| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-282099-02 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$822,168,756

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2025-C64

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Goldman Sachs Mortgage Company

Citi Real Estate Funding Inc.

UBS AG

Societe Generale Financial Corporation

JPMorgan Chase Bank, National Association

Bank of Montreal

LMF Commercial, LLC

Natixis Real Estate Capital LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2025-C64

January 30, 2025

WELLS

FARGO

SECURITIES | BMO

CAPITAL

MARKETS | CITIGROUP | GOLDMAN

SACHS & CO.

LLC | J.P.

MORGAN | SOCIÉTÉ

GÉNÉRALE | UBS

SECURITIES LLC |

Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner |

| Academy Securities, Inc. | Drexel Hamilton | Natixis Securities Americas LLC | Siebert Williams Shank |

| Co-Manager | Co-Manager | Co-Manager | Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-282099) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, BMO Capital Markets Corp., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, UBS Securities LLC, J.P. Morgan Securities LLC, SG Americas Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Natixis Securities Americas LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Société Générale is the marketing name for SG Americas Securities, LLC.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Issue Characteristics |

| I. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate Cut-off Date Balance | Approx. % of Initial Pool

Balance |

| Goldman Sachs Mortgage Company | 5 | | 7 | | $193,000,055 | | 23.5 | % |

| Citi Real Estate Funding Inc. | 8 | | 28 | | 172,246,464 | | 21.0 | |

| Wells Fargo Bank, National Association | 5 | | 5 | | 132,187,683 | | 16.1 | |

| UBS AG | 3 | | 10 | | 81,500,000 | | 9.9 | |

| Societe Generale Financial Corporation | 6 | | 6 | | 78,004,605 | | 9.5 | |

| JPMorgan Chase Bank, National Association | 1 | | 2 | | 70,000,000 | | 8.5 | |

| Bank of Montreal | 1 | | 1 | | 45,000,000 | | 5.5 | |

| LMF Commercial, LLC | 2 | | 2 | | 30,229,949 | | 3.7 | |

| Natixis Real Estate Capital LLC | 1 | | 1 | | 20,000,000 | | 2.4 | |

Total | 32 | | 62 | | $822,168,756 | | 100.0 | % |

Loan Pool:

| Initial Pool Balance: | $822,168,756 |

| Number of Mortgage Loans: | 32 |

| Average Cut-off Date Balance per Mortgage Loan: | $25,692,774 |

| Number of Mortgaged Properties: | 62 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $13,260,786 |

| Weighted Average Interest Rate: | 6.6418% |

| Ten Largest Mortgage/Cross-collateralized Loans as % of Initial Pool Balance: | 58.8% |

| Weighted Average Original Term to Maturity (months): | 118 |

| Weighted Average Remaining Term to Maturity (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 356 |

| Weighted Average Remaining Amortization Term (months)(2): | 355 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.80x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 13.3% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 54.2% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 52.2% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 17.5% |

| % of Mortgage Loans with Single Tenants(3): | 4.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans or Cross-Collateralized Mortgage Loans |

| Mortgage Loan Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans/ Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Property Type | Number of SF/ Units/ Rooms | Cut-off Date Balance Per SF/Unit/ Room ($) | Cut-off Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

| GSMC | TheWit Chicago | Chicago | IL | 1 / 1 | $81,000,000 | 9.9 | % | Hospitality | 310 | $261,290 | 54.4% | 54.4 | % | 1.59 | x | 13.5 | % |

| WFB | Ventana Residences | San Francisco | CA | 1 / 1 | 73,500,000 | 8.9 | | Multifamily | 193 | 380,829 | 65.6 | 65.6 | | 1.25 | | 7.9 | |

| JPMCB | Soho Grand & The Roxy Hotel | New York | NY | 1 / 2 | 70,000,000 | 8.5 | | Hospitality | 548 | 371,350 | 40.1 | 40.1 | | 3.49 | | 21.9 | |

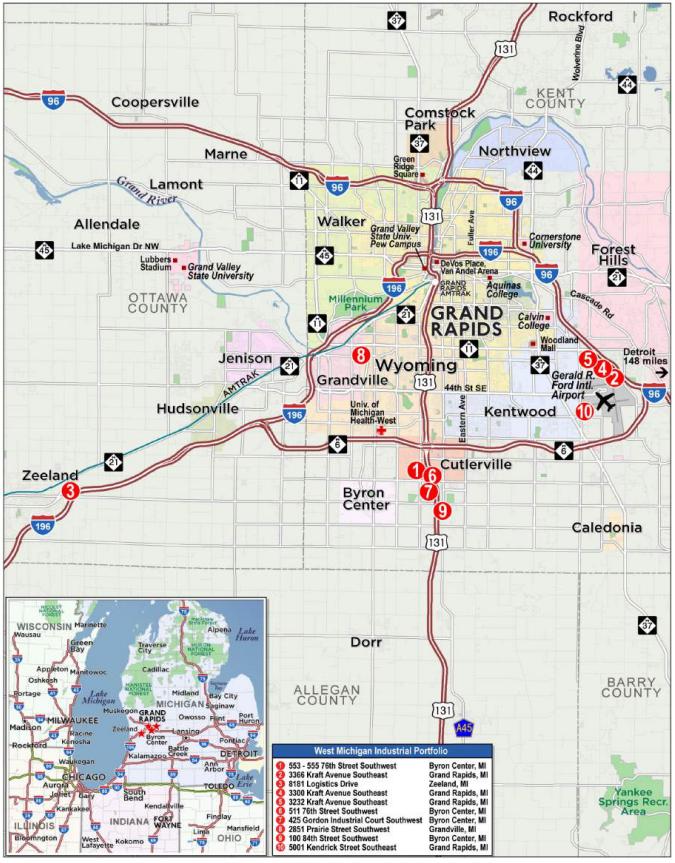

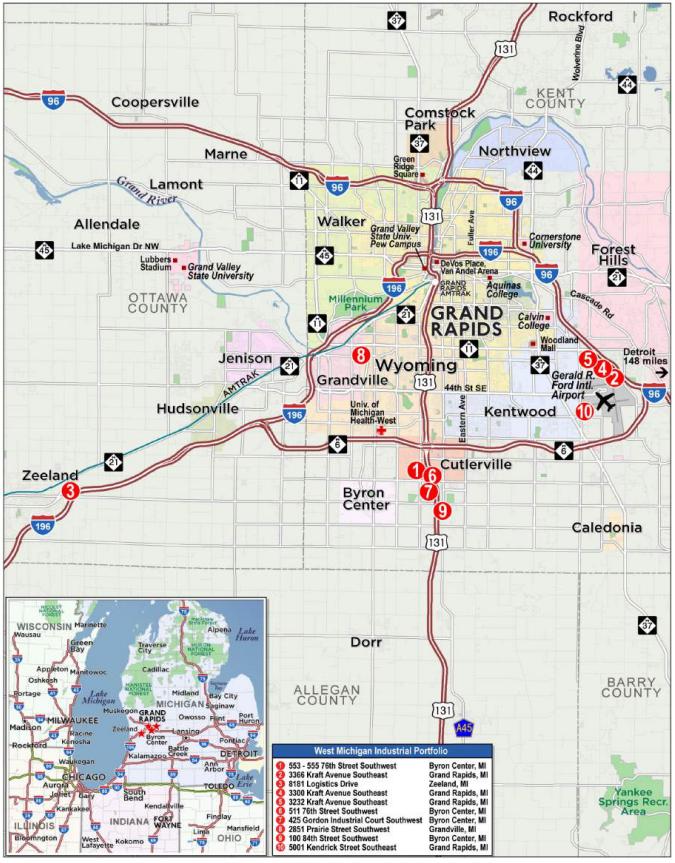

| CREFI | West Michigan Industrial Portfolio | Various | MI | 1 / 10 | 57,000,000 | 6.9 | | Industrial | 1,696,701 | 34 | 57.6 | 57.6 | | 1.90 | | 12.6 | |

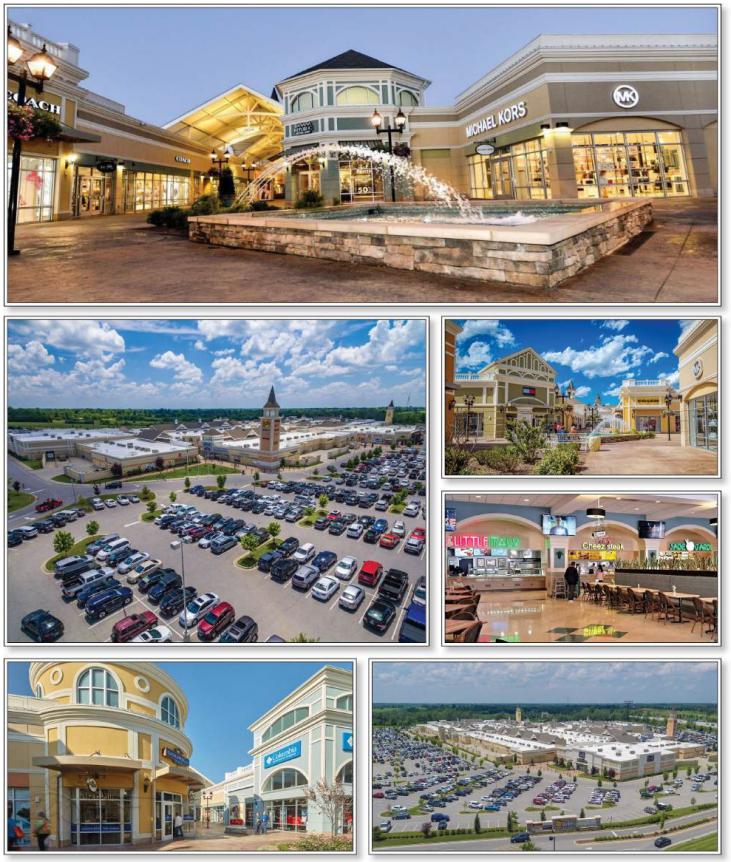

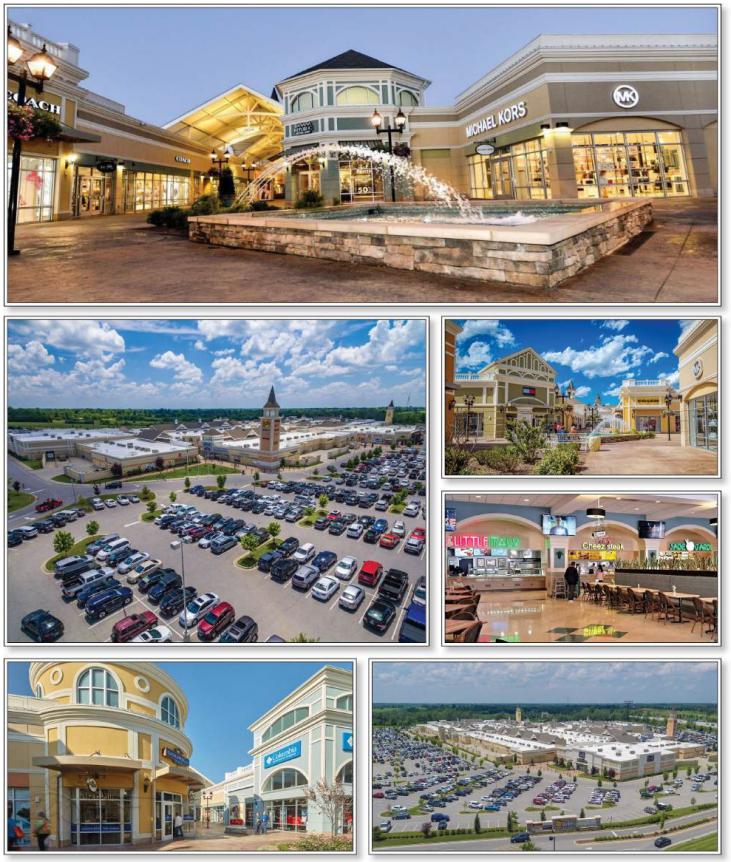

| GSMC | Outlet Shoppes of the Bluegrass | Simpsonville | KY | 1 / 1 | 45,900,055 | 5.6 | | Retail | 428,074 | 154 | 60.4 | 52.6 | | 1.72 | | 14.2 | |

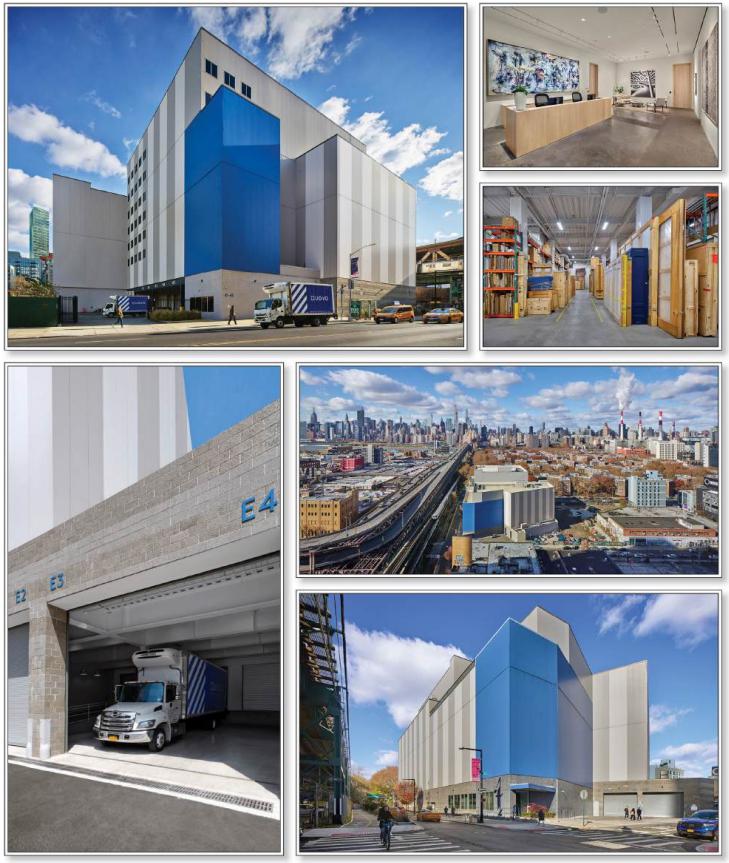

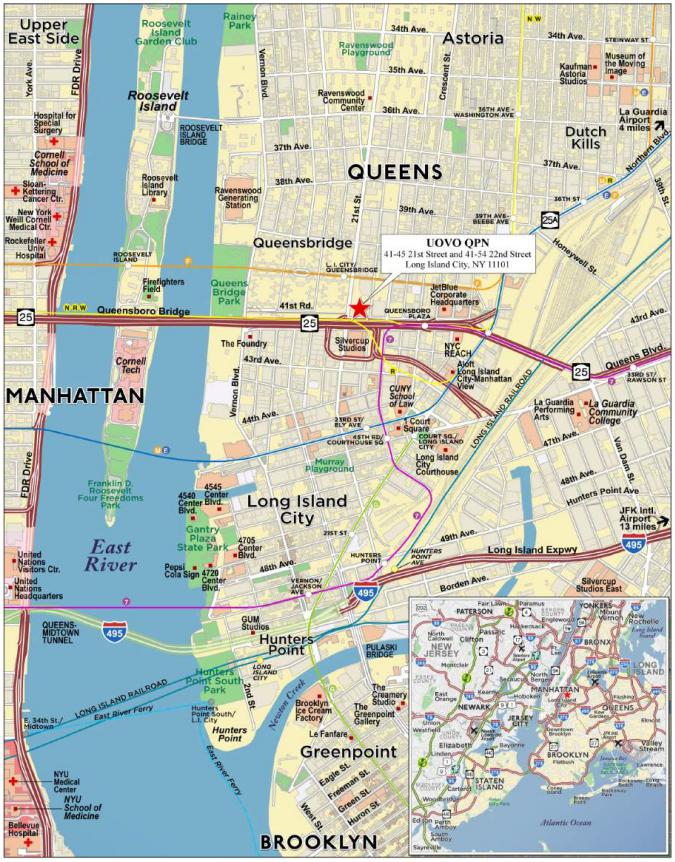

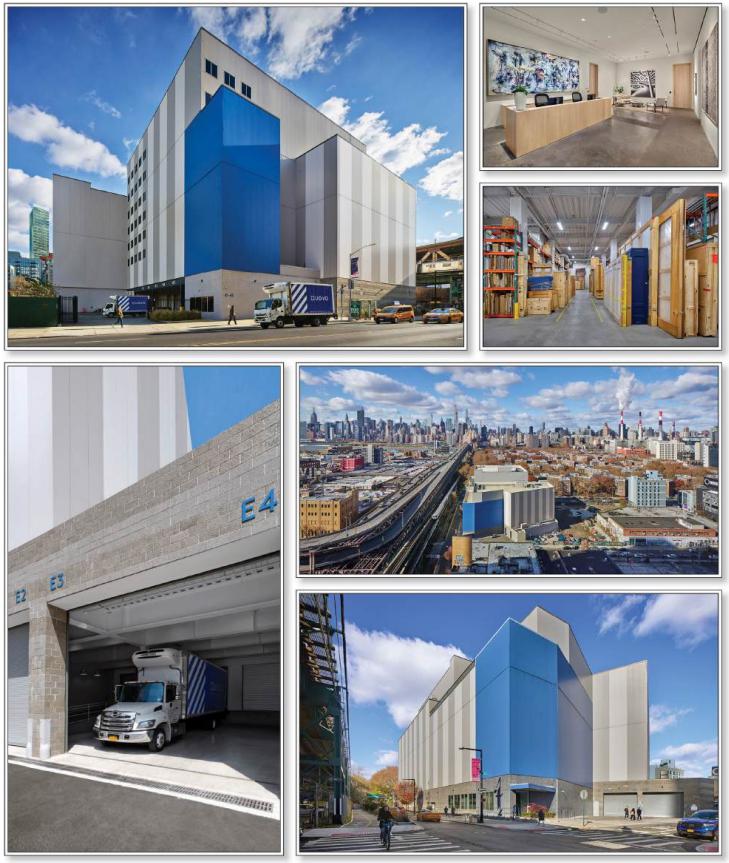

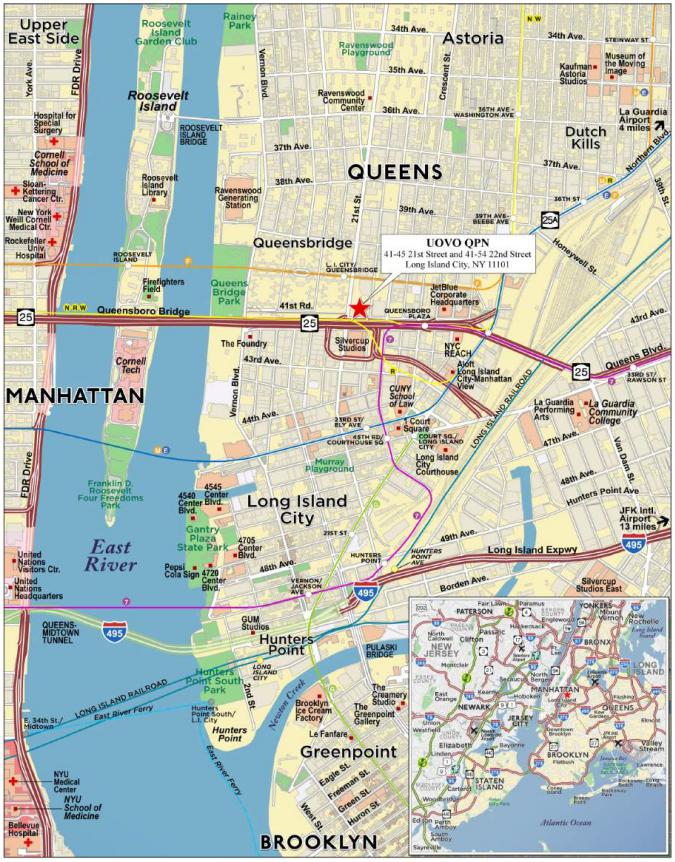

| BMO | UOVO QPN | Long Island City | NY | 1 / 1 | 45,000,000 | 5.5 | | Self Storage | 281,494 | 508 | 60.9 | 60.9 | | 1.47 | | 9.7 | |

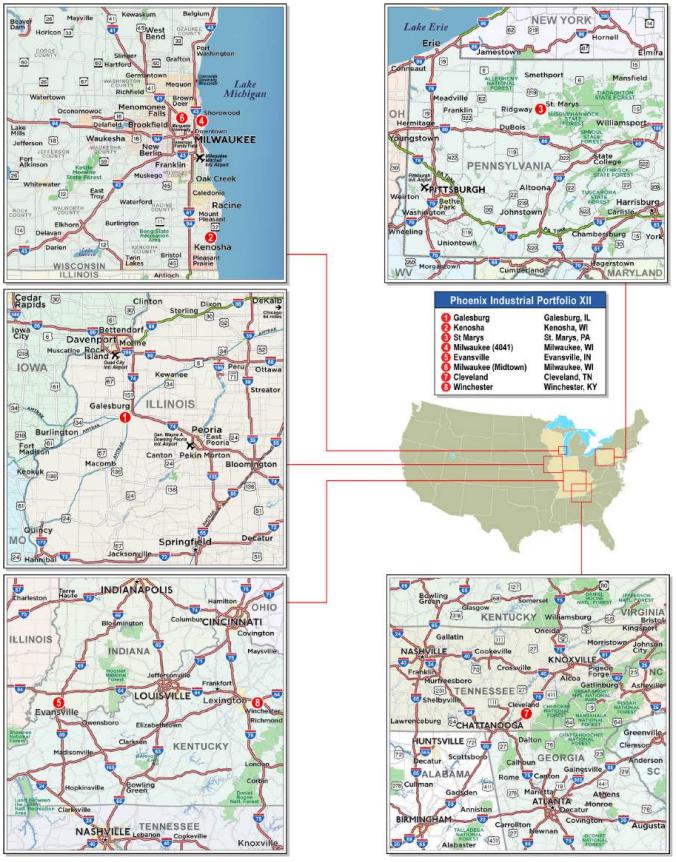

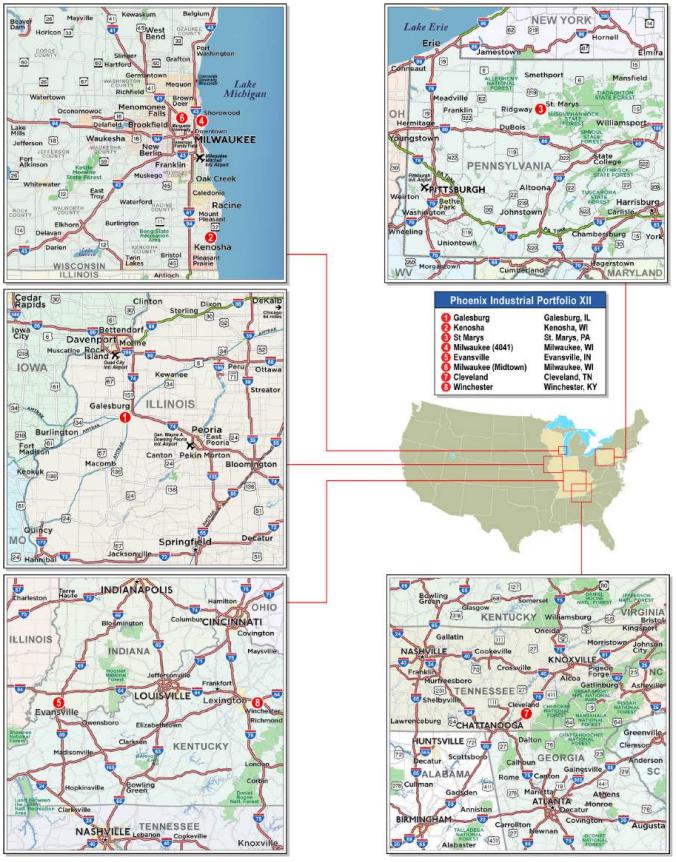

| UBS AG | Phoenix Industrial Portfolio XII | Various | Various | 1 / 8 | 30,000,000 | 3.6 | | Industrial | 2,013,085 | 26 | 48.1 | 48.1 | | 1.60 | | 11.7 | |

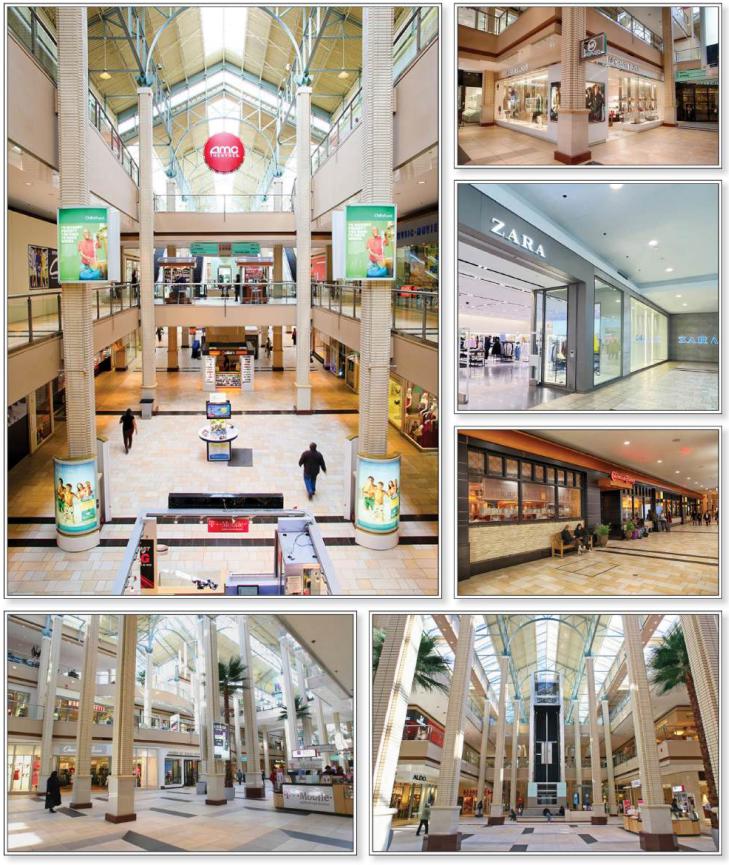

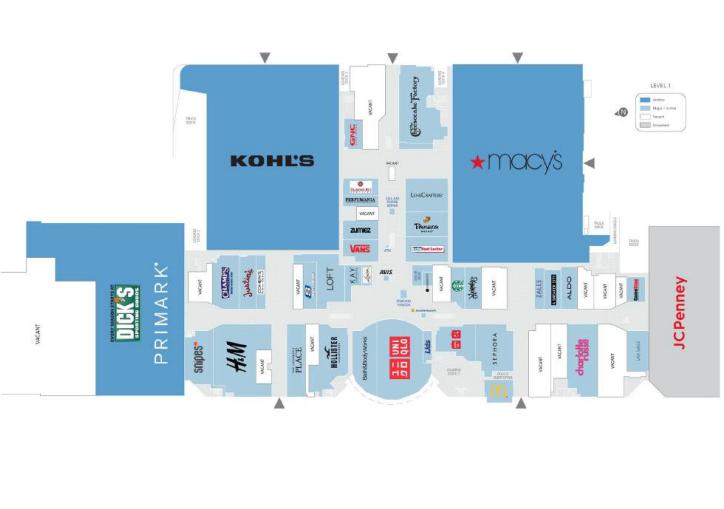

| GSMC | Newport Centre | Jersey City | NJ | 1 / 1 | 28,000,000 | 3.4 | | Retail | 966,186 | 195 | 43.0 | 43.0 | | 2.66 | | 15.3 | |

| UBS AG | Union Square Shopping Center | Harrisburg | PA | 1 / 1 | 27,950,000 | 3.4 | | Retail | 307,913 | 91 | 65.0 | 65.0 | | 1.56 | | 11.2 | |

| CREFI | Shops at Mission Viejo | Mission Viejo | CA | 1 / 1 | 25,000,000 | 3.0 | | Retail | 1,012,005 | 178 | 52.4 | 49.5 | | 1.69 | | 13.4 | |

| Top Three Total/Weighted Average | | 3 / 4 | $224,500,000 | 27.3 | % | | | | 53.6% | 53.6 | % | 2.07 | x | 14.3 | % |

| Top Five Total/Weighted Average | | 5 / 15 | $327,400,055 | 39.8 | % | | | | 55.3% | 54.2 | % | 1.99 | x | 14.0 | % |

| Top Ten Total/Weighted Average | | 10 / 27 | $483,350,055 | 58.8 | % | | | | 55.0% | 54.2 | % | 1.92 | x | 13.3 | % |

| Non-Top Ten Total/Weighted Average | | 22 / 35 | $338,818,701 | 41.2 | % | | | | 53.0% | 49.5 | % | 1.64 | x | 13.2 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loansss |

| Loan No. | Property Name | Mortgage Loan Seller in WFCM 2025-C64 | Mortgage Loan Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Combined Cut-off Date Balance | Controlling Pooling / Trust and Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Combined UW NCF DSR(2) | Combined UW NOI Debt Yield(2) | Combined Cut-off Date LTV(2) |

| 3 | Soho Grand & The Roxy Hotel | JPMCB | $70,000,000 | $133,500,000 | $203,500,000 | BANK 2024-BNK48 | Wells Fargo | LNR | BANK 2024-BNK48 | 3.09x | 19.4% | 45.3% |

| 5 | Outlet Shoppes of the Bluegrass | GSMC | $45,900,055 | $19,956,546 | $65,856,600 | WFCM 2025-C64 | Wells Fargo | Rialto Capital Advisors, LLC | Future Securitization | 1.72x | 14.2% | 60.4% |

| 6 | UOVO QPN | BMO | $45,000,000 | $98,000,000 | $143,000,000 | WFCM 2025-C64 | Midland | Rialto Capital Advisors, LLC | Future Securitization | 1.47x | 9.7% | 60.9% |

| 7 | Phoenix Industrial Portfolio XII | UBS AG | $30,000,000 | $22,500,000 | $52,500,000 | WFCM 2025-C64 | Wells Fargo | Rialto | BBCMS 2025-C32 | 1.60x | 11.7% | 48.1% |

| 8 | Newport Centre | GSMC | $28,000,000 | $160,000,000 | $188,000,000 | BBCMS 2024-C30 | Midland | Rialto Capital Advisors, LLC | BBCMS 2024-C30; BMO 2024-C10; BANK 2024-BNK48 | 2.66x | 15.3% | 43.0% |

| 10 | Shops at Mission Viejo | CREFI | $25,000,000 | $155,000,000 | $180,000,000 | BBCMS 2025-C32 | Midland | Argentic Services Company LP | BBCMS 2025-C32 | 1.69x | 13.4% | 52.4% |

| 11 | 900 North Michigan | GSMC | $25,000,000 | $155,000,000 | $180,000,000 | BBCMS 2024-C28 | Wells Fargo | LNR Partners, LLC | BBCMS 2024-C28; WFCM 2024-C63; BANK 2024-BNK48; BBCMS 2024-C30 | 1.77x | 12.6% | 57.1% |

| 19 | Twin Cities Premium Outlets | Natixis | $20,000,000 | $75,000,000 | $95,000,000 | BBCMS 2024-C30 | Midland | Rialto Capital Advisors, LLC | BBCMS 2024-C30 | 2.01x | 14.3% | 47.0% |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

| (2) | DSCR, Debt Yield and LTV calculations include any related pari passu companion loans and exclude any subordinate companion loans and/or mezzanine loans, as applicable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 2 | WFB | Ventana Residences | $73,500,000 | 8.9 | % | NAP | $34,750,000 | 6.7547% | 1.25x | 0.78x | 7.9% | 5.4% | 65.6% | 96.7% |

| 3 | JPMCB | Soho Grand & The Roxy Hotel | 70,000,000 | 8.5 | | $26,500,000 | NAP | 5.5400 | 3.49 | 3.09 | 21.9 | 19.4 | 40.1 | 45.3 |

| Total/Weighted Average | $143,500,000 | 17.5 | % | $26,500,000 | $34,750,000 | 6.1622% | 2.34x | 1.91x | 14.7% | 12.2% | 53.2% | 71.6% |

(1) Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt.

(2) With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan or mezzanine debt.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Previous Securitization |

| 3.00 | JPMCB | Soho Grand & The Roxy Hotel | New York | NY | Hospitality | $70,000,000 | 8.5 | % | CSAIL 2015-C1, CSAIL 2015-C2, CSAIL 2015-C3 |

| 4.01 | CREFI | 553 - 555 76th Street Southwest | Byron Center | MI | Industrial | 7,600,000 | 0.9 | | COMM 2015-PC1 |

| 4.02 | CREFI | 3366 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 7,400,000 | 0.9 | | COMM 2015-PC1 |

| 4.03 | CREFI | 8181 Logistics Drive | Zeeland | MI | Industrial | 7,100,000 | 0.9 | | COMM 2015-PC1 |

| 4.04 | CREFI | 3300 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 7,100,000 | 0.9 | | COMM 2015-PC1 |

| 4.05 | CREFI | 3232 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 6,900,000 | 0.8 | | COMM 2015-PC1 |

| 4.06 | CREFI | 511 76th Street Southwest | Byron Center | MI | Industrial | 6,800,000 | 0.8 | | COMM 2015-PC1 |

| 4.07 | CREFI | 425 Gordon Industrial Court Southwest | Byron Center | MI | Industrial | 5,400,000 | 0.7 | | COMM 2015-PC1 |

| 4.08 | CREFI | 2851 Prairie Street Southwest | Grandville | MI | Industrial | 4,100,000 | 0.5 | | COMM 2015-PC1 |

| 4.09 | CREFI | 100 84th Street Southwest | Byron Center | MI | Industrial | 2,700,000 | 0.3 | | COMM 2015-PC1 |

| 4.10 | CREFI | 5001 Kendrick Street Southeast | Grand Rapids | MI | Industrial | 1,900,000 | 0.2 | | COMM 2015-PC1 |

| 5.00 | GSMC | Outlet Shoppes of the Bluegrass | Simpsonville | KY | Retail | 45,900,055 | 5.6 | | CSMC 2022-NWPT |

| 6.00 | BMO | UOVO QPN | Long Island City | NY | Self Storage | 45,000,000 | 5.5 | | CD 2017-CD4 |

| 8.00 | GSMC | Newport Centre | Jersey City | NJ | Retail | 28,000,000 | 3.4 | | CSMC 2022-NWPT |

| 9.00 | UBS AG | Union Square Shopping Center | Harrisburg | PA | Retail | 27,950,000 | 3.4 | | CGCMT 2015-GC27; JPMCC 2004-C3 |

| 11.00 | GSMC | 900 North Michigan | Chicago | IL | Mixed Use | 25,000,000 | 3.0 | | LBUBS 2005-C3 |

| 15.04 | CREFI | Tuckaway Village MHP | Germantown Hills | IL | Manufactured Housing | 2,150,000 | 0.3 | | WFCM 2015-C31 |

| 15.05 | CREFI | Minot MHP | Minot | ND | Manufactured Housing | 2,020,000 | 0.2 | | CGCMT 2015-GC35 |

| 16.00 | SGFC | Escondido HHSA Building | Escondido | CA | Mixed Use | 21,000,000 | 2.6 | | CSAIL 2016-C5 |

| 19.00 | Natixis | Twin Cities Premium Outlets | Eagan | MN | Retail | 20,000,000 | 2.4 | | GSMS 2014-GC26; CGCMT 2015-GC27 |

| 28.00 | WFB | Security Public Storage | Fairfield | CA | Self Storage | 9,465,474 | 1.2 | | WFRBS 2014-C24 |

| 29.00 | WFB | North Huntingdon Square | Irwin | PA | Retail | 7,974,238 | 1.0 | | JPMBB 2014-C19 |

| 31.00 | CREFI | Skyview Plaza | East Liverpool | OH | Retail | 7,481,998 | 0.9 | | JPMBB 2014-C24 |

| | Total | | | | | $368,941,765 | 44.9 | % | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

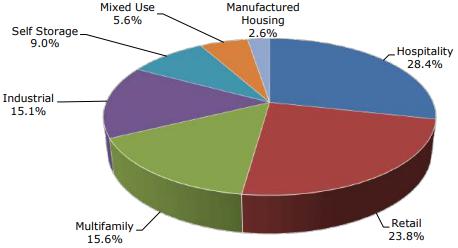

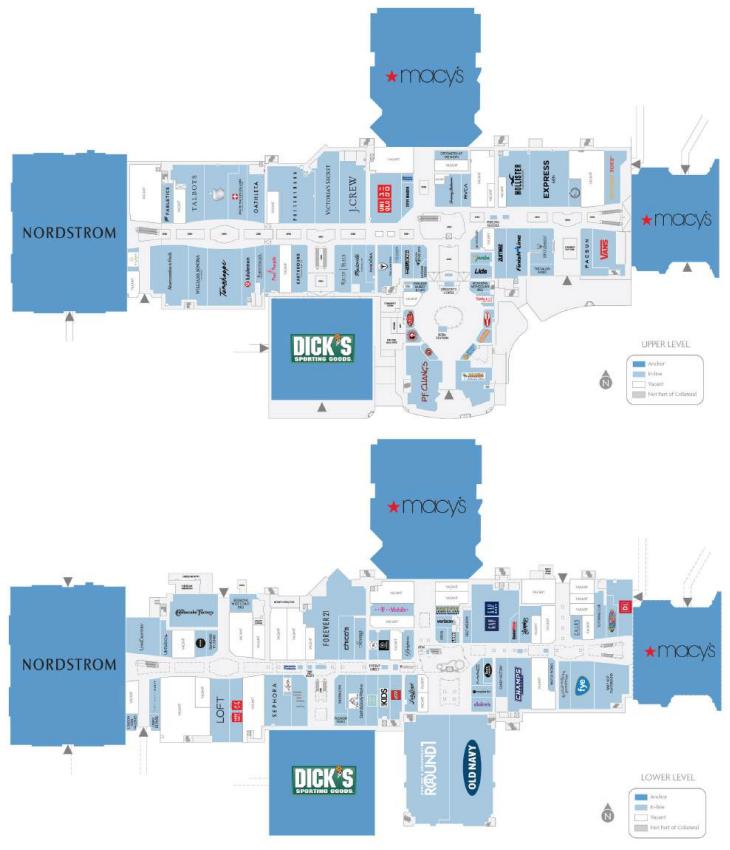

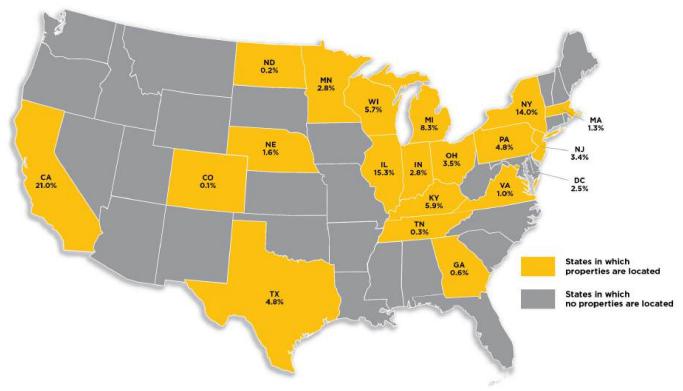

| E. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Hospitality | 8 | $233,712,386 | 28.4% | 47.6% | 45.7% | 2.28x | 17.5% | 15.5% | 6.8065% |

| Full Service | 4 | 174,550,000 | 21.2 | 47.1 | 47.1 | 2.35 | 17.0 | 15.0 | 6.7208 |

| Extended Stay | 1 | 20,947,971 | 2.5 | 25.7 | 22.1 | 2.99 | 25.6 | 22.3 | 6.3100 |

| Select Service | 1 | 15,800,000 | 1.9 | 72.1 | 59.6 | 1.34 | 13.4 | 12.4 | 7.9900 |

| Limited Service; Extended Stay | 1 | 11,584,466 | 1.4 | 48.5 | 42.1 | 1.98 | 17.3 | 15.5 | 6.7800 |

| Limited Service | 1 | 10,829,949 | 1.3 | 59.8 | 52.9 | 1.64 | 15.3 | 13.8 | 7.4500 |

| Retail | 11 | 195,706,291 | 23.8 | 57.6 | 54.3 | 1.80 | 13.2 | 12.6 | 6.5322 |

| Outlet Center | 2 | 65,900,055 | 8.0 | 56.3 | 50.9 | 1.81 | 14.2 | 13.6 | 6.7949 |

| Anchored | 3 | 55,731,998 | 6.8 | 65.8 | 63.3 | 1.54 | 11.7 | 11.1 | 6.5945 |

| Super Regional Mall | 2 | 53,000,000 | 6.4 | 47.4 | 46.1 | 2.20 | 14.4 | 13.9 | 6.0445 |

| Shadow Anchored | 4 | 21,074,238 | 2.6 | 65.1 | 62.0 | 1.46 | 11.2 | 10.6 | 6.7727 |

| Multifamily | 6 | 127,904,605 | 15.6 | 60.8 | 59.0 | 1.31 | 9.2 | 9.0 | 6.5677 |

| Mid Rise | 1 | 73,500,000 | 8.9 | 65.6 | 65.6 | 1.25 | 7.9 | 7.8 | 6.1660 |

| Garden | 4 | 33,004,605 | 4.0 | 57.0 | 49.9 | 1.28 | 10.6 | 10.4 | 7.1560 |

| Student Housing | 1 | 21,400,000 | 2.6 | 50.4 | 50.4 | 1.55 | 11.5 | 11.1 | 7.0400 |

| Industrial | 21 | 123,780,000 | 15.1 | 51.4 | 50.8 | 1.73 | 12.4 | 11.6 | 6.5346 |

| Warehouse/Distribution | 9 | 41,881,018 | 5.1 | 53.2 | 53.2 | 1.76 | 12.2 | 11.3 | 6.3512 |

| Warehouse | 6 | 37,001,651 | 4.5 | 56.5 | 56.5 | 1.86 | 12.5 | 11.7 | 6.2240 |

| Manufacturing/Warehouse | 1 | 24,000,000 | 2.9 | 38.1 | 35.2 | 1.55 | 12.9 | 12.6 | 7.1950 |

| Manufacturing/Distribution | 2 | 12,780,000 | 1.6 | 56.1 | 56.1 | 1.60 | 12.0 | 11.1 | 6.8400 |

| Manufacturing | 3 | 8,117,331 | 1.0 | 50.3 | 50.3 | 1.67 | 11.9 | 10.9 | 6.4634 |

| Self Storage | 3 | 73,865,474 | 9.0 | 60.2 | 59.2 | 1.46 | 9.8 | 9.8 | 6.4396 |

| Self Storage | 3 | 73,865,474 | 9.0 | 60.2 | 59.2 | 1.46 | 9.8 | 9.8 | 6.4396 |

| Mixed Use | 2 | 46,000,000 | 5.6 | 59.3 | 55.8 | 1.64 | 12.6 | 12.2 | 6.9489 |

| Retail/Office | 1 | 25,000,000 | 3.0 | 57.1 | 57.1 | 1.77 | 12.6 | 12.3 | 6.8530 |

| Office/Retail | 1 | 21,000,000 | 2.6 | 61.9 | 54.2 | 1.49 | 12.7 | 12.0 | 7.0630 |

| Manufactured Housing | 11 | 21,200,000 | 2.6 | 40.5 | 40.5 | 1.44 | 10.4 | 10.1 | 6.9500 |

| Manufactured Housing | 11 | 21,200,000 | 2.6 | 40.5 | 40.5 | 1.44 | 10.4 | 10.1 | 6.9500 |

| Total/Weighted Average | 62 | $822,168,756 | 100.0% | 54.2% | 52.2% | 1.80x | 13.3% | 12.4% | 6.6418% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

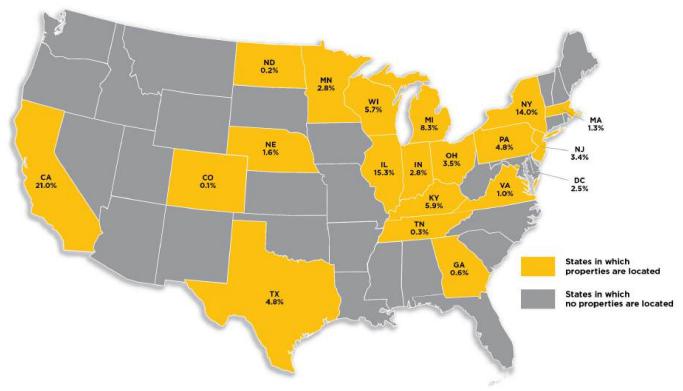

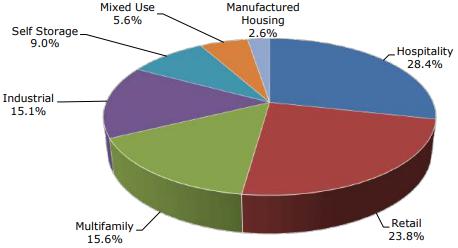

| F. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of

Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Interest Rate (%) |

| California | 6 | | $172,365,474 | 21.0 | % | 58.3 | % | 56.1 | % | 1.42 | x | 10.3 | % | 10.1 | % | 6.5336 | % |

| Northern California | 3 | | 102,365,474 | 12.5 | | 63.7 | | 63.0 | | 1.31 | | 8.5 | | 8.4 | | 6.2232 | |

| Southern California | 3 | | 70,000,000 | 8.5 | | 50.3 | | 46.0 | | 1.58 | | 13.0 | | 12.6 | | 6.9875 | |

| Illinois | 6 | | 126,188,074 | 15.3 | | 53.2 | | 53.2 | | 1.61 | | 12.9 | | 11.6 | | 7.1096 | |

| New York | 3 | | 115,000,000 | 14.0 | | 48.2 | | 48.2 | | 2.70 | | 17.1 | | 15.7 | | 5.9098 | |

| Michigan | 11 | | 68,584,466 | 8.3 | | 56.1 | | 55.0 | | 1.91 | | 13.4 | | 12.5 | | 6.2813 | |

| Kentucky | 2 | | 48,265,942 | 5.9 | | 59.8 | | 52.4 | | 1.71 | | 14.1 | | 13.5 | | 6.8239 | |

| Wisconsin | 11 | | 46,478,484 | 5.7 | | 53.9 | | 48.9 | | 1.36 | | 10.9 | | 10.4 | | 7.0073 | |

| Other(3) | 23 | | 245,286,316 | 29.8 | | 53.0 | | 50.8 | | 1.82 | | 14.0 | | 13.0 | | 6.8162 | |

| Total/Weighted Average | 62 | | $822,168,756 | 100.0 | % | 54.2 | % | 52.2 | % | 1.80 | x | 13.3 | % | 12.4 | % | 6.6418 | % |

| (1) | The mortgaged properties are located in 19 states and the District of Columbia. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 13 other states and the District of Columbia. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7,284,605 - 8,000,000 | 4 | $30,410,841 | 3.7 | % |

| 8,000,001 - 9,000,000 | 1 | 8,600,000 | 1.0 | |

| 9,000,001 - 10,000,000 | 2 | 18,915,474 | 2.3 | |

| 10,000,001 - 15,000,000 | 4 | 48,294,415 | 5.9 | |

| 15,000,001 - 20,000,000 | 3 | 55,200,000 | 6.7 | |

| 20,000,001 - 30,000,000 | 12 | 288,347,971 | 35.1 | |

| 30,000,001 - 50,000,000 | 2 | 90,900,055 | 11.1 | |

| 50,000,001 - 70,000,000 | 2 | 127,000,000 | 15.4 | |

| 70,000,001 - 80,000,000 | 1 | 73,500,000 | 8.9 | |

| 80,000,001 - 81,000,000 | 1 | 81,000,000 | 9.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Average: | $25,692,774 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.27 - 1.30 | 1 | $73,500,000 | 8.9 | % |

| 1.31 - 1.40 | 5 | 52,404,605 | 6.4 | |

| 1.41 - 1.50 | 3 | 82,000,000 | 10.0 | |

| 1.51 - 1.60 | 5 | 86,374,238 | 10.5 | |

| 1.61 - 1.70 | 3 | 58,815,474 | 7.2 | |

| 1.71 - 1.80 | 5 | 98,811,998 | 12.0 | |

| 1.81 - 1.90 | 4 | 162,730,003 | 19.8 | |

| 1.91 - 2.00 | 1 | 57,000,000 | 6.9 | |

| 2.01 - 2.25 | 2 | 31,584,466 | 3.8 | |

| 2.26 - 3.00 | 1 | 28,000,000 | 3.4 | |

| 3.01 - 3.50 | 1 | 20,947,971 | 2.5 | |

| 3.51 - 3.91 | 1 | 70,000,000 | 8.5 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 1.93x | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7.9 - 8.0 | 1 | $73,500,000 | 8.9 | % |

| 8.1 - 12.1 | 15 | 261,574,317 | 31.8 | |

| 12.2 - 16.1 | 13 | 384,562,001 | 46.8 | |

| 16.2 - 20.1 | 1 | 11,584,466 | 1.4 | |

| 20.2 – 25.6 | 2 | 90,947,971 | 11.1 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 13.3% | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Refinance | 29 | $769,688,756 | 93.6 | % |

| Acquisition | 2 | 39,700,000 | 4.8 | |

| Recapitalization | 1 | 12,780,000 | 1.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| MORTGAGE RATE |

Range of Mortgage

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 5.4370 - 5.5000 | 1 | $28,000,000 | 3.4 | % |

| 5.5001 - 5.7500 | 1 | 70,000,000 | 8.5 | |

| 5.7501 - 6.0000 | 1 | 9,465,474 | 1.2 | |

| 6.0001 - 6.2500 | 2 | 130,500,000 | 15.9 | |

| 6.2501 - 6.5000 | 4 | 81,404,207 | 9.9 | |

| 6.5001 - 6.7500 | 6 | 142,650,000 | 17.4 | |

| 6.7501 - 7.0000 | 6 | 123,749,126 | 15.1 | |

| 7.0001 - 7.2500 | 7 | 105,220,000 | 12.8 | |

| 7.2501 - 7.5000 | 2 | 91,829,949 | 11.2 | |

| 7.5001 - 8.3450 | 2 | 39,350,000 | 4.8 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 6.6418% | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.25 - 1.30 | 5 | $106,504,605 | 13.0 | % |

| 1.31 - 1.40 | 2 | 35,200,000 | 4.3 | |

| 1.41 - 1.50 | 6 | 128,574,238 | 15.6 | |

| 1.51 - 1.60 | 9 | 237,627,472 | 28.9 | |

| 1.61 - 1.70 | 2 | 35,829,949 | 4.4 | |

| 1.71 - 1.80 | 2 | 70,900,055 | 8.6 | |

| 1.81 - 1.90 | 1 | 57,000,000 | 6.9 | |

| 1.91 - 2.00 | 1 | 11,584,466 | 1.4 | |

| 2.01 - 2.25 | 1 | 20,000,000 | 2.4 | |

| 2.26 - 2.75 | 1 | 28,000,000 | 3.4 | |

| 2.76 - 3.00 | 1 | 20,947,971 | 2.5 | |

| 3.01 - 3.49 | 1 | 70,000,000 | 8.5 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 1.80x | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7.8 - 8.1 | 1 | $73,500,000 | 8.9 | % |

| 8.2 - 12.1 | 19 | 428,056,315 | 52.1 | |

| 12.2 - 16.1 | 10 | 229,664,470 | 27.9 | |

| 16.2 - 22.3 | 2 | 90,947,971 | 11.1 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 12.4% | | |

| (1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity) and may be currently prepayable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Original Terms to

Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 60 | 1 | $21,200,000 | 2.6 | % |

| 120 | 31 | 800,968,756 | 97.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 118 months | | |

| REMAINING TERM TO MATURITY |

Range of Remaining

Terms to Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 60 | 1 | $21,200,000 | 2.6 | % |

| 114 - 120 | 31 | 800,968,756 | 97.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 116 months | | |

| ORIGINAL AMORTIZATION TERM(1) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 16 | $568,880,000 | 69.2 | % |

| 300 | 1 | 15,800,000 | 1.9 | |

| 360 | 15 | 237,488,756 | 28.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average(3): | 356 months | | |

| REMAINING AMORTIZATION TERM(2) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 16 | $568,880,000 | 69.2 | % |

| 300 | 1 | 15,800,000 | 1.9 | |

| 356 - 360 | 15 | 237,488,756 | 28.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average(3): | 355 months | | |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Hard / Springing Cash Management | 14 | $486,374,293 | 59.2 | % |

| Springing | 15 | 204,514,463 | 24.9 | |

| Soft / Springing Cash Management | 2 | 118,500,000 | 14.4 | |

| Hard / In Place Cash Management | 1 | 12,780,000 | 1.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Lockout / Defeasance / Open | 19 | $428,148,677 | 52.1 | % |

| Lockout / GRTR 1% or YM / Open | 11 | 339,554,605 | 41.3 | |

| Lockout / GRTR 1% or YM or Defeasance / Open | 2 | 54,465,474 | 6.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off

Date LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 25.7 - 30.0 | 1 | $20,947,971 | 2.5 | % |

| 30.1 - 40.0 | 1 | 24,000,000 | 2.9 | |

| 40.1 - 45.0 | 4 | 142,750,000 | 17.4 | |

| 45.1 - 50.0 | 3 | 61,584,466 | 7.5 | |

| 50.1 - 55.0 | 4 | 136,865,474 | 16.6 | |

| 55.1 - 60.0 | 10 | 154,070,790 | 18.7 | |

| 60.1 - 65.0 | 5 | 159,250,055 | 19.4 | |

| 65.1 - 70.0 | 3 | 106,900,000 | 13.0 | |

| 70.1 - 72.1 | 1 | 15,800,000 | 1.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 54.2% | | |

| BALLOON LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 22.1 - 25.0 | 1 | $20,947,971 | 2.5 | % |

| 25.1 - 40.0 | 1 | 24,000,000 | 2.9 | |

| 40.1 - 45.0 | 6 | 163,799,940 | 19.9 | |

| 45.1 - 50.0 | 6 | 100,720,000 | 12.3 | |

| 50.1 - 55.0 | 8 | 202,870,844 | 24.7 | |

| 55.1 - 60.0 | 4 | 110,580,000 | 13.4 | |

| 60.1 - 65.0 | 3 | 92,350,000 | 11.2 | |

| 65.1 - 68.8 | 3 | 106,900,000 | 13.0 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 52.2% | | |

| AMORTIZATION TYPE |

| Amortization Type | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Interest Only | 16 | $568,880,000 | 69.2 | % |

| Amortizing Balloon | 13 | 183,988,756 | 22.4 | |

| Interest Only, Amortizing Balloon | 3 | 69,300,000 | 8.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 36 | 1 | $24,000,000 | 2.9 | % |

| 60 | 2 | 45,300,000 | 5.5 | |

| Total: | 3 | $69,300,000 | 8.4 | % |

| Weighted Average: | 52 months | | |

| SEASONING |

| Seasoning (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 0 | 8 | $202,220,000 | 24.6 | % |

| 1 | 4 | 153,550,000 | 18.7 | |

| 2 | 6 | 115,784,466 | 14.1 | |

| 3 | 9 | 210,174,578 | 25.6 | |

| 4 | 2 | 17,439,712 | 2.1 | |

| 5 | 2 | 98,000,000 | 11.9 | |

| 6 | 1 | 25,000,000 | 3.0 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 2 months | | |

| (1) | The original amortization term shown for any mortgage loan that is interest only for part of its term does not include the number of months in its interest only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (2) | The remaining amortization term shown for any mortgage loan that is interest only for part of its term does not include the number of months in its interest only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (3) | Excludes the non-amortizing mortgage loans. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $81,000,000 |

| 201 North State Street | TheWit Chicago | Cut-off Date LTV: | | 54.4% |

Chicago, IL 60601 | | UW NCF DSCR: | | 1.59x |

| | | UW NOI Debt Yield: | | 13.5% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $81,000,000 |

| 201 North State Street | TheWit Chicago | Cut-off Date LTV: | | 54.4% |

Chicago, IL 60601 | | UW NCF DSCR: | | 1.59x |

| | | UW NOI Debt Yield: | | 13.5% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Mortgage Loan No. 1 – TheWit Chicago |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | GSMC | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/Moody’s/KBRA): | [NR/NR/NR] | | Location: | Chicago, IL 60601 |

| Original Balance: | $81,000,000 | | General Property Type: | Hospitality |

| Cut-off Date Balance: | $81,000,000 | | Detailed Property Type: | Full Service |

| % of Initial Pool Balance: | 9.9% | | Title Vesting: | Fee |

| Loan Purpose: | Refinance | | Year Built/Renovated: | 2009/2019, 2023 |

| Borrower Sponsors: | Scott D. Greenberg, an individual, Scott David Greenberg, as Trustee of Declaration of Trust of Scott David Greenberg dated October 3, 2001 | | Size: | 310 rooms |

| Guarantor: | Scott David Greenberg | | Cut-off Date Balance Per Room: | $261,290 |

| Mortgage Rate: | 7.2690% | | Maturity Date Balance Per Room: | $261,290 |

| Note Date: | 12/11/2024 | | Property Manager: | Dreamweaver Hotels Inc. – TheWit |

| Maturity Date: | 1/6/2035 | | | (borrower affiliated) |

| Term to Maturity: | 120 months | | | |

| Amortization Term: | 0 months | | Underwriting and Financial Information |

| IO Period: | 120 months | | UW NOI: | $10,932,267 |

| Seasoning: | 1 month | | UW NCF: | $9,503,101 |

| Prepayment Provisions: | L(23),YM1(90),O(7) | | UW NOI Debt Yield: | 13.5% |

| Lockbox/Cash Mgmt Status: | Hard/Springing | | UW NCF Debt Yield: | 11.7% |

| Additional Debt Type: | NAP | | UW NOI Debt Yield at Maturity: | 13.5% |

| Additional Debt Balance: | NAP | | UW NCF DSCR: | 1.59x |

| Future Debt Permitted (Type): | No (NAP) | | Most Recent NOI: | $11,430,385 (12/31/2024) |

| | | | 2nd Most Recent NOI: | $6,528,974 (12/31/2023) |

| Reserves(1) | | 3rd Most Recent NOI: | $9,731,261 (12/31/2022) |

| Type | Initial | Monthly | Cap | | Most Recent Occupancy: | 69.8% (12/31/2024) |

| Taxes: | $572,275 | $206,202 | NAP | | 2nd Most Recent Occupancy: | 60.0% (12/31/2023) |

| Insurance: | $0 | Springing | NAP | | 3rd Most Recent Occupancy: | 65.7% (12/31/2022) |

| Replacement Reserves: | $0 | $118,052 | NAP | | Appraised Value (as of): | $149,000,000 (10/3/2024) |

| FF&E Reserve: | $0 | $0 | NAP | | Appraised Value Per Room: | $480,645 |

| PIP Reserve: | $192,500 | $0 | NAP | | Cut-off Date LTV Ratio: | 54.4% |

| | | | | | Maturity Date LTV Ratio: | 54.4% |

| | | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Mortgage Loan | $81,000,000 | 98.6% | | Loan Payoff | $80,721,571 | 98.3% |

| Principal Cash Contribution | $1,155,066 | 1.4% | | Upfront Reserves | $764,775 | 0.9% |

| | | | | Closing Costs | $668,720 | 0.8% |

| Total Sources | $82,155,066 | 100.0% | | Total Uses | $82,155,066 | 100.0% |

| (1) | See “Escrows” below for further discussion of reserve information. |

The Mortgage Loan. The mortgage loan (“TheWit Chicago Mortgage Loan”) is evidenced by a single promissory note issued by ECD-Great Street DE, LLC in the original principal amount of $81,000,000 and secured by the borrower’s fee simple interest in a 310-room full-service hotel located in Chicago, Illinois (“TheWit Chicago Property”). TheWit Chicago Mortgage Loan has a 10-year interest-only term and accrues interest a rate of 7.2690% per annum on an Actual/360 basis.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $81,000,000 |

| 201 North State Street | TheWit Chicago | Cut-off Date LTV: | | 54.4% |

Chicago, IL 60601 | | UW NCF DSCR: | | 1.59x |

| | | UW NOI Debt Yield: | | 13.5% |

The Borrower and the Borrower Sponsor. The borrower is ECD-Great Street DE, LLC, a Delaware limited liability company and special purpose entity with two independent directors in its organizational structure. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of TheWit Chicago Mortgage Loan. The borrower sponsors and non-recourse carveout guarantor is Scott David Greenberg.

The Property. TheWit Chicago Property is a 310-room full-service hotel located on the northeast corner of North State Street and East Lake Street in Downtown Chicago. The hotel commenced operations in May 2009 and was originally affiliated with the Doubletree by Hilton flag. Between 2019 and 2023, TheWit Chicago Property underwent a renovation to an upscale/luxury hotel. Today, the property spans 27 floors and offers multiple food and beverage operations (State & Lake Chicago Tavern and ROOF on TheWit), as well as an on-site spa, fitness center, business center, valet parking services and 11,934 SF of meeting and event space, exclusive of the 4,917 SF rooftop indoor/outdoor venue.

The Market. TheWit Chicago Property is located in the Chicago CBD hotel submarket. According to a third party report, as of January 2025, submarket occupancy is 67.5% and submarket ADR is $239.67.

The following table presents the Competitive Properties of the TheWit Chicago Property:

| Competitive Properties(1) |

| Property | Year Built | # of Rooms | % Commercial | % Meeting & Group | % Leisure | Total Meeting Space |

| TheWit Chicago | 2009 | 310 | 40.00% | 15.00% | 45.00% | 11,934 |

| The Allegro Royal Sonesta Hotel Chicago Loop | 1927 | 483 | 35.00% | 20.00% | 45.00% | 14,000 |

| Westin Chicago River North | 1987 | 445 | 35.00% | 35.00% | 30.00% | 29,294 |

| Renaissance Chicago Downtown Hotel | 1991 | 560 | 40.00% | 40.00% | 20.00% | 41,572 |

| Luxury Collection The Gwen Chicago | 2001 | 311 | 35.00% | 25.00% | 40.00% | 15,000 |

| Hyatt Centric The Loop Chicago | 2015 | 257 | 40.00% | 15.00% | 45.00% | 2,500 |

| LondonHouse Chicago, Curio Collection | 2016 | 452 | 35.00% | 25.00% | 40.00% | 25,000 |

| Total/Averages | | 2,818 | 37.00% | 27.00% | 36.00% | 139,300 |

Appraisal. According to the appraisal, TheWit Chicago Property had an “as-is” appraised value of $149,000,000 as of October 3, 2024.

Environmental Matters. According to the Phase I environmental report dated October 11, 2024, there was no evidence of any recognized environmental condition at the TheWit Chicago Property.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $81,000,000 |

| 201 North State Street | TheWit Chicago | Cut-off Date LTV: | | 54.4% |

Chicago, IL 60601 | | UW NCF DSCR: | | 1.59x |

| | | UW NOI Debt Yield: | | 13.5% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the TheWit Chicago Property:

| Cash Flow Analysis(1) |

| | 2019 | 2021 | 2022 | 2023 | 2024 | U/W(2) | U/W $ per Unit |

| Occupancy | 79.5% | 40.8% | 65.7% | 60.0% | 69.8% | 69.8% | |

| ADR | $225.68 | $192.15 | $255.13 | $254.29 | $265.63 | $265.63 | |

| RevPAR | $179.51 | $78.33 | $167.49 | $152.54 | $185.52 | $185.52 | |

| | | | | | | | |

| Rooms Revenue | $20,311,928 | $8,863,189 | $18,951,986 | $17,259,734 | $21,049,467 | $20,991,955 | $67,716 |

| Food and Beverage Revenue | 10,951,225 | 5,199,619 | 12,314,213 | 12,126,988 | 14,467,362 | 14,427,834 | 46,541 |

| Spa Income | 341,079 | 112,399 | 204,110 | 123,340 | (43) | (43) | 0 |

| LED Display Revenue | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Miscellaneous Income | 694,022 | 208,612 | 494,297 | 143,305 | 1,200,088 | 1,200,088 | 3,871 |

| Total Operating Revenue | $32,298,254 | $14,383,819 | $31,964,606 | $29,653,367 | $36,716,874 | $36,619,834 | $118,128 |

| | | | | | | | 0 |

| Rooms Expense | $5,257,098 | $2,204,659 | $4,362,520 | $4,985,903 | $5,927,970 | $5,911,773 | $19,070 |

| Food and Beverage Expense | 7,745,897 | 3,118,093 | 7,837,701 | 7,758,772 | 8,496,231 | 8,473,017 | 27,332 |

| Spa Expense | 335,658 | 112,665 | 247,328 | 171,876 | 4,793 | 4,780 | 15 |

| Administrative and General | 2,410,345 | 1,859,214 | 2,502,900 | 2,716,057 | 2,290,324 | 2,290,324 | 7,388 |

| Sales and Marketing | 2,385,556 | 746,633 | 1,815,400 | 1,996,409 | 2,259,990 | 2,259,990 | 7,290 |

| Franchise Fees | 1,697,740 | 760,333 | 1,626,614 | 1,176,367 | 1,404,165 | 1,315,577 | 4,244 |

| Property Operation and Maintenance | 1,150,072 | 898,642 | 1,265,460 | 1,377,032 | 1,483,029 | 1,483,029 | 4,784 |

| Utilities | 664,156 | 525,482 | 543,501 | 602,384 | 763,723 | 763,723 | 2,464 |

| Base Management Fee(3) | 970,267 | 431,533 | 1,024,513 | 891,684 | 1,104,825 | 1,098,595 | 3,544 |

| Total Operating Expenses | $22,616,789 | $10,657,254 | $21,225,937 | $21,676,484 | $23,735,050 | $23,600,809 | $76,132 |

| Income Before Non-Operating Income and Expenses | $9,681,465 | $3,726,565 | $10,738,669 | $7,976,883 | $12,981,824 | $13,019,025 | $41,997 |

| Property and Other Taxes | $1,400,953 | $1,434,262 | $633,528 | $986,422 | $1,016,702 | $1,603,283 | $5,172 |

| Insurance | $252,231 | $291,934 | $373,880 | $461,487 | $534,737 | $483,475 | $1,560 |

| Net Operating Income | $8,028,281 | $2,000,369 | $9,731,261 | $6,528,974 | $11,430,385 | $10,932,267 | $35,265 |

| FF&E | 0 | 0 | 0 | 0 | 0 | 1,429,166 | 4,610 |

| Net Cash Flow | $8,028,281 | $2,000,369 | $9,731,261 | $6,528,974 | $11,430,385 | $9,503,101 | $30,655 |

| | | | | | | | |

| NOI DSCR | 1.34x | 0.34x | 1.63x | 1.09x | 1.91x | 1.83x | |

| NCF DSCR | 1.34x | 0.34x | 1.63x | 1.09x | 1.91x | 1.59x | |

| NOI Debt Yield | 9.9% | 2.5% | 12.0% | 8.1% | 14.1% | 13.5% | |

| NCF Debt Yield | 9.9% | 2.5% | 12.0% | 8.1% | 14.1% | 11.7% | |

| (1) | TheWit Chicago Property shut operations during 2020 due to the COVID-19 pandemic. |

| (2) | Based on the underwritten cash flow dated December 31, 2024. |

| (3) | Base Management Fee is based on 3.0% of total operating revenue. |

Escrows and Reserves. At origination, the borrower deposited (a) $572,274.60 for real estate taxes and (b) $192,500 into a property improvement plan reserve for current renovations.

Tax Escrows – On each payment date, the borrower is required to deposit into a real estate tax reserve an amount equal to 1/12 of the amount that the lender reasonably estimates will be necessary to pay real estate taxes over the next 12-month period, initially estimated to be $206,201.68 through June 6, 2025, to be recalculated starting July 6, 2025.

Insurance Escrows – On each payment date, the borrower is required to deposit into an insurance reserve an amount equal to 1/12 of the amount that the lender reasonably estimates will be necessary to cover premiums over the next 12-month period (such reserve will be conditionally waived (i) so long as no event of default under TheWit Chicago Mortgage Loan documents has occurred and is continuing, and (ii) the borrower has provided evidence that

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $81,000,000 |

| 201 North State Street | TheWit Chicago | Cut-off Date LTV: | | 54.4% |

Chicago, IL 60601 | | UW NCF DSCR: | | 1.59x |

| | | UW NOI Debt Yield: | | 13.5% |

insurance satisfying the requirements set forth in TheWit Chicago Mortgage Loan documents has been obtained under one or more blanket insurance policies and insurance premiums have been paid in accordance with the requirements of TheWit Chicago Mortgage Loan documents.

FF&E Reserve - On each payment date, the borrower is required to deposit into a FF&E reserve an amount equal to (i) $118,052,44 through January 2026 and (ii) thereafter a consistent monthly amount equal to the greater of (a) the monthly amount required to be reserved pursuant to the related franchise agreement for the replacement of FF&E or (b) 4% of the operating income of TheWit Chicago Property for the previous 12-month period (excluding any parking revenue and any revenue attributable to the display), which consistent monthly payment for each 12-month period as described immediately above will be as determined on the anniversary of the last day of the calendar month in which the origination date occurred.

Lockbox / Cash Management. TheWit Chicago Mortgage Loan is structured with a hard lockbox and springing cash management. The borrower is required to deliver direction letters to each of the credit card companies with which borrower has entered into a merchant’s or other credit card agreement directing them to pay to the lender-controlled lockbox account all payments which would otherwise be paid to borrower under the applicable credit card processing agreement. The borrower and property manager are required to deposit all revenue generated by TheWit Chicago Property into the lender-controlled lockbox account within two business days of receipt. All funds deposited into the lockbox are required to be transferred on each business day to or at the direction of the borrower unless a Cash Management Period (as defined below) exists. Upon the occurrence and during the continuance of a Cash Management Period, all funds in the lockbox account are required to be swept on each business day to a cash management account under the control of the lender to be applied and disbursed in accordance with TheWit Chicago Mortgage Loan documents, and all excess cash flow funds remaining in the cash management account after the application of such funds in accordance with TheWit Chicago Mortgage Loan documents may be held by the lender in an excess cash flow reserve account as additional collateral for TheWit Chicago Mortgage Loan.

A "Cash Management Period" means any of the following periods: (i) the period from the commencement of a Trigger Period (as defined below) until the earlier to occur of the end of such Trigger Period or the indebtedness is paid in full; or (ii) the period from the occurrence of an event of default until the earlier to occur of such event of default is no longer continuing or is waived by the lender or the indebtedness is paid in full. A Cash Management Period will not be terminated unless, at the time the borrower satisfies the conditions for termination of the applicable Cash Management Period as set forth in clause (i) or clause (ii) above, there is no continuing event of default and no other event has occurred which would cause an additional Cash Management Period as described above. In the event that a Cash Management Period is terminated as set forth in clause (i) or clause (ii) above, a Cash Management Period will be reinstated upon the subsequent occurrence of a Trigger Period or event of default.

A “Trigger Period” means each of the following:

(i) each period that commences when debt yield, determined as of the first day of any two consecutive fiscal quarters, is less than 9.4% (each, a "Debt Yield Trigger Event") and the borrower has not timely made the cash deposit into the excess cash flow account or delivered the letter of credit to the lender, in each case, as required under the related loan agreement, and concludes upon the earlier to occur of (y) the debt yield, determined as of the first day of each of any two consecutive fiscal quarters thereafter, is equal to or greater than 9.4% or (z) an appropriate deposit of cash is made to the excess cash flow account or a letter of credit is deposited with the lender as permitted pursuant to the terms and conditions of the related loan agreement;

(ii) if the financial reports required under the related loan agreement are not delivered to the lender as and when required (subject, in any event, to the notice and cure period specified in the loan agreement), a Trigger Period will be deemed to have commenced and be ongoing, unless and until such reports are delivered and they indicate that, in fact, no Trigger Period is ongoing); and

(iii) except as provided in franchise agreement provisions of the related loan agreement, any period from (a) the date TheWit Chicago Property is no longer subject to the related franchise agreement or any replacement thereof entered in accordance with TheWit Chicago Mortgage Loan documents to (b) the date upon which the New License Conditions (as defined below) are satisfied.

“New License Conditions” means the delivery to the lender of the following items, each of which is satisfactory to the lender in its commercially reasonable discretion: (i) a replacement franchise agreement with the franchisor or another franchisor or licensor acceptable to lender, or the extension of the existing franchise agreement, in any case for a term of no less than five years beyond the maturity date and which contains market terms reasonably consistent with other license agreements being issued by the franchisor or any replacement thereof for other properties; (ii) a tri-party agreement or comfort letter issued by the franchisor or any replacement thereof for the benefit of the lender in substantially the same form provided to lender prior to the origination date or otherwise approved by the lender, which approval may not be unreasonably withheld, delayed or conditioned, and which relates to the franchise agreement, as extended, or any replacement franchise agreement referenced in subsection (i) immediately above; and (iii) a completion guaranty from the borrower sponsors (or another person reasonably acceptable to the lender and the borrower) in form reasonably satisfactory to the lender for the completion of any PIP requirements required to satisfy any PIP implemented in conjunction with the entering of any extension or replacement franchise agreement as referenced in subsection (i) above.

Property Management. TheWit Chicago Property is managed by Dreamweaver Hotels Inc. – TheWit, an affiliate of the borrower.

Terrorism Insurance. The borrower is required to obtain and maintain property insurance and business interruption insurance for 18 months plus a 12-month extended period of indemnity. Such insurance is required to cover perils of terrorism and acts of terrorism (provided that if TRIPRA or a similar statute is not in effect, the borrower will not be obligated to pay terrorism insurance premiums in excess of two times the premium for the casualty and business interruption coverage on a stand-alone basis). See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the prospectus.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

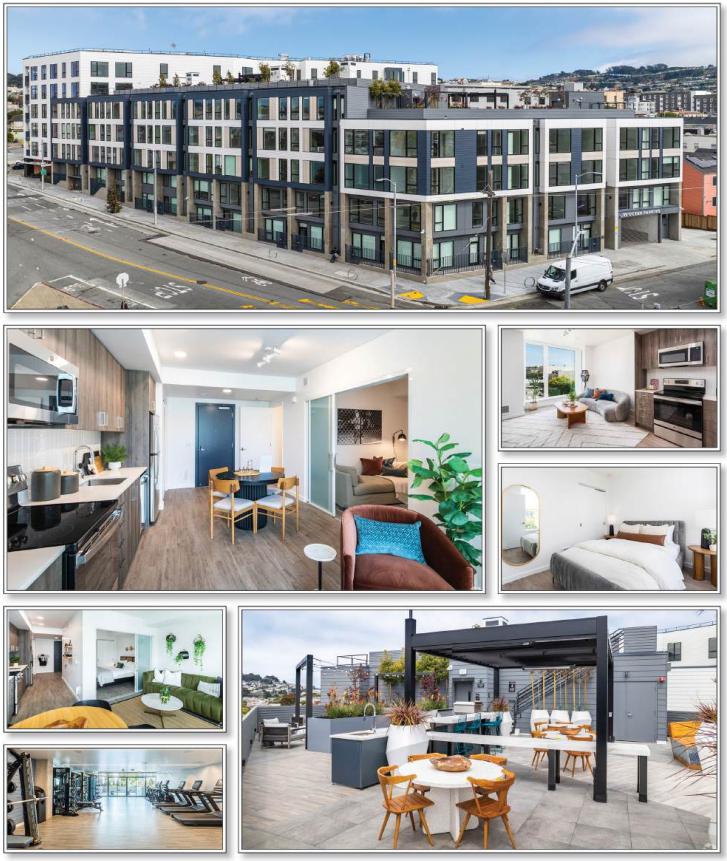

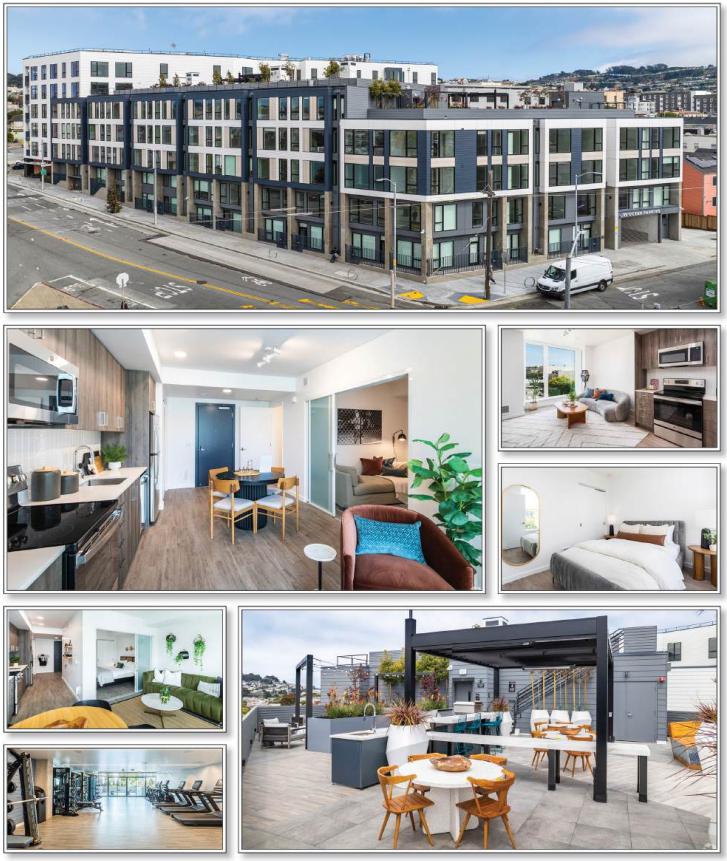

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $73,500,000 |

99 Ocean Avenue and 1820 Alemany

Boulevard | Ventana Residences | Cut-off Date LTV: | | 65.6% |

| San Francisco, CA 94112 | | UW NCF DSCR: | | 1.25x |

| | | UW NOI Debt Yield: | | 7.9% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 18 | |

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $73,500,000 |

99 Ocean Avenue and 1820 Alemany

Boulevard | Ventana Residences | Cut-off Date LTV: | | 65.6% |

| San Francisco, CA 94112 | | UW NCF DSCR: | | 1.25x |

| | | UW NOI Debt Yield: | | 7.9% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 19 | |

| Mortgage Loan No. 2 – Ventana Residences |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Sellers: | WFB | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (Fitch/KBRA/Moody’s): | [NR/NR/NR] | | Location: | San Francisco, CA 94112 |

| Original Balance: | $73,500,000 | | General Property Type: | Multifamily |

| Cut-off Date Balance: | $73,500,000 | | Detailed Property Type: | Mid Rise |

| % of Initial Pool Balance: | 8.9% | | Title Vesting: | Fee |

| Loan Purpose: | Refinance | | Year Built/Renovated: | 2023/NAP |

| Borrower Sponsor: | Presidio Bay Ventures, LLC | | Size: | 193 Units |

| Guarantors: | Libertas Ventures, LLC and K. Cyrus Sanandaji | | Cut-off Date Balance per Unit: | $380,829 |

| Mortgage Rate: | 6.1660% | | Maturity Balance per Unit: | $380,829 |

| Note Date: | 1/29/2025 | | Property Manager: | Greystar California, Inc. |

| Maturity Date: | 2/11/2035 | | | |

| Term to Maturity: | 120 months | | Underwriting and Financial Information |

| Amortization Term: | 0 months | | UW NOI: | $5,819,367 |

| IO Period: | 120 months | | UW NCF: | $5,758,221 |

| Seasoning: | 0 months | | UW NOI Debt Yield: | 7.9% |

| Prepayment Provisions: | L(24),D(92),O(4) | | UW NCF Debt Yield: | 7.8% |

| Lockbox/Cash Mgmt Status: | Soft/Springing | | UW NOI Debt Yield at Maturity: | 7.9% |

| Additional Debt Type(1): | Mezzanine | | UW NCF DSCR: | 1.25x |

| Additional Debt Balance(1): | $34,750,000 | | Most Recent NOI: | $2,059,103 (12/31/2024) |

| Future Debt Permitted (Type): | No (NAP) | | 2nd Most Recent NOI(3): | NAV |

| | | | 3rd Most Recent NOI(3): | NAV |

| Reserves(2) | | Most Recent Occupancy: | 92.2% (1/22/2025) |

| Type | Initial | Monthly | Cap | | 2nd Most Recent Occupancy: | 91.7% (12/31/2024) |

| RE Taxes: | $0 | $84,581 | NAP | | 3rd Most Recent Occupancy: | 40.4% (12/31/2023) |

| Insurance: | $115,548 | $19,258 | NAP | | Appraised Value (as of): | $112,000,000 (10/28/2024) |

| Replacement Reserve: | $0 | $4,096 | NAP | | Appraised Value per Unit: | $580,311 |

| TI/LC Reserve: | $0 | $1,000 | NAP | | Cut-off Date LTV Ratio: | 65.6% |

| Master Lease Reserve: | $345,000 | $0 | NAP | | Maturity Date LTV Ratio: | 65.6% |

| | | | | | | | |

Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Mortgage Loan Amount: | $73,500,000 | 67.9% | | Loan Payoff: | $80,624,431 | 74.5% |

| Mezzanine Loan Amount: | $34,750,000 | 32.1% | | Closing Costs: | $7,940,708 | 7.3% |

| | | | | Upfront Reserves: | $460,548 | 0.4% |

| | | | | Mezzanine Loan Reserve: | $2,500,000 | 2.3% |

| | | | | Equity(4): | $16,724,313 | 15.4% |

| Total Sources: | $108,250,000 | 100.00% | | Total Uses: | $108,250,000 | 100.00% |

| (1) | See “Mezzanine Loan and Preferred Equity” section below. |

| (2) | See “Escrows and Reserves” section below. |

| (3) | Historical NOI figures are not presented as the Ventana Residences Property (as defined below) was delivered in April 2023 and has been undergoing lease up. |

| (4) | Existing preferred equity will be extinguished no later than February 13, 2025 in exchange for (i) the payment of $16.7MM and (ii) a 31.5% common equity ownership position in the Borrower (as defined below). |

The Mortgage Loan. The second largest mortgage loan (the “Ventana Residences Mortgage Loan”) is evidenced by a promissory note in the original principal amount of $73,500,000 and secured by the borrower’s fee interest in a mid-rise multifamily property totaling 193 units located in San Francisco, CA (the “Ventana Residences Property”).

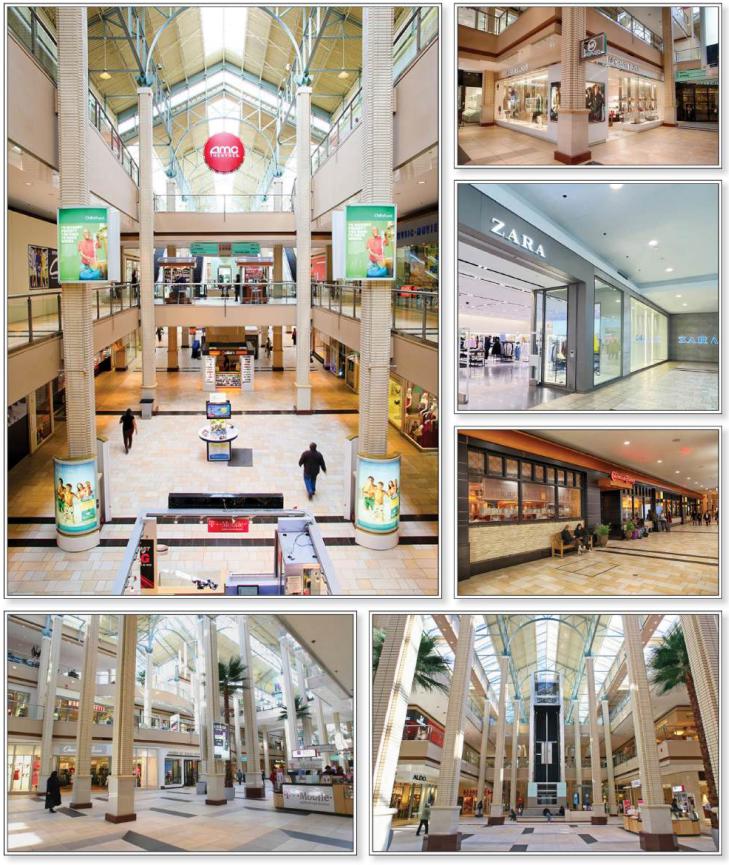

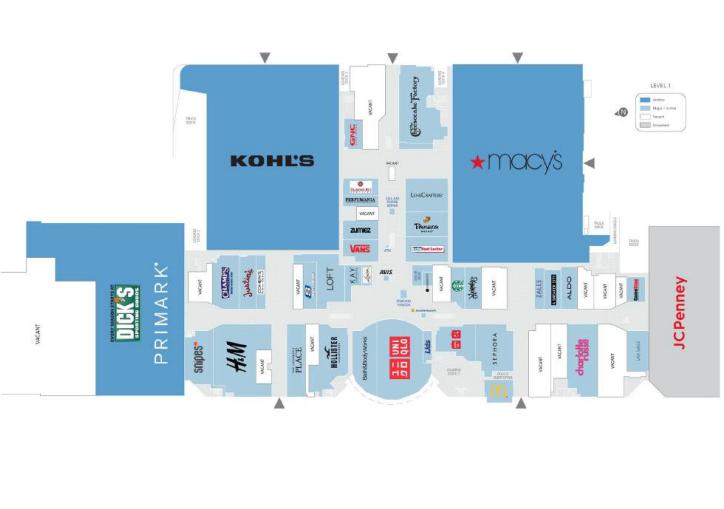

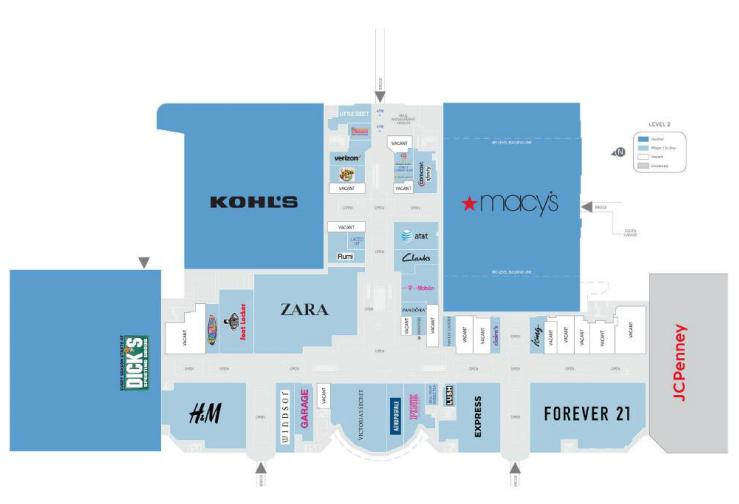

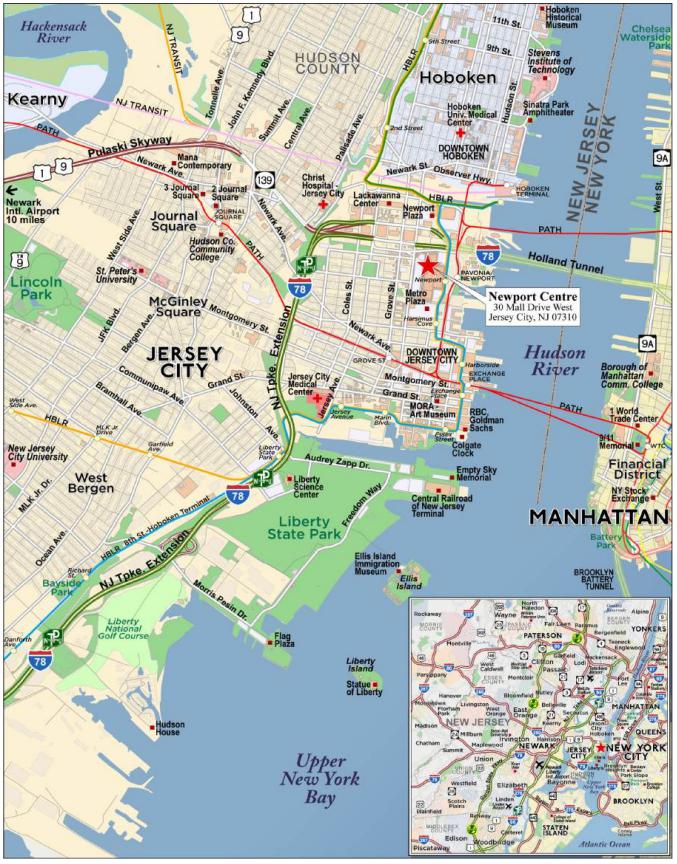

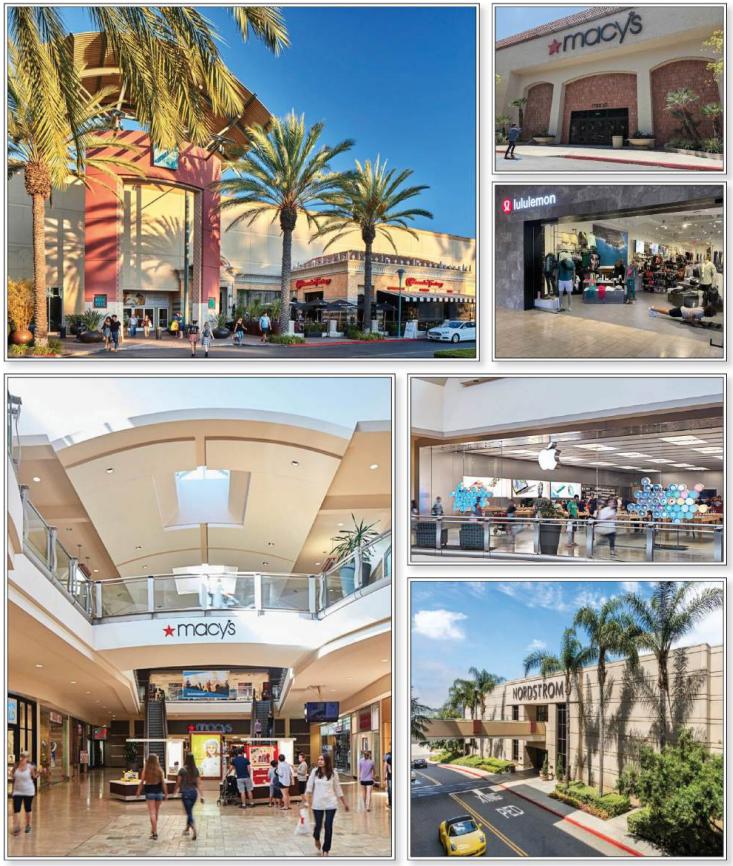

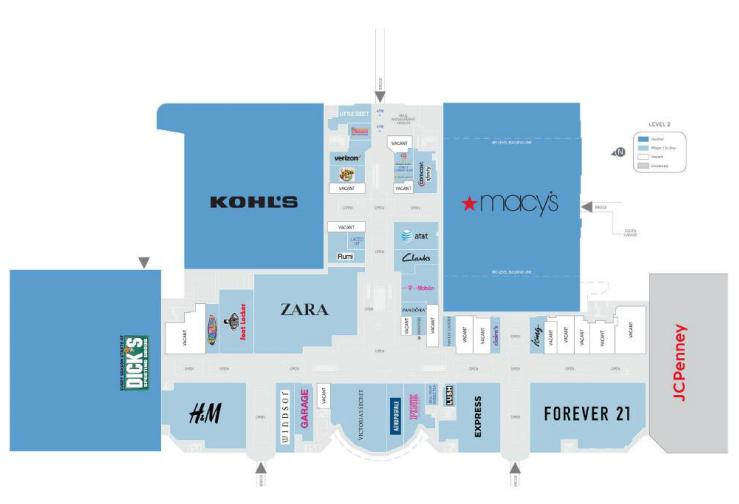

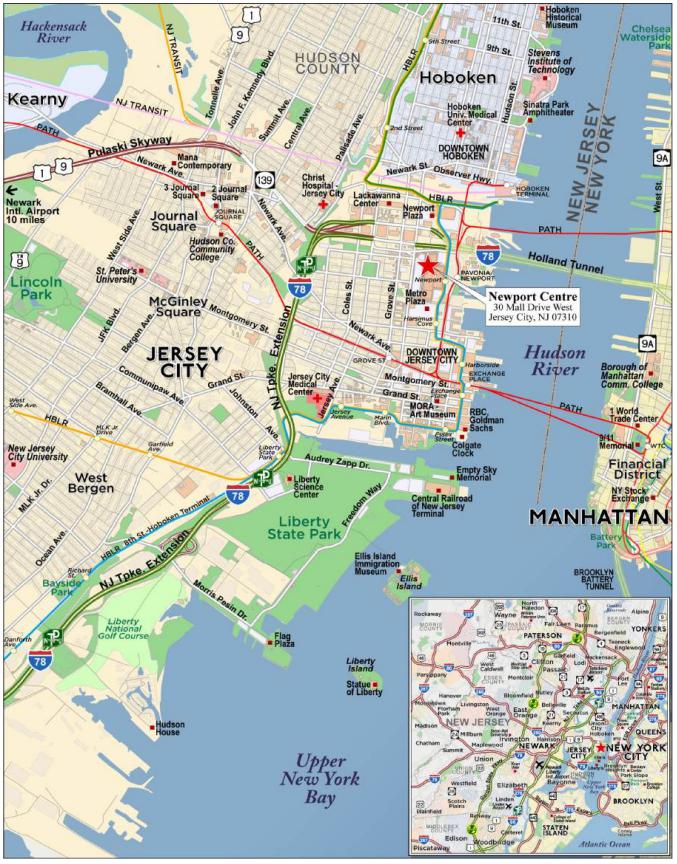

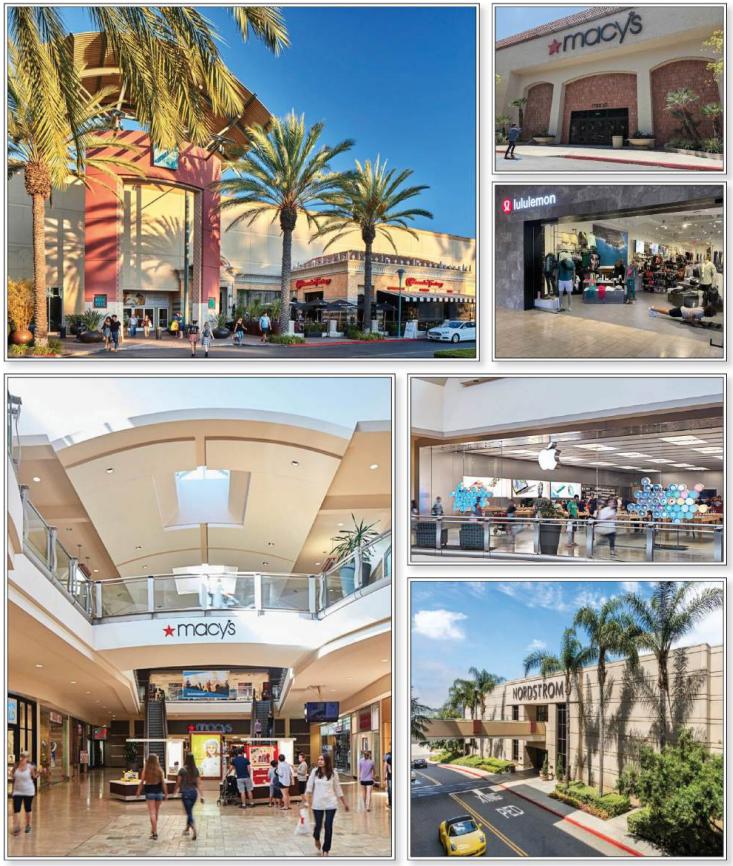

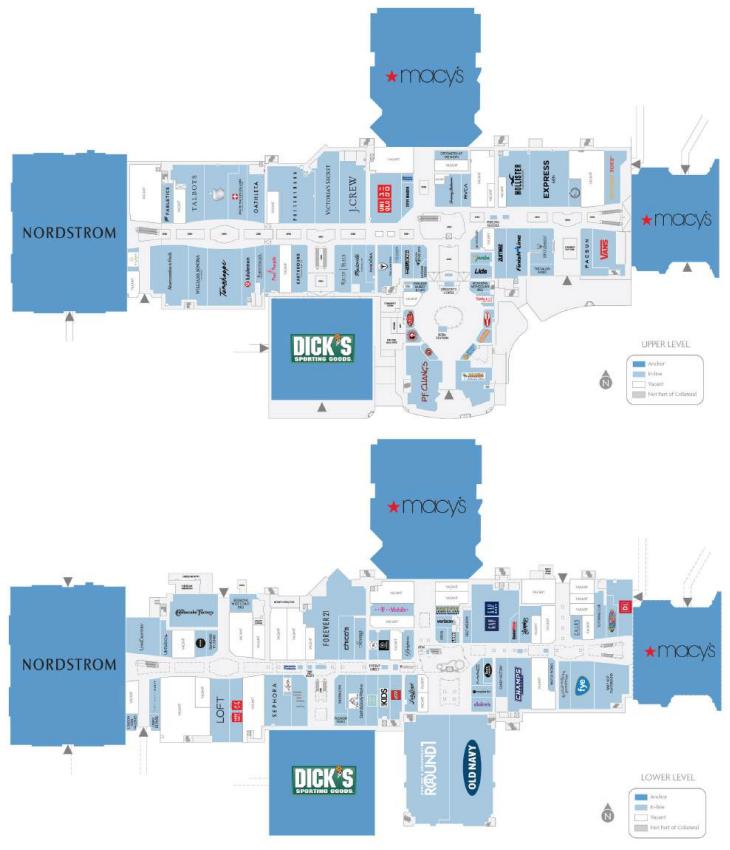

The Borrower and the Borrower Sponsor. The borrower is 99 Ocean Avenue LP, a Delaware limited partnership. The borrower is structured to be a single purpose bankruptcy-remote entity with one independent director. The borrower sponsor is Presidio Bay Ventures, LLC (“Presidio Bay”) and the non-recourse carveout guarantors are Libertas Ventures, LLC, a California limited liability company, and K. Cyrus Sanandaji.