UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ___________

Commission file number 001-11001

FRONTIER COMMUNICATIONS PARENT, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

| 86-2359749 |

(State or other jurisdiction of |

| (I.R.S. Employer Identification No.) |

incorporation or organization) |

|

|

|

|

|

1919 McKinney Avenue |

|

|

Dallas, Texas |

| 75201 |

(Address of principal executive offices) |

| (Zip Code) |

|

|

|

Registrant's telephone number, including area code: (972) 445-0042

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

| FYBR |

| The NASDAQ Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes __ No _X_

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes __ No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer o Non-Accelerated Filer o

Smaller Reporting Company o Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

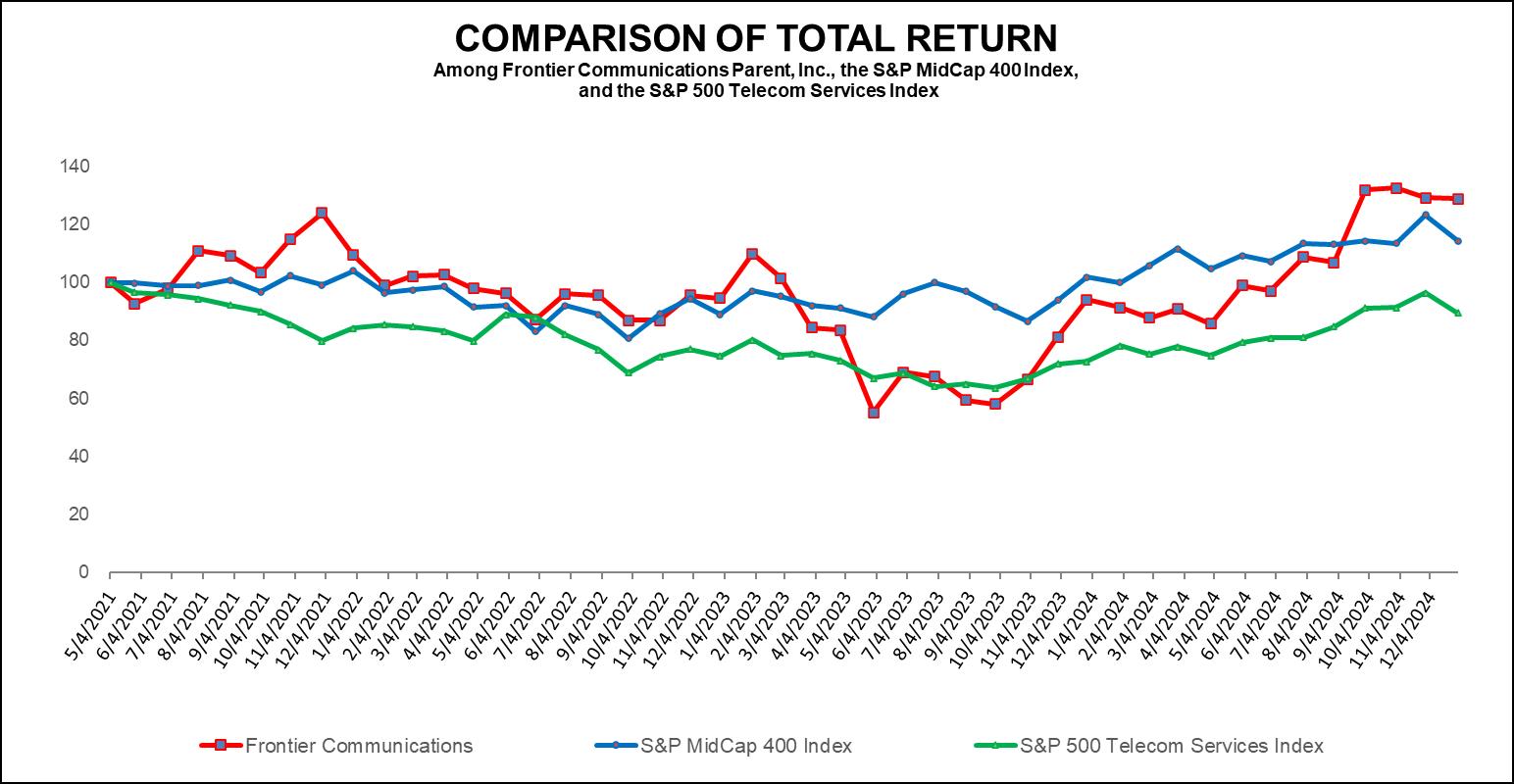

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2024, based on the closing price per share on such date was $6.4 billion. The number of shares outstanding of the registrant's common stock as of February 17, 2025 was 249,701,000.

DOCUMENT INCORPORATED BY REFERENCE

Portions of the proxy statement for the Registrant’s 2024 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

PART I

Unless the context indicates otherwise, the use of the terms the "Company,” “Frontier”, “we,” “us” or “our” shall refer to Frontier Communications Parent, Inc.

Overview

Frontier is a leading communications and technology provider offering broadband services to 3.1 million broadband customers in 25 states as of December 31, 2024. We are building critical infrastructure across the country with our fiber-optic network and cloud-based solutions, enabling secure high-speed connections. Driven by our purpose of Building Gigabit AmericaTM, we are focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment.

Our investment strategy is underpinned by the rapid growth in demand for high-speed broadband, with data usage per household expected to grow significantly through over-the-top video consumption, more connected devices per household, and increased demand for upstream data (e.g., videoconferencing and gaming). We believe that our ability to provide symmetrical high-speed connectivity through our fiber-optic technology provides competitive advantages, and that we are well positioned to meet this growing demand with faster upload and download speeds, and lower latency than our competition.

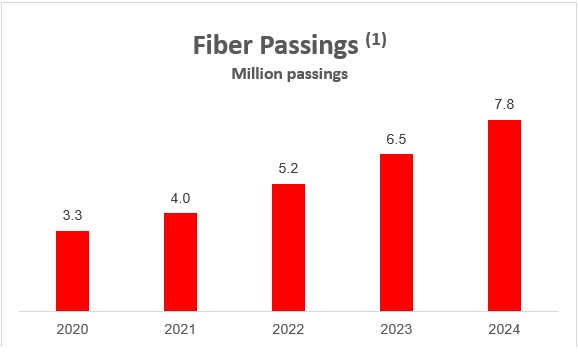

In August 2021, we announced our plan to pass 10 million total locations with fiber. We prioritize our activities to locations that we believe will provide the highest investment returns. As we implement our fiber expansion plan, we expect our business mix will shift significantly, with a larger percentage of revenue coming from fiber.

On September 4, 2024 we entered into a merger agreement (the “Merger Agreement”) with Verizon Communications Inc. (“Verizon”), pursuant to which, subject to certain terms and conditions therein, Verizon will acquire Frontier for $38.50 per share in cash (the “Merger”), representing a premium of 43.7% to Frontier’s 90-Day volume-weighted average share price (VWAP) on September 3, 2024, the last full trading day prior to published market speculation regarding a potential sale of Frontier. Subject to receipt of certain required regulatory approvals and other customary conditions specified in the Merger Agreement, we currently expect the Merger to close by the first quarter of 2026. See Note 2 - ‘‘Merger Agreement’’ to the Consolidated Financial Statements included in Part II of this Annual Report for more detail.

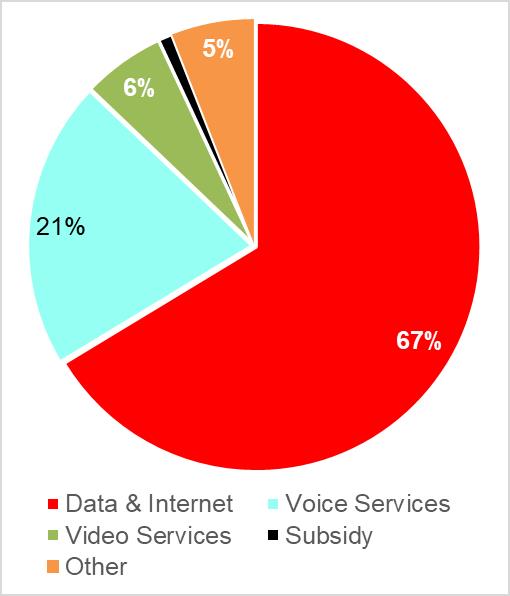

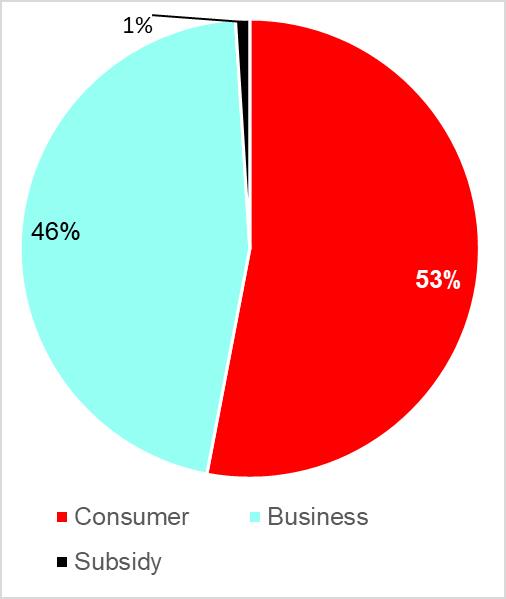

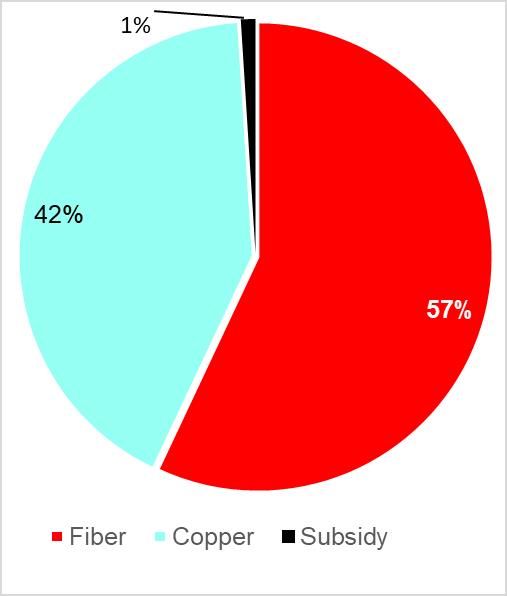

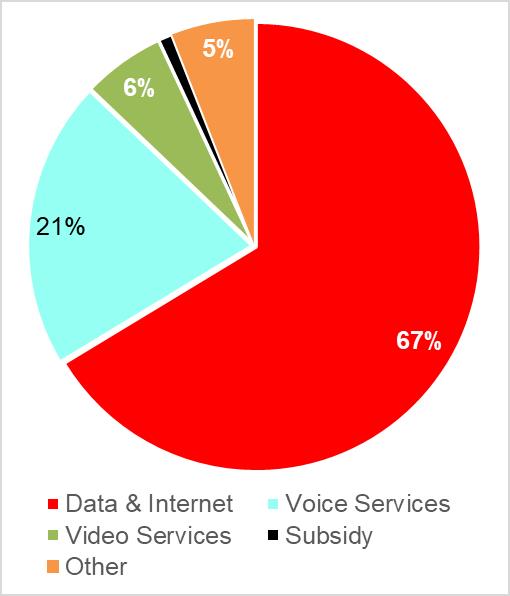

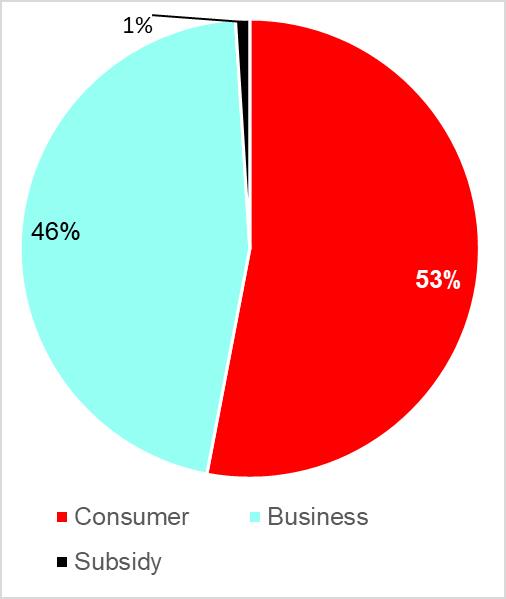

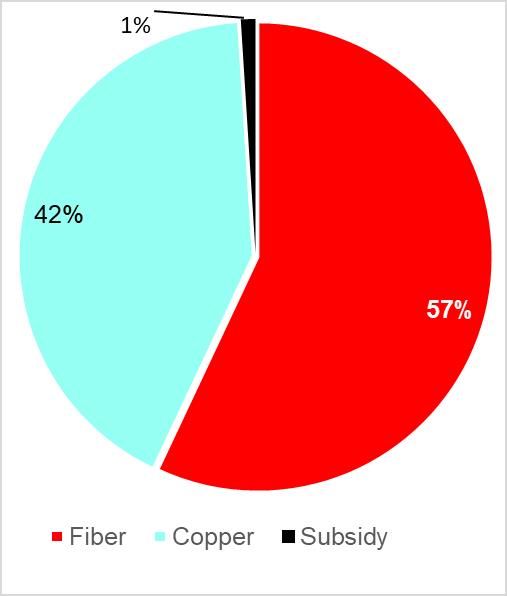

We generated revenue of approximately $5.9 billion for the year ended December 31, 2024 with approximately 57% of our revenue attributable to our fiber-optic products and 42% of our revenue related to our copper products. Over time, we expect our business mix will shift significantly, with a larger percentage of revenue coming from fiber as we implement our expansion plan.

|

|

|

|

|

Revenue by Product |

| Revenue by Customer |

| Revenue by Technology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In 2024, we advanced our purpose of Building Gigabit America and made substantial progress in executing on our four key strategic priorities: fiber deployment, fiber penetration, improving the customer experience, and operational efficiency.

Key milestone accomplishments against these four strategic priorities in 2024 include:

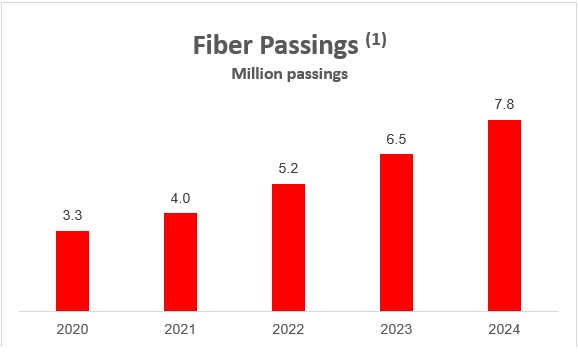

Fiber Deployment: We met our 2024 build plan, adding approximately 1.3 million new fiber locations. As of December 31, 2024, we had approximately 7.8 million total locations passed with fiber, more than doubling our fiber footprint since we started our build in 2020. Our build plan is solidified by multi-year agreements with key labor and equipment partners.

The following table shows our fiber passings as of December 31, 2024, 2023, 2022, 2021 and 2020:

(1)Fiber passings represent our estimate of the number of locations, such as single-family units, apartment and condominium units, and small and medium businesses passed by our fiber distribution network in areas where we offer service and that are open to Frontier sales efforts.

Fiber Penetration: We strive to deliver new best-in-market products to meet customer demands and increase penetration across our fiber footprint. We are targeting terminal penetration of 45% or higher in markets we have passed with fiber.

In 2024, we added a record 385,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 19% as compared to 2023. Fiber broadband customer net additions continued to outpace copper broadband customer net losses, resulting in 151,000 total broadband customer net additions in 2024.

These record fiber broadband net additions resulted in rising fiber broadband customer penetration across our footprint.

oIn our base fiber footprint, which consists of the 3.2 million locations that we passed with fiber at the end of 2019, penetration increased to 46.2% at the end of 2024, up from 44.5% at the end of 2023.

oIn our expansion fiber footprint, which consists of the new locations that we passed with fiber since the beginning of 2020, penetration increased to 19.6% at the end of 2024, up from 17.5% at the end of 2023.

Customer Experience: In 2024, we continued to focus on improving our customer service by systematically removing reasons why customers needed to call us and introducing new digital self-service tools. Among other results:

oFiber broadband churn remained low at 1.36% in 2024.

oWe reduced customer contacts into call centers by 1 million from 2023 to 2024.

Operational Efficiency: Across the company, we have identified opportunities to simplify and digitize our operations. We achieved our annualized gross run rate cost savings target of $500 million in 2023 – double our initial target of $250 million. As of December 31, 2024, we had realized $597 million of gross annualized cost savings.

Customers

We deliver communications and technology services to consumer and business customers.

Consumer

Our consumer customers include customers in single or multi-family units. We provide broadband, video, voice and other value-added services and products to our consumer customers over both fiber and copper-based networks.

Business

Our business customers include larger enterprise customers, small and medium businesses (“SMB”), and wholesale customers.

oLarger Enterprise: These customers consist of Fortune 1000 companies, companies with multiple locations, large government entities, educational institutions, and non-profits.

oSmall and Medium Business: These customers consist of single location and smaller multi-location companies, as well as mid-sized government entities, educational institutions, and non-profits.

oWholesale: These customers are often referred to as carriers or service providers and use our network facilities to provide services to their customers. Our wholesale customers include local, long distance, wireless, cable and other carriers. These companies need Frontier’s network to access locations within our footprint to offer their services. Wholesale customers buy both voice and data services to supplement their own network infrastructure.

Services

We offer a broad portfolio of communications and technology services for consumer and business customers. These services are offered on either a standalone basis or in a bundled package based on individual customer needs.

Data and Internet Services: We offer a comprehensive range of broadband and networking services. The principal consumer and SMB services we provide are broadband internet and related value-added services. Larger enterprise business services include a complete portfolio of ethernet services, dedicated Internet, software defined wide area network (“SDWAN”), managed Wi-Fi, traditional circuit-based data services, and optical transport services. These services are all supported by 24/7 technical support and an advanced network operations center. We also provide wireless broadband services (via unlicensed spectrum) in select markets utilizing networks that we own or operate.

Voice Services: We offer voice services, including data-based voice over internet protocol (“VoIP”) and unified communications as a service (“UCaaS”), long-distance and voice messaging services, to consumer and business customers in all our markets. These services are billed monthly in advance. Long-distance service to and from points outside our operating properties are provided by interconnection with the facilities of other carriers. Our long-distance services are billed in advance for unlimited use service and billed in arrears for usage-based services.

Video Services: We provide video services under the Frontier TV brand in some of our markets, including portions of California, Indiana, Texas, Florida, and Connecticut. We also offer satellite TV video service to our customers under various agency relationships with satellite providers and Over the Top (“OTT”) video through partnerships with OTT video providers.

Access Services: We offer a range of access services. Our switched access services allow other carriers to use our facilities to originate and terminate their local and long-distance voice traffic. These services are generally offered on a month-to-month basis, and the service is billed primarily on a minutes-of-use basis. Switched access charges are based on access rates filed with the Federal Communications Commission (“FCC”) for interstate services, and with the respective state regulatory agency for intrastate services. See “Regulatory Environment” below.

Advanced Hardware and Network Solutions: We offer our SMB and larger enterprise customers various hardware and network solutions utilizing cloud functionality, including end-to-end solutions like cloud managed services and Managed Wireless LAN. We offer third-party communications equipment tailored to their specific business needs through partnering with other providers.

Bundles: We also provide packages of services. These packages permit customers to bundle their products and services, including voice service, video, and broadband services, as well as other value-added services and product offerings.

Network Architecture and Technology

Our local exchange carrier networks consist of host central office and remote sites, primarily equipped with digital and Internet Protocol switches. The outside plant consists of transport and distribution delivery networks connecting our host central office with remote central offices, and ultimately, with our customers. We own fiber optic and copper cable, which have been deployed in our networks and are the primary transport technologies between our host and remote central offices, and interconnection points with other communication carriers.

We have expanded and enhanced our fiber-optic and copper transport systems to support increasing demand for high bandwidth transport services. Our core fiber network is currently being upgraded to support up to 400 Gbps and in the future we believe will be capable of 800 Gbps and higher with limited additional investment. We routinely enhance our networks and upgrade with Internet protocol transport and routing equipment, reconfigurable optical add/drop multiplexer transport systems, passive optical networks, ultra-high speed digital subscriber line broadband equipment, and VoIP switches. These systems support advanced services such as ethernet, dedicated Internet, VoIP, and SDWAN.

We connect to households and business locations in our service territory using fiber-optic, copper, or fixed wireless technologies. In some cases, we provide direct fiber into a residence (fiber-to-the-home) or business premise. In other cases, a location is served with a combination of fiber and copper. We provide data, video, and voice services to customers over both architectures. Additionally, we provide service using fixed wireless broadband and which is deployed for some business ethernet services.

Competition

Competition within the wireline communications industry is intense. Technological advances as well as regulatory and legislative changes have enabled a wide range of historically non-traditional communications service providers to compete with traditional providers such as Frontier. More market participants are now competing to meet the communications needs of the same customer base, thus increasing competitive pressures.

We face competition from cable operators, wireless carriers, satellite providers, wireline carriers, fiber “overbuilders,” and OTT video providers:

-Cable Operators: Cable operators offer high speed internet, video, and voice services, and compete with us aggressively for consumer and business customers on speed and price, primarily by marketing with significant promotional period pricing.

-Wireless Carriers: Wireless carriers offer broadband, video and voice services and compete with us for consumer and business customers by offering increasingly larger data packages that utilize the latest 5G technology to mobile customers.

-Satellite Providers: Satellite providers offer broadband and video services and compete with us for consumer and business customers.

-Wireline Carriers / Fiber Overbuilders: The demand for high-speed data is continuing to attract new entrants into markets, including Frontier’s markets. These new entrants offer broadband, video and voice services and compete directly for Frontier’s customers.

-OTT Video Providers: Many consumers are opting for OTT video services rather than traditional, multi-channel video services. We have made investments in our network to deliver OTT video content to consumers who might not opt for traditional video services. Additionally, we have developed partnerships with leading OTT providers to offer their services to our customers.

Many of our competitors are larger, have stronger brand recognition, have more service offerings, and have greater financial resources than we currently do. All these factors create potential downward pressure on the demand for and pricing of our services. Further, many of our competitors are not subject to the same regulations as traditional communications providers such as Frontier and have lower cost structures than we do. The industry has also experienced substantial consolidation in recent years, leading to competitors with significant scale.

However, for the majority of our locations passed, we currently face competition from no more than one wireline competitor. In addition, we operate in many dense, urban markets with favorable demographic characteristics that correlate to higher broadband

usage. As an example, we have a strong presence in Texas and Florida, the two states in the U.S. with the highest population gains from 2010 to 2021. Given our footprint, we believe we are well positioned to capitalize on attractive demographic trends.

Competition for consumer customers is based on price, bandwidth, quality, and speed of service, including promotions as well as bundling of service offerings. Our focus is to improve our customer experience by efficiently responding to their specific needs. We believe this will improve overall service quality and encourage migration to higher speed Internet services.

Competition for business customers is also based on price, bandwidth, quality, and speed of service, including pricing and promotions and bundled offerings. As compared to our consumer customers, business customers often require more sophisticated and more data-centered solutions (e.g., IP PBX, ethernet and SIP trunking). To differentiate ourselves from other service providers, Frontier delivers end-to-end solutions such as cloud managed services and managed wireless LAN.

As customers continue to migrate to OTT video models, broadband is a core growth component for attracting and retaining consumer customers as well as our smaller business customers. We are committed to growing our customer base through providing higher broadband speeds and capacities that we believe will enable us to reach new markets, target new customers, and grow our business while maximizing our full geographic footprint.

In addition to the focus on our broadband capabilities, we continue to evolve our other product offerings to meet the changing needs of the market, provide strong customer service and support, invest in our network to enable capacity and capabilities, and package our offerings at attractive prices. We are continuing to execute on our initiatives to build out and invest in our fiber network, drive operational performance, increasingly win more customers in our footprint, deliver an exceptional customer journey, and simplify our operations.

Regulatory Environment

Some of our operations are subject to regulation by the FCC and various state regulatory agencies, often called public service or utility commissions. We expect federal and state lawmakers, the FCC, and the state regulatory agencies to continue to revise and enforce the statutes and regulations governing communications services.

Regulation of Our Business

We are subject to federal, state, and local regulation and we have various regulatory authorizations for our regulated service offerings. At the federal level, the FCC generally exercises jurisdiction over information services, interstate, or international telecommunications services and over facilities to the extent they are used to provide, originate, or terminate interstate or international services. State regulatory commissions generally exercise jurisdiction over intrastate telecommunications services and the facilities used to provide, originate, or terminate those services. Most of our local exchange companies operate as incumbent carriers in the states in which they operate and are certified in those states to provide local telecommunications services. Certain federal and state agencies, including attorneys general, monitor and exercise oversight related to consumer protection issues, including marketing, sales, provision of services, and service charges. In addition, local governments often regulate the public rights-of-way necessary to install and operate networks and may require service providers to locate and work around other utility facilities and obtain licenses or franchises to use public rights-of-way. Municipalities and other local government agencies also may regulate other aspects of our business, by requiring us to obtain licenses and construction permits and to abide by applicable regulations and requirements.

Some state regulatory agencies have substantial oversight over incumbent telephone companies, and their interconnection with competitive providers and provision of non-discriminatory network access to certain network elements to them. Under the Federal Telecommunications Act of 1996, state regulatory commissions have jurisdiction to set certain rates, arbitrate, and review interconnection disputes and agreements between incumbent telephone companies and CLECs, in accordance with rules set by the FCC. The FCC and some state regulatory commissions also impose fees on providers of telecommunications services to support the federal and state universal service programs. Many of the states in which we operate require prior approvals or notifications for certain acquisitions, transfers or encumbrances of assets, customers, or ownership of regulated entities. The FCC and certain states also require certain approvals or notifications to discontinue the use of certain telecommunications facilities and the provision of some services.

Additionally, in some states we are subject to operating restrictions and minimum service quality standards. Failure to meet either may result in penalties or other obligations, including subjecting the Company to additional reporting and compliance obligations. In some of our markets, the Company has also agreed to and been required by certain states to comply with additional service quality, expenditures, reporting, and other requirements. We also are required to report certain financial information. At the federal level and in a number of the states in which we operate, we are subject to price cap or incentive regulation plans under which prices for regulated services are capped. Some of these plans have limited terms and, as they expire, we may need to renegotiate with various states. These negotiations could impact rates, service quality, and/or infrastructure requirements, which could also impact our earnings and capital expenditures. In other states, we are subject to regulation that limits levels of earnings and returns on investments. We continue to advocate for competitive neutral policies and no or reduced regulation in all states. In some of the states where we operate in, we have already been successful in reducing or eliminating price regulation on end-user services.

Frontier, along with all telecommunications providers, is subject to federal and state rules governing certain of our operations and services, including the privacy of specified customer information. Among other things, these privacy-related rules obligate carriers to implement procedures to: protect specified customer information from inappropriate disclosure; obtain customer permission to

use specified information in marketing; authenticate customers before disclosing account information; and periodically certify compliance with certain rules. Although most of these regulations are generally consistent with our business plans, they may restrict our flexibility in operating our business.

Some regulations are, or could in the future be, the subject of judicial proceedings, legislative hearings and administrative proposals or challenges that could change the manner in which the entire industry operates or the way we provide services. Neither the outcome of any of these developments, nor their potential impact on us, can be predicted at this time. Regulatory oversight and requirements can change rapidly in the communications industry, and such changes may have an adverse effect on us.

The current status of material regulatory initiatives is as follows:

Connect America Fund (“CAF”)/ Rural Digital Opportunity Fund (“RDOF”):

In 2015, Frontier accepted the FCC’s CAF Phase II offer, which provided $313 million in annual support through 2021 in return for the Company’s commitment to make broadband available to households within the CAF II areas in our existing 25 states. The Company was required to complete the CAF II deployment by December 31, 2021. Thereafter, USAC and the FCC have been reviewing carriers’ CAF II program completion data, and should USAC or the FCC determine that the Company did not satisfy certain applicable CAF Phase II requirements, Frontier could be required to return a portion of the funds previously received and may be subject to certain other fines, requirements and obligations.

On January 30, 2020, the FCC adopted an order establishing the RDOF competitive reverse auction to provide support to serve high-cost areas. Frontier was awarded approximately $371 million over ten years to build gigabit-capable broadband over a fiber-to-the-premises network to approximately 127,000 locations in eight states (California, Connecticut, Florida, Illinois, New York, Pennsylvania, Texas, and West Virginia). We began receiving RDOF funding in the second quarter of 2022 and we will be required to complete the buildout to the awarded locations by December 31, 2028, with interim target milestones over this period. To the extent that Frontier is unable to fulfill the RDOF requirements, meet the milestones or construct to all locations by the required deadlines, funding provided to us can be discontinued and Frontier could be required to return a portion of funds previously received and may be subject to certain fines, requirements and obligations. Fines and penalties could also be assessed to the extent Frontier were ever to decide to surrender RDOF locations previously awarded.

Federal Funding Initiatives: The Federal government has undertaken several measures to facilitate enhanced access to high-speed broadband, including through several new funding programs. As these large amounts of federal funding flow through the broadband ecosystem, we will evaluate and pursue funding opportunities that make sense for our business. Frontier does not know what funding it may receive the impact these programs may have, or changes that may be made to these programs, if any, in the future.

In November 2021, Congress passed the Infrastructure Investment and Jobs Act (“IIJA”). The IIJA funds several programs dedicated to broadband expansion and upgrades, including a $2 billion tribal broadband program, a $60 million Digital Equity fund, a $2 billion Rural Utilities Service loan and grants program, and a $1 billion middle mile grants program, in addition to other smaller amounts or amounts less directly related to deployment and adoption.

The IIJA also provides $65 billion to fund broadband connectivity programs, including broadband deployment to unserved and underserved locations. The National Telecommunications and Information Administration (NTIA) is administering the principal last mile infrastructure funding program in the amount of $42.5 billion, the Broadband Equity, Access & Deployment Program (BEAD), and will distribute funding through direct grants to states, who will then award the funds based on competitive grant programs. The NTIA has allocated approximately $25.5 billion to states in Frontier’s footprint. The requirements and funding under these programs is subject to change. We are closely tracking implementation of the BEAD program, including state determinations regarding subsidy award criteria. We are actively pursuing awards of these stimulus funds, however, we continue to evaluate our opportunities as the process is complex and any awards that we ultimately receive under the IIJA may require significant up-front capital expenditures or other costs.

Privacy

Our businesses are subject to federal and state laws and regulations that impose various restrictions and obligations related to privacy and the handling of customers’ personal information. Privacy-related legislation has been adopted in a number of states in which we operate. Certain state requirements give consumers increased rights including the right to know what personal information is being collected about them and obtain a copy of such information, opt-out of the sale of personal information or sharing of personal information for purposes of certain targeted advertising, and to request the correction or deletion of this information. Complying with such laws, as well as other legislative and regulatory action related to privacy, could result in increased costs of compliance, claims against the Company or investigations related to compliance, and increased uncertainty in the use and availability of certain consumer data.

Video Programming

Federal, state, and local governments extensively regulate the video services industry. Our linear video services are subject to, among other things: subscriber privacy regulations; requirements that we carry a local broadcast station or obtain consent to carry a local or distant broadcast station; rules for franchise renewals and transfers; the manner in which program packages are marketed to subscribers; and program access requirements.

We provide video programming in some of our markets including California, Connecticut, Florida, Indiana, and Texas pursuant to franchises, permits and similar authorizations issued by state and local franchising authorities. Most franchises require payment of a franchise fee as a requirement to the granting of authority.

Many franchises establish facilities and service requirements, as well as specific customer service standards and monetary penalties for non-compliance. Franchises are generally granted for fixed terms and must be periodically renewed.

Environmental Regulation

The local exchange carrier subsidiaries we operate are subject to federal, state, and local laws, and regulations governing the use, storage, disposal of, and exposure to hazardous materials, the release of pollutants into the environment and the remediation of contamination. As an owner and former owner of property, we are subject to environmental laws that could impose liability for the entire cost of cleanup at contaminated sites, including sites formerly owned by us or our predecessors, regardless of fault or the lawfulness of the activity that resulted in contamination. We believe that our operations are in substantial compliance with applicable environmental laws and regulations.

Segment Information

Our operations are managed and reported to our CEO, our chief operating decision maker (“CODM”), on a consolidated basis. The CEO assesses performance and allocates resources based on the consolidated results of operations. Under this organizational and reporting structure, we have one reportable segment.

Intellectual Property

We own or have licenses to various trademarks, trade names and intellectual property rights that are necessary for the operation of our business.

We own or have the rights to use various trademarks, service marks and trade names referred to in this report. Solely for convenience, we refer to certain trademarks, service marks and trade names in this report without the ™, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this report are the property of their respective owners.

Human Capital Management

We are building a high-performing and diverse workforce committed to our purpose of Building Gigabit AmericaTM. As of December 31, 2024, we had approximately 13,000 employees.

Our Board of Directors and executive leadership team oversee the execution of our fiber-first strategy: build fiber, sell fiber, improve the customer experience, and simplify operations. Motivated by a belief that Frontier’s success depends on our employees’ success, we strive to provide the skills they need to thrive by creating an inclusive culture that rewards them with competitive compensation and benefits, makes safety paramount, and nurtures professional and personal development.

Talent Engagement and Development

We continue to invest in making Frontier a great place to work, where people develop through support, challenge, respect, and reward. When we create a culture that allows our people to be themselves, we find that they become their best selves. And that makes us a better company.

In 2024, we continued to advance our culture through:

Employee Forums: Our leadership team hosts regular all-hands meetings to share progress on priorities and solicit feedback from employees. For example, our CEO’s monthly “Listen Live” events are open to all employees. During these calls, we discuss new products and programs, recognize individuals who go above and beyond, and answer our employees’ questions live.

Performance Management: Our end-to-end performance management program for non-union teammates reinforces goal setting, alignment to our strategic priorities, development planning, performance coaching and feedback enhancing our pay-for-performance culture.

Employee Development: We launched a new professional development program, Frontier Forward. Through the program, we are offering every leader and employee opportunities to learn, grow and develop in their career. This year, we also offered a range of mentoring opportunities and development workshops response to employee feedback.

Frontline Training: We added new programs to further develop our customer-facing teammates including training on our products, services and technology. Our Door-to-Door sales teams received individualized training to increase their sales potential through AI generated insights on their performance.

Recognition: We continued our Changemaker program, recognizing the most outstanding builders of Gigabit America. Every quarter we award winners, one of whom becomes Changemaker of the Year. We also launched a new program called Frontier Heroes that recognizes teammates who have performed courageous acts.

Community Engagement: Through our Broadband for Good program, our employees helped strengthen the communities we serve by donating fiber internet and critical resources to 50% more non-profits this year.

Health and Safety

The health and safety of our employees is our top priority, and 2024 was our safest year yet. We set new safety records for our company — building on our 2023 results with year-over-year improvements on key safety measures.

Our people made a collective effort to build a safer work environment, and we prioritized policies and habits that encompassed both industry best practices and the lessons employees learned on the job. We’re proud of how far we’ve come in building a safer work environment, and we’re constantly looking for ways to do better.

To continue to strengthen our safety culture, we use monthly scorecards to track and review our performance at every level of the organization– from EVPs to the frontline supervisors. We compare our performance against the Bureau of Labor Statistics for our industry category as well as research data and practices in similar industries to help with our assessments and, along with team-member feedback, to make improvements.

Across Frontier, senior leaders have embraced the importance of safety and promoting it across the organization. And out on the road, we are using telematics in our fleet to help reinforce our safety practices to ensure safety is part of our everyday working life in all corners of the company.

Our commitment to safety is guided by our Occupational Safety & Health Program and reinforced by our Environmental Health and Safety Methods and Procedures. Together, they provide a framework for identifying, controlling and reducing risks.

As a standard practice, we maintain environmental, health, and safety compliance programs, including ongoing safety training for our field technicians.

Our Workforce

Our employee base decreased by approximately 2% from approximately 13,300 employees as of December 31, 2023 to approximately 13,000 as of December 31, 2024. Approximately 66% of our total employees are represented by unions and are subject to collective bargaining agreements. The term of our collective bargaining agreements is typically three years and at any point in time we generally have several agreements under negotiation and on extension. Approximately 43% of our unionized employees are covered by collective agreements that are scheduled to expire in 2025. We consider our relations with our employees to be good.

In addition, our workforce is currently supplemented by approximately 126 contract workers, primarily in construction planning. We are a federal contractor and follow the rules set forth by the Department of Labor, Office of Federal Contract Compliance Programs (OFCCP), including those applicable to recruiting, hiring and diversity.

Available Information

We make available, free of charge on our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as practicable after we electronically file these documents with, or furnish them to, the SEC. These documents may be accessed through our website at www.frontier.com under “Investors.” The information posted or linked on our website is not part of, or incorporated by reference into, this report. We also make our Annual Report available in printed form upon request at no charge.

We make available on our website, as noted above, or in printed form upon request, free of charge, our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Specific Code of Business Conduct and Ethics Provisions for Certain Officers, and the charters for the Audit, Compensation and Human Capital, and Nominating and Corporate Governance Committees of the Board of Directors. Stockholders may request printed copies of these materials by writing to: 1919 McKinney Avenue, Dallas, Texas 75201 Attention: Corporate Secretary.

Forward-Looking Statements

This Annual Report on Form 10-K contains "forward-looking statements," related to future events. Forward-looking statements address our expectations or beliefs concerning future events, including, without limitation, the proposed Merger with Verizon, our future operating and financial performance, our ability to implement strategic initiatives, such as our fiber build and fiber penetration and our ability to realize cost savings initiatives, our ability to comply with the covenants in the agreements governing our indebtedness, our capital expenditures, and other matters. These statements are made based on management’s views and assumptions, as of the time the statements are made, regarding future events and performance and contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “may,” “will,” “would,” or “target.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. We do not intend, nor do we undertake any duty, to update any forward-looking statements, except as required by law.

A wide range of factors could materially affect future developments and performance, including but not limited to:

the risk that the Merger may not be completed in a timely manner or at all;

the possibility that any or all of the various conditions to the consummation of the Merger may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals);

the possibility that competing offers or acquisition proposals for the Company will be made;

the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement relating to the Merger, including in circumstances which would require the Company to pay a termination fee;

the effect of the pendency of the Merger on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, suppliers and other business counterparties, or our operating results and business generally;

risks related to the Merger diverting management’s attention from the Company’s ongoing business operations;

the risk that the Company’s stock price may decline significantly if the Merger is not consummated;

our significant indebtedness, our ability to incur substantially more debt in the future, and covenants in the agreements governing our current indebtedness that may reduce our operating and financial flexibility;

declines in Adjusted EBITDA and revenue relative to historical levels that we are unable to offset;

economic uncertainty, volatility in financial markets, and rising interest rates could limit our ability to access capital or increase the cost of capital needed to fund business operations, including our fiber expansion plans;

our ability to successfully implement strategic initiatives, including our fiber buildout and other initiatives to enhance revenue and realize productivity improvements;

our ability to secure necessary construction resources, materials and permits for our fiber buildout initiative in a timely and cost-effective manner;

inflationary pressures on costs, including tight labor markets, increased fuel and electricity costs, and potential disruptions in our supply chain, which could adversely impact our financial condition or results of operations and hinder our fiber expansion plans;

our ability to effectively manage our operations, operating expenses, capital expenditures, debt service requirements and cash paid for income taxes and liquidity;

the impact of potential information technology or data security breaches or other cyber-attacks or other disruptions;

the impact of laws and regulations relating to the handling of privacy and data protection;

competition from cable, wireless carriers, satellite providers, wireline carriers, fiber “overbuilders” and Over-the-Top video providers, and the risk that we will not respond on a timely or profitable basis;

our ability to successfully adjust to changes in the communications industry, including the effects of technological changes and competition on our capital expenditures, products, and service offerings;

our ability to retain or attract new customers and to maintain relationships with existing customers, including wholesale customers;

our reliance on a limited number of key supplies and vendors;

declines in revenue from our voice services, switched and nonswitched access and video and data services that we cannot stabilize or offset with increases in revenue from other products and services;

our ability to secure, continue to use or renew intellectual property and other licenses used in our business;

our ability to dispose of certain assets or asset groups or to make acquisition of certain assets on terms that are attractive to us, or at all;

the effects of changes in the availability of and requirements for receiving federal and state universal service funding, grants or other subsidies to us and our competitors and our ability to obtain future subsidies;

our ability to comply with the applicable CAF II and RDOF requirements and the risk of discontinuance of funding, penalties, or obligations to return certain CAF II and RDOF funds;

our ability to defend against litigation or government investigations and potentially unfavorable results from current pending and future litigation or investigations;

our ability to comply with applicable federal and state consumer protection requirements;

the effects of governmental legislation and regulation on our business, including costs, disruptions, possible limitations on operating flexibility and changes to the competitive landscape resulting from such legislation or regulation;

the impact of regulatory, investigative, and legal proceedings and legal compliance risks;

our ability to effectively manage service quality in the states in which we operate and meet mandated service quality metrics or regulatory requirements;

the effects of changes in income tax rates, tax laws, regulations, or rulings, or federal or state tax assessments, including the risk that such changes may benefit our competitors more than us, as well as potential future decreases in the value of our deferred tax assets;

the effects of changes in accounting policies or practices;

our ability to successfully renegotiate union contracts;

the effects of increased medical expenses and pension and postemployment expenses;

changes in pension plan assumptions, interest rates, discount rates, regulatory rules, and/or the value of our pension plan assets;

the impact of adverse changes in economic, political and market conditions in the areas that we serve, the U.S. and globally, including but not limited to, disruption in our supply chain, inflation in pricing for key materials or labor, the imposition of trade tariffs or other adverse changes resulting from epidemics, pandemics, and outbreaks of contagious diseases, natural disasters, economic or political instability, terrorist attacks and wars, including the ongoing war in Ukraine and the Israel-Hamas war, or other adverse widespread developments;

potential adverse impacts of climate change and increasingly stringent environmental laws, rules and regulations, and customer expectations and other environmental liabilities;

potential adverse impacts from natural disasters, wildfires and other severe weather events impacting our network operations and customer base in certain markets;

market overhang due to substantial common stock holdings by our former creditors;

certain provisions of Delaware law and our certificate of incorporation that may prevent efforts by our stockholders to change the direction or management of our company; and

certain other factors set forth in our other filings with the SEC.

This list of factors that may affect future performance and the accuracy of forward-looking statements is illustrative and is not intended to be exhaustive. Any of the foregoing events, or other events, could cause our results to vary from management’s forward-looking statements included in this report. You should consider these important factors, as well as the risks set forth under Item 1A. “Risk Factors,” in evaluating any statement in this report or otherwise made by us or on our behalf.

ITEM 1A. Risk Factors

Before you make an investment decision with respect to any of our securities, you should carefully consider all the information we have included in this Annual Report on Form 10-K and our subsequent filings with the SEC. In particular, you should carefully consider the risk factors described below and the risks and uncertainties related to “Forward-Looking Statements,” any of which could materially adversely affect our business, operating results, financial condition, and the actual outcome of matters as to which forward-looking statements are made in this annual report. The risks and uncertainties described below are not the only ones facing Frontier.

Additional risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not specific to us, may also adversely affect our business and operations. The following risk factors should be read in conjunction with the balance of this annual report, including the consolidated financial statements and related notes included in this report.

Risks Related to the Proposed Merger with Verizon

The Merger may not be completed on the terms or timeline currently contemplated or at all, which could adversely affect our stock price, business, financial condition and results of operations.

On September 4, 2024, the Company entered into the Merger Agreement with Verizon, which provides that the consummation of the Merger is subject to certain conditions, including (i) the Company Stockholder Approval; (ii) the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR waiting period”); (iii) the receipt of certain required consents or approvals from the FCC and certain specified state public utility commissions and local franchise authorities; (iv) the absence of legal restraints prohibiting the Merger; and (v) other customary conditions specified in the Merger Agreement. The Company Stockholder Approval was obtained on November 13, 2024 and the applicable HSR waiting period expired on February 14, 2025. While it is currently anticipated that the Merger will be consummated by the first quarter of 2026, there can be no assurance that the foregoing conditions will be satisfied in a timely manner or at all, or that an effect, event, development, or change will not transpire that could delay or prevent these conditions from being satisfied.

If the Merger is not consummated for any reason, the trading price of our common stock may decline to the extent that the market price of the common stock reflects positive market assumptions that the Merger will be consummated, and the related benefits will be realized. We may also be subject to additional risks if the Merger is not completed, including:

the requirement in the Merger Agreement that, under certain circumstances, we pay Verizon a termination fee of $320 million in cash;

incurring substantial costs related to the Merger, such as financial advisory, legal, accounting, and other professional services fees that have already been incurred or will continue to be incurred until closing;

limitations on our ability to retain and hire key personnel;

the imposition of additional regulatory and operational requirements on our business;

reputational harm including relationships with investors, customers, and business partners due to the adverse perception of any failure to successfully complete the Merger; and

potential disruption to our business and distraction of our workforce and management team to pursue other opportunities that could be beneficial to us, in each case without realizing any of the benefits of having the Merger completed.

The pendency of the Merger could negatively impact our business, financial conditions, and results of operations.

The pendency of the Merger could adversely affect our business, financial condition and results of operations and may result in our inability to hire or the departure of key personnel. In connection with the Merger, some of our customers and business partners may delay or defer decisions or may end their relationships with us, which could negatively affect our revenues, earnings and cash flows, regardless of whether the Merger is completed. Similarly, our current and prospective employees may experience uncertainty about their future roles with us following the Merger, which may materially adversely affect our ability to attract and retain key personnel during the pendency of the Merger.

Until the completion of the Merger or the termination of the Merger Agreement in accordance with its terms, we are prohibited from entering into certain transactions and taking certain actions that might otherwise be beneficial to the Company and its stockholders.

From and after the date of the Merger Agreement and prior to completion of the Merger, the Merger Agreement restricts us from taking specified actions without the consent of Verizon and requires that the business of our Company and its subsidiaries

be conducted in the ordinary course in all material respects. These restrictions may prevent us from making changes to our business or organizational structure or from pursuing business opportunities that may arise prior to the completion of the Merger. Adverse effects arising from these restrictions during the pendency of the Merger could be exacerbated by any delays in the consummation of the Merger or the termination of the Merger Agreement.

We have incurred, and will continue to incur, direct and indirect costs as a result of the Merger.

We have incurred, and will continue to incur, significant costs and expenses, including regulatory costs, fees for professional services and other transaction costs in connection with the Merger, for which we have received little or no benefit if the Merger is not completed. There are a number of factors beyond our control that could affect the total amount or the timing of these costs and expenses. Many of these fees and costs will be payable by us even if the Merger is not completed and may relate to activities that we would not have undertaken other than to complete the Merger.

Litigation challenging the Merger Agreement may prevent the Merger from being consummated within the expected timeframe or at all.

Lawsuits have been filed (see Note 20 - “Commitments and Contingencies” to the Consolidated Financial Statements included in Part I of this Annual Report for further discussion), and additional lawsuits may be filed in the future, against us, our Board of Directors or other parties to the Merger Agreement, challenging the adequacy of the proxy disclosures or making other claims in connection with the Merger. Such lawsuits have been brought by purported stockholders, and additional lawsuits may be brought by purported stockholders or other interested parties, seeking, among other things, to enjoin consummation of the Merger. One of the conditions to the consummation of the Merger is that the consummation of the Merger is not restrained, made illegal, enjoined or prohibited by any order or legal or regulatory restraint or prohibition of a court of competent jurisdiction or any governmental entity. As such, if the plaintiffs in such current or potential lawsuits are successful in obtaining an injunction prohibiting the defendants from completing the Merger on the agreed upon terms, then such injunction may prevent the Merger from becoming effective within the expected timeframe or at all.

Risks Related to Our Indebtedness

We have a significant amount of indebtedness, and we may incur substantially more debt in the future. Such debt and debt service obligations may adversely affect us.

As of December 31, 2024, we had indebtedness of approximately $11.6 billion of which approximately $11 billion was secured. We may also be able to incur substantial additional indebtedness in the future. Although the terms of the agreements currently governing our existing indebtedness restrict our restricted subsidiaries’ ability to incur additional indebtedness and liens, such restrictions are subject to several exceptions and qualifications, and the indebtedness and/or liens incurred in compliance with such restrictions may be substantial. Also, these restrictions do not prevent us or our restricted subsidiaries from incurring obligations that do not constitute indebtedness. In addition, to the extent other new debt is added to our subsidiaries’ current debt levels, the substantial leverage risks described below would increase.

The potential significant negative consequences on our financial condition and results of operations that could result from our substantial debt include:

limitations on our ability to obtain additional debt or equity financing on favorable terms or at all;

instances in which we are unable to comply with the covenants contained in our indentures and credit agreements or to generate cash sufficient to make required debt payments, which circumstances have the potential of accelerating the maturity of some or all of our outstanding indebtedness;

the allocation of a substantial portion of our cash flow from operations to service our debt, thus reducing the amount of our cash flows available for other purposes, including capital expenditures that would otherwise improve our competitive position, results of operations or stock price;

requiring us to sell debt or equity securities or to sell some of our core assets, possibly on unfavorable terms, to meet payment obligations;

compromising our flexibility to plan for, or react to, competitive challenges in our business and the telecommunications industries;

increasing our vulnerability to general adverse economic and industry conditions, including increases in interest rates, particularly given a portion of our indebtedness bears interest at variable rates, as well as to catastrophic events; and

the possibility of being put at a competitive disadvantage with competitors who, relative to their size, do not have as much debt as we do, and competitors who may be in a more favorable position to access additional capital resources.

In addition, our First Lien Notes and Second Lien Notes, as well as a portion of our subsidiary indebtedness (other than a portion of the securitized Class A and Class B notes), are rated below “investment grade” by independent rating agencies. This has resulted in higher borrowing costs for us. These rating agencies may lower our debt ratings further, if in the rating agencies’ judgment such an action is appropriate. A further lowering of a rating would likely increase our future borrowing costs and reduce our access to capital. Our negotiations with vendors, customers and business partners could also be negatively impacted if they deem us a credit risk as a result of our credit rating.

Economic uncertainty and volatility in the U.S. and global financial markets could limit our ability to access capital or increase the cost of capital needed to fund business operations, including our fiber expansion plans.

As of December 31, 2024, economic uncertainty, inflationary pressures, the ongoing war in Ukraine, the Israel-Hamas war, rising interest rates and the expectations around the terminal target rate of the Federal Reserve continue to produce volatility in the debt and equity markets. Such volatility may affect our ability to access capital markets, which could lead to higher borrowing costs or other unattractive financing terms or, in some cases, the inability to fund ongoing operations. Adverse changes or continued volatility in the financial markets could render us either unable to access additional financing or able to access these markets only at higher costs and with restrictive financial or other conditions, which could severely affect our business operations and hinder our fiber expansion plans.

The agreements governing our current indebtedness contain various covenants that impose restrictions on us and certain of our subsidiaries that may reduce our operating and financial flexibility and we may not be able to satisfy our obligations under these or other, future debt arrangements.

The agreements governing our existing indebtedness contain covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to:

incur additional debt and issue preferred stock;

incur or create liens;

redeem and/or prepay certain debt;

pay dividends on our stock or repurchase stock;

make certain investments;

engage in specified sales of assets;

enter into transactions with affiliates; and

engage in consolidation, mergers, and acquisitions.

In addition, our credit facilities require us to comply with specified financial ratios, including a maximum first lien coverage ratio. Any future indebtedness may also require us to comply with similar or other covenants.

These restrictions on our ability to operate our business could seriously harm our business by, among other things, limiting our ability to take advantage of financings, mergers, acquisitions, and other corporate opportunities. Various risks, uncertainties and events beyond our control could affect our ability to comply with these covenants. Failure to comply with any of the covenants in our financing agreements could result in a default under those agreements and under other agreements containing cross-default provisions. A default would permit lenders to accelerate the maturity for the debt under these agreements and to foreclose upon any collateral securing the debt. Under these circumstances, we might not have sufficient funds or other resources to satisfy all of our obligations. In addition, the limitations imposed by financing agreements on our ability to incur additional debt and to take other actions might significantly impair our ability to obtain other financing. This could have serious consequences to our financial condition and results of operations.

Frontier is primarily a holding company and, as a result, we rely on the receipt of funds from our subsidiaries in order to meet our cash needs and service our indebtedness, including the notes.

Frontier is primarily a holding company, and its principal assets consist of the shares of capital stock or other equity instruments of its subsidiaries. As a holding company, we depend on distributions, transfers, and other intracompany payments from our subsidiaries to fund our obligations. The operating results of our subsidiaries at any given time may not be sufficient to make distributions, transfers, or other payments to us in order to allow us to make payments on our indebtedness. In addition, the payment of these distributions, transfers, and other payments, as well as other transfers of assets, between our subsidiaries and from our subsidiaries to us may be subject to legal, regulatory, or contractual restrictions. Some state regulators have imposed, and others may consider imposing on regulated companies, including us, cash management practices that could limit the ability of such regulated companies to transfer cash between subsidiaries or to the parent company. While none of the existing state regulations materially affect our cash management, any changes to the existing regulations or imposition of new regulations or restrictions may materially adversely affect our ability to transfer cash within our consolidated companies.

We expect to make contributions to our pension plan in future years, the amount of which will be impacted by volatility in asset values related to Frontier’s pension plan and changes in pension plan assumptions.

Under Internal Revenue Service (“IRS”) regulations, we are required to make minimum contributions to our pension plan annually, based upon, among other factors, the value of plan assets relative to the funding target. We made contributions of $133

million and $134 million to our pension plan in 2024 and 2023, respectively. Our required contributions for plan years 2024 and 2023, calculated as of January 1 of the relevant year, were approximately $130 million and $126 million, respectively. In 2021, we received an IRS waiver of the minimum funding standard under Section 412(c) of the Internal Revenue Code, and Section 302(c) of the Employee Retirement Income Security Act of 1974 for the plan year 2020 minimum required distribution. With this waiver, we are spreading the 2020 minimum required contribution over the five subsequent plan years, in addition to the minimum contributions owed for those plan years. There was a modification to the funding waiver in January 2024 which, due to Section 412(c) of the Internal Revenue Code and Frontier’s intention to adopt amendments that increased benefit liabilities, accelerated the final 2025 plan year waiver amortization installment into the 2024 minimum required contribution, thereby increasing the required contributions attributable to the 2024 plan year.

We expect to make contributions to our pension plan in future years and the amount of required contributions for future years could be significant. Volatility in our asset values, liability calculations, or returns may impact the costs of maintaining our pension plan and our future funding requirements. Any future contribution to our pension plan could be material and could have a material adverse effect on our liquidity by reducing cash flows.

Significant changes in discount rates, rates of return on pension assets, mortality tables and other factors could adversely affect our earnings and equity and increase our pension funding requirements.

Pension costs and obligations are determined using actual results as well as actuarial valuations that involve several assumptions. The most critical assumptions are the discount rate, the long-term expected return on assets and lump sum conversion interest rates. Other assumptions include salary increases, mortality, and retirement age. Some of these assumptions, such as the discount rate and return on pension assets, are reflective of economic conditions and impacted by factors such as inflationary pressures that are largely out of our control. Changes in the pension assumptions could have a material impact on pension costs and obligations, and could in turn have a material adverse effect on our earnings, equity, and funding requirements.

Risks Related to Our Business

If our fiber expansion plan or other initiatives to increase our revenues, customer trends, profitability and cash flows are unsuccessful, our financial position and results of operations will be negatively and adversely impacted.

We must produce adequate revenues and operating cash flows that, when combined with cash on hand and borrowing under our revolving credit facility and other financings, will be sufficient to service our debt, fund our capital expenditures, taxes, pension and other employee benefit obligations and other operating expenses. We may experience revenue declines as compared to prior years. We have undertaken, and expect to continue to undertake, programs and initiatives with the objective of improving revenues, customer trends, profitability, and cash flows by enhancing our operations and customer service and support processes. In particular, under our fiber expansion plan we intend to grow our fiber network and optimize our existing copper network at attractive internal rates of return (IRRs) in order to increase our revenues and customer trends, and in turn increase our profitability and cash flows. We have historically experienced significant challenges in achieving such improvements. In addition, these programs and initiatives require significant investment and other resources and may divert attention from ongoing operations and other strategic initiatives.

There can be no assurance that our current and future initiatives and programs will be successful, or that the actual returns from these programs and initiatives will not be lower than anticipated or take longer to realize than we anticipate. For example, we may not reach our targets to expand and penetrate our existing fiber network on the timelines we anticipate, or at all. If current and future programs and initiatives are unsuccessful, result in lower returns than we anticipate, or take longer than we anticipate, it could have a material adverse effect on our financial position and our results of operations.

The communications industry is very competitive, and some of our competitors have superior resources which may place us at a disadvantage.

We face competition in every aspect of our business. Through mergers and various service expansion strategies, service providers are striving to provide integrated solutions both within and across geographic markets. Our competitors include cable operators, wireless carriers, satellite providers, wireline carriers, fiber “overbuilders” and OTT video providers, many of which are subject to less regulation than we are. These entities may provide services that are competitive with the services that we offer or intend to introduce. For example, our competitors may seek to introduce networks in our primarily copper-based markets that are competitive with or superior to our copper-based networks. Several competitors were successful bidders in the RDOF auction and have or may be successful in securing funding through BEAD and other federal state grant programs in areas within Frontier’s service footprint and we expect these competitors will deploy expanded services in these areas that will compete with our services. We also believe that wireless, cable, and other providers have increased their penetration of various services in our markets. We expect that competition will remain robust. Our revenue and cash flow will be adversely impacted if we cannot reverse our customer losses or continue to provide high-quality services.

Some of our competitors have market presence, engineering, technical, marketing, and financial capabilities which are substantially greater than ours. In addition, some of these competitors have less debt and are able to raise capital at a lower cost than we are able to. Consequently, some of these competitors may be able to develop and expand their communications and network infrastructures more quickly, adapt more swiftly to new or emerging technologies and changes in customer preferences, including leading edge technologies such as artificial intelligence (“AI”), machine learning and various types of data science, as

well as take advantage of acquisition and other opportunities more readily and devote greater resources to the marketing and sale of their products and services than we will be able to. New developments in areas such as AI, machine learning, cloud computing and software as a service provider could in turn make it easier for our competition to lower up-front technology costs. In addition, we may not be able to maintain our existing systems or replace or introduce new technologies and systems as quickly as our competition or in a cost-effective manner. Further, the greater brand name recognition of some competitors may require us to price our services at lower levels in order to retain or obtain customers. Finally, the cost advantages and greater financial resources of some of these competitors may give them the ability to reduce their prices for an extended period of time if they so choose. Our business and results of operations may be materially adversely impacted if we are not able to effectively compete.

We cannot predict which of the many possible future technologies, products or services will be important to maintain our competitive position or what expenditures will be required to develop and provide these technologies, products, or services. Our ability to compete successfully will depend on the effectiveness of capital expenditure investments in infrastructure, products and services, our marketing efforts, our ability to deliver high quality customer service, our ability to anticipate and respond to various competitive factors affecting the industry, including a changing regulatory environment that may affect our business and that of our competitors differently, new services that may be introduced, changes in consumer preferences, or habits, demographic trends, economic conditions and pricing strategies by competitors. Increasing competition may reduce our revenues and increase our marketing and other costs as well as require us to increase our capital expenditures and thereby decrease our cash flows.

We rely on network and information systems and other technology, and a breach, disruption or failure of such networks, systems or technology as a result of cyber-attacks, malware, misappropriation of data or other malfeasance, as well as outages, accidental releases of information or similar events, may disrupt our business and materially impact our results of operations, financial condition and cash flows.

Our business involves the receipt, storage, and transmission of confidential information about our customers and others, including sensitive personal, account and payment card information, confidential information about our employees and suppliers, and other sensitive information about our company, such as our business plans, transactions, financial information, and intellectual property. Cyber-attacks against companies like ours have increased in frequency and potential harm over time, and the methods used to gain unauthorized access constantly evolve, making it increasingly difficult to anticipate, prevent, and/or detect incidents successfully in every instance. Likewise, our information technology, networks, and infrastructure may be subject to damage, disruptions, or shutdowns due to cyber-attacks, malware, including ransomware or other information security breaches, employee or third-party error or malfeasance, power outages, communication or utility failures, systems failures, natural disasters, or other catastrophic events.

Further, our network and information systems are subject to various risks related to our vendors, third parties and other parties we may not fully control. We use encryption and authentication technology licensed from third parties to provide secure transmission of confidential information, including our business data and customer information. Similarly, we rely on employees in our network operations centers, data centers and call centers to follow our procedures when handling sensitive information. Use of vendors and third-party technologies could also expose us to supply chain cybersecurity risks, and we may not have accurate or complete information about the risks that third-party service providers face or the security of their systems. While we select our employees and third-party business partners carefully, our ability to monitor these third parties is limited, which could expose us to cyber-security and other risks. In addition, our customers using our network to access the Internet may become victim to malicious and abusive internet activities, such as unsolicited mass advertising (or spam), peer-to-peer file sharing, distribution of viruses, worms and other destructive or disruptive software; these activities could adversely affect our network, result in excessive call volume at our call centers and damage our or our customers’ equipment and data.

We have experienced criminal cyber-attacks and are vulnerable to disruption, data loss and other security breaches, whether directly or indirectly through third parties whose products and services we rely on in operating our business.

While we maintain security measures, disaster recovery plans and business continuity plans and work to upgrade our existing technology systems and provide employee training around the cyber risks we face, these risks are constantly evolving and are challenging to mitigate. Like many companies, we and our third-party service providers are the subject of increasingly frequent cyber-attacks. Security incidents result from the actions of a wide variety of actors with a wide range of motives and expertise, such as traditional hackers, personnel or the personnel of third parties, sophisticated nation-states and nation-state-supported actors.

On April 14, 2024, we detected that a third party had gained unauthorized access to portions of our information technology environment. Based on our investigation, we determined that the third party was likely a cybercrime group, which gained access to, among other information, personally identifiable information. Upon detection, we immediately activated our incident response plan, took action to contain the incident, launched an investigation with the assistance of leading cybersecurity experts, and notified law enforcement and applicable regulatory authorities. While the incident did not have a material impact on our financial condition or results of operations, the containment measures, which included shutting down certain of the Company’s systems, resulted in an operational disruption.