As filed with the U.S. Securities and Exchange Commission on February 28, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Maius Pharmaceutical Group Co., Ltd.

Co-registrant is listed on the following page

(Exact name of registrant as specified in its charter)

| Cayman Islands | | 2834 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

Room 913, Building 1, No. 515 Huanke Road,

Pudong New District, Shanghai,

China

+86-021-58370356

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 302-738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Lawrence S. Venick, Esq. Loeb & Loeb LLP 2206-19 Jardine House 1 Connaught Road Central Hong Kong SAR Tel: +1 (310) 728-5129 | | Dan Ouyang, Esq. K. Ronnie Li, Esq.

Wilson Sonsini Goodrich & Rosati

Professional Corporation

Unit 2901, 29F, Tower C, Beijing

Yintai Centre

No. 2 Jianguomenwai Avenue

Chaoyang District, Beijing 100022

People’s Republic of China

Tel: (86) 10-6529-8300 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement and on completion of the business combination described in the enclosed proxy statement/prospectus.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant and Co-registrant hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant and Co-registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF CO-REGISTRANT

Exact Name of Co-registrant as Specified in Its Charter | | State or Other Jurisdiction of Incorporation or Organization | | Primary Standard Industrial Classification Code Number | | I.R.S. Employer Identification Number |

| Maius Pharmaceutical Co., Ltd. | | Cayman Islands | | 2834 | | N/A |

| (1) | The Co-registrant has the following principal executive offices: |

Room 913, Building 1, No. 515 Huanke Road,

Pudong New District, Shanghai,

China

| (2) | The agent for service for the Co-registrant is: |

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

+1 302-738-6680

The information in this proxy statement/prospectus is not complete and may be changed. The registrant may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. The proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY, SUBJECT TO COMPLETION, DATED [ ]

PROXY STATEMENT

FOR EXTRAORDINARY GENERAL MEETING OF

DT CLOUD ACQUISITION CORPORATION

(A CAYMAN ISLANDS EXEMPTED COMPANY)

PROSPECTUS FOR

UP TO [34,982,214] ORDINARY SHARES

OF

MAIUS PHARMACEUTICAL GROUP CO., LTD.

(AFTER THE MERGERS DESCRIBED HEREIN)

The board of directors of DT Cloud Acquisition Corporation, a Cayman Islands exempted company (“SPAC” or “DT Cloud”), has unanimously approved the Business Combination Agreement, dated as of October 22, 2024 (the “Business Combination Agreement”), by and among DT Cloud Acquisition Corporation, Maius Pharmaceutical Co., Ltd., a Cayman Islands exempted company (“Target” or “Maius”), Maius Pharmaceutical Group Co., Ltd., a Cayman Islands exempted company (“Pubco”), Chelsea Merger Sub 1 Limited, a Cayman Islands exempted company and a direct wholly owned subsidiary of Pubco (“Merger Sub 1”), Chelsea Merger Sub 2 Limited, a Cayman Islands exempted company and a direct wholly owned subsidiary of Pubco (“Merger Sub 2”), and XXW Investment Limited, a BVI business company (the “Target Shareholders’ Representative”), a copy of which is attached to this proxy statement/prospectus as Annex A.

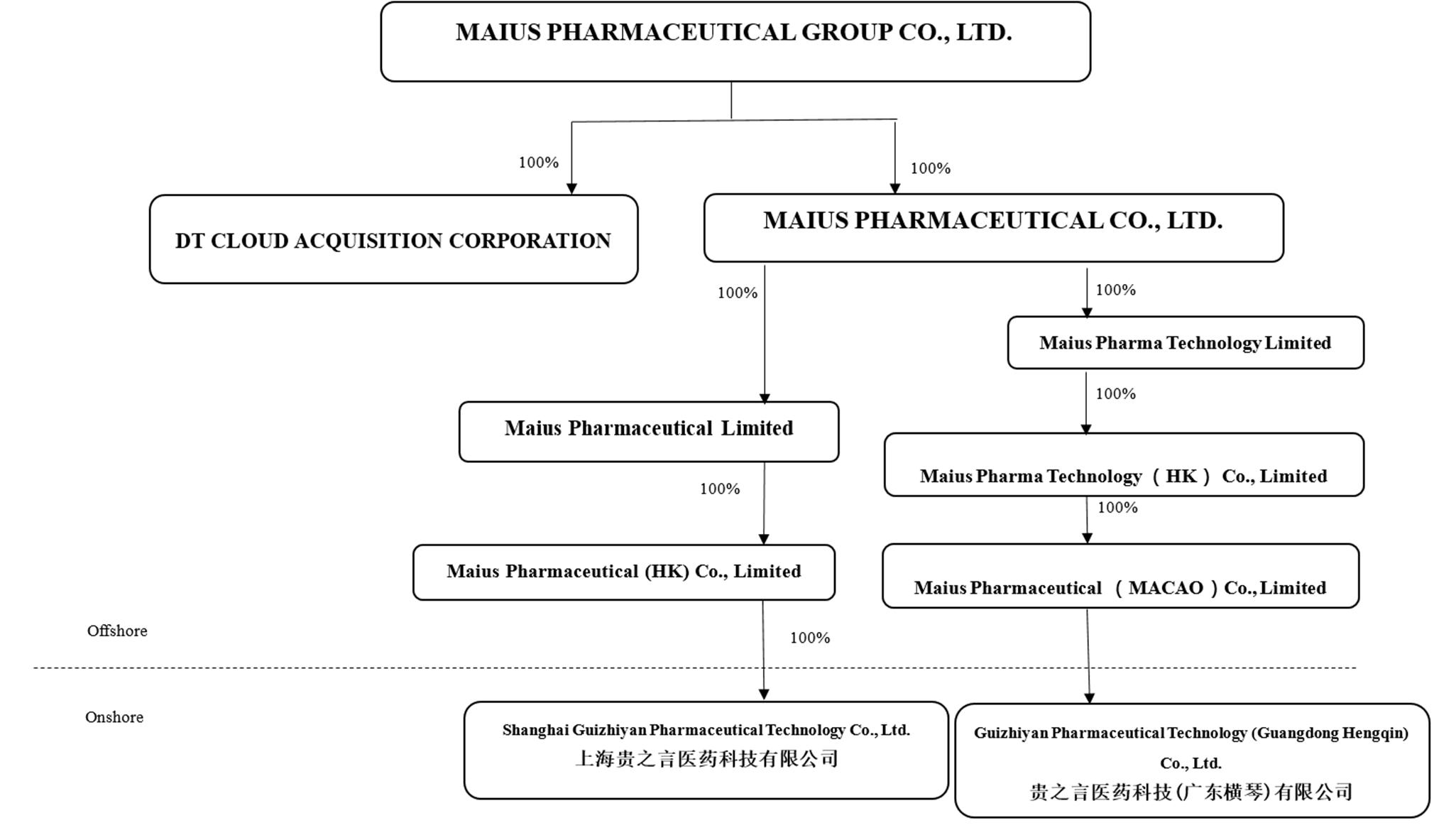

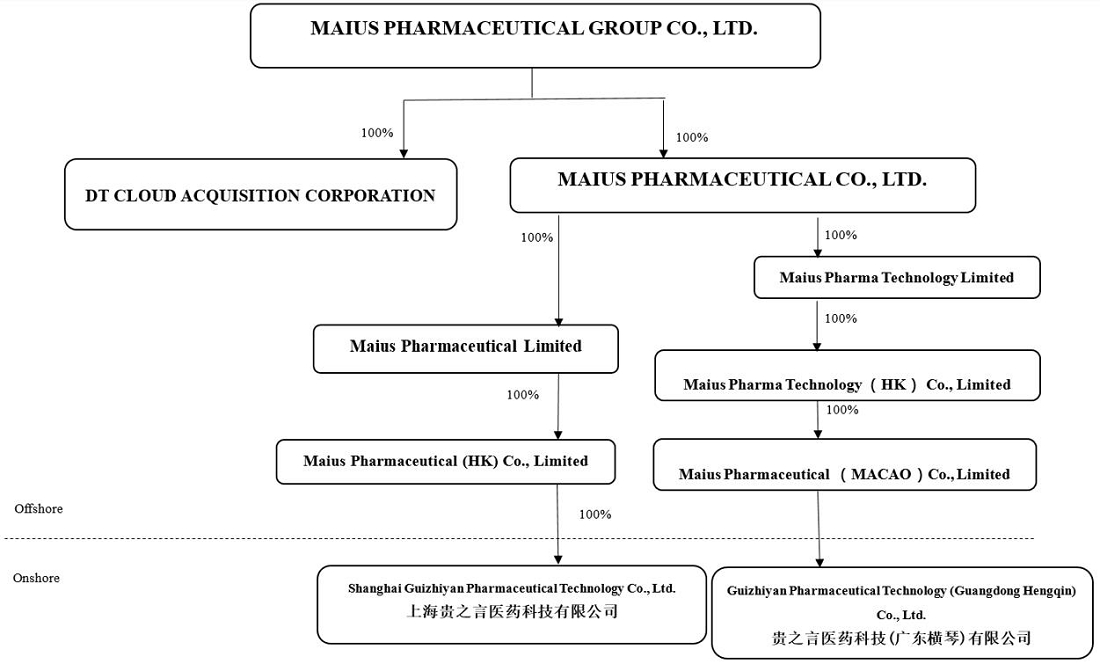

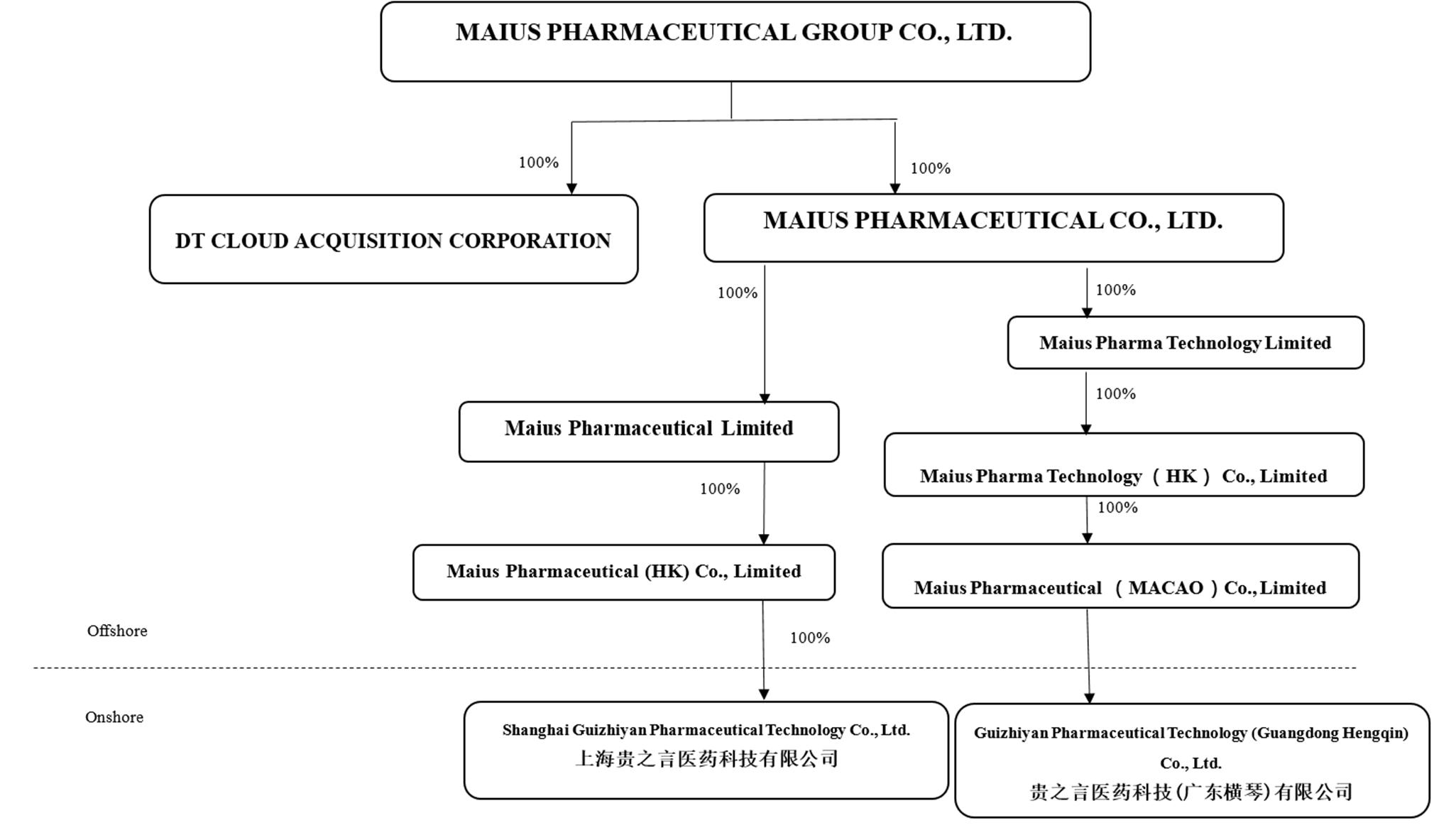

Pursuant to the Business Combination Agreement, the business combination will be effected in two steps. Subject to the approval and adoption of the Business Combination Agreement by the shareholders of SPAC, on the date of the consummation of the Business Combination (the “Closing Date”): (1) Merger Sub 1 will merge with and into DT Cloud (the “SPAC Merger”), with DT Cloud surviving the SPAC Merger as a wholly owned subsidiary of Pubco (the time at which the SPAC Merger becomes effective is sometimes referred to herein as the “SPAC Merger Effective Time”) (DT Cloud, in its capacity as the surviving corporation of the SPAC Merger, is sometimes referred to herein as the “SPAC Merger Surviving Corporation”); and (2) immediately following the SPAC Merger, Merger Sub 2 will merge with and into Maius (the “Acquisition Merger” and, together with the SPAC Merger, the “Mergers,” and together with all other transactions contemplated by the Business Combination Agreement, the “Business Combination”), with Maius surviving the Acquisition Merger as a wholly owned subsidiary of Pubco (Maius, in its capacity as the surviving corporation of the Acquisition Merger, is sometimes referred to herein as the “Surviving Corporation”).

Pursuant to the Business Combination Agreement: (1) at the SPAC Merger Effective Time, each ordinary share of Pubco, par value of $0.0001 each, issued and outstanding immediately prior to the SPAC Merger Effective Time shall be canceled without any conversion thereof or payment therefor; (2) immediately prior to the SPAC Merger Effective Time, each unit of DT Cloud (“DT Cloud Unit”) that is issued and outstanding immediately prior to the SPAC Merger Effective Time shall be automatically detached and the holder thereof shall be deemed to hold one ordinary share of DT Cloud (“DT Cloud Ordinary Share”) and one right of DT Cloud (“DT Cloud Right”) in accordance with the terms of the applicable DT Cloud Unit (“Unit Separation”); (3) immediately prior to the SPAC Merger Effective Time and immediately following the Unit Separation, in accordance with the terms of the applicable DT Cloud Rights, for such purposes treating it as if such Business Combination had occurred immediately prior to the SPAC Merger Effective Time, and without any action on the part of any holder of a DT Cloud Right, every seven (7) DT Cloud Rights (which, for the avoidance of doubt, includes the DT Cloud Rights held as a result of the Unit Separation) that were issued and outstanding immediately prior to the SPAC Merger Effective Time shall automatically be converted to one DT Cloud Ordinary Share; (4) at the SPAC Merger Effective Time and immediately following the Unit Separation and the conversion of the DT Cloud Rights, each then issued and outstanding DT Cloud Ordinary Share (including each share of DT Cloud Ordinary Share converted from DT Cloud Rights and each DT Cloud Ordinary Share held as a result of the Unit Separation, other than the DT Cloud Excluded Shares, DT Cloud Redeeming Shares and the DT Cloud Dissenting Shares) will be canceled and convert automatically, on a one-for-one basis, into one ordinary share of Pubco, par value of $0.0001 each (“Pubco Ordinary Shares”); (5) at the SPAC Merger Effective Time, each then issued and outstanding DT Cloud Ordinary Share held by shareholders of DT Cloud who have demanded properly in writing dissenters’ rights for such DT Cloud Ordinary Shares, as applicable, shall be canceled and cease to exist in consideration for the right to receive payment of such DT Cloud Ordinary Shares as provided in the Business Combination Agreement; and (6) at the SPAC Merger Effective Time, each then issued and outstanding ordinary share of Merger Sub 1 will be converted into and exchanged for one ordinary share of the SPAC Merger Surviving Corporation.

On the Closing Date and immediately following the SPAC Merger (the “Acquisition Merger Effective Time”), pursuant to the Acquisition Merger: (1) each issued and outstanding ordinary share of Maius, par value of $1.00 each (“Maius Ordinary Shares”), will be canceled and converted into the right to receive a number of Pubco Ordinary Shares based on the Pro Rata Portion (as defined herein); (2) each then issued and outstanding Maius Ordinary Share held by Maius shareholders who have validly exercised dissenters’ rights for such Maius Ordinary Shares will be canceled and cease to exist in consideration for the right to receive payment of such Maius Ordinary Share as provided in the Business Combination Agreement; and (3) each then issued and outstanding ordinary share of Merger Sub 2 will be converted into and exchanged for one ordinary share of the Surviving Corporation.

Pursuant to covenants under the Business Combination Agreement, DT Cloud and Maius agreed to use commercially reasonable efforts to obtain executed subscription agreements for an aggregate investment amount of no less than $10,000,000 from third party investors (such investors, collectively, with any permitted assignees or transferees, the “PIPE Investors”), pursuant to which the PIPE Investors make or commit to make private equity investments in DT Cloud, Maius or Pubco to purchase shares of DT Cloud, Maius or Pubco in connection with a private placement, and/or enter into backstop or other alternative financing arrangements with potential investors (a “PIPE Investment”). DT Cloud may terminate the Business Combination Agreement at any time prior to the Closing if DT Cloud is not in material breach of any of our obligations in the Business Combination Agreement while Maius fails to perform such covenants in connection with the PIPE Investment within the time period specified in the Business Combination Agreement. On January 20, 2025, SPAC, Maius, Pubco and certain investor (the “Investor”) entered into a Subscription Agreement (the “Subscription Agreement”), pursuant to which, among other things, the Investor agreed to subscribe for and purchase, and Pubco agreed to issue and sell to the Investor, 30,000 ordinary shares of Pubco, par value $0.0001 per share, at $10.00 per share in a private placement (the “Private Placement”) in connection with a financing effort related to the transactions contemplated by the Business Combination Agreement. The closing of the Private Placement is conditioned upon, among other things, the completed or concurrent consummation of the Transactions set forth in the Business Combination Agreement.

This proxy statement/prospectus covers the registration of up to [34,982,214] Pubco Ordinary Shares. The number of Pubco Ordinary Shares covered in this proxy statement/prospectus is represents the maximum number of Pubco Ordinary Shares that may be issued to holders of Maius Ordinary Shares in connection with the Acquisition Merger (as more fully described in this proxy statement/prospectus), together with the shares issued or issuable to the existing holders of DT Cloud Ordinary Shares, DT Cloud Rights and DT Cloud Units in connection with the SPAC Merger.

The DT Cloud Units, DT Cloud Ordinary Shares and DT Cloud Rights are currently listed on the Nasdaq Stock Market (“Nasdaq”) under the symbols “DYCQU,” “DYCQ” and “DYCQR,” respectively. Immediately prior to the SPAC Merger, the DT Cloud Ordinary Shares and the DT Cloud Rights comprising each issued and outstanding DT Cloud Unit, consisting of one DT Cloud Ordinary Share and one DT Cloud Right, will be automatically separated and the holder thereof will be deemed to hold one DT Cloud Ordinary Share and one DT Cloud Right. Accordingly, there will be no DT Cloud Units nor any Nasdaq listing of DT Cloud Units following the consummation of the Business Combination. The parties anticipate that, following the Business Combination, the Pubco Ordinary Shares will be listed on Nasdaq under the symbol “[ ],” and the DT Cloud Units, DT Cloud Ordinary Shares and DT Cloud Rights will cease trading on Nasdaq and will be deregistered under the Securities Exchange Act of 1934, as amended, upon the consummation of the Business Combination.

The DT Cloud board of directors received a fairness opinion from CHFT Advisory and Appraisal Limited (“CHFT”) as to the fairness of the transactions to the holders of DT Cloud Ordinary Shares from a financial point of view. See “The Business Combination—Opinion of Financial Advisor to the DT Cloud Board” and the opinion of CHFT included as Annex C to this proxy statement/prospectus. As permitted under the DT Cloud Articles (as defined herein) and the Companies Act (Revised) of the Cayman Islands, the independent directors of DT Cloud did not retain an unaffiliated representative to act solely on behalf of unaffiliated securityholders of DT Cloud for purposes of negotiating the terms of the Business Combination Agreement and/or preparing a report concerning the approval of the Business Combination.

The DT Cloud board of directors has unanimously approved and adopted the Business Combination Agreement and determined that each of the proposals is fair to and in the best interest of DT Cloud and its shareholders, and unanimously recommends that the DT Cloud Shareholders vote FOR all of the proposals presented to the shareholders at the extraordinary general meeting. The Business Combination was not structured to require the approval of at least a majority of unaffiliated securityholders of DT Cloud, as permitted under the DT Cloud Articles and the Companies Act (Revised) of the Cayman Islands. When you consider the DT Cloud board of directors’ recommendation of these proposals, you should keep in mind that DT Cloud Capital Corp. (the “Sponsor”) and DT Cloud’s directors and officers have interests in the Business Combination that may conflict with your interests as a shareholder.

These interests include, among other things, the interests listed below:

| ● | The fact that immediately following the consummation of the Business Combination, the initial shareholders are expected to hold 1,993,000 Pubco Ordinary Shares on an as-converted basis, consisting of (i) 1,725,000 Pubco Ordinary Shares to be converted from DT Cloud Ordinary Shares held by the initial shareholders, (ii) 234,500 Pubco Ordinary Shares to be converted from DT Cloud Ordinary Shares underlying the DT Cloud Private Units held by the initial shareholders; and (iii) 33,500 Pubco Ordinary Shares to be converted from DT Cloud Rights underlying the DT Cloud Private Units held by the initial shareholders, which in the aggregate, would be approximately [5.7]% and [7.1]% ownership interest in the Pubco following the consummation of the Business Combination under the no redemption scenario and the maximum redemption scenario (assuming the NTA Proposal will be approved), respectively, on an as converted basis. |

| | | |

| ● | The fact that the Sponsor acquired 234,500 DT Cloud Units at $10.00 per private unit through private placement simultaneously with the closing of DT Cloud IPO on February 23, 2024. |

| | | |

| | ● | The fact that the initial shareholders paid $25,000, or approximately $0.01 per share, for 1,725,000 Founder Shares prior to DT Cloud IPO, which will be canceled and convert automatically, on a one-for-one basis, into the same number of Pubco Ordinary Shares at the SPAC Merger Effective Time pursuant to the Business Combination Agreement. All of the Founder Shares are subject to certain transfer restrictions and could have a significantly higher value at the time of the Business Combination, which if unrestricted and freely tradable would be valued at approximately $18.0 million, based on the most recent closing price of DT Cloud Ordinary Shares of $10.44 per share on December 27, 2024. |

| | | |

| | ● | The fact that if the Business Combination or another business combination is not consummated by February 23, 2026 (subject to the Sponsor’s deposit of additional funds into the Trust Account), DT Cloud will cease all operations except for the purpose of winding up, redeeming 100% of outstanding Public Shares for cash and, subject to the approval of DT Cloud’s remaining shareholders and DT Cloud’s Board, liquidating and dissolving. In such event, the Founder Shares and Private Shares held by the Sponsor would be worthless because DT Cloud’s initial shareholders are not entitled to participate in any redemption or distribution with respect to such shares. |

| | | |

| ● | The fact that if the Business Combination is consummated, each of issued and outstanding DT Cloud Ordinary Shares will be converted into one Pubco Ordinary Share. Given the differential in the purchase price that the Sponsor paid for the Founder Shares, as compared to the price of DT Cloud Public Shares paid by DT Cloud Public Shareholders in the DT Cloud IPO and the substantial number of Pubco Ordinary Shares that the Sponsor will receive upon conversion of the Founder, the Sponsor is likely to be able to recoup their investment in DT Cloud and make a substantial profit on that investment, even if Pubco Ordinary Shares have lost significant value. This means that the Sponsor could earn a positive rate of return on their investment, even if DT Cloud Public Shareholders experience a negative rate of return in the Pubco following the consummation of the Business Combination. |

| ● | The fact that the Sponsor agreed that if DT Cloud liquidates the Trust Account prior to the consummation of a business combination, it will be liable to pay debts and obligations to target businesses or vendors or other entities that are owed money by DT Cloud for services rendered or contracted for or products sold to us in excess of the net proceeds of DT Cloud IPO not held in the Trust Account, but only to the extent necessary to ensure that such debts or obligations do not reduce the amounts in the trust account and only if such parties have not executed a waiver agreement. |

| | | |

| ● | The fact that DT Cloud’s Sponsor, officers, directors, or their affiliates may, but are not obligated to, loan DT Cloud funds as may be required (“Working Capital Loan”) to fund working capital deficiencies or finance transaction costs in connection with an initial business combination. Up to $300,000 of such Working Capital Loan may be convertible upon consummation of our business combination into private DT Cloud Units at $10.00 per unit. |

| | | |

| | ● | The fact that the Sponsor is entitled to $10,000 per month for office space, administrative and support services until the completion of an initial business combination under the Administrative Services Agreement (as defined in the proxy statement/prospectus). |

| | | |

| ● | The fact that the Business Combination Agreement provides for the continued indemnification of DT Cloud’s current directors and officers and the continuation of directors and officers liability insurance covering DT Cloud’s current directors and officers. |

| | ● | DT Cloud’s officers and directors and their affiliates are entitled to reimbursement of out-of-pocket expenses incurred by them in connection with certain activities on DT Cloud’s behalf, such as identifying and investigating possible business targets and business combinations. However, if DT Cloud fails to consummate a business combination within the required time period under the DT Cloud Articles, these persons will not have any claim against the Trust Account for reimbursement. Accordingly, DT Cloud may not be able to reimburse these expenses if the Business Combination with Maius or another business combination is not completed by February 23, 2026 (subject to the Sponsor’s deposit of additional funds into the Trust Account). |

| ● | The fact that Maius, the Sponsor and Pubco will enter into an amendment to the Registration Rights Agreement of DT Cloud on or prior to the Closing which provides for registration rights following consummation of the Business Combination. |

| | | |

| ● | The fact that pursuant to the Business Combination Agreement, the Sponsor shall promptly provide non-interest bearing loans to us (the “Extension Loans”) for the sole purpose of extending the deadline for the consummation of DT Cloud’s initial business combination, which shall immediately be repaid by DT Cloud to the Sponsor and/or Maius (as the case may be) upon the earlier of the Closing or the expiry of the deadline for the consummation of DT Cloud’s initial business combination. |

| | | |

| ● | The fact that in addition to these interests of the Sponsor and DT Cloud’s officers, directors and advisors, to the fullest extent permitted by applicable laws and DT Cloud’s memorandum and articles of association, waive certain applications of the doctrine of corporate opportunity in some circumstances where the application of any such doctrine would conflict with any fiduciary duties or contractual obligations they may have, and DT Cloud will renounce any expectation that any of its directors or officers will offer any such corporate opportunity of which he or she may become aware to us. DT Cloud does not believe that the pre-existing fiduciary duties or contractual obligations of its officers and directors materially impacted its search for an acquisition target. Further, DT Cloud does not believe that the waiver of the application of the corporate opportunity doctrine had any impact on its search for a potential business combination target. |

For a discussion of all potential sources of conflicts of interests, see “The Business Combination—Interests of the Sponsor and DT Cloud Directors and Officers in the Business Combination.”

The Sponsor, DT Cloud Capital Corp., has 80% and 20% of its outstanding shares held by Mr. Ip Ping Ki and Infinity-Star Holdings Limited, a British Virgin Islands (the “BVI”) company, respectively. The Sponsor currently holds (i) 1,725,000 DT Cloud Ordinary Shares, (ii) 234,500 DT Cloud Ordinary Shares underlying the DT Cloud Private Units; and (iii) 33,500 DT Cloud Ordinary Shares underlying the DT Cloud Private Rights.

At the Closing, the Sponsor is expected to hold 1,993,000 Pubco Ordinary Shares, consisting of (i) 1,725,000 Pubco Ordinary Shares to be converted from DT Cloud Ordinary Shares held by the initial shareholders, (ii) 234,500 Pubco Ordinary Shares to be converted from DT Cloud Ordinary Shares underlying the DT Cloud Private Units held by the initial shareholders; and (iii) 33,500 Pubco Ordinary Shares to be converted from DT Cloud Rights underlying the DT Cloud Private Units held by the initial shareholders. The Sponsor did not and will not receive any cash compensation during the ordinary course of managing DT Cloud or in connection with the Business Combination.

The independent directors of DT Cloud currently do not hold any DT Cloud Ordinary Shares. None of the officers or directors of DT Cloud have received any cash compensation for services rendered to DT Cloud or in connection with the Business Combination. At the Closing, the independent directors of DT Cloud are not expected to hold Pubco Ordinary Shares.

The following table sets forth the consideration received or to be received by (1) the Sponsor, (2) the DT Cloud IPO Underwriter, (3) DT Cloud Public Shareholders, (4) Holders of DT Cloud Public Rights, and (5) the existing Maius Shareholders, in connection with the Business Combination, in each case, assuming no redemption, 50% redemption and 100% redemption (assuming the NTA Proposal will be approved). Unless otherwise specified, the share amounts were determined under the assumptions set forth under the section of this proxy statement/prospectus titled “Conventions That Apply to This Proxy Statement/Prospectus.” If the actual facts are different from the foregoing assumptions, the share amounts and cash value set forth below will be different.

| | | Assuming no redemption scenario | | | Assuming 50% redemption scenario | | | Assuming maximum redemption scenario | |

| Shareholders | | Number of Pubco Ordinary Shares | | | Value ($)(1) | | | Number of Pubco Ordinary Shares | | | Value ($)(1) | | | Number of Pubco Ordinary Shares | | | Value ($)(1) | |

| Sponsor | | | | | | | | | | | | | | | | | | | | | | | | |

| - Founder shares | | | 1,725,000 | | | | 17,250,000 | | | | 1,725,000 | | | | 17,250,000 | | | | 1,725,000 | | | | 17,250,000 | |

| - Private Units(2) | | | 234,500 | | | | 2,345,000 | | | | 234,500 | | | | 2,345,000 | | | | 234,500 | | | | 2,345,000 | |

| - Private Rights(3) | | | 33,500 | | | | 335,000 | | | | 33,500 | | | | 335,000 | | | | 33,500 | | | | 335,000 | |

| DT Cloud IPO Underwriter | | | 103,500 | | | | 1,035,000 | | | | 103,500 | | | | 1,035,000 | | | | 103,500 | | | | 1,035,000 | |

| Holders of DT Cloud Public Ordinary Shares | | | 6,900,000 | | | | 69,000,000 | | | | 3,450,000 | | | | 34,500,000 | | | | - | | | | - | |

| Holders of DT Cloud Public Rights(4) | | | 985,714 | | | | 9,857,140 | | | | 985,714 | | | | 9,857,140 | | | | 985,714 | | | | 9,857,140 | |

| PIPE Investors(5) | | | 30,000 | | | | 300,000 | | | | 30,000 | | | | 300,000 | | | | 30,000 | | | | 300,000 | |

| Existing Maius Shareholders | | | 25,000,000 | | | | 250,000,000 | | | | 25,000,000 | | | | 250,000,000 | | | | 25,000,000 | | | | 250,000,000 | |

| (1) | The value of the consideration to be received is calculated based on a deemed value of $10.00 per Pubco Ordinary Shares. |

| (2) | Represents the number of DT Cloud Ordinary Shares included in the Private Units, which will be converted into Pubco Ordinary Shares on a one-on-one basis. |

| (3) | Represents the maximum number of DT Cloud Ordinary Shares upon conversion of the Private Rights, which will be converted into Pubco Ordinary Shares on a one-on-one basis. Every seven (7) Private Rights will be converted to one DT Cloud Ordinary Share. |

| (4) | Represents the maximum number of DT Cloud Ordinary Shares upon conversion of the DT Cloud Public Rights, which will be converted into Pubco Ordinary Shares on a one-on-one basis. Every seven (7) DT Cloud Public Rights will be converted to one DT Cloud Ordinary Share. |

| (5) | On January 20, 2025, SPAC, Maius, Pubco and certain Investor entered into the Subscription Agreement, pursuant to which, among other things, the Investor has agreed to subscribe for and purchase, and Pubco has agreed to issue and sell to the Investor, 30,000 ordinary shares of Pubco, par value $0.0001 per share, at a purchase price equal to $10.00 per share in the Private Placement at the Closing, upon other conditions. |

The following table illustrates the potential impact of redemptions on the ownership percentage of Public Shareholders in a range of redemption scenarios, with the maximum redemption scenario representing the redemption of all Public Shares, assuming the NTA Proposal will be approved.

| | | Assuming no redemption scenario | | | Assuming 50% redemption scenario | | | Assuming maximum redemption scenario | |

| Shareholders | | Number of Pubco Ordinary Shares | | | Share Ownership % | | | Number of Pubco Ordinary Shares | | | Share Ownership % | | | Number of Pubco Ordinary Shares | | | Share Ownership % | |

| Sponsor | | | | | | | | | | | | | | | | | | | | | | | | |

| - Founder shares | | | 1,725,000 | | | | 4.9 | % | | | 1,725,000 | | | | 5.5 | % | | | 1,725,000 | | | | 6.2 | % |

| - Private Units | | | 234,500 | | | | 0.7 | % | | | 234,500 | | | | 0.8 | % | | | 234,500 | | | | 0.8 | % |

| - Private Rights | | | 33,500 | | | | 0.1 | % | | | 33,500 | | | | 0.1 | % | | | 33,500 | | | | 0.1 | % |

| DT Cloud IPO Underwriter | | | 103,500 | | | | 0.3 | % | | | 103,500 | | | | 0.3 | % | | | 103,500 | | | | 0.4 | % |

| DT Cloud Public Shareholders | | | 6,900,000 | | | | 19.7 | % | | | 3,450,000 | | | | 10.9 | % | | | - | | | | 0.0 | % |

| Holders of DT Cloud Public Rights | | | 985,714 | | | | 2.8 | % | | | 985,714 | | | | 3.1 | % | | | 985,714 | | | | 3.5 | % |

| Existing Maius Shareholders | | | 25,000,000 | | | | 71.4 | % | | | 25,000,000 | | | | 79.2 | % | | | 25,000,000 | | | | 88.9 | % |

| PIPE Investor(s) | | | 30,000 | | | | 0.1 | % | | | 30,000 | | | | 0.1 | % | | | 30,000 | | | | 0.1 | % |

| Total Pubco Ordinary Shares Outstanding at Closing | | | 35,012,214 | | | | 100.0 | % | | | 31,562,214 | | | | 100.0 | % | | | 28,112,214 | | | | 100.0 | % |

The foregoing numbers of percentage ownership were determined under the assumptions set forth under the section titled “Conventions That Apply to This Proxy Statement/Prospectus.” If actual facts are different from the assumptions set forth therein, the percentage ownership numbers will be different. Shareholders will experience additional dilution to the extent that Pubco issue additional Pubco Ordinary Shares after the Closing. For details of the source of dilution and its impact, see “Questions and Answers About the Business Combination and the Extraordinary General Meeting — Q: What are the possible sources and the extent of dilution that the Public Shareholders that elect not to redeem their shares will experience in connection with the Business Combination?”

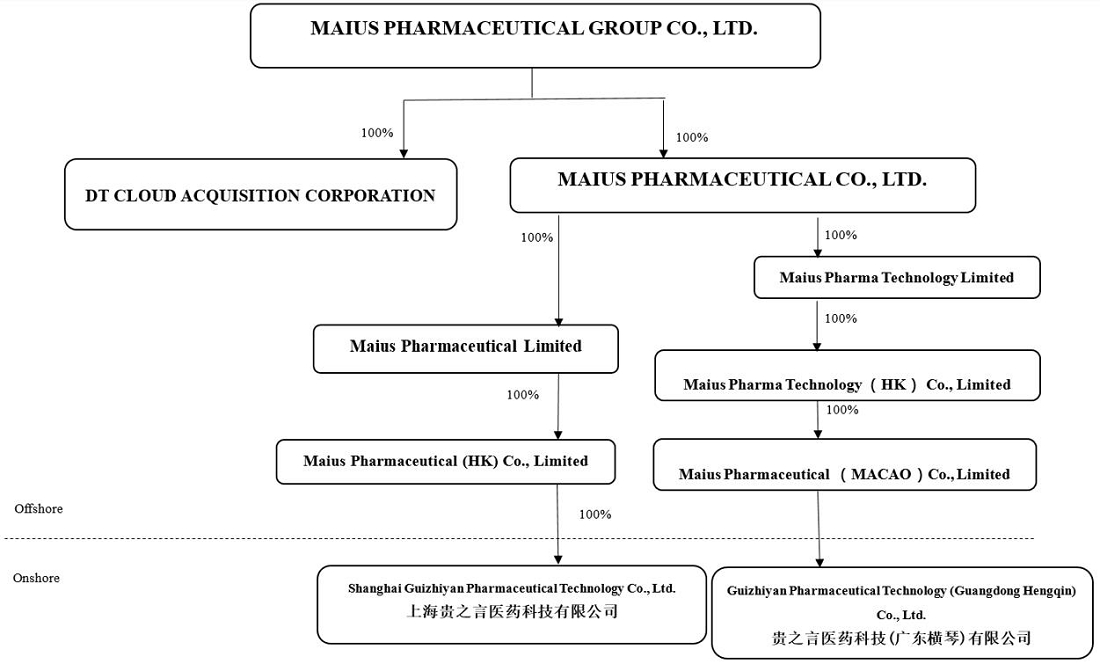

Maius is an exempted company with limited liability incorporated under the laws of the Cayman Islands with no substantive operations. Maius carries out its business in China through its PRC subsidiaries.

Maius faces various legal and operational risks and uncertainties related to doing business in China, as Maius, through its subsidiaries, conducts its operations in China. Maius is subject to complex and evolving laws and regulations in China. The PRC government has indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, and initiated various regulatory actions and made various public statements, some of which are published with very short notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. For example, Maius faces risks associated with regulatory approvals on overseas offerings and oversight on cybersecurity and data privacy, which may impact Maius’ ability to conduct certain business, accept foreign investments, or list and conduct offerings on a U.S. or other foreign stock exchange. These risks could result in a material adverse change in Maius’ operations, and following the completion of the Business Combination, significantly limit or completely hinder Pubco’s ability to offer or continue to offer securities to investors, or cause the value of such securities to significantly decline or be worthless. See “Risk Factors—Risks Related to Doing Business in China.”

Maius is, and following the completion of the Business Combination, Pubco will be subject to a number of prohibitions, restrictions and potential delisting risk under the Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023 (the “HFCAA”). Pursuant to the HFCAA and related regulations, if Pubco filed an audit report issued by a registered public accounting firm that the Public Company Accounting Oversight Board (the “PCAOB”) determined it is unable to inspect and investigate completely, the Securities and Exchange Commission (the “SEC”) will identify Pubco as a “Commission-identified Issuer,” and the trading of Pubco’s securities on any U.S. national securities exchanges, as well as any over-the-counter trading in the United States, will be prohibited if following the completion of the Business Combination, Pubco is identified as a Commission-identified Issuer for two consecutive years. Maius’ auditor, Wei, Wei & Co., LLP, is an independent registered public accounting firm headquartered in New York with offices in New York. In August 2022, the PCAOB, the China Securities Regulatory Commission (the “CSRC”) and the Ministry of Finance (the “MOF”) of the PRC signed a Statement of Protocol (the “Statement of Protocol”), which establishes a specific and accountable framework for the PCAOB to conduct inspections and investigations of PCAOB-governed accounting firms in mainland China and Hong Kong. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of Pubco and its auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. Because the registered accounting firm of Maius is headquartered in the United States with offices in Beijing and Shenzhen, China, if the PRC government adopts positions at any time in the future that would prevent the PCAOB from continuing to inspect or investigate completely accounting firms located in mainland China or Hong Kong, or if Pubco’s registered public accounting firm otherwise fails to meet the PCAOB’s requirements for two consecutive years, Pubco’s securities will be delisted from the Nasdaq Stock Market and will not be permitted for trading over the counter in the United States under the HFCAA and related regulations. See “Risk Factors—Risks Related to Pubco’s Securities—The securities of Pubco may be delisted or prohibited from being traded “over-the-counter” under the HFCAA and the Accelerated Holding Foreign Companies Accountable Act if the PCAOB were unable to fully inspect the company’s auditor.”

On February 17, 2023, the CSRC promulgated Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies (the “Overseas Listing Trial Measures”) and circulated five supporting guidelines, which became effective on March 31, 2023. The Overseas Listing Trial Measures regulate both direct and indirect overseas offering and listing of PRC domestic companies’ securities by adopting a filing-based regulatory regime. Based on the Overseas Listing Trial Measures and the clarification issued by at a press conference held by CSRC, Maius shall complete the filing procedures with the CSRC in connection with this Business Combination as required by the Overseas Listing Trial Measures prior to the listing of Pubco’s securities on Nasdaq. Maius submitted the filing for this business combination to the CSRC on January 6, 2025. Neither Pubco nor Maius can assure you that Maius and its PRC subsidiaries can complete the filing procedures in a timely manner or at all. If Maius fails to complete required filing procedures for the Business Combination and the listing of Pubco’s securities on Nasdaq, DT Cloud has the right to terminate the Business Combination Agreement in accordance with its terms, and the Business Combination may not be consummated. DT Cloud, Pubco and Maius will not consummate the Business Combination without first completing the CSRC filing and receiving the CSRC approval under the Overseas Listing Trial Measures, even if the securityholders of DT Cloud have approved the Business Combination in the extraordinary general meeting. In addition, neither Pubco nor Maius can guarantee that new rules or regulations promulgated in the future will not impose any additional requirement or otherwise tightening the regulations on companies with contractual arrangements. If Maius violates or is deemed to have violated any current or future rules or regulations, regulatory agencies in China may impose fines and penalties on Maius’ operations in China, limit its operating privileges in China, delay or restrict the repatriation of the proceeds from offshore fund-raising activities into the PRC or take other actions that could materially adversely affect Maius’ business, financial condition and results of operations, as well as the trading price of Pubco Ordinary Shares following the consummation of the Business Combination. See “Government Regulations Applicable to Maius’ Business,” and “Risk Factors—Risks Related to Doing Business in China—The approval of or clearance by the CSRC, the CAC and other compliance procedures may be required in connection with this business combination, and, if required, we cannot predict whether we will be able to obtain such approval or clearance”

Cash is transferred among Maius, its offshore subsidiaries and its PRC subsidiaries, in the following manner: (1) funds are transferred to its PRC subsidiaries from Maius as needed through Maius’ subsidiaries outside China in the form of capital contributions or shareholder loans, as the case may be; and (2) dividends or other distributions may be paid by its PRC subsidiaries to Maius through its subsidiaries outside China. Maius and its subsidiaries generate and retain cash generated from operating activities and re-invest it in its business. None of Maius’ subsidiaries outside China has made dividends or distribution to its shareholders. In the future, following the completion of the Business Combination, Pubco’s ability to pay dividends, if any, to its shareholders and to service any debt it may incur will depend upon dividends paid by Maius and its subsidiaries. As of the date of this proxy statement/prospectus, no dividends or distributions have been made to date between Maius and its subsidiaries. As of the date of this proxy statement/prospectus, Maius made a cash transfer to Maius Pharmaceutical Limited, a British Virgin Islands company and wholly-owned subsidiary of Maius, and Maius Pharmaceutical (HK) Co., Limited, a Hong Kong company and wholly-owned subsidiary of Maius Pharmaceutical Limited, for the registered share capital contribution and funding for acquisition of Shanghai Maius of $1,177,591 and $1,840,237 respectively. In the future, cash proceeds raised from overseas financing activities may be transferred by Pubco through its subsidiaries outside China to its PRC subsidiaries via capital contribution and shareholder loans, as the case may be. Its PRC subsidiaries will pay dividends to their offshore shareholder to meet the capital needs of Pubco’s business operations out of the PRC. Neither Pubco nor Maius has a cash management policy that dictates how funds are transferred, however, Shanghai Guizhiyan has its financial policy manual in connection with its daily operations. For details about the applicable PRC regulations and rules relating to such cash transfers through Pubco, Maius and their respective subsidiaries and the associated risks, see “Risk Factors—Risks Related to Doing Business in China.”

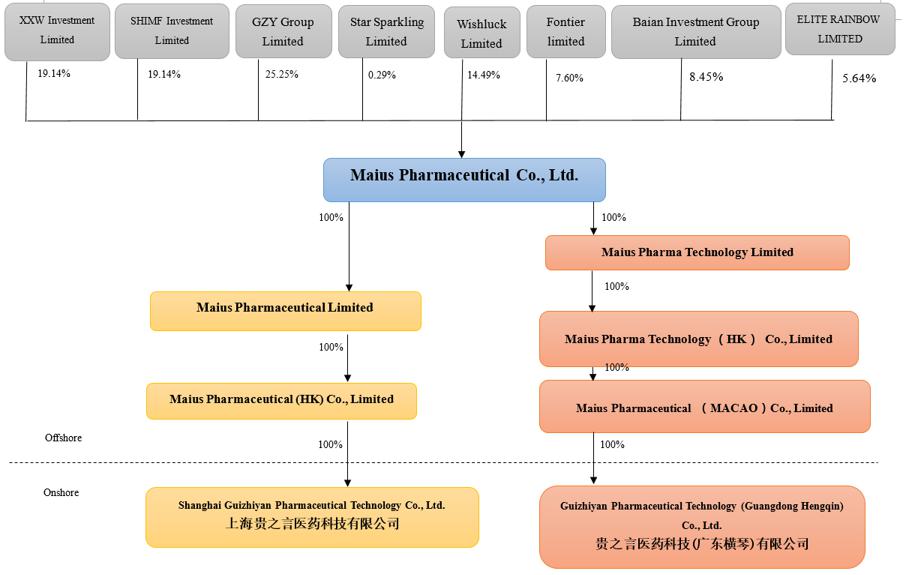

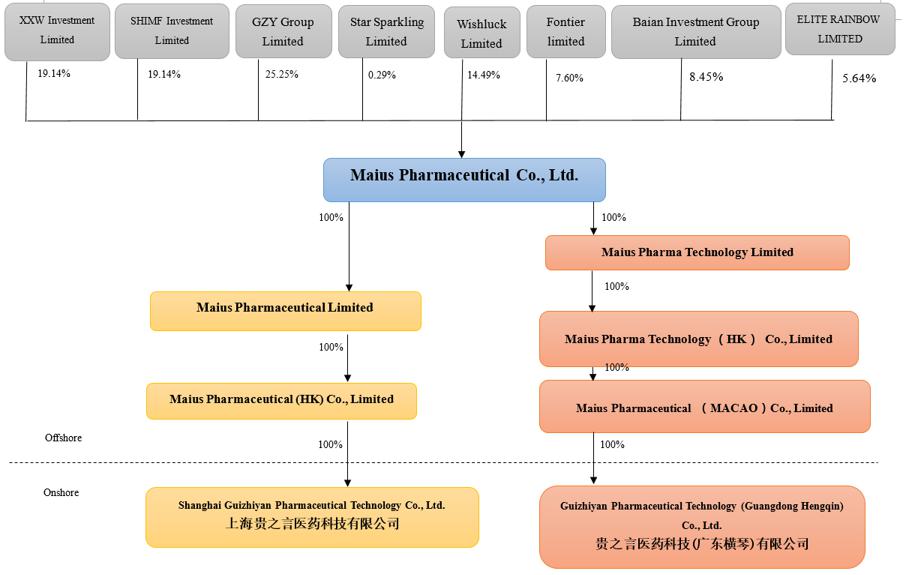

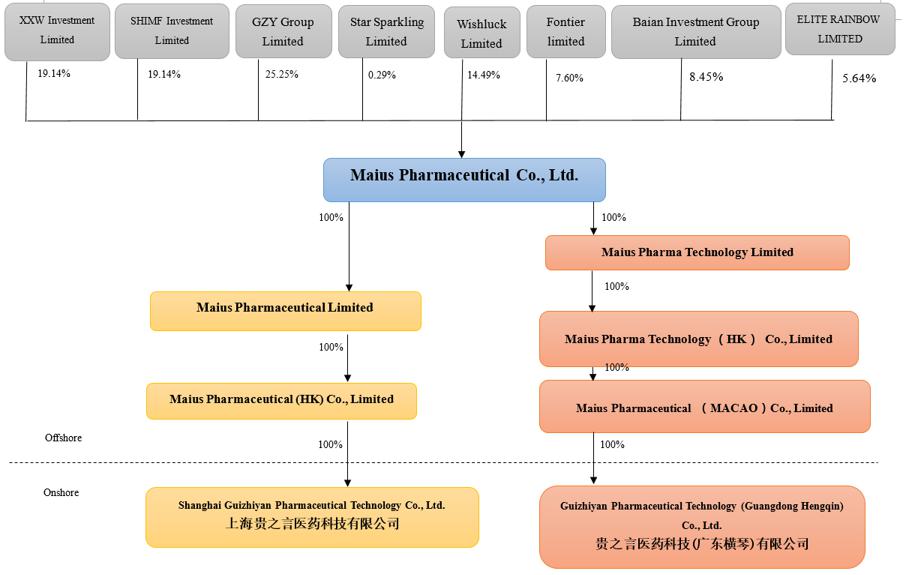

On December 20, 2024, XXW Investment Limited, SHIMF Investment Limited, Fontier Limited, Wishluck Limited, and Maius Pharmaceutical Co., Ltd. entered into an Acting-in-Concert Agreement (the “Acting-in-Concert Agreement”), pursuant to which SHIMF Investment Limited, Fontier Limited, Wishluck Limited undertake that following the completion of the Business Combination, they shall take actions in accordance with the instructions of XXW Investment Limited, a wholly owned subsidiary of Xingwei Xue, with regard to any matter submitted to vote by the shareholders of the Pubco, for a period of two years after the closing of the Business Combination. As a result of the Acting-in-Concert Agreement, immediately following the completion of the Business Combination, Xingwei Xue through his holding entity XXW Investment Limited will hold 60.37% of the voting power of the then issued and outstanding share capital of Pubco following the completion of the Business Combination, assuming full redemption of SPAC Public Shares, or 43.14% of the voting power of the then issued and outstanding share capital of Pubco following the completion of the Business Combination, assuming no redemption of SPAC Public Shares. As a result of Xingwei Xue’s majority voting power, assuming full redemption, which would give him the ability to control the outcome of certain matters submitted to Pubco’s shareholders for approval, including the appointment or removal of directors, Pubco may qualify as a “controlled company” within the meaning of the corporate governance standards of Nasdaq Stock Market. Under these rules, a company of which more than 50% of the voting power is held by an individual, group or another company is a controlled company and may elect not to comply with certain corporate governance requirements, including the requirement that a majority of its directors be independent, as defined in the Corporate Governance Rules of the Nasdaq and the requirement that the compensation committee and nominating and corporate governance committee of Pubco consist entirely of independent directors. Pubco currently does not intend to rely on these exemptions. However, if Pubco decides to rely on exemptions applicable to controlled company under the Corporate Governance Rules of Nasdaq in the future, its public shareholders will not have the same protections afforded to shareholders of companies that are subject to all of Nasdaq corporate governance requirements.

Pubco is an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, as amended, and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the completion of the Business Combination.

Pubco is a foreign private issuer within the meaning of the rules under the Exchange Act, and as such Pubco is exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, such as the rules regulating solicitation of proxies and certain insider reporting and short-swing profit rules. Moreover, the information Pubco is required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. In addition, as an exempted company incorporated in the Cayman Islands, Pubco is permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance standards of the Nasdaq Stock Market.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued in the Business Combination or otherwise, or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

NOTICE OF MEETING

NOTICE OF EXTRAORDINARY GENERAL MEETING OF

DT CLOUD ACQUISITION CORPORATION

TO BE HELD ON [ ]

To the Shareholders of DT Cloud Acquisition Corporation:

NOTICE IS HEREBY GIVEN that an extraordinary general meeting (the “extraordinary general meeting”) of DT Cloud Acquisition Corporation, a Cayman Islands exempted company (“DT Cloud,” “we,” “our,” or “us”), will be held in person on [ ], at 10:00 A.M., Eastern time, at [ ], or such other date, time, and place to which such meeting may be adjourned. We are also planning for the meeting to be held virtually pursuant to the procedures described in the accompanying proxy statement/prospectus, but the physical location of the meeting will remain at the location specified above for the purposes of Cayman Islands law and our Amended and Restated Memorandum and Articles of Association (the “DT Cloud Articles”). At the extraordinary general meeting, DT Cloud shareholders will be asked to consider and vote upon the following proposals:

Proposal No. 1 — The NTA Proposal — to consider and vote upon a proposal to approve by special resolution the following articles of DT Cloud Articles be amended as follows with effect from prior to the consummation of the proposed Business Combination (such amendments shall be collectively referred to as the “NTA Amendments”):

| (a) | Article 37.2(b) of the DT Cloud Articles shall be deleted in its entirety and replaced with the following language: “provide Members with the opportunity to have their Shares repurchased by means of a tender offer (a Tender Offer) for a per-Share repurchase price payable in cash, equal to the aggregate amount then on deposit in the Trust Account, calculated as of two days prior to the consummation of such Business Combination, including interest earned on funds held in the Trust Account not previously released to the Company to pay its income taxes, if any, divided by the number of DT Cloud Public Shares then in issue.” |

| | | |

| (b) | Article 37.6 of the DT Cloud Articles shall be deleted in its entirety and replaced with the following language: “Any Member holding Public Shares who is not a Founder, Officer or director may, contemporaneously with any vote on a Business Combination, elect to have their Public Shares redeemed for cash (the IPO Redemption), provided that no such Member acting together with any Affiliate of his or any other person with whom he is acting in concert or as a partnership, syndicate, or other group for the purposes of acquiring, holding, or disposing of Shares may exercise this redemption right with respect to more than 15% of the Public Shares without the Company’s prior consent, and provided further that any holder that holds Public Shares beneficially through a nominee must identify itself to the Company in connection with any redemption election in order to validly redeem such Public Shares. In connection with any vote held to approve a proposed Business Combination, holders of Public Shares seeking to exercise their redemption rights will be required to either tender their certificates (if any) to the Company’s transfer agent or to deliver their shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, at the holder’s option, in each case up to two business days prior to the initially scheduled vote on the proposal to approve a Business Combination. If so demanded, the Company shall pay any such redeeming Member, regardless of whether he is voting for or against such proposed Business Combination or abstains from voting, a per-Share redemption price payable in cash, equal to the aggregate amount then on deposit in the Trust Account calculated as of two business days prior to the consummation of a Business Combination, including interest earned on the Trust Account not previously released to the Company to pay its income taxes, if any, divided by the number of Public Shares then in issue (such redemption price being referred to herein as the Redemption Price).” |

Proposal No. 2 — The Business Combination Proposal — to consider and vote upon proposals to approve and authorize, by ordinary resolution, the business combination agreement, dated as of October 22, 2024, by and among DT Cloud, Maius Pharmaceutical Co., Ltd., a Cayman Islands exempted company (“Maius”), Maius Pharmaceutical Group Co., Ltd., a Cayman Islands exempted company (“Pubco”), Chelsea Merger Sub 1 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of Pubco (“Merger Sub 1”), Chelsea Merger Sub 2 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of Pubco (“Merger Sub 2”), and XXW Investment Limited, a BVI business company, as the Company Shareholders’ Representative (the “Target Shareholders’ Representative”) (such agreement, the “Business Combination Agreement”), a copy of which is attached to this proxy statement/prospectus as Annex A, and the transactions contemplated therein, including (1) on the Closing Date (as defined in the Business Combination Agreement), Merger Sub 1 will merge with and into DT Cloud (the “SPAC Merger”), with DT Cloud surviving the SPAC Merger as a wholly-owned subsidiary of Pubco (the time at which the SPAC Merger becomes effective, the “SPAC Merger Effective Time”); and (2) on the Closing Date and immediately following the SPAC Merger Effective Time, Merger Sub 2 will merge with and into Maius (the “Acquisition Merger” and, together with the SPAC Merger and all other transactions contemplated by the Business Combination Agreement, the “Business Combination”), with Maius surviving the Acquisition Merger as a wholly owned subsidiary of Pubco (the “Business Combination Proposal”).

Proposal No. 3 — The Merger Proposal — to consider and vote upon proposals to approve and authorize that, by special resolution, the SPAC Merger, the adoption at the SPAC Merger Effective Time of the proposed amended and restated memorandum and articles of association of DT Cloud as the surviving company of the SPAC Merger, a copy of which is attached to the First Plan of Merger, and the First Plan of Merger, substantially in the form attached to this proxy statement/prospectus as Annex D.

Proposal No. 4 — The Governance Proposal — to consider and vote upon a proposal to approve by special resolution the proposed amended and restated memorandum and articles of association of Pubco (the “Proposed Pubco Organizational Documents”) which, if approved, would take effect immediately prior to the SPAC Merger Effective Time (such proposal, the “Governance Proposal”). Copies of the Proposed Pubco Organizational Documents are attached to the accompanying proxy statement/prospectus as Annex B.

Proposal No. 5 — The Advisory Organizational Documents Proposals — to consider and vote upon separate proposals to approve, on a non-binding advisory basis, by ordinary resolution, material differences between the DT Cloud Articles and the Proposed Pubco Organizational Documents, which are being presented separately in accordance with U.S. Securities and Exchange Commission guidance to give shareholders the opportunity to present their separate views on important corporate governance provisions (collectively, the “Advisory Organizational Documents Proposals”).

Proposal No. 6 — The Nasdaq Proposal — to consider and vote upon a proposal to approve by ordinary resolution, for purposes of complying with applicable listing rules of The Nasdaq Stock Market, the issuance of up to [35,012,214] ordinary shares, par value of $0.0001 each, of Pubco (the “Pubco Ordinary Shares”) in connection with the Business Combination and the PIPE Investment (the “Nasdaq Proposal”).

Proposal No. 7 — The Pubco Director Election Proposal — to consider and vote upon a proposal to approve by as an ordinary resolution, that five (5) directors be elected to serve terms on Pubco’s board of directors effective at the Acquisition Merger Effective Time until the 2026 annual meeting of shareholders of Pubco or until their respective successors are duly elected and qualified appointed be approved in all respects (such proposal, the “Pubco Director Election Proposal”).

Proposal No. 8 — The Adjournment Proposal — to consider and vote upon a proposal to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the NTA Proposal, the Business Combination Proposal, the Merger Proposal, the Governance Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal or the Pubco Director Election Proposal (the “Adjournment Proposal” and, together with the NTA Proposal, the Business Combination Proposals, the Merger Proposal, the Governance Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal, and the Pubco Director Election Proposal, the “Proposals”).

The Business Combination Proposal is conditioned on the approval of the Merger Proposal, the Governance Proposal, the Nasdaq Proposal and the Pubco Director Election Proposal (collectively, the “Condition Precedent Proposals”). Each of the NTA Proposal, the Merger Proposal, the Governance Proposal, the Nasdaq Proposal and the Pubco Director Election Proposal is conditioned on the approval of the Business Combination Proposal. Therefore, if the Business Combination Proposal is not approved, then the NTA Proposal, the Merger Proposal, the Governance Proposal, the Nasdaq Proposal and the Pubco Director Election Proposal will not be presented to DT Cloud’s shareholders at the Meeting. The Advisory Organizational Documents Proposals and the Adjournment Proposal are not conditioned on the approval of any other Proposal set forth in the accompanying proxy statement/prospectus.

Only holders of record of ordinary shares, par value of $0.0001 each, of DT Cloud (the “DT Cloud Ordinary Shares”) at the close of business on [ ] (the “Record Date”) are entitled to notice of the extraordinary general meeting and to vote at the extraordinary general meeting and any adjournments thereof.

DT Cloud is providing the accompanying proxy statement/prospectus and accompanying proxy card to its shareholders in connection with the solicitation of proxies to be voted at the extraordinary general meeting and at any adjournments of the extraordinary general meeting. Information about the extraordinary general meeting, the Business Combination, and other related business to be considered by DT Cloud’s shareholders at the extraordinary general meeting is included in the accompanying proxy statement/prospectus.

Whether or not you plan to attend the extraordinary general meeting, all of DT Cloud’s shareholders are urged to read the accompanying proxy statement/prospectus, including the annexes and other documents referred to therein, carefully and in their entirety. In particular, you should carefully consider the matters discussed under “Risk Factors” beginning on page 60 of the accompanying proxy statement/prospectus.

Pursuant to the DT Cloud Articles, a holder of DT Cloud Ordinary Shares issued as part of the units sold in DT Cloud’s initial public offering (the “Public Shares,” and holders of such Public Shares, the “Public Shareholders”), other than the initial shareholders, may request that DT Cloud redeem all or a portion of its Public Shares for cash if the Business Combination is consummated. As a holder of Public Shares, you will be entitled to receive cash for any Public Shares to be redeemed only if you:

| ● | hold Public Shares, or if you hold Public Shares through DT Cloud units sold in DT Cloud’s IPO (the “DT Cloud Units”), you elect to separate your DT Cloud Units into the underlying Public Shares and DT Cloud Rights prior to exercising your redemption rights with respect to the Public Shares; |

| | | |

| ● | submit a written request to Continental Stock Transfer & Trust Company, DT Cloud’s transfer agent, in which you (1) request that DT Cloud redeem all or a portion of your Public Shares for cash; (2) identify yourself as the beneficial holder of the Public Shares and provide your legal name phone number, and address; and |

| | | |

| ● | deliver your Public Shares to Continental Stock Transfer & Trust Company, DT Cloud’s transfer agent, physically or electronically using the Depository Trust Company’s (“DTC”) DWAC (Deposit/Withdrawal At Custodian) System. |

Holders must complete the procedures for electing to redeem their Public Shares in the manner described above prior to 5:00 P.M., Eastern time, on [ ] (two business days before the extraordinary general meeting) in order for their Public Shares to be redeemed.

Holders of DT Cloud Units must elect to separate the DT Cloud Units into the underlying DT Cloud Ordinary Shares and DT Cloud Rights prior to exercising redemption rights with respect to the Public Shares. If Public Shareholders hold their DT Cloud Units in an account at a brokerage firm or bank, such Public Shareholders must notify their broker or bank that they elect to separate the DT Cloud Units into the underlying Public Shares and DT Cloud Rights, or if a holder holds DT Cloud Units registered in its own name, the holder must contact Continental Stock Transfer & Trust Company, DT Cloud’s transfer agent, directly and instruct it to do so. The redemption rights include the requirement that a holder must identify itself to DT Cloud in order to validly redeem its shares. Public Shareholders (other than the initial shareholders) may elect to exercise their redemption rights with respect to their Public Shares even if they vote “FOR” the Business Combination Proposal. If the Business Combination is not consummated, the Public Shares will be returned to the respective holder, broker, or bank. If the Business Combination is consummated, and if a Public Shareholder properly exercises its redemption right with respect to all or a portion of the Public Shares that it holds and timely delivers its shares to Continental Stock Transfer & Trust Company, DT Cloud will redeem the related Public Shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the funds held in the Trust Account and not previously released to DT Cloud, divided by the number of the then-outstanding DT Cloud Public Shares, which redemption will completely extinguish Public Shareholders’ rights as shareholders (including the right to receive further liquidation distributions, if any). For illustrative purposes, as of September 30, 2024, this would have been approximately $10.36 per issued and outstanding Public Share. If a Public Shareholder exercises its redemption rights in full, then it will not own Public Shares or Pubco Ordinary Shares following the redemption. See “Extraordinary General Meeting of DT Cloud Shareholders—Redemption Rights” in the accompanying proxy statement/prospectus for a detailed description of the procedures to be followed if you wish to exercise your redemption rights with respect to your Public Shares.

The approval of each of the Business Combination Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal, the Pubco Director Election Proposal and the Adjournment Proposal are being proposed as an ordinary resolution, being the affirmative vote (in person or by proxy) of the holders of a majority of the DT Cloud Ordinary Shares entitled to vote and actually casting votes thereon at the extraordinary general meeting. Approval of each of the NTA Proposal, the Merger Proposal and the Governance Proposal requires a special resolution under Cayman Islands law, being the affirmative vote (in person or by proxy) of the holders of at least two-thirds of the DT Cloud Ordinary Shares entitled to vote and actually casting votes thereon at the extraordinary general meeting. Accordingly, a shareholder’s failure to vote in person, online, or by proxy at the extraordinary general meeting will have no effect on the outcome of the vote on any of the Proposals. Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will not count as votes cast at the extraordinary general meeting.

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF DT CLOUD ORDINARY SHARES YOU OWN. To ensure your representation at the extraordinary general meeting, please complete and return the enclosed proxy card or submit your proxy by following the instructions contained in the accompanying proxy statement/prospectus and on your proxy card. Please submit your proxy promptly, whether or not you expect to attend the meeting. If you hold your shares in “street name,” you should instruct your broker, bank, or other nominee how to vote in accordance with the voting instruction form you received from your broker, bank, or other nominee.

After careful consideration, the board of directors of DT Cloud unanimously approved the Business Combination Agreement and related transactions and the other Proposals described in the accompanying proxy statement/prospectus, and determined is advisable to consummate the Business Combination. The board of directors of DT Cloud recommends that you vote “FOR” the NTA Proposal, “FOR” the Business Combination Proposal, “FOR” the Merger Proposal, “FOR” the Governance Proposal, “FOR” the Advisory Organizational Documents Proposals, “FOR” the Nasdaq Proposal, “FOR” the Pubco Director Election Proposal, and “FOR” the Adjournment Proposal.

Your attention is directed to the proxy statement/prospectus accompanying this notice (including the annexes thereto) for a more complete description of the proposed Business Combination and related transactions and each of our Proposals. We encourage you to read the accompanying proxy statement/prospectus carefully. If you have any questions or need assistance voting your shares, please call our proxy solicitor, [ ] toll-free at [ ].

, 2025

By Order of the Board of Directors

TABLE OF CONTENTS

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms a part of a registration statement on Form F-4 filed with the SEC, constitutes a prospectus of Pubco under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the issuance of up to (1) [9,982,214] Pubco Ordinary Shares to DT Cloud’s shareholders (including the conversion of DT Cloud Rights), and (2) [25,000,000] Pubco Ordinary Shares to Maius’ shareholders, in each case in connection with the Business Combination. This document also constitutes a proxy statement of DT Cloud under Section 14(a) of the Exchange Act, as amended (the “Exchange Act”), and the rules thereunder, and a notice of meeting with respect to the extraordinary general meeting of DT Cloud shareholders to consider and vote upon the proposals to adopt the NTA Proposal, the Business Combination Proposal, the Merger Proposal, the Governance Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal, the Pubco Director Election Proposal, and, if necessary, the Adjournment Proposal.

| ● | Proposal No. 1 — The NTA Proposal — to consider and vote upon to consider and vote upon a proposal to approve by special resolution the following articles of DT Cloud Articles be amended as follows with effect from prior to the consummation of the proposed Business Combination (such amendments shall be collectively referred to as the “NTA Amendments”): |

| (a) | Article 37.2(b) of the DT Cloud Articles shall be deleted in its entirety and replaced with the following language: “provide Members with the opportunity to have their Shares repurchased by means of a tender offer (a Tender Offer) for a per-Share repurchase price payable in cash, equal to the aggregate amount then on deposit in the Trust Account, calculated as of two days prior to the consummation of such Business Combination, including interest earned on funds held in the Trust Account not previously released to the Company to pay its income taxes, if any, divided by the number of DT Cloud Public Shares then in issue.” |

| | | |

| (b) | Article 37.6 of the DT Cloud Articles shall be deleted in its entirety and replaced with the following language: “Any Member holding Public Shares who is not a Founder, Officer or director may, contemporaneously with any vote on a Business Combination, elect to have their Public Shares redeemed for cash (the IPO Redemption), provided that no such Member acting together with any Affiliate of his or any other person with whom he is acting in concert or as a partnership, syndicate, or other group for the purposes of acquiring, holding, or disposing of Shares may exercise this redemption right with respect to more than 15% of the Public Shares without the Company’s prior consent, and provided further that any holder that holds Public Shares beneficially through a nominee must identify itself to the Company in connection with any redemption election in order to validly redeem such Public Shares. In connection with any vote held to approve a proposed Business Combination, holders of Public Shares seeking to exercise their redemption rights will be required to either tender their certificates (if any) to the Company’s transfer agent or to deliver their shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, at the holder’s option, in each case up to two business days prior to the initially scheduled vote on the proposal to approve a Business Combination. If so demanded, the Company shall pay any such redeeming Member, regardless of whether he is voting for or against such proposed Business Combination or abstains from voting, a per-Share redemption price payable in cash, equal to the aggregate amount then on deposit in the Trust Account calculated as of two business days prior to the consummation of a Business Combination, including interest earned on the Trust Account not previously released to the Company to pay its income taxes, if any, divided by the number of Public Shares then in issue (such redemption price being referred to herein as the Redemption Price).” |

| ● | Proposal No. 2 — The Business Combination Proposal — to consider and vote upon proposals to approve and authorize, by ordinary resolution, the business combination agreement, dated as of October 22, 2024, by and among DT Cloud, Maius Pharmaceutical Co., Ltd. (“Maius”), Maius Pharmaceutical Group Co., Ltd., a Cayman Islands exempted company (“Pubco”), Chelsea Merger Sub 1 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of Pubco (“Merger Sub 1”), Chelsea Merger Sub 2 Limited, a Cayman Islands exempted company and a wholly-owned subsidiary of Pubco (“Merger Sub 2”), and XXW Investment Limited, a BVI business company, as the Company Shareholders’ Representative (the “Target Shareholders’ Representative”) (such agreement, the “Business Combination Agreement”), a copy of which is attached to this proxy statement/prospectus as Annex A, and the transactions contemplated therein, and the transactions contemplated therein, including (1) on the Closing Date (as defined in the Business Combination Agreement), Merger Sub 1 will merge with and into DT Cloud (the “SPAC Merger”), with DT Cloud surviving the SPAC Merger as a wholly-owned subsidiary of Pubco (the time at which the SPAC Merger becomes effective, the “SPAC Merger Effective Time”); and (2) on the Closing Date and immediately following the SPAC Merger Effective Time, Merger Sub 2 will merge with and into Maius (the “Acquisition Merger” and, together with the SPAC Merger and all other transactions contemplated by the Business Combination Agreement, the “Business Combination”), with Maius surviving the Acquisition Merger as a wholly owned subsidiary of Pubco (the “Business Combination Proposal”). |

| ● | Proposal No. 3 — The Merger Proposal — to consider and vote upon proposals to approve and authorize that, by special resolution, the SPAC Merger, the adoption at the SPAC Merger Effective Time of the proposed amended and restated memorandum and articles of association of DT Cloud as the surviving company of the SPAC Merger, a copy of which is attached to the First Plan of Merger, and the First Plan of Merger, substantially in the form attached to this proxy statement/prospectus as Annex D. |

| | | |

| ● | Proposal No. 4 — The Governance Proposal — to consider and vote upon a proposal to approve by special resolution, the proposed amended and restated memorandum and articles of association of Pubco (the “Proposed Pubco Organizational Documents”) which, if approved, would take effect immediately prior to the SPAC Merger Effective Time (such proposal, the “Governance Proposal”). Copies of the Proposed Pubco Organizational Documents are attached to the accompanying proxy statement/prospectus as Annex B. |

| | | |

| ● | Proposal No. 5 — The Advisory Organizational Documents Proposals — to consider and vote upon separate proposals to approve, on a non-binding advisory basis, by ordinary resolution, material differences between the DT Cloud Articles and the Proposed Pubco Organizational Documents, which are being presented separately in accordance with U.S. Securities and Exchange Commission guidance to give shareholders the opportunity to present their separate views on important corporate governance provisions (collectively, the “Advisory Organizational Documents Proposals”). |

| | | |

| ● | Proposal No. 6 — The Nasdaq Proposal — to consider and vote upon a proposal to approve by ordinary resolution, for purposes of complying with applicable listing rules of The Nasdaq Stock Market, the issuance of up to [35,012,214] ordinary shares, par value of $0.0001 each, of Pubco (the “Pubco Ordinary Shares”) in connection with the Business Combination and the PIPE Investment (the “Nasdaq Proposal”). |

| | | |

| ● | Proposal No. 7 — The Pubco Director Election Proposal — to consider and vote upon a proposal to approve by ordinary resolution, that five (5) directors be elected to serve terms on Pubco’s board of directors effective at the Acquisition Merger Effective Time until [2026] annual meeting of shareholders of Pubco or until their respective successors are duly elected and appointed (the “Pubco Director Election Proposal”). |

| | | |

| ● | Proposal No. 8 — The Adjournment Proposal — to consider and vote upon a proposal to approve by ordinary resolution the adjournment of the extraordinary general meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Business Combination Proposals, the Governance Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal or Pubco Director Election Proposal (the “Adjournment Proposal” and, together with the NTA Proposal, the Business Combination Proposal, the Merger Proposal, the Governance Proposal, the Advisory Organizational Documents Proposals, the Nasdaq Proposal and the Pubco Director Election Proposal, the “Proposals”). |

This proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is not lawful to make any such offer or solicitation in such jurisdiction.

MARKET, INDUSTRY AND OTHER DATA

This proxy statement/prospectus contains estimates, projections and other information concerning Maius’ industry, including market size and growth of the markets in which it participates, that are based on industry publications, reports and forecasts prepared by its management. In some cases, Maius does not expressly refer to the sources from which these estimates and information are derived. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. The industry in which Maius operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications and reports.

The sources of certain statistical data, estimates, and forecasts contained in this proxy statement/prospectus include independent industry reports from Frost & Sullivan, a third-party research firm.

Certain estimates of market opportunity, including internal estimates of the addressable market for Maius and forecasts of market growth, included in this proxy statement/prospectus may prove inaccurate. Market opportunity estimates and growth forecasts, whether obtained from third-party sources or developed internally, are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. The estimates and forecasts in this proxy statement/prospectus relating to the size of Maius’ target market, market demand and adoption, capacity to address this demand, and pricing may prove to be inaccurate. The addressable market Maius estimates may not materialize for many years, if ever, and even if the markets in which it competes meet the size estimates in this proxy statement/prospectus, Maius’ business could fail to successfully address or compete in such markets, if at all.

Certain monetary amounts, percentages and other figures included in this proxy statement/prospectus have been subject to rounding adjustments. Certain other amounts that appear in this proxy statement/prospectus may not add up due to rounding.

CONVENTIONS THAT APPLY TO THIS PROXY STATEMENT/PROSPECTUS

| “Acquisition Closing” | | means the closing of the Acquisition Merger. |

| | | |

| “Acquisition Closing Date” | | means the date of closing of the Acquisition Merger. |

| | | |

| “Acquisition Merger” | | means the merger on the Closing Date of Merger Sub 2 with and into Maius, with Maius surviving the merger as a wholly owned subsidiary of Pubco. |

| | | |

| “Acquisition Merger Effective Time” | | means the date and time at which the Acquisition Merger becomes effective; |

| | | |

| “Administrative Services Agreement” | | means the administrative services agreement dated February 20, 2024 between DT Cloud and the Sponsor. |

| | | |

| “Ancillary Documents” | | means each agreement, document, instrument and/or certificate entered into in connection with the Business Combination Agreement or therewith and any and all exhibits and schedules thereto. |

| | | |

| “Brookline” or “DT Cloud IPO Underwriter” | | means Brookline Capital Markets, a division of Arcadia Securities LLC, the representative of the underwriters of DT Cloud. |

| | | |

| “Business Combination” | | means the SPAC Merger, the Acquisition Merger, and all other transactions contemplated by the Business Combination Agreement. |

| | | |

| “Business Combination Agreement” | | means that certain Business Combination Agreement, dated as of October 22, 2024, by and among DT Cloud, Maius, Pubco, Merger Sub 1, Merger Sub 2, and Target Shareholders’ Representative. |

| | | |

| “CAC” | | means the Cyberspace Administration of the PRC. |

| | | |

| “Cayman Companies Act” | | means the Companies Act (Revised) of the Cayman Islands. |

| | | |

| “Closing Date” | | means the date on which the Initial Closing and the Acquisition Closing occur. |

| | | |

| “Code” | | means the U.S. Internal Revenue Code of 1986, as amended. |

| | | |

| “Combination Period” | | means the period from the closing of DT Cloud’s initial public offering to February 23, 2025 (or up to February 23, 2026 if DT Cloud extends the period of time to consummate a business combination which may be accomplished only if the Sponsor deposits additional funds into the Trust Account) by which DT Cloud must consummate a business combination. |

| | | |

| “CSRC” | | means the China Securities Regulatory Commission. |

| | | |

| “Dissent Rights” | | means the right of each holder of record of DT Cloud Ordinary Shares to dissent in respect of the SPAC Merger pursuant to Section 238 of the Cayman Companies Act. |

| “Dissenting DT Cloud Shareholders” | | means holders of Dissenting DT Cloud Shares. |

| | | |

| “Dissenting DT Cloud Shares” | | means DT Cloud Ordinary Shares that are (1) issued and outstanding immediately prior to the SPAC Merger Effective Time, and (2) held by DT Cloud shareholders who have validly exercised their Dissent Rights (and not waived, withdrawn, lost or failed to perfect such rights). |

| | | |

| “DT Cloud” | | means DT Cloud Acquisition Corporation, an exempted company incorporated under the laws of the Cayman Islands. |

| | | |

| “DT Cloud Articles” | | means DT Cloud’s amended and restated memorandum and articles of association adopted by special resolution dated February 19, 2024. |

| | | |

| “DT Cloud Board” | | means the board of directors of DT Cloud. |

| | | |

| “DT Cloud Ordinary Shares” | | means an ordinary share of DT Cloud, par value of $0.0001 each. |

| | | |

| “DT Cloud Founder Shares” | | means the 1,725,000 DT Cloud Ordinary Shares held by the Sponsor, which were acquired for an aggregate price of $25,000 prior to the DT Cloud IPO. |

| | | |

| “DT Cloud IPO” | | means the initial public offering of DT Cloud, which was consummated on February 23, 2024. |

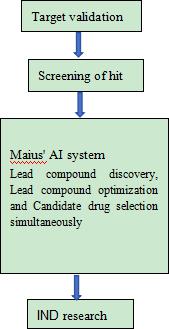

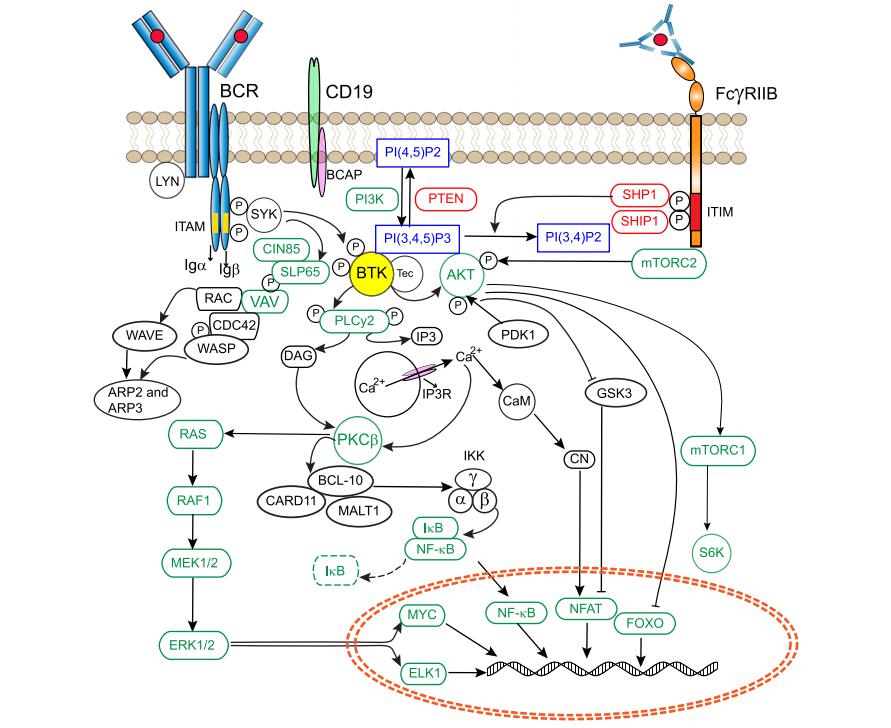

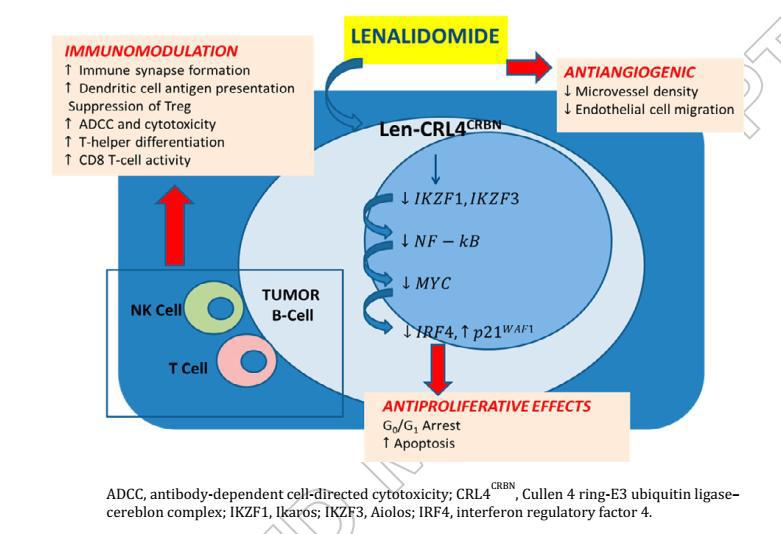

| | | |