In certain circumstances, due to separate evaluations of creditworthiness by lenders or facility providers, a Portfolio Company or other Fund subsidiary is expected to bear higher rates under a borrowing facility than are borne by the Fund, resulting in a potential net benefit to the Fund, or additional potential liquidity constraints or other burdens on the relevant Portfolio Company or Fund subsidiary.

In other circumstances, lenders and other market participants are expected to seek “cross default” rights under which the Fund will be treated as in default under the relevant facility in the event of a default by another Vista PE Fund or a Vista affiliate relating to their respective lending or other facilities; if any such provision were to be triggered, the Unitholders could suffer adverse effects resulting from any default by any other Vista PE Fund or a Vista affiliate, whether or not related to the Fund in which such Unitholders have invested.

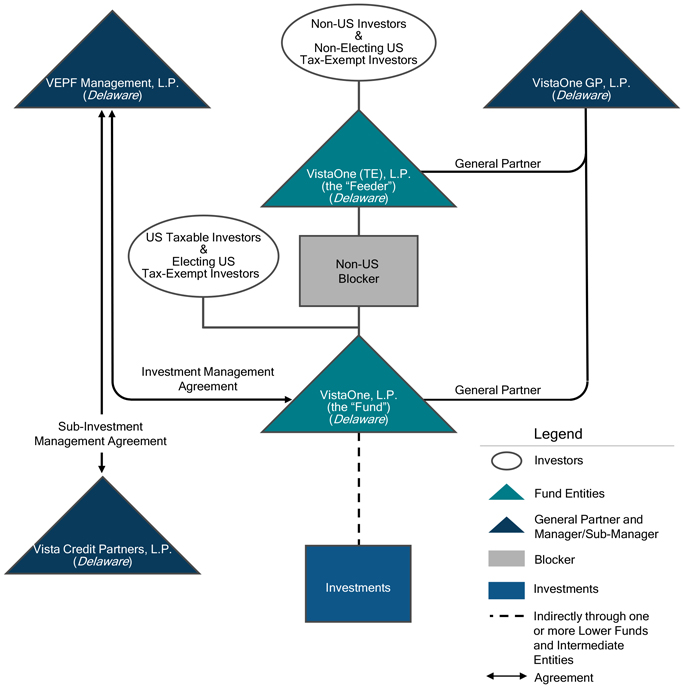

Tax-exempt Unitholders should note that the use of leverage by the Fund may create UBTI to Unitholders. Such investors should refer to the discussion of “—Risks Related to Taxation—UBTI & ECI; Tax Treatment of Corporations” in “Item 1(c). Business—Regulatory, Tax and ERISA Considerations” and should consider an investment in the Feeder.

Cross-Guarantees and Cross-Collateralization. In certain circumstances the Fund and its Portfolio Companies can be expected to enter into cross-collateralization or any cross-guarantee or similar arrangements (including with respect to Asset Pools (as defined below)) with other Vista Entities (including co-investment vehicles) and their portfolio companies, particularly in circumstances in which better financing terms are available through such arrangements. Also, it is expected that cross-collateralization will generally occur at the level of the portfolio companies rather than the Fund for obligations that are non-recourse to the Fund except in limited circumstances such as “bad boy” events. Any cross-collateralization arrangements with other Vista Entities could result in the Fund losing its interests in otherwise performing Investments (or other Vista Entities) due to poorly performing or non-performing investments of other Vista Entities in the collateral pool or such persons otherwise defaulting on their obligations under the terms of such arrangements (and for the avoidance of doubt, the Fund’s obligations under such cross-collateralization arrangements are expected to apply to investments in which the Fund has not participated). The Fund can, in certain circumstances, be exposed to risks associated with borrowings or other indebtedness of other Vista Entities when such other entities are not in turn exposed to risks associated with the Fund’s borrowing for a similar purpose if, for example, such other entities or the partners thereof are excused from cross-collateralizing certain partnership expenses, management fees or other obligations of the Fund and other Vista Entities.

Similarly, a lender could require that it lend to only one portfolio company of the Fund and other Vista Entities, even though multiple portfolio companies of the Fund and other Vista Entities benefit from the lending, which will typically result in (i) the portfolio company facing the lender being solely liable with respect to the entire obligation, and therefore being required to contribute amounts in respect of the shortfall attributable to other portfolio companies, and (ii) portfolio companies of the Fund and other Vista Entities being jointly and severally liable for the full amount of the obligation, liable on a cross-collateralized basis or liable for an equity cushion (which cushion amount may vary depending upon the type of financing or refinancing (e.g., cushions for re-financings may be smaller)). The portfolio companies of the Fund and other Vista Entities benefiting from a financing can be expected to enter into a back-to-back or other similar reimbursement agreement whereby each agrees that no portfolio company shall bear more than its pro rata portion of the debt and related obligations. It is not expected that the portfolio companies would be compensated (or provide compensation to other portfolio companies) for being primarily liable, or jointly liable, for other portfolio companies’ pro rata share of any financing.

Preferred Financing; Margin Loans. In addition to secured financing arrangements, the Fund could employ preferred financing arrangements or margin loans with respect to some or all of the Fund’s Investments. In such arrangements, a third party typically provides cash liquidity in exchange for the right to receive a return of such amount plus a preferred return thereon prior to the return of any additional proceeds to us. Subject to the Fund LPA, such arrangements could be employed to provide for additional capital for new or follow-on investments by the Fund and will not be treated as borrowings incurred by the Fund for purposes of determining the Fund’s adherence to the 30% target. These arrangements could result in the Fund receiving a lower overall return of distributions than the Fund would otherwise have received if, for example, an Investment is held for a long period of time, resulting in a compounding preferred return in favor of the third party financing provider, or where the proceeds of the financing are reinvested in Investments that do not perform as well as the original Investment(s) that were subject to the financing arrangement. In addition, in the event of a margin call, the Fund will be obligated to contribute additional capital in connection with the investment in order to avoid a default on the margin loan. Furthermore, to the extent a margin loan is entered into on behalf of both the Fund and a co-investment vehicle on a cross-collateralized basis, in the event of a margin call, the Fund and such co-investment vehicle will both be obligated to contribute additional capital in connection with the investment in order to avoid a default on the margin loan. Because co-investment vehicles frequently have limited or no remaining unpaid capital commitments, co-investors may have an option (but not an obligation) to increase their capital commitment to fund their share of such margin call, and in the event that one or more co-investors decline to do so, the Fund is expected to be liable for such amounts. Because margin calls are most likely to occur at times when the underlying investment has declined in value, the likelihood that co-investors elect not to fund their share of such margin call is greater than in the case of ordinary course follow-on investments, and the Fund’s exposure to further decreases in value of the related investment may be higher as a result. Similar risks and potential adverse results will be present where the Fund co-invests alongside other Vista Entities and the relevant Portfolio Company requires additional capital, and such other Vista Entities have insufficient capital to participate in a follow-on investment, or an option on whether to participate.

The use of margin borrowings results in certain additional risks to the Fund. For example, such margin financing arrangements secured by a pledge of equity of a Portfolio Company are not necessarily treated as borrowings incurred by the Fund to the extent not recourse to the Fund for purposes of determining the Fund’s adherence to the 30% leverage ratio target set forth in this Registration Statement. For example, should the securities pledged to brokers to secure the Fund’s margin accounts decline in value, the Fund could be subject to a “margin call,” pursuant to which the Fund must either deposit additional funds or securities with the broker, or suffer mandatory liquidation of the pledged securities to compensate for the decline in value. In the event of a sudden drop in the value of the Fund’s assets, the Fund might not be able to liquidate assets quickly enough to satisfy its margin requirements.

The Fund may be subject to margin calls in connection with its derivative transactions that are subject to variation margin requirements. The dynamic nature of the margin models utilized by the clearinghouses and the fact that the margin models might be changed at any time could subject the Fund to an unexpected increase in collateral obligations to clearinghouses during a volatile market environment, which could have a detrimental effect on the Fund. Clearinghouses may also limit collateral that they will accept to cash, U.S. treasuries and, in some cases, other highly rated sovereign and private debt instruments, which in certain circumstances would require the Fund to borrow eligible securities from a dealer to meet margin calls and would raise the Fund’s costs of cleared trades.

Leverage Limit Risk. There is no guarantee that the relevant leverage ratio will remain equal to or below 30%. Investors should be aware that where the Fund makes an Investment and utilizes leverage at the time of acquisition, in the event that the value of the Investment decreases from the purchase price, the relevant leverage ratio may increase and, where such leverage ratio has increased above the relevant leverage target in such circumstances, the Fund will not be required to undertake remedial action to reduce such leverage ratio below the applicable leverage target. In circumstances where the relevant leverage ratio exceeds the relevant leverage target, the Fund’s ability to secure further financing in respect of its future or existing Investments may be reduced and this may have an adverse effect on the returns of the Fund.

Securitizations; Back Leverage; Holding Vehicles. To finance investments or otherwise manage the Fund’s capital needs, the Fund may securitize or otherwise restructure or repackage some or all of its Investments and/or other assets on an individual or cross-collateralized basis with other Investments and/or assets held by the Fund and/or other Vista Entities (and the General Partner and/or Manager may otherwise structure or package some or all Investments and/or assets held by other Vista Entities in holdings vehicles as described herein, unrelated to any financing arrangements, but which will nevertheless give rise to similar risks). This would typically involve the Fund creating one or more investment or holding vehicles, contributing assets to such vehicle or a related entity, and issuing debt or preferred equity interests in such entity or having such entity make borrowings or incur other indebtedness or engaging in such transactions with existing investment or holding vehicles. To the extent such financing arrangements are entered into by any such vehicle or entity (and not the Fund itself), such financing arrangements will not be subject to the limits on borrowings or other indebtedness (or any limits on issuing additional interests) by the Fund that are set forth in this Registration Statement. In connection with the foregoing, distributions from Investments may be used to pay interest and/or principal (or the equivalent amounts regarding preferred securities) or other obligations.

If the Fund were to utilize one or more investment vehicles for any such purpose, the Unitholders would be exposed to risks associated with the Fund’s interest in Investments and/or other assets contributed to such vehicles. For example, in the event that the value of an investment were to meaningfully deteriorate, there could be a margin call on the Fund’s facility, in response to the decrease in the collateral value. A decline in the value of such investment could also result in increased costs of borrowing for the Fund as a whole. Unitholders may also have an interest in certain investments that are disproportionate to their exposure to leverage through cross-collateralization on other investments. Similar circumstances could arise in a situation where the Fund and a co-invest vehicle participate in borrowings that experience a margin call, and the co-invest vehicle’s investors already have funded their full commitments to such vehicle and accordingly have the option (and not the obligation) to fund additional amounts or otherwise be diluted by the Fund and/or other Vista Entities. In addition, if the Fund is excused or excluded from or otherwise does not participate in an investment, through cross-collateralization, the Fund may nevertheless be indirectly exposed to risks associated with leverage on investments made by other Vista Entities in which the Fund is not invested and distributions from unrelated investments may be used to satisfy obligations with respect to such investment, in which case the Unitholders may receive such proceeds later than they otherwise would have, in a reduced amount, or not at all. The Unitholders and/or the Fund could also have an interest in certain Investments that are disproportionate to their exposure to leverage through cross-collateralization on other Investments. In addition, the Fund would depend on distributions from an investment vehicle’s assets out of its earnings and cash flows to enable the Fund to make distributions to Unitholders (in the event any are made). The ability of such an investment vehicle to make distributions will be subject to various limitations, including the terms and covenants of the debt/preferred equity it incurs. For example, tests (based on interest coverage or other financial ratios or other criteria) may restrict the Fund’s ability, as the holder of an investment vehicle’s common equity interests, to receive cash flow from these investments. There is no assurance any such performance tests will be satisfied. Also, an investment vehicle could take actions that delay distributions in order to preserve ratings and to keep the cost of present and future financings lower or be required to prepay all or a portion of its cash flows to pay outstanding obligations to credit parties. As a result, there could be a lag, which could be significant, between the repayment or other realization from, and the distribution of cash out of, such an investment vehicle, or cash flow may be completely restricted for the life of the relevant investment vehicle. To the extent any such investment vehicle defaults in its obligations to any credit parties, such credit parties may be entitled to foreclose on any collateral pledged by the applicable investment vehicle(s) and/or otherwise exercise rights and remedies as a creditor against the assets of any such investment vehicle(s), which could result in a loss of all or a part of the Fund’s interest in any applicable investment and/or distributions therefrom.

The Fund expects that the terms of the financing that any investment vehicles enter into will generally provide that the principal amount of assets must exceed the principal balance or market value of the related debt/preferred equity by a certain amount, commonly referred to as “over-collateralization.” The Fund anticipates that the financing terms could provide that, if certain delinquencies and/or losses exceed specified levels, the required level of over-collateralization may be increased or may be prevented from decreasing as would otherwise be permitted if losses or delinquencies did not exceed those levels. Failure to obtain favorable terms with regard to over-collateralization could materially and adversely affect the liquidity of the Fund. If assets held by such investment vehicles fail to perform as anticipated, their over-collateralization or other credit enhancement expenses may increase, resulting in a reduction in income and cash flow to the Fund from these investment vehicles.

In addition, a decline in the quality of assets in an investment vehicle due to poor operating results of the relevant issuer or declines in the value of collateral (whether due to poor operating results or economic conditions), among other things, may force an investment vehicle to sell certain assets at a loss, reducing its earnings and, in turn, cash, potentially available for distribution to the Fund for distribution to the Unitholders, or in certain cases a margin call or mandatory prepayment may be triggered by such perceived decrease in value which may require a large amount of funding on short notice.

The equity interests that the Fund will hold in such an investment vehicle will not be secured by the assets of the investment vehicle, and the Fund will rank behind all known or unknown creditors and other stakeholders, whether secured or unsecured, of the investment vehicle. To the extent that any losses are incurred by the investment vehicle in respect of any collateral, such losses will be borne first by the Fund as owner of common equity interests.

Asset Pooling. The Fund may pool certain or all Investments with one or more Vista Entities (any such pool, an “Asset Pool”), including for the purposes of obtaining leverage or other financing, or seeking a full or partial exit from one or more Investments including through securitization. In such circumstances an Asset Pool may be managed or controlled by the General Partner or any of its affiliates (or other Vista Entities) and securities or other interests in the Asset Pool will be owned by the Fund and other Vista Entities. The consummation of any such transaction will generally not require the consent of the Board of Directors and will involve the exercise of the General Partner’s and its affiliates’ discretion with respect to a number of material matters, which may give rise to actual or potential conflicts. For example, in connection with such transactions, the General Partner and its affiliates will have broad discretion to determine (i) whether and to what extent such a transaction constitutes a disposition of the contributed assets for any purposes, (ii) the proportionate interest of the Fund and the other Vista Entities in the Asset Pool (or particular classes or tranches of securities or others interests in the Asset Pool), which will require the General Partner and its affiliates to determine the relative value of assets contributed to the Asset Pool and value of securities or interests (or particular classes or tranches thereof) issued by the Asset Pool and (iii) how interests in or proceeds from the Asset Pool are attributed to Unitholders or the Fund, each of which may have a material impact on Unitholders’ returns in respect of such investments or the Fund more generally. In making these determinations the General Partner and its affiliates may, but are not required to, engage or seek the advice of any third-party independent expert. However, even if such advice was sought, valuing such assets and interests and, therefore, the value of the Fund’s interest in, or proceeds received from, any Asset Pool, will be subjective. The Fund will generally be exposed to the performance of all assets in an Asset Pool and those investments contributed to the Asset Pool by the other Vista Entities may not perform as well as those investments contributed by the Fund. Accordingly, the returns of the Fund in respect of investments contributed by it may be lower than if they had not been contributed to the Asset Pool. The receipt, use and recontribution by such Asset Pools of any such proceeds shall not be considered distributions received by, or contributions made by, the Fund or the Unitholders for any purposes (including, for example, that such proceeds will not be subject to the Performance Participation Allocation, the Hurdle Amount or the High Water Mark and will not be subject to the requirements described in this Registration Statement with respect to the timing of distribution of proceeds) and may result in higher or lower reported returns than if such proceeds had otherwise been distributed (or deemed distributed) to the Fund or the Unitholders.

Benchmark Rates. To the extent that (i) the Fund’s investments (whether made, acquired or otherwise) and/or (ii) the Fund’s and/or its affiliates’ credit arrangements or facilities, hedging activities, derivative-or other structures, in each case, are subject to, utilize or otherwise reference, whether directly or indirectly, a variable interest rate that is based on (or calculated with reference to) benchmark or reference rates, including the Euro Interbank Offered Rate, the Secured Overnight Financing Rate, the Sterling Overnight Index Average, or any other reference rate, benchmark or index, including in each case, any permutations thereof and any credit spread adjustments thereto (collectively, the “Benchmark Rates”), the Fund may be subject to certain material risks, including the risk that a Benchmark Rate is terminated, ceases to be published or otherwise ceases to be broadly used by the market. Regulators, central banks, governments and other market participants have transitioned historical instruments and contracts away from the London Interbank Offered Rate to new Benchmark Rates. This transition includes the potential to: increase volatility or illiquidity in markets; cause delays in or reductions to financing options for the Funds and their Portfolio Companies; increase the cost of borrowing; reduce the value of certain instruments or the effectiveness of certain hedges; cause uncertainty under applicable legal documentation; or otherwise impose costs and administrative burdens relating to factors that include document amendments and changes in systems. Future transitions to and from Benchmark Rates have the potential to have similar effects.

While Vista has prior experience in investing during the period of Benchmark Rate transition, there can be no assurance that Vista will be able to manage the Fund’s business or performance in a profitable manner after future transition.

Bridge Financings. The Fund will, from time to time, provide interim financing, including in connection with any co-investment opportunities allocated to third-party co-investors in order to facilitate a Portfolio Company investment, to Portfolio Companies on a short-term, unsecured basis in anticipation of a future issuance of equity or long-term debt securities or other refinancing or syndication. Such bridge loans would typically be convertible into a more permanent, long-term security; however, for reasons not always within the Fund’s control, such long-term securities may not be issued or such co-investment may not occur, and such bridge loans may remain outstanding. In such event, the interest rate on such loans or the terms of such interim investments may not adequately reflect the risk associated with the unsecured position taken by the Fund.

Assumption of Contingent Liabilities. In connection with an investment, the Fund reserves the right to assume, or acquire a Portfolio Company subject to, contingent liabilities. These liabilities may be material and may include liabilities associated with pending litigation, regulatory investigations, environmental actions, or payment of indebtedness among other things. To the extent that these liabilities are realized or the Fund is unable to negotiate or collect on any indemnification relating thereto, they may materially adversely affect the value of a Portfolio Company. In addition, if the Fund has assumed or guaranteed these liabilities, the obligation would be payable from the assets of the Fund.

54