The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 8, 2025

PRELIMINARY PROSPECTUS

$710,600,000 Recovery Bonds, Series 2025-A

New York State Electric & Gas Corporation

Sponsor, Depositor and Initial Servicer

Central Index Key Number: 0000071675

NYSEG Storm Funding, LLC

Issuing Entity

Central Index Key Number: 0002046062

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tranche | | Expected Weighted

Average Life (Years) | | | Principal

Amount

Offered | | | Scheduled

Final

Payment Date | | | Final Maturity

Date | | | Interest Rate | | | Initial Price to

Public (1) | | | Underwriting

Discounts and

Commissions | | | Proceeds to Issuing

Entity (Before

Expenses) | |

A-1 | | | | | | $ | 225,000,000 | | | | | | | | | | | | | | | | | | | | | | | | | |

A-2 | | | | | | $ | 225,000,000 | | | | | | | | | | | | | | | | | | | | | | | | | |

A-3 | | | | | | $ | 260,600,000 | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | If the recovery bonds are delivered to a purchaser after , 2025, such purchaser will pay accrued interest from , 2025 up to, but not including the date the recovery bonds are delivered to such purchaser. |

The total initial price to the public is $ . The total amount of the underwriting discounts and commissions is $ . The total amount of proceeds to the issuing entity before deduction of expenses (estimated to be $ ) is $ . The distribution frequency is semi-annual. The first expected payment date is .

Investing in the recovery bonds involves risks. Please read “Risk Factors” beginning on page 20 in this prospectus to read about factors you should consider before buying the recovery bonds.

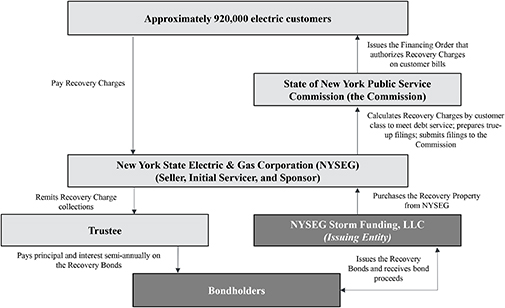

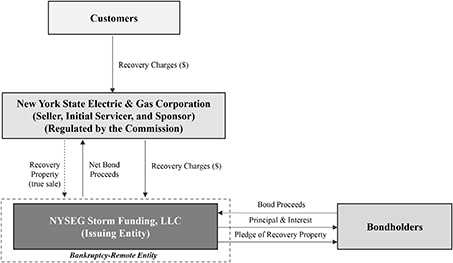

New York State Electric & Gas Corporation, as “sponsor”, is offering $710,600,000 of Recovery Bonds, Series 2025-A, referred to herein as the “recovery bonds”, in three tranches to be issued by NYSEG Storm Funding, LLC, as the “issuing entity”. New York State Electric & Gas Corporation is also the “seller”, initial “servicer” and “depositor” with regard to the recovery bonds. The recovery bonds are senior secured obligations of the issuing entity supported by “recovery property”, which includes the right to a non-bypassable charge, known as the “recovery charges”, and paid by all existing and future customers receiving electric transmission or distribution service, or both, from NYSEG or its successors or assignees within the geographical area within which it provided electric distribution services (the “service area”) as of the date of the approval of the financing order under rate schedules or special contracts approved by the State of New York Public Service Commission (the “Commission”). The Securitization Law (as defined below) requires that recovery charges be adjusted (or “trued-up”) at least annually, and the Commission authorizes the recovery charges to be adjusted at least semi-annually to provide for timely payment of scheduled principal of and interest on the recovery bonds and payment of all other ongoing financing costs and, to the extent required, replenishing the capital subaccount, as described further in this prospectus. Credit enhancement for the recovery bonds will be provided by such “true-up” mechanisms as well as by funds held in accounts held under the indenture.

The recovery bonds will be issued pursuant to Chapter 224 of the Laws of 2024 of the State of New York (the “Securitization Law”), and an irrevocable financing order issued by the Commission approving the issuance of the recovery bonds (the “financing order”) as Case 24-E-0493. The financing order was issued by the Commission on December 19, 2024. Absent an appeal or challenge to the financing order it will become final and not subject to further appeal on January 22, 2025. The financing order will become irrevocable at the time of the transfer of recovery property to an assignee or the issuance of recovery bonds and the State of New York will not in any way take or permit any action that limits, alters or impairs the value of recovery property or, except as required by the true-up mechanism described in the financing order, reduce, alter or impair the recovery charges that are imposed, collected and remitted for the benefit of the owners of the recovery bonds, any assignee, and all financing parties, until all principal, interest and redemption premium in respect of the recovery bonds, all other financing costs and all amounts to be paid to an assignee or financing party under an ancillary agreement are paid or performed in full.

The recovery bonds represent obligations only of the issuing entity, NYSEG Storm Funding, LLC, and do not represent obligations of the sponsor or any of its affiliates other than the issuing entity. The recovery bonds are secured by the collateral, consisting principally of the recovery property acquired pursuant to the sale agreement and funds on deposit in the collection account for the recovery bonds and related subaccounts. Please read “Security for the Recovery Bonds” in this prospectus. The recovery bonds are not a debt or a general obligation of the State of New York or any of its political subdivisions, agencies, or instrumentalities and are not a charge on their full faith and credit. The recovery bonds shall not, directly or indirectly or contingently, obligate the State of New York or any agency, political subdivision, or instrumentality of the State of New York to levy any tax or make any appropriation for payment of the recovery bonds, other than for paying recovery charges in their capacity as consumers of electricity.

Interest will accrue on the recovery bonds from the date of issuance. The recovery bonds are scheduled to pay principal and interest semi-annually on and of each year. The first scheduled payment date is . On each payment date, each recovery bond will be entitled to payment of principal, but only to the extent funds are available in the collection account after payment of certain fees and expenses and after payment of interest.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The underwriters expect to deliver the recovery bonds through the book-entry facilities of The Depository Trust Company for the accounts of its participants, including Clearstream Banking, S.A. and Euroclear Bank SA/NV, as operator of the Euroclear System, against payment in immediately available funds on or about , 2025.

Joint Book-Running Managers

| | | | |

| J.P. Morgan | | BofA Securities | | Citigroup |

The date of this prospectus is , 2025