THIRD QUARTER 2015 FINANCIAL REVIEW Results are based on preliminary, unaudited financials

Forward-Looking Statements

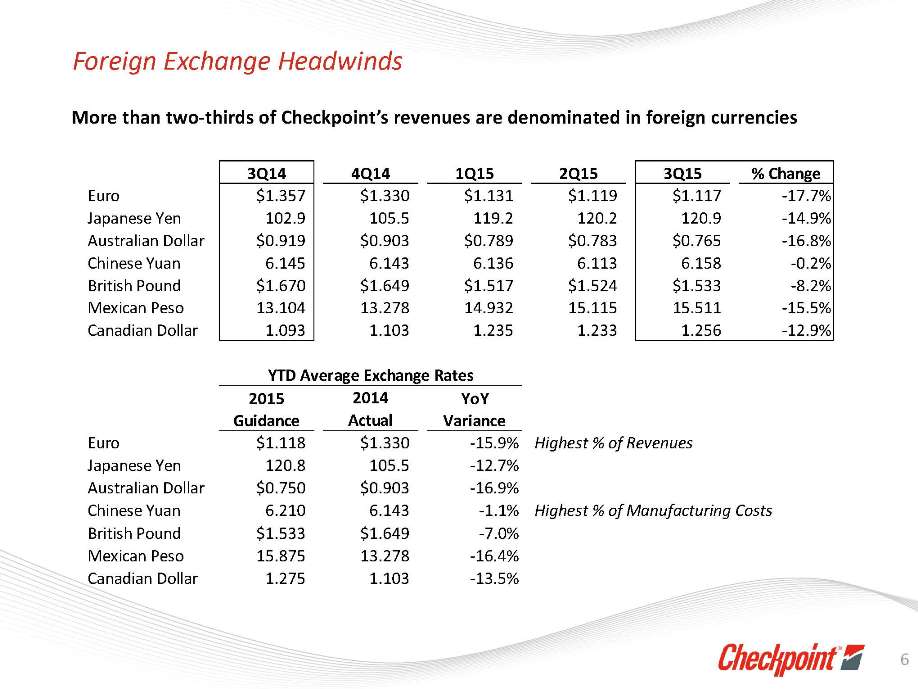

This presentation includes information that constitutes forward-looking statements. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” or “will.” By their nature, forward-looking statements address matters that are subject to risks and uncertainties. Any such forward-looking statements may involve risk and uncertainties that could cause actual results to differ materially from any future results encompassed within the forward-looking statements. Factors that could cause or contribute to such differences include: the impact upon operations of accounting policies review and improvement; the impact upon operations of legal and compliance matters or internal controls review, improvement and remediation, including the detection of wrongdoing, improper activities, or circumvention of internal controls; our ability to successfully implement our strategic plan; our ability to manage growth effectively including our ability to integrate acquisitions and to achieve our financial and operational goals for our acquisitions; changes in economic or international business conditions; foreign currency exchange rate and interest rate fluctuations; lower than anticipated demand by retailers and other customers for our products; slower commitments of retail customers to chain-wide installations and/or source tagging adoption or expansion; possible increases in per unit product manufacturing costs due to less than full utilization of manufacturing capacity as a result of slowing economic conditions or other factors; our ability to provide and market innovative and cost-effective products; the development of new competitive technologies; our ability to maintain our intellectual property; competitive pricing pressures causing profit erosion; the availability and pricing of component parts and raw materials; possible increases in the payment time for receivables as a result of economic conditions or other market factors; our ability to comply with covenants and other requirements of our debt agreements; changes in regulations or standards applicable to our products; our ability to successfully implement global cost reductions in operating expenses including, field service, sales, and general and administrative expense, and our manufacturing and supply chain operations without significantly impacting revenue and profits; our ability to maintain effective internal control over financial reporting; risks generally associated with information systems upgrades and our company-wide implementation of an enterprise resource planning (ERP) system and additional matters disclosed in our Securities and Exchange Commission filings. We believe that the most significant risk factors that could affect our financial performance in the near-term include: (1) changes in economic or international business conditions including foreign currency exchange rate and interest rate fluctuations; (2) our ability to successfully implement our strategic plan; (3) our ability to manage growth effectively including our ability to integrate acquisitions and to achieve our financial and operational goals for our acquisitions, and (4) lower than anticipated demand by retailers and other customers for our products including slower commitments of retail customers to chain-wide installations and/or source tagging adoption or expansion. For a more detailed discussion of these and other factors, see “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial Condition” in our 2014 Form 10-K, filed on March 5, 2015 with the Securities and Exchange Commission as amended by our Amendment No. 1 to our Annual Report on Form 10-K/A filed on November 3, 2015 with the Securities and Exchange Commission. The forward-looking statements included in this document are made only as of the date of this document, and we undertake no obligation to update these statements to reflect subsequent events or circumstances, other than as may be required by law. 2

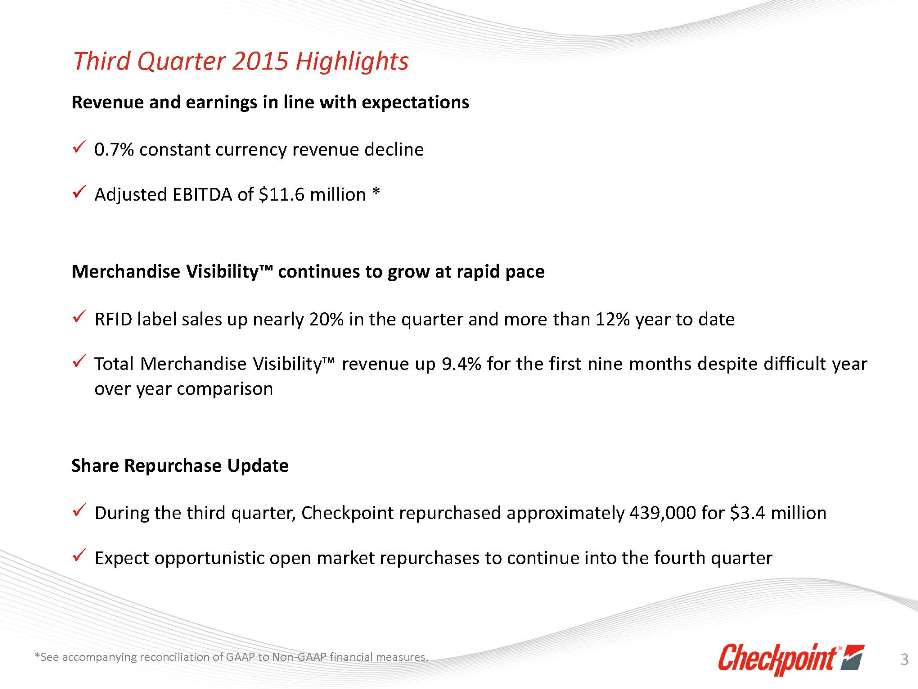

Third Quarter 2015 Highlights

Revenue and earnings in line with expectations

ü0.7% constant currency revenue decline

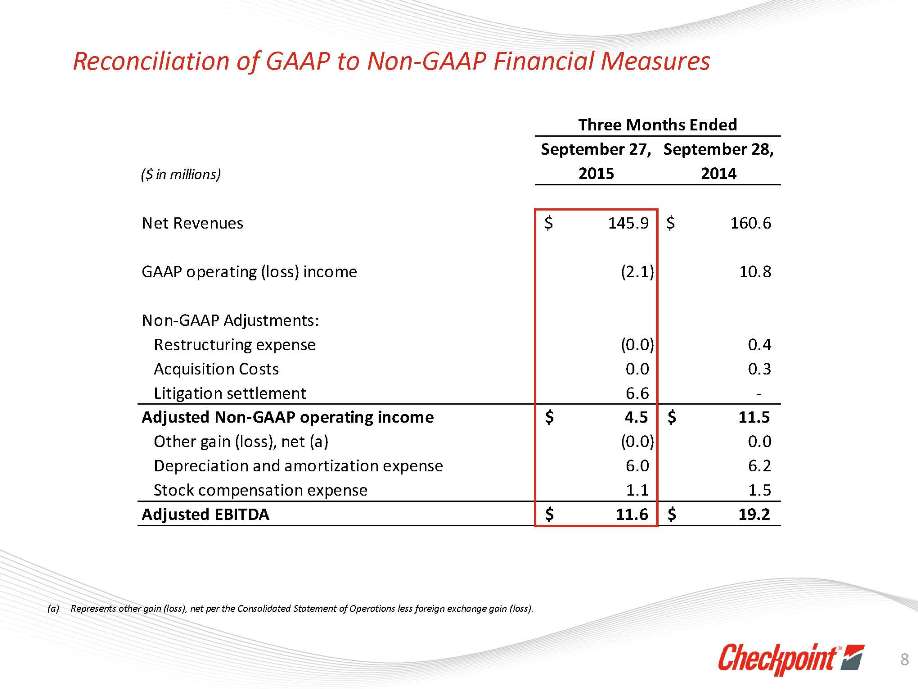

üAdjusted EBITDA of $11.6 million * Merchandise Visibility™ continues to grow at rapid pace

üRFID label sales up nearly 20% in the quarter and more than 12% year to date

üTotal Merchandise Visibility™ revenue up 9.4% for the first nine months despite difficult year over year comparison Share Repurchase Update

üDuring the third quarter, Checkpoint repurchased approximately 439,000 for $3.4 million

üExpect opportunistic open market repurchases to continue into the fourth quarter

*See accompanying reconciliation of GAAP to Non-GAAP financial measures.

New Business Update

Current Projects

üCheckpoint successfully deployed our new E10 2.0 dual RF/RFID-enabled antennas in more than 700 stores for an enterprise customer in North America

üOur previously-announced EAS competitive swap out project is under way in Asia Pac Checkpoint new business pipeline continues to strengthen

üNow in discussion, proof of concept, pilot, or partial deployment with more than 40 customers across the globe

üAdded several significant EAS pilots to the development pipeline R&D Update

üOn pace to file twice as many new patents in 2015 as were filed in 2012, 2013 and 2014 combined