have less predictable earnings and may lack the management experience, financial resources, product diversification and competitive strengths of larger companies. Securities of small- and mid-cap companies may be less liquid and more volatile than the securities of larger companies.

Note 9. Subsequent events

Management has evaluated the events and transactions that have occurred through the date the financial statements were issued. Other than as noted in Note 1, Note 3 and below, there were no items requiring adjustment of the financial statements or additional disclosure.

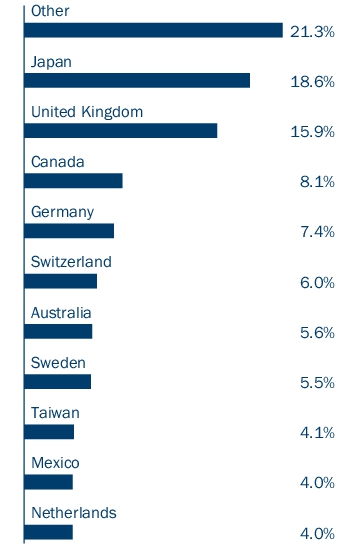

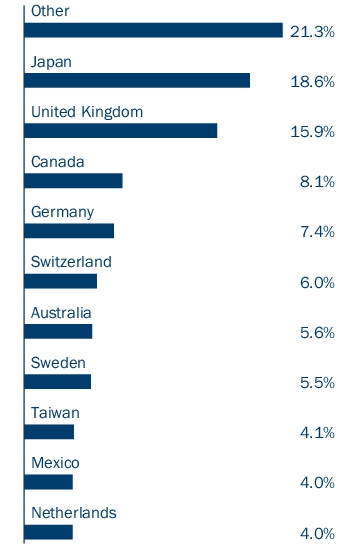

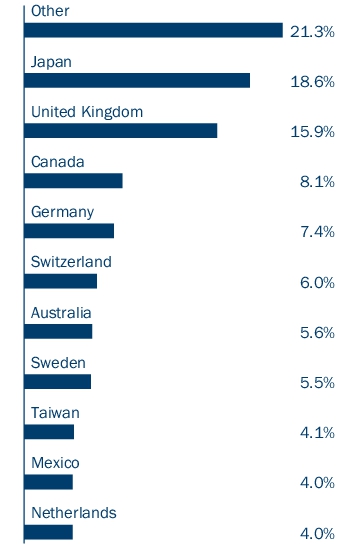

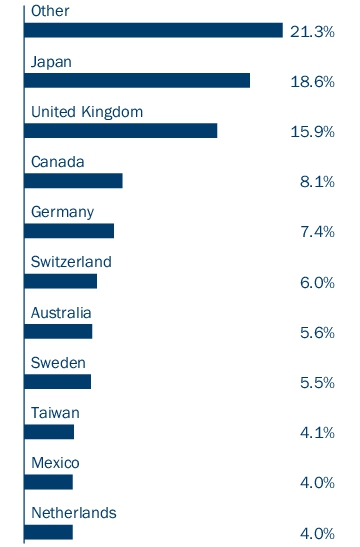

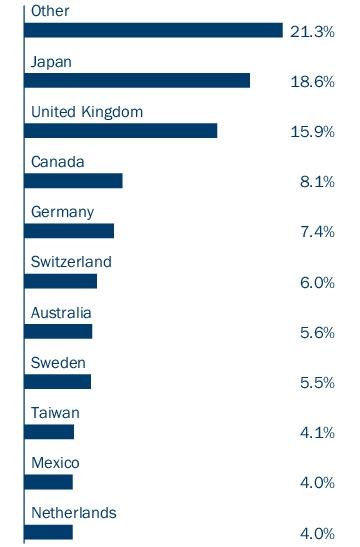

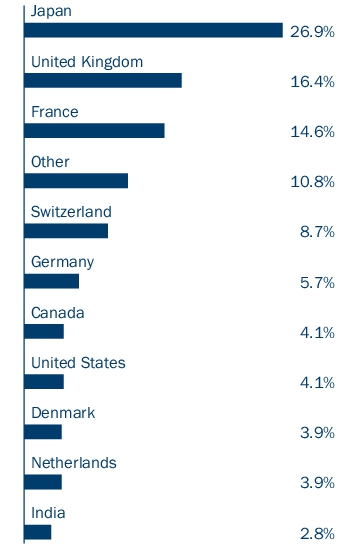

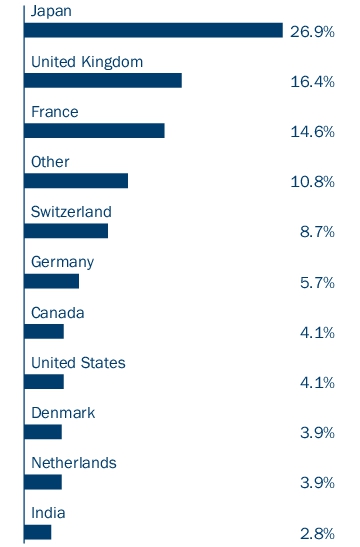

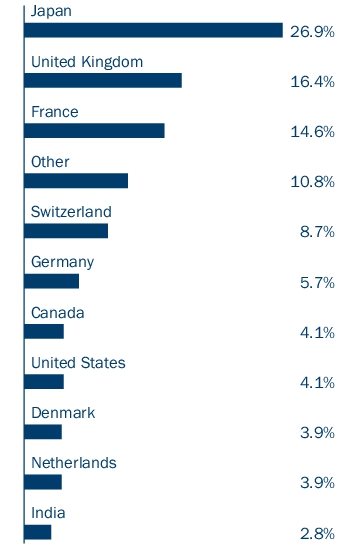

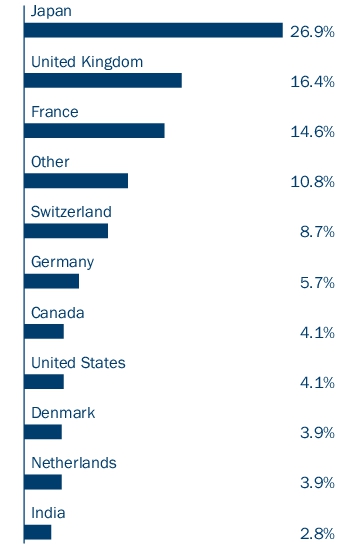

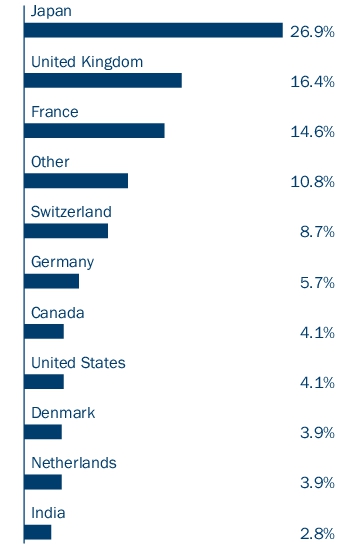

The Fund’s Board of Trustees approved changes to the principal investment strategies of Columbia Acorn International® and Columbia Acorn International SelectSM and the advisory fee rates of Columbia Acorn International® (see Note 3). As a result, effective September 3, 2024 each of the Funds will align its principal investment strategies to invest at least 65% of its assets in developed markets and change the emerging markets mandate to an optional investment of up to 20% of fund net assets (down from 35% for Columbia Acorn International®). Accordingly, the benchmarks to which these funds compare their performance will change from a variation of MSCI ACWI – ex U.S. indices to a series of MSCI EAFE indices in keeping with the updated investment style’s greater focus on developed markets over emerging markets.

Note 10. Information regarding pending and settled legal proceedings

Ameriprise Financial and certain of its affiliates are involved in the normal course of business in legal proceedings which include regulatory inquiries, arbitration and litigation, including class actions concerning matters arising in connection with the conduct of their activities as part of a diversified financial services firm. Ameriprise Financial believes that the Funds are not currently the subject of, and that neither Ameriprise Financial nor any of its affiliates are the subject of, any pending legal, arbitration or regulatory proceedings that are likely to have a material adverse effect on the Funds or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Funds. Ameriprise Financial is required to make quarterly (10-Q), annual (10-K) and, as necessary, 8-K filings with the Securities and Exchange Commission (SEC) on legal and regulatory matters that relate to Ameriprise Financial and its affiliates. Copies of these filings may be obtained by accessing the SEC website at www.sec.gov.

There can be no assurance that these matters, or the adverse publicity associated with them, will not result in increased Fund redemptions, reduced sale of Fund shares or other adverse consequences to the Funds. Further, although we believe proceedings are not likely to have a material adverse effect on the Funds or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Funds, these proceedings are subject to uncertainties and, as such, we are unable to estimate the possible loss or range of loss that may result. An adverse outcome in one or more of these proceedings could result in adverse judgments, settlements, fines, penalties or other relief that could have a material adverse effect on the consolidated financial condition or results of operations of Ameriprise Financial or one or more of its affiliates that provide services to the Funds.

Note 11. Fund reorganization for Columbia Acorn® Fund

At the close of business on April 21, 2023, Columbia Acorn® Fund (the Fund) acquired the assets and assumed the identified liabilities of Columbia Acorn USA® (the Acquired Fund), a series of Columbia Acorn Trust. The reorganization was completed after the Board of Trustees of the Acquired Fund approved a plan of reorganization at a meeting held in December 2022. The purpose of the reorganization was to combine two funds with comparable investment objectives and strategies.

The aggregate net assets of the Fund immediately before the reorganization were $2,625,263,610 and the combined net assets immediately after the reorganization were $2,789,110,597.

The reorganization was accomplished by a tax-free exchange of 16,969,670 shares of the Acquired Fund valued at $163,846,987 (including $18,196,450 of unrealized appreciation/(depreciation)).

In exchange for the Acquired Fund’s shares, the Fund issued the following number of shares: