EXHIBIT 99.2

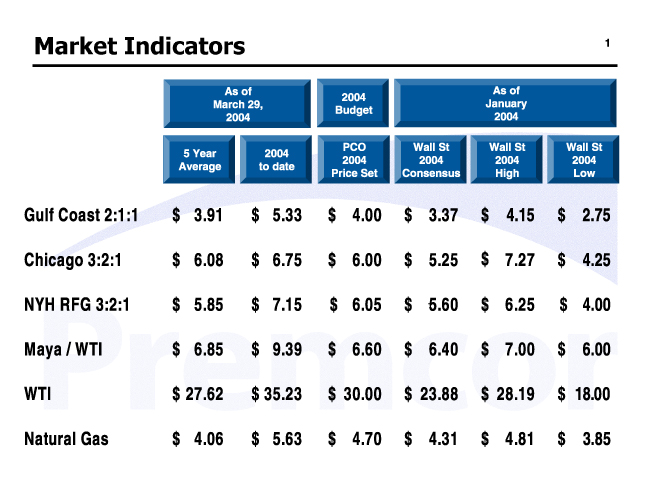

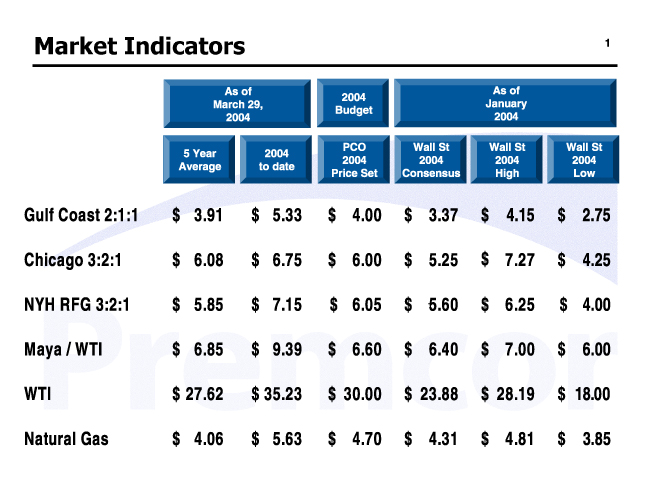

Market Indicators 1

As of March 29, 2004 2004 Budget As of January 2004

PCO Wall St Wall St Wall St

5 Year 2004

2004 2004 2004 2004

Average to date Price Set(1) Consensus High Low

Gulf Coast 2:1:1 $ 3.91 $ 5.33 $ 4.00 $ 3.37 $ 4.15 $ 2.75

Chicago 3:2:1 $ 6.08 $ 6.75 $ 6.00 $ 5.25 $ 7.27 $ 4.25

NYH RFG 3:2:1 $ 4.80 $ 7.18 $ 6.05 $ 5.60 $ 6.25 $ 4.00

Maya / WTI $ 6.85 $ 9.39 $ 6.60 $ 6.40 $ 7.00 $ 6.00

WTI $ 27.62 $ 35.23 $ 30.00 $ 23.88 $ 28.19 $ 18.00

Natural Gas $ 4.06 $ 5.63 $ 4.70 $ 4.31 $ 4.81 $ 3.85

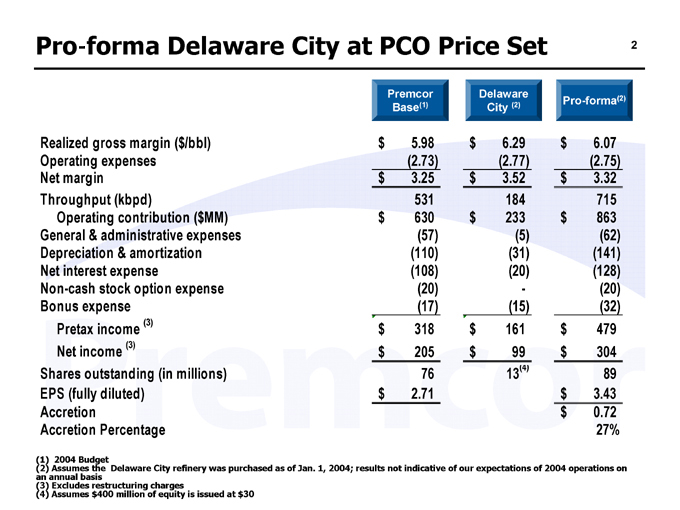

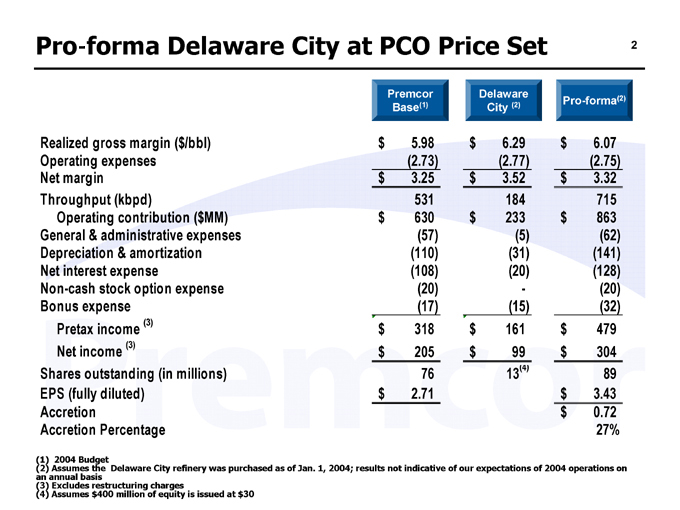

Pro formaDelaware City at PCO Price Set 2

Premcor Delaware

Pro-forma(2)

Base(1) City (2)

Realized gross margin ($/bbl) $ 5.98 $ 6.29 $ 6.07

Operating expenses (2.73) (2.77) (2.75)

Net margin $3.25 $ 3.52 $ 3.32

Throughput (kbpd) 531 184 715

Operating contribution ($MM) $ 630 $ 233 $ 863

General & administrative expenses (57) (5) (62)

Depreciation & amortization 531 (31) (141)

Net interest expense (108) (20) (128)

Non-cash stock option expense (20) - (20)

Bonus expense (17) (15) (32)

Pretax income (3) $318 $ 161 $ 479

Net income (3) $205 $ 99 $ 304

Shares outstanding (in millions) 76 13(4) 89

EPS (fully diluted) $2.71 $ 3.43

Accretion $ 0.72

Accretion Percentage 27%

(1) 2004 Budget

(2) Assumes the Delaware City refinery was purchased as of Jan. 1, 2004; results not indicative of our expectations of 2004 operations on an annual basis

(3) Excludes restructuring charges

(4) Assumes $400 million of equity is issued at $30

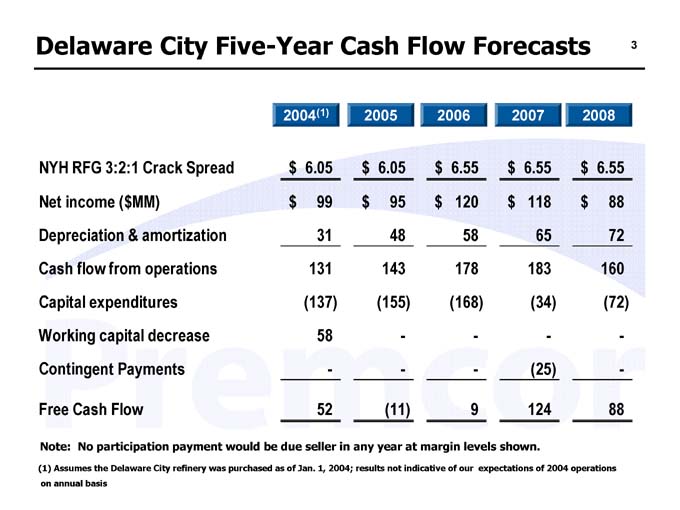

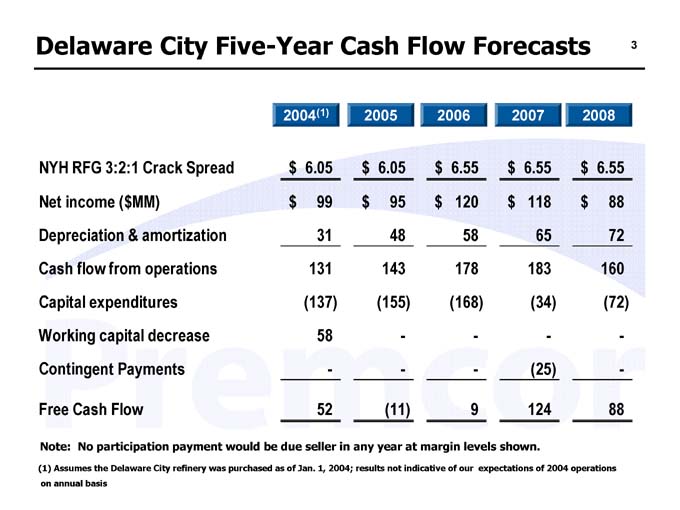

Delaware City Five-Year Cash Flow Forecasts 3

2004(1) 2005 2006 2007 2008

NYH RFG 3:2:1 Crack Spread $ 6.05 $ 6.05 $ 6.55 $ 6.55 $ 6.55

Net income ($MM) $ 99 $ 95 $ 120 $ 118 $ 88

Depreciation & amortization 31 48 58 65 72

Cash flow from operations 131 143 178 183 160

Capital expenditures (137) (155) (168) (34) (72)

Working capital decrease 58 - - - -

Contingent Payments - - - (25) -

Free Cash Flow 52 (11) 9 124 88

Note: No participation payment would be due seller in any year at margin levels shown.

(1) Assumes the Delaware City refinery was purchased as of Jan. 1, 2004; results not indicative of our expectations of 2004 operations on annual basis