bank USA (“GSBI”) and German American Capital Corporation (“GACC”) and has an aggregate outstanding principal balance as of the Cut-off Date of $260,000,000. The Colony Square Whole Loan is interest only for the entire term and accrues interest on an Actual/360 basis.

The Colony Square Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BMO 2024-5C7 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus.

The table below identifies the promissory notes that comprise the Colony Square Whole Loan:

| Whole Loan Summary |

| Note | Original

Balance | Cut-off Date Balance | | Note Holder | Controlling Piece |

| A-1(1) | $45,000,000 | | $45,000,000 | | | BMO | Yes |

| A-2 | $30,000,000 | | $30,000,000 | | | BMO 2024-5C7 | No |

| A-3(1) | $25,000,000 | | $25,000,000 | | | BMO | No |

| A-4(1) | $30,531,915 | | $30,531,915 | | | BMO | No |

| A-5 | $4,468,085 | | $4,468,085 | | | BMO 2024-5C7 | No |

| A-6(1) | $16,667,000 | | $16,667,000 | | | GSBI | No |

| A-7 | $12,765,957 | | $12,765,957 | | | BMO 2024-5C7 | No |

| A-8(1) | $9,259,000 | | $9,259,000 | | | GSBI | No |

| A-9(1) | $5,752,043 | | $5,752,043 | | | GSBI | No |

| A-10(1) | $5,556,000 | | $5,556,000 | | | GSBI | No |

| A-11(1) | $16,667,000 | | $16,667,000 | | | GACC | No |

| A-12 | $12,765,957 | | $12,765,957 | | | BMO 2024-5C7 | No |

| A-13(1) | $9,259,000 | | $9,259,000 | | | GACC | No |

| A-14(1) | $5,752,043 | | $5,752,043 | | | GACC | No |

| A-15(1) | $5,556,000 | | $5,556,000 | | | GACC | No |

| A-16(1) | $25,000,000 | | $25,000,000 | | | Morgan Stanley Mortgage Capital Holdings LLC | No |

| Whole Loan | $260,000,000 | | $260,000,000 | | | | |

| (1) | Expected to be contributed to one or more future securitization trust(s). |

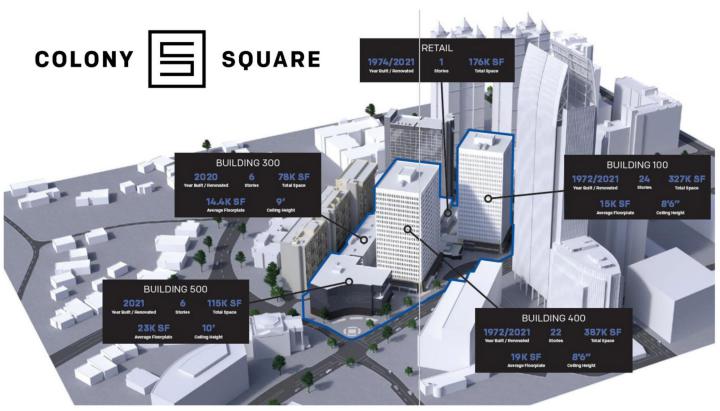

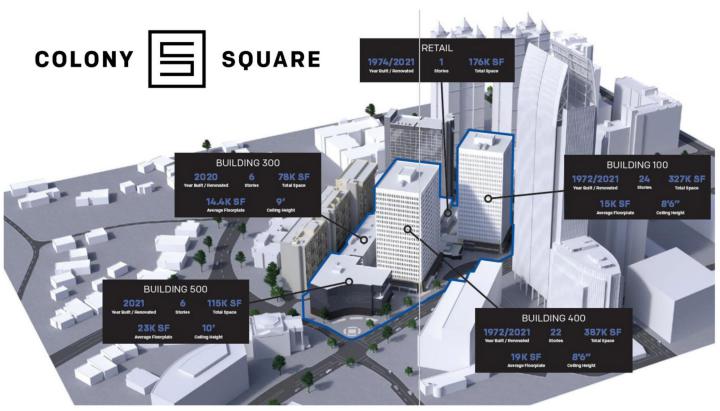

The Property. The Colony Square Property consists of both (i) four Class A office buildings (“Building 100”, “Building 300”, “Building 400” and “Building 500”), (ii) a retail component (the “Retail Component”) and (iii) a parking garage. The Colony Square Property totals 1,085,612 square feet across four buildings, the largest being Building 100 which consists of 329,011 square feet of net rentable area. Building 100 consists of 329,011 square feet (30.3% of NRA and 31.3% of underwritten base rent) including 310,158 square feet of office space, 11,164 square feet of amenity space and 7,689 square feet of storage space. Building 300 consists of 78,100 square feet (7.2% of NRA and 5.8% of underwritten base rent) including 73,200 square feet of office spaces and 4,900 square feet of other spaces. Building 400 consists of 388,411 square feet (35.8% of NRA and 34.1% of underwritten base rent) including 381,034 square feet of office spaces, 7,236 square feet of storage spaces, and 141 square feet of other spaces. Building 500 consists of 121,437 square feet of office spaces (11.2% of NRA and 14.0% of underwritten base rent). The Retail Component consists of 168,653 square feet (15.5% of NRA and 14.9% of underwritten base rent).

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 23 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

| Property Summary(1) |

| Space Type | Total SF | % Total SF | Occupancy | UW Base Rent(2) | % of UW Base Rent(2) | UW Base Rent PSF(2)(3) |

| Office | 885,829 | | 81.6% | | 80.2% | $28,553,290 | | 84.8% | | $40.17 |

| Retail | 155,215 | | 14.3% | | 98.0% | $4,992,868 | | 14.8% | | $32.81 |

| Storage | 15,609 | | 1.4% | | 52.2% | $138,439 | | 0.4% | | $16.99 |

| Amenity/Other | 28,959 | | 2.7% | | 83.1% | $0 | | 0.0% | | $0.00 |

| Total / Wtd. Avg. | 1,085,612 | | 100.0% | | 82.5% | $33,684,597 | | 100.0% | | $37.63 |

| (1) | Based on the underwritten rent roll dated July 1, 2024. |

| (2) | UW Base Rent, UW Base Rent PSF and % of UW Base Rent are inclusive of contractual rent steps through August 2025. |

| (3) | UW Base Rent PSF excludes vacant space and vacant underwritten base rent. |

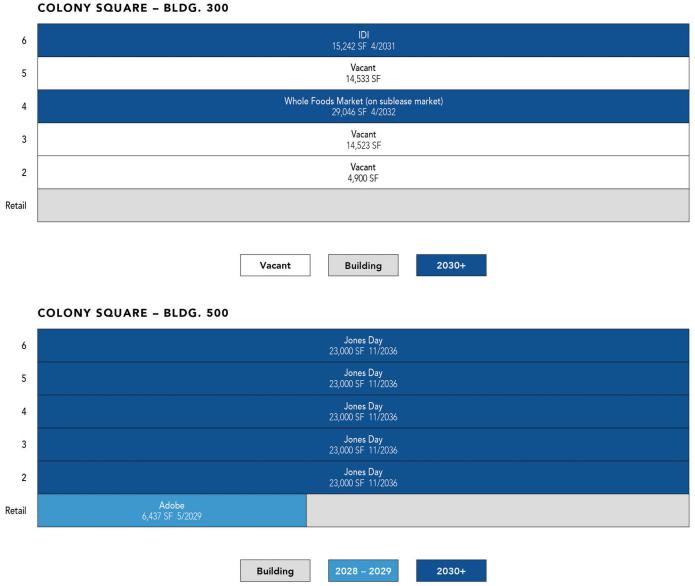

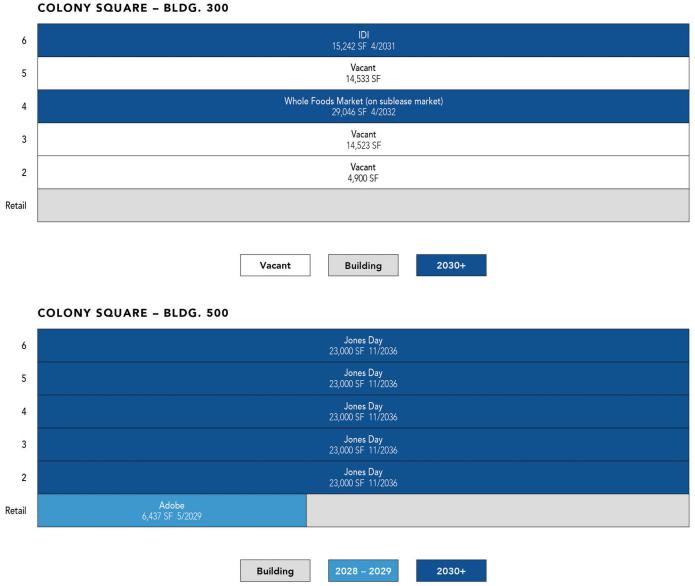

Major Tenants. The largest tenants by underwritten base rent at the Colony Square Property are Jones Day, WeWork and WebMD.

Jones Day (115,000 square feet; 10.6% of Total NRA; 12.9% of underwritten base rent): Jones Day is a global law firm providing legal services to national and multinational corporations. Jones Day provides legal support on complex transactions, high stakes litigation, cyber security, capital markets activities, and many more. The firm employs over 2,400 lawyers in 40 different offices across the world. Jones Day is ranked ninth in law firms based on size, 12th in the Am law 200 ranking, and 15th in the 2024 Global 200 survey. The firm reported approximately $2.7 billion in revenue in 2023 and has worked with clients on over 3,000 transactions that hold a collective value of approximately $1.5 trillion over the past five years. Jones Day’s lease at the Colony Square Property commenced in June 2021, expires on November 30, 2036 and has a contraction option to terminate one floor 120 months (June 2031) after lease commencement date.

WeWork (44,463 square feet; 4.1% of Total NRA; 5.5% of underwritten base rent): Founded in 2010 and headquartered in New York City, WeWork is a provider of shared office and coworking space in 119 cities and 37 countries. WeWork’s private workspace service allows customers to own a private desk, whole office, or an entire floor of private office space. The company’s other coworking services include day to day office rentals, monthly memberships, and additional meeting and event space rentals. WeWork reported approximately $3.2 billion in revenue and $4.8 billion in expenses in 2022. WeWork’s lease at the Colony Square Property commenced in May 2017 and was amended in November 2017 to expand its leased space at the Colony Square Property. WeWork’s lease expires on April 30, 2032 and has two, five-year renewal options and no termination options.

WebMD (42,112 square feet; 3.9% of Total NRA; 5.2% of underwritten base rent): WebMD is an online health information website that provides information on a number of medical conditions, drugs & supplements, overall wellbeing, symptom checking, and medical practitioner location. Beyond their core services, WebMD also creates content such as news, blogs, and podcasts. The company has over 1,800 employees and was bought by private equity firm KKR for $2.8 billion in 2017. WebMD’s lease at the Colony Square Property commenced in August 2010 and is scheduled to expire on March 31, 2028. WebMD has one, five-year renewal option and no termination option.

The following table presents certain information relating to the historical occupancy of the Colony Square Property:

| Historical and Current Occupancy(1) |

| 2022 | 2023 | July 2024 | Current(2) |

| 81.3% | 82.8% | 83.3% | 82.5% |

| (1) | Historical occupancies are as of December 31 of each respective year unless otherwise stated. |

| (2) | Current Occupancy is as of July 1, 2024. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 24 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The following table presents certain information relating to the tenants at the Colony Square Property:

| Tenant Summary(1) |

| Tenant | Tenant Type | Ratings

Moody’s/S&P/Fitch(2) | Net Rentable Area (SF) | % of

Total NRA | UW Base Rent PSF(3) | UW Base Rent(3) | % of Total

UW Base Rent(3) | Lease

Expiration Date |

| Jones Day | Office | NR/NR/NR | 115,000 | | 10.6 | % | $37.73 | $4,338,950 | 12.9% | 11/30/2036 |

| WeWork | Office | NR/NR/NR | 44,463 | | 4.1 | | $41.77 | 1,857,081 | 5.5 | 4/30/2032 |

| WebMD | Office/Storage | NR/NR/NR | 42,112 | | 3.9 | | $41.92 | 1,765,443 | 5.2 | 3/31/2028 |

| SPACES | Office/Retail | NR/NR/NR | 42,273 | | 3.9 | | $37.11 | 1,568,751 | 4.7 | 5/31/2029 |

| iPic Theater | Retail | NR/NR/NR | 38,011 | | 3.5 | | $39.44 | 1,499,154 | 4.5 | 12/31/2040 |

| Whole Foods | Office | NR/NR/NR | 29,046 | | 2.7 | | $41.41 | 1,202,795 | 3.6 | 4/30/2032 |

| CBS Radio East | Office/Storage | Baa2/NR/BBB | 29,688 | | 2.7 | | $35.40 | 1,050,846 | 3.1 | 11/30/2028 |

| Diamond Sports | Office/Storage | NR/NR/NR | 36,883 | | 3.4 | | $28.49 | 1,050,824 | 3.1 | 9/30/2026 |

| Lord, Aeck & Sargent | Office | NR/NR/NR | 30,016 | | 2.8 | | $31.56 | 947,305 | 2.8 | 11/30/2027 |

| Tosca Services | Office | NR/NR/NR | 23,385 | | 2.2 | | $39.42 | 921,741 | 2.7 | 12/31/2027 |

| Office/Retail/Storage Tenants | | | 430,877 | | 39.7 | % | $37.60 | $16,202,890 | 48.1% | |

| Remaining Occupied | | | 464,305 | | 42.8 | | 37.65 | 17,481,707 | 51.9 | |

| Total Occupied | | | 895,182 | | 82.5 | % | $37.63 | $33,684,597 | 100.0% | |

| Vacant Space | | | 190,430 | | 17.5 | | | | | |

| Collateral Total | | | 1,085,612 | | 100.0 | % | | | | |

| | | | | | | | | |

| (1) | Based on the underwritten rent roll dated July 1, 2024, with contractual rent steps through August 2025. |

| (2) | In certain instances, ratings provided are those of the parent company of the entity shown, whether or not the parent company guarantees the lease. |

| (3) | UW Base Rent, UW Base Rent PSF and % of Total UW Base Rent are inclusive of contractual rent steps underwritten through June 2025. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 25 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The following table presents certain information relating to the tenant lease expirations at the Colony Square Property:

| Lease Rollover Schedule(1)(2)(3) |

| Year | Number of Leases Expiring | Net Rentable Area Expiring | % of NRA Expiring | UW Base Rent Expiring(4) | % of UW Base Rent Expiring(4) | Cumulative Net Rentable Area Expiring | Cumulative % of NRA Expiring | Cumulative UW Base Rent Expiring(4) | Cumulative % of UW Base Rent Expiring(4) |

| MTM(5) | 10 | 13,704 | 1.3 | % | $22,466 | 0.1 | % | 13,704 | 1.3% | $22,466 | 0.1% | |

| 2024 | 4 | 4,224 | 0.4 | | 44,768 | 0.1 | | 17,928 | 1.7% | $67,234 | 0.2% | |

| 2025 | 17 | 70,888 | 6.5 | | 2,386,574 | 7.1 | | 88,816 | 8.2% | $2,453,808 | 7.3% | |

| 2026 | 18 | 96,572 | 8.9 | | 3,015,645 | 9.0 | | 185,388 | 17.1% | $5,469,453 | 16.2% | |

| 2027 | 20 | 107,574 | 9.9 | | 4,262,340 | 12.7 | | 292,962 | 27.0% | $9,731,794 | 28.9% | |

| 2028 | 27 | 124,858 | 11.5 | | 5,249,578 | 15.6 | | 417,820 | 38.5% | $14,981,372 | 44.5% | |

| 2029 | 21 | 104,577 | 9.6 | | 4,485,385 | 13.3 | | 522,397 | 48.1% | $19,466,757 | 57.8% | |

| 2030 | 10 | 32,823 | 3.0 | | 1,528,896 | 4.5 | | 555,220 | 51.1% | $20,995,653 | 62.3% | |

| 2031 | 11 | 61,332 | 5.6 | | 1,809,607 | 5.4 | | 616,552 | 56.8% | $22,805,261 | 67.7% | |

| 2032 | 8 | 79,551 | 7.3 | | 3,333,631 | 9.9 | | 696,103 | 64.1% | $26,138,891 | 77.6% | |

| 2033 | 1 | 2,980 | 0.3 | | 92,082 | 0.3 | | 699,083 | 64.4% | $26,230,973 | 77.9% | |

| 2034 | 4 | 12,017 | 1.1 | | 515,289 | 1.5 | | 711,100 | 65.5% | $26,746,262 | 79.4% | |

| 2035 & Beyond | 7 | 184,082 | 17.0 | | 6,938,335 | 20.6 | | 895,182 | 82.5% | $33,684,597 | 100.0% | |

| Vacant | NAP | 190,430 | 17.5 | | NAP | NAP | | 1,085,612 | 100.0% | NAP | NAP | |

| Total / Wtd. Avg. | 158(6) | 1,085,612 | 100.0 | % | $33,684,597 | 100.0 | % | | | | |

| (1) | Based on the underwritten rent roll dated July 1, 2024. |

| (2) | Lease Rollover Schedule is based on the lease expiration dates of all direct leases in place. Certain tenants have more than one lease. |

| (3) | Certain tenants may have termination or contraction options (which may become exercisable prior to the originally stated expiration date of the tenant lease) that are not considered in the above Lease Rollover Schedule. |

| (4) | UW Base Rent Expiring, % of UW Base Rent Expiring, Cumulative UW Base Rent Expiring and Cumulative % of UW Base Rent Expiring are inclusive of contractual rent steps underwritten through August 2025. |

| (5) | MTM includes leases that are considered amenities, management office, and four storage spaces that are dependable on other tenant leases. |

| (6) | The number of expiring leases includes office, retail, storage and mixed-use tenants. |

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 26 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The following table presents certain information relating to the operating history and underwritten net cash flow of the Colony Square Property:

| Operating History and Underwritten Net Cash Flow(1) |

| | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Underwritten | Per Square Foot | %(2) |

| Base Rent | $18,260,518 | $19,784,299 | $23,062,339 | $28,545,982 | $31,820,621 | $31,929,941 | $32,794,612 | | $30.21 | | 72.4 | % |

| Rent Steps | 0 | 0 | 0 | 0 | 0 | 0 | 889,985 | | 0.82 | | 2.0 | |

| Vacancy Lease-Up | 0 | 0 | 0 | 0 | 0 | 0 | 7,564,548 | | 6.97 | | 16.7 | |

| Total Base Rent | $18,260,518 | $19,784,299 | $23,062,339 | $28,545,982 | $31,820,621 | $31,929,941 | $41,249,145 | | $38.00 | | 91.1 | % |

| Total Reimbursements | 1,003,124 | 654,243 | 1,078,643 | 3,819,783 | 4,002,407 | 4,014,008 | 4,030,272 | | 3.71 | | 8.9 | |

| Gross Potential Rent | $19,263,642 | $20,438,542 | $24,140,982 | $32,365,766 | $35,823,028 | $35,943,949 | $45,279,418 | | $41.71 | | 100.0 | % |

| Other Income(3) | 5,007,108 | 3,069,143 | 6,423,279 | 9,868,036 | 11,866,796 | 11,751,442 | 12,199,068 | | 11.24 | | 26.9 | |

| (Vacancy/Credit Loss/Abatements) | 0 | 0 | 0 | 0 | 0 | 0 | (7,564,548) | | (6.97) | | (16.7 | ) |

| Effective Gross Income | $24,270,750 | $23,507,685 | $30,564,261 | $42,233,801 | $47,689,824 | $47,695,391 | $49,913,938 | | $45.98 | | 100.0 | % |

| Total Expenses(4) | 13,662,908 | 11,280,709 | 14,009,811 | 18,192,479 | 17,977,232 | 18,506,436 | 19,331,831 | | 17.81 | | 38.7 | |

| Net Operating Income | $10,607,842 | $12,226,976 | $16,554,450 | $24,041,323 | $29,712,592 | $29,188,955 | $30,582,107 | | $28.17 | | 61.3 | % |

| Capital Expenditures | 0 | 0 | 0 | 0 | 0 | 0 | 229,823 | | 0.21 | | 0.5 | |

| TI/LC | 0 | 0 | 0 | 0 | 0 | 0 | 1,085,612 | | 1.00 | | 2.2 | |

| Net Cash Flow | $10,607,842 | $12,226,976 | $16,554,450 | $24,041,323 | $29,712,592 | $29,188,955 | $29,266,672 | | $26.96 | | 58.6 | % |

| (1) | Based on the underwritten rent roll dated July 1, 2024, with contractual rent steps through August 2025. |

| (2) | % column represents percent of Gross Potential Rent for revenue lines and percent of Effective Gross Income for all remaining fields. |

| (3) | Other Income is based on the borrower’s 2024 budget and is comprised of percentage rent, parking, direct billing, administrative fees, roof and telecom, late fees and deposit fees bad debt, and miscellaneous income. |

| (4) | Total Expenses includes management fees, real estate taxes, insurance, common area maintenance, repairs and maintenance, utilities, payroll, general and administrative, security, elevators and escalators, parking expenses, marketing and direct bill expenses. |

Environmental. According to the Phase I environmental assessment dated June 5, 2024, there was no evidence of any recognized environmental conditions at the Colony Square Property.

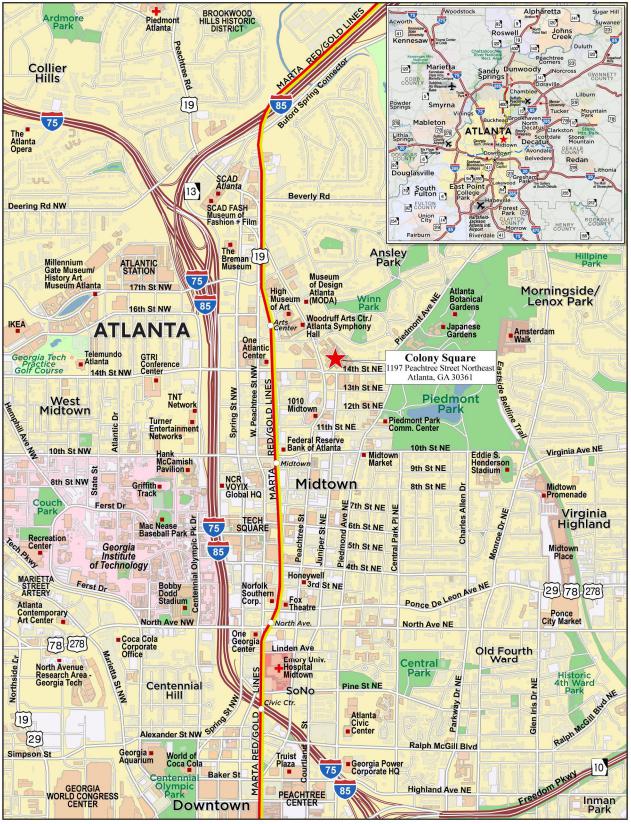

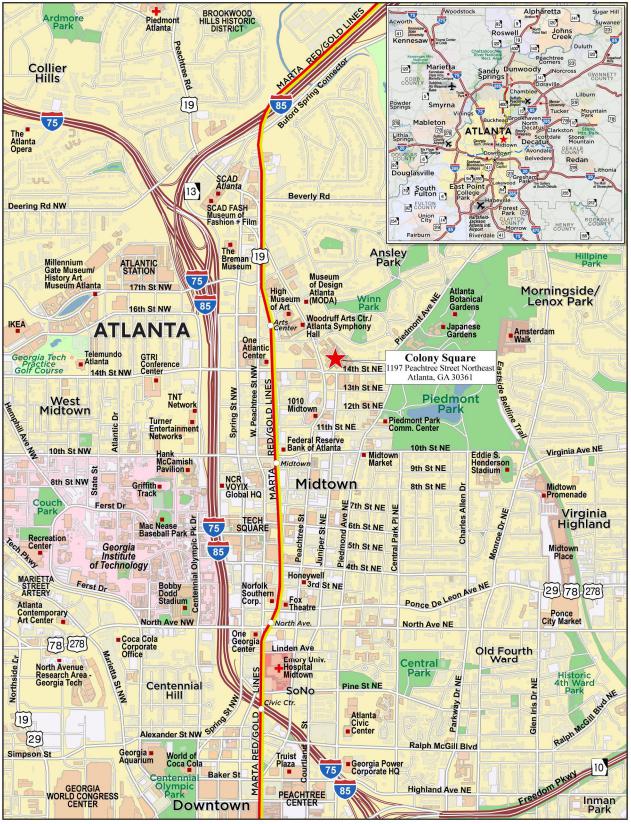

The Market. The Colony Square Property is located in Atlanta, Georgia. According to the appraisal, the Atlanta metropolitan statistical area (“MSA”) has an estimated 2023 population of 6,313,755 which is an average annual 1.2% increase over the 2020 census. Additionally, the current estimated employment in the Atlanta MSA is 3,054,867 jobs which is a 22.0% increase over the past 10 years. Atlanta has the 10th strongest GDP out of all metropolitan area economies in the nation. According to the appraisal, the 2023 total population within a 1-, 3- and 5-mile radii of the Colony Square Property was 34,855, 202,261 and 422,620, respectively, and the 2023 median household income within the same radii was $113,273, $96,372 and $92,474, respectively.

According to the appraisal, the Colony Square Property is located in the Midtown/Brookwood retail submarket. According to the appraisal, this submarket is ranked 27th in inventory in the metro area with 6,904,227 SF, and has an asking rent of $35.96/SF, which is 71.5% greater than the metro area average of $20.97/SF. The Midtown/Brookwood retail submarket also holds a low vacancy rate of 2.3%

According to the appraisal, the Colony Square Property is also located in the Midtown/Pershing Point office submarket. According to the appraisal, the Midtown/Pershing Point office submarket had an inventory of 31.4 million square feet with a 21.4% vacancy rate. The average asking rent is $42.12 per square foot, which is 73.3% greater than the metro area average of $24.30 per square foot.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 27 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The following table presents certain information relating to comparable retail leases for the Colony Square Property:

| Comparable Retail Rental Summary(1) |

| Property / Location | Year Built / Renovated | Gross Building Area (SF) | Tenant Size (SF) | Tenant Name | Base Rent PSF | Commencement | Lease Term (Months) |

Colony Square

Atlanta, GA | 1972, 1974, 2020, 2021 / 2000 | 1,085,612(2) | 3,535(2)(3) | Chic-Fil-A | $32.28(2) | May-19(2) | 143(2) |

|

2274 Peachtree Road Northwest Atlanta, GA | NAV | NAV | 1,553 | Pulse Performance | $35.00 | Apr-24 | 60.0 |

|

3050 Peachtree Road Northeast Atlanta, GA | NAV | NAV | 2,672 | Ideal Image | $37.00 | Dec-23 | 60.0 |

|

4330 Peachtree Road Northeast Brookhaven, GA | NAV | NAV | 2,825 | MHBV Salon | $36.50 | Aug-24 | 120.0 |

|

2860 Cumberland Mall Atlanta, GA | NAV | NAV | 3,003 | Superior | $45.32 | Oct-23 | 48.0 |

|

2955 Cobb Parkway Southeast Atlanta, GA | NAV | NAV | 4,000 | Mattress Firm | $49.00 | Oct-23 | 120.0 |

|

4330 Peachtree Road Atlanta, GA | NAV | NAV | 2,087 | Tobbany | $33.00 | Sep-24 | 60.0 |

|

2300 Peachtree Road Northwest Atlanta, GA | NAV | NAV | 3,382 | Fete Atlanta | $40.00 | Nov-23 | 60.0 |

|

| | (1) | Information obtained from the appraisal unless otherwise indicated. |

| (2) | Based on the underwritten rent roll dated July 1, 2024. Base Rent PSF includes contractual rent steps through August 2025. |

| (3) | Excluding 150 square feet of Chick-Fil-A’s storage space. |

The following table presents certain information relating to comparable office leases for the Colony Square Property:

| Comparable Office Rental Summary(1) |

| Property Address/Location | Year Built / Renovated | Gross Building Area (SF) | Tenant Size (SF) | Tenant Name | Base Rent PSF | Commencement | Lease Term (Months) |

Colony Square Atlanta, GA | 1972, 1974, 2020, 2021 / 2000 | 1,085,612(2) | 115.000(2) | Jones Day | $37.73(2) | Jun-21(2) | 186(2) |

One Atlantic Center Atlanta, GA | 1987 / NAP | 1,101,022 | 8,000 | Duff & Phelps | $45.00 | Sep-24 | 120 |

Atlantic Station Atlanta, GA | 2007 / NAP | 390,276 | 4,392 | N/A | $45.00 | Dec-23 | 36 |

Atlantic Station Atlanta, GA | 2007 / NAP | 390,276 | 7,023 | Tractian | $44.00 | Nov-23 | 42 |

Ponce City Market Atlanta, GA | 2014 / NAP | 685,773 | 196,355 | MailChimp | $55.00 | Oct-23 | 6 |

| (1) | Information obtained from the appraisal unless otherwise indicated. |

| (2) | Based on the underwritten rent roll dated July 1, 2024. Base Rent PSF includes contractual rent steps through August 2025. |

The Borrower. The borrower is LVA4 Atlanta Colony Square, L.P., a Delaware limited partnership structured as a single purpose, bankruptcy-remote entity, with its general partner structured as a single purpose, bankruptcy-remote Delaware single member limited liability company with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Colony Square Whole Loan.

| THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 28 | |

| Structural and Collateral Term Sheet | | BMO 2024-5C7 |

| No. 2 – Colony Square |

The Borrower Sponsors. The borrower sponsors and non-recourse carveout guarantors are North American Ventures LLC and Lionstone U.S. Value-Add Four, L.P.

Property Management. The Colony Square Property is managed by North American Properties-Atlanta, LTD., a property management company affiliated with North American Ventures LLC.

Escrows and Reserves. At origination of the Colony Square Whole Loan, the borrower deposited $4,000,000 for a rollover reserve fund, approximately $3,965,065 for outstanding landlord obligations and approximately $965,127 for free rent reserves.

Tax Escrows – On a monthly basis, the borrower is required to escrow 1/12th of the estimated annual real estate tax payments (initially estimated to be approximately $375,955).

Insurance Escrows – On a monthly basis, the borrower is required to escrow 1/12th of the annual estimated insurance payments. Such reserve has been conditionally waived so long as the borrower maintains a blanket policy meeting the requirements of the Colony Square Whole Loan documents and the borrower provides evidence of the renewal of any insurance policy prior to the expiration thereof and receipts for the payment of the applicable premiums.

Replacement Reserve – On a monthly basis, the borrower is required to escrow approximately $19,152 for the payment or reimbursement of approved capital expenses.

Rollover Reserve – On a monthly basis, the borrower is required to escrow (a) approximately $90,468 for approved leasing expenses and (b) $425,000 tenant improvement and leasing commission obligations incurred following the origination date (the “Additional Rollover Reserve”). Such monthly deposits in the Additional Rollover Reserve will not be required during such time that the balance of the Additional Rollover Reserve exceeds $5,100,000 (the “Additional Rollover Reserve Required Amount”).

Free Rent Reserve – Provided that no event of default exists, on each monthly payment date, the free rent funds deposited for each applicable lease will be disbursed in the amounts equal to the applicable monthly rent credits or free rent amounts set forth in the Colony Square Whole Loan documents.

Lockbox / Cash Management. The Colony Square Whole Loan is structured with a hard lockbox and springing cash management. The borrower was required to deliver tenant direction letters to the existing tenants at the Colony Square Property, directing them to remit their rent directly to the lender-controlled lockbox. The borrower is required to cause revenue received by the borrower or the property manager, as applicable, from the Colony Square Property to be deposited into such lockbox within two business days. During the continuance of a Trigger Period (as defined below), provided no event of default is then continuing, all funds in the lockbox account are required to be swept each business day into the lender-controlled cash management account and applied and disbursed in accordance with the Colony Square Whole Loan documents.