| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-280318-01 |

| | | |

| BANK5 2025-5YR13 | Structural Overview |

BANK5 2025-5YR13

Free Writing Prospectus

Structural and Collateral Term Sheet

$737,090,260

(Approximate Total Mortgage Pool Balance)

$591,699,000

(Approximate Offered Certificates)

J.P. Morgan Chase Commercial Mortgage Securities Corp.

as Depositor

JPMorgan Chase Bank, National Association

Bank of America, National Association

Wells Fargo Bank, National Association

Morgan Stanley Mortgage Capital Holdings LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2025-5YR13

February 3, 2025

J.P. MORGAN

Co-Lead Bookrunner

Manager | WELLS FARGO SECURITIES

Co-Lead Bookrunner

Manager | MORGAN STANLEY

Co-Lead Bookrunner

Manager | BofA SECURITIES

Co-Lead Bookrunner

Manager |

Academy Securities

Co-Manager | | | Drexel Hamilton

Co-Manager |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| BANK5 2025-5YR13 | Structural Overview |

This material is for your information, and none of J.P. Morgan Securities LLC, BofA Securities, Inc., Wells Fargo Securities, LLC, Morgan Stanley & Co. LLC, Drexel Hamilton, LLC or Academy Securities, Inc. (each individually, an “Underwriter”, and together, the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The Depositor has filed a registration statement (including a prospectus) with the SEC (SEC File no. 333-280318) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the Depositor has filed with the SEC for more complete information about the Depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Depositor, any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling (800) 408-1016 or by emailing the ABS Syndicate Desk at abs_synd@jpmorgan.com. Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended), such Regulation as it forms part of the domestic law of the United Kingdom and/or Part VI of the Financial Services and Markets Act 2000 (as amended); and does not constitute an offering document for any other purpose.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) that have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected in this document. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the Computational Materials. The specific characteristics of the certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any certificate described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the certificates.

This information is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this document. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of their dates, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Investors should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor’s view only as of the date of this document.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

“BofA Securities” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation, including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and member of FINRA and SIPC, and, in other jurisdictions, locally registered entities.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of the New York Stock Exchange, Financial Industry Regulatory Authority (“FINRA”), the National Futures Association (“NFA”) and the Securities Investor Protection Corporation (“SIPC”), Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, National Association. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

Capitalized terms used in this material but not defined herein shall have the meanings ascribed to them in the Preliminary Prospectus (as defined below).

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-2 | |

| BANK5 2025-5YR13 | Structural Overview |

Offered Certificates

| | | | | | | | | |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life

(Years)(4) | Expected Principal

Window

(Months)(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate

Principal

to Value

Ratio(6) |

| Class A-1 | AAAsf/AAA(sf)/Aaa(sf) | $2,050,000 | 30.000% | (7) | 2.52 | 1 - 54 | 18.4% | 40.2% |

| Class A-2(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 18.4% | 40.2% |

| Class A-3(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 18.4% | 40.2% |

| Class X-A | AAAsf/AAA(sf)/Aaa(sf) | $490,165,000(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-B | A-sf/AAA(sf)/NR | $128,668,000(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class A-S(8) | AAAsf/AAA(sf)/Aa2(sf) | $66,522,000(8) | 20.500% | (7)(8) | 4.97 | 60 - 60 | 16.2% | 45.6% |

| Class B(8) | AA-sf/AA(sf)/NR | $35,012,000(8) | 15.500% | (7)(8) | 4.97 | 60 - 60 | 15.3% | 48.5% |

Privately Offered Certificates(12)

| | | | | | | | | |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate

Initial Credit

Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(4) | Expected Principal

Window (Months)(4) | Certificate

Principal UW NOI Debt

Yield(5) | Certificate

Principal

to Value

Ratio(6) |

| Class X-D | BBB-sf/BBB(sf)/NR | $24,508,000(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-H | B-sf/BB-(sf)/NR | $10,503,000(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-J | NR/B-(sf)/NR | $7,003,000(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class X-K | NR/NR/NR | $22,757,747(10) | N/A | Variable IO(11) | N/A | N/A | N/A | N/A |

| Class C(8) | A-sf/A-(sf)/NR | $27,134,000(8) | 11.625% | (7)(8) | 4.97 | 60 - 60 | 14.6% | 50.7% |

| Class D | BBBsf/BBB+(sf)/NR | $16,630,000 | 9.250% | (7) | 4.97 | 60 - 60 | 14.2% | 52.1% |

| Class E | BBB-sf/BBB(sf)/NR | $7,878,000 | 8.125% | (7) | 4.97 | 60 - 60 | 14.0% | 52.7% |

| Class F | BBsf/BBB-(sf)/NR | $9,628,000 | 6.750% | (7) | 4.97 | 60 - 60 | 13.8% | 53.5% |

| Class G | BB-sf/BB+(sf)/NR | $7,003,000 | 5.750% | (7) | 4.97 | 60 - 60 | 13.7% | 54.1% |

| Class H | B-sf/BB-(sf)/NR | $10,503,000 | 4.250% | (7) | 4.97 | 60 - 60 | 13.5% | 55.0% |

| Class J | NR/B-(sf)/NR | $7,003,000 | 3.250% | (7) | 4.97 | 60 - 60 | 13.3% | 55.5% |

| Class K | NR/NR/NR | $22,757,747 | 0.000% | (7) | 4.97 | 60 - 60 | 12.9% | 57.4% |

Non-Offered Eligible Vertical Interest(12)

| Class or Interest | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial VRR Interest Balance(2) | Approximate

Initial Credit

Support(3) | VRR Interest Rate Description | Expected Weighted Average Life

(Years)(4) | Expected Principal

Window (Months)(4) | Certificate

Principal UW NOI Debt

Yield(5) | Certificate

Principal

to Value

Ratio(6) |

| Class RR(13) | NR/NR/NR | $29,104,513.01 | N/A | (14) | 4.89 | 1 - 60 | N/A | N/A |

| RR Interest | NR/NR/NR | $7,750,000.01 | N/A | (14) | 4.89 | 1 - 60 | N/A | N/A |

| (1) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus to be dated on or about the date hereof (the “Preliminary Prospectus”). Capitalized terms used but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus. |

| (2) | Approximate, subject to a variance of plus or minus 5%. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-H, Class X-J and Class X-K certificates (collectively, the “Class X certificates”) may vary depending upon the final pricing of the classes of principal balance certificates or trust components whose certificate or principal balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any class of the Class X-A, Class X-B, Class X-D, Class X-H, Class X-J and Class X-K certificates, as applicable, would be equal to zero at all times, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2 and Class A-3 certificates, are presented in the aggregate, taking into account the principal balance of the Class A-2 and Class A-3 trust components. The approximate initial credit support percentage set forth for each class of the Class A-S, Class B and Class C certificates represents the approximate credit support for the underlying trust component with the same alphanumeric designation. The VRR Interest provides credit support only to the limited extent that it is allocated a portion of any |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-3 | |

| BANK5 2025-5YR13 | Structural Overview |

losses incurred on the underlying mortgage loans, which such losses are allocated between it, on the one hand, and to the certificates, on the other hand, pro rata in accordance with their respective Percentage Allocation Entitlements (as defined below). See “Credit Risk Retention” in the Preliminary Prospectus.

| (4) | The Expected Weighted Average Life and Expected Principal Window during which distributions of principal would be received as set forth in the foregoing table with respect to each class of principal balance certificates and the VRR Interest are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates of the mortgage loans. |

| (5) | Certificate Principal UW NOI Debt Yield for any class of principal balance certificates shown in the table above is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the sum of the aggregate initial certificate balance of all the principal balance certificates and the initial principal balance of the VRR Interest, and the denominator of which is the sum of (x) the aggregate initial certificate balance of the subject class of principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of principal balance certificates, if any, that are senior to such class and (y) the initial principal balance of the VRR Interest, multiplied by the applicable VRR Interest Computation Percentage. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | Certificate Principal to Value Ratio for any class of principal balance certificates shown in the table above is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the sum of (x) the aggregate initial certificate balance of the subject class of principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of principal balance certificates, if any, that are senior to such class and (y) the initial principal balance of the VRR Interest, multiplied by the applicable VRR Interest Computation Percentage, and the denominator of which is the sum of the aggregate initial certificate balance of all the principal balance certificates and the initial principal balance of the VRR Interest. The Certificate Principal to Value Ratios of the Class A-1, Class A-2 and Class A-3 certificates are calculated in the aggregate for those classes as if they were a single class. With respect to any class of principal balance certificates, the “VRR Interest Computation Percentage” is equal to a fraction, expressed as a percentage, the numerator of which is the aggregate initial certificate balance of the subject class of principal balance certificates (or, with respect to the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, the initial principal balance of the trust component with the same alphanumeric designation) and all other classes of principal balance certificates, if any, that are senior to such class, and the denominator of which is the aggregate initial certificate balance of all the principal balance certificates. |

| (7) | The pass-through rate for each class of the Class A-1, Class A-2, Class A-3, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G Class H, Class J and Class K certificates for any distribution date will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class A-2-1, Class A-2-2, Class A-2-X1, Class A-2-X2, Class A-3-1, Class A-3-2, Class A-3-X1, Class A-3-X2, Class A-S-1, Class A-S-2, Class A-S-X1, Class A-S-X2, Class B-1, Class B-2, Class B-X1 and Class B-X2 certificates are also offered certificates. Such classes of certificates, together with the Class A-2, Class A-3, Class A-S, Class B, Class C, Class C-1, Class C-2, Class C-X1 and Class C-X2 certificates constitute the “Exchangeable Certificates”. The Class A-1, Class D, Class E, Class F, Class G, Class H, Class J and Class K certificates and the Exchangeable Certificates with a certificate balance are referred to as the “principal balance certificates.” Each Class of Exchangeable Certificates will have the certificate balance or notional amount and pass-through rate described below under “Exchangeable Certificates.” Each class of Class A-2, Class A-3, Class A-S, Class B and Class C Exchangeable Certificates will have the same ratings as the Class A-2, Class A-3, Class A-S, Class B and Class C certificates, respectively, shown in the table above. |

| (9) | The exact initial principal balances or notional amounts of the Class A-2, Class A-2-X1, Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components (and consequently, the exact aggregate initial certificate balances or notional amounts of the Exchangeable Certificates with an “A-2” or “A-3” designation) are unknown and will be determined based on the final pricing of the certificates. However, the initial principal or certificate balances, weighted average lives and principal windows of the Class A-2 and Class A-3 trust components are expected to be within the applicable ranges reflected in the chart below. The aggregate of the initial principal balances of the Class A-2 and Class A-3 trust components is expected to be approximately $488,115,000 , subject to a variance of plus or minus 5%. The Class A-2-X1 and Class A-2-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-2 trust component. The Class A-3-X1 and Class A-3-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-3 trust component. In the event that the Class A-3 trust component is issued with an initial certificate balance of $488,115,000 , the Class A-2 trust component (and, correspondingly, the Class A-2 Exchangeable Certificates) will not be issued. For purposes of the disclosure herein regarding the aggregate certificate balance of the offered certificates, it is assumed that the maximum amount of the Class A-2 trust component will be issued. |

| Trust Component or Class of Certificates | Expected Range of Initial Principal Balance or Initial Certificate Balance | Expected Range of Weighted Average Life (Years) | Expected Range of Principal Window (Months) |

| Class A-2 trust component | $0 – $200,000,000 | NAP– 4.79 | NAP/ 54 – 59 |

| Class A-3 trust component | $288,115,000– $488,115,000 | 4.90– 4.86 | 59 - 60/ 54 – 60 |

| (10) | The Class X certificates are notional amount certificates and will not be entitled to distributions of principal. The notional amount of the Class X-A certificates will be equal to the aggregate certificate or principal balance of the Class A-1 certificates and the Class A-2 and Class A-3 trust component outstanding from time to time. The notional amount of the Class X-B certificates will be equal to the aggregate principal balance of the Class A-S, Class B and Class C trust components outstanding from time to time. The notional amount of the Class X-D certificates will be equal to the aggregate certificate balance of the Class D and Class E certificates outstanding from time to time. The notional amount of the Class X-H certificates will be equal to the certificate balance of the Class H certificates outstanding from time to time. The notional amount of the Class X-J certificates will be equal to the certificate balance of the Class J certificates outstanding from time to time. The notional amount of the Class X-K certificates will be equal to the certificate balance of the Class K certificates outstanding from time to time. |

| (11) | The pass-through rate for the Class X-A certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1 certificates and the Class A-2, Class A-2-X1 and Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components for the related distribution date, weighted on the basis of their respective certificate or principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-B |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-4 | |

| BANK5 2025-5YR13 | Structural Overview |

certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, Class A-S-X1, Class A-S-X2, Class B, Class B-X1, Class B-X2, Class C, Class C-X1 and Class C-X2 trust components for the related distribution date, weighted on the basis of their respective certificate or principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-D certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and Class E certificates for the related distribution date, weighted on the basis of their respective certificate balances outstanding immediately prior to that distribution date. The pass-through rate for the Class X-H certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class H certificates for the related distribution date. The pass-through rate for the Class X-J certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class J certificates for the related distribution date. The pass-through rate for the Class X-K certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class K certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis

| (12) | Not offered pursuant to the Preliminary Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates and the VRR Interest is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class R certificates, which do not have a certificate balance, notional amount, credit support, pass-through rate, rating, assumed final distribution date or rated final distribution date, and which are not shown in the chart. The Class R certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Preliminary Prospectus. |

| (13) | The Class RR certificates will be certificated but will not be “certificates” for purposes of this Term Sheet. |

| (14) | Although they do not have a specified pass-through rate (other than for tax reporting purposes), the effective pass-through rate for each of the Class RR Certificates and the RR Interest will be a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months). |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-5 | |

| BANK5 2025-5YR13 | Structural Overview |

Issue Characteristics

| Offered Certificates: | $591,699,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of 13 principal balance classes (Class A-1, Class A-2, Class A-2-1, Class A-2-2, Class A-3, Class A-3-1, Class A-3-2, Class A-S, Class A-S-1, Class A-S-2, Class B, Class B-1 and Class B-2,) and 10 interest-only classes (Class A-2-X1, Class A-2-X2, Class A-3-X1, Class A-3-X2, Class X-A, Class X-B, Class A-S-X1, Class A-S-X2, Class B-X1 and Class B-X2). |

| Co-Lead Managers and Joint Bookrunners: | J.P. Morgan Securities LLC, BofA Securities, Inc., Wells Fargo Securities, LLC and Morgan Stanley & Co. LLC |

| Co-Managers: | Drexel Hamilton, LLC and Academy Securities, Inc. |

| Mortgage Loan Sellers: | JPMorgan Chase Bank, National Association, Bank of America, National Association, Wells Fargo Bank, National Association and Morgan Stanley Mortgage Capital Holdings LLC |

| Rating Agencies: | Fitch, KBRA and Moody’s |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | K-Star Asset Management LLC |

| Trustee/Certificate Administrator/ Certificate Registrar/Custodian: | Computershare Trust Company, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| Initial Directing Certificateholder: | KKR CMBS IIII Aggregator Category 2 L.P. (or an affiliate) is expected to be appointed as the initial directing certificateholder with respect to all serviced mortgage loans (other than any Excluded Loans). |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be addressed by JPMorgan Chase Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU/UK Risk Retention: | None of the sponsors, the depositor or the underwriters, or their respective affiliates, or any other person, intends to retain a material net economic interest in the securitization constituted by the issue of the certificates and the VRR Interest, or to take any other action in respect of such securitization, in a manner prescribed or contemplated by the EU Securitization Regulation or the UK Securitization Framework. In particular, no such person undertakes to take any action which may be required by any potential investor or certificateholder for the purposes of its compliance with any requirement of the EU Securitization Regulation or the UK Securitization Framework. In addition, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirement of the EU Securitization Regulation or the UK Securitization Regulation. Consequently, the Offered Certificates may not be a suitable investment for investors that are subject to any requirement of the EU Securitization Regulation or the UK Securitization Framework. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Regulation and UK Securitization Framework Due Diligence Requirements” in the Preliminary Prospectus. |

| Cut-off Date: | The mortgage loans will be considered part of the trust fund as of their respective cut-off dates. The cut-off date with respect to each mortgage loan is the respective due date for the monthly debt service payment that is due in February 2025 (or, in the case of any mortgage loan that has its first due date after February 2025, the date that would have been its due date in February 2025 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Pricing Date: | Week of February 3, 2025 |

| Expected Closing Date: | February 25, 2025 |

| Determination Dates: | The 11th day of each month or, if the 11th day is not a business day, then the business day immediately following such 11th day. |

| Distribution Dates: | The 4th business day following each determination date. The first distribution date will be in March 2025. |

| Rated Final Distribution Date: | The distribution date in January 2058. |

| Interest Accrual Period: | Preceding calendar month |

| Payment Structure: | Sequential pay |

| Tax Treatment: | REMIC, except that the Exchangeable Certificates will evidence interests in a grantor trust |

| Optional Termination: | 1.00% clean-up call |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A and Class X-B certificates); $1,000,000 for the Class X-A and Class X-B certificates |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| Legal/Regulatory Status: | Each class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. Until the SEC adopts rules establishing a different creditworthiness standard, the Class A-1 certificates, the Class A-2 Exchangeable Certificates, the Class A-3 Exchangeable Certificates, the Class X-A certificates, the Class X-B |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-6 | |

| BANK5 2025-5YR13 | Structural Overview |

| certificates, the Class A-S Exchangeable Certificates and the Class B Exchangeable Certificates will constitute “mortgage related securities” for purposes of SMMEA, so long as they are rated in one of the two highest rating categories by one of the rating agencies or another NRSRO, and the other classes of certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC® reports and supplemental notices received by it to certain modeling financial services as described in the Preliminary Prospectus. |

| Bloomberg Ticker: | BANK5 2025-5YR13<MTGE><GO> |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-7 | |

| BANK5 2025-5YR13 | Structural Overview |

Structural Overview

Allocation Between the VRR

Interest and the Certificates: | The aggregate amount available for distributions to the holders of the certificates and the VRR Interest on each distribution date (net of specified expenses of the issuing entity, including fees payable to, and costs and expenses reimbursable to, each applicable master servicer, primary servicer and special servicer, the certificate administrator, the trustee, the operating advisor, the asset representations reviewer and CREFC®) will be allocated between amounts available for distribution to the holders of the VRR Interest, on the one hand, and to the holders of the certificates (other than the Class R Certificates), on the other hand. The portion of such aggregate available funds allocable to: (a) the VRR Interest will at all times be the product of such aggregate available funds multiplied by a fraction, expressed as a percentage, the numerator of which is the initial VRR interest balance of the VRR Interest, and the denominator of which is the sum of the aggregate initial Certificate Balances of the Principal Balance Certificates and the initial VRR Interest Balance of the VRR Interest (the “VRR Percentage”); and (b) the Non-VRR Certificates will at all times be the product of such aggregate available funds multiplied by the difference between 100% and the VRR Percentage (such difference, the “Non-VRR Percentage”) (each of the VRR Percentage and Non-VRR Percentage are referred to as the respective “Percentage Allocation Entitlement”). The Class RR Certificates and the RR Interest will collectively constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules), which is expected to be acquired and retained by certain of the sponsors as described under “Credit Risk Retention” in the Preliminary Prospectus. The Class RR Certificates and the RR Interest collectively comprise the “VRR Interest”. |

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

Amount and Order of

Distributions: | On each distribution date, the certificates’ Percentage Allocation Entitlement of funds available for distribution from the mortgage loans, net of any yield maintenance charges and prepayment premiums, will be distributed in the following amounts and order of priority: First, to the Class A-1, Class X-A, Class X-B, Class X-D, Class X-H, Class X-J and Class X-K certificates and the Class A-2, Class A-2-X1 and Class A-2-X2, Class A-3, Class A-3-X1 and Class A-3-X2 trust components, in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those classes of certificates and trust components; Second, to the Class A-1 certificates and the Class A-2 and Class A-3 trust components, as follows: (i) to the extent of funds allocated to principal and available for distribution: (a) first, to principal on the Class A-1 certificates, until the certificate balance of the Class A-1 certificates has been reduced to zero, (b) second, to principal on the Class A-2 trust component, until the principal balance of the Class A-2 trust component has been reduced to zero, and (c) third, to principal on the Class A-3 trust component, until the principal balance of the Class A-3 trust component has been reduced to zero, or (ii) if the certificate or principal balance of each class of certificates and trust component other than the Class A-1 certificates and Class A-2 and Class A-3 trust component has been reduced to zero as a result of the allocation of mortgage loan losses to those classes of certificates or trust components, funds available for distributions of principal will be distributed to the Class A-1 certificates and Class A-2 and Class A-3 trust component remaining outstanding, pro rata, without regard to the distribution priorities described above; Third, to the Class A-1 certificates and Class A-2 and Class A-3 trust component, to reimburse the Class A-1 certificates and Class A-2 and Class A-3 trust component, first, (i) up to an amount equal to, and pro rata in accordance with, the aggregate previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by each such class or trust component, then, (ii) up to an amount equal to, and pro rata in accordance with, all accrued and unpaid interest on the amount set forth in clause (i) at the pass-through rate for such class or trust component; Fourth, to the Class A-S, Class A-S-X1 and Class A-S-X2 trust components as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class A-S trust component until its certificate or principal balance has been reduced to zero; and (c) to reimburse the Class A-S trust component, first, in an amount equal to any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by those certificates or trust components, and then in an amount equal to interest on that amount at the pass-through rate for such trust component; Fifth, to the Class B, Class B-X1 and Class B-X2 trust components as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class B trust component until its certificate or principal balance has been reduced to zero; and (c) to reimburse the Class B trust component, first, in an amount equal to any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by those certificates or trust components, and then in an amount equal to interest on that amount at the pass-through rate for such trust component; Sixth, to the Class C, Class C-X1 and Class C-X2 trust components as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of funds allocable to principal remaining after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-8 | |

| BANK5 2025-5YR13 | Structural Overview |

| clauses set forth above), to principal on the Class C trust component until its certificate or principal balance has been reduced to zero; and (c) to reimburse the Class C trust component, first, in an amount equal to any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by those certificates or trust components, and then in an amount equal to interest on that amount at the pass-through rate for such trust component; Seventh, to the Class D, Class E, Class F, Class G, Class H, Class J and Class K certificates in the amounts and order of priority described in “Description of the Certificates—Distributions” in the Preliminary Prospectus; and Eighth, to the Class R certificates, any remaining amounts. Principal and interest payable on each trust component will be distributed pro rata to the corresponding classes of Exchangeable Certificates representing interests therein in accordance with their Class Percentage Interests therein as described below under “Exchangeable Certificates.” |

Interest and Principal

Entitlements: | The interest entitlement of each class of Offered Certificates on each distribution date generally will be the interest accrued during the related interest accrual period on the related certificate balance or notional amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that class for such distribution date as described below. If prepayment interest shortfalls arise from voluntary prepayments on serviced mortgage loans during any collection period, the master servicer is required to make a limited compensating interest payment to offset those shortfalls. See “Description of the Certificates—Prepayment Interest Shortfalls” in the Preliminary Prospectus. The remaining amount of prepayment interest shortfalls will be allocated between the VRR Interest, on one hand, and the certificates, on the other hand, in accordance with their respective Percentage Allocation Entitlements. The prepayment interest shortfalls allocated to the certificates will be allocated among such classes of certificates (other than the Exchangeable Certificates) and trust components that are entitled to interest, on a pro rata basis, based on their respective amounts of accrued interest for the related distribution date, to reduce the interest entitlement on each such class of certificates and trust components. For any distribution date, prepayment interest shortfalls allocated to a trust component will be allocated among the related classes of Exchangeable Certificates, pro rata, in accordance with their respective class percentage interests for that distribution date. If a class of certificates or trust component receives less than the entirety of its interest entitlement on any distribution date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding distribution date. The principal distribution amount for each distribution date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and any workout-delayed reimbursement amounts that are reimbursed to the master servicer or the trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections before reimbursement from other amounts. Workout-delayed reimbursement amounts will be reimbursable from principal collections. The certificates and the VRR Interest will be entitled to their respective Percentage Allocation Entitlements of the aggregate principal distribution amount. |

| Exchangeable Certificates: | Certificates of each class of Exchangeable Certificates may be exchanged for certificates of the corresponding classes of Exchangeable Certificates set forth next to such class in the table below, and vice versa. Following any exchange of certificates of one or more classes of Exchangeable Certificates (the applicable “Surrendered Classes”) for certificates of one or more classes of other Exchangeable Certificates (the applicable “Received Classes”), the Class Percentage Interests (as defined below) of the outstanding principal balances or notional amounts of the Corresponding Trust Components that are represented by the Surrendered Classes (and consequently their related certificate balances or notional amounts) will be decreased, and those of the Received Classes (and consequently their related certificate balances or notional amounts) will be increased. The dollar denomination of the certificates of each of the Received Classes must be equal to the dollar denomination of the certificates of each of the Surrendered Classes. No fee will be required with respect to any exchange of Exchangeable Certificates. |

| | Surrendered Classes (or Received Classes) of Certificates | Received Classes (or Surrendered Classes) of Certificates |

| | Class A-2 | Class A-2-1, Class A-2-X1 |

| | Class A-2 | Class A-2-2, Class A-2-X2 |

| | Class A-3 | Class A-3-1, Class A-3-X1 |

| | Class A-3 | Class A-3-2, Class A-3-X2 |

| | Class A-S | Class A-S-1, Class A-S-X1 |

| | Class A-S | Class A-S-2, Class A-S-X2 |

| | Class B | Class B-1, Class B-X1 |

| | Class B | Class B-2, Class B-X2 |

| | Class C | Class C-1, Class C-X1 |

| | Class C | Class C-2, Class C-X2 |

| On the closing date, the issuing entity will issue the following “trust components,” each with the initial principal balance (or, if such trust component has an “X” suffix, notional amount) and pass-through rate set forth next to it in the table below. Each trust component with an “X” suffix will not be entitled to distributions of principal. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-9 | |

| BANK5 2025-5YR13 | Structural Overview |

| | Trust Component | Initial Principal Balance

or Notional Amount | Pass-Through Rate |

| | Class A-2 | See footnote (9) to the first table above

under “Structural Overview” | Class A-2 certificate pass-through rate

minus 1.00% |

| | Class A-2-X1 | Equal to Class A-2 trust component

principal balance | 0.50% |

| | Class A-2-X2 | Equal to Class A-2 trust component

principal balance | 0.50% |

| | Class A-3 | See footnote (9) to the first table above

under “Structural Overview” | Class A-3 certificate pass-through rate

minus 1.00% |

| | Class A-3-X1 | Equal to Class A-3 trust component

principal balance | 0.50% |

| | Class A-3-X2 | Equal to Class A-3 trust component

principal balance | 0.50% |

| | Class A-S | $66,522,000 | Class A-S certificate pass-through rate

minus 1.00% |

| | Class A-S-X1 | Equal to Class A-S trust component

principal balance | 0.50% |

| | Class A-S-X2 | Equal to Class A-S trust component

principal balance | 0.50% |

| | Class B | $35,012,000 | Class B certificate pass-through rate

minus 1.00% |

| | Class B-X1 | Equal to Class B trust component

principal balance | 0.50% |

| | Class B-X2 | Equal to Class B trust component

principal balance | 0.50% |

| | Class C | $27,134,000 | Class C certificate pass-through rate minus 1.00% |

| | Class C-X1 | Equal to Class C trust component

principal balance | 0.50% |

| | Class C-X2 | Equal to Class C trust component

principal balance | 0.50% |

| Each class of Exchangeable Certificates represents an undivided beneficial ownership interest in the trust components set forth next to it in the table below (the “Corresponding Trust Components”). Each class of Exchangeable Certificates has a pass-through rate equal to the sum of the pass-through rates of the Corresponding Trust Components and represents a percentage interest (the related “Class Percentage Interest”) in each Corresponding Trust Component, including principal and interest payable thereon (and reimbursements of losses allocable thereto), equal to (x) the certificate balance (or, if such class has an “X” suffix, notional amount) of such class of certificates, divided by (y) the principal balance of the Class A-2 trust component (if such class of Exchangeable Certificates has an “A-2” designation), the Class A-3 trust component (if such class of Exchangeable Certificates has an “A-3” designation), the Class A-S trust component (if such class of Exchangeable Certificates has an “A-S” designation), the Class B trust component (if such class of Exchangeable Certificates has a “B” designation), or the Class C trust component (if such class of Exchangeable Certificates has a “C” designation). |

| | Group of Exchangeable Certificates | Class of Exchangeable Certificates | Corresponding Trust Components |

| | “Class A-2 Exchangeable Certificates” | Class A-2 | Class A-2, Class A-2-X1, Class A-2-X2 |

| | Class A-2-1 | Class A-2, Class A-2-X2 |

| | Class A-2-2 | Class A-2 |

| | Class A-2-X1 | Class A-2-X1 |

| | Class A-2-X2 | Class A-2-X1, Class A-2-X2 |

| | “Class A-3 Exchangeable Certificates” | Class A-3 | Class A-3, Class A-3-X1, Class A-3-X2 |

| | Class A-3-1 | Class A-3, Class A-3-X2 |

| | Class A-3-2 | Class A-3 |

| | Class A-3-X1 | Class A-3-X1 |

| | Class A-3-X2 | Class A-3-X1, Class A-3-X2 |

| | “Class A-S Exchangeable Certificates” | Class A-S | Class A-S, Class A-S-X1, Class A-S-X2 |

| | Class A-S-1 | Class A-S, Class A-S-X2 |

| | Class A-S-2 | Class A-S |

| | Class A-S-X1 | Class A-S-X1 |

| | Class A-S-X2 | Class A-S-X1, Class A-S-X2 |

| | “Class B Exchangeable Certificates” | Class B | Class B, Class B-X1, Class B-X2 |

| | Class B-1 | Class B, Class B-X2 |

| | Class B-2 | Class B |

| | Class B-X1 | Class B-X1 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-10 | |

| BANK5 2025-5YR13 | Structural Overview |

| | | Class B-X2 | Class B-X1, Class B-X2 |

| | “Class C Exchangeable Certificates” | Class C | Class C, Class C-X1, Class C-X2 |

| | Class C-1 | Class C, Class C-X2 |

| | Class C-2 | Class C |

| | Class C-X1 | Class C-X1 |

| | Class C-X2 | Class C-X1, Class C-X2 |

| The maximum certificate balance or notional amount of each class of Class A-2 Exchangeable Certificates, Class A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates or Class C Exchangeable Certificates that could be issued in an exchange is equal to the principal balance of the Class A-2, Class A-3, Class A-S, Class B or Class C trust component, respectively. The maximum certificate balances of Class A-2, Class A-3, Class A-S, Class B and Class C certificates (subject to the constraint on the aggregate of the initial principal balances of the Class A-2 and Class A-3 trust components discussed in footnote (9) to the first table above under “Structural Overview”) will be issued on the closing date, and the certificate balance or notional amount of each other class of Exchangeable Certificates will be equal to zero on the closing date. Each class of Class A-2 Exchangeable Certificates, Class A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and Class C Exchangeable Certificates will have a certificate balance or notional amount equal to its Class Percentage Interest multiplied by the principal balance of the Class A-2, Class A-3, Class A-S, Class B or Class C trust component, respectively. Each class of Class A-2 Exchangeable Certificates, A-3 Exchangeable Certificates, Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and Class C Exchangeable Certificates with a certificate balance will have the same approximate initial credit support percentage, Expected Weighted Average Life, Expected Principal Window, Certificate Principal UW NOI Debt Yield and Certificate Principal to Value Ratio as the Class A-2, Class A-3, Class A-S, Class B or Class C certificates, respectively, shown above. |

| Special Servicer Compensation: | The principal compensation to be paid to a special servicer in respect of its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee. The special servicing fee for each distribution date is calculated based on the outstanding principal balance of each serviced mortgage loan that is a specially serviced mortgage loan (and any related serviced companion loan) or as to which the related mortgaged property has become an REO property at the special servicing fee rate, which will be a rate equal to the greater of 0.25% per annum and the per annum rate that would result in a special servicing fee for the related month of $3,500. The special servicing fee will be payable monthly, first, from liquidation proceeds, insurance and condemnation proceeds, and other collections in respect of the related specially serviced mortgage loan or REO property and, then, from general collections on all the mortgage loans and any REO properties. The special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% (or, in any case, if such rate would result in an aggregate liquidation fee less than $25,000, then the liquidation fee rate will be equal to the lesser of (i) 3.0% and (ii) such lower rate as would result in an aggregate liquidation fee equal to $25,000) of liquidation proceeds and certain other collections in respect of each non-specially serviced loan with respect to which it acts as the enforcing servicer or each specially serviced mortgage loan (and any related serviced companion loan) or related REO property and of amounts received in respect of mortgage loan repurchases by the related mortgage loan sellers and (ii) workout fees generally equal to 1.0% of interest (other than default interest) and principal payments made in respect of a rehabilitated mortgage loan (and any related serviced companion loan), subject to a floor of $25,000 with respect to any mortgage loan, whole loan or related REO property, and in the case of each of clause (i) and (ii), subject to certain adjustments and exceptions as described in the Preliminary Prospectus under “Pooling and Servicing Agreement—Servicing and Other Compensation and Payment of Expenses—Special Servicing Compensation”. With respect to any non-serviced mortgage loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such non-serviced mortgage loan under such other pooling and servicing agreement as further described in the Preliminary Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. |

| Prepayment Premiums/Yield Maintenance Charges: | If any yield maintenance charge or prepayment premium is collected during any collection period with respect to any mortgage loan, then on the immediately succeeding distribution date, the certificate administrator will pay: (A) to the classes of certificates specified below, in the following amounts: (1) to the holders of each class of the Class A-1, Class A-2, Class A-2-1, Class A-2-2, Class A-3, Class A-3-1, Class A-3-2, Class A-S, Class A-S-1, Class A-S-2, Class B, Class B-1, Class B-2, Class C, Class C-1, Class C-2 and Class D certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) the related Base Interest Fraction for such class and the applicable principal prepayment, and (z) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the YM Denominator for that distribution date, (2) to the holders of the Class A-2-X1 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-11 | |

| BANK5 2025-5YR13 | Structural Overview |

| equal to the amount of principal distributed to the Class A-2-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-2 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-2-1 certificates and the applicable principal prepayment, (3) to the holders of the Class A-2-X2 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-2-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-2 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-2-2 certificates and the applicable principal prepayment, (4) to the holders of the Class A-3-X1 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-1 certificates and the applicable principal prepayment, (5) to the holders of the Class A-3-X2 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-2 certificates and the applicable principal prepayment, (4) to the holders of the Class A-S-X1 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-1 certificates and the applicable principal prepayment, (5) to the holders of the Class A-S-X2 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-2 certificates and the applicable principal prepayment, (6) to the holders of the Class B-X1 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class B-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class B certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class B-1 certificates and the applicable principal prepayment, (7) to the holders of the Class B-X2 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class B-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class B certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class B-2 certificates and the applicable principal prepayment, (8) to the holders of the Class C-X1 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class C-1 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class C certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class C-1 certificates and the applicable principal prepayment, (9) to the holders of the Class C-X2 certificates, the product of (x) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium, (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class C-2 certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class C certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class C-2 certificates and the applicable principal prepayment, (10) to the holders of the Class X-A certificates, the excess, if any, of (x) the product of (1) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium and (2) a fraction, the numerator of which is equal to the total amount of principal distributed to the Class A-1 certificates, the Class A-2 Exchangeable Certificates and the Class A-3 Exchangeable Certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, over (y) the total amount of such yield maintenance charge or prepayment premium distributed to the Class A-1 certificates, the Class A-2 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-12 | |

| BANK5 2025-5YR13 | Structural Overview |

| Exchangeable Certificates and the Class A-3 Exchangeable Certificates as described above, (11) to the holders of the Class X-B certificates, the excess, if any, of (x) the product of (1) the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium and (2) a fraction, the numerator of which is equal to the total amount of principal distributed to the Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and the Class C Exchangeable Certificates for that distribution date, and the denominator of which is the YM Denominator for that distribution date, over (y) the total amount of such yield maintenance charge or prepayment premium distributed to the Class A-S Exchangeable Certificates, Class B Exchangeable Certificates and the Class C Exchangeable Certificates as described above, and (12) to the holders of the Class X-D certificates, any remaining portion of the certificates’ Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium not distributed as described above; and (B) to the VRR Interest (and, correspondingly, pro rata to the Class RR Certificates and the RR Interest based on their respective Percentage Interests in the VRR Interest), the VRR Interest’s Percentage Allocation Entitlement of such yield maintenance charge or prepayment premium. “YM Denominator” means, for any distribution date, the total amount of principal distributed to the Class A-1, Class D, Class E, Class F, Class G, Class H, Class J and Class K certificates and the Class A-2 Exchangeable Certificates, the Class A-3 Exchangeable Certificates, the Class A-S Exchangeable Certificates, the Class B Exchangeable Certificates and the Class C Exchangeable Certificates. All yield maintenance charges and prepayment premiums referred to above will be net of any liquidation fees or workout fees payable therefrom. Notwithstanding any of the foregoing to the contrary, if at any time the certificate balances of the principal balance certificates (other than the Control Eligible Certificates) have been reduced to zero as a result of the allocation of principal payments on the mortgage loans, the certificate administrator will be required to pay to the holders of each remaining class of principal balance certificates then entitled to distributions of principal on such distribution date the product of (a) the certificates’ Percentage Allocation Entitlement of any yield maintenance charge or prepayment premium distributable on the subject distribution date (net of any liquidation fees payable therefrom) and (b) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to all principal balance certificates for that distribution date. No yield maintenance charges or prepayment premiums will be distributed to the holders of the Class X-H, Class X-J, Class X-K, Class E, Class F, Class G, Class H, Class J, Class K or Class R Certificates. “Base Interest Fraction” means, with respect to any principal prepayment of any mortgage loan that provides for the payment of a yield maintenance charge or prepayment premium, and with respect to any class of principal balance certificates, a fraction (A) the numerator of which is the greater of (x) zero and (y) the difference between (i) the pass‑through rate on that class, and (ii) the applicable discount rate and (B) the denominator of which is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided, that: under no circumstances will the Base Interest Fraction be greater than one; if the discount rate referred to above is greater than or equal to both the mortgage interest rate on the related mortgage loan and the pass‑through rate on that class, then the Base Interest Fraction will equal zero; and if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan and is less than the pass‑through rate on that class, then the Base Interest Fraction will be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: |

| | | (Pass-Through Rate – Discount Rate) | |

| | | (Mortgage Rate – Discount Rate) | |

| Realized Losses: | On each distribution date, immediately following the distributions to be made to the certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the aggregate stated principal balance of the mortgage loans, including any successor REO loans, expected to be outstanding immediately following that distribution date is less than (ii) the sum of the then aggregate certificate balance of the principal balance certificates and the principal balance of the VRR Interest after giving effect to distributions of principal on that distribution date. The certificates’ Percentage Allocation Entitlement of such amount will be applied to the Class K, Class J, Class H, Class G, Class F, Class E and Class D certificates, the Class C, Class B and Class A-S trust components, in that order, in each case until the related certificate or principal balance has been reduced to zero, and then to the Class A-1 certificates and the Class A-2 and Class A 3 trust component, pro rata, based upon their respective certificate or principal balances, until their respective certificate or principal balances have been reduced to zero. The VRR Interest’s Percentage Allocation Entitlement of such amount will be applied to the VRR Interest until the related VRR Interest balance has been reduced to zero. Any portion of such amount applied to the Class A-2, Class A-3, Class A-S, Class B or Class C trust component will reduce the certificate balance or notional amount of each class of certificates in the related group of Exchangeable Certificates by an amount equal to the product of (x) its certificate balance or notional amount, divided by the principal balance of such trust component prior to the applicable reduction, and (y) the amount applied to such trust component. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | T-13 | |

| BANK5 2025-5YR13 | Structural Overview |

| The Notional Amount of the Class X-A Certificates will be reduced by the amount of all losses that are allocated to the Class A-1 certificates or Class A-2 or Class A-3 trust components as write-offs in reduction of their principal balances. The Notional Amount of the Class X-B Certificates will be reduced by the amount of all losses that are allocated to the Class A-S, Class B or Class C trust components as write-offs in reduction of their principal balances. |

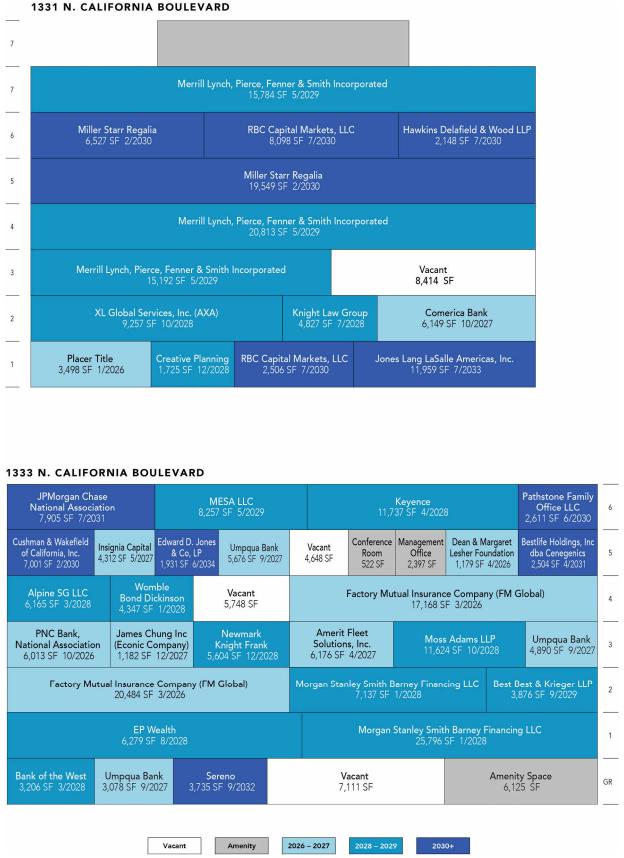

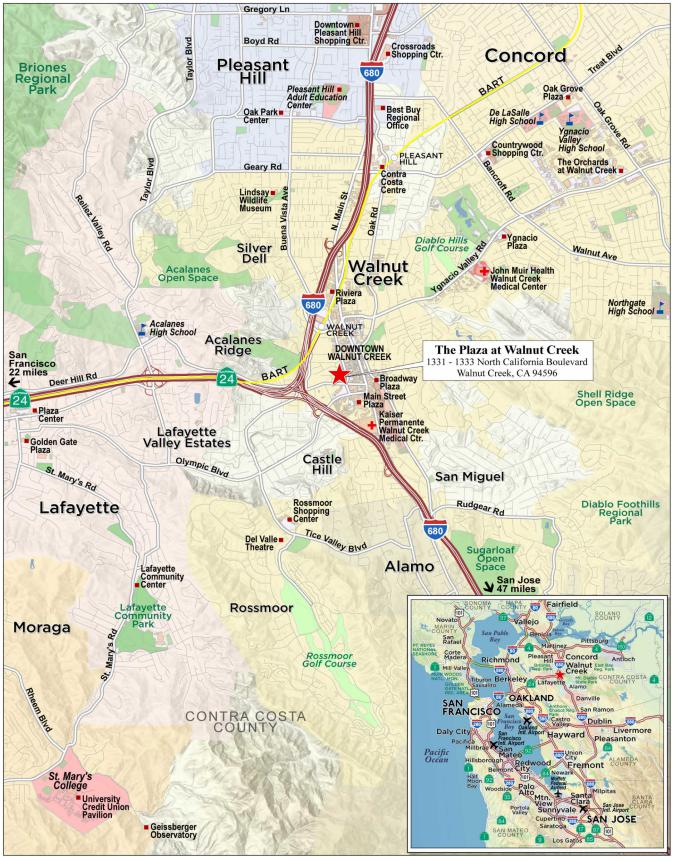

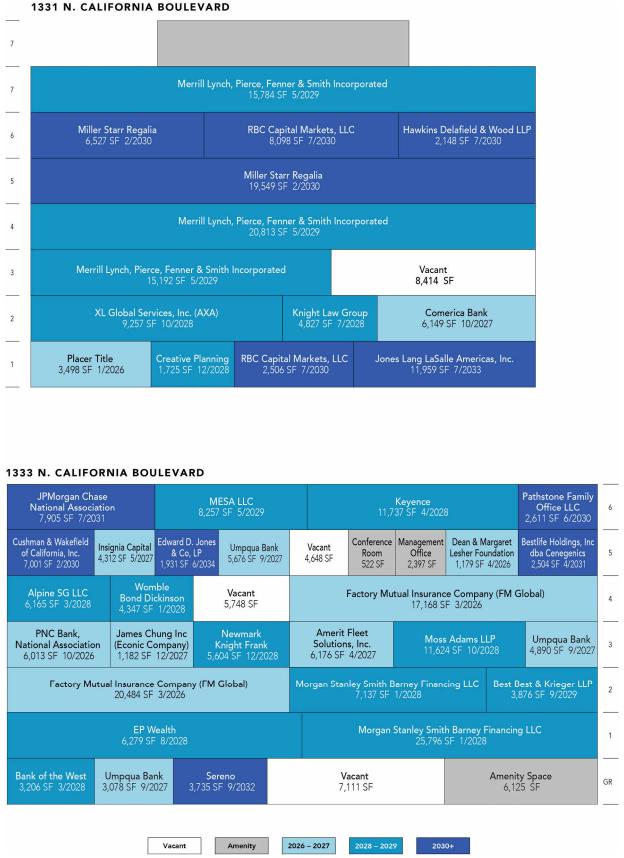

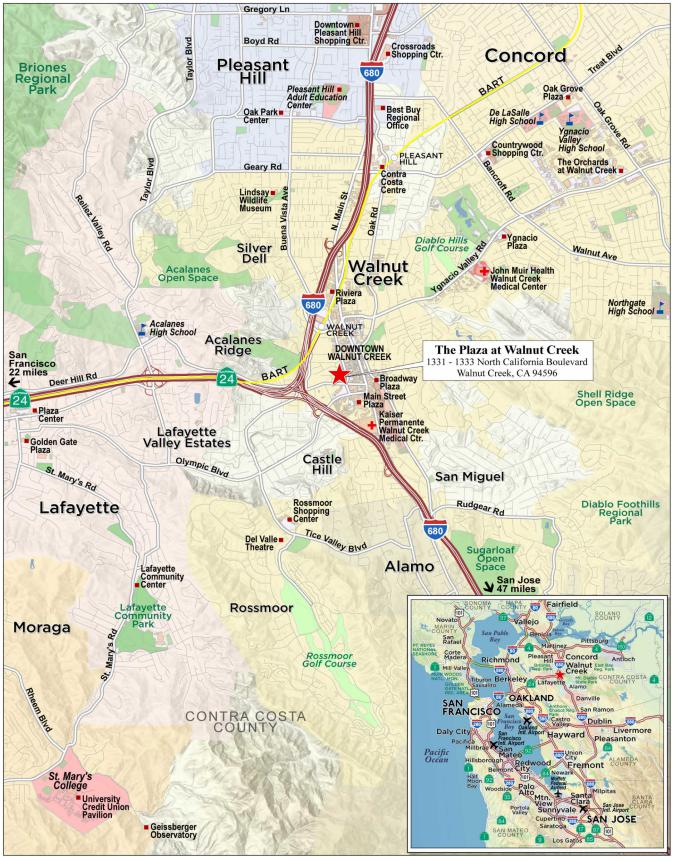

| Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan and one or more pari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each, a “serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for this transaction: The Plaza at Walnut Creek. With respect to each such mortgaged property or portfolio of mortgaged properties, the related mortgage loan, together with the related serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for this transaction) as a “serviced whole loan.” Each serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. See the tables below entitled “Mortgage Loans with Pari Passu Companion Loans” and “Mortgage Loans with Subordinate Debt,” as well as “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus, for additional information regarding each such whole loan. There will be no servicing shift mortgage loans related to the trust as of the Closing Date. |

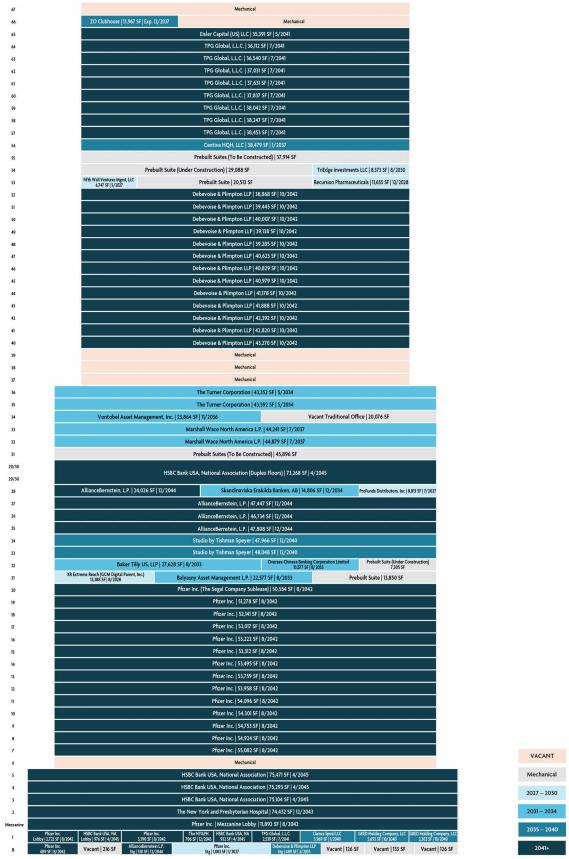

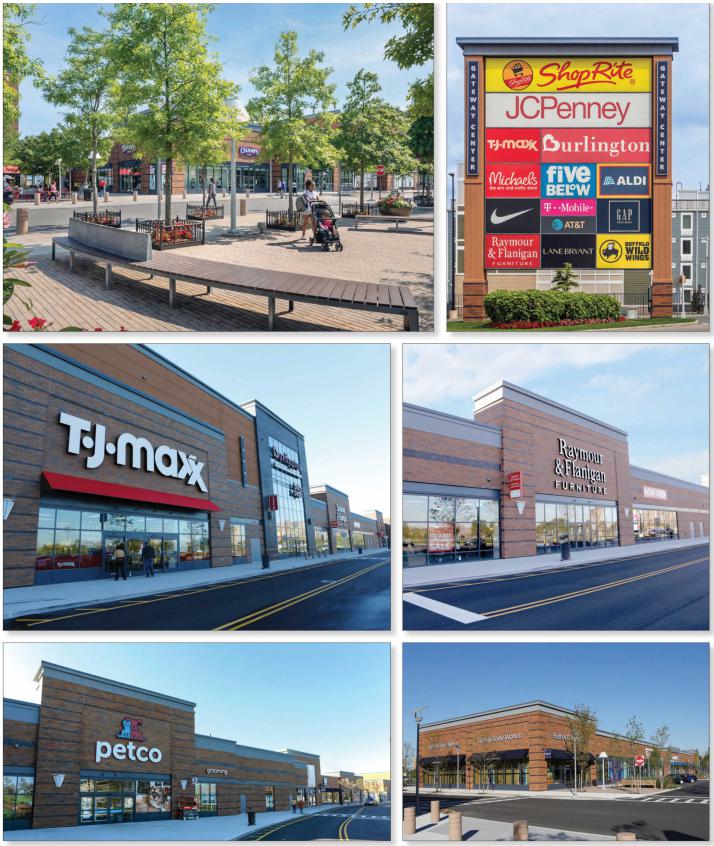

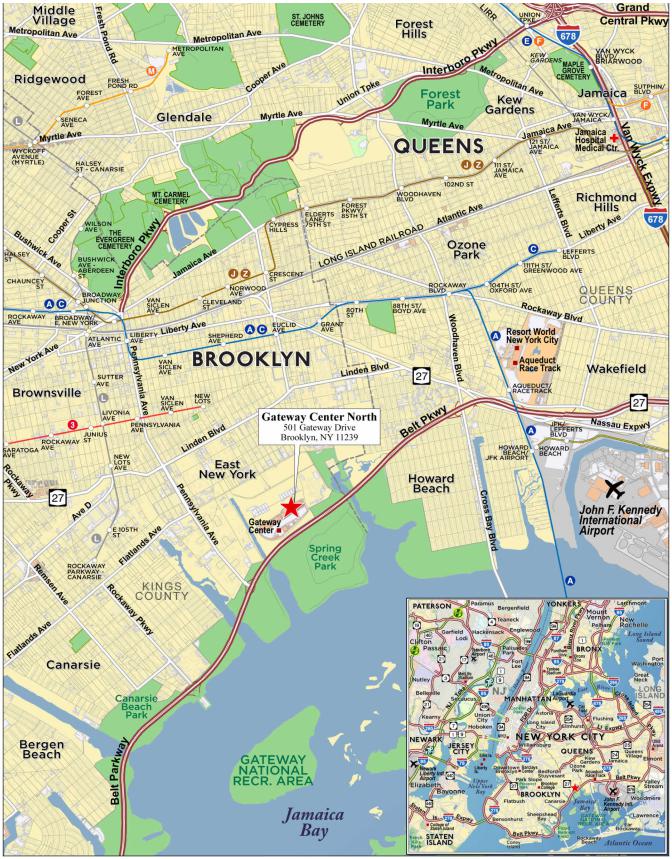

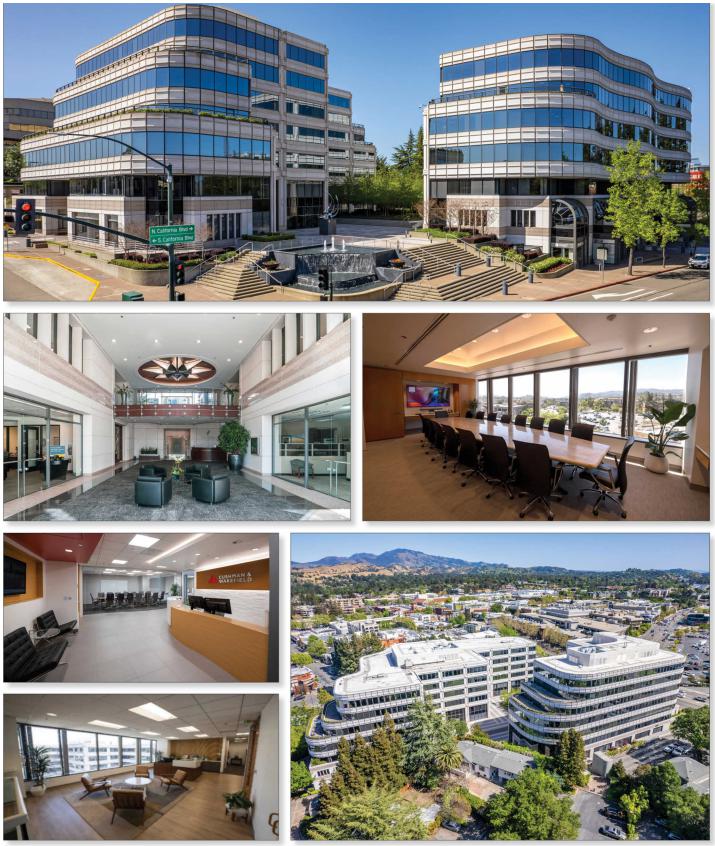

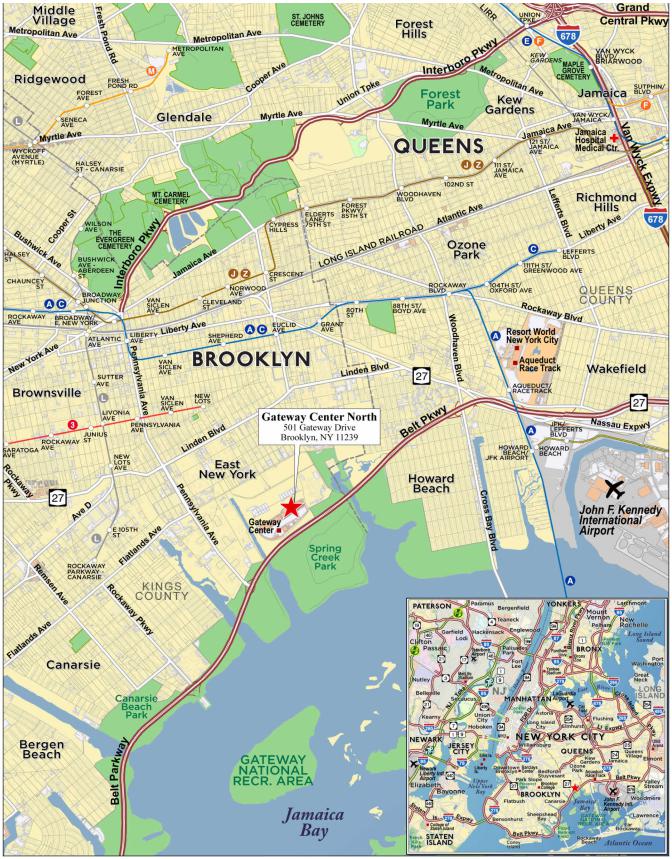

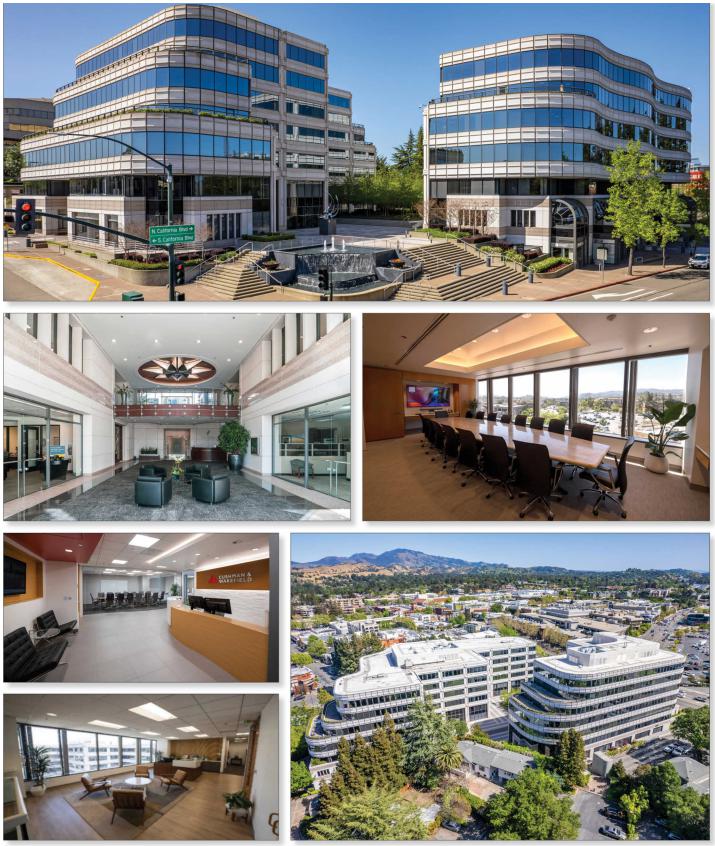

| Non-Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan (each, a “non-serviced mortgage loan”), one or more pari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each such promissory note, a “non-serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement or trust and servicing agreement (referred to herein as a related “pooling and servicing agreement”) for another securitization transaction The Spiral, Gateway Center North and Radius at Harbor Bay. With respect to each such mortgaged property or portfolio of mortgaged properties, the related mortgage loan, together with the related non-serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for another securitization transaction) as a “non-serviced whole loan.” Each non-serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. Servicing of each non-serviced whole loan will generally be directed by the holder of the related control note (or, if such control note is included in a securitization, the directing certificateholder thereunder (or other party designated thereunder to exercise the rights of such control note)), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. See the tables below entitled “Mortgage Loans with Pari Passu Companion Loans” and “Mortgage Loans with Subordinate Debt,” as well as “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus, for additional information regarding each such whole loan. |

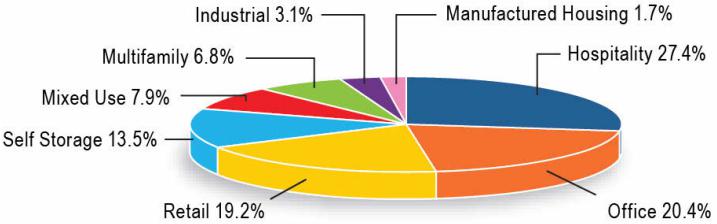

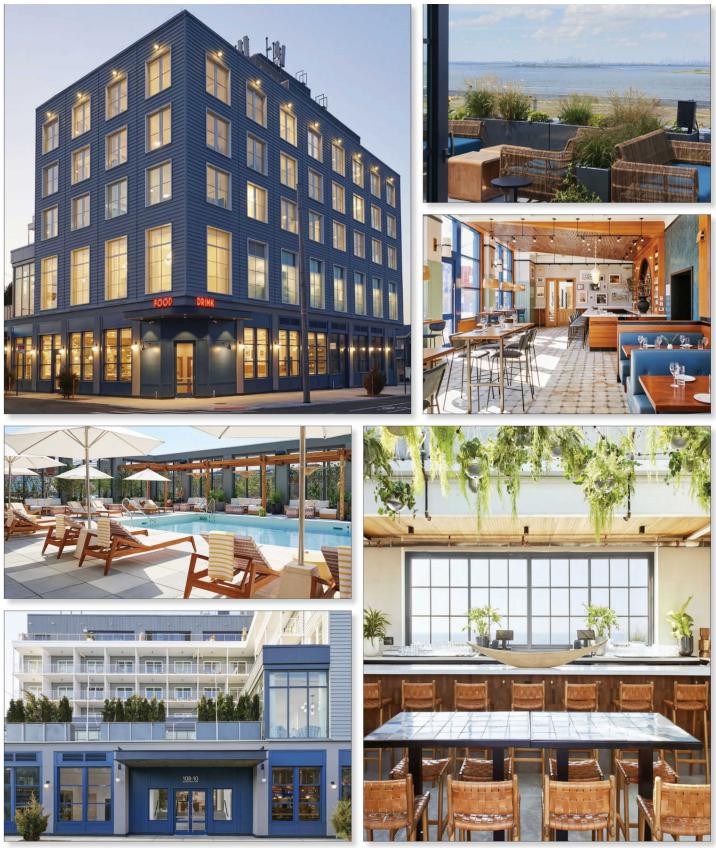

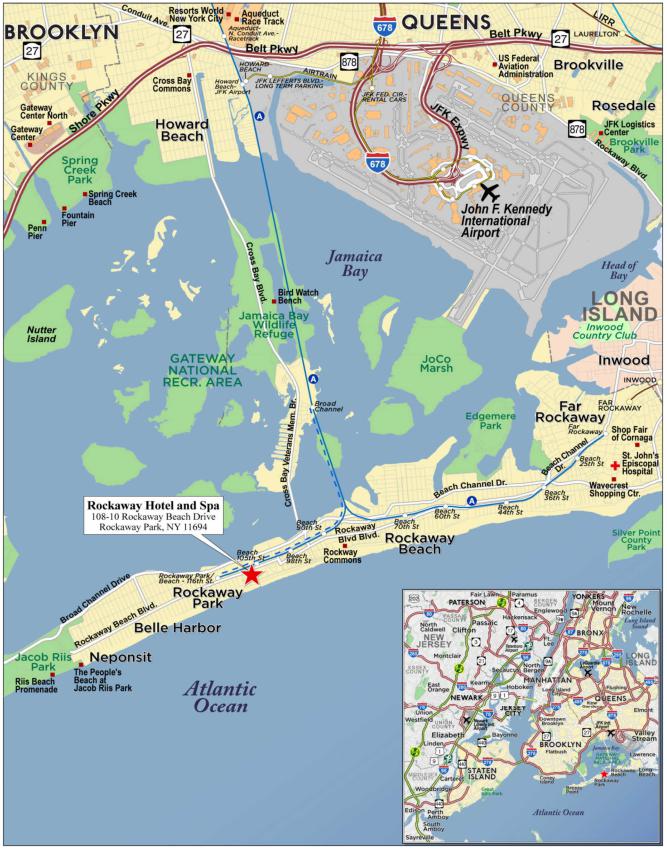

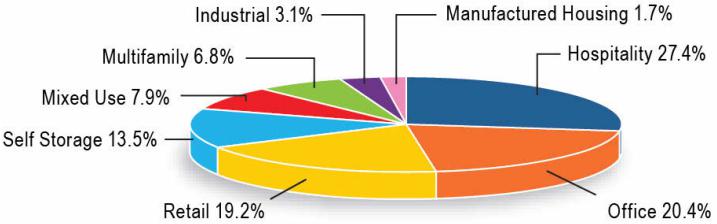

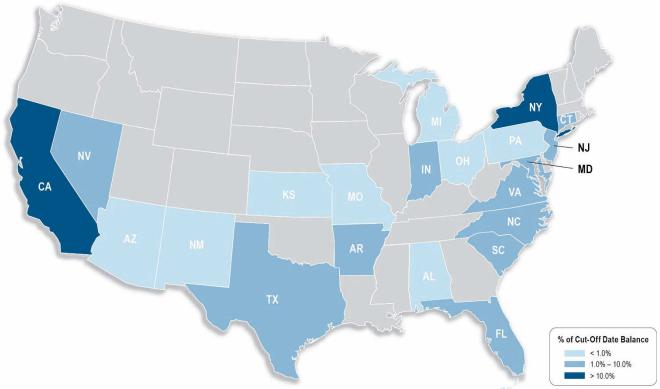

Directing Certificateholder/