3

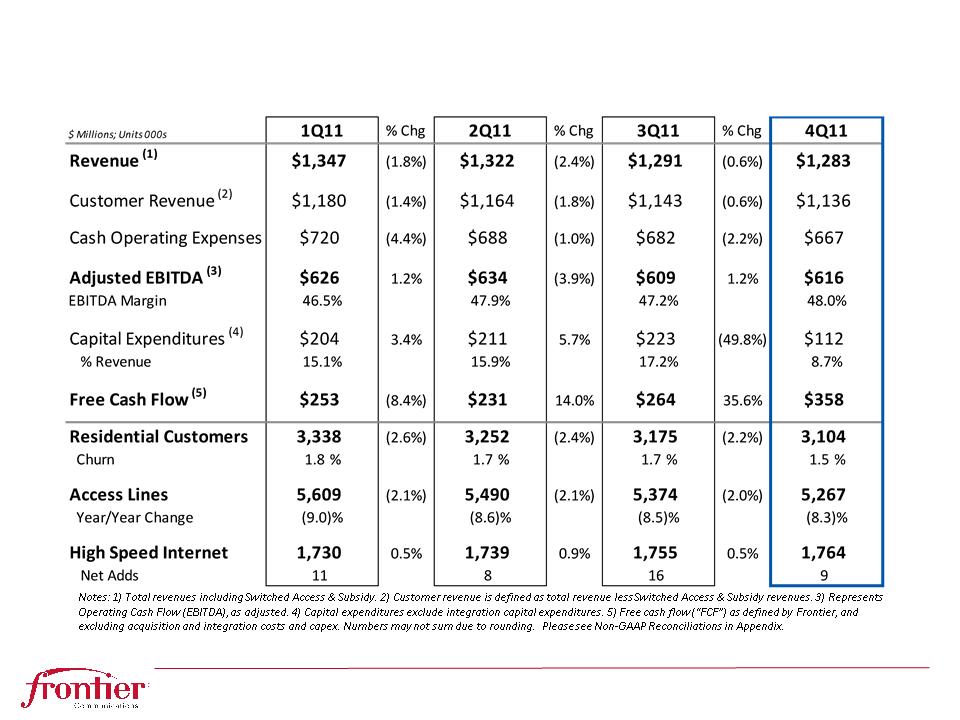

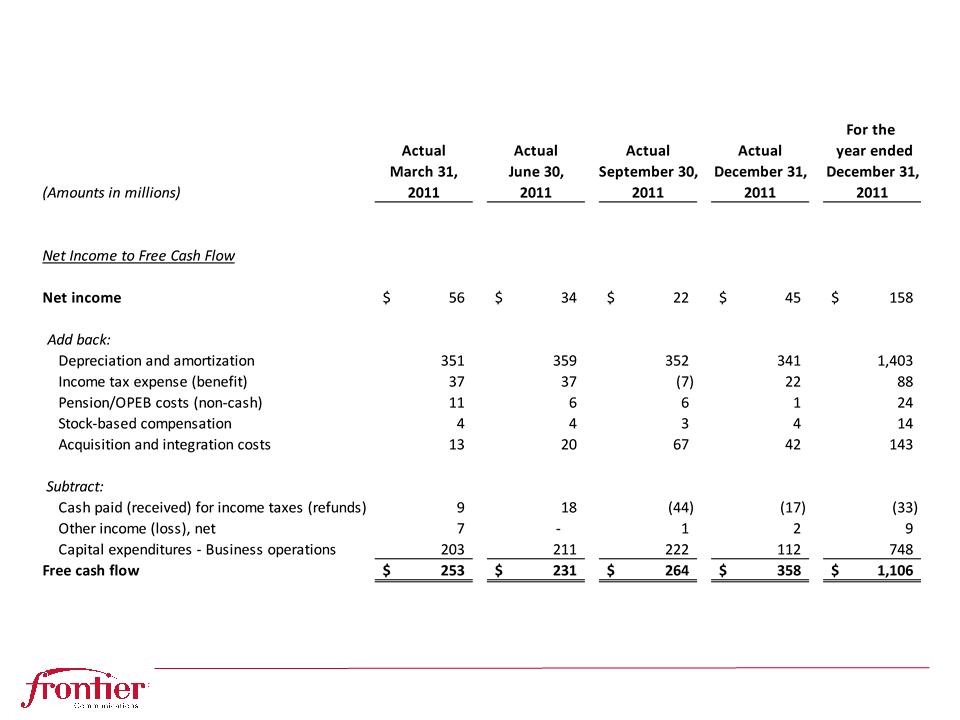

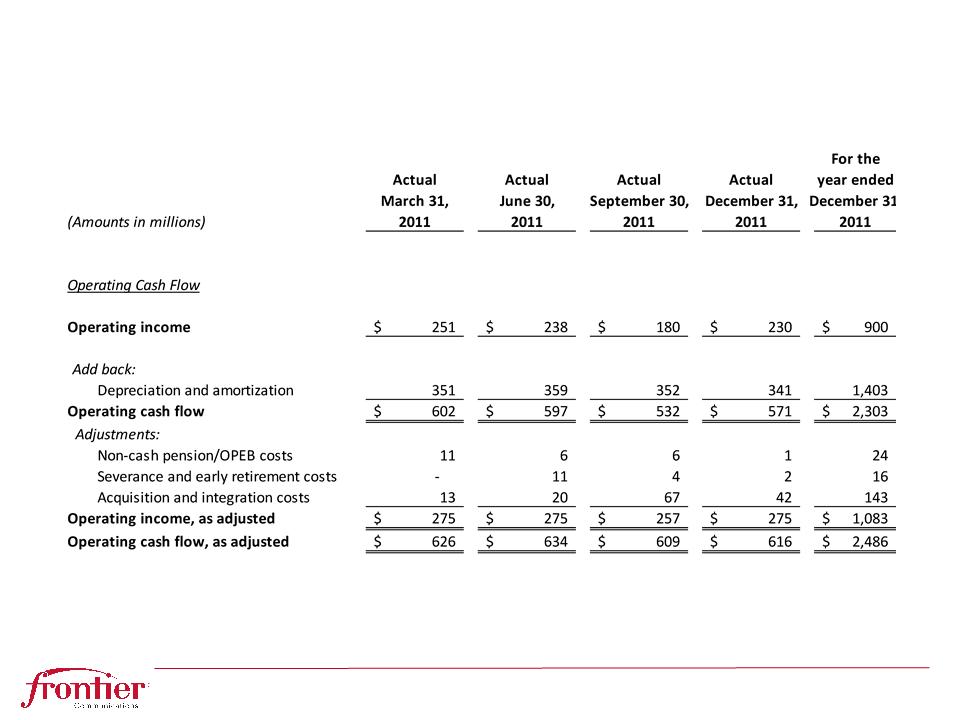

Non-GAAP Financial Measures

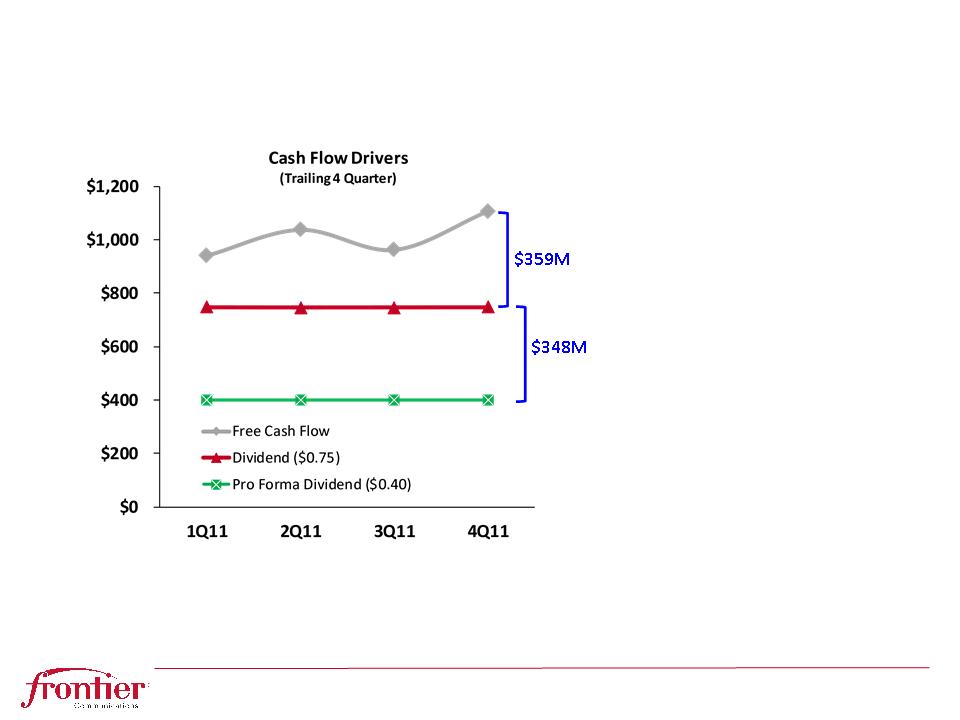

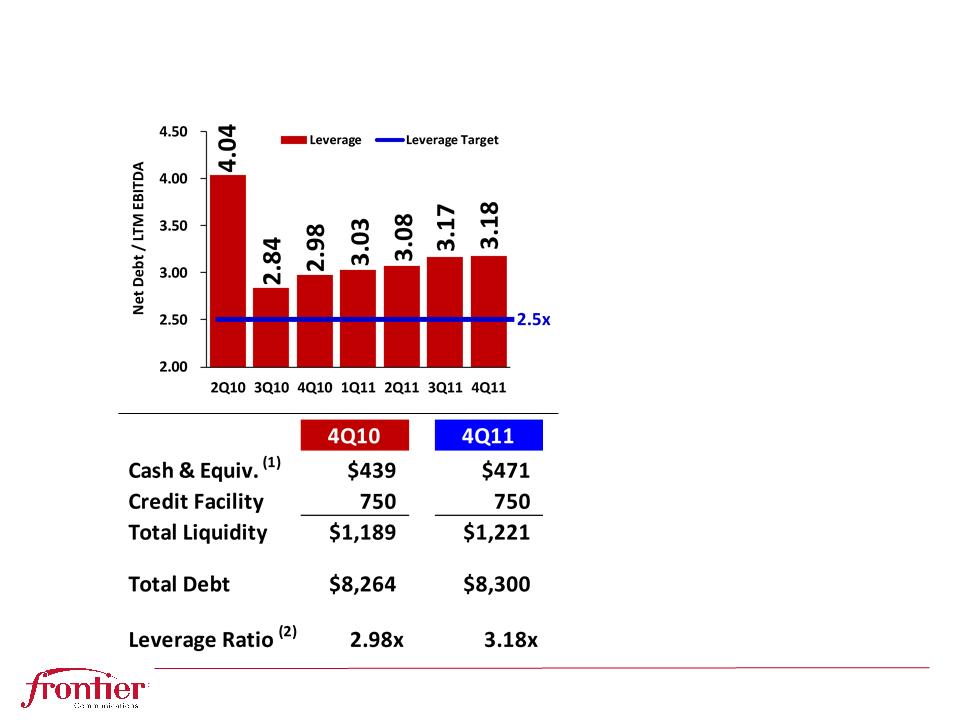

The Company uses certain non-GAAP financial measures in evaluating its performance. These include free cash flow, EBITDA or “operating cash flow,” which

we define as operating income plus depreciation and amortization (“EBITDA”), and Adjusted EBITDA; a reconciliation of the differences between EBITDA and

free cash flow and the most comparable financial measures calculated and presented in accordance with GAAP is included in the appendix. The non-GAAP

financial measures are by definition not measures of financial performance under generally accepted accounting principles and are not alternatives to operating

income or net income reflected in the statement of operations or to cash flow as reflected in the statement of cash flows and are not necessarily indicative of

cash available to fund all cash flow needs. The non-GAAP financial measures used by the Company may not be comparable to similarly titled measures of

other companies.

The Company believes that the presentation of non-GAAP financial measures provides useful information to investors regarding the Company’s financial

condition and results of operations because these measures, when used in conjunction with related GAAP financial measures, (i) together provide a more

comprehensive view of the Company’s core operations and ability to generate cash flow, (ii) provide investors with the financial analytical framework upon

which management bases financial, operational, compensation and planning decisions and (iii) presents measurements that investors and rating agencies

have indicated to management are useful to them in assessing the Company and its results of operations. In addition, the Company believes that free cash

flow and EBITDA, as the Company defines them, can assist in comparing performance from period to period, without taking into account factors affecting cash

flow reflected in the statement of cash flows, including changes in working capital and the timing of purchases and payments.

The Company has shown adjustments to its financial presentations to exclude certain costs because investors have indicated to management that such

adjustments are useful to them in assessing the Company and its results of operations. These adjustments are detailed in the Appendix for the reconciliation

of free cash flow and operating cash flow.

Management uses these non-GAAP financial measures to (i) assist in analyzing the Company’s underlying financial performance from period to period, (ii)

evaluate the financial performance of its business units, (iii) analyze and evaluate strategic and operational decisions, (iv) establish criteria for compensation

decisions, and (v) assist management in understanding the Company’s ability to generate cash flow and, as a result, to plan for future capital and operational

decisions. Management uses these non-GAAP financial measures in conjunction with related GAAP financial measures. These non-GAAP financial measures

have certain shortcomings. In particular, free cash flow does not represent the residual cash flow available for discretionary expenditures, since items such as

debt repayments and dividends are not deducted in determining such measure. EBITDA has similar shortcomings as interest, income taxes, capital

expenditures, debt repayments and dividends are not deducted in determining this measure. Management compensates for the shortcomings of these

measures by utilizing them in conjunction with their comparable GAAP financial measures. The information in this document should be read in conjunction with

the financial statements and footnotes contained in our documents filed with the U.S. Securities and Exchange Commission.