Fidelity® Nasdaq Composite Index® Tracking Stock

Semi-Annual Report

May 31, 2020

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Nasdaq®, OMX®, NASDAQ OMX®, Nasdaq Composite®, and The Nasdaq Stock Market®, Inc. are registered trademarks of The NASDAQ OMXGroup, Inc. (which with its Affiliates are the Corporations) and are licensed for use by Fidelity. The product has not been passed on by the Corporations as to its legality or suitability. The product is not issued, endorsed or sold by the Corporations. The Corporations make no warranties and bear no liability with respect to shares of the product.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to shareholders:

(No Action is Required by You)

As part of a regular review of its organizational structure, Fidelity has decided to merge certain entities to streamline operations, increase efficiency, simplify reporting, and reduce legal, compliance, and accounting complexity and costs. In separate events, Fidelity has merged four of its investment advisers and two of its broker-dealers.

Effective on or about January 1, 2020, following any required regulatory notices and approvals:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to “Fidelity Management & Research Company LLC”.

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. (“FIISC”). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to “Fidelity Distributors Company LLC”.

These mergers are not expected to affect fund shareholders or Fidelity clients, nor are they expected to result in any changes to the day-to-day management of Fidelity’s brokerage services, the Fidelity funds, their investment policies and practices, their portfolio management teams, or the funds’ expenses.

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

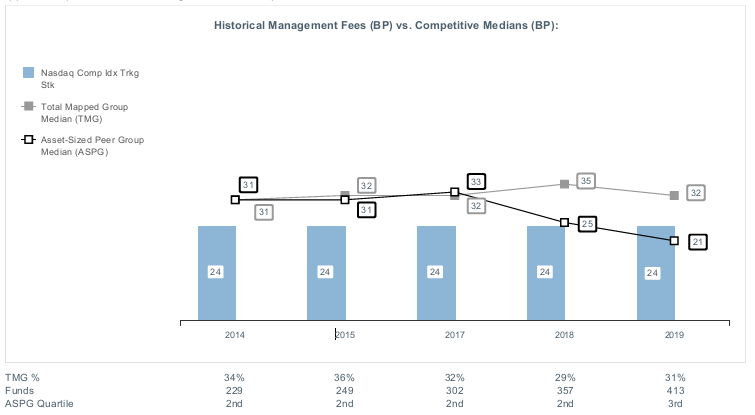

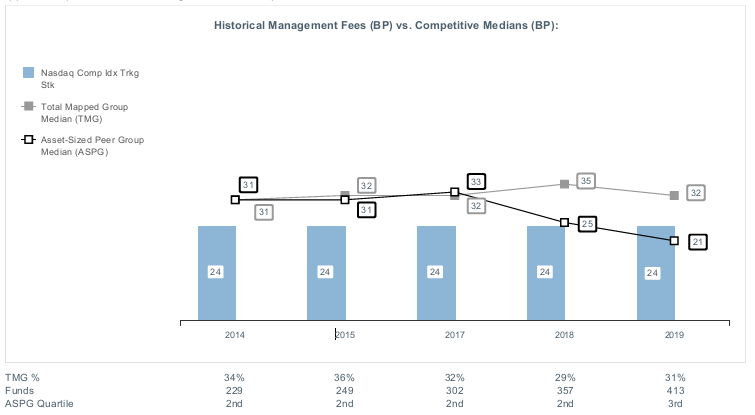

Premium/Discount Analysis (Unaudited)

Shares of Fidelity® Nasdaq Composite Index® Tracking Stock (the fund) are listed on The Nasdaq Stock Market® and can be bought and sold on the secondary market at market prices. Although the market price is expected to approximate the fund's NAV, it is possible that the market price and NAV will vary significantly. The closing market price is the daily closing price as reported on The Nasdaq Stock Market.

Premiums or discounts are the differences (expressed as a basis point differential with 1 basis point equaling 1/100 of 1%) between the fund's NAV and closing market price. A premium indicates that the closing market price is trading above the NAV. A discount indicates that the closing market price is trading below the NAV. A discrepancy may exist with respect to the timing of when the NAV is calculated and the determination of the closing market price.

The chart below presents information about the differences between the fund's daily closing market price and the fund's NAV.

Shares of Fidelity® Nasdaq Composite Index® Tracking Stock (the fund) are listed on The Nasdaq Stock Market® and can be bought and sold on the secondary market at market prices. Although the market price is expected to approximate the fund's NAV, it is possible that the market price and NAV will vary significantly. The closing market price is the daily closing price as reported on The Nasdaq Stock Market. Premiums or discounts are the differences (expressed as a basis point differential with 1 basis point equaling 1/100 of 1%) between the fund's NAV and closing market price. A premium indicates that the closing market price is trading above the NAV. A discount indicates that the closing market price is trading below the NAV. A discrepancy may exist with respect to the timing of when the NAV is calculated and the determination of the closing market price. The chart below presents information about the differences between the fund's daily closing market price and the fund's NAV.

Period Ended May 31, 2020

| From June 1, 2015 to May 31, 2020 | Closing Price Below NAV | Closing Price Above or Equal to NAV |

| Basis Point Differential | Number of Days | % of Total Days | Number of Days | % of Total Days |

| 0 - <25 | 352 | 27.96% | 825 | 65.53% |

| 25 - <50 | 12 | 0.95% | 63 | 5.00% |

| 50 - <75 | 0 | -- | 4 | 0.32% |

| 75 - <100 | 0 | -- | 1 | 0.08% |

| 100 or above | 0 | -- | 2 | 0.16% |

| Total | 364 | 28.91% | 895 | 71.09% |

Investment Summary (Unaudited)

Top Ten Stocks as of May 31, 2020

| | % of fund's net assets |

| Microsoft Corp. | 9.7 |

| Apple, Inc. | 9.7 |

| Amazon.com, Inc. | 8.5 |

| Facebook, Inc. Class A | 3.8 |

| Alphabet, Inc. Class C | 3.4 |

| Alphabet, Inc. Class A | 3.0 |

| Intel Corp. | 1.9 |

| NVIDIA Corp. | 1.5 |

| Cisco Systems, Inc. | 1.4 |

| Adobe, Inc. | 1.3 |

| | 44.2 |

Top Market Sectors as of May 31, 2020

| | % of fund's net assets |

| Information Technology | 41.9 |

| Communication Services | 17.6 |

| Consumer Discretionary | 15.1 |

| Health Care | 10.9 |

| Financials | 4.4 |

| Consumer Staples | 4.1 |

| Industrials | 3.4 |

| Real Estate | 1.1 |

| Utilities | 0.7 |

| Materials | 0.3 |

Asset Allocation (% of fund's net assets)

| As of May 31, 2020 * |

| | Stocks and Equity Futures | 100.0% |

* Foreign investments - 5.2%

Schedule of Investments May 31, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.7% | | | |

| | | Shares | Value |

| COMMUNICATION SERVICES - 17.6% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| ATN International, Inc. | | 4,018 | $238,669 |

| Bandwidth, Inc. (a)(b) | | 4,104 | 454,928 |

| Cogent Communications Group, Inc. | | 9,251 | 707,887 |

| Consolidated Communications Holdings, Inc. (b) | | 28,927 | 175,298 |

| GCI Liberty, Inc. (a) | | 18,088 | 1,251,509 |

| Iridium Communications, Inc. (a) | | 26,593 | 611,639 |

| PDVWireless, Inc. (a) | | 4,619 | 247,578 |

| Vonage Holdings Corp. (a) | | 52,680 | 507,308 |

| | | | 4,194,816 |

| Entertainment - 2.4% | | | |

| Activision Blizzard, Inc. | | 138,693 | 9,983,122 |

| Bilibili, Inc. ADR (a) | | 31,250 | 1,013,438 |

| Electronic Arts, Inc. (a) | | 51,299 | 6,303,621 |

| iQIYI, Inc. ADR (a) | | 56,692 | 940,520 |

| LiveXLive Media, Inc. (a) | | 43,378 | 124,061 |

| NetEase, Inc. ADR | | 13,267 | 5,079,934 |

| Netflix, Inc. (a) | | 78,630 | 33,003,370 |

| Roku, Inc. Class A (a) | | 18,183 | 1,991,220 |

| Take-Two Interactive Software, Inc. (a) | | 20,911 | 2,847,451 |

| Zynga, Inc. (a) | | 172,255 | 1,576,133 |

| | | | 62,862,870 |

| Interactive Media & Services - 10.9% | | | |

| Alphabet, Inc.: | | | |

| Class A (a) | | 53,670 | 76,937,018 |

| Class C (a) | | 61,016 | 87,186,983 |

| Baidu.com, Inc. sponsored ADR (a) | | 50,227 | 5,351,687 |

| CarGurus, Inc. Class A (a) | | 18,851 | 489,749 |

| Facebook, Inc. Class A (a) | | 430,462 | 96,892,692 |

| IAC/InterActiveCorp (a) | | 14,365 | 3,883,865 |

| Luokung Technology Corp. (a) | | 61,953 | 29,285 |

| Match Group, Inc. (a)(b) | | 13,534 | 1,205,067 |

| Momo, Inc. ADR | | 31,934 | 619,520 |

| Qutoutiao, Inc. ADR (a)(b) | | 45,219 | 107,621 |

| SINA Corp. (a) | | 13,740 | 430,199 |

| TripAdvisor, Inc. | | 25,666 | 494,840 |

| Weibo Corp. sponsored ADR (a)(b) | | 15,477 | 476,227 |

| Yandex NV Series A (a)(b) | | 53,840 | 2,165,983 |

| YY, Inc. ADR (a) | | 9,261 | 565,384 |

| Zillow Group, Inc.: | | | |

| Class A (a) | | 12,263 | 710,763 |

| Class C (a)(b) | | 27,538 | 1,596,929 |

| | | | 279,143,812 |

| Media - 3.2% | | | |

| AMC Networks, Inc. Class A (a)(b) | | 10,199 | 288,326 |

| Cardlytics, Inc. (a) | | 5,933 | 403,978 |

| Charter Communications, Inc. Class A (a) | | 37,565 | 20,435,360 |

| Comcast Corp. Class A | | 814,488 | 32,253,725 |

| comScore, Inc. (a) | | 41,517 | 156,312 |

| Criteo SA sponsored ADR (a) | | 19,102 | 195,796 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(b) | | 27,955 | 608,021 |

| Class C (non-vtg.) (a) | | 65,253 | 1,278,306 |

| DISH Network Corp. Class A (a) | | 54,112 | 1,712,645 |

| Fox Corp.: | | | |

| Class A | | 64,789 | 1,889,895 |

| Class B | | 49,181 | 1,415,429 |

| Liberty Broadband Corp.: | | | |

| Class A (a) | | 4,465 | 601,391 |

| Class C (a) | | 27,321 | 3,732,595 |

| Liberty Global PLC: | | | |

| Class A (a)(b) | | 36,415 | 773,455 |

| Class C (a) | | 82,504 | 1,702,058 |

| Liberty Latin America Ltd.: | | | |

| Class A (a) | | 13,767 | 137,257 |

| Class C (a)(b) | | 27,083 | 259,997 |

| Liberty Media Corp.: | | | |

| rights 6/2/20 (a) | | 5,245 | 57,013 |

| Liberty Braves Class C (a) | | 11,194 | 245,708 |

| Liberty Formula One Group Series C (a) | | 37,992 | 1,316,423 |

| Liberty SiriusXM Series A (a) | | 20,278 | 740,147 |

| Liberty SiriusXM Series C (a) | | 35,338 | 1,288,777 |

| Loral Space & Communications Ltd. | | 7,999 | 150,621 |

| News Corp.: | | | |

| Class A | | 67,741 | 829,827 |

| Class B | | 34,788 | 426,501 |

| Nexstar Broadcasting Group, Inc. Class A | | 8,874 | 739,293 |

| Scholastic Corp. | | 8,469 | 248,989 |

| Sinclair Broadcast Group, Inc. Class A (b) | | 16,067 | 300,292 |

| Sirius XM Holdings, Inc. (b) | | 804,739 | 4,683,581 |

| ViacomCBS, Inc.: | | | |

| Class A (b) | | 6,513 | 159,764 |

| Class B | | 97,606 | 2,024,348 |

| | | | 81,055,830 |

| Wireless Telecommunication Services - 1.0% | | | |

| Millicom International Cellular SA (b) | | 21,091 | 512,722 |

| Shenandoah Telecommunications Co. (b) | | 10,487 | 551,721 |

| T-Mobile U.S., Inc. (a) | | 220,742 | 22,083,030 |

| VEON Ltd. sponsored ADR | | 361,603 | 538,788 |

| Vodafone Group PLC sponsored ADR | | 75,099 | 1,239,884 |

| | | | 24,926,145 |

|

| TOTAL COMMUNICATION SERVICES | | | 452,183,473 |

|

| CONSUMER DISCRETIONARY - 15.1% | | | |

| Auto Components - 0.1% | | | |

| Dorman Products, Inc. (a) | | 6,292 | 439,937 |

| Fox Factory Holding Corp. (a) | | 8,083 | 582,865 |

| Gentex Corp. | | 44,536 | 1,177,532 |

| Gentherm, Inc. (a) | | 7,661 | 311,803 |

| The Goodyear Tire & Rubber Co. | | 52,191 | 397,174 |

| Visteon Corp. (a)(b) | | 6,254 | 450,288 |

| | | | 3,359,599 |

| Automobiles - 1.1% | | | |

| Tesla, Inc. (a) | | 32,988 | 27,544,980 |

| Distributors - 0.1% | | | |

| Core-Mark Holding Co., Inc. | | 11,338 | 317,237 |

| LKQ Corp. (a) | | 57,208 | 1,570,932 |

| Pool Corp. | | 7,049 | 1,896,322 |

| | | | 3,784,491 |

| Diversified Consumer Services - 0.2% | | | |

| Afya Ltd. (b) | | 11,903 | 233,894 |

| Arco Platform Ltd. Class A (a) | | 6,581 | 319,047 |

| Career Education Corp. (a) | | 17,328 | 282,100 |

| Frontdoor, Inc. (a) | | 17,062 | 778,880 |

| Grand Canyon Education, Inc. (a) | | 9,371 | 914,516 |

| Laureate Education, Inc. Class A (a) | | 26,971 | 262,428 |

| Strategic Education, Inc. | | 4,442 | 753,496 |

| Weight Watchers International, Inc. (a) | | 13,937 | 333,094 |

| | | | 3,877,455 |

| Hotels, Restaurants & Leisure - 1.5% | | | |

| Bloomin' Brands, Inc. | | 21,526 | 245,612 |

| Caesars Entertainment Corp. (a) | | 114,914 | 1,308,870 |

| Churchill Downs, Inc. (b) | | 7,314 | 970,348 |

| Cracker Barrel Old Country Store, Inc. | | 4,394 | 470,729 |

| Dave & Buster's Entertainment, Inc. | | 7,582 | 100,007 |

| Denny's Corp. (a) | | 14,695 | 159,367 |

| DraftKings, Inc. Class A (a)(b) | | 55,865 | 2,217,841 |

| Dunkin' Brands Group, Inc. | | 14,474 | 924,454 |

| Eldorado Resorts, Inc. (a)(b) | | 17,758 | 629,699 |

| Extended Stay America, Inc. unit | | 39,278 | 451,697 |

| Golden Entertainment, Inc. (a)(b) | | 13,876 | 169,218 |

| Huazhu Group Ltd. ADR | | 28,664 | 969,416 |

| Jack in the Box, Inc. | | 5,257 | 352,324 |

| Luckin Coffee, Inc. ADR (b) | | 7,624 | 16,468 |

| Marriott International, Inc. Class A | | 57,301 | 5,071,139 |

| Melco Crown Entertainment Ltd. sponsored ADR | | 40,074 | 642,386 |

| Monarch Casino & Resort, Inc. (a) | | 7,152 | 287,081 |

| Paddy Power Betfair PLC | | 11,954 | 1,517,656 |

| Papa John's International, Inc. (b) | | 6,876 | 535,572 |

| Penn National Gaming, Inc. (a) | | 23,512 | 771,429 |

| Playa Hotels & Resorts NV (a) | | 56,492 | 147,444 |

| Red Rock Resorts, Inc. | | 16,004 | 220,855 |

| Scientific Games Corp. Class A (a) | | 20,609 | 324,180 |

| Starbucks Corp. | | 209,877 | 16,368,307 |

| Texas Roadhouse, Inc. Class A | | 13,721 | 711,434 |

| The Cheesecake Factory, Inc. (b) | | 10,213 | 219,375 |

| Wendy's Co. | | 41,384 | 879,824 |

| Wingstop, Inc. (b) | | 5,974 | 728,529 |

| Wynn Resorts Ltd. | | 18,430 | 1,534,850 |

| | | | 38,946,111 |

| Household Durables - 0.3% | | | |

| Cavco Industries, Inc. (a) | | 2,167 | 412,142 |

| Garmin Ltd. | | 35,060 | 3,161,360 |

| Helen of Troy Ltd. (a)(b) | | 5,019 | 913,056 |

| iRobot Corp. (a)(b) | | 5,021 | 370,148 |

| LGI Homes, Inc. (a)(b) | | 5,634 | 469,988 |

| Newell Brands, Inc. | | 82,655 | 1,086,913 |

| Sonos, Inc. (a) | | 27,949 | 303,526 |

| Universal Electronics, Inc. (a) | | 4,542 | 205,480 |

| | | | 6,922,613 |

| Internet & Direct Marketing Retail - 10.3% | | | |

| Amazon.com, Inc. (a) | | 89,024 | 217,429,547 |

| Baozun, Inc. sponsored ADR (a)(b) | | 11,195 | 296,556 |

| CNOVA NV (a)(b) | | 49,959 | 177,462 |

| Ctrip.com International Ltd. ADR (a) | | 96,736 | 2,570,276 |

| eBay, Inc. | | 125,351 | 5,708,485 |

| Etsy, Inc. (a) | | 22,191 | 1,797,027 |

| Expedia, Inc. | | 25,130 | 1,997,332 |

| Groupon, Inc. (a) | | 130,366 | 166,217 |

| JD.com, Inc. sponsored ADR (a) | | 167,255 | 9,086,964 |

| Liberty Interactive Corp. QVC Group Series A (a)(b) | | 79,288 | 652,937 |

| MakeMyTrip Ltd. (a)(b) | | 15,644 | 242,326 |

| MercadoLibre, Inc. (a) | | 8,992 | 7,658,217 |

| Pinduoduo, Inc. ADR (a) | | 48,967 | 3,274,423 |

| Secoo Holding Ltd. ADR (a) | | 16,141 | 37,609 |

| Stamps.com, Inc. (a) | | 3,488 | 691,147 |

| Stitch Fix, Inc. (a)(b) | | 13,368 | 309,068 |

| The Booking Holdings, Inc. (a) | | 7,319 | 11,998,915 |

| The RealReal, Inc. (b) | | 21,422 | 287,269 |

| Waitr Holdings, Inc. (a) | | 46,861 | 115,747 |

| | | | 264,497,524 |

| Leisure Products - 0.2% | | | |

| BRP, Inc. | | 10,508 | 363,890 |

| Hasbro, Inc. | | 25,735 | 1,891,780 |

| Mattel, Inc. (a)(b) | | 66,624 | 613,607 |

| Peloton Interactive, Inc. Class A (a) | | 36,763 | 1,551,031 |

| | | | 4,420,308 |

| Multiline Retail - 0.2% | | | |

| Dollar Tree, Inc. (a) | | 43,333 | 4,241,001 |

| Ollie's Bargain Outlet Holdings, Inc. (a)(b) | | 12,498 | 1,142,942 |

| | | | 5,383,943 |

| Specialty Retail - 0.8% | | | |

| Bed Bath & Beyond, Inc. (b) | | 28,414 | 206,570 |

| Five Below, Inc. (a) | | 9,897 | 1,035,721 |

| Monro, Inc. (b) | | 7,406 | 408,071 |

| National Vision Holdings, Inc. (a) | | 16,590 | 444,280 |

| O'Reilly Automotive, Inc. (a) | | 13,237 | 5,523,006 |

| Office Depot, Inc. | | 132,937 | 328,354 |

| Rent-A-Center, Inc. (b) | | 12,808 | 326,092 |

| Ross Stores, Inc. | | 65,085 | 6,310,642 |

| Sleep Number Corp. (a) | | 6,687 | 208,434 |

| The Children's Place Retail Stores, Inc. (b) | | 4,039 | 168,184 |

| Tractor Supply Co. | | 21,151 | 2,580,845 |

| Ulta Beauty, Inc. (a) | | 10,622 | 2,591,874 |

| Urban Outfitters, Inc. (a) | | 22,082 | 374,069 |

| | | | 20,506,142 |

| Textiles, Apparel & Luxury Goods - 0.3% | | | |

| Columbia Sportswear Co. | | 12,930 | 944,666 |

| Crocs, Inc. (a) | | 14,505 | 415,568 |

| lululemon athletica, Inc. (a) | | 22,119 | 6,637,801 |

| Sequential Brands Group, Inc. (a)(b) | | 44,132 | 8,142 |

| Steven Madden Ltd. | | 17,196 | 404,450 |

| | | | 8,410,627 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 387,653,793 |

|

| CONSUMER STAPLES - 4.1% | | | |

| Beverages - 1.6% | | | |

| Coca-Cola Bottling Co. Consolidated (b) | | 1,579 | 384,376 |

| MGP Ingredients, Inc. (b) | | 5,421 | 203,342 |

| Monster Beverage Corp. (a) | | 97,272 | 6,994,830 |

| National Beverage Corp. (a)(b) | | 9,965 | 567,806 |

| PepsiCo, Inc. | | 248,930 | 32,746,742 |

| | | | 40,897,096 |

| Food & Staples Retailing - 1.3% | | | |

| Casey's General Stores, Inc. | | 6,772 | 1,081,692 |

| Costco Wholesale Corp. | | 79,253 | 24,447,173 |

| Grocery Outlet Holding Corp. | | 18,126 | 667,218 |

| HF Foods Group, Inc. (a)(b) | | 19,024 | 136,212 |

| PriceSmart, Inc. | | 7,060 | 383,923 |

| Sprouts Farmers Market LLC (a) | | 24,453 | 614,504 |

| Walgreens Boots Alliance, Inc. | | 160,473 | 6,890,711 |

| | | | 34,221,433 |

| Food Products - 1.1% | | | |

| Beyond Meat, Inc. (b) | | 11,719 | 1,503,431 |

| Bridgford Foods Corp. (a) | | 4,317 | 68,036 |

| Cal-Maine Foods, Inc. | | 9,625 | 428,890 |

| Calavo Growers, Inc. (b) | | 4,245 | 248,375 |

| Freshpet, Inc. (a) | | 7,764 | 599,226 |

| Hostess Brands, Inc. Class A (a)(b) | | 28,166 | 340,104 |

| J&J Snack Foods Corp. | | 4,024 | 517,607 |

| Lancaster Colony Corp. | | 5,501 | 844,183 |

| Mondelez International, Inc. | | 255,946 | 13,339,906 |

| Pilgrim's Pride Corp. (a) | | 41,719 | 862,332 |

| Sanderson Farms, Inc. | | 3,756 | 495,867 |

| The Hain Celestial Group, Inc. (a)(b) | | 21,418 | 674,239 |

| The Kraft Heinz Co. | | 221,142 | 6,738,197 |

| The Simply Good Foods Co. (a) | | 20,692 | 352,385 |

| | | | 27,012,778 |

| Household Products - 0.1% | | | |

| Central Garden & Pet Co. Class A (non-vtg.) (a) | | 10,100 | 346,026 |

| Reynolds Consumer Products, Inc. | | 38,992 | 1,301,943 |

| WD-40 Co. (b) | | 2,823 | 541,593 |

| | | | 2,189,562 |

| Personal Products - 0.0% | | | |

| Inter Parfums, Inc. | | 6,815 | 316,284 |

|

| TOTAL CONSUMER STAPLES | | | 104,637,153 |

|

| ENERGY - 0.2% | | | |

| Energy Equipment & Services - 0.0% | | | |

| CSI Compressco LP | | 34,012 | 14,795 |

| Geospace Technologies Corp. (a) | | 8,177 | 64,435 |

| KLX Energy Services Holdings, Inc. (a)(b) | | 100,470 | 148,696 |

| Patterson-UTI Energy, Inc. | | 72,637 | 268,031 |

| SAExploration Holdings, Inc. (a)(b) | | 48,225 | 78,125 |

| Smart Sand, Inc. (a)(b) | | 82,648 | 87,607 |

| | | | 661,689 |

| Oil, Gas & Consumable Fuels - 0.2% | | | |

| Alliance Resource Partners LP | | 37,274 | 118,159 |

| Altus Midstream Co. (a)(b) | | 112,996 | 77,967 |

| Amplify Energy Corp. New warrants 5/4/22 (a) | | 322 | 5 |

| Blueknight Energy Partners LP | | 44,338 | 61,630 |

| Centennial Resource Development, Inc. Class A (a) | | 198,625 | 200,611 |

| Clean Energy Fuels Corp. (a) | | 88,851 | 185,699 |

| Diamondback Energy, Inc. | | 30,285 | 1,289,535 |

| Extraction Oil & Gas, Inc. (a)(b) | | 225,638 | 65,435 |

| National Energy Services Reunited Corp. (a)(b) | | 28,417 | 161,409 |

| Nextdecade Corp. (a)(b) | | 29,365 | 44,341 |

| Noble Energy, Inc. | | 95,502 | 833,732 |

| Pacific Ethanol, Inc. (a) | | 142,466 | 95,025 |

| PDC Energy, Inc. (a) | | 24,417 | 297,399 |

| Rosehill Resources, Inc. (a)(b) | | 128,821 | 43,245 |

| StealthGas, Inc. (a) | | 18,277 | 48,617 |

| Tellurian, Inc. (a)(b) | | 93,210 | 93,201 |

| Viper Energy Partners LP | | 22,706 | 238,186 |

| Westwater Resources, Inc. (a)(b) | | 26,701 | 59,543 |

| | | | 3,913,739 |

|

| TOTAL ENERGY | | | 4,575,428 |

|

| FINANCIALS - 4.4% | | | |

| Banks - 1.6% | | | |

| 1st Source Corp. | | 7,300 | 252,507 |

| Ameris Bancorp | | 14,522 | 351,868 |

| BancFirst Corp. | | 8,247 | 314,376 |

| Bank OZK (b) | | 20,469 | 460,348 |

| Banner Corp. | | 8,948 | 336,087 |

| BOK Financial Corp. (b) | | 13,690 | 697,369 |

| Boston Private Financial Holdings, Inc. | | 25,876 | 177,768 |

| Bridge Bancorp, Inc. | | 7,860 | 167,418 |

| Brookline Bancorp, Inc., Delaware | | 23,659 | 220,029 |

| Camden National Corp. | | 5,560 | 186,482 |

| Cathay General Bancorp | | 16,541 | 449,750 |

| Centerstate Banks of Florida, Inc. | | 25,981 | 410,500 |

| City Holding Co. | | 4,373 | 275,062 |

| Columbia Banking Systems, Inc. | | 15,054 | 366,715 |

| Commerce Bancshares, Inc. (b) | | 21,307 | 1,357,895 |

| Community Trust Bancorp, Inc. | | 5,968 | 195,989 |

| ConnectOne Bancorp, Inc. | | 12,650 | 185,449 |

| CVB Financial Corp. | | 29,035 | 566,473 |

| Eagle Bancorp, Inc. | | 7,916 | 256,162 |

| East West Bancorp, Inc. (b) | | 27,787 | 971,156 |

| Enterprise Bancorp, Inc. | | 3,398 | 78,290 |

| Enterprise Financial Services Corp. | | 7,956 | 233,668 |

| Farmers & Merchants Bancorp, Inc. | | 2,033 | 44,177 |

| Fifth Third Bancorp | | 123,115 | 2,387,200 |

| First Bancorp, North Carolina | | 8,876 | 225,628 |

| First Busey Corp. | | 14,174 | 253,856 |

| First Citizens Bancshares, Inc. | | 1,883 | 724,955 |

| First Financial Bancorp, Ohio | | 21,223 | 282,054 |

| First Financial Bankshares, Inc. | | 26,712 | 818,456 |

| First Financial Corp., Indiana | | 5,031 | 176,588 |

| First Hawaiian, Inc. | | 26,209 | 452,105 |

| First Internet Bancorp | | 7,264 | 116,805 |

| First Interstate Bancsystem, Inc. | | 7,975 | 249,219 |

| First Merchants Corp. | | 11,585 | 325,075 |

| First Midwest Bancorp, Inc., Delaware | | 23,812 | 310,747 |

| First of Long Island Corp. | | 9,012 | 137,613 |

| Flushing Financial Corp. | | 11,514 | 130,569 |

| Fulton Financial Corp. | | 34,385 | 385,456 |

| German American Bancorp, Inc. | | 7,835 | 242,728 |

| Glacier Bancorp, Inc. | | 18,339 | 755,383 |

| Great Southern Bancorp, Inc. | | 4,802 | 194,769 |

| Grupo Financiero Galicia SA sponsored ADR (b) | | 18,972 | 151,966 |

| Hancock Whitney Corp. | | 13,213 | 285,665 |

| HarborOne Bancorp, Inc. | | 21,236 | 169,251 |

| Heartland Financial U.S.A., Inc. | | 8,751 | 280,120 |

| Home Bancshares, Inc. | | 34,186 | 494,671 |

| Hope Bancorp, Inc. | | 31,405 | 298,190 |

| Howard Bancorp, Inc. (a) | | 8,407 | 86,676 |

| Huntington Bancshares, Inc. | | 174,270 | 1,549,260 |

| IBERIABANK Corp. | | 8,115 | 344,157 |

| Independent Bank Corp., Massachusetts | | 7,296 | 506,853 |

| Independent Bank Group, Inc. | | 11,374 | 430,847 |

| International Bancshares Corp. | | 14,664 | 451,358 |

| Investar Holding Corp. | | 3,593 | 46,889 |

| Investors Bancorp, Inc. | | 54,536 | 473,372 |

| Lakeland Bancorp, Inc. | | 17,336 | 192,430 |

| Lakeland Financial Corp. (b) | | 6,784 | 289,609 |

| Live Oak Bancshares, Inc. (b) | | 12,397 | 167,855 |

| Mid Penn Bancorp, Inc. | | 3,946 | 73,632 |

| NBT Bancorp, Inc. | | 10,735 | 336,220 |

| OceanFirst Financial Corp. | | 15,705 | 262,274 |

| Old National Bancorp, Indiana | | 35,069 | 476,588 |

| Opus Bank | | 11,412 | 222,420 |

| Pacific Premier Bancorp, Inc. (b) | | 13,490 | 291,654 |

| PacWest Bancorp (b) | | 19,845 | 343,517 |

| People's Utah Bancorp | | 7,507 | 185,948 |

| Peoples Financial Services Corp. | | 846 | 27,960 |

| Peoples United Financial, Inc. | | 79,628 | 911,741 |

| Pinnacle Financial Partners, Inc. | | 12,178 | 485,293 |

| Popular, Inc. | | 16,363 | 646,175 |

| Preferred Bank, Los Angeles | | 5,112 | 192,058 |

| Renasant Corp. | | 12,868 | 310,376 |

| Republic Bancorp, Inc., Kentucky Class A | | 6,170 | 197,749 |

| S&T Bancorp, Inc. | | 9,972 | 221,777 |

| Sandy Spring Bancorp, Inc. | | 10,120 | 245,410 |

| Seacoast Banking Corp., Florida (a) | | 13,465 | 292,864 |

| ServisFirst Bancshares, Inc. | | 12,242 | 427,001 |

| Signature Bank | | 9,659 | 994,008 |

| Simmons First National Corp. Class A | | 23,838 | 408,822 |

| South State Corp. | | 7,118 | 374,193 |

| Southside Bancshares, Inc. | | 9,162 | 258,368 |

| Stock Yards Bancorp, Inc. | | 6,877 | 234,024 |

| SVB Financial Group (a) | | 8,848 | 1,900,108 |

| TCF Financial Corp. | | 25,296 | 731,560 |

| Texas Capital Bancshares, Inc. (a) | | 10,537 | 281,970 |

| The First Bancorp, Inc. | | 2,649 | 54,596 |

| TowneBank | | 12,516 | 236,052 |

| Trico Bancshares | | 8,733 | 247,755 |

| Trustmark Corp. | | 14,115 | 335,796 |

| UMB Financial Corp. | | 10,017 | 513,672 |

| Umpqua Holdings Corp. | | 34,140 | 388,855 |

| Union Bankshares Corp. | | 16,860 | 390,309 |

| United Bankshares, Inc., West Virginia | | 23,155 | 673,347 |

| United Community Bank, Inc. (b) | | 17,090 | 334,110 |

| Univest Corp. of Pennsylvania | | 10,716 | 176,171 |

| Valley National Bancorp | | 74,573 | 595,093 |

| Veritex Holdings, Inc. | | 12,244 | 214,515 |

| Washington Trust Bancorp, Inc. | | 6,014 | 192,268 |

| WesBanco, Inc. | | 14,661 | 314,039 |

| Westamerica Bancorp. (b) | | 6,376 | 376,056 |

| Wintrust Financial Corp. | | 8,808 | 373,107 |

| Zions Bancorp NA | | 27,066 | 890,607 |

| | | | 40,583,971 |

| Capital Markets - 1.7% | | | |

| BGC Partners, Inc. Class A (b) | | 84,793 | 218,342 |

| Blucora, Inc. (a) | | 15,044 | 182,785 |

| Carlyle Group LP (b) | | 65,725 | 1,817,954 |

| CME Group, Inc. | | 64,195 | 11,722,007 |

| Diamond Hill Investment Group, Inc. | | 1,391 | 145,999 |

| E*TRADE Financial Corp. | | 38,174 | 1,738,444 |

| Hamilton Lane, Inc. Class A | | 6,659 | 487,239 |

| Interactive Brokers Group, Inc. | | 15,828 | 670,316 |

| LPL Financial | | 15,403 | 1,099,620 |

| MarketAxess Holdings, Inc. | | 6,954 | 3,536,735 |

| Morningstar, Inc. | | 8,225 | 1,261,057 |

| Northern Trust Corp. | | 38,541 | 3,045,124 |

| SEI Investments Co. | | 28,325 | 1,535,782 |

| T. Rowe Price Group, Inc. | | 42,230 | 5,105,607 |

| TD Ameritrade Holding Corp. | | 97,582 | 3,636,881 |

| The NASDAQ OMX Group, Inc. | | 29,915 | 3,543,731 |

| Tradeweb Markets, Inc. Class A | | 14,930 | 984,783 |

| Virtu Financial, Inc. Class A (b) | | 25,454 | 607,078 |

| XP, Inc. Class A (a) | | 65,717 | 1,995,168 |

| | | | 43,334,652 |

| Consumer Finance - 0.2% | | | |

| Credit Acceptance Corp. (a)(b) | | 3,095 | 1,144,593 |

| Encore Capital Group, Inc. (a)(b) | | 8,052 | 255,812 |

| EZCORP, Inc. (non-vtg.) Class A (a) | | 26,400 | 136,224 |

| First Cash Financial Services, Inc. | | 8,594 | 599,603 |

| LendingTree, Inc. (a)(b) | | 2,580 | 670,852 |

| LexinFintech Holdings Ltd. ADR (a) | | 23,192 | 189,015 |

| Navient Corp. | | 46,534 | 346,213 |

| PRA Group, Inc. (a)(b) | | 10,691 | 364,777 |

| SLM Corp. | | 78,434 | 594,530 |

| | | | 4,301,619 |

| Insurance - 0.7% | | | |

| American National Insurance Co. | | 5,573 | 418,811 |

| Amerisafe, Inc. | | 4,707 | 288,916 |

| Arch Capital Group Ltd. (a) | | 70,221 | 1,981,637 |

| Brighthouse Financial, Inc. (a) | | 20,404 | 606,203 |

| Cincinnati Financial Corp. | | 29,312 | 1,727,942 |

| eHealth, Inc. (a) | | 4,919 | 641,536 |

| Enstar Group Ltd. (a) | | 3,227 | 459,525 |

| Erie Indemnity Co. Class A (b) | | 8,731 | 1,573,675 |

| Fanhua, Inc. ADR | | 9,307 | 174,879 |

| James River Group Holdings Ltd. | | 8,043 | 311,023 |

| Kinsale Capital Group, Inc. | | 4,597 | 686,424 |

| National General Holdings Corp. | | 24,075 | 488,723 |

| National Western Life Group, Inc. | | 1,054 | 206,510 |

| Palomar Holdings, Inc. (a) | | 5,778 | 429,999 |

| Principal Financial Group, Inc. | | 48,810 | 1,885,042 |

| Safety Insurance Group, Inc. | | 3,871 | 295,125 |

| Selective Insurance Group, Inc. | | 9,630 | 505,094 |

| State Auto Financial Corp. | | 12,066 | 240,596 |

| Trupanion, Inc. (a)(b) | | 8,871 | 267,195 |

| United Fire Group, Inc. | | 7,714 | 206,967 |

| United Insurance Holdings Corp. | | 18,151 | 142,304 |

| Willis Group Holdings PLC | | 22,628 | 4,591,221 |

| | | | 18,129,347 |

| Mortgage Real Estate Investment Trusts - 0.0% | | | |

| AGNC Investment Corp. | | 92,273 | 1,194,013 |

| New York Mortgage Trust, Inc. | | 73,054 | 151,952 |

| | | | 1,345,965 |

| Thrifts & Mortgage Finance - 0.2% | | | |

| Capitol Federal Financial, Inc. | | 32,772 | 384,252 |

| HomeStreet, Inc. | | 8,200 | 195,324 |

| Kearny Financial Corp. | | 25,397 | 217,652 |

| Meridian Bancorp, Inc. Maryland | | 17,192 | 198,052 |

| Meta Financial Group, Inc. | | 11,067 | 200,534 |

| NMI Holdings, Inc. (a) | | 18,646 | 286,496 |

| Northfield Bancorp, Inc. | | 16,799 | 183,613 |

| Northwest Bancshares, Inc. | | 27,925 | 278,133 |

| TFS Financial Corp. | | 55,890 | 861,265 |

| Trustco Bank Corp., New York | | 32,373 | 203,950 |

| Washington Federal, Inc. | | 17,176 | 444,171 |

| WMI Holdings Corp. (a) | | 25,168 | 280,623 |

| WSFS Financial Corp. | | 12,372 | 342,333 |

| | | | 4,076,398 |

|

| TOTAL FINANCIALS | | | 111,771,952 |

|

| HEALTH CARE - 10.9% | | | |

| Biotechnology - 6.5% | | | |

| ACADIA Pharmaceuticals, Inc. (a) | | 28,865 | 1,434,013 |

| Acceleron Pharma, Inc. (a) | | 10,359 | 1,023,780 |

| ADMA Biologics, Inc. (a)(b) | | 59,414 | 195,472 |

| Aduro Biotech, Inc. (a) | | 65,308 | 213,557 |

| Agios Pharmaceuticals, Inc. (a) | | 14,018 | 725,291 |

| Aileron Therapeutics, Inc. (a) | | 76,558 | 124,024 |

| Aimmune Therapeutics, Inc. (a)(b) | | 16,419 | 272,720 |

| Akebia Therapeutics, Inc. (a) | | 34,792 | 404,979 |

| Aldeyra Therapeutics, Inc. (a)(b) | | 30,923 | 152,141 |

| Alector, Inc. (a)(b) | | 17,110 | 559,497 |

| Alexion Pharmaceuticals, Inc. (a) | | 40,420 | 4,846,358 |

| Alkermes PLC (a) | | 31,562 | 516,354 |

| Allakos, Inc. (a)(b) | | 9,911 | 644,215 |

| Allena Pharmaceuticals, Inc. (a) | | 67,231 | 112,948 |

| Allogene Therapeutics, Inc. (a)(b) | | 24,120 | 1,161,619 |

| Alnylam Pharmaceuticals, Inc. (a) | | 20,720 | 2,802,794 |

| Amarin Corp. PLC ADR (a)(b) | | 61,911 | 424,709 |

| Amgen, Inc. | | 105,581 | 24,251,956 |

| Amicus Therapeutics, Inc. (a)(b) | | 52,426 | 654,014 |

| Apellis Pharmaceuticals, Inc. (a) | | 15,320 | 516,131 |

| Applied Therapeutics, Inc. (a)(b) | | 6,114 | 278,309 |

| Arbutus Biopharma Corp. (a)(b) | | 78,780 | 170,953 |

| Arena Pharmaceuticals, Inc. (a) | | 10,607 | 633,980 |

| Argenx SE ADR (a) | | 4,667 | 1,023,473 |

| Arrowhead Pharmaceuticals, Inc. (a) | | 19,031 | 613,559 |

| Ascendis Pharma A/S sponsored ADR (a) | | 8,767 | 1,275,511 |

| Atara Biotherapeutics, Inc. (a) | | 28,587 | 328,751 |

| Athenex, Inc. (a)(b) | | 20,027 | 217,693 |

| Aurinia Pharmaceuticals, Inc. (a) | | 23,612 | 374,722 |

| AVROBIO, Inc. (a) | | 12,279 | 248,281 |

| Axovant Gene Therapies Ltd. (a)(b) | | 29,979 | 95,633 |

| BeiGene Ltd. ADR (a) | | 8,043 | 1,331,438 |

| Bellicum Pharmaceuticals, Inc. (a)(b) | | 13,350 | 101,861 |

| BeyondSpring, Inc. (a) | | 9,953 | 169,201 |

| BioCryst Pharmaceuticals, Inc. (a)(b) | | 54,937 | 246,942 |

| Biogen, Inc. (a) | | 30,999 | 9,519,483 |

| BioMarin Pharmaceutical, Inc. (a) | | 33,069 | 3,523,502 |

| bluebird bio, Inc. (a) | | 11,483 | 730,663 |

| Blueprint Medicines Corp. (a) | | 11,020 | 717,843 |

| Bridgebio Pharma, Inc. (b) | | 24,562 | 720,403 |

| CareDx, Inc. (a)(b) | | 10,508 | 337,517 |

| Cellectis SA sponsored ADR (a) | | 11,354 | 209,708 |

| ChemoCentryx, Inc. (a) | | 11,894 | 742,067 |

| Chimerix, Inc. (a) | | 62,326 | 194,457 |

| China Biologic Products Holdings, Inc. (a) | | 6,143 | 680,460 |

| Clementia Pharmaceuticals, Inc. rights (a)(c) | | 20,215 | 27,290 |

| Coherus BioSciences, Inc. (a) | | 17,417 | 324,653 |

| Constellation Pharmaceuticals, Inc. (a) | | 9,633 | 342,260 |

| Cortexyme, Inc. (b) | | 7,045 | 324,704 |

| Corvus Pharmaceuticals, Inc. (a)(b) | | 32,532 | 112,235 |

| CRISPR Therapeutics AG (a)(b) | | 12,226 | 789,555 |

| Cyclerion Therapeutics, Inc. (a)(b) | | 52,765 | 210,005 |

| Cytokinetics, Inc. (a)(b) | | 15,984 | 331,029 |

| CytomX Therapeutics, Inc. (a) | | 24,335 | 215,608 |

| Deciphera Pharmaceuticals, Inc. (a) | | 10,631 | 622,658 |

| Denali Therapeutics, Inc. (a)(b) | | 26,847 | 747,152 |

| Dicerna Pharmaceuticals, Inc. (a) | | 16,869 | 363,864 |

| Diffusion Pharmaceuticals, Inc. (a) | | 150,578 | 195,751 |

| Eagle Pharmaceuticals, Inc. (a) | | 3,973 | 203,656 |

| Editas Medicine, Inc. (a)(b) | | 12,307 | 333,150 |

| Eidos Therapeutics, Inc. (a)(b) | | 8,027 | 392,601 |

| Enanta Pharmaceuticals, Inc. (a) | | 5,064 | 260,745 |

| Epizyme, Inc. (a)(b) | | 20,870 | 366,269 |

| Esperion Therapeutics, Inc. (a)(b) | | 6,375 | 270,109 |

| Exact Sciences Corp. (a) | | 27,595 | 2,369,859 |

| Exelixis, Inc. (a) | | 57,829 | 1,428,955 |

| Exicure, Inc. (a) | | 54,159 | 150,020 |

| Fate Therapeutics, Inc. (a) | | 16,436 | 533,019 |

| FibroGen, Inc. (a) | | 16,365 | 547,246 |

| Five Prime Therapeutics, Inc. (a) | | 41,491 | 219,902 |

| G1 Therapeutics, Inc. (a) | | 10,955 | 185,906 |

| Galapagos Genomics NV sponsored ADR (a)(b) | | 1,233 | 250,028 |

| Gilead Sciences, Inc. | | 225,899 | 17,581,719 |

| Global Blood Therapeutics, Inc. (a)(b) | | 11,940 | 834,845 |

| GlycoMimetics, Inc. (a) | | 38,409 | 108,697 |

| Gossamer Bio, Inc. (a) | | 22,850 | 277,628 |

| Grifols SA ADR | | 26,199 | 495,947 |

| Gritstone Oncology, Inc. (a)(b) | | 18,268 | 118,011 |

| Halozyme Therapeutics, Inc. (a) | | 28,310 | 687,084 |

| Heron Therapeutics, Inc. (a)(b) | | 20,631 | 375,897 |

| Homology Medicines, Inc. (a) | | 13,757 | 195,900 |

| IGM Biosciences, Inc. (a)(b) | | 5,854 | 379,222 |

| ImmunoGen, Inc. (a) | | 58,073 | 271,782 |

| Immunomedics, Inc. (a)(b) | | 40,790 | 1,370,136 |

| Incyte Corp. (a) | | 39,647 | 4,040,426 |

| InflaRx NV (a)(b) | | 27,132 | 239,304 |

| Insmed, Inc. (a)(b) | | 20,485 | 497,581 |

| Intercept Pharmaceuticals, Inc. (a)(b) | | 6,688 | 483,275 |

| Ionis Pharmaceuticals, Inc. (a)(b) | | 25,224 | 1,417,841 |

| Iovance Biotherapeutics, Inc. (a)(b) | | 24,981 | 801,640 |

| Ironwood Pharmaceuticals, Inc. Class A (a)(b) | | 35,773 | 348,071 |

| Kalvista Pharmaceuticals, Inc. (a) | | 11,120 | 125,100 |

| Karuna Therapeutics, Inc. (a)(b) | | 5,626 | 528,056 |

| Karyopharm Therapeutics, Inc. (a) | | 16,332 | 301,979 |

| Kiniksa Pharmaceuticals Ltd. (a)(b) | | 9,855 | 205,674 |

| Kodiak Sciences, Inc. (a)(b) | | 9,384 | 606,300 |

| Lexicon Pharmaceuticals, Inc. (a)(b) | | 45,979 | 87,820 |

| Ligand Pharmaceuticals, Inc.: | | | |

| Class B (a)(b) | | 3,265 | 331,626 |

| General CVR (a) | | 1,530 | 20 |

| Glucagon CVR (a) | | 1,530 | 21 |

| rights (a) | | 1,530 | 21 |

| TR Beta CVR (a) | | 1,530 | 367 |

| Macrogenics, Inc. (a) | | 14,139 | 272,034 |

| Madrigal Pharmaceuticals, Inc. (a) | | 2,812 | 326,248 |

| Magenta Therapeutics, Inc. (a) | | 14,194 | 125,475 |

| Marker Therapeutics, Inc. (a)(b) | | 45,135 | 102,456 |

| Minerva Neurosciences, Inc. (a) | | 19,919 | 73,899 |

| Mirati Therapeutics, Inc. (a) | | 8,587 | 851,745 |

| Moderna, Inc. (a) | | 66,979 | 4,119,209 |

| Momenta Pharmaceuticals, Inc. (a) | | 23,602 | 742,991 |

| Myriad Genetics, Inc. (a) | | 19,089 | 277,363 |

| Natera, Inc. (a) | | 15,931 | 698,574 |

| Neurocrine Biosciences, Inc. (a) | | 17,189 | 2,144,500 |

| NextCure, Inc. (b) | | 6,622 | 206,673 |

| Novavax, Inc. (a) | | 10,372 | 477,527 |

| NuCana PLC ADR (a)(b) | | 13,541 | 84,902 |

| Opko Health, Inc. (a)(b) | | 150,282 | 342,643 |

| Organogenesis Holdings, Inc. Class A (a) | | 18,427 | 76,104 |

| Ovid Therapeutics, Inc. (a)(b) | | 32,887 | 175,945 |

| Precigen, Inc. (a)(b) | | 55,758 | 122,668 |

| Principia Biopharma, Inc. (a) | | 6,838 | 436,880 |

| ProQR Therapeutics BV (a)(b) | | 24,820 | 137,999 |

| Prothena Corp. PLC (a) | | 14,923 | 159,079 |

| PTC Therapeutics, Inc. (a) | | 12,729 | 645,488 |

| Regeneron Pharmaceuticals, Inc. (a) | | 19,275 | 11,811,913 |

| REGENXBIO, Inc. (a) | | 9,361 | 352,535 |

| Repligen Corp. (a) | | 9,981 | 1,307,212 |

| Replimune Group, Inc. (a) | | 11,498 | 215,932 |

| Revolution Medicines, Inc. (b) | | 12,877 | 395,581 |

| Rocket Pharmaceuticals, Inc. (a)(b) | | 20,219 | 380,319 |

| Rubius Therapeutics, Inc. (a)(b) | | 31,954 | 206,103 |

| Sage Therapeutics, Inc. (a) | | 10,500 | 375,060 |

| Sangamo Therapeutics, Inc. (a) | | 29,011 | 324,633 |

| Sarepta Therapeutics, Inc. (a) | | 14,490 | 2,206,392 |

| Savara, Inc. (a) | | 50,673 | 123,642 |

| Seattle Genetics, Inc. (a) | | 31,336 | 4,926,333 |

| Sellas Life Sciences Group, Inc. (a)(b) | | 34,771 | 119,265 |

| Seres Therapeutics, Inc. (a)(b) | | 37,600 | 206,424 |

| Solid Biosciences, Inc. (a)(b) | | 43,917 | 129,555 |

| Springworks Therapeutics, Inc. (a)(b) | | 11,303 | 430,305 |

| Synlogic, Inc. (a)(b) | | 40,203 | 100,910 |

| T2 Biosystems, Inc. (a)(b) | | 163,099 | 136,889 |

| TCR2 Therapeutics, Inc. (a) | | 11,657 | 117,736 |

| TG Therapeutics, Inc. (a) | | 27,276 | 508,697 |

| Tobira Therapeutics, Inc. rights (a)(c) | | 1,750 | 14,963 |

| Tocagen, Inc. (a) | | 67,993 | 82,272 |

| Turning Point Therapeutics, Inc. (a) | | 7,761 | 537,449 |

| Twist Bioscience Corp. (a)(b) | | 8,860 | 336,237 |

| Ultragenyx Pharmaceutical, Inc. (a)(b) | | 11,541 | 790,097 |

| uniQure B.V. (a) | | 9,225 | 619,551 |

| United Therapeutics Corp. (a) | | 8,568 | 1,010,596 |

| UNITY Biotechnology, Inc. (a)(b) | | 21,484 | 175,739 |

| UroGen Pharma Ltd. (a)(b) | | 7,178 | 168,468 |

| Vertex Pharmaceuticals, Inc. (a) | | 46,650 | 13,433,334 |

| Viela Bio, Inc. (b) | | 10,925 | 512,383 |

| Vir Biotechnology, Inc. (a)(b) | | 21,783 | 744,543 |

| Voyager Therapeutics, Inc. (a) | | 29,418 | 355,958 |

| Xencor, Inc. (a) | | 12,824 | 387,926 |

| Y-mAbs Therapeutics, Inc. (a) | | 9,315 | 355,647 |

| Zai Lab Ltd. ADR (a) | | 9,574 | 712,306 |

| | | | 167,566,508 |

| Health Care Equipment & Supplies - 2.0% | | | |

| Abiomed, Inc. (a) | | 8,507 | 1,904,717 |

| Accelerate Diagnostics, Inc. (a)(b) | | 19,640 | 163,994 |

| Align Technology, Inc. (a) | | 14,453 | 3,549,946 |

| Atricure, Inc. (a) | | 8,872 | 424,170 |

| Atrion Corp. (b) | | 462 | 296,599 |

| Cardiovascular Systems, Inc. (a) | | 8,390 | 324,861 |

| Dentsply Sirona, Inc. | | 40,314 | 1,875,407 |

| DexCom, Inc. (a) | | 16,579 | 6,272,001 |

| electroCore, Inc. (a) | | 104,052 | 96,716 |

| Heska Corp. (a)(b) | | 2,474 | 217,539 |

| Hologic, Inc. (a) | | 48,717 | 2,582,001 |

| ICU Medical, Inc. (a) | | 4,095 | 817,444 |

| IDEXX Laboratories, Inc. (a) | | 15,544 | 4,801,231 |

| Inari Medical, Inc. | | 7,833 | 344,652 |

| InMode Ltd. (a)(b) | | 9,185 | 269,212 |

| Insulet Corp. (a) | | 11,503 | 2,169,121 |

| Integra LifeSciences Holdings Corp. (a) | | 16,816 | 876,282 |

| Intuitive Surgical, Inc. (a) | | 20,893 | 12,118,567 |

| iRhythm Technologies, Inc. (a) | | 5,503 | 684,078 |

| LeMaitre Vascular, Inc. (b) | | 7,036 | 189,198 |

| LivaNova PLC (a) | | 10,254 | 548,486 |

| Masimo Corp. (a) | | 10,022 | 2,407,184 |

| Merit Medical Systems, Inc. (a)(b) | | 11,898 | 535,291 |

| Natus Medical, Inc. (a)(b) | | 9,390 | 200,946 |

| Neogen Corp. (a) | | 10,739 | 764,832 |

| Novocure Ltd. (a) | | 19,140 | 1,290,610 |

| NuVasive, Inc. (a) | | 10,531 | 638,179 |

| Orthofix International NV (a) | | 5,932 | 202,163 |

| Quidel Corp. (a) | | 7,980 | 1,396,500 |

| Shockwave Medical, Inc. (a) | | 7,639 | 336,192 |

| Silk Road Medical, Inc. (a) | | 7,837 | 299,922 |

| SmileDirectClub, Inc. (a)(b) | | 32,207 | 251,537 |

| Staar Surgical Co. (a)(b) | | 10,272 | 398,554 |

| Tactile Systems Technology, Inc. (a)(b) | | 5,158 | 249,905 |

| Tandem Diabetes Care, Inc. (a) | | 11,767 | 978,426 |

| Varex Imaging Corp. (a) | | 11,502 | 215,778 |

| Wright Medical Group NV (a) | | 25,436 | 751,634 |

| | | | 51,443,875 |

| Health Care Providers & Services - 0.5% | | | |

| 1Life Healthcare, Inc. (a)(b) | | 25,163 | 812,765 |

| Acadia Healthcare Co., Inc. (a) | | 19,171 | 548,482 |

| Addus HomeCare Corp. (a) | | 3,677 | 363,876 |

| Amedisys, Inc. (a) | | 6,208 | 1,192,246 |

| BioScrip, Inc. (a)(b) | | 37,626 | 571,915 |

| BioTelemetry, Inc. (a) | | 7,894 | 372,439 |

| Corvel Corp. (a) | | 4,205 | 285,477 |

| Covetrus, Inc. (a) | | 26,271 | 401,421 |

| Guardant Health, Inc. (a) | | 17,700 | 1,599,903 |

| HealthEquity, Inc. (a) | | 14,200 | 879,974 |

| Henry Schein, Inc. (a) | | 24,868 | 1,509,985 |

| LHC Group, Inc. (a) | | 6,184 | 1,004,962 |

| Magellan Health Services, Inc. (a) | | 5,402 | 405,096 |

| National Research Corp. Class A | | 6,083 | 345,028 |

| Patterson Companies, Inc. (b) | | 21,900 | 431,211 |

| Pennant Group, Inc. (a) | | 8,465 | 215,773 |

| Premier, Inc. (a)(b) | | 13,718 | 477,249 |

| Progyny, Inc. (a) | | 18,295 | 456,643 |

| R1 RCM, Inc. (a) | | 26,953 | 285,971 |

| The Ensign Group, Inc. | | 11,658 | 509,688 |

| | | | 12,670,104 |

| Health Care Technology - 0.4% | | | |

| Allscripts Healthcare Solutions, Inc. (a) | | 38,859 | 245,589 |

| Cerner Corp. | | 57,028 | 4,157,341 |

| Change Healthcare, Inc. | | 57,473 | 717,263 |

| Health Catalyst, Inc. (b) | | 9,815 | 266,379 |

| HMS Holdings Corp. (a) | | 18,796 | 587,187 |

| Inovalon Holdings, Inc. Class A (a)(b) | | 18,695 | 351,840 |

| Livongo Health, Inc. (b) | | 18,832 | 1,128,602 |

| Nextgen Healthcare, Inc. (a) | | 20,526 | 211,828 |

| Omnicell, Inc. (a) | | 8,589 | 574,690 |

| Schrodinger, Inc. (b) | | 9,039 | 618,720 |

| Tabula Rasa HealthCare, Inc. (a)(b) | | 5,394 | 288,201 |

| | | | 9,147,640 |

| Life Sciences Tools & Services - 0.8% | | | |

| 10X Genomics, Inc. (a) | | 9,770 | 761,767 |

| Adaptive Biotechnologies Corp. | | 23,223 | 898,730 |

| Bio-Techne Corp. | | 7,178 | 1,900,734 |

| BioNano Genomics, Inc. (a)(b) | | 209,443 | 94,040 |

| Bruker Corp. | | 27,432 | 1,187,257 |

| ICON PLC (a) | | 9,148 | 1,540,981 |

| Illumina, Inc. (a) | | 26,258 | 9,532,967 |

| Luminex Corp. | | 10,463 | 326,027 |

| Medpace Holdings, Inc. (a) | | 7,390 | 685,940 |

| NeoGenomics, Inc. (a)(b) | | 21,260 | 567,429 |

| Pacific Biosciences of California, Inc. (a)(b) | | 45,258 | 159,308 |

| PPD, Inc. | | 61,214 | 1,667,469 |

| PRA Health Sciences, Inc. (a) | | 12,272 | 1,270,152 |

| Syneos Health, Inc. (a) | | 20,126 | 1,227,485 |

| | | | 21,820,286 |

| Pharmaceuticals - 0.7% | | | |

| AcelRx Pharmaceuticals, Inc. (a) | | 75,544 | 105,006 |

| Aclaris Therapeutics, Inc. (a)(b) | | 73,002 | 102,933 |

| Adamis Pharmaceuticals Corp. (a)(b) | | 232,779 | 114,783 |

| Aerie Pharmaceuticals, Inc. (a)(b) | | 13,597 | 190,766 |

| Akcea Therapeutics, Inc. (a)(b) | | 21,631 | 322,302 |

| Amphastar Pharmaceuticals, Inc. (a)(b) | | 12,990 | 242,134 |

| ANI Pharmaceuticals, Inc. rights (a)(c) | | 739 | 0 |

| Arvinas Holding Co. LLC (a) | | 8,704 | 289,582 |

| Assertio Holdings, Inc. (a)(b) | | 133,767 | 131,975 |

| AstraZeneca PLC rights (a)(c) | | 1,845 | 0 |

| Axsome Therapeutics, Inc. (a) | | 7,409 | 570,345 |

| Corcept Therapeutics, Inc. (a)(b) | | 26,468 | 400,726 |

| Cronos Group, Inc. (a)(b) | | 75,384 | 494,402 |

| CymaBay Therapeutics, Inc. (a)(b) | | 77,195 | 286,007 |

| Dova Pharmaceuticals, Inc. rights (a)(c) | | 7,729 | 4,174 |

| Eloxx Pharmaceuticals, Inc. (a)(b) | | 30,808 | 104,439 |

| Endo International PLC (a)(b) | | 56,731 | 218,982 |

| EyeGate Pharmaceuticals, Inc. (a) | | 22,182 | 113,350 |

| GW Pharmaceuticals PLC ADR (a)(b) | | 5,996 | 736,009 |

| Horizon Pharma PLC (a) | | 35,825 | 1,817,402 |

| Innoviva, Inc. (a) | | 23,787 | 332,304 |

| Intra-Cellular Therapies, Inc. (a)(b) | | 16,529 | 345,126 |

| Jazz Pharmaceuticals PLC (a) | | 10,459 | 1,247,968 |

| Mylan NV (a) | | 97,533 | 1,664,888 |

| MyoKardia, Inc. (a) | | 9,411 | 962,651 |

| Nektar Therapeutics (a)(b) | | 33,817 | 733,829 |

| OptiNose, Inc. (a)(b) | | 28,800 | 124,416 |

| Pacira Biosciences, Inc. (a) | | 9,410 | 413,570 |

| Paratek Pharmaceuticals, Inc. (a)(b) | | 44,448 | 197,349 |

| Reata Pharmaceuticals, Inc. (a)(b) | | 5,252 | 763,221 |

| resTORbio, Inc. (a)(b) | | 111,435 | 241,814 |

| Revance Therapeutics, Inc. (a)(b) | | 15,645 | 326,981 |

| Sanofi SA sponsored ADR | | 39,006 | 1,915,585 |

| Supernus Pharmaceuticals, Inc. (a) | | 13,000 | 313,560 |

| Tetraphase Pharmaceuticals, Inc. (a) | | 32,907 | 71,079 |

| TherapeuticsMD, Inc. (a)(b) | | 139,587 | 157,733 |

| Theravance Biopharma, Inc. (a)(b) | | 14,294 | 360,924 |

| Tilray, Inc. Class 2 (a)(b) | | 31,597 | 311,230 |

| Tricida, Inc. (a)(b) | | 11,620 | 312,113 |

| Verrica Pharmaceuticals, Inc. (a)(b) | | 11,056 | 126,923 |

| Zogenix, Inc. (a) | | 10,914 | 317,925 |

| | | | 17,486,506 |

|

| TOTAL HEALTH CARE | | | 280,134,919 |

|

| INDUSTRIALS - 3.4% | | | |

| Aerospace & Defense - 0.1% | | | |

| AeroVironment, Inc. (a) | | 5,545 | 392,752 |

| Axon Enterprise, Inc. (a) | | 11,665 | 886,073 |

| Elbit Systems Ltd. (b) | | 8,484 | 1,195,311 |

| Kratos Defense & Security Solutions, Inc. (a) | | 23,685 | 439,357 |

| Mercury Systems, Inc. (a)(b) | | 10,589 | 946,127 |

| | | | 3,859,620 |

| Air Freight & Logistics - 0.2% | | | |

| Air Transport Services Group, Inc. (a) | | 14,753 | 317,780 |

| Atlas Air Worldwide Holdings, Inc. (a) | | 6,919 | 270,256 |

| C.H. Robinson Worldwide, Inc. | | 23,158 | 1,878,809 |

| Expeditors International of Washington, Inc. | | 30,535 | 2,331,958 |

| Forward Air Corp. | | 6,328 | 314,375 |

| Hub Group, Inc. Class A (a) | | 7,570 | 354,049 |

| | | | 5,467,227 |

| Airlines - 0.2% | | | |

| Allegiant Travel Co. (b) | | 3,475 | 370,261 |

| American Airlines Group, Inc. (b) | | 69,917 | 734,129 |

| Hawaiian Holdings, Inc. (b) | | 9,827 | 141,804 |

| JetBlue Airways Corp. (a) | | 49,956 | 503,057 |

| Ryanair Holdings PLC sponsored ADR (a) | | 18,932 | 1,358,750 |

| SkyWest, Inc. | | 11,277 | 361,653 |

| United Airlines Holdings, Inc. (a)(b) | | 51,892 | 1,455,052 |

| | | | 4,924,706 |

| Building Products - 0.1% | | | |

| AAON, Inc. | | 10,994 | 595,545 |

| American Woodmark Corp. (a) | | 3,795 | 238,174 |

| Apogee Enterprises, Inc. | | 7,358 | 151,943 |

| Builders FirstSource, Inc. (a) | | 21,594 | 449,371 |

| Caesarstone Sdot-Yam Ltd. | | 14,273 | 159,001 |

| Gibraltar Industries, Inc. (a) | | 7,331 | 322,637 |

| Patrick Industries, Inc. (b) | | 5,845 | 303,180 |

| Ufp Industries, Inc. | | 12,655 | 578,713 |

| | | | 2,798,564 |

| Commercial Services & Supplies - 0.5% | | | |

| Casella Waste Systems, Inc. Class A (a) | | 9,898 | 504,303 |

| Cimpress PLC (a)(b) | | 5,764 | 519,509 |

| Cintas Corp. | | 18,305 | 4,538,908 |

| Copart, Inc. (a) | | 42,649 | 3,812,394 |

| Healthcare Services Group, Inc. (b) | | 16,928 | 404,918 |

| Herman Miller, Inc. | | 12,655 | 291,318 |

| Interface, Inc. | | 18,057 | 153,304 |

| Kimball International, Inc. Class B | | 11,847 | 132,568 |

| McGrath RentCorp. | | 5,419 | 302,163 |

| Mobile Mini, Inc. | | 9,897 | 317,100 |

| SP Plus Corp. (a)(b) | | 6,102 | 124,298 |

| Stericycle, Inc. (a) | | 15,252 | 836,267 |

| Tetra Tech, Inc. | | 10,821 | 853,777 |

| U.S. Ecology, Inc. | | 7,192 | 242,155 |

| | | | 13,032,982 |

| Construction & Engineering - 0.0% | | | |

| Aegion Corp. (a)(b) | | 12,840 | 192,728 |

| Primoris Services Corp. | | 13,919 | 232,308 |

| Williams Scotsman Corp. (a)(b) | | 26,620 | 355,111 |

| | | | 780,147 |

| Electrical Equipment - 0.1% | | | |

| Ballard Power Systems, Inc. (a)(b) | | 50,234 | 537,055 |

| Encore Wire Corp. | | 5,310 | 256,420 |

| Sunrun, Inc. (a) | | 27,056 | 451,835 |

| TPI Composites, Inc. (a) | | 10,621 | 220,386 |

| Vicor Corp. (a) | | 5,420 | 330,512 |

| | | | 1,796,208 |

| Industrial Conglomerates - 0.1% | | | |

| Icahn Enterprises LP | | 40,023 | 1,998,348 |

| Raven Industries, Inc. | | 9,109 | 195,388 |

| | | | 2,193,736 |

| Machinery - 0.5% | | | |

| Altra Industrial Motion Corp. | | 14,662 | 454,522 |

| Chart Industries, Inc. (a) | | 8,721 | 342,299 |

| Columbus McKinnon Corp. (NY Shares) | | 6,660 | 202,531 |

| Franklin Electric Co., Inc. | | 9,623 | 488,079 |

| Kornit Digital Ltd. (a) | | 8,400 | 392,700 |

| Lincoln Electric Holdings, Inc. (b) | | 10,002 | 821,864 |

| Middleby Corp. (a) | | 9,099 | 619,642 |

| Nordson Corp. | | 9,842 | 1,853,741 |

| Omega Flex, Inc. (b) | | 3,346 | 342,296 |

| PACCAR, Inc. | | 63,157 | 4,664,776 |

| RBC Bearings, Inc. (a) | | 5,117 | 719,706 |

| Sun Hydraulics Corp. | | 8,236 | 294,602 |

| TriMas Corp. (a) | | 10,847 | 256,532 |

| Woodward, Inc. | | 10,284 | 705,277 |

| | | | 12,158,567 |

| Marine - 0.0% | | | |

| Golden Ocean Group Ltd. (b) | | 48,181 | 148,398 |

| Star Bulk Carriers Corp. (b) | | 27,830 | 141,655 |

| | | | 290,053 |

| Professional Services - 0.5% | | | |

| 51job, Inc. sponsored ADR (a) | | 7,391 | 476,646 |

| CoStar Group, Inc. (a) | | 6,678 | 4,386,110 |

| Exponent, Inc. | | 10,385 | 770,982 |

| Forrester Research, Inc. (a) | | 5,927 | 186,108 |

| Huron Consulting Group, Inc. (a) | | 5,397 | 249,665 |

| ICF International, Inc. | | 4,324 | 283,568 |

| Kelly Services, Inc. Class A (non-vtg.) | | 12,217 | 183,133 |

| Upwork, Inc. (a) | | 24,940 | 310,254 |

| Verisk Analytics, Inc. | | 28,879 | 4,986,826 |

| | | | 11,833,292 |

| Road & Rail - 0.9% | | | |

| AMERCO | | 3,241 | 1,045,223 |

| ArcBest Corp. (b) | | 8,426 | 188,658 |

| Avis Budget Group, Inc. (a)(b) | | 14,278 | 307,405 |

| CSX Corp. | | 137,765 | 9,861,219 |

| Heartland Express, Inc. | | 18,662 | 408,698 |

| J.B. Hunt Transport Services, Inc. | | 18,287 | 2,188,405 |

| Landstar System, Inc. | | 6,246 | 726,160 |

| Lyft, Inc. (a) | | 55,901 | 1,747,465 |

| Marten Transport Ltd. | | 13,256 | 339,221 |

| Old Dominion Freight Lines, Inc. | | 21,445 | 3,669,025 |

| Saia, Inc. (a) | | 5,515 | 598,047 |

| Universal Logistics Holdings, Inc. | | 11,009 | 163,594 |

| Werner Enterprises, Inc. (b) | | 14,321 | 661,917 |

| | | | 21,905,037 |

| Trading Companies & Distributors - 0.2% | | | |

| Beacon Roofing Supply, Inc. (a) | | 12,667 | 311,862 |

| BMC Stock Holdings, Inc. (a) | | 14,894 | 389,776 |

| Fastenal Co. | | 104,660 | 4,318,272 |

| H&E Equipment Services, Inc. | | 8,428 | 144,456 |

| HD Supply Holdings, Inc. (a) | | 29,364 | 931,132 |

| Rush Enterprises, Inc. Class A | | 6,945 | 289,051 |

| | | | 6,384,549 |

|

| TOTAL INDUSTRIALS | | | 87,424,688 |

|

| INFORMATION TECHNOLOGY - 41.9% | | | |

| Communications Equipment - 1.7% | | | |

| Acacia Communications, Inc. (a) | | 8,710 | 587,925 |

| Cisco Systems, Inc. | | 760,030 | 36,344,635 |

| CommScope Holding Co., Inc. (a) | | 43,086 | 444,217 |

| EchoStar Holding Corp. Class A (a) | | 11,669 | 363,606 |

| Ericsson (B Shares) sponsored ADR | | 68,981 | 630,486 |

| F5 Networks, Inc. (a) | | 11,479 | 1,663,537 |

| Infinera Corp. (a) | | 46,687 | 232,501 |

| InterDigital, Inc. | | 7,036 | 386,769 |

| Ituran Location & Control Ltd. | | 9,333 | 159,688 |

| Lumentum Holdings, Inc. (a) | | 14,415 | 1,056,908 |

| NETGEAR, Inc. (a)(b) | | 8,769 | 225,626 |

| NetScout Systems, Inc. (a) | | 16,291 | 447,514 |

| Radware Ltd. (a) | | 11,959 | 284,863 |

| ViaSat, Inc. (a) | | 13,091 | 549,822 |

| Viavi Solutions, Inc. (a) | | 48,144 | 557,989 |

| | | | 43,936,086 |

| Electronic Equipment & Components - 0.8% | | | |

| Avnet, Inc. | | 18,795 | 511,976 |

| CDW Corp. | | 24,887 | 2,760,217 |

| Cognex Corp. (b) | | 32,113 | 1,822,092 |

| Coherent, Inc. (a) | | 4,938 | 717,047 |

| ePlus, Inc. (a) | | 3,466 | 255,479 |

| Flextronics International Ltd. (a) | | 98,550 | 956,921 |

| FLIR Systems, Inc. | | 24,734 | 1,142,711 |

| Hollysys Automation Technologies Ltd. | | 17,162 | 214,353 |

| II-VI, Inc. (a) | | 17,548 | 834,056 |

| Insight Enterprises, Inc. (a) | | 7,567 | 387,884 |

| IPG Photonics Corp. (a) | | 10,073 | 1,565,344 |

| Itron, Inc. (a) | | 8,087 | 520,965 |

| Littelfuse, Inc. | | 4,923 | 799,938 |

| MTS Systems Corp. | | 7,210 | 126,968 |

| National Instruments Corp. | | 25,219 | 976,480 |

| Novanta, Inc. (a) | | 7,124 | 731,706 |

| OSI Systems, Inc. (a) | | 4,237 | 321,037 |

| PC Connection, Inc. | | 6,344 | 274,568 |

| Plexus Corp. (a) | | 6,425 | 412,614 |

| Sanmina Corp. (a) | | 15,211 | 404,765 |

| ScanSource, Inc. (a) | | 6,952 | 171,367 |

| Tech Data Corp. (a) | | 5,953 | 811,037 |

| Trimble, Inc. (a) | | 43,809 | 1,713,808 |

| TTM Technologies, Inc. (a) | | 24,744 | 286,288 |

| Zebra Technologies Corp. Class A (a) | | 9,338 | 2,440,206 |

| | | | 21,159,827 |

| IT Services - 3.7% | | | |

| Akamai Technologies, Inc. (a) | | 29,680 | 3,140,144 |

| Amdocs Ltd. | | 25,374 | 1,579,785 |

| Automatic Data Processing, Inc. | | 77,035 | 11,284,857 |

| Cardtronics PLC (a)(b) | | 10,442 | 252,592 |

| Cass Information Systems, Inc. | | 4,182 | 168,702 |

| Cognizant Technology Solutions Corp. Class A | | 97,099 | 5,146,247 |

| CSG Systems International, Inc. (b) | | 7,567 | 358,297 |

| Euronet Worldwide, Inc. (a) | | 9,063 | 858,538 |

| Exela Technologies, Inc. (a)(b) | | 168,590 | 54,758 |

| ExlService Holdings, Inc. (a) | | 7,228 | 442,137 |

| Fiserv, Inc. (a) | | 121,231 | 12,943,834 |

| GDS Holdings Ltd. ADR (a) | | 19,845 | 1,131,165 |

| Jack Henry & Associates, Inc. | | 14,165 | 2,561,882 |

| ManTech International Corp. Class A | | 5,733 | 445,683 |

| MongoDB, Inc. Class A (a) | | 9,197 | 2,134,716 |

| NIC, Inc. | | 15,647 | 376,467 |

| Okta, Inc. (a) | | 20,573 | 4,023,667 |

| Paychex, Inc. | | 65,288 | 4,719,017 |

| PayPal Holdings, Inc. (a) | | 210,093 | 32,566,516 |

| Perficient, Inc. (a) | | 6,078 | 206,895 |

| QIWI PLC Class B sponsored ADR | | 15,347 | 214,014 |

| Sabre Corp. (b) | | 61,761 | 430,474 |

| StoneCo Ltd. Class A (a)(b) | | 27,288 | 864,484 |

| Sykes Enterprises, Inc. (a) | | 9,917 | 270,337 |

| Ttec Holdings, Inc. | | 10,400 | 440,544 |

| Tucows, Inc. (a)(b) | | 3,235 | 194,326 |

| VeriSign, Inc. (a) | | 20,520 | 4,494,085 |

| Verra Mobility Corp. (a) | | 37,479 | 408,896 |

| Virtusa Corp. (a) | | 7,331 | 220,443 |

| Wix.com Ltd. (a) | | 9,586 | 2,131,255 |

| | | | 94,064,757 |

| Semiconductors & Semiconductor Equipment - 9.7% | | | |

| Advanced Energy Industries, Inc. (a) | | 8,255 | 551,682 |

| Advanced Micro Devices, Inc. (a) | | 208,514 | 11,218,053 |

| Ambarella, Inc. (a) | | 7,189 | 407,904 |

| Amkor Technology, Inc. (a) | | 48,067 | 508,549 |

| Analog Devices, Inc. | | 66,621 | 7,524,842 |

| Applied Materials, Inc. | | 163,315 | 9,175,037 |

| ASML Holding NV | | 12,998 | 4,282,971 |

| Axcelis Technologies, Inc. (a) | | 9,477 | 254,457 |

| Broadcom, Inc. | | 71,472 | 20,817,649 |

| Brooks Automation, Inc. | | 15,088 | 603,067 |

| Cabot Microelectronics Corp. | | 5,890 | 853,225 |

| Canadian Solar, Inc. (a)(b) | | 14,771 | 277,695 |

| Cirrus Logic, Inc. (a) | | 11,604 | 841,058 |

| Cree, Inc. (a)(b) | | 21,068 | 1,110,073 |

| Diodes, Inc. (a) | | 10,763 | 523,512 |

| Enphase Energy, Inc. (a) | | 23,363 | 1,359,493 |

| Entegris, Inc. | | 25,580 | 1,531,730 |

| First Solar, Inc. (a)(b) | | 17,035 | 794,172 |

| FormFactor, Inc. (a) | | 16,830 | 423,611 |

| Intel Corp. | | 766,005 | 48,204,695 |

| KLA-Tencor Corp. | | 28,526 | 5,019,435 |

| Kopin Corp. (a) | | 56,043 | 58,285 |

| Kulicke & Soffa Industries, Inc. | | 14,556 | 325,472 |

| Lam Research Corp. | | 26,293 | 7,195,605 |

| Lattice Semiconductor Corp. (a)(b) | | 27,678 | 688,352 |

| MACOM Technology Solutions Holdings, Inc. (a) | | 14,754 | 468,440 |

| Marvell Technology Group Ltd. | | 123,030 | 4,013,239 |

| Maxim Integrated Products, Inc. | | 49,724 | 2,868,080 |

| Microchip Technology, Inc. | | 43,534 | 4,180,135 |

| Micron Technology, Inc. (a) | | 200,236 | 9,593,307 |

| MKS Instruments, Inc. | | 10,661 | 1,126,121 |

| Monolithic Power Systems, Inc. | | 8,395 | 1,760,851 |

| Nova Measuring Instruments Ltd. (a) | | 6,979 | 332,898 |

| NVIDIA Corp. | | 109,648 | 38,927,233 |

| NXP Semiconductors NV | | 50,854 | 4,887,069 |

| ON Semiconductor Corp. (a) | | 78,812 | 1,299,610 |

| Power Integrations, Inc. | | 6,074 | 658,118 |

| Qorvo, Inc. (a) | | 21,001 | 2,199,645 |

| Qualcomm, Inc. | | 204,331 | 16,526,291 |

| Rambus, Inc. (a) | | 25,215 | 391,841 |

| Semtech Corp. (a) | | 13,557 | 720,961 |

| Silicon Laboratories, Inc. (a) | | 8,591 | 804,633 |

| Silicon Motion Technology Corp. sponsored ADR | | 8,026 | 361,732 |

| Skyworks Solutions, Inc. | | 31,185 | 3,696,670 |

| SolarEdge Technologies, Inc. (a) | | 8,511 | 1,207,711 |

| SunPower Corp. (a)(b) | | 41,020 | 296,164 |

| Synaptics, Inc. (a)(b) | | 7,212 | 459,549 |

| Teradyne, Inc. | | 30,121 | 2,018,709 |

| Texas Instruments, Inc. | | 167,109 | 19,842,523 |

| Tower Semiconductor Ltd. (a) | | 19,991 | 402,019 |

| Universal Display Corp. | | 8,435 | 1,236,571 |

| Xilinx, Inc. | | 43,754 | 4,023,180 |

| | | | 248,853,924 |

| Software - 15.9% | | | |

| 2U, Inc. (a) | | 11,348 | 413,862 |

| ACI Worldwide, Inc. (a) | | 23,065 | 636,133 |

| Adobe, Inc. (a) | | 86,599 | 33,479,173 |

| Alarm.com Holdings, Inc. (a) | | 10,457 | 494,512 |

| Altair Engineering, Inc. Class A (a)(b) | | 8,844 | 345,712 |

| ANSYS, Inc. (a) | | 15,385 | 4,353,955 |

| AppFolio, Inc. (a)(b) | | 3,570 | 565,881 |

| Appian Corp. Class A (a)(b) | | 7,758 | 441,896 |

| Aspen Technology, Inc. (a) | | 12,863 | 1,358,847 |

| Atlassian Corp. PLC (a) | | 21,596 | 4,001,739 |

| Autodesk, Inc. (a) | | 39,707 | 8,353,559 |

| Blackbaud, Inc. | | 10,278 | 602,394 |

| BlackLine, Inc. (a) | | 11,306 | 840,036 |

| Bottomline Technologies, Inc. (a) | | 9,492 | 480,295 |

| Cadence Design Systems, Inc. (a) | | 50,868 | 4,643,740 |

| CDK Global, Inc. | | 23,195 | 911,795 |

| Check Point Software Technologies Ltd. (a) | | 25,366 | 2,781,889 |

| Citrix Systems, Inc. | | 21,409 | 3,171,101 |

| CommVault Systems, Inc. (a) | | 10,263 | 415,241 |

| Cornerstone OnDemand, Inc. (a) | | 12,252 | 473,540 |

| Coupa Software, Inc. (a) | | 11,707 | 2,663,460 |

| Crowdstrike Holdings, Inc. (b) | | 20,362 | 1,787,987 |

| CyberArk Software Ltd. (a) | | 6,590 | 683,910 |

| Datadog, Inc. Class A (a) | | 31,416 | 2,239,018 |

| Descartes Systems Group, Inc. (Canada) (a) | | 16,872 | 804,356 |

| DocuSign, Inc. (a) | | 32,782 | 4,580,957 |

| Dropbox, Inc. Class A (a) | | 42,600 | 961,482 |

| Ebix, Inc. (b) | | 7,714 | 172,871 |

| Everbridge, Inc. (a) | | 6,681 | 977,163 |

| FireEye, Inc. (a) | | 46,977 | 586,273 |

| Five9, Inc. (a) | | 11,843 | 1,234,041 |

| Fortinet, Inc. (a) | | 31,194 | 4,342,205 |

| GTY Govtech, Inc. (a)(b) | | 23,510 | 88,163 |

| Intuit, Inc. | | 46,860 | 13,604,395 |

| j2 Global, Inc. | | 9,559 | 748,470 |

| LivePerson, Inc. (a)(b) | | 13,877 | 519,694 |

| LogMeIn, Inc. | | 7,819 | 663,833 |

| Magic Software Enterprises Ltd. | | 9,210 | 93,666 |

| Manhattan Associates, Inc. (a) | | 12,353 | 1,092,005 |

| Microsoft Corp. | | 1,360,105 | 249,239,218 |

| MicroStrategy, Inc. Class A (a) | | 2,027 | 252,321 |

| Mimecast Ltd. (a) | | 12,709 | 530,982 |

| NICE Systems Ltd. sponsored ADR (a) | | 8,388 | 1,561,342 |

| Nortonlifelock, Inc. | | 111,662 | 2,543,660 |

| Nuance Communications, Inc. (a) | | 50,759 | 1,161,366 |

| Nutanix, Inc. Class A (a) | | 35,568 | 855,766 |

| Open Text Corp. | | 50,057 | 2,079,573 |

| Parametric Technology Corp. (a) | | 21,579 | 1,648,204 |

| Pareteum Corp. (a)(b) | | 176,841 | 77,120 |

| Paylocity Holding Corp. (a) | | 10,117 | 1,315,261 |

| Pegasystems, Inc. | | 15,093 | 1,435,646 |

| Pluralsight, Inc. (a)(b) | | 23,307 | 485,485 |

| Progress Software Corp. | | 9,866 | 398,586 |

| Proofpoint, Inc. (a) | | 10,895 | 1,266,762 |

| Qualys, Inc. (a)(b) | | 7,768 | 895,806 |

| Rapid7, Inc. (a) | | 10,199 | 498,629 |

| RealPage, Inc. (a) | | 15,744 | 1,067,758 |

| Safe-T Group Ltd. ADR (a)(b) | | 52,870 | 69,260 |

| Sapiens International Corp. NV (b) | | 12,306 | 289,437 |

| Splunk, Inc. (a) | | 27,760 | 5,158,918 |

| SPS Commerce, Inc. (a) | | 7,703 | 525,036 |

| SS&C Technologies Holdings, Inc. | | 45,484 | 2,633,296 |

| SurveyMonkey (a) | | 28,840 | 581,126 |

| Synopsys, Inc. (a) | | 27,393 | 4,955,668 |

| Talend SA ADR (a)(b) | | 8,506 | 262,240 |

| Tenable Holdings, Inc. (a) | | 19,634 | 613,955 |

| The Trade Desk, Inc. (a)(b) | | 7,511 | 2,340,127 |

| TiVo Corp. | | 35,000 | 213,150 |

| Varonis Systems, Inc. (a) | | 6,445 | 543,894 |

| Verint Systems, Inc. (a) | | 12,580 | 583,335 |

| Workday, Inc. Class A (a) | | 29,948 | 5,493,362 |

| Zoom Video Communications, Inc. Class A (a) | | 29,927 | 5,371,298 |

| Zscaler, Inc. (a)(b) | | 24,295 | 2,383,097 |

| | | | 405,939,933 |

| Technology Hardware, Storage & Peripherals - 10.1% | | | |

| Apple, Inc. | | 782,446 | 248,770,881 |

| Logitech International SA (b) | | 31,430 | 1,868,199 |

| Nano Dimension Ltd. ADR (a)(b) | | 104,690 | 271,147 |

| NetApp, Inc. | | 41,046 | 1,828,189 |

| Seagate Technology LLC | | 48,255 | 2,559,445 |

| Stratasys Ltd. (a)(b) | | 14,173 | 253,130 |

| Super Micro Computer, Inc. (a) | | 10,491 | 272,346 |

| Western Digital Corp. | | 54,939 | 2,437,643 |

| | | | 258,260,980 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 1,072,215,507 |

|

| MATERIALS - 0.3% | | | |

| Chemicals - 0.1% | | | |

| AgroFresh Solutions, Inc. (a) | | 12,872 | 34,240 |

| Balchem Corp. | | 6,484 | 652,615 |

| Innospec, Inc. | | 5,500 | 423,995 |

| Loop Industries, Inc. (a)(b) | | 7,688 | 65,963 |

| Methanex Corp. | | 17,783 | 288,150 |

| | | | 1,464,963 |

| Containers & Packaging - 0.0% | | | |

| Silgan Holdings, Inc. | | 20,638 | 690,135 |

| Metals & Mining - 0.2% | | | |

| Ferroglobe PLC (a)(b) | | 104,116 | 74,079 |

| Ferroglobe Representation & Warranty Insurance (a)(c) | | 7,187 | 0 |

| Kaiser Aluminum Corp. | | 4,107 | 294,677 |

| Pan American Silver Corp. (b) | | 40,930 | 1,199,249 |

| Royal Gold, Inc. | | 12,364 | 1,646,885 |

| SSR Mining, Inc. (a) | | 26,191 | 503,713 |

| Steel Dynamics, Inc. | | 37,840 | 1,005,030 |

| | | | 4,723,633 |

| Paper & Forest Products - 0.0% | | | |

| Mercer International, Inc. (SBI) | | 22,566 | 182,108 |

|

| TOTAL MATERIALS | | | 7,060,839 |

|

| REAL ESTATE - 1.1% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.0% | | | |

| American Finance Trust, Inc. | | 24,182 | 177,012 |

| Brookfield Property REIT, Inc. Class A (b) | | 11,320 | 117,615 |

| CareTrust (REIT), Inc. | | 20,899 | 389,348 |

| CyrusOne, Inc. | | 19,541 | 1,452,678 |

| Equinix, Inc. | | 15,287 | 10,664,670 |

| Gaming & Leisure Properties | | 40,025 | 1,382,464 |

| Gladstone Commercial Corp. | | 9,533 | 170,831 |

| Government Properties Income Trust | | 10,839 | 274,118 |

| Hospitality Properties Trust (SBI) | | 32,213 | 217,438 |

| Industrial Logistics Properties Trust | | 14,964 | 280,575 |

| Lamar Advertising Co. Class A | | 14,622 | 969,439 |

| Potlatch Corp. | | 14,419 | 490,102 |

| Regency Centers Corp. | | 28,436 | 1,216,776 |

| Retail Opportunity Investments Corp. | | 30,382 | 285,287 |

| Sabra Health Care REIT, Inc. | | 41,440 | 557,782 |

| SBA Communications Corp. Class A | | 19,881 | 6,245,219 |

| Senior Housing Properties Trust (SBI) | | 71,407 | 255,637 |

| Uniti Group, Inc. | | 36,010 | 297,083 |

| | | | 25,444,074 |

| Real Estate Management & Development - 0.1% | | | |

| Brookfield Property Partners LP | | 74,362 | 768,005 |

| Colliers International Group, Inc. | | 7,735 | 399,489 |

| FirstService Corp. | | 8,466 | 790,132 |

| Newmark Group, Inc. | | 29,112 | 123,726 |

| Redfin Corp. (a) | | 15,912 | 477,201 |

| The RMR Group, Inc. | | 5,203 | 140,273 |

| | | | 2,698,826 |

|

| TOTAL REAL ESTATE | | | 28,142,900 |

|

| UTILITIES - 0.7% | | | |

| Electric Utilities - 0.6% | | | |

| Alliant Energy Corp. | | 45,569 | 2,249,286 |

| Exelon Corp. | | 175,518 | 6,724,095 |

| MGE Energy, Inc. | | 7,236 | 491,252 |

| Otter Tail Corp. | | 8,658 | 371,515 |

| Xcel Energy, Inc. | | 93,023 | 6,049,286 |

| | | | 15,885,434 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Atlantica Sustainable Infrastr (b) | | 19,978 | 523,424 |

| Terraform Power, Inc. | | 45,055 | 828,111 |

| | | | 1,351,535 |

| Water Utilities - 0.0% | | | |

| Middlesex Water Co. (b) | | 4,453 | 302,181 |

|

| TOTAL UTILITIES | | | 17,539,150 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $1,734,601,587) | | | 2,553,339,802 |

|

| Money Market Funds - 3.2% | | | |

| Fidelity Cash Central Fund 0.11% (d) | | 4,854,069 | 4,855,040 |

| Fidelity Securities Lending Cash Central Fund 0.10% (d)(e) | | 76,965,721 | 76,973,418 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $81,826,255) | | | 81,828,458 |

| TOTAL INVESTMENT IN SECURITIES - 102.9% | | | |

| (Cost $1,816,427,842) | | | 2,635,168,260 |

| NET OTHER ASSETS (LIABILITIES) - (2.9)% | | | (73,562,474) |

| NET ASSETS - 100% | | | $2,561,605,786 |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount | Value | Unrealized Appreciation/(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini NASDAQ 100 Index Contracts (United States) | 44 | June 2020 | $8,413,020 | $1,547,476 | $1,547,476 |

The notional amount of futures purchased as a percentage of Net Assets is 0.3%

For the period, the average monthly notional amount at value for futures contracts in the aggregate was $134,872,707.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Level 3 security

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $1,144,903 |

| Fidelity Securities Lending Cash Central Fund | 687,426 |

| Total | $1,832,329 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of May 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $452,183,473 | $452,183,473 | $-- | $-- |

| Consumer Discretionary | 387,653,793 | 387,653,793 | -- | -- |

| Consumer Staples | 104,637,153 | 104,637,153 | -- | -- |

| Energy | 4,575,428 | 4,575,428 | -- | -- |

| Financials | 111,771,952 | 111,771,952 | -- | -- |

| Health Care | 280,134,919 | 280,088,492 | -- | 46,427 |

| Industrials | 87,424,688 | 87,424,688 | -- | -- |

| Information Technology | 1,072,215,507 | 1,072,215,507 | -- | -- |