Exhibit D

TABLE OF CONTENTS

| | | | |

INTRODUCTION | | | D-1 | |

| |

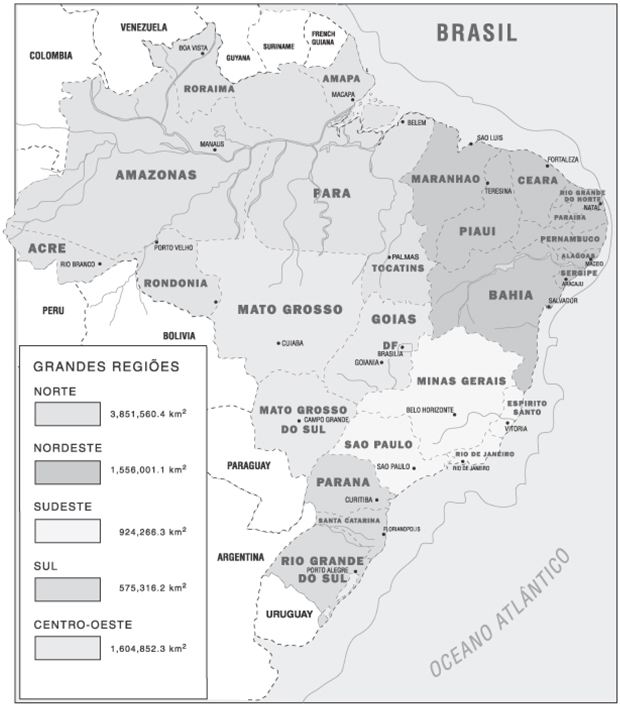

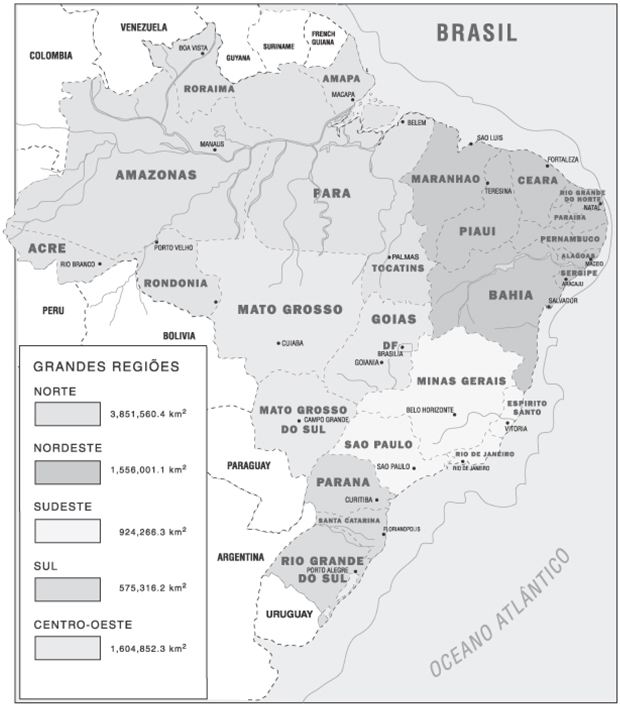

MAP OF BRAZIL | | | D-2 | |

| |

SUMMARY | | | D-3 | |

| |

THE FEDERATIVE REPUBLIC OF BRAZIL | | | D-5 | |

Area, Population and Society | | | D-5 | |

Form of Government and Political Parties | | | D-7 | |

Foreign Affairs and Membership in International Organizations | | | D-8 | |

| |

THE BRAZILIAN ECONOMY | | | D-10 | |

Historical Background | | | D-10 | |

The 2012-2015 Multi-Year Plan | | | D-10 | |

The Brazilian Economy in 2012 | | | D-12 | |

Gross Domestic Product | | | D-13 | |

Prices and Wages | | | D-15 | |

Employment and Labor | | | D-17 | |

State-Controlled Enterprises | | | D-18 | |

Environment | | | D-19 | |

Education | | | D-20 | |

Wealth and Income Distribution | | | D-21 | |

Antitrust Law | | | D-21 | |

Incentives for Private Investment | | | D-22 | |

| |

PRINCIPAL SECTORS OF THE ECONOMY | | | D-25 | |

Industry | | | D-25 | |

Services | | | D-26 | |

Agriculture and Livestock | | | D-29 | |

| |

BALANCE OF PAYMENTS AND FOREIGN TRADE | | | D-31 | |

Balance of Payments | | | D-31 | |

Foreign Trade | | | D-32 | |

Foreign Investment | | | D-38 | |

International Reserves | | | D-39 | |

Foreign Exchange Rates and Exchange Controls | | | D-40 | |

Swap Transactions | | | D-41 | |

| |

THE FINANCIAL SYSTEM | | | D-43 | |

General | | | D-43 | |

Institutional Framework | | | D-43 | |

Monetary Policy and Money Supply | | | D-44 | |

Limitation of Public Sector Debt | | | D-46 | |

Public Sector Financial Institutions | | | D-46 | |

Private Sector Financial Institutions | | | D-47 | |

Regulation by Central Bank | | | D-47 | |

| | | | |

Securities Markets | | | D-51 | |

| |

PUBLIC FINANCE | | | D-53 | |

Consolidated Public Sector Fiscal Performance | | | D-53 | |

Budget Process | | | D-55 | |

2013 Budget | | | D-56 | |

Taxation and Revenue Sharing Systems | | | D-59 | |

Sovereign Fund | | | D-60 | |

Fiscal Responsibility Law and Fiscal Crime Law | | | D-61 | |

| |

PUBLIC DEBT | | | D-63 | |

General | | | D-63 | |

Legal Aspects: Public Debt Regulation and Taxation | | | D-68 | |

Contingent Liabilities | | | D-70 | |

Public Sector External Debt | | | D-70 | |

External Federal Public Debt | | | D-72 | |

Advances in External Debt Management | | | D-75 | |

Advances in Domestic Debt Management | | | D-75 | |

External Debt Restructuring and Debt Record | | | D-77 | |

| |

TABLES AND SUPPLEMENTARY INFORMATION | | | D-78 | |

INTRODUCTION

This description of the Federative Republic of Brazil (“Brazil” or the “Republic”) is dated as of August 27, 2013 and appears as Exhibit D to the Republic’s Annual Report on Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended December 31, 2012. In this report, references to “dollars”, “U.S. dollars”, “U.S.$” and “$” are to United States dollars, and references to “real”, “reais” and “R$” are to Brazilian reais. The fiscal year of the federal government of Brazil (the “Federal Government”) ends December 31 of each year. The fiscal year ended December 31, 2012 is referred to herein as “2012”, and other years are referred to in a similar manner. Tables herein may not add due to rounding.

The following table sets forth certain exchange rate information reported by the Central Bank for the sale of U.S. dollars, expressed in nominal reais, for the periods indicated. The Federal Reserve Bank of New York does not report a noon buying rate for the real.

Table No. 1

Commercial Exchange Rates (Sell Side)

R$/$1.00

| | | | | | | | | | | | |

Year | | Average for

Period(1) | | | End of

Period | | | Percentage

Change

(End of

Period) | |

| | | |

2008 | | | 1.8375 | | | | 2.337 | | | | 31.9 | |

2009 | | | 1.9935 | | | | 1.7412 | | | | –25.5 | |

2010 | | | 1.7593 | | | | 1.6662 | | | | –4.3 | |

2011 | | | 1.6746 | | | | 1.8758 | | | | 12.6 | |

2012 | | | 1.955 | | | | 2.0435 | | | | 8.9 | |

| (1) | Weighted average of the exchange rates on business days during the period. |

Source: BCB.

The Brazilian real-U.S. dollar exchange rate (sell side), as published by the Central Bank of Brazil was R$ 2.4457 to U.S.$1.00 on August 22, 2013.

D-1

MAP OF BRAZIL

D-2

SUMMARY

The following summary does not purport to be complete and is qualified in its entirety by the more detailed information appearing elsewhere herein.

Table No. 2

SELECTED BRAZILIAN ECONOMIC INDICATORS

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

The Economy | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Gross Domestic Product (“GDP”): | | | | | | | | | | | | | | | | | | | | |

(in billions of current Brazilian reais) | | R$ | 3,032.20 | | | R$ | 3,239.40 | | | R$ | 3,770.08 | | | R$ | 4,143.01 | | | R$ | 4,402.54 | |

(in U.S.$ billions current prices)(1) | | $ | 1,650.9 | | | $ | 1,625.6 | | | $ | 2,143.9 | | | $ | 2,475.1 | | | $ | 2,252.6 | |

Real GDP Growth (decline)(2) | | | 5.2 | % | | | (0.3 | )% | | | 7.5 | % | | | 2.7 | % | | | 0.9 | % |

Population (millions) | | | 189.6 | | | | 191.5 | | | | 193.3 | | | | 194.9 | | | | 196.5 | |

| | | | | |

GDP Per Capita(3) | | U.S.$ | 8,706,68 | | | U.S.$ | 8,489,82 | | | U.S.$ | 11,093,88 | | | U.S.$ | 12,696,1 | | | U.S.$ | 11,462,22 | |

Unemployment Rate(4) | | | 6.8 | % | | | 6.8 | % | | | 5.3 | % | | | 4.7 | % | | | 4.6 | % |

IPCA (rate of change)(5) | | | 5.9 | % | | | 4.3 | % | | | 5.9 | % | | | 6.5 | % | | | 5.8 | % |

IGP-DI (rate of change)(6) | | | 9.1 | % | | | (1.4 | )% | | | 11.3 | % | | | 5.0 | % | | | 8.1 | % |

Nominal Devaluation Rate(7) | | | 31.9 | % | | | (25.5 | )% | | | (4.3 | )% | | | 12.6 | % | | | 8.9 | % |

Domestic Real Interest Rate(8) | | | 6.20 | % | | | 5.38 | % | | | 3.66 | % | | | 4.80 | % | | | 2.50 | % |

| | | | | |

Balance of Payments (in U.S.$ billions) | | | | | | | | | | | | | | | | | | | | |

Exports | | | 197.9 | | | | 153.0 | | | | 201.9 | | | | 256.0 | | | | 242.6 | |

Imports | | | (173.1 | ) | | | (127.7 | ) | | | (181.8 | ) | | | (226.2 | ) | | | (223.2 | ) |

Current Account | | | (28.2 | ) | | | (24.3 | ) | | | (47.3 | ) | | | (52.5 | ) | | | (54.2 | ) |

Capital and Financial Account (net) | | | 29.4 | | | | 71.3 | | | | 99.9 | | | | 112.4 | | | | 70.2 | |

Overall Balance (Change in Reserves) | | | 3.0 | | | | 46.7 | | | | 49.1 | | | | 58.6 | | | | 18.9 | |

Total Official Reserves | | | 193.8 | | | | 238.5 | | | | 288.58 | | | | 352.01 | | | | 378.61 | |

| | | | | |

Public Finance (% of GDP) | | | | | | | | | | | | | | | | | | | | |

Central Government Primary Balance(9) | | | 2.4 | % | | | 1.3 | % | | | 2.1 | % | | | 2.3 | % | | | 2.0 | % |

Consolidated Public Sector Primary Balance(10) | | | 3.4 | % | | | 2.0 | % | | | 2.7 | % | | | 3.1 | % | | | 2.4 | % |

| | | | | |

Federal Public Debt (in R$ billions) | | | | | | | | | | | | | | | | | | | | |

Domestic Federal Public Debt (DFPD or DPMFi) | | R$ | 1,264.82 | | | R$ | 1,398.42 | | | R$ | 1,603.94 | | | R$ | 1,783.06 | | | R$ | 1,916.71 | |

External Federal Public Debt (EFPD or DPFe) | | R$ | 132.51 | | | R$ | 98.97 | | | R$ | 90.10 | | | R$ | 83.29 | | | R$ | 91.28 | |

Federal Public Debt as % of Nominal GDP | | | 46.1 | % | | | 46.2 | % | | | 44.9 | % | | | 45.0 | % | | | 45.6 | % |

Total Federal Public Debt (in R$ billions)(11) | | R$ | 1,397.34 | | | R$ | 1,497.39 | | | R$ | 1,694.00 | | | R$ | 1,866.35 | | | R$ | 2,007.98 | |

General Government Gross Debt (GGGD or DBGG) (in R$ billions)(12) | | R$ | 1,740.88 | | | R$ | 1,973.42 | | | R$ | 2,011.52 | | | R$ | 2,243.60 | | | R$ | 2,583.95 | |

DBGG as % of GDP | | | 57.4 | % | | | 60.9 | % | | | 53.4 | % | | | 54.2 | % | | | 58.7 | % |

| | | | | |

Public Sector Net Debt (NPSD or DLSP) (in R$ billions)(13) (14) | | R$ | 1,168.24 | | | R$ | 1,362.71 | | | R$ | 1,475.82 | | | R$ | 1,508.55 | | | R$ | 1,550.08 | |

DLSP as % of GDP | | | 38.5 | % | | | 42.1 | % | | | 39.2 | % | | | 36.4 | % | | | 35.2 | % |

| (1) | Converted into U.S. dollars based on the weighted average exchange rate for each year. |

| (2) | Calculated based upon current Brazilian reais. |

| (3) | Not adjusted for purchasing power parity. |

| (4) | Unemployment in the metropolitan areas of Rio de Janeiro, São Paulo, Belo Horizonte, Porto Alegre, Salvador and Recife at the end of the relevant period. |

D-3

| (5) | The Extended National Consumer Price Index (Índice de Preços ao Consumidor Amplo or “IPCA”) as reported by the National Bureau of Geography and Statistics (Fundação Instituto Brasileiro de Geografia e Estatística or “IBGE”). |

| (6) | The General Price Index-Domestic Supply (Índice Geral de Preços-Disponibilidade Interna or “IGP-DI”) is one indicator of inflation. While many inflation indicators are used in Brazil, the IGP-DI, calculated by the Getúlio Vargas Foundation, an independent research organization, is one of the most widely utilized indices. |

| (7) | Year-over-year percentage appreciation of the U.S. dollar against the Brazilian real (sell side). |

| (8) | Brazilian federal treasury securities deflated by the IPCA and adjusted at each month-end to denote real annual yield. |

| (9) | The Central Government consists of the National Treasury Secretariat, the Social Security System (“RGPS”) and the Central Bank. The Consolidated Public Sector consists of the Central Government, Regional Governments and Public Enterprises, except Petrobras and Eletrobras. |

| (10) | Primary results represent Government revenues less Government expenditures, excluding interest expenditures on public debt. |

| (11) | Total Federal Public Debt announced by the National Treasury Secretariat. |

| (12) | The General Government Gross Debt (“GGGD”) pertains to that of the federal, State and municipal governments, both with the private sector and the public financial sector. However, debts that are the responsibility of state-owned companies (at the three levels of government) are not covered by the GGGD category. Although the Central Bank is not an entity whose liabilities figure in this indicator, its open-market operations committed to the financial sector are classified as general government debt. |

| (13) | The Net Public Sector Debt (“NPSD”) refers to the total obligations of the non-financial public sector deducted from its financial assets held by non-financial private agents as well as public and private financial agents. For Brazil, unlike for many other countries, net debt includes Central Bank assets and liabilities including, among other items, international reserves (assets) and the monetary base (liabilities). |

| (14) | NPSD is the main indebtedness indicator used by the Brazilian government when making economic policy decisions and, as compared to GGGD, more adequately reflects the dynamics of public liabilities and the government’s fiscal efforts, which are shown by the consolidated primary balance at all levels. For example, in its fiscal reports, the federal government generally focuses on the NPSD/GDP ratio, and includes in its Budgetary Guidelines Law (“LDO”) an annual estimate of this indicator’s evolution for the current year and three subsequent years, based on its expectations about real interest rates, economic growth and primary surplus targets for the whole public sector. |

Sources: IBGE; Getúlio Vargas Foundation; Central Bank; National Treasury Secretariat

D-4

THE FEDERATIVE REPUBLIC OF BRAZIL

Area, Population and Society

Brazil is the fifth largest country in the world and occupies nearly half the land area of South America, sharing borders with every country in South America except Chile and Ecuador. Brazil is officially divided into five regions consisting of 26 States and the Federal District, where the Republic’s capital, Brasília, is located. The official language of Brazil is Portuguese.

Brazil has one of the most extensive river systems in the world. The dense equatorial forests and semi-arid plains of the North are drained by the Amazon River and the fertile grasslands of the South by the Paraná, Paraguay and Uruguay Rivers. Other river systems drain the central plains of Mato Grosso and the hills of Minas Gerais and Bahia. Most of the country lies between the Equator and the Tropic of Capricorn, and the climate varies from tropical to temperate. More than half of the total terrain of Brazil consists of rolling highlands varying from 650 to 3,000 feet in altitude.

According to the demographic census conducted by the IBGE in 2010, Brazil had an estimated population of 193.3 million that year. The IBGE estimated that Brazil’s population as of December 31, 2012 was 196.5 million. The average age of the Brazilian population, as reported by IBGE in its 2010 Population Census, was 32.1 years. The following table sets forth the age distribution of the Brazilian population as of 2010:

Brazilian Population Distribution by Sex, According to Age Groups

| | | | | | | | | | | | | | | | |

Age | | Number of

Men | | | Percentage of

Men | | | Number of

Women | | | Percentage of

Women | |

0 - 4 years | | | 7,016,987 | | | | 3.7 | % | | | 6,779,172 | | | | 3.6 | % |

5 - 9 years | | | 7,624,144 | | | | 4.0 | % | | | 7,345,231 | | | | 3.9 | % |

10 - 14 years | | | 8,725,413 | | | | 4.6 | % | | | 8,441,348 | | | | 4.4 | % |

15 - 19 years | | | 8,558,868 | | | | 4.5 | % | | | 8,432,002 | | | | 4.4 | % |

20 - 24 years | | | 8,630,227 | | | | 4.5 | % | | | 8,614,963 | | | | 4.5 | % |

25 - 29 years | | | 8,460,995 | | | | 4.4 | % | | | 8,643,418 | | | | 4.5 | % |

30 - 34 years | | | 7,717,657 | | | | 4.0 | % | | | 8,026,855 | | | | 4.2 | % |

35 - 39 years | | | 6,766,665 | | | | 3.5 | % | | | 7,121,916 | | | | 3.7 | % |

40 - 44 years | | | 6,320,570 | | | | 3.3 | % | | | 6,688,797 | | | | 3.5 | % |

45 - 49 years | | | 5,692,013 | | | | 3.0 | % | | | 6,141,338 | | | | 3.2 | % |

50 - 54 years | | | 4,834,995 | | | | 2.5 | % | | | 5,305,407 | | | | 2.8 | % |

55 - 59 years | | | 3,902,344 | | | | 2.0 | % | | | 4,373,875 | | | | 2.3 | % |

60 - 64 years | | | 3,041,034 | | | | 1.6 | % | | | 3,468,085 | | | | 1.8 | % |

65 - 69 years | | | 2,224,065 | | | | 1.2 | % | | | 2,616,745 | | | | 1.4 | % |

70 - 74 years | | | 1,667,373 | | | | 0.9 | % | | | 2,074,264 | | | | 1.1 | % |

75 - 79 years | | | 1,090,518 | | | | 0.6 | % | | | 1,472,930 | | | | 0.8 | % |

80 - 84 years | | | 668,623 | | | | 0.4 | % | | | 998,349 | | | | 0.5 | % |

85 - 89 years | | | 310,759 | | | | 0.2 | % | | | 508,724 | | | | 0.3 | % |

90 - 94 years | | | 114,964 | | | | 0.1 | % | | | 211,595 | | | | 0.1 | % |

95 - 99 years | | | 31,529 | | | | 0.0 | % | | | 66,806 | | | | 0.0 | % |

Over 100 years | | | 7,247 | | | | 0.0 | % | | | 16,989 | | | | 0.0 | % |

Source: IBGE

D-5

IBGE also estimated that, as of 2010, the population was growing at a rate of 1.17% per year. Approximately 160.9 million people, or 84.4% of the population, live in urban areas. According to the 2010 Census, the largest cities in Brazil were São Paulo and Rio de Janeiro, with estimated populations of 11.2 million and 6.3 million, respectively. Other cities with populations in excess of one million were Brasília, Belém, Belo Horizonte, Curitiba, Fortaleza, Goiânia, Manaus, Porto Alegre, Recife and Salvador. The States with the largest GDP in Brazil, São Paulo, Rio de Janeiro and Minas Gerais, had populations in excess of 41.2 million, 15.9 million and 19.5 million, respectively.

According to the United Nations’ Human Development Report Office, Brazil has made significant progress in improving social welfare over the past three decades. During that period, life expectancy in Brazil increased by 18.1% (from 62.5 years in 1980 to 73.8 years in 2012) and the infant mortality rate decreased 67.8% (from 59 per 1,000 live births in 1990 to 19 per 1,000 live births in 2010). Adjusted for purchasing power parity by the International Monetary Fund, real GDP per capita rose 200.87% from 1980 ($3,760.62) to 2010 ($11,314.41). In addition, the reduction in inflation under the Plano Real and the consequent diminution of the erosion of purchasing power have improved the social welfare of large numbers of lower-income Brazilians.

The following table sets forth comparative GDP per capita figures and other selected comparative social indicators for 2011.

Table No. 3

Social Indicators

| | | | | | | | | | | | | | | | | | | | |

| | | Brazil | | | Chile | | | Colombia | | | Mexico | | | U.S. | |

Real GDP per capita(1) | | $ | 11,634.1 | | | $ | 21,000.6 | | | $ | 10,076.3 | | | $ | 16,012.8 | | | $ | 48,112.6 | |

Life expectancy at birth (years)(2) | | | 73.4 | | | | 79.0 | | | | 73.6 | | | | 76.9 | | | | 78.6 | |

Infant mortality rate (per 1,000 births)(2) | | | 13.9 | | | | 7.7 | | | | 15.4 | | | | 13.4 | | | | 6.4 | |

Adult literacy rate(3) | | | 90.3 | % | | | 98.6 | % | | | 93.4 | % | | | 93.1 | % | | | n.a. | |

| (1) | GDP per capita estimates here are derived from purchasing power parity (PPP) calculations with current international $. Data presented is for 2011. |

| (2) | Data presented is for the most recent year available (2011). |

| (3) | Data presented is for the most recent year available (2009 for Brazil and Chile, 2010 for Colombia and Mexico). |

Source: World Bank.

D-6

Form of Government and Political Parties

Brazil is a democratic state with a civilian led government. The current Brazilian Constitution (Constituição da República Federativa do Brasil or the “Constitution”) was adopted in 1988. Brazil is a federative republic with broad powers granted to the Federal Government. The Constitution provides for three independent branches of government: an executive branch headed by the President; a legislative branch consisting of the bicameral National Congress of Brazil (Congresso Nacional do Brasil or the “National Congress”), composed of the Chamber of Deputies and the Senate; and a judicial branch consisting of the Federal Supreme Court (Supremo Tribunal Federal) and lower federal and State courts.

Under the Constitution, the President is elected by direct vote, and the President and certain other elected officials may be re-elected for a second term. The President’s powers include the right to appoint ministers and key executives in selected administrative posts. The President may issue provisional measures (medidas provisórias) with the same scope and effect as legislation enacted by the National Congress. However, the Constitution prohibits the issuance of provisional measures for, among other things, the implementation of multi-year plans and budgets, the seizure of financial or other assets, and the regulation of matters that the Constitution specifically requires the National Congress to regulate through complementary law. Provisional measures are enforceable for up to 60 days and are extendable for a single additional period of 60 days. If a provisional measure is rejected or if it is not approved by the National Congress within the enforcement period, the provisional measure becomes invalid as of the date it was issued. The Constitution expressly prohibits the re-issuance of provisional measures not approved by the National Congress within the enforcement period.

In October 2010, the Workers’ Party (Partido dos Trabalhadores or “PT”) candidate, Dilma Vana Rousseff, was elected as Brazil’s first female president. She took office on January 1, 2011, replacing outgoing president Luiz Inácio Lula da Silva. In December 2010, President Rousseff announced that her administration would be based on democratic principles and would continue the goal of eradicating poverty with the Brazil Without Poverty Plan (Plano Brasil Sem Miséria).

The legislative branch of the Federal Government consists of a bicameral National Congress composed of the Senate and the Chamber of Deputies. The Senate has 81 senators, elected for staggered eight-year terms, and the Chamber of Deputies has 513 deputies, elected for concurrent four-year terms. Each State and the Federal District is entitled to three senators. The number of deputies from each State is generally proportional to the size of its population. However, each State, regardless of size, is entitled to have a minimum of 8 deputies and a maximum of 70 deputies. This quasi-proportional system assures smaller States (whether by size or population) an important role in the National Congress.

During the October 2010 elections, 513 federal deputies and 54 of 81 senators were elected, taking office on February 1, 2011. Following the October 2010 elections, the coalition of political parties supporting President Rousseff obtained 59% (304/513) of the seats in the Chamber of Deputies and 62% (50/81) of the seats in the Senate. As of July 31, 2013, 70% (359/513) of the seats in the Chamber of Deputies and 77% (62/81) of the seats in the Senate were held by parties that support President Rousseff. Senator Renan Calheiros and Deputy Henrique Eduardo Alves, both allied to President Rousseff, are the current presidents of the Senate and of the Chamber of Deputies, respectively.

Judicial power is exercised by the Federal Supreme Court (composed of 11 justices), the Superior Court of Justice (composed of 33 justices), the Federal Regional Courts (appeals courts), military courts, labor courts, electoral courts and several lower federal courts. The Federal Supreme Court, whose members are appointed for life by the President (with mandatory retirement at 70 years of age), has ultimate appellate jurisdiction over decisions rendered by lower federal and State courts on Constitutional matters.

Brazil is divided administratively into 26 States and the Federal District. The States are designated as autonomous entities within the federative union and have all powers that the Constitution does not preclude the States from exercising. The Constitution reserves to the Federal Government the exclusive power to legislate in certain areas, including, among others, monetary systems, foreign affairs and trade, social security and national defense. The States may exercise legislative power in matters not reserved exclusively to the Federal Government and have, concurrently with the Federal Government, certain powers of taxation. At the State level, executive power is exercised by governors elected for four-year terms and legislative power by State deputies, also elected for four-year terms. Judicial power at the State level is vested in State courts, and appeals of State court judgments may be taken to the Superior Court of Justice and the Federal Supreme Court.

Brazil has recently experienced a wave of mass demonstrations against various levels of government. The protests began in early June 2013 in response to an increase in bus fares in the city of São Paulo, and reached a peak in late June 2013, with simultaneous protests in many urban centers. According to newspaper reports, up to 1 million people demonstrated in more than 100 Brazilian cities on June 20, 2013, protesting in support of political and tax reform and improved public services (including health, education and transportation). While the wave of demonstrations has abated, smaller, sporadic protests continue in major cities.

D-7

As a result of these protests, President Rousseff initially proposed a constitutional assembly to review Brazil’s political system, which proposal was later withdrawn. President Rousseff has instead proposed a national plebiscite on how Brazilians would like to change the political system, including with respect to public financing of campaigns, the abolition of secret ballots in Congress and the rules that govern political alliances. The President also proposed a R$50 billion urban transportation spending plan and increased spending on health and education, while at the same time committing the Government to fiscal responsibility. Following the protests, the Government’s public approval rating fell.

The protests are likely to have a negative impact on Brazilian economic and financial conditions in the short term. The magnitude of this impact is still unknown. In the long term, protests may contribute to strengthening Brazilian democracy and producing more efficient controls and accountability over public services.

Foreign Affairs and Membership in International Organizations

Brazil maintains diplomatic and trade relations with almost every nation in the world. It has been a member of the United Nations since 1945. The Republic participates in the organizations under the control of the United Nations Secretariat, as well as others of a voluntary character, such as the Food and Agriculture Organization.

Brazil is an original member of the International Monetary Fund (“IMF”) and the World Bank, as well as three affiliates of the World Bank: the International Finance Corporation, the International Development Association and the Multilateral Investment Guaranty Agency. Brazil was an original member of the General Agreement on Tariffs and Trade (“GATT”) and is a charter member of the World Trade Organization. In addition, Brazil is an original member of the Inter-American Development Bank (“IDB”), the Inter-American Investment Corporation, the African Development Bank Group and the International Fund for Agricultural Development.

Brazil is an active member of the Group of Twenty, or G-20, which is the premier forum for international cooperation on the most important aspects of international economic and financial issues. It brings together the world’s major advanced and emerging economies.

Brazil is also a member of the Brazil-Russia-India-China-South Africa (“BRICS”) group. The last BRICS summit took place in South Africa, on March 27, 2013, with an overarching theme of “BRICS and Africa: Partnership for Development, Integration and Industrialisation.” This event was the fifth since the BRICS group was formed in 2009.

At the regional level, Brazil participates in the Organization of American States (“OAS”) and in several sub-regional organizations under the OAS, as well as in the Latin American Economic System, the Latin American Integration Association, the Andean Development Corporation, the Financial Fund for the Development of the River Plate Basin and the Southern Common Market (Mercado Comum do Sul or “Mercosul”). Brazil is also a member state of the Union of South American Nations (União das Nações Sul-Americanas or “UNASUR”).

In March 1991, Brazil, Argentina, Paraguay and Uruguay signed the Treaty of Asunción, formally establishing Mercosul. In December 1994, the four member countries signed an agreement establishing the date of January 1, 1995 for the implementation of a Common External Tariff (“CET”) intended to transform the region into a customs union. On June 29, 2012, Paraguay was suspended from Mercosul following the impeachment of Paraguay’s president by the Paraguayan Senate. The suspension resolution provided that Paraguay’s suspension would be lifted once its democratic government had been restored. After the Paraguayan national elections were held on April 21, 2013, the Mercosul Secretariat released a communiqué on April 23, 2013, stating that “through democratic election of its public officials, in full recognition of the rule of law and under the observance of all constitutional guarantees, the Republic of Paraguay moves towards its reintegration into Mercosul.” Paraguay’s suspension from Mercosur was lifted on August 15, 2013, upon the inauguration of a new constitutional government in Paraguay. However, Paraguayan officials have expressed reservations about reincorporating into Mercosul, citing concerns about the propriety of Paraguay’s suspension in 2012 and the admission of Venezuela as a full member of Mercosul during Paraguay’s suspension. On July 31, 2012, Venezuela was admitted to Mercosul as its fifth full member. If Paraguay had not been suspended at the time, Paraguay could have consented to, or vetoed, the admission of Venezuela as a full member of Mercosul.

D-8

On December 7, 2012, Bolivia signed a Mercosur incorporation protocol to become a full member of Mercosul. The protocol sets forth the requirements that Bolivia must meet to attain full membership, which may only take place after the legislatures of the full members in good standing ratify the protocol. In addition to the full member countries, Mercosul has four associate members: Chile, Colombia, Ecuador and Peru. Associate members are included in free trade treaties but have no voting rights within Mercosul.

At the London G-20 meeting on April 2, 2009, former President da Silva announced Brazil’s intention to assist international efforts to confront the global financial crisis by contributing substantial funding to the IMF. On June 10, 2009, the Minister of Finance, Guido Mantega, announced that Brazil would lend $10 billion to the IMF, which is approximately the amount of Brazil’s quota in the IMF. The closing of this loan was conditioned upon the issuance of notes by the IMF and final negotiation of the related New Agreement to Borrow (“NAB”). The NAB was signed between Brazil and the IMF on January 22, 2010, and the IMF issued notes to Brazil in exchange for the $10 billion loan.

In March 2011, ten bilateral agreements were signed between Brazil and the United States. The ten agreements address several strategic areas of bilateral cooperation, including trade and economic cooperation (establishing the Brazil-United States Commission on Economic and Trade Relations, with the objective of promoting bilateral economic and trade cooperation), air transportation, peaceful use of outer space, support for large sports events (the FIFA World Cup and the Olympic Games), research in biodiversity, development of a biofuel for aviation and technical cooperation with other countries.

On March 26, 2013, Brazil and China signed a Memorandum of Understanding on Bilateral Cooperation on Macroeconomic, Fiscal and Financial Policies. The memorandum aims to strengthen macroeconomic, fiscal, financial, monetary and supervisory cooperation between Brazil and China, through both bilateral and multilateral initiatives. The Central Bank of Brazil and the People’s Bank of China announced the establishment of a bilateral currency swap of R$60 billion, or CNY190 billion, for an initial period of three years. This program seeks to facilitate bilateral trade between the two countries.

D-9

THE BRAZILIAN ECONOMY

Historical Background

The Brazilian economy experienced high inflation during the late 1980s and early 1990s. This prompted the Federal Government to pursue a series of stabilization plans, which were mostly ineffective. In December 1993, the Federal Government announced a new stabilization program, known as the Plano Real, which proved to be effective in terms of curtailing inflation and building a foundation for sustained economic growth. The Plano Real was also designed to address persistent deficits in the Federal Government’s accounts, expansive credit policies and widespread, backward-looking indexation.

The Plano Real was very successful in reducing Brazilian inflation from hyperinflation, fighting indexation and adopting monetary austerity. Largely as a result of the measures implemented under the Plano Real, the average monthly rate of inflation dropped significantly; the annual rate of inflation for 1994 fell to 916.5%, down from 2,477.1% in 1993. The public sector operational balance also showed a surplus of 1.3% of GDP in 1994, versus a surplus of 0.2% of GDP in 1993.

However, after only a few years, in 1998, the fixed exchange rate was threatened by an adverse global economic environment and a fragile fiscal policy. In early 1999, due to market pressures, the Federal Government announced that the real would float. In July 1999, the Federal Government formally adopted inflation targeting as its monetary policy framework. After a successful start in 1999 and 2000, the Republic was unable to meet inflation targets between 2001 and 2003. In each year since 2005, the Central Bank has kept annual inflation within the limits determined by the National Monetary Council (“CMN”), a target of 4.5%, with a tolerance interval of plus or minus two percentage points.

To stabilize its foreign exchange market, in 1999 Brazil renegotiated a standby loan facility with the IMF. With the facility, Brazil was able to reduce its balance of payments funding needs while the exchange market stabilized. In 2005, Brazil decided not to renew its credit facility and paid all outstanding amounts to the IMF. As a result, Brazil is no longer a debtor of the IMF. Indeed following its April 9, 2009 G-20 London summit announcement, Brazil has become a lender and net provider of resources to the IMF.

Maintenance of a Fiscal Primary Balance surplus has contributed to the success of Brazil’s monetary policy. In each year from 2000 through 2012, the Federal Government achieved its Fiscal Primary Balance target, which is set in Brazil’s annual budget and adjusted by amendment as circumstances require. In 2009 and 2010, during the international financial crisis, the Federal Government met the adjusted targets of 1.93% and 2.5% of GDP, respectively. In 2012, due to a drop in tax revenue collections, increased tax exemptions and the inability of Brazil’s regional governments to meet their fiscal targets, the Federal Government adjusted its Fiscal Primary Balance target to 2.4% of GDP.

The 2012-2015 Multi-Year Plan

The 2012-2015 Multi-Year Plan (the 2012-2015 Plano Plurianual or “PPA”), called the More Brazil Plan (Plano Mais Brasil), outlines anticipated challenges and prospects for the Republic over the four year period. Specifically, the More Brazil Plan discusses development initiatives, the creation of jobs and income, the mass consumption market, public investments (particularly in infrastructure) and Brazil’s growing strength in international affairs.

In the 2012-2015 PPA, the following 11 macro challenges were defined to guide Federal Government policies embodied in government programs.

1. National Development Project: give continuity to the National Development Project, which aims at reducing regional inequalities, rural and urban disparities, and continue the transition to more sustainable productivity, leading to job creation and income distribution. The Federal Government’s agenda includes improvement of programs like Brazil without Poverty (Brasil Sem Miséria), Family Grant (Bolsa Família), the Education Development Plan (Plano de Desenvolvimento da Educação) and the Growth Acceleration Program (“PAC”). For additional information on the Education Development Plan, please see “—Education” below.

2. Extreme Poverty Eradication: overcome extreme poverty and continue to reduce social inequality. Since 2004, Brazil has been experiencing an unprecedented cycle of development, by combining economic growth with a reduction of inequality.

D-10

As a result, 28 million people no longer live in absolute poverty, and 36 million have ascended to the middle class. However, there are still 16 million people living in extreme poverty. To change that, the Brazil without Poverty Plan was created, promoting social and productive inclusion of the share of the population classified as extremely poor.

3. Science, Technology and Innovation: consolidate science, technology and innovation as a framework for Brazilian economic development. This challenge can be divided into four main goals: minimize technological disparity; assist Brazil’s international inclusion; stimulate the development of the green and creative economy; aid the eradication of poverty and reduce social inequality.

4. Knowledge, Education and Culture: provide access to education, knowledge, culture and sports, ensuring quality and equity, and valuing diversity. The National Education Plan, which will last until 2020, includes several goals, such as raising enrollment and attendance rates in several stages and types of education; improving the quality of the basic levels of education; training and enhancing the skills of more teachers and professors; encouraging full-time education; increasing literacy; and increasing public investment in education. The 2012-2015 Multi-Year Plan will serve as a stepping stone to achieve the National Education Plan’s goals, building a systemic view of the educational policies and commitments.

5. Health Care, Social Security and Social Assistance: facilitate universal access to health care, social security and social assistance, to achieve equity and an improved quality of life. Advancements in this area will be crucial to improving social welfare by 2015.

6. Civic engagement and belonging: increase civic engagement and a sense of belonging, promoting gender and ethnic equality, respecting the diversity of human relations, and improving the quality of public services, as well as expanding access to them.

7. Infrastructure: expand and improve the quality of productive, urban and social infrastructures to achieve integration within Brazil and with South America. The election of Brazil as the host for the 2014 FIFA World Cup, and Rio de Janeiro as the host for the 2016 Olympic and Paralympic Games will also stimulate the development of the country’s logistics infrastructure. The ports and airports sectors will benefit directly from the expansion and recovery of their infrastructure. Both public and private investments in the ports and airports that will cater to both events will benefit the country not only during those events: their legacy will be of great importance to the country’s development.

8. Democracy and Social Engagement: strengthen democracy, stimulate social participation and increase the transparency of public actions. This challenge represents the strong commitment of the Federal Government to social participation, by creating conditions to guarantee equal opportunities to every citizen.

9. National Integrity and Sovereignty: preserve constitutional powers, territorial integrity and national sovereignty; actively participate in the promotion and defense of human rights, peace and global development.

10. Public Security: promote citizen safety and integrity by tackling violence and developing a culture of peace. One of the main challenges is dealing with more troubled urban spaces, typical of larger cities. The PPA places particular emphaisis on border security, given that the borders constitute a major gateway for organized crime, drugs, weapons and smuggling. The major sporting events Brazil will host in coming years are another concern, due to the large number of people that will be expected to attend. For those events, the Federal Government must focus efforts, specifically on special training, police intelligence and the infrastructure of public security institutions.

11. Public Management: improve the tools for public management, endorsing ethics in the public service and improving the quality of services provided for citizens.

Governmental planning for the four years included in the Multi-Year Plan 2012-2015, presented in the “Programs, Objectives, Targets and Initiatives” section, suggests an investment of over R$5.4 trillion. The resources to finance the 2012-2015 Multi-Year Plan come from the Annual Budget, the State-Owned Companies Investment Budget and Extra Budget Funds (tax waivers, State-Owned Companies global expenditures plans, Government Credit Agencies and Public Private Partnerships).

Of the resources allotted for social policies, R$1.4 trillion will be directed to the Social Security Program and, in the four year period of the Multi-Year Plan, 57% of the resources for Themed Programs will be designated for Social Themed Programs. One of them is the Brazil without Poverty Program, with a budget of around R$20 billion a year to benefit several programs, such as the Family Grant (Bolsa Família), which will extend the benefits already granted to 13 million families to another 800,000 families in a situation of extreme poverty.

D-11

In the area of infrastructure, Brazil is making investments in its geological Pre-Salt layer, which should place it among the five countries with the largest oil reserves by 2020. Taking into account only the Pre-Salt areas under concession, it is estimated that the country will add between 35 and 40 billion barrels in oil reserves. Other noteworthy investments are to reach the production rate of 3.1 million barrels of oil per day; build two million houses with the My House, My Life Program (Minha Casa, Minha Vida); provide electric power for 495,000 rural homes, through the Light For All Program (Luz para Todos); build and adapt 14,700 km of roads and 4,500 km of railroads; dredge and improve waterway access in 17 ports; and adapt airport infrastructure in order to double the annual passenger handling capacity and reach 305 million per year.

The main goals of the Federal Government’s productive agenda are to increase investment, raise the aggregate value of Brazil’s domestic industry, raise the share of GDP attributable to high and medium-high technology industries, and increase Brazil’s domestic industry share in energy markets. In the area of environmental development, the budget provides for environmental applications associated with the preservation of the remaining native vegetation in various biomes, as well as the consolidation of already deforested areas into productive areas.

The Brazilian Economy in 2012

During 2012, public sector management analysts concluded that the ongoing international financial crisis would have a dampening impact on global inflation. At the same time, Brazil’s current inflation showed signs of a downward trend, making it possible for Brazil to continue employing a flexible monetary policy. Domestic economic indicators released in the first quarter of the year demonstrated that a slow global economy had an impact on Brazil’s economy through several channels, as exemplified by deteriorations in trade, investment and credit flows. Of particular importance were uncertainties related to the solvency of countries in the Euro Zone and economic recovery in the United States. Fragile political and economic conditions surrounding these issues produced a highly restrictive economic environment in the early months of 2012. Despite some progress in coping with financial difficulties, particularly European Central Bank (“ECB”) liquidity operations, concerns that economic woes would spread to advanced economies in the Euro Zone persisted and contributed to deepening perceptions of risk in the second quarter of the year. Although no major market ruptures occurred, the first half of the year was characterized by intense volatility.

In March 2012, Brazil’s 2011 GDP result was announced, leading to perceptions that monetary policy would have to be more expansionary than previously thought. As a result, the Monetary Policy Committee (“COPOM”) continued with its trend of deploying an expansionary monetary policy by adopting interest rate (Selic) reductions of 50 basis points and 75 basis points at its January and March meetings, respectively. After these reductions, the basic interest rate (Selic) was 9.75% per year.

As part of its efforts to meet the primary balance target, the Federal Government set aside a total of R$55 billion for debt reduction in its 2012 budget. Despite this, the extension of tax reductions, designed to stimulate the economy, partially offset the Federal Government’s efforts to meet the target. The overall objective of these measures was to produce a favorable interest rate and inflationary environment, while still reducing public debt.

In addition, concerns about global liquidity persisted in early 2012 as a result of the more flexible monetary policies adopted by foreign economies important to Brazil. To limit the impact of these economic pressures, the Federal Government adopted a new foreign exchange policy, coupled with additional measures designed to maintain a balanced budget.

At the start of the second quarter of 2012, the Federal Government announced new incentive policies, including a payroll tax reduction for labor-intensive industrial sectors and changes to the rules governing savings account earnings. These changes removed an important institutional barrier to further interest rate reductions, as the earnings of saving accounts (which are fixed and tax-free) compete to attract funds important to monetary policy and Brazil’s financial system.

In the second quarter, as economic indicators suggested that the Brazilian economy was unable to maintain consistent growth, the Federal Government continued adopting policies to bolster the automotive sector and the capital goods industry, segments that otherwise would be directly impacted by a deepening international economic crisis. In conjunction with these measures, tepid economic activity in Brazil resulted in lower government revenues, making it more difficult for the Federal

D-12

Government to meet the 2012 primary surplus target. External macroeconomic indicators, coupled with the balance of inflationary risks and the still uncertain pace of domestic economic activity led COPOM to again reduce the basic interest rate (Selic) by 75 basis points and 50 basis points at its April and May meetings, respectively. After these reductions, the Selic rate was 8.50% per year.

At the end of the third quarter of 2012, the Brazilian economy showed signs of recovery, including: (i) an increase in consumption levels; (ii) improvements in both the labor and credit markets; and (iii) both leading and coincident indicators that suggested Brazil’s third quarter GDP would expand at a rate of 4% year-over-year. Still, the pace of investment growth in Brazil raised concerns. There was a growing perception that COPOM’s cycle of greater monetary policy flexibility was nearing its end, particularly in light of concerns about inflation. The basic interest rate (Selic) at the end of the third quarter was 7.50% per year, following COPOM’s decision to reduce the rate by 50 basis points at each of its July and August meetings.

Fiscally, forecasts that the primary balance would fall short of the budgeted target did not result in expectations that the Federal Government would fail to reduce the overall public debt. As a result the Federal Government continued enacting costly structural changes, including: (i) authorizing reductions in electricity rates for families and industries; (ii) granting fiscally sound States permission to increase their indebtedness, mainly to encourage investments in infrastructure; and (iii) broadening the list of sectors considered eligible for payroll tax reductions, as a way of reducing labor costs and making Brazilian companies more competitive.

In October 2012, COPOM decided to reduce the Selic rate by 25 basis points to 7.25% per year, thus ending the monetary loosening cycle, which had resulted in aggregate reductions of 525 basis points since August 2011. In reducing the Selic rate, COPOM stressed its view that keeping monetary conditions stable for a prolonged period was the most effective means of ensuring that inflation would converge to its target. Viewed as a whole, both leading and coincident indicators of domestic activity affirmed that the Brazilian economy was responding appropriately to the monetary and fiscal incentive measures adopted in 2012.

However, in light of the fiscal challenges faced by the Federal Government, the Ministry of Finance decided to deduct PAC expenses, as permitted by the LDO, to make the 2012 primary balance target more attainable. Lower than expected tax revenue throughout 2012 was the principal factor in the Ministry of Finance’s decision.

A key economic policy change in 2012 involved a shift in Brazil’s foreign exchange policy. As the global economy worsened, excessively flexible monetary policies adopted around the world exacerbated a rise in international market liquidity and intensified potentially destabilizing financial flows into economies like Brazil. In light of this trend, the Ministry of Finance and the Central Bank were concerned about excess risk and volatility entering the Brazilian economy, and they adopted specific measures through taxation and spot or futures market operations. These measures resulted in depreciation of the exchange rate from R$1.70 to $1.00 in the first quarter to an exchange rate of between R$2.00 to $1.00 and R$2.10 to $1.00 in the final quarter of 2012.

Despite a slowdown in Brazil’s domestic economic activity, foreign direct investment continued flowing into its economy during 2012. This was the principal source of financing for Brazil’s current account deficit, continuing the trend observed in recent years. Brazil’s international reserves reached the highest level in history in 2012, surpassing U.S.$370 billion, which is more than Brazil’s total public and private external debt.

Finally, in light of the obstacles to economic growth in Brazil throughout 2012, the Federal Government adopted a series of measures designed to bolster investment and productivity. The measures were not only anti-cyclical in nature, but also structural and designed for the long-term, capable of generating positive impacts on Brazil’s economy for years to come. In 2012, the Federal Government continued to prioritize the expansion of investment which it believes, when taken together with other factors (lower real interest rates, more competitive exchange rates and tax reductions), will strengthen the Brazilian economy through a period of international economic uncertainty.

Gross Domestic Product

Brazil’s GDP increased 0.9% in 2012, relative to 2011, as a result of increases in value added at basic prices (0.8%) and net taxes on products (1.6%). The services sector increased by 1.7% in 2012, relative to the previous year, while the industrial

D-13

and agricultural sectors decreased by 0.8% and 2.3%, respectively, in 2012 relative to 2011. Gross Fixed Capital Formation (investments in manufacturing plants, machinery and capital equipment) decreased by 4.0%; household consumption rose by 3.1%; and general government consumption expenditure rose 3.2% in 2012 relative to 2011. Brazil’s GDP for the first quarter of 2013 increased 0.6% relative to the fourth quarter of 2012 and 1.9% relative to the first quarter of 2012,

On March 14, 2013, the Federal Government launched a program know as the Inova Empresa Plan (“IEP”). Through IEP, the Federal Government will invest an estimated R$32.9 billion to boost productivity and competitiveness in various sectors of the economy through technological innovation. The funds, to be used in 2013 and 2014, will benefit companies of all sizes in the industrial, agricultural and service sectors. The agencies administering the program are the National Bank of Economic and Social Development (“BNDES”) and the Studies and Projects Financing Agency (“FINEP”), which is linked to Brazil’s Ministry of Science, Technology and Innovation. Of the total amount to be invested, R$23.5 billion is earmarked for seven strategic areas: Agriculture and Agribusiness; Energy; Oil and Gas; Health; Defense; Information and Communication Technology; and Environmental Sustainability. Another R$5 billion will be invested in comparable activities for companies operating in non-strategic sectors and small businesses. The funds will finance research and development activities towards incremental innovation and product and process engineering, including research, development and innovation infrastructure projects. The remaining R$4.4 billion will come from the National Petroleum Agency (Agência Nacional do Petróleo or “ANP”), the National Electricity Agency (Agência Nacional de Energia Elétrica or “ANEEL”) and the Brazilian Service for Support for Micro and Small Enterprises (Serviço Brasileiro de Apoio às Micro e Pequenas Empresas or “SEBRAE”). The funds will finance innovations in the oil and gas and renewable energy industries and will support micro and small businesses.

The following table sets forth Brazil’s GDP at current prices and expenditures for each of the years indicated.

Table No. 4

Gross Domestic Product at Current Prices(1)—In Billions of Reais (R$)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Domestic Product at Current Prices (1) — In Billions of Reais (R$) | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | R$ | | | % | | | R$ | | | % | | | R$ | | | % | | | R$ | | | % | | | R$ | | | % | |

Final Consumption | | | 2,398.9 | | | | 79.1 | | | | 2,666.8 | | | | 82.3 | | | | 3,046.0 | | | | 80.8 | | | | 3,356.1 | | | | 81.0 | | | | 3,689.0 | | | | 83.8 | |

Gross Capital Formation | | | 627.5 | | | | 20.7 | | | | 577.8 | | | | 17.8 | | | | 763.0 | | | | 20.2 | | | | 817.3 | | | | 19.7 | | | | 776.5 | | | | 17.6 | |

Gross Fixed Capital Formation | | | 579.5 | | | | 19.1 | | | | 585.3 | | | | 18.1 | | | | 733.7 | | | | 19.5 | | | | 798.7 | | | | 19.3 | | | | 798.7 | | | | 18.1 | |

Changes in Inventories | | | 48.0 | | | | 1.6 | | | | (7.5 | ) | | | (0.2 | ) | | | 29.3 | | | | 0.8 | | | | 18.5 | | | | 0.4 | | | | (22.2 | ) | | | (0.5 | ) |

Exports of Goods and Services | | | 414.3 | | | | 13.7 | | | | 355.7 | | | | 11.0 | | | | 409.9 | | | | 10.9 | | | | 492.6 | | | | 11.9 | | | | 552.8 | | | | 12.6 | |

Less: Imports of Goods and Services | | | 408.5 | | | | 13.5 | | | | 360.8 | | | | 11.1 | | | | 448.8 | | | | 11.9 | | | | 523.0 | | | | 12.6 | | | | 615.8 | | | | 14.0 | |

Gross Domestic Product | | | 3,032.2 | | | | 100.0 | | | | 3,239.4 | | | | 100.0 | | | | 3,770.1 | | | | 100.0 | | | | 4,143.0 | | | | 100.0 | | | | 4,402.5 | | | | 100.0 | |

| (1) | Figures stated in accordance with revised methodology. In March 2007, IBGE revised its methodology for calculating GDP and restated its historic GDP data dating back to 1995. Under the new methodology, a broader range of sources of information is used to provide a more accurate measure of Brazil’s GDP. Sources such as IBGE’s annual survey of economic segments, tax receipts information and household surveys are utilized to calculate GDP. As a result, activities that were previously estimated under the prior methodology, such as government consumption and financial intermediation, are now actually measured. In addition, the relative weights of economic activities were adjusted to give greater importance to services such as telecommunications and transportation. |

Source: IBGE

D-14

The following tables set forth the share of GDP by sector at current prices and real growth at current prices by sector for each of the years indicated.

Table No. 5

Share of GDP by Sector at Current Prices

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Agriculture | | | 5.9 | % | | | 5.6 | % | | | 5.3 | % | | | 5.5 | % | | | 5.2 | % |

Industry | | | 27.9 | % | | | 26.8 | % | | | 28.1 | % | | | 27.5 | % | | | 26.3 | % |

Mining, Oil and Gas | | | 3.2 | % | | | 1.8 | % | | | 3.0 | % | | | 4.1 | % | | | 4.3 | % |

Manufacturing | | | 16.6 | % | | | 16.6 | % | | | 16.2 | % | | | 14.6 | % | | | 13.3 | % |

Construction | | | 4.9 | % | | | 5.3 | % | | | 5.7 | % | | | 5.8 | % | | | 5.7 | % |

Public Utilities | | | 3.1 | % | | | 3.1 | % | | | 3.2 | % | | | 3.1 | % | | | 3.1 | % |

Services | | | 66.2 | % | | | 67.5 | % | | | 66.6 | % | | | 67.0 | % | | | 68.5 | % |

Retail Services | | | 12.5 | % | | | 12.5 | % | | | 12.5 | % | | | 12.6 | % | | | 12.7 | % |

Transportation | | | 5.0 | % | | | 4.8 | % | | | 5.0 | % | | | 5.1 | % | | | 5.3 | % |

Communications | | | 3.8 | % | | | 3.6 | % | | | 3.2 | % | | | 3.0 | % | | | 2.9 | % |

Financial Services(1) | | | 6.8 | % | | | 7.2 | % | | | 7.5 | % | | | 7.4 | % | | | 7.0 | % |

Government(2) | | | 15.8 | % | | | 16.3 | % | | | 16.2 | % | | | 16.3 | % | | | 16.9 | % |

Rental Services | | | 8.2 | % | | | 8.4 | % | | | 7.8 | % | | | 7.9 | % | | | 8.2 | % |

Other Services | | | 14.1 | % | | | 14.7 | % | | | 14.3 | % | | | 14.5 | % | | | 15.5 | % |

Value Added at Basic Prices | | | 100,0 | % | | | 100,0 | % | | | 100,0 | % | | | 100,0 | % | | | 100,0 | % |

Taxes | | | 17.5 | % | | | 15.9 | % | | | 16.8 | % | | | 17.3 | % | | | 17.7 | % |

GDP | | | 117.5 | % | | | 115.9 | % | | | 116.8 | % | | | 117.3 | % | | | 117.7 | % |

| (1) | Financial intermediation. complementary social security and related services |

| (2) | Includes Public Education, Health and Administration |

Source: IBGE

Table No. 6

Real Growth (Decline) at Current Prices by Sector

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Real GDP | | | 5.2 | % | | – | 0.3 | % | | | 7.5 | % | | | 2.7 | % | | | 0.9 | % |

Agriculture and Livestock | | | 6.3 | % | | – | 3.1 | % | | | 6.3 | % | | | 3.9 | % | | – | 2.3 | % |

Industry | | | 4.1 | % | | – | 5.6 | % | | | 10.4 | % | | | 1.6 | % | | – | 0.8 | % |

Mining, Oil and Gas | | | 3.5 | % | | – | 3.2 | % | | | 13.6 | % | | | 3.2 | % | | – | 1.1 | % |

Manufacturing | | | 3.0 | % | | – | 8.7 | % | | | 10.1 | % | | | 0.1 | % | | – | 2.5 | % |

Construction | | | 7.9 | % | | – | 0.7 | % | | | 11.6 | % | | | 3.6 | % | | | 1.4 | % |

Public Utilities | | | 4.5 | % | | | 0.9 | % | | | 8.1 | % | | | 3.8 | % | | | 3.6 | % |

Services | | | 4.9 | % | | | 2.1 | % | | | 5.5 | % | | | 2.7 | % | | | 1.7 | % |

Retail Services | | | 6.1 | % | | – | 1.0 | % | | | 10.9 | % | | | 3.4 | % | | | 1.0 | % |

Transport | | | 7.0 | % | | – | 3.6 | % | | | 9.2 | % | | | 2.8 | % | | | 0.5 | % |

Communications | | | 8.8 | % | | | 0.8 | % | | | 3.7 | % | | | 4.9 | % | | | 2.9 | % |

Government | | | 0.9 | % | | | 3.0 | % | | | 2.3 | % | | | 2.3 | % | | | 2.8 | % |

Financial Intermediation | | | 12.6 | % | | | 7.8 | % | | | 10.0 | % | | | 3.9 | % | | | 0.5 | % |

Rental Services | | | 1.8 | % | | | 2.6 | % | | | 1.7 | % | | | 1.4 | % | | | 1.3 | % |

Other Services | | | 4.3 | % | | | 3.2 | % | | | 3.7 | % | | | 2.3 | % | | | 1.8 | % |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Source: IBGE.

Prices and Wages

Since the adoption of the Plano Real in July 1994, Brazil reduced inflation from a high of 2,477.1% per annum in 1993 to much lower single-digit rates. The implementation of the inflation targeting regime by the Central Bank in June 1999 also contributed to a relatively stable rate of inflation since that time.

D-15

The following table sets forth principal price indices for the periods indicated.

Table No. 7

Extended National Consumer Price Index (IPCA)

| | | | | | |

| | | | | IPCA | |

Period | | | | Trailing

12 Months | |

2008 | | December | | | 5.9 | |

| | |

2009 | | December | | | 4.3 | |

| | |

2010 | | December | | | 5.9 | |

| | |

2011 | | December | | | 6.5 | |

| | |

2012 | | December | | | 5.2 | |

| | |

2013 | | June | | | 6.7 | |

| (1) | IPCA is the official price index adopted to verify results under Brazil’s inflation targeting regime. The index is released by IBGE. |

Source: IBGE.

For 2012 the target was 4.5%, with a tolerance interval of plus or minus 2.0 percentage points. The inflation rate, as measured by the Extended National Consumer Price Index (“IPCA”), rose 5.9% in 2008, 4.3% in 2009, 5.9% in 2010, 6.5% in 2011 and 5.8% in 2012. For 2013, 2014 and 2015, the inflation target is 4.5%, with a tolerance interval of plus or minus 2.0 percentage points.

In the first half of 2013, the twelve-month inflation measured by the IPCA reached 6.70%, 1.78% higher than the twelve-month inflation recorded in the first half of 2012. Inflation growth was due to an acceleration in market prices, which presented a cumulative increase of 8.28% over the trailing 12-month period ended June 30, 2013 (2.94% higher than the cumulative increase recorded over the trailing 12-month period ended June 30, 2012). During the same period, administered and monitored prices presented a cumulative increase of 1.77% (2.00% lower than the cumulative increase recorded for the same period in 2012). Within the set of market prices goods, prices of non-tradable goods presented a cumulative increase of 9.63% over the trailing 12-month period ended June 30, 2013 compared to a cumulative increase of 7.52% over the same period in 2012; and prices of tradable goods presented a cumulative increase of 6.75% over the trailing 12-month period ended June 30, 2013 (2.97% for 2012). The food and beverage group – influenced by weather factors, but less pronouncedly at the margin – presented a cumulative increase of 12.80% over the trailing 12-month period ended June 30, 2013 compared to a cumulative increase of 7.34% over the same period in 2012. Meanwhile, inflation in the service sector reached 8.64% over the trailing 12-month period ended June 30, 2013 (7.50% for 2012), remaining higher than the overall inflation rate. In the first half of 2013, there were also inflationary pressures, though declining, in the food and beverage segment.

Law No. 12,382, signed by President Rousseff on February 25, 2011, set a monthly minimum wage of R$545 and also established guidelines for minimum wage adjustments until 2015 based on inflation and GDP growth. For 2013, the minimum wage is R$678, an increase of 9.0% compared to the minimum wage of R$622 in 2012.

According to the Monthly Employment Survey conducted by IBGE in six major metropolitan regions of Brazil (Rio de Janeiro, São Paulo, Belo Horizonte, Porto Alegre, Recife and Salvador), the average real wages of all workers increased by 3.6% in 2008, 0.7% in 2009, 5.9% in 2010, 2.6% in 2011 and 3.2% in 2012.

D-16

Employment and Labor

The Ministry of Labor customarily reports Brazilian employment statistics in terms of formal employment. Formal employment comprises employment duly registered with the Ministry of Labor and subject to social security contributions by employers. The Ministry of Labor’s General File of Employed and Unemployed shows that formal employment rose 5.7% in 2008 (or 1,707,289 jobs), 4.4% in 2009 (or 1,397,844 jobs), 7.9% in 2010 (or 2,629,827 jobs), 5.4% in 2011 (or 1,944,560 jobs) and 3.4% in 2012 (or 1,301,842 jobs). In the first half of 2013, formal employment rose 2.1% with 826,168 new jobs created.

The table below sets forth employment levels by sector for the periods indicated.

Table No. 8

Level of Employment by Sector(1)

| | | | | | | | | | | | | | | | | | | | |

Sector | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Manufacturing | | | 99.8 | | | | 100.0 | | | | 106.5 | | | | 108.9 | | | | 109.3 | |

| | | | | |

Public Utility/Industrial Services(2) | | | 98.6 | | | | 100.0 | | | | 105.1 | | | | 107.2 | | | | 109.6 | |

| | | | | |

Commerce | | | 96.0 | | | | 100.0 | | | | 107.0 | | | | 111.9 | | | | 115.5 | |

| | | | | |

Services | | | 96.3 | | | | 100.0 | | | | 106.6 | | | | 112.4 | | | | 116.0 | |

| | | | | |

Construction | | | 91.7 | | | | 100.0 | | | | 111.2 | | | | 117.7 | | | | 120.6 | |

| | | | | |

Government Service | | | 97.7 | | | | 100.0 | | | | 100.8 | | | | 102.0 | | | | 101.9 | |

| | | | | |

Total | | | 97.0 | | | | 100.0 | | | | 106.5 | | | | 111.1 | | | | 113.7 | |

| (1) | December 31, 2009 = 100. |

| (2) | Including water, electricity, telephone and gas services. |

Source: Central Bank.

The Federal Government measures unemployment using the average annual rate of unemployment in six major metropolitan areas (Rio de Janeiro, São Paulo, Belo Horizonte, Porto Alegre, Salvador and Recife). According to that measure, the unemployment rate (calculated by averaging the unemployment rate for each month in the year) was 7.9% in 2008, 8.1% in 2009, 6.7% in 2010, 6.0% in 2011 and 5.5% in 2012. The estimated unemployment rate was 6.0% in June 2013, a minor change over the June 2012 rate (5.9%).

Law No. 7,998, which was enacted on January 11, 1990, established a worker support fund (Fundo de Amparo ao Trabalhador, or “FAT”) to finance unemployment security programs and professional training programs. FAT receives funding from monthly federal contributions to certain other social programs, including unemployment programs (known by their acronym, “PIS/PASEP”). In accordance with the Constitution, 40% of the funds provided for FAT are allocated to finance economic growth programs managed by BNDES. As of December 31, 2012, FAT had a positive total balance of R$203.8 billion.

Under the Constitution, professional or union associations may be freely organized. There are no Federal Government formalities for the organization of a union other than registration at the appropriate agency, and public authorities are prohibited from intervening in or interfering with unions. No more than one union may be created to represent the same professional or economic group in the same geographic area.

Under Brazilian law, the main function of a union is to represent the general interests of its members as a group or individually. It may also enter into collective labor agreements and promote conciliation in collective labor disputes. The union must provide free legal assistance for its members. A union may not be affiliated with any international organization other than the International Labor Organization unless authorized by the President of the Republic.

D-17

The Constitution introduced a number of significant labor reforms, such as a reduction in the work week from 48 hours to 44 hours and a six-hour limit on the duration of an uninterrupted work shift. In addition, pregnant workers may not be dismissed for taking maternity leave of up to four months. With Law No. 11,770 dated September 9, 2008, the Federal Government established the Citizen Company Program (Programa Empresa Cidadã), which extends by 60 days the length of maternity leave for employees of a legal entity joining the program.

Under Brazil’s state-operated social security and pension system, employers are generally required to contribute 20% of each employee’s wages to the system on a monthly basis (except for employers of domestic employees, who contribute 12% of wages, and for employers of financial market employees, who contribute 22.5% of wages), while employees generally contribute between 8% and 11% of their monthly wages for retirement benefits (paid in connection with retirement due to old age, illness or length of service), workers’ compensation, death benefits, maternity leave, sick leave, disability and other social services. The contributions and benefits above minimum wage were readjusted by 6.2%, effective January 1, 2013. The cap on social security pensions paid to private sector retirees was raised to R$4,159 per month in 2013.

In November 1999, the National Congress enacted Law No. 9,876, which changed the rules for retirement for private sector employees. The law introduced a social security factor that is used to calculate benefits for retirees, taking into account not only age and years of contributions to the INSS, but also life expectancy. The new social security factor was phased in over a five-year period.

On December 19, 2003, the rules related to retirement and social security for civil servants were further modified by Constitutional Amendment No. 41. The adjustments included (i) an increase in the minimum retirement age for civil servants from 48 to 55 years for women and from 53 to 60 years for men; (ii) a reduction of 30.0% in pensions paid to widows and orphans of civil servants in excess of the monthly ceiling for retirement payments under the general social security system; (iii) a contribution to the social security system by retired civil servants of 11.0% of the amount by which the retired employee’s pension exceeds 60.0% of the above-mentioned ceiling in the case of federal retirees and 50.0% of the above-mentioned ceiling in the case of all other retired civil servants; (iv) a uniform contribution level for municipal, state and federal workers consisting of at least 11.0% of the amount of the employee’s salary; and (v) the institution of a complementary regime for new civil servants. The changes to the social security system under Constitutional Amendment No. 41 were intended to reduce the consolidated deficit in the pension system, which reached R$80.9 billion (2.7% of GDP) in 2008, R$92.3 billion (2.8% of GDP) in 2009, R$95.7 billion (2.5% of GDP) in 2010, R$93.0 billion (2.2% of GDP) in 2011 and R$102.6 billion (2.3% of GDP) in 2012.

Law No. 12,470, dated August 31, 2011, reduced the tax burden of the Micro Individual entrepreneur, by reducing the social security contribution rate from 11% to 5%. The objective of the reduction is to expand the incentives for the formalization of these entrepreneurs and their inclusion in the social security system.

Law No. 12,618, dated April 30, 2012, created a complementary regime for new civil servants. Under the new law, which seeks to reduce the country’s pension deficit gradually, the pension ceiling for defined-benefit plans of future Federal Government employees will be the same as the ceiling applicable to private-sector workers. To receive a larger benefit, public workers must make contributions to individual retirement accounts created by the law. The Federal Government will match any such contributions by public workers, with the government’s matching contributions limited to 8.5% of the amount by which each employee’s salary exceeds the pension ceiling.

State-Controlled Enterprises

In Brazil, there are two types of state enterprises: public companies and mixed-ownership companies. Public companies are corporations wholly-owned by the States or the Republic, created by special law to carry on economic activities in any of the corporate forms provided for by law. Examples of federal public companies are BNDES, Federal Savings Bank (Caixa Economica Federal or “CEF”), the Brazilian Post Office and Telegraph Corporation (Empresa Brasileira de Correios e Telégrafos) and the Mineral Resources Exploration Company (Companhia de Pesquisa de Recursos Minerais). Mixed-ownership companies are in corporate form and are majority owned by the Federal Government or a State government. Examples of mixed-ownership companies majority-owned by the Federal Government are Petrobras, Banco do Brasil and Eletrobras. Unless otherwise provided by the law authorizing the creation of a mixed-ownership company, the rights of the Federal Government are those conferred by Brazilian corporate law on majority shareholders generally.

Brazil also has autonomous institutions and public foundations. Autonomous institutions are entities established to carry out public functions which require decentralized financial and operating management, such as the Central Bank, the Securities

D-18

Commission (Comissão de Valores Mobiliarios or “CVM”), the Brazilian Institute of the Environment and Renewable National Resources (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais Renovávies or “IBAMA”), the National Institute of Industrial Property (Instituto Nacional da Propriedade Industrial or “INPI”), the National Transportation Infrastructure Department (Departamento Nacional de Infraestrutura de Transportes or “DNIT”) and the National Department of Mineral Production (Departamento Nacional de Produção Mineral or “DNPM”).

Public foundations are non-profit public law entities created to carry out activities not performed by public companies. Public foundations have administrative autonomy and manage their own assets, but their expenses are defrayed by the Federal Government and other sources. Examples of public foundations are the Brazilian Geographic and Statistics Institute (Instituto Brasileiro de Geografia e Estatistica or “IBGE”), the Applied Economics Research Institute (Instituto de Pesquisa Econômica Aplicada) and the National Council of Technological and Scientific Development (Conselho Nacional de Desenvolvimento Científico e Tecnológico).

Under Brazilian law, private parties may only engage in activities considered to be public services if they are authorized to do so by the Federal Government. Through public concessions, the Federal Government has authorized private parties to participate in areas formerly reserved to the Republic under the Constitution, including broadcasting and telecommunications, electric power service and facilities, hydroelectric power generation, certain interstate and international navigational services, interstate and international highway passenger transportation services and the operation of ports. The mining and processing of nuclear ores and minerals and their by-products remain under Federal Government monopoly.

Environment

The Ministry of the Environment (Ministério do Meio Ambiente, dos Recursos Hídricos e da Amazônia Legal) is the federal body responsible for formulating and implementing environmental policies. The National Council on the Environment (Conselho Nacional do Meio Ambiente) prepares environmental regulations, and IBAMA is charged with supervising and overseeing the application of those regulations. Provisional Measure No. 366, dated April 26, 2007 (subsequently enacted as Law No. 11,516 dated August 28, 2007), created the Chico Mendes Institute of Biodiversity Preservation (Instituto Chico Mendes de Conservação da Biodiversidade, or “ICMBIO”), vested with responsibility for the execution of national environmental preservation policies.

The Constitution contains a chapter on environmental protection, providing for the right to a clean environment and imposing upon the Federal Government, the States, the Federal District and municipalities duties to protect the environment, take measures against pollution and protect fauna and flora.

Guided by the premise that economic growth can be reconciled with the sustainable use of natural resources, over the past four decades Brazil has increased its efforts to improve the environment, aiming at ensuring long-term sustainable development. Today, the country is a key player in the global environmental agenda and an active member of important multilateral environmental agreements. Brazil also boasts one of largest reserves of tropical rainforest and freshwater biodiversity on the planet and one of the cleanest energy matrices in the industrialized world, with 46% of all energy deriving from renewable sources. It is also the world’s leading producer of sugarcane ethanol.

The Brazilian government’s efforts to promote sustainable development of the nation’s biomes have centered on combating deforestation, promoting the recovery and rational use of biological diversity, and expanding protected areas. These objectives have been pursued through the following strategies: coordination of specific policies for each biome, creation of spaces for the participation of society, institutional reform of the forest sector and expanded interpretation of the concept of biodiversity.

Law No. 12,651, dated May 25, 2012, established a new Brazilian Forest Code (Código Florestal Brasileiro). With the adoption of the new Forest Code, Brazil now has clearer rules on land use in rural and urban areas. The new Forest Code also better defines the roles of government, producers and citizens in preserving biodiversity, water, soil and climate integrity. It also provides funding for restoration of deforested areas. The new code does not change land allocation rules to accomplish its preservation goals. Instead, the code establishes rules designed to restore lands damaged as a result of non-compliance with preservation rules.

The new code contains rules for restoring Legal Reserves (sub-divided areas within larger privately owned lands that must be set aside and preserved for their natural resources) and Permanent Preservation Areas (Áreas de Preservação Permanente or “APP” – lands that cannot be used for economic purposes and must remain undeveloped). The Forest Code

D-19

distinguishes between landowners that engaged in deforestation prior to July 2008, when the Federal Government began considering substantial reforms to Brazil’s forestry laws, and those that engaged in deforestation after 2008. Fines imposed by IBAMA before July 22, 2008 may be suspended for landowners who join Brazil’s Environmental Recovery Program (Programa de Recuperação Ambiental) and, after a deforested area has been restored, the new Forest Code authorizes fines to be redirected for environmental services.

Lands designated as APPs and Legal Reserves are subject to certain preservation requirements under the Forest Code. The percentage of a biome that may be designated as an APP depends on the width of the biome’s water courses. A marginal zone around water courses must be preserved in order to prevent water contamination.