UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule14A-6(E)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

NEW ENGLAND BUSINESS SERVICE, INC.

(Name of Registrant as Specified In Its Certificate)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

NEW ENGLAND BUSINESS SERVICE, INC.

Notice of Annual Meeting of Stockholders

To Be Held October 25, 2002

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of New England Business Service, Inc., a Delaware corporation (the “Company”), will be held at the principal executive offices of the Company, 500 Main Street, Groton, Massachusetts, on Friday, October 25, 2002 at 11:00 a.m., local time, for the purpose of considering and voting upon the following matters:

| | 1. | | To fix the number of directors and elect a Board of Directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified; |

| | 2. | | To approve the NEBS 2002 Equity Incentive Plan; |

| | 3. | | To ratify the selection of Deloitte & Touche LLP as independent auditors of the Company for the fiscal year ending June 28, 2003; and |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on August 30, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at this meeting. Accordingly, only stockholders of record at the close of business on that date are entitled to vote at the meeting or at any adjournment thereof.

A copy of the Company’s annual report to stockholders for the fiscal year ended June 29, 2002, which contains financial statements and other information of interest to stockholders, accompanies this notice and the accompanying proxy statement.

The business matters listed above are discussed more fully in the accompanying proxy statement. Whether or not you plan to attend the meeting, you are urged to study the proxy statement carefully and then to fill out, sign and date the enclosed proxy card. Record holders may also vote by telephone or through the Internet by following the instructions printed on the enclosed proxy card.

By order of the Board of Directors

CRAIG BARROWS

Secretary

September 20, 2002

Whether or not you plan to attend the meeting, you are requested to sign and mail promptly the enclosed proxy which is being solicited on behalf of the Board of Directors. A return envelope which requires no postage if mailed in the United States is enclosed for that purpose.

NEW ENGLAND BUSINESS SERVICE, INC.

500 Main Street

Groton, Massachusetts 01471

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held October 25, 2002

We are mailing this proxy statement, with the accompanying proxy card, to you on September 20, 2002 in connection with the solicitation of proxies by the Board of Directors of New England Business Service, Inc. for the 2002 annual meeting of stockholders and any adjournment of that meeting. The meeting will be held on Friday, October 25, 2002, beginning at 11:00 a.m., local time, at the principal executive offices of the Company, 500 Main Street, Groton, Massachusetts.

INFORMATION ABOUT VOTING

Who can attend and vote at the meeting?

Stockholders of record at the close of business on August 30, 2002 are entitled to attend and vote at the meeting. Each share of the Company’s common stock is entitled to one vote on all matters to be voted on at the meeting, and can be voted only if the record owner is present to vote or is represented by proxy. The proxy card provided with this proxy statement indicates the number of shares of the Company’s common stock that you own and are entitled to vote at the meeting.

What constitutes a quorum at the meeting?

The presence at the meeting, in person or represented by proxy, of the holders of a majority of the common stock outstanding on August 30, 2002, the record date, will constitute a quorum for purposes of the meeting. On the record date, 13,086,983 shares of common stock were outstanding. For purposes of determining whether a quorum exists, proxies received but marked “withhold” or “abstain” and so-called “broker non-votes” (described below) will be counted as present.

How do I vote by proxy?

If you properly fill in your proxy card and our transfer agent receives it in time to vote at the meeting, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. No postage is required if your proxy card is mailed in the United States in the return envelope that has been enclosed with this proxy statement.

1

If you sign, date and return the proxy card but do not specify how your shares are to be voted, then your proxy will vote your shares as follows:

| | · | | To fix the number of directors at ten and to elect the persons named below under “Election of Directors”. |

| | · | | To approve the NEBS 2002 Equity Incentive Plan. |

| | · | | To ratify the selection of Deloitte & Touche LLP as independent auditors for fiscal year 2003. |

| | · | | In their discretion as to any other business which may properly come before the meeting. |

Can I vote by telephone or through the Internet?

If you hold your shares in your own name, you may vote by telephone or through the Internet by following the instructions printed on your proxy card.

How do I vote if my shares are held by my broker?

If your shares are held by your broker in “street name”, you will need to instruct your broker concerning how to vote your shares in the manner provided by your broker.

What discretion does my broker have to vote my shares held in “street name”?

A broker holding your shares in “street name” must vote those shares according to any specific instructions it receives from you. If specific instructions are not received, your broker generally may vote your shares in its discretion, depending on the type of proposal involved. Under NYSE rules, there are certain matters on which brokers may not vote without specific instructions from you. If such a matter comes to a vote at the meeting, your shares will not be voted on that matter, giving rise to what is called a “broker non-vote”. Shares represented by broker non-votes will be counted for purposes of determining the existence of a quorum. Pursuant to NYSE rules, brokers do not have discretion to vote your shares on the proposal to approve the NEBS 2002 Equity Incentive Plan without specific instructions from you, and your failure to instruct your broker how to vote on this proposal will result in a broker non-vote.

Can I change my vote after I return my proxy card?

Yes. You may change your vote at any time before your proxy is exercised. To change your vote, you may:

| | · | | Deliver to our corporate secretary a written notice revoking your earlier vote; or |

| | · | | Deliver to our transfer agent a properly completed and signed proxy card with a later date; or |

| | · | | Vote again by telephone or through the Internet; or |

| | · | | Vote in person at the meeting. |

Your attendance at the meeting will not be deemed to revoke a previously-delivered proxy unless you clearly indicate at the meeting that you intend to revoke your proxy and vote in person.

2

How do I vote my 401(k) shares?

If you participate in the Company’s 401(k) plan, you will receive a proxy card that covers Company shares allocated to your account. Properly completed and signed proxy cards will serve to instruct the plan trustee on how to vote any shares allocated to your account. The plan trustee will vote all shares as to which no instructions have been received from plan participants as directed by the Company’s retirement committee in their best judgment.

How are votes counted?

| | · | | Election of directors. Assuming that the number of directors is fixed at ten, the ten nominees who receive the highest number of “For” votes will be elected. If you do not vote for a particular nominee, or you withhold authority for one or all nominees, your vote will have no effect on the outcome of the election. |

| | · | | Other business. The approval of the NEBS 2002 Equity Incentive Plan, ratification of selection of independent auditors and approval of all other business which may properly come before the meeting require the favorable vote of a majority of the votes cast on the matter. Pursuant to NYSE rules, the total vote cast on the proposal to approve the NEBS 2002 Equity Incentive Plan must represent a majority of the outstanding shares of common stock. Abstentions and broker non-votes, which are described above, will have no effect on the outcome of voting on these matters, except that abstentions and broker non-votes will not be counted in determining whether holders of a majority of the outstanding shares have cast votes on the proposal to approve the NEBS 2002 Equity Incentive Plan. |

How is the Company soliciting proxies?

We bear the cost of preparing, assembling and mailing the proxy material relating to the solicitation of proxies by the Board of Directors for the meeting. In addition to the use of the mails, certain of our officers and regular employees may, without additional compensation, solicit proxies in person, by telephone or other means of communication. We will also request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy material to those persons for whom they hold shares, and will reimburse those record holders for their reasonable expenses in transmitting this material. In addition, we have engaged the services of Georgeson Shareholder Communications Inc. to assist in the solicitation of proxies for a fee of $15,000, plus reimbursement of reasonable out-of-pocket expenses.

3

VOTING SECURITIES

Who owns more than 5% of the Company’s stock?

On August 30, 2002, there were 13,086,983 shares of common stock outstanding. On that date, to our knowledge there were six stockholders who owned beneficially more than 5% of the common stock. The table below contains information, as of that date (except as noted below), regarding the beneficial ownership of these persons or entities. Unless otherwise indicated, we believe that each of the persons or entities listed below has sole voting and investing power with respect to all the shares of common stock indicated.

Name and Address of Beneficial Owner

| | Number of Shares Beneficially Owned

| | | Percent

|

| T. Rowe Price Associates, Inc. | | 1,397,300 | (1) | | 10.68 |

| 100 E. Pratt Street | | | | | |

| Baltimore, MD 21202 | | | | | |

| Fenimore Asset Management, Inc. | | 1,292,447 | (2) | | 9.88 |

| 384 North Grand Street | | | | | |

| Cobleskill, NY 12043 | | | | | |

| Royce & Associates, LLC | | 998,100 | (3) | | 7.63 |

| 1414 Avenue of the Americas | | | | | |

| New York, NY 10019 | | | | | |

| FMR Corp. | | 990,800 | (4) | | 7.57 |

| 82 Devonshire Street | | | | | |

| Boston, MA 02109 | | | | | |

| David L. Babson & Company Inc. | | 666,300 | (5) | | 5.09 |

| 1 Memorial Drive | | | | | |

| Cambridge, MA 02142 | | | | | |

| Robert J. Murray | | 820,215 | (6) | | 6.03 |

| c/o New England Business Service, Inc. | | | | | |

| 500 Main Street | | | | | |

| Groton, MA 01471 | | | | | |

| (1) | | Information is based on Form 13F dated August 13, 2002, filed with the SEC by T. Rowe Price Associates, Inc. for the period ended June 30, 2002. |

| (2) | | Information is based on a Form 13F dated July 24, 2002, filed with the SEC by Fenimore Asset Management, Inc. for the period ended June 30, 2002. |

| (3) | | Information is based on a Form 13F dated August 8, 2002, filed with the SEC by Royce & Associates, LLC for the period ended June 30, 2002. |

| (4) | | Information is based on a Form 13F dated August 14, 2002, filed with the SEC by FMR Corp. for the period ended June 30, 2002. |

| (5) | | Information is based on a Form 13F dated August 13, 2002, filed with the SEC by David L. Babson & Company Inc. for the period ended June 30, 2002. |

| (6) | | Includes (a) 278,993 shares owned jointly by Mr. Murray and his wife (as to which Mr. Murray shares voting and investment power); (b) 524,778 shares which may be acquired within 60 days of August 30, |

4

| | 2002 through the exercise of stock options; (c) 10,196 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Murray has sole voting power, but no investment power); and (d) 6,248 equivalent shares allocated to his account in the Company’s 401(k) plan. |

How much stock do the Company’s directors and executive officers own?

On August 30, 2002, the directors and nominees, the executive officers of the Company named in the summary compensation table below, and all of the directors and executive officers of the Company as a group beneficially owned the number of shares of common stock shown below:

Name of Beneficial Owner

| | Number of Shares Beneficially Owned(1)

| | Percent(1)

|

| William T. End(2) | | 6,292 | | * |

| Neil S. Fox(3) | | 5,802 | | * |

| Robert L. Gable(4) | | 23,928 | | * |

| Thomas J. May(5) | | 7,638 | | * |

| Herbert W. Moller(6) | | 14,028 | | * |

| Robert J. Murray(7) | | 820,215 | | 6.03 |

| Joseph R. Ramrath(8) | | 2,670 | | * |

| Richard T. Riley(9) | | 81,068 | | * |

| Brian E. Stern(10) | | 10,061 | | * |

| M. Anne Szostak(11) | | 8,638 | | * |

| George P. Allman(12) | | 135,172 | | 1.02 |

| Daniel M. Junius(13) | | 66,012 | | * |

| Robert D. Warren(14) | | 119,050 | | * |

| All directors and executive officers as a group (18 persons)(15) | | 1,633,117 | | 11.49 |

| (1) | | The number and percent of the shares of common stock with respect to each named beneficial owner are calculated by assuming that all shares which may be acquired by such person within 60 days of August 30, 2002 are outstanding. |

| (2) | | Includes (a) 3,292 shares owned by Mr. End individually; and (b) 3,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options. |

| (3) | | Includes (a) 1,802 shares owned jointly by Mr. Fox and his wife (as to which Mr. Fox shares voting and investment power); and (b) 4,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options. |

| (4) | | Includes (a) 13,928 shares owned by Mr. Gable individually; (b) 7,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; and (c) 3,000 shares owned by Mr. Gable’s wife individually, as to which Mr. Gable disclaims beneficial ownership. |

| (5) | | Includes (a) 3,638 shares owned by Mr. May individually; and (b) 4,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options. |

| (6) | | Includes (a) 1,000 shares owned by Mr. Moller individually; (b) 6,028 shares owned jointly by Mr. Moller and his wife (as to which Mr. Moller shares voting and investment power); and (c) 7,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options. |

5

| (7) | | Includes (a) 278,993 shares owned jointly by Mr. Murray and his wife (as to which Mr. Murray shares voting and investment power); (b) 524,778 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; (c) 10,196 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Murray has sole voting power, but no investment power); and (d) 6,248 equivalent shares allocated to his account in the Company’s 401(k) plan. |

| (8) | | Includes 2,670 shares owned by Mr. Ramrath and his wife (as to which Mr. Ramrath shares voting and investment power). |

| (9) | | Includes (a) 8,483 shares owned by Mr. Riley individually; (b) 65,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; (c) 6,814 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Riley has sole voting power, but no investment power); and (d) 771 equivalent shares allocated to his account in the Company’s 401(k) plan. |

| (10) | | Includes (a) 1,638 shares owned by Mr. Stern individually; (b) 5,000 shares which may be exercised within 60 days of August 30, 2002 through the exercise of stock options; and (c) 3,423 shares owned by Mr. Stern’s wife individually, as to which Mr. Stern disclaims beneficial ownership. |

| (11) | | Includes (a) 2,128 shares owned by Ms. Szostak individually; (b) 1,510 shares owned jointly by Ms. Szostak and her husband (as to which Ms. Szostak shares voting and investment power); and (c) 5,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options. |

| (12) | | Includes (a) 4,218 shares owned by Mr. Allman individually; (b) 16,777 shares owned by a family trust of which Mr. Allman is a co-trustee (as to which Mr. Allman shares voting and investment power); (c) 105,278 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; (d) 5,746 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Allman has sole voting power, but no investment power); and (e) 3,153 equivalent shares allocated to his account in the Company’s 401(k) plan. |

| (13) | | Includes 3,317 shares owned by Mr. Junius individually; (b) 55,000 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options, (c) 5,664 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Junius has sole voting power, but no investment power), and (d) 2,031 equivalent shares allocated to his account in the Company’s 401(k) plan. |

| (14) | | Includes (a) 850 shares owned by Mr. Warren individually; (b) 5,000 shares owned jointly by Mr. Warren and his wife (as to which Mr. Warren shares voting and investment power); (c) 103,628 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; (d) 6,258 restricted shares awarded under the Company’s Stock Compensation Plan (as to which Mr. Warren has sole voting power, but no investment power); and (e) 3,314 equivalent shares allocated to his account in the Company’s 401(k) plan. |

| (15) | | Includes (a) 75,975 shares owned by directors and executive officers individually; (b) 348,781 shares owned jointly by directors and executive officers and their respective spouses (including family trusts); (c) 1,122,045 shares which may be acquired within 60 days of August 30, 2002 through the exercise of stock options; (d) 52,108 restricted shares awarded to the executive officers under the Company’s Stock Compensation Plan (as to which each has sole voting power, but no investment power); (e) 27,785 equivalent shares allocated to the accounts of the executive officers under the Company’s 401(k) plan; and (f) 6,423 shares owned individually by spouses of directors and executive officers, as to which the directors and executive officers disclaim beneficial ownership. |

6

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, the directors and executive officers of the Company, and certain persons who own more than 10% of the common stock, are required to report their ownership of the common stock and changes in that ownership to the SEC and the NYSE. Specific due dates for these reports have been established, and we are required to report in this proxy statement any failure to file by these dates during the Company’s fiscal year 2002.

Based solely on our review of copies of the reports we have received, or written representations from certain reporting persons, we believe that, during the Company’s fiscal year 2002, all of these reporting requirements were timely satisfied by our directors, executive officers and 10% holders, except as follows. Mr. Ramrath’s Form 3 filing on October 26, 2001 failed to include 18 shares acquired in August 2001 pursuant to a broker-sponsored dividend reinvestment program, and a Form 4 reporting the purchase by Mr. Ramrath of an additional 23 shares in November 2001 pursuant to the same dividend reinvestment program was filed late on February 11, 2002. Form 4’s reporting the purchase by Mr. Riley of 84 shares in May 2001 and 76 shares in August 2001 pursuant to a broker-sponsored dividend reinvestment plan were filed late on December 10, 2001.

7

PROPOSAL ONE

ELECTION OF DIRECTORS

Who sits on the Company’s Board of Directors?

The Company’s by-laws provide for a Board of Directors of not fewer than three nor more than ten directors. The Board of Directors currently consists of nine members.

You are being asked to fix the number of directors for the next year at ten and to vote for all ten directors at the meeting. The Board is nominating all nine current directors for re-election, and is nominating Richard T. Riley, who is not currently a director, for election at the meeting. Persons elected as directors at the meeting will hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified, subject to their prior death, resignation or removal.

All of the nominees other than Mr. Riley were most recently elected as directors at the 2001 annual meeting of stockholders. We have no reason to believe that any of the nominees will be unavailable to serve if elected. However, if any one of them becomes unavailable, the persons named as proxies in the accompanying proxy card have discretionary authority to vote for a substitute chosen by the Board. Any vacancies not filled at the meeting may be filled by the Board.

Information About the Nominees

William T. End, age 54, has been a director of the Company since 2000. Mr. End was Executive Chairman of the Board of Cornerstone Brands, Inc., a catalog retailer, from 2001 to his retirement in August 2002. Prior to that he was Chairman and Chief Executive Officer of Cornerstone Brands, Inc. from 1995 to 2001. Prior to that he was President and Chief Executive Officer of Lands’ End, Inc., a catalog retailer, from 1993 to 1995. Mr. End is a director of IDEXX Laboratories, Inc.

Neil S. Fox, age 62, has been a director of the Company since 1999. Mr. Fox has been Chairman and Chief Executive Officer of Neil Fox Consultancy, which provides consulting services in the field of database and direct response marketing, since 2000. Prior to that he was Chairman and Chief Executive Officer of Lowe Fox Pavlika, a marketing consulting firm affiliated with the Interpublic Group of Companies, from 1998 to 2000. Prior to that he was Chairman of Fox Pavlika & Partners for more than five years. Mr. Fox is also Managing Director of Punchline Networks Inc., a customer relationship management services firm that he founded in July 2002.

Robert L. Gable, age 71, has been a director of the Company since 1996. Mr. Gable was Chairman of Unitrode Corporation, a supplier of electronic components and sub-systems, from 1990 until his retirement in 1998, and was Chief Executive Officer of Unitrode from 1990 to 1997. Mr. Gable is a director of Ibis Technology Corporation.

Thomas J. May, age 55, has been a director of the Company since 1999. Mr. May has been Chairman and Chief Executive Officer of NSTAR, an energy utility holding company formed in connection with the combination of BEC Energy and Commonwealth Energy Systems, and its principal operating subsidiaries since 1999. Prior to that he was Chairman and Chief Executive Officer of BEC Energy, an energy utility holding company, and its principal operating subsidiaries from 1998 to 1999. He has been Chairman and Chief Executive

8

Officer of Boston Edison Company, a regulated public utility company, since 1994, and was President of Boston Edison from 1994 to 1999. Mr. May is a trustee of NSTAR and a director of FleetBoston Financial Corporation and RCN Corporation.

Herbert W. Moller, age 61, has been a director of the Company since 1996. Mr. Moller retired from The Gillette Company, a diversified consumer products company, in 1998, having been with Gillette for 32 years. Mr. Moller served in a variety of capacities during his career at Gillette, and during the six years immediately preceding his retirement, he was Vice President, Finance and Strategic Planning, Gillette North Atlantic Group.

Robert J. Murray, age 61, has been a director of the Company since 1991. Mr. Murray has served as Chairman of the Board and Chief Executive Officer of the Company since 1995. From 1995 to July 31, 2002 he also served as President of the Company. Mr. Murray retired from The Gillette Company in 1995, having been with Gillette for more than 34 years. Mr. Murray served in a variety of capacities during his career at Gillette, and during the four years immediately preceding to his retirement, he was Executive Vice President, North Atlantic Group of Gillette. Mr. Murray is a director of LoJack Corporation, Allmerica Financial Corporation and the Delhaize Group.

Joseph R. Ramrath, age 45, has been a director of the Company since 2001. Mr. Ramrath has been a Managing Director of Colchester Partners LLC, an investment banking and strategic advisory firm, since April 2002. Prior to that he was Executive Vice President and Chief Legal Officer of the United Asset Management division of Old Mutual plc, an international financial services firm headquartered in London, England, from 2000 to 2002. Prior to that he was Senior Vice President, General Counsel and Secretary of United Asset Management Corporation from 1996 until its acquisition by Old Mutual in 2000.

Richard T. Riley, age 46, has served as President and Chief Operating Officer of the Company since August 1, 2002. Prior to that, he served as a Senior Vice President of the Company from 1998 to July 31, 2002, and as President—NEBS Direct Marketing from 2001 to July 31, 2002, as President—Integrated Marketing Services from 2000 to 2001, and as President—RapidForms from 1998 to 2000. He served as President of Rapidforms, Inc. from 1992 to 2001, and during 1998 he held the additional office of Vice President of the Company.

Brian E. Stern, age 54, has been a director of the Company since 1995. Mr. Stern has been Senior Vice President of Xerox Corporation, a provider of document processing products and services, and President of the Xerox Supplies Business Group since 2001. Prior to that he was Senior Vice President and President of Xerox Technology Enterprises from 1999 to 2001, and Senior Vice President and President of the Office Document Products Group of Xerox from 1994 to 1999. Mr. Stern is a director of HON Industries, Inc.

M. Anne Szostak, age 52, has been a director of the Company since 1998. Ms. Szostak has been Executive Vice President and Corporate Director of Human Resources and Diversity of FleetBoston Financial Corporation, a diversified financial services company, since 1998. In addition, Ms. Szostak has served as Chairman and Chief Executive Officer of Fleet Rhode Island since 2001. From 1994 to 1998, Ms. Szostak was Senior Vice President and Corporate Director of Human Resources of Fleet. Ms. Szostak is a director of Tupperware Corporation.

What committees has the Board established?

The Board of Directors has standing Audit, Organization and Compensation, Nominating, and Executive Committees.

9

The Audit Committee recommends the selection of the Company’s outside auditors, and provides a means of communication among the outside auditors, internal audit department, management and the Board. In addition, the Committee reviews the Company’s audited financial statements with the outside auditors and with management, and reports to the Board its assessment of the quality and performance of the Company’s internal auditors and outside auditors, the independence of the outside auditors, and the adequacy of the Company’s financial controls. During fiscal year 2002, members of the Committee were Messrs. End, May, Moller (chairman) and Ramrath. At the annual meeting of the Board held on October 26, 2001, Mr. Ramrath was appointed to the Committee in place of Mr. End. The Committee met five times during the last fiscal year.

The Organization and Compensation Committee reviews and makes recommendations to the Board concerning the election of officers and the compensation of the officers and directors. In addition, the Committee administers and grants awards under the Company’s Stock Compensation Plan and stock option plans. During fiscal year 2002, members of the Committee were Messrs. End, Gable (chairman) and May. The Committee met three times during the last fiscal year.

The Nominating Committee recommends to the Board persons to be nominated for election as directors by the stockholders at the annual meeting of stockholders or by the Board to fill vacancies. During fiscal year 2002, members of the Committee were Messrs. Fox and Stern and Ms. Szostak (chairman). The Committee recommended the persons nominated for election as directors by the stockholders at the 2002 annual meeting of stockholders.

The Executive Committee may exercise all of the authority of the Board, except those powers that are expressly reserved to the Board by law, the Company’s charter or by-laws or resolution of the Board. During fiscal year 2002, members of the Committee were Messrs. Gable, Moller and Murray (chairman) and Ms. Szostak and, prior to October 26, 2001, former director Benjamin H. Lacy, who retired from the Board at the 2001 annual meeting of stockholders. The Committee met or acted by unanimous written consent six times during the last fiscal year.

How often did the Board meet in fiscal year 2002?

The Board of Directors met five times during the last fiscal year. All of the directors attended at least 75% of the meetings of the Board of Directors and committees of the Board on which they served.

How are the directors compensated?

Directors who are also employees of the Company receive no additional compensation for serving on the Board or its committees.

Non-employee directors receive as compensation for all services as directors an annual retainer of $22,000, plus $1,000 for each Board meeting and each committee meeting (not held on the same day as a Board meeting) which they attend. The annual retainer is paid 50% in cash and 50% in shares of common stock in accordance with the Company’s Stock Compensation Plan. Each chairman of a committee (other than Mr. Murray) receives an additional annual fee of $3,000.

10

Under the terms of the NEBS 1997 Key Employee and Eligible Director Stock Option and Stock Appreciation Rights Plan, each non-employee director is annually granted on the tenth day following his or her election at the annual meeting of stockholders an option to purchase 1,000 shares of common stock. In the case of the first annual meeting of stockholders at which a non-employee director is elected, the option grant to that director is for 3,000 shares. Each of these option grants becomes exercisable one year after the date of grant, and expires ten years after the date of grant. If the NEBS 2002 Equity Incentive Plan is approved by stockholders at the meeting, the annual option grant to non-employee directors will be increased from 1,000 to 3,000 shares, and the initial option grant to non-employee directors will be increased from 3,000 to 5,000 shares.

Non-employee directors may defer receipt of their cash fees and retainers pursuant to a deferral plan. Deferred amounts are generally paid to the director beginning on the first day of the first fiscal year beginning after the director’s 70th birthday, and may be paid in a lump sum at that time or in quarterly installments over a period not to exceed ten years. Interest is credited to each participating director’s account quarterly at the so-called “prime rate” of interest of Fleet National Bank on the last preceding June 30th and December 31st. None of the current directors has elected to defer payments as described above.

11

EXECUTIVE COMPENSATION

How were the executive officers compensated for fiscal year 2002?

The following table sets forth all compensation paid by the Company to the Chief Executive Officer and each of the other four most highly compensated executive officers of the Company, who are collectively referred to as the “named executive officers”, in all capacities for the last three fiscal years.

Summary Compensation Table

| | | | | Annual Compensation

| | Long-Term Compensation Awards(1)

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus(2)

| | Other Annual Compensation(3)

| | Restricted Stock Awards(4)

| | Securities Underlying Options(#)

| | All Other Compensation(5)

|

| Robert J. Murray | | 2002 | | $ | 500,000 | | $ | 94,015 | | $ | 85,169 | | $ | 181,309 | | — | | $ | 17,819 |

| Chairman, President and CEO | | 2001 | | | 500,000 | | | — | | | 70,309 | | | — | | 80,000 | | | 18,655 |

| | | 2000 | | | 500,000 | | | 113,988 | | | 40,742 | | | 37,993 | | 25,000 | | | 10,590 |

|

| George P. Allman | | 2002 | | | 230,000 | | | 41,688 | | | — | | | 113,870 | | — | | | 16,953 |

| Senior Vice President, | | 2001 | | | 210,000 | | | — | | | — | | | — | | 30,000 | | | 14,759 |

| President—Diversified Operations | | 2000 | | | 185,000 | | | 34,113 | | | — | | | 11,350 | | 10,000 | | | 10,333 |

|

| Daniel M. Junius | | 2002 | | | 206,667 | | | 33,856 | | | — | | | 111,261 | | — | | | 11,177 |

| Senior Vice President, Chief | | 2001 | | | 195,000 | | | — | | | — | | | — | | 30,000 | | | 11,729 |

| Financial Officer and Treasurer | | 2000 | | | 181,667 | | | 36,165 | | | — | | | 12,035 | | 10,000 | | | 10,319 |

|

| Richard T. Riley | | 2002 | | | 275,000 | | | 76,739 | | | — | | | 125,578 | | — | | | 74,062 |

| Senior Vice President, | | 2001 | | | 210,000 | | | — | | | — | | | — | | 30,000 | | | 11,267 |

| President—NEBS Direct Marketing | | 2000 | | | 200,000 | | | 64,814 | | | — | | | 21,601 | | 10,000 | | | 11,300 |

|

| Robert D. Warren | | 2002 | | | 196,667 | | | 52,907 | | | — | | | 117,617 | | — | | | 16,394 |

| Senior Vice President, | | 2001 | | | 185,000 | | | — | | | — | | | — | | 30,000 | | | 10,343 |

| President—International | | 2000 | | | 171,250 | | | 53,656 | | | — | | | 17,866 | | 9,000 | | | 10,280 |

| (1) | | The Company has not issued stock appreciation rights. In addition, the Company does not maintain a “long-term incentive plan,” as that term is defined by applicable rules. Securities underlying options are shares of the Company’s common stock. |

| (2) | | For fiscal years 2000 and 2002, 25% of the annual executive bonus for each named executive officer was paid in the form of restricted shares in lieu of cash. The dollar value of these restricted shares is excluded from the amounts reported in this column, and is included under the column heading “Restricted Stock Awards”. |

| (3) | | The amounts reported include certain occupancy expenses associated with Mr. Murray’s residence in Boston, Massachusetts that were paid directly by the Company, and the value of the Company’s reimbursement to Mr. Murray for his tax liability arising from the Company’s payment of such expenses. For fiscal year 2002, such amounts were $61,627 and $23,542, respectively. |

12

| (4) | | The amounts reported include the value of restricted shares that were awarded to each named executive officer under the Company’s Stock Compensation Plan in lieu of cash as part of his annual executive bonus for the years shown. For fiscal year 2002, the value of such awards was $31,309, $13,870, $11,261, $25,578 and $17,617 for Messrs. Murray, Allman, Junius, Riley and Warren, respectively. These awards vest on the third anniversary of the date of grant, except that such awards will vest immediately in case of the holder’s death, disability or retirement, or a change in control of the Company. |

The amounts reported also include the value of payments to each named executive officer under the 2002 performance restricted stock bonus plan that were made in the form of restricted shares issued under the Company’s Stock Compensation Plan. The value of such awards was $150,000 for Mr. Murray and $100,000 for each of the other named executive officers. These awards vest in accordance with the following schedule: 15% on the date of the first annual meeting of stockholders following the date of grant; an additional 35% on the date of the second annual meeting of stockholders following the date of grant; and the remaining 50% on the date of the third annual meeting of stockholders following the date of grant, except that such awards will vest immediately in the case of the holder’s death, disability or retirement, or a change in control of the Company.

Dividends are payable on unvested awards to the same extent as they are paid on the common stock generally, except that such dividend payments are automatically reinvested in shares of common stock, and the additional shares are subject to the same restrictions that are applicable to the underlying restricted shares.

As of June 29, 2002, each of the named executive officers held the following number of unvested shares of restricted stock having the corresponding fiscal year-end values, based on the closing price ($25.14) of the common stock on June 28, 2002, the last trading day of fiscal year 2002:

Name

| | Number of Shares

| | Value at Fiscal Year End

|

| Robert J. Murray | | 3,703 | | $ | 93,093 |

| George P. Allman | | 1,715 | | | 43,115 |

| Daniel M. Junius | | 945 | | | 23,757 |

| Richard T. Riley | | 1,448 | | | 36,403 |

| Robert D. Warren | | 1,433 | | | 36,025 |

| (5) | | The table below presents the components of this column for fiscal year 2002, which represent (a) the value of Company contributions to the account of each named executive officer pursuant to the terms of the Company’s 401(k) plan, (b) the value of premiums paid by the Company on group term life insurance for the benefit of the named executive officers, and (c) in the case of Mr. Riley, the portion of the principal on the Company’s outstanding unsecured loan to Mr. Riley that was forgiven by the Company during fiscal year 2002. The terms of this loan are described elsewhere in this proxy statement under the heading “Employment Agreements; Change in Control Agreements”. |

Name

| | 401(k) Plan Contribution

| | Group Term Life Insurance Premium

| | Forgiven Principal on Unsecured Loan

|

| Robert J. Murray | | $ | 17,000 | | $ | 819 | | | — |

| George P. Allman | | | 16,200 | | | 753 | | | — |

| Daniel M. Junius | | | 10,500 | | | 677 | | | — |

| Richard T. Riley | | | 13,243 | | | 819 | | $ | 60,000 |

| Robert D. Warren | | | 15,750 | | | 644 | | | — |

13

Stock Option Plan

No stock options were granted to any of the named executive officers during the Company’s last fiscal year.

As indicated in the following table, none of the named executive officers exercised stock options during the last fiscal year. In addition, the table includes the number of shares underlying both exercisable and unexercisable stock options at the end of the last fiscal year. The table also shows the value of “in-the-money” options, which represents the positive spread, if any, between the exercise prices of stock options held by each named executive officer and the closing price ($25.14) of the common stock on June 28, 2002, the last trading day of fiscal year 2002.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year End Option Values

| | | Number of Shares Acquired at Exercise

| | Value Realized

| | Number of Unexercised Options at Fiscal Year End

| | Value of Unexercised In-the-Money Options at Fiscal Year End

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Robert J. Murray | | — | | — | | 486,028 | | 80,000 | | $ | 2,319,013 | | $ | 273,950 |

| George P. Allman | | — | | — | | 91,528 | | 23,750 | | | 251,167 | | | 63,975 |

| Daniel M. Junius | | — | | — | | 38,750 | | 26,250 | | | 63,975 | | | 63,975 |

| Richard T. Riley | | — | | — | | 51,250 | | 23,750 | | | 63,975 | | | 63,975 |

| Robert D. Warren | | — | | — | | 90,378 | | 23,000 | | | 247,417 | | | 63,975 |

Stock Compensation Plan

Under the Company’s Stock Compensation Plan, the Organization and Compensation Committee may grant awards of common stock to officers and other key employees in lieu of cash in payment of all or part of their regular, bonus, or other special compensation. During fiscal year 2002, 50% of each non-employee director’s annual retainer was paid in common stock in accordance with the terms of the Stock Compensation Plan. For fiscal year 2002, 25% of the annual executive bonus for each named executive officer was paid in the form of restricted shares issued under the Stock Compensation Plan. In addition, payments to each named executive officer under the 2002 performance restricted stock bonus plan were made in the form of restricted shares issued under the Stock Compensation Plan. The number of restricted shares awarded to each named executive officer under both the annual executive bonus plan and the performance restricted stock bonus plan was determined by the $22.30 closing price of the common stock on the NYSE on August 5, 2002, which was the third business day following the public release of the Company’s financial results for the fourth quarter of fiscal year 2002. The material terms of the awards are described in footnote 4 to the summary compensation table. Dividend payments on unvested awards of restricted shares are reinvested in additional shares of common stock under the Stock Compensation Plan, and the additional shares are subject to the same restrictions that are applicable to the underlying restricted shares.

Deferred Compensation Plan

Officers of the Company, including the named executive officers, may defer, until 60 days following the termination of employment with the Company, a portion of all compensation payable by the Company for

14

personal services rendered to the Company. Each participating officer may request that the deferred amounts be allocated among several available investment options established and offered by the Company, subject to approval by the Company’s retirement committee. The benefit payable under the plan at any time to a participant following termination of employment is equal to the applicable deferred amounts, plus or minus any earnings or losses attributable to the investment of such deferred amounts. The amount of compensation in any given fiscal year that is deferred by a named executive officer is included in the summary compensation table under the column headings “salary” or “bonus”, as appropriate.

The Company has established a trust for the benefit of participants in the deferred compensation plan. Pursuant to the terms of the trust, as soon as possible after any deferred amounts have been withheld from a plan participant, the Company will contribute such deferred amounts to the trust to be held for the benefit of the participant in accordance with the terms of the plan and the trust. However, the assets in the trust will become available to the Company’s creditors if the Company becomes insolvent or bankrupt. If the funds in the trust are insufficient to pay amounts due under the plan to a participant, the Company remains obligated to pay any deficiency.

Supplemental Executive Retirement Plan

The Company maintains a supplemental executive retirement plan, or SERP, for key employees who are designated as participants by the Organization and Compensation Committee. Benefits under the SERP are payable as a life annuity upon normal retirement at age 65, or in a reduced amount in the event of earlier retirement on or after age 55, and are based on age, length of service (not less than 5 years), the participant’s highest annual base salary paid during the five years immediately preceding the termination of the participant’s employment, and an average of the participant’s three highest bonuses paid under the Company’s annual executive bonus plan during the five years immediately preceding the termination of the participant’s employment. Benefits payable under the SERP are not subject to any reduction for Social Security or other offset amounts. The following table shows the annual benefit payable under the SERP to participants who retire at or after the age 65.

Retirement Benefit Table

Average Final Compensation Used as Basis for Computing Retirement Benefit

| | Annual Retirement Benefit

|

| | 5 Years of Service

| | 10 Years of Service

| | 15 or More Years of Service

|

| $200,000 | | $ | 27,500 | | $ | 55,000 | | $ | 75,000 |

| 300,000 | | | 41,250 | | | 82,500 | | | 112,500 |

| 400,000 | | | 55,000 | | | 110,000 | | | 150,000 |

| 500,000 | | | 68,750 | | | 137,500 | | | 187,500 |

| 600,000 | | | 82,500 | | | 165,000 | | | 225,000 |

| 700,000 | | | 96,250 | | | 192,500 | | | 262,500 |

As of June 29, 2002, Messrs. Murray, Allman and Warren, who are the only named executive officers who participate in the SERP, had 6, 5 and 5 years of service, respectively, for purposes of the SERP.

15

Employment Agreements; Change-in-Control Arrangements

Richard T. Riley assumed the position of Senior Vice President and President—NEBS Direct Marketing on July 1, 2001, and in connection therewith entered into a letter agreement with the Company dated June 29, 2001. The agreement is effective through June 30, 2003, and provides for a base salary of $275,000, and further provides that 50% of his bonus target under the Company’s 2002 executive bonus plan was guaranteed. If Mr. Riley’s employment with the Company is terminated during the term of the agreement by the Company without cause (as defined in the agreement) or by Mr. Riley for good reason (as defined in the agreement), Mr. Riley will continue to receive his base salary and benefits for the remaining term of the agreement. The Company also provided an unsecured loan in the amount of $300,000 to Mr. Riley in connection with his relocation to Massachusetts in 2001. The loan is interest-free, and 20% of the principal amount will be forgiven annually so long as Mr. Riley’s employment with the Company has not been terminated voluntarily by Mr. Riley (except for good reason as described in the promissory note) or by the Company for cause. If the Company terminates Mr. Riley’s employment for cause, or if he otherwise voluntarily terminates his employment (except for good reason), then the theretofore unforgiven principal amount will become immediately due and payable, together with interest at the prime rate accruing from the date the loan becomes due to the date of payment. Mr. Riley is solely responsible for his income tax obligations, if any, based on the value of foregone interest and forgiven principal.

The Company has entered into agreements with each named executive officer providing for certain benefits in the event of a change in control of the Company. A change in control includes, among other events and subject to certain exceptions, the acquisition by any person of beneficial ownership of 35% or more of the outstanding common stock. If a tender offer or exchange offer is made for more than 25% of the outstanding common stock, the named executive officer has agreed not to leave the employ of the Company, except in the case of disability or retirement, and to continue to render services to the Company until such offer has been abandoned or terminated or a change in control has occurred.

If, within 24 months after a change in control of the Company, the executive’s employment is terminated (1) by the Company other than for cause or disability (as those terms are defined in the agreement) or (2) by the named executive officer for good reason (as defined in the agreement), the Company has agreed to pay the executive, in addition to salary, benefits and awards accrued through the date of termination, an amount equal to 2 times (in the case of Mr. Murray, 2-1/2 times) the sum of the executive’s then current annualized base salary and bonus target under the Company’s annual executive bonus plan. The Company has also agreed to provide the executive with benefits under all employee welfare benefit plans, or equivalent benefits, for up to 30 months following such termination. The Company must give 90 day advance notice of termination to the executive unless such termination is for cause. If the executive’s employment with the Company or any of its subsidiaries is governed by a separate written employment agreement that provides benefits upon a termination of employment, the aggregate of any payments or benefits under such employment agreement will offset and reduce the aggregate of payments and benefits under the change in control agreement.

Each change in control agreement provides that if any payments or benefits to be made under the agreement, individually or together with any other payments or benefits, are subject to excise tax pursuant to section 4999 of the Internal Revenue Code of 1986, as amended, the Company will “gross up” the payments to the executive as necessary (after taking into account all income taxes payable by the executive officer as a result of the receipt of the “gross up” payment) to place the executive in the same after-tax position the executive would have been in had no such excise tax been paid or incurred with respect to such payment or benefits.

16

Each change in control agreement continues in effect through June 30, 2004, subject to automatic one-year extensions thereafter unless notice is given of the Company’s or the executive’s intention not to extend the term of the agreement; provided, however, that the agreement continues in effect for 24 months following a change in control that occurs during the term of the agreement. Except as otherwise provided in the change in control agreement, the Company and each executive may terminate the executive’s employment at any time. Each change in control agreement terminates if either party terminates the executive’s employment before a change in control, except that any such termination by the Company without cause or by the executive for good reason during a “potential change in control period” (as defined in the agreement) will entitle the executive to the benefits under the agreement described above.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

No member of the Organization and Compensation Committee during the Company’s last fiscal year is a present or former officer or employee of the Company or any of its subsidiaries. To the Company’s knowledge, there were no other relationships involving members of the Organization and Compensation Committee or other directors of the Company which require disclosure in this proxy statement.

REPORT OF THE ORGANIZATION AND COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

What is our executive compensation philosophy?

The Organization and Compensation Committee, in exercising responsibility for setting base salary and total compensation levels, retains a nationally recognized compensation and benefits consulting firm to assist in the review of the direct compensation of the executive officers of the Company.

In providing for the compensation of the executive officers, a salary structure has been developed with salary ranges for executive officers targeted to reflect a midpoint which in general is about the 50th percentile of the base salaries of officers in similar positions in a representative group of non-durable goods manufacturers and direct marketing companies of comparable size. In addition, annual bonuses are provided for, the payment and the amount of which depend upon the degree of attainment of pre-established Company and business unit sales and earnings targets and, in some instances and to varying extents, upon the attainment of pre-established individual objectives. Long-term compensation is tied directly to the increase in value of the common stock, and hence takes the form of stock options, with option prices equal to 100% of current market value, in amounts reflecting the level of responsibility of the grantees for the Company’s long-range success.

In determining its executive compensation policies from year to year, the Company expects to take appropriate measures to prevent the employee remuneration paid by it from being rendered non-deductible by operation of the terms of Section 162(m) of the Internal Revenue Code. Such measures may include (1) limiting the amount of non-performance-based compensation paid to any employee, and (2) complying with the statutory requirements for exempting performance-based compensation from non-deductibility by obtaining stockholder approval of qualified performance-based plans. In October 1997, such approval was obtained for the NEBS 1997 Key Employee and Eligible Director Stock Option and Stock Appreciation Rights Plan, and such approval is being sought for the NEBS 2002 Equity Incentive Plan.

17

How were executive base salaries determined for fiscal year 2002?

The individual salaries of the executive officers for fiscal year 2002 were approved by the Organization and Compensation Committee at the beginning of that year in accordance with the above-stated policy. These salary recommendations were made after review of individual performance evaluations by the Chief Executive Officer and discussion with him of the performance of the Company during fiscal year 2001 and of the individual performances of the executive officers (other than himself) during that year.

How were annual executive bonuses determined for fiscal year 2002?

At the beginning of fiscal year 2002, all of the executive officers were designated as participants in the Company’s annual executive bonus plan and target bonuses of 70% of base salary for the Chief Executive Officer and 60% of base salary for the other executive officers were established. A combination of financial performance targets and personal objectives, 80% and 20%, respectively, of the target bonus were established as the goals for the achievement of 100% of the target bonus for each of the executive officers.

Based on these criteria, the Chief Executive Officer received a bonus of 25.06% of his base salary and the other executive officers received bonuses ranging from 21.48% to 37.21% of their respective base salaries.

At the beginning of fiscal year 2002, all of the executive officers were also designated as participants in the 2002 performance restricted stock bonus plan and target bonuses of $300,000 for the Chief Executive Officer and $200,000 for the other executive officers were established. An earnings per share target was established as the goal for achievement of 100% of the target bonus for each of the executive officers, and based on the Company’s performance against the earnings per share target, bonus payouts could range between 0% and 150% of the target bonus. Bonuses were payable in the form of restricted shares having a fair market value equal to the amount of the bonus payout, under the terms of the Company’s Stock Compensation Plan.

As allowed by the plan, the Committee determined that certain extraordinary events, including the September 11, 2001 attacks and the anthrax scare which disrupted mail service, severely impacted the Company’s fiscal second quarter and its financial performance for the fiscal year. Accordingly, the earnings per share target was adjusted to reflect the Company’s mid-year forecast in order to recognize the impact of these events.

Based on the adjusted target, the Chief Executive Officer received a bonus of $150,000 and the other executive officers received bonuses of $100,000, in each case paid in the form of restricted shares, which vest in accordance with the following schedule: 15% on the date of the first annual meeting of stockholders following the date of grant; an additional 35% on the date of the second annual meeting of stockholders following the date of grant; and the remaining 50% on the date of the third annual meeting of stockholders following the date of grant.

What long-term incentive compensation programs did executives participate in for fiscal 2002?

Long-term incentive compensation consists of stock options. In fiscal 2002, none of the executive officers was granted stock options, and in lieu thereof, the executive officers were designated as participants in the 2002 performance restricted stock bonus plan described above.

18

How was the Chief Executive Officer’s compensation determined for fiscal year 2002?

The process by which the compensation of Robert J. Murray, as Chairman, President and Chief Executive Officer, was arrived at is as stated above and differed in no material way from that employed with respect to the other executive officers. With Mr. Murray’s base salary being in an appropriate range as determined by the Committee’s independent compensation consultant, there was no adjustment made to Mr. Murray’s base salary for fiscal year 2002.

Because Mr. Murray’s principal residence is located more than 75 miles from the Company’s headquarters, the Company pays certain occupancy expenses associated with a second residence within a shorter commuting distance and reimburses Mr. Murray for his tax liability arising from this arrangement. Otherwise, Mr. Murray was not provided any fringe benefits other than those available to all officers of the Company.

ORGANIZATIONAND COMPENSATION COMMITTEE

William T. End

Robert L. Gable (Chairman)

Thomas J. May

REPORT OF THE AUDIT COMMITTEE

The Board of Directors has adopted a written charter under which the Audit Committee operates (a copy of which was included as Appendix A to the Company’s proxy statement relating to the 2001 annual meeting of stockholders), and has determined that all members of the Committee are “independent” in accordance with the currently applicable rules of the NYSE.

In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company for the fiscal year ended June 29, 2002 with the Company’s management and Deloitte & Touche LLP, our independent auditors.

The Committee has discussed with Deloitte & Touche the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees”. In addition, the Committee has received the written disclosures and the letter from Deloitte & Touche required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees” and has discussed with Deloitte & Touche its independence from the Company and its management.

Based on the review and discussions referred to above, the Committee recommended to the Board of Directors that the audited consolidated financial statements of the Company be included in our annual report on Form 10-K for the fiscal year ended June 29, 2002 for filing with the SEC.

AUDIT COMMITTEE

Thomas J. May

Herbert W. Moller (Chairman)

Joseph R. Ramrath

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

At the end of fiscal year 2002, the Company had outstanding borrowings of approximately $28,146,250 from Fleet National Bank, one of several banks party to an unsecured, revolving credit facility with the Company. Fleet National Bank is a wholly owned subsidiary of FleetBoston Financial Corporation, of which M. Anne Szostak is an executive officer. Ms. Szostak is a director of the Company. The terms of the Company’s revolving credit facility were negotiated on an arm’s length basis, and management believes that such terms are no less favorable to the Company than could have been obtained from a comparably qualified unrelated third party.

The Company paid approximately $1,600,000 to Xerox Corporation during fiscal year 2002, related primarily to the procurement and maintenance of digital presses utilized throughout the Company’s plants. Brian E. Stern is a Senior Vice President of Xerox, and is a director of the Company. Each of the transactions between the Company and Xerox was made in the ordinary course of business on an arm’s length basis, and management believes that the terms of each such transaction were no less favorable to the Company than could have been obtained from a comparably qualified unrelated third party.

20

PERFORMANCE GRAPH

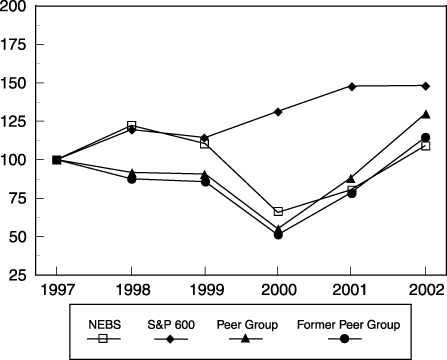

The following chart compares the value of $100 invested in the Company’s common stock from June 27, 1997 through June 29, 2002 with a similar investment in the S&P 600 small cap stock index, and in a peer group consisting of six(1) publicly held companies selected on the basis of similarity to the Company in the nature of products offered, marketing and distribution channels utilized and customer markets served. The comparison assumes that all dividends are reinvested.

Peer Group Companies:

| Deluxe Corporation | | Moore Corporation, Ltd. |

| Ennis Business Forms, Inc. | | The Standard Register Co. |

| John H. Harland Co. | | Wallace Computer Services, Inc. |

| (1) | | Systemax Inc. was previously included in the index of peer group companies. The Company has re-appraised its index of peer group companies, and has determined that Systemax’s lines of business, taken as a whole, are not sufficiently similar to the Company’s lines of business to justify the continued inclusion of Systemax in the peer group. In accordance with SEC rules, return data for the peer group, including Systemax, is provided above as the “former peer group” for comparative purposes, but will not be provided in future years. |

21

PROPOSAL TWO

APPROVAL OF THE NEBS 2002 EQUITY INCENTIVE PLAN

Introduction

On August 2, 2002, the Board of Directors voted to adopt, subject to approval by the stockholders, the NEBS 2002 Equity Incentive Plan (the “2002 Plan”), which amends and restates the NEBS 1997 Key Employee and Eligible Director Stock Option and Stock Appreciation Rights Plan (the “1997 Plan”). The vote required to approve the 2002 Plan is described at the beginning of this proxy statement under the general heading “Information About Voting”. If approved by the stockholders, the effective date of the 2002 Plan will be October 25, 2002 (the “Effective Date”).

The 1997 Plan is currently in effect. The number of shares initially made available under the 1997 Plan was 1,474,559 shares, of which 150,355 shares remained available for option grants immediately prior to the adoption of the 2002 Plan by the Board. The Company believes that additional shares must be made available to give the Company reasonable flexibility in providing appropriate incentives to its employees, prospective employees and non-employee directors. The Company has also made additional changes in the 2002 Plan in order to increase the flexibility available to the plan administrator in making employee awards, and to increase the number of options issued to non-employee directors of the Company. If the 2002 Plan is not approved by the stockholders, the 1997 Plan will remain in effect, and awards may continue to be granted under such plan, in accordance with its terms.

Significant Changes

The significant changes to the 1997 Plan include:

| | · | | Making 1,000,000 additional shares available for awards. If the 2002 Plan is approved by the stockholders, a total of 1,150,355 shares will be initially available for awards under the 2002 Plan. This number includes a total of 150,355 shares remaining available for awards under the 1997 Plan immediately prior to the adoption of the 2002 Plan by the Board. Shares subject to options that are outstanding under the 1997 Plan on the date the 2002 Plan was adopted by the Board and that subsequently expire without being exercised will also be available for awards under the 2002 Plan. If the 2002 Plan is approved by stockholders, awards granted by the Company after the Effective Date will be made under the 2002 Plan. |

| | · | | Permitting the award of restricted stock. The 2002 Plan permits restricted stock awards to employees and prospective employees. These are awards of shares of Company stock that become vested only if the employee receiving the award has remained employed by the Company or a subsidiary for a specified period of time, or has met specified criteria, as determined by the plan administrator at the time of grant (or is employed by the Company or a subsidiary at the time of a “change in control”, as defined in the 2002 Plan). No more than 250,000 shares may be issued under vested restricted stock awards. Restricted stock awards were not available under the 1997 Plan. |

| | · | | Giving the administrator discretion to determine the exercise price for options. Under the 2002 Plan, the Committee may set an exercise price for stock options (other than options granted to non-employee directors) that is equal to or greater than (but not less than) the fair market value of the shares at the time of grant. Under the 1997 Plan, the exercise price for all options was required to be the fair market value of the shares related to the options on the date of grant. |

22

| | · | | Changing the option exercise period. Under the 2002 Plan, unless the award agreement provides otherwise, vested option awards may be exercised for up to two years after the optionee’s retirement (or cessation of service as a director), up to one year after the optionee’s death, or up to 30 days after any other termination (other than a termination for cause). If the award agreement so provides, periods of paid severance can be treated as a period of employment for vesting and exercise purposes. Under the 1997 Plan, incentive stock options (“ISOs”), within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), could be exercised for three months after retirement, while non-qualified stock options (“NQSOs”) could be exercised for two years after retirement. Both ISOs and NQSOs could be exercised for one year after the optionee’s death under the 1997 Plan. Option awards under the 1997 Plan expired on the date of any other termination, unless the award agreement provided otherwise. Under both the 1997 Plan and the 2002 Plan, option awards may not be exercised after the award’s 10-year term. |

| | · | | Providing for discretionary deferral of awards. Under the 2002 Plan, the payment of any proceeds upon exercise of an award (including the delivery of shares) may be deferred to a non-qualified deferred compensation plan maintained by the Company, if permitted by the plan administrator. This provision is intended to permit employees to defer the recognition of taxable income that would otherwise be required under federal law. Any amounts deferred under such a non-qualified deferred compensation plan will be subject to the claims of creditors of the Company. The 1997 Plan did not contain a similar provision. |

| | · | | Allowing awards to prospective employees. The 2002 Plan will permit awards to be made to prospective employees to whom the Company is making (or has made) an offer of employment. However, no such awards may vest or become exercisable unless the individual actually enters the Company’s employ. The 1997 Plan did not contain a similar provision. |

| | · | | Increasing the number of shares awarded to non-employee directors in a year. Pursuant to the 2002 Plan, each non-employee director is annually granted on the tenth day following his or her election at the annual meeting of stockholders an option to purchase 3,000 shares. In the case of the first annual meeting of stockholders at which a non-employee is elected, the option grant to that director is for 5,000 shares. Under the 1997 Plan, the amounts of these automatic option awards to non-employee directors were 1,000 and 3,000, respectively. |

Summary of 2002 Plan

Purpose. The purpose of the 2002 Plan is to provide a means whereby the Company, by granting options to purchase shares of its common stock (par value $1.00 per share), stock appreciation rights (“SARs”) in connection with such options, and restricted stock, can attract and retain persons of ability as key employees of the Company and its subsidiaries and as directors of the Company. It is also the purpose of the 2002 Plan to provide key employees with a performance incentive and to encourage stock ownership in the Company by key employees and directors.

Administration. The 2002 Plan is to be administered and interpreted by the Organization and Compensation Committee or any other committee (the “Committee”) appointed by the Board of Directors, whose members must consist of not less than two “Non-Employee Directors”, as defined in Rule 16b-3 under the Securities Exchange Act of 1934. Subject to the express terms of the 2002 Plan, the Committee will determine the employees and prospective employees to whom discretionary options will be granted, the number of shares as

23

to which options will be granted to each employee or prospective employee, whether any options will contain SARs, when such options become vested and exercisable, and the expiration date and other terms and conditions of each option agreement. The Committee will also determine the employees and prospective employees to whom restricted stock will be granted, the number of shares to be granted, and the applicable restrictions and other terms and conditions that will apply to such restricted stock.

Available Shares. The total number of shares as to which awards may be granted under the 2002 Plan may not exceed the sum of (i)1,150,355 plus (ii) the aggregate number of shares subject to options that were outstanding under the 1997 Plan on the date the 2002 Plan was adopted by the Board and that subsequently expire without having been exercised; subject to adjustment to reflect stock splits or combinations, stock dividends or reclassification or other actions of a similar nature. Shares allocable to terminated or surrendered portions of options (including options issued under the 1997 Plan) or restricted stock awards, and previously acquired shares surrendered in connection with the exercise or payout of awards, may be reallocated to new awards subsequently granted under the 2002 Plan. No more than 250,000 shares may be issued under vested restricted stock awards. The 2002 Plan provides for the granting of ISOs, NQSOs, SARs, and restricted stock to employees, as determined by the Committee in its sole discretion, and for the granting to non-employee directors of options as described below under the heading “Director Options”.

Eligibility. All employees and prospective employees of the Company or a subsidiary and non-employee directors are eligible to participate in the 2002 Plan; provided that prospective employees may not receive payment or exercise rights relating to awards under the 2002 Plan until they have begun employment. Employees may be granted ISOs, NQSOs, SARs or restricted stock. The aggregate fair market value of stock with respect to which ISOs may become exercisable for the first time by any individual during any calendar year shall not exceed $100,000. The maximum number of shares of common stock with respect to which awards may be granted to any employee during any single fiscal year is 100,000. The Committee selects the employees and prospective employees of the Company or subsidiaries who otherwise meet the foregoing terms of eligibility to receive an award under the 2002 Plan. Non-employee directors are eligible to receive only the automatic option grants described below under the heading “Director Options”.

Types of Grants. The 2002 Plan provides for the grant of ISOs, NQSOs, SARs and restricted stock.

| | · | | ISOs and NQSOs. For both ISOs and NQSOs, optionees receive the right to purchase a specified number of shares of common stock at a specified option exercise price and subject to other terms and conditions set forth in the option grant. Options may not be granted with an exercise price less than the fair market value of the shares on the date of grant (or less than 110% of the fair market value of the shares in the case of ISOs granted to optionees holding more than 10% of the voting power of the Company or any of its subsidiaries). Options may not be granted for a term of more than ten years (or more than five years in the case of ISOs granted to optionees holding more than 10% of the voting power of the Company or any of its subsidiaries). |

| | · | | SARs. An option award agreement may provide, if the Committee so determines, that the option holder shall have the right, at any time while the option is exercisable, to surrender the option, in whole or in part, to the extent then exercisable, for an appreciation distribution by the Company in an amount equal to the difference between the fair market value, on the date of the option surrender, of the shares of common stock subject to the surrendered option and the option exercise price for such shares. Any such appreciation distribution may be made in the form of shares of common stock, or in cash, as the Committee may determine in its sole discretion. |

24

| | · | | Restricted Stock. Restricted stock awards provide the recipient with shares of common stock, subject to forfeiture of some or all of the shares if the conditions specified in the award are not satisfied prior to the end of the restriction period established for the award. Awards of restricted stock may be made subject to such conditions and restrictions as the Committee may determine. Awards of restricted stock may be contingent upon the employee providing an additional period of service, or attainment of specified performance goals described in the award agreement, such as attainment of specified levels of or percentage changes in various measurements, including but not limited to revenue, earnings per share, pre-tax income, profit from operations, return on capital or return on assets. Awards of restricted stock conditioned solely upon time-based restrictions on vesting may not vest in full prior to the third anniversary of the date of grant, except that such awards may vest in installments so long as not more than 50% of the shares subject to such award may vest prior to the third anniversary of the date of grant. Awards of restricted stock conditioned upon the achievement of performance-based goals must have a minimum vesting period of at least one year from the date of grant. The Committee may provide for the acceleration of the date on which restrictions on awards of restricted stock lapse only (1) in connection with the termination of the recipient’s employment with the Company or a subsidiary by reason of such recipient’s death, disability, retirement, or by or at the request of the Company or such subsidiary (other than for cause), or (2) upon the occurrence of a change in control. Recipients of restricted stock awards may exercise voting rights and receive dividends with respect to the shares of restricted stock, if the award agreement so provides, except for shares that are forfeited under the terms of the award agreement. |

| | · | | Director Options. Non-employee directors will receive as part of their compensation for service as directors automatic option grants for 5,000 shares in their first year of service as a director, and 3,000 shares in each year of service as a director thereafter. Such awards vest and become exercisable after one year from the date of grant, and expire ten years after the date of grant. Options granted to non-employee directors will be NQSOs only. |