CNA Financial Corporation Fourth Quarter 2024 Results February 10, 2025

Notices and Disclaimers Forward Looking Statements The statements made in the course of this presentation and/or contained in the presentation materials may include statements that relate to anticipated future events (forward-looking statements) rather than actual present conditions or historical events. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and generally include words such as “believes,” “expects,” “intends,” “anticipates,” “estimates” and similar expressions. Forward-looking statements, by their nature, are subject to a variety of inherent risks and uncertainties that could cause actual results to differ materially from the results projected. Many of these risks and uncertainties cannot be controlled by CNA. For a detailed description of these risks and uncertainties, please refer to CNA’s filings with the Securities and Exchange Commission available at www.cna.com. Any forward-looking statements and other financial information contained in this presentation speak only as of the date hereof. Further, CNA does not have any obligation to update or revise any forward-looking statement made in the course of this presentation and/or contained in the presentation materials even if CNA’s expectations or any related events, conditions or circumstances change. Reconciliation of GAAP Measures to Non-GAAP Measures This earnings presentation contains financial measures that are not in accordance with accounting principles generally accepted in the United States of America (GAAP). Management utilizes these financial measures to monitor the Company's insurance operations and investment portfolio. The Company believes the presentation of these measures provides investors with a better understanding of the significant factors that comprise the Company's operating performance. Reconciliations of these measures to the most comparable GAAP measures can be found in the Appendix to this presentation. For additional information, please refer to CNA's filings with the Securities and Exchange Commission, available at www.cna.com Available Information and Risk Factors CNA files annual, quarterly and current reports and other information with the SEC. The SEC filings are available on the CNA website (www.cna.com) and at the SEC's website (www.sec.gov). These filings describe some of the more material risks we face and how these risks could lead to events or circumstances that may have a material adverse effect on our business, financial condition, results of operations or cash flows. You should review these filings as they contain important information about CNA and its business. "CNA" is a registered trademark of CNA Financial Corporation. Certain CNA Financial Corporation subsidiaries use the "CNA" trademark in connection with insurance underwriting and claims activities. Copyright © 2025 CNA. All rights reserved. 2

Fourth Quarter Overview • Net income of $21 million, includes $290 million after-tax loss from the previously announced pension settlement transaction, versus $367 million in the prior year quarter; core income of $342 million versus $362 million in the prior year quarter. • P&C core income of $451 million versus $434 million, reflects higher investment income and higher underlying underwriting income partially offset by higher catastrophe losses. • Life & Group core loss of $18 million versus core income of $4 million in the prior year quarter. • Corporate & Other core loss of $91 million versus $76 million in the prior year quarter. • Net investment income up 5% to $644 million pretax, includes a $17 million increase from fixed income securities and other investments to $550 million and a $16 million increase from limited partnerships and common stock to $94 million. • P&C combined ratio of 93.1%, compared with 92.1% in the prior year quarter, including 1.8 points of catastrophe loss impact compared with 1.0 point in the prior year quarter. P&C underlying combined ratio was 91.4%, consistent with the prior year quarter. P&C underlying loss ratio was 61.1% and the expense ratio was 30.0%. • P&C segments, excluding third party captives, generated gross written premium growth of 9% and net written premium growth of 10% in the quarter. P&C renewal premium change of +4%, with written rate of +3% and exposure change of +1%. 3

Full Year Overview • Net income of $959 million, includes $293 million after-tax loss from pension settlement transactions, versus $1,205 million in the prior year; record core income of $1,316 million, versus $1,284 million in the prior year. • P&C core income of $1,549 million versus $1,505 million, reflects higher investment income and record high underlying underwriting income partially offset by higher catastrophe losses. • Life & Group core loss of $23 million versus core loss of $48 million in the prior year. • Corporate & Other core loss of $210 million versus core loss of $173 million in the prior year. • Net investment income up 10% to $2,497 million pretax, includes a $118 million increase from limited partnerships and common stock to $320 million and a $115 million increase from fixed income securities and other investments to $2,177 million. • P&C combined ratio of 94.9%, compared with 93.5% in the prior year, including 3.6 points of catastrophe loss impact compared with 2.6 points in the prior year. P&C underlying combined ratio was 91.5% compared with 90.9% in the prior year. P&C underlying loss ratio was 60.9% and the expense ratio was 30.2%. • P&C segments, excluding third party captives, generated gross written premium growth of 8% and net written premium growth of 8%. P&C renewal premium change of +5%, with written rate of +4% and exposure change of 1%. Stockholders' Equity • Book value per share of $38.82; book value per share excluding AOCI of $46.16, an 8% increase from year-end 2023 adjusting for $3.76 of dividends per share paid. • Increased quarterly cash dividend 5% to $0.46 per share; special dividend of $2.00 per share. 4

Financial Performance 5 (In millions, except ratios and per share data) Fourth Quarter Year to Date 2024 2023 Change 2024 2023 Change Revenues $3,689 $3,507 5 % $14,270 $13,299 7 % Core income 342 362 (6) % 1,316 1,284 2 % Net income1 21 367 (94) % 959 1,205 (20) % Diluted earnings per common share: Core income $1.25 $1.33 (6) % $4.83 $4.71 3 % Net income 0.07 1.35 (95) % 3.52 4.43 (21) % Core ROE 10.9 % 11.6 % (0.7) pts 10.5 % 10.4 % 0.1 pts Record core income for 2024 as a result of continued strong underwriting and investment results 1 Includes a $290 million after-tax loss for the fourth quarter and a $293 million after-tax loss for the full year, from pension settlement transactions.

Continued strong premium growth & underlying combined ratio below 92% for 16 consecutive quarters Property & Casualty Operations 6 (In millions, except ratios) Fourth Quarter Year to Date 2024 2023 2024 2023 GWP ex. 3rd party captives $3,230 $2,974 $12,194 $11,279 GWP change (% year over year) 9 % 8 % Net written premium $2,752 $2,508 $10,176 $9,446 NWP change (% year over year) 10 % 8 % Net earned premium $2,571 $2,368 $9,775 $9,030 NEP change (% year over year) 9 % 8 % Underwriting gain $178 $186 $496 $585 Loss ratio 62.8 % 60.6 % 64.3 % 62.5 % Less: Effect of catastrophes impacts 1.8 % 1.0 % 3.6 % 2.6 % Less: Effect of favorable development-related items (0.1) % (0.3) % (0.2) % — % Underlying loss ratio 61.1 % 59.9 % 60.9 % 59.9 % Expense ratio 30.0 % 31.2 % 30.2 % 30.7 % Combined ratio 93.1 % 92.1 % 94.9 % 93.5 % Underlying combined ratio 91.4 % 91.4 % 91.5 % 90.9 %

Property & Casualty Production Metrics Continued robust new business growth, higher retention and stable overall rate increase 7 Property & Casualty Rate & Retention 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 5% 5% 5% 4% 4% 4% 3% 3% 7% 7% 6% 5% 6% 5% 5% 4% 86% 86% 84% 85% 85% 85% 85% 86% Retention Renewal Premium Change Rate GWP ex. 3rd party captives ($M) $2,724 $2,986 $2,595 $2,974 $2,936 $3,203 $2,825 $3,230 New Business ($M) $503 $555 $475 $547 $529 $595 $547 $591 Specialty Rate 2% (1)% 1% —% 2% —% —% 1% Retention 88% 89% 87% 89% 88% 90% 89% 89% Commercial Rate 7% 8% 8% 7% 6% 7% 6% 6% Retention 86% 85% 83% 83% 85% 84% 84% 84% International Rate 4% 4% 2% 2% 1% —% (2)% (3)% Retention 83% 83% 84% 83% 82% 80% 82% 85%

Highest quarterly growth in 10 quarters and continued strong profitability Specialty 8 (In millions, except ratios) Fourth Quarter Year to Date 2024 2023 2024 2023 GWP ex. 3rd party captives $1,049 $1,004 $3,895 $3,800 GWP change (% year over year) 4 % 3 % Net written premium $934 $891 $3,445 $3,329 NWP change (% year over year) 5 % 3 % Net earned premium $868 $869 $3,361 $3,307 NEP change (% year over year) — % 2 % Underwriting gain $54 $80 $249 $317 Loss ratio 60.1 % 58.0 % 59.5 % 58.2 % Less: Effect of catastrophes impacts — % — % — % — % Less: Effect of favorable development-related items — % (0.6) % (0.3) % (0.3) % Underlying loss ratio 60.1 % 58.6 % 59.8 % 58.5 % Expense ratio 33.4 % 32.5 % 32.8 % 32.0 % Combined ratio 93.8 % 90.8 % 92.6 % 90.4 % Underlying combined ratio 93.8 % 91.4 % 92.9 % 90.7 %

Specialty Production Metrics Consistently strong retention with improving renewal premium change 9 Specialty Rate & Retention 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2% (1)% 1% —% 2% —% —% 1% 4% —% 2% —% 3% 1% 2% 3% 88% 89% 87% 89% 88% 90% 89% 89% Retention Renewal Premium Change Rate GWP ex. 3rd party captives ($M) $886 $961 $949 $1,004 $880 $984 $982 $1,049 New Business ($M) $108 $120 $121 $132 $94 $118 $129 $121 FI & Mgmt Liability Rate (3)% (9)% (4)% (7)% (3)% (6)% (5)% (4)% Retention 89% 91% 88% 91% 90% 92% 91% 89% Affinity Professional E&O Rate 3% 4% 3% 4% 2% 3% 2% 3% Retention 88% 89% 89% 92% 92% 92% 91% 93% Medical Malpractice Rate 6% 5% 7% 7% 7% 9% 7% 9% Retention 84% 85% 84% 81% 80% 85% 83% 84% Surety Net Written Premiums $178 $170 $157 $136 $184 $175 $176 $157 Warranty & Alt. Risks Revenues $460 $460 $460 $448 $461 $459 $452 $443

Commercial 10 (In millions, except ratios) Fourth Quarter Year to Date 2024 2023 2024 2023 GWP ex. 3rd party captives $1,794 $1,610 $6,816 $5,994 GWP change (% year over year) 11 % 14 % Net written premium $1,452 $1,292 $5,469 $4,880 NWP change (% year over year) 12 % 12 % Net earned premium $1,384 $1,211 $5,158 $4,547 NEP change (% year over year) 14 % 13 % Underwriting gain $106 $86 $171 $182 Loss ratio 64.8 % 62.8 % 68.3 % 65.9 % Less: Effect of catastrophes impacts 2.3 % 1.4 % 6.2 % 4.5 % Less: Effect of favorable development-related items — % (0.1) % (0.1) % (0.1) % Underlying loss ratio 62.5 % 61.5 % 62.2 % 61.5 % Expense ratio 27.0 % 29.8 % 27.9 % 29.6 % Combined ratio 92.3 % 92.9 % 96.7 % 96.0 % Underlying combined ratio 90.0 % 91.6 % 90.6 % 91.6 % Record underlying results and 11th straight quarter of double-digit premium growth

Commercial Production Metrics 11 Commercial Rate & Retention 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 7% 8% 8% 7% 6% 7% 6% 6% 9% 11% 9% 9% 8% 7% 8% 7% 86% 85% 83% 83% 85% 84% 84% 84% Retention Renewal Premium Change Rate GWP ex. 3rd party captives ($M) $1,440 $1,604 $1,340 $1,610 $1,682 $1,802 $1,538 $1,794 New Business ($M) $310 $343 $292 $352 $367 $405 $345 $395 Middle Market Rate 4% 6% 5% 5% 5% 5% 4% 4% Retention 85% 86% 83% 83% 83% 84% 85% 84% Construction Rate 5% 6% 7% 8% 8% 9% 9% 9% Retention 86% 84% 85% 85% 86% 87% 84% 86% National Accounts Rate 17% 20% 18% 12% 8% 7% 6% 6% Retention 90% 84% 80% 85% 87% 83% 85% 84% Small Business Rate 2% 2% 3% 2% 3% 4% 4% 5% Retention 85% 84% 84% 82% 81% 79% 80% 81% Marine / Other Net Written Premium $87 $101 $78 $92 $104 $116 $95 $94 Record new business for 2024 with stable retention and renewal premium change throughout the year

1 Excluding currency fluctuations, GWP and NWP grew 6% and 12% in the fourth quarter, and GWP declined 1% and NWP grew 2% for the year. International Consistently profitable results with return to growth in the fourth quarter 12 (In millions, except ratios) Fourth Quarter Year to Date 2024 2023 2024 2023 Gross written premium $387 $360 $1,483 $1,485 GWP change (% year over year)1 8 % — % Net written premium $366 $325 $1,262 $1,237 NWP change (% year over year)1 13 % 2 % Net earned premium $319 $288 $1,256 $1,176 NEP change (% year over year) 11 % 7 % Underwriting gain $18 $20 $76 $86 Loss ratio 61.6 % 58.9 % 60.9 % 61.4 % Less: Effect of catastrophes impacts 3.9 % 1.8 % 3.2 % 2.5 % Less: Effect of (favorable) unfavorable development- (0.4) % (0.6) % (0.4) % 1.1 % Underlying loss ratio 58.1 % 57.7 % 58.1 % 57.8 % Expense ratio 33.2 % 34.1 % 33.1 % 31.2 % Combined ratio 94.8 % 93.0 % 94.0 % 92.6 % Combined ratio excl. catastrophes and development 91.3 % 91.8 % 91.2 % 89.0 %

Full year results reflect higher investment income; underwriting results broadly in line with expectations Life & Group 13 (In millions) Fourth Quarter Year to Date 2024 2023 2024 2023 Net earned premiums $108 $111 $437 $451 Total claims, benefits and expenses 366 349 1,429 1,436 Net investment income 230 237 940 896 Core income (loss) before income tax (28) (2) (52) (90) Income tax benefit 10 6 29 42 Core income (loss) ($18) $4 ($23) ($48)

Pretax Net Investment Income Strong contributions from fixed income, limited partnership and common stock portfolios 611 609 618 626 644 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Total CNAF Limited Partnership & Common Stock Highlights Fixed Income Securities 507 510 520 525 529 4.7% 4.7% 4.8% 4.8% 4.8% Fixed Income Effective Yield (Pretax) Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 78 68 78 80 94 3.4% 2.9% 3.1% 3.1% 3.5% Limited Partnership & Common Stock Return (Pretax) Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $M $M $M 14 • Net investment income of $644M is up 5% year- over-year • Fixed income benefited from strong operating cash flows and the continued impact of higher reinvestment rates • Strong limited partnership and common stock returns in the quarter; full year income of $320M, a 13.3% return

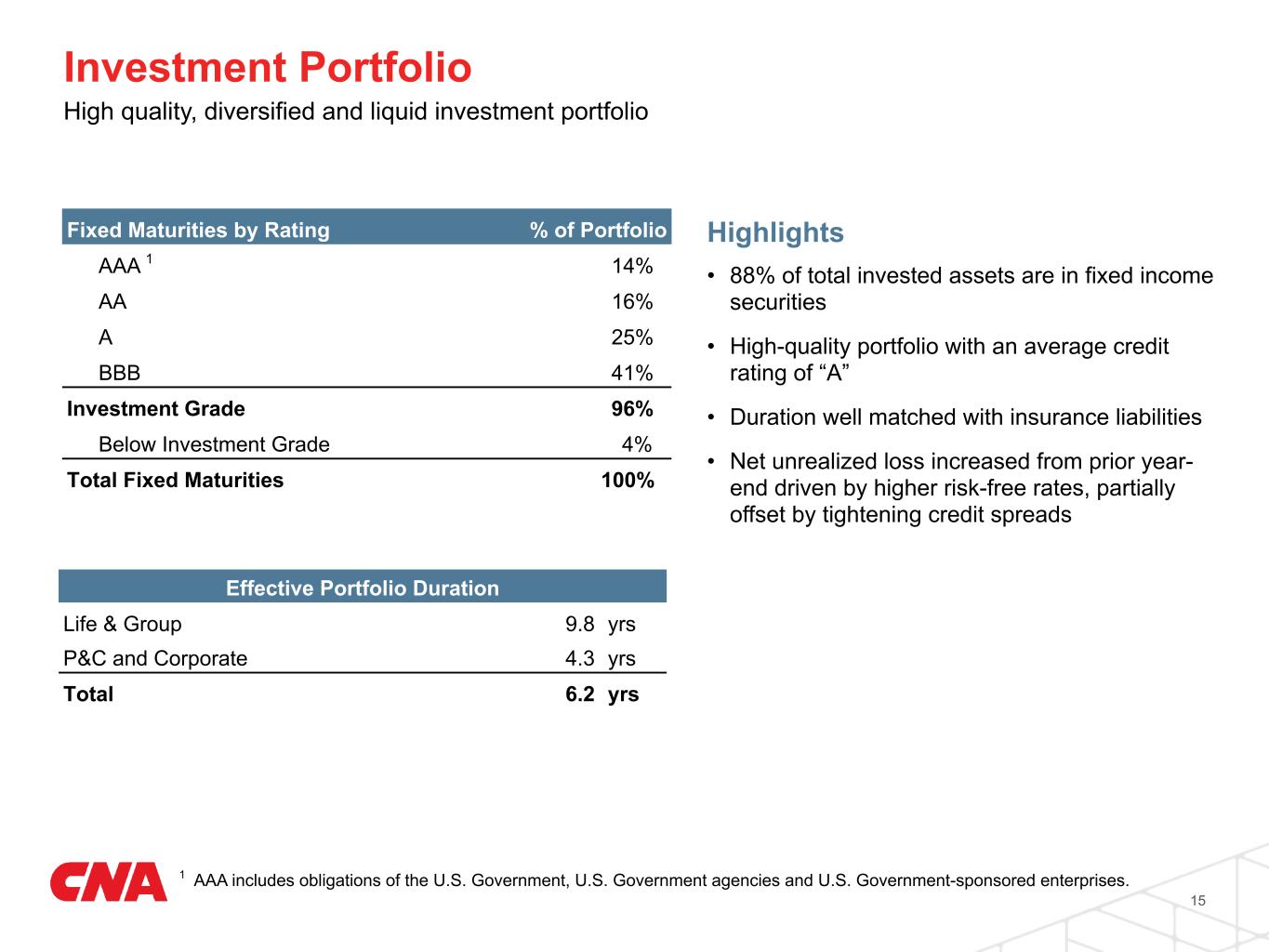

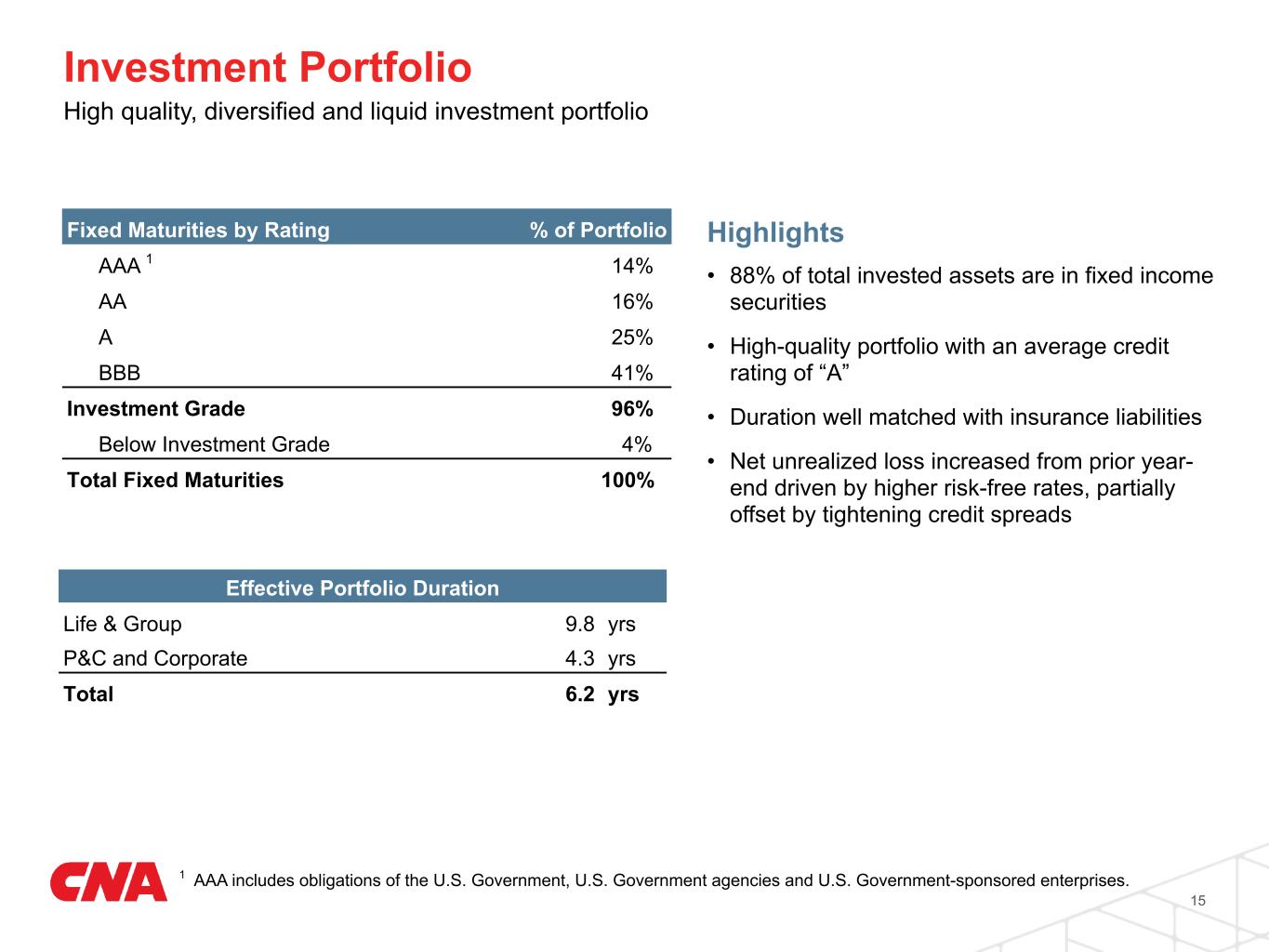

Investment Portfolio 15 Effective Portfolio Duration Life & Group 9.8 yrs P&C and Corporate 4.3 yrs Total 6.2 yrs Fixed Maturities by Rating % of Portfolio AAA 1 14% AA 16% A 25% BBB 41% Investment Grade 96% Below Investment Grade 4% Total Fixed Maturities 100% 1 AAA includes obligations of the U.S. Government, U.S. Government agencies and U.S. Government-sponsored enterprises. High quality, diversified and liquid investment portfolio Highlights • 88% of total invested assets are in fixed income securities • High-quality portfolio with an average credit rating of “A” • Duration well matched with insurance liabilities • Net unrealized loss increased from prior year- end driven by higher risk-free rates, partially offset by tightening credit spreads

Capital • Financial strength ratings from all four rating agencies were affirmed in the past year • Moody’s and AM Best revised outlooks to positive in the fourth quarter; S&P and Fitch maintain stable outlooks • Statutory surplus remains very strong • Adjusting for dividends, book value per share ex AOCI increased 8% Leverage • Debt maturity schedule is termed out to effectively manage refinancing • Next debt maturity of $500M in the first quarter of 2026 Liquidity • Ample liquidity at both holding and operating company levels to meet obligations Financial Strength Conservative capital and debt profile support business objectives (In millions, except per share data) Dec 31, 2024 Dec 31, 2023 Debt $2,973 $3,031 Stockholders' equity 10,513 9,893 Total capital $13,486 $12,924 AOCI (1,991) (2,672) Capital ex AOCI $ 15,477 $ 15,596 BVPS ex AOCI $46.16 $46.39 Dividends per share (YTD) $3.76 $2.88 Debt-to-capital 22.0 % 23.5 % Debt-to-capital ex AOCI 19.2 % 19.4 % Statutory surplus 11,165 $10,946 Holding company liquidity 1 $1,207 $1,262 16 1 Includes $250 million available under credit facility

APPENDIX 17

Results for the Three Months Ended December 31 Results for the Year Ended December 31 2024 2023 2024 2023 Net income $21 $367 $959 $1,205 Less: Net investment (losses) gains (31) 5 (64) (79) Less: Pension settlement transaction losses (290) — (293) — Core income $342 $362 $1,316 $1,284 Core income (loss) is calculated by excluding from net income (loss) the after-tax effects of net investment gains or losses and gains or losses resulting from pension settlement transactions. Net investment gains or losses are excluded from the calculation of core income (loss) because they are generally driven by economic factors that are not necessarily reflective of our primary operations. The calculation of core income (loss) excludes net investment gains or losses because net investment gains or losses are generally driven by economic factors that are not necessarily reflective of our primary operations. Management monitors core income (loss) for each business segment to assess segment performance. Presentation of consolidated core income (loss) is deemed to be a non-GAAP financial measure. Reconciliation of Net Income (Loss) per Diluted Share to Core Income (Loss) per Diluted Share Results for the Three Months Ended December 31 Results for the Year Ended December 31 2024 2023 2024 2023 Net income per diluted share $0.07 $1.35 $3.52 $4.43 Less: Net investment (losses) gains (0.12) 0.02 (0.23) (0.28) Less: Pension settlement transaction losses (1.06) — (1.08) — Core income per diluted share $1.25 $1.33 $4.83 $4.71 Core income (loss) per diluted share provides management and investors with a valuable measure of the Company's operating performance for the same reasons applicable to its underlying measure, core income (loss). Core income (loss) per diluted share is core income (loss) on a per diluted share basis. 18 Reconciliation of Net Income (Loss) to Core Income (Loss) Reconciliation of GAAP Measures to Non-GAAP Measures

19 Underwriting gain (loss) is deemed to be a non-GAAP financial measure and is calculated pretax as net earned premiums less total insurance expenses, which includes insurance claims and policyholders' benefits, amortization of deferred acquisition costs and insurance related administrative expenses. Net income (loss) is the most directly comparable GAAP measure. Management believes some investors may find this measure useful to evaluate the profitability, before tax, derived from our underwriting activities which are managed separately from our investing activities. Underlying underwriting gain (loss) is also deemed to be a non-GAAP financial measure, and represents pretax underwriting results excluding catastrophe losses and development-related items. Management believes some investors may find this measure useful to evaluate the profitability, before tax, derived from our underwriting activities, excluding the impact of catastrophe losses, which are unpredictable as to timing and amount, and development-related items as they are not indicative of our current year underwriting performance. Results for the Three Months Ended December 31, 2024 (In millions) Specialty Commercial International Property & Casualty Net income $ 165 $ 222 $ 37 $ 424 Net investment losses (gains), after tax 12 16 (1) 27 Core income $ 177 $ 238 $ 36 $ 451 Less: Net investment income 165 199 36 400 Non-insurance warranty revenue (expense) 19 — — 19 Other revenue (expense), including interest expense (13) (4) (15) (32) Income tax expense on core income (48) (63) (3) (114) Underwriting gain 54 106 18 178 Effect of catastrophe losses — 33 12 45 Effect of favorable development-related items — — (1) (1) Underlying underwriting gain $ 54 $ 139 $ 29 $ 222 Reconciliation of Net Income to Underwriting Gain (Loss) and Underlying Underwriting Gain (Loss) Reconciliation of GAAP Measures to Non-GAAP Measures

20 Results for the Three Months Ended December 31, 2023 (In millions) Specialty Commercial International Property & Casualty Net income $ 179 $ 204 $ 44 $ 427 Net investment losses (gains), after tax 3 5 (1) 7 Core income $ 182 $ 209 $ 43 $ 434 Less: Net investment income 151 175 29 355 Non-insurance warranty revenue (expense) 13 — — 13 Other revenue (expense), including interest expense (13) 4 6 (3) Income tax expense on core income (49) (56) (12) (117) Underwriting gain 80 86 20 186 Effect of catastrophe losses — 17 5 22 Effect of favorable development-related items (5) — (2) (7) Underlying underwriting gain $ 75 $ 103 $ 23 $ 201 Reconciliation of GAAP Measures to Non-GAAP Measures

21 Results for the Twelve Months Ended December 31, 2024 (In millions) Specialty Commercial International Property & Casualty Net income $ 663 $ 658 $ 153 $ 1,474 Net investment losses, after tax 31 44 — 75 Core income $ 694 $ 702 $ 153 $ 1,549 Less: Net investment income 626 733 131 1,490 Non-insurance warranty revenue (expense) 62 — — 62 Other revenue (expense), including interest expense (53) (14) (10) (77) Income tax expense on core income (190) (188) (44) (422) Underwriting gain 249 171 76 496 Effect of catastrophe losses — 318 40 358 Effect of favorable development-related items (8) — (6) (14) Underlying underwriting gain $ 241 $ 489 $ 110 $ 840 Reconciliation of GAAP Measures to Non-GAAP Measures

22 Results for the Twelve Months Ended December 31, 2023 (In millions) Specialty Commercial International Property & Casualty Net income $ 666 $ 594 $ 147 $ 1,407 Net investment losses (gains), after tax 42 58 (2) 98 Core income $ 708 $ 652 $ 145 $ 1,505 Less: Net investment income 558 645 103 1,306 Non-insurance warranty revenue (expense) 80 — — 80 Other revenue (expense), including interest expense (52) (1) 4 (49) Income tax expense on core income (195) (174) (48) (417) Underwriting gain 317 182 86 585 Effect of catastrophe losses — 207 29 236 Effect of (favorable) unfavorable development-related items (12) (4) 13 (3) Underlying underwriting gain $ 305 $ 385 $ 128 $ 818 The underlying loss ratio excludes the impact of catastrophe losses and development-related items from the loss ratio. The underlying combined ratio is the sum of the underlying loss ratio, the expense ratio and the dividend ratio. The underlying loss ratio and the underlying combined ratio are deemed to be non-GAAP financial measures, and management believes some investors may find these ratios useful to evaluate our underwriting performance since they remove the impact of catastrophe losses, which are unpredictable as to timing and amount, and development-related items as they are not indicative of our current year underwriting performance. The components to reconcile the combined ratio and loss ratio to the underlying combined ratio and underlying loss ratio for Property & Casualty, Specialty, Commercial and International segments are set forth on pages 6, 8, 10 and 12, respectively. Components to reconcile the combined ratio and loss ratio to the underlying combined ratio and underlying loss ratio Reconciliation of GAAP Measures to Non-GAAP Measures

December 31, 2024 December 31, 2023 Book value per share $38.82 $36.52 Less: Per share impact of AOCI (7.34) (9.87) Book value per share excluding AOCI $46.16 $46.39 Book value per share excluding AOCI allows management and investors to analyze the amount of the Company's net worth primarily attributable to the Company's business operations. The Company believes this measurement is useful as it reduces the effect of items that can fluctuate significantly from period to period, primarily based on changes in interest rates. Calculation of Return on Equity and Core Return on Equity Results for the Three Months Ended December 31 Results for the Year Ended December 31 ($ millions) 2024 2023 2024 2023 Annualized net income $81 $1,468 $959 $1,205 Average stockholders' equity including AOCI (a) 10,635 9,228 10,203 9,220 Return on equity 0.8 % 15.9 % 9.4 % 13.1 % Annualized core income $1,366 $1,448 $1,316 $1,284 Average stockholders' equity excluding AOCI (a) 12,549 12,435 12,534 12,355 Core return on equity 10.9 % 11.6 % 10.5 % 10.4 % Core return on equity provides management and investors with a measure of how effectively the Company is investing the portion of the Company's net worth that is primarily attributable to its business operations. a Average stockholders' equity is calculated using a simple average of the beginning and ending balances for the period. 23 Reconciliation of Book Value per Share to Book Value per Share Excluding AOCI Reconciliation of GAAP Measures to Non-GAAP Measures